Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, September 24, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

SF NET Quarterly Survey Finds Rebounding

Confidence Among Bank and Non-Bank Lenders

Hugh Swandel Appointed Chair

of Canadian Finance & Leasing Association

Leasing and Finance Industry Help Wanted

Balboa Capital – Several Positions Available

Top Salaries and Benefits

It’s Now Fall -- Very Important

Prospecting with Precision End of Year

By Scott Wheeler, CLFP

New Website for Oakmont Capital Services

JA Mitsui Leasing Group, West Chester, PA

Axios Bank Acquires Purchasing

$1.1 Billion Dollar Verdant Commercial Capital

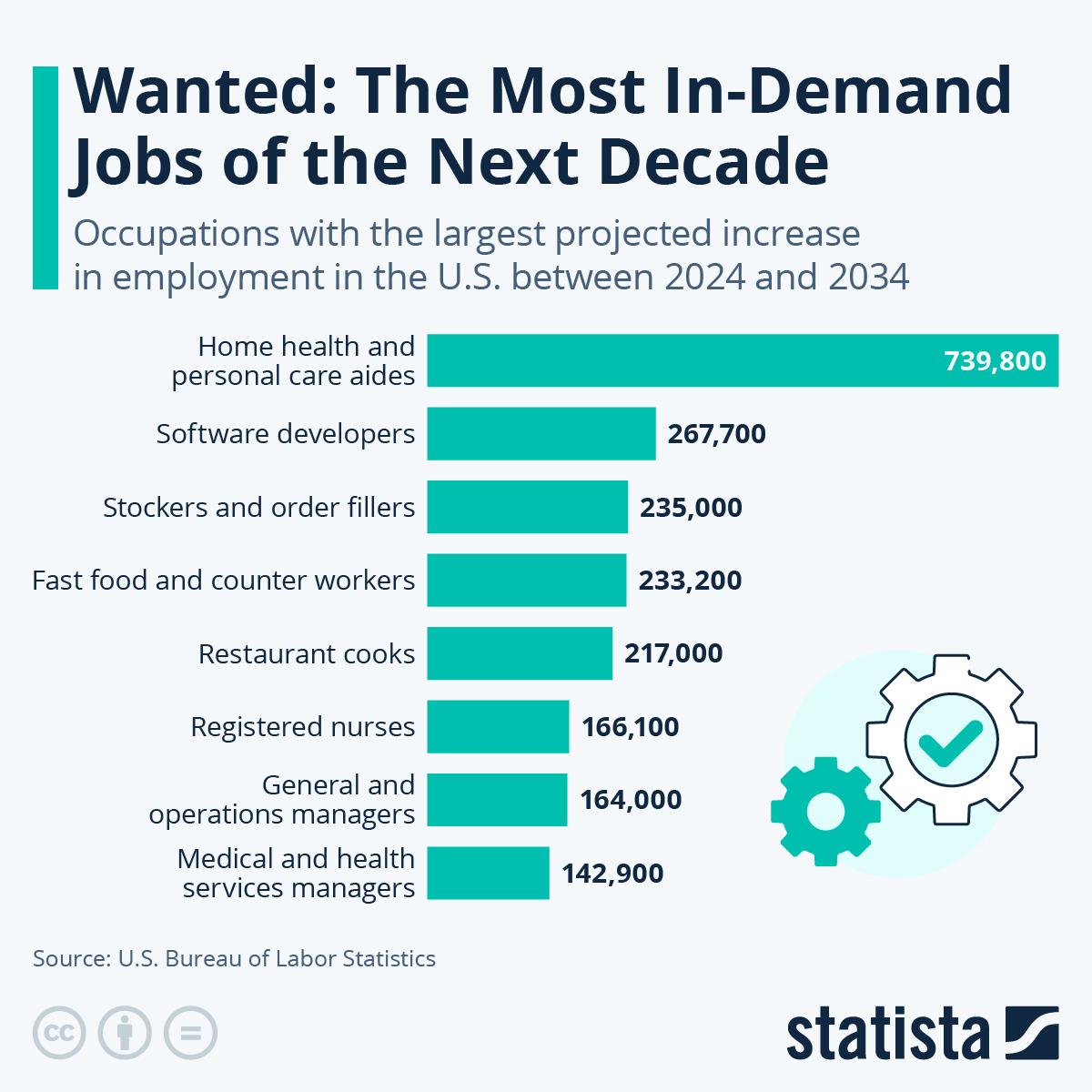

Wanted: The Most In-Demand Jobs

of the Next Decade - Graphic

News Briefs

GATX Corporation to Acquire Approximately

6,000 Freight Railcars From DB Cargo AG

Bojangles’ Largest Franchisee

Bought by Investment Firm

Ag Lender Warns Farm Finances Under Greatest

Stress Since the 1980s

Trump’s $100,000 Visa Fee Knocks Down Bridge

Between India and the U.S.

Federal judge orders Trump to restore $500 million

in frozen UCLA medical research grants

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Tom Griffith was hired as Vice President, Business Development, Acquis, Conshohocken, Pennsylvania, where he is also located. Previously, he was Senior Account Manager, DLL (May, 2024 - September, 2025); Financial Sales Manager, Siemens, Malvern, Pennsylvania; Fleet Solutions Account Manager, DLL (May, 2021 - June, 2022). He joined Phillips Medical Capital, September, 2002, Senior Territory Manager, promoted August, 2014, National Sales Manager, Financial Specialist (August, 2014 - December, 2017), promoted Vice President, Business Development (December, 2017 - April, 2023). Full Bio:

https://www.linkedin.com/in/tomgriffithacquis/details/experience/

https://www.linkedin.com/in/tomgriffithacquis/

Shannon Stangl is retiring, “After 30 incredible years at DLL, I’ve made the decision to retire at the end of September.“ It’s been an amazing journey—one filled with meaningful relationships, creative problem-solving, and the absolute privilege of working with some of the finest professionals in the Office Equipment industry.

