Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Thursday, May 29, 2025

Today's Leasing News Headlines

Kris Roglieri’s Chief Operating Officer Pleads Guilty

Details of Roglieri's Operation Revealed

Bob Coleman, Coleman Report

Types of Fraud

Found in Commercial Financing & Leasing

Opportunity

By Ken Lubin, Managing Director, ZRG Partners

Embrace Your Competition

by Scott Wheeler, CLFP

Balboa Capital Available Position

Program Manager II - Equipment Broker Sales

Full Job Details - Benefits

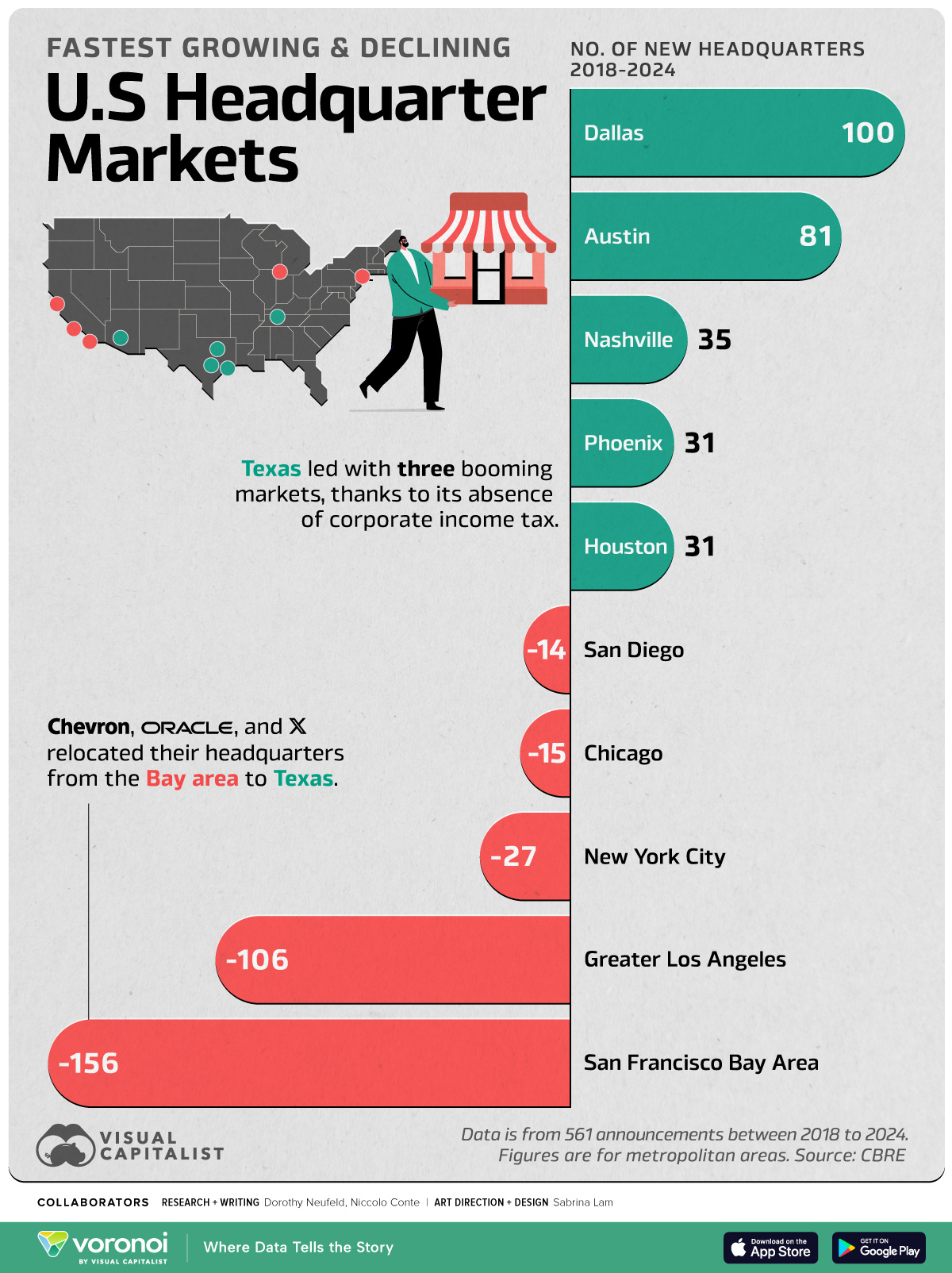

Charted: The U.S. Cities Gaining and Losing

Corporate HQs

Amur Completes its 15th Term Securitization -

Despite economic uncertainty, Amur’s $329.25mm

transaction received overwhelming investor support

News Briefs---

GM to pour $888M into building new V-8 engine

in New York plant

Salesforce is gobbling up a Bay Area competitor

for $8 billion

The Sun is Killing of SpaceX's

Starlink Satellites

Kohl's will close 27 stores by Saturday. Macy's is closing more

Here's where they all are

Mainstay for Small Businesses

Clamps Down

You May Have Missed ---

Donald Trump Photo on $100 Bill

Introduced March 3, 2025

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Kris Roglieri’s Chief Operating Officer Pleads Guilty

to Loan Fraud - Details of Roglieri's Operation Revealed

May Seal January 2026 Trial Outcome

Bob Coleman, Editor Coleman Reports

Christopher Snyder, former Chief Operating Officer of Prime Capital Ventures, has agreed to plead guilty to one count of conspiracy to commit wire fraud. This development is part of a larger fraud case involving three co-conspirators.

The main suspect, Kris Roglieri, is currently sitting in a New York County Jail awaiting trial on fraud charges, set to begin in January, 2026. Bail has been denied for threatening an FBI agent.

The third co-conspirator remains unidentified by federal authorities.

In Snyder’s plea agreement, he says Roglieri transferred, stole, and fraudulently diverted borrower loan funds by initiating wire transfers over the internet from his home to KeyBank servers in Ohio.

Snyder says approximately 18 victim borrowers paid Prime Capital over $40 million in due diligence and ICA payment fees. The conspirators claimed these ICA payments would be held separately and refunded if loans didn’t materialize. However, Snyder knew Prime Capital was unable to secure loans and was operating a Ponzi-like scheme, using new client funds to pay off earlier borrowers.

As part of the scheme, conspirators asked prospective clients to sign a letter of intent and pay a $25,000 to $75,000 due diligence fee to Prime Capital.

