Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Monday, March 10, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Funders Forum & Broker Expo March 4-6

Seminole Hard Rock Hotel & Casino

Hollywood, Florida

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Why You Need an Attorney in California

By Ken Green, Leasing News Editor, Emeritus

Top Ten Most Read by Readers

March 3 to March 7

Commercial Finance/Leasing Finance

Conferences and Forums - Updated

Leasing News Advisor

Randy Haug

Celebrating International Women's Day

March 8,

2025 - CLFP

The World's Top 20 Economies

by GDP Growth (2015-2025) Graphic

News Briefs---

Federal workers’ salaries represent less than

5% of federal spending and 1% of GDP

Tesla’s stock nosedives — wiping out $700B in gains

since Trump’s election victory

How Walmart Built the Biggest

Threat Amazon Has Faced

VS’s New Mini Stores Go All In on Medicine and

Skip Everything Else

You May Have Missed ---

Ex-central banker to replace Trudeau as Canada’s

prime minister after winning Liberal Party vote

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Victoria Grillo was hired as Senior Account Executive, Insight Capital Finance, Costa Mesa, California. She is located in East Setauket, New York. Previously, she was at Macrolease Corporation, starting May, 2020, Senior Sales Associate, promoted National Sales Executive (January, 2022 - February, 2025); Contract Analyst Officer, Sumitomo Mitsui Banking Corporation (August, 2015 - May, 2020).

https://www.linkedin.com/in/victoria-grillo-19263998/

Paul Knowlton was hired as National Program Manager, Regional Sales Manager, PEAC Solutions, Mount Laurel, New Jersey. He is located in Oakland, California. Previously, he was National Program Manager, Huntington National Bank (June, 2021 - March, 2025); National Program Manager, Equipment Finance, Bank of the West (September, 2015 - October, 2017). Full Bio:

https://www.linkedin.com/in/paul-knowlton-5817b5a/details/experience/

https://www.linkedin.com/in/paul-knowlton-5817b5a/

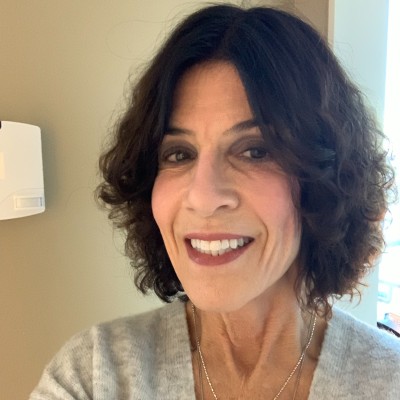

Nancy Pistorio, CLFP, was hired as Business Development Officer, Oakmont Capital Services, JA Matsui Leasing Group, West Chester, Pennsylvania. She is located in Orlando, Florida. On January 6, she announced her assuming a leadership role with Oakmont Capital Services, West Chester, Pennsylvania. She recently announced that she left Madison Capital, LLC, December 31, 2024 but she remains a partner. She was President and Partner since 1986. Previously, she was in Real Estate at William Koons Real Estate (April, 1984 - April, 1986), becoming Vice President, then President and Partner for 19 years at Madison Capital.

https://www.linkedin.com/in/nancy-pistorio-clfp-99b4929/

Cary Thomas as Director of Collections was hired as Director, Collections, BriteCap Financial, Las Vegas, Nevada. He is located in San Diego, California. Previously, he was Vice President of Collections, Levo Funding (August, 2023 - March, 2025); Collection Supervisor, National Funding (March, 2023 - August, 2023); He joined Reliant Funding March, 2019, Collections, appointed Director of Collections & Client Services (January, 2021 - March, 2023). Full Bio:

https://www.linkedin.com/in/cary-thomas-621635189

[headlines]

--------------------------------------------------------------

Funders Forum & Broker Expo

Seminole Hard Rock Hotel & Casino

Hollywood, Florida

Bob Rodi covered the conference for Leasing News readers. He wrote a three part series on what he saw, observed, and learned.

