Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Monday, November 18, 2024

Today's Leasing News Headlines

Roglieri Release From Jail Doubtful

With Revelation of Violent Text

Messages to Ex-Wife

By Ken Greene, Leasing News Emeritus

New Hires/Promotions in the Leasing Business

and Related Industries

CLFP Foundation Adds 11 New CLFPs

with Photos

Leasing and Finance Industry Help Wanted

Many Openings, Excellent Opportunities

Leave Your Ego at the Door: Why Humility

Outperforms Ego in Leadership-

By Ken Lubin, Managing Director, ZRG Partner

Top Ten Most Read by Readers

November 12 to November 15

Most Influential Lawyers

in Equipment Finance and Leasing

Key Takeaways from the ELFA Women’s

Council on Market Expansion Strategies

By Jen Martin, SVP, CPO, LTi Technology Solutions

News Briefs---

Tesla’s next step of dominance comes from

Trump EV tax credit policy: Wedbush

Reports of Unwanted Telemarketing Calls Down

More Than 50 Percent Since 2021

Element Reports Record Third Quarter Results,

and Provides Full-Year 2025 Guidance

How Bluesky, Alternative to X and Facebook,

Is Handling Explosive Growth

Slash First, Fix Later: How Elon Musk

Cuts Costs - Apply to US Government?

Returns Are a Headache. More Retailers Are Saying,

Just ‘Keep It.’

Millions may not have health coverage if subsidies

return to pre-Biden level

You May Have Missed ---

Top Ten Best States to Start a Business

and Ten Worst States

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Roglieri Release From Jail Doubtful

With Revelation Of Violent Text

Message To Ex-Wife

By Ken Greene, Leasing News Emeritus

Delaney Sexton, Contributing Editor at the Coleman Report, has reported to Leasing News that Kris Roglieri’s defense team is “taking a bite at the apple” to get their client released. The doctor who did the assessment states, “Given the totality known of information at this time, it is the overall opinion of this evaluator that Mr. Roglieri’s risk of violence is minimal.” His attorney goes on to say, “Put another way, it is not possible for any able-bodied man to have a lower risk of violence that Mr. Roglieri.”

As would be expected, the prosecution opposes this maneuver. First, they state that no new evidence has been presented which would warrant release. Additionally, the information they have presented does not negate the “deeply disturbing” statements Mr. Roglieri made leading up to his arrest. The proposed release plan that was presented omits key details and fails to consider how Mr. Roglieri could “defeat even the most restrictive conditions to follow through on his threats.”

In another recent news, the U.S. Attorney’s Office filed a civil forfeiture complaint against Mr. Roglieri with hopes of gaining control of his extensive watch collection and an expensive sports car. The document describes the Ponzi scheme in which cash deposits from certain borrowers would be used to repay or fund loans to other borrowers.

Leasing News has previously reported about Mr. Roglieri’s threatening messages prior to his arrest to the investigators, but the prosecution now provides more communications that paint a picture of his mental state leading up to that arrest.

In messages to his ex-wife from last December, he makes comments such as “You f*** with the hand that feeds you and you’re gonna get f***ed up the a** royally,” and “Go to the chicken farm where you f***ing belong,” and “And listen, I’ll gladly talk about this, but my fear is I’ll rip off your f***ing throat and p*ss down your f***ing neck.”

Ironically, Roglieri’s attorneys cite as grounds for his release his need to care for his family!

Lastly, the Saratoga Automobile Museum is set to auction off more of Roglieri’s property including twenty-two firearms, a sword, a knife set, furniture, home fixtures, and other belongings on November 16. The auctions will be held online and require pre-registration.

Defense Motion

https://colemanreport.com/wp-content/uploads/2024/11/48.pdf

Prosecution Response

https://colemanreport.com/wp-content/uploads/2024/11/51-1.pdf

Law Offices of Kenneth Charles Greene

Suite 208

5743 Corsa Avenue

Westlake Village, CA 91362

T: 818.575.9095

F: 805.435.7464

E: ken@kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Lee Bergeron was hired as Vice President of Structured Products at North Mill Equipment Finance, Norwalk, Connecticut. He is located in Bradenton, Florida. "He will be focusing on developing innovative operating lease products for vendors, dealers and manufacturers in partnership with NMEF’s deep referral partner network." Previously, he was President, Taunton Commercial Capital (2015 - November, 2024); President, Vice President, General Manager, Global Financial Services, Board Director, Wheel Financial Services from Pitney Bowes (2018 - 2021). Full Bio:

https://www.linkedin.com/in/leebergeron/details/experience/

https://www.linkedin.com/in/leebergeron/

Paul Cheslock was promoted to Vice President of Structured Products, North Mill Equipment Finance, Norwalk, California. He is located in Columbia, Missouri. Previously, he was Vice President of Customer Relations’ (October, 2018 - November, 2024); National Sales Manager, Healthcare, Marlin Business Services Corp. (2013 - 2016); Director of Client Services, MBS Textbook Exchange (2009 - 2013); Sales Manager, LEAF Financial Corporation (2004 -2009).

