Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, November 22, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Equipment Leasing & Finance Foundation

Releases Highest Monthly Confidence in 3 Years

Brean Capital Upsizes Corporate Note

Financing for Dext Capital

Leasing and Finance Industry Help Wanted

Many Openings, Many Remote, excellent Opportunities

Decisions: Why Are They So Hard

to Make in Today's World?

Mack Trucks reaches 200,000 connected

Class 8 vehicle milestone

Equipment finance growth facilitates broker rise

82% of purchasers used financing in 2023

National Equipment Finance Association Announces

2024 - 2025 Board of Directors

Film Reviews by Leasing News'

Fernando Croce - New Streaming Options

News Briefs---

EV mandates throw wrench into

commercial truck dealer ops

Altrata Report Finds Billionaires' Wealth Surged

by 9%, Reaching a Record of $12.1 Trillion

Hello Alice reaches $50 million in grant funding

to Small Business

Silicon Valley tech boom lifts California’s

dreary budget view

Packaging trade groups urge US House to pass

recycling infrastructure, data bills

Anheuser-Busch Invests $14M in its Houston Brewery

to Drive Economic Growth

You May Have Missed ---

What you need to know about the proposed measures

designed to curb Google's search monopoly

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Ralph Cioffi was promoted as Vice President of Sales at PEAC Solutions, Mount Laurel, New Jersey. He is located in Mount Laurel, New Jersey. He joined the company November, 2022, Sales Director. Previously, he was Strategic Account Manager, Marlin Capital Solutions (October, 2012 - November, 2022).

https://www.linkedin.com/in/ralph-cioffi-65215556/

Niki Maldonado was hired as Vice President of Operations, Slim Capital, Beverly Hills, California. She is located in San Marcos, California. Previously, she was Vice President, Credit and Underwriting, Fundcanna (2021 - April, 2024. She joined National Funding 2012 as EVP Credit and Operations, promoted VP Quality Assurance (2020 - 2021); Credit Manager, Innovative Lease Services (2012 -2012); Vice President of Credit, CapNet Financial Services (2006 - 2009).

Full Bio:

https://www.linkedin.com/in/nikki-maldonado-600b24143/details/experience/

https://www.linkedin.com/in/nikki-maldonado-600b24143/

Mike Olson was hired as Client Success Director, Tamarack Technology, Inc., Greater Minneapolis-St. Paul Area. He is located in Minneapolis, Minnesota. “As our business continues to grow, we’re evolving our approach to engage with clients as true partners,” said Mitch Peterson, Executive Vice President of operations at Tamarack Technology. “Mike's extensive client-side experience in the equipment finance industry will be invaluable in understanding our clients’ challenges and opportunities. His expertise will help us deliver targeted solutions and develop strategies that drive our clients' success. This partnership approach, centered around joint success and value creation, will ensure that we not only meet our clients' immediate needs but also contribute significantly to their long-term goals.”

Previously, he was at Wells Fargo for 26 years and six months: Full Bio:

https://www.linkedin.com/in/mike-olson-3aa4733/details/experience/

https://www.linkedin.com/in/mike-olson-3aa4733/

[headlines]

