Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Thursday, October 17, 2024

Today's Leasing News Headlines

Law Firm of Berger Montague, Toronto

Files Action Against Chesswood Group Limited

North Mill Sues Traction Capital and Leasing

Ken Greene, Esq., Leasing New Emeritus

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Many Openings, Many Remote

Confidence "Steady" Reports

Equipment Leasing & Finance Foundation

Maxim Commercial Capital Funds Nearly 80%

More Transactions for the 3Q of 2024

Equipment Leasing & Finance Foundation

Scholarship Winners - Where Are They Now?

Special Halloween Movives Editon, Part 1

by Fernando Croce

2024 CLFP Lifetime Members

Nancy Geary CPA, CLFP and Stephen Crane, CLFP

News Briefs---

Small Business Administration Depletes

Disaster Loan Funds

Holiday Sales Growth Expected to

Normalize in an Abnormal Year

Profits Leap at Goldman Sachs as

Banks See Steady Economy

Walgreens will close 1,200 stores by 2027

as earnings top estimates

7-Eleven to close over 400 stores

in North America

You May Have Missed ---

Can Remote Workers

Reverse Brain Drain?

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Law Firm of Berger Montague, Toronto, Canada

Files Action Against Chesswood Group Limited

Attorney Andrew Morganti has their firm has over

2,000 Clients regarding the Chesswood case

Case Number: CV-24-729269-00CP

Practice Area: Securities Investor Protection

Court: Ontario Superior Court of Justice

Ticker Symbol: CHW (TSX)

CUSIP: 16550A

Class Period Start Date: 09/05/2023

Class Period End Date: 12/07/2024

https://bergermontague.ca/cases/chesswood-group-limited/

[headlines]

--------------------------------------------------------------

North Mill Sues Traction Capital and Leasing

Ken Greene, Esq., Leasing New Emeritus

Leasing News has been advised that North Mill Equipment Finance has filed suit against Traction Capital and Leasing for breaching their loss reserve pool funding obligations. According to the complaint, Parsonex Special Situations Fund funded, in August 2022, a $1.5 million cash loss pool to reimburse NMEF for claims to be made by NMEF related to defaulted transactions for EFAs sold by Traction to NMEF. Traction was obligated to replenish the loss pool for claims paid to keep the balance at $1.5 million. Over time, as claims were paid, the loss pool balance began to dissipate as Traction breached their obligation to replenish the loss pool balance. Traction further breached its obligations by causing Parsonex not to pay two claims and for failing to go through the disputed claims provisions of the agreements.

According to Traction’s website, its principals are Dakota Forgione, Ash Bianco, and Scott Valentine. Based on the underwriting guidelines contained in the filing, the EFAs to be originated by Traction were primarily targeted at the trucking industry.

Here is a link to the lawsuit, filed in August 2024, in the Superior Court of California, Los Angeles County, Van Nuys Courthouse

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Dallas Bardwell was hired as Vice President of Sales, Sales Manager of Transportation/Construction, Oswego, Oregon. He is located in Orlando, Florida. Previously, he was Senior Sales Executive, JB&B Capital, LLC (August, 2013 - September, 2024); Senior Sales Manager, Tandem Finance (November, 2020 - August, 2023).

https://www.linkedin.com/in/dallas-bardwell-79100411a/

Austin Conterio was hired as Sales team Lead, Lendio, Lehi, Utah. He is located in Sandy, Utah. Previously, he was at Acima, starting July 2018, Inside Sales Representative, promoted February, 2020, Manager of Inside Sales, promoted Senior Manager, Merchant Success and Sales (March, 2023 - February, 2024).

https://www.linkedin.com/in/austinconterio/

Bob Fite was hired as Regional Finance Manager, CLAAS Financial Services, Cincinnati Metropolitan Area. Previously, he was Equipment Finance Specialist, Jupiter Equipment Finance (August, 2024 - October, 2024). He was hired as Operations Manager for Jupiter Equipment Finance, May, 2015, promoted Relations Manager II, Program Manager (July, 2022 - March 2004).

