Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Friday, May 17, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

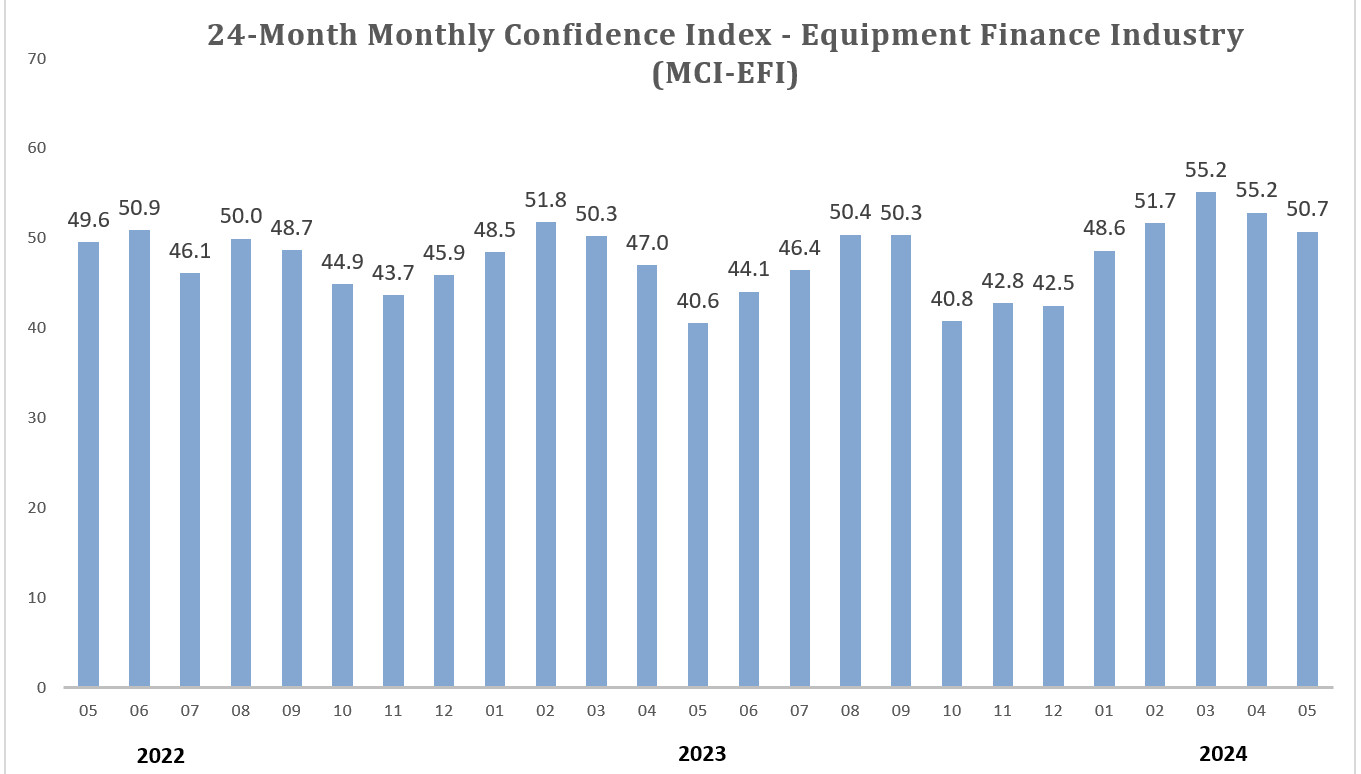

ELFF Reports 2nd Month of Confidence Down

May Fell to 50.7 d from April 52.9

Leasing and Finance Industry Help Wanted

We Are Growing Our Senior Sales Team Now

Hiring the Right Salesperson

"Ducks in Eagle School" by Steve Chriest

The Number of AI Startups By Country

Plus What Industry is Receiving the Most Funding

U.S. Trade Deficit with China

Narrows to Lowest Since 2010

Southern California Bancorp & California Bancorp

Receive of Regulatory Approval

DLL Closes Second U.S. Securitization

Transaction of 2024

Mitsubishi HC Capital America and Electrada Partner

to Provide EV Charging-as-a-Service

New Streaming Releases

Reviews By Fernando Croce

Belgian/Malinios Mix

San Francisco, Adopt-a-Dog

News Briefs ---

Element Reports Record First Quarter Results

Solid net revenue growth of 16.8% led by

continued strength in services revenue

Walmart stock pops after earnings beat

retailer surpasses $500 billion in market cap

Supreme Court rules Consumer Financial Protection

Bureau funding structure is legal

After Dow briefly tops 40,000 for first time,

Wall Street edges back from record

58% of businesses’ long-term debt rose over

the past year: report

You May Have Missed ---

Nasal Breathing vs. Mouth Breathing: Which Is

Better for Your Airway Health?

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Eric DeHart was hired as Marketing Director, Head of Technology Finance, Alliance Funding Group, Tustin, California. Previously, he was Vice President of Sales, CCA Financial (October, 2021 - April, 2024); Vice President, U.S. Bank Technology Finance Group (June, 2014 - June, 2021); Relationship Manager, JP Morgan Chase (July, 2013 - June, 2014). Full Bio:

https://www.linkedin.com/in/deharteric/details/experience/

https://www.linkedin.com/in/deharteric/

James Weyland was hired as Equipment Finance Relationship Manager, Jupiter Equipment Finance, Jupiter, Florida. He is located in Greater Philadelphia. Previously, he was Regional Sales Manager, Equify Financial, LLC (June, 2023 - May, 2024); Account Manager, North Mill Equipment Finance (January, 2021 - June, 2023); Sales Development Representative, Marlin Capital Solutions (March, 2020 - January, 2021). Full Bio:

https://www.linkedin.com/in/james-weyand-424620112/details/experience/

https://www.linkedin.com/in/james-weyand-424620112/

Joleen Williams was hired as Sales Operations Specialist, GuidePoint Security, Herndon, Virginia. She is located in the greater Chicago area. Previously, she was at Old National Equipment Finance Company, starting December, 2018, Loan Lease Administrator, promoted Lease Servicing Special III (Decrement, 2019 - May, 2014); Executive Sales Assistant to CEO, IFSC (October, 2013 - December, 2019). Full Bio:

https://www.linkedin.com/in/joleenwilliams1/details/experience/

https://www.linkedin.com/in/joleenwilliams1

[headlines]

--------------------------------------------------------------

ELFF Reports 2nd Month of Monthly confidence Down

May Fell to 50.7 from April 52.9

(ELFF Chart)

“The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 50.7, a decrease from the April index of 52.9."

Jason Lueders, President, Farm Credit Leasing, said, “The delay of expected or hoped-for interest rate reductions seems to be leading some entities to reconsider capital projects. To date, volume and credit quality have held up, but it’s not clear what the future will hold.”

Bruce J. Winter, President, FSG Capital, Inc., said, “This year, the story of our industry centers on the availability of funding, creating a world of ‘haves’ versus ‘have nots.’ Undoubtedly some active funders today will become ‘have nots’ as their traditional funding mechanisms change. This will create substantial opportunities for strong and experienced participants to pick up not only market share, but more importantly, key personnel that have become displaced from their historical employers. Making the right move(s) now in this time of market disruption will allow these entities to grow and diversify their businesses while others are unable.”

Donna Yanuzzi, EVP, First Equipment Finance, Inc. (FNCB Bank), said,"“Businesses will always need equipment. There may be a few less buyers, but in times like these there is less competition as lenders pull back so it evens out. Having a strong sales team to find those buyers and the right program structure to attract those buyers is key.”

Full Press Release:

https://www.leasefoundation.org/industry-resources/monthly-confidence-index/

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

Hiring the Right Salesperson

“Ducks in Eagle School”t

Anyone who has managed salespeople must admit to making hiring mistakes. At one time or another, all of us have found ourselves unable to resist the temptation of hiring the next great superstar, even though our intuition made us uneasy, or something in their story just didn't jive with reality.

If you continue to rely on “gut checks” in your hiring process, you are likely to make more bad hires than necessary. I once heard someone admonish sales managers: “Don't send your ducks to eagle school!” It just won't work. You send the ducks out hunting, they find a rabbit and they make friends with it! You then yell to the ducks, “No, no, reread page twenty-one of your hunting manual!”

