Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Friday, May 19, 2023

Today's Leasing News Headlines

Russell H. Wilder, CLFP, Announces Retirement

Executive Vice President, Chief Credit Officer

ATEL Capital Group, Inc., and Affiliates

Why I Became a CLP (June 6, 2006)

Russ Wilder-"The ATEL Credit Man"

Leasing and Finance Industry Help Wanted

Now Hiring for These Departments

Unleashing the Power of an Irresistible Employer

Brand to Attract Top Talent!

Charting the Rise of America's Debt Ceiling

By Dorothy Neufeld, Nick Routley Graphics

CLFP Foundation Thanks U.S. Bank

Plus Learn More about the CLFP Journey

Equipment Leasing & Finance Foundation Reports

Downward Confidence Continues Again

13,000+ Hotels Across the US

Are About to Get EV Charging Stations

By Michelle Lewis

Creed III, How to Blow up a Pipeline

Inside, No Bears, Showing Up

Reviews by Leasing News Fernando Croce

Labrador Retriever

Walnut Creek, California Adopt-a-Dog

News Briefs ---

Automakers find a tax credit loophole

to increase EV leasing and boost sales

Electric Vans, Delayed by Production Problems,

Find Eager Buyers

The real reason America’s nonprofit sector

is seeing massive growth, and more

Disney Pulls Plug on $1 Billion Development

in Florida

ESPN Plans to Stream Flagship Channel

Eyeing Cable TV’s Demise

Home Prices Posted Largest Annual Drop

in More Than 11 Years in April

You May Have Missed ---

Supreme Court hands tech companies a win,

and not just about Section 230

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Russell H. Wilder, CLFP, Announces Retirement

Executive Vice President, Chief Credit Officer

ATEL Capital Group, Inc., and Affiliates

"Hi Kit,

“After what will have been nearly 31 years here at ATEL and just shy of 45 years in the equipment leasing and financing industry I am retiring June 30th this year. Patrick von Tscharner, a 35-year veteran in the industry joined us a little over 7 months ago and will be taking over my position.

"I’ve enjoyed and valued our relationship over the decades and wish you best of luck going forward.

"Attached is my new business card."

[headlines]

--------------------------------------------------------------

Why I Became a CLP (June 6, 2006)

Russ Wilder-"The ATEL Credit Man"

This is the twelth article in a series about the Certified Lease Professional program, explaining why individuals decided to become a CLP, the process, and their reaction to the knowledge and other benefits gained.

"The ATEL Credit Man"

Russ Wilder talks about his background in his story of how and why he became a Certified Lease Professional. Kit Menkin has known

him since his days at Fireside Thrift, where American Leasing discounted leases, and may have been one of the first to do so, having been a personal friend of the founder of Fireside Thrift, Sid Stern, who sold they company, started a thrift in Nevada and also kept partnership in Key Leasing, Redwood City (that is another story.) Russ had a unique way of looking at leases in the beginning, the old school, figuring out the consumer debt and cash flow, then analyzing the financial statements, and also always considering the "collateral" and "Dealer." He was neither "easy" nor "conservative," but very thorough. One thing is he always wanted his "yield," that's what I remember the most as they had no "rate card" in the beginning. Russ has been successful because he takes his attitude about life, in my opinion, to his job.

Kit Menkin, editor

At the time I took the CLP exam it was 1990 and the CLP designation was pretty new. I had been an active attendee to many WAEL (Western Association of Equipment Lessors -now known as the United Association of Equipment Leasing) events from 1985-1989 when I ran a small ticket leasing operation for Fireside Thrift Co., which was and still is, primarily a consumer lending outfit.

About the middle of 1989 Fireside's ownership structure was changed. What was formerly a subsidiary of Teledyne, Inc. became a subsidiary of a new holding company spun off from Teledyne that had a bunch of finance and insurance firms Teledyne had acquired over the years. Shortly thereafter the senior honchos at the new holding company parent visited Fireside's headquarters where my office was located and discovered that the largest branch (in terms of loans on the books) of Fireside Thrift was in fact a business equipment financing operation. As there were some recent changes in our regulatory environment from the state, as part of some refocusing of Fireside's operations it was decided to shut down my operation as my operation was like a square peg trying to fit into a pegboard with round holes.

After my severance from Fireside Thrift at the end of 1989 and spending a couple of months trying to find a new job I started laying the groundwork to become a lease broker. As Fireside Thrift had exited the business they let me take the entire contact list of every lessee we had ever dealt with in the nearly five years I was there so I thought I would have a good start on the marketing side. At the time I thought having the CLP designation would give me more credibility in developing potential funding sources at least, if not my customer base. I signed up to take the CLP exam.

Back then the CLP Handbook had not been developed yet but WAEL did run a one or two day cram course for the exam and I flew down to southern California to take it. This was a useful course, especially on the use of the HP 12C. While I had by then been in the equipment financing and leasing industry twelve years on the credit, documentation, collection and other operations end I had never been on the sales side and really had very little experience doing lease pricing as I had mostly just been "PVing" rental streams on leases discounted to Fireside Thrift or my prior employers.

The exam itself was like taking three blue book finals in college all in the same day. My writing hand was very fatigued by the end of the exams.

After getting the CLP designation I tried brokering leases and learning the sales side. I believe having the CLP designation was useful in lining up potential funding sources when I was getting the brokering operation set up as I did not have much trouble getting approved by any.

I was not successful as a broker though. Primarily this was because I had no training in sales. Also my timing of entry was poor as Gulf War I had broken out in August 1990 and the economy went into a mild recession. Firms I contacted were not acquiring new equipment unless they absolutely had to.

While brokering deals I was still trying to get full time employment with an equipment financing or leasing firm or a bank. By the early 1990s many of the firms that had branches in the Bay Area that competed with my former employers in the equipment financing industry (Westinghouse Credit Corporation, Wells Fargo Leasing Corporation) had either closed down their offices in the Bay Area entirely or vastly reduced the headcounts here to just sales offices so there was much less opportunity in the area than when I had started in 1978.

I think I was able to get maybe two or three interviews with equipment leasing or financing firms in two years. To any of them that were WAEL members at the time, I think having the CLP designation was a plus. In reality, I did not get any job offers as nearly all the firms I spoke with ended up closing their offices in the Bay Area in the next year or two.

I suspect the senior management of those offices became aware of the likelihood of their closing down in the near future while I was in the interview process.

I also applied to banks as I figured my credit and collections experience would be transferable skills and experience to a bank's commercial or corporate lending groups, especially since I had undergone one formal training program while at Wells Fargo Leasing Corporation that was designed for the bank's commercial and corporate lending groups.

