|

|

|

|

|

|

Bank of the West and its subsidiaries are equal opportunity/affirmative action employers. It is our policy to recruit, advertise, employ, promote, transfer, discipline, and discharge without regard to race, religion, color, national origin, ancestry, age, physical or mental disability, medical condition, veteran status, sexual orientation, sex, marital status, or any other protected status. |

Thursday, March 10, 2005

Headlines---

Classified Ads---Credit

FTC Serves CIT Financial

Preferred Capital, Brecksville, Ohio

Vanguard Capital, Orange, California

Classified Ads--- Help Wanted

Leasing Association Spring Conferences

Maglietta at Citicapital Going Away Party

Young Forms Allegiance Leasing

USXL Closes $150,000,000 Conduit Facility

Clear Blue Ventures New CFO: Christopher Lutes

Alta Consultants to Address CFO Concerns

Universal Express Signs Agreement With Cyphermint

eCredit and PayNet Announce Strategic Alliance

IDB Leasing, Inc. Acquires Fleetwood Financial

CIT New Chief Sales Officer: Walter J. Owens

Beige Report: The Fed Says All Is Well, or Mostly So

News Briefs----

"Gimme that Wine"

This Day in American History

Winter Poem

######## surrounding the article denotes it is a “press release”

|

----------------------------------------------------------------

Classified Ads---Credit

Atlanta, GA.

VP Credit/Operations/Sr. Credit Officer. 15yrs exp. in equipment leasing. Strong financial analysis and management skills. Experience developing and maintaining profitable customer/vendor relationships.

Email: credops@msn.com

Atlanta, GA.

Senior Credit Officer in middle-market equip. finance, vendor, 3rd party, specialty, flow credit to the fortune 1000. Team builder, originations capable, strong work ethic, ability to multi-task.

Email: kyletrust@hotmail.com

Atlanta, GA.

10 yrs experience in credit/collections/recovery/documentation in the leasing industry. P&L responsibility, team builder & strong portfolio mgnt skills.

email: mortimerga@adelphia.net

Boston Ma.

Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development.

Email: bernd.janet@verizon.net

Corona, CA.

VP credit Consumer Credit prime/sub prime Auto lending/leasing/mortgages. 20+yrs exp. If you are looking for someone to affect the bottom line I am that person. Will relocate.

Email: amosca2000@yahoo.com

Fairfield, CT.

Diversified background in credit, operations and portfolio management. Demonstrated success in creative structuring of deals, problem solving & providing tactical guidance.

Email: sailer0102@aol.com

Fort Lee NJ

Credit/Documentation 3 Years Experience. Looking in NJ/NY.

Email: angitravis@mail.com

Irvine, CA,

I have over 16 years of Credit/Collection experience in the finance industry. Prompt results, extremely effective and knowledgeable, professional, excellent manager and team player.

Email: newportresources@sbcglobal.net

Los Angeles, CA

Over 15 years experience in Credit/Operations with Small Ticket and transactions up to $500,000.00. CLP, with excellent relationships with most major lenders.

Email: jonbh123@earthlink.net

Mill Valley, CA

Senior corporate officer with financial services credit background. M and A, fund raising and workout expertise.

Email: nywb@aol.com

New Jersey, NJ

Credit Analyst with 10+ years experience in small-ticket lending up to $500,000. Experience with both vendor-direct and with brokers.

Email: b.leavy@worldnet.att.net

New York, NY.

V.P. Credit & Collections w/23 years exp.looking for a situation where I can utilize my varied & extensive knowledge of credit/collections/risk-management & leasing.

Email: rcouzzi@yahoo.com

New York, NY.

5+ yrs leasing credit exp./highly proficient knowledge of Ops: documentation & recovery. Currently in the SMB segment - moving back to NY/NJ area.

Email: SMBOPS2004@aol.com

New York, NY

3+ years of leasing credit / contracts experience. Currently in the leasing industry and moving to NY! Exp. working at both funding source and broker. Email: lease4you@mail.com

Orange, CA.

Credit/Operations Manager 15 years exper., looking for a new home. Have handled both middle/ large ticket transaction, plus muni & international finance.

email: equiplender@aol.com

Phoenix, AZ.

Credit/Leasing Manager- 8 years underwriting. Proven performer, strong negotiator and sales support. Worked with the best- Randy Schiell, Chuck Brazier, Jim Lahti.

Contact: Elizabeth Rose (480)510-7434

ravenfinance@aol.com

Portland, OR.

Well known Equipment Leasing Industry Professional (Credit Analyst) with 17 years experience working in the Portland, Oregon area for three major Fortune 500 Funding Sources.

Email: jimmyfrank@verizon.net

| RESUME |

http://64.125.68.90/LeasingNews/Resumes/Jimmy%20Frank-Resume.pdf

Senior Credit Officer experienced in middle-market leasing; structured, vendor and 3rd party to the fortune 1000. Proactive team builder, originations capable with strong work ethic.

Email: kyletrust@hotmail.com

Full listing of 96 “Job Wanted ads” at:

http://64.125.68.90/LeasingNews/JobPostings.htm

------------------------------------------------------------------

FTC Serves CIT Financial

WASHINGTON (Dow Jones)--CIT Group Inc. (CIT) reported it was served with a subpoena on Monday in connection with a federal grand jury proceeding related to the purchase of leases from a defunct telecommunications services company.

In its annual report, CIT Group also said the Federal Trade Commission asked the company to provide documents for transactions related to the telecom company, called NorVergence. The company said it is in the process of complying with the information requests.CIT Group said the grand jury proceeding being conducted by the U.S. Attorney for the Southern District of New York served the subpoena last month. The proceeding is related to an investigation of transactions related to NorVergence, a reseller of telecommunications and Internet services from which CIT acquired equipment leases, CIT Group said in its annual Form 10-K filing with the Securities and Exchange Commission.

Last year, NorVergence was ordered to be liquidated under Chapter 7 of the U.S. Bankruptcy Code. Various state attorneys general starting investigating NorVergence and financial institutions - including CIT Group - that purchased NorVergence leases.

CIT Group, which provides commercial and consumer finance solutions, said in the filing that it reached some settlements in connections with the investigations. Negotiations with other attorneys general are continuing, the filing said.

-By Shira Ovide, Dow Jones Newswires; 202-862-1356;

shira.ovide@dowjones.com [ 03-07-05 1830ET ]

(Note: It should be brought to reader's attention that CIT Financial did make a settlement agreement at behalf of the attorney general's staff of New York, plus is making settlements in other states. It appears they have recognized their responsibilities and despite other publicity, are taking the high road on this matter. They also were one of the first to report the “problem” they discovered in their SEC filing. To learn more about the company, see story below on Walter J. Owens as New Chief Sales Officer editor.)

