![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Friday, May 3, 2019

Today's Leasing News Headlines

Bulletin Board Complaint May be Coming Next Week

Keeping a Deposit/Charging a Fee

By Christopher Menkin, Editor

Commitment to Lease or Make Loan Agreements

Often Have Full Disclosure

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads---Help Wanted

Centra Funding

Vermont Added to States Require Residual Notification

“Evergreen Clause”—The Danger of Automatic Renewal

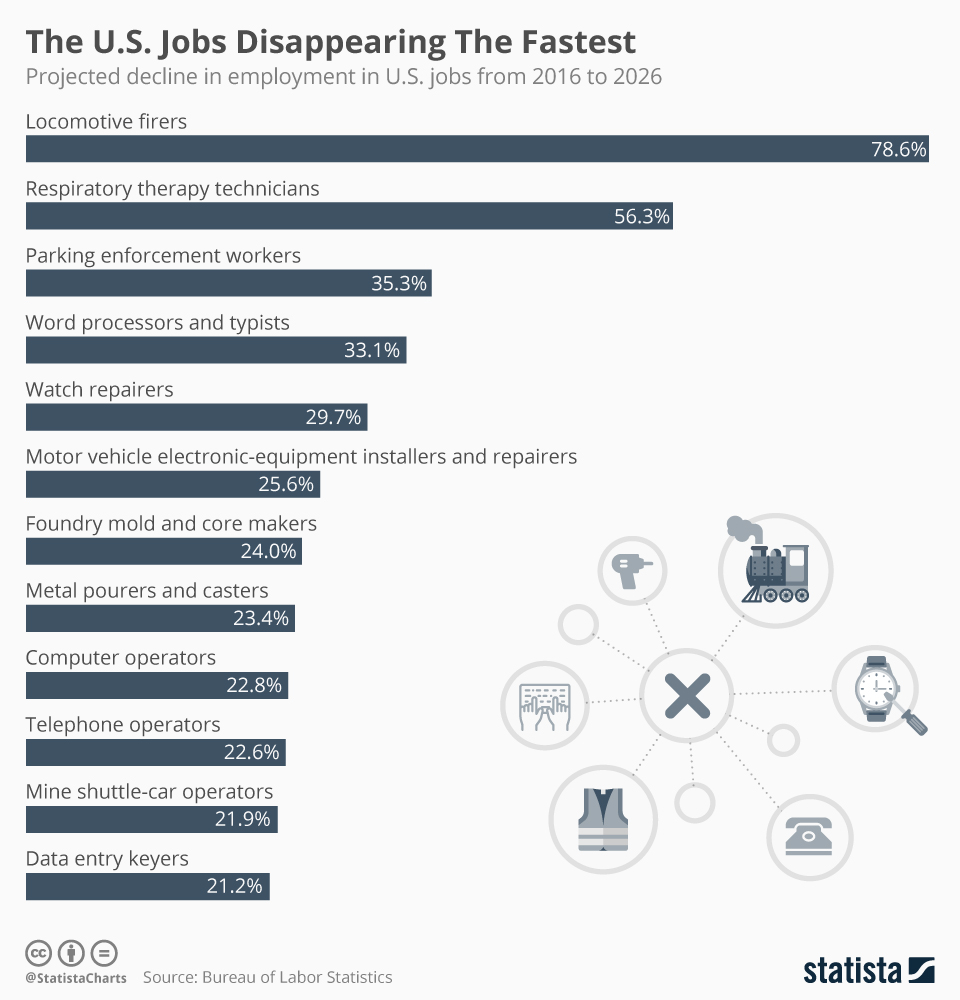

Chart: Which U.S. Jobs Are Disappearing Fastest?

By Niall McCarthy, Statista

North Mill Posts Record Originations for April

"Best Month in the Company's History"

Marlin Business Services reports $5.1 Million Net Income

Compared with Net Income of $6.2 Million a Year Ago

OnDeck 1st Quarter Down $8.1 Million

From Previous Quarter Net Income

Moorari K. Shar to Receive ELFA

2019 David H. Fenig Distinguished Service Advocacy Award

Under the Silver Lake/Her Smell

The Mule/Bumblebee/A Face in the Crowd

Film/Digital Reviews by Leasing News' Fernando Croce

Papillion Mix

Toronto, Ontario, Canada Adopt-a-Dog

deBanked Broker Fair Manhattan Monday May 6

Sold Out, Next Stop

News Briefs---

Struggling Subway closed more than

1,000 restaurants in 2018

CVS closing 46 stores:

See the list of struggling locations that are going away

A Busy Month for FinTech Funding

By Nathan DiCamillo, American Banker

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

50 Worst Product Flops of All Time

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Bulletin Board Complaint May be Coming Next Week

Keeping a Deposit/Charging a Fee

By Christopher Menkin, Editor

In this case which may be posted next week, the first complaint was settled after the applicant withdrew complaints they posted online. The complaint was made February 6, 2019, and after 53 emails and many telephone calls, the $4,000 refund was returned from a transaction that need not go through since November, 2018.

The above may be posted with the Southern California Leasing name as per policy posted on Leasing News website:

"Should a new complaint be posted, previous complaints that have not been posted, or removed as the matter has been satisfied, may be re-instated as per policy regarding the postings."

The second one that may trip the full telling of the first one, involves $5,150 in advance payments for a loan that did not go through, many email, telephone calls, LinkedIn messages with the "owner" of the leasing company, and the fact is the applicant is in business in Idaho.

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

"26-2503. FEES PROHIBITED UNTIL A LOAN IS MADE. No loan broker shall directly or indirectly receive any fee, interest or other charge of any nature until a loan or extension of credit is made or a written commitment to loan or extend credit is made by any person exempt under section 26-2502, Idaho Code.

[26-2503, added 1979, ch. 298, sec. 1, p. 781; am. 1992, ch. 28, sec.

1, p. 89.]

2

26-2504. FEES RECOVERABLE. A person damaged as a result of a violation of the provisions of this chapter may recover from the loan broker the amount of the fee thus paid, plus damages in the amount of twice the fee.

[26-2504"

In addition, the original "Term-Sheet" of January 15, 2019, states "The amount due is fully refundable..."

[headlines]

--------------------------------------------------------------

Commitment to Lease or Make Loan Agreements

Often Have Full Disclosure

In small and medium size leases, the actual lease payment is often given and calls for the first and last payment as well as the documentation fee. Often a clause contains a "documentation" fee is noted, along with a clause that it is non-refundable if the lease is not approved. Often the wording is different and seems to be buried. Sometimes it is quite obvious and is spelled out as a processing fee.

This form was developed by Attorney Ken Greene, who is also a longtime advisor to Leasing News. It is aimed at keeping fees for working on an application.He is currently General Counsel for the American Association of Commercial Finance Brokers (formerly the National Association of Equipment Leasing Brokers) and has spoken at conference panels.

Greene Agreement to Keep Expenses

http://leasingnews.org/PDF/GreeneAgreementExpenses2016.pdf

In larger ticket size leases, a form as this is often used, which specifically charges a fee to process the application:

Charges a Fee Form

http://leasingnews.org/PDF/ChargesFeeForm2016.pdf

Business Loans or "Working Capital" loan commitment letters are explicit. This is a form most often used by California License Finance Lenders:

Authorization to Find Lender

http://leasingnews.org/PDF/ChargesFeeForm2016.pdf

The dollar size of the lease proposal often dictates the details and length of the commitment letter.

This form is one of the most widely used in the leasing industry for leases $50,000 and above and covers most of the bases. Note: Last sentences about the signatures makes this more a “proposal,” than commitment. If required, these sentences may be removed.

Lease Commitment Agreement

http://leasingnews.org/PDF/LeaseCommittmentAgreement2016.pdf

It is a good idea to have the form you use reviewed by an attorney with equipment leasing experience. This does not mean your college friend who became a lawyer. You wouldn't take your children to an Endodontist to get braces on their teeth, although the practitioner is a "dentist." The same with going to an attorney. You go to a specialist who has experience in the leasing and finance industry.

Some things to consider in your form.

#1: ACH---If you are going to require it or may require it, you should have this spelled out in the agreement. If not in the contract and becomes a requirement of the lease, the proposal is invalid.

