Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Tuesday, June 18, 2013

![]()

Today's Equipment Leasing Headlines

Archives---June 18, 2008

GreatAmerica gets flooded out!

Classified Ads---Collections

One Out, Another Getting Out, Not the Third

Convictions of Lease Theft

Sheldon Player is a Player at the Table

---While E.A.R. Bankruptcy Goes On and On!

Can Small Business Rely On Community Banks?

(Reprinted with permission from Optirate)

Leasing 102 by Mr. Terry Winders, CLP

What is a Finance Lease?

Classified Ads---Help Wanted

“Follow-Up After Sending Resume”

Career Crossroad---By Emily Fitzpatrick/RII

Wells Fargo Equipment Finance Gets Derailed in

Train Lease Litigation

By Tom McCurnin

Largest remaining banks & thrifts in TARP

By Aarti Kanjani, SNL Financial

Regulators take 4th chunk of Capitol Bancorp franchise

By David Hayes and Lindsey White and Tahir Ali

Top Stories June 11-June 13

(You May Have Missed)

Classified ads—Asset Management

Australian Shepherd

Grand Rapids, Michigan Adopt-a-Dog

News Briefs---

Making a Case for Transparent Accounting Information

Embraer Wins 150 Orders as ILFC, SkyWest Buy Newest Jets

At Paris Show, Some Signs of Renewed Demand for Big Jets

The Lending Chill is Gone

Burlington, VT, Lease Default Slows Credit Rating

Huntington Expands Auto Dealer Financing Business into Connecticut

SolSolutions sees market opportunity portable solar generators

Jack in the Box closing 67 Qdoba stores

Napa wine executive accused of embezzling $900,000

Obama Says Bernanke Has Stayed at Fed ‘Longer Than He Wanted’

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

| Working Capital Loans $10,000-$250,000 | |

|

|

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives---June 18, 2008

GreatAmerica gets flooded out!

Great American---before

(Photo: GreatAmerica.com)

Last Wednesday, in the bottom left hand corner you will see the Great America building surrounded/flooded with water.

(Photo Courtesy: Daryl Warmbrand, Pyramid Leasing)

If you were on our mailing list you received a report from

from Rosanne Wilson, CLP, 1st Independent Leasing, Inc. :

"GreatAmerica was smart enough to have set up a complete backup system at a remote location. They are still approving deals for me and are still funding. They had hoped they would never have to test this system, but are delighted it worked! They won't be able to get Fed Ex or UPS deliveries or even Mail but are funding off of faxed documents! God Bless them."

(From a news article on GreatAmerica web site:

http://www.greatamerica.com/images/NewsImages/GreatAmerica_Bucks_Trend.pdf )

GreatAmerica President Tony Golobic sent out a press release:

"We are continuing to operate and serve our customers with minimal interruption," said GreatAmerica CEO Tony Golobic. "Our primary concern is for the safety and well- being of our employees and uninterrupted service to our customers."

GreatAmerica has moved to pre-arranged emergency office space until their building becomes available. With each new day, GreatAmerica is getting closer to normal operating levels and will continue to expand its temporary accommodations to return to full capacity.

"Each day, GreatAmerica proves that its extraordinary and resilient people are rising to the occasion and proving that we are more than just a physical location," Golobic said. "A disaster like this would have caused a serious blow to many organizations, but we are proving our mettle and winning the battle."

In a previous interview, Chris Walker, CLP, who heads sales for the "broker" direct program group, told Leasing News no one in the building has an office, even the president. Everyone shares communication in open environment. This is done to give their customers access to decision makers."

Perhaps this style was helpful in the move to a back-up facility.

Today

Tony Golobic Receives Leasing News Person of Year Award

Presented by Bruce Kropschot

Tony Golobic, CEO, Bruce Kropschot, Leasing News Advisor

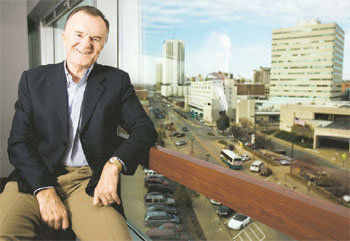

Tony Golobic, CEO, GreatAmerica Financial Services received the 2012 Leasing News Person of the Year engraved Crystal Award at the Don Cesar Hotel, St. Pete Beach, Florida, from Leasing News Advisor Bruce Kropschot, Senior Managing Director and Merger & Acquisition Advisory Practice Leader, The Alta Group. Bruce drove up from his home in the Villages with his wife Barbara, about half way from the Golobic's home in Florida, and they had lunch with Tony and Magda Golobic.

(Design, actual crystal award is engraved, difficult to read in jpeg)

Leasing News Advisory Board chose Mr. Golobic "For outstanding leadership and direction, particularly recognizing the management and staff in divisions of executive leaders, office of the president, senior leaders, managing directors, sales leaders, and the various departments of finance/treasury, legal, HR, information technology, corporate communications/Marketing.

http://www.greatamerica.com/about/executive-bios/default.aspx"

Leasing News appreciates Bruce and his wife as well as the Golobics for the photograph.

Leasing Person of the Year Article:

http://leasingnews.org/archives/Jan2013/1_07.htm#poy

Bookmark us

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois

Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

One Out, Another Getting Out, Not the Third

Convictions of Lease Theft

James M. Horton, 2006

June 6, 2006 James M. Horton, then 54, Grand Rapids, Michigan, former president of CyberNet plead guilty to four felony counts: criminal conspiracy, bank fraud, money laundering and attempting to conceal the whereabouts of $700,000 in fraud proceeds. In the Cybernet scandals, Only $4 million in assets were found with over $114 million in liabilities, many for computers that did not exist. An auction on CEO and founder Bart Watson wine collection and personal items raised over $1 million. He had committed suicide in his wine collection at his Ada township in 2004.

Horton was sentenced this date in 2006 for ten years and with good behavior, was released from federal prison last year (September 28, 2012 at the age of 62).

April 15, 2013, Legal News Editor Attorney Tom McCurnin wrote about U.S. Bankruptcy Judge Jeffrey Hughes added an estimated $9 million to an earlier judgment that calls on Huntington Bank to pay $72 million to victims of the CyberNET 2004 Ponzi scheme (1)

LifeCare LPV 120

Another person getting off for good behavior is Bruce Donner, 53, getting out of prison on August 1st. He was at the Canaan Penitentiary until this month and is now CCM Community Corrections Office in New York so it may be house arrest for his last month.

Donner was the owner of Donner Medical Marketing, who executed over $135 million dollars in phony vendor invoices for Charles Schwartz's Allied Health Care Services. He plead guilty to crimes carrying a maximum penalty of 20 years in prison and a fine of $250,000 or twice the gross gain or loss from the offense. He was sentenced March 12 to 18 months in prison by Judge Susan D. Wigenton. But with time served before the trial as well as good behavior he's getting out early. (2a,b)

(Mug shot: Essex County Corrections Facility)

As for Charles Schwartz, he supposedly lost everything, received 16 years and three months, as well as being ordered to pay $80 million in restitution for fraud, as well as to forfeit $75 million regarding $135 million in phony leases. He is at FCI Fort Dix and is scheduled not to get out until 2024.

(1) Huntington Bank Hit with $81 Million Judgment

Check Kite Crashes into El Camino Resources

http://leasingnews.org/archives/Apr2013/4_15.htm#huntington

(2a) Bruce Donner Release Date

http://www.leasingnews.org/PDF/BruceDonnerReleaseDate_62013.pdf

(2b) FBI Press Release on Donner Plea:

http://www.leasingnews.org/PDF/DonnerFBIPressRelease_62013.pdf

Swindled List of banks, et. al.

http://leasingnews.org/archives/Aug2010/8_26.htm#allied_alert

Allied Health Care Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Sheldon Player is a Player at the Tables

---While E.A.R. Bankruptcy Goes On and On!

(Reportedly Player's favorite game on the Riverboat Casinos)

Equipment Acquisition Resources, Inc. Bankruptcy Petition #: 09-39937 filed on October 23, 2009, a major hearing will be held today, June 18, 2:00pm, Central Time, Courtroom 6, US Bankruptcy Court, Northern District of Illinois, Eastern Division, 219 South Dearborn Street, Chicago, Illinois 60604.