----------------------------------------------------------------

Preferred Capital, Brecksville, Ohio

Have some breaking news, but need further confirmation

and looking for it from readers, as the cause appears to

be the many law suits regarding the NorVergence bankruptcy.

Preferred Capital is not making it public at this time.

Any comments please send to: kitmenkin@leasingnews.org

----------------------------------------------------------------

Vanguard Capital, Orange, California

Leasing News has received several complaints about Vanguard Capital, Orange, California, naming Mark Johnston and Chad Lee, who was part

of GSC Capital L.L.C, another company that closed down.

We presently have two complaints about advance rentals

not being returned, and no longer can reach Vanguard

Capital, as the telephone appears to be disconnected. We are told

by several sources the company has closed down, and one informed

source, an attorney, states they are considering filing bankruptcy.

For the last several days the telephones appear to be disconnected

and e-mail is also not answered by Vanguard Capital.

Should anyone have any information that we may verify, please

contact: kitmenkin@leasingnews.org

Here is their latest Better Business Bureau report:

http://www.leasingnews.org/items/Company_Report.htm

-----------------------------------------------------------------

Classified Ads--- Help Wanted

Collection Attorney

|

Spiwak & Iezza, LLP, Westlake Village, Ca. is an extremely aggressive collection law firm that believes in taking action against debtors quickly and pushing through to final resolution without delay. |

Marketing Officer

|

Bank of the West and its subsidiaries are equal opportunity/affirmative action employers. It is our policy to recruit, advertise, employ, promote, transfer, discipline, and discharge without regard to race, religion, color, national origin, ancestry, age, physical or mental disability, medical condition, veteran status, sexual orientation, sex, marital status, or any other protected status. |

National Account Manager

|

|

Platform Business Manager / Asset Manager

|

Asset Manager: Organized, decisive individual w/ asset mngt./ remarketing exper., covering wide range assets from manufacturing equipment to transportation, energy-related,, technology, retail, etc. Send your resume to: Kathy.odwyer@rbos.com About the Company: RBS Lombard, Inc., based in Chicago, is a member of The Royal Bank of Scotland Group, an AA rated company that is the 6th largest bank in the world by market capitalization as of January 14, 2005. Founded in 2002, RBS Lombard, Inc. has grown to net assets exceeding $2.8 billion and new business volume surpassing $1.1 billion in 2004. |

Sales Professionals

|

|

|

Madison Capital, a Baltimore based equipment and vehicle leasing company for 30 years is a national provider of direct financing services for both vendors and lessees. www.madisoncapital.com |

Small Ticket Sales Representative

|

Advantage Leasing is a 20 yr. old company located in West Chester, PA. We have multiple funding sources as well as internal financing. |

|

About the Company: A rapidly expanding Middle Market Leasing / Finance Company located in CT. Equilease Financial Services, Inc |

-----------------------------------------------------------------

Leasing Association Conferences—Spring

![]()

April 6-7,2005

National Funding Exhibition Fairmont Hotel

Chicago, IL

(note: ELA will allow a one time conference attendance to a non-member. However, the ability to attend not only the conferences but information from their website is well-worth the membership fee)

http://www.elaonline.org/events/calendar/ataglance.cfm#now

-----------------------------------------------------------------

![]()

April 14-17,2005

Mills House

Charleston, South Carolina

“The famous Mills House in beautiful, historic Charleston, South Carolina will be the setting for this super conference. Bill Cowden of Springs Leasing, chairman of this event, promises a conference to remember. If you have any workshop ideas or want to volunteer as a panelist, call Alison at 212-809- 1602.”

EAEL.org web site

To view the Mills house, please go here:

http://www.millshouse.com/virtual-tour.htm

----------------------------------------------------------------

![]()

April 21-24, 2005

Spring Leadership Conference

Doubletree Paradise Valley Resort

Scottsdale, Arizona

Chairman: Steve Reid - Pacific Capital Bank

Content:

- Great Educational Sessions and Roundtables

- Strong Speakers

- Spouse Function

- Golf

- Texas Hold-em Tournament

- Arizona Diamondbacks Game

For brochure, click here:

http://www.uael.org/events/conferences/slc/register.asp

---------------------------------------------------------------

May 4-6,2005

Loews Miami Beach Hotel

South Beach, Miami, Florida

for more information, please go here:

http://leasingnews.org/PDF/25AM05_springpgm.pdf

---------------------------------------------------------------

May 12-15,2005

Hyatt Regency Union Station

St. Louis, Missouri

Claude Elmore—Conference Chairman

Netbank Business Finance

Conference information:

http://www.naelb.org/associations/2004/files/

NAELB05%20Reg%20Brochure%20FINAL.pdf

General Conference Information:

http://www.naelb.org/displayconvention.cfm

----------------------------------------------------------------

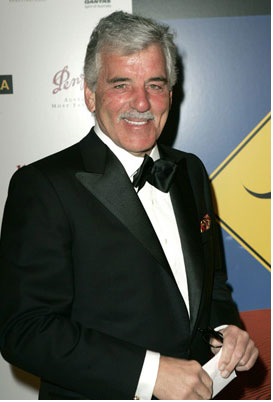

Maglietta at Citicapital Going Away Party

Re: Sal Maglietta, the new president and CEO of U.S. Bancorp Equipment Finance

“Like Brian Carey said, Sal is a great guy. He went out of his way to make everyone feel welcome at Citicapital. When he left, they gave him a big going away party, formal attire, and all.

Here is a correct picture of Sal taken at the Citicapital going

away party:

( You may be able to meet Sal Maglietta at one of the leasing

association conferences and take a picture to send to Leasing

News to show a picture of yourself with Maglietta. Send to us

and we will print it. editor )

-----------------------------------------------------------------

### Press Release ######################

Young Forms Allegiance Leasing

WESTERN SPRINGS, ILLINOIS -- Unwavering integrity and red carpet customer service is what drove entrepreneur David Young to launch Allegiance Leasing Company in 2005. Founded with the belief that there is a need for a new approach in leasing, Young hopes to set a new standard for the industry.

“Our customers believe in us because we consistently place their best interests above all others,” says founder Young. “We believe customers should be treated as we would want to be treated.”

Young also knows the importance of contributing to his community. That's why Allegiance has committed a portion of its revenues to be donated to Habitat for Humanity International each quarter.

Allegiance has extensive experience working in a wide variety of industries, including information technology, manufacturing, telecommunications, healthcare and homeland security. Focused on venture capital and private equity funds portfolio companies, Allegiance knows their customers need a financing partner that will understand their market. The company aids businesses in building customer loyalty through sales finance private label programs.