This was followed by soliciting upfront monies from the borrowers in the form of an interest credit account (ICA) payment. The theory was that the money represented prepaid interest for a construction loan. Prime Capital promised that the ICA payment would be kept in a separate account and would be fully refundable if the loan did not materialize.

Kris Roglieri explained this to one prospective borrower during a recorded phone call in December 2023.

Snyder knew Prime Capital had been unsuccessful in securing loans for its borrowers and that the company was using a Ponzi-type scheme, utilizing newer fundings to pay off older borrower clients.

But Snyder continued to work the fraud. One specific instance, which was used for the criminal indictment against Kris Roglieri occurred in December 2023. Roglieri and another co-conspirator fraudulently sought and obtained a $5 million ICA payment from 1800 Park Avenue, a Minnesota company that was seeking a $100 million line of credit to construct an egg farm.

It remains unclear whether Snyder will testify against Roglieri in the upcoming trial. Snyder’s sentencing hearing has not yet been scheduled.

Source: https://colemanreport.com/kris-roglieris-chief-operating-officer-pleads-guilty-to-loan-fraud/

[headlines]

--------------------------------------------------------------

Types of Fraud

Found in Commercial Financing & Leasing

Methods of lease fraud are constantly evolving. Individuals perpetrating these frauds have studied our industry's practices and methods. Many of these frauds involve Vendors and Lessees who meet most of the screening criteria utilized by leasing companies - directory assistance listing, time in business, and physical storefronts. Lease Police, Inc. has identified the following general types of lease fraud:

Disguised Working Capital Fraud - In this scenario, a vendor presents himself as a legitimate seller of equipment; however, he is nothing other than someone soliciting for working capital loans. He will take a customer's current equipment and disguise it as his equipment and lease it back to the customer (the lessee). The vendor will keep 30% to 50% of the lease proceeds and will give the remainder to the lessee. This type of fraud can be very damaging and hard to detect, as many of the re-liquefied lessees will make payments for a while after funding. Most funders will experience a default rate between 10% to 40% with these transactions. Many of these vendors will "spread their paper" among several sources to further conceal their detection. Using LeasePolice.com, detecting these vendors is easy - just take note of excessive early termination activity.