There are 29 pages regarding 21 status hearings, 18 DM Adversary Proceedings, and one conclusion/Administrative matter, which is noted will be continued to the next omnibus status date of July 23, 3013.

Both Leasing News and Lease Police sent out warnings and alerts, including the fact of Player’s conviction for pulling the same stunt with Greyhound Leasing, where he served time in a federal penitentiary.

What is reminded here is not only the loss of money, but the administrative cost of executive time and attorney fees, as the cases wind through the bankruptcy court, settled disputes between creditors and debtors through the process as the main culprit remains free with a lot of cash and certainly continuing to enjoy his lifestyle.

Omnibus Hearing (29 pages):

http://www.leasingnews.org/PDF/OmnibusHearing_6182013.pdf

Those Notified of Hearing (12 pages):

http://www.leasingnews.org/PDF/ThoseNotifiedOmnibus_6182013.pdf

His Favorite Game: Roulette

http://leasingnews.org/archives/Oct2012/10_05.htm#roulette

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Can Small Business Rely On Community Banks?

(Reprinted with permission from Optirate-

Strategy Consultants to Banks & Credit Unions)

"Res Ipsa Loquitur" – Let the Facts Speak For Themselves.

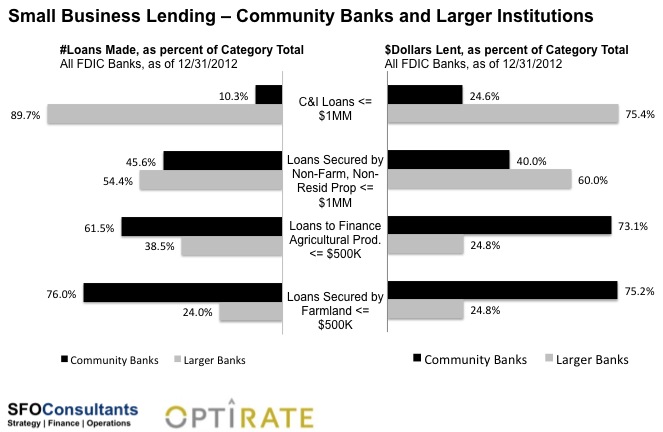

Numerous news stories and common folklore continues to tell us that Community Banks are the lifeline of financial support for small business. The Independent Community Bankers of America tells us that Community Banks provide 60% of all Small Business Loans.

A recent article in “Bank Investment Consultant” publication stated that Community Banks are “making hefty commitments” to Small Business Lending and quoted a Community Bank executive stating that “Small-business lending is a rounding error at big banks” but a “livelihood” for Community Banks.

Truth be told, on the surface this seems plausible. Yet, we decided to do a bit of fact-checking, and you will not be surprised that certain industry organizations, publications and executives have been taking “poetic license” to describe reality.

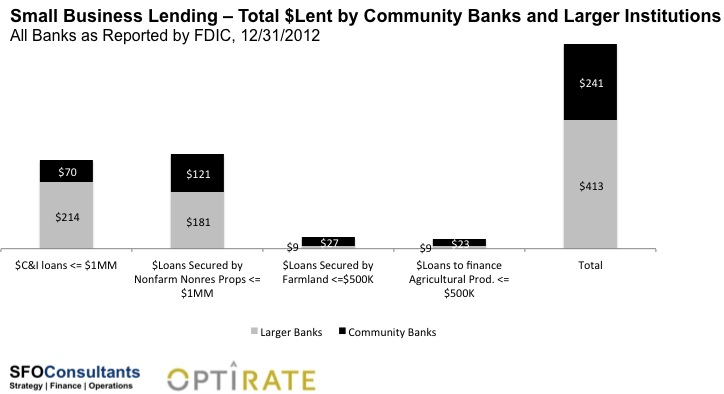

According to FDIC, 37% of Small Business Lending is provided by Community Banks. As the chart below shows, Community Banks (those with assets of less than $1 billion) dominate Farmland and Agricultural Lending categories, but taken together these categories total less than $70 million. Community Banks were responsible for just 25% of total commitments of Small Business Commercial & Industrial loans and 40% of Small Business Nonfarm/Non-Residential Loans.

The chart below compares the total Number of Loans Made with the Total Amounts Lent by subcategory of Small Business Lending.

For Commercial & Industrial Loans, Community Banks were responsible for 25% of all dollars lent but accounted for just ~ 10% of Loans by volume. This suggests that Community Banks, on average, made much larger Commercial & Industrial Loans than Larger Banks, which of course, is contrary to the commonly held belief that Community Banks are willing to make smaller loans to accommodate Small Business borrowers.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

What is a Finance Lease?

The term finance lease was introduced in 1955 when the IRS issued the first revenue ruling for leasing RR55-540. It represented a transaction that the IRS determine not to be a lease because the “intent” of the two parties to the lease, the Lessee and Lessor, was to create a disguised conditional sales contract (a loan) evidenced by a structure that included a bargain purchase option or allowed the Lessee to use the equipment for its complete useful life meaning the Lessor could no longer use it. Hence a transaction like this looked like a loan so it looked like a financing not a lease.

Then in 1975 when the Financial Accounting Standards Board created SFAS #13 accounting for leases they began to use the term “Direct Finance Lease” to classify a lease for a three party Lessor that meet one of the requirements of paragraph 7. A direct finance lease broke the transaction into depreciation and interest expense. This totally disregards the legal or tax issues and only looks at the economic structure of the lease. Therefore a true tax lease (not a finance lease) could be classified to look like a loan even though the lessee had no right to purchase the equipment at lease termination.

Then in 1988 with the introduction of Article 2A for the Uniform Commercial Code (UCC) the legal profession decided to call the three party legal lease a Finance lease where the Lessor is not held responsible for equipment performance providing the Supply Contract (Vendors warrantees and guarantees) is passed through to the Lessee in the lease agreement.

The term money over money was used by many Lessors’ in the early days because it was clear that if the only return was cash then no tax issues were involved so it was a disguised sale. While this is acceptable for tax issues it still left open the question; is it a legal lease? Also there is a term use in legal to describe a lease that is not an Article 2A lease and therefore is covered by Article 9 that is a “lease intended as a security”. A fancy term meaning it’s a loan not a lease.

Therefore we needed a term that would describe a transaction that fails all the rules and is in fact a financing or a conditional sales contract so we chose “Non-lease Lease” because it describes a transaction that is not a lease but for contract purposes is placed on a lease agreement.

Today it is usually referred to as a "capital lease," meaning the lessee capitalizes the lease, takes the depreciation, although legally the owner of the equipment is the lessor. In an Equipment Finance Agreement, referred to in the industry as "EFA" (pronounced E.F.A.) the owner of the equipment is the debtor and the lender is the creditor. It basically is a loan secured by the equipment.

These types of agreements were popular fifty years ago when most required 25% deposit, as well as were shorter terms, 24 to 36 months, and many states required the APR interest rate be declared on the contract. As leasing became more popular with little money up front and longer terms, the actual rate not declared on contracts, finance agreements were slow to change as the basis of the credit was generally on collateral with the fact the equipment had a long life and the borrower main thrust was to own the equipment. (The leasing philosophy was, " It is not ownership that makes a profit, but the use of modern equipment.")

Particularly in the small ticket marketplace, EFA's appears to have become popular forms of financing today with businesses than a "Finance Lease" due to no "fair market" balloon payment at the end as well as Evergreen clause abuse (additional payments imposed). From a lessors viewpoint, it is similar to a "Finance Lease," but less responsibilities, including warranty or equipment use disputes.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

Small Ticket Leasing Sales Reps |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

“Follow-Up After Sending Resume”

Career Crossroad---By Emily Fitzpatrick/RII

Question: Most of these ads on the internet, say to email or fax a resume. How do you suggest I follow up, by email or telephone, and then what, as for an interview or ask more about the job?