https://www.linkedin.com/in/bob-fite-76935b240/

Travis Pocok was hired as SVP, SLR Business Credit, Princeton, New Jersey. He is located in Cornelius, North Carolina. He was self-employed as Travis Glenn Consulting, LLC (September, 2022 - October, 2024); Senior Vice President, Alterna Capital Solutions (October, 2018 - October, 2022);SVP, Business Development Manager, ENGS Commercial Capital, a Division of Engs Commercial Finance (May, 2018 - October, 2018). Full Bio:

https://www.linkedin.com/in/travispocock/details/experience/

https://www.linkedin.com/in/robertseltzer1/

Robert Seltzer was promoted to Executive Vice President, Ansley Park Capital, New York. He is located in New York City. He joined the company as Executive Vice President, Originations (February, 2024 - October, 2024). Prior, he was Chief Commercial Officer, BCI Capital Corp. (July, 2021 - March, 2024); Chief Commercial Officer, BCI Capital (July, 2021 - March, 2024); Managing Director, Capital Equipment Finance, CIT (2015 - July, 2021). Full Bio:

https://www.linkedin.com/in/robertseltzer1/details/experience/

https://www.linkedin.com/in/robertseltzer1/

Kristopher Tozier was hired as Vice President & Vendor Development - Hard Assets, Financial Partners Group, Dover, New Hampshire. He is located in Hampton Falls, New Hampshire. Previously, he was at First Citizens Bank, starting October, 2005, as Salesperson, promoted Senior Finance Manager (October, 2025 - October,2024).

https://www.linkedin.com/in/kristopher-tozier-937a9b98

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Many Openings, Many Remote

[headlines]

