Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, September 20, 2024

Today's Leasing News Headlines

Recap: Canadian Finance and Leasing Association Conference

By Hugh Swandel, President, Meridian OneCap

Leasing Industry Ads --- Help Wanted

Better Opportunity, Benefits, Support

Video Job Interview Pointers

By Emily Fitzpatrick

Customer Experience and Operational Efficiency

KLC Turns to Leasepath

Equipment Finance Industry Confidence

Up Again in September

Sudhir Amembal's Winning With Leasing Seminar

Attended by 48 Equipment Leasing Professionals

New Foundation Study Examines Competitive Roles

of Bank and Independent Lessors

Rewarding collection of new Criterion releases

Reviews by Fernando Croce

News Briefs

Investor Alert: Berger Montague (Canada) PC encourages

market participants to discuss Chesswood Group Limited

Dow, S&P 500 close at all-time highs day

after Fed delivers big rate cut

30-Year Mortgage Rate Drops to 6.09%

After Fed Rate Cut

FTC study finds ‘vast surveillance’

of social media users

Nike C.E.O. John Donahoe Abruptly Retires

Amid Declining Sales

You May Have Missed ---

America’s Inflation Fight Is Ending,

but It’s Leaving a Legacy

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Recap: Canadian Finance and Leasing Association Conference

By Hugh Swandel, President, Meridian OneCap

The backdrop for this year’s gathering of the Canadian industry was the scenic city of St. John’s, Newfoundland on the east coast of Canada. Newfoundland is known for its hospitality and the community did not disappoint. Attendees were impressed by local restaurants, fantastic local musicians and great pubs. The weather also cooperated with attendees finding the time to hike up to Signal Hill and enjoy a spectacular view of this harbor community.

CFLA Lunch

Attendees were in good spirits despite very high industry delinquency driven in general by anti-inflation efforts but more specifically by an epic transportation recession that continues to cause elevated delinquency and loss across the majority of Canadian Lessors. Attendance exceeded the association’s expectations but was off from previous years due to the tougher economic times

The agenda for the conference was well received by those who attended sessions. Highlights included an update on the Canadian Certified Lease and Finance Professional (CCFLP) program.

The CCFLP session included Reid Raykovich the CEO of the U.S. based CLFP organization. Reid has become renowned for her successful efforts to bring leasing certification to more and more countries around the world. The momentum built under Reid’s leadership is impressive and her comments during the panel were inspiring.

Other well attended sessions included updates from the associations Anti-Fraud taskforce, Artificial Intelligence initiatives, Women in Leadership and other traditional sessions on industry data, technology and politics.

American Industry Executives go to the Dogs At Canadian Leasing Conference

Left To Right – Robert Boyer EVP First Commonwealth Equipment Finance, Reid Raykovich CLFP Legend, and Chad Sluss CEO NEFA

The social side of the event included a walk through local pubs culminating in several members being “Screeched In,” a local tradition that involves alcohol and kissing a dead fish! People love to have fun in this part of the country and members were up for some recreation in addition to taking in the strong content.

This year’s keynote speakers were very well received. Tareq Hadhad inspired the crowd with his story of how his family fled Syria after losing everything and rebuilt the family Chocolate business from scratch after relocating to Canada. This incredible story has been well told in both a book and a movie. It was a very positive reminder of how immigration creates entrepreneurs who can inspire others while contributing to the economy.

Alan Doyle was the second keynote speaker and his talk received a standing ovation as he wowed the crowd with his singing and stories of his incredible career. Alan is a well-known Canadian singer from Newfoundland and is also an actor and writer (among other things). He humbly spoke about singing for 4 different presidents, acting alongside Russel Crowe and performing to arenas sized crowds around the globe.

His three foundations for success were simple and inspiring. It will be difficult to top this speech, and it will be talked about for many years to come. Canadians love Alan Doyle, and he patiently spoke to and posed for pictures before and after his presentation. They say “don’t meet your heroes” but Alan Doyle is an exception to that theory.