Answer: When making your follow-up call, your goal should be to arrange a time to discuss potential employment via phone and/or to arrange a face-to-face interview, if that is possible.

Don’t be afraid to follow-up, as the email may not have reached the right party, or they may waiting to collect a group of resumes.

You definitely should follow up, but not expect to hold anyone’s attention for an extended period ---so you need to be brief yet thorough. You want to be vague enough to encourage questions. Be able to paint a representation of your skills in broad-brush strokes with examples of your accomplishments.

You need to grab their attention, interest, and desire to know more about you and encourage them to take action. In general, you want to generate an open dialogue and give a brief introduction of yourself. This should include a vague and generalized description of your duties and responsibilities. Secondly, you want to generate some interest by identifying a few of your accomplishments, and finally, request an interview.

-

Results of your call will either lead to the employer:

-

Agreeing to an interview, via phone or even video conference

-

Or Agreeing to meet with you

-

Asking a series of questions

-

Giving you objections –And be prepared to handle these

Definitely follow-up, as that may be one of the qualifications the company is looking for---taking initiative!!!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

Small Ticket Leasing Sales Reps |

[headlines]

--------------------------------------------------------------

Wells Fargo Equipment Finance Gets Derailed in

Train Lease Litigation

By Tom McCurnin

Leasing News Legal News Editor

Perfectly Drafted Lease and Assignment to Lessor Results in Surprising Loss at Trial. Case Pits Equities of Case Against Strict Reading of Lease Terms.

Wells Fargo Equipment Finance v Titan Leasing 2012 WL 6184896 (D. Ill. 2012).

It’s not often that the equipment lessor has a perfectly drafted lease and the assignee has a marvelous assignment, and the Court uses those perfectly drafted documents against the assignee.

Today’s case and the resulting decision came as a surprise to me. While the equities were clearly on the Bank’s side, a technical reading of the lease documents resulted in the lease assignee losing against the assignor. This is especially surprising because there was a no default clause (the assignor represents that the lease is not in default) and a representation of delivery and acceptance by the lessee. The lessee had never made a payment and at least from the lessee’s perspective, had never received, nor accepted the equipment. Yet the Court seemed to ignore those facts and ruled on the basis of the written lease and assignment. The facts follow:

Wells Fargo Equipment Finance was an assignee of a railroad locomotive lease, having been assigned that lease from Titan Leasing.

Titan Leasing was the original lessor, having leased the locomotive to Gerdau Ameristeel for use in its Knoxville, Tennessee location in May 2008. The lease had an unusual, but critical provision—the shipment of the locomotive was deemed acceptance of the equipment under the lease. So whether the equipment was late in receipt or defective did not matter. According to the lease, payments were to start upon receipt of possession. So far, so good.

But problems with the transaction happened almost immediately from the signing of the original lease. The locomotive was towed with its brakes on, resulting in massive damage and a several month delay before it could be delivered. In addition, the lessee wanted a remote control unit on the locomotive, and it was sent to a train repair depot for further outfitting. It took a full 9-10 months to repair the locomotive, so it was not delivered for further outfitting until March, 2009. The train depot wanted the locomotive out of its yard, and reluctantly, the lessee took possession of the unit in August, 2009, and it was still not functioning. The lessee became quite sick of the delay, and simply cancelled the lease for lack of delivery in late 2009.

In the midst of this debacle, the lessor Titan assigned the lease to Wells Fargo Equipment Finance in March 2009. The assignment was without recourse, but had some modest representations and warranties as to receipt of the equipment and no default under the lease, mentioned above. Again, so far so good.

What Wells Fargo didn’t know is that the equipment had not yet been delivered by the lessor Titan--- and that Titan and the lessee were in a dog fight over delivery and repairs. Did Titan have a duty to inform the Bank that the equipment had not been actually delivered and might not be in the near future? Ethically, yes. Contractually, no. So Wells Fargo Equipment Finance was in dark on this one.

When the Bank finally figured out that the locomotive had not been delivered, the lessee voluntarily allowed the Bank to repossess the locomotive in June 2010. The Bank filed suit against the lessor and assignor Titan for breach of two representations and warranties: (1) That the equipment had been delivered and accepted (it had not per the lessee); and (2) The lease was in default (payments were to commence upon possession, and the Bank knew the lessee had possession of the locomotive as of late 2009.

The trial court, a United States District Court judge made two unusual findings.

First, on the issue of acceptance and receipt: the Bank argued that the assignor Titan represented and warranted the lessee’s acceptance and argued that the equipment had not been delivered nor accepted at the time of the assignment. That part was true vis-a vis the lessee. However, the Court looked at the lease and discovered that acceptance occurs upon shipment of the locomotive, and that the lessee had the opportunity to inspect prior to shipment, a right apparently not exercised by the lessee. Therefore, there had been acceptance under the lease. Wells Fargo lost that argument.

Second, on the issue of default: the Bank argued that as of the date of the assignment, the lessee had not made any payments and therefore the lease was in default. That was true. But the Court again went to the lease and pulled out an obscure clause that payments were not to commence until possession. Thus, no payments were due as of the date of the assignment, and the lease was not in default. Wells Fargo also lost that argument.

As a result of the two arguments, Titan’s motion for summary judgment was granted, and the Bank’s motion for summary judgment was lost. Titan obtained a Judgment for the defense against the Bank.

While the ruling was surprising to me, it was not so out of context as to be a complete shock. Federal Judges are more swayed by documents than by emotions and appeals to equity. This decision might have gone the other way in a local State Court. It was also a bit of a role reversal to see an equipment lessor like Wells Fargo argue against the language in the documents for which it had bargained. That’s a tough argument for any financial institution to make. To Titan’s credit, its lawyer, Lawrence A. Stein, at Huck Bouma PC in Wheaton, Illinois, stayed focused like a laser beam on the lease documents. His papers rarely exceeded three pages.

There are some anomalies with this decision, summarized below:

First, on the issue of acceptance, if the lease was accepted upon shipment as the lease states, does not that mean that the lessee is deemed to be in possession? Isn’t acceptance and possession the same thing? I guess not.

Second, a search of PACER did not reflect any suit by Wells Fargo against the lessee. If the Court is correct about acceptance, and the lessee in fact received possession of the locomotive later in 2009, doesn’t that mean that the payments were to commence? Perhaps the Bank simply didn’t want to sue the lessee for policy reasons.

Third, for any lease that it deserving of being assigned as collateral, a simple “Estoppel Agreement” with the lessee is recommended. In this type of agreement, the lessee represents and warrants that it has received the equipment in good working order and has no claims of offsets to the original lessor. This form of agreement can be as short as a one page.

The bottom line to today’s case is that when an assignor takes a lease as collateral for a loan, especially a non-recourse assignment, the terms of the lease should be carefully scrutinized, and a lessee’s estoppel agreement should be part of the documentation paperwork. It’s a simple one page agreement, that the assignor should cheerfully provide as a condition of receiving the assignment proceeds.

Wells Fargo Train Case:

http://www.leasingnews.org/PDF/WellsFargoEquip_62013.pdf

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Largest remaining banks & thrifts in TARP

By Aarti Kanjani, SNL Financial

![]()

Columbus, Ga.-based Synovus Financial Corp. and Hato Rey, Puerto Rico-based Popular Inc. — two of the 50 largest publicly traded banks and thrifts in the U.S. — continue to have TARP outstanding, with Synovus still owing the largest outstanding TARP investment of $967.9 million.

Looking at the exit plans of the major TARP holders, Synovus expects TARP repayment will likely occur during the third quarter of 2013. Its unit, Synovus Bank, on April 26 entered into a $30 million senior unsecured term loan agreement with BNC Bancorp, which helped BNC redeem $31.3 million in TARP funds.

"Actions drive us closer to TARP exit in the most shareholder-friendly fashion," Popular Inc. said in a Form 8-K filed April 30.

No. 4 on the list of the largest TARP holders as of June 3, Cathay General Bancorp, said March 20 that it has paid the U.S. Treasury $129 million, plus accrued and unpaid dividends, to redeem 50% of its outstanding series B preferred stock issued under the TARP Capital Purchase Program.