Relax and recharge like a true rock star arrived at the Hardrock on Tuesday (March 4th) in time for the welcome reception. My first task was to check in as a member of the press, representing Leasing News. The check-in process was extremely easy. A registration desk had iPad screens that asked you to type in your last name. Upon doing so, my name popped up at which time I selected “OK” and a fully laminated conference badge, bearing my name was produced from an attached printer.

I grabbed one of the lanyards on the reception desk, attached my badge and I was on my way to the welcome reception. In all candor I was not prepared for this and it was nothing like I expected. The welcome reception was held in one of the Hard Rock’s large night club spaces. Upon entering the area, I immediately saw a sea of happy attendees socializing with each other, moving around the room, greeting each other with handshakes, hugs and smiles. My immediate impression was that this was a very tight-knit group of colleagues.

Given the relative youth of the RBF\MCA segment, in general, I was somewhat surprised at the attendance and overall size of the crowd. I would estimate that there were at least 600-700 people attending this event and the atmosphere was that of an enormous party. There was an open bar, catered Hors d’ Oeuvres and stations offering various types of sliders, appetizers and sandwiches. The color of one’s lanyard indicated an attendee’s status. If the lanyard was “green,” it indicated a funding source. If the lanyard was “white,” it indicated a broker.

Of course, there were several people to whom I spoke that claimed to be both a broker and a funder. As is the case with any Financial Services conference, this one was also well attended by attorneys and other service providers to the member firms.

The conference was the semiannual meeting of the Revenue Based Finance Coalition (RBFC for short). Admittedly, and in the interest of full disclosure, I was not nearly as well informed about this segment of Specialty Finance as I thought I was. When Kit Menkin asked me to cover this conference for Leasing News, my expectation as that I would be attending more of a meeting than a full blown conference where companies offered credit card receivable “loans.”

Attendees would gather to discuss their future business prospects, exchange ideas on how to source more business, where they could get funding for their products, possibly some discussions on the regulatory pitfalls, best practices and whether economic uncertainty was good or bad for business.

While it was all of that, I wholeheartedly admit that I couldn’t have been more wrong or uninformed about Revenue Based Financing or their coalition. One of the first things I learned, and subsequently heard many times over the next two days, is that RBF\MCA transactions should not be referred to as “loans.”

As I worked my way around the room, I introduced myself to several of the attendees and finally camped out at one of the bars thinking that it would be an excellent place to speak to people and learn more about this conference, the RBFC and its members. I not only met people from all over Florida and the East Coast but also from TX, AZ and the Midwest. This conference was extremely well attended with nearly 800 registered attendees.

RFBC is the official name of the association that meets twice a year to discuss changes in the Revenue Based Finance segment of the Specialty Finance Industry. Before attending this conference, I had only known this as Merchant Cash Advance and I thought it was primarily for credit challenged businesses who could not secure loans or leases from more conventional banks or lenders.

I was interested in how the attendees got into the business and what it took to get started. The most common responses from those with whom I spoke reported that there were few, if any, barriers to entry and that there really isn’t a lot of underwriting associated with approving and MCA advance for customers. Indeed, one of the attractive things about this type of financing is that it is quick and relatively easy for the customer.

Several of the attendees I spoke to had only been in the business for a few short years and the MCA business itself had only come into its own in the last 8-10 years. One group of attendees, after finding out more about my background and that I was there representing Leasing News, told me that they had looked at becoming leasing or loan brokers but that the requirements to do so were too stringent with respect to experience, time in business, sourcing business and getting set up with funding sources. Instead, they decided on the MCA space for reasons cited above.

Several funders in attendance were mostly “private money” people representing “family offices.” There were a few lenders who were also involved in factoring and saw MCA itself as a natural extension of that business for clients who don’t generate invoices for products where credit is extended on a 30–60-day basis. While there were several banks in attendance, none of them were lenders to any of the individuals representing themselves as the funders.