What I found though was that banks by and large did not want to talk to me. My perception was that bankers did not understand leasing and did not see how anyone with a leasing background had experience applicable to their needs. My having the CLP designation meant nothing to any banks I was able to interview with. To say the least, I was getting pretty discouraged, and was barely making a living as a lease broker. Trying to move from credit into sales was not working for me, and maybe those who I was interviewing with thought that was what I really wanted to do. It wasn't.

Ultimately, after a few months of "off and on" conversations with ATEL founder AJ Batt, who was quite a unique man, I joined ATEL in the fall of 1992.

I'm not sure if having the CLP designation meant anything to AJ, he was clearly focused on my credit and operations experience, especially my start up experiences for Fireside Thrift Co.'s fledgling leasing operation. Partly due to the fact that ATEL was not an overly active member of WAEL/UAEL and with Dean Cash having bought out AJ five years ago now, the CLP has never carried any weight within ATEL.

The CLP designation has always meant something to me as I have renewed it now two or three times. When ATEL was actively in the small ticket market the packages I received from brokers that had the CLP got a bit more consideration from me as they were clearly more complete, organized and otherwise more professionally packaged than most submissions via brokers. I think more leasing professionals having the CLP would definitely improve the overall caliber of professionalism within the industry and any serious broker should seek the designation.

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Highly Trained Operation Staff/Work from Home

Excellent Compensation/Marketing Support

[headlines]

--------------------------------------------------------------

Unleashing the Power of an Irresistible Employer

Brand to Attract Top Talent!

The Ultimate Hire by Ken Lubin, ZRG Partners

In the fiercely competitive job market of today, organizations must tap into the immense potential of an electrifying employer brand to attract and retain top talent. Are you ready to revolutionize recruitment? Let’s explore the captivating world of building a strong employer brand that commands attention, fuels aspirations, and magnetizes the brightest minds.

1. Craft Your Employer Value Proposition (EVP): Prepare for an expedition into creating an Employer Value Proposition (EVP) that radiates irresistible allure. Unearth the unique treasures that set your organization apart with purpose and distinction. Align your mission, vision, and culture to blaze a trail. Offer a captivating mix of growth opportunities, work-life harmony, unwavering support, and a thriving environment that sparks the imagination of top talent, drawing them irresistibly to your organization.

2. Cultivate a Dynamic Company Culture: Behold the power of a dynamic and pulsating company culture! In this era of exponential possibilities, foster an environment where passion and collaboration ignite innovation. Cultivate a culture that radiates authenticity, inclusivity, and a strong belief in the power of diversity. Watch in awe as employee happiness and engagement create a contagious energy, attracting like-minded individuals eager to be part of a powerful force.

3. Enhance Your Online Presence: Create a digital presence that illuminates the vast reaches of the online realm! Craft a compelling online presence that mesmerizes and captivates potential candidates. Illuminate your company website and social media platforms with, engaging content that brings your EVP to life. Share employee testimonials, success stories, and behind-the-scenes snapshots that reveal the true essence of your organization. Engage, interact, and create an online community that pulsates with the allure of a grand adventure.

4. Foster Employee Development: Fuel the flames of ambition and personal growth within your organization! Offer a range of learning and growth initiatives to empower your employees. Provide training sessions, mentorship programs, and exciting career advancement opportunities that entice top talent with the promise of progress. Watch as the brightest stars align, drawn irresistibly to the opportunities your organization provides for their professional growth.

5. Deliver an Unforgettable Candidate Experience: Experience the transformative magic of an unforgettable candidate journey! Ignite sparks of respect, transparency, and professionalism throughout every step of the recruitment process. Illuminate the path with clear communication, timely feedback, and a personal touch that resonates with candidates. Even if they are not selected, leave an indelible mark, a memorable experience that sets your organization apart and inspires them to share their positive impressions.

6. Ignite Employee Advocacy: Witness the fire of employee advocacy as it sweeps through your organization! Stoke the flames of enthusiasm and empower your employees to become passionate champions of your employer brand. Encourage an authentic and unstoppable wave of advocacy as they share their exciting experiences, both online and offline. Recognize and reward those who lead the way, igniting a wildfire of positive perception that resonates far and wide, attracting exceptional talent to your organization.

Prepare to embark on a thrilling journey of crafting an irresistible employer brand that leaves all in awe and captivated. Create a captivating EVP, foster an electric company culture, establish a glowing online presence, fuel employee development, and deliver an unforgettable candidate experience.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

https://www.linkedin.com/in/klubin/

"What is the Ultimate Hire? The Ultimate Hire is the professional that every business, team or leader needs in their organization. This is the high performance individual that always rises to the top, brings the team to the next level and can significantly add to the bottom line. The Ultimate Hire is the person that you can't afford to be without. Finding, Attracting, Hiring and Retaining these professionals is critical to the success of your business. We have identified these traits and can help you find these top professionals.

The Ultimate Hire Collections:

http://leasingnews.org/Conscious-Top%20Stories/ultimate.html

[headlines]

