Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, October 23, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

No Longer taking Broker/Discounting Business

plus Finance and Leasing Companies

Out of Business Updated

Leasing and Finance Industry Help Wanted

Balboa Capital has many local, offices,

and Remote Positions Open

Being a Contributor

By Scott Wheeler, CLFP

Academy for Certified Lease

& Finance Professionals

Only 1 Left 2024 – Classes for 2025

Being Scheduled

CLFP's by Company

Members with Three of More CLFP’s

More Police on Electric Bicycles Are Pulling

Cars Over in Traffic Stops

By Mathew W. Daus, Esq.

SouthState Bank Expands Equipment Finance

Capabilities with LTi Technology Solutions

Q4 Update to the 2024 Economic Outlook

Forecasts 4.4% Expansion in Equipment

and Software Investment, 2.7% GDP Growth

News Briefs---

A Small Bank’s Failure Leaves Big

Depositors Feeling the Pain

Denny’s gets burned as business slows,

set to shutter 150 underperforming diners

Despite Global Crises, Gas Prices Slide

as U.S. Election Nears

Arkansas May Have Vast Lithium Reserves,

Researchers Say

Bed Bath & Beyond stores are back

from the grave. Sort of

5 things: This will be the deciding factor

in the Kroger, Albertsons merger

BRA Assigns Preliminary Ratings to Mulligan Asset

Securitization II LLC, Series 2024-1 Notes

You May Have Missed ---

IRS announces 2025 tax bracket changes:

What you need to know

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Timothy Amero, Jr., was hired as Senior Vice President of Sales, BriteCap Financial, Las Vegas, Nevada. He is located in Portsmouth, New Hampshire. Previously, he was Vice President of Sales, Direct Originations and Renewals, CAN Capital (June, 2021 - October, 2024); Director of Sales,

Direct Originations & Franchise Finance, Marlin Capital Solutions (November, 2016 - June, 2021); Senior Franchise Finance Manager, Direct Capital, a Division of CIT Bank, NA (NYSE: CIT), (December, 2007 - November, 2016).

https://www.linkedin.com/in/timothy-amero-jr-71bb0140/

Roger Beil, CLFP, was hired as Vice President, Equipment Finance, First Business Bank, Kansas City Metropolitan Area. He is located in Olathe, Kansas. Previously, he was Vice President, Vendor Sales, Ascentium Capital (December, 2022 - September, 2024); Regional Account Manager, Arvest Equipment Finance (June, 2021 - December, 2022): Full Bio:

https://www.linkedin.com/in/rogerbeil/

https://www.linkedin.com/in/rogerbeil/details/experience/

John Hersey, CLFP Associate, was promoted at First American Finance, Victor, New York. He is located in Rochester, New York. He joined First American as Senior Credit Analyst (November, 2022 - October,2024); Project Manager, Loan Vantage Install, Jack Henry & Associates (June, 2021 - November, 2022). He joined The Upstate National Bank September, 2018, Credit Analyst Intern, promoted May, 2019, Credit Analyst, promoted Assistant Vice President, Credit Analyst & System Support (July, 2020 - May, 2021).

https://www.linkedin.com/in/jhersey10/

Vince Monteleone was hired as SVP, Vendor Sales, PNC, Pittsburgh, Pennsylvania. He is located in Denison, Texas. Previously, he was SVP, Vendor Sales, SLR Equipment Finance (November, 2023 - October, 2024). Full Bio:

https://www.linkedin.com/in/vince-monteleone-6b414112/details/skills/

https://www.linkedin.com/in/vince-monteleone-6b414112/

[headlines]

--------------------------------------------------------------

No Longer taking Broker/Discounting Business

plus Finance and Leasing Companies Out of Business

(While there is a lawsuit by 2,000 stock holders against Chesswood Group Limited and its companies,

Pawnee Leasing NS Tandem Finance, are listed as doing business in the major list. They told Leasing News they are in business but, for the time being, not taking originations. They said the situation was temporary. At this time, they are not listed as being out of business. Companies such as Rifco.Net and several others are primarily in business in Canada and were sold or not in business. This major list is primarily the United States. - Editor)

Companies with an * are no longer in business. The others are companies that were taking broker business, but announced that they no longer are accepting broker business. Many have also down-sized or are managing an existing portfolio. This does not include companies merged or acquired who are still in business.

