Gerry Egan Out of the Hospital

---Hopes to attend NEFA Conference

Former president of the National Association of Equipment Brokers, today Executive Director, National Equipment Finance Association, Gerry Egan was in the hospital, reportedly quite seriously ill. Today he is out of the hospital, resting at home, and looking forward to the NEFA Funding Symposium September 12-September 15, Washington, DC.

"I had a rough couple of weeks but am home from the hospital and doing very well. I'm very tired and need to work on regaining my strength. It was initially thought that I had Rocky Mountain Spotted Fever based on my early symptoms; it's very common in North Carolina. However, I failed to respond to treatment for that and ultimately required hospitalization as various organs began to be adversely affected and my heart beat increased and my blood pressure dropped dramatically.

"While we may never be 100% sure, it appears that I had a reaction to something, most likely ibuprofen. Once treatment was focused on that, I actually responded fairly quickly. I did require a cardio conversion to get my heart back into a normal sinus rhythm. Once that was done I began feeling much better. I've been told to resume normal activities as my energy level permits and not to anticipate any ongoing issues.

"It's still my hope to be strong enough to attend NEFA's Funding Symposium in Washington, DC, next week but I may not be quite as active there as I might otherwise be.

“I’d like to add that I received excellent care in the Intensive Care Unit at Duke Raleigh Hospital and will always be especially appreciative of the generous doses of humor that the nurses and doctors delivered along with their medical wisdom and care.

"All's well that ends well."

Gerry E.

Gerry Egan

Executive Director

National Equipment Finance Association

Phone: 847-380-5052

Fax: 847-380-5055

E-Mail: mailto:GEgan@NEFAssociation.org

Internet: www.NEFAssociation.org

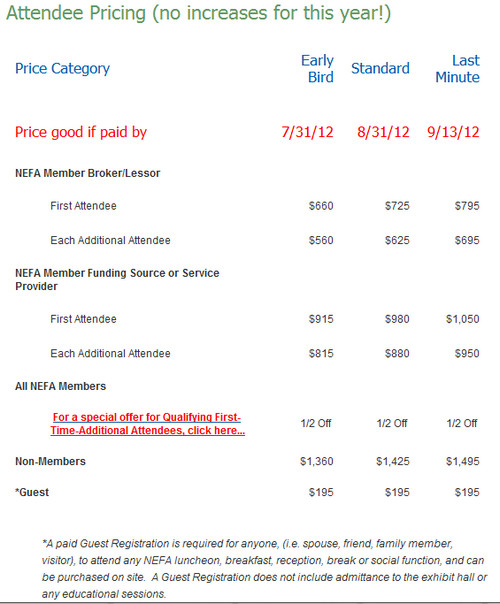

Hugh Swandel, president, NEFA, reports, "The NEFA Fall Funding Symposium is still on and we have reached numbers in excess of last year already! Kim King and Jamie Egan are ready to take your registration for the event. Gerry wants everyone to know that he hopes to see them in Washington DC September 13 through 15th. We have a great lineup of education, speakers and events.”

About the Funding Symposium

https://m360.nefassociation.org/event.aspx?eventID=41686&instance=0

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment or looking

to improve their position)

Long Grove, Illinois

17+ years Comdisco, accounts receivable, collections, customer service, plus senior management, seeking full time or part time assignment. 847-726-1883roborgaard@aol.com | Resume |

Port St Lucie, FL

20+ yrs exp. commercial collection/late stage specialist.

Prefer to work from home based office or transfer to Sarasota areamichaelgalan@comcast.net | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry.

He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

502.649.0488/Leaseconsulting@msn.com

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Why is Republic Bank in Liquidation/Out of Leasing?

by Christopher Menkin

Republic Bank, Bountiful, Utah is very successful, especially on a "per employee" basis, so why would such a successful industrial bank board of director's order a three year liquidation of assets and liabilities? (1) Could it be from recent court cases and the new bank attorney's viewpoint of exposure to lessees, perhaps the industrial bank examiners potential viewpoint, as well as FDIC who issue “cease and desist” orders. Is there a fear of bank exposure?

Republic Bank is reportedly an industrial bank, 10 employees as of June 30, 2012, perhaps classified as a small “one pony” operation as their main business is equipment leasing and finance, perhaps even exclusively to a limited number of super brokers, who also have their own sales force for a specific “Evergreen” clause.

Is the loss of several recent cases involving "Purchase, Renewal or Return Clauses" a coincidence for the exiting the leasing business, Particularly liquidating the bank assets and liabilities? (2)

In the next article, well-known leasing and finance attorney (legal columnist for Leasing News) Tom McCurnin explores the bank's exposure by examining one of the cases involved: UNIFIED CONTAINER, LLC, and Anderson Dairy, Inc., Plaintiffs, v. MAZUMA CAPITAL CORP., and Republic Bank, Inc., Defendant.

(1) Republic Bank Added to Current List

---In Orderly Liquidation

http://leasingnews.org/archives/Sep2012/9_05.htm#republic

(2) "Purchase, Renewal or Return Clauses"

http://leasingnews.org/PDF/Paragraph.pdf

|

Gary DiLillo, President 440.871.0555 or gary@avptc.com

Comprehensive personal property tax outsourcing services.

Click here to see what our clients say about us. |

[headlines]

--------------------------------------------------------------

Mazuma and Republic Bank Get Snared on

PRR Provision in Equipment Lease

by Tom McCurnin, Esq.

Barton, Klugman & Oetting

Los Angeles, California

Bank Taking Assignment on Renewal Proceeds Which Had Not Been Exercised Demonstrated “Business Behavior” Which Cause Bank to Lose Motion to Dismiss. As a Result of Losing Motions, Bank Wisely Settles Case

Well, it’s football season again, and have to start today’s legal analysis with a football quote, attributed to Vince Lombardi which is “The best defense is a good offense.” That may be true in football, (example, San Diego Chargers 1979-81), but it’s not true in law, and one Bank’s odd unexplained assignment and a hyper-aggressive litigation strategy got it snared in a piece of litigation in Utah over an end of lease option clause.

The case is Unified Container, LLC v. Mazuma Capital Corp., 280 F.R.D. 632 (D. Utah 2012).