Instead, they were there looking to build businesses like ISOs or credit card processors which allowed them to secure the depository and overnight sweep accounts for tens of thousands or even millions of ACHs that are generated by this MCA activity on a daily or weekly basis .

As the welcome reception, lasting a good 3 hours, wound down, many people split into groups to head to other parts of the venue for dinners, to discuss business, catch up after the last conference or just gamble and have fun.

Bob Rodi, long time friend, original member of Advisory Board and contributing writer for Leasing News. https://www.linkedin.com/in/bob-rodi-1437246

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Why You Need an Attorney in California

By Ken Green, Leasing News Editor, Emeritus

I have been practicing law for 45 years and I have had many, many clients. However, I know there are some people who believe they can go it alone in California. This article will explain why that is a mistake.

1. Licensing If you are in the finance business, whether as a lender or broker, you most definitely need a California Financing Law (CFL) license. There are exemptions but the Department of

Financial Protection and Innovation (DFPI), which oversees that industry, views those exemptions narrowly. Banks are definitely exempt. Many industry experts believe that this exemption includes the subsidiaries of federal and state banks but the DFPI strenuously disagrees with this position. So, unless you are an actual bank, not a subsidiary, or fall within one of the other licensing exemptions, you must have a license.

That process is difficult to navigate. It can take as long as ten months to complete the application and review. An attorney familiar with the licensing process can help and perhaps even expedite the process.

It is foolhardy to ignore the DFPI. It is empowered to issue an enforceable cease and desist order which will effectively shut down your business. It may also assess substantial penalties for violations of the CFL law. Accordingly, if you are making or brokering financial transactions in California, whether consumer or commercial, you should seek experienced counsel.

2. Disclosures Then there are the infamous disclosure laws and regulations. The required disclosures are specific and comprehensive and may apply even if you are exempt from licensure. Failure to

adhere to those rules may result in penalties and citations by the DFPI.

In addition, if your lending or brokering involves borrowers from another state, you could be subject to that state’s disclosure laws. As of 2025, fifteen states have introduced or passed commercial finance disclosure laws. An attorney is crucial to avoid the traps and pitfalls of those laws.

3. Rosenthal Act On July 1, 2025, the debt collection landscape in California will change dramatically. On that date, the revised Rosenthal Fair Debt Collection Practices Act (the Act) takes effect. The Act has been around since 1977 but has always been applicable to consumer transactions only, much like its federal counterpart, the Fair Debt Collection Practices Act. That will change on July 1. Not only will the restrictions and prohibitions under the Act apply to commercial transactions, but also to creditors as well as debt collectors. If your business model includes repayment of the loans you broker or make (and I’m sure it does), you should be familiar with the Act.

4. Miscellaneous Apart from these laws, there are many reasons to have an attorney review or draft your contracts. For brokers, an essential document is the broker agreement, since it determines the extent of the broker’s liability if a deal goes south. For the lender, all of the loan documents are critical, as they govern, inter alia, the enforceability of the agreement against the debtor or bankruptcy trustee, as well as the lender’s ability to assign or securitize its portfolio. In summary, to paraphrase the old Latin “caveat emptor”, let the financier beware, for operating in the commercial space without counsel is a very risky business.

|

[headlines]