“Our purpose is to get our customers the financing they need to grow their business, without all the hassles that can occur with a large corporation or one too small,” says Young. “We understand that managing your own business is time consuming and can be stressful, buying the equipment you need shouldn't be.”

Allegiance founder Young has been in the leasing industry for more than 20 years. Most recently, he was a co-founder of DNJ Capital Partners, which was the first equipment leasing company to have a U.S. Small Business Investment license. After working with several large corporations, he grew dissatisfied with the big companies, poor customer service and complicated policies that were the norm in the leasing industry. Believing there was a better way to help businesses reach their goals, Young founded Allegiance Leasing Company.

“We help companies grow their operations, increase their revenue and decrease their operating costs with our world-class financing services,” Young says. “Our clients enjoy our personal service, attention to detail, and simple finance and leasing programs.”

### Press Release #####################

USXL Closes $150,000,000 Conduit Facility

PARSIPPANY, N.J., -- US Express Leasing, Inc. announces that it has entered into an agreement arranged by Credit Suisse First Boston (CFSB) establishing a $150,000,000 conduit facility.

According to USXL's CEO Jim McGrane, the facility will provide USXL with the financing needed to support the company's continuing growth. "This facility brings us a step closer to our ultimate goal of becoming a significant issuer in the term ABS market," McGrane says. "CSFB is a recognized leader in this market, and we are fortunate to have their support as we continue to build the USXL franchise."

The $150,000,000 commitment provided by the conduit facility complements USXL's existing $75,000,000 credit facility provided through Wells Fargo Foothill Lender Finance. In addition to the initial commitment, the conduit facility's structure is designed to accommodate future expansion as USXL grows its lease portfolio. "We anticipate that this facility will grow as USXL continues to expand its business," McGrane says.

About USXL

US Express Leasing (USXL), headquartered in Parsippany, N.J., is an independent leasing company originating transactions through dealers and manufacturers. USXL provides financing to the healthcare, technology, office products, and commercial and industrial equipment markets. For more information, visit US Express Leasing on the Internet at

http://www.usxl.com.

### Press Release #######################

Clear Blue Ventures Appoints Christopher Lutes as Chief Financial Officer

TUCSON, Ariz., -- Clear Blue Ventures, a venture lending firm that provides short-term financing to emerging growth companies, announced the appointment of Christopher Lutes as chief financial officer. Mr. Lutes is the former chief financial officer and executive vice president for Silicon Valley Bank, a commercial bank focused on venture capital-backed technology and life sciences companies across the U.S. Mr. Lutes is charged with directing and leading the overall financial strategies for Clear Blue Ventures. As the third general partner of Clear Blue Ventures and serving an active role on its Board of Advisors, Mr. Lutes will also play an integral role in investments, strategic planning and fundraising on behalf of the firm.

Under Mr. Lutes' leadership SIVB was named the top-performing publicly traded large bank based on return on equity in 2000 (33 percent ROE) by the ABA Banking Journal. Mr. Lutes also served as a director responsible for managing approximately $200 million in off-balance sheet private equity funds raised by SIVB. He helped oversee $50 million in strategic investments in roughly 300 venture capital funds and start-up technology companies spanning the U.S., Europe, Israel and Asia.

"We are uniquely positioned to strengthen our capabilities in this core area of focus," said Rick Gibson, president at Clear Blue Ventures. "We continue to see significant opportunities for venture lending, and Chris' addition to the team will play an integral role in establishing strategic alliances and bridging the gap between venture capitalists and early-stage companies."

"There continues to be a need for venture lending products for early-stage companies to complement the equity they raise from venture capitalists. I am excited about joining Clear Blue Ventures as I believe we help meet that need," said Christopher Lutes, chief financial officer. "What's unique about our firm is that it offers entrepreneurs a portfolio of comprehensive venture lending products, which is something growing companies value."

Since 2001, Mr. Lutes has been the chief financial officer for two privately held financial services and technology companies, both of which had successfully liquidity events. He is also currently the CFO for several early-stage technology and life sciences companies.

Mr. Lutes is a CPA and received a bachelor's degree in accounting from Arizona State University.

About Clear Blue Ventures

Clear Blue Ventures is a leading venture-lending firm that provides innovative financing solutions to emerging growth companies, especially in technology and life sciences industries. Clear Blue Ventures offers short- term financing in the form of bridge loans, accounts receivable financing, purchase order financing, and venture leasing. By filling the gap between equity investors and banks, Clear Blue Ventures is helping emerging growth companies obtain sufficient working capital and grow without excessive levels of equity dilution or long-term debt.

For more information about Clear Blue Ventures, please call 1-800-221-5664 or visit www.clearblueventures.com.

### Press Release #######################

Alta Consultants to Address CFO Concerns in New Customer Financing Session at National Manufacturing Week

CHICAGO, -- The National Association of Manufacturers (NAM), in cooperation with The Alta Group, an international consultancy, will provide a new session this year during National Manufacturing Week. This special program will focus on customer financing and will be held on today, March 10 in conjunction with a CFO lunch in the President's Club at 10:30 a.m.

The Alta Group is a well respected international consulting firm specializing in helping manufacturers to give their customers more and better financing options when acquiring the companies' products.

The session, titled Customer Financing -- Promises and Pitfalls, will explain how successful customer financing programs are created and ways to address some of the common concerns in this area. The session will outline various opportunities for manufacturers and give attendees time to ask questions and share their views in special areas of concern -- from emerging tax issues to shareholder perceptions to new reporting requirements.

This program, to be presented by Paul Bent and Shawn Halladay of The Alta Group, will also provide real world examples from companies such as GE, IBM and Dell. At the end of the session manufacturers will know more about when customer financing may make sense for them and how to establish a viable vendor finance program; and those who may already have a vendor program or a captive division in place will learn ways to improve its performance.

Halladay is a managing principal of Alta's Professional Development Division and is well known throughout the equipment leasing and finance industry as an author and educator in the field of equipment leasing and finance. He has more than 20 years experience as a lessor, trainer, consultant and auditor. He has served lessors throughout North America, South America, Asia and Europe, providing training in all aspects of equipment leasing and consulting services supporting vendor finance, benchmarking studies, competitive analysis, strategic planning, litigation support, mergers and acquisitions and accounting and quantitative analysis.

He has authored or co-authored eight books on equipment leasing, including "A Guide to Equipment Leasing," "An Introduction to Leasing" and "The Handbook of Equipment Leasing."