The case started like many leasing cases. Unified Container was desirous of equipment financing for its operations. The lessee noticed a purchase option clause, and, according to the Complaint, had a series of conversations with an employee of Mazuma as to the meaning of the clause and how it worked. According the Complaint, the employee stated that no matter what the form stated, the equipment could be purchased at the end of the lease for 10-12% of the market value at the time of the exercise.

The true fact is that this clause in question does not allow return or purchase, merely a renewal term. The particular clause, used by some leasing companies, is called a “Purchase, Renewal or Return Clause.” It is nearly impossible to understand, even by a trained lawyer. The clause ostensibly lays out three scenarios for the end of lease options, but only one is really in play—a forced renewal period. The purchase option and return options are illusory.

But lessees being lessees, they would rather rely upon a salesman’s pitch than take the documents to competent counsel, so Unified inked the leases. Unified didn’t know this, but the leases were almost immediately assigned to Republic Bank.

Of course, when it came time to exercise the option, Mazuma denied that the employee promised the Unified a better deal and pointed to the integration clause at the end of the leases, e.g., that oral contracts are barred.

Dissatisfied with this alleged bait and switch, Unified sought counsel and sued for fraud and conspiracy. Unified alleged that Mazuma never intended to honor the 10-12% purchase option and that the other options were illusory. Mazuma denied those allegations.

So far, so good. This case is like a 100 other reported cases, and might come down to a good integration clause in the lease, a good judge, or a credible salesman denying those phone calls ever existed. But instead, Unified counsel got nosey, and obtained, over the strenuous objection of Republic Bank, the assignment of the leases to Republic Bank. What happened next was a key point in this lawsuit which snared the Bank.

Unified discovered that Mazuma assigned the lease and ascertained that Republic Bank purchased not only the payment stream, but also the renewal payments in a yet to be renewed lease. “How could that be?” Unified’s counsel argued to the Court. “If the Court wants to believe that this is a typical assignment and the lessee could actually return the equipment at the end of the lease, why would Mazuma sell the yet to be exercise renewal option?” Unified then brought Republic Bank into the case on the theories of fraud and conspiracy to commit fraud.

Republic Bank aggressively fired back. The first salvo was a Motion to Dismiss, claiming two things—First, that this was a routine, garden variety assignment; and Second, that the Complaint was vague. The Bank also fired a second, misguided salvo, a Motion for Rule 11 Sanctions, essentially calling Unified’s lawyers pirates, cutthroats, and liars. The latter motion, making those kinds of accusations against fellow lawyers, is generally a big mistake unless the moving party really has the goods.

As far as the Motion to Dismiss went, the Court had no problem at all ruling that the Complaint stated a cause of action against the Bank. The Court looked at the assignment, and specifically noted that the Bank bought a yet to be exercised renewal option, which of course makes no sense. Unified’s counsel argued that it does make sense if you buy into the conspiracy theory that no one at Republic ever believed that the purchase or return options were in play. The Court went “all-in” for the conspiracy, stating:

| “[Business] behavior may imply an agreement to conspire where no formal agreement has been shown. Business behavior is admissible circumstantial evidence from which the fact finder may infer agreement. A court may look to the relationship of the parties and use reasonable inferences in determining whether a conspiracy existed and that a conspiracy may be inferred from circumstantial evidence, including the nature of the act done, the relations of the parties, and the interests of the alleged conspirators.” |

In other words, where there is smoke, there’s fire. Rack one for the lessee.

As for the second point of the motion, that the Complaint was vague, the Court noted that the Complaint specified actual dates and persons the Unified principals spoke with, and that the Bank actually responded to the Complaint months previously by Answering it. If it was so vague, the Court humorously stated, why did the Bank Answer it? Rack another for the lessee.

The Court held that the Complaint stated a cause of action, and the case would proceed against the Bank for fraud and conspiracy. But the interesting part of the case was yet to unfold—The Bank’s Motion for Sanctions may have been its undoing.

Although the Bank’s lawyers leveled an aggressive full court attack on Unified counsel, Unified responded with a cool, 63-page Opposition, which laid out in detail, all the smoking guns Unified had on the Bank. It certainly didn’t help much that the Bank refused to turn over documents without a Court Order. Discovery in Federal Court is still viewed as a gentleman’s exchange of documents in a professional atmosphere, not a “hide the ball” game. In any event, the Court quickly denied the Motion for Sanctions.

What happened next is really the point of this article. After the Court summarily dismissed te Motion for Sanction as being frivolous, the Court seriously considered whether it should require Republic Bank to pay for the lessee’s attorney fees in defending this frivolous motion for sanctions. As rare as Motions for Rule 11 Sanctions are, having the moving party pay for the other side’s attorney fees for defense of the motion is unheard of, but the Court seriously discussed the issue.

Apparently, the Bank’s counsel threw one of his colleagues under the bus, as the Court noted:

| “The court's only reason for not awarding fees is Republic Bank's change in counsel after Republic Bank answered the Amended Complaint and provided initial disclosures. New counsel apparently disagreed with prior counsel’s handling of the case. But, had a single set of attorneys proceeded in this manner, the court would have awarded fees to Plaintiffs’ counsel.” |

The record was unclear which lawyer drafted this frivolous motion, and if the new lawyer disagreed with the actions, why he didn’t simply take the motion off calendar at his earliest opportunity. But whatever the flaws existed for the Bank’s counsel, it was defense counsel eating their own which convinced the court to deny the counter sanctions, which given the huge amount of paperwork, the counter-sanction would have been substantial. The Bank dodged a bullet.

The Court’s holding was fairly discreet—The Bank was required to continue with the litigation, and presumably, deposition notices would get served and the true facts would be uncovered by the parties. Someone, somewhere, would have to respond to the question why the Bank would buy a renewal option that hadn’t been exercised yet.

But just 6 weeks after this disastrous ruling, the case settled. Presumably, because of this ruling, and the impending discovery, Mazuma and/or Republic Bank threw some money at this case and made it go away. My calls to Unified’s counsel to explain the case were met with uncomfortable silence and the sounds of crickets. I surmised that the Bank placed a gag provision in the settlement. Rack another for the Bank.

The lessons for the leasing professional here have been aptly demonstrated in this case and others similar to it.