Any updates or changes, please contact: kitmenkin@leasingnews.org

*ABCO Leasing Inc., Bothell, WA

*ACC Capital, Midvale, Utah

Advantage Business Capital, Lake Oswego, Oregon

*Advantage Funding, Lake Success, New York

AEL Financial, Buffalo Grove, Illinois

(No longer taking new broker business)

Agility Solutions Corp., Prescott, Arizona

Allegiant Partners, Bend, Oregon

Alliance Financial, Syracuse, New York

Allstate Leasing, Towson, Maryland

*Alternative Capital, Apollo Beach, Florida

*AMC Funding, Charlotte, North Carolina

*American Bank Leasing, Alpharetta, Georgia

*American Equipment Finance, Warren, New Jersey

American Leasefund, Tigard, OR (no longer a funder)

*American Leasing, Santa Clara, California

Bank of Ozark Leasing/Finance, Little Rock, Arkansas

*Bank of West Indirect Leasing, Dublin, California

*Bank of the West Leasing Indirect, San Ramon, California

*Bank Midwest Leasing, Overland Park, KS

Bankers Healthcare Group, Weston, FL

*BBVA Compass Equipment Leasing, Houston, Texas

*Blackstone Equipment Financing, Orange, California

*BusinessFinance.com (on line aggregate funder)

*Business Leasing NorthWest, Seattle, WA

*Capital One Equipment Finance, Towson, Maryland

*CapitalSource Healthcare Finance, Chevy Chase, Maryland

*CapNet, Los Angeles, California

*C and J Leasing Corp, Des Moines, Iowa

*Carlton Financial Corporation, Wayzata, Minnesota

*Chase Industries, Inc., Grand Rapids, Michigan

*Chesterfield Financial, Chesterfield, Missouri

CHG-MERIDIAN U.S. Finance, Ltd, Woodland Hills, CA

(Sales Management focuses very selectively on certain brokers.)

*Churchill Group/Churchill Leasing, Jericho, NY

CIT Group (limited)

Citizens Business Bank, Ontario, CA

*Colonial Pacific, Portland, Oregon

Columbia Bank Leasing, Tacoma, WA

*Columbia Equipment Finance, Danville, California

*Commercial Capital Training Group

Commercial Equipment Lease, Eugene, Oregon

Concord Financial Services, Long Beach, California

*Court Square, Malvern, Pennsylvania

*Creative Capital Leasing Group, LLC, San Diego, CA

Crossroads Equipment Lease & Finance, Rancho Cucamonga, CA

*Direct Capital, Portsmith, New Hampshire

Diversified Financial Service, Omaha, NE

*Dolsen Leasing, Bellevue/Yakima, Washington

Equipment Finance Partners, a division of Altec, Birmingham, Alabama

Evans National Leasing, Inc., Hamburg, NY

*Enterprise Capital Partners dba Enterprise Leasing, Spokane, WA

Enterprise Funding, Grand Rapids, Michigan

Enverto Investment Group, LLC, West Los Angeles, California

Equify Financial Fort Worth, Texas

*Evergreen Leasing, South Elgin, Illinois

Exchange Bank, Santa Rosa, California

*Excel Financial Leasing, Lubbock Texas

*First Corp.(IFC subsidiary), Morton Grove, Illinois

First Federal Financial Services, Inc., Menomonee Falls, Wisconsin

First Republic Bank, San Francisco, CA

Fora Financial, New York, New York

Frontier Capital, Teaneck New Jersey

*GCR Capital, Safety Harbor, Florida

GE Capital, Conn (limited)

Global Funding LLC., Clearwater, FL

*Greystone, Burlington, MA

*Heritage Pacific Leasing, Fresno, CA

*Hillcrest Bank Leasing, Overland Park, KS (Parent bank sold)