--------------------------------------------------------------

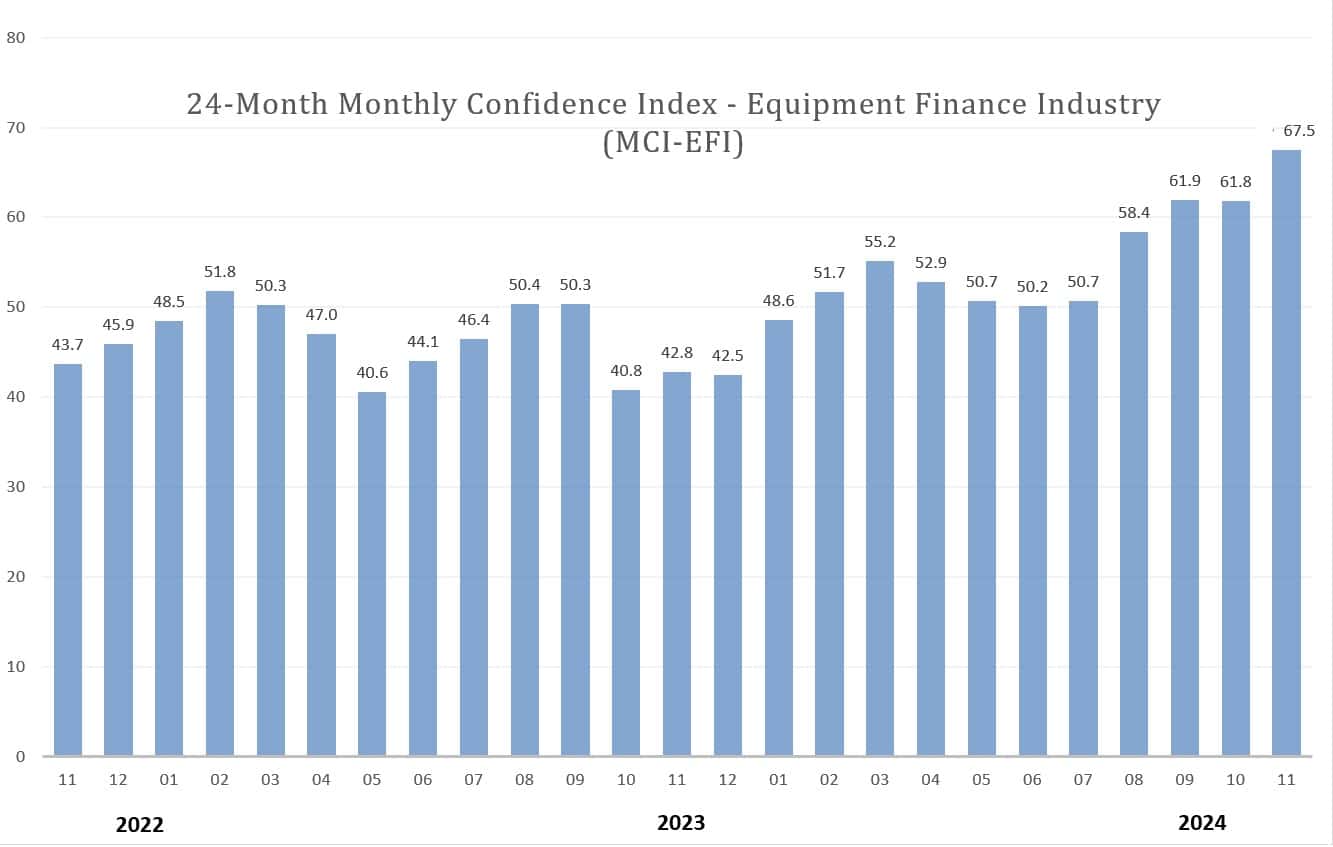

Equipment Leasing & Finance Foundation

Releases Highest Monthly Confidence in 3 Years

The Equipment Leasing & Finance Foundation released the November Monthly Confidence Index (MCI-EFI) for the $1.3 trillion equipment finance industry. The November MCI-EFI is 67.5, up from the October index of 61.8, and the highest level since August 2021.

Mark Bonanno, President and COO, North Mill Equipment Finance, commented, “I’m still concerned about the state of the consumer and the U.S. from a debt load perspective, but more optimistic on growth after the U.S. election cycle.”

James D. Jenks, CEO, Global Finance and Leasing Services, LLC remarked, "The election is over. Looking forward, Trump's policies will improve the economy and begin reducing government over-regulation.”

Charles Jones, Senior Vice President, 1st Equipment Finance, Inc., said, “Businesses still need equipment. Political uncertainty has had an impact and should resolve itself. With the election behind us, businesses will need to continue to operate and look to grow. Calmer heads seem to be prevailing and the industry is coming back. Delinquency has hopefully leveled, and lenders are licking their wounds and looking forward.”

Full Press Release:

https://www.leasefoundation.org/industry-research/monthly-confidence-index/

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

[headlines]

--------------------------------------------------------------

Brean Capital Upsizes Corporate Note

Financing for Dext Capital

Dext Capital (Dext), the leading essential-use healthcare and technology equipment lessor, announced the upsize of its investment-grade corporate note. The proceeds will be used to fund new originations and growth initiatives.