• First, salespeople have been lying to lessees about purchase options since the first equipment lease in the 1940s. However, management should not encourage this and perhaps all phone calls should be recorded, “for quality control purposes.” While those recordings would make nice evidence for aggressive counsel like Unified’s lawyers in this case, it might also help management determine whether their employees are, in fact, lying to lessees or not. Collection shops tape phone calls, why not in leasing?

• Second, the “business behavior” authority this Court cited struck a nerve with me. The lessor should not stake out a position early which might come around and bite the lessor in the hindquarters later. I didn’t understand how an assignee could buy and pay for something which hasn’t happened yet, and clearly the Court was troubled by this fact as well.

• Third, I didn’t think much of the hyper-aggressive motions of the Bank’s counsel, and neither did the Court. It’s one thing to be firm in one’s arguments, but attacking the other side’s lawyers is generally not a good play call.

• Fourth, if the lessor has a stinker, throw some money at the case and quietly make the problem go away. Here the lessor and the Bank did the right thing by getting rid of the case, and gagging the lessee’s counsel. It actually should have been done earlier so as to avoid this published decision. But better late than never.

So football provides some good lessons for equipment lessor, and while Vince Lombardi had some good ideas, I think also most appropriate might come from Premier Mao Tse Tung, who opined that “the only real defense is good defense.” I think the Pittsburgh Steelers, and now Republic Bank, might have to agree with Mao.

Tom McCurnin

Barton, Klugman & Oetting

Los Angeles, California

email: tmccurnin@bkolaw.com

Voice: (213) 621-4000

Fax (213) 625-1832

Visit our Web Site at www.bkolaw.com

Court Case:

http://leasingnews.org/PDF/UnitedContainer&AndersonDiary.pdf

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Companies who utilize Evergreen Clauses for Extra Lease Payments

These companies use language in their purchase options to confuse, perhaps to deceive, with the result an automatic continuation for an additional twelve months of payments.

Several have contiuation of payments and the requirement of replacing the equipment for a new lease. Leasing News has had complaints involving companies who invoke the twelve months on a $1.00 purchase option, as well as on an Equipment Finance Agreements.

ACC Capital, Midvale, Utah

IFC Credit, Morton Grove, Illinois

Jules and Associates

LEAF Financial Group, Philadelphia, Pennsylvania

Marlin Business Leasing, Mount Laurel, New Jersey

Marquette Equipment Finance, Midvale, Utah

Mazuma Capital Corporation, Draper, Utah

Onset Financial, South Jordan, Utah

Republic Bank, Bountiful, Utah

Tetra Financial Group, Salt Lake City, Utah

ACC Capital, Midvale, Utah---This company is no longer in business, although its portfolio is being wound down, according to its owner Loni Lowder; the receivables are being collected by creditors. Lowder today is an employee, manager, Stalwart Contract Finance, Salt Lake City, Utah. To date, all Evergreen Clause complaints have been satisfied.

IFC Credit, Morton Grove, Illinois---This company is in bankruptcy, appeared many times in the Leasing News Bulletin Board prior to filing bankruptcy, but engaged in Evergreen Clauses, and unfortunately a recent example is a complaint to the trustee, stemming from M&T Bank lease assignment expiring and notify the lessee that they did not notify about the residual, which was a $1.00. This has happened many times with other banks who have taken over the IFC Credit Corporation portfolio. Calls and letters to the trustee and attorneys have gone unanswered.

Jules and Associates, Los Angeles, California--- Jules and Associates, Los Angeles, California---A repeat customer, who notified Jules and Associates on a lease, but was not before the 180 day expiration, so Jules and Associates instead of the 1% due for the residual ($2,308.79) charged six more payments or $40,463.94, and if 1% is not paid in this time, they will be subject to another three months.

http://leasingnews.org/archives/Aug2011/8_29.htm#jules

LEAF Financial Group, Philadelphia, Pennsylvania---It appears this company is in a more wind down phase, moving its operation of LEAF Commercial Credit with basically the same management. There have been complaints about the Evergreen Clause, including one this year for an Equipment Finance Agreement!

Marlin Business Leasing, Mount Laurel, New Jersey---The actual SEC filings state the profit earned from Evergreen Clause, primarily from copier leases. Bulletin Board Complaints have been received about this practice in addition to the SEC financial statement filings.

(9) Marlin Response to posting

Marquette Equipment Finance, Midvale, Utah --- According to Dorran Sampson, Vice-President/Broker Relations: "Marquette Equipment Finance does not offer an Evergreen product. Our master lease provides for extensions but is negotiated at the schedule level. Notice periods are also negotiated at the schedule level and vary depending on the Lessee’s needs."

When the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) he maintained the same position. It was noted his old company was still on the list, and a request of his "master lease" was made.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage."

A search of PACER, a national index for U.S. district, bankruptcy and appellate courts brought up a number of Marquette cases, and the first one hit pay dirt: Merchants & Farmers Bank, a Mississippi Corporation versus Marquette Equipment Finance and Applied Financial. It was a similar case and while "dismissed with prejudice" (6), it had the arguments regarding the purchase option and a copy of the complete contract with a similar PPR as with Mazuma Capital:

"(g) Lessee's Options at End of Initial Period. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor and Lessee have not agreed to either option (1) or (3) by the end of the Initial Period or if Lessee fails to give written notice of its option via certified mail at least one-hundred-eighty (180) days prior to the termination of the Initial Period, then option (2) shall apply at the end of the Initial Period. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at least ninety (90) days prior written notice of termination."

The first option is to purchase the equipment for a price to be determined by Lessor and Lessee and requires a certified letter 180 days prior. This sounds like a fair market purchase option, but the “price to be determined” language means that the Lessor can set any price it wants. This option is illusory in my opinion.

The second option is to continue the lease for an additional 12 months, the “Evergreen” period. No notice of this provision is given to the lessee either in advance of signing or prior to exercising this option. Republic Bank purchases these 12 month extensions in advance of their exercise. How would the bank know that the lessee is going to exercise this option, unless everyone knows it is the only practical option for the lessee to exercise? Republic Bank President Boyd Lindquist confirmed in a telephone call that he “buys” these extensions from Mazuma and has for quite some time.

The third option is to return the equipment, but the clause is draped with the condition that the lessee has to re-lease identical equipment for a similar term. It also has 180 day certified letter requirement, and applies to the second option of 12 months, but also has the clause of an automatic six month option. So what is the point of exercising this option? At the end of this re-lease, there would be the same three identical options, so the lessee would be required to re-lease and re-lease. It’s just like Groundhog Day.