Full Bio:

https://www.linkedin.com/in/paulcheslock/details/experience/

https://www.linkedin.com/in/paulcheslock/

Mark J. Simshauser was hired as Senior Vice President, SLR Business Credit, Princeton, New Jersey. He is located in the New York City Metropolitan Area. "He will have the responsibility of supporting and financing SME’s through the Northeast United States." Previously, he was Senior Director, Northeast United States, Prestige Capital (September,2023 - November, 2024). Full Bio:

https://www.linkedin.com/in/marksimshauser/details/experience/

Christian Torresluna was hired as Regional Sales Manager, Equify Financial, Fort Worth, Texas. He is located in Fullerton, California. He is Co-Founder/Silent Partner, The Winston Box, Self-Employed (May, 2016 - Present). Previously, he was Regional Leasing Manager, Konica Minolta Business Solutions, USA, Inc. (October, 2018 - November, 2022); Regional Manager, Wells Fargo (October, 2011 - October, 2018). Full Bio:

https://www.linkedin.com/in/christiantorresluna/details/experience/

https://www.linkedin.com/in/christiantorresluna/

Gregory Walker was promoted to Manager, Mitsubishi HC Capital Canada, Burlington, Ontario, Canada. He joined the company in May, 2016, with five promotions to the present position. Full Bio:

https://www.linkedin.com/in/gregorymwalker/details/experience/

https://www.linkedin.com/in/gregorymwalker/

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

[headlines]

--------------------------------------------------------------

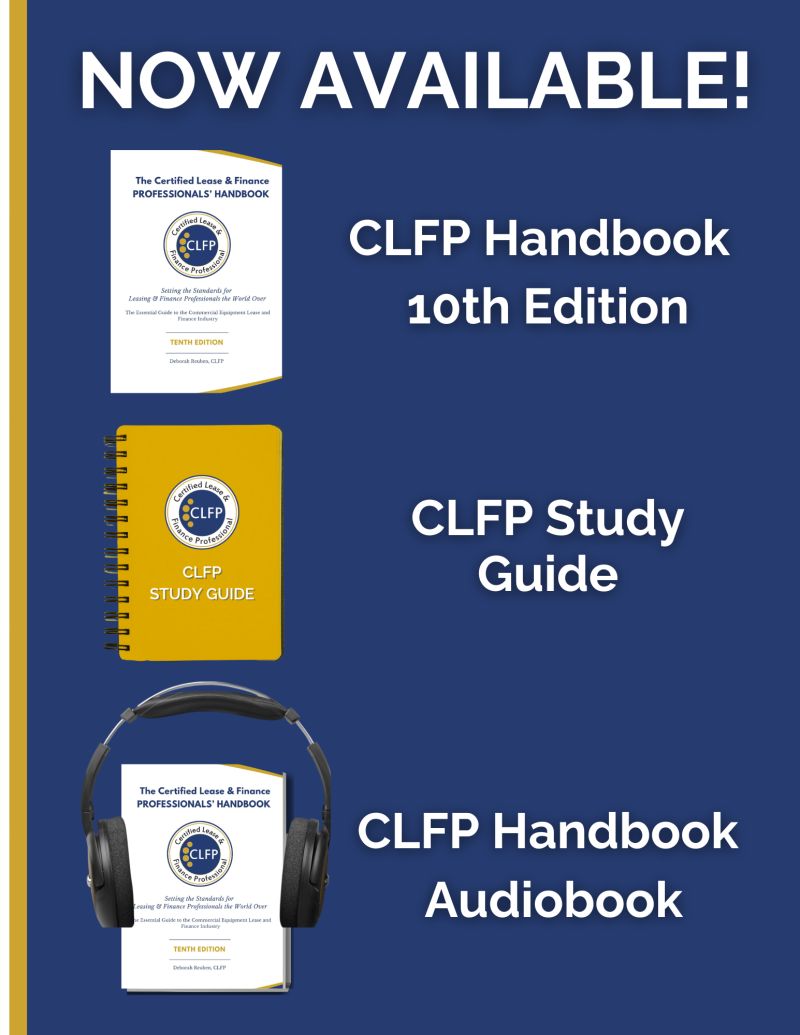

CLFP Foundation Adds 11 New CLFPs

with Photos

The Certified Lease & Finance Professional (CLFP) Foundation is pleased to announce that 11 individuals who recently sat through the online proctored CLFP exam, have passed. They are:

