Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, November 20, 2024

Today's Leasing News Headlines

2024 NEFA Fall Conference Report –

Victory Requires Investment

By Vicki Shimkus, CLFP, Balboa Capital

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Inspect to Create Expectations

By Scott Wheeler, CLFP

90% of Small Banks Meet with Small Business

Loan Applicants — Versus 40% for Large Banks

China is the World Leader

in Battery Recycling

Free AACFB Webinar - Boost Business Growth

with Working Capital - Nov 21 - 3pm ET

Equipment Leasing & Finance Foundation

Elects Officers, Welcomes New Trustees

Presents Research Award

News Briefs---

Walmart Earnings: Holiday Shopping

Is Off to a Strong Start

Jersey Mike’s chain acquired by private

firm Blackstone for $8 billion

3 ways TikTok might survive a ban, with

or without Trump’s help

Robots Struggle to Match Warehouse Workers

on ‘Really Hard’ Jobs

You May Have Missed ---

For Decades, Installing E.V. Chargers Didn’t

Pay Off for Retailers. Now It Does

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

2024 NEFA Fall Conference Report –

Victory Requires Investment

By Vicki Shimkus, CLFP, Balboa Capital

The National Equipment Finance Association held their 2024 Fall Conference in Indianapolis November 11th to the 14th. The focus was “Victory Requires Investment” with a continuing theme of sports and football specifically.

Chad Sluss, Chief Executive Officer, NEFA,said the Conference Planning Committee and NEFA staff did an excellent job in putting together a successful conference.

NEFA Fall Conference Planning Committee:

Kirsten Dargy, LTi Technology Solutions – Chair

Kim King, CLFP, Odessa

Alyssa Lawrence, CLFP, Marshall Capital Group

Michelle Noyes, GreatAmerican Insurance Group

Monday evening kicked off a “Monday Night Lights” charity event to benefit Folds of Honor – Indiana and the Chris Walker Education Fund. Folds of Honor provides scholarships to the spouses and children of fallen or disabled military members who served in the US Armed Forces. This event was a lot of fun with attendees invited to wear their favorite teams gear. There were snacks and fun games while watching the broadcast of the Monday Night Football game between the Miami Dolphins vs. LA Rams (Dolphins won). It was a good time to benefit two great non-profits.

Tuesday got off to a good start with the Women in Leasing Luncheon with 77 attendees for this great event. The women enjoyed a wonderful lunch at Agave + Rye where all were encouraged to network while enjoying tasty tacos. I met several new people which is always a victory.

Exhibiting hours started at 1pm with over 50 exhibitors in the large comfortable hall. I really enjoyed that there was a central “lounge” where you could have one on one meetings in addition to good meeting space out in the reception area. The booths were busy with many attendees meeting with funders and service providers. Various committee meetings also took place during this time.

After Welcome remarks the first spotlight session was with Holly Rowe, a well-known announcer from ESPN. Stephanie Hall of Apex Commercial Capital led an interesting Q&A with Ms. Rowe who gave great insights to her successful career.

The day was capped off with a Welcome Reception in the Exhibit Hall then dinner on our own. Though we may have been technically all on our own many people got the memo that the St Elmo Steak House is the place to be in Indianapolis where we ran into many of the conference attendees enjoying their famous shrimp cocktail and flavorful steaks.

Wednesday started early with breakfast prior to networking time again in the Exhibit Hall. Mid-morning we joined the CEO Address and Update session with Chad Sluss and Robert Hornby updating us on the status of NEFA’s initiatives for 2024 and looking forward to continued success in 2025 with Paul Fogle updating on upcoming plans.

The second Spotlight Session was a presentation by Rodney Peete, former quarterback with over 16 years in the NFL. Rodney gave an inspiring talk about investing in your own success and insight into his career and how he learned that it takes “Small Wins” to stay focused and successful. He encouraged all to “Win the Day” for success. There was a Q&A led by Robert Hornby after Mr. Peete’s presentation with a meet and greet later in the Exhibit Hall.

The Annual meeting was combined with lunch where the meeting chair Kirsten Dargy, LTi Technology Solutions spoke before more information was shared about committees, plans and upcoming focus of NEFA’s Executive committee and board.