Brean Capital, LLC served as the Company’s exclusive financial advisor and sole placement agent in connection with the transaction.

Founded in 2018, Dext specializes in providing financing solutions to the healthcare and technology industries, helping customers acquire and upgrade mission-critical equipment, improve cash flow and manage risk. As a well-capitalized platform with extensive sector expertise, Dext Capital has established itself as a trusted partner for hospitals and other healthcare providers throughout the United States.

Conrad Nilsen, Head of Finance for Dext Capital, said, “This transaction further strengthens Dext’s balance sheet and adds efficiency to our capital stack.

“We are positioned to meet the financing needs of our vendor partners and customers, and these notes provide the growth capital to expand our platform in a meaningful way.”

Dext Capital is an independent equipment finance company with strong financial sponsorship from Sightway Capital, a Two Sigma company, and a leadership team of industry veterans with over 150 years of combined leasing experience. The executives team leverages demonstrated skill and knowledge to create an equipment finance company the “right way” – enabled by innovative technology and effective use of data, unburdened by current barriers to customer excellence, and focused on successful growth by employing the best people and embracing a respectful culture. For more information, please visit: www.dextcapital.com.

Sightway Capital is a Two Sigma company focused on middle market growth equity investing in financial services and real assets. The company employs a principal mindset and flexible capital approach to building successful business platforms with experienced operators and strategic partners. The team at Sightway Capital thinks long-term, targeting business opportunities that we believe afford both asymmetric risk rewards and enterprise value creation over time. They look for opportunities in and around several asset-intensive industries where our team has significant experience and a network of long-standing relationships. For more information, please visit: https://www.twosigma.com/businesses/sightway-capital/

Brean Capital’s Investment Banking Group is dedicated to helping its clients achieve their strategic and financial goals. For more than 50 years, the Firm has specialized in providing capital raising, M&A and financial advisory services to middle market businesses. Throughout its history, Brean Capital has established a track record of providing its clients with deep market knowledge, commitment and experience to ensure a successful transaction. For more information, please visit: website.

[headlines]

--------------------------------------------------------------

Decisions: Why Are They So Hard

to Make in Today's World?

By Ken Lubin, ZRG Partners, Managing Director

In today’s world, it feels like making decisions has become harder than ever. We’re surrounded by options, opinions, and conflicting information at every turn, making even simple choices seem overwhelming. Whether it's in our careers, personal lives, or how we view the future, it seems like no one can make a decision without second-guessing or getting stuck. So, what’s really going on here?

1. Too Much Information

In the digital age, we have constant access to information. News, social media, and endless online resources offer opinions on every choice we face. While access to information can be empowering, it can also lead to "information overload," where we’re so flooded with data and perspectives that it’s tough to see the big picture. Every choice is dissected, analyzed, and debated online, making it easy to feel like we’re missing something crucial if we make a decision too quickly.

- The Fix: Don’t try to take it all in. Set boundaries around the information you consume, especially if you’re working through a big decision. Decide whose opinions really matter to you, focus on those, and let the rest go.

2. Fear of Judgment

With everyone sharing their lives online, it feels like every decision we make is up for public review. There’s a pressure to make choices that won’t invite criticism or cause people to judge us. From the jobs we take to the relationships we choose, it’s easy to worry about how others will view our decisions. The truth is, fear of judgment can keep us from doing what we know is right for ourselves.

- The Fix: Remember, at the end of the day, you’re the one who lives with the outcome of your choices. Focus on what feels true to you. Surround yourself with people who respect that, and remember, those who judge you for your decisions are not the ones who will be affected by them.

3. Endless Options

Choices are supposed to be a good thing, right? But with more options than ever, we often fall into "choice paralysis." In the past, we may have had just a few clear paths; now, every decision is layered with alternatives. Whether it’s career moves, lifestyles, or even what we eat, having too many options can make us afraid to commit because we worry we’ll miss out on something better.

- The Fix: Simplify. Limit yourself to a few solid options that fit your core values and goals, and don’t be afraid to cut out the noise. Remind yourself that choosing one option doesn’t mean the others will disappear forever; life is flexible, and there’s always room to adjust as you go.