Huntington Equipment Finance, Vendor Finance Group, Bellevue, Washington

*IFC Credit Corp., Morton Grove, Illinois

Irwin Financial (Irwin Union Bank), Columbus, Indiana

Irwin Union Bank, F.S.B. (Louisville, Kentucky)

Lakeland Bank, Montville, NJ

LaSalle Systems Leasing

*Latitude Equipment Leasing, Marlton, New Jersey

*Leaf Specialty Finance, Columbia, South Carolina

*LEAF Third Party Funding, Santa Barbara, Ca.

Lease Corporation of America, Troy, Michigan

Lombard, part of Royal Bank of Scotland, worldwide

*M2 Equipment Finance, Waukesha, Wisconsin

*M&T Credit, Baltimore, Maryland (Merged with M&T Bank)

Note: M&T Bank | Commercial Equipment Finance, Baltimore, MD

(accepts broker business)

Manufacturer's Lease Plans, Inc., Phoenix, Arizona

*Marlin Capital Solutions, Mount Laurel, New Jersey

*MarVista Financial, Villa Park, California

*MericapCredit, Lisle, Illinois

*Meridian Healthcare Finance, San Diego, California

Merrill Lynch Financial

Midwest Leasing Group, Livonia, Minnesota

*Mintaka Financial LLC. Gig Harbor, Washington

*Mount Pleasant Capital, Wexford, PA

*National Alliance of Commercial Loan Brokers, Albany, NY

National City, Cleveland, Ohio

*Navigator (Pentech subsidiary) San Diego, California

*Northwest Leasing Company, Clyde Hill, WA

OFC Capital, Roswell, Georgia

Old National Bank, Evansville, Illinois

*P&L Capital, Omaha, Nebraska

*Pentech Financial, Campbell, CA

*PFF Bancorp, Inc, Pomona, CA

Pinnacle Business Finance, Fife, Washington

*Pioneer Capital Corporation, Addison, Texas

PredictiFund, a subsidiary of Capital Access Network, Inc

*Prime Capital Ventures, Albany, NY

*Prime Commecial Lending, LLC, Albany, NY

*Podium Financial Group, Inc.,Costa Mesa, CA

Popular Finance, St. Louis, Missouri

Providence Bank & Trust, Chicago,Illinois

Puget Sound Leasing, Seattle, Washington

Quality Equipment Finance, Carmel, Indiana

Radiance-Capital, Tacoma, WA

Rapid Finance. Bethesda, Maryland

Rational Technology Solutions, Rolling Meadows, IL

*Reliant National Finance, Jacksonville, Florida

Sandy Springs, Olney, MD

*Securities Equipment Lsg. (SEL, Inc.), Glendora, CA

*Select Equipment Leasing Co., Concord, CA

* Sharpe Financial Network, Phoenix, Arizona

*Silicon Valley Bank, Santa Clara, California

Sovereign Bank, Melville, New York

*Snider Leasing, Sacramento sold to Financial Pacific Leasing

Specialty Funding, Albuquerque, NM

Sterling National Bank, Montebello, New York

*Studebaker-Worthington Leasing, Corp., Jerico, NY

(part of sale from Main Street Bank to Ascentium Capital)

*Summitt Leasing, Yakima, Washington

Sun Trust Equipment Finance & Leasing, Baltimore, Maryland

*SunBridge Capital, Mission, Kansas

Suncoast Equipment Funding Corp., Tampa, Florida

TCF Equipment Finance, Minnetonka, Minnesota

TechLease, Morgan Hill, California

*Tennessee Commerce Bank, Franklin, Tennessee

Textron Financial

*Town and Country Leasing, Lancaster, Pennsylvania

*Triad Leasing & Financial, Inc., Boise, Idaho

*TriStar Capital, Santa Ana, California

Tri Counties Bank, Chico, California

*Union Capital Partners, Midvale, Utah

US Bank, Manifest Funding, Marshall, Minnesota

(new requirement: large yearly funding)

