![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a website that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Wednesday, July 31, 2019

Today's Leasing News Headlines

Meet Don Cosenza, the Funder

July 31, 2019 at 3:00 PM (ET) Webinar

Reaction to SB 1235 Requirements

for Doing Business in California

By Christopher Menkin, Editor/Publisher

Current Regulations in United States

Not Official, Compiled from Many Sources

"Goldilocks Economy" Creates Opportunities

for Age 50+ Entrepreneurs

Career Security for Originators

Sales Makes it Happen by Scott Wheeler, CLFP

Leasing Industry Ads---Help Wanted

$10,000 Starting Bonus/National Account Manager

The Top U.S. Cities for Clean Energy - Chart

By Niall McCarthy, Statista

Rottweiler

Martinez, California Adopt-a-Dog

Canadian Finance & Leasing Association

Conference, September 18 - 19, Vancouver, BC

News Briefs---

Apple revenue forecast tops expectations,

iPhone business stabilizes

Companies Build Up Cash Holdings — Again

168 senior treasury and finance professionals report

Trump Goads China and Plays Down Chances

of a Trade Deal Before 2020

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Registration for members and non-members included

A First! Open to Non-Members

Meet North Mill Equipment Finance

The NAELB, now American Association of Commercial Finance Brokers, for years held a weekly "Meet the Funder,” originally by telephone, then online.

In an experiment to attract new members, the webinar is being open to non-members.

Title: “Meet North Mill Equipment Finance

A premier small-ticket lender with decades of experience, North Mill achieved record originations in 2019. You'll learn about the company, its products, and how the many enhancements made in the last year translate into growth opportunities for your business.”

Date: Wednesday, July 31, 2019 @ 3:00 pm EST

Speaker: Don Cosenza, Chief Marketing Officer

North Mill Equipment Finance

DCosenza@northmillef.com

Register for North Mill’s webinar and AACFB will waive the new member application fee.

https://zoom.us/webinar/register/WN_yCaBBwEPTr2JtwGlJKAjAg

[headlines]

--------------------------------------------------------------

Reaction to SB 1235 Requirements

for Doing Business in California

By Christopher Menkin, Editor/Publisher

The law will cover traditional term loans, lines of credit, merchant cash advances, lease financing, factoring, and asset-based financing. While federally chartered banks are exempt due to federal pre-emption issues, the bill does cover online platforms that partner with banks and do the marketing and underwriting that lead to financing that is ultimately provided by a bank.

The DBO has received comments to date. The Equipment Leasing and Finance letter in particular appears as an attempt to essentially re-legislate the bill, regarding the provisions that the author wanted put in. Many of the letters appear similar; however, the DBO questionnaire is about the forms, not re-writing the bill passed by both houses and signed by the governor into law. (1)

Perhaps the best letter comes from the author of SB 1235,

Senator Steven Glazer. His comments are simple, direct, and to the point. I would invite you to read his letter. And take all other comments in context with his letter.

I believe that of all of the comments Senator Glazer‘s thoughts will be most convincing to the California Department of Business Oversight.

Here is a highlight from the five page letter.

Senator Glazer:

“The requirement that lenders disclose an annualized rate was a crucial component of SB 1235 because without it, borrowers would find it almost impossible to compare different types of financing that have different amounts financed, term lengths and charges. The annualized rate is the "common denominator" that allows each of these products to be measured against one another.

“As introduced, SB 1235 required that lenders disclose an Annual Percentage Rate as calculated using the Federal Truth in Lending Act and Regulation Z. The bill was later amended to require disclosure of a rate (Annualized Cost of Capital) that represented all of the costs of the financing as a percentage of the amount financed, expressed as an annual rate. The final version of the bill maintained the requirement that all financing covered by the bill disclose an annualized rate but delegated to the department the choice of which annualized rate to require.

“The main difference between APR and ACC is that APR recognizes the time-value of money. ACC is simpler, but provides less information that would help the borrower make an informed decision.

“I continue to believe, as I did when I introduced SB 1235, that the Annual Percentage Rate is the best option -- as long as the department can provide sufficient guidance for lenders who use an estimated term to calculate the APR. An APR or estimated APR is already familiar to borrowers and is used by lenders not subject to SB 1235, including federally and state chartered banks and personal credit card providers. Requiring APR would therefore make it easy for small business borrowers to compare the options available to them.” (2)

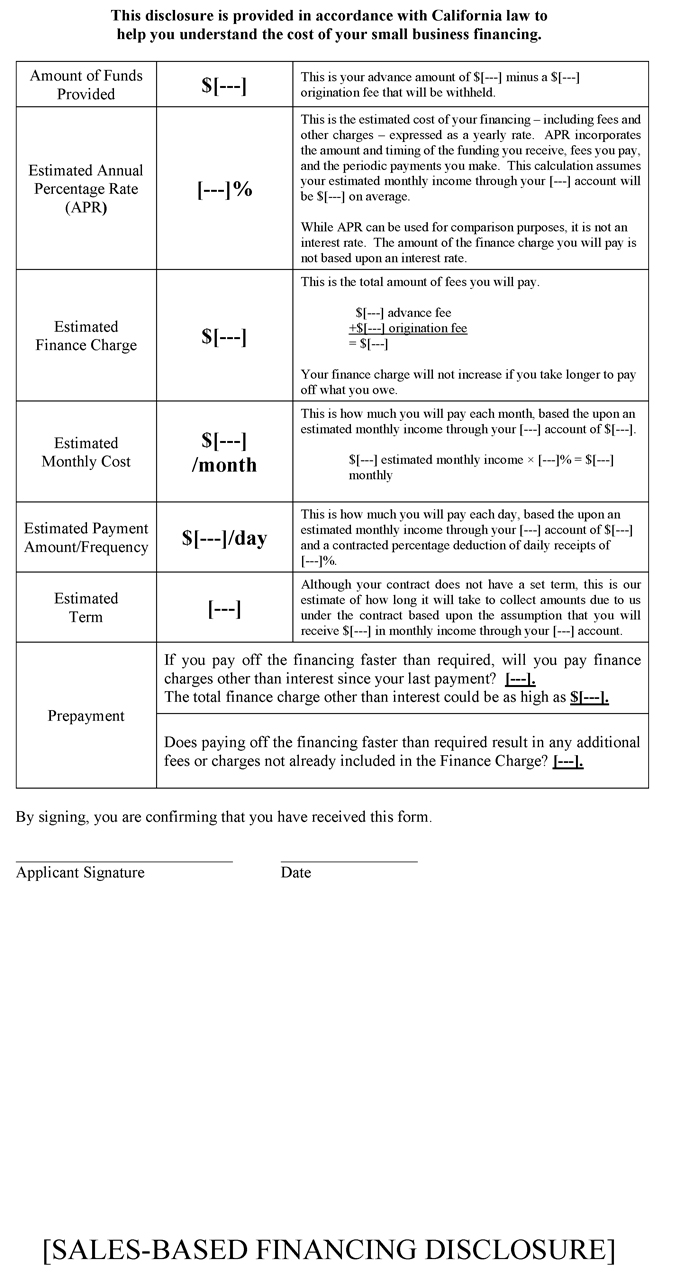

Disclosures (the actual sample forms for the debtor to sign):

This may be for Merchant Cash Advance

Sales-Based Financing (PDF)

Here are the others:

Asset-Based Lending (PDF)

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/07/Asset-Based-Lending-7-26-19.pdf

Closed-End Transaction (PDF)

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/07/Closed-End-Transaction-7-26-19.pdf

General Factoring (PDF)

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/07/General-Factoring-7-26-19.pdf

Lease Financing (PDF)

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/07/Lease-Financing-7-26-19.pdf

Open-End Credit Plan (PDF)

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/07/Open-End-Credit-Plan-7-26-19.pdf

Many of the attorneys in the field belong to the Equipment Leasing and Finance Association Law Committee, including Leasing News Legal Editor Barry Marks, Esq., CLFP, and long-time contributor Marshall Goldberg, Esq. This ELFA Committee is meeting today and may have a statement for Friday’s news edition.

In the meantime, Leasing News has requested its longtime Advisor, Ken Greene, who is also the General Counsel for the American Association of Commercial Leasing Brokers, for a comment. He appears concerned how the licensing and reporting will be for the small broker and larger broker/lessor organizations who will have to obtain a license to do business in California, particularly filing all the rules and regulations and how this then affects being licensed in other states.

- Letters received by DBO to date:

https://dbo.ca.gov/comments-on-proposed-commercial-financing-disclosures-rulemaking-under-the-california-financing-law-pro-01-18/ - Senator Glazer Five Page Letter:

https://dbo.ca.gov/wp-content/uploads/sites/296/2019/04/PRO-01-18-CA-State-Senate.pdf

[headlines]

--------------------------------------------------------------

Current Regulations in United States

Not Official, Compiled from Many Sources

Please see your financial attorney for a legal opinion.

Any up-dates or additions, please send to kitmenkin@leasingnews.org

Alaska: Money Service License. License required to have exemption from usury rates for loans of $10,000 to $25,000, and 24% rate for $850 to $10,000

http://commerce.state.ak.us/dnn/Portals/3/pub/MoneyservicesStatutes.pdf

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California: On September 22, 2016, California Governor Jerry Brown signed SB 777 into law, a bill that restores a de minimus exemption to the California Finance Lenders Law (CFLL) to allow a person or entity that makes one commercial loan per year to be exempt from the CFLL's licensing requirement, regardless of whether the loan is "incidental" to the business of the person relying on the exemption.

"In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://leasingnews.org/archives/May2016/05_02.htm#dob

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Delaware : License required for More Than 5 Loans Per Year.

http://banking.delaware.gov/services/applicense/llintro.shtml

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas: Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Non-Louisiana leasing companies, with or without offices in the state, must qualify to do business in Louisiana, and are subject to payment of state and local occupational license fees. See: Collector of Revenues v Wells Fargo Leasing Corp., 393 So.2d 1255 (La. App. 1981). Common misunderstanding of Louisiana law. Motor vehicle lessors, with or without offices in Louisiana, additionally are required to be licensed by the Louisiana Motor Vehicle Commission in order to lease a motor vehicle in the state. (La. R.S. 32:1254(N)) Common misunderstanding of Louisiana law.

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Maryland: Lending threshold is $6,000 or less, so now need for license if over

this dollar amount

Massachusetts: Lending threshold is $6,000 or less, so now need for license if over this dollar amount.

Minnesota: License required for loans of $100,000 or less

Money Transfer License

http://mortgage.nationwidelicensingsystem.org/slr/PublishedState

Documents/MN-Money-Transmitter-Company-Description.pdf

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

Nevada: Foreign Corporations Foreign corporations engaged in activities in Nevada are subject to the provisions of Chapter 80 of the Nevada Revised Statutes. Specifically, NRS 80.010 through 80.055 set forth the requirements for a foreign corporation to qualify to do business in Nevada. Of primary importance are the statutes that establish (a) the filing requirements to qualify to do business (NRS 80.010); (b) the activities in which a foreign corporation may engage that do not constitute “doing business” so as to require qualification (NRS 80.015); and (c) the penalties to which a foreign corporation will be subject for failing to comply with the qualification provisions (NRS 80.055). The penalties for failure to comply with the qualification statutes include a fine (capped at $10,000) and/or denial of the right to maintain a court action. However, failure to comply will not impair the validity of contracts entered into by a foreign corporation nor prevent such corporation from defending itself in court. Foreign LLCs Foreign LLCs engaged in activities in Nevada are subject to the provisions of Chapter 86 of the Nevada Revised Statutes, specifically NRS 86.543 through 86.549. Foreign LLCs seeking to operate in Nevada must comply with the initial filing and registration requirements in NRS 86.544, and annual filing requirements of NRS 86.5461. The LLC must also maintain certain records, such as a list of current members and managers, in accordance with NRS 86.54615.

Additionally, NRS 86.5483 lists the activities which do not constitute “doing business” in Nevada for purposes of the Chapter. Foreign LLCs that fail to comply with the Chapter risk penalties similar to those facing a non-compliant foreign corporation. Those penalties are outlined in NRS 86.548.

Nevada has no usury statue.

New Hampshire

Any person making small loans, title loans, or payday loans in New Hampshire must obtain a license from the bank commissioner. N.H. Rev. State. Ann. § 399-A:2. This law does not apply to banks, trust companies, insurance companies, savings or building and loan associations, or credit unions. Id. Any person who violates any provision of this chapter shall be guilty of a misdemeanor if a natural person, or a felony if any other person. N.H. Rev. Stat. Ann § 399-A:18.Consumer loans must give full interest and cost disclosure (doesn't seem to cover commercial loans).

https://www.doj.nh.gov/consumer/sourcebook/loans.htm

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

Although New Jersey does not require a lessor to obtain a license to conduct a leasing business in the state, the New Jersey Corporation Business Activities Report Act requires foreign corporations to register with the state. See N.J. STAT. ANN. 14A:13-14. In particular, foreign corporations must file a Notice of Business Activities Report with New Jersey's Department of Taxation. Activities that trigger the requirement of a report include: (a) maintaining an office or other place of business in New Jersey; (b) maintaining personnel in New Jersey, even if the personnel is not regularly stationed in the state; (c) owing or maintaining real or tangible personal property directly used by the corporation in New Jersey; (d) owning or maintaining tangible and/or property in New Jersey used by others; (e) receiving payments from residents in New Jersey, or businesses located in New Jersey, that are greater than $25,000.00; (f) deriving any income from any source or sources within New Jersey; or (g) conducting or engaging in any other activity, property or interrelationships with New Jersey as may be designated by the Director of the Division of Taxation. See N.J.S.A. 14A:13-15. Corporations not required to file a report are those which either received a certificate of authority to do business, or filed a timely tax return under the Corporation Business Tax Act, or Corporation Income Tax Act. See N.J. STAT. ANN. 14A:13-16. Reports must be filed annually by April 15th.

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

New York: No person or other entity shall engage in the business of making loans in the principal amount of twenty-five thousand dollars or less for any loan to an individual for personal, family, household, or investment purposes and in a principal amount of fifty thousand dollars or less for business and commercial loans, and charge, contract for, or receive a greater rate of interest than the lender would be permitted by law to charge if he were not a licensee hereunder except as authorized by this article and without first obtaining a license from the superintendent.

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

https://www.sosnc.gov/Corporations/pdf/FAQ

TreeLoanBrokerAct20130805.pdf

http://www.ncleg.net/EnactedLegislation/Statutes

/PDF/ByArticle/Chapter_66/Article_20.pdf

North Dakota: License Required “Money Broker’s License”. N.D. Cent. Code Ann. § § 13-04.1-02.1 and 13-04.1-01.1 http://www.nd.gov/dfi/regulate/index.html

Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: Ohio law provides that no person may engage in the business of lending money, credit, or choses in action in amounts of $5,000 or less, or exact, contract for, or receive, directly or indirectly, on or in connection with any such loan, any interest and charges that in the aggregate are greater than the interest and charges that the lender would be permitted to charge for a loan of money if the lender were not a licensee, without first having obtained a license from the Division of Financial Institutions. O.R.C. 1321.02. This rule is applied to any person, who by any device, subterfuge, or pretense, charges, contracts for, or receives greater interest, consideration, or charges than that authorized by such provision for any such loan or use of money or for any such loan, use, or sale of credit, or who for a fee or any manner of compensation arranges or offers to find or arrange for another person to make any such loan, use, or sale of credit. O.R.C. 1321.02.

Rhode Island: Any person who acts as a lender, loan broker, mortgage loan originator, or provides debt-management services must be licensed. R.I. Gen Laws § 19-14-2(a). The licensing requirement applies to each employee of a lender or loan broker. R.I. Gen Laws § 19-14-2(b). No lender or loan broker may permit an employee to act as a mortgage loan originator if that employee is not licensed. R.I. Gen Laws § 19-14-2(b) R.I. Gen. Laws § 19-14-2 (2012) No person engaged in the business of making or brokering loans shall accept applications from any lender, loan broker, or mortgage loan originator who is required to be licensed but is not licensed. R.I. Gen Laws § 19-14-2(d). There is an exemption from the licensing requirement for a person who makes not more than 6 loans in the state within a 12-month period. R.I. Gen Laws § 19-14.1-10. Persons lending money without a license are guilty of a misdemeanor and can be fined not more than $1,000, or imprisoned for not more than 1 year, or both; each violation constitutes a separate offense. R.I. Gen Laws § 19-14-26.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application: $600

South Dakota has no usury status

Vermont: In the past, Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum. As of May 1, 2017. "Loan solicitation licensees must maintain a surety bond, include a specific disclosure in all advertisements of loans and solicitation of leads, observe record retention requirements, and file an annual report and financial statements with the Commissioner of Financial Regulation."

Full information available here:

http://www.counselorlibrary.com/public/alert.cfm?itemID=2420

Ontario, Canada: General Requirements: 1. Branch Operation If a foreign corporation wants to carry on business via a branch operation, without a Canadian corporate entity, it may have to obtain a provincial license in each province in which it intends to carry on business. Pursuant to the Ontario Extra-Provincial Corporations Act R.S.O. 1990 c. E.27 ("EPCA"), a class 3 extra-provincial corporation (a corporation that has been incorporated or continued under the laws of a jurisdiction outside Canada) is prohibited from carrying on business in Ontario without a license under the Act [s. 4(2)]. Failure to comply with this licensing requirement can lead to a maximum fine of $2,000 for a person and $25,000 for a corporation [s. 20(1)]. Directors, officers and any person acting as a representative of the corporation can be fined up to $2,000 for authorizing, permitting or acquiescing to an offence by the corporation [s. 20(2)]. For the purposes of the EPCA, an extra-provincial business is considered to be "carrying on business in Ontario" if: a. It has a resident agent, representative, warehouse, office or place where it carries on its business in Ontario; b. It holds an interest, otherwise than by way of security in real property situate in Ontario; or c. It otherwise carries on business in Ontario [s. 1(2)]. This last category is a catchall. Recent case law in the area stresses that it is very much a fact-specific analysis hinging on the extent to which business is actually conducted in Ontario. 2. Incorporation: a foreign corporation can also choose to incorporate a subsidiary, either federally or provincially. If a subsidiary is incorporated provincially in Ontario, it may have to obtain an extra-provincial license to carry on business in other provinces. An Ontario-incorporated company does not have to obtain a license to carry on business in Quebec but does have to make annual information filings. 3. Bank Act If the financing company is a bank and intends to carry on business in Canada, it must obtain appropriate approval under the Bank Act 1991 c. 46. Whether an entity will be considered a bank under the Bank Act needs to be reviewed on a case-by-case basis, as there are a number of relevant factors.

[headlines]

--------------------------------------------------------------

"Goldilocks Economy" Creates Opportunities

for Age 50+ Entrepreneurs

By Mary Miller, Contributing Editor, Coleman Reports

To coin a phrase from the classic children's tale of Goldilocks and The Three Bears, a Goldilocks Economy is one that is not too hot (inflation), not too cold (recession), but just right. An economy that enjoys moderate economic growth, low inflation and a favorable monetary policy is just right.

For people aged 50 or older, the time is just right to make the transition from the corporate workplace or retirement to entrepreneurship.

Consider the stats:

- According to a 2018 Bureau of Labor Statistics analysis, U.S. workers aged 55+ made up almost one half of the 2.9 million jobs in the workforce. Of all age groups, they comprise the largest overall share.

- USA Today reports that 39.2 percent of the population aged 55+ were gainfully employed at the end of last year, the highest percentage since 1961. Of this group, the share of those aged 65 or older breakdown by men at 24% and women at 16%.

- According to the Kauffman Index of Startup Activity, the second highest rate of American entrepreneurial activity is among the 55-64 age group, or 28.5%. Stats indicate that an estimated 27 million Americans will transition from the corporate workforce to full time self-employment by 2020. Longer life spans, insufficient retirement savings and the desire to remain active are all contributing factors for the upward trend.

- The National Federation of Independent Business (NFIB) reports that small businesses are creating jobs at an all-time high rate. In 2018, there was a reported number of 30.2 million small businesses in the U.S., employing 58 million people.

- 57% of small business owners are aged 50 and up, according to a Babson College study entitled, "The State of Small Business in America."

- As stated in the Fast Company article, "Our Aging Population," there are 108.7 million people over the age of 50 generating $7.6 trillion annually.

While the population and baby boomers age, they also continue to make significant contributions to stimulating U.S. economic growth. The stats support the fact that this is a strong, long-term trend that will continue well past a Goldilocks Economy.

Reprinted with Permission

Originally appeared in "Main Street Monday,"

Coleman Report, 28081 Marguerite Pkwy.,

#4525, Mission Viejo, CA 92690

bob@colemanreport.com

[headlines]

-------------------------------------------------------------

Career Security for Originators

Sales Makes it Happen by Scott Wheeler, CLFP

I was recently asked by a top producing originator:

How do I build job (career) security?

The answer is quite simple: Contribute to the financial health of your employer and stakeholders.

Most originators are rightfully focused on the top line (production and total revenues); however, bottom-line outcomes are equally, if not more, important in building job security. As an originator, you want to be aligned (employed) with a healthy company which has the capacity to thrive in all economic cycles and you must be a contributor.

Successful originators are invested in building profits and equity for their employers and funding partners because they know personal long-term sustainability depends upon combined success.

- Successful originators focus on quality assets and know the harm that delinquencies and charge-offs mean to any employer or funding source. Successful originators build personal security by being associated with a high-quality portfolio which they helped originate. Successful originators know the performance of the assets they originate.

- Successful originators want to maximize their personal incomes and be paid a fair income for their efforts and contribution. However, they realize that their employers and partners are incurring risk and future expenses with every funded transaction. There must be enough money in each transaction to cover overhead, build future reserves, and provide adequate returns to the investors. Successful originators demand fairness but are never greedy.

- Successful originators build long-term security by contributing to the financial well-being of their employers (and funding partners). More importantly, they can quantify their contribution. Successful originators understand the full impact of maximizing margins on every transaction. Conversely, they understand the impact of minimizing margins, especially with higher-risk transactions. Successful originators sell value over price to protect their employers and funding partners; and by doing so, they build personal security for the long term.

Successful originators build job (career) security by having a complete understanding of all aspects of originating, funding, and collecting commercial equipment financing and leasing assets. Successful originators fully understand their personal contribution to bottom-line results.

Contribute

The response to the 2019 Production and Compensation survey has been strong. The survey will end this week. Please participate in our 2019 Production and Compensation survey by clicking HERE:

https://www.surveymonkey.com/r/XTQGZ2B

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

-------------------------------------------------------------

Help Wanted

[headlines]

-------------------------------------------------------------

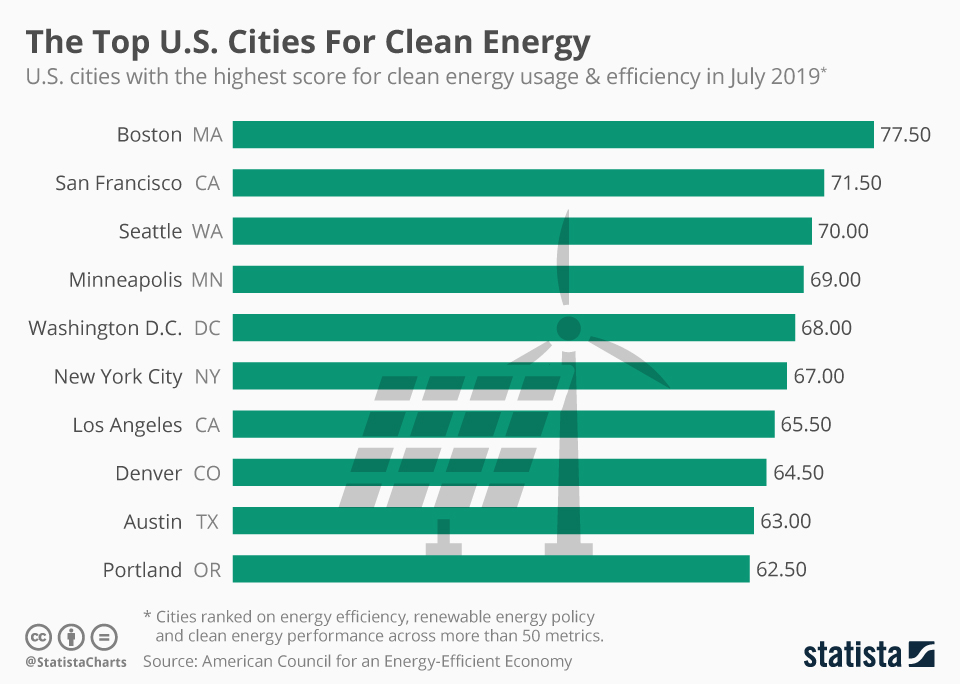

The non-profit American Council for an Energy-Efficient Economy has released its 2019 City Clean Energy Scorecard which details the level of progress U.S. cities are making in clean energy adoption. It tracked renewable energy policy efforts, efficiency and performance across 50 metrics in 75 large American cities, finding that only 11 are on pace to meet their community-wide climate goals. That's despite local governments in all cities included in the research taking around 265 actions (new initiatives or expansions of past ones) to advance clean energy from January 2017 to April 2019.

Boston was once again the top-ranked city this year and it had a score of 77.5 out of 100. It performed well across all metrics and excelled in building policies and energy and water utilities. The city has a stringent building code called the Massachusetts Stretch Energy Code which helped it score extremely well for building policy. Boston also did well in efficiency due to considerable investments in electricity and gas efficiency programs while it also focused on comprehensive low-income and multifamily program offerings.

San Francisco came second on the scorecard with 71.50 and its transportation policy boosted its performance. Seattle came third due to high scores in community-wide initiatives as well as its building and transportation policies. It also has a strict building energy code like Boston and it has endeavored to boost energy in existing structures. The research also noted cities that have made progress since the last scorecard and in 2019 the cities to watch are Hartford, Cincinnati and Providence.

By Niall McCarthy, Statista

https://www.statista.com/chart/18840/us-cities-with-the-highest-score-for-clean-energy/

[headlines]

--------------------------------------------------------------

Rottweiler

Martinez, California Adopt-a-Dog

Ranger

ID#A0890103

My name is Ranger and I am described as a neutered male, black and tan Rottweiler. You will find me in Kennel # TRUCK. The shelter thinks I am about 5 years old. I have been at the shelter since Jul 13, 2019.

Contra Costa County Animal Services - Martinez.

4800 Imhoff Place

Martinez, CA 94553

(925) 608-8400

Hours: Sunday: Closed

Monday: Closed

Tuesday: 10 am to 5 pm

Wednesday:10 am to 7 pm

Thursday: 10 am to 5 pm

Friday: 10 am to 5 pm

Saturday: 10 am to 5 pm

Closed on major holidays

Adoption Fees:

http://www.co.contra-costa.ca.us/806/Adoption-Fees

[headlines]

--------------------------------------------------------------

Le Centre Sheraton

The Westin Bayshore

1601 Bayshore Dr.

Vancouver, BC V6G 2V4

Frequently Asked Questions:

http://cflaimis.etechhosting.ca/cfla/Conference2019/Event_Details/FAQs_FA

Program:

http://cflaimis.etechhosting.ca/CFLA/Conference2019/Program.aspx

Registrations (members)

https://www.cfla-acfl.ca/login/?LoginRedirect=true&returnurl=https://members.cfla-acfl.ca/cfla/EventDetail?EventKey=19CONF

Registration (non-members)

http://cflaimis.etechhosting.ca/cfla/Conference2019/Registration

Tips for First Timers:

http://cflaimis.etechhosting.ca/cfla/Conference2019/Event_Details/Tips_for_1st_

[headlines]

--------------------------------------------------------------

News Briefs----

Apple revenue forecast tops expectations,

iPhone business stabilizes

https://www.reuters.com/article/us-apple-results/apple-revenue-forecast-tops-expectations-iphone-business-stabilizes-idUSKCN1UP2EC

Companies Build Up Cash Holdings — Again

168 senior treasury and finance professionals report

https://www.cfo.com/cash-management/2019/07/companies-build-up-cash-holdings-again/

Trump Goads China and Plays Down Chances

of a Trade Deal Before 2020

https://www.nytimes.com/2019/07/30/business/trump-china-trade.html

|

[headlines]

--------------------------------------------------------------

You May Have Missed---

The Fastest Growing and Shrinking State Economies

https://247wallst.com/special-report/2019/07/29/the-fastest-growing-and-shrinking-state-economies-2/2/

[headlines]

--------------------------------------------------------------

In '69

by Tim Peeler

Twelve and persistent

As the worst salesman

That ever stuck a toe in a door,

I began telling people at the church

That we were going to see the Braves.

Now the interstate to Atlanta was still

A long, strung-out thing back then,

But I told my buddy Coffey and the Hefners

And some of the men who stood out front

In ties and shirtsleeves,

Smoking by the wall before the service.

And soon it become known

That we were gong on an autumn Sunday,

With my frugal Dad, the dedicated minister,

Carefully picking a Lutheran church to attend-

More carefully than our field-level seats,

First base side, overweight Ken Johnson pitching

For the Cubs, the lanky Ron Reed for the Braves

In a bright afternoon of contrasts.

My head wheeled from side to side

In the round stadium, trying to take it

All in—the sheltered preacher's son,

A bit scared of all the beer drinkers,

Amazed at the wildness and color of it all,

The remarkable green open space of the field.

Then I turned away for a blink,

I missed the sudden pop of the ball as it left Aaron's bat,

Crashing in blue seats above

Chief Noc-A-Homa's tent.

I willed the trip, the game, the day,

Then blinked at a bright piece of history

In '69.

--- with the permission of the author, from his book of baseball poetry:

“Waiting for Godot's First Pitch”

More Poems from Baseball

available from Amazon or direct from the publisher at:

www.mcfarlandpub.com

[headlines]

--------------------------------------------------------------

Sports Briefs---

Larry Fitzgerald: I’ve never seen a rookie QB come in like Kyler Murray

https://www.yahoo.com/sports/larry-fitzgerald-ve-never-seen-221741077.html

Watch 49ers QB Jimmy Garoppolo find

Richie James on deep ball at camp

https://www.yahoo.com/sports/watch-49ers-qb-jimmy-garoppolo-014152901.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California to receive $70 million from drug companies accused

of illegally delaying cheaper generics

https://www.sfchronicle.com/business/article/California-to-receive-70-million-from-drug-14200334.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

China, Heat, and Trump: Why French Winemakers

Are Having the Worst Summer Ever

https://fortune.com/2019/07/29/why-french-winemakers-are-having-the-worst-summer-ever/

Six Things to Do With Surplus Cabernet Sauvignon Grapes

https://wineeconomist.com/2019/07/30/surplus-cab/

Depression and Anxiety? Have some Red Wine!

https://www.sciencetimes.com/articles/23489/20190728/depression-anxiety-red-wine.htm

Sonoma County vineyard managers spend millions

to build on-site housing for pickers

https://www.northbaybusinessjournal.com/northbay/sonomacounty/9844982-181/sonoma-wine-worker-housing-h2a-visa

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1498 - Christopher Columbus first sighted the island that he called La Trinidad. The island was inhabited by two tribes: the Arawaks, who were peaceful fishermen and farmers, and the more belligerent Caribs. Upon his return to Spain, Columbus described the islands to the King as very lush and pleasant, and soon the Spaniards began to colonize them. Trinidad and Tobago remained under Spanish rule from 1498 until Feb 18, 1797, when the Spanish Governor, Chacon, surrendered the islands to the British Navy. British rule continued until 1962 when Trinidad and Tobago gained their independence, after having been self-governing since 1956. The chief exports were slaves. Those that were not captured were killed and many maimed in the battles between well-armed soldiers on horses and Indians with primitive weapons at best.

http://www1.minn.net/~keithp/cctl.htm

http://www.visittnt.com/General/about/general.html

http://users.carib-link.net/~richjob/trinidad.htm

http://latino.si.edu/rainbow/education/historyandpeople.htm

1777 - The Vermont state constitution made it the first state to abolish slavery and adopt universal male suffrage, without regard to property. From 1777 to 1791, Vermont was an independent country, often referred to in the present day as the Vermont Republic. It was followed to a lesser degree by other New England states, which with Vermont were destined to become strongholds of abolitionism in the 1850s. Vermont had declared itself an independent state on Jan. 16, 1777 and has been known for its “independence” ever since.

1777 - The Second Continental Congress passes a resolution that the services of Gilbert du Motier "be accepted, and that, in consideration of his zeal, illustrious family and connections, he have the rank and commission of major-general of the United States." Thus, the Marquis de Lafayette, a 19-year-old French nobleman, was made an officer in the American Continental Army.

1790 - The US Patent Office opened its doors. The first US Patent was signed by George Washington and Thomas Jefferson. It went to Samuel Hopkins of Vermont for a new method of making pearash and potash, useful in many applications, including bleaching cotton.

1792 - The cornerstone of the Philadelphia Mint, the first US Government building, was put in place.

1811 - Jane Currie Blaikie Hoge (d. 1890) birthday, Philadelphia. Author also well-known for caring for orphans. After seeing some of the deplorable conditions suffered by soldiers in the Civil War, she became one of the leaders in sanitary reform (collecting and distributing clothing, providing nursing care, medical and hospital supplies, food, just about everything else for sanitary and health care that the army never supplied to its men). The women of the sanitary reform movement did unbelievably hard and effective work. The women of the commission received adulation immediately after the war and then their names and work were forgotten while the names of battles and how they were fought (usually forgetting the gruesome results) were glorified.

http://www.britannica.com/women/articles/Hoge_Jane_Currie_Blaikie.html

1816 - Birthday of Union General George H. Thomas (d. 1870), born in Southampton County, Virginia. Known as the "Rock of Chickamauga.”

(Lower half of http://memory.loc.gov/ammem/today/jul31.html )

1816 - Lydia Moss Bradley (d. 1908) birthday, Vevay, IN. American financier and philanthropist. Although left a wealthy widow, she increased the estate astronomically through wise investments and real estate transactions that rank her as a major financial genius. Her philanthropic gifts included a home for older women. In 1876, she endowed Bradley University with $2 million and 28 acres in honor of her six children who all died young.

http://www.search.eb.com/women/articles/Bradley_Lydia_Moss.html

http://www.alliancelibrarysystem.com/IllinoisWomen/files/br/

htm1/bradley.cfm

1831 - Helena Petrovna Hahn Blavatsky (d. 1891), birthday, Yekaterinoslav, Ukraine. Founder of the Theosophy religion/belief/philosophy that combines various religions and spiritualism and the occult. She wrote a number of books, the most important of which was “The Secret Doctrine,” “The Synthesis of Science,” “Religion, and Philosophy” (1888) and “Key to Theosophy” (1889), that are the basic texts of the movement. She died at the home of Annie Besant who carried on the movement that still has millions of followers today.

http://school.eb.com/women/articles/Blavatsky_Helena_Petrovna.html

http://www.blavatskyarchives.com/natcyclop.htm

http://www.crystalinks.com/blavatsky.html

1846 - The "Brooklyn" arrived in Yerba Buena, now San Francisco, with 230 Mormons under the leadership of 26-year-old Prophet Samuel Brannan. He was to meet other Saints who were crossing the country from Illinois.

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/

1996/07/26/MN64895.DTL

1849 - Revolutionizing warfare, Benjamin Chambers, Sr., obtained a patent for a “Breech-loading cannon.” It was the most successful and simple operation, which he called “an improvement in movable breeches for fire-arms and the locks and appurtenances of the same.” His wooden model was discovered in an old smithy and became part of the collection of the Virginia Historical Society.

1867 – S.S. Kresge (d. 1966) was born in Allentown, PA. He created and owned two chains of department stores, the S.S. Kresge Company, one of the 20th century's largest discount retail organizations, and the Kresge-Newark traditional department store chain. The discounter was renamed the Kmart Corporation in 1977 and evolved into today's Sears Holdings Corporation, parent of Kmart and Sears.

1912 - Birthday of Milton Friedman (d. 2006), a Nobel Price-winning economist, teacher, and author, was born at Brooklyn, NY. In 1946, he became a professor of economics at the University of Chicago, where he did some of his best-known work. The Chicago School, of which he was a member with like-minded scholars, promulgated influential free-market theories. Friedman challenged what he later called "naïve Keynesian" theory with his 1950s interpretations of the consumption function. In the 1960s, he became the main advocate opposing Keynesian government policies and described his approach (along with mainstream economics) as using "Keynesian language and apparatus" yet rejecting its "initial" conclusions. He theorized that there existed a “natural rate of unemployment” and argued that employment above this rate would cause inflation to accelerate. Friedman was an advisor to President Ronald Reagan and British Prime Minister Margaret Thatcher. His political philosophy extolled the virtues of a free market economic system with minimal intervention.

1918 - Pianist Hank Jones (d. 2010) birthday, Vicksburg, MS.

http://www.npr.org/programs/jazzprofiles/archive/jones_h.html

http://www.jazzradio.org/hank.htm

1919 – “The Cowboy,” Curt Gowdy (d. 2006), was born in Green River, WY. Gowdy is known as the longtime voice of the Boston Red Sox and for his coverage of many nationally televised sporting events, primarily for NBC Sports in the 1960s and 1970s. Gowdy called Ted Williams’ final at-bat where he hit a home run into the bullpen in right-center field off Jack Fisher of Baltimore; Tony Conigliaro’s home run in his first at-bat at Fenway Park on April 17, 1964 at the age of 19; beginning in 1960, he covered the first five seasons of the American Football League with broadcast partner Paul Chrisman; Super Bowl I; the AFL’s infamous “Heidi” game in 1968, and (after the 1968 pro football season), Super Bowl III in which Joe Namath and the New York Jets defeated the heavily-favored NFL champion Baltimore Colts. In 1971, Gowdy's telecast on NBC caused many a Christmas dinner to be delayed as the country locked in that Christmas Day to the longest game in pro football history, when the Miami Dolphins defeated the Kansas City Chiefs 27-24 in the final game at Kansas City's Municipal Stadium. He also covered Franco Harris’ Immaculate Reception" of 1972; Clarence Davis’ miraculous catch in a "sea of hands" from Oakland Raiders QB Ken Stabler to defeat the Dolphins in the final seconds of a legendary 1974 AFC playoff game, and Hank Aaron’s 715th home run in 1974 that broke Babe Ruth’s long-time career home run record.

1921 - Birthday of Whitney Young (d. 1971), former Executive Director of the National Urban League, in Shelby County, KY.

http://blackhistory.eb.com/micro/650/67.html

1930 – “The Shadow” Radio premiere. “Who knows what evil lurks in the hearts of men? The Shadow Knows.” The popular crime and suspense program premiered on CBS radio. Originally, the Shadow was just the narrator of the changing stories, but later he became a character with his own adventures—with the alter ego of Lamont Cranston. Orson Welles was the first Shadow.

1931 - Birthday of great guitarist Kenny Burrell, Detroit, MI.

http://www.hopper-management.com/kb_bio_e.htm.

1932 – The “mistake by the lake,” Cleveland’s Municipal Stadium, opened as a crowd in excess of 80,000 watched the Indians lose to the Philadelphia A’s, 1-0.

1941 - Under instructions from Hitler, Nazi official Hermann Goring, ordered SS General Heydrich to "submit to me as soon as possible a general plan of the administrative material and financial measures necessary for carrying out the desired Final Solution of the Jewish question." Heydrich was killed in action in 1942. Göring was convicted of war crimes and crimes against humanity at the Nuremberg trials. He was sentenced to death by hanging, but committed suicide the night before the sentence was to be carried out.

1942 - Harry James Band with Helen Forrest cut “I’ve Heard that Song Before.” All phonographs are banned the next day due to the war until 1945.

1943 - KISTERS, GERRY H., Medal of Honor

Rank and organization: Second Lieutenant (then Sergeant), U.S. Army, 2d Armored Division. Place and date: Near Gagliano, Sicily, 31 July 1943. Entered service at: Bloomington, Ind. Birth: Salt Lake City, Utah. G.O. No.: 13, 18 February 1944. Citation: On 31 July 1943, near Gagliano, Sicily, a detachment of 1 officer and 9 enlisted men, including Sgt. Kisters, advancing ahead of the leading elements of U.S. troops to fill a large crater in the only available vehicle route through Gagliano, was taken under fire by 2 enemy machineguns. Sgt. Kisters and the officer, unaided and in the face of intense small arms fire, advanced on the nearest machinegun emplacement and succeeded in capturing the gun and its crew of 4. Although the greater part of the remaining small arms fire was now directed on the captured machinegun position, Sgt. Kisters voluntarily advanced alone toward the second gun emplacement. While creeping forward, he was struck 5 times by enemy bullets, receiving wounds in both legs and his right arm. Despite the wounds, he continued to advance on the enemy, and captured the second machinegun after killing 3 of its crew and forcing the fourth member to flee. The courage of this soldier and his unhesitating willingness to sacrifice his life, if necessary, served as an inspiration to the command.

1944 - Sherry Lansing was born Sherry Lee Duhl in Chicago. After a brief acting and writing career – she was head script writer at MGM for “The China Syndrome” and “Kramer vs. Kramer” – then vice-president of production at Columbia Pictures. She then became the first woman to be placed in charge of production at a major film studio, and on Jan 2, 1980, she became president of production at Twentieth Century Fox. She held office until 2004. Her mother fled Nazi Germany and raised her and her sister by working in real estate.

http://centerstage.net/theatre/whoswho/SherryLansing.html

http://www.ucop.edu/regents/regbios/lansing.htm

http://www.lukeford.net/profiles/profiles/sherry_lansing.htm

1948 - New York's International Airport at Idlewild Field was dedicated by President Harry S. Truman. It was later renamed John F. Kennedy International Airport.

1946 - Birthday of singer Gary Lewis, born Gary Harold Lee Levitch, Los Angeles. Son of actor/comedian, writer Jerry Lewis and Patti Lewis, the former Esther Calonico. His band, Gary Lewis and the Playboys had a number 1 hit, “This Diamond Ring” in 1965.

http://www.members.aol.com/oldies1/lewis.htm

http://www.tsimon.com/lewis.htm

1951 - Evonne Goolagong was born Griffith, New South Wales, Australia. Outstanding Australian aborigine (First People) tennis player who won Wimbledon 1971 and 1980 and was named AP woman athlete of the year in 1971.

http://www.abc.net.au/btn/australians/goolagon.htm

http://www.hickoksports.com/biograph/goolagonge.shtml

http://www.teachers.ash.org.au/thwaites/goolag.htm

http://www.tennisfame.org/enshrinees/evonne_goolagong.html

1952 - Faye Marder Kellerman birthday, St. Louis, MO. American novelist specializing in mysteries that feature authentic Orthodox Jewish life.

http://www.amazon.com/exec/obidos/search-handle-form/103-5362656-4423850

1956 - Top Hits

“The Wayward Wind” - Gogi Grant

“Hound Dog/Don't Be Cruel” - Elvis Presley

“Whatever Will Be Will Be (Que Sera Sera)” - Doris Day

“I Walk the Line” - Johnny Cash

1960 - Elijah Muhammad, leader of Nation of Islam, calls for a black state.

1961 - President John F. Kennedy agreed during talks held with General Chen Cheng (July 31—Aug 1, 1961), to support Nationalist China in its bid for UN membership and oppose the admission of Communist China to the United Nations.

1962 – The National League rejected MLB Commissioner Ford Frick’s proposal for interleague play in 1963.

1963 - Wesley Snipes Birthday, born Orlando, Florida. “Blade,” “White Men Can’t Jump,” “US Marshal,” “Major League,” among several box office hits. On April 24, 2008, Snipes was sentenced to three years in prison for willful failure to file federal income tax returns. The US Court of Appeals affirmed Snipes’ convictions in a 35-page decision issued on July 16, 2010. Snipes reported to prison on December 9, 2010 and he was released on April 2, 2013.

1964 - Top Hits

“Rag Doll” - The 4 Seasons

“A Hard Day's Night” - The Beatles

“The Little Old Lady (From Pasadena)” - Jan & Dean

“Dang Me” - Roger Miller

1968 - The Beatles laid down the bed tracks for "Hey Jude" during the first of a two day session in London. A 36-piece orchestra will be added tomorrow. It tops Billboard's Hot 100 singles chart for nine weeks, making it the mega group’s biggest hit.

1970 - Chet Huntley retires from NBC, ends "Huntley-Brinkley Report." It was NBC’s flagship evening news program from 1956, anchored by Huntley in New York and David Brinkley in Washington, DC. It succeeded the Camel News Caravan, anchored by John Cameron Swayze. The program ran for 15 minutes at its inception but expanded to 30 minutes on September 9, 1963 exactly a week after the “CBS Evening News” with Walter Cronkite did so.

http://www.museum.tv/archives/etv/H/htmlH/huntleychet/huntleychet.htm

1971 - The first astronauts to ride a vehicle on the moon were Colonel David Randolph Scott and Lieutenant Colonel James Benson Irwin, who rode the four-wheeled electric cart “Rover,” an LRV (Lunar Roving Vehicle) alongside the 1,200 foot deep canyon Hadley Hills on the moon ( Apollo 15).

1971 - Hamilton, Joe Frank and Reynolds had the top tune on the Cashbox Best Sellers list with "Don't Pull Your Love." Dan Hamilton, Joe Frank Carollo and Tom Reynolds enjoyed their first taste of success in 1965 with a group called The T-Bones when they scored the Top Ten hit "No Matter What Shape" that was used in Alka Seltzer commercials.

1971 - James Taylor scored his only Billboard number one record with the Carole King written, "You've Got a Friend." The song would go on to win the 1971 Grammy Award for Best Pop Vocal Performance, Male.

1972 - Thomas Eagleton, the Democratic vice-presidential candidate, withdrew from the ticket with presidential candidate George McGovern following disclosure that Eagleton had once undergone psychiatric treatment for depression. Eagleton was replaced by Sargent Shriver, who, incidentally, was the only Democratic vice-presidential nominee who did not serve in Congress at any point in his or her career.

1972 - Top Hits

“Alone Again (Naturally)” - Gilbert O'Sullivan

“Brandy (You're a Fine Girl)” - Looking Glass

“(If Loving You is Wrong) I Don't Want to Be Right” - Luther Ingram

“It's Gonna Take a Little Bit Longer” - Charley Pride

1972 - White Sox Dick Allen becomes the seventh Major Leaguer to hit two inside-the-park HRs in one game. The homers help pace the White Sox over the Twins, 8-1.

1974 - One of the President Nixon's main men, John Ehrlichman was sentenced to prison for his role in the break-in at the office of Daniel Ellsberg's psychiatrist. Ellsberg was the Pentagon consultant who leaked the "Pentagon Papers" (which purportedly told Americans how and why the U.S. really got into the Vietnam War). Ehrlichman also created the White House unit that was called the ‘plumbers' because it was intended to plug leaks.

1976 - A stationary thunderstorm produced more than ten inches of rain which funneled into the narrow Thompson River Canyon of northeastern Colorado. A wall of water six to eight feet high wreaked a twenty-five mile path of destruction from Estes Park to Loveland killing 156 persons. The flash flood caught campers, and caused extensive structural and highway damage. Ten miles of U.S. Highway 34 were totally destroyed as the river was twenty feet higher than normal at times.

1978 - No. 1 Billboard Pop Hit: "Miss You," The Rolling Stones. The song is the band's eighth No. 1 single.

1980 - Top Hits

“It's Still Rock & Roll to Me” - Billy Joel

“Magic” - Olivia Newton-John

“Cupid/I've Loved You for a Long Time” - Spinners

“Bar Room Buddies” - Merle Haggard & Clint Eastwood

1981 - African-American Arnette Hubbard installed as first woman president of the National Bar Association.

http://www.nationalbar.org/about/index.shtml

http://www.siu.edu/~oirs/Stan/walloffame.html

1981 - The seven-week baseball players' strike came to an end as the players and owners agreed on the issue of free agent compensation.

1983 – The Baseball Hall of Fame welcomed Brooks Robinson, Juan Marichal, George Kell and Walter Alston.

1984 - US men's gymnastics team won team gold medal at LA Summer Olympics

http://www.nationalbar.org/about/index.shtml

1986 - The temperature at Little Rock, AR, soared to 112 degrees to establish an all-time record high for that location. Morrilton, AR, hit 115 degrees, and daily highs for the month at that location averaged 102 degrees.

1987 - The deadliest tornado in 75 years struck Edmonton, Alberta, killing 26 persons and injuring 200 others. The twister caused more than $75 million damage along its nineteen mile path, leaving 400 families homeless. At the Evergreen Mobile Home Park, up to 200 of the 720 homes were flattened by the tornado.

1987 - Afternoon highs of 106 degrees at Aberdeen, SD, and 102 degrees at Ottumwa, IA, and Rapid City, SD, established records for the date. It marked the seventh straight day of 100 degree heat for Rapid City. Baltimore, MD, reported a record twenty-two days of 90 degree weather in July. Evening thunderstorms produced golf ball size hail at Lemmon, SD, and wind gusts to 80 mph at Beulah, ND.

1988 - Top Hits

“Roll with It” - Steve Winwood

“Hands to Heaven” - Breathe

“Make Me Lose Control” - Eric Carmen

“Don't We All Have the Right” - Ricky Van Shelton

1988 - Twenty-one cities in the north central U.S. reported record high temperatures for the date, including Sioux City, IA, with a reading of 107 degrees. The reading of 105 degrees at Minneapolis, MN, was their hottest since 1936. Pierre and Chamberlain, SD, with highs of 108 degrees, were just one degree shy of the hot spot in the nation, Palm Springs, CA.

1990 - Nolan Ryan of the Texas Rangers won the 300th game of his career, defeating the Milwaukee Brewers, 11-3. Ryan pitched in the Majors from 1966 until 1993 and finished with 324 wins.

1993 - Top Hits

“Can’t Help Falling In Love (From ‘Sliver’)” - UB40

“Whoomp! (There It Is)” - Tag Team

“Weak”- SWV

“I'm Gonna Be (500 Miles)” - The Proclaimers

1994 - The San Francisco Giants joined the battle against AIDS by staging their first “Until There's A Cure” Day at Candlestick Park. The Giants wore red ribbons sewn on their uniforms. Together with the visiting Colorado Rockies, they joined 700 Aids volunteers to form a giant human red ribbon on the field. One dollar from the price of every ticket sold went to Bay Area AIDS organizations. The Giants won the game, 9-4, behind home runs by Barry Bonds, Darryl Strawberry and Matt Williams, who hit two.

1994 – Steve Carlton, Leo Durocher and Phil Rizzuto were inducted into the Baseball Hall of Fame.

1995 - Heat Wave in Chicago, Illinois; 525 deaths attributed.

http://www.sws.uiuc.edu/atmos/statecli/1995chicago.htm

1995 - Selling 331,000 copies, Selena's "Dreaming of You," her first English album, debuts at No. 1 on the Billboard chart. The slain Tejano singer becomes the first Latin artist ever to debut at No. 1.

1997 - In New York City, police seized five bombs believed bound for terrorist attacks on city subways. 2 potential suicide bombers were shot and wounded in an explosives laden Brooklyn apartment. Gazi Ibrahim Abu Mezer (23) and Lafi Khalil (22) were recovering from wounds. In 1998, Khalil was acquitted and Gazi Ibrahim Aby Mezer was convicted of plotting to bomb a subway station.

1998 - Top Hits

“The Boy Is Mine”- Brandy

“You're Still the One”- Shania Twain

“My Way” - Usher

“Adia” -Sarah McLachlan

1999 - The U.S. heat wave, linked to at least 94 deaths, continued. As Chicago baked in 100-degree weather, thousands of hot and sweaty residents were forced to endure the heat without air conditioning or fans, due to sporadic power outages and brownouts.

http://hpccsun.unl.edu/nebraska/heatwave99.html

http://www.disastercenter.com/guide/heat.html

2002 - A plan to sell beer outside Boston's Fenway Park is approved on a trial basis by city officials. During the 14 games, brew will be available three hours before game time to one hour after games start to game ticket-holders who pass through a turnstile.

2012 - U.S. Olympic swimming champion Michael Phelps won a record 19th Olympic medal, with gold in the 4x200metres freestyle relay.

2013 - Republicans unveiled a series of bills designed to prevent government abuse, including the 'STOP IRS Act,' which would allow IRS employees to be fired when they take actions for political purposes.

2014 – President Barack Obama authorized air strikes against Islamic State militants for situations in which the forces appear to threaten U.S. personnel. Food drops were also carried out along the Syrian border to civilians trapped by the violence.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()