Overpriced Equipment Working Capital Fraud - A vendor will overprice a piece of equipment and offer the debtor or lessee money back. For example, a vendor will lease a $5,000 computer for $30,000 and give the debtor or lessee $15,000 as an inducement to enter into the lease. This type of fraud will have higher loss rates over the portfolio life, but because the debtor/lessee has just received a "lump sum" from the vendor, they will make payments for a while. Using LeasePolice.com, detecting these vendors is easy - just take note of excessive early termination activity.

Product Representation Fraud - In this scenario, the vendor may offer a deal that is "too good to be true." It may involve a 100% money back guarantee, inflated promises on the equipment, or a "promise and disappear" scheme. These vendors appear to be tremendous engines of new leases. They can produce hundreds of new leases per month from the beginning of their existence. In most of these cases, the vendor is gone after one to two years, leaving funders an endless stream of litigation. Using LeasePolice.com, detecting these vendors is easy - just take note of a high number of recent inquiries for a newer vendor.

"Broken Up" Transaction Fraud - This type of fraud includes activity by Vendors and Debtors/Lessees who break up a larger deal into smaller pieces to avoid financial disclosure (without disclosing their other requests to the lenders). In most cases, those involved are aware of the application-only limits and apply for a large number of smaller transactions due to poor financial information. Imagine a $350,000 deal that is achieved by "splitting the transaction into five $70,000 transactions with five different funders. Some of these deals are further disguised by applying for corporation-only signatures - with no credit bureau reports reviewed. In many cases, the debtor/lessee is already in distress and they fold under the higher debt levels. Using LeasePolice.com, detecting these lessees is easy - just take note of a high number of recent inquiries. Even corporation only transactions are shown in LeasePolice.com.

Past Due Account "Layoff" Fraud - This is one of the oldest and least reported types of fraud in the industry. A Vendor has an internal delinquent open account with a customer. They usually threaten the customer to either pay the past due balance or they will pick up the equipment. As an option, they offer the past due customer the option to convert their account into a lease. By converting the delinquent customer into a lease, they get paid by the equipment leasing company and the leasing company gets an almost instantaneous delinquency. Many of these deals show up as first payment defaults. All participants are legitimate companies and fraud is almost never suspected! Using LeasePolice.com, detecting these Vendors is easy - just take note of a high number of early terminations/defaults using the LeasePolice.com system.

General Misrepresentations By Vendors and Lessees - This general category includes activities such as submitting altered financial statements, hiding prior bankruptcies, hiding ownership, false references, misrepresenting used equipment as new, falsifying actual date of sale or delivery, equipment being sent to other locations without disclosure, concealing large judgments or liens, and leasing the same collateral twice. Using LeasePolice.com, detecting these transactions is easy. LeasePolice.com subscribers can report any suspicious activities and they will be posted in our data files for future review.

[headlines]

--------------------------------------------------------------

Opportunity

By Ken Lubin, ZRG Partners

This is a crazy time; there is no other way to describe it but with adversity comes opportunity. Be positive, NOT negative.

Fortunately, yes, I said fortunately, I have been an executive search professional through 2 major downturns, 9/11 and the great recession. Now it looks highly likely that I am entering my third (perhaps I am bad luck and you don’t want to hang out with me). With each of these downturns, I have learned that there is tremendous opportunity to be had. It does not happen instantly; a bit of patience, ingenuity, empathy and persistence are involved. In our instant gratification world, this is difficult but bear with me. There are a few things we can and should all be doing.