Leasing News is working on obtaining information on other companies so named to add to the list, including follow-up on the master lease for Pacific Western Equipment Finance. If you have a copy, please send and will keep your name “off the record.”

((7) See for Copy of Filing, including contract.)

Mazuma Capital Corp, Draper, Utah Several routie "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) "8. The basic scheme involves the inclusion of a purchase, renewal, return (“PRR”) provision in the lease. The lessor assures the customer they will be able to purchase the equipment at the end of the initial term in the lease for a reasonable or nominal price. Often, the lessor promises the equipment can be purchased at a fixed percentage of the total amount financed. However, at the end of the initial lease term, the lessor refuses to honor the agreed upon purchase price or negotiate in good faith regarding a purchase price, but instead, insists the lease automatically renews for an additional term (usually twelve months).

9. The inclusion of the purchase and return options in the lease are entirely illusory and intended only to give the customer the false impression that it can exercise any of the three options at the end of the initial lease term, when in fact, the lessor will only allow an automatic renewal at the end of the initial lease term.) There are other exhibits. This case was settled "out of court."

(page 3)

H. Jared Belnap, President & CEO, Mazuma Capital Corp., takes exception on beingon the Evergreen list. His full letter and Leasing News Response is at (5).

Onset Financial, South Jordan, Utah --- Onset contract, which contained:

“Section 20

n. Lessee's Options at Maturity of Base Period. At the maturity of the Base Period of any Lease, Lessee shall, provided at least one hundred fifty (150) days prior written notice is received by Lessor from Lessee via certified mail, do one of the meowing: (1) purchase the Property for a price to be determined by Lessor end Lessee, (2) renew the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) terminate the Schedule and return the Properly to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due end owing under the Schedule must first be paid in full, the provisions of Sections 8f, 8g and 7d hereof roust be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property fisted on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor end Lessee have not agreed to either option (1) or (3) by the maturity of the Base Period, or if Lessee fails to give written notice of Its option via certified marl at least one hundred fifty (150) days prior to Use maturity of the Base Period, or if an Event of Default has occurred under any Lease, then option (2) shall apply at the maturity of the Base Period. At the maturity of the renewal period provided for In option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the maturity of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at best thirty (30) days prior written notice of termination." (1)

((8) See for Copy of Onset Contract with PPR purchase option.

Republic Bank, Bountiful, Utah Purchases and participates in extended Evergreen clause agreements.

They are legal in all states, except four states require advance notification be given to the lessee regarding termination of the lease and its residual (Four states: New York Rhode Island, Texas, Illinois (In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)"

Tetra Financial Group, Salt Lake City, Utah Several routine "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1)

“22. Mazuma Capital is associated with Republic Bank and obtains financing for its leases containing PRR provisions from Republic Bank.

23. Like what took place at Amplicon, Inc., the PRR scheme utilized by Matrix, Applied Financial, LLC, Mazuma Capital, Tetra Financial Group, LLC and others has begun to be exposed through litigation and negative press. See Deseret News (2) articles attached hereto as Exhibits B (2) and C. (3)”

Here is a case where New York courts threw out the Evergreen Clause as not legal in New York, even though venue appears to be Utah. (4))

(1) 36 main pdf

http://leasingnews.org/PDF/36main.pdf

(2) Deseret News

http://leasingnews.org/PDF/DeseretNewsarticle.pdf

(3) Exhibit C

http://leasingnews.org/PDF/ExhibitCDeseret.pdf

(4) Salon Management case

http://leasingnews.org/PDF/SalonManagement.pdf

(5) Mazuma Takes Exception on Being on Evergreen List

http://leasingnews.org/archives/Jul2012/7_30.htm#mazuma

(6) Order to Dismiss with Prejudice

http://leasingnews.org/PDF/Marquette_order_dismiss.pdf

(7) Copy of filing, including contract

http://leasingnews.org/PDF/Maquette.pdf

(8) Copy of Onset Contract with PPR purchase option

http://leasingnews.org/PDF/OnsetContract.pdf

(9) Marlin Response to posting.

http://leasingnews.org/archives/Jul2012/7_13.htm#response

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Joshua Boucher named Associate Planner at Applied Medical, Long Beach, California. Previously he was vice-president, commercial finance division, Culver Capital Group (August, 2011-August, 2012). University of Massachusetts Dartmouth Bachelor of Science, Finance, Economics (2007 – 2011) Chancellor's List recipient: Spring 2010, Fall 2010, Spring 2011 Dean's List recipient: Fall 2007, Spring 2008.

www.linkedin.com/in/joshuarboucher

Mark Carpenter has joined the credit and underwriting team of the division of TAB Bank, Ogden, Utah. Previously he was senior vice president and chief credit officer, Republic Bank (May, 2008-September, 2012), vice president and credit manager, Wells Fargo Equipment Finance, January, 2000-May, 2008). University of Utah, MBA, BS in Finance (1974 – 1983), Olympus High School (1969 – 1971). “While at Republic, he managed and grew relationships from eight to 15 banks and commercial leasing firms selling transactions to the bank. These expanded relationships led to portfolio growth of 48% from 2008 to 2012. He also spent a large portion of his career with Wells Fargo Equipment Finance as vice president and credit manager. During this time, he developed and managed marketing relationships with Wells Fargo Business Banking hubs in Boise, ID; San Jose, CA and San Antonio, TX.”

www.linkedin.com/pub/mark-carpenter/25/440/475

Nathan Farnsworth has joined the credit and underwriting team of the division of TAB Bank, Ogden, Utah. Previously he was Senior Associate, Healthcare and Medical, Republic Bank (July, 2010-September, 2012), corporate finance, NSB (March, 2009-June, 2010), Sr. Associate, new Resource (July, 2007-December, 2008), associate/portfolio manager Specialty Finance, SVB Financial Group (December, 2005-April, 2007). "He has gained extensive credit, underwriting, financial analysis, collateral evaluation, account management and deal structuring experience in his previous positions. During his time at Republic Bank, he assisted in managing a portfolio consisting of various commercial leases and loans to hospitals, skilled nursing facilities, senior living centers, and medical equipment manufacturers." University of Michigan, Undergraduate (2001 – 2004), Weber High School (1994 – 1996).www.linkedin.com/pub/nathan-farnsworth/10/93b/945