--------------------------------------------------------------

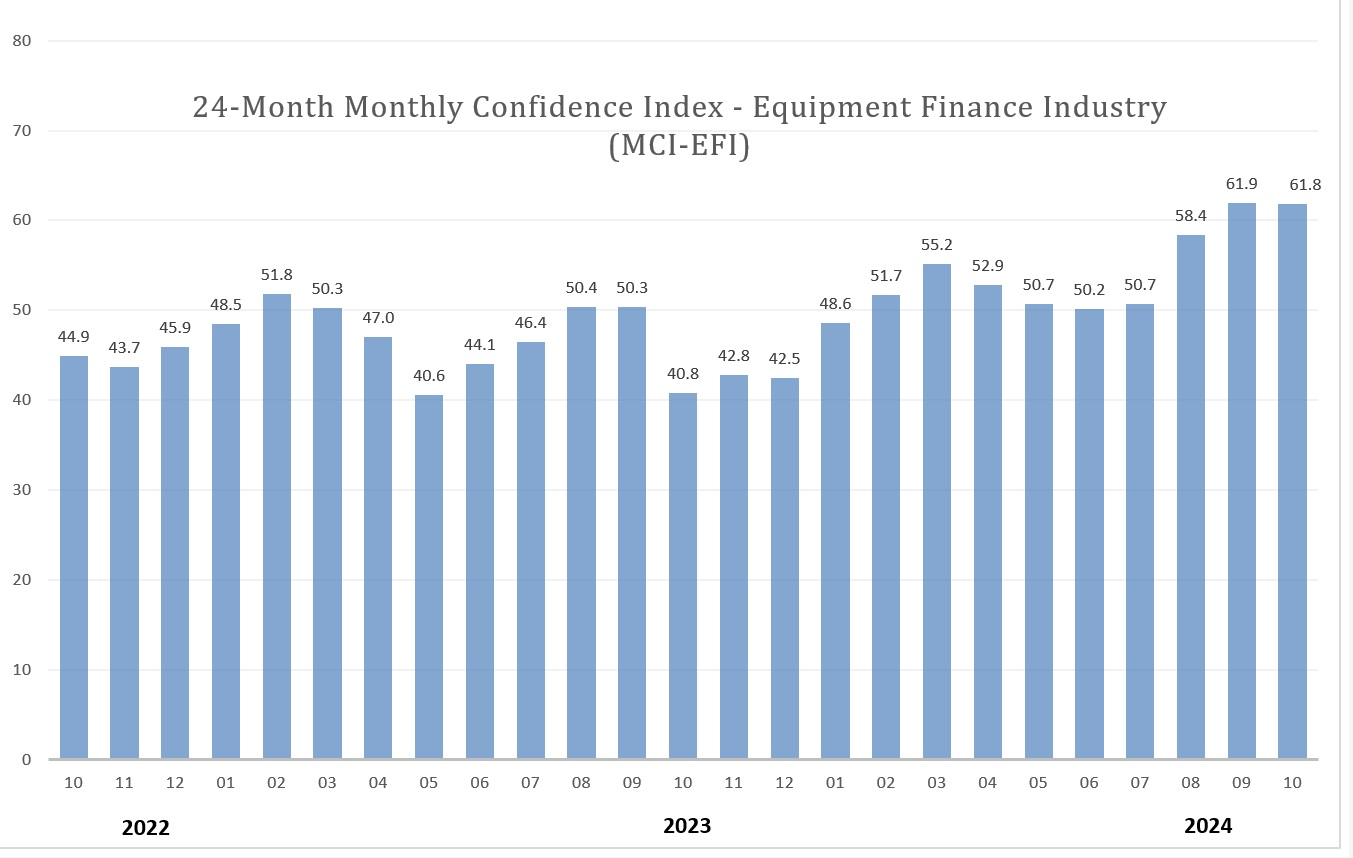

Confidence "Steady" Reports the

the Equipment Leasing & Finance Foundation

(Chart: ELFF)

The October 2024 Monthly Confidence Index for the Equipment Finance Industry " Overall, confidence in the equipment finance market is 61.8, steady with the September index of 61.9, which was the highest level since January 2022. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future..."

Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc., observed, "The Fed’s intent to lower interest rates combined with stabilizing of inflation will stimulate investment, spending and expansion.”

Jeffry Elliott, CLFP, President, Huntington Equipment Finances, “Lower interest rates will ignite capex for smaller companies that have been on the sidelines for a few years and need to add or replace equipment for growth. Getting past the election should provide some clarity on the economic direction of the U.S., thus more capex investments can be made. Lastly, on shoring will continue to promote infrastructure investment which requires capex spending to execute.”

David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance, stated, “With the upcoming election close and the Fed starting the cycle of rate cuts, the uncertainty around these specific concerns will lessen. I think this will help business get back to work solving their customers’ problems and increase investment in capital equipment.

"Additionally, equipment finance companies, specifically within the bank segment, have unfrozen and are actively investing in the equipment finance sector providing needed access to capital at more attractive rates.”

[headlines]

--------------------------------------------------------------

### Press Release #########################

Maxim Commercial Capital Funds Nearly 80%

More Transactions for the Third Quarter of 2024

LOS ANGELES, CALIF.) – Maxim Commercial Capital (“Maxim”) reported robust results for the third quarter of 2024, funding nearly 80% more transactions than during Q3 2023. Despite a slow freight market, hurricane damage in the southeast, and the upcoming election, Maxim experienced a steady flow of applications from equipment vendors and finance brokers. Maxim provides loans and leases from $10,000 to $3 million secured by class 6 and 8 trucks, trailers, heavy equipment, and real estate for small and mid-sized business owners nationwide.

Michael Kianmahd, Maxim’s CEO, said, “While economic headwinds and other issues are reducing overall demand for financing, many of our competitors have exited the business creating opportunity for Maxim.

“Undoubtedly, the fact that we are a closely held business, unbeholden to a large corporate parent, enables us to adapt quickly to changes in the market for the benefit of our customers. And our team’s commitment to exceptional service is evident by the positive feedback received from customers. We are well-positioned to withstand continued flux and an eventual improvement in the market.”

The used truck industry was soft during the period, with stable prices and abundant inventory on dealer lots. Maxim funded truck purchases and leases in 32 states during Q3 2024 with competitive down payments. Examples include a $57,000 2020 Freightliner Cascadia 126 with 490K miles for an experienced owner-operator with a 713 FICO for just 21% down; a $40,000 2019 Kenworth T680 with 565K miles for a start-up owner operator with challenged credit and a co-applicant with better credit for 30% down; and a $46,000 2020 Freightliner Cascadia with 546K miles for an experienced owner operator with a 608 FICO for 26% down.

Finance brokers turned to Maxim during the period to provide funding for customers seeking to purchase heavy construction equipment to grow their business. Financings included a $59K, 30-month term loan for a challenged credit contractor in Mississippi to purchase a 2018 CASE 650M LGP Dozer and a 2018 CASE CX130D Crawler Excavator so he could continue growing his six employee, $1.0MM revenue business; a $50K, 36-month term loan for a start-up contractor in Texas with a 778 FICO to buy a 2018 Mack XHU613 tri-axle axle dump truck; and a $44K, 30-month term loan for a contractor in Alabama with seven years of experience and a 633 FICO and discharged bankruptcy to buy a 2012 Vermeer 20x22 Series II Directional Drill.