Communicating with those we care about: Many people are lonely and a quick phone call, face time, or even text can go a long way. It doesn’t just have to be family members or friends, but it can be colleagues, clients, vendors, etc.

Build a blog, create a voice, be an expert: This is an amazing opportunity to get your voice and expertise heard. We are all experts in something. Be the expert, share your ideas and communicate. It has never been easier to do this. You can start with free accounts and templates at weebly.com or wix.com

Get outside your comfort zone: Whether you believe it or not, we are all outside our comfort zones right now. It is not a time to hibernate but a time to expand. This is not a time to say you don’t have time, because all you have is time. Embrace it.

Believe in yourself. For me, this is the hardest thing. Believing that I will make it through these tough times, or believing in my ability, or believing that others believe in me. When I really think about it, I have made it this far. What is going to stop me from the next part of the journey?

Life is going to throw curve balls and knuckle balls: Sometimes it will be a hard ball, sometimes it will be a balloon, but no one ever said this was going to be easy. Let’s take advantage of the tough times, rather than the tough times taking advantage of us. Go outside, breathe some fresh air, and sweat! We are all in the same boat, be the one who is rowing faster than the others. There is amazing opportunity to be had.

Please call me if you have any questions.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

klubin@zrgpartners.com

C: 508-733-4789

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Embrace Your Competition

by Scott Wheeler, CLFP

Over my four decades in the commercial equipment finance and leasing industry, I have learned more from my competition than from any other resource.

In the early days of my career—as a territorial sales representative—originators conducted most of their business in person. It was common to run into competitors in the waiting rooms of end-users or vendors. Originators knew their competition well—not only their names, but their strategies, strengths, and weaknesses. They saw each other’s proposals. They measured themselves against each other regularly. There was a healthy sense of rivalry. Originators respected their competitors and often congratulated them on a transaction well played and won.

Fast forward to 2025, and much of that face-to-face interaction has disappeared. Business is increasingly conducted remotely, making it more difficult for originators to develop a personal understanding of their competition.

Yet, staying connected to the competition remains a powerful and essential attribute for successful originators. Understanding the competitive landscape—how others approach deals, structure terms, or support clients—can sharpen your own edge and elevate your performance.

There is plenty of business in the market for all participants. In fact, the health and success of the competition benefits everyone. It pushes originators and companies to refine their skills, offer better products, and deliver more meaningful solutions to both vendors and end-users.

Top originators learn from their competition, embrace it, and often build lasting alliances that lead to stronger outcomes. (Some of the most successful mergers and acquisitions began as healthy rivalries.)

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Key Takeaways

- Dallas is the fastest-growing headquarter market in America, gaining 100 relocations between 2018 and 2024.

- The San Francisco Bay Area lost 156 corporate headquarters over the period, fueled by high taxes and stringent regulations.

- In just 2024 alone, California lost 17 headquarters, of which 12 moved to Texas.

Today, public companies based in Dallas-Fort Worth hold a combined $1.5 trillion in value—a figure doubling in the past five years.

Owing to its pro-business policies and lower cost of living, Texas is attracting scores of corporate headquarters, particularly from California. As a result, states are losing billions in tax revenues as the corporate landscape shifts south.

[headlines]

--------------------------------------------------------------

##### Press Release ######################

Amur Completes its 15th Term Securitization

Despite economic uncertainty, Amur’s $329.25mm transaction

received overwhelming investor support

GRAND ISLAND, NE, -Amur Equipment Finance, Inc. (“Amur”) has successfully completed its 15th term securitization, in which it issued $329.25 million in notes backed by equipment loans and leases originated through its platform. BMO served as sole structuring agent and lead book runner, with Bank of America and Truist serving as joint book runners. Moody’s and Fitch rated the transaction.

Kalyan Makam, Amur’s Chief Executive Officer, said, “At Amur, we are anchored to our mission of delivering value to our partners and customers in all markets. It’s why we relentlessly innovate, test and sharpen how we serve our partners and it’s why we believe we are building an institution that will stand the test of timer.

“The support we received in this transaction, given the swirl of economic crosswinds, validates that we are on course.”

Amur’s transaction was supported by both long-time investors as well as new participation from large global financial institutions. In all, Amur received a remarkable $1.45 billion of orders across all classes for $329.25 million in notes.

Rich Chenitz, Chief Commercial Officer, said, “Our focus is on intentional growth and developing products and service that resonate with our increasingly up-market and diversified customer base. In 2025, we have been thrilled to see a record share of originations in our A-credit and in our Construction, Industrial and Vocational segments, and this transaction reflects that,

“And we’ve only just begun – we have several new programs that we are excited to roll out this year that we believe will allow us to access an entirely new set of partners and customers. But it all starts with our team – the commitment of and alignment between our sales, underwriting, operations, technology and back-end functions is what powers our success.”

About Amur Equipment Finance, Inc.

Amur Equipment Finance is one of the largest and fastest growing independent providers of commercial equipment finance in the country and is dedicated to serving its partners and customers with fast, flexible and competitive solutions. With nearly 30 years of experience, a growing team of talented and dedicated employees and an efficient, purpose-built decisioning platform designed to deliver a differentiated experience, Amur is well-positioned to serve the financing needs of its partners and customers well into the future. Headquartered in Grand Island, NE since 1996, Amur serves economy-essential industries such as construction, manufacturing, specialty vehicles, transportation, franchise and many more.

###### Press Release ########################

News Briefs

GM to pour $888M into building new V-8 engine

in New York plant

By Pilar Arias, Fox Business

https://nypost.com/2025/05/28/business/gm-to-pour-888m-into-building-new-v-8-engine-in-new-york-plant/

Salesforce is gobbling up a Bay Area competitor

for $8 billion

https://www.sfgate.com/tech/article/salesforce-gobbles-bay-area-informatica-20347520.php

The Sun is Killing of SpaceX's Starlink Satellites

https://www.newscientist.com/article/2481905-the-sun-is-killing-off-spacexs-starlink-satellites/

Kohl's said it planned to close 27 of its more than 1,150 locations by Saturday. The 66 locations Macy's announced are among the 150 it's closing as part of its "Bold New Chapter" initiative "designed to return the company to sustainable, profitable sales growth."

https://www.recordnet.com/story/news/2025/03/28/kohls-and-macys-closing-dozens-of-stores-map-list-show-where/82712691007/

Mainstay for Small Businesses

Clamps Down

https://www.nytimes.com/2025/05/23/business/economy/trump-small-business-administration.html?searchResultPosition=1

[headlines]

--------------------------------------------------------------

Donald Trump Photo on $100 Bill

Introduced April6, 2025 - A Live!

Originally introduced in Congress to replace Ben Franklin's name and likeness of the $100 with President Trump. While not passed yet, the proposed $100 was part of the May 11 weekend Trump

rally in Wildwood, New Jersey, perhaps to add to the

collection of Crypto Coins. The reality of passing congress

is still alive. However, the availability of sale as souvenir

is available. It certainly is a sign of his popularity.

[headlines]

--------------------------------------------------------------

Sports Briefs---

Two-time French Open finalist Casper Ruud

lost 2-6, 6-4, 6-1, 6-0 to Nuno Borges

in the second round at Roland-Garros

while bothered by a bad left knee.

https://www.pressdemocrat.com/article/sports/ruud-upset-in-second-round-at-french-open/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Downtown San Jose, Oakland, San Francisco

combat empty office space

https://www.mercurynews.com/2025/05/21/economy-tech-san-jose-oakland-bay-area-office-property-jobs-develop

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

The Ultimate Guide to Exploring the

Sonoma Coast on Highway

https://www.sonomamag.com/best-places-to-stop-along-highway-1-in-sonoma-county/

Wine Inventory Tightens Across the US

https://www.meiningers-international.com/wine/insights/wine-inventory-tightens-across-us

Can Organic Wines Thrive in Texas?

Halter Ranch Thinks So

https://www.localprofile.com/longform/organic-wines-texas-halter-ranch-10719345

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/May2014/5_29.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()