Bent joined Alta as an associate last year and is a specialist in large- ticket leasing and asset-based corporate financing. Bent has worked with major corporations, institutions, and law firms throughout the United States, the Far East, and Europe in arranging, structuring, negotiating, documenting, and closing over $2 billion in equipment financings, energy projects, asset- based fundings, corporate acquisitions, and related transactions. He has worked directly with clients in sourcing and arranging transactions, managing the development of proposals, placement memoranda, and transaction documentation, and negotiating with all parties through transaction closing.

The Alta Group and NAM have also provided annual conferences on the subject of customer financing for senior executives from both the manufacturing and equipment financing business sectors. For more information, see http://www.thealtagroup.com.

About The Alta Group

The Alta Group (http://www.thealtagroup.com) is a leading source of international consulting and advisory services, education and training for the equipment leasing and finance industry. It is composed of more than 20 professionals, including former CEOs, company founders and industry organization leaders, who collectively represent nearly 600 years of experience. The company has an active practice in North America, Latin America and Europe.

SOURCE The Alta Group

### Press Release #######################

Universal Express Signs Agreement With Cyphermint, Inc.

NEW YORKUniversal Express (OTCBB:USXP) announces that its division, Universal Cash Express has partnered with kiosk software developer Cyphermint, Inc. for deployment of their PayCash OneStop(R) financial kiosk terminal to UniversalPost's network of postal stores.

"Besides being able to offer bill payments, the financial kiosk may offer when appropriate, payday advance, check cashing, money transfer, wireless, long distance, and over 100 gift cards including our newest luggage express gift card. (www.866shipbags.com/giftcard) The kiosk also allows the merchant to upload, in real-time, funds to the Universal Cash Express Visa Gift Card, empowering the merchants with access to the prepaid debit and transfer card market worth millions of dollars annually," said Brett Hudson, President of Universal Cash Express.

The future of the kiosk industry is now. Companies are finally learning to build the business case for self-service, and deployments are growing as a result. Next steps will be the incorporation of leading-edge technologies like Wi-Fi, RFID, biometrics and electronic advertising.

"This growing and evolving partnership revolutionizes the capabilities of the pre-paid industry. Universal Cash Express fast and easy impulse purchases over a touch screen terminal can generate substantial profits," said Richard A. Altomare.

"Our PayCash OneStop kiosk will enable eCommerce and financial services for merchants who want unparalleled security, scalability and management through self-service and full service applications" said Joe Barboza, President and CEO of Cyphermint."

About Cyphermint

Cyphermint is a provider of Global Electronic Cash Payment and e-commerce infrastructure and integration solutions. Our core technology, PayCash(TM) is used in three major areas: (1) Internet Cash Payment Systems, for secure e-commerce services for the un-banked and emerging consumer market. (2) The PayCash Now(TM) Visa(R) Debit Prepaid Card. (3) Kiosk Solutions - Cyphermint's kiosk software solutions provide retailers with secure end-to-end integration to kiosk networks and provides existing networks with eCommerce capabilities. Cyphermint's core technology provides consumer's access to financial services such as Internet shopping, bill payment, and check cashing. Cyphermint provides turnkey solutions that deliver secure transactional, financial self-service and merchandising services. www.cyphermint.com

About Universal Express

Universal Express, Inc. owns and operates several subsidiaries including Universal Express Capital Corp., (including its USXP Cash Express division) Universal Express Logistics, Inc. (including Virtual Bellhop, LLC and Luggage Express, Universal Express Courier Association) and UniversalPost Network. These subsidiaries and divisions provide the private postal industry and consumers with value-added services and products, logistical services, equipment leasing, and cost-effective delivery of goods and people worldwide. www.usxp.com.

Investor Relations: Equitilink L.L.C. Ron Garner 877-788-1940 toll free 858-824-1940 International or local www.equitilinkpr.com

### Press Release #######################

eCredit and PayNet Announce Strategic Alliance

DEDHAM, Mass. and SKOKIE, Ill.,-- eCredit, a leading provider of online software for credit and collections professionals, announced that it has entered into a strategic alliance with PayNet, the leading resource for industry-specific credit information for the commercial equipment finance industry. This alliance will allow commercial lenders, which include a substantial number of eCredit's existing customers, to improve both the efficiency and effectiveness of their credit operations.

"The integration of PayNet's powerful risk assessment tools and payment history data with eCredit's full-powered credit management software offers distinct advantages for XTRA Lease as well as the rest of the equipment finance industry," said John Pomilio, Vice President, Customer Financial Services, XTRA Lease. "Incorporating PayNet's data into eCredit's already powerful decision support platform will enable us to make even more reliable decisions quicker and as a result, offer exceptional service to our customers."

"Commercial credit is undergoing rapid change. Combining application software with predictive information provides lenders with increased originations and sound credit decisions," said William Phelan, PayNet President. "The partnership between eCredit and PayNet delivers this benefit to our clients."

"This alliance with PayNet is the latest in a series of partnerships designed to enhance the capabilities and performance of our software, making it increasingly applicable to and useful for a variety of vertical markets," said Jeff Dickerson, eCredit CEO. "Combining our leading online solutions for credit processing with PayNet's comprehensive database of customer credit data will enable companies to make more reliable credit decisions using the most appropriate data, delivering significant benefit to corporate operations."

Effective immediately, this alliance is available to new and existing customers in the eCredit and PayNet families.

About eCredit

eCredit is a leading provider of online software for credit and collections professionals. Its award-winning product family -- Personal Edition, Professional Edition, and Enterprise Edition -- supports the mission critical processes of granting credit, monitoring portfolio risk, resolving disputes and collecting accounts receivable. With deep roots in the credit and collections community, eCredit has over a decade of experience helping companies reduce bad debt and DSO while improving productivity, lowering costs and demonstrating results. Its on-demand software supports companies of any size in a broad array of industries and geographies, including ChevronTexaco, Cisco, Samsung Electronics, Cargill, NEC Financial, Graybar, CDW, Sun Microsystems, and Ryder System. eCredit is a private company headquartered in Dedham, Massachusetts. For more information, please visit http://www.ecredit.com or call 1-877-LOWR-DSO.

About PAYNET, Inc.

PayNet, Inc. manages the data repository for the commercial equipment finance industry, an industry that represents more than $550 billion in assets. With the exclusive endorsement of the Equipment Leasing Association (ELA) this repository has become the nation's largest online database of current and historical lease and loan payment information used for credit decision purposes. Over 90 commercial lenders are Members including eight of the ten largest leasing companies, representing a majority of the net assets in the industry. PayNet uses its proprietary technology and the power of information tools to increase profitability, improve operational efficiency, and reduce credit losses. PayNet Inc. is headquartered in suburban Chicago.

For more information, visit PayNet at

http://www.paynetonline.com .