US Bank, Middle-Market, Portland, Oregon

Velocity Financial Group, Rosemont, Illinois

VenCore, Portland, Oregon (former company Len Ludwig)

*Vision Capital, San Diego, California

Vision Financial Group, Inc. (VFG Leasing & Finance), Pittsburg, PA

Wachovia Bank Leasing

*Warren Capital, Novato, California

*Washington Mutual Financial

Wells Fargo stepping back mortgage market,

shutting down buying loans from 3rd parties

Western Bank, Devils Lake, ND

*Westover Financial, Inc., Santa Ana, California

*Your Leasing Solution, Las Vegas, Nevada

Funders looking for new Brokers:

http://www.leasingnews.org/Funders_Only/New_Broker.htm

|

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Many Openings, Many Remote

[headlines]

--------------------------------------------------------------

Being a Contributor

By Scott Wheeler, CLFP

Top originators in the commercial equipment finance and leasing industry contribute to the well-being of all stakeholders. Too often, originators are measured strictly by their production on a monthly or quarterly basis. There are additional contributions that top originators provide to their stakeholders including:

- Generating long-term, well-performing assets which contribute continuous bottom-line profits for their companies or funding sources.

- Identifying new "blue oceans" in the market which will contribute to well-performing assets for their companies and a sustainable future.

- Creating partnerships with the "right" vendors and manufacturers which will contribute to the partner's ability to increase sales and profitability in the short- and long-term.

- Gathering market intelligence which will contribute to predictive analytics for existing and new opportunities and challenges.

- Building a positive culture of success for other originators and operational professionals which will contribute to improving the quality of service provided by their companies.

- Engaging with industry professionals through association events and advocating for best practices which will contribute to the long-term sustainability of the commercial equipment finance and leasing industry.

Top originators understand the importance of their contributions beyond funding single transactions this month. They strive to generate the best quality assets which will perform over the long term. They strive to create a culture of success for themselves and all of their stakeholders.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Academy for Certified Lease

& Finance Professionals

Only 1 Left 2024 – Classes for 2025 Being Scheduled

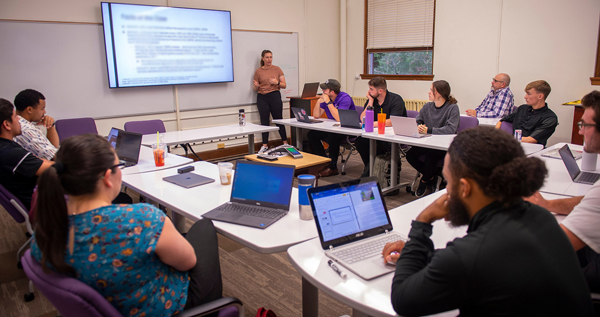

The Certified Lease & Finance Professional (CLFP) Foundation is pleased to present the Academy for Lease & Finance Professionals (ALFP). The ALFP is a three-day event designed to fully prepare an individual to sit for and pass the CLFP exam.’

First Commonwealth EF Online, ALFP

November 6 -7

Mel Vinson, CLFP, Director of Academies, VP of Marketing and Development, active with Academies both online and in person said, “As for ALFPs in 2025, I have only booked one private class for DLL, happening April 15-16. Typically companies book with me in November/December for spring 2025.”

If you plan to earn your CLFP in 2025 and beyond, please purchase the 10th Edition.

https://www.amazon.com/Certified-Lease-Finance-Professionals-Handbook/dp/B0D2LHWNQH

For more information on the academy

https://clfpfoundation.org/academy-for-lease-and-finance-professionals

|

[headlines]