Carol Forsyte appointed” Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer at Air Lease Corp. (NYSE:AL), Los Angeles, California. Previously, Carol Forsyte served as Board Secretary, Chief Governance and SEC Counsel of Motorola Mobility Inc., now part of Google (Nasdaq: GOOG).” Previously she was VP, Motorola (1995-2010), associate, Winston & Strawn, LLP (1990-1995). University of California, Hastings College of the Law JD, Law (1985 – 1988), Rutgers, The State University of New Jersey-New Brunswick (1980 – 1984).www.linkedin.com/pub/forsyte-carol/6/4a/780

Eric Sheehan has joined the credit and underwriting team of the division of TAB Bank, Ogden, Utah. Previously he was an underwriter and then Lease Portfolio Manager, Republic Bank (2005-2012), Risk Manager, Citi (1999-2004). He "...has over 20 years of experience in the industry of commercial credit and finance. He has specialized in the development, implementation, and oversight of credit policies and procedures during his career. He has served as a credit and underwriting manager for several financial institutions including American West Bank and Citigroup. While at Republic Bank, he provided underwriting and financial analysis of all lease transactions and negotiated lease rates, terms and covenants for each approved transaction."

www.linkedin.com/pub/eric-sheehan/13/606/1b3

Rick Wolfert was named a director of St. Mary's Good Samaritan Hospital. He continues as an independent director of Sandion Money Management (September, 2011) and principal at Jackson Ridge Advisors (December, 2009). Previously he was CEO, Tygris Commercial Finance Group, Inc. (May 2008 – December 2009), vice chairman commercial finance, CIT (September, 2004-March, 2007), president & CEO, GE Healthcare Financial Services (2001-2004), president & COO, Heller Financial (1998-2001), chairman, president& CEO, KeyBank USA (April, 1986-December, 1977), VP, United States Leasing (1979-1987). University of Delaware - Lerner College of Business and Economics, MS, Banking (1991 – 1993) Stonier Graduate School of Banking - American Bankers Association. Louisiana State University and Agricultural and Mechanical College BS, Business (1972 – 1976).

www.linkedin.com/pub/rick-wolfert/15/57a/aa1

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

General Legal Counsel

National Bank Holding Company in Southern California

10+ yrs exp. commercial finance/leasing industry.

Background in employment law, contract origination,bankruptcy litigation/

must possess

an immense veracity, extensive understanding on

wide range of legal issues and business experience.

Salary requirements + resume: rose.jones98@yahoo.com

|

Los Angeles, CA

Taycor has developed and tested an innovative and

unique marketing engine, and we are ready to grow!

We are looking for closers and relationship builders,

not cold callers. (Full description)

jobs@taycor.com or apply online at www.taycor.com

|

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Help Wanted Classified Ads

Cost

$595 four HTML lines

(note, a space is counted as a line)

$40 for each additional line or space

The classified ad will appear for 21 days.

The idea is to attract an applicant to learn more, either to click to a full description on your web site or to a full job description attachment (free, no charge).

All Help Wanted ads appear chronologically above the headlines, as well as appear in the news edition "classified ads" and the web site, "classified ads."

Contact kitmenkin@leasingnews.org for more

information or to help word a classified ad.

Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

"The Memory Shock"

by Barry Reitman

Well known leasing broker, active in the National Association of Equipment Leasing Brokers (NAELB), former moderator of the NAELB blogs, is also a lecturer on memory with a list of clients including the NYPD Police Academy.

In reading his new book on improving your memory, it was both entertaining and informative--- but make no mistake this is no game or trick, but divided into several levels, with the reader deciding which to reach for, or to re-read and study. I found it to be learning a new way of "thinking," of opening the existing memory, the attic as Sherlock Holmes called it, and bringing this out of storage.

There really are no secrets in Barry's book, as he explains it, and it is organized to open your thinking, more than just like exercising a muscle, as it also brings creativity and insight that exists. He not only demonstrates but illustrates, almost as if he is there talking with you.

It is 238 pages. You can stop after reaching the goal you want to, or continue.

If you have a child or grandchild in college, this is a must Christmas or birthday present.

---Kit Menkin, editor

$19.95 at Amazon.com

"The Memory Shock" by Barry Reitman

(Also available in Kindle edition--$9.99)

http://www.amazon.com/s/ref=nb_sb_noss_1?url=search-alias%3Dstripbooks&field-keywords=memory+shock+by+barry+reitman

[headlines]

--------------------------------------------------------------

CLP Spotlight

Bud Callahan, CLP

National Equipment Leasing, Inc.

Indianapolis, Indiana

What events in your life, from child to adulthood, have helped shaped you?

When I was 21 years old I was sent to Vietnam. I grew up very quickly! I started off in electrical engineering to get an associate degree at ITT and decided to join the Air Force Reserve to avoid being drafted and sent to Vietnam.

It turned out that our Air Force Reserve unit was the only one to be called up! We flew C-119 aircraft that were converted into gunships in Vietnam. We flew at night protecting our troops on the ground and never lost a soldier. All 350 of our unit came home too. I was proud to have served.

What so far, has been the highlight of your life?

I would say getting married and the birth of my first child have to be right up there at the top!

What is your secret to success?

“Working smarter, not harder”. Remember, “Don’t flog a dead deal!” Time is money. Don’t be too busy with a dead deal to miss the new one that has just come in the door.

What hurdles did you overcome to get where you are today?

Probably the biggest hurdle was the 23% Prime Rate back in 1978. I made it to the other side! We called it the “Baptism with Fire”! Then we eventually entered the Reagan years and it was much easier. With ITC, being able to sell it too, and Safe Harbor Leasing it was the most fun we had in the industry!

We understand you are a pilot – how long have you been flying?

I’ve had my pilot’s license since 1984, but my stint in the Air Force was when I caught the flying bug.

Would you recommend book, program, website for other members / colleagues?

There are two books that are must reads – “Who Moved the Cheese” by Dr. Spencer Johnson and “A Peacock in the Land of Penguins” by BJ Gallagher-Hateley and Warren H. Schmidt

If you won $50,000,000 in the lottery, what would you do with the money?