The same thing happens when you send the wrong salespeople on a hunting expedition for new prospects and you realize that they make friends with potential customers, buying them lunch, treating them to sporting events, and showering them with expensive gifts. In frustration, you yell, “No, no, bring in the orders, close the prospects, close the prospects!”

The first step in avoiding hiring mistakes is to recognize some of the myths about sales. For example, just like expecting ducks to hunt, you can't train someone for a job they can't do. All the training in the world won't help someone with a poor aptitude for math work successfully as a physicist.

Another myth about sales is that you can train talent. The truth is talent can't be trained. You either can sing like an American Idol or you can't. When it comes to talented salespeople, however, the experts tell us that talented folks can be improved by up to 20%.

Let's look at the numbers. If you can improve someone in the 80th percentile by 20%, they can become a 96%. The bad news, unfortunately, is that all the time and money in the world won't make a 20% more than a 25%!

Nearly 45% of all money spent by business on employee training and education is spent on sales. At some point, companies will demand a better system for selecting sales candidates with the potential and will to perform up to management's expectations. For many companies, this may become their single most important investment to improve market share and profitability.

Finally, avoiding bad hires is a true win-win. The company and sales managers win because time and resources aren't squandered on candidates that just don't have the aptitude or the will to succeed in sales. The candidates win because they are free to pursue other opportunities more.

Steve Chriest is the CEO of Open Advance and author of “Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101.” He is the former president of several leasing companies. Today, he produces video and radio blogs, as well as continuing as a columnist for Leasing News since 2005.

800-570-7145

schriest@sbcglobal.net

http://www.openadvance.com

[headlines]

--------------------------------------------------------------

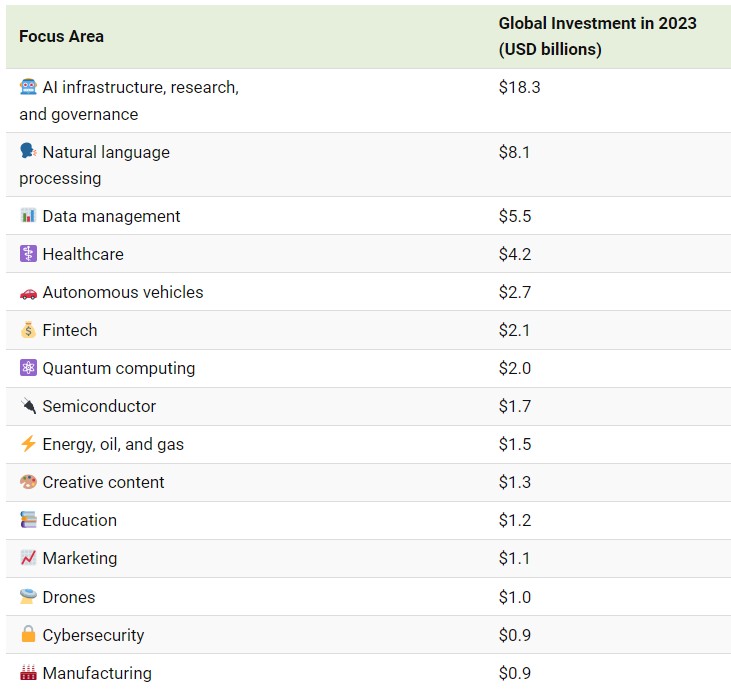

The Number of AI Startups By Country

Plus What Industry is Receiving the Most Funding

The figures in this graphic represent the number of newly funded AI startups within that country, between 2013 and 2023. Only companies that received over $1.5 million in private investment were considered.

Industry Where Money Invest in A1

Chart here

Source: www.visualcapitalist.com

[headlines]

--------------------------------------------------------------

Is the U.S. Pulling Away From China Economically?

By Felix Richter, Statista

he U.S. trade deficit in goods trade with China narrowed to its lowest level since 2010 last year, as imports from China fell by more than $100 billion compared to the previous year. In fact, imports from the world’s largest exporter were even lower than in 2020, when imports from China had fallen to $432 billion amid an ongoing trade war between the two countries and disruptions caused by the Covid-19 pandemic.

