Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, May 23, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

The Dominoes Begin To Fall:

Roglieri Associate Pleads Guilty

By Ken Greene, Chief Leasing News Legal Editor, Emeritus

Balboa Capital

Job Ads

Navigating Uncertainty with Opportunity

By Scott Wheeler, CLFP

REGISTER NOW! Conferences and Forums

Commercial Finance/Leasing Finance

AACFB Meet the Funder - Channel

Wednesday, May 28 at 2:00 PM CST

American Financial Partners Marks 20 Years

with Strategic Growth, New Divisions

ELFA

CapEx Finance Index (CFI) April 2025

New Business Dip; Conditions Strengthen

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Michelle Paolini was hired as Contract Adinistrator Dext Capital. She was Sales Support Representative (June, 2024 - May, 2925), Previously, she was Equipment Finance Sales Analyst, Senior Specialist, Huntington National Bank (September, 2017 - May, 2024); Structured Sales Support Analyst, DLL (August, 2006 - September, 2017).

https://www.linkedin.com/in/michellepaolini/

PEAC, Mount Laurel, New Jersey announced the appointment of Eileen Schoonmaker as President of the Americas, effective June 16, 2025. She is located in Chester Springs, Pennsyvania. Her background is "Financial Services/Asset & Equipment Finance Excutive/Transformation ."Leader/Mentor in Stripes.

Full Biography:

https://www.linkedin.com/in/eileen-schoonmaker-6287448/details/experience/

https://www.linkedin.com/in/eileen-schoonmaker-6287448/

Lea (Reeves) Stevens was promoted to Senior Vice President, Sales at CSI Leasing, Inc, She has 15 years of experience in the equipment financing industry and has been at CSI for a total of 9 years.

https://www.linkedin.com/in/lea-stevens-48580311/

[headlines]

--------------------------------------------------------------

The Dominoes Begin To Fall:

Roglieri Associate Pleads Guilty

By Ken Greene, Chief Leasing News Legal Editor, Emeritus

Christopher Snyder of Virginia, formerly the COO of Prime Capital Ventures, pled guilty to one count of conspiracy to commit wire fraud. The plea is the first known admission of guilt in the ongoing federal investigation related to Prime.

As most Leasing News readers are aware, Kris Roglieri, once a well-known loan broker, has been accused of stealing tens of million dollars of client funds. Not only are he and his companies facing claims of more than $200 million in civil lawsuits, but, critically, five criminal charges of wire fraud. He is scheduled for trial in January of 2026. Among other accusations, prosecutors claim that Mr. Roglieri engaged in a classic Ponzi scheme.

Mr. Snyder’s guilty plea was entered before U.S. District Court Judge Mae A. D’Agostino, the same federal judge who will preside over Mr. Roglieri’s trial on January 5. The charges against Mr. Snyder were based on allegations that he received $65,000 from a $2 million cash deposit paid to Prime as collateral for a $100 million construction loan that never materialized.

Besides Mr. Snyder, several other individuals and companies have been named as defendant in the cases related to Prime. These include Tina Roglieri, Kimberley Humphrey, Prime Commercial Lending, LLC, Commercial Capital Training Group, LLC, The Finance Marketing Group, National Alliance of Commercial Loan Brokers, and FUPME, LLC.

Stay tuned as we await the next domino to fall!

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Navigating Uncertainty with Opportunity

By Scott Wheeler, CLFP

While uncertainty in the macroeconomy persists and market volatility is expected to continue through 2025, there is an abundance of positive momentum within the commercial equipment finance and leasing industry—especially for originators.

The Outlook is Strong for Originators

Opportunities abound for those who are well-positioned and willing to work hard. Over the past 18 months, portfolio performance has improved significantly, and companies are eager to grow their asset bases. In support of this growth, firms have been investing heavily in automation and operational efficiency, giving originators the tools they need to solicit, win, and fund more transactions. The message is clear: Embrace technology.

Structured transactions are once again in high demand, as originators bring flexibility, innovation, and compelling cash-flow solutions to the table for end-users. Meanwhile, the capital markets remain active, with new sources of funding entering the space—an encouraging sign that confidence in future growth remains strong.

We’re also witnessing the rise of a new generation of professionals entering the industry, bringing with them fresh perspectives, energy, and a heightened sense of opportunity. This influx of talent bodes well for both newcomers and seasoned professionals—especially originators.

Focus on What Matters

In today’s noisy environment—marked by political tensions, global uncertainty, and sudden market shifts—it is easy to become distracted. But originators are best served by tuning out the background noise and focusing on what truly matters: delivering superior products and solutions for their vendors and end-users.[headlines]

--------------------------------------------------------------

Conferences and Forums – Coverage Updated

Commercial Finance/Leasing Finance

September 10-12: AACFB Commercial Financing Expo, Austin, Texas

Conference Details Coming Soon

Mel Vinson, CLFP, Vice President of Marketing and Development, CLFP Foundation, will be covering The conferences for Leasing News reads.

September 17: Brokers Expo NYC returns at Center415 on Fifth Avenue in Midtown

The Wait is Over:

Conference details and sign-up

Don Cosenza, CLFP, will cover the Expo as he did last year for Leasing News readers.

October 14-16: National Equipment Finance Association Fall Conference, Renaissance Hotel, Minneapolis, Minnesota

Conference Details Coming Soon

Vicki Shimkus, CLFP, Balboa Capital Relationship Manager, will be covering the conference for Leasing News readers.