--------------------------------------------------------------

Top Ten Most Read by Readers

March 3 to March 7

(1)North Mill Equipment Finance to Acquire

Pawnee & Tandem according to recent court filings

https://leasingnews.org/archives/Mar2025/03_07.htm#nm

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Mar2025/03_05.htm#hires

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Mar2025/03_03.htm#hires

(4) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Mar2025/03_07.htm#hires

(5) Why You Should Not Ignore Disclosure Laws

By Ken Greene, Leasing Legal Editor, Emeritus

https://leasingnews.org/archives/Mar2025/03_03.htm#why

(6) New Story Credit Financing Different Approach

Business Loans, SBA Loans, Working Capital

Footnotes First

https://leasingnews.org/archives/Mar2025/03_07.htm#sc

(7) CLFP Foundation Adds 14 New CLFPs

With Photo's

https://leasingnews.org/archives/Mar2025/03_05.htm#clfp

(8) Internal Collaboration

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Mar2025/03_07.htm#internal

(9) Changed Direction Again: FinCEN Not Issuing Fines

or Penalties in Connection with Beneficial Ownership

Information Reporting Deadlines

https://leasingnews.org/archives/Mar2025/03_07.htm#bo

(10) Seek Out New Opportunities

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Mar2025/03_05.htm#seek

[headlines]

--------------------------------------------------------------

Commercial Finance/Leasing Finance

Conferences and Forums - Updated

March 11-13: National Equipment Finance Association Spring Conference, Omni, La Costa Resort & Spa, Carlsbad, California.

Conference Details Vicki Shimkus CLFP, Balboa Capital, A Division of Ameris Bank | Broker Relationship Manager, will cover the conference for Leasing News.

April 9–11: NVLA Conference, Clearwater Beach, Florida

Conference Details This year's conference will feature Keynote Speaker, Michelle "MACE" Curran, Women in Leasing Poolside Social, informative education sessions, and ample networking opportunities.

April 9-11: AACFB Annual Conference, Las Vegas, Nevada

The deadline to get the AACFB group rates for the 2025 AACFB Annual Conference in Las Vegas is fast approaching. The block at the Paris Hotel is oversold, making some nights only available at a higher rate. However, the group rate is still available at the Horseshoe Hotel next door to the Paris. Book NOW! https://conta.cc/4kmi84u Conference Details List of Exhibitors Theresa Kabot, CLFP, K2 Funding, Kabot Commercial; Leasing advisory board original member of Leasing News Advisory board and long time friend will be covering the AACFB conference for Leasing News readers.

April 15-17: ELFA 36th Annual National Funding Conference, Chicago, Illinois

Conference Details

Don't miss your chance to connect with over 600 industry professionals at the ELFA Funding Conference. Funding is the lifeblood of the equipment leasing and finance industry – this event is your opportunity to secure the partnerships you need to drive success. Register and view hotel information

May 19: Broker Fair, New York City

https://brokerfair.org

https://brokerfair.org/register/

September 10-12: AACFB Commercial Financing Expo, Austin, TX

Conference Details Coming Soon

October 14-16: National Equipment Finance Association Fall Conference, Renaissance Hotel, Minneapolis, Minnesota

Confernce Details Coming Soon

October 26-28: ELFA 64th Annual Convention, Marco Island, Florida

Conference Details

To be listed or update: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Randy Haug

Randy Haug | EVP/ Co-Founder

LTi Technology Solutions

w: 402.493.3445 ext. 1014

Mobile: 402-981-3155

rhaug@ltisolutions.com

www.ltisolutions.com

Randy Haug is the EVP, Vice Chairman, and Co-Founder at LTi. He is responsible for overseeing the market direction and strategies of LTi and serves as an advisor to clients regarding their business issues and strategies. He has spent the majority of his career in the equipment finance industry, working and mentoring LTi’s Executive Management Group, Divisional Managers, Product Managers, Sales, Account Managers, and Marketing team.

He is widely considered an industry thought leader and uses his consultative problem-solving and mentoring skills set to improve the lives of those at LTi as well as those in the industry with whom he collaborates with.

He also enjoys working with both of his sons in the business, who have become Subject Matter Experts and leaders in their own right. While EVP, Vice Chairman, and Co-Founder is his primary job function by day, Randy also loves traveling, as well as spending time with his family, friends, his grandson, and new granddaughter.