### Press Release ######################

IDB Leasing, Inc. Acquires Fleetwood Financial as its New Division

New York, NY, IDB Leasing, Inc., a subsidiary of Israel Discount Bank of New York (“IDBBank”), has announced that it has recently acquired substantially all the assets of Fleetwood Financial Corporation, 1001 Durham Avenue, South Plainfield, NJ. Richard Miller, President of IDBLeasing®, stated, “We are extremely excited to have Fleetwood Financial join us. This new affiliation enables us to expand the Bank's business presence in New Jersey and puts us light years ahead of our original projections for IDBLeasing. Fleetwood's expertise in vendor-driven direct lease financing completely complements what IDBLeasing has been doing for the past 5 years.”

Established in 1999, IDBLeasing quickly began to attract creditworthy middle market clients as well as investment grade business, and its portfolio's sustained growth since then has consistently surpassed annual projections. The company discounts all types of leases and installment obligations nationwide, with flexible terms and even next day funding capabilities. While currently 90% of IDBLeasing's business is indirect, the ratio is expected to change with the new acquisition. Direct contact with IDBLeasing's decision makers enables quick response and turnaround and, for customers of IDBBank, whatever the decision, there is no impact on their borrowing capabilities with the Bank. IDBBank, headquartered at 511 Fifth Avenue in NYC, is a New York State-chartered commercial bank and a member of the FDIC. The Bank is ranked ninth largest commercial bank in the NY by Crain's New York Business and is also one of the strongest banks in the U.S. based on its liquidity position and capital ratios. Total assets exceed $8 billion.

Fleetwood Financial, established in 1985, is primarily a small ticket vendor-driven lessor, with a national presence. As IDBLeasing's new division, it will maintain the Fleetwood name and be headed by Fleetwood's 3 principals, Bob Sponheimer, Joe O'Sullivan and Rick Frank; the three have also been named EVPs of IDBLeasing. Mr. Sponheimer commented that their “goal was to join a major, prestigious financial organization and expand our base, something we'd been unable to do because of capital restrictions. We couldn't be happier.”

Mr. Miller views the new relationship as a “winning proposition” for all involved. “We fully expect that the collective professional expertise combined with the strength of IDBBank's balance sheet will prove to be quite profitable for both IDBLeasing and the Bank. With the Bank's financial support, the Fleetwood division of IDB Leasing should bring in substantial new business in 2005 and beyond.”

### Press Release ######################

CIT Appoints Walter J. Owens as New Chief Sales Officer

NEW YORK, / -- CIT Group Inc. (NYSE: CIT), a leading provider of commercial and consumer finance solutions, announced the appointment of Walter J. Owens as Executive Vice President, Chief Sales and Marketing Officer. In this newly-created position, Mr. Owens will assume responsibility for overseeing CIT's sales organization across all of the company's business units, effective immediately. He will report directly to Jeffrey M. Peek, Chairman and Chief Executive Officer.

"We are pleased to have Walter Owens lead our efforts to further build a sales and growth culture that matches the unrivaled excellence of our risk and credit culture," Mr. Peek said. "Walter brings a solid understanding of the marketplace and substantial experience in building market share and presence. He also possesses the credibility and experience to work in partnership with our business leaders to formulate strategic sales plans that achieve our goals for growth."

"I am excited to join CIT, a proven industry leader that is committed to re-energizing its focus on building long-term, profitable relationships with its customers," Mr. Owens said. "I look forward to working with and across CIT's businesses to help build a market-focused, best-in-class sales organization."

Mr. Owens recently served as Chief Marketing Officer for GE Commercial Finance where he was responsible for executing growth strategies for existing and new products and markets. Prior to this assignment, Mr. Owens held a number of key roles at GE including leading the Heller integration for its GE Corporate Finance Services unit, as Managing Director of Global Securitization for GE Capital Market Services and as Managing Director and General Manager of GE Small Enterprise Services.

Before joining GE, Mr. Owens served as Vice President at Citibank's

Corporate Policy & Advisory Group from 1990 to 1992. He began his career in 1982 where he held a number of positions at Deloitte, Haskins and Sells in the Accounting and Auditing Services Division. He holds an M.B.A. from New York University and a B.S. from Villanova University. Additionally, he is a Certified Public Accountant (CPA).

About CIT

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has nearly $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and component of the S&P 500, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. CIT, with its principal offices in Livingston, New Jersey and New York City, has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit

### Press Release ######################

----------------------------------------------------------------

Beige Report: The Fed Says All Is Well, or Mostly So

http://www.nytimes.com/2005/03/10/business/10econ.html?pagewanted=all

Fed report: economic activity is expanding moderately: The nation's employment climate improved, stores rang up sales and factories boosted production last month, fresh signs the economy is chugging ahead at a respectable pace.

Summary of Beige Report:

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/default.htm

Report by District:

Boston

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/1.htm

New York

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/2.htm

Philadelphia

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/3.htm

Cleveland

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/4.htm

Richmond

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/5.htm

Atlanta

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/6.htm

Chicago

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/7.htm

St. Louis

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/8.htm

Minneapolis

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/9.htm

Kansas City

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/10.htm

Dallas

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/11.htm

San Francisco

http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/12.htm

Full Report: http://federalreserve.gov/FOMC/BeigeBook/2005/20050309/FullReport.htm

------------------------------------------------------------------

|

|

News Briefs---

Senate Delays Action on Bankruptcy

http://www.washingtonpost.com/wp-dyn/articles/A21147-2005Mar9.html

Bankruptcy rules soon could get tougher

http://www.usatoday.com/money/companies/

2005-03-09-bankruptcy-usat_x.htm

Oil Prices Briefly Rise Over $55 on Demand

http://apnews.myway.com/article/20050310/D88NSEIG1.html

Dollar Spins to 2-Month Low Vs Euro

http://www.washingtonpost.com/wp-dyn/articles/A22414-2005Mar10.html

Doubts Creeping Into Market's Rosy Outlook--ABSnet

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/.htm

William Clay Ford Sr. to retire from Ford Motor board

http://www.usatoday.com/money/autos/2005-03-09-

william-clay-ford-sr-retires_x.htm

To recap, Janay, Amanda, Travis and Nikko were eliminated.

http://www.tvrules.net/modules.php?name=News&file=article&sid=7491

The cast before elimination Wednesday

http://www.idolonfox.com/contestants/

Castine's 'Idol' exit no shock to viewers

http://www.ajc.com/news/content/metro/gwinnett/0305/10idol.html

-----------------------------------------------------------------

“Gimme that Wine”

Wineries bank on robust glass

http://busjrnl.com/htmlos/002235.1.1949251989681273408

In search of the all- important ‘terroir,' Jeff Cohn and Rosenblum Cellars comb California for extraordinary vineyard fruit

http://msnbc.msn.com/id/7129396/

Calistoga spurns 'Mondavi Highway'