I would pay off my house, buy a better airplane and continue to live just like I do now.

In the movie about your life, who would you cast to play you?

Gary Sinise. I’d pick Gary because I especially like all that he does for our troops.

If you could be a super hero, what would be your super power and why?

I would be Donald Trump on steroids and I’d fix the economy!

Would you like to share an interesting hobby or accomplishment?

I guess my proudest accomplishment was to receive the Grand Master Sales Award from Ford Motor Company five years in a row. Only 50 people in the country are presented with this award. It was also a great honor to be recognized by my peers in this industry as a CLP. My most humbling experience was to have been elected President of the National Association of Equipment Leasing Brokers.

What is the most interesting place you have ever visited or traveled to?

The Callahan Farm owned by my great, great grandfather in Ireland. I have a piece of his home in a display case in my basement.

What advice would you give a new broker?

To a new broker, I would advise them to find a seasoned veteran to “buddy” up with and learn the business, called on-the-job-training (OJT), and then after two years break out on their own. The knowledge that you would gain about our industry from working with a leasing veteran is invaluable. It is worth sharing the points you earn on the transactions. NAELB has a list of seasoned veterans who have volunteered to mentor new brokers. Every new broker member should take advantage of this opportunity.

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means)

1630 - The Massachusetts town of Trimontaine (Shawmut), was renamed Boston, and became the state capital. It was named after a town of the same name in Lincolnshire, England.

1816 - Teabout and Chapman launched the Frontenac, the first steamboat “ to sail” on the Great Lakes, revolutionizing shipping.

1825 - The Marquis de Lafayette, the French hero of the American Revolution, bade farewell to President John Quincy Adams at the White House.

1864 - In preparation for his march to the sea, Union General William T. Sherman orders residents of Atlanta, Georgia, to evacuate the city. Even though Sherman had just successfully captured Atlanta with minimal losses, he was worried about his supply lines, which stretched all the way to Louisville, Kentucky. With Confederate cavalry leader Nathan Bedford Forrest on the loose, Sherman expected to have a difficult time maintaining an open line of communication and reasoned that he could not stay in Atlanta for long. The number of troops committed to guarding the railroad and telegraph lines was almost as many as he had with him in Atlanta. For Sherman, the defeated residents of Atlanta could only hinder him in his preparations since they represented mouths to feed in addition to his own army. Furthermore, he did not want to bear responsibility for women and children in the midst of his army. Eviction of the residents was Sherman's most logical solution.

Sherman's order surely didn't win him any fans among the Southerners, but he was only starting to build his infamous reputation with the Confederates. In November, he embarked on his march to the sea, during which his army destroyed nearly everything that lay in its path.

1881 - The temperature soared to 101 degrees at New York City, 102 degrees at Boston MA, and 104 degrees at Washington D.C.

1903 - the Federation of American Motorcyclists was organized at Manhattan Beach , NY . The first president was R.G. Betts of the New York Motor Cycle Club. About 200 delegates attended the first meeting, considered the first rumble of motorcyclists in the U.S.

1908 - trumpeter Max Kamisnky birthday

1922 - Joe Newman Birthday ( Great Count Basie trumpet player-12 years )

1929 - tenor saxophonist Sonny Rollins Birthday

1936 - September 7, Singer Buddy Holly http://www.buddyholly.com/bio.html***

While there is controversy regarding separation of “church and state” today, 1994, Continental Congress opened with a prayer at Carpenters' Hall, Philadelphia , PA. The Reverend Jacob Duche, an Episcopalian minister, rector of the Christ Church , appeared in his canonicals, attended by his clerk. The morning service of the Episcopal Church was read, with the clerk making the responses. The Psalter for the seventh day of the month includes the 35 th Psalm, wherein David prays for protection against his enemies: “Plead my cause, O Lord, with them that strive with me; fight against them that fight against me” The rector concluded with an a appeal so heartfelt that Congress gave him a vote of thanks.

1944---MAXWELL, ROBERT D. Medal of Honor

Rank and organization: Technician Fifth Grade, U.S. Army, 7th Infantry, 3d Infantry Division. Place and date: Near Besancon, France, 7 September 1944. Entered service at: Larimer County, Colo. Birth: Boise, Idaho. G.O. No.: 24, 6 April 1945. Citation: For conspicuous gallantry and intrepidity at risk of life above and beyond the call of duty on 7 September 1944, near Besancon, France. Technician 5th Grade Maxwell and 3 other soldiers, armed only with .45 caliber automatic pistols, defended the battalion observation post against an overwhelming onslaught by enemy infantrymen in approximately platoon strength, supported by 20mm. flak and machinegun fire, who had infiltrated through the battalion's forward companies and were attacking the observation post with machinegun, machine pistol, and grenade fire at ranges as close as 10 yards. Despite a hail of fire from automatic weapons and grenade launchers, Technician 5th Grade Maxwell aggressively fought off advancing enemy elements and, by his calmness, tenacity, and fortitude, inspired his fellows to continue the unequal struggle. When an enemy hand grenade was thrown in the midst of his squad, Technician 5th Grade Maxwell unhesitatingly hurled himself squarely upon it, using his blanket and his unprotected body to absorb the full force of the explosion. This act of instantaneous heroism permanently maimed Technician 5th Grade Maxwell, but saved the lives of his comrades in arms and facilitated maintenance of vital military communications during the temporary withdrawal of the battalion's forward headquarters.

1950 - “ Truth of Consequences” premiered on television. The half-hour show was based on a parlor game: contestants who failed to answer a question before the buzzer ( nickname Beulah) went off had to perform stunts ( i.e., pay the consequences.) Ralph Edwards created and hosted the show until 1954, then it became a prime-time show hosted by Jack Bailey. My father's very closed friend Morris Burman was the lead writer. Bob Barker succeeded Bailey in 1966 and hosted it through syndication. In 1955, the show was revived as “The New Truth of Consequences” with Bob Hilton as host.