Haug is a member of the Equipment Leasing and Finance Association Board of Directors. He has participated in a number of different industry associations, including as a member of the Equipment Leasing and Finance Association, (ELFA) Advocacy Advisory Committee; Executive Committee Board Member & Development Committee Chair for Equipment Leasing and Finance Foundation (ELFF); Board of Trustee to ELFF; Past President of the National Equipment and Finance Association (NEFA); and Current Chair and Co-Founder of the Chris Walker Education Committee of NEFA. He has also participated in a number of different industry association committees in both the ELFA and NEFA associations and has been an industry speaker and panelist at a number of educational events within those associations.

He was elected 2024 Leasing News Person of the Year.

Randy is a servant leader and has sat on board level positions in many industry companies and organizations. Randy had been involved in the Equipment Finance industry for 35 years while at LTI Technology Solutions, Inc. and its previously named LeaseTeam, Inc. company.

[headlines]

--------------------------------------------------------------

Celebrating International Women's Day

March 8, 2025

[headlines]

--------------------------------------------------------------

The World's Top 20 Economies

by GDP Growth (2015-2025)

This graphic ranks countries by their forecasted gross domestic product (GDP) in 2025, and visualizes their inflation-adjusted growth since 2015.

The 2015 figure was calculated by reversing the effects of real GDP growth for every intervening year. All figures are in 2025 dollars.

Data for this chart is sourced from the International Monetary Fund.

[headlines]

--------------------------------------------------------------

News Briefs

Federal workers’ salaries represent less than

5% of federal spending and 1% of GDP

https://www.marketplace.org/2025/03/06/federal-workers-salaries-represent-less-than-5-of-federal-spending-and-1-of-gdp/

Tesla’s stock nosedives — wiping out $700B in gains

since Trump’s election victory

https://nypost.com/2025/03/07/business/tesla-stock-drop-erases-700b-in-gains-since-trump-election

How Walmart Built the Biggest Threat Amazon Has Faced

https://www.wsj.com/business/retail/walmart-ecommerce-amazon-competitor-b7fe1cd5?mod=business_lead_pos4

VS’s New Mini Stores Go All In on Medicine and

Skip Everything Else

The national drugstore chain is preparing to open a dozen stores offering full-service pharmacies but very limited retail.

https://www.linkedin.com/news/story/new-cvs-stores-focus-on-medication-6653601/

[headlines]

--------------------------------------------------------------

Ex-central banker to replace Trudeau as Canada’s

prime minister after winning Liberal Party vote

https://www.bostonglobe.com/2025/03/09/wires/canada-prime-minister/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Draymond Green hits go-ahead 3, Stephen Curry surpasses

25,000 points as Warriors hold off Pistons 115-110

https://www.pressdemocrat.com/article/sports/draymond-green-hits-

Departing 49ers star recalls unforgettable moment

in Bay Area Target

https://www.sfgate.com/49ers/article/departing-49ers-star-recalls-bay-area-target-20211875.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Trump Administration Cuts Hit Home, Dealing A

Potential Huge Blow To Davis And UC Davis

https://davisvanguard.org/2025/03/analysis-trump-administration-cuts-hit-home-dealing-a-potential-huge-blow-to-davis-and-uc-davis/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Cliff Lede Vineyards expands estate with purchase

of prime Stags Leap District vineyard

https://www.winebusiness.com/news/article/299211

Bourbon Is Banned, California Wine Canceled,

as Canada Pulls U.S. Alcohol

https://www.nytimes.com/2025/03/06/world/canada/canada-liquor-boycott-tariffs.html

This will be the year of California winery closures

https://www.sfchronicle.com/food/wine/article/winery-close-napa-california-20204351.php

Local vintners test autonomous wildfire suppression

system

https://www.northbaybusinessjournal.com/article/business/napa-sonoma-firedome-wildfire-wine/

Austin Hope's Latest Quest Leads To Cabernet Franc

https://www.winebusiness.com/news/article/299215

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Mar2023/03_10.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()