--------------------------------------------------------------

CLFP's by Company

Members with Three of More CLFP’s

| Company Name | CLFP Count |

| First American Equipment Finance | 156 |

| DLL | 110 |

| U.S. Bank Equipment Finance | 66 |

| The Huntington National Bank | 60 |

| Stearns Bank NA-Equipment Finance Division | 48 |

| Ascentium Capital | 42 |

| Arvest Equipment Finance | 36 |

| Amur Equipment Finance | 33 |

| AP Equipment Financing | 32 |

| Oakmont Capital Holdings, LLC | 30 |

| Channel | 30 |

| Key Equipment Finance | 27 |

| North Mill Equipment Finance | 26 |

| First Citizens Bank Equipment Finance | 26 |

| Financial Pacific Leasing, Inc. | 24 |

| Navitas Credit Corp. | 21 |

| KLC Financial, Inc. | 20 |

| ECS Financial Services, Inc. | 18 |

| Wintrust | 18 |

| GreatAmerica Financial Services | 18 |

| Stryker | 15 |

| Northland Capital Equipment Finance | 15 |

| Odessa | 13 |

| Ivory Consulting Corporation | 12 |

| Auxilior Capital Partners, Inc. | 11 |

| Orion First Financial LLC | 11 |

| Tokyo Century (USA) Inc. | 11 |

| Taycor Financial | 10 |

| Beacon Funding Corporation | 10 |

| Alliance Funding Group | 10 |

| Cadence Bank | 10 |

| Fleet Advantage, LLC | 10 |

| Great American Insurance | 10 |

| Transport Enterprise Leasing LLC | 9 |

| 1st Source Bank | 9 |

| Solifi | 9 |

| LTi Technology Solutions | 9 |

| Tamarack Technology, Inc. | 9 |

| Dext Capital | 9 |

| Commercial Equipment Finance, Inc. | 8 |

| BMO | 8 |

| FIS | 7 |

| Canon Financial Services, Inc. | 7 |

| Crossroads Equipment Lease & Finance LLC | 7 |

| Cisco Systems Capital Corporation | 6 |

| Quality Equipment Finance | 6 |

| Mitsubishi HC Capital America, Inc. | 6 |

| FinWise Bank | 6 |

| Leasepath | 6 |

| Civista Leasing and Finance | 5 |

| Ten Oaks Commercial Capital LLC | 5 |

| Falcon Equipment Finance | 5 |

| LEAF Commercial Capital Inc. | 5 |

| Univest Capital, Inc. | 5 |

| 360 Equipment Finance | 5 |

| Nexseer Capital | 5 |

| Financial Partners Group | 4 |

| Truist | 4 |

| Commercial Capital Company, LLC | 4 |

| MAZO Capital Solutions | 4 |

| Balboa Capital a Division of Ameris Bank | 4 |

| CoreTech | 4 |

| The Alta Group LLC | 4 |

| APEX Commercial Capital | 4 |

| First Commonwealth Bank | 4 |

| Northteq | 4 |

| UniFi Equipment Finance, Inc. | 4 |

| Western Equipment Finance | 4 |

| PEAC Solutions | 4 |

| NCMIC Finance Corporation | 3 |

| First National Capital Corporation | 3 |

| M&T Bank | 3 |

| QuickFi by Innovation Finance | 3 |

| Commonwealth Bank of Australia (CBA) | 3 |

| Fifth Third Bank | 3 |

| Verdant Commercial Capital | 3 |

| Lion Technology Finance, LLC | 3 |

| OnPoint Capital, LLC | 3 |

| Commerce Bank | 3 |

| John Deere Financial | 3 |

| TD Equipment Finance, Inc. | 3 |

| Hanmi Bank | 3 |

| Element Fleet Management | 3 |

[headlines]

--------------------------------------------------------------

More Police on Electric Bicycles Are Pulling

Cars Over in Traffic Stops

By Mathew W. Daus, Esq.

Image: LAPD

We often hear about police departments going electric with fleets of new Teslas or other electric cars but you might not realize that electric bicycles are actually becoming a common police vehicle in many departments around the US.

Lieutenant Bryan Zink of the CCSD police department in Las Vegas explained that Class 3 electric bicycles reaching speeds of up to 28 mph (45 km/h) are useful when his officers need to zip across campus or keep up with cars during traffic stops.

His police department recently added a large fleet of e-bikes thanks to a grant from the State Board of Education with funding earmarked for school safety. The new electric bikes help officers patrol the area around the school more effectively, even pulling over car drivers that endanger students.

The Cleveland Division of Police recently added the locally produced electric motorcycle The District from LAND Moto to its fleet.

E-bikes offer several advantages, including enhanced mobility in congested urban areas where navigating narrow streets or crowded events is challenging for cars. They allow officers to quickly respond to incidents while maintaining a lower environmental impact.

Source: electrek

https://electrek.co/2024/10/21/more-cops-on-electric-bicycles-are-pulling-cars-over-in-traffic-stops

Matthew W. Daus, Esq.

Partner and Chairman, Windels Marx Transportation

Practice Group

President, International Association of Transportation

Regulators,

Transportation Technology Chair, University

Transportation Research Center

Contact: mdaus@windelsmarx.com

156 West 56th Street | New York, NY 10019

T. 212.237.1106 | F. 212.262.1215

[headlines]

--------------------------------------------------------------

##### Press Release #######################

SouthState Bank Expands Equipment Finance Capabilities with

LTi Technology Solutions’ ASPIRE and JDR Solutions’ Portfolio Servicing

SouthState Bank is scaling its equipment finance division through an agreement with LTI Technology Solutions and JDR Solutions, which will enhance portfolio management and streamline operations. This strategic collaboration positions SouthState Bank for future growth by leveraging LTi's ASPIRE platform and JDR Solutions' expert servicing capabilities.

Through this agreement, SouthState will enhance operational efficiency, optimize the equipment leasing lifecycle and provide customers with superior service. With ASPIRE's automation, advanced data management tools, and full lifecycle capabilities, SouthState is set to accelerate its equipment finance business.

Why SouthState Bank Chose ASPIRE

Chris Hobbs, Division Head & Director of the Equipment Finance Group at SouthState Bank, said,

“Following a comprehensive search, we selected ASPIRE for its proven track record in successfully managing equipment finance and leasing portfolios, as well as its rapid deployment and proven implementation methodology.

“As we scale and grow our equipment finance division, seamless data management and accurate financial reporting capabilities are essential, and ASPIRE consistently delivers in these key areas.”

A Collaborative Partnership to Drive Success

Tara Aasand, VP Sales and Relationship Management at LTi Technology Solutions, explained, “SouthState Bank’s decision to adopt ASPIRE reinforces our commitment to providing best-in-class solutions for the equipment and asset finance industry.

“We are honored to support SouthState’s growth by equipping their team with a platform trusted by top-tier clients across the industry.”

Joey Enevoldsen, Chief Operating Officer at JDR Solutions commented, “We are delighted to welcome ASPIRE. With our deep expertise in the proven ASPIRE platform and decades of experience in portfolio management, I am confident this partnership will foster growth and deliver long-term success for SouthState Bank’s expanding equipment finance division."

About SouthState Bank

SouthState Corporation (NYSE: SSB) is a financial services company headquartered in Winter Haven, Florida. SouthState Bank, N.A., the company’s nationally chartered bank subsidiary, provides consumer, commercial, mortgage and wealth management solutions to more than one million customers throughout Florida, Alabama, Georgia, the Carolinas and Virginia. The bank also serves clients coast to coast through its correspondent banking division. Additional information is available at https://www.southstatebank.com/global/about

About LTi Technology Solutions

With 35 years of industry leadership, LTi Technology Solutions is a global provider of customer-centric, cloud native, full-lifecycle leasing and loan finance platforms. From its Omaha, NE headquarters, LTi serves equipment and asset finance companies, captives, small ticket, middle market, and independent banks throughout the U.S., UK, and Canada. LTi’s highly configurable platform, ASPIRE, empowers customers to scale their business by streamlining the transaction lifecycle. Backed by comprehensive and integrated interfaces, their powerful technology solutions allow for improved efficiencies and decisioning. LTi is the ecosystem of choice of 40% of the Monitor 100, 50% of the Independents 30 and 36% of the Bank 50.