1951--CRUMP, JERRY K. Medal of Honor

Rank and organization: Corporal, U.S. Army, Company L, 7th Infantry Regiment, 3d Infantry Division. Place and date: Near Chorwon, Korea, 6 and 7 September 1951. Entered service at: Forest City, N.C. Born: 18 February 1933, Charlotte, N.C. G.O. No.: 68, 11 July 1952. Citation. Cpl. Crump, a member of Company L, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. During the night a numerically superior hostile force launched an assault against his platoon on Hill 284, overrunning friendly positions and swarming into the sector. Cpl. Crump repeatedly exposed himself to deliver effective fire into the ranks of the assailants, inflicting numerous casualties. Observing 2 enemy soldiers endeavoring to capture a friendly machine gun, he charged and killed both with his bayonet, regaining control of the weapon. Returning to his position, now occupied by 4 of his wounded comrades, he continued his accurate fire into enemy troops surrounding his emplacement. When a hostile soldier hurled a grenade into the position, Cpl. Crump immediately flung himself over the missile, absorbing the blast with his body and saving his comrades from death or serious injury. His aggressive actions had so inspired his comrades that a spirited counterattack drove the enemy from the perimeter. Cpl. Crump's heroic devotion to duty, indomitable fighting spirit, and willingness to sacrifice himself to save his comrades reflect the highest credit upon himself, the infantry and the U.S. Army.

1951--KANELL, BILLIE G. Medal of Honor

Rank and organization: Private, U.S. Army, Company I, 35th Infantry Regiment, 25th Infantry Division. Place and date: Near Pyongyang, Korea, 7 September 1951. Entered service at: Poplar Bluff, Mo. Born: 26 June 1931, Poplar Bluff, Mo. G.O. No.: 57, 13 June 1952. Citation: Pvt. Kanell, a member of Company I, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. A numerically superior hostile force had launched a fanatical assault against friendly positions, supported by mortar and artillery fire, when Pvt. Kanell stood in his emplacement exposed to enemy observation and action and delivered accurate fire into the ranks of the assailants. An enemy grenade was hurled into his emplacement and Pvt. Kanell threw himself upon the grenade, absorbing the blast with his body to protect 2 of his comrades from serious injury and possible death. A few seconds later another grenade was thrown into the emplacement and, although seriously wounded by the first missile, he summoned his waning strength to roll toward the second grenade and used his body as a shield to again protect his comrades. He was mortally wounded as a result of his heroic actions. His indomitable courage, sustained fortitude against overwhelming odds, and gallant self-sacrifice reflect the highest credit upon himself, the infantry, and the U.S. Army.

1952--PORTER, DONN F. Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company G, 14th Infantry Regiment, 25th Infantry Division. Place and date: Near Mundung-ni Korea, 7 September 1952. Entered service at: Baltimore, Md. Born: 1 March 1931, Sewickley, Pa. G.O. No.: 64, 18 August 1953. Citation: Sgt. Porter, a member of Company G, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. Advancing under cover of intense mortar and artillery fire, 2 hostile platoons attacked a combat outpost commanded by Sgt. Porter, destroyed communications, and killed 2 of his 3-man crew. Gallantly maintaining his position, he poured deadly accurate fire into the ranks of the enemy, killing 15 and dispersing the remainder. After falling back under a hail of fire, the determined foe reorganized and stormed forward in an attempt to overrun the outpost. Without hesitation, Sgt. Porter jumped from his position with bayonet fixed and, meeting the onslaught and in close combat, killed 6 hostile soldiers and routed the attack. While returning to the outpost, he was killed by an artillery burst, but his courageous actions forced the enemy to break off the engagement and thwarted a surprise attack on the main line of resistance. Sgt. Porter's incredible display of valor, gallant self-sacrifice, and consummate devotion to duty reflect the highest credit upon himself and uphold the noble traditions of the military service.

1953 - American tennis great Maureen “ Little Mo”) Connolly became the first woman to win the Grand Slam, the four major tournaments in the same year. She began with the Australian Open, then the French Open and then Wimbledon . At the US championships at Forest Hills , NY , she defeated Doris Hart in the final, 6-2, 5-4. Connolly was so dominating that the match lasted only 43 minutes.

1956 - “ The Adventures of Jim Bowie” premiered. My father Lawrence Menkin wrote some of the episodes. This half-hour western about the inventor of the Bowie knife starred Scott Forbes as the title character. There was much criticism about the early violence, and as a results action was greatly decreased on this original television series ( Bowie rarely used his knife and even fist fights were removed from air.)

1957-Elvis enters a recording studio to cut "Treat Me Nice", "Don't" and the tracks for his upcoming Christmas album

1958-Georgia Gibbs performs "The Hula-Hoop Song" on The Ed Sullivan Show, boosting the craze that is sweeping North America. The song would be the last of nine Top-40 hits for Gibbs.

1963-Three weeks after its release, The Beatles' "She Loves You" hits #1 in England. It remained on the charts for thirty-one consecutive weeks, eighteen of those in the top three.

1966 - Roy Orbison begins filming his one and only starring role, in the unlikely Western comedy The Fastest Guitar Alive, with a cameo by Sam "The Sham" Samudio of "Wooly Bully" fame.

1967 At Candlestick Park, the Giants tie a National League mark using a record 25 players to beat the Astros in 15 innings, 3-2. Manager Herman Franks uses all his starters and five relief pitchers, sends six pinch hitters to the plate; three players enter the contest as pinch runners along with two defensive substitutions.

1967 - “The Flying Nun” premiered on television, about a nun at a convent in Puerto Rico who discovers that she can fly, starring Sally Fields.

1968 - The Doors' LP Waiting for the Sun hits #1

1970 - A lightning bolt struck a group of football players at Gibbs High School in Saint Petersburg FL, killing two persons and injuring 22 others. All the thirty-eight players and four coaches were knocked off their feet

1970-ENGLISH, GLENN H., JR. Medal of Honor

Rank and organization: Staff Sergeant, U.S. Army, Company E, 3d Battalion, ~03 Infantry, 173d Airborne Brigade. Place and date: Phu My District, Republic of Vietnam, 7 September 1970. Entered service at: Philadelphia, Pa. Born: 23 April 1940, Altoona, Pa. Citation: S/Sgt. English was riding in the lead armored personnel carrier in a 4-vehicle column when an enemy mine exploded in front of his vehicle. As the vehicle swerved from the road, a concealed enemy force waiting in ambush opened fire with automatic weapons and anti-tank grenades, striking the vehicle several times and setting it on fire. S/Sgt. English escaped from the disabled vehicle and, without pausing to extinguish the flames on his clothing, rallied his stunned unit. He then led it in a vigorous assault, in the face of heavy enemy automatic weapons fire, on the entrenched enemy position. This prompt and courageous action routed the enemy and saved his unit from destruction. Following the assault, S/Sgt. English heard the cries of 3 men still trapped inside the vehicle. Paying no heed to warnings that the ammunition and fuel in the burning personnel carrier might explode at any moment, S/Sgt. English raced to the vehicle and climbed inside to rescue his wounded comrades. As he was lifting 1 of the men to safety, the vehicle exploded, mortally wounding him and the man he was attempting to save. By his extraordinary devotion to duty, indomitable courage, and utter disregard for his own safety, S/Sgt. English saved his unit from destruction and selflessly sacrificed his life in a brave attempt to save 3 comrades. S/Sgt. English's conspicuous gallantry and intrepidity in action at the cost of his life were an inspiration to his comrades and are in the highest traditions of the U.S. Army.