According to the U.S. Census Bureau, the deficit with China decreased more than 25 percent to $279 billion in 2023, as tensions – both economic and political – between the two superpowers have remained high. Amid those tensions, many companies have tried to reduce their dependency on China by diversifying their supply chain or moving final assembly to other Asian countries.

Moreover, Chinese platforms like Temu, which are shipping increasingly large quantities of packages directly to U.S. consumers, take advantage of the so-called de minimis exception, which allows packages worth less than $800 to enter the U.S. tariff free. These shipments aren’t counted in U.S. trade data, meaning that actual imports from China are higher than official data suggests.

|

[headlines]

--------------------------------------------------------------

#### Press Release ########################

Southern California Bancorp & California BanCorp

Announced Receipt of Regulatory Approval

for Merger of Equals

Southern California Bancorp and California BanCorp have received required regulatory approvals from the Office of the Comptroller of the Currency and the Federal Reserve Bank of San Francisco necessary to complete their previously announced merger of equals between the two bank holding companies and their respective subsidiaries, Bank of Southern California and California Bank of Commerce.

David Rainer, chairman and CEO of Southern California Bancorp and Bank of Southern California, said, “We are pleased to announce the receipt of these regulatory approvals for the proposed merger of these two outstanding banks, as it represents an important milestone on our merger timeline.”

Under the terms of the agreement, dated January 30, 2024, California BanCorp will merge with and into Southern California Bancorp. The consummation of the proposed transaction is expected to close in the third quarter of 2024, subject to the satisfaction of the remaining closing conditions set forth in the merger agreement, including receipt of the requisite shareholder approvals.

Steve Shelton, CEO of California BanCorp, said, “With the receipt of these regulatory approvals, we are one step closer to the merger of these two exceptional companies that we believe will result in the premier statewide commercial banking franchise in California,” , said.

### Press Release #######################

|

[headlines]

--------------------------------------------------------------

##### Press Release #######################

DLL Closes Second U.S. Securitization

Transaction of 2024

Des Moines, IA – Leading global vendor finance company, DLL announced the closing of “DLLAD 2024-1”, the second U.S. securitization transaction this year, issuing notes totaling USD 650 million. The notes are backed by loans and leases secured with Agricultural, Golf and Turf assets of DLL Finance LLC.

Chris Morris, US Treasurer for DLL, said, “This is our second Asset Backed Securities (ABS) transaction this year with again, strong investor interest including new investors. We are happy with the continued investor interest driven by the programmatic issuance of DLL ABS programs”

Grégory Raison, CFO and Member of the DLL Executive Board added: “It is always great to see that investors are willing to put their trust and confidence in our securitization platform. DLL U.S. securitization transactions will continue to be a part of DLL’s long-term growth strategy to diversify our USD funding base.”

The transaction is rated F1+/P-1 or AAA/Aaa by Fitch and Moody’s, respectively.

About DLL

DLL is a global asset finance company for equipment and technology with a managed portfolio of more than EUR 44 billion. Founded in 1969 and headquartered in Eindhoven, the Netherlands, DLL provides financial solutions to the Agriculture, Food, Healthcare, Clean Technology, Construction, Transportation, Industrial, Office Equipment and Technology industries in more than 25 countries. DLL partners with equipment manufacturers, dealers and distributors, as well as end-customers on a direct basis, to enable businesses to more easily access equipment, technology and software. The company also delivers insights and advice to partners and customers that drive smarter and more economical methods of use. DLL combines customer focus with deep industry knowledge to deliver sustainable solutions for the complete asset life cycle, including commercial finance, retail finance and used equipment finance. DLL is a wholly owned subsidiary of Rabobank Group. To learn more about DLL, visit www.dllgroup.com.

[headlines]

--------------------------------------------------------------

### Press Release #########################

Mitsubishi HC Capital America and Electrada Partner

to Provide EV Charging-as-a-Service for Vehicle

OEMs and Commercial Customers

NORWALK, Conn., (GLOBE NEWSWIRE) -- Despite a recent growth forecast of 27.5% CAGR and the size of the electric vehicle (EV) charging infrastructure market estimated to exceed $224.8 billion by 2032, the lack of reliable and managed on-site charging options remains a key challenge to broad EV adoption for commercial fleets. To provide vehicle OEMs and commercial users with access to critical EV infrastructure, Mitsubishi HC Capital America, the largest non-bank, non-captive finance provider in North America, and Electrada, the electric fuel solutions leader for fleets, announce their partnership to provide Electrada’s 360 Charging-as-a-Service (CaaS) as part of a holistic offering.

