Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Thursday, September 26, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Story Credit Financing

Business Loans, SBA Loans, Working Capital

Key Receivers

Sales Makes it Happen by Steve Chriest

ELFA Reports $9.2 billion New Business

Down 17% from July

Ed Kaye Appointed Vice President of

Putnam Leasing, Greenwich, Connecticut

AP Equipment Financing Expands Offerings

With Fleet Management and Rental Solutions

Syndifi and Tamarack Technology Partner to

Streamline Equipment Finance Syndication

for KLC Financial, LLC

A Vibrant Slew of New Releases

Reviews by Fernando Croce

Wine Spectator Winners of

2024 Video Contest

News Briefs

Congress Passes Short-Term Spending Bill

to Avert a Shutdown

Shoppers will spend a record $241 billion online

this holiday season

Market for AI products and services could reach up

to $990 billion by 2027, finds Bain & Company's

5th annual Global Technology Report

Google Paid $2.7 Billion to Bring Back an

AI Genius Who Quit in Frustration

Boeing workers felt schedule pressure even

after midair blowout

AOC says embattled NYC Mayor Eric Adams should

resign for the 'good of the city'

Zoo to send giant pandas back to China

because they’re too expensive to keep

You May Have Missed ---

Brian Huey note

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Andy Cooper was hired as Vice President, The Commercial Loan Fund. He is located in Pittsburgh, Pennsylvania. Previously, he was Finance Manager, Highway Equipment Company (May, 2017 - June, 2024); Sales & Finance Manager, Various new car franchises (July, 2014 - 2017); Senior Branch Account Manager, CitiFinancial (May, 2010 - August, 2011).

https://www.linkedin.com/in/andy-cooper-a5513550/

Mathew Corbin was promoted to Equipment Financial Specialist, South Central Territory Manager, Patriot Capital Corporation, Atlanta, Georgia. Located in Atlanta, Georgia. He joined Patriot January, 2021, Business Development Manager, promoted to Account Manager (January, 2023 - September, 2024). Full Bio: https://www.linkedin.com/in/matthew-corbin-91b672100/recent-activity/all/

https://www.linkedin.com/in/matthew-corbin-91b672100/

Stephanie Hall, CLFP, was hired as Senior Vice-President, Indirect Lending, Apex Commercial Capital, Horsham, Pennsylvania. She is located in Lansdale, Pennsylvania. Donald Wampler, CLFP, Managing Director of Equipment Finance, said, “We are thrilled to have Stephanie join our team and be the face of our broker channel.” Previously, she was SVP, Indirect Lending, Apex Commercial Capital (August, 2024 - September, 2024); Vice President of Sales, Quality Equipment Finance (October, 2022 - August, 2024); EVP, Small-Ticket, BankFinancial Equipment Finance (January, 2020 - October, 2022). Full Bio:

https://www.linkedin.com/in/stephanie-hall-clfp/recent-activity/all/

https://www.linkedin.com/in/stephanie-hall-clfp/

Fabian Ndrejaj was hired as Credit Assistant, Dakota Financial, LLC., Brentwood, California. Previously, he was at Taycor Financial, starting April, 2021, Transaction Coordinator, promoted Credit Analyst (May, 2022 - August, 2024).

https://www.linkedin.com/in/fabian-ndrejaj-9a4787269/

Elena Zucchi, CLFP, was hired as Partner Success Manager-Team Lead, PEAC Solutions, Mount Laurel, New Jersey. She is located in Greater Philadelphia. Previously, she was VP of Sales, Central Region, Channel/Your Partner in Funding (April, 2022 - September, 2024); VP Broker Relations East Coast, Centra Funding (August, 2020 - October, 2021); Sr. Business Development Manager, Marlin Business Bank (January, 2014 - August, 2020); CFO, Total Financial Solutions (2008 - 2010).

https://www.linkedin.com/in/elena-zucchi-clfp-339aa619

[headlines]

--------------------------------------------------------------

Alphabetical list - click on company name to view more details

Here are funders who take "A" and "B" rated applicants. They are also more interested not in "application only." They become more comfortable learning more, beyond reviewing financial statements and tax returns, additional collateral, learning more about the story behind the business as qualifiers.

To qualify for this list, the company must be a funder (as qualified by Leasing News) and are on the “Funder List” and not a "Broker” or “Super Broker.”

Leasing News reserves the right to not list a company who does not meet these qualifications.

Funder List “A”

http://www.leasingnews.org/Funders_Only/Funders.htm

We encourage companies who are listed to contact us for any change or addition they would like to make. Adding further information as an "attachment" or clarification of what they have to offer would be helpful to readers is also very much encouraged."

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Business Reports |

| Balboa Capital Corp. 1988 A Division of Ameris Bank since December 2021 Robert J. Rasmussen Chief Operating and Risk Officer 949-399-6344 robertjr@balboacapital.com https://www.balboacapital.com AACFB, ELFA, NEFA |

229 |

USA |

$3,000 - $5,000,000 |

|

Financial Pacific Leasing A subsidiary of Umpqua Bank 1975 Terey Jennings, CLFP 800.447.7107 tjennings@finpac.com www.finpac.com ELFA, AACFB (BBB) |

140

|

USA |

$5,000 - $100,000 |

|

North Mill Equipment Finance |

110 |

All 50 states |

App Only: $15k to $250k |

|

Maxim Commercial Capital, LLC |

30 |

Nationwide |

$5,000 - |

|

P&L Capital Corporation 1996 Phil Lieber 800.698.1686 phil@plcapital.com www.plcapital.com AACFB (Click for further description) |

28 |

Nationwide |

$10,000 |

|

| Blue Bridge Financial, LLC 2010 877-439-1534 www.bluebridgefinancial.com NAELB, NEFA |

35 |

United States |

$20,000-$500,000 avg. size: $85,000 |

|

Quality Leasing Co. Inc. |

30 |

National Do not fund in HI or RI |

$30,000 up to $3 million |

|

BSB Leasing, Inc. 1992 Colorado, Hawaii Don Meyerson, Pres. DMyerson@bsbleasing.com www.bsbleasing.com NAELB (click here for further description) |