Vicki Shimkus, CLFP

Commercial Equipment Finance Specialist

Balboa Capital

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Bryan Bellows was hired as Senior Sales Executive, Deutsche Leasing USA, Chicago, Illinois. He is located in Glen Ellyn, Illinois. Previously, he was Director of Sales, Asset Management, Mitsubishi HC Capital American, Inc. (February, 2024 - November, 2024): Full Bio:

https://www.linkedin.com/in/bryan-bellows-6776444/details/experience/

https://www.linkedin.com/in/bryan-bellows-6776444/

Myra Lastner was promoted to IT Project Manager, Truist, Hunt Valley, Maryland. She joined Truist December, 2019, Vice President, Sr. Business System Analyst, promoted Vice President, Sr. Requirements Analyst (October, 2021 - November, 2024); Joined SunTrust, December, 2001, Operations Manager, promoted Vice President, Sr. Business System Analyst (January, 2005 -December, 2019). She was at GE Capital, starting Senior Transaction Coordinator, Team Leader, October, 1994, promoted Business Development Associate, October, 1998, promoted Operations Analyst (June, 2000 - June, 2001); Commercial Finance Officer, Signet Leasing and Financial Corporation (July, 1992 - October, 1994); Account Administrator, MNC Leasing, a Division of MNC Credit Corp. (June, 1988 - July, 1992).

https://www.linkedin.com/in/myra-lastner-943a3a5/

Mike Underwood was hired as Vice President, Commercial Dealer Services, Wintrust Commercial Finance, Frisco, Texas. He is located in St. Michael, Minnesota. Previously, he was Vice President, Credit Officer, Equipment Finance, Bell Bank (November, 2020 - November, 2024); VP, Underwriting Officer III, Wells Fargo Equipment Finance (August, 2014 - November, 2020). Full Bio:

https://www.linkedin.com/in/mike-underwood-83079974/details/experience/

https://www.linkedin.com/in/mike-underwood-83079974/

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

[headlines]

--------------------------------------------------------------

Inspect to Create Expectations

By Scott Wheeler, CLFP

Originators are developing their plans for 2025. The first step of the process is for originators to dissect their current network of vendors, end-users, and partners. Top originators rank their database based upon realistic future potential and then create a marketing plan to maximize their outcomes (production). The inspection process includes:

Knowing the specific data regarding actual production numbers in 2023 and 2024. What vendors and end-users contributed the most to an originator's production.

- Knowing the common characteristics of the relationships which contributed the most to the originator's production and identifying new prospects which share these same characteristics.

- Identifying missed opportunities - relationships or transactions which should have been won but were not. Knowing the shortcomings and striving to correct mistakes is critical to long-term sustainability.

- Identifying relationships that can be expanded in 2025, based upon specific conversations and data shared between the originator and her end-users, vendors, and partners.

- What went right in 2024? What went wrong? What needs to change? What does the originator need to continue doing?

- Were 2024 goals met? Why or why not?

- What were the originator's greatest achievements in 2024? What were his disappointments?

- What are the greatest opportunities for 2025? Why?

Strong originators inspect their activities to formulate future expectations. The data matters and the numbers are essential in creating a marketing plan for 2025.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

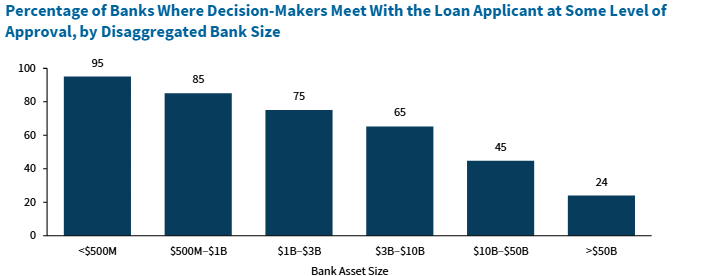

90% of Small Banks Meet with Small Business Loan Applicants

— Versus 40% for Large Banks

Coleman Report

Among the largest banks the practice of decision makers meeting with applicants is fairly rare -- less than 25% of the time.

However, 95% of banks with less than $500 million in assets meet with applicants, compared to only 65% of banks with $3 billion to $10 billion in assets.