October 26-28: ELFA 64th Annual Convention, Marco Island, Florida

Conference Details

Randy Haug, LTi Technology, will be covering the conference for Leasing News. He remembers, "This is going to be back to the same venue and property that the ELFA had previously scheduled but the hurricane came through and the ELFA had to cancel at the last minute, then reschedule up in Orlando a few weeks later." He will also be in Washington DC at the annual ELFA Capitol Connections meeting in early June this year.

To be listed or update: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Catch Alecia & Stephen live at American Association of Commercial Finance Brokers

Meet the Funder next Wednesday, May 28 at 2:00 PM CST. They'll break down what we offer and answer any questions. Make sure you are there for exclusive prizes and merch! Don’t miss it.

[headlines]

--------------------------------------------------------------

American Financial Partners Marks 20 Years

with Strategic Growth, New Divisions

Founded in 2004, the Gary, South Dakota-based company has built its reputation on relationship-driven service and financial expertise. Its team now has more than 200 years of combined experience to clients nationwide.

“We’ve always believed growth should be intentional and rooted in our values,” said Amy Wagner, CLFP, founder and CEO of AFP. “This next chapter is about expanding our impact, strengthening our team, and entering new sectors, like transportation, with leaders like Kim Langlois and Gina Calco who bring unmatched experience and integrity to the table.”

Strategic expansion highlights include:

- Leadership additions: JoJo Williams joins as national business development director, and Gabby Giannonatti as senior operations specialist. Both bring strong industry experience, and a people-first approach aligned with AFP’s core values.

- Red Thread Financial growth: Led by Alayna Pederson, the creative and industrial division continues to support entrepreneurs and legacy businesses with flexible equipment financing and personalized service.

- Transportation division launch: Industry veterans Kim Langlois and Gina Calco now lead AFP’s newly formed transportation unit, providing tailored, fast, and flexible financing solutions to trucking companies across the country.

- Technology with a personal touch: A new vendor portal, set to launch soon, will streamline deal flow and improve visibility—while preserving AFP’s hallmark of hands-on review and personalized support.

“Growth only matters if it creates value for our partners,” Wagner said. “JoJo and Gabby bring unmatched energy and insight. Kim and Gina are game changers. Their industry expertise and passion for helping customers succeed are exactly what this next phase is all about.”

AFP remains focused on helping businesses grow through fast, fair and relationship-based financing.

###

About American Financial Partners

American Financial Partners is a full-service, national commercial finance company based in Gary, South Dakota. Since 2004, AFP has delivered fast, flexible financing solutions that help thousands of businesses across industries grow and succeed. With a focus on service, strategy, and long-term, Midwest values, AFP partners with companies to provide equipment financing and working capital that fits their goals. Learn more at www.financewithafp.com.

About Red Thread Financial

Red Thread Financial is the creative services division of American Financial Partners, offering specialized financing for quilting, embroidery, and maker-based businesses. Since 2011, Red Thread has helped entrepreneurs turn their craft into sustainable success with tailored equipment financing and a simple, supportive process. Learn more at redthread.financewithafp.com.

--------------------------------------------------------------

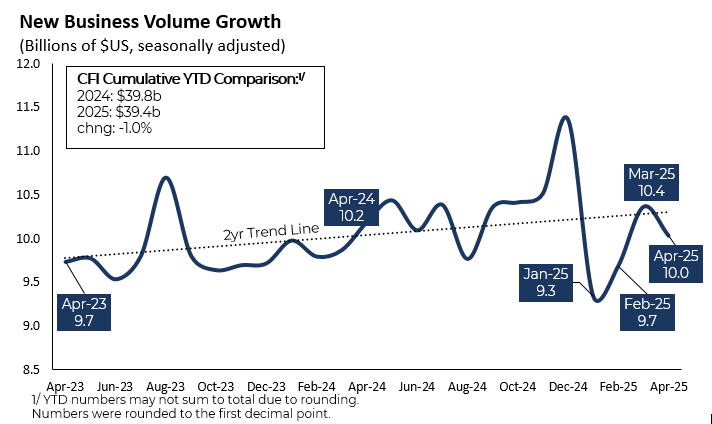

CapEx Finance Index (CFI) April 2025

New Business Volumes Dip; Financial Conditions Strengthen

- Forecast: A slight contraction in new business volumes suggests a 0.4% decline in new durable goods orders in April.

- Total new business volume (NBV) rose by $10 billion seasonally adjusted among surveyed ELFA member companies, a decrease of 3.2% from the prior month.

- NBV year-to-date contracted by 1.0% relative to the same period in 2024.

- Year-over-year, NBV dropped by 4.4% on a non-seasonally adjusted basis.

- Charge-offs (losses) declined to 0.40%, the largest single-month decrease since October of 2020.

“The April CFI showed a sector that weathered the recent surge in economic and financial market volatility. Demand for new equipment eased a little, but remained healthy, especially given all the April ups-and-downs,” said Leigh Lytle, President and CEO at ELFA. “Financial conditions strengthened remarkably, with losses and delinquencies plummeting. The across-the-board improvement in charge-offs highlights the industry’s resiliency, while the reduction in delinquencies suggests more improvements in financial conditions are on the horizon. Even if some of the impact from changing trade policy is delayed, the strength in financial conditions shows that it will take a lot more than uncertainty to knock the industry off course. While I don’t expect calm waters over the remainder of the year, I am optimistic that uncertainty will ease, which suggests a strong second half of the year for our industry.”

![]()