#2 Date---It is a good idea to have a time period involved. This can be based on completion of all the documents and/or lease contracts. The time factor may be important, particularly if the matter goes to small claims court, or a higher court, depending on the money involved.

(Attorneys most likely will have different opinions on this, but it is important to let the applicant know there is a time frame involved in conducting credit or having to re-do credit and even ask for more current financial information, due to the time involved in collecting what you originally required.)

#3 Personal guarantees---of all officers who own 10% or more of a privately held corporation. (This will protect if the final approval comes in with terms and conditions but requires other guarantors who are not named on the application or in the proposal.)

Ken Greene

Law Offices of Kenneth Charles Greene

5743 Corsa Avenue Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

Skype: 424.235.1658

ken@kengreenelaw.com

kenlaw100@gmail.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Shawn Arnone was promoted to Senior Vice President, Key Equipment Finance, Superior, Colorado. He is based in Fort Lee, New Jersey. He joined the firm May, 2015 as Vice President of Sales, Technology Finance; promoted January, 2018, Senior Vice President, Technology Finance. Previously he was Chief Originations Officer at Century Tokyo Leasing (USA) Inc. (May, 2014 - January, 2015). Senior Vice President, RBS Citizens Asset Finance (July, 2013 – May, 2014); Senior Vice President, Originations, EverBank Commercial Finance (October, 2008 - March, 2013); Vice President of Sales, Direct Capital Corporation, (August, 2009 - September, 2010); Senior Vice President, EverBank Commercial Finance (f.k.a.) Tygris Vendor Finance) (October, 2008 – February, 2009); Senior Vice President, Global Business Development, The CIT Group (March, 2005 – October, 2008); Vice President, Key Equipment Finance (March, 2001 – March, 2005); Senior Program Manager, Citigroup Equipment Finance (March, 2000 – March, 2000); Major Account Executive, Canon Business Solutions (March, 1997 – March, 2001); Program Manager, Canon Financial Services, Inc. (March, 1997 – March, 2000); Regional Sales Manager, Sequa Credit Corporation (1991 – 1993). Education: City University of New York-Baruch College - Zicklin School of Business, MBA, Finance & Strategic Management (2001 – 2003); St. Peter's University, Marketing (1986 – 1989). North Bergen (1982 – 1986). https://www.linkedin.com/in/sarnone/

Tim Evenson was promoted to Global Sales Leader, Value-Base Care at IBM Watson Healthcare, Greater Seattle Area. He joined the first February, 2018 as Client Executive. Previously,, he was Director of Sales, Americas for Microsoft Financing, Microsoft (February, 2016 - February, 2018), He was hired October, 2013, as Director of Marketing for Philips Health Systems, North America; promoted May, 2014, Region Sales Leader. Prior, he was at Philips Medical Capital, starting September, 2002, as Director, Finance Marketing; promoted November, 2003, VP Sales & Marketing; Global Account Executive, Dell Financial Services (October, 1998 - September, 2002); Leverage Lease Pricing Analyst, GE Capital Corporation, Business Asset Funding (January, 1997 - October, 1998). He joined NCR Credit Corporation/AT&T Capital Corporation, 1998, as Credit Analyst, Financial Services Executive; promoted, January, 1990, Area Sales Manager. Volunteer: MBA Student Mentor, University of Washington. Foster School of Business (September, 2005 - Present). Volunteer and Project Lead for Philips Healthcare, Seattle King County Clinic (SKCC) (October, 2014 - Present.). Education: Thunderbird School for Global Management, MBA, International Finance, Spanish (1987); University of Nebraska-Lincoln, B.S., Economics (1981 - 1985). Papillion Las Vista High School (1978 - 1981).

Activates and Societies: National Honor Society. Varsity Basketball. https://www.linkedin.com/in/tim-evenson/

Joseph Flavin was hired as Financial Solutions Consultant, Technology Finance Corporation, Scottsdale, Arizona. He is located in the Greater Philadelphia Area. Previously, he was Sr. Account Executive, Presidio Technology Capital, LLC (June, 2000 - March, 2019); Client Manager, CIT Technology Finance (April, 2007 - June, 2008); Client Sales Manager, CitiCapital Vendor Finance (September, 2003 - April, 2007); Account Executive, De Lage Landen Financial Services (1985 - 1988); Leasing Support, Master Lease (1985 - 1988). Education: Saint Joseph University. Business. (1983 - 1985).

https://www.linkedin.com/in/joseph-flavin-4688a9b/

Benjamin Hall was promoted to Senior Counsel, Key Equipment Finance, Superior, Colorado. He joined the firm 2004 as Compliance Analyst; promoted January, 2008, Audit Services Director; promoted August, 2011, Contracts Administration Manager; promoted to Key Government Finance, March, 2015, Vice President, Originations; promoted back to Key Equipment Finance as Associate Counsel, January, 2016. Education: University of Colorado, Colorado Springs, Juris Doctor, Law (2003 - 2006); University of Colorado Springs, MBA, Finance, International Business (2000 - 2003). Named the Outstanding Graduate in International Business. Colorado Christian University, BS, Information Systems Manager (1998 - 2000). https://www.linkedin.com/in/benjamin-hall-181a7610/

Bob Hyndman was promoted to SBA Loan & Equipment Lease Processor, Business Finance Depot, Mount Dora, Florida. He is located in Nashville, Tennessee. He joined the company in August, 2018. Prior, he spent 17 years with John Winchester at ComCo Equipment Finance. He was Partner, Dark Wings Publishing (2012). He was the owner of Vista Equipment Finance (December, 2007). Education: UT Nashville.

https://www.linkedin.com/in/bob-hyndman-8182b411/

Jennifer Martin was promoted to Vice President, Leasing and Vendor Program Support, Key Equipment Finance. She joined the firm 1995 as Originations Manager; promoted August, 2013, Senior Project Manager; promoted Senior Product Owner, November, 2013; promoted VP, Vendor Program Development and Originations Control, June, 2014; promoted April, 2018, VP, Originations. Certified Six Sigma Green Belt (May, 2014 - Present). Communications Chair for the Key4 Women Capital Region Steering Committee (February, 2007 - February, 2014). Board Member, Duanesburg Area Community Center (2010 – 2010).Languages: Sign Languages. Duanesburg Heat AAU basketball, Founder, Treasurer (March 2012 – Present). Additional Organizations: Twin Rivers Council; Boy Scouts of America Duanesburg Little League. College at St. Rose. Psychology (2001 – 2003), South Colonie (1987 – 1991). https://www.linkedin.com/in/jenmartinkef/

Victor Munoz was hired as Vice President, Logistics Finance, Capital Equipment Finance, CIT, Miami/Fort Lauderdale Area. Prior, he was Regional Manager, Meridian Leasing Corporation (March, 2011 - March, 2019); Vice President, U.S. Bank Equipment Finance, Technology Finance Group (September, 1999 - February, 2011). Volunteer: Board Member, Director of Interactive Leasing, HFMA Florida Chapter (May, 2015). Education: California State University, San Bernardino, College of Business and Public Administration, Bachelors of Science, Finance and International Business (1992 - 1997). Activities and Societies: Financial Management Association, Sigma Chi Fraternity, Student Body Council. https://www.linkedin.com/in/smartinfrastructure/

Dale Newman was hired as Equipment Finance Specialist, Division at ENGS Commercial Finance Co. (a sub. of Mitsubishi UFJ Lease and Finance, Itasca, Illinois. He is based in Seal Beach, California. Previously, he was Financial Area Manager, Hewlett Packard Enterprise Financial Services (2015 - 2018); West Regional Manager, NEC Financial Services, LLC (2004 - 2015); Business Development Manager, American Express Business Finance (2033 - 2004); West Regional Manager, Herman Miller Capital, Key Equipment Finance (1999 - 2001); Various positions including National Strategic Accounts Manager and Healthcare Finance Manager, De Lage Landen/Tokai Financial Services (1986 - 1998). Education: University of Utah, Organizational Communications (1985). Dixie State University, Finance (1982). https://www.linkedin.com/in/dalegnewman/