Of the five largest TARP holders among U.S. public banks and thrifts as of Feb. 10, 2013 — SNL's previous examination of the matter — Flagstar Bancorp Inc. and Citizens Republic Bancorp Inc. have since exited the plan. Citizens was the third-largest TARP holder in SNL's previous analysis, with an investment of $300 million. It sold to FirstMerit Corp. on April 12, and FirstMerit purchased from the Treasury all of the outstanding shares preferred stock originally issued by Citizens, including all accrued but unpaid dividends, for a purchase price of approximately $355 million.

Flagstar was the fourth-largest holder of TARP funds in SNL's prior analysis. In an auction that commenced June 3, the Treasury auctioned its warrant positions in the company. It held $266.7 million in TARP. It was previously dropped from a Treasury auction, after the thrift announced an unfavorable court ruling.

Other notable exits since Feb. 10 include United Community Banks Inc. and Old Second Bancorp Inc., the TARP for which was auctioned June 3.

NewBridge Bancorp on May 2 issued notices to redeem 37,372 shares of the company's 52,372 outstanding shares of series A preferred stock issued under TARP. The Treasury on April 18 held an auction to sell all of its TARP investment in the company's series A preferred stock. The sale was settled April 29. As a result, the company is no longer subject to the rules and regulations of TARP. As of Feb. 10, 2013, the company was the 11th-largest TARP holder.

To date, Treasury has recovered $271 billion through repayments, dividends, interest and other income, compared to the $245 billion initially invested through TARP, according to the department's June 6 report.

The Treasury has held 16 rounds of auctions. Its losses spiked in auction 14; the aggregate discount fell to 8.95% in auction 15. Pricing continued to improve in the latest auction, resulting in an 8.26% aggregate discount.

[headlines]

--------------------------------------------------------------

Regulators take 4th chunk of Capitol Bancorp franchise

By David Hayes and Lindsey White and Tahir Ali

SNL Financial

Capitol Bancorp Ltd. has repeatedly warned that the failure of one unit could bring down the entire franchise. As of June 6, regulators had seized four of the company's subsidiaries in the space of a month.

The North Carolina Office of the Commissioner of Banks closed Asheville-based Pisgah Community Bank on May 10, and shortly thereafter the Georgia Department of Banking and Finance shut down Valdosta-based Sunrise Bank.

Pisgah Community Bank, Ashville, North Carolina May 10, 2013

http://leasingnews.org/archives/May2013/5_13.htm#bank_beat

Sunrise Bank, Valdosta, Georgia May 10, 2013

http://leasingnews.org/archives/May2013/5_13.htm#bank_beat

In a rare Tuesday failure, the Arizona Banking Superintendent seized Scottsdale-based Central Arizona Bank on May 14. FDIC spokesman Greg Hernandez told SNL that the bank was scheduled to be closed by the state regulator May 10, but the closing was delayed through a legal challenge.

Central Arizona Bank, Scottsdale, Arizona May 14, 2013

http://leasingnews.org/archives/May2013/5_15.htm#wef

State regulators also attempted to close North Las Vegas, Nev.-based 1st Commerce Bank on May 10, but the bank fended them off with a temporary restraining order. The FDIC stepped in and closed 1st Commerce on June 6.

1st Commerce Bank North Las Vegas, Nevada June 6, 2013

http://leasingnews.org/archives/May2013/5_15.htm#wef

All four failed banks were small — as of March 31, Pisgah had $21.9 million in assets and $21.2 million in deposits; Sunrise Bank had about $60.8 million in total assets and $57.8 million in total deposits; Central Arizona had roughly $31.6 million in assets and $30.8 million in deposits; and 1st Commerce had about $20.2 million in assets and $19.6 million in deposits. All four had significant concentrations of commercial real estate loans.

North Carolina's Interim Commissioner of Banks seized Pisgah after the bank failed to come up with a recapitalization plan that did not rely on injections from its holding company. In an Order Taking Possession, the commissioner called the bank's problems "permanent and irremediable."

"Since May 2010, the officers and directors of the Bank have been aware of the problems and deficiencies and have not made appropriate corrections," the order stated.

Pisgah had a 2.48% leverage ratio March 31. At 2.44%, 1st Commerce Bank's was even lower. Among Capitol's remaining subsidiaries, Sunrise Bank of Arizona had a leverage ratio of 2.27% March 31. Bank of Las Vegas, the unit Capitol was seeking to merge with 1st Commerce, had a leverage ratio of 2.21% at the end of the first quarter.

After state regulators appointed the FDIC receiver, Rockville, Md.-based Capital Bank NA, a unit of Capital Bancorp Inc., assumed all of Pisgah's deposits and approximately $19.8 million of its assets.

Columbus, Ga.-based Synovus Bank, a unit of Synovus Financial Corp., assumed about $54 million in deposits from Sunrise Bank and purchased about $13.2 million of the failed bank's assets.

On May 14, Devils Lake, N.D.-based Western State Bank, a unit of Western State Agency Inc., assumed all of the deposits and purchased essentially all of the assets of Central Arizona Bank.

The FDIC signed a purchase and assumption agreement with Irvine, Calif.-based Plaza Bank to acquire all the deposits and essentially all the assets of 1st Commerce Bank on June 6. Plaza Bank is a unit of PB Holdings Inc., whose ownership is shared by funds affiliated with Carpenter Bank Partners Inc.

When the first Capitol Bancorp subsidiary went down, the FDIC declined to comment on whether a failure would trigger cross-liability claims against other Capitol units. "We wouldn't comment on the other institutions, as they are open and operating. And we also wouldn't comment on potential enforcement action," FDIC spokeswoman LaJuan Williams-Young told SNL on May 10.

Capitol Bancorp has warned that the failure of any of its subsidiary banks would have "disastrous consequences."

"If even a single subsidiary bank were to be seized by the FDIC, it is likely that the FDIC would assert cross guarantee claims against the Company's solvent subsidiary banks, thereby crippling these subsidiary banks as well," Capitol Bancorp said in a June 2012 filing.

of Capitol Bancorp units continue to operate. Greg Dingens, executive vice president and head of investment banking at Monroe Securities, said regulators continue to knock off the worst of Capitol Bancorp's subsidiaries but still have not decided to exercise their cross-guaranty rights. He called this a wise strategy, given the situation and the company's unique ownership structure.

"My guess is [regulators] keep doing something like this until they feel like moving on the entire organization makes sense, but they haven't gotten to that point yet," Dingens told SNL.

Cross-guaranty claims have toppled entire franchises in the past. Andrew Christians, vice president at Donnelly Penman & Partners, gave the example of Oak Park, Ill.-based FBOP Corp., which saw nine of its banking units shuttered in one day in 2009. U.S. Bancorp assumed all deposits and most assets of the failed banks.

Of course, there are differences between the two situations. "When FBOP failed, granted, it was [several] years ago, it was much larger, the economy was in a different place, and its geographies were quite a bit different at the subsidiary banks," Christians said.

Capitol Bancorp's ownership structure is also different, and some observers say it may be preventing the FDIC from taking more sweeping action. The company has partial ownership in several banking units spread across the U.S.

Dingens said the FDIC is "breaking their own rules a little bit" to give local investors in Capitol Bancorp's subsidiaries a chance to recapitalize and get out from underneath the holding company ownership. "They're not penalizing the local investors for the sins of the parent as quickly as they might otherwise," he said.

Christians suggested that the FDIC may be in the process of looking for interested buyers for Capitol Bancorp's remaining banking units. "A lot of folks like certain parts of the franchise but don't like the entire franchise. It's a very convoluted structure," he said, adding that the FDIC may be "dragging their feet" on the cross-guaranty liability because of a lack of buyers.

Lansing, Mich.-based Capitol Bancorp has struggled to raise capital for years, restructuring and selling off a number of parts in the process. In August 2012, the company filed for a prepackaged Chapter 11 bankruptcy reorganization in the U.S. Bankruptcy Court for the Eastern District of Michigan, but various challenges forced it to scrap that plan.