1974 - Elton John is awarded a Gold record for "Don't Let The Sun Go Down On Me". The single was #2 on the Hot 100 for four straight weeks, but was kept out of the top spot by John Denver's "Annie's Song", Roberta Flack's "Feel Like Makin' Love" and Paper Lace's "The Night Chicago Died".

1977 - In Washington, President Jimmy Carter and Panamanian dictator Omar Torrijos sign a treaty agreeing to transfer control of the Panama Canal from the United States to Panama at the end of the 20th century. The Panama Canal Treaty also authorized the immediate abolishment of the Canal Zone, a 10-mile-wide, 40-mile-long U.S.-controlled area that bisected the Republic of Panama. Many in Congress opposed giving up control of the Panama Canal--an enduring symbol of U.S. power and technological prowess--but America's colonial-type administration of the strategic waterway had long irritated Panamanians and other Latin Americans. The rush of settlers to California and Oregon in the mid-19th century was the initial impetus of the U.S. desire to build an artificial waterway across Central America. In 1855, the United States completed a railroad across the Isthmus of Panama (then part of Colombia), prompting various parties to propose canal-building plans. Ultimately, Colombia awarded the rights to build the canal to Ferdinand de Lesseps, the French entrepreneur who had completed the Suez Canal in 1869. Construction on a sea-level canal began in 1881, but inadequate planning, disease among the workers, and financial problems drove Lesseps' company into bankruptcy in 1889

1986 - Off the Coast of Florida — An F-106 “Delta Dart” of the 125th Fighter-Interceptor Squadron encounters a Soviet Air Force Tu-95 “Bear” bomber flying parallel to the twelve-mile limit of U.S. airspace as it makes its way from Russia to Cuba. These are routine flights which are just as routinely met by Air Guard fighters who act as ‘escorts’ to be sure the bombers pose no threat to the U.S. homeland. Since 1953 Air Guard fighter-interceptor units took on an air defense mission, challenging unidentified aircraft flying into American airspace. Air Guard pilots and aircraft stood alert 24 hours a day, every day. This mission grew each year and by 1965 the 22 interceptor squadrons flew 30,000 hours and completed 38,000 alert sorties. By 1988 the Air Guard provided 86% of the Air Force units assigned to national airspace security. In the post 9/11 environment the Air Guard has continued and expanded its role in homeland defense by flying overhead cover for major cities in times of heightened alert as well as investigating all suspicious air traffic heading toward or across the country.

1988 - Fifty cities across the eastern U.S. reported record low temperatures for the date. The low of 56 degrees at Mobile AL was their coolest reading of record for so early in the season. The mercury dipped to 31 degrees at Athens OH, and to 30 degrees at Thomas WV.

1993 - Dr. Joycelyn Elders, born in 1933 in Schaal, AR, became the first African-American Surgeon General. Elders, the former health director of the state of Arkansas , was confirmed by a Senate vote of 65 to 34.

1996 In a pre-game ceremony in front of sellout crowd at the Metrodome, the Twins bid farewell to Kirby Puckett, one of team's popular players in recent years. After a remarkable 12-year Hall of Fame career, the talented and personable outfielder was forced to retire in July because of blindness in his right eye caused by glaucoma.

2001 - During his 30th Anniversary celebration at Madison Square Garden, Michael Jackson is reunited onstage with the Jackson 5 for the first time since 1984.

2010 Trevor Hoffman earns his 600th save when he induces pinch-hitter Aaron Miles to hit a grounder for the final out in the Brewers' 4-2 victory over St. Louis at Miller Park. The 42-year-old reliever, baseball's career saves leader, has converted 600 of his 676 save opportunities (89%) during his 18-year career with Florida, San Diego and Milwaukee.

One of the hoaxes on the internet:

*** The airplane Buddy Holly died in was the "American Pie." (Thus the name of the Don McLean song.) 1. One of the hoaxes on the internet

http://www.americanleasing.com/resources/virus/index.html

Both the Buddy Holly internet pages and Don McClean internet pages, with

analysis of the lyrics, actual Civil Aeronatics Review of the crash, and all the information you would want to know report the plane was a rented plane, the crash was pilot error, and the name of the plane was not "American Pie."

This is a response from an e-mail to the administrator of the Buddy Holly Fan Club page: AS IN AS AMERICAN as apple PIE a reference to the loss of innocence "I don't want you to pledge your future,the futures not yours to give ............" - Don McLean There are two other opinions, but both are "not confirmed" and also do not apply to the lyric analysis on the Don McLaren Home page. They are also sent around as trivia, but they are also false. Don McLean dated a Miss America candidate during the pageant ( not confirmed) The Annotated American Pie From: rsk@gynko.circ.upenn.edu (Rich Kulawiec)

**Don McLean dated a Miss America candidate during a pageant and broke up with her on February 3, 1959 ( not confirmed ).http://www.levitt.co.uk/interpret.html

The name of the plane or an ex-girl friend: These interpretations are off base. If you listen to the song, you will realize it could never been a homage or reference to a rented aircraft by an inexperienced pilot who had very little experience in flying in the weather by instruments on this small aircraft ( seehttp://www.geocities.com/SunsetStrip/Towers/5236 to find out more about Buddy Holly ). Listen to the song, and answer the question yourself.

http://www.fiftiesweb.com/amerpie-1.htm

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()

![]()

![]()

![]()

![]()

![]()