16 |

National |

$10,000 Minimum Application Only to $250,000 Financial Statement Transaction Up to $1MM Business Loans Up to $500K |

|

TEAM Funding Solutions 1992 Ted Reynolds – Owner and President Jeff Deskins – Credit Manager App Submittal: Lynn Smith – Senior Broker Development Manager 888-457-6700 x115, Martin Lacayo – Broker Development Manager 888-457-6700 x106, Bill Baskerville – Broker Development Manager 888-457-6700 x114, Funding: Stephen Stuesser – CFO Jamie Moore – Marketing Manager Phone: 888-457-6700 x109, Enrollment Fax: 512-258-2322 www.teamfundingsolutions.com AACFB (Z) |

13 |

48 states |

$20,000 - $200,000 |

|

Global Financial & |

12 |

All 50 states |

$25,000 to $1 Million |

|

10 |

United States |

$10K Minimum Loans Only, No Leases |

||

Dakota Financial Charla Laird Sales & Marketing Manager 310-432-2935 Direct 858-212-4994 Cell 310.696.3035 fax charla@dakotafin.com 310.696.3030 x122 www.dakotafinancial.com AACFB |

9 |

Nationwide |

$10,000 to $1MM |

|

Forum Financial Services, Inc. 1996 Tim O'Connor 972-690-9444 ext. 225 tim@forumleasing..com 275 West Campbell Road Suite 320 Richardson, Texas 75080 Fax: 972-690-9464 www.forumleasing.com AACFB (W) |

7 |

Nationwide |

$50,000 to $1.0 million. Our average size transaction is $250,000. Does Subprime Leases |

|

Bankers Capital 1990 James Aiksnoras - President 508-351-6000 Jamesa@bankers-capital.com www.bankers-capital.com AACFB (GG) |

6 |

Nationwide - 50 States |

$25,000 + |

|

SLIM Capital, LLC |

5 |

Nationwide |

$25,000 to $2 million(Avg $200,000) |

|

Gonor Funding 2001 Norman J. Gonor ngonor@gonorfunding.com 818.784.5444 Jason Gonor 818.402.6999 www.gonorfunding.com (Y) |

3 |

USA |

$10,000 to $100,000 with an average of $25,000 - $35,000 Does Subprime Leases |

|

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Business Reports |

-------------------------------------------------------------------------------------------------------

(P) Financial Pacific Leasing supports a nationwide network of Brokers and Lessors. We specialize in "B" and "C" credits for established companies as well as companies under two years in business. Broker Qualify - Please Call or see "Prospective Broker" section on website

(S) We at Summit Leasing consider ourselves to be primarily "B" credit lenders, working almost exclusively through brokers. Broker Qualify - Contact us

(W) Forum Financial Services, Inc., prefer venture capital backed start-ups and middle market to large corporate turnaround companies including companies in bankruptcy and post bankruptcy. Our absolute minimum sales for an established business with financial problems are $10.0 million. (this does not include venture capital backed start-ups). Broker Qualify - Please visit our website at www.forumleasing.com or call 972-690-9444 ext. 225

(Y) Gonor Funding specializes in hard to fund leases with D credit. Collateral based with good rates and commission program. Broker Qualify - Please Call

(Z) TEAM Funding Solutions is a C-credit funder that provides a unique alternative to credit scoring. We fund new business start-ups and older businesses with weaker credits when we roll up our sleeves to understand “their story.” Equipment leases are approved and funded based on common sense, the Lessee’s ability to pay and the Broker’s input.

(CC) Provides financing, leasing, and lending services to businesses and municipalities with “A” through “D” credit profiles throughout the United States, Canada, Mexico, and South America. Since inception, FMEF has provided nearly $1 billion in financing to over ten thousand customers. Also seeks third party originations.

Financing programs, leases, and loans for equipment costing from $10,000 to $10,000,000+. “Application only” programs (No financials or tax returns required) for equipment up to $350,000 and we generally make a credit decision on these transactions within 24 hours. www.netlease.com

(DD) Maxim Commercial Credit provides creative and flexible asset-based financing for today's challenging credit market.

(EE) BSB Leasing, Inc. is a direct funding source. In addition we offer an experienced Syndication Desk that can place transactions that fall outside of credit, equipment, geographic or dollar amount appetite.

(FF) NFS Leasing is a Technology Leasing Specialist which provides funding for B, C, and D and story credits. We make our own credit decisions, service the full lifecycle of transactions on our own balance sheet. We are fast, flexible, and easy to work with. IT & Computer Equipment, Medical, Scientific Equipment, & Office Equipment. We service Canada and the UK as well.

(GG) Bankers Capital will do ANY Type of equipment, in ANY industry (including cannabis), in ANY state. Our specialty is applicants new in business and/or with challenged credit. We require a full financial package on every applicant. Bankers Capital structures “story” or C&D credits with additional collateral which might include mortgages on residential or commercial real estate, additional equipment, assignment of marketable securities or life insurance policies with cash surrender value, security deposits, or vendor agreements Bankers Capital looks for a way to approve the request instead of looking for a way to decline it.

Quality

Quality funds titled and non-titled commercial equipment for A- to C+ customer profiles. *Our sales team has over 100 years of combined experience in leasing and finance. Some sales reps have long-standing vendor relationships, but we do not pursue vendor relationships that come to us from brokers."

--------------------------------------------------------------

Key Receivers

Sales Make it Happen by Steve Chriest

¦ Rule #1 - Everyone in an organization is a salesperson.

¦ Rule #2 - Not everyone believes rule number one.

¦ Rule #3 - Everyone has customers.

The most successful, customer-centric organizations we encounter work hard to create a culture that champions all customers, including the company's employees - their "key receivers."

Managers in these organizations recognize that they oversee a volunteer workforce, and they realize that their success as managers depends, to a large degree, on their ability to persuade employees to work at fulfilling the company's mission.

We've noticed that these same managers faithfully follow their company's sales process when interacting with subordinates. The methodology they use in working with customers works as well when working with "key receivers."

We don't think it is an accident that companies that are satisfied with their implementation of highly complex CRM (Customer Relationship Management) systems share a common approach to managing their employees.

Instead of simply announcing the arrival of new CRM software, managers solicited input from all affected business units during the project's planning phase, launched modules in stages to promote user adoption, and addressed the cultural shift issues that a major change in software often entails. In short, they approached their employees as customers of the new software system!

A willingness to accept the three rules that apply to all organizations today, and a commitment to treat everyone in the organization as a "customer," helps create a true customer-focused enterprise. In these organizations, providing excellent customer service be-comes the habit of the company's "key receivers."

Steve Chriest is the CEO of Open Advance and author of “Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101.” He is the former president of several leasing companies. Today, he produces video and radio blogs, as well as continuing as a columnist for Leasing News since 2005.