The closing night Dinner included the announcement of this year’s David Powell CFLA Member of the Year – Mark Aylward from Siemens Financial. Mark was a well deserving recipient for his work in organizing the association’s inaugural Innovation and Technology Summit held in the spring of 2024.

As the event drew to a close, many commented how they felt rejuvenated by the gathering and headed home with knowledge and motivation. The association will gather again in September of 2025 in Winnipeg, a destination known for its hospitality and entrepreneurial culture.

Hugh Swandel | President

Meridian OneCap Credit Corp

204 – 3185 Willingdon Green

Burnaby, B.C. V5G 4P3

T: 604-646-2254 | 888-735-2201, extension 8298 (toll-free)

C: 236-888-9031

@: hugh.swandel@meridianonecap.ca

meridiancu.ca/mocc

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

Video Job Interview Pointers

By Emily Fitzpatrick

60% of HR Managers will use or have used video interviewing in the hiring process. More importantly, it is most often used for jobs where you will be working remotely.

There are two types of video interviews:

(1) LIVE interviews using Skype, FaceTime, Live Messenger, Microsoft Teams, Zoom, etc., coupled with Interview Platforms.

(2) Recorded question-and-answer interviews, also called “time-shifted” video interviews, often found on Job Board Services.

In a recorded interview (time-shifted interviews), the job seeker is directed to a website to answer questions on video, using their computer or phone (I always recommend using a computer). These video interviews provide an apples-to-apples approach to assessing candidates.

All applicants are mostly asked the same questions. The HR team is typically the first to review these recordings and rate the responses. The candidates’ recordings that pass this step (answers are scrutinized for essential experience, personality, culture fit, communication skills, and similar) are then forwarded to the hiring manager(s) for the next round of interviews.

Highly rated platforms include Spark Hire, Premier Virtual, HR Avatar, ZipRecruiter, Indeed, Google Workspace, InterviewOpps, and more

There are also interviewing software with specific features, candidate assessment templates, prerecorded questions, and email notifications. The video interview can be conducted on a computer with a webcam or using an app. Don’t be surprised if AI has been utilized to help evaluate the answers.

Prep:

Remember, this is a “Real” Interview and you need to prepare.

Be mindful of where you set up for your video interview. Be sure the area is free of visual distractions (clutter). Carefully consider what is in the background. Additionally, check your technology well in advance of the interview, e.g., connectivity. You may also have to download the platform software, read instructions, and explore the technology.

One of the best things you can do to prepare for a live video interview is practice with friends or family before your job interview. Also, clarify with the interviewer who will initiate the call and double-check the username. Furthermore, be sure to account for time zone differences.

POINTERS:

Eye Contact: Make sure to affix a specific spot on your computer or screen. Do not look straight into the camera. A habit I have is looking up or sideways/ Practice and tape an X where to fix your gaze.

Dress: Professional dress from head to toe is recommended. Always expect the unexpected because you never know when you might need to stand during an interview

Lighting is important. If the light source is behind you, you may appear as a dark silhouette on the screen. Position a lamp or other light source in front of you.

Positioning: Prop up the computer so that you are not looking down at it and practice where to sit so you are framed correctly by the webcam. Make sure your torso is visible, including your hands.

Communication Clarity: It is expected these days that you use a USB-connected headset or “buds” for an interview instead of the computer’s speakers Headsets are inexpensive but earbuds can be expensive (however, in 2022, almost everyone has a pair; contact me for suggestions) and can provide a much clearer interview experience.

Dial-up the Enthusiasm: Someone who speaks with normal energy in a one-on-one conversation can come across as flat and monotone in a video interview. It is essential to be a little more enthusiastic than normal.

Lean In: You have heard that “the camera adds 10 pounds.” The reason for this is that many people lean backward in their chair when they should be leaning forward. Sitting back and relaxing in your chair will position your head further away from the webcam than your stomach. Lean forward.

Emily Fitzpatrick

Senior Executive Recruiter & Career Consultant

Recruiters International, Inc. | RII | RII Career

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also, follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Customer Experience and Operational Efficiency

KLC Turns to Leasepath

The transition to Leasepath Enterprise is part of KLC Financial's broader initiative to optimize internal processes and enhance the overall customer experience. By leveraging Leasepath Enterprise’s cutting-edge technology, KLC Financial aims to streamline operations, improve data accuracy, and accelerate response times, ensuring that clients receive faster and more efficient service.

Spencer Thomas, CEO of KLC Financial, said, "We have completed our implementation to Leasepath Enterprise, which marks a significant milestone in our journey to enhance operational efficiency and customer service.

"This new platform not only supports our current growth but also positions us for future expansion as we continue to meet the evolving needs of our clients."

Amy Lewis, VP of Operations at KLC Financial, added, "Leasepath provides us with the tools we need to optimize our processes and deliver even greater value to our clients. The platform has already yielded significant improvements in our workflow, allowing our team to focus more on building relationships and less on administrative tasks. We are confident that this upgrade will further enhance the quality of service we offer."

Michael Baez, VP of Professional Services and Customer Strategy, added, “Leasepath is excited to partner with KLC and support them in achieving their ambitious growth objectives,” said. “The Leasepath platform is designed to empower equipment finance companies like KLC to streamline operations, elevate efficiency, and deliver superior customer service; exactly what equipment finance teams need in today’s environment.”

Jeff Bilbrey, CEO of Leasepath, shared his enthusiasm for the partnership, commented, “KLC Financials on boarding to Leasepath Enterprise underscores its dedication to adopting the latest technology to better serve clients and partners.: “KLC has long been a premier player in the equipment finance industry, and by leveraging the Leasepath platform.

“KLC is positioned to elevate their customer service, maximize efficiency, and accelerate their growth trajectory.”

Key Benefits the Leasepath Enterprise platform brings to KLC Financial:

- Enhanced Workflow Efficiency: Leasepath’s user-friendly interface and automation capabilities allow the team to manage transactions with greater speed and precision.

- Improved Data Management: With real-time data synchronization and advanced analytics, KLC Financial can now provide more accurate and insightful financial solutions.

- Superior Client Experience: The integration of Leasepath empowers KLC Financial to offer a more personalized and responsive service, reinforcing its commitment to client satisfaction. .

About KLC Financial: KLC Financial is a Minneapolis-based equipment finance company specializing in providing customized financing solutions to businesses across various industries. With a focus on building long-term relationships, KLC Financial partners with clients to understand their unique needs and deliver tailored financial products that drive success.

About Leasepath: Leasepath is the leading provider of cloud-based software solutions for the equipment and asset finance industry. Designed to streamline operations, improve efficiency, and enhance customer service, Leasepath empowers businesses to Win Fast, Risk Less, and Profit More. For more information, please visit www.Leasepath.com.

For more information, please visit www.klcfinancial.com

[headlines]

--------------------------------------------------------------

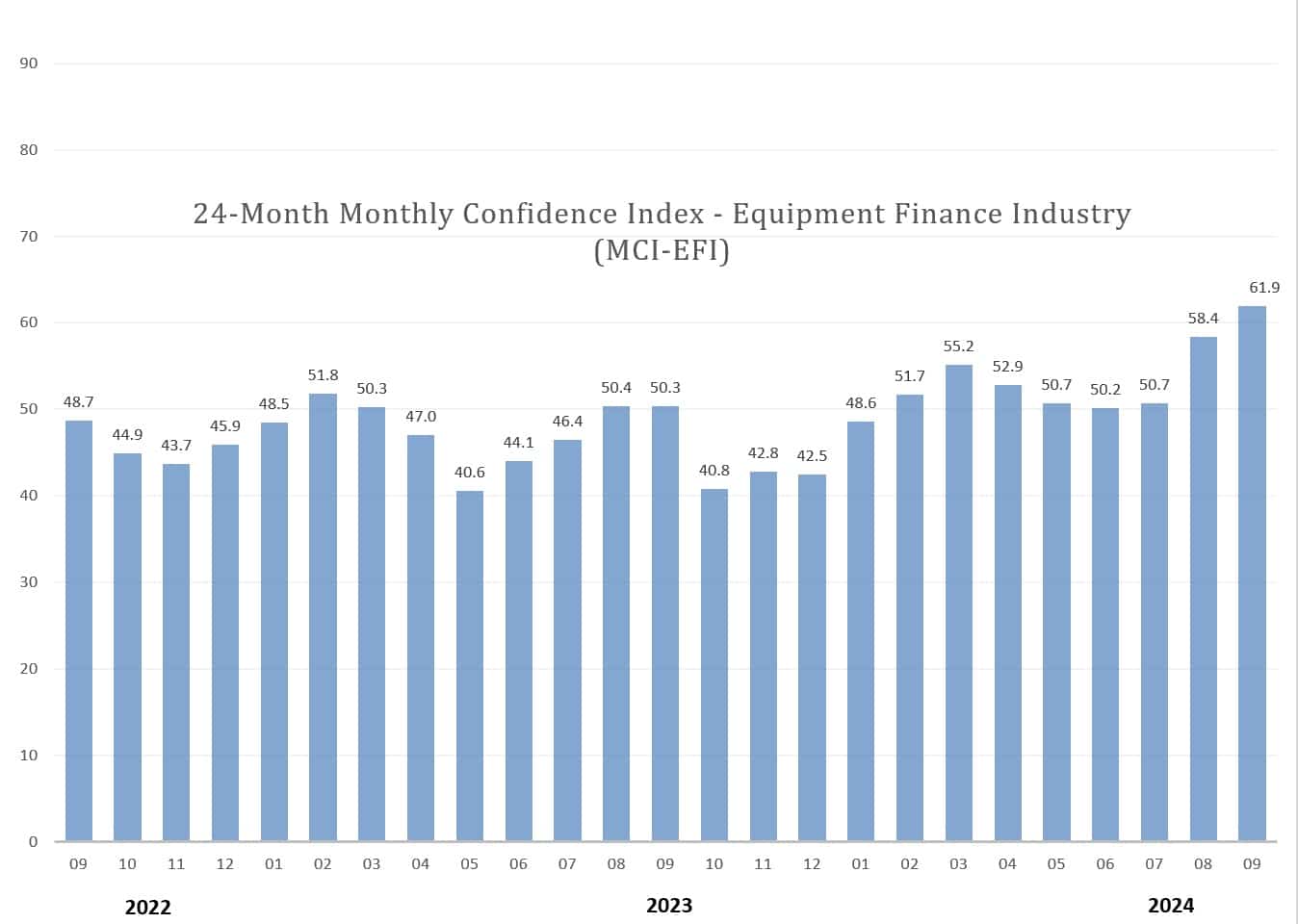

Equipment Finance Industry Confidence

Up Again in September

The Equipment Leasing & Finance Foundation reported: Overall, confidence in the equipment finance market is 61.9, an increase from the August index of 58.4, and the highest level since January 2022.

Reaction from Key Executives:

Mark Bonanno, President and COO, North Mill Equipment Finance:“There is still concern of the risk that the Fed will not be able to guide to a soft landing and inflation will remain sticky. Consumer debt and U.S. debt levels are unsustainable.”

James D. Jenks, CEO, Global Finance and Leasing Services, LLC: “Interest rates should begin to fall this month and the federal election is around the corner. We expect business activity will begin to improve soon.”

David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance: “I am optimistic for 2024 and 2025 as opportunities are in solid supply if you have liquidity to fund and scale your balance sheet. While there are many examples of uncertainty to point to today, I find businesses are adapting and finding ways to win and it is an opportunity for us to adapt and grow with them. Even with solid liquidity, delinquency and portfolio performance are challenging for many, so credit discipline is required more now than over the last few years.”

Nancy Pistorio, President, Madison Capital: “Many firms, particularly small and medium-sized businesses, have been delaying equipment purchases, citing continued high interest rates and uncertainty about the economy amplified by the upcoming election. This ‘let’s wait and see what happens’ mindset has contributed to diminished demand for equipment financing. Assuming the Federal Reserve lowers rates this fall, and once the election is behind us, I think we will begin to see an increase in business volumes. Barring any prolonged adverse reaction from the financial markets to the election outcome, I anticipate a more robust December and first quarter 2025 for our industry.”

Full ELFF Press Release:

https://www.leasefoundation.org/industry-resources/monthly-confidence-index/.

[headlines]

--------------------------------------------------------------

Sudhir Amembal's Winning With Leasing Seminar Attended

by 48 Equipment Leasing Professionals

Sudhir Amembal's fourth Winning With Leasing virtual seminar, held on September 17, was attended by 48 equipment finance professionals. All industry segments (banks, independents, captives and service providers) were represented. Attendees ranged in experience from less than one year in the industry to seasoned professionals with over 30 years of experience. The seminar is an extract from his live flagship seminar attended by over 35,000 equipment leasing professionals worldwide.

The material focused on the substantial benefits of leasing (35 in all!) Attendees were provided with the knowledge and tools on how best to understand varied customer motivations and arrive at deal-clinching responses to commonly encountered objections. It concluded with a host of approaches on how to add value, outsmart competition, and comprehend why only a few outperform.

Sudhir Amembal, CEO of Amembal & Halladay and an affiliate of Rinaldi Advisory Services, states: "The feedback I received after the seminar was heartening. Those who completed the feedback survey indicated that the seminar was of substantial benefit. I am grateful to be able to offer the type of lease training which leads to career enrichment and advancement.”

The next one-day seminar is scheduled to be held on October 24.

For further information including seminar outline and fee person, contact sudhir@amembalandhalladay.com.

Amembal, who pioneered lease training, has been honored by our industry in a multiplicity of ways for having led his firm in training over 80,000 equipment finance professionals worldwide, publishing 18 industry books, and providing consultancy services to a host of equipment finance companies. He is an inductee in ELFA's Hall of Fame, Monitor Converge 2023 and 2024 Nominee for MVP Behind the Scene, and the first ever honorary CLFP.

-------------------------------------------------------------------

##### Press Release #######################

New Foundation Study Examines Competitive Roles of

Bank and Independent Lessors

Private Capital Involvement Expected to Increase

Washington, DC,– In the wake of U.S. bank failures in spring 2023 many banks, which represent the largest share of new business volume among lessor types, pulled back from equipment finance activity.

A new report, “The Changing of the Guard: The Evolving Roles of Banks and Independents in Equipment Finance,” released by the Equipment Leasing & Finance Foundation Foundation evaluates the current and expected competitive landscape for both banks and independent equipment finance companies in the $1 trillion equipment finance industry. It also assesses the increasing importance of the asset management sector in equipment finance, which includes private equity (PE) firms, credit funds, business development companies, and family offices.

The report was commissioned by the Foundation and prepared by management consulting firm FIC Advisors, Inc. The findings are based upon multiple interviews with equipment finance leaders, a review of recent survey results and other research, as well as FIC Advisors’ client experience.

The six key summary takeaways derived from the report are:

Many banks appear hesitant about their commitment to equipment finance and are reducing their exposure. At the same time, a smaller number of banks are beginning to reengage and grow equipment finance assets.

- Banks continue to face deposit shrinkage.

- Independents are in a stronger competitive position than they have been for many years; however, access to funding and capital, critical to their success, are available only to the stronger performers.

- Private funds, in particular PE firms, are playing an increasing role, primarily with Independents.

- Credit quality has declined from previous years.

- The current M&A market shows little activity. Analysts do not expect a rebound until at least 2025.

Valerie Gerard, Foundation Research Committee Chair and Co-CEO of The Alta Group, said, “We have seen dramatic shifts in the industry over the last year as banks have reduced their equipment finance exposure, creating an opening for independent providers to grow their market share.

“This study provides a comprehensive examination of how banks and independents are navigating market volatility and opportunities in their respective sectors, emerging trends and likely operating options for these groups over the next few years. The insights are invaluable to equipment finance practitioners for their business strategy and decision-making, as well as advisors and vendors to the industry.”

Download the full report at https://www.store.leasefoundation.org/cvweb/cgi-bin/msascartdll.dll/ProductInfo?productcd=BankIndependent2024

### Press Release #########################

[headlines]

--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

A sweeping epic (“The Last Emperor”), a restored classic (“Pat Garrett and Billy the Kid”), a poetic drama (“Perfect Days”), and a pair of sharp satires (“Real Life,” “Risky Business”) make for a rewarding collection of Criterion releases.

The Last Emperor (1987): Italian master Bernardo Bertolucci (“Last Tango in Paris”) went to Hollywood and scored a slew of Oscars with this opulent historical drama, which won the Academy Award for Best Picture. Unfolding over six decades, the story follows the life of Pu Yi (John Lone), the last emperor of China prior tothe Cultural Revolution. Crowned while still atoddler, he lives in a lavish private world while history changes dramatically outside the walls of Forbidden City. Tutored by a Scottish diplomat (Peter O’Toole) and married to Wanrong (Joan Chen), Pu Yi sees the country pass through Japanese and Russian before the rise of Mao Zedong. Bringing his thematic obsessions to the epic production, Bertolucci fashions a visually staggering spectacle that remains one of the most beautiful titles in the Criterion collection.

Pat Garrett and Billy the Kid (1973): Sam Peckinpah (“The Wild Bunch”) turned the Western genre inside out with his sense of brutal poetry, leaving behind a collection of blood-soaked classics. Among them is this retelling of two of the American West’s most famous figures, outlaw Billy the Kid (Kris Kristofferson) and the sheriff on his trail, Pat Garrett (James Coburn). Former friends now on opposite sides of the law, they enact an extended chase through a desert full of corrupt authorities and seamy bandits, sanguinary ambushes and narrow escapes. Cut against the director’s wishes when originally released, the film can now be seen in Peckinpah’s original version in Criterion’s restoration, certainly a reason for cinephiles to rejoice. The cast also includes Jason Robards, Slim Pickens and, fascinatingly, Bob Dylan.

Perfect Days (2023): Veteran German director Wim Wenders (“Wings of Desire”) delivers his strongest film in years with this acclaimed, melancholy drama, which was nominated for a Best International Feature Film Oscar. Set in Tokyo, it follows the life of Hirayama (Koji Yakusho), who works cleaning public toilets in an upscale district. In his free time, he reveals a passion for music, books, and photography. Among the people he meets are Takashi (Toko Emoto), a brash assistant and impulsive girl-chaser, and Niko (Arisa Nakano), the estranged niece who briefly stays with him when she runs away from home. Mostly, however, Wenders eschews plot to focus on the main character’s quotidian routines, where the search for beauty in the everyday is ongoing. The results brim with meditative poetry. With subtitles.

.jpg)

Real Life (1979): Beloved for his distinctively dry wit, scene-stealing comic Albert Brooks made his directorial debut with this ingeniously deadpan satire of media and family, which predicted reality television some two decades in advance. Brooks stars as “Albert Brooks,” a self-involved Hollywood filmmaker interested in making a documentary about suburban American life. His project involves bringing cameras to film one year in the life of a typical family, namely the Yeagers in Phoenix, AZ. When disastrouscomplications arise involving the sad-sack patriarch (Charles Grodin) and his restless wife (Frances Lee McCain), the protagonistquickly learns that the line between recording reality and influencing it is a thin one indeed. Showcasing the Brooks’sharp humoras well as his stylistic rigor, this prophetic comedy has scarcely aged since its release.

Risky Business (1983): Tom Cruise became a star in this iconic romantic comedy, which takes a conventional plot and turns it into a slick satire of Reagan-era materialism. Cruise plays Joel Goodsen, a Chicago high school senior who has the run of the family home when his parents go on vacation. The fun quickly grows complicated, however, when he becomes involved with a gorgeous call-girl named Lana (Rebecca De Mornay). When his house is raided by her pimp (Joe Pantoliano) and his father’s priceless Porsche is wrecked, Joel needs to find a way to come up with money, and fast. What follows is the protagonist’s transformation from wannabe preppie to shrewd businessman, done with dreamy style by writer-director Paul Brickman. Though often imitated, its subversive style remains its own.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since 2008. His reviews appear each Friday.

[headlines]

--------------------------------------------------------------

News Briefs

Investor Alert: Berger Montague (Canada) PC encourages

market participants to discuss Chesswood Group Limited

https://finance.yahoo.com/news/investor-alert-berger-montague-canada-173900182.html

Dow, S&P 500 close at all-time highs day

after Fed delivers big rate cut

https://nypost.com/2024/09/19/business/dow-jumps-to-another-all-time-high-day-after-fed-delivers-big-rate-cut/

30-Year Mortgage Rate Drops to 6.09%

After Fed Rate Cut

https://www.nytimes.com/2024/09/19/business/mortgage-rates-fed-rate-cut.html

FTC study finds 'vast surveillance'

of social media users

https://www.bostonglobe.com/2024/09/19/business/ftc-study-finds-vast-surveillance-social-media-users/

Nike C.E.O. John Donahoe Abruptly Retires

Amid Declining Sales

https://www.nytimes.com/2024/09/19/business/nike-elliott-hill-john-donahoe.html

[headlines]

--------------------------------------------------------------

America’s Inflation Fight Is Ending,

but It’s Leaving a Legacy

https://www.nytimes.com/2024/09/19/business/economy/inflation-interest-rates-effects.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers beat writer, columnist poached from

the Athletic by SF startup

https://www.sfgate.com/sports/article/tim-kawakami-leaves-the-athletic-for-standard-19761642.php

The Pac-12 is back, kind of

"On the verge of full resurrection."

https://www.sfgate.com/collegesports/article/pac-12-is-back-kind-of-boise-fresno-colorado-sdsu-19760875.php

The 49ers' Christian McCaffrey problem

just got so much worse

https://www.sfgate.com/49ers/article/49ers-christian-mccaffrey-problem-gotten-worse-19763753.php

49ers fall to Vikings in Minnesota again, lose 23-17

as Brock Purdy gets pummeled in the pocket

https://www.sfchronicle.com/sports/49ers/article/49ers-trail-vikings-brock-purdy-hits-george-19766351.ph

Seahawks 23, Patriots 20: New England fails

to score in overtime, falls to 1-1

https://www.bostonglobe.com/2024/09/15/sports/new-england-patriots-live-game-score-seahawks/

Saints stun Cowboys, snap NFL's longest active

regular-season home win streak

https://www.usatoday.com/story/sports/nfl/2024/09/15/dallas-cowboys-new-orleans-saints-score/75238785007//

Kansas city Chiefs Beat Cincinnati Bengals

https://www.cincinnati.com/story/sports/nfl/bengals/2024/09/15/bengals-chiefs-game-score-live-updates-highlights-tv-channel/75236534007/

Oakland drops back-to-back games

to lose White Sox series

https://www.eastbaytimes.com/2024/09/15/white-sox-win-back-to-back-games-for-first-time-in-nearly-3-months-beat-athletics-4-3

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Dreamforce commits to S.F. for three more years

in major economic boost for city

https://www.sfchronicle.com/sf/article/dreamforce-salesforce-sf-19777947.php

Cisco to lay off hundreds of Bay Area employees

in second round of cuts this year

https://www.sfchronicle.com/tech/article/cisco-bay-area-tech-layoffs-2024-19777849.php

A Millennium Tower condo lost 45% value in a decade.

Has downtown S.F. real estate bottomed out?

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

An incredible ride': Press Democrat wine writer

leaves after 25 years, shares favorite stories

https://www.pressdemocrat.com/article/lifestyle/peg-melnik-the-press-democrat/

Gallo Glass Plans to Install New Hybrid Electric

Furnace to Decarbonize Glass Production

https://www.winebusiness.com/news/article/292719

Stoller Family Estate's Wine Bar Named

Best Winery in Bend, Oregon

https://www.winebusiness.com/news/article/292696

Wine Spectator 2024 video contest finalists

— Vote Now for the Winner

https://www.winespectator.com/videovotingr!

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Sept2023/09_20.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()