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/20050309/

NEWS/503090303/1033/NEWS01

Sparkling wine sales jump 5.2%

http://busjrnl.com/htmlos/002235.3.2429944252481273408

March 08, 2005 06:02 AM US Pacific Timezone

Elvis Rocks the Wine Charts -- Hottest Small Brand of the Year; Wine Business Monthly Magazine Honors Graceland Cellars

http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=

news_view&newsId=20050308005587&newsLang=en

-----------------------------------------------------------------

This Day in American History

1776- Charleston,S.C., set up an independent government under a temporary local constitution that was to be in effect until an agreement with England could be reached. John Rutledge was chosen president. This government, said to be the first independent government within the recognized borders of the colonies, successfully defended Charleston against the British army and fleet on June 28, 1776, thus freeing the South from attack for nearly three years . Culture was also flourishing here and New York City, Philadelphia, Boston, but most of all in Charleston. In the mid-eighteenth century musical concerts were flourishing in the colonial centers, and musical societies, music dealers, and instrument makers all benefited. the first music society in America was founded in Charleston, the St. Cecila Society in 1762. In Europe, Charleston was considered the chief cultural center of the colonies, and many artists, actors and musicians chose to settle there when they immigrated to America. Other cities could boast of cultural achievements as well. In Boston a group of gentlemen sponsored a concert in Faneui Hall as early as 1744, and in 1954 the first concern hall in Boston was opened by Gilbert Dubois. Philadelphia boasted four organ makers who produced spinets and virginals as well as organs. “In 1762, the women of Charleston founded the St. Cecila Society as a musical organization; however, by the 1840's, the society had become more of a cotillion club than an organization to provide quality music to the socially refined. The society held their largest ball annually during February (just before lent) in Hibernian Hall on Meeting Street. A contemporary remarked "the membership remains exclusive and its affairs somewhat secret." Even today, the club remains secretive and its historical records and membership lists remain off-limits to non-members.”

http://www.ego.net/us/sc/myr/history/riceles.htm

http://www.wrightgroup.net/proj_faneui.htm

1849-Besides being an attorney, Abraham Lincoln was an inventor, as on this day he received a patent for a device for “buoying vessels over shoals” by means of inflated cylinders.

1854-Hallie Quinn Brown, women's right activist, born Pittsburgh, PA.

http://voices.cla.umn.edu/authors/BROWNhallie.html

http://docsouth.dsi.internet2.edu/neh/brownhal/brownhal.html

1862-The first paper money was issued in the US on this date in 1862. The denominations were $5 (Hamilton), $10 (Lincoln and $20 (Liberty).

1864-Gen. Ulysses S. Grant was made general in chief by Pres. Lincoln, replacing Gen. Henry W. Halleck.

http://www.mscomm.com/~ulysses/

http://memory.loc.gov/cgi-bin/ampage?collId=mcc&fileName=017/

page.db&recNum=0&itemLink=D?mcc:4:./temp/~ammem_pRfu::

http://memory.loc.gov/ammem/cwphtml/cwgrant.gif

1865- Battle of Monroe's Crossroads, North Carolina, one of the largest Calvary battles of the war between two flamboyant generals

http://www.cr.nps.gov/seac/cavclash.htm

http://www.cr.nps.gov/seac/mcattack.htm

http://www.bragg.army.mil/culturalresources/monroe's_crossroads.htm

http://www.kingwoodcable.com/tsalagi/alcwmb/archive/archivefiles/127.html

http://www.townofaberdeen.net/MalcolmBlue_FarmskillsFestival.htm

1867-American sociologist, founder of the Nery Street Settlement at New York City, Lillian D. Wald birthday. The Henry Street Settlement was the first nonsectarian public health nursing service. Born at Cincinnati, OH; died at Westport, CT, Sept. 1, 1940.

1876- Alexander Graham Bell transmitted the first telephone message to his assistant in the next room: “ Mr. Watson, come here, I want you,” at Cambridge, Massachusetts. Born at Edinburgh, Scotland, Bell acquired his interest in the transmission of sound from his father, Melville Bell, a teacher of the deaf. Bell's use of visual devices to teach articulation to the deaf contributed to the theory from which he derived the principle of the vibrating membrane used in the telephone. Bells other accomplishments include a refinement of Edison's phonograph, the first successful phonograph record and the audiometer.

http://memory.loc.gov/ammem/today/mar10.html

1880- Salvation Army Commissioner George Scott Rail ton and seven women officers landed at New York to officially begin the work of the Salvation Army in the United States.

1903-Playwright and politician Clare Booth Luce born at New York City. Luce wrote for and edited Vogue and Vanity Fair as well as writing plays, three of which were later adapted into motion pictures---The Women(1936), Kiss the Boys Goodbye(1938) and Margin of error(1939) She served in the US House of Representatives(1943-47) and as ambassador to Italy(1953-56)---the first woman appointed ambassador to a major country. Luce died Oct 9, 1987 at Washington, DC.

1903 –Birthday of legendary trumpet player Bix Beiderbecke.

http://www.redhotjazz.com/bix.html

http://www.jazzbymail.com/albums_rw/rwbix.html

http://www.citypaper.net/articles/020702/mus.cds1.shtml

1924- Guy Lombardo and the Royal Canadians made their first recordings at a session in Richmond, Indiana. Two songs were released on the Gennett label.

http://www.dotydocs.com/lombardo.htm

http://www.bigbandsandbignames.com/GuyLombardo.html

1924-Tenor sax/Trumpet player Bunny Williams born Magnolia, MS

http://www.alligator.com/artists/album.cfm?AlbumID=

al2803&ArtistID=036

1922-Dodge City, Kansas was buried under 17.5 inches of snow in 24 hours -- the city's biggest 24 hour snowfall on record

1933 -Major earthquake in Long Beach CA

http://www.scecdc.scec.org/longbeac.html

http://nisee.berkeley.edu/long_beach/long_beach.html

1935 - On Victor Records, Nelson Eddy recorded "Ah! Sweet Mystery of Life". The song was from the film, "Naughty Marietta". Later, Eddy recorded the song with Jeanette MacDonald.