.jpg)

Kevin Angelo, CLFP – Sales Manager – Client

Development, Financial Partners Group

Heidi Brooks, CLFP – Sales Manager,

Commercial Finance, DLL

Rebecca Crown, CLFP – Credit Underwriter

F&A, DLL

Gillianne Daum, CLFP – Account Manager,

Healthcare Retail, DLL

Swinkey Jindal, CLFP – Agile Software

Engineer, DLL

Mackenzie Luft, CLFP – Account Executive,

DLL

- Headshot.jpg)

Ravi Patel, CLFP Associate – Director,

Treasury, DLL

Kinna Pattani, CLFP – Global Head Finance

and Regulatory Compliance, Alfa Financial Software Inc.

Nicholas Pierandri, CLFP – Vice President

Sales, First American Equipment Finance

Kevin Smallwood, CLFP – Head of Strategic

Initiatives, DLL

.jpg)

Ryan Steger, CLFP – Middle Market Specialist,

DLL

Kinna Pattani, said, “Deciding to sit for the CLFP Exam was a multifaceted decision rooted in both personal and professional growth,” says. “Having been in the industry for over 20 years and having fulfilled various roles, why even decide to do this?

“I saw the CLFP as an opportunity to challenge myself and assess how much my industry knowledge had evolved over time. The process was a chance to broaden my professional network, offering me a platform to engage and exchange ideas with a diverse group of industry professionals.”

“Beyond personal assessment, it was a crucial to understand the value that CLFP certification holds for our team and understand the demands so that I can provide them the required support,” Pattani said.

“How was my experience? It was like deciding to run a marathon after a 20-year hiatus from jogging (and yes, it’s been that long since I have done any meaningful jogging). It was exciting, terrifying, and left everyone around me, including myself, wondering what on earth I was thinking.

“Now that I have come out on the other end, I can’t want to sit another test. Was it worth it? Yes! I will be encouraging my team to participate in the academy as part of a cohort. It will be a valuable opportunity for them to learn from one another and strengthen their collective knowledge.”

The CLFP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the commercial equipment finance industry. There are Certified Lease & Finance Professionals and Associates located throughout the United States (including Puerto Rico), Canada, India, Pakistan, Africa, and Australia. For more information, visit http://www.CLFPFoundation.org

[headlines]

--------------------------------------------------------------

Leave Your Ego at the Door:

Why Humility Outperforms Ego in Leadership

By Ken Lubin, Managing Director

ZRG Partner

After 25 years in executive recruiting, I’ve seen the brightest careers stall, or worse, come undone because of unchecked ego. The harsh reality is that in the world of leadership, ego is often a silent saboteur. It may give a temporary confidence boost, but it ultimately undermines success in ways that become painfully obvious when performance suffers and relationships strain. Here’s how ego can hold you back in ways that experience has proven again and again:

- Undermines Collaboration and Team Success: Ego can be a powerful barrier to effective collaboration. I’ve seen leaders walk into meetings with all the answers, convinced their approach is best, only to miss out on the insights and innovation others bring to the table. When leaders prioritize their own voices over team input, they shut down ideas before they even surface. The best leaders, the ones who drive real results, are the ones who check their ego, bring out the strengths in others, and cultivate a team where every idea is valued.

- Shuts Down Self-Awareness and Growth: One thing I’ve learned over decades is that growth demands self-awareness. But ego resists any feedback that challenges it, leading professionals to disregard areas where they could improve. I’ve seen talented people plateau because they chose ego over self-reflection. Leaders who are open to learning—and willing to recognize when they don’t have all the answers—continue to evolve, and that adaptability keeps them valuable as they move up the ladder.

- Clouds Judgment and Decision-Making: Ego-driven decisions are short-sighted. When leaders make choices to reinforce their self-image rather than focusing on what’s best for the organization, it often backfires. I’ve seen it time and again: leaders who prioritize their reputation or pride over thoughtful analysis make decisions that harm the organization and their standing in the long run. The smartest leaders set ego aside, assess situations objectively, and make decisions that support the team and the business.