Joshua Parrish was hired as Business Development, Vendor Programs & Business Funding Solutions, SLIM Capital, LLC, Beverly Hills, Orange County, California. He is based in Walnut Creek, California. Previously, he was Manager, Strategic Partnerships, Currency (October, 2015 - January, 2019); Sales Manager, Balboa Capital (April, 2013 - October, 2015); Outside Sales Executive, Central Payment (October, 2012 - April, 2013); Owner, S&J Painting Service (September, 2011 - 2012); Regional Account Executive, Reply.com (January, 2010 - July, 2011); Account Executive, Weedman (January, 2006 - July, 2009). Education: Lord Fairfax Community College. Associate of Arts (AA), Political Science and Government (2006 - 2008).

https://www.linkedin.com/in/joshua-parrish-7825a987/

Heather Patrick was hired as Business Development Manager, Ampil, Austin, Texas. Previously, she was Global Vendor Program Manager, CSI Leasing, Inc. (November, 2014 - March, 2019_; Higher Education, Sr. Account Executive, Apple (December, 2004 - November, 2014); Client Service Supervisor/Onsite Manager, Dell Computer (November, 2002 - September, 2004); Technical/Biotech On-site Manager; Business Development Manager/Project Manager, Genentech (June, 2000 - August, 2001). Licenses: Series 6, 63, and 7. Volunteer: March of Dimes (January, 2018 - Present). Education: University of North Texas. Business Finance, Business and Personal/Financial Services Marketing, Operations (1995 - 1998). Activities and Societies: Volleyball. https://www.linkedin.com/in/hpatrick/

Gary Raffensberger was promoted to Director of Operations, Business Finance Depot, Mount Dora, Florida. He joined the firm as an Agent, February, 2017. He previously was National Accounts Manager, First Financial Leasing & Finance, joining the firm January, 2006. Education: William Penn High School (1970 - 1973). Activities and Societies: Photography, Sports.

https://www.linkedin.com/in/gary-raffensberger-07762b39/

Meaghan (Sheeran) Sliwowski was hired as Broker Relationship Manager, Targeted Lease Capital, LLC., Williamsville, New York. Previously, she was Assistant Vice President of Broker Relations, Blue Bridge Financial, LLC (September, 2015 - March, 2019); Credit Manager, Bluebridge Financial Services (February, 2014 - August, 2015). She started at First Niagara Bank, January, 2009, as Business Development Officer; promoted March, 2010, Small Business Portfolio Underwriter II, Banking Officer; Corporate Sales Officer, HSBC (January, 2006 - January, 2009). Education: Niagara University, MBA, Master in Business Administration (2006 - 2008); Niagara University, MA, Master in Elementary Education (2001 - 2002); Syracuse University, Maxwell School. BA, International Relations/Political Science. Lewiston Porter. https://www.linkedin.com/in/meaghan-sliwowski-a6786413/

Shannon Smith, CLFP, was promoted to Chief Credit Officer, KLC Financial, Minnetonka, Minnesota. He joined the firm as Credit Manager, January, 2008' Promoted January, 2017, Vice President, Credit & Operations. Previously, he was Underwriter Wells Fargo (September, 2008 - January, 2008); Branch Lending Manager, TCF Bank (June, 2002 - September, 2005). Education: Saint John's University, BA, Accounting Major (1998-2002).

https://www.linkedin.com/in/shannon-smith-clfp-806a312/

Justin Tabone was hired as SVP Originations, Vendor Equipment Finance, TIAA Commercial Finance, Parsippany, New Jersey. He previously was at TIAA Bank as Vice President, Originations, Healthcare (June, 2018 - March, 2019); EverBank Commercial Finance he joined July, 2008 as Vice President, Business Development, Healthcare; promoted, December, 2013, Vice President Originations, Healthcare. Prior, he was Vice President Strategic Account Group, MarCap Corporation (March, 2004 - June, 2008); Regional Sales Manager, DVI Financial Services (July, 1988 - October, 2003); Bank Officer, Key Private Bank, KeyBank (October, 1995 - June, 1998). Education: Boston University, BA, International Relations (1990 - 1994). https://www.linkedin.com/in/justin-tabone-786a346/

Todd Waller was hired as Business Development Officer, CoreFund Capital, Weatherford, Texas. He is located in Santa Ana, California. He began his career at Orange Commercial Credit September, 2005, Collections; promoted December, 2005, Account Executive; promoted June, 2010, Account Executive Supervisor; promoted National Sales Director, December, 2010. Education: California State University, Fullerton. BA, Business/Economics (2003 - 2005).

https://www.linkedin.com/in/todd-waller/

Tina Vang was hired as Post Closer, Sovereign Lending Group, Incorporated, Costa Mesa, California. Previously, she was Funding Manager, Anuva Capital (March, 2018); Funder, Partners Capital Group (February, 2018 - March, 2019). She joined CarFinance Capital, February, 2014 as Loan Servicing Specialist; promoted January, 2015, Jr. Funder; promoted May, 2015, Funding Analyst. Education: Savanna High School (2004 -2008). https://www.linkedin.com/in/tina-vang-aa426789/

[headlines]

--------------------------------------------------------------

Help Wanted

[headlines]

--------------------------------------------------------------

“Evergreen Clause”—The Danger of Automatic Renewal

The inclusion of automatic renewal (or “evergreen”) clauses in true leases has been a fairly common practice from time immemorial. It is included in most company leasing contracts, whether "fair market value," 10%options, or even $1.00 (Yes, companies will continue payments if not notified and there have been several cases where the residual is $1.00)

There is no question that these clauses provide important protections to the lessor to obtain their residual. If the lessee has no intent to renew, the lessor has in interest in knowing it before the end of the term so that he can start planning for remarketing or some other disposition of the equipment.

However, the question of whether a lessee should be reminded by the lessor of the notice deadline in plenty of time for the lessee to react is an entirely different question. These states have statutes requiring commercial equipment lessors to provide a written notice – a fair warning – before the notice deadline date arrives:

This is an unofficial list:

Louisiana

New York

Rhode Island

Texas

Vermont

Wisconsin

Most of the abuses occur in the small-ticket world. Larger lessees often overlook the notification clause in the contract or do not have “tickler” systems to remind them. Consider the corner dry-cleaner. He signs up for a five year lease in 2014. Does he mark it 90 days before the expiration in his computer calendar for 2019, or more important, did he overlook this as the residual is 10% or a $1.00. And the more apt question is: What possible interest does a lessor have in not voluntarily reminding its customer of the notice deadline – unless it’s to create a chance that the lessee will slip up and get trapped in a renewal it does not want?

Companies who utilize Evergreen Clauses

for Extra Lease Payments

These companies use language in their lease documents regarding purchase options to confuse, perhaps to deceive, resulting in an automatic continuation for an additional twelve months of payments. Often they win transactions with lower monthly payments as the lessee does not carefully read and prepare for the end-of-lease notification requirement (many are on ACH payments).

Several have continuation of payments and the requirement of replacing the equipment for a new lease. Leasing News has had complaints involving companies who invoke the twelve months on a $1.00 purchase option, as well as on an Equipment Finance Agreements.

Several have appeared in Leasing News "Complaints" Bulletin Board:

http://www.leasingnews.org/bulletin_board.htm

Additionally, Tom McCurnin has written often about Evergreen Clause court cases involving these companies.

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Two of the companies on this list do a lot of copier leasing, where it is reported manufacturers are now getting a piece of auto-renewals and as well as insisting that they be in the lease as a condition of the business. Leasing News has heard from a very reliable source that some copier manufacturers also give dealers 4-5 months’ notice of a discontinued model and agree to sell it to the dealer at 40% of list price, on the condition that the captive finance division not receive the business. Also buried in the contract on one is a one month rental return fee including an inspection fee at the location specified by lessor and at lessee’s return expense (often not the local dealer who supplied the copier).