For more examples of recent fundings:

https://www.maximcc.com/financing-solutions/recent-fundings/

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners nationwide by providing loans and leases (“financing”) from $10,000 to $3 million secured by trucks, trailers, heavy equipment, and real estate. It funds equipment purchase financings and leases, working capital, and debt consolidations. Maxim’s more creative financing structures leverage equity in real estate and owned heavy equipment to facilitate growth and preserve customers’ cash. As a leading provider of transportation equipment financing, Maxim supports start up and experienced owner-operators and non-CDL small fleet owners by funding loans and leases for class 8 and class 6 trucks, trailers, and reefers. Learn more at www.maximcc.com https://www.maximcc.com/financing-solutions/recent-fundings/ or by calling 877-776-2946.

#### Press Release ########################

[headlines]

--------------------------------------------------------------

Equipment Leasing & Finance Foundation

Scholarship Winners - Where Are They Now?

[headlines]

--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

Special Halloween Edition, Part One

With Halloween just around the corner, we’ve put together a multi-part catalog of classic frightfests to go with your pumpkin treats. Check back next week for more indelible horror tales.

What Ever Happened to Baby Jane? (1962): It’s battle of the divas in this deliciously lurid Gothic melodrama, which finds macho director Robert Aldrich (“The Dirty Dozen”) depicting a different kind of warfare. “Baby” Jane Hudson (Bette Davis) is a former child star who now cares for her sister Blanche (Joan Crawford), who’s been paralyzed from the waist down since a car accident decades earlier. Their crumbling Hollywood becomes an arena of cruelty, as the increasingly deranged Jane keeps Blanche trapped in her own bedroom while nursing dreams of making a big-screen comeback with the help of a seedy songwriter (Victor Buono). Can Blanche escape before madness consumes her sister? Made with fierce style and a rich vein of dark humor, this is an entertaining ride through Tinseltown’s dark side.

Rabid (1977): Synonymous with a distinctive brand of horror, director David Cronenberg (“The Fly”) scored an early box-office hit with this vigorous variant of the zombie subgenre. Rose (Marilyn Chambers) is a young Montreal woman who, after undergoing experimental surgery in the wake of a motorcycle crash, finds herself inexplicably hungering for human blood. Feeding off farmers while wandering the countryside, she kicks off a chaotic pandemic as a new strain of rabies sweeps across the region. Martial law is declared in an attempt to contain the marauding ghouls, and Rose’s boyfriend Hart (Frank Moore) struggles to track her down before it’s too late. Cementing Cronenberg’s talent for visceral chills full of fascinating subtext, the movie offers plenty of shocks along with a touching turn from legendary adult star Chambers.

Bram Stoker’s Dracula (1992): The oft-filmed vampire classic gets the operatic treatment in this lavish version from Francis Ford Coppola (“The Godfather”). Splendidly played by Gary Oldman, the eponymous bloodsucker is a medieval prince cursed to stalk the living for the ages, mourning the loss of his beloved. Said beloved returns unexpectedly in the form of Mina Harker (Winona Ryder), the bride of Jonathan (Keanu Reeves), the young lawyer who comes to his Transylvanian castle. Dracula sets off to London and rekindles the connection to his reincarnated muse, though their reunion proves to be short-lived as Professor Van Helsing (Anthony Hopkins) investigates the occult happenings. Bringing the old tale to spirited life with a vigorous panoply of cinematic techniques, Coppola serves up a full feast of voluptuous expressionism.

Pulse (2001): Japanese horror is rich enough to deserve a column all of its own, but for now let’s just focus on one of its most accomplished achievements, namely this remarkably unsettling vision of technological shivers. Set in Tokyo, the story kicks off with the suicide of a college student (Kenji Mizuhashi) and follows with a pair of distinct but parallel tales focusing on how the Internet has become a literally haunted netherworld. In one, a young woman (Kumiko Aso) is plagued by spectral images and messages on her computer. In the other, a student (Haruhiko Kato) is drawn to websites where actual ghosts may dwell. Director Kiyoshi Kurosawa goes beyond easy scares to craft a snapshot of modern alienation, employing surreal imagery to portray a world edging toward a cyber-void. With subtitles.