4. Pressure to Be Perfect

Today, perfectionism is practically an expectation. We’re bombarded with images of people living "perfect" lives, making flawless career moves, and always looking like they have it all together. This pressure to make “the right decision” can make it feel like anything less than perfect is a failure. But the reality is, perfection is an illusion, and it keeps us from moving forward.

- The Fix: Embrace the idea that decisions are a learning process. There’s rarely a perfect choice, and every decision brings experience and growth. It’s better to make a choice, learn from it, and adapt than to stay stuck waiting for the "perfect" path to appear.

5. Uncertainty and Complexity

The world has become more complex and unpredictable, from economic shifts to rapid changes in technology. We’re dealing with unprecedented levels of uncertainty, which can make even simple decisions feel risky. The stakes feel higher because so much seems out of our control, and it’s tough to make a confident choice when the future is so unclear.

- The Fix: Control what you can. Instead of waiting for absolute certainty, work with the best information you have and trust your ability to adapt if things change. Sometimes, the only way to find out what works is to take the first step.

Making decisions today is challenging, and you’re not alone if you feel like it’s harder than it used to be. But understanding these pressures can help you approach choices with more clarity and confidence. By focusing on what truly matters to you, setting boundaries around the information and opinions you take in, and letting go of the need to be perfect, you’ll be able to navigate today’s world with a little more ease. Remember, decision-making is less about being right and more about being true to yourself.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

klubin@zrgpartners.com

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

Mack Trucks reaches 200,000 connected

Class 8 vehicle milestone

Trucknews.com

(Photo: Mack Trucks)

Patrick Brown, Director of strategy at Mack Trucks, explained, “The real power of having 200,000 connected vehicles lies in how this technology actively supports our customers’ businesses.

“These connected services help our customers maximize productivity and uptime through innovative technology and comprehensive support.”

Connected Mack trucks are supported 24/7 by Mack OneCall agents at the company’s Uptime Center, ensuring continuous operational support. Each truck is equipped with its proprietary telematics gateway, the company announced in a news release commemorating the milestone.

Mack’s integrated connectivity features — which became standard on all Mack trucks with Mack engines in late 2014 — include the Mack GuardDog Connect system for proactive diagnostics, Mack Over The Air (OTA) for remote software updates, and fleet monitoring through the Mack Connect portal

OTA updates have contributed to reducing unplanned downtime by over 24%, the company said, adding the service allows remote software updates, which optimize truck performance without the need for shop visits, while the Mack Connect portal offers fleet managers real-time insights into vehicle location, fuel economy, and safety metrics. Meanwhile, Mack GuardDog Connect monitors fault codes, categorizing alerts by severity and enabling fleets to make informed service decisions.

[headlines]

--------------------------------------------------------------

Equipment finance growth facilitates broker rise

82% of purchasers used some form of financing in 2023

Equipment Finance News

A growing number of brokers are looking to seize the opportunity to capitalize on growing demand in the equipment and equipment finance industry.

American Financial Partners (AFP) and other equipment brokers have experienced an “interesting” shift since the pandemic, Chief Executive Amy Wagner told Equipment Finance News.

“During the pandemic, a lot of businesses pulled back on spending and focused on cash flow, but since then, we have seen demand pick up,” she said. “Now, more companies are reinvesting in new equipment or updating what they have, which is driving a lot of volume through our space.”

AFP holds transactions in niche industries that it has served for many years, representing a broad mix of equipment financing deals, from $10,000 to $5 million, Wagner said. The broker and lessor covers the software, construction equipment, creative services, woodworking and high-end manufacturing tools industries, offering financing products such as equipment finance agreements and operating leases, which benefited from industry growth.

The equipment finance industry grew to an all-time high of more than $1.3 trillion in 2023, according to the Equipment Leasing and Finance Foundation’s (ELFF) Horizon Report, released Oct. 28. ELFF estimates that 82% of buyers use some form of financing to pay for their equipment and software, opening the door for brokers to connect those transactions with lenders, Wagner said.

An estimated 15% to 20% of equipment finance transactions are broker-originated, based on the Equipment Leasing and Finance Association’s Aug. 23 Survey of Equipment Finance Activity.