Small banks have a flatter organizational structure than large banks, particularly in how they gather information. Small banks are much more likely than large banks to have meetings directly between small business loan applicants and decision-makers.

Nearly 90% of small banks meet with applicants, compared to less than 40% of large banks.

These meetings allow small banks to lend more flexibly, especially to start-up businesses, as they may yield valuable soft information that can compensate for a lack of hard information. In-person meetings, as opposed to virtual meetings or teleconferences, further emphasize the importance of banks' proximity to small business borrowers.

Banks that do not have direct meetings between decision-makers and applicants typically lend to start-ups 26% of the time. In contrast, banks that meet one or both of these criteria have a 56% to 74% likelihood of lending to start-ups.

The specific strategy used to mitigate start-up lending risk varies by bank size. Small banks use meetings with applicants to manage risk. A majority of small banks that hold such meetings typically lend to start-ups (69%), compared to a minority that do not hold meetings (45%).

There is only a slight difference in the likelihood of start-up lending between large banks that do and do not meet with applicants. Instead, large banks rely on SBA guarantees to manage risk.

There is only a slight difference in the likelihood of start-up lending between large banks that do and do not meet with applicants. Instead, large banks rely on SBA guarantees to manage risk.

Source: FDIC 2024 Small Business Lending Survey

[headlines]