Us (2019): For his follow-up to the Oscar-winning “Get Out,” writer-director Jordan Peele serves up another sharp and evocative horror vision. Lupita Nyong’o is excellent as Adelaide, a young wife and mother who moves with her family back to her childhood home, a site of haunting memories. Her sense of dread grows stronger as mysterious figures start to circle her house, wearing masks and mimicking their actions. What begins as a home invasion grows more bizarre as the masks come off and Adelaide and her family come face to face with a deeper horror than they ever dreamed. Without giving too much away, it’s clear to see how Peele has drawn on “Invasion of the Body Snatchers” for his second film, displaying keen cinematic expertise while expertly combining humor and fright.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since 2008. His reviews appear each Friday.

[headlines]

--------------------------------------------------------------

We are proud to announce that Nancy Geary CPA, CLFP and Stephen Crane, CLFP were honored with Lifetime Member Awards during CLFP Day.

The award was created in 2022 to honor those who contributed significantly to the Foundation over the years and remained involved throughout retirement. In 2023, the award was renamed the Larry LaChance Lifetime Member Award, in honor of long-time CLFP and Board Member, Larry LaChance, who passed earlier that year. Nominees were submitted by Foundation Board members and then voted on by the entire Board.

Join us in congratulating Nancy and Steve in this exciting honor!

[headlines]

--------------------------------------------------------------

News Briefs

Small Business Administration Depletes

Disaster Loan Funds

https://www.nytimes.com/2024/10/15/us/politics/small-business-administration-fema-helene-milton.html

Holiday Sales Growth Expected to

Normalize in an Abnormal Year

https://www.nytimes.com/2024/10/15/business/holiday-sales-growth.html

Profits Leap at Goldman Sachs as

Banks See Steady Economy

https://www.nytimes.com/2024/10/15/business/goldman-sachs-citi-bank-of-america-profit.html

Walgreens says it will close 1,200 stores by 2027,

as earnings top estimates

https://www.cnbc.com/2024/10/15/walgreens-wba-earnings-q4-2024.html

7-Eleven to close over 400 stores

in North America

https://www.npr.org/2024/10/12/g-s1-28033/7-eleven-store-closures-us-canada

[headlines]

--------------------------------------------------------------

Can Remote Workers Reverse Brain Drain?

Researchers found that when remote workers

were paid to move to Tulsa, Okla.

https://www.nytimes.com/2024/10/16/business/tulsa-remote-workers.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers’ Ricky Pearsall practices for first time

since San Francisco shooting

https://www.eastbaytimes.com/2024/10/14/49ers-ricky-pearsall-practices-for-first-time-since-san-francisco-shooting/

Former Major League Baseball sluggers differ on

A’s move to Sacramento. What they said

https://www.sacbee.com/news/local/article293961839.html

How Roger Goodell Became the N.F.L.’s

$20 Billion Man

https://www.nytimes.com/2024/10/12/business/roger-goodell-nfl.html

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

L.A. Catholic Church to pay record settlement over

clergy abuse; cumulative payouts top $1.5 billion

https://www.latimes.com/california/story/2024-10-16/archdiocese-of-los-angeles-to-pay-880-million-in-the-largest-clergy-sexual-abuse-settlement

BART is dying. But will the SF Bay Area pay

higher taxes to save it?

https://www.sfchronicle.com/sf/article/bart-office-work-tax-19824343.php

Historic San Francisco tiki bar the Tonga Room is

a rite of passage. But is it really worth visiting?

https://www.sfgate.com/food/article/visiting-San-Francisco-tiki-bar-the-Tonga-Room-17213576.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Leading Sustainable Alexander Valley Wine Estate

Completes Milestone for LEED Platinum Certification

https://www.winebusiness.com/news/article/293850

He criticized one of California’s most popular wines.

Then he got a letter from its lawyers

https://www.sfchronicle.com/food/wine/article/meiomi-pinot-noir-sugar-19811640.php

Napa Valley Farmworker Foundation to Host

Leadership and Viticulture Conference

for Napa County Farmworkers in Spanish

https://www.winebusiness.com/news/article/293856

[headlines]

----------------------------------------------------------------

![]()

This Day in History

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()