“I’m deeply grateful to those who challenged me, supported me, and helped me grow into a respected leader. To my customers: thank you for your trust, your partnership, and your belief in DLL and in me. It’s been an honor to serve you, and I’ll continue cheering you on—even from retirement.

“I’m especially thankful to the leaders who saw potential in me, and who coached, challenged, and encouraged me to grow into a trusted advisor. Their mentorship shaped not only my career, but also my commitment to pay it forward to others. Mentoring others—helping them find clarity in their roles, confidence in their potential, and the courage to pursue their goals—has been the most meaningful part of my professional journey. It’s what it’s all about!

Thank you, DLL, for your trust in me and for 30 great years!

“Wishing my network continued success. I look forward to staying in touch!”

She began at DLL, Wayne, Pennsylvania as Manager, Inside Sales, 1995 - July, 2019; US Vice President, Sales, Office Equipment; promoted Regional Sales Manager, North America Office Equipment, July, 2020 – Retiring End of September, 2025).

https://www.linkedin.com/in/shannon-stangl-36421ab/

[headlines]

--------------------------------------------------------------

SF NET Quarterly Survey Finds Rebounding

Confidence Among Bank and Non-Bank Lenders

NEW YORK – The Secured Finance Network (SFNet) recently released its Q2 2025 Asset-Based Lending Index and Lender Confidence Index, offering a snapshot of how the industry has rebounded after a first quarter riddled with tariff challenges while offering a safe haven amid broader market volatility.

The Q2 2025 Asset-Based Lending Index and Lender Confidence Index are based on survey data from leading bank and non-bank lenders.

According to the Q2 survey, conducted between late July and mid-August, both bank and non-bank lenders saw lender confidence surge. For banks, the combined sentiment score rose 7.4 points to 56.5 but stayed in the neutral territory, hinting that banks anticipate conditions to remain the same next quarter. For non-banks, the combined score rose into slightly positive territory, up 10.8 points to 63.3, illustrating cautious optimism for near-term improvement.