For more information about LTi, call (402) 493-3445 or +1 (800) 531-5086, or visit https://www.ltisolutions.com/lti-ecosystem-of-solutions/

### Press Release #########################

[headlines]

--------------------------------------------------------------

### Press Release #########################

Q4 Update to the 2024 Economic Outlook Forecasts 4.4% Expansion in Equipment and Software Investment, 2.7% GDP Growth

The Foundation's report is focused on the $1.16 trillion equipment leasing and finance industry and highlights key trends in equipment investment, placing them in the context of the broader U.S. economic climate.

Leigh Lytle, President of the Foundation, and President & CEO of the Equipment Leasing and Finance Association, said, “The Foundation’s Q4 Outlook continues to support a soft-landing scenario and provides optimism for 2025 investment activity. The U.S. economy has been impressively resilient, but heightened political and economic uncertainty, and weather-related business interruptions, are likely to slow investment growth in Q4. We are optimistic that activity will remain strong in 2025, however, as Fed rate cuts start taking effect and election-related uncertainty abates. The Monthly Confidence Index for the Equipment Finance Industry agrees with Q4 Outlook findings, holding steady in October at its highest level since 2022.”

Highlights from the Q4 update to the 2024 Outlook include:

- Equipment and software investment bounced back in Q2 after three consecutive weak quarters, expanding by a strong 7.0% (annualized). Aircraft investment was primarily responsible for the improvement, along with information processing equipment, while industrial equipment contracted modestly.

- The U.S. economy experienced broad-based growth in the second quarter, expanding at a 3.0% annualized rate (up from 1.6% in Q1). Softer-than-anticipated job growth and rising unemployment over the summer raised questions about the long-term sustainability of the current economic expansion. However, layoffs remain low by historical standards, real wage growth is healthy, inflation is modestly elevated but largely contained, and the prospect for additional rate cuts later this year and next year should provide a boost to hiring and investment. The economy appears poised for growth in the new year.

- The manufacturing sector continues to struggle. Both shipments and new orders of core capital goods are sluggish, industrial production is soft, the ISM Purchasing Managers Index for Manufacturing has contracted for 22 out of the last 23 months, and manufacturing employment has fallen by 50,000 workers in 2024 (including 34,000 in the last two months).

- Small business owners have adopted a more cautious posture despite generally favorable business conditions. Recent shifts in the labor market, rising geopolitical tension, and the 2024 election have led to a rapid rise in uncertainty that may depress investment activity in the near term. At the same time, if inflation remains in check and the Fed gradually cuts rates as expected, activity should pick up again in early 2025.

- The Fed is characterizing its decision to cut rates by 50 bps rather than 25 bps as a “recalibration” rather than an emergency reaction to a weakening labor market. The Fed maintains that rate cuts are not intrinsically linked to a looming recession, but rather that a controlled easing of monetary policy, if properly timed and calibrated, can help keep the economy on track.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is released in conjunction with the Economic Outlook, tracks 12 equipment and software investment verticals. In addition, the Momentum Monitor Sector Matrix provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength. . Over the next three to six months the Foundation expects the following trends to materialize on a year-over-year basis:

- Agriculture machinery investment growth will continue to weaken.

- Construction machinery investment growth will continue to contract.

- Materials handling equipment investment growth may improve modestly.

- All other industrial equipment investment growth will remain muted, though recent movement is encouraging

- Medical equipment investment growth may expand modestly, but momentum is soft.

- Mining and oilfield machinery investment growth will remain weak, though recent movement is encouraging.

- Aircraft investment growth should continue to improve.

- Ships and boats investment growth appears to have bottomed out and should improve.

- Railroad equipment investment growth should remain positive, though momentum is slowing.

- Trucks investment growth will remain soft and may turn negative.

- Computers investment growth should continue to expand at a robust pace.

- Software investment growth will expand at a solid pace.

The Foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economic and public policy consulting firm Keybridge Research. The annual economic forecast provides the U.S. macroeconomic outlook, credit market conditions, and key economic indicators. The Q4 report is the third update to the 2024 Economic Outlook, and will be followed by the publication of the 2025 Economic Outlook in December.