John Critelli, Director of SDG Sales, Transportation Finance at Mitsubishi HC Capital America, said, “Electrada’s approach represents a comprehensive infrastructure and electric fuel solution to unlock the benefits for fleets going electric and complements the long-standing financing support provided by Mitsubishi HC Capital America to commercial customers and vehicle OEMs,”

“The clear difference with this type of service model is that it’s not entirely about equipment finance, but rather about a risk mitigation solution for the energy component of a customer’s electric fleet program. The customer makes a fixed-rate, pre-negotiated CaaS payment for the entire contract term, covering everything from capital equipment to energy supply to maintenance and uptime management.

“Electrada shifts the technology, performance and price risk from the customer, providing a more predictable experience that will accelerate OEM success in selling more EVs and fleets.”

Electrada’s 360 CaaS model already serves numerous light-, medium- and heavy-duty fleet customers at their own depots, deploying 100% of the charging and related energy infrastructure as investor/operator under a performance contract structure. Under this partnership with Electrada, Mitsubishi HC Capital America provides the financing for the vehicle component of the electrification program, an efficient integration of EV and energy through a unified offering.

Autocar, LLC, a manufacturer of severe-duty class 7 and 8 trucks for various vocational sectors, will be the first vehicle OEM to commercialize this partnership’s fleet solution for its own customers.

Mark Aubry, President, Terminal Tractor, Autocar Industries, said, “Our customers are looking for a more seamless way to go all-electric with the trucks we deliver. This new partnership will drive greater adoption of our BEV trucks across our entire customer base by providing an end-to-end solution for the whole sales and use cycle, from vehicle financing provided by Mitsubishi HC Capital America to the fully capitalized, owned and managed electric fuel solution that Electrada delivers through 360 CaaS.

.

“This partnership makes acquiring and operating a BEV exponentially simpler for our customers, and provides the necessary ingredients to dramatically reduce operating costs and carbon emissions.,” added Aubry.

[headlines]

--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

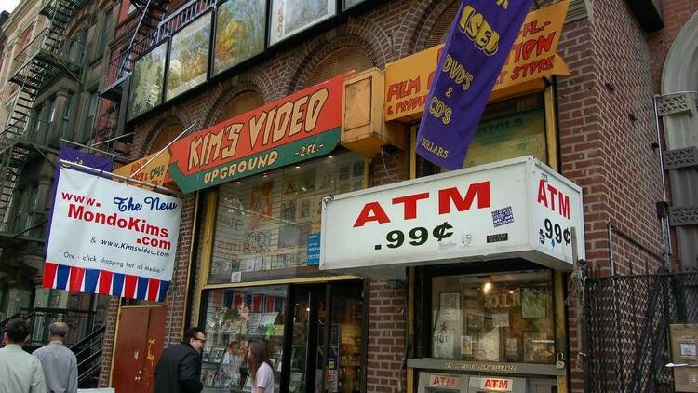

New streaming releases include plenty of robust action (“The Beekeeper,” “Monkey Man”) and provocative thrills (“Immaculate,” “Love Lies Bleeding”), along with an offbeat documentary (“Kim’s Video”).

The Beekeeper (Amazon Prime, Apple TV): Director David Ayer (“Suicide Squad”) serves up a solid slice of action in this dynamic thriller, anchored by a dependably muscular Jason Statham. Statham plays Adam Clay, a former secret agent who’s turned his back on his violent past to live a quiet life in the country, tending to bees. His closest friend is Eloise (Phylicia Rashad), a rancher on whose property he lives. When she kills herself after being bilked out of her savings by online scammers, Adam goes back to his old ways to dole out justice. He tracks down the ones responsible, only to find that their organization reaches much higher. Bone-crunching stunts, Statham’s macho minimalism and a dastardly Jeremy Irons supporting turn add to a brutally engaging time.