In February, the court granted approval for an interim emergency motion by Capitol Bancorp to pursue a $1 million loan to prevent the possible imminent seizure of its Sunrise Bank of Albuquerque unit. Bankruptcy counsel for the company warned that Capitol Bancorp's other banking units "probably would go under" if Sunrise Bank of Albuquerque failed and the FDIC asserted cross-guaranty liabilities.

In a Form 10-Q filed May 15, Capitol Bancorp said it sold its remaining stake in Capitol National Bank in April. Capitol Bancorp said that proceeds from the sale are in escrow pending the issuance by the FDIC of a waiver of cross-guaranty liability. However, the company, in a Chapter 11 liquidation plan it proposed May 16, said the sales of its interests in Maumee, Ohio-based Bank of Maumee and Capitol National Bank remain "pending" and "are subject to regulatory approval and other significant contingencies."

"My understanding is that it's the FDIC's right, but not obligation, to seize other subsidiaries of the same holding company in order to try to recover their funds," Dingens said. "[The FDIC has] been exercising a judgment call and saying, 'I'd rather not take them all down, I'd rather give some of them a chance to be recapitalized independently.'"

Christians said the fact that the failure of four subsidiary banks has not toppled Capitol Bancorp suggests that the FDIC will continue closing one bank at a time, instead of taking down the entire franchise. "If they failed the holding company, I don't know if there would be one buyer for all those assets," Christians said. "So it might be in the best interest of everyone involved for them to allow the banks to continue to operate as community banks, until the time comes where they cannot or there's a capital solution in place."

In the wake of the four failures, Capitol Bancorp Corporate President Cristin Reid told SNL that the company will stay focused on finding positive solutions for its remaining affiliate banks.

[headlines]

--------------------------------------------------------------

Top Stories June 11-June 13

(You May Have Missed)

Here are the top stories opened by readers:

(1) Charlie Bancroft Passes Away

http://leasingnews.org/archives/Jun2013/6_11.htm#bancroft

(2) More on Capital One Raid SunTrust Staff

by Kit Menkin

http://leasingnews.org/archives/Jun2013/6_13.htm#more

(3) Capital One Equipment Finance

Terminates Specialty Vehicle

http://leasingnews.org/archives/Jun2013/6_13.htm#capone

(4) Archives---June 13, 2006

Bob Fisher Promoted to Executive Vice President

http://leasingnews.org/archives/Jun2013/6_13.htm#archives

(5) CapitalSource Healthcare Finance No Longer in Business

Readers Respond Why

http://leasingnews.org/archives/Jun2013/6_11.htm#readers

(6) Capital One Raids SunTrust to Beef Up Leasing Unit

http://www.americanbanker.com/issues/178_110/capital-one-raids-suntrust-to-beef-up-leasing-unit-1059721-1.html

(7) Leasing 102 by Mr. Terry Winders, CLP

Lease Format Chart

http://leasingnews.org/archives/Jun2013/6_11.htm#chart

(8) On Deck Crosses $500 Million Lending Mark

Increases Loan Amount & Funding Process One Day

http://leasingnews.org/archives/Jun2013/6_13.htm#on_deck_crosses

(9) Sales Makes it Happen by Steve Chriest

Vendor Hidden Issues

http://leasingnews.org/archives/Jun2013/6_13.htm#vendor

(Tie) (10) New Hires---Promotions

http://leasingnews.org/archives/Jun2013/6_13.htm#hires

(Tie) (10) ---Update: Leasing Companies Out of Business

plus No Longer taking Broker/Discounting Business

http://leasingnews.org/archives/Jun2013/6_11.htm#update

[headlines]

--------------------------------------------------------------

Classified ads—Asset Management

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277. Email: chris@dovermanagementgroup.com |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

Asset Management: NorthWest Sequent provides collateral recovery, remarketing, and storage services to lenders with assets located in the greater Pacific Northwest. Professional services at reasonable pricing. Contact rossr@sequentam.com |

Asset Management: Orange City, FL We help Lessors Liquidate un-wanted Assets valued at $750,000+. It's an effective method of Liquidating Assets such as Jets, Planes, Helicopters, Freighters, etc. Eric R. Sanders Tel 386-789-9441 www.ValuedAssetSales.com www.The-RandolphCapital.com EQPMNTLEASING@aol.com |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |  Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968 ecastagna@inplaceauction.com |

| Asset Management: South East US- AllState Asset Management Recovery, remarketing, inspections. 25 years experience, dedicated to deliver, prompt, professional services. Call Brian @ 704-671-2376. |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. www.testequipmentconnection.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email:Jamie@bulldogasset.com www.bulldogasset.com |

Asset Management: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested

and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

[headlines]

--------------------------------------------------------------

Australian Shepherd

Grand Rapids, Michigan Adopt-a-Dog

13-06-12-00115

“Buddy”

Male

Adult

Compatibility: Good with Most Dogs, Good with Kids and Adults

Personality: Very High Energy, Very Submissive

Health: Needs to be Neutered

“Buddy is a very good dog. We rescued him in Indiana when he was just a pup. We do not live on a farm and he needs to work and play! He is highly intelligent and follows any command. My husband works out of State and I am in Law School. Our children are grown. Buddy spends 24/7 on a run. It is unfair to keep him tied up but we have no choice. There is no fee for adoption we just want him to be happy and see that he has a good home.”

Contact: Amy Bouman 231-580-9449

eMail: http://editor.rescueme.org/

Michigan Dog Rescue

http://dog.rescueme.org/Michi

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Making a Case for Transparent Accounting Information

http://www.newswise.com/articles/view/604332/?sc=bwhn

Embraer Wins 150 Orders as ILFC, SkyWest Buy Newest Jets

http://www.businessweek.com/news/2013-06-17/embraer-said-to-win-order-for-upgraded-jets-from-lessor-ilfc

At Paris Show, Some Signs of Renewed Demand for Big Jets

http://www.nytimes.com/2013/06/18/business/global/big-jets-may-be-back-in-demand-with-economy.html?ref=business

The Lending Chill is Gone

http://www.crainsnewyork.com/article/20130616/SMALLBIZ/306169979

Burlington, VT, Lease Default Slows Credit Rating

http://www.bloomberg.com/news/2013-06-17/burlington-s-quest-for-fast-internet-slows-credit-rating.html

Huntington Expands Auto Dealer Financing Business into Connecticut

http://www.fortmilltimes.com/2013/06/17/2765025/huntington-expands-auto-dealer.html

SolSolutions sees market opportunity portable solar generators

http://www.northbaybusinessjournal.com/74679/solsolutions-sees-market-opportunity-in-diesel-regulations/

Jack in the Box closing 67 Qdoba stores

http://www.utsandiego.com/news/2013/jun/17/jack-box-closing-qdoba-stores/

Napa wine executive accused of embezzling $900,000

http://www.pressdemocrat.com/article/20130617/ARTICLES/13

Obama Says Bernanke Has Stayed at Fed ‘Longer Than He Wanted’

http://www.bloomberg.com/news/2013-06-18/obama-says-bernanke-fed-term-lasting-longer-than-he-wanted-1-.html

[headlines]

--------------------------------------------------------------

---You May Have Missed

DirecTV Wants Its $400 From Wiped-Out Colorado Fire Victim

http://www.deadline.com/2013/06/directv-fire-victim-400-bill/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Are You Able to Interpret Food Labels?

SparkPeople Nutrition Quiz

http://www.sparkpeople.com/resource/quizzes_start.asp?quizid=64

[headlines]

--------------------------------------------------------------

Baseball Poems

by Dan Zamudio

Bat boy

Steady

breeze rustles his

oversized uniform

as he kneels outside our home team

dugout

and waits

patiently for

the moment when both hands

will hold smooth pine still trembling from

a hit.

Confucius says

Only two things can last forever —

an old baseball mitt

with softened leather

and a double-header

delayed by

stormy weather.

Baseball Riddle

A ll professional

L eagues forbid its

U se.

M ade to be

I ndestructible.

N ever cracks.

U nfilled inside the

M iddle.

B aseball's

A ttempt to save

T rees.