--------------------------------------------------------------

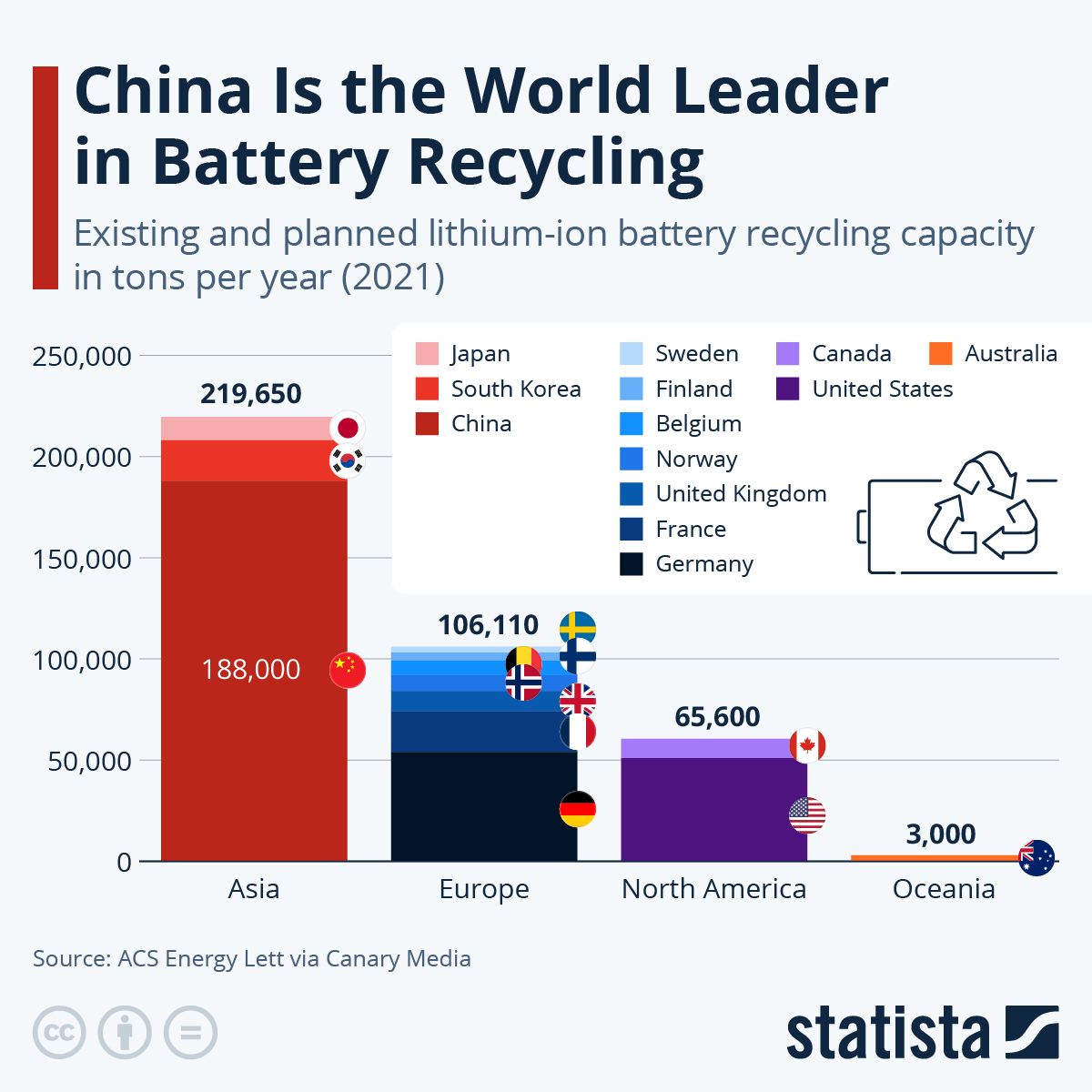

As many countries around the world scramble towards a green transition, a new era of electric cars is being ushered in and with it comes the need for batteries. While these batteries - also needed for home, industrial and grid energy storage - are being newly manufactured, the market for the recycling of lithium-ion batteries is growing too, especially since it “conserves the critical minerals and other valuable materials that are used in batteries and is a more sustainable approach than disposal”, as the U.S. Environmental Protection Agency writes.

Data from ACS Energy Lett, cited in an article by Maria Virginia Olano on Canary Media shows how China was the leading country for this type of battery recycling in 2021, with 188,000 tons of existing and planned lithium-ion battery recycling capacity per year. It was followed by Germany and the United States, albeit with both countries lagging some way behind.

Since 2021, there have been even more plans for the expansion of lithium-ion battery recycling plants. According to researchers at the Fraunhofer Institute for Systems and Innovation Research, while the majority of lithium-ion battery recycling capacity is located in East Asia, Europe is also building capacity and could increase its recycling capacities to an estimated 400,000 tons per year by 2025.

The extent to which policy exists on battery recycling varies greatly by country and region. For example, the European Council has now agreed to set the target for lithium recovery from waste batteries to 50 percent by 2027 and 80 percent in 2031 and has said that there will be a new rule on mandatory minimum levels of recycled content for industrial, SLI batteries and EV batteries. Olano of Canary Media argues that it’s the comparative lack of policy supporting the growth of lithium-ion battery recycling in the U.S. in past years that has held the country back in this regard, falling behind markets in Asia and Europe.

One Bloomberg analysis says, however, that the recycling industry has “boomed too soon” in the U.S., as there are too many recycling plants and not enough discarded batteries to recycle, and “there won't be for more than a decade”.

Source: Statista

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Equipment Leasing & Finance Foundation Elects Officers, Welcomes

New Trustees, and Presents Research Award

During Annual Meeting

Washington, DC,–The Equipment Leasing & Finance Foundation (Foundation) announces the 2025 officers of its Board of Trustees(Board). Board Officers serving are Zack Marsh, CLFP, SVP, Accounting and Analysis, AP Equipment Financing as Chair; Miles Herman, CEO, LEAF Commercial Capital, Inc. as Vice Chair; Peter Bullen, EVP & Group Head, Key Equipment Finance as Secretary/Treasurer; and Leigh Lytle, President and CEO, Equipment Leasing and Finance Association (ELFA) as President. Nancy Pistorio, CLFP, President, Madison Capital LLC is Immediate Past Chair. The officer elections were held during the Board‘s annual meeting.

New members appointed to the Foundation Board of Trustees include Eric McGriff, Chief Risk Officer, 36th Street Capital, and Shari Williams, Chief Risk Officer, SLR Equipment Finance.

“We are privileged to have the leadership experience, professional expertise and commitment of our Trustees to guide the Foundation in 2025,” said Zack Marsh. “We’re grateful for their dedication to the Foundation’s mission to advance the equipment finance industry and the success of everyone in it.”

Trustees continuing on the Board for 2025 are:

- Andrew Blacklock, Vice President, Strategy and Business Operations, Cisco Systems Capital Corporation

- Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc.