Immaculate (Amazon Prime, iTunes): Sydney Sweeney captivates in this moody horror film, which re-teams her with her “The Voyeurs” director, Michael Mohan. A stranger in a strange land, Sister Cecilia (Sweeney) is a young American nun who joins aconvent in Italy. Though she barely speaks the language, she becomes friends with another nun (Benedetta Porcaroli) and is warmly mentored by the resident priest (Alvaro Forte). Things take a bizarre turn, however, when the virginal Cecilia finds herself pregnant, news that some see as a miracle while she suspects something darker. Gradually, the convent that welcomed her starts looking like a trap full of subterranean secrets. Influenced by the convent-set thrillers of the 1970s, as well as the classic “Rosemary’s Baby,” this is twisty, bloody fun solidly founded on its star’s charisma.

Kim’s Video (Amazon Prime, Apple TV): Movie buffs, as well as lovers of the increasingly vanishing physical media, will enjoythis offbeat documentary about the titular, beloved New York City video store. A staple of hipster cinephilia from its opening in the 1980s to its closing in the late 2000s, Kim’s Video is lovingly recalled as a haven for hardcore movie-lovers, where classics and bootlegged rarities shared space on the shelves. DirectorsDavid Redmon and Ashley Sabin, as well as several ardent former clients who went on to cinematic fame, recount the place’s eclectic collection and underground atmosphere. In addition to waxing nostalgic, Redmon travels abroadto track down Kim’s legendary tapes, which were last seen in Sicily after the business closed. The results are brisk, enthusiastic, enjoyably oddball.

Love Lies Bleeding (Amazon Prime, iTunes): British director Rose Glass follows the psychological terror of her debut “Saint Maud” with this romantic neo-noirthriller, which is just as intense but features a new, welcome propulsive vitality. Set in New Mexico in the late 1980s, it centers on Lou (afirst-rateKristin Stewart), who runs a small-timegym and whose lonely life changes when she meets a bold bodybuilder named Jackie (Katy O’Brian). Their romance is complicated by Lou’s family, which includes an arms-dealing father (Ed Harris) and an abusive brother-in-law (Dave Franco). Following a bout of violence, the couple head to Las Vegas while being pursued by Daisy (Anna Baryshnikov), an obsessive friend of Lou’s. Re-energizing familiar pulp tropes with sheer, fierce verve, the film is a blazingride.

Monkey Man (Amazon Prime, Apple TV): “Slumdog Millionaire” star Dev Patel makes an auspicious directorial debut with this kinetic, Mumbai-set revenge thriller. Patel also stars as the nameless main character, a young man who makes his living taking beatings while wearing a gorilla mask at the local underground boxing club. Determined to rise in this seedy world, he infiltrates the gang of a crime boss called Queenie (Ashwini Kalsekar). There, he sets in motion a scheme to take down Baba (Makarand Deshpande), the heartless, politically-connected spiritual guru who’s behind the protagonist’s childhood trauma. While spiking the narrative with allegorical nods to underclass outcasts and nationalistic cults, Patel mainly keeps things rooted in fast and furious action, staging stunts and fights with a visceral energy that’s reminded critics of the “John Wick” movies.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since 2008. His reviews appear each Friday.

[headlines]

--------------------------------------------------------------

Belgian/Malinios Mix

San Francisco, Adopt-a-Dog

Odette

RTUG-A-659

Female

4 Year, 4 Months, 4 Weeks

Good with Dogs

Are you ready to meet a cheerful pup that loves the outdoors and can actively keep up with you? If yes, this canine stunner may be your ideal match.

Odette is a gentle gal, giving her fosters sweet kisses and affection. She handles her treats and soft toys with extra care. Playful and spirited, Odette gets along with fellow doggies when properly introduced.

This lovely lady will fancy your skills as a delegator. Odette is most content when she stays productive and squeezes in some essential snuggle time. She is very sweet, good in the house, cuddles on the couch and sleeps on the bed near the pillow.

She is not suited for first time dog owners, no small children, no small pets, no cats. Her prey drive is over the top, a fence might slow her down but it won't stop her from chasing a critter.