“It is like a wave of modernization, and the equipment finance industry overall has surged back,” Wagner said. “It’s clear businesses are optimistic about growth and are ready to make big investments again.”

Growing broker presence

Wheatland, Wyo.-based C.H. Brown is one equipment lender that is growing its broker mix, recently adding five brokers to the more than 500 to whom it markets most of its finance offerings, Kit West, business development director of broker relations, told EFN. C.H. Brown also is on the receiving end of deals from 120 brokers a year on average, he said.

Still, the equipment broker space includes thousands of brokers, Steven Geller, owner of equipment finance intermediary and management consulting firm Leasing Solutions, previously told EFN.

With so many brokers, the breadth and depth of options results in tailored solutions for almost every equipment segment, AFP’s Wagner said.

“Equipment finance brokers are everywhere these days — and for a good reason,” she said. “We bring a unique advantage to the table by connecting businesses with tailored financing options that suit their specific needs.”

ELFF also estimates a 2.7% growth in real GDP and a 4.4% growth in real equipment and software investment for 2024, according to the foundation’s Q4 industry snapshot. With more growth expected in the equipment finance sector, the demand for broker transactions appears set to grow.

Source: https://equipmentfinancenews.com

[headlines]

--------------------------------------------------------------

##### Press Release ############################

National Equipment Finance Association Announces

2024 - 2025 NEFA Board of Directors

The National Equipment Finance Association (NEFA) is a trade association comprised of professionals serving the equipment leasing and finance industry. NEFA’s member companies are diverse and include independent and bank-owned lessors and funding sources, commercial finance brokers, specialty lenders, and various specialized service/product providers serving the needs of these equipment finance specialists.

During the NEFA Annual Meeting, in conjunction with the 2024 Fall Conference (Indianapolis, IN), the new Board of Directors were announced. Dennis Dressler, Dressler & Peters & NEFA Legal Committee Chair, announced that the quorum was reached during the NEFA election, and the slate of new board members was approved. Special thanks to the NEFA Nominating Committee, which was responsible for organizing the slate of board members, which included:

• Chair & Past President - Adam Peterson – CHANNEL

• Ron Elwood, CLFP – Navitas Credit Corp.

• Robert Hornby – CSG Law

• Jaimie Haver, CLFP – Happy Manufacturing

• Shervin Rashti, CLFP – SLIM Capital

Thank you to everyone who was nominated for the vacant board positions.

Below you will find the new NEFA Board members:

• Jeffrey Bilbrey – Leasepath

• Melissa Fisher, CLFP – Mazo Capital

• Dave Gruber – Great American Insurance Group

• Kristi Schon – CHANNEL

• Amy Wagner, CLFP – American Financial Partners

The 2024-2025 NEFA Board of Directors:

• Executive Committee

o President - Paul Fogle – Quality Equipment Finance

o Vice President - Kim King, CLFP – Odessa

o Treasurer – Shervin Rashti – SLIM Capital

o Secretary – Ron Elwood, CLFP – Navitas Credit Corp.

• Directors

o Jeff Bilbrey – Leasepath

o Melissa Fisher, CLFP – Mazo Capital

o Dave Gruber – Great American Insurance Group

o Jaimie Haver, CLFP – Happy Manufacturing

o Beth McLean, CLFP – Northland Capital

o Drew Olynick, CLFP – Taycor

o Kristi Schon – CHANNEL

o Amy Wagner, CLFP – American Financial Partners

Finally, thank you to the following members that rolled off the NEFA Board of Directors:• Past President - Adam Peterson – CHANNEL

• Director – Don Cosenza, CLFP (in transition)

• Director – Scott Forrest (in transition)

• Director - Kayla Perlinger, CLFP – Oakmont Capital Services

• Director – Bob Rinaldi, CLFP – Rinaldi Advisory Services

To learn more about NEFA, visit www.nefassociation.org

### Press Release ############################

[headlines]

--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

Newest streaming releases include emotional animation (“Look Back”), an audacious passion project (“Megalopolis”), an engaging documentary (“Music by John Williams”), a frenetic dramatization (“Saturday Night”) and a delirious horror movie (“The Substance”).