- Jeffrey Dicosola, Sales Manager, Great American Insurance Group

- Cindy Fleck, CLFP, Senior Vice President and General Manager Equipment Finance, Channel

- Martin Klotzman, CLFP, Director of Marketing and Operations, Ivory Consulting Corporation

- Shari Lipski, CLFP, Principal, ECS Financial Services, Inc.

- Mark Loken, Vice President, CoBank Farm Credit Leasing

- David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

- Brittany Ogden, Attorney, Partner, Quarles & Brady LLP.

- Ricardo E. Rios, CFA, CLFP, President & COO, Commercial Equipment Finance, Inc. (CEFI)

- William Tefft, Equipment Manager – Corporate Asset Finance, EverBank Corporate Asset Finance

- Donna Yanuzzi, EVP, 1st Equipment Finance, Inc.

Kelli Nienaber will continue to serve as Executive Director.

Steven R. LeBarron Award

Research Committee Chair Valerie Gerard honored Board Trustee Will Tefft with the Steven R. LeBarron Award for Principled Research. He has been a member of the Foundation Research Committee (FRC) and a Foundation Trustee since 2020. In that time, he has been the lead in developing the Foundation’s Vertical Market Outlook Series of reports and the associated Vertical podcast series. He has been instrumental in the development of podcast episodes covering trucking, IT equipment, additive manufacturing, and corporate aircraft, among other topics. This award is presented annually in memory of Steven LeBarron to the FRC member who demonstrates the insight, fortitude, and dedication he exemplified.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and student talent development programs that contribute to industry innovation, individual careers, and the advancement of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

### Press Release ############################

[headlines]

--------------------------------------------------------------

News Briefs

Walmart Earnings: Holiday Shopping

Is Off to a Strong Start

https://www.wsj.com/business/retail/walmart-wmt-q3-earnings-report-2025-6bde10d3?mod=business_feat3_retail_pos1

Jersey Mike’s chain acquired by private

firm Blackstone for $8 billion

https://www.mercurynews.com/2024/11/19/jersey-mikes-sandwich-chain-is-acquired-by-private-equity-firm-blackstone-for-8-billion/

3 ways TikTok might survive a ban, with

or without Trump’s help

https://www.bostonglobe.com/2024/11/19/business/tiktok-ban-trump/

Robots Struggle to Match Warehouse Workers

on ‘Really Hard’ Jobs

https://www.nytimes.com/2024/11/19/business/robots-warehouses-amazon.html

[headlines]

--------------------------------------------------------------

For Decades, Installing E.V. Chargers Didn’t

Pay Off for Retailers. Now It Does.

https://www.nytimes.com/2024/11/18/business/ev-chargers-store-parking-lots.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers falter in fourth quarter, Seahawks come back

for 20-17 win after Nick Bosa exits

https://www.sfchronicle.com/sports/49ers/article/49ers-lead-seahawks-halftime-despite-bogged-down-19923646.php

Warriors say Waters ‘good to go,’ but Curry

questionable for Monday game

https://www.sfchronicle.com/sports/warriors/article/warriors-say-waters-good-go-curry-19924012.php

Jets lose heartbreaker against Colts on last-minute

touchdown to bury their playoff hopes for good

https://nypost.com/2024/11/17/sports/jets-lose-heartbreaker-vs-colts-to-bury-playoff-hopes-for-good/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Big housing development with several hundred

units is eyed in San Jose

https://www.mercurynews.com/2024/11/19/san-jose-home-affordable-build-property-real-estate-economy-office/

Hundreds of affordable apartments targeted for

former Orchard Supply Hardware site in East San Jose

https://www.mercurynews.com/2024/11/19/san-jose-affordable-housing-developer-orchard-supply-hardware/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Rodney Strong Vineyards Wine Cocktails

Have Arrived

https://www.winebusiness.com/news/article/295214

Grenache Fest Brings out The Rocks'

Stars and Rock Stars

https://www.winebusiness.com/news/article/295239

Restaurant spending reaches new high compared

to grocery shopping

https://www.nrn.com/finance/restaurant-spending-reaches-new-high-compared-grocery-shopping

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Nov2023/11_20.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()