Malinois are historically herding animals and can make amazing guard dogs. With this in mind, Odette's ideal home offers her room to roam and a job to do. She would thrive in an environment with attentive humans without small children and pets.

Odette is ready to begin her furever adventure. To schedule a meet and greet, fill out the online application and a volunteer will respond in a few days.

Rescue the Dog

https://www.rescuetheunderdog.com

[headlines]

--------------------------------------------------------------

News Briefs

Element Reports Record First Quarter Results

Solid net revenue growth of 16.8% led by

continued strength in services revenue

https://finance.yahoo.com/news/element-reports-record-first-quarter-210100258.html

Walmart stock pops after earnings beat,

retailer surpasses $500 billion in market cap

https://finance.yahoo.com/news/walmart-stock-pops-after-earnings-beat-retailer-surpasses-500-billion-in-market-cap-133920047.html

Supreme Court rules Consumer Financial Protection

Bureau funding structure is legal

https://www.cnbc.com/2024/05/16/supreme-court-rules-consumer-financial-protection-bureau-funding-structure-is-legal.html

After Dow briefly tops 40,000 for first time,

Wall Street edges back from record

https://www.mercurynews.com/2024/05/16/dow-crosses-40000-for-the-first-time/

58% of businesses’ long-term debt rose over

the past year: report

https://www.cfo.com/news/58-of-businesses-say-their-long-term-debt-has-increased-in-the-last-year

[headlines]

--------------------------------------------------------------

Nasal Breathing vs. Mouth Breathing: Which Is

Better for Your Airway Health?

https://www.airwayhealth.org/post/nasal-breathing-vs-mouth-breathing-which-is-better-for-your-airway-health

[headlines]

--------------------------------------------------------------

Sports Briefs---

A’s, Oakland still ‘far apart’ on Coliseum

extension; Sacramento meeting looms

https://www.eastbaytimes.com/2024/04/02/oakland-as-and-city-officials-remain-far-apart-on-coliseum-lease-extension-after-tuesdays-meeting/

49ers to open season on ‘Monday Night Football’

against Aaron Rodgers, Jets

https://www.pressdemocrat.com/article/sports/49ers-jets-monday-night-football/

Warriors head coach Steve Kerr honored

by Pro Basketball Writers Association

https://www.sfchronicle.com/sports/warriors/article/warriors-steve-kerr-honored-pro-basketball-19457408.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Nvidia widens South Bay property holdings

with $350 million-plus deal

https://www.mercurynews.com/2024/05/16/nvidia-widens-south-bay-property-holdings-with-350-million-plus-deal/

Big San Jose housing project advances

with property purchase deal

https://www.mercurynews.com/2024/05/16/san-jose-house-home-build-develop-real-estate-property-economy-buy/

First commercial hydrogen fueling station in the

nation for big rigs set to open in West Oakland

https://www.eastbaytimes.com/2024/05/16/first-commercial-hydrogen-fueling-station-in-the-nation-for-big-rigs-set-to-open-in-west-oakland/

Cupertino adopts housing plan for 4,588 homes,

seeks to allow zoning for high-density projects

https://www.eastbaytimes.com/2024/05/16/cupertino-adopts-housing-plan-for-4588-homes-seeks-to-allow-zoning-for-high-density-projects/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

This Rising Star Sonoma Winemaker Is Bringing

the Natural Wine Community Together

https://www.sonomamag.com/this-rising-star-sonoma-winemaker-is-bringing-the-natural-wine-community-together/?utm_id=a2l0bWVua2luQGxlYXNpbmduZXdzLm9yZw

U.S. Wine Industry Surpasses $107 Billion

In 2023 Sales, Report Reveals

https://www.forbes.com/sites/lizthach/2024/05/15/wine-triumphs-us-wine-industry-surpasses-107-billion-in-2023-sales-report-reveals/?sh=1473d5491727

California’s beleaguered wine industry

finally gets some good news

https://www.sfchronicle.com/food/wine/article/bmo-report-19447266.php

Argentina winemakers talk inflation,

exports and future of Malbec

https://www.just-drinks.com/features/argentina-winemakers-talk-inflation-exports-and-future-of-malbec/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/May2023/05_17.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()