1937 - An audience of 21,000 jitterbuggers crowded the Paramount Theatre in New York City to see the ‘King of Swing', Benny Goodman.

http://www.streetswing.com/histmain/z3jtrbg.htm

http://www.savoystyle.com/

1937- Canadian country singer Tommy Hunter was born in London, Ontario. Hunter joined CBC TV's "Country Hoedown" in 1956 as rhythm guitarist with King Ganam's Sons of the West. "The Tommy Hunter Show" succeeded "Country Hoedown" on the CBC network in 1965. It became one of the most popular TV variety programs in the country, and received international exposure via The Nashville Network pay TV channel in the US. When the CBC cancelled "The Tommy Hunter Show" in 1992, it was the longest-running music show on any North American network. Hunter is known as "Canada's Country Gentleman," and has received several J no Awards as Canada's best male country singer.

http://www.fmsystems.net/index.html?frm-r-tommyhunterlink.html

1938 - Jezebel, directed by William Wyler, opened in United States theaters. The film starred Bette Davis, Henry Fonda, George Brent, and Fay Bainter. Davis won her second Oscar as a ruthless Southern belle who goes too far to make fiancé Fonda jealous. Bainter received a Best Supporting Actress Oscar, and the film was nominated for a Best Picture Oscar. Bette Davis starred in a series of acclaimed films that won her Best Actress nominations for five consecutive years: Jezebel (1938), Dark Victory(1939), The Letter (1940), The Little Foxes (1941), and Now, Voyager (1942). In 1950, she won the New York Film Critics' Best Actress Award for her stunning performance as actress Margo Channing in All About Eve. Her career tapered off in the late 1950s but revived in 1962 with her leading role in Whatever Happened to Baby Jane?”. She spent most of the 1970s doing television work until cancer forced her to slow down. In 1977, she became the first woman to receive the American Film Institute's Life Achievement Award, and her filmography includes more than 80 works. She wrote two autobiographies, The Lonely Life in 1962 and This 'N' That in 1987, and has been the subject of many biographies. She died of cancer in 1989.

1938 - The day: the 10th of the month. The movies being celebrated were for the year 1937, whose numbers add up to 10 (1+9, 3+7); and it was the 10th Annual Academy Awards. We wonder if these winners were superstitious or had some reason to think that the number 10 was lucky. Two awards were won by "The Life of Emile Zola", a Warner Bros. movie, produced by Henry Blanke, Best Picture honors and Best Actor in a Supporting Role to Joseph Schildkraut. Other lucky recipients of the coveted prize awarded by the Academy of Motion Picture Arts and Sciences at Los Angeles' Biltmore Hotel were Leo McCarey as Best Director for "The Awful Truth"; Spencer Tracy for his Best Actor role (Manuel) in "Captains Courageous"; Luise Rainer for her Best Actress role (O-Lan) in "The Good Earth"; Alice Brady as the Best Actress in a Supporting Role (Molly O'Leary "In Old Chicago") and Harry Owens for his Best Music/Song, "Sweet Leilani" from "Waikiki Wedding".

http://www.infoplease.com/ipa/A0148062.html

1939 - The Little Princess, starring Shirley Temple and based on Frances Hodgson Burnett's novel, opened in United States theaters.

1940- Dean Torrance of the surfing music duo of Jan and Dean was born in Los Angeles. He went to the same high school I did, University High School in Los Angeles. He really was a “surfer.” In 1959, Dean and Jan Berry had their first top-ten hit, "Baby Talk," which was arranged by the then-unknown Herb Alpert. Their biggest success came in 1963 with the number-one song "Surf City," written by Brian Wilson of the Beach Boys. In 1966, Jan Berry suffered brain damage when his car rammed into a parked truck in Los Angeles. That ended Jan and Dean's career, although they have performed together occasionally since Berry's recovery in 1973. Dean Torrance turned to designing album covers as head of Kitty Hawk Graphics in Hollywood.

http://www.jananddean.com/

http://www.jananddeanstory.com/

1941 - The Brooklyn Dodgers announced their players would wear batting helmets for the 1941 season. General Manager Larry McPhail correctly predicted all baseball players would wear the new devices soon

1944-vibraphone player David Friedman born New York City

http://www.dmprecords.com/CD-503.htm

1945 - 300 United States B-29 bombers devastated Japan's capital in what became known as the Great Tokyo Air Raid in World War II. The firestorm they created killed 100,000 people.

http://www.cafb29b24.org/history-b29.shtml

http://history.independence.co.jp/ww2/eng/phtop.html

http://www.smh.com.au/articles/2002/04/11/1018333400535.html

1948 -- Zelda Fitzgerald and eight other women killed in sanitarium fire in Asheville, North Carolina. Trapped on the third story, she dies at 48. . Both she and her husband were alcoholics, which affected her earlier than it did F. Scott. ( here is corroboration of the date, but go back to the beginning and read the chronological series of her life to better understand their “condition.” Simply put: Once you become a pickle, you can't go back to being a cucumber.

http://www.zeldafitzgerald.com/chronology/chronology_30.asp

More information of Zelda Fitzgerald

http://www.sc.edu/fitzgerald/zeldabib.html

http://www.poprocks.com/zelda.htm

http://www.alabamatravel.org/central/szfm.html

http://www.zeldafitzgerald.com/chronology/chronology_30.asp

1949—Top Hits

Far Away Places - Margaret Whiting

Powder Your Face with Sunshine - Evelyn Knight

Galway Bay - Bing Crosby

Don't Rob Another Man's Castle - Eddy Arnold

1956 - Louisa May Alcott's popular novel, Little Women, was again adapted for the screen, and opened in movie theaters on this date. This version starred June Allyson, Peter Lawford, Margaret O'Brien, Elizabeth Taylor, Janet Leigh, Rossano Brazzi, and Mary Astor. The film won an Oscar for Best Art Direction-Set Decoration, Color (1949).

1957—Top Hits

Young Love - Tab Hunter

Young Love - Sonny James

Round and Round - Perry Como

There You Go - Johnny Cash

1959 - Tennessee William's play "Sweet Bird of Youth", opened at the Martin Beck Theatre in New York City, starring Geraldine Page, Paul Newman, Rip Torn and Diana Hyland. Critics called Page “fabulous” and said Newman was “the perfect companion piece.”

1959- Elvis Presley's "I Need Your Love Tonight" backed with "A Fool Such as I" is released on RCA Records. The following day, based on advanced orders for the disco totaling nearly one million, RCA ships a gold record for the platter to Elvis, who is stationed in Germany.

1960 -a heavy snowstorm left 10 inches in Georgia, 22 inches in Tennessee, 24 inches in Kentucky and 15 inches in Virginia. Many buildings collapsed from the weight of the snow.

1961- Twenty-two year old songwriter Jeff Barry whose "Tell Laura I Love Her" was a Top Ten hit for Ray Peterson, signs an exclusive writing and recording deal with Trinity Music. In 1962, he hooks up with Phil Spector and Shadow Moaton, and with his new wife Ellie Greenwich, they start cranking out the hits. They include "Da Doo Ron Ron" and "Then He Kissed Me" (Crystals), "Be My Baby" (Ronettes), "Chapel of Love" (Dixie Cups), "Do Wah Diddy" (Manfred Mann), "Leader of the Pack" (Shangri-Las) "River Deep , Mountain High" (Ike and Tina Turner), "Hanky Panky" (Tommy James) and "Cherry Cherry" (Neil Diamond).