- Damages Relationships and Reputation: Ego can strain, and even destroy, professional relationships. It’s difficult to lead effectively if your colleagues view you as unapproachable or arrogant. Respect, trust, and empathy are the cornerstones of strong working relationships, and I’ve seen how ego can erode these fundamentals. A strong reputation takes years to build, but ego can tear it down in a matter of months.

- Blocks Adaptability: The world of business isn’t static, and neither should be a leader. Ego can create a false sense of certainty, preventing leaders from pivoting when market demands shift or new strategies are needed. The best executives I’ve recruited are those who embrace change, know when to let go of their initial approach, and adapt to what the moment demands.

Final Thoughts: Ego and confidence are not the same things. Real confidence doesn’t need to push others down to feel strong. In my experience, the most effective leaders are those who leave ego out of the equation and are willing to learn, adapt, and grow. When leaders let go of ego, they open themselves to new opportunities, stronger teams, and lasting success.

Ken Lubin, Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

Top Ten Most Read by Readers

November 12 to November 15

(1) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Nov2024/11_12.htm#hires

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Nov2024/11_15.htm#hires

(3) Brokers, Funders and a Shark Gather

at the 2024 Brokers Expo in NYC

By Don Cosenza, CLFP

https://leasingnews.org/archives/Nov2024/11_12.htm#expo

(4) It's Called Fishing, Not Catching

(This has run before but worth re-reading)

By Ken Lubin, Managing Director, ZRG Partners

https://leasingnews.org/archives/Nov2024/11_15.htm#called

(5) Meet the 16 people in the $100 billion club

— who are jointly worth more than Amazon or Google

https://finance.yahoo.com/news/meet-15-members-100-billion-203855987.html

(6) NFL Ticket Cost Inflation

Over the Last Decade

https://leasingnews.org/archives/Nov2024/11_12.htm#nfl

(7) Commercial Finance/Leasing Finance

Conferences and Forums

https://leasingnews.org/archives/Nov2024/11_12.htm#conf

(8) CFL Streamlines Leasing Operations

with Northteq’s Aurora LOS

https://leasingnews.org/archives/Nov2024/11_15.htm#cfl

(9) Define Your Capabilities

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Nov2024/11_12.htm#define

(10) ELFA Announces 2025

Business Council Steering Committees

https://leasingnews.org/archives/Nov2024/11_15.htm#elfa

[headlines]

--------------------------------------------------------------

Most Influential Lawyers

in Equipment Finance and Leasing

Andrew Alper

Julie Babcock

Bill Carey

Richard Contino

Jonathan Fleisher

Marshall Goldberg

Kenneth Greene

David G. Mayer

Allan J. Mogol

Frank Peretore

John G. Sinodis

Mark Stout

Kevin Trabaris

Allan Umans

Mark Wada

Irwin Wittlin

Andrew K. Alper is a recognized influential attorney representing equipment lessors, funding sources, and other financial institutions since 1979. He is a longtime contributor to the Legal Column for the Monitor magazine. He has been a director of Western Association of Equipment Lessors and United Association of Equipment Lessors, now the National Equipment Finance Association, as well as being active with the Equipment Leasing and Finance Association, including serving as instructor for its Principles of Leasing class. He has presented seminars on Equipment Leasing for the Los Angeles County Bar Association. Mr. Alper also sits on the Los Angeles County Bar Commercial Law Committee.

Julie Babcock has been practicing law in the leasing industry since 1993. Julie joined the Key Equipment Finance law group in 2002 and is currently legal counsel for the Specialty Finance, Vendor, and Syndications groups. For a brief period, Julie left Key Equipment Finance to provide legal counsel for KeyBank’s Commercial Lending Group, supporting commercial real estate, real estate construction, commercial loan servicing, healthcare, Native American lending, asset- based lending, letters of credit, SBA, multi-family, and middle market lending.

Prior to joining Key, Julie was the head of the Legal Department at Republic Financial Corporation, Assistant General Counsel at MetLife Capital Corporation, an associate with the law firm of Bogle & Gates, and an Independent Petroleum Landman. She has been a frequent speaker at the Legal Forum of the Equipment Leasing and Finance Association. She received the Award for the Article Making the Greatest Contribution to the Leasing Industry for her article, “Buyer Beware: Key Issues Related to Acquisitions,” Journal of Equipment Lease Financing, Vol. 13/No. 1, Spring, 1995.

A Colorado native and avid Colorado Buffaloes fan, she earned her Bachelor of Science degree (with distinction) and her Juris Doctor degree (Order of the Coif) from the University of Colorado in Boulder, Colorado. She lives in Windsor, Colorado with her husband and three dogs.