800-570-7145

schriest@sbcglobal.net

http://www.openadvance.com

Sales Makes It Happen

https://leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

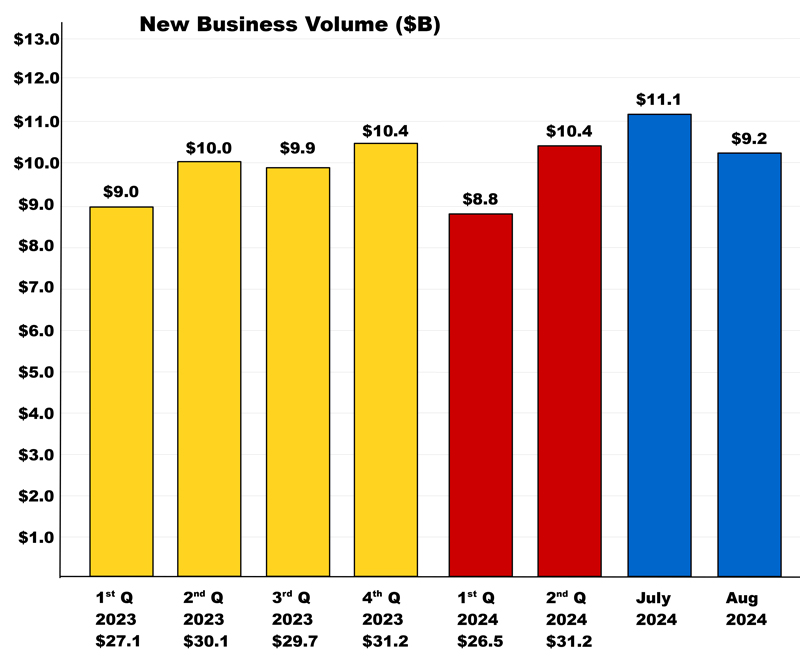

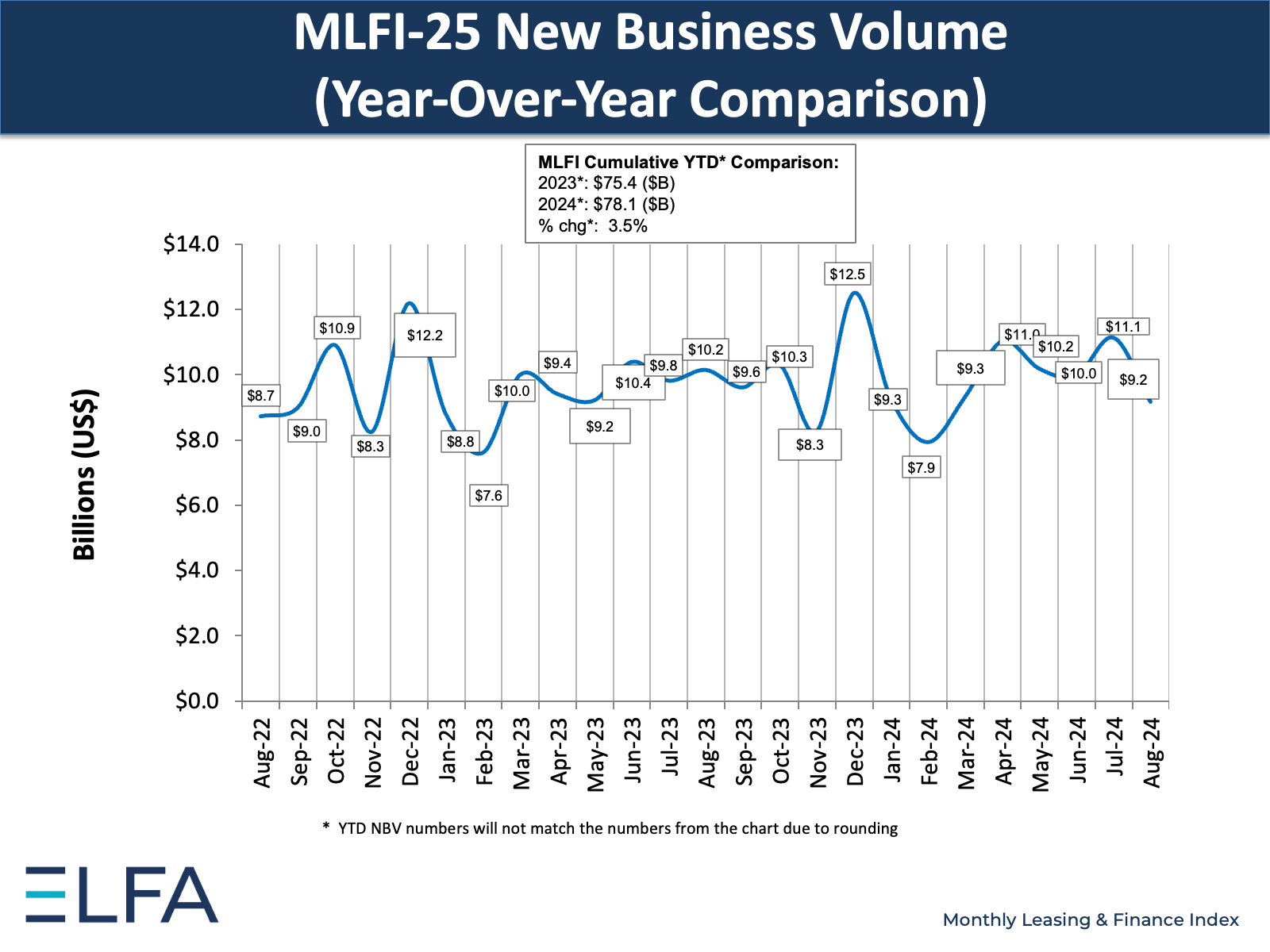

ELFA Reports $9.2 billion New Business

Down 17% from July

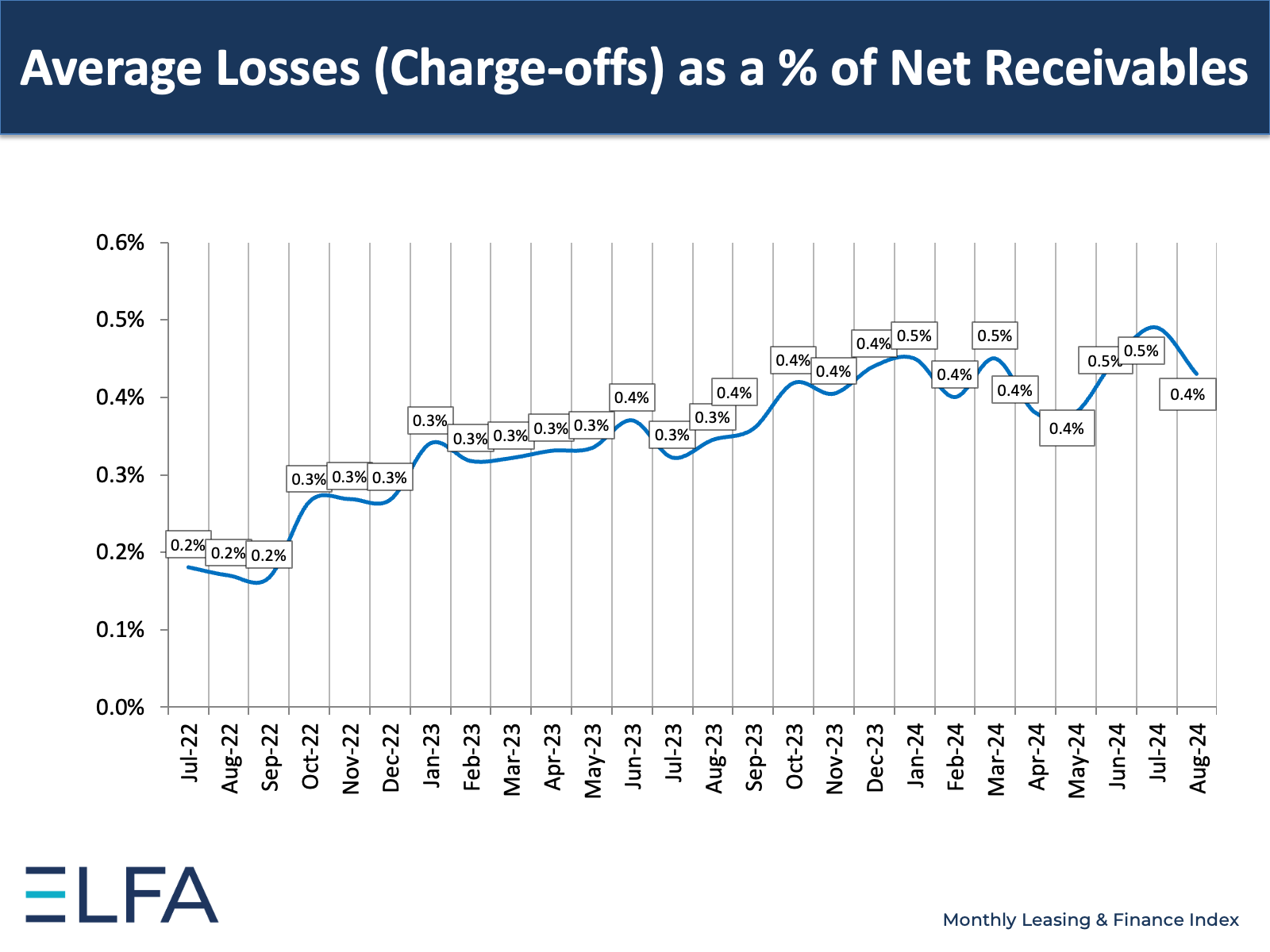

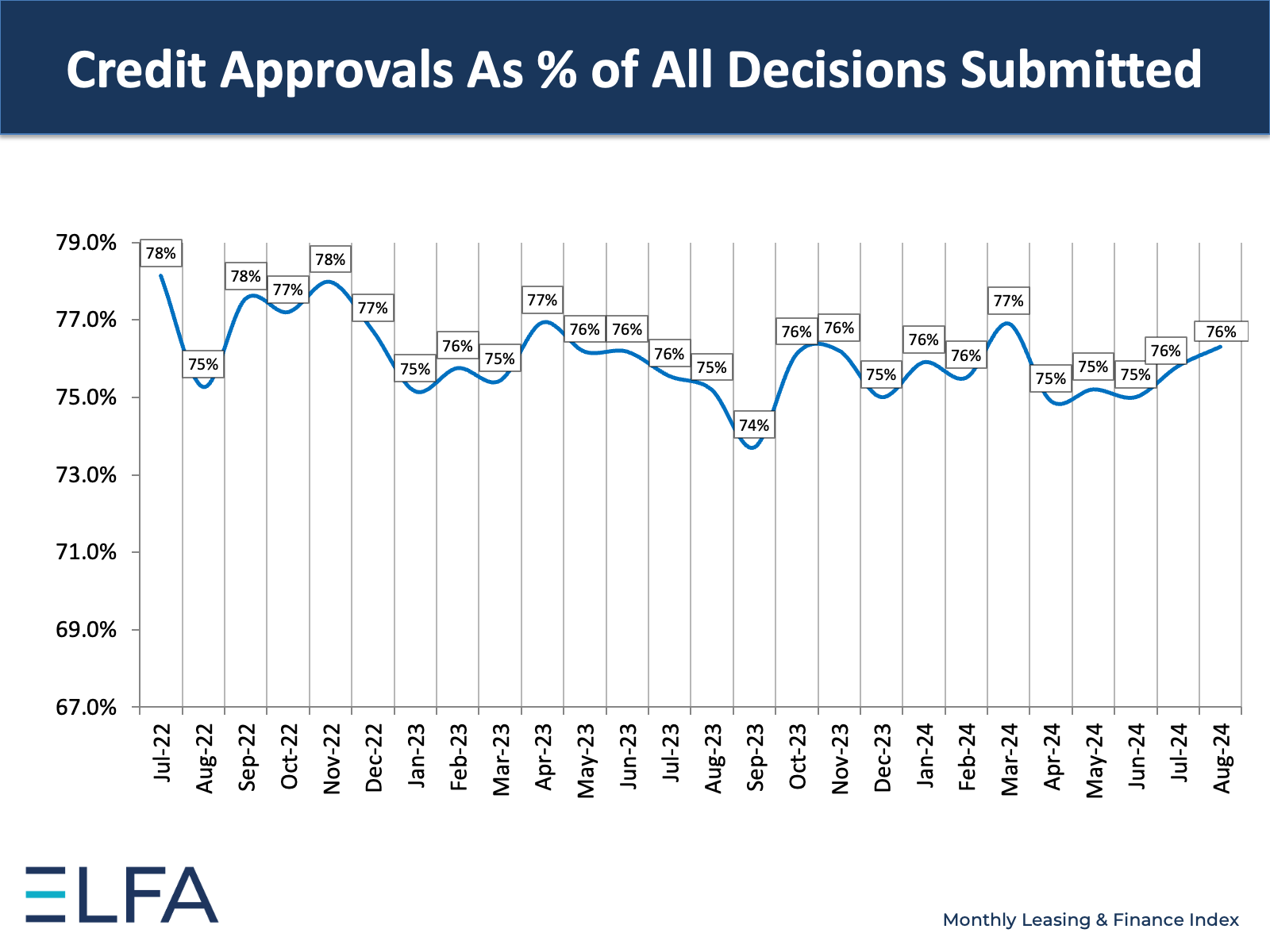

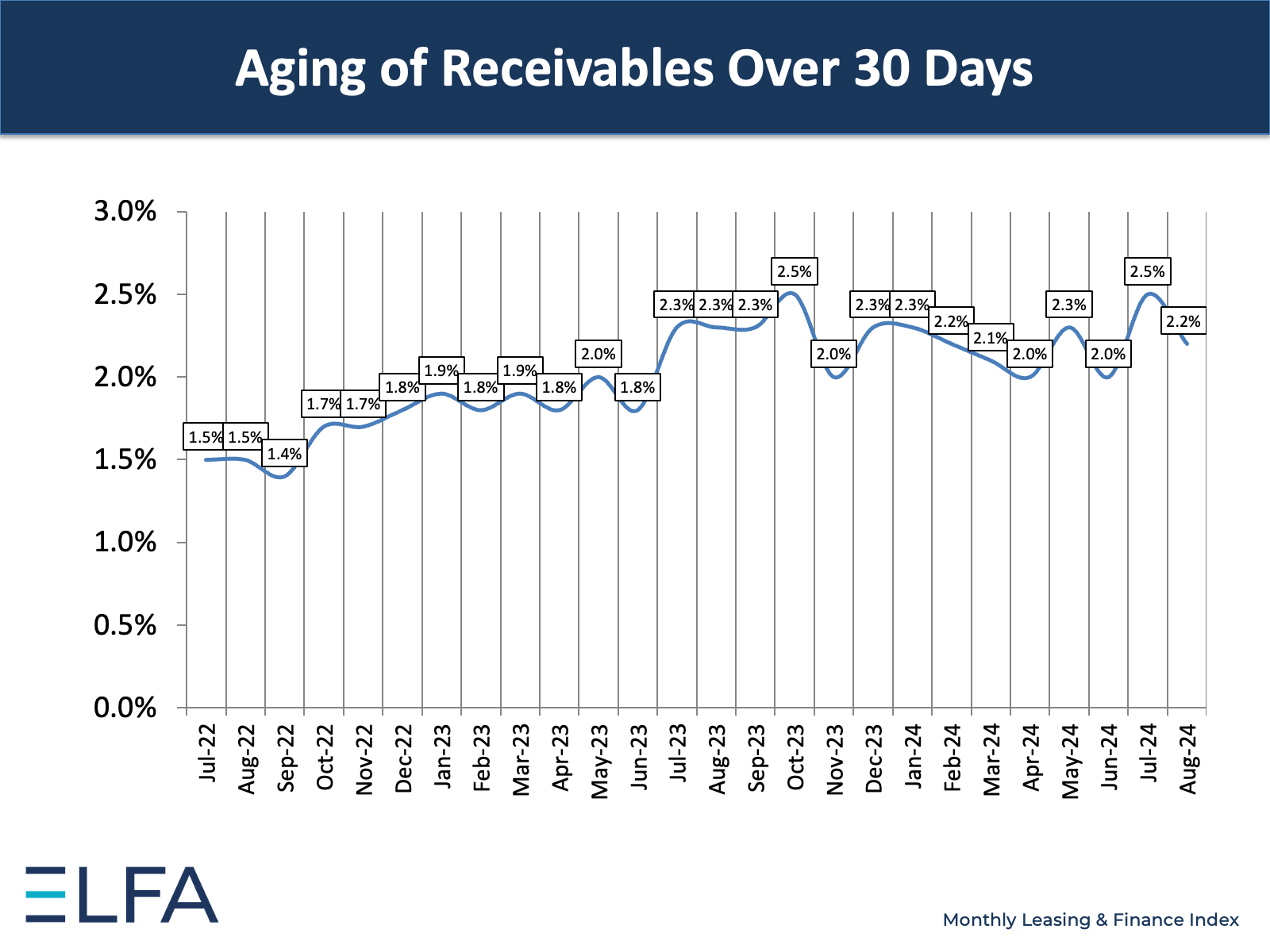

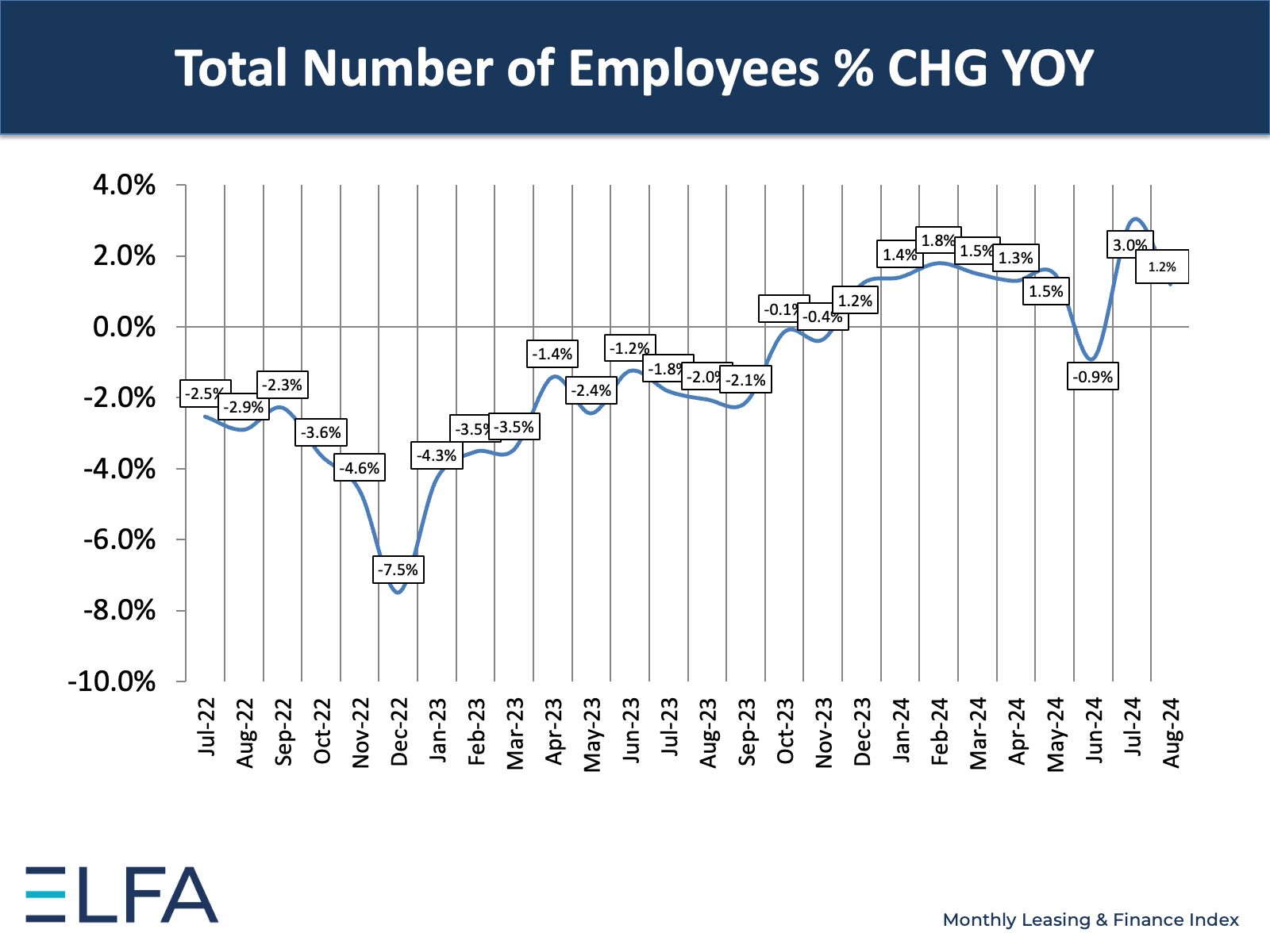

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), a survey of economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, reports that in August new business volume (NBV) was $9.2 billion, down 10% from August 2023.

ELFA President and CEO Leigh Lytle said, “The Fed’s decision to begin lowering interest rates will support demand for equipment, even if some businesses wait for rates to fall further before investing. That wait-and-see approach showed up in our August MLFI as new business volumes declined. However, ELFA members expect acquisitions to pick up once we‘re past the election and interest rates fall a bit further. That sentiment was also reflected in our Foundation’s recent Monthly Confidence Index, which showed that equipment finance executives are very optimistic about their organizations’ prospects over the next four months. Finally, credit conditions remain healthy, which will allow lessors and financiers to service new demand when it shows up later this year.”

Marci Slagle, CLFP, President, BankFinancial Equipment Finance, said, “It appears there is still a slight slowdown in the equipment finance industry, which was heavily weighted in the decrease in origination activity at banks, which led to a dip in new business volume. However, it's reassuring to hear that portfolio quality is remaining stable, with improvements in receivables and a reduction in losses. What was not into these numbers was the Fed rate drop this month. This will help stimulate growth, for both independent lessors and banks. The anticipation of further rate reductions may indeed boost demand, encouraging businesses to invest in capital . It's pivotal time for both independent lessors and banks as we navigate these changes, but I think we are going to start trending in the right direction.”

Full Press Release:

https://www.elfaonline.org/knowledge-hub/monthly-leasing-and-finance-index/view-mlfi/monthly-leasing-and-finance-index--august-2024

[headlines]

--------------------------------------------------------------

Ed Kaye Appointed Vice President of

Putnam Leasing, Greenwich, Connecticut

Ed Kaye is long time Leasing News Advisor and contributor of news and articles in Leasing News for many years. He has over 35 years of experience in the vehicle leasing and finance industry. He has founded several independent vehicle leasing companies, which he successfully sold to a leading foreign trading company and a domestic family office. Previously, he was a named partner in a law firm representing vehicle lessors and lenders. Kaye is a past president of the National Vehicle Leasing Association and currently serves on its board of directors.

Steven Posner, CEO of Putnam Leasing, said, “Ed’s extensive experience in the auto finance and leasing industry, combined with his customer-centric approach, makes him an ideal fit for Putnam Leasing.

“His expertise and personality will drive process improvements, innovation, and growth.”

“It is my honor to join Putnam Leasing, one of the most recognizable brands in the exotic and luxury car market,” Kaye stated. “They are an industry-leading firm with great people, products, and processes. I’m excited to help them continue to drive Putnam forward, meeting the needs of their clients and shareholders more effectively.”

Founded in 1983, Putnam Leasing designs bespoke leases for collectible, exotic, and luxury automobiles ranging in price from $75,000 to $5,000,000 throughout the U.S.

Putnam Leasing is proud to help car collectors lease the vehicles of their dreams in the most flexible and secure way possible. For additional information on Putnam Leading’s lease-to-own options, please visit www.putnamleasing.com or call (800) 278-0071.

Putnam Leasing Company I, LLC

500 West Putnam Avenue, 4th Floor

Greenwich, CT 06830

Direct: 203-340-7020

Phone: 203-961-8200

Cell: 646-294-6333

Fax: 203-961-8300

e.kaye@PutnamLeasing.com

[headlines]

--------------------------------------------------------------

##### Press Release #######################

AP Equipment Financing Expands Offerings

with Fleet Management and Rental Solutions

BEND, OR. – AP Equipment Financing, a trusted name in business-essential equipment financing since 1998, is excited to announce the expansion of its services to include fleet management and rental solutions.

To spearhead this initiative, AP has on boarded several industry-leading professionals with extensive experience in fleet management and rental programs. The AP Fleet Management service aims to provide flexible and efficient solutions tailored to a broad spectrum of industries. Plans are already underway to expand these services to additional sectors starting in 2025.

Alex Coveney, EVP of Fleet and Mobility, said, “This is an exciting time at AP. Our new products, programs and offerings will allow AP to provide purpose-built solutions for all our customers' needs.”

“Our team of industry experts combines years of experience in financing, leasing, and rental with a shared commitment to delivering the best client experience in the industry. We are excited about the future and how we are shifting gears on how businesses think about fleet management.”

AP Fleet Management offers a variety of flexible options, including rentals, leasing, and financing solutions. The rental program is ideal for businesses experiencing rapid growth or those requiring additional fleet capacity for short-, mid-, or long-term needs, such as seasonal demand or project-based work. With access to vehicles throughout the lower 48 states and service options like full maintenance packages, fleet remarketing, toll management, telematics and in-house titling, AP is empowering businesses to seamlessly build up their fleets. For businesses looking at mid to long-term solutions, AP Fleet provides tailored leasing and financing options, designed to support scalable growth and operational efficiency.

In today’s fast-paced business environment, flexibility is crucial. AP Fleet’s versatile rental, leasing, and financing solutions enable businesses to navigate demand fluctuations and growth opportunities with ease. AP Fleet provides flexible fleet management options to help businesses stay ahead.

For more information on how AP Fleet can support business needs, please visit https://apfinancing.com/fleet-management-solutions or contact fleet@apfinancing.com.

About AP Equipment Financing

Founded in 1998 and based in Bend, Oregon, AP Equipment Financing is a subsidiary of Tokyo Century (USA) Inc., the U.S. subsidiary of Tokyo Century Corporation. Tokyo Century Corporation, headquartered in Tokyo, has 7,800 employees, and offers specialty leasing and other high value-added financial services in more than 30 countries.

##### Press Release #######################

[headlines]

--------------------------------------------------------------

##### Press Release #######################

Syndifi and Tamarack Technology Partner to Streamline Equipment Finance Syndication

for KLC Financial, LLC

(“This release is focused on the newly formed collaboration between KLC, Syndifi and Tamarack emphasizing how leveraging a Tech Eco System can be beneficial to drive smarter business decisions.” Alistar Canal, President)

Chicago --- Syndifi Inc., , has joined forces with Tamarack Technology to streamline, simplify and enhance syndication for KLC Financial, LLC. The collaboration between the industry forerunners will enable KLC to syndicate more effectively and elevate its operational efficiency.

Spencer Thomas, CEO of KLC Financial, said, “The collaboration between KLC Financial, Syndifi, and Tamarack reflects our dedication to utilizing innovative technology to drive growth and efficiency.

“We anticipate that this partnership will allow us to streamline our capital market operations, making our syndication efforts more effective while continuing to deliver the high level of service our clients expect.”

Creating efficient syndication workflows via the array of non-syndication centric technology options in the Equipment Finance industry can be overwhelming, which is why Syndifi and Tamarack have partnered to deliver a best-in-class syndication solution via their cohesive platforms. This collaboration reflects a shared commitment to making technology more intuitive and user-friendly, ensuring a seamless experience for all.

Alistair Canal, president of Syndifi, Inc., commented, “By joining forces with Tamarack, together we will deliver a more seamless tech ecosystem that will better enable our clients and the entire Syndifi user community to syndicate smarter.

‘Designed to address the needs of capital market teams, the Syndifi platform and Tamarack’s SyndicationBuilderTM work in tandem to enhance the syndication process by eliminating time-consuming and labor-intensive activities.’

• Syndifi’s cutting-edge platform offers a comprehensive suite of features, including streamlined documentation management, portfolio oversight

and activity monitoring. The platform’s advanced capabilities include real-time deal offer submissions, pool management and seamless integration with DocuSign, enabling organizations to syndicate smarter and elevate operational prowess.

• Tamarack’s Syndication Builder was developed to accelerate portfolio syndication and securitization processes. It provides comprehensive asset pool analysis and automated “data tape” generation that enables capital market teams to quickly create targeted asset pools that align

with strategic goals.

Alistair Canal, President of Syndifi, Inc,“ stated, “Like Tamarack, Syndifi recognizes the opportunity data presents to accelerate and expand capital market team efforts. We are excited to partner with Syndifi to advance customers’ business goals through the integration of our two platforms..

About KLC Financial, LLC

KLC Financial, LLC, a wholly owned subsidiary of Gulf Coast Bank & Trust, was founded in 1987. Headquartered in Minnetonka, MN, the company leases and finances capital equipment and assets for businesses nationwide. KLC Financial is built on strong relationships with customers, vendors and bank partners. Its mission is to bring advantageous equipment finance solutions to clients with integrity, depth of knowledge and speed.

https://klcfinancial.com/

About Syndifi, Inc.

Syndifi is a pioneering online syndication platform designed specifically for the Equipment Finance industry. By facilitating secure transactions between buyers and sellers in the cloud, Syndifi has enabled over 700 leading buyers and sellers to syndicate more efficiently. For more information,

please visit www.syndifi.com. About Tamarack Technology, Inc.

For more than 20 years, Tamarack Technology, Inc. has been helping equipment finance companies improve productivity and profitability with software consulting and cutting-edge technology products. Today, Tamarack is the only professional services and product provider in the industry to deliver AI business intelligence and customer self-service that maximize equipment finance operations across the entire software ecosystem. Tamarack’s industry experts understand equipment finance and can enhance a company’s existing systems, close technology gaps and drive improved performance. For more information, please email discover@tamarack.ai or visit www.tamarack.ai.

### Press Release #########################

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

A vibrant slew of releases includes heartening drama (“Ghostlight”), engaging documentary (“Made in England: The Films of Powell and Pressburger”), a great director’s farewell (“The Old Oak”), and a pair of exceptional animated films (“Howl’s Moving Castle,” “Robot Dreams”).

Ghostlight (Amazon Prime, Apple TV): The blurred lines between art and life, as well as grief and humor, are explored in this heartfelt indie drama from directors Kelly O’Sullivan and Alex Thompson. Dan (Keith Kupferer) is a construction worker struggling with the death of his son and the unruliness of his daughter (Katherine Mallen Kupferer). Much to his surprise, he finds himself cast as Lord Capulet in an amateur production of “Romeo and Juliet” after Rita (Dolly De Leon), a community theater actress, recognizes his potential talent. As the play’s story comes to subtly reflect the happenings in his own life, Dan begins to see the healing possibilities of performance. Highlighting the need for emotional truth onstage as well as off, the film offers a poignant portrait of our search for wholeness.

Howl’s Moving Castle (Amazon Prime, Max): Celebrating its 20th anniversary, this 2004 animated feature from beloved Japanese master Hayao Miyazaki (“Spirited Away”) is being re-released in theaters. Tired of seeing life go by while she works in a hat store, young, shy Sophie (voiced by Emily Mortimer) sees things take a sharp turn when she befriends Howl (Christian Bale). A wizard who lives in a flying palace, Howl introduces Sophie to a fantastical new world that includes a witch (Lauren Bacall) who turns her into an aged woman. While hoping to break the spell, she gets to know the magical inhabitants of Howl’s castle. Mixing the quotidian with the enchanted as only Miyazaki can, this is a sparkling fantasy that’s worth revisiting, or discovering for the very first time.

Made in England: The Films of Powell and Pressburger (Amazon Prime): A brilliant filmmaker as well as a voracious cinephile, Martin Scorsese pays tribute to two of his idols, the idiosyncratic duo of Michael Powell and Emeric Pressburger, in this engaging documentary. Known as The Archers, the British Powell and the Hungarian Pressburger crafted some of the most imaginative films ever made, making fantastic use of color and movement. With clips from their most iconic works, Scorsese discusses the repressed passion of “Black Narcissus,” the artistic obsession of “The Red Shoes,” the ritualized emotions of “The Life and Death of Colonel Blimp,” and the lurid reflexivity of “Peeping Tom.” Depicting Scorsese’s personal friendship with Powell in his later years, this is a choice overview of the Archers’ inimitable brand of cinematic alchemy.

The Old Oak (Amazon Prime, Apple TV): In what it is hinted to be his final film, veteran British director Ken Loach (“I, Daniel Blake”) brings his customary political engagement and dogged humanism to this engrossing, intimate ensemble drama. Set in a former mining town, the plot centers on TJ Ballantine (Dave Turner), the landlord of the titular struggling pub. With a group of Syrian refugees arriving in town, the locals gather to share their grievances. What starts out in fear and prejudice, however, gradually grows into understanding and empathy, particularly as TJ meets Yara (Elba Mari), a Syrian photographer whose father is missing. Offering a hopeful portrait of intercultural connection in an age when division often reigns supreme, Loach’s film is fierce, thoughtful, and more relevant than ever.

Robot Dreams (Amazon Prime, Apple TV): The transformative power of friendship is delicately visualized in this wise and tender animated feature, directed by Pablo Berger (“Blancanieves”) without dialogue but with oodles of pure feeling. Set in New York during the 1980s, it focuses on Dog, a lonely pooch with not much to look forward to besides microwave dinners and video games. He forges a deep bond with Robot, a companion automaton Dog orders in the mail and assembles. Suddenly best pals, the two enjoy activities in the Big Apple until Labor Day, when a case of rust threatens to separate them. Adapted from Sara Varon’s children’s graphic novel, Berger’s film works a deceptively modest canvas that enlarges with universal emotions. Brimming with joy and sadness, this is a bittersweet gem.

Fernando Croce is a nationally recognized film reviewer and has been contributing to Leasing News since 2008. His reviews appear each Friday.

[headlines]

--------------------------------------------------------------

News Briefs

Congress Passes Short-Term Spending Bill

to Avert a Shutdown

https://www.nytimes.com/2024/09/25/us/politics/house-short-term-spending-bill.html

Shoppers will spend a record $241 billion online

this holiday season

https://www.washingtonpost.com/business/2024/09/25/online-holiday-shopping-record/

Market for AI products and services could reach up

to $990 billion by 2027, finds Bain & Company's

5th annual Global Technology Report

https://www.prnewswire.com/news-releases/market-for-ai-products-and-services-could-reach-up-to-990-billion-by-2027-finds-bain--companys-5th-annual-global-technology-report-302257755.html

Google Paid $2.7 Billion to Bring Back an

AI Genius Who Quit in Frustration

https://www.wsj.com/tech/ai/noam-shazeer-google-ai-deal-d3605697?mod=hp_lead_pos9

Boeing workers felt schedule pressure even

after midair blowout

https://www.bostonglobe.com/2024/09/25/business/boeing-workers-pressure-faa/

AOC says embattled NYC Mayor Eric Adams should

resign for the 'good of the city'

https://www.nbcnews.com/news/us-news/aoc-says-embattled-nyc-mayor-eric-adams-resign-good-city-rcna172726

Zoo to send giant pandas back to China

because they’re too expensive to keep

https://edition.cnn.com/2024/09/24/europe/finland-panda-return-china-cost-intl-hnk/index.html

[headlines]

--------------------------------------------------------------

Brian Huey a writer-producer and Long Time Lease Broker

Sent a report on his movie:

“Did I tell you my new grandson is Kit Bridger Huey? They live in KC.

“Hope you are well.

“The Perpetual Movie did well in 2023. 35 festival selections. 16 festival wins including Paris, Austin, 3 in LA, and my favorites The Swedish Academy Awards, and Salerno, Italy (the oldest festival in the world).

“Have to do something in my spare time away from the finance business.

“LeaseSource is still thriving in a tougher lease world.

“Also – you’re father and mine would appreciate this – the actors that played Matthew and Maria and met at auditions (21 and 25) got married 1 year later (this week). You can’t make that stuff up. Examples: Ryan Gosling and Eva Menendez, Lopez and Afleck and a hundred other couples.

“We are vying for the feature film and TV series and have quite a bit of producer financial support from the equipment leasing industry.“

HueyMedia.com BrianHuey.com

[headlines]

--------------------------------------------------------------

Sports Briefs---

Kyle Shanahan is getting torched for 49ers'

special teams gaffes

https://www.sfgate.com/49ers/article/kyle-shanahan-49ers-special-teams-gaffes-19787181.php

What fans should expect at A’s final game

at Oakland Coliseum

https://www.eastbaytimes.com/2024/09/25/what-fans-should-expect-at-as-final-game-at-oakland-coliseum/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

S.F.’s office vacancy reaches record high.

Here’s why experts think the market is stabilizing

https://www.sfchronicle.com/realestate/article/sf-office-vacancy-record-19790321.php

Telecom giant AT&T to remove 8 miles of lead

cables in Lake Tahoe after legal battle

https://www.sfgate.com/renotahoe/article/att-remove-lead-cables-lake-tahoe-legal-battle-19786749.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Desperate California wine growers are slashing

prices on grapes. No one is buying

https://www.sfchronicle.com/food/wine/article/grape-growers-prices-california-19771879.php

Sonoma County Wine Celebration raises vital

funds for nonprofits

https://www.pressdemocrat.com/article/lifestyle/sonoma-county-wine-celebration-2024/

Producers Celebrate International Grenache Day in Style:

Praise "Grenache as What Pinot Noir Wants

To Be When it Grows Up"

https://www.winebusiness.com/news/article/292946

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Sep2022/09_26.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()