Advice for Broker or Lessor

Dealing with a Company that Uses Evergreen Clauses

http://leasingnews.org/archives/Nov2013/11_18.htm#advice

ACC Capital, Midvale, Utah

Balboa Capital, Irvine, California

De Lage Landen, Wayne, Pennsylvania

IFC Credit, Morton Grove, Illinois

Jules and Associates, Los Angeles, California

LEAF Financial Group, Philadelphia, Pennsylvania

Marlin Business Leasing, Mount Laurel, New Jersey

Marquette Equipment Finance, Midvale, Utah

Mazuma Capital Corporation, Draper, Utah

Onset Financial, South Jordan, Utah

Pacific Western Equipment Finance, Cottonwood Heights, Utah

Republic Bank, Bountiful, Utah

Tetra Financial Group, Salt Lake City, Utah

ACC Capital, Midvale, Utah---This company is no longer in business, although its portfolio is being wound down, according to its owner Loni Lowder; the receivables are being collected by creditors. Lowder today is an employee, manager, Stalwart Contract Finance, Salt Lake City, Utah. All Evergreen Clause complaints have not been satisfied, but were when the company was active.

Balboa Capital, Irvine, California---This company had its first Bulletin Board Complaint in 2006. While a new president stated this was no longer the practice, recent bulletin Board Complaints demonstrate the practice continues.

http://leasingnews.org/archives/Dec2012/12_10.htm#bbc

http://leasingnews.org/archives/Mar2013/3_22.htm#bbc

De Lage Landen, Wayne, Pennsylvania -- $34,560 in lease payments were collected illegally, although the lease contract had an Evergreen clause that if the lessee did not notify in 90 days before expiration, the payments would continue. It appears this went on for almost three years. The purchase option was 10%.

What makes it even more shameless is a collection agency was involved after payments stopped, but wait, it gets worse: the lessee has settled with the funder and the funder's collection agency, but the lessor, who sold the lease to the funder, De Lage Landen (DLL,) remains in the suit as being party, or “in collusion,” with the Evergreen clause collection matter. The fact is the lessor was not directly involved in the collection of payments or received any remuneration, as well as the suit continues, now solely against the lessor.

http://leasingnews.org/archives/Nov2013/11_18.htm#dll

IFC Credit, Morton Grove, Illinois---This company is in bankruptcy, appeared many times in the Leasing News Bulletin Board prior to filing bankruptcy, but engaged in Evergreen Clauses, and unfortunately a recent example is a complaint to the trustee, stemming from M&T Bank lease assignment expiring and notify the lessee that they did not notify about the residual, which was a $1.00. This has happened many times with other banks who have taken over the IFC Credit Corporation portfolio. Calls and letters to the trustee and attorneys have gone unanswered. Bankruptcy was adjudicated in 2013, and it is believed most cases involving leases with funders are resolved.

Jules and Associates, Los Angeles, California--- Jules and Associates, Los Angeles, California---A repeat customer, who notified Jules and Associates on a lease, but was not before the 180 day expiration, so Jules and Associates instead of the 1% due for the residual ($2,308.79) charged six more payments or $40,463.94, and if 1% is not paid in this time, they will be subject to another three months.

http://leasingnews.org/archives/Aug2011/8_29.htm#jules

LEAF Financial Group, Philadelphia, Pennsylvania---It appears this company is in a more wind down phase, moving its operation of LEAF Commercial Credit with basically the same management. There have been complaints about the Evergreen Clause, including one this year for an Equipment Finance Agreement. Company merged into LEAF Commercial Capital and was sold to People's United Bank, Bridgeport, Connecticut.

Marlin Business Leasing, Mount Laurel, New Jersey---The actual SEC filings state the profit earned from Evergreen Clause, primarily from copier leases. Bulletin Board Complaints have been received about this practice in addition to the SEC financial statement filings. (9) Marlin Response to posting

Marquette Equipment Finance, Midvale, Utah --- According to Dorran Sampson, Vice-President/Broker Relations: "Marquette Equipment Finance does not offer an Evergreen product. Our master lease provides for extensions but is negotiated at the schedule level. Notice periods are also negotiated at the schedule level and vary depending on the Lessee’s needs."

When the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) he maintained the same position. It was noted his old company was still on the list, and a request of his "master lease" was made.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage."

A search of PACER, a national index for U.S. district, bankruptcy and appellate courts brought up a number of Marquette cases, and the first one hit pay dirt: Merchants & Farmers Bank, a Mississippi Corporation versus Marquette Equipment Finance and Applied Financial. It was a similar case and while "dismissed with prejudice" (6), it had the arguments regarding the purchase option and a copy of the complete contract with a similar PPR as with Mazuma Capital:

"(g) Lessee's Options at End of Initial Period. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor and Lessee have not agreed to either option (1) or (3) by the end of the Initial Period or if Lessee fails to give written notice of its option via certified mail at least one-hundred-eighty (180) days prior to the termination of the Initial Period, then option (2) shall apply at the end of the Initial Period. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at least ninety (90) days prior written notice of termination."

The first option is to purchase the equipment for a price to be determined by Lessor and Lessee and requires a certified letter 180 days prior. This sounds like a fair market purchase option, but the “price to be determined” language means that the Lessor can set any price it wants. This option is illusory in my opinion.

The second option is to continue the lease for an additional 12 months, the “Evergreen” period. No notice of this provision is given to the lessee either in advance of signing or prior to exercising this option. Republic Bank purchases these 12 month extensions in advance of their exercise. How would the bank know that the lessee is going to exercise this option, unless everyone knows it is the only practical option for the lessee to exercise? Republic Bank President Boyd Lindquist confirmed in a telephone call that he “buys” these extensions from Mazuma and has for quite some time.

The third option is to return the equipment, but the clause is draped with the condition that the lessee has to re-lease identical equipment for a similar term. It also has 180 day certified letter requirement, and applies to the second option of 12 months, but also has the clause of an automatic six month option. So what is the point of exercising this option? At the end of this re-lease, there would be the same three identical options, so the lessee would be required to re-lease and re-lease. It’s just like Groundhog Day.

Leasing News is working on obtaining information on other companies so named to add to the list, including follow-up on the master lease for Pacific Western Equipment Finance. If you have a copy, please send and will keep your name “off the record.”

((7) See for Copy of Filing, including contract.)

Mazuma Capital Corp, Draper, Utah Several routie "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) "8. The basic scheme involves the inclusion of a purchase, renewal, return (“PRR”) provision in the lease. The lessor assures the customer they will be able to purchase the equipment at the end of the initial term in the lease for a reasonable or nominal price. Often, the lessor promises the equipment can be purchased at a fixed percentage of the total amount financed. However, at the end of the initial lease term, the lessor refuses to honor the agreed upon purchase price or negotiate in good faith regarding a purchase price, but instead, insists the lease automatically renews for an additional term (usually twelve months).

9. The inclusion of the purchase and return options in the lease are entirely illusory and intended only to give the customer the false impression that it can exercise any of the three options at the end of the initial lease term, when in fact, the lessor will only allow an automatic renewal at the end of the initial lease term.) There are other exhibits. This case was settled "out of court."

(page 3)

H. Jared Belnap, past President & CEO, Mazuma Capital Corp., takes exception on beingon the Evergreen list. His full letter and Leasing News Response is at (5).

Onset Financial, South Jordan, Utah --- Onset contract, which contained:

“(Section 20:

n. Lessee's Options at Maturity of Base Period. At the maturity of the Base Period of any Lease, Lessee shall, provided at least one hundred fifty (150) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor end Lessee, (2) renew the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) terminate the Schedule and return the Properly to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 8f, 8g and 7d hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor end Lessee have not agreed to either option (1) or (3) by the maturity of the Base Period, or if Lessee fails to give written notice of Its option via certified mail at least one hundred fifty (150) days prior to the maturity of the Base Period, or if an Event of Default has occurred under any Lease, then option (2) shall apply at the maturity of the Base Period. At the maturity of the renewal period provided for In option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the maturity of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at best thirty (30) days prior written notice of termination." (3)

((8) See for Copy of Onset Contract with PPR purchase option.

Pacific Western Equipment Finance, Cottonwood Heights, Utah

Dorran Sampson, then Vice-President/Broker Relations, Marquette Equipment Finance, now Vice President Broker Relations Pacific Western Equipment Finance told Leasing News when the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) they maintained the same position as Marquette.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage.

Leasing News has obtained a copy of a Pacific Western Equipment Finance agreement, and confirms the same procedures as their former company Marquette utilized:

“14. LESSEE’S OPTIONS AT END OF INITIAL PERIOD.