Bill Carey served as General Counsel and Corporate Secretary for USXL since it was founded in March 2004, and he continued in that position at Tygris Vendor Finance, now EverBank Commercial Finance. He has over 15 years of experience in the commercial finance industry, serving in leadership positions as an attorney with CIT, Newcourt Commercial Finance and AT&T Capital, and handling transactions in vendor leasing, commercial lending, fractional aircraft finance and venture leasing, M&A and other corporate finance matters. For a three-year period, Bill was the executive vice president and general counsel of a London-based technology publisher.

He also received two additional nominations:

"Bill Carey is the most effective leasing lawyer I have ever worked with—and I have worked with many! Bill is the perfect example of a legal business partner, akin to an HR business partner, or a Finance business partner. He provides timely, organized, and meaningful legal guidance to senior management regarding overall business matters, and to the sales teams regarding individual transactions and/or vendor program legal issues and opportunities."

"I worked with Bill for over 5 years while at *** and found him to be one of the best in the business for many reasons. In sales-driven organizations, in-house counsel often have to maintain a fine balance, managing risk by providing good sound legal advice while not being so conservative that they become an obstacle to the company achieving its mission. Bill always excelled at that; he understands the business. He was reasonable and creative in his approach to resolving problems, very accessible, responsive and balanced. He was always a gentleman in his dealings with customers and vendors, diplomatic and poised regardless of the situation. In addition, Bill was a great coach to his Legal Dept. as well as to his internal “clients,” always making time for a teaching moment. Bill is well known in the industry. He has served as a past Chair of the ELFA Legal Committee and I’m certain he left his positive mark there as well."

Richard M. Contino is an internationally-recognized equipment leasing expert, with an extensive legal, business, marketing, tax, transaction structuring, financial and management background. He is an advisor on all types of start-up and on-going equipment leasing business activities for lessors, lease lenders and syndicators, equipment vendors, lease investors and corporate lessees. He is former General Counsel of De Lage Landen, Wayne, Pennsylvania, a subsidiary of The Rabobank Group, and the 14th largest equipment lessor in the U.S. Mr. Contino is the author of eight books on business, negotiating, and equipment leasing. He has conducted private on-site and publicly-held business success, communication, finance, and negotiation seminars throughout the United States for professional organizations (e.g., American Management Association, Equipment Leasing and Finance Association, Illinois Institute of Continuing Legal Education, National Seminars Group, Practicing Law Institute, and University of California Graduate School of Law) as well as corporations (e.g., AT&T, EXXON Corporation, NYNEX, and Texas Instruments Corporation). He is a retired JAG Captain, US Air Force.

Jonathan Fleisher is a Toronto, Canada attorney whose practice

focuses on the commercial finance industry with a particular emphasis on innovative cross-border transactions and equipment and asset finance, where he has been recognized as a leading lawyer by the Canadian Legal Expert Directory and Best Lawyers. He has particular expertise assisting public and private US commercial finance companies with both establishing operations in Canada and purchasing and selling finance and lease companies, providing both legal and practical business advice. He is also a prolific writer on topics related to equipment finance and cross-border transactions. Jonathan is the legal editor for Fleet Digest magazine and has completed both the Equipment Finance and Subordinated Debt chapters for Canadian Forms & Precedents. He has also drafted specific guides for US lenders expanding operations to Canada. He is a Director of the Canadian Finance and Leasing Association, Member of the Legal Committee of the Equipment Leasing and Finance Association, member of the American College of Commercial Finance Lawyers.

Kenneth Charles "Ken" Greene is Leasing News Emeritus and Past Leasing News Legal Editor. He has sat on the Board of the National Equipment Finance Association Board twice as well as Legal Committee Chair, Legal Line Editor, Regional Committee Chair and Conference Chairman. He is very active in music, music production, and musical theater at the school and community levels and he has served on many community associations. Ken received his B. A. at Brandeis University, graduating cum laude. He received his J.D. at Santa Clara University in 1980, also graduating with honors.

Marshall Goldberg has been an active member and leader for many years in financial institution associations, including the Equipment Leasing and Finance Association ("ELFA"), and the National Vehicle Leasing Association ("NVLA"). For ELFA, Marshall has served on the Legal Committee, the Credit and Collections Management Committee and as a member of the Editorial Review Board of the Journal of Equipment Lease Financing. He is currently the Chairman of the Professional Development, Education and Information Sub-Committee for the ELFA Legal Committee. He is responsible for developing, organizing, managing and editing the Legal Website, which includes an online compendium of legal issues pertaining to the 50 States, "What's New in the Law," and the "Catalogue of Legal Information." He developed and now chairs and monitors the Legal Listserve, an daily online forum for attorneys to discuss pertinent legal issues. He is also the sole 2009 recipient of the annual "Excellence in Leasing Award," presented on behalf of ELFA and its Legal Committee.

Marshall is co-author and co-editor of the “Executive Guide to Remedies,” and the “Executive Guide to Lease Documentation.” He also speaks and instructs extensively within the legal and business communities. He has given numerous educational and strategic seminars throughout the United States on subjects including Loan and Lease Enforcement, and he provides annual legal update presentations for financial association lawyers, including written summaries of current case and statutory law.

David G. Mayer, Perhaps best known as the author of "Business Leasing for Dummies" (September, 2001) as well as an online newsletter "Business Leasing and Finance News" (2002-2012) which had 6,000 subscribers in 33 countries. He has written other articles, primarily on business aviation, aircraft leasing and finance, for which he is known, especially involving international and cross-border transactions. He started this specialty, rising to Senior Counsel, GATX Corp, then going as corporate counsel, primarily in transportation equipment, including aircraft, vessels, truck and trailers, including project financing and operation. He is active in the Equipment Leasing and Finance Association, as well as has been a contributing author to the Equipment Leasing and Finance Foundation surveys. He is an Eagle Scout.

Alan J. Mogol, Over the last 40+ years, created a large volume of the middle market lease documentation currently used by the majority of the larger bank and finance companies in the industry, including standard forms of lease documentation for syndication, assignment, notice of assignment, participation and motor vehicle titling trust documents. Much of what Mogol has created is considered de facto industry standard in the bank middle market space. He is a frequent lecturer and author in the equipment financing area.

Frank Peretore has written many articles on leasing for the news media as a recognized expert on commercial lenders and lessors, including two books, "Workouts and Enforcement for the Secured Creditor and Equipment Lessor" and "Secured Transactions for the Practitioner: How to Properly Perfect Your Personal Property Lien and Assure Priority." He is currently the Secretary of the National Equipment Finance Association, serving on the board since 2009, as well as serving on many legal committees. He was also on the Board of Directors, Eastern Association of Equipment Lessors, and served on legal committees for the Equipment Leasing & Finance Association. He brings his law experience to his writing and leasing association meetings and conferences. He is highly respected by his colleagues for his dedication to the finance and leasing industry as well as to law.

John G. Sinodis' practice emphasizes the representation of equipment lessors and funding sources in all aspects of equipment leasing including litigation, documentation, insolvency, and transactional matters. Besides representing equipment lessors and funding sources, Mr. Sinodis represents financial institutions and asset-based lenders in the areas of commercial litigation, secured transactions, asset recovery, loan restructure and business litigation. Mr. Sinodis is an active member of the Equipment Leasing and Finance Association (ELFA) and the National Equipment Finance Association (NEFA). Prior to joining the firm, Mr. Sinodis served as the president of General Leasing Co. and is presently a member of its board of directors.

"In just three days, Mark Stout helped me to locate, obtain and return a stolen truck to one of my lessees after the truck had been driven across the state of Texas by utilizing his expertise and relationships 6 counties away. This could have been a disaster for my lessee. I called Stout who called whoever it was he called and the truck was returned. Easy – and that’s what I like."

Mr. Stout represents in excess of thirty financial institutions and leasing companies.

Within the last four years, Mr. Stout has represented commercial lenders in excess of 150 state court proceedings. Mr. Stout handles an extensive trial docket that generally entails at least three court appearances each week in various courts in Texas. In conjunction with his state court proceedings, Mr. Stout frequently utilizes sequestration/replevin proceedings to quickly recover his client’s collateral. Mr. Stout has filed approximately 200 sequestration/replevin actions in Texas. Mr. Stout represents in excess of thirty financial institutions and leasing companies. Within the last four years, Mr. Stout has represented commercial lenders in excess of 150 state court proceedings. Mr. Stout handles an extensive trial docket that generally entails at least three court appearances each week in various courts in Texas. In conjunction with his state court proceedings, Mr. Stout frequently utilizes sequestration/replevin proceedings to quickly recover his client’s collateral. Mr. Stout has filed approximately 200 sequestration/replevin actions in Texas.