1965—Top Hits

My Girl - The Temptations

The Jolly Green Giant - The Kingsmen

Eight Days a Week - The Beatles

I've Got a Tiger by the Tail - Buck Owens

1965 - Walter Matthau and Art Carney opened in one of Neil Simon's greatest theatrical triumphs, "The Odd Couple"; which would also become a television hit starring Tony Randall as the tidy Felix Ungar and Jack Klugman as slovenly sportswriter, Oscar Madison.

1965-Heather Farr, golfer born at Phoenix, AZ. Farr was an outstanding amateur golfer and a promising member of the LPGA tour when she was stricken with breast cancer in 1988. Radical treatment allowed her to fight the disease with great courage for five years without losing her spirit or sense of humor. In Farr's honor, the LGPA annually present the Heather Farr Player Award to the golfer, “who, through her hard work, dedication, and love of the game of golf, has demonstrated determination, perseverance and spirit in fulfilling her goals as a player.” Died November 20,1993.

http://www.grayhawkgolfclub.com/heather.html

http://www.lpga.com/utility/index.cfm?cont_id=134225

1968 -- César Chávez breaks his fast at a mass in Delano's public park with 4,000 supporters at his side, including Senator Robert Kennedy.

http://www.sfsu.edu/~cecipp/cesar_chavez/achieve.htm

1969 - James Earl Ray was sentenced in Memphis, Tennessee, to 99 years in prison for the murder of Martin Luther King Jr. in April 1968. The King family believes he is not the one who pulled the trigger.

1973—Top Hits

Killing Me Softly with His Song - Roberta Flack

Dueling Banjos - Eric Weissberg & Steve Mandell

Love Train - O'Jays

'Till I Get It Right - Tammy Wynette

1977- Pink Floyd's album "Animals" was certified platinum - one million copies sold - in the US.

1978-“The Incredible Hulk” premieres on TV. A wonderfully campy action series based on the popular Marvel comic books as well as a modern-day Jekyll and Hyde story. Bill Bixby played the erudite scientist, Dr. David Banner, who accidentally exposed himself to a gamma radiation. When provoked, Banner metamorphosed into the shirt-shredding, body-baring, green-skin, snarling Neanderthal Hulk. The 6'5” 275-lb former Mr. Universe, Louis Ferrigno, played the largely non-speaking part of the Hulk.

1978- The Bee Gee's "Night Fever" moves into the #1 spot on the chart. It replaces another Gibb Brothers tune, "Stayin' Alive."

1981-New Denver Broncos owners Edgar F. Kaiser, Jr., named Dallas Cowboys offensive coordinator Dan Reeves head coach. In 12 seasons, Reeves too the Broncos to three Super Bowls and compiled a 117-79-1 record.

1981—Top Hits

I Love a Rainy Night - Eddie Rabbitt

9 to 5 - Dolly Parton

Keep on Loving You - REO Speedwagon

Do You Love as Good as You Look - The Bellamy Brothers

1982- known as the Jupiter effect, the much-talked-about and sometimes-feared planetary configuration of a semi-alignment of the planets on the same side of the sun occurred on this date without causing any of the disasters or unusual natural phenomena that some had predicted.

1985 - The Dallas Mavericks' Dick Motta became the fourth coach in the National Basketball Association to win 700 games as the Mavs beat the New Jersey Nets 126- 113. The three other coaches in NBA history to have that many wins were: Red Auerbach (938 games), Jack Ramsey (733 games) and Gene Shue (717).

1986-A Green Beret camp was overrun by about 2000 North Vietnamese troops after a 72-hour siege. About 200 U.S. and South Vietnamese troops were killed or captured at the Special Forces base in the Ashau Valley.

1986 -severe thunderstorms and tornadoes hit Indiana, Kentucky, and Ohio. A total of 19 tornadoes occurred. 3 of the tornadoes in Indiana reached F3 intensity (winds 158-206 mph). A densely populated subdivision of southeast Lexington, Kentucky was heavily damaged by a tornado. 20 people were injured and 900 homes were damaged or demolished. A very strong thunderstorm downburst hit the Cincinnati area. At the Greater Cincinnati airport, windows were blown out of the control tower, injuring the 6 controllers on duty. At Newport, Kentucky, 120 houses were destroyed from winds estimated from 100 to 140 mph.

1989—Top Hits

Lost in Your Eyes - Debbie Gibson

The Lover in Me - Sheena Easton

The Living Years - Mike & The Mechanics

I Still Believe in You - The Desert Rose Band

1989 –Thirty-four cities in the central and southwestern US reported record high temperatures for the date. The high of 85 degrees at Hanksville, Utah was a record for March and Pueblo, Colorado equaled their March record of 86 degrees. Hill City, Kansas warmed from a morning low of 30 degrees to an afternoon high of 89 degrees.

1990 - American Jennifer Capriati, at 13 years and 11 months, became the youngest player ever to reach the final of a professional tennis tournament, an event in Florida.

1993-Giants Hire a Woman PA Voice: The San Francisco Giants made baseball history by hiring Sherry Davis to be the team's public address announcer. Davis, a legal secretary, became the first woman PA voice in the major leagues after having done voice-over work since 1981.

1993- Michael Jackson, in a live TV interview with Oprah Winfrey, said he had an inherited disorder that causes skin pigmentation to fade. He denied altering most of his face, but did admit to minor cosmetic surgery. Jackson also said he finds the comfort in children and animals that he missed in a friendless, workaholic childhood. In the wake of Jackson's first solo interview in nearly a decade, sales of his "Dangerous" album, released 14 months earlier, skyrocketed

1995- Citing the labor unrest as the reason, former Chicago Bulls great Michael Jordan announces he is leaving baseball to return the NBA.

-----------------------------------------------------------------

Winter Poem

Warm Winter Brew

This is an easy thoughtful gift. Just put this poem with a packet of apple cider and tie on a cinnamon stick with a piece of raffia. Or use a packet of hot chocolate mix. What could be easier!

Warm Winter Brew |

|

Brrrrr! It's cold out today. |

|

|

I filled it with the whistling of birds, |

I packed it full of laughter so fine, |

|

|

I put in the sound of leaves rustling |

So sip and think of days to come. |

|

Try this. Take your spouse out to lunch, just the two of you, at least once a week. Make a Friday or Saturday date. And demonstrate your youth with a fun thought, just as above.

|

www.leasingnews.org |