Look Back (Amazon Prime): Known for the gonzo series “Chainsaw Man,” Japanese artist Tatsuki Fujimoto reveals a gentler side in this lyrical screen adaptation of his one-shot manga, which run short of an hour but provides a gratifying emotional journey. Fujino (voiced by Yumi Kawai) is a student whose love of drawing has made her a minor celebrity at her school, where her comic strips run every week. When she has to share space with another student, a shut-in named Kyomoto (Mizuki Yoshida), she’s at first jealous of her supposed rival’s talent. Gradually Fujino comes to admire Kyomoto’s art, and the two become close friends and collaborators. Their bond as time passes is put to the test when tragedy strikes. The result is an animated gem and an ode to creativity and connection.

Megalopolis (Amazon Prime, Apple TV): A long-gestating passion project for legendary director Francis Ford Coppola (“The Godfather”), this one-of-a-kind epic is arguably the year’s most audacious release. Taking place in a fantasy New York City that melds futuristic designs with invocations of ancient Rome, the plot is a fierce battle of wills between architect Cesar Catilina (Adam Driver) and the city’s mayor, Franklyn Cicero (Giancarlo Esposito). While Cesar envisions utopian changes to society, Cicero stands for a regressive, corrupt status quo. Around them orbits a gallery of characters, including Cicero’s daughter (Nathalie Emmanuel), Cesar’s cousin (Shia LaBeouf) and uncle (Jon Voght), and a power-hungry media figure (Aubrey Plaza). Overflowing with striking images and ideas and with a creative energy that puts most younger filmmakers to shame, Coppola’s delirious opus is something to behold.

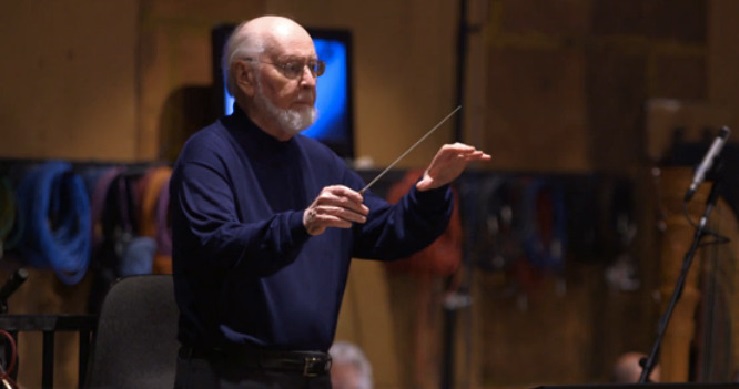

Music by John Williams (Disney Plus): The maestro behind some of the cinema’s most recognizable themes, veteran composer John Williams is the subject of this heartfelt tribute by documentary filmmaker Laurent Bouzereau. Before his ascension as the favorite scorer of Hollywood blockbusters, Williams remembers his early days in a family of musicians, where he got his first glimpse into his art thanks to his jazz drummer father. From there, his passion for composing and orchestral arrangements found the perfect home at the movies, leading to indelible themes for “Star Wars,” “Jaws,” “Superman,” “Raiders of the Lost Ark” and “E.T. The Extraterrestrial,” among many others. Featuring interviews with Steven Spielberg, George Lucas, J.J. Abrams, Ron Howard, and Lawrence Kasdan, Bouzereau’s film is an engaging look at Williams’ craft and legacy.

Saturday Night (Amazon Prime, Apple TV): As “Saturday Night Live” nears its 50th anniversary, director Jason Reitman (“Juno”) serves up a frenetic dramatizationof the first night when the legendary sketch comedy show went on the air. Told in real time starting at 10pm on October 11, 1975, the movie follows the intrepid group of comics and writer as they face one potential setback after another and premiere time looms. There’s Jim Belushi (Matt Wood) still negotiating a contract, Chevy Chase (Cory Michael Smith) getting on the nerves of veteran comedians, host George Carlin (Matthew Rhys) lost in a druggy haze, and producer Lorne Michaels (Gabriel LaBelle) trying to keep everything together. Meticulously sanding off the show’s anarchic edges in favor of middlebrow entertainment, this is in line with Reitman’s crowd-pleasing brand.