Download the full report at https://www.leasefoundation.org/industry-resources/u-s-economic-outlook/.

#### Press Release #######################

[headlines]

--------------------------------------------------------------

News Briefs

A Small Bank’s Failure Leaves Big

Depositors Feeling the Pain

https://www.wsj.com/finance/banking/a-small-banks-failure-leaves-big-depositors-feeling-the-pain-574b83a2?st=aHUMPJ&reflink=desktopwebshare_permalink

Denny’s gets burned as business slows,

set to shutter 150 underperforming diners

https://nypost.com/2024/10/22/business/dennys-to-close-150-restaurants-slash-hours-menu-items-amid-inflation-woes/

Despite Global Crises, Gas Prices Slide

as U.S. Election Nears

https://www.nytimes.com/2024/10/22/business/energy-environment/gas-prices-oil-trump-harris.html

Arkansas May Have Vast Lithium Reserves,

Researchers Say

https://www.nytimes.com/2024/10/21/business/energy-environment/arkansas-lithium-ev-batteries.html

Bed Bath & Beyond stores are back

from the grave. Sort of

https://www.washingtonpost.com/business/2024/10/22/bed-bath-and-beyond-new-stores-kirklands/

5 things: This will be the deciding factor

in the Kroger, Albertsons merger

https://www.supermarketnews.com/mergers-acquisitions/5-things-this-will-be-the-deciding-factor-in-the-kroger-albertsons-merger

BRA Assigns Preliminary Ratings to Mulligan Asset

Securitization II LLC, Series 2024-1 Notes

https://www.businesswire.com/news/home/20241014398861/en/KBRA-Assigns-Preliminary-Ratings-to-Mulligan-Asset-Securitization-II-LLC-Series-2024-1-Notes

[headlines]

--------------------------------------------------------------

IRS announces 2025 tax bracket changes:

What you need to know

https://www.sfchronicle.com/personal-finance/article/irs-2025-tax-brackets-update-19854237.php

[headlines]

--------------------------------------------------------------

Sports Briefs---

Steve Kerr’s plan for deep rotation echoes

Warriors’ title team 50 years ago

https://www.sfchronicle.com/sports/jenkins/article/warriors-deep-rotation-steve-kerr-19844508.php

Minus Steph Curry, Warriors pound Lakers backups

to finish preseason undefeated

https://www.sfchronicle.com/sports/warriors/article/warriors-pound-lakers-backups-finish-preseason-19844200.php

Patriots once were the embodiment of NFL,

the best of the best; but the past is all they have left nowadays.

https://www.bostonglobe.com/2024/10/20/sports/patriots-tara-sullivan-commentary/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

September unemployment rates drop

across the San Francisco North Bay

https://www.northbaybusinessjournal.com/article/industrynews/north-bay-unemployment-jobs-rates/

A wealthy Orange County city is spending big

on sand. It may not be enough

https://www.sfgate.com/california/article/orange-county-city-spends-big-on-sand-project-19855013.phph

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Wine Star: Schramsberg Vineyards'

Hugh Davies

https://www.winespectator.com/articles/2024-new-york-wine-experience-wine-star-hugh-davies

People don’t really know him’: Inside the rise

of California wine’s billionaire sports tycoon

https://www.sfchronicle.com/food/wine/article/bill-foley-billionaire-sports-tycoon-19518760.php

Wine Spectator 2024 Grand Tastings:

Two Nights Not to Be Missed

https://www.winespectator.com/articles/the-2024-grand-tastings-a-night-of-wine-not-to-be-missed

More than $100 million is available for conservation

practices on farms, ranches and private

non-industrial forestland

https://lodigrowers.com/historic-on-farm-conservation-funding-assistance-available-for-farmers/

Shipments to mainland China boost Australian

wine export volume and value to 3-year highs

https://www.wineaustralia.com/news/media-releases/shipments-to-mainland-china-boost-australian-wine-export-volume-and-value-to-3-year-highs

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Oct2023/10_23.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()