SFNet CEO Rich Gumbrecht, said, “The topline U.S. GDP figure of +3.3% growth in Q2 may seem robust, but deeper analysis reveals fragility beneath the surface.

“The bulk of growth was driven by a collapse in imports (following a tariff-driven surge in Q1), which mechanically boosts GDP in accounting terms.”

“When stripping out volatile trade and inventory components, final sales to private domestic purchasers grew by just 1.9%, highlighting underlying demand weakness,” Gumbrecht continued. “Risks tied to tariffs, inflation and Fed policy remain, but ABL appears to be on strong footing to meet evolving borrower needs, especially as refinancing demand rises and non- bank lending grows more competitive.”

“And indeed, the second quarter of 2025 was a strong one for banks and non-banks:

Total commitments for banks rose 1.1%; total commitments for non-banks jumped 5.2%

New outstandings for banks rose 6.5%; new outstandings for non-banks soared 47.4%

“New outstandings” refers to new amounts of money that a borrower has drawn or borrowed under the ABL facility during a specific period.

Bank portfolio performance was mixed in the second quarter. Non-accruals rose, write-offs edged higher but remained within its historical range, and criticized loans – which have elevated credit risk – edged down 9 basis points. The decline in criticized loans among banks suggests a normalization trend, where previously stressed borrowers have improved their financial condition or exited their portfolios.

Non-bank portfolio performance was similarly uneven.

Criticized loans and non-accruals climbed higher and write-offs held steady and were nearly flat as a share of outstandings. Non-bank lenders’ steadier write-off rates demonstrate tighter underwriting and a more selective approach to new origination.

“Despite broader economic challenges, the asset-based lending industry is healthy and optimistic,” noted Gumbrecht. “We’re seeing a surge in new deal activity, stronger renewal cycles, and stable portfolio performance, all of which position the industry to meet growing demand through the remainder of the year.”

Full quarterly and annual data reports are available at: SFNet Asset-Based Lending & Factoring Surveys.

About Secured Finance Network

Founded in 1944, the Secured Finance Network (formerly Commercial Finance Association) is an international trade association connecting the interests of companies and professionals who deliver and enable secured financing to businesses. With more than 1,000 member organizations throughout the US, Europe, Canada and around the world, SFNet brings together the people, data, knowledge, tools and insights that put capital to work. For more information, please visit

https://www.sfnet.com/

[headlines]

--------------------------------------------------------------

Hugh Swandel Appointed Chair

of Canadian Finance & Leasing Association

Hugh Swandel, President of Meridian OneCap Credit Corp., has been named the new Chair of the Canadian Finance & Leasing Association (CFLA-ACFL). He is also a long-time member of the Leasing News Advisory Board.

He is a former Board Member and President of the National Equipment and Finance Association (NEFA), an active member of the Equipment Leasing and Finance Association (ELFA), and has previously served on the CFLA Board. He is also a three-time recipient of CFLA’s “Member of the Year” award, the industry’s highest honor in Canada.

Hugh joined Meridian OneCap in 2019, bringing a wealth of experience from senior leadership roles across the equipment finance sector. Prior to OneCap, he served as Senior Managing Director for The Alta Group in Canada, where he advised commercial finance organizations across North America. He also held executive roles at National Leasing Group and Electronic Financial Group (EFA) and founded Swandel & Associates.

The CFLA role is a two-year appointment and, during that time, Hugh will lead the Board to provide the CFLA with overall strategic insight, budgeting and support. The CFLA advocates for Canada’s asset-based financing, vehicle and equipment leasing industry's interests. It is the only organization in the country that represents the interests of this group and has more than 200 member companies. The professional, engaged board of directors, which Hugh will now lead, oversees the CFLA-ACFL’s essential work. He most recently served the board as Vice-Chair.

“It is an honor to serve as Chair of the CFLA,” said Swandel. “Canada’s asset-based finance sector is a cornerstone of our economy, empowering businesses of all sizes to innovate and grow. My priority is to help champion the development and sustainability of this ecosystem—by fostering collaboration, advocating for our members, and driving forward the values that make our industry resilient and future-ready.

“ I look forward to working with our dedicated members and partners to ensure the CFLA continues to be a strong voice for progress and opportunity across Canada.”

The CFLA plays a leading role in lobbying and regulatory engagement on behalf of the asset-backed finance industry in Canada. They provide exclusive access to data and benchmarking tools that help members understand market dynamics while also fostering growth and connection through professional development and networking. The organization is committed to equipping members with the knowledge, tools and pathways necessary to thrive amid today's unique industry challenges and opportunities.

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

[headlines]

--------------------------------------------------------------

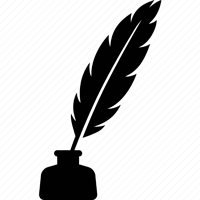

It’s Now Fall -- Very Important

Prospecting with Precision

By Scott Wheeler, CLFP

In today’s competitive commercial equipment finance and leasing landscape, top originators aren’t just gaining market share—they’re redefining how prospecting is done. Armed with confidence and clarity, they leverage technology and data to anticipate buying behavior with near-perfect accuracy. End-users don’t purchase equipment randomly. Their acquisition cycles are shaped by:

- Industry-specific trends

- Geographic and regional dynamics

- Macro and microeconomic indicators

- Seasonal fluctuations and operational rhythms

By decoding these matrices, originators can predict when prospects are likely to make their next move—and they make contact at the appropriate times to maximize their efforts. For existing clients, forecasting is straightforward. (ABC Company acquires equipment in Q1 or Q2 annually, with every third year showing a spike in volume.) This predictability allows originators to plan outreach and structure financing proactively.

The real challenge lies in identifying non-clients—those who haven’t yet entered the portfolio. For decades, originators would visit courthouses to comb through UCC filings uncovering:

- What equipment was purchased

- Who signed the financing documents

- Which competitor funded the deal

- The terms and structure of the agreement

This diligence gave originators a strategic edge. Today, that same intelligence, and significantly more public information, is available at the click of a button. In 2025, top originators use:

- Public databases and UCC filings accessed remotely

- Industry trend analysis tools

- Territory-specific buying pattern dashboards

- AI-driven lead scoring and predictive modeling

They no longer make “cold calls”—they make informed introductions. Every outreach is backed by meaningful data, turning blind prospecting into precision engagement. Top originators don’t guess. They know. They understand the prospect’s history, anticipate their needs, and tailor their approach accordingly.

This isn’t just smart selling—it’s strategic relationship-building.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

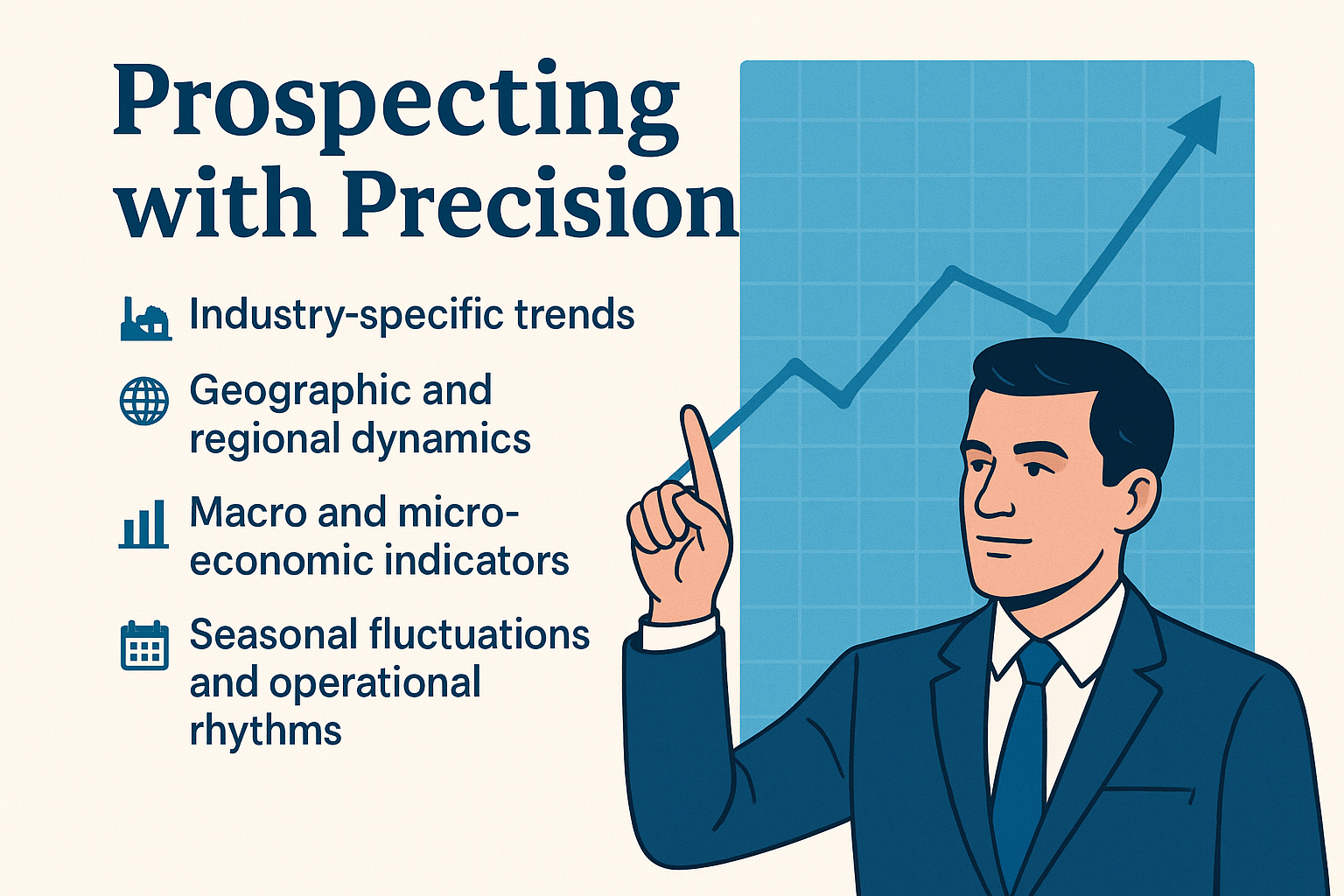

New Website for Oakmont Capital Services

JA Mitsui Leasing Group, West Chester, Pennsylvania

We’re thrilled to announce the launch of our new and improved website.

After 25 years of helping businesses grow, we’ve revamped our digital home to make your financing journey even smoother. Whether you're looking for equipment financing, working capital, or just want to explore how we “Make It Possible,” our new site is faster, smarter, and easier to navigate.

What's New?

- Streamlined application process

- Enhanced mobile experience

- Fresh design with intuitive navigation

- More resources to guide your business forward

Come check it out, explore our services, and meet the team that’s been fueling growth since 1998. Let’s make the next 25 years even better — together it is faster, smarter, and easier to navigate: https://oakmontfinance.com

[headlines]

--------------------------------------------------------------

#### Press Release ###########################

Axios Bank Acquires Purchasing

$1.1 Billion Dollar Verdant Commercial Capital

SAN DIEGO - Axos Bank (“Axos” or the “Company”), the banking subsidiary of Axos Financial, Inc. (NYSE: AX), announced today the acquisition of 100% of the membership interests in Verdant Commercial Capital, LLC (“Verdant” or “VCC”), an independent equipment leasing company with approximately $1.1 billion of loans and leases on its balance sheet at August 31, 2025, including approximately $750 million of on-balance sheet securitizations and $350 million of loans and leases.

Verdant originates small to mid-ticket leases between $50,000 and $5 million nationwide in six specialized industry verticals. Verdant offers a full suite of products, including equipment finance leases, conditional sale leases, fair market value (FMV) leases, and terminal rental adjustment clause (TRAC) leases.

Greg Garrabrants, President and CEO of Axos Financial, Inc., said, “This acquisition provides us with more scale and enhances our existing equipment leasing business with good risk-adjusted returns,

“We like Verdant’s specialization in vendor-based equipment leasing and believe we can scale this business profitably. Additionally, we see opportunities to cross-sell commercial deposits and floorplan lending to manufacturers and dealers in several industry verticals such as specialty vehicles, golf, sports and entertainment. After replacing their high-cost funding with our lower-cost deposit funding and growing new originations, we expect the transaction to be accretive to earnings per share by approximately 2%-3% in fiscal 2026 and 5%-6% in fiscal 2027.”

Axos will pay a 10% premium on Verdant’s book value at closing. The projected initial purchase price of $43.5 million, including a $4 million premium to book value, will be paid in cash at closing. The seller can earn incremental performance-based cash considerations over a four-year period after close if VCC generates a return on equity (“ROE”) above 15%. The total earn-out is capped at $50 million.

Axos and the seller signed a member interest purchase agreement on September 19, 2025. Keefe, Bruyette, and Woods, a Stifel Company (NYSE: SF), acted as the exclusive financial advisor to Verdant in the transaction. The Company expects to close the transaction on September 30, 2025.

About Axos Financial, Inc. and Subsidiaries

Axos Financial, Inc., with approximately $24.8 billion in consolidated assets as of June 30, 2025, is the holding company for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank provides consumer and business banking products nationwide through its low-cost distribution channels and affinity partners. Axos Clearing LLC (including its business division Axos Advisor Services), with approximately $39.4 billion of assets under custody and/or administration as of June 30, 2025, and Axos Invest, Inc., provide comprehensive securities clearing services to introducing broker-dealers and registered investment advisor correspondents, and digital investment advisory services to retail investors, respectively. Axos Financial, Inc.’s common stock is listed on the NYSE under the symbol “AX” and is a component of the Russell 2000® Index and the S&P SmallCap 600® Index, among other indices. For more information on Axos Financial, Inc., please visit http://investors.axosfinancial.com.

### Press Releases ##########################

[headlines]

--------------------------------------------------------------

In light of the rapid advancements that AI tools have made since the release of ChatGPT in late 2022, people have been pondering the potential of artificial intelligence to replace certain occupations, trying to figure out if and how the nascent technology will change the way people work. And while the focus of discussions like this is often on the risk of certain jobs being replaced by emerging technologies, these shifts, as well as societal changes, usually offer new employment opportunities as well.

Think of the rise of e-commerce for example: while it has led to a decline in retail jobs and is projected to continue to do so, it has supported strong job growth in transportation and warehousing and still does. According to the U.S. Bureau of Labor Statistics’ Occupational Employment Projections, transportation and material moving will be among the faster-growing occupational groups for the coming decade as well, projected to add 580,000 jobs by 2034, with warehouse workers and truck drivers particularly in demand.

By far the biggest increase in employment is expected in the healthcare and social assistance sector, which is driven less by technological changes and more by demographic shifts. Due to the ageing population and the growing prevalence of chronic conditions, the wider healthcare sector is projected to account for 1.7 million new jobs by 2034, making up one third of all new jobs expected by the end of the projection period.

Looking at individual occupations, this trend is also evident, with home health and personal care aids projected to be by far the fastest-growing occupation over the next decade, adding 740,000 jobs by 2034. With registered nurses, medical and health service managers as well as nurse practitioners also in the top 10, it’s clear that the health sector as a whole is going to be a major driver of employment growth in the near future.

By Felix Richter, Statista

[headlines]

--------------------------------------------------------------

News Briefs

GATX Corporation to Acquire Approximately

6,000 Freight Railcars From DB Cargo AG

https://ir.gatx.com/press-releases/press-release-details/2025/GATX-Corporation-to-Acquire-Approximately-6000-Freight-Railcars-From-DB-Cargo-AG/default.aspx

Bojangles’ Largest Franchisee Bought by Investment Firm

https://www.qsrmagazine.com/story/bojangles-largest-franchisee-bought-by-investment-firm/?spMailingID=171898&puid=2643274&E=2643274&utm_source=newsletter&utm_

medium=email&utm_campaign=171898

Ag Lender Warns Farm Finances Under Greatest

Stress Since the 1980s

https://www.agweb.com/news/policy/ag-economy/ag-lender-warns-farm-finances-under-greatest-stress-1980s?utm_medium=email&_hsenc=p2ANqtz-_9D8vhgtF3DZMeifVX9q_c-7SFY1KRqJB0L3pGG20oNWu0laP2gl7tEJRFokAsUJITY2qg_EdDwgvCWaRhrl_K

EiGK4NnB_CrnCxJKY6GyNEiMncI&_hsmi=381419586&utm_content=381419586

&utm_source=hs_email

Trump’s $100,000 Visa Fee Knocks Down Bridge

Between India and the U.S.

https://www.nytimes.com/2025/09/22/business/trump-h-1b-visa-fee-india.html

Federal judge orders Trump to restore $500 million

in frozen UCLA medical research grants

https://www.latimes.com/california/story/2025-09-22/rita-lin-federal-judge-restores-ucla-nih-grants?sfmc_id=6529c8173ed79c24f8836c38&utm_id=41673084&skey_id=a71e23d7b5e50172

2d1ef586e79e2c78687a4f90db93d96edefe96a93c356ffc&utm_source=Sailthru&utm_medium=

email&utm_campaign=ALERT-Email-List-Federal%20judge%20orders%20Trump%20to%20restore%20%24500%20million%20in%20

frozen%20UCLA%20medical%20research%20grants-20250922&utm_term=Alert%20-%20News%20lerts

[headlines]

--------------------------------------------------------------

American Colleges Are Going All Out

to Hold On to International Students

https://www.wsj.com/us-news/education/international-student-enrollment-decline-college-ad13f943?mod=us-news_trendingnow_article_pos1

[headlines]

--------------------------------------------------------------

Sports Briefs---

49ers reportedly had insurance policy to cover

Nick Bosa's season-ending injury

https://www.sfgate.com/49ers/article/49ers-lose-star-edge-rusher-season-ending-i

njury-21061606.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Opa! restaurant group files for bankruptcy

as company shuts its South Bay sites

https://www.mercurynews.com/2025/09/22/san-jose-opa-restaurant-food-jobs-economy-court-retail-property-work-dine/

Family-owned Bay Area farm reportedly sold for $12M

in all-cash deal to make room for Residential Housing

https://www.sfgate.com/food/article/bay-area-olivera-egg-farm-

reportedly-sold-millions-21057771.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Hope Family Wines offers hands-on harvest experiences

https://pasoroblesdailynews.com/hope-family-wines-offers-hands-on-harvest-experiences/214580/

Turning Vineyard Waste into Opportunity,

SB 279 Heads to Governor's Desk

https://www.winebusiness.com/news/article/308220

Gallo snaps up Gen Z wine brand Whiny Baby

https://www.just-drinks.com/news/gallo-snaps-up-gen-z-wine-brand-whiny-baby/

Texas grape growers report excellent quality in 2025

https://www.farmprogress.com/grapes/texas-grape-growers-report-excellent-quality-in-2025

Joe Montana makes a splash with new canned cocktail

https://www.pressdemocrat.com/2025/09/20/joe-montana-makes-a-splash-with-new-canned-cocktail/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Sep2021/09_24.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()