At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee’s expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. IN THE EVENT LESSOR AND LESSEE HAVE NOT AGREED TO EITHER OPTION (1) OR (3) BY THE END OF THE INITIAL PERIOD OR IF LESSEE FAILS TO GIVE WRITTEN NOTICE OF ITS OPTION VIA CERTIFIED MAIL AT LEAST ONE-HUNDRED-EIGHTY (180) DAYS PRIOR TO THE TERMINATION OF THE INITIAL PERIOD, THEN OPTION (2) SHALL APPLY AT THE END OF THE INITIAL PERIOD. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six (6) month renewal period by either Lessor or Lessee giving to the other party at least thirty (30) days prior written notice of termination” (10) (Also see Marquette listing)

(10) http://leasingnews.org/PDF/PacificWesternEquipmentFinance.pdf

Pacific Western Bank Responds to Evergreen Non-Notification

http://leasingnews.org/archives/Mar2013/3_28.htm#pacwest

Republic Bank, Bountiful, Utah Purchases and participates in extended Evergreen clause agreements.

They are legal in all states, except four states require advance notification be given to the lessee regarding termination of the lease and its residual (Four states: New York Rhode Island, Texas, Illinois (In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)"

The bank is closed and it appears all cases have been resolved, according to pacer.gov.

Tetra Financial Group, Salt Lake City, Utah Several routine "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1)

“22. Mazuma Capital is associated with Republic Bank and obtains financing for its leases containing PRR provisions from Republic Bank.

23. Like what took place at Amplicon, Inc., the PRR scheme utilized by Matrix, Applied Financial, LLC, Mazuma Capital, Tetra Financial Group, LLC and others has begun to be exposed through litigation and negative press. See Deseret News (2) articles attached hereto as Exhibits B (2) and C. (3)”

Here is a case where New York courts threw out the Evergreen Clause as not legal in New York, even though venue appears to be Utah. (4))

(1) 36 main pdf

http://leasingnews.org/PDF/36main.pdf

(2) Deseret News

http://leasingnews.org/PDF/DeseretNewsarticle.pdf

(3) Exhibit C

http://leasingnews.org/PDF/ExhibitCDeseret.pdf

(4) Salon Management case

http://leasingnews.org/PDF/SalonManagement.pdf

(5) Mazuma Takes Exception on Being on Evergreen List

http://leasingnews.org/archives/Jul2012/7_30.htm#mazuma

(6) Order to Dismiss with Prejudice

http://leasingnews.org/PDF/Marquette_order_dismiss.pdf

(7) Copy of filing, including contract

http://leasingnews.org/PDF/Maquette.pdf

(8) Copy of Onset Contract with PPR purchase option

http://leasingnews.org/PDF/OnsetContract.pdf

(9) Marlin Response to posting.

http://leasingnews.org/archives/Jul2012/7_13.htm#response

Companies who notify lessee in advance of lease expiration

http://www.leasingnews.org/Pages/lease_expiration.html

[headlines]

-------------------------------------------------------------

A long list of U.S. jobs is being rendered obsolete by technological advancements and automation. Which workers are most at risk? According to the Bureau of Labor Statistics, locomotive firer is the job set to shrink the most over the coming decade. A locomotive firer is responsible for monitoring instruments on trains as well as watching for signals and dragging equipment. The workforce is small, numbering 1,200 in 2016. By 2026, however, that is going to decrease even further to just 300, a decline of 79 percent.

Respiratory therapy technicians are also set to see their ranks decimated by 2026 with the number of staff set to fall 56 percent. Parking enforcement workers are the third most endangered profession in America with their numbers expected to drop 35 percent by 2026.

By Niall McCarthy, Statista

https://www.statista.com/chart/9622/which-us-jobs-are-disappearing-fastest/

[headlines]

--------------------------------------------------------------

### Press Release ##############################

North Mill Posts Record Originations for April

"Best Month in the Company's History"

SOUTH NORWALK, CT – North Mill Equipment Finance LLC (“North Mill”), a leading independent commercial equipment lessor located in South Norwalk, Connecticut, announces record originations for April. It was the best month in the company’s history and the surge in volume is expected to continue as the year forges ahead.

David Lee, Chairman and CEO of North Mill, said, “This was a tremendous team effort across the board and everybody at the firm should be proud of how far we have come over the past year.

“We also will be closing on a new larger credit facility, giving us substantially greater funding capacity for our originations.”

The firm continues to stay ahead of the curve with respect to obtaining facilities necessary to fund this level of robust growth; March also was an exceptional month in overall volume as the company witnessed its average deal size and credit rating increase appreciably since last year.

“As a 100% broker-centric lender, we remain staunchly committed to the referral agents with whom we work each day,” Lee explained. “It’s them we have to thank for our healthy vital signs; the hundreds of business associates who have stood by us and continue to believe in what we do. They represent the lifeblood of our firm.”

About North Mill Equipment Finance

Headquartered in Norwalk, Connecticut, North Mill Equipment Finance originates and services small-ticket equipment leases and loans, ranging from $15,000 to $300,000 in value. A broker-centric private lender, the company handles A – D credit qualities and finances transactions for numerous asset categories including construction, transportation, vocational, manufacturing, and material handling equipment. North Mill is majority owned by an affiliate of Wafra Capital Partners, Inc. (WCP). For more information, visit www.nmef.com.

##### Press Release ############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Marlin Business Services reports $5.1 Million Net Income

Compared with Net Income of $6.2 Million a Year Ago

First Quarter Summary:

- Net Investment in Leases and Loans totaled $1.0 billion, up 9.9% from a year ago, and total managed assets ended the first quarter at $1.2 billion, up 19.1% from a year ago

- Total sourced origination volume of $208.4 million, up 27.1% year-over-year; Direct origination volume of $43.6 million, up 41.1% year-over-year

- Total origination yield of 12.76%, up 40 basis points from the prior quarter and up 32 basis points year-over-year

- Annualized net charge-offs of 1.83%, compared with 2.30% in the prior quarter and 1.68% in the first quarter last year

- Equity to assets ratio decreased to 16.17%, compared with 17.17% in the first quarter last year

Jeffrey A. Hilzinger, Marlin’s President and CEO, said, “We enjoyed a solid start to 2019 as strong execution delivered excellent origination volume growth and stable portfolio performance. First quarter total sourced origination volume was $208.4 million, up 27.1% year-over-year, and a record for a first quarter. Growth in the quarter was driven by increased customer demand for both our Equipment Finance and Working Capital Loan products and was strong in both our Direct and Indirect origination channels. We also referred or sold $56.5 million of leases and loans as part of our capital markets initiatives. Because of these origination and capital markets activities, our Net Investment in Leases and Loans is now consistently in excess of $1 billion and up 10% from a year ago. Total managed assets, which includes both our balance sheet portfolio and assets we sell but continue to service for others, grew to more than $1.2 billion, an increase of 19.1% from the first quarter last year. In addition, our focus on maintaining disciplined underwriting standards continues to be a top priority and portfolio performance during the quarter was stable and within expectations.”

Mr. Hilzinger concluded, “First quarter net income of $0.41 per diluted share was negatively impacted by $0.04 because of the timing of expense recognition due to the adoption of a new lease accounting standard. We expect the timing impact to normalize over the course of the year and we continue to expect earnings to be more heavily-weighted towards the second half of 2019, as our recent investments in our salesforce continue to generate returns. Importantly, we are affirming our previously issued earnings guidance for the full year.”

Full Press Release:

http://www.snl.com/Cache/c397779224.html

#### Press Release ##############################

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

OnDeck 1st Quarter Down $8.1 Million

From Previous Quarter Net Income

OnDeck announced first quarter net income of $5.9 million, compared to prior quarter's net income of $14.0 million. It was stated it was "OnDeck Originations Slide in First Quarter."

Noah Breslow, Chairman and Chief Executive Officer, said, "Our first quarter results reflect the continued execution of our strategy as we prudently grew the portfolio and maintained strong margins while investing in our strategic growth initiatives.

"These initiatives are gaining momentum as we closed our business combination with Evolocity Financial Group in Canada, grew ODX volume and advanced our equipment finance offering by insourcing key processes and starting to fund loans on our balance sheet. While the economic environment remains healthy, we continue to monitor customer and market trends and adjust our risk decisioning accordingly."