--------------------------------------------------------------

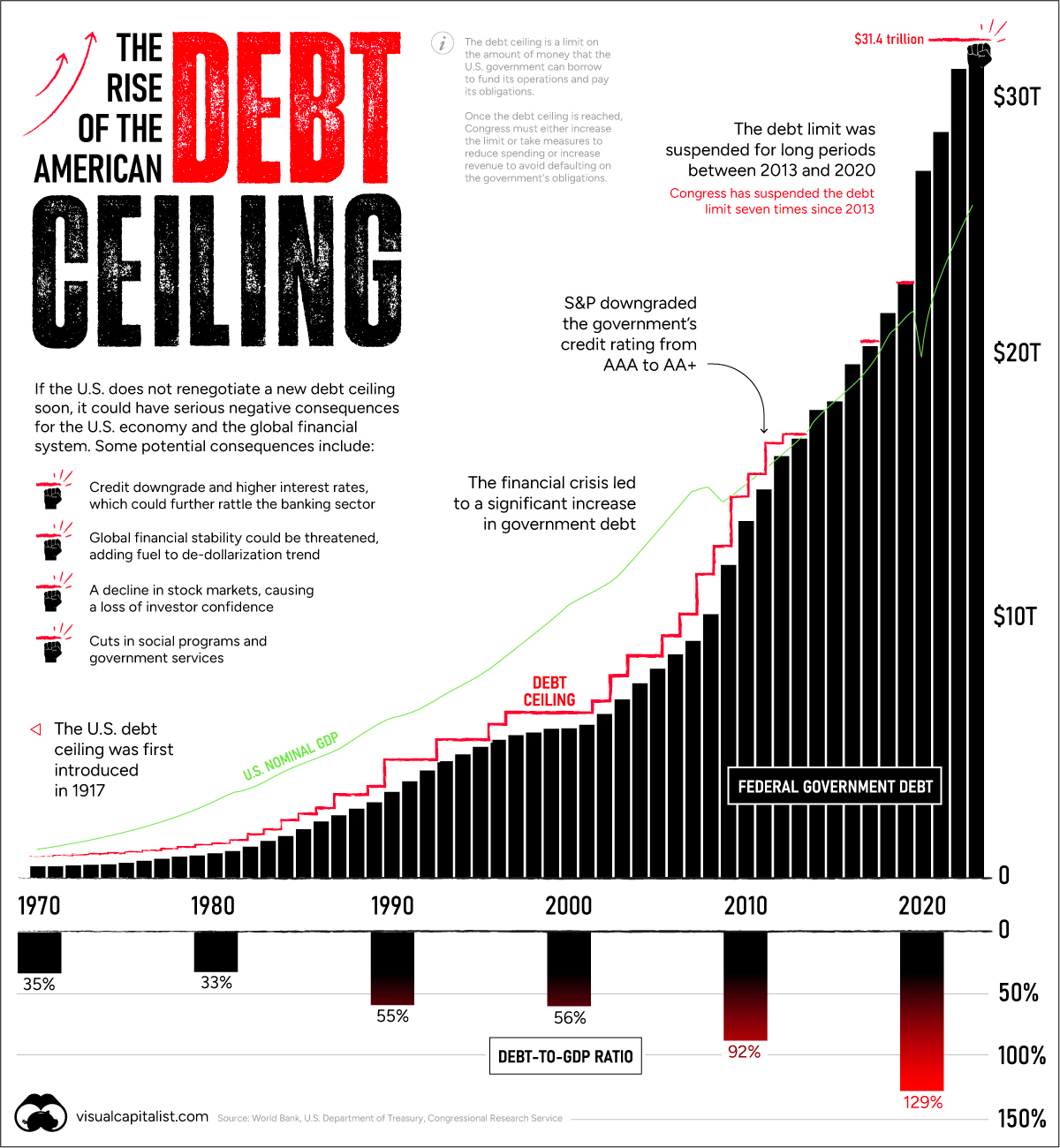

Charting the Rise of America's Debt Ceiling

By Dorothy Neufeld, Nick Routley Graphics

Every few years the debt ceiling standoff puts the credit of the U.S. at risk.

The above graphic shows the sharp rise in the debt ceiling in recent years, pulling data from various sources including the World Bank, U.S. Department of Treasury, and Congressional Research Service.

In January, the $31.4 trillion debt limit—the amount of debt the U.S. government can hold—was reached. That means U.S. cash reserves could be exhausted by June 1 according to Treasury Secretary Janet Yellen. Should Republicans and Democrats fail to act, the U.S. could default on its debt, causing harmful effects across the financial system.

Familiar Territory

Raising the debt ceiling is nothing new. Since 1960, it’s been raised 78 times.

In the 2023 version of the debate, Republican House Majority Leader Kevin McCarthy is asking for cuts in government spending. However, President Joe Biden argues that the debt ceiling should be increased without any strings attached. Adding to this, the sharp uptick in interest rates have been a clear reminder that rising debt levels can be precarious.

Consider that historically, interest payments on the U.S. debt have been equal to about half the cost of defense. More recently, however, the cost of servicing the debt has risen, and is now almost on par with the defense budget as a whole.

Key Moments In Recent History

Over history, raising the debt ceiling has often been a typical process for Congress.

Unlike today, agreements to raise the debt ceiling were often negotiated faster. Increased political polarization over recent years has contributed to standoffs with damaging consequences.

For instance, in 2011, an agreement was made just days before the deadline. As a result, S&P downgraded the U.S. credit rating from AAA to AA+ for the first time ever. This delay cost an estimated $1.3 billion in extra costs to the government that year.

Before then, the government shut down twice between 1995 and 1996 as President Bill Clinton and Republican House Speaker Newt Gingrich went head-to-head. Over a million government workers were furloughed for a week in late November 1995 before the debt limit was raised.

Full Visual Report:

https://www.visualcapitalist.com/rise-of-americas-debt-ceiling

[headlines]

--------------------------------------------------------------

CLFP Foundation Thanks U.S. Bank

Plus Learn More about the CLFP Journey

We are incredibly grateful to U.S. Bank Equipment Finance for hosting the biggest class of the year as we kick off this week's latest cohort. It's always so exciting to see our CLFP Candidates participating in Academies to prepare themselves for the CLFP Exam! We appreciate each opportunity to continue to expand our knowledge with industry participants striving for their next steps in their careers, and we congratulate everyone who has embarked on the path to becoming a CLFP.

Interested in beginning your own CLFP Journey? Read more here: https://buff.ly/3i2RQoW

[headlines]