Kevin Trabaris has extensive experience representing banks, financial companies, equipment lessors, insurers, and other funding and intermediary entities and borrowers in connection with thousands of business financing matters. He has handled everything from small ticket transactions to billion dollar syndicated loans, real estate financing to asset-based facilities. He is an active member of the Commercial Finance Association, LinkedIn Capital Equipment Leasing Group and Equipment Leasing Professionals Group. He has an excellent reputation among his colleagues.

Allan Umans is in charge of documentation and legal affairs at Pacific Rim Capital, reportedly the nation's largest independent lessor of material handling equipment. In his field, he has an excellent reputation. He previously served as General Counsel and Secretary of Relational Technology Services, Inc. and Assistant General Counsel and Assistant Secretary of El Camino Resources, Ltd., both independent technology leasing companies. Mr. Umans has a JD degree from Southwestern University Law School and a BA degree in Economics, with honors, from the University of Manitoba.

Mark Wada, founding shareholder of the Portland, Oregon law firm Farleigh Wada Witt, has been listed in Oregon Super Lawyers for the tenth consecutive year in the specialty area of banking and finance. And for the seventh consecutive year, Mark was selected by his peers for inclusion in The Best Lawyers in America for banking and finance law. Mark has expertise in representing banks, commercial lenders, equipment lessors, private equity funds, lenders in commercial loans and leases to high tech companies, including intellectual property security agreements and warrant terms and other financial service providers; numerous commercial lenders and lessors in workouts, collateral liquidations, collection matters and sales of individual loans and portfolios. In 2010, he was appointed to serve a three-year term on the Equipment Leasing and Finance Association Legal Committee. He is past-president of the Oregon Law Foundation and Campaign for Equal Justice and has served as a member of the Executive Committee of the Oregon State Bar Debtor-Creditor Section, the Board of Directors of the Multnomah Bar Association, as well as its treasurer, representative to the American Bar Association House of Delegates, and the Board of Directors and Executive Committee of the United Cerebral Palsy Association of Oregon and Southwest Washington.

Irwin Wittlin is well-known in the leasing industry as he was past member of the Board of Directors of the United Association of Equipment Leasing (UAEL) at time of merger and formation of National Equipment Finance Association (NEFA). He is a past chairman of the legal committee and has spoken on a variety of legal issues at recent conventions, including the topics of, "Effective Lease Collections," “Working With Outside Counsel," "Fraud Prevention," "Maintaining Your Business Credit Line," and “Selected Issues in NorVergence." He is an instructor for the Certified Lease Program Foundation ("CLP") on the subjects of lease law, lease documentation, and collections. Mr. Wittlin is a frequent speaker on various legal and collection related topics for various professional organizations, with an emphasis on leasing, business litigation and collections.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Expanding Horizons in Equipment Finance:

Key Takeaways from the ELFA Women’s Council

on Market Expansion Strategies

By Jen Martin, SVP, CPO LTi Technology Solutions

At the recent Equipment Leasing and Finance Association (ELFA) Annual Meeting, the Women’s Council hosted a dynamic session titled “Strategies for Market Expansion – Effective Approaches for Entering New Markets and Expanding Business Reach.” Moderated by Catherine Roddick, Lead Relationship Manager at CoBank, the discussion offered attendees a comprehensive look into the strategic and operational complexities of incorporating a growth mindset and execution strategy within equipment finance organizations.

The session featured industry experts with diverse backgrounds including Kristi Schon, Chief Marketing Officer at Channel, Reid Raykovich, CEO of the CLFP Foundation; and myself. Each panelist brought their diverse backgrounds and shared their own unique perspectives. Together, we explored key strategies, challenges and forward-thinking approaches in adopting a growth-oriented mindset within equipment finance organizations.

Key Insights for Equipment Finance Growth: Strategy, Collaboration, and Technology

Our discussion highlighted crucial themes–collaboration, inclusivity, and the critical importance of an organized operational structure–cornerstone of successful market expansion. Each panelist contributed a unique perspective drawing from their diverse background offering actionable insights that addressed both the opportunities and challenges of pursuing growth in the equipment finance sector.

Balancing Ambitious Growth with Practical Realities

One central theme was the challenge of balancing ambitious growth goals with the realities of limited resources—both human and technological. Achieving this balance often requires carefully structured teams that can harness distinct skill sets to coordinate efforts from ideation through execution. Technology emerged as pivotal, playing a vital role; organizations must adopt scalable tools that drive efficiency while meeting growing demands.

Our panel emphasized the importance of strong partnerships with technology providers, stressing that the right investments allow companies to launch impactful capabilities quickly while maintaining alignment with customer needs. Building these strong partnerships ensures that technology strategies support both immediate plans and long-term vision.