Full Press Release:

https://finance.yahoo.com/news/ondeck-reports-first-quarter-2019-110000063.html

##### Press Release ############################

|

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Moorari K. Shar to Receive ELFA

2019 David H. Fenig Distinguished Service Advocacy Award

Washington, D.C. – The Equipment Leasing and Finance Association (ELFA) has selected Moorari K. Shah, Counsel for Buckley LLP, to receive its 2019 David H. Fenig Distinguished Service in Advocacy Award. The award honors individuals who have made significant contributions to the association’s advocacy efforts to promote sound public policies for the equipment finance industry. Shah will be formally recognized during a ceremony at ELFA’s Capitol Connections event on Wednesday, May 15, in Washington, D.C.

Shah is recognized for his extraordinary contributions to the association’s state advocacy program. He has assisted the industry in promoting its policy objectives in a number of ways, most notably through providing analysis and guidance to ELFA, its membership and specific issue workgroups. In addition, his willingness to assist ELFA state negotiations has been invaluable to the association’s success on a number of critical issues.

For example, Shah has advised on industry exemptions to onerous financial disclosure requirements in California and New Jersey. He leads ELFA’s California DBO Workgroup, which represents the industry with comments and guidance to the California Department of Business Oversight. In addition, he leads ELFA’s newly created California Attorney General Privacy Workgroup.

Shah has been active on a number of committees and subcommittees, including the ELFA Legal Committee, the State Legislative and Regulatory Affairs Subcommittee and the Equipment Finance Regulatory and Compliance Subcommittee, and he serves as the Co-Chair of the Motor Vehicle Subcommittee.

He also has made many presentations and participated on numerous panels at the ELFA Legal Forum, an annual event for attorneys working in the equipment finance industry, and other ELFA events. At the 2019 ELFA Legal Forum in April, he participated on panels discussing the implications of consumer privacy law and current state legislative and regulatory agendas affecting equipment financers and lessors. He has also contributed articles on legal topics to the association’s Equipment Leasing & Finance magazine, including an analysis of applicable state licensing laws.

As Counsel in the Los Angeles office of Buckley LLP, Shah represents banks, FinTechs, mortgage companies, auto lenders and other nonbank financial institutions in transactional, licensing, regulatory compliance and government enforcement matters covering mergers and acquisitions, consumer and commercial lending and leasing, equipment finance and supervisory examinations and enforcement actions involving state and federal agencies.

Prior to joining Buckley, Shah was Managing Counsel and Director of Vendor Management for Toyota Motor Credit Corporation. Before that, he was the Manager of Business and Legal Affairs for British Telecommunications (formerly Infonet), and an associate at New York law firm Friedman Kaplan Seiler & Adelman LLP, where he represented public and private corporations in mergers and acquisitions, debt and equity financings and commercial contracts. He began his career as an Assistant District Attorney with the Manhattan District Attorney’s Office. He received his J.D. from Boston University School of Law (cum laude) and his B.A. from Duke University. He is a Certified Information Privacy Professional (CIPP) and a certified Six Sigma Black Belt.

About the Award

The David H. Fenig Distinguished Service in Advocacy Award is named for ELFA’s former Vice President of Federal Government Relations, David H. Fenig, who served as an accomplished advocate on behalf of the equipment leasing and finance industry from 2004-2011.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

### Press Release ############################

|

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A shaggy noir (“Under the Silver Lake”) and a fierce indie drama (“Her Smell”) come to theaters, while DVD releases offer a compelling trip (“The Mule”), sweet-natured action (“Bumblebee”), and a prophetic classic (“A Face in the Crowd”).

In theaters:

Under the Silver Lake (A24): Promising writer-director David Robert Mitchell follows the dread of his horror hit “It Follows” with the shaggy dreaminess of this neo-noir comedy-drama, set in a serenely surreal Los Angeles. Andrew Garfield stars as Sam, a thirtysomething slacker who fancies himself a private detective, scrambling to dodge an eviction notice while gazing obsessively at the mysterious blonde (Riley Keough) who turns up in his swimming pool. When she vanishes, however, Sam takes it up himself to track her down, determined to untangle what he sees as a network of conspiracies lurking under the bright California sun. Could he be onto something, or is that merely the haze of his own paranoia? Aiming for vibes out of “The Long Goodbye” or “Mulholland Drive,” Mitchell’s film weaves its own beguiling spell.

Her Smell (Gunpowder & Sky): A specialist in imploding characters, indie filmmaker Alex Ross Perry (“Listen Up Philip”) dives into another venomous protagonist with this shattering drama, which gives Elisabeth Moss a cyclonic role. She stars as Becky Something, a rock ‘n’ roll musician whose obvious talented is frequently overshadowed by her self-destructive behavior. Whether in studios or concert halls, whether surrounded by fans or band members, Becky always finds a way to meltdown over the course of the years. Among those caught in her whirlpool is scheming protégé Zelda (Amber Heard), hapless ex-husband Danny (Dan Stevens), and manager Howard (Eric Stoltz). Putting a fierce female spin on music biopics like “The Doors,” Perry risks alienating viewers but wisely keeps Moss front and center with a galvanizing performance.

|

On DVD:

The Mule (Warner Bros.): Screen legend Clint Eastwood continues his recent elegiac streak with this offbeat road movie, which he directs as well as stars in. Eastwood plays Earl Stone, an elderly horticulturist who, facing financial troubles, becomes a drug courier for a Mexican cartel. With a federal agent (Bradley Cooper) on his trail, Earl embarks on another assignment. What sounds like a thriller, however, soon reveals itself to be a leisurely, humorous, delightfully crusty character study about the peculiar detours of the American Dream. A sort of companion piece to his “Gran Torino,” the film finds Eastwood in a salty and contemplative mood, reflecting on masculine identity, prejudice, and the deliciousness of a good pulled pork sandwich. The results are low-key yet compelling, poignant, and deeply revealing of its inimitable star-director.

Bumblebee (Paramount): After years of noisy, ugly metallic blockbusters, it’s a pleasure to finally see an appealing “Transformers” entry in this fresh and warm action-fantasy, directed by talented former animator Travis Knight (“Kubo and the Two Strings”). Set in the late 1980s, the story follows the eponymous Transformer robot, on the run after being damaged in battle. Hiding out as a mustard Volkswagen in a junkyard in a small California town, Bumblebee is discovered by teenage loner Charlie (Hailee Steinfeld), who quickly forges a close bond with the towering but sweet-natured alien. With a tenacious government agent (John Cena) on her trail, Charlie must help reunite Bumblebee with the other Transformers so that their mission can continue. Anchored by the vivacious Steinfeld, the film has thrills and heart.

A Face in the Crowd (Criterion): Controversial, Oscar-winning director Elia Kazan (“On the Waterfront”) delivers a powerful look at pop fascism with this raw, fascinating drama from 1957. Andy Griffith is mesmerizing as Lonesome Rhodes, a backwoods singer discovered while in a Deep South jail by a radio producer named Marcia (Patricia Neal). She gets him a spot on a television show, and Rhodes quickly becomes a superstar due to his plainspoken charm. As his popularity rises, he flirts with politics and possibly even a presidential run, while Marcia begins to see the frightening ambition behind the grinning façade. Analyzing the thin line between entertainers and demagogues, Kazan’s vivid film offers an always relevant view of the nation’s obsession with con men. The superb cast also includes Lee Remick and Walter Matthau.

[headlines]

--------------------------------------------------------------

Papillion Mix

Toronto, Ontario, Canada Adopt-a-Dog

Yasmin

#37362860

Female

3 Years, 4 Months

Small

Black

Spayed

Declawed: NO

Location: Room A2

Intake Date: 1/21/2019

Toronto Humane Society

11 River Street,

Toronto, Ontario, M5A 4C2

Phone: 416.392.2273

SHELTER HOURS

Monday to Friday11am - 6pm (animal viewing until 7pm)

Saturday and Sunday10am - 5pm (animal viewing until 6pm

[headlines]

--------------------------------------------------------------

deBanked Broker Fair Manhattan Monday May 6

Sold Out, Next Stop:

Leasing News Advisor Edward P. Kaye, Access Commercial Capital, will be covering the New York City Broker Fair for Leasing News readers.