--------------------------------------------------------------

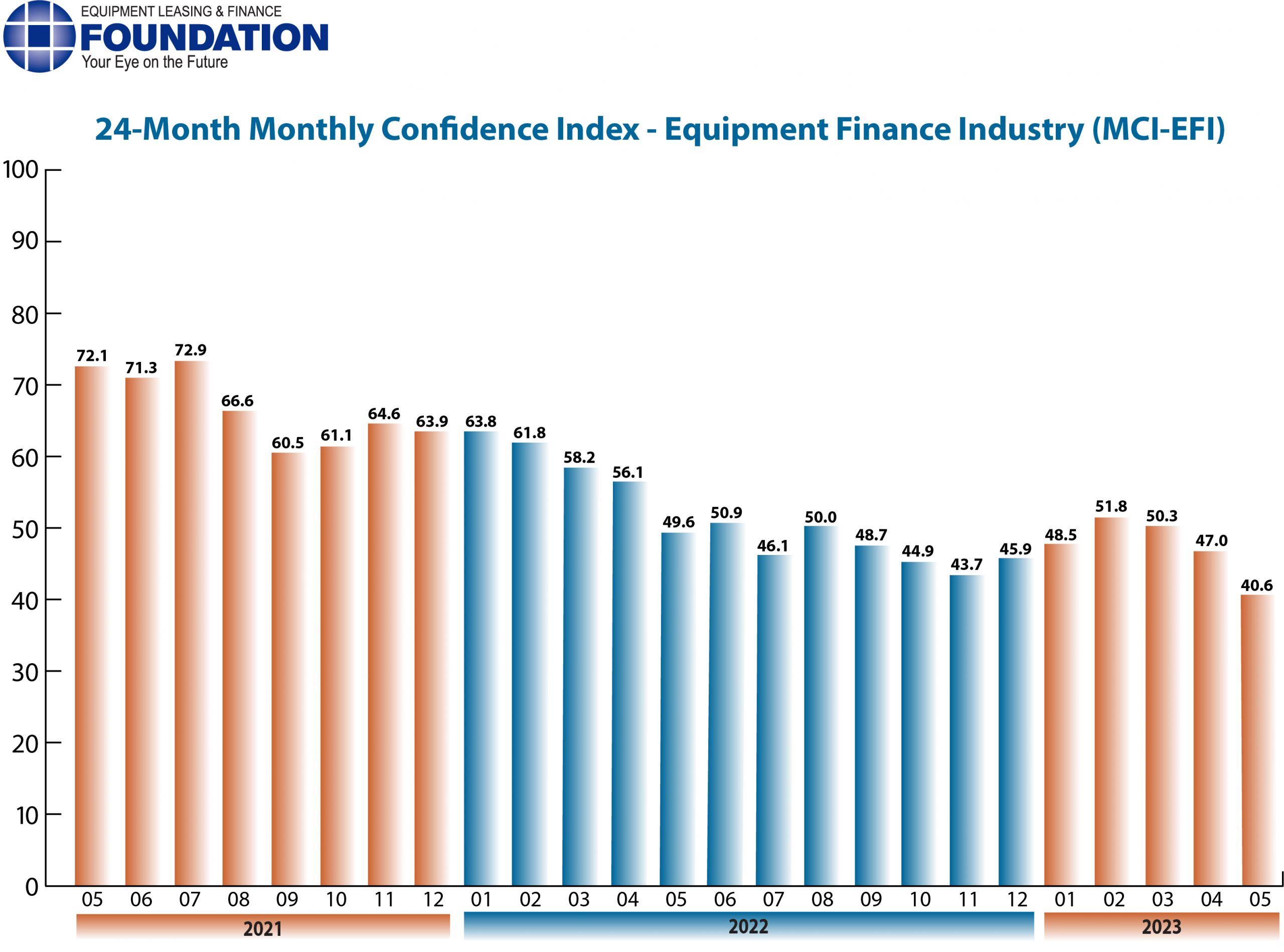

Equipment Leasing & Finance Foundation Reports

Downward Confidence Continues Again

ELFF released the May 2023 Monthly Confidence Index poll for the Equipment Finance Industry. It showed an overall lack of confidence reporting 40.6, a decrease from the April index of 47.0.

Full Report:

Monthly Confidence Index (MCI-EFI)

[headlines]

--------------------------------------------------------------

13,000+ Hotels Across the US

Are About to Get EV Charging Stations

By Michelle Lewis

LNG Electric may become one of the top three owner-operators of EV charging stations in the US by 2028, as it’s deploying a huge number of EV charging stations at hotels.

That’s because the EV charging provider is partnering with digital infrastructure consultancy MD7 to install Level 2 and DC fast charging EV charging stations at more than 13,000 hotels and more than 40 multifamily communities across the US.

Michael Fraunces, President of MD7, said, “We support [LNG Electric’s] mission to provide affordable EV grid access to more people than ever before, and we can’t wait for what’s next.”

Boston-based minority-owned startup LNG Electric will roll out its 13,000 chargers over the next five to six years, and it’s beginning this month with Level 2 charger installations, with Level 3 chargers to follow. Its plan is to create a charging network that covers 10-15% of the US hospitality market.

The company’s first EV chargers will be deployed at Marriott and Hilton hotels in Ohio, Florida, and Illinois.

LNG Electric is an official distributor of Enel X Way EV home and commercial charging stations.

[headlines]--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

A solid crowd-pleaser (“Creed III”), an urgent eco-thriller (“How to Blow Up a Pipeline”), a claustrophobic allegory (“Inside”), a self-reflexive drama (“No Bears”) and a gentle indie comedy (“Showing Up”) make for a varied batch of new streaming releases.

Creed III (iTunes, Vudu): The eponymous boxer steps back into the ring in this exciting entry in the crowd-pleasing franchise, which has star Michael B. Jordan also handling directing duties. Enjoying family life after his retirement, heavyweight champion Adonis Creed (Jordan) sees his struggle continue with the return of a figure from his past. Once a promising boxer, his friend Damian Anderson (Jonathan Majors) emerges from a prolonged stint in prison determined to take another stab at fame. Previously as close as brothers, the two men become antagonists as Creed’s hard-won achievement collides with Damien’s fury and ambition. Can they rekindle their bond, or are they headed for battle on the canvas? The first “Rocky” chapter without Sylvester Stallone, the movie is anchored by the charisma of both Jordan and Majors.

How to Blow Up a Pipeline (iTunes, Vudu): Activism and suspense are urgently mixed in this engrossing drama, which tackles Swedish writer Andreas Malm’s provocative climate-crisis manifesto in the guise of a twisty heist thriller. Told in flashback, the film chronicles the tangled paths of a group of young people who’ve decided to take action in the face of environmental calamity and corporate indifference. Among them are college students, drifters, Native American crusaders and patients, strangers from different states who come together to sabotage an oil pipeline in Texas. As is the norm with capers, however, the plan is gradually eroded by emotions and tensions as their personal reasons come to the fore. Directed with kinetic tautness by Daniel Goldhaber, the film expertly taps into a generation’s moral outrage.

Inside (iTunes, Vudu): Luxury becomes a cage in this claustrophobic thriller, set inside a Manhattan penthouse full of priceless works of art. That’s the high-tech place into which Nemo (Willem Dafoe), a cunning thief, finds himself trapped in during a botched burglary. When he triggers the alarm system during his escape, he’s sealed inside the high-rise chamber, unable to communicate with anyone or reach the skylight that is the one way out. Without food or water and subjected to wildly changing temperatures, Nemo must use his larcenous ingenuity to survive in an increasingly dangerous environment. When visceral needs are juxtaposed with the world of art, the suspense in Vasilis Katsoupis’ film takes on an allegorical dimension. More than anything, however, this is a prime showcase for Dafoe’s splendidly immersive performance.

No Bears (Vudu, Amazon Prime): Iranian director Jafar Panahi (“This is Not a Film”) continues his layered, self-reflexive examinations of cinema and freedom with this ingenious and courageous drama, secretly filmed while he was imprisoned in his home. With a story following parallel couples, Pahani moves between exiles in Turkey and illicit lovers in a village in Iran while playing a fictionalized version of himself in Zoom meetings. As the lines separating documentary and fiction turn increasingly blurred, can romance survive in the face of superstition, corruption and brutality? Making use ofgentle observation that gradually darkens into suspense, this is cinema as defiant political protest, at once angry and joyous, acerbic and hopeful. One of last year’s finest releases, finally available for streaming. With subtitles.

Showing Up (Vudu): Known for her spare and glum character studies, director Kelly Reichardt (“Certain Woman”) lightens up in this deft comedy-drama, which features a terrific performance from her frequent star, Michelle Williams. Williams plays Lizzy, a frazzled sculptor who specializes in minimalistic portraits and has an upcoming gallery showing in her small Oregon community. Coming up with new works is just a small part of her week, however, as she must deal with drama from family members as well as her neighbor and landlord, Jo (Hong Chau). Plot remains less important than mood and observation, as Reichardt burrows gently but deeply into her prickly heroine’s quotidian psyche. The resultingsnapshot of the struggle between art and lifeshowcases the director’s mastery of silences that speak volumes.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since the summer of 2008. His reviews appear each Friday.