Documented Frameworks for Efficiency in Market Expansion

Kristi Schon shared her experience documenting a structured framework to support efficient market expansion. Her work to document a framework proved invaluable by adding structure and efficiency to the market expansion process, allowing teams to approach growth initiatives methodically. Many attendees resonated with the notion that having a documented strategy can streamline efforts and enable seamless integration of growth work into daily operations.

The Power of Inclusivity in Driving Resilient Growth

The Women’s Council has long advocated for inclusivity as an essential component of effective market expansion. Diverse perspectives not only lead to stronger strategic decisions but also enhance organizational resilience by fostering adaptability. This collaborative approach cultivates an environment of innovation, enabling teams to respond to challenges more effectively and with greater flexibility.

Actionable Takeaways for Equipment Finance Professionals

Attendees left the session equipped with actionable strategies for expanding their market presence, grounded in the understanding that growth within the equipment finance industry requires both strategic inclusivity and the judicious use of technology. By leveraging collaborative structures and fostering diverse viewpoints, companies can confidently expand their reach while staying adaptable to evolving industry demands.

Key Takeaway: Thoughtful Growth in Equipment Finance

This session underscored that successful market expansion in equipment finance hinges on inclusivity, collaboration, and the strategic application of technology. As industry professionals continue to navigate new markets, integrating these principles can help their organizations grow sustainably and with resilience.

### Press Release ############################

[headlines]

--------------------------------------------------------------

News Briefs

Tesla’s next step of dominance comes from

Trump EV tax credit policy: Wedbush

https://www.teslarati.com/tesla-tsla-next-step-dominance-comes-trump-ev-tax-credit-policy-wedbush/

Reports of Unwanted Telemarketing Calls Down

More Than 50 Percent Since 2021

https://www.ftc.gov/news-events/news/press-releases/2024/11/reports-unwanted-telemarketing-calls-down-more-50-percent-2021?utm_source=govdelivery

Element Reports Record Third Quarter Results,

and Provides Full-Year 2025 Guidance

https://www.elementfleet.com/news/news-releases/element-reports-record-third-quarter-results-raises-common-dividend-and-provides-full-year-2025-guidance

How Bluesky, Alternative to X and Facebook,

Is Handling Explosive Growth

https://www.nytimes.com/2024/11/17/technology/bluesky-growing-pains.html

Slash First, Fix Later: How Elon Musk

Cuts Costs - Apply to US Government?

https://www.nytimes.com/2024/11/16/technology/elon-musk-cost-cuts.html

Returns Are a Headache. More Retailers Are Saying,

Just ‘Keep It.’

https://www.nytimes.com/2024/11/15/business/returns-online-shopping.html

Millions may not have health coverage if subsidies

return to pre-Biden level

https://www.washingtonpost.com/business/2024/11/17/marketplace-insurance-expiration-subsidy-trump

[headlines]

--------------------------------------------------------------

Top Ten Best States to Start a Business

and Ten Worst States

https://www.prnewswire.com/news-releases/top-10-states-to-start-a-business-in-2025-national-business-capital-puts-colorado-in-the-lead-302306620.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers falter in fourth quarter, Seahawks come back

for 20-17 win after Nick Bosa exits

https://www.sfchronicle.com/sports/49ers/article/49ers-lead-seahawks-halftime-despite-bogged-down-19923646.php

Warriors say Waters ‘good to go,’ but Curry

questionable for Monday game

https://www.sfchronicle.com/sports/warriors/article/warriors-say-waters-good-go-curry-19924012.php

Jets lose heartbreaker against Colts on last-minute

touchdown to bury their playoff hopes for good

https://nypost.com/2024/11/17/sports/jets-lose-heartbreaker-vs-colts-to-bury-playoff-hopes-for-good/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Meet the new director leading San Jose’s efforts

to solve its housing crisis

https://www.mercurynews.com/2024/11/15/san-jose-housing-homelessness-erik-solivan/

Bay Area tech company Chegg lays off hundreds more

CEO blames Google and AI

https://www.sfgate.com/tech/article/bay-area-chegg-layoffs-blames-google-ai-19913481.php

Here’s how a host of new housing laws

change California

https://www.sfchronicle.com/opinion/openforum/article/ornia in 2025

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Beaujolais nouveau wine, but make

it California

https://www.sfchronicle.com/food/wine/article/nouveau-beaujolais-california-wine-19894912.php

Georges Duboeuf Unveils its

2024 Beaujolais Nouveau

https://www.winebusiness.com/news/article/295110

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Nov2019/11_12.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()