Dan Zamudio is a Chicago writer and lifelong Cub fan who recently forced his tired girlfriend to take three rolls of action photos while he played catch with

[headlines]

--------------------------------------------------------------

Sports Briefs----

49ers strike deal with Yahoo to enhance stadium experience

http://blogs.sacbee.com/49ers/archives/2013/06/dear-mr-fantasy-49ers-strike-seal-with-yahoo.html

NFL roundup: Packers release LB Bishop

http://sports.yahoo.com/news/nfl-roundup-packers-release-lb-224027740--nfl.html

Bruin blank Blackhawks

http://www.boston.com/sports/hockey/bruins/2013/06/17/bruins-beat-blackhawks-lead-cup-finals/n9D2d1vwWas3eShRyHXHsJ/story.html

Chad Johnson freed after apology to judge

http://espn.go.com/nfl/story/_/id/9395324/chad-johnson-leaving-jail-apologizing-judge

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

San Jose Based Orchard Supply selling most of its stores to Lowe's

http://www.contracostatimes.com/breaking-news/ci_23477470/orchard-supply-files-bankrupcy-most-its-stores-going

Video of Guide Dogs trio escaping backwards-driving car goes viral

http://www.marinij.com/sanrafael/ci_23480481/video-guide-dogs-trio-escaping-backwards-driving-car

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Donkey & Goat " Winery Score Style Points

http://www.nytimes.com/2013/06/19/dining/10-california-wines-score-style-points.html?ref=dining

Bordeaux’s Vinexpo Wine Show Marred by Racist Bottle Attack on Chinese Student

http://www.ibtimes.co.uk/articles/479587/20130617/china-france-racist-attack-bottle-bordeaux-vinexpo.htm

Oregon sets standard for Northwest Pinot Gris

http://www.greatnorthwestwine.com/2013/06/13/oregon-pinot-gris/

Washington Pinot Gris on a rocketship

http://www.greatnorthwestwine.com/2013/06/12/washington-pinot-gris/

Francis Ford Coppola Explains His Passion For Wine

http://www.forbes.com/sites/larryolmsted/2013/06/17/qa-francis-ford-coppola-talks-about-his-passion-for-wine/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1621-The first duel of record took place between two servants of Stephen Hopkins, one of the leaders of the Plymouth Colony. Governor William Bradford’s decision was rendered as follows: “The Second Offense is the first Duel fought in New England, upon a Challenge at Single Combat with Sword and Dagger between Edward Dotey and Edward Leister, Servants of Mr. Hopkins; Both being wounded, the one in the Hand, the other in the Thigh; they are adjug’d by the whole Company to have their Head and Feet tied together, and so to lie for 24 hours, without Meat or Drink; which is begun to be inflicted, but within an Hour, because of their great Pains, at their own and their Master’s humble request, upon Promise of better Carriage, they are Released by the Governor.”

1778-The British Redcoats evacuate Philadelphia. After almost nine months of occupation, the fifteen thousand British troops under Sir Henry Clinton evacuate Philadelphia, the former US capital. The British position in Philadelphia had become untenable after France’s entrance into the war on the side of the Americans. In order to avoid the French fleet, General Clinton was forced to lead his British-Hessian force to New York City by land. Other loyalists in the city sailed down the Delaware River to escape the Patriots, who returned to Philadelphia the day after the British departure.

http://www.wpi.edu/Academics/Depts/MilSci/BTSI/abs_phila.html

1812-A after much debate in Congress between “hawks” such as Henry Clay and John Calhoun, and “doves” such as John Randolph, Congress issued a declaration of war on Great Britain on this day. The action was prompted primarily by Britain’s violation of America’s rights on the high seas and British incitement of Indian warfare on the frontier. War was seen by some as a way to acquire Florida and Canada. The hostilities ended with the signing of the Treaty of Ghent on Dec 24, 1814, at Ghent, Belgium. ( lower half of: http://memory.loc.gov/ammem/today/jun18.html )

1811-The term Coodies came into the American language. The term Coodies was applied derisively to the faction of the Federalist Party that urged support for the War of 1812, a position highly unpopular with the majority of the party and the population of America, who did not want to go to war. The term derived from the series of pro-war articles written by Gulian Crommelin Verplanck, under the

pen name Abimeleck Coody. Verplanck was a distinguished editor, author, and Shakespearean scholar. People who were pro war were considered to have the Coodies. The epithet King Coody was applied to Rep. Roger Brooke Taney of Maryland, later chief justice of the Supreme Court.

1812-After much debate in Congress between “hawks” such as Henry Clay and John Calhoun, and “doves” such as John Randolph, Congress issued a declaration of war on Great Britain. The action was prompted primarily by Britain’s violation of America’s rights of the high seas and British incitement of Indian warfare on the frontier. War was seen by some as a way to acquire Florida and Canada. The hostilities ended with the sign of the treaty of Ghent on December 24, 1814, Ghent, Belgium.

1836-- Cynthia Ann Parker, a blue-eyed blonde Caucasian woman, was captured by the Comanche at age nine. When U.S. soldiers found her four years later in a Comanche camp where she was living under the name "Prelock," she refused to return. She said she was happy living as a Comanche. ///In 1860 she and her infant daughter were captured in a U.S. army raid and was forcibly detained. She was sent to Parker's father. The infant died soon after capture and Prelock died in 1864, according to legend, by starving herself to death longing to go back to the Comanche way of life. ///Her eldest son Quanah became chief of the Kwahadi tribe which held out against the white man. Some called him the most ferocious Indian who ever lived. In 1875 he suddenly brought his people in and settled near the Wichita Mountains in Oklahoma and saw to it that Comanche children went to school and were educated.

1848-Captain Charles Welsh arrived in San Francisco. He was to build the first brick house in North Beach. A street was later named for him.

1848-Captain Charles Welsh arrived in San Francisco. He was to build the first brick house in North Beach. A street was later named for him.

1851-The grant or patent of the "Suisun Rancho," was made for military services of Francisco Solano, Indian chief, and a Mexican citizen.

1855, Abby Leach who in 1879 was one of the first women to be enrolled in the Harvard annex, the precursor of Radcliffe College. Later she became head of the Greek Department and very active during Vassar's formative years.

1857-birthday of Henry Clay Folger, Jr., American businessman and industrial who developed one of the finest collections of Shakespearna in the world and bequeathed it ( The Folger Shakespeare Library, Washington, DC) to the American people. Born at New York, NY. Died June 11, 1930, at Brooklyn, NY. http://search.biography.com/print_record.pl?id=14824

1863 - After repeated acts of insubordination, General Ulysses S. Grant relieves General John McClernand during the siege of Vicksburg.

1864-At Petersburg, Grant ends 4 days of assaults.

The pontoon bridge serves to bring supplies, but no victories.

http://www2.cr.nps.gov/abpp/battles/va098.htm

http://members.aol.com/siege1864/richpete.html

1864 - Union war hero Joshua Lawrence Chamberlain is severely wounded at Petersburg, Virginia, while leading an attack on a Confederate position. Chamberlain, a college professor from Maine, took a sabbatical to enlist in the Union army. As commander of the 20th Maine, he earned distinction at Gettysburg when he shored up the Union left flank and helped save Little Round Top for the Federals. His bold counterattack against the Confederates earned him the Congressional Medal of Honor. His wound at Petersburg was the most serious of the six he received during the war. Doctors in the field hospital pronounced his injury fatal, and Union General Ulysses S. Grant promoted him to brigadier general as a tribute to his service and bravery. Miraculously, he survived and spent the rest of the Petersburg campaign convalescing at his Maine home. He returned to the Army of the Potomac in time for Lee's surrender at Appomattox, and he was given the honor of accepting the arms of the Confederate infantry. Chamberlain returned to Maine after the war and served four terms as governor. He then became president of Bowdoin College—the institution that had refused to release him for military service—and held the position until 1883. Chamberlain remained active in veterans' affairs and, like many soldiers, attended regimental reunions and kept alive the camaraderie created during the war. He was present for the 50th anniversary of Gettysburg in 1913, one year before he died of an infection from the wound he suffered at Petersburg.