These broker fairs generally sell out. Presented by deBanked.com and its magazine, it is the largest gathering of merchant cash advance and business loan brokers in the country. Until now, there’s never been anything like it. Brokers can expect:

- Education

- Inspiration

- Opportunities

- Learn to do things the right way, sell better, and meet your peers and funding sources in the year’s most important one-day event!

2018: Brooklyn, Miami, San Diego, Brooklyn 2nd time, all a success. 2019: Miami, New York City and coming July 25, 2019. deBanked Connect in Toronto. To register or learn more about the event: https://www.debankedcanada.com/

[headlines]

--------------------------------------------------------------

News Briefs----

Struggling Subway closed more than

1,000 restaurants in 2018

https://nypost.com/2019/04/30/struggling-subway-closed-more-than-1000-restaurants-in-2018/

CVS closing 46 stores:

See the list of struggling locations that are going away

https://www.usatoday.com/story/money/2019/05/02/cvs-health-cvs-pharmacy-store-closing-list/3649440002

A Busy Month for FinTech Funding

By Nathan DiCamillo, American Banker

https://www.americanbanker.com/list/a-busy-month-for-fintech-funding

[headlines]

--------------------------------------------------------------

You May Have Missed---

50 Worst Product Flops of All Time

https://247wallst.com/special-report/2019/04/25/50-worst-product-flops-of-all-time-5/

[headlines]

--------------------------------------------------------------

Poem

Foul shot

One second is left in the game

you're at the foul line and going insane

the game is on your shoulders the score is tied

right now you feel like want to hide

the first attempt you shoot like a brick

and you just wish there was something to kick

your hands are sweaty, your knees are weak

the adrenaline in your body is at its peak

the ref hands you the ball

you feel very very small

you remember how you shot the ball and feel like a jerk

and then you remember you have science homework

you concentrate with all your might

your stomach is very very light

the crowd is so loud it awakens the dead

your feet feel like buckets of lead

you shoot the ball that is what you do

do you make it? that depends on you

-Mark

[headlines]

--------------------------------------------------------------

Sports Briefs---

‘One of the Rarest Things in Baseball’:

Noah Syndergaard Does It All

https://www.nytimes.com/section/sports

Nine players taken in 2019 NFL draft who could make

a Super Bowl difference for their new teams

https://www.usatoday.com/story/sports/nfl/draft/2019/05/02/2019-nfl-draft-9-rookies-super-bowl-impact/3641299002/

Jerry Jones: No reason Cowboys shouldn't be better

http://www.theredzone.org/Blog-Description/EntryId/76367/Jerry-Jones--No-reason-Cowboys-shouldn-t-be-better

Elway confident Drew Lock is his answer at quarterback

http://www.theredzone.org/Blog-Description/EntryId/76366/Elway-confident-Drew-Lock-is-his-answer-at-quarterback

Posey's hit sends Giants to 2-1 win over Dodgers

https://www.sfgate.com/sports/article/Posey-s-hit-sends-Giants-to-2-1-win-over-Dodgers-13812523.php

Warriors encouraged by Stephen Curry’s recovery from finger injury

https://www.sfchronicle.com/warriors/article/Warriors-encouraged-by-Stephen-Curry-s-recovery-13814845.php?psid=2jekC

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

These are the fastest-growing cities in California

https://www.sacbee.com/news/state/california/article229924279.html

Marin County family business Point Reyes Farmstead Cheese

wins Small Business Administration award

https://www.northbaybusinessjournal.com/northbay/sonomacounty/9555029-181/marin-county-farmstead-cheese-small-business

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Six Sonoma County Masters of Old Vines and Zinfindel

https://thepress.sfchronicle.com/trip/sonoma-old-vines-zinfandel/

Bordeaux Rising: The 2018s En Primeur

https://jebdunnuck.com/2019/05/bordeaux-rising-the-2018s-en-primeur/

Jackson Family Wines CEO calls for protections against imports

https://www.northbaybusinessjournal.com/industrynews/wineindustry/9556660-181/jackson-family-wines-ceo-calls

Mechanized Variable Rate Shoot Thinning for Grapevines

https://www.winebusiness.com/news/?go=getArticle&dataId=213315

24th Annual Vineyard Economics Symposium is Next Week

https://www.winebusiness.com/news/?go=getArticle&dataId=213305

Hall Wines Raises $1,000,000 for Charity

in 10 Years of Cabernet Cookoffs- Cheers to 10 Years

https://www.winebusiness.com/news/?go=getArticle&dataId=213329

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1494 - Christopher Columbus saw the island of Jamaica on his second voyage. He never actually saw nor did his discoveries include the United States, but the island off the continent. The islands were Europe's main gateway into the New World. Nearly 300 years later, the first Revolutionary War naval battle was fought here to gain control of this ocean thoroughfare.

http://memory.loc.gov/ammem/today/may03.html

http://www1.minn.net/~keithp/cctl.htm

1654 - Richard Thurlow built the first toll bridge with his own money over the Newbury River at Rowley, MA. The court fixed a rate of toll for animals, but passengers were permitted free passage. It remained until 1680.

http://www.angelfire.com/ny/chickened/thurlowfamily.html

1761 - Large tornadoes swept the Charleston, South Carolina harbor when a British Fleet of 40 sails was at anchor. It raised a wave 12 feet high, leaving many vessels on their beam ends. 4 people drowned.

1774 - A May snowstorm from New York City to Virginia covered the ground. A severe frost killed fruit in North Carolina

1802 – Washington, DC incorporated. The US Constitution provided for a federal district under the exclusive jurisdiction of Congress and the District is therefore not a part of any state. The states of Maryland and Virginia each donated land to form the federal district, which included the pre-existing settlements of Georgetown and Alexandria. In the 1830s, the District's southern territory of Alexandria went into economic decline partly due to neglect by Congress. The city of Alexandria was a major market in the American slave trade and pro-slavery residents feared that abolitionists in Congress would end slavery in the District, further depressing the economy. Alexandria's citizens petitioned Virginia to take back the land it had donated to form the District, through a process known as retrocession. The Virginia General Assembly voted in February, 1846 to accept the return of Alexandria and on July 9, 1846, Congress agreed to return all the territory that had been ceded by Virginia. Therefore, the District's current area consists only of the portion originally donated by Maryland. In 1871, it created a single municipal government for the remaining portion of the District. The Twenty-third Amendment to the Constitution was ratified in 1961, granting the District three votes in the Electoral College for the election of president and vice president, but still no voting representation in Congress. In 1973, Congress enacted the District of Columbia Home Rule Act, providing for an elected mayor and 13-member council for the District. In 1975, Walter Washington became the first elected and first black mayor of the District.

1825 - Laura Matilda Towne (d. 1901) birthday, Pittsburgh, PA. After the Civil War, she and her close friend, Ellen Murray, founded one of the earliest and most successful schools for former slaves on the coastal islands of South Carolina. She had studied homeopathic medicine privately and taught school in her native Pennsylvania before volunteering to teach - and in many ways care for - a large population of former slaves of the sea islands of South Carolina. She taught, acted as physician, and directed relief aid and, in 1862, with Murray founded the freedman's Penn School that used the same curriculum as New England schools. For dozens of years, Penn School was the only education available for the black population of the islands. Her school was eventually taken over by the South Carolina public school system.

http://www.aaregistry.com/african_american_history/2200/

Laura_M_Towne_was_a_primetime_educator

1862 - After nearly a month's siege, General Joseph Johnston's outnumbered Confederate forces evacuated Yorktown, VA, and moved back to Richmond. General McClellan's Army of the Potomac occupied Yorktown the following day. General Johnston is considered one of the top generals of the Confederacy and, if it were not for the overwhelming amount of money, the ability to “buy” foreign recruits, the war may have gone the way of the Confederacy due to military leaders such as Johnston. With the capture of Yorktown, President Abraham Lincoln left Washington, DC, for Fort Monroe, VA, to observe the ongoing Peninsula Campaign.

http://tennessee-scv.org/camp28/johnstonbio.html

http://ngeorgia.com/site/johnstonstatue.html

http://einsys.einpgh.org:8887/MARION/AAJ-1380

http://www.eaglesongthemusical.com/linkedpages/johnston.html

http://www.civilwarhome.com/johnston1stmanassas.htm

http://www.qmfound.com/BG_Joseph_Johnston.htm

1886 - At the height of the movement for the 8-hour day, police opened fire in a crowd of workers participating in a general strike at McCormick Harvester Co. in Chicago. Four workers were killed.

1895 - A F5 tornado carved a 13-mile path through Sioux County in Iowa. 9 people were killed and 35 were injured.

1898 - Israeli founder and Prime Minister Golda Meir was born Goldie Mabovitch in Kiev, Ukraine.

1903 – Bing Crosby (d. 1977) was born Harry Lillis Crosby in Tacoma, WA. The first multimedia star, Crosby was a leader in record sales, radio ratings, and motion picture grosses from 1931 to 1954. His early career coincided with recording innovations such as the microphone. This allowed him to develop an intimate singing style that influenced many male singers who followed him, including Perry Como, Frank Sinatra, Dick Haymes and Dean Martin. Yank magazine said that he was "the person who had done the most for the morale of overseas servicemen" during World War II. In 1948, American polls declared him the "most admired man alive", ahead of Jackie Robinson and Pope Pius XII. Also in 1948, Music Digest estimated that his recordings filled more than half of the 80,000 weekly hours allocated to recorded radio music. Crosby also influenced the development of the postwar recording industry. After seeing a demonstration of a German broadcast quality reel-to-reel recorder brought to America by John T. Mullin, he invested $50,000 in a Californian Electronics company called Ampex to build copies. He then convinced ABC to allow him to tape his shows. He became the first performer to pre-record his radio shows and master his commercial recordings onto magnetic tape. Through the medium of recording, he constructed his radio programs with the same directorial tools and craftsmanship (editing, retaking, rehearsal, time shifting) used in motion picture production, a practice that became an industry standard. In addition to his work with early audio tape recording, he helped to finance the development of videotape, bought television stations, bred racehorses, and co-owned the Pittsburgh Pirates baseball team. Crosby's was among the most popular and successful musical acts of the 20th century. Billboard magazine used different methodologies during his career. But his chart success remains impressive: 396 chart singles, including 41 No. 1 hits. If the many times "White Christmas" charted are counted, that would bring that number up to 43 – more than The Beatles and Elvis combined! He may have been the best-selling recording artist with up to 1 billion units sold. He received 23 gold and platinum records, according to the book Million Selling Records. The Recording Industry Association of America did not institute its gold record certification program until 1958 when Crosby's record sales were low. Before 1958, gold records were awarded by record companies. Universal Music, owner of Crosby's Decca catalog, has never requested RIAA certification for any of his hit singles.

1903 - John “Honey” Russell (d. 1973), Basketball Hall of Fame player and coach born at New York, NY. Russell played in more than 3,200 pro basketball games in the sport's early years. In 1936, he became coach at Seton Hall University, remaining there for 11 seasons. He was also a baseball scout, a football scout and a promoter. Inducted into the Naismith Memorial Basketball Hall of Fame in 1964. [Note: Russell ran a tryout for the Phillies at Hinchcliffe Stadium in Paterson, NJ that I attended in 1962. As I was 15 at the time, he was kind enough to let me down easy for being too young to be signed…Ralph Mango]

http://www.hoophall.com/halloffamers/RussellJ.htm

1906 - Birthday of actress Mary Astor (d. 1987), born Lucile Vasconcellos Langhanke, Quincy, IL. "She was so beautiful she almost made me faint." said John Barrymore but even beyond her beauty, she was a fine actor of screen and stage appearing in more than 100 movies. Astor began her long motion picture career as a teenager in the silent movies of the early 1920s. She eventually changed to talkies. At first her voice was considered too masculine and she was off the screen for a year. But she appeared in a play with friend Florence Eldridge and the film offers came in and she was able to resume her career in talking films. Four years later, her career was nearly destroyed due to scandal. In 1936, Astor was later branded an adulterous wife by her ex-husband, in a custody fight over her daughter. Overcoming these stumbling blocks in her private life, Astor went on to greater success on screen, eventually winning an Academy award for Best Supporting Actress for her performance in “The Great Lie” (1941). She is also the creator of one of the most memorable roles on the screen, Brigit O'Shaughnessy in “The Maltese Falcon.”

1911 - Trumpet player Yank Lawson (d. 1995) born Trenton, MO.

http://www.pudbrown.com/YankLawson.htm

http://www2.cybercd.de/artist/Lawson,+Yank.htm

1913 - Birthday of playwright William Inge (d. 1973), born in Independence, Kansas. He won the Pulitzer Prize for “Picnic,” some of his other plays included “Bus Stop,” “Come Back, Little Sheba.”

http://memory.loc.gov/ammem/today/may03.html

http://www.imagi-nation.com/moonstruck/clsc63.html

1918 - Tenor Leopold Simoneau (d. 2006), considered one of the most distinguished Canadian singers of the century, was born in St-Flavien, Quebec. Simoneau developed an international reputation in the 1950's as a specialist in the works of Mozart. Among the many highlights of his career was his 1952 appearance in Paris in a production of Stravinsky's "Oedipus Rex," with the composer as conductor and Jean Cocteau as narrator.

1919 - Birthday of folksinger, songwriter Pete Seeger (d. 2014), born New York, New York. In the 1940's, he performed with Woody Guthrie, before forming the Weavers, who had hits with such folk tunes as "On Top of Old Smokey" and "Goodnight Irene." Seeger was blacklisted by the US government during the '50s. On August 18, 1955, Seeger was subpoenaed to testify before the House Un-American Activities Committee (HUAC) as he once was a member of the US Communist Party. Seeger refused to plead the Fifth Amendment and instead, as the Hollywood Ten had done, refused to name personal and political associations on the grounds that this would violate his First Amendment rights: "I am not going to answer any questions as to my association, my philosophical or religious beliefs or my political beliefs, or how I voted in any election, or any of these private affairs. I think these are very improper questions for any American to be asked, especially under such compulsion as this." Seeger's refusal to answer questions that violated his fundamental Constitutional rights led to a March 26, 1957 indictment for contempt of Congress; for some years, he had to keep the federal government apprised of where he was going any time he left the Southern District of New York. He was convicted in a jury trial of contempt of Congress in March, 1961, and sentenced to ten 1-year terms in jail (to be served simultaneously), but in May 1962, an appeals court ruled the indictment to be flawed and overturned his conviction. In the 1960s, he re-emerged on the public scene as a prominent singer of protest music in support of disarmament, civil rights, counterculture and the environment. A prolific songwriter, his best-known songs include "Where Have All the Flowers Gone?” (with Joe Hickerson), "If I Had a Hammer" (with Lee Hayes of the Weavers), and "Turn, Turn, Turn" (lyrics adapted from Ecclesiastes), all of which became hits by multiple artists.

http://www.peteseeger.com

1920 - Pianist John Lewis (d. 2001) born LaGrange, Il.

http://www.jazclass.aust.com/lewis.htm

http://www.holeintheweb.com/drp/bhd/MJQ.htm

1921 - Reece “Goose” Tatum (d. 1967), basketball player, born at Calion, AR. Tatum played football and baseball and came into his own when Abe Saperstein asked him to play basketball with the Harlem Globetrotters. Tatum's best asset was his hands, big enough to allow him to hold the ball with one hand. He perfected the overhand hook shot later used by Wilt Chamberlain, Connie Hawkins and Kareem Abdul-Jabbar. Suspended by Saperstein in 1955, he formed his own team, the Harlem Magicians.

1921 - “Sugar Ray” Robinson, boxer, born Walker Smith, Jr., (d. 1989) at Detroit, Ml. Generally considered “pound for pound the greatest boxer of all time,” Robinson was a welterweight and middleweight champion who won 175 professional fights and lost only 19. A smooth and precise boxer, he fought until he was 45, dabbled in show business and established the Sugar Ray Robinson Youth Foundation to counter juvenile delinquency. To this day, his name connotes class, style and dignity. My father took me to his fight in Yankee Stadium when we lived in New York. My father was a great fight fan and took my brother and I to many bouts.