--------------------------------------------------------------

Labrador Retriever

Walnut Creek, California Adopt-a-Dog

.jpg)

Jonah

Male

Background: This guy was found as a stray (near Modesto) suffering from two broken rear legs. A wonderful central valley dog rescue advocate notified us of his situation and we immediately pulled the dog and got him to our vet. Our vet determined that both legs had been fractured for more than four weeks. We named this dog Jonah as he has clearly been through a lot, but still has much to do. Our vet was able to perform FHO surgery on Jonah's right rear leg but Jonah's left rear leg had to be amputated as the fracture was too severe (and too old) to save that leg. Jonah is now recovering fabulously at a Lab Rescue foster home in Walnut Creek.

What Jonah's Foster Says: Jonah (aka Joe, JoJo, Joey) is fun, funny, smart and energetic. He loves to play and explore. Some walks are brisk – let’s get going! Others are sniff-fests – what’s on this blade of grass? He is well adapted to his 3-legged life and ready to move to his permanent home. He is learning “wait” to get out of the x-pen and go outside. He’s also learning “leave-it”, “drop-it”, “watch”, “chin rest” (in my hand) and “touch” (my palm). All of this is new to him and needs to be reinforced. He has a soft mouth when taking treats, but can be mouthy when excited (i.e. getting ready to go for a walk). We are working on correcting that and he is getting better. He barks a bit to get our attention when he needs a potty break, water, food or play. Jonah yips or whines when we leave him alone, but stops within a few minutes. Once he is allowed out of the x-pen and given more freedom, this may subside. He gets along well with our resident dog. He wants to play and wrestle, but that isn’t allowed yet. Jonah enjoys meeting new people on our walks. His response to dogs has been mixed: some greetings have been calm and other times he has barked. He is cautious around moving cars.

What Jonah's Rescue Rep Says: Jonah has all the energy and personality of a four-legged pooch. Jonah is a vibrant, engaging pup that will live a long life. He loves people and wants to play with other dogs. Eventually Jonah will be able to run and romp – his right rear leg just needs to fully heal from the surgery. Obviously, he would do best in a home with few steps and stairs. Kids and other dogs would be great roomies. Jonah has not yet been exposed to cats. We think Jonah is a Lab/Shepherd mix. This is one awesome dog!

Medical: In great health. Current on vaccinations, microchipped, neutered, and heartworm negative.

Located in: Walnut Creek.

Video and other information:

https://www.labrescue.org/labs/Jonah2023-03.html

|

[headlines]

--------------------------------------------------------------

News Briefs---

Automakers find a tax credit loophole

to increase EV leasing and boost sales

https://www.cnbc.com/2023/05/13/electric-vehicles-inflation-reduction-act-tax-credit-loophole-boosts-leasing.html

Electric Vans, Delayed by Production Problems,

Find Eager Buyers

https://www.nytimes.com/2023/05/16/business/energy-environment/electric-vehicle-delivery-vans.html

The real reason America’s nonprofit sector

is seeing massive growth, and more

https://www.washingtonpost.com/business/2023/05/12/force-behind-americas-fast-growing-nonprofit-sector-more/

Disney Pulls Plug on $1 Billion Development

in Florida

https://www.nytimes.com/2023/05/18/business/disney-ron-desantis-florida.html

ESPN Plans to Stream Flagship Channel

Eyeing Cable TV’s Demise

https://www.wsj.com/articles/espn-lays-plans-to-stream-flagship-channel-eyeing-cable-tvs-demise-ad0fb727?st=8dwsk48ns0uy3sh&reflink=desktopwebshare_permalink

Home Prices Posted Largest Annual Drop

in More Than 11 Years in April

https://www.wsj.com/articles/home-prices-posted-largest-annual-drop-in-more-than-11-years-in-april-613f2d58?st=ubxmb1rxvtd0wcf&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Supreme Court hands tech companies a win,

and not just about Section 230

https://www.washingtonpost.com/technology/2023/05/18/scotus-social-media-analysis

[headlines]

--------------------------------------------------------------

Sports Briefs---

The Data That Explains LIV Golf vs. the PGA Tour

https://www.wsj.com/articles/pga-championship-liv-golf-pga-tour-rankings-owgr-5df61bf8?st=sybmg6thzqqx9nr&reflink=desktopwebshare_permalink

Is Victor Wembanyama the Best European NBA Prospect Ever?

https://www.theringer.com/nba-draft/2023/5/16/23725034/victor-wembanyama-prospect-analysis-luka-doncic

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Bay Area expected to host the

2026 Super Bowl at Levi’s Stadium

https://www.sfchronicle.com/sports/49ers/article/report-49ers-levi-s-stadium-expected-host-2026-18107578.php?utm_campaign=premiumsfgate_breakingnews_20230518&utm_source=newsletter&utm_medium=email

California cannabis operators again

await outcome of SAFE Banking Act

https://www.northbaybusinessjournal.com/article/industrynews/california-cannabis-operators-again-await-outcome-of-safe-banking-act/

Illicit Marijuana Worsens Water Crisis in California

"the plant needs up to five gallons of water every day"

https://www.cannabisnewswire.com/420-with-cnw-illicit-marijuana-worsens-water-crisis-in-california/

San Jose no longer in top 10

most populous U.S. cities

https://www.mercurynews.com/2023/05/18/san-jose-no-longer-in-top-10-most-populous-u-s-cities/

UC regents take groundbreaking step toward

hiring immigrant students without legal status

https://www.latimes.com/california/story/2023-05-18/uc-students-legal-status-work-permits-daca

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

Gloria Ferrer vineyards a Sonoma County pioneer

in using AI to monitor crops

https://www.pressdemocrat.com/article/lifestyle/gloria-ferrer-vineyards-a-sonoma-county-pioneer-in-using-ai-to-monitor-crop/

The 15 Best Wines In 2023 So Far

https://www.tastingtable.com/1255933/best-wines-2023/

Archaeologists uncover elaborate ancient

winery among Roman ruins

https://www.thedrinksbusiness.com/2023/04/archaeologists-uncover-elaborate-ancient-winery-among-roman-ruins/

Oregon State researchers make breakthrough in

understanding the chemistry of wildfire smoke in wine

https://today.oregonstate.edu/news/oregon-state-researchers-make-breakthrough-understanding-chemistry-wildfire-smoke-wine

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1792 - Twenty-four brokers signed an agreement to fix the rates of commission on stocks and bonds, forming the New York Stock Exchange, with the first meeting at the Merchants Coffee House, Second and Gold Streets, New York City. The first president was Matthew McConnell.

1804 - Lewis and Clark began their exploration of the Louisiana Purchase.

1853 - Earning a place on the game of monopoly, the first major railroad merger took place as ten companies consolidated into the Central Railroad Company, consisting of 187 first-class passenger coaches, 55 second class coaches, 65 baggage, mail and express cards, and 1,702 freight cars. There were 298 miles of main line, 236 miles of branch line, and 29 miles of leased road.

http://www.cprr.org/Museum/index.html

1868 - Japan: The Scioto sets sail out of Yokohama for Hawaii, carrying 153 Japanese migrants bound for employment on the sugar plantations. These adventurers constitute the first mass emigration of Japanese overseas. They became known as the Gannenmono.

1872 - Bohemian Club incorporated.

1875 - The first running of the Kentucky Derby took place at Churchill Downs, Louisville, KY. African-American Jockey Oliver Lewis rode the horse Aristides to a winning time of 2:37:25.

http://horseracing.about.com/library/weekly/aa012499.htm

http://memory.loc.gov/ammem/today/may17.html

1877 - First interstate telephone call took place when a call was made from New Brunswick, NJ, to Dr. Alexander Graham Bell at Chickering Hall, New York City. In 1915, he made the first East Coast to West Coast call. Bell's first telephone call was so famous, he repeated the phrase from the first call and first interstate call in 1915 in the formal opening of the completed transcontinental telephone lines connecting America's East and West coasts. Picking up the phone in New York, Mr. Bell said, "Mr. Watson, come here, I want you." But this time Watson replied that it would take him a week; he was on the other end of the line in San Francisco.

http://www.fitzgeraldstudio.com/html/bell/theman.html

http://www.historybuff.com/library/refgarfield.html

http://parkscanada.pch.gc.ca/parks/nova_scotia/alex_g_bell/Alex_g_bell_e.htm

1877 - Edwin Thomas Holmes operating an electrical burglar alarm business at 342 Washington Street, Boston, MA, converted it into the first telephone exchange or switchboard. Holmes' office was connected by wire to a number of banks and similar institutions, and the telephone were placed in the offices of six of his subscribers and connected to these wires. The system served as a telephone system by day and as a burglar alarm system at night. The telephones were connected only in the daytime.

1878 - Canada's governor general and his wife, Lord and Lady Dufferin, were treated to a demonstration of Thomas Edison's recent invention, the phonograph, at Rideau Hall in Ottawa. The early phonograph both recorded and played back crude reproductions of the human voice on a tin-foil covered cylinder, and was not yet used for recording music. Lady Dufferin wrote in her diary that "we were so amazed when we heard this bit of iron speak."

1883 - Buffalo Bill Cody's Wild West show premiered in Omaha, NE.

1896 - An F5 tornado tracked 100 miles through Northeastern Kansas and extreme Southeastern Nebraska. Seneca, Oneida, Sabetha, and Reserve, Kansas sustained severe damage. While passing through Reserve the tornado was 2 miles wide. 25 were killed and 200 were injured.

1898 – In the Presidio, Camp Merritt formed, a U.S. military camp in San Francisco for American troops destined for the Philippines during the Spanish-American War. Formerly a racetrack, the camp was named for General Wesley Merritt commanding officer of the Philippine expeditionary forces and the Eighth Corps at the time.

1903 - Birthday of James “Cool Papa” Bell (d. 1991), Starkville, MS. This famous Negro League baseball player was active for 25 seasons (from 1922 to 1946---one year before Jackie Robinson broke the “color barrier” in Major League Baseball) with a career average of .338. Regarded as the fastest man ever to play the game—he could round the bases in 13 seconds. Cool Papa often stole two bases on one pitch or scored from second on a sacrifice fly. Satchel Paige said Bell could turn off the light and “be in bed before the room was dark.” He batted .400 several times and stole 175 bases in one year. He was inducted into the Baseball Hall of Fame in 1974.

http://www.negroleaguebaseball.com/1999/October/cool_pap_bell.html

1910 - Halley's Comet terrifies millions on earth.

1912 – Boston’s Fenway Park was officially dedicated, one month after hosting its first game.

1916 - Birthday of tenor sax player Paul “Vice-President” Quinichette (d. 1983), Denver, CO.

http://www.vh1.com/artists/az/quinichette_paul/bio.jhtml

1924 - The Giant Dipper roller coaster opened at Santa Cruz Beach Boardwalk at Santa Cruz, CA, a half hour from my office. It quickly became the park's most popular ride. The Dipper was built by Arthur Looff, the son of master carousel-horse carver Charles I.D. Looff. In June of 1987, the Giant Dipper and the Looff carousel were designated National Historic Landmarks by the US National Park Service. The Boardwalk is still a popular place, day and night.

http://www.beachboardwalk.com/

http://www.cinternet.net/~bowersda/artgall.htm

1924 - The Marx Brothers take New York by storm. In one of show business's great strokes of luck, the opening night of a major dramatic play is cancelled, leading all the top New York critics instead to the premiere of a vaudeville revue called “I'll Say She Is,” starring the unknown Marx Brothers comedy team. The brothers' incredible banter and slapstick astounds the critics, ensuring the Marx's' fame.

1925 - Cleveland Indians centerfielder Tris Speaker collected the 3,000th hit of his Major League career off Tom Zachary of the Washington Senators, off whom Babe Ruth hit home run #60 in 1927. Speaker played from 1907 through 1928, got 3,515 hits and batted .344. He was inducted into the Baseball Hall of Fame in 1937, was named 27th in The Sporting News’ 100 Greatest Baseball Players (1999) and was included in the MLB All-Century Team.

1932 - Alto sax player Jackie McLean (d. 2006) birthday, NYC.

http://www.pbs.org/jazz/biography/artist_id_mclean_jackie.htm

1933 - Country singer Jimmie Rodgers began to record a series of 24 songs for RCA Victor Records. Rodgers was in failing health at the beginning of the session but persevered to complete the job at hand. The singing star died nine days later (he was 35). Jimmie Rodgers was born in 1897 and was known as the Blue Yodeler and the Singing Brakeman. Rodgers was the first member of the Country Music Hall of Fame, elected in 1961 (along with Fred Rose and Hank Williams). His recording career began in 1927. His yodel became a trademark of his music. Jimmie Rodgers recorded over 100 songs and sold millions of 78 RPM records. His songs were about the Depression and many were about trains. "Brakeman's Blues," "Blue Yodel," "Tuck Away My Lonesome Blues" and his famous "‘T' for Texas" are all classics. He died of tuberculosis.

http://www.jimmierodgers.com/

http://www.ping.be/ml-cmb/jrindex.htm

http://www.eyeneer.com/America/Genre/Folk.bluegrass/Profiles/Rodgers/

http://sonymusic.com/artists/JimmieRodgers/TheSongsOfJimmieRodgers/biography.html

http://www.studioclub.com/JRSaga2.htm

1939 - Glenn Miller opens a three-month stand at Glen Island Casino, New Rochelle, NY. Both NBC and Mutual carried the event, which was attended by 1,800 people in the casino ballroom.

1939 - The first baseball game ever televised – Princeton vs. Columbia at the Baker Bowl - was watched by a handful of viewers via W2XBS in NYC. Bill Stern announces the ten-inning victory of visiting Princeton, 2 - 1. Reviewing the game the next day, the New York Times reported: "it is difficult to see how this sort of thing can catch the public fancy."

1944 - General Eisenhower sets D-Day for June 5th. As the Allies required a full moon and a spring tide, possible dates for the invasion were limited. This was Eisenhower’s first choice but was forced to delay due to poor weather and high seas. Faced with the possibility of recalling the invasion force to port, he received a favorable weather report for June 6 from Group Captain James M. Stagg. After some debate, orders were issued to launch the invasion on June 6. Due to the poor conditions, the Germans believed that no invasion would occur in early June. As a result, Rommel returned to Germany and many officers left their units to attend war games.

1944 - Birthday of guitarist/songwriter Jesse Winchester (d. 2014), Bossier City, LA

http://www.jessewinchester.com/

1946 – President Harry Truman seized control of the nation’s railroads. Unions that continued to press beyond the general labor settlements established in the auto and steel industries after World War II found themselves facing an additional and powerful adversary—the federal government. In the spring of 1946, both coal miners and railroad workers staged nationwide strikes. President Harry Truman decided that the unions had gone too far and, after the railroad workers rejected a settlement, he seized control of the railroads. Despite the government takeover, the workers continued with their strike plans. As a result, Truman issued an ultimatum declaring that the government would operate the railroads and use the army as strikebreakers. When the deadline passed, Truman went before Congress to seek the power to deny seniority rights to strikers and to draft strikers into the armed forces. Just as Truman reached the climax of his speech, he received a note saying that the strike was “settled on the terms proposed by the President.”

1948 - No. 1 Billboard Pop Hit: "Nature Boy," Nat King Cole.

1953 - Top Hits

“I Believe” - Frankie Laine

“April in Portugal” - The Les Baxter Orchestra

“Song from Moulin Rouge” - The Percy Faith Orchestra

“Mexican Joe

- Jim Reeves

1954 - The US ruled on Brown vs. Board of Education. This was a major event because the US Supreme Court ruled unanimously that segregation of public schools “solely on the basis of race" denied black children “equal education opportunity" even though "physical facilities and other 'tangible' factors may have been equal. It reversed the 1896 "separate but equal" Plessy vs Ferguson decision. The Supreme Court previously approved racial segregation May 18, 1896. The case was argued before the Court by Thurgood Marshall, who would go on to become the first black appointed to the Supreme Court.

1956 - Birthday of former boxer Ray Charles “Sugar Ray” Leonard, born Washington, DC.

http://www.ipcress.com/box/leonard.html

http://www.times-olympics.co.uk/historyheroes/srleon.html

1956 - The first synthetic mica was produced commercially by the Synthetic Mica Corporation, Caldwell Township, NY, and offered for sale this day under the trade name of Synthamica. It was chemically pure and sustained temperatures as high as 20000 degrees without physical or electrical failure. The birth of new technology was now able to be born, replacing tubes and bringing a new dawn to both business and recreational products.

1958 - "South Pacific" soundtrack album goes to #1 and stays #1 for 31 weeks

1961 - Top Hits

“Runaway” - Del Shannon

“Mother-In-Law” - Ernie K-Doe

“A Hundred Pounds of Clay” - Gene McDaniels

“Hello Walls” - Faron Young

1963 - The first Monterey Folk Festival in California featured performances by Bob Dylan, Pete Seeger, Joan Baez and Peter, Paul and Mary. I was there and it was mellow (we brought wine, others brought other things).

1969 - Top Hits

“Aquarius/Let the Sun Shine In” - The 5th Dimension

“Hair” - The Cowsills

“Get Back” - The Beatles

“My Life (Throw It Away if I Want To)” - Bill Anderson

1970 - Henry Aaron of the Atlanta Braves, on his way to becoming baseball's all-time home run king, got the 3,000th hit of his career, a scratch single off Wayne Simpson of the Cincinnati Reds. Aaron finished his career in 1976 with a .305 batting average, 3,771 hits and 755 home runs and was the first to hit 500 HRs and 3000 hits.

http://www.baseballhalloffame.org/hofers_and_honorees/hofer_bios/aaron_hank.htm

http://sportsillustrated.cnn.com/baseball/mlb/all_time_stats/players/a/42389/index.html

1970 - Jordan Knight of New Kids on the Block is born in Worcester, MA. His older brother Jon is also a member of the pop group from Boston.

1971 - The musical, "Godspell," opened this night at the Cherry Lane Theatre in New York City. "Godspell" featured the song "Day by Day" (a top-15 hit in 1972). The rock musical that featured Robin Lamont played for 2,124 performances and was the third longest-running off-Broadway production at the time.

1972 – Hall of Fame US soccer player, Mia Hamm, was born in Selma, AL.

1973 – Congressional hearings on the Watergate scandal were begun. Several major revelations and egregious presidential action against the investigation later in 1973 prompted the House to commence an impeachment process against President Nixon. The Supreme Court ruled that Nixon had to release the Oval Office tapes to government investigators. The tapes revealed that Nixon had conspired to cover up activities that took place after the break-in and had attempted to use federal officials to deflect the investigation. The House Judiciary Committee then approved articles of impeachment against Nixon for obstruction of justice, abuse of power, and contempt of Congress. With his complicity in the cover-up made public and his political support completely eroded, Nixon resigned from office on August 9, 1974. It is believed that, if he had not done so, he would have been impeached by the House and removed from office by a trial in the Senate. He is the only U.S. president to have resigned from office. On September 8, 1974, Nixon's successor, Gerald Ford, pardoned him. There were 69 people indicted and 48 people—many of them top Nixon administration officials—who were convicted.

1973 - Captain Robin Lindsay Quigley became the first female Navy Officer to hold a major command: Navy Service School, San Diego, CA, supervising 30,000 students.

1973 - Yes receive gold records for both "Yessongs" their triple-record live set and "The Yes Album."

1974 - No. 1 Billboard Pop Hit: "The Streak," Ray Stevens.

1975 - NBC-TV paid a whopping $5,000,000 for the rights to show "Gone with the Wind" just one time. It was the top price paid for a single opportunity to show a film on television. It became, at that time, the highest-rated television program ever presented on a single network, watched by 47.5 percent of the households sampled in America, and 65 percent of television viewers, still the record for the highest rated film to ever air on television.

1975 - Elton John's "Captain Fantastic and the Brown Dirt Cowboy" album was released and certified a platinum record on the very same day. It was the first album to be certified a million seller (in this case, a two-million seller) on the first day of release.

1976 - Race jockey Steve Cauthen began an enviable win streak. Cauthen, age 16, rode his first winner at River Downs, KY. He went on to win 94 races, becoming horse racing's most-watched jockey.

1977 - Top Hits

“When I Need You” - Leo Sayer

“Sir Duke” - Stevie Wonder

“Couldn't Get It Right” - Climax Blues Band

“Some Broken Hearts Never Mend” - Don Williams

1977 - The movie "Smokey & the Bandit" premieres.

1978 – “Thank God It's Friday,” a movie celebration of disco which is Casablanca Records chief Neil Bogart's response to Saturday Night Fever, premieres in Los Angeles. It stars Donna Summer as a singer looking for her big break in a "typical" Hollywood disco on a "typical" Friday night. Summer's song "The Last Dance" is introduced and it goes on to top the pop charts and wins the 1978 Academy Award for Best Song. The film, meantime, is a flop.

1979 - "In The Navy" by Village People hits #3

1979 - -12ºF (-11ºC), on top of Mauna Kea HI (state record)

1979 - With the wind really blowing out at Wrigley Field, the Cubs and Phillies combined for a wild ten-inning slugfest won by the Phillies, 23-22. Dave Kingman hit three home runs and collected six RBI for the Cubs while teammate Bill Buckner had a grand slam and seven RBI. Mike Schmidt belted two home runs, including the game-winner in the 10th inning. Bob Boone, pitcher Randy Lerch, and Garry Maddox also homered for the Phillies and Steve Ontiveros and Jerry Martin do it for the Cubs. The eleven home runs between the two teams tied a MLB game record. The contest included 50 hits. In 2010, the MLB Network named it the 20th greatest game of the previous 50 years.

1983 - A golfer playing the Fox Meadows course in Memphis, Tennessee was struck by a bolt of lightning that went through his neck, down his spine, came out a pocket containing his keys, and went into a nearby tree. Miraculously, he survived!

1983 - No. 1 Billboard Pop Hit: "Let's Dance," David Bowie.

1984 - Baseball's Mario Soto threw four strikeouts in one inning — only 15th pitcher since 1900 to do so. The catcher dropped the ball on the third strike. The runner ran to first and was safe. The catcher must hold on to the ball for a third strike call to take effect (or tag the runner or make the throw out to first).

1985 - Bobby Ewing died on the season finale of "Dallas" on CBS-TV. It was the “talk of the town.” Young Bobby Ewing, played by actor Patrick Duffy, died in a violent car explosion, but came back to life the following season (he was seen taking a shower, just as Victoria Principal, his TV wife, was about to step into the shower stall).

1985 - Top Hits

“Don't You Forget About Me” - Simple Minds

“One Night in Bangkok” - Murray Head

“Everything She Wants” - Wham!

“Somebody Should Leave” - Reba McEntire

1987 - The US Navy's guided missile frigate, Stark, sailing off the Iranian coast in the Persian Gulf, was struck and set afire by two Exocet sea-skimming missiles fired from an Iraqi warplane at 2:10pm, EDT. Also struck was a Cypriot flag tanker. At least 28 American naval personnel were killed. Only hours earlier a Soviet oil tanker in the Gulf had struck a mine.

1987 - Eric ‘Sleepy' Floyd of the Golden State Warriors set a playoff record for points in a single quarter. He poured in 29 points in the fourth period in a game against Pat Riley's Los Angeles Lakers.

1988 - Thunderstorms produced large hail and damaging winds across the Mid-Atlantic region during the afternoon and evening hours. A "thunderstorm of a lifetime" in Northern Spartanburg County, South Carolina produced hail for 45 minutes. Hail accumulated to knee-deep in some places.

1992 - Betsy King shot 267 to win the LPGA Championship by 11 strokes over Karen Noble. King recorded rounds of 68, 66, 67 and 66, the first time that any LPGA player finished four rounds under 70 in that any LPGA player finished four rounds under 70 in a major championship. Her 267 was the lowest score ever recorded by any golfer, man or woman, in a major championship.

1992 - The Toronto Blue Jays reached the one million mark in home attendance faster than any other team in baseball history. The Blue Jays drew 1,006,294 fans in just 21 days, surpassing the record held jointly by the 1981 Los Angeles Dodgers and the 1991 Blue Jays.

1998 - ESPN's “Sportscenter,” the cable network's signature program, broadcast its 20,000th edition with a special 90-minute show hosted by longtime anchors Chris Berman, Dan Patrick, and Bob Ley. “Sportscenter” made its debut on September 7, 1979, ESPN's launch day, and is broadcast live three times each weekday and four times on Saturday and Sunday.

1998 - Lefthander David Wells of the New York Yankees pitched a perfect game (allowing no hits and no base runners of any kind) against the Minnesota Twins, winning 4-0. This was the first perfect game pitched in Yankee Stadium since Don Larsen's in Game 5 of the 1956 World Series. Oddly enough, Wells and Larsen attended the same high school, Point Loma in San Diego, CA.

2004 – Massachusetts became the first state to sanction gay marriage.

2011 - The final episode of “The Oprah Winfrey Show” was recorded in Chicago, Illinois with many celebrities attending the star-studded event.

2012 - U.S. Ambassador to Israel, Daniel B. Shapiro, says America 'is ready' to attack Iran to prevent them from developing nuclear weapons.

2014 - Google, Inc. and Apple, Inc. have agreed to drop certain patent lawsuits against each other; the lawsuits revolve around Google's Motorola Mobility technology.

2018 - Michigan State University will pay $500 million in claims to 300 survivors of sexual abuse involving Larry Nassar. Largest sexual abuse case in sports history. Nassar's cumulative sexual assault crimes were the basis of the USA Gymnastics sex abuse scandal that began in 2015, in which he sexually assaulted at least 265 young women and girls dating back to 1992. His victims included numerous Olympic and US women’s national gymnastics team gymnasts. Nassar has admitted to 10 of those accusations. Nassar was sentenced to 60 years in federal prison in July 2017 after pleading guilty to child pornography charges. On January 24, 2018, Nassar was sentenced to 175 years in a Michigan state prison after pleading guilty to seven counts of sexual assault of minors. On February 5, 2018, he was sentenced to an additional 40 to 125 years in prison after pleading guilty to an additional three counts of sexual assault. His state prison sentences are to run consecutively with his federal sentence, amounting to a practical life sentence.

Stanley Cup Champions:

1983 - New York Islanders

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()