1873 - Susan B. Anthony is fined $100 for attempting to vote for president.

1877 - birthday of James Montgomery Flag, Pelham Manor, New York, creator of the illustration of Uncle Sam.

http://memory.loc.gov/ammem/today/jun18.html

1878 - The 45th Congress enacted a rider on an Army appropriations bill that became known as the Posse Comitatus Act [Chapter 263, Section 15, U.S. Statutes, Vol. 20.] This act limited active-duty military involvement in civil law enforcement leaving the Revenue Cutter Service as the only military force consistently charged with federal law enforcement on the high seas and in U.S. waters and the militia, later to become the National Guard, available for such duty. The rider prohibited the use of the Army in domestic civilian law enforcement without Constitutional or Congressional authority. The use of the Navy was prohibited by regulation and the rider was amended in 1976 outlawing the use of the Air Force. In 1981, however, new legislation allowed the Secretary of Defense to bring Army, Navy, Air Force and Marine Corps support to civilian authorities in intelligence, equipment, base and research facilities, and related training.

1892- Macadamia nuts first planted in Hawaii; became a major export item throughout the world

1900--Birthday of author Laura Z. Hobson - wrote revolutionary novels about social injustices. Gentleman's Agreement dealt with anti-Semitism, Tenth Month, on unwed motherhood, Consenting Adult, on homosexuality.

1906-birthday of Kay Keyser, American bandleader whose band, “ Kay Kyser’s Kollege of Musical Knowledge” enjoyed immense popularity tin the swing era. He was born James King Kern Kissers in Rocky Mount, NC. A shrewd showman and performer, he said he never learned to read music or play an instrument. Among his hit recordings were “ Three Little Fishes,” and “ Praise the Lord and Pass the Ammunition, “ a World War II favorite. Kyser retired from show business in 1951 and died at Chapel Hill, SC, July 23, 1985.

1909-drummer Ray Bauduc born New Orleans, LA.http://www.angelfire.com/mac/keepitlive/drummers/Baudue/bauduc.htm

http://www.parabrisas.com/d_bauducr.html

http://www.parabrisas.com/d_bauducr_f.html

1910-drummer Ray McKinley, born Ft. Worth, Texas.

http://americanhistory.si.edu/archives/d5635b.htm

http://www.angelfire.com/mac/keepitlive/drummers/McKinley/mckinley.htm

1911-Tenor sax Babe Russin born Pittsburgh, Pa.www.artistdirect.com/music/artist/bio/0,,488048,00.html?artist=Babe+Russin

1912—Tennessee University opens as Tennessee A&L State College

1913-birthday Sylvia Porter, American financial journalist, born at Patchogue, NY. Her column was syndicated by the Los Angeles Times, reaching 450 newspapers worldwide. She also wrote more than 20 books and was noted for her ability to turn complex economic language into readable prose. Porter died June 6, 1991, at Pound Ridge, NY.

http://www.us-israel.org/jsource/biography/porter.html

1913- Sammy Cahn--- the Tin Pan Alley legend Sammy Cahn was born Samuel Cohen at New York City. He was nominated for 25 Academy Awards and won four times for” Three Coins in the Fountain” (1954), “All the Way” (1957), “High Hopes” (1959) and “Call Me Irresponsible” (1963). In the late 1940s he began working with composer Jimmy Van Heusen, and the two in essence were the personal songwriting team for Frank Sinatra. Cahn wrote the greatest number of Sinatra hits, including “Love and Marriage,” “The Second Time Around,” High Hopes” and “The Tender Trap.” Sammy Cahn died Jan 15, 1993, at Los Angeles, CA.

http://users.bestweb.net/~foosie/samycahn.htm

1914-Birthday of country bandleader and songwriter Pee Wee King.

1915—World famous firefighter “Red” Adair, born Houston, Texas, died August 7, 2004. He became world famous as an innovator in the highly specialized and extremely hazardous profession of extinguishing and capping blazing, erupting oil wells, both land-based and offshore.

http://www.dailycelebrations.com/asp/displayByDate/displayByDate.asp?month=5&day=28

1928 - Amelia Earhart becomes the first woman to cross the Atlantic by airplane.

1934-the first Nationwide highway planning survey was authorized by Congress to be made by the Bureau of Public Roads of the department of Agriculture, in cooperation with state highway departments, to obtain traffic volume, load weight, and other information needed for the national planning of a nationwide system of interstate highways.

1936- Mobster Charles 'Lucky' Luciano is found guilty on 62 counts of compulsory prostitution.

1937-Birthday of American novelist Gail Godwin, born Birmingham, among her books, The Odd Woman; A Mother & Two Daughters.

http://www.amazon.com/exec/obidos/ASIN/0345389913/absolutsearch05/

102-3944147-3635339

1938- Babe Ruth wears a Dodger uniform for the first time as a coach. The 'Bambino' also takes batting practice with the team.

1939 - birthday of baseball Hall of Fame outfielder Louis Clark (Lou” Brock, El Dorado, AR.

1942 - Birthday of Paul McCartney, the most commercially-successful former member of the Beatles, was born in Liverpool, England. McCartney's association with John Lennon began in 1956 when he asked to join Lennon's group, the Quarrymen, which evolved into the Beatles. McCartney began a career on his own in 1969, just before the break-up of the Beatles, by recording a solo album which contained the hit single, "Maybe I'm Amazed." His second album, "Ram," yielded two major hits - "Another Day" and "Uncle Albert-Admiral Halsey." In 1971, McCartney formed the band Wings, which stayed together for ten years, longer than the Beatles. With Wings, McCartney had number-one hits with "My Love" in 1973 and "Silly Love Songs" in 1976. In 1982, McCartney released a solo album, "Tug of War," with numerous guest performers. Among them was Stevie Wonder, who sang with McCartney on the hit single "Ebony and Ivory." McCartney, meanwhile, sang on Michael Jackson's "The Girl is Mine," a top ten hit in 1983.

1942 - The U.S. Navy commissions its first black officer, Harvard University medical student Bernard Whitfield Robinson.

1944--Birthday of American Composer Paul Lansky

1945---Top Hits

Sentimental Journey - The Les Brown Orchestra (vocal: Doris Day)

Dream - The Pied Pipers

Laura - The Woody Herman Orchestra

At Mail Call Today - Gene Autry

1945-- Lt. Gen. Simon Bolivar Buckner, killed by Japanese artillery on Okinawa. On April 1, 1945, with his Tenth Army, he had launched the invasion of Okinawa, a strategic Pacific island located midway between Japan and Formosa. Possession of Okinawa would give the US a base large enough for an invasion of the Japanese home islands. Although there were over 100'000 Japanese defenders on the island, most were deeply entrenched in the island's densely forested interior, and by the evening of 01 April, 60'000 US troops had come safely ashore.

However, on 04 April, Japanese land resistance stiffened and at sea Kamikaze pilots escalated their deadly suicide attacks on US vessels. Over the next month, the battle raged on land and sea, with the Japanese troops and flyers making the Americans pay dearly for every strategic area of land and water won. On 18 June, with US victory imminent, General Buckner, the hero of Iwo Jima, was killed by Japanese artillery. Three days later, his Tenth Army reached the southern coast of the island, and, on 22 June, Japanese resistance effectively came to an end. Lieutenant General Mitsuru Ushijima, the Japanese commander, with some of his officers and troops, committed suicide rather than surrender.

as the US Tenth Army overcomes the last major pockets of Japanese resistance on Okinawa Island, ending one of the bloodiest battles of World War II.

The Japanese lost 120'000 troops in the defense of Okinawa, while the Americans suffered 12'500 dead and 35'000 wounded. Of the thirty-six Allied ships lost, most were destroyed by the 2000 or so Japanese pilots who gave up their lives in Kamikaze missions. With the capture of Okinawa, the Allies prepared for the invasion of Japan, a military operation predicted to be far bloodier than the 1944 Allied invasion of Western Europe. The plan called for invading the southern island of Kyushu in November of 1945, and the main Japanese island of Honshu in March of 1946.