The Substance (Amazon Prime, Apple TV): Glamour and gore collide in this go-for-broke horror extravaganza from provocative French director Coralie Fargeat (“Revenge”). Demi Moore delivers a fearless performance as Elisabeth Sparkle, a movie star struggling with Hollywood’s prejudices when she’s fired from her exercise show due to her age. Desperate, she orders a mysterious drug known as “The Substance,” which indeed turns her into a younger version of herself, Sue (Margaret Qualley). Beauty comes at a cost, however, as the two halves grow to hate each other and engage in increasingly gruesome battlesfor the control of their conscience. Taking aim at society’s sexist and ageist standards that here literally distort women, Fargeat’s movieis a gleeful update of “Dr. Jekyll and Mr. Hyde” anchored by the full-bodiedcommitment of its two actresses.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since 2008. His reviews appear each Friday.

[headlines]

--------------------------------------------------------------

News Briefs

EV mandates throw wrench into

commercial truck dealer ops

https://equipmentfinancenews.com/news/dealer-operations/ev-mandates-throw-wrench-into-commercial-truck-dealer-ops/

Altrata Report Finds Billionaires' Wealth Surged

by 9%, Reaching a Record of $12.1 Trillion

https://www.prnewswire.com/news-releases/altrata-report-finds-billionaires-wealth-surged-by-9-reaching-a-record-of-12-1-trillion-302310788.html

Hello Alice reaches $50 million in grant funding

to Small Business

https://www.pressdemocrat.com/article/north-bay/hello-alice-fintech/

Silicon Valley tech boom lifts California’s

dreary budget view

https://www.mercurynews.com/2024/11/21/silicon-valley-tech-boom-lifts-californias-dreary-budget-view/

Packaging trade groups urge US House to pass

recycling infrastructure, data bills

https://www.packagingdive.com/news/letter-recycling-composting-accountability-act-infrastructure-passage-carper-capito/733439/

Anheuser-Busch Invests $14M in its Houston Brewery

to Drive Economic Growth

https://www.winebusiness.com/news/article/295356

[headlines]

--------------------------------------------------------------

What you need to know about the proposed measures

designed to curb Google's search monopoly

https://www.pressdemocrat.com/article/trending/what-you-need-to-know-about-the-proposed-measures-designed-to-curb-googles/

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers falter in fourth quarter, Seahawks come back

for 20-17 win after Nick Bosa exits

https://www.sfchronicle.com/sports/49ers/article/49ers-lead-seahawks-halftime-despite-bogged-down-19923646.php

Warriors say Waters ‘good to go,’ but Curry

questionable for Monday game

https://www.sfchronicle.com/sports/warriors/article/warriors-say-waters-good-go-curry-19924012.php

Jets lose heartbreaker against Colts on last-minute

touchdown to bury their playoff hopes for good

https://nypost.com/2024/11/17/sports/jets-lose-heartbreaker-vs-colts-to-bury-playoff-hopes-for-good/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Tahoe ski resort village expansion approved

in unanimous vote

https://www.sfgate.com/renotahoe/article/placer-county-approves-development-palisades-tahoe-19932316.php

San Jose approves scaled-down El Paseo

urban village project

https://www.mercurynews.com/2024/11/21/san-jose-development-rightsize-shopping-center/

Kaiser preps construction project for

modern hospital in San Jose

https://www.mercurynews.com/2024/11/21/san-jose-kaiser-hospital-health-medical-jobs-build-property-economy/

Good Samaritan Hospital clears rezoning

hurdle at San Jose City Council

https://www.mercurynews.com/2024/11/20/good-samaritan-hospital-san-jose-healthcare/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Minnesota's oldest winery is changing

hands after 51 years

https://bringmethenews.com/minnesota-lifestyle/minnesotas-oldest-winery-is-changing-hands-after-51-years

Ciatti Report: Is the Bulk Wine Market Nearing

Supply-Demand Equilibrium?

https://www.meiningers-international.com/wine/news/ciatti-report-bulk-wine-market-nearing-supply-demand-equilibrium?utm_medium=Newsletter&utm_term=MI_Newsletter&utm_campaign=Newsletter

Wine Spectator to Reveal #1 Wine of the Year Today

https://top100.winespectator.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Nov2023/11_22.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()