1945 - Gen. Dwight D. Eisenhower received a tumultuous welcome in Washington, where he addressed a joint session of Congress. Eisenhower went on to meet Pres. Harry Truman and the 2 men established a warm relationship that later soured. In 2001 Steve Neal authored “Harry and Ike: The Relationship That Remade the Postwar World.”

1946-Bobby Sherwood Band records “Sherwood’s Forest.”

1948-Columbia Records begins the first mass production of the 33 1/3 RPM LP. The new format could contain a maximum of 23 minutes of music per side versus the approximately three minutes that could be squeezed on to a 78 RPM disc.

1950-Brithday of American Composer Frank Ferko, born Barberton, OH.

1953—Top Hits

Song from Moulin Rouge - The Percy Faith Orchestra

April in Portugal - The Les Baxter Orchestra

I’m Walking Behind You - Eddie Fisher

Take These Chains from My Heart - Hank Williams

1953-Birthday of Robbie Bachman, drummer for Bachman-Turner Overdrive, was born in Winnipeg. The Canadian rock band, which also included Robbie's brothers Randy and Tim on guitars, was internationally popular in the 1970's with such hits as "Blue Collar," "Let It Ride," "Takin' Care of Business" and "You Ain't Seen Nothing Yet," a 1974 million-seller. At its peak, BTO won many polls and honors in the US, as well as seven Juno Awards.

1953- Sending 23 batters to the plate at Fenway, the Red Sox enjoy a 17-run and 14-hit seventh inning as they pound the Tigers, 23-3. Sammy White sets a modern major league record scoring three times in the frame and outfielder Gene Stephens collect three hits in the to establish an American League record.

1954 - Albert Patterson was assassinated in Phoenix, Ala. He had recently been elected as attorney general on a platform to crack down on vice. His murder led the governor to call in the National Guard to replace local law enforcement and cleanup the vice. Patterson’s son John filled the attorney general position. He was elected governor in 1958.

1958--- Connie Francis records "Stupid Cupid

1959-- Fats Domino records "I Want To Walk You Home"

1959 - A Federal Court annuls the Arkansas law allowing school closings to prevent integration.

1960-Don Sutton of the California Angels pitched a three-hitter against the Texas Rangers to win the 300th game of his career by the score of 5-1. Sutton pitched in the majors from 1966 to 1988 and finished with 324 victories.

1961---Top Hits

Moody River - Pat Boone

Quarter to Three - U.S. Bonds

Tossin’ and Turnin’ - Bobby Lewis

Hello Walls - Faron Young

1963- Three thousand Blacks boycott Boston public school.

1965 - No. 1 Billboard Pop Hit: ``I Can't Help Myself,'' Four Tops.

1966 - Gen. William Westmoreland, senior U.S. military commander in Vietnam, sends a new troop request to the Joint Chiefs of Staff. Westmoreland stated that he needed 542,588 troops for the war in Vietnam in 1967--an increase of 111,588 men to the number already serving there. In the end, President Johnson acceded to Westmoreland's wishes and dispatched the additional troops to South Vietnam, but the increases were done in an incremental fashion. The highest number of U.S. troops in South Vietnam was 543,500, which was reached in 1969.

1966 - Gen. William Westmoreland, senior U.S. military commander in Vietnam, sends a new troop request to the Joint Chiefs of Staff. Westmoreland stated that he needed 542,588 troops for the war in Vietnam in 1967--an increase of 111,588 men to the number already serving there. In the end, President Johnson acceded to Westmoreland's wishes and dispatched the additional troops to South Vietnam, but the increases were done in an incremental fashion. The highest number of U.S. troops in South Vietnam was 543,500, which was reached in 1969.

1967 - The Jimi Hendrix Experience makes its debut performance at the Monterey (Calif.) Pop Festival. The Hendrix album ``Electric Ladyland,'' released in 1968, tops Billboard's pop album chart for two weeks.

1968—Poor People’s Campaign’s Solidarity Day takes place.

1969---Top Hits

Get Back - The Beatles

Love Theme from Romeo & Juliet - Henry Mancini

In the Ghetto - Elvis Presley

Running Bear - Sonny James

1970 - Wind and rain, and hail up to seven inches deep, caused more than five million dollars damage at Oberlin KS.

1976-Electric Light Orchestra's "OLE ELO" goes gold. The LP is a greatest hits collection.

1977 - Fleetwood Mac worked "Dreams" to the number one spot on the pop music charts this day. It would be the group’s only single to reach number one. Fleetwood Mac placed 18 hits on the charts in the 1970s and 1980s. Nine were top-ten tunes.

1977--James Taylor enters the Billboard chart with an update of Jimmy Jones's 1960 #1 hit, "Handy Man". Taylor's version will reach #4.

1977---Top Hits

Dreams - Fleetwood Mac

Got to Give It Up (Pt. I) - Marvin Gaye

Gonna Fly Now (Theme from "Rocky") - Bill Conti

Luckenbach, Texas (Back to the Basics of Love) - Waylon Jennings

1980-The film, "The Blues Brothers", starring Dan Ackroyd and John Belushi, premieres in New York City. Cameo's in the film include Aretha Franklin, Ray Charles, James Brown and John Lee Hooker.

1980---One of my favorite movies, if not my favorite: "The Blues Brothers" movie opened in the US and Canada.

1983-Dr. Sally Ride, 32-year-old physicist and pilot, functioned as a “mission specialist and became the first American woman in space when she began a six-day mission aboard the space shuttle Challenger in 1983. The “near-perfect” mission was launched from Cape Canaveral, FL, and landed, June 24, 1983, at Edwards Air Force Base, CA.

1985---Top Hits

Everybody Wants to Rule the World - Tears for Fears

Heaven - Bryan Adams

Sussudio - Phil Collins

Country Boy - Ricky Skaggs

1987 - It was a hot day in the Upper Great Lakes Region. Nine cities in Michigan and Wisconsin reported record high temperatures for the date. The high of 90 degrees at Marquette, MI, marked their third straight day of record heat. Severe thunderstorm in the Northern and Central High Plains Region spawned half a dozen tornadoes in Wyoming and Colorado. Wheatridge, CO, was deluged with 2.5 inches of rain in one hour.

1989 - Unseasonably hot weather prevailed in the southwestern U.S. In Arizona, afternoon highs of 103 degrees at Winslow, 113 degrees at Tucson, and 115 degrees at Phoenix were records for the date.

1993-- Having sold their label to Polygram three years earlier for half a billion dollars, A&M label founders Herb Alpert and Jerry Moss announce their intention to leave the company entirely. Begun in 1962, A&M was one of the first artist-owned labels, and the first successful independent label.

1998 - The Walt Disney Co. becomes an even bigger player on the Internet with the purchase of a 43% stake in Web search engine company Infoseek Corp. Disney Plans to launch an Internet portal - a Web site that contains entertainment, news and search capabilities in one location.

1999- Disney release the animated feature "Tarzan." The soundtrack features five tracks by Phil Collins each sung in five different languages -- English, French, German, Italian and Spanish. Collins did two versions in Spanish -- one with a Latin American accent and another with a Castilian.

2001- Citing he wants to spend more time with his family, Orioles legend Cal Ripken Jr. announces he will retire at the end of the season. The two-time MVP will be best remembered for his streak of playing in consecutive 2,632 games.

2001- With the time starting when the pitcher enters fair territory, a two-minute limit for warm-up tosses thrown by relievers who come in during an inning is now mandated by the commissioner's office. At the beginning of an inning the allotted warm-up time will be 1:40 unless the game is on national television in which event the time allowed will be increased by 20 seconds.

2002- In the first major league game to feature four players with 400 career homers, the Cubs beat the Rangers, 4-3, as Alex Gonzalez hits a walk-off homer in the bottom of the ninth inning. Sammy Sosa (475), Fred McGriff (459) and Juan Gonzalez (401) watched Rafael Palmerio add his 460th home run to the total.

2005 - After 136 at-bats and 155 plate appearances with the bases full, Derek Jeter hits the first grand slam in his carrier. The Yankees shortstop’s homer ends the longest drought (at bats and number of homers) among current major leaguers without hitting a bases loaded home run.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx