Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Contact: kitmenkin@leasingnews.org

![]()

Monday, August 26, 2024

Today's Leasing News Headlines

The Unfortunate Tale of Dallin Hawkins

By Ken Greene, Leasing New Emeritus

ELFA Reports Leasing New Business Up

to $11.1 Billion July from $10 Billion in June

Leasing and Finance Industry Help Wanted

Positions Open with Attractive Income & Benefits

Commercial Finance/Leasing Finance

Conferences & Forums - Updated

Top Ten Most Read by Readers

August 19 - August 23

Car Insurance Rates Could Jump as High as

50% in several States This Year

Dext Capital Announces Lana Kralik, CLFP

as Senior Operations Director

ELFA 2024 Survey of Equipment Finance

Reveals Business Growth of 1.1%

News Briefs ---

TSA readies for busiest Labor Day travel period

on record, provides top travel tips to help

airline passengers prepare

Self-driving trucks are thriving in Singapore,

thanks in part to this Boston company

U.S. Tightens Technology Controls to Target

Russian War Machine

Small grocers feel squeezed by suppliers,

and shoppers bear the pain

Telegram Becomes Free Speech Flashpoint

After Founder’s Arrest

The secret meaning behind this common sound

you hear at Trader Joe's

Hundreds of cats roam freely on this

remote Hawaii island

You May Have Missed ---

TikTok Part 2: One Winery's Journey

Tips on Getting Started, Ordering Wine Direct

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

The Unfortunate Tale of Dallin Hawkins

By Ken Greene, Leasing News Emeritus

photo from LinkedIn

This is yet another tale of how the “mighty” have fallen. Mr. Dallin Brad Hawkins, he of Envision Capital Group and Integrity Financial Group notoriety, is presently more accurately identified as Offender Number 215741 at the Central Utah Correctional Facility, CUCF Boulder, where he has been incarcerated since April 17, 2024.

The convictions that landed him in the new digs include reckless endangerment (a class A felony), a third-degree felony DUI, felony retaliation against a witness, felony tampering with a witness, and wrongful appropriation in connection with a financing agreement. The latter charge appears to be a repetitive theme throughout Mr. Hawkins’ beleaguered career. He is presently serving concurrent five-year sentences.

Mr. Hawkins has had extensive dealings with the civil, criminal, and bankruptcy courts. He often represents himself in propria persona (without counsel). It appears he was arrested at least four times in Utah by the time he was 40. Charges included several DUIs, bribery or offering a bribe, and reckless endangerment. Other records suggest even more arrests.

In 2011, Mr. Hawkins started the Integrity Financial Groups (not to be confused with a host of other finance and insurance companies using the name “Integrity”). Although he is currently incarcerated, LinkedIn still shows the company as active.

Criminal records obtained online reveal a long history of legal problems going back almost 12 years. Since 2012, many complaints have been made to Leasing News about Mr. Hawkins, often by customers complaining of deposits that were not returned, one of the more insidious practices in the commercial finance industry, and one that has certainly raised the ire of honest brokers and lenders. A Leasing News reader once remarked that the name “Integrity” “does not describe the company and is a deception”.

Upon losing a counterclaim in 2016, Mr. Hawkins found solace in the bankruptcy court, filing a Chapter 7 petition in Utah. Amazingly, many of his debts based on claims of unreturned deposits were discharged!

The moral of this story is simple. Pigs get fat and hogs get slaughtered.

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

This article is presented by Leasing News. All copyrightable text, the selection, arrangement, and presentation of all materials (including information in the public domain), and the overall design of this presentation are the property of the Leasing News and Kenneth Charles Greene. All rights reserved. Permission is granted to download and reprint materials from this article for viewing, reading, and retaining for reference. Any other copying, distribution, retransmission, or modification of information or materials from this article, whether in electronic or hard copy form, without the express prior written permission of Kenneth Charles Greene, is strictly prohibited. The materials available from this article are for informational purposes only and not to provide legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. Use of and access to these materials does not create an attorney-client relationship between the Law Office of Kenneth Charles Greene and the user or viewer. The opinions expressed herein are the opinions of the individual author.

As noted in each Leasing News edition: “When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.”

[headlines]

--------------------------------------------------------------

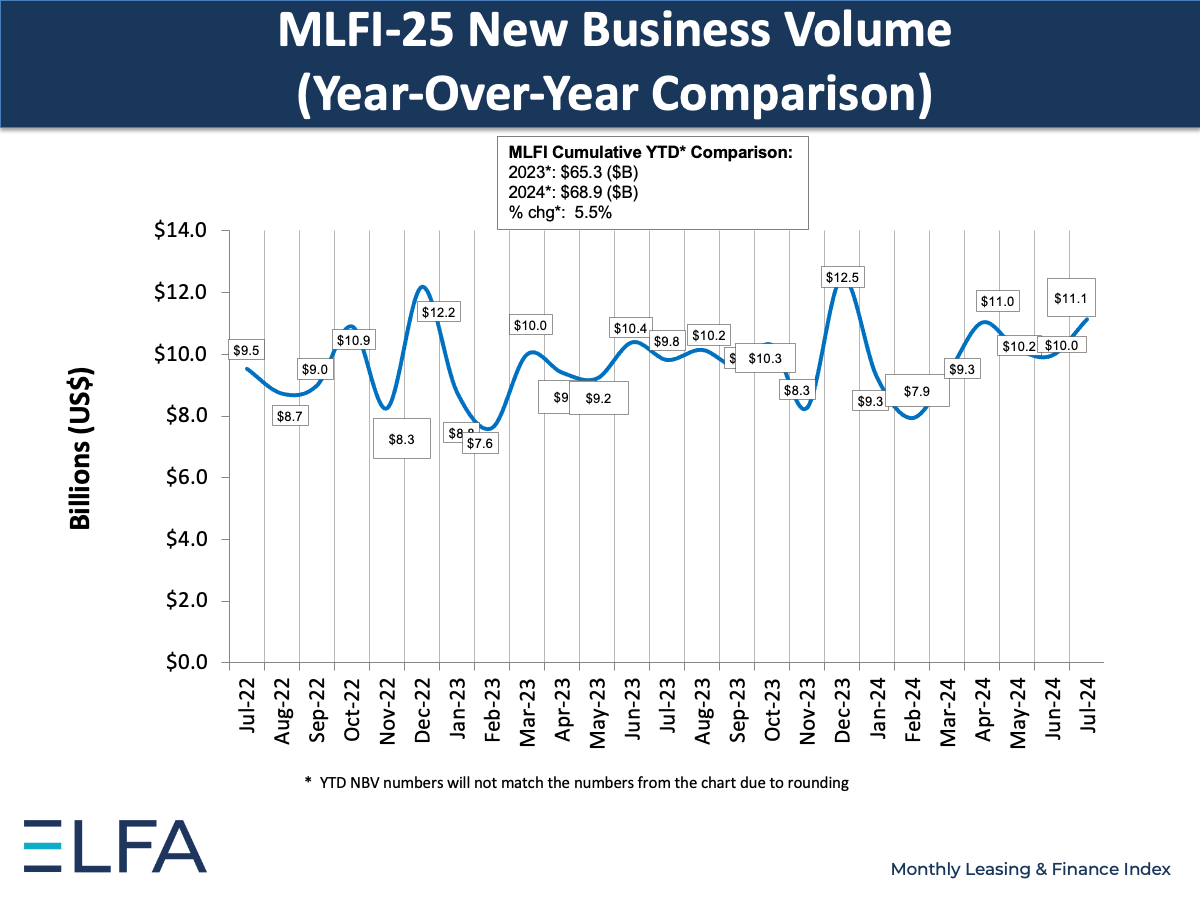

ELFA Reports Leasing New Business Up

to $11.1 Billion July from $10 Billion in June

(Source: Leasing News)

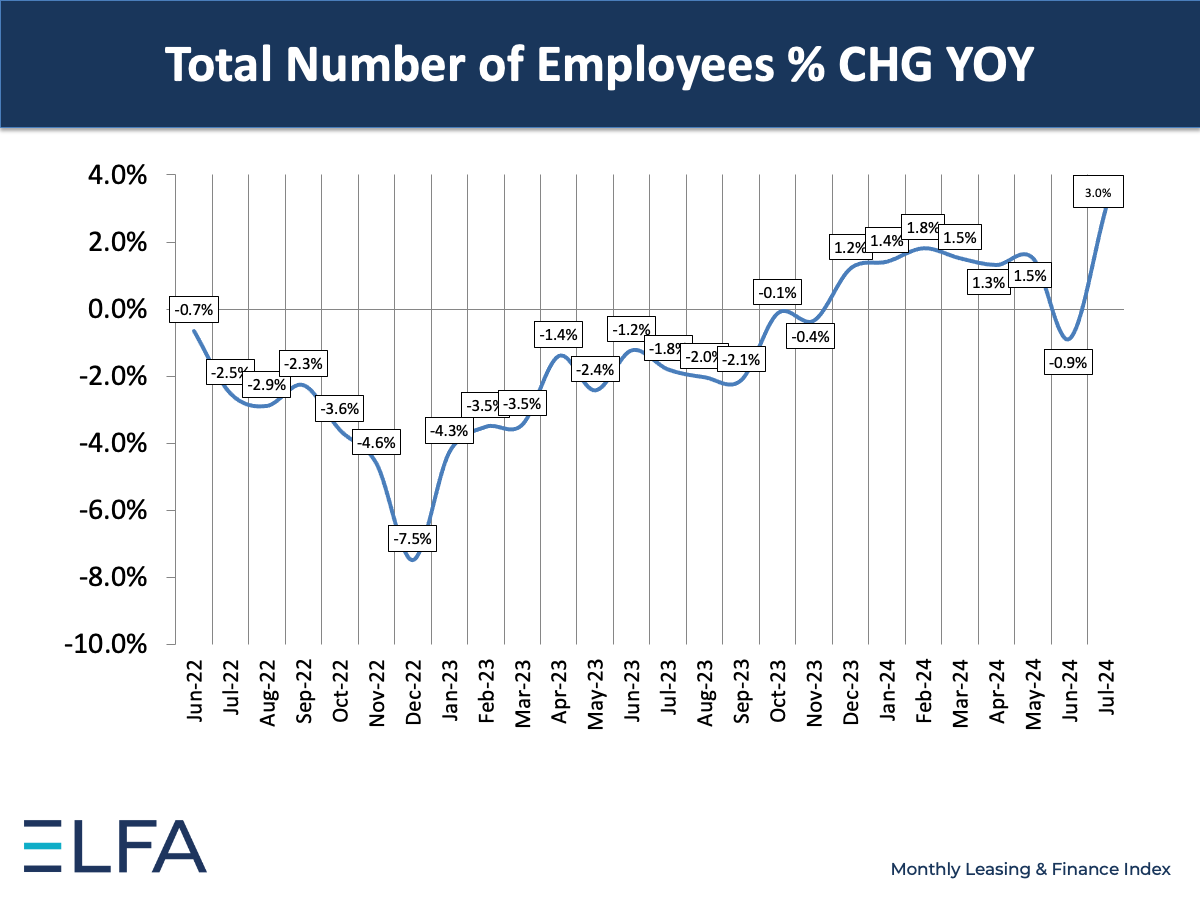

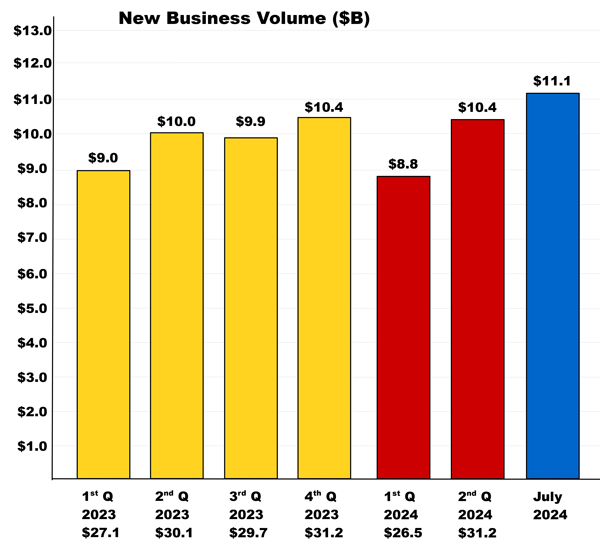

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index, a survey of economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, reports that in July, 2024, business was up 11%, to up $11.1 billion from $10 billion in June, 2024.

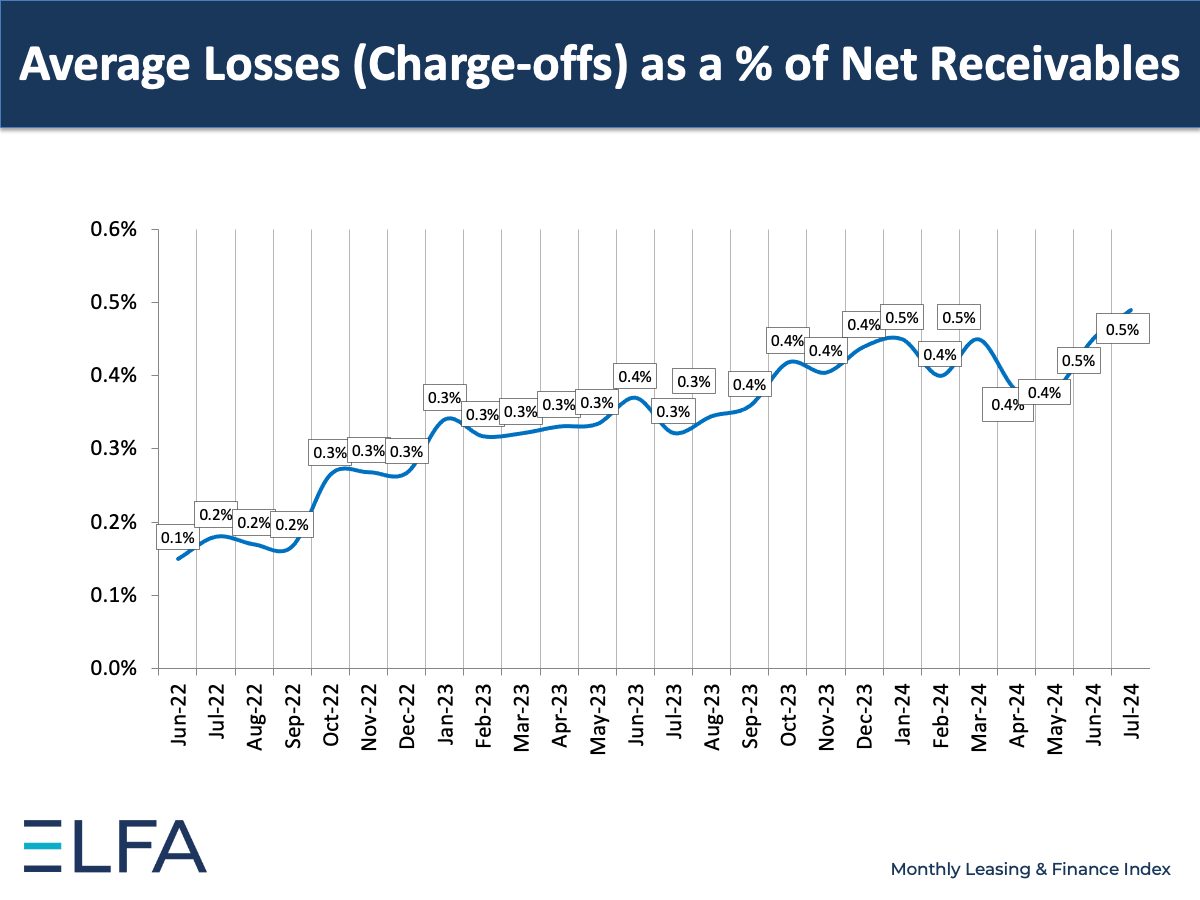

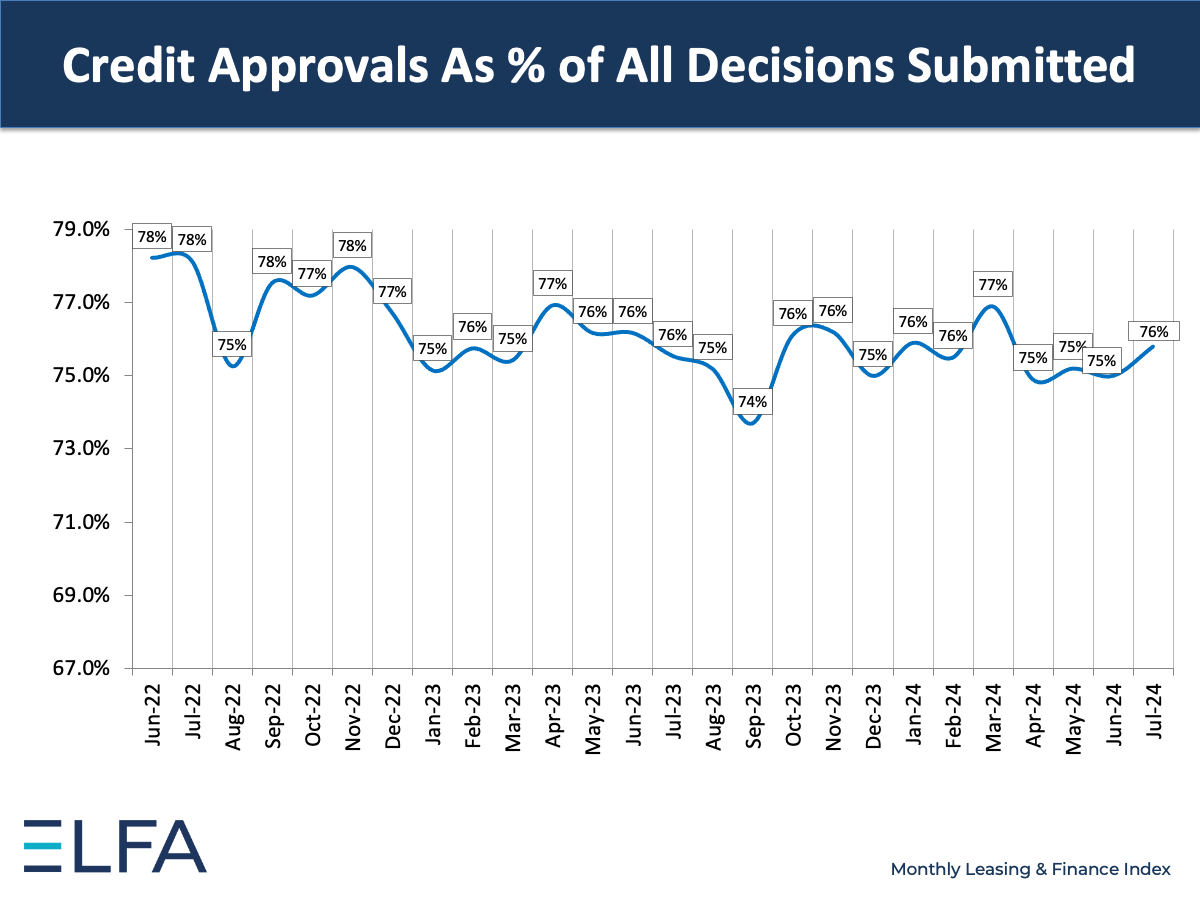

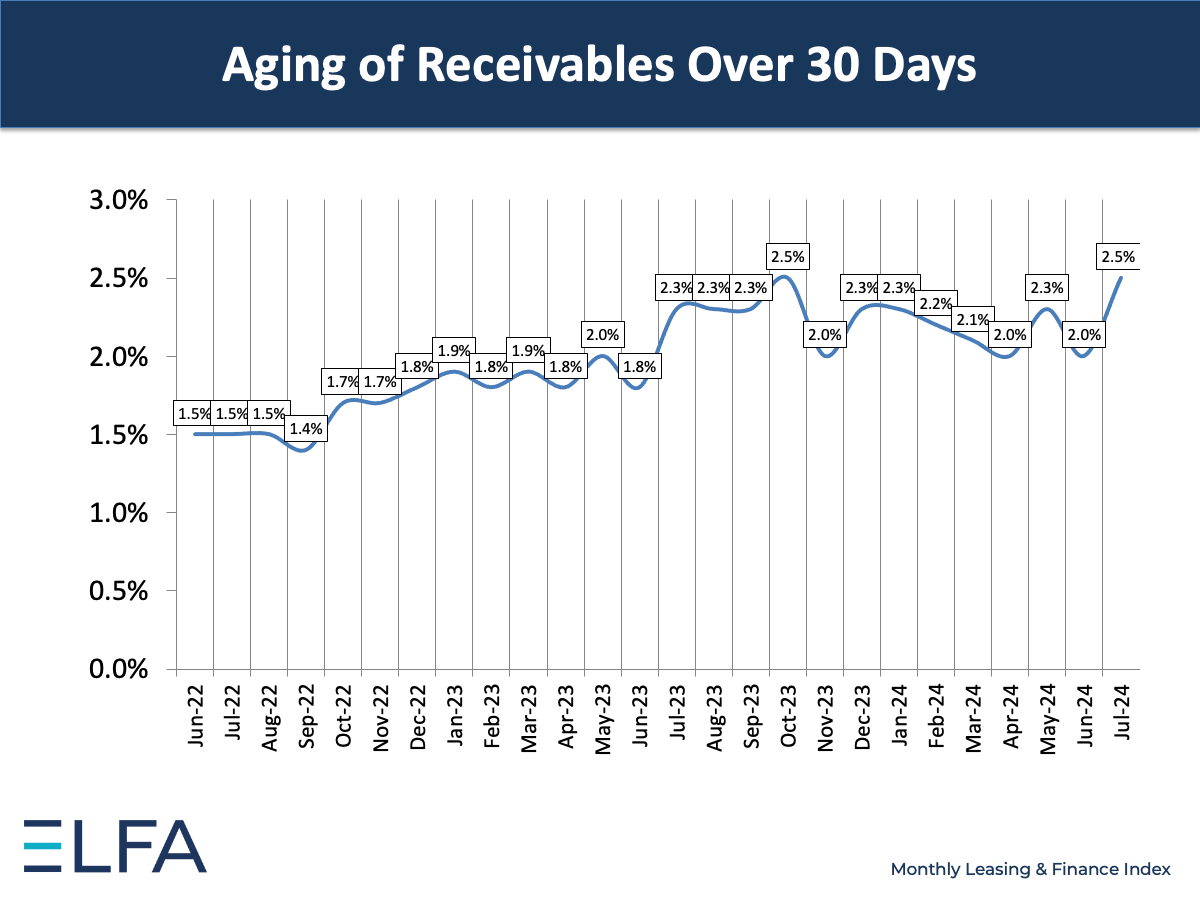

ELFA President and CEO Leigh Lytle said, “Our July MLFI report showed strength in demand amidst a slight deterioration in financial conditions. Originations grew by double digits from June, but bank activity slowed. Given that banks comprise more than half of equipment finance activity, their continued pullback and the ability of captives and independents to pick up the slack bears watching in future surveys.

"Credit quality deteriorated, with both receivables and losses up year over year. Overall our latest report reflects optimism from industry leaders that equipment demand should remain healthy over the second half of the year as the Fed begins to ease monetary policy.”

Amrita Patel, Head of Equipment Finance, Wells Fargo, commented, “The equipment finance sector continues to exhibit strength, with demand in the pipelines indicating growth appetite into 2025. Potential rate cuts in September could contribute to this uptick, particularly for equipment replacement and acquisition.

"While smaller firms cautiously consider labor and borrowing costs against equipment needs, larger companies are progressing through capital expenditure cycles and at times, leveraging their cash in this environment.”

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

Commercial Finance/Leasing Finance

Conferences & Forums - Updated

Sept. 4-5: AACFB Commercial Financing Expo, New Orleans, Louisiana https://expo.aacfb.org/home

Complete List of 2024 AACFB Funding Exhibitors

https://leasingnews.org/archives/Aug2024/08_12.htm#aacfbitors

More Information:

https://leasingnews.org/archives/Jul2024/07_22.htm#aacfb

Vicki Shimkus, CLFP, Balboa Capital, Broker Relationship Manager, will be covering the conference for Leasing News readers.

Sept. 10-12: CFLA Conference, St. John's, NL, Canada

CLFP to Present New Program

https://leasingnews.org/archives/Aug2024/08_23.htm#clfp

Full Information:

https://cfla-acfl.ca/cfla-annual-national-conference-2024.html

Hugh Swandel, President, Meridian OneCap Commercial Credit, will be covering the conference for Leasing News

Sept. 23 - 24: B2B Finance Expo, Wynn, Las Vegas, NV

https://www.b2bfinexpo.com/

It also features Poker Game for 50, Sunday, Sept. 22, 2024

https://www.b2bfinexpo.com/page/3932469/poker-party

Accepting Reservations:

https://book.passkey.com/gt/220111918?gtid=3de05f54910c4c17c858cd28e9e1b9cf

Oct. 16-18: NVLA Conference, Clearwater Beach, Florida

https://www.nvla.org/page/2024conference

Early Bird Special expired 7/19/2024

https://leasingnews.org/archives/Jul2024/07_12.htm#nvla

Sloan Schickler, Esq., Schickler & Schickler, will be covering the conference for Leasing News. She is also presenting there.

Oct. 27-29: 63rd ELFA Annual Convention, Austin, TX

List of Attendees

https://leasingnews.org/archives/Aug2024/08_23.htm#elfa

Convention detailshttps://www.elfaonline.org/education-networking/2024/annual-conventionEarly Registration https://leasingnews.org/archives/Aug2024/08_16.htm#elfa

Bruce Kropschot, Senior Managing Director, The Alta Group, will be covering the ELFA Convention, as he has done for Leasing News for many years.

Nov. 6, 2024, Brokers Expo, New York City

https://brokerexponewyorkcity.com/

Super-Early-Bird-Pricing-Announced (to expire 9/1/24)

https://reg.eventmobi.com/BENY24/register

Elevate Your Brand - Become a Sponsor

https://leasingnews.org/archives/Jul2024/07_26.htm#expo

Nov. 11-14: NEFA Fall Conference, Indianapolis, Indiana

https://www.nefassociation.org/events/upcoming

Don Cosenza, CLFP, Senior Vice President of North Mill Equipment Finance, will be covering the conference for Leasing News

To be listed or update: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Top Ten Most Read by Readers

August 19 - August 23

(1) Ken Greene, Esq., Leasing News Emeritus answers

Which One are You on Friday?

https://leasingnews.org/archives/Aug2024/08_19.htm#greene

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Aug2024/08_23.htm#hires

(3) Canadian Stock Exchange Halts Trading

Chesswood Group Limited Stock

https://leasingnews.org/archives/Aug2024/08_19.htm#cgl

(4) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Aug2024/08_21.htm#hires

(5) Axis Auto Finance Provides Update

on Strategic Review Process

https://leasingnews.org/archives/Aug2024/08_23.htm#axis

(6) List of 630 Registered for October 27 -29

63rd ELFA Annual Convention

https://leasingnews.org/archives/Aug2024/08_23.htm#elfa

(7) ELFF Monthly Confidence Index Hits

Highest Level since February 2022

https://leasingnews.org/archives/Aug2024/08_23.htm#elff

(8) CLFP to Present New Program

at Canadian Finance & Leasing Association Conference

https://leasingnews.org/archives/Aug2024/08_23.htm#clfp

(9) CLFP Foundation Adds 14 New CLFPs

With Photos

https://leasingnews.org/archives/Aug2024/08_19.htm#clfp

(10) "Double Down"

Sales Makes it Happen by Scott Wheeler, CLFP

https://leasingnews.org/archives/Aug2024/08_19.htm#dd

[headlines]

--------------------------------------------------------------

Car Insurance Rates Could Jump as High as

50% in several States This Year

By Matthew W. Daus, Esq.

There's some bad news ahead for the nation's business and personal car owners, with a new report forecasting that auto insurance — one of the biggest drivers of inflation this year — will continue to rise in 2024. Especially in three states that could see their coverage rates spike by 50% in 2024.

That's according to a new report from Insurify, a company that provides data about auto insurance rates. The typical U.S. insurance policy will jump 22% this year to an average annual premium of $2,469 by year-end, the report found. That comes after drivers saw their policies jump 24% in 2023, it noted.

The three states where insurance rates could jump by more than 50% this year are California, Minnesota and Missouri, the Insurify report found. Drivers in those states could see their rates rise by 54%, 61% and 55%, respectively.

CBS Reports "Increasingly severe and frequent weather events are driving up auto insurance premiums," Insurify said in its report. "Hail-related auto claims represented 11.8% of all comprehensive claims in 2023, up from 9% in 2020, according to CCC Intelligent Solutions.

"Drivers in Maryland currently pay the highest average rate, at $3,400, for annual full coverage as of June, the Insurify analysis found. Their rates are projected to jump 41% to $3,748 by year-end compared with the state's 2023 rates, it noted. The second most expensive state is South Carolina, with an average policy premium of $3,336 in June. That could rise by 38% to $3,687 by the end of the year versus its 2023 rate."

Auto insurance remains a pain point for car owners and lessees after experiencing more than two years of elevated inflation. And even as the overall inflation rate is cooling — the Consumer Price Index dropped to 2.9% in July, the first time since March 2021 it's fallen below 3% — drivers are continuing to see their policy rates rev up, fueled by more climate events that are causing vehicle damage.

Matthew W. Daus, Esq.

Partner and Chairman, Windels Marx Transportation Practice Group

President, International Association of Transportation Regulators,

Transportation Technology Chair, University Transportation Research Center

Contact: mdaus@windelsmarx.com

[headlines]

--------------------------------------------------------------

##### Press Release #######################

Dext Capital Announces Lana Kralik, CLFP

as Senior Operations Director

Lake Oswego, OR –August 26th 2024 - Dext Capital is pleased to announce the addition of Lana Kralik, CLFP, as Senior Operations Director. Lana comes to Dext with over 17 years in the equipment finance industry with US Bank with expertise across a wide range of areas including documentation, contracts and credit.

A Certified Lease & Finance Professional (CLFP) since 2017, Lana has demonstrated a strong ability in policy development and effective leadership across multiple functions. She has been actively involved with the Equipment Leasing and Finance Association (ELFA) and served as Chair of the Emerging Talent Advisory Council (ETAC) from 2022-2023.

Kyin Lok, President and CEO, said, “We are thrilled to have Lana join the Dext team. Her experience, enthusiasm and commitment to excellence is a perfect fit for our company. "

For more information about Dext Capital, please visit www.dextcapital.com

Linkedin: https://www.linkedin.com/company/dext-capital/

Instagram: https://www.instagram.com/dextcapital/

Tiktok: https://www.tiktok.com/@dextcapital

##### Press Release #######################

[headlines]

--------------------------------------------------------------

##### Press Release #######################

ELFA 2024 Survey of Equipment Finance

Activity Reveals New Business Volume Growth

of 1.1% in 2023

(There is a fee to purchase the full report, but the Executive Summary is available free to ELFA members and nonmembers at www.elfaonline.org/SEFA)

The equipment finance industry saw new business volume (NBV) increase 1.1% in 2023, according to the 2024 Survey of Equipment Finance Activity (SEFA) released by the Equipment Leasing and Finance Association (ELFA). This decrease from NBV growth of 6.3% in 2022 was largely driven by pullback from bank lessors. The 2024 SEFA reveals key statistical, financial and operations information for the $1 trillion equipment finance industry, based on a comprehensive survey of 101 equipment finance companies.

Key findings for 2023 as reported in the 2024 SEFA include:

• By organization type, banks saw a 3.3% decrease in new business volume, while NBV for captives and independents increased by 6.3% and 10.0%, respectively.

• By market segment, NBV rose 8.0% in the large ticket segment and 7.2% in small ticket, while middle ticket decreased 3.6% year over year, reflecting the predominance of banks in this sector.

• From an asset perspective, the top-five most-financed equipment types were transportation, agricultural, construction, IT & related technology services, and industrial & manufacturing. The top five end-user industries representing the largest share of new business volume were services, agriculture, industrial & manufacturing, construction and transportation.

• Delinquencies were 1.4% overall, down from 2.4% in 2022, with mining/oil & gas extraction continuing to experience the highest delinquency rate.

• Charge-offs were 0.26%, up from 0.21% in 2022, and recoveries declined to 0.13% from 0.29% the year prior.

• Credit approvals decreased year over year driven by banks, with declines in the number of credit applications booked and funded, and in dollar volume. In 2023, 77.5% of applications submitted were approved versus 78.5% in 2022. Both captives and independents saw an increase in dollar volume booked and funded.

• Employment levels declined slightly by 0.47%. Banks' headcount remained flat, captives' declined 5.4% and independents' increased 7.6% albeit from a smaller headcount number.

In addition to the 2024 SEFA, ELFA released the 2024 Small-Ticket SEFA, which focuses on small-ticket and micro-ticket equipment transactions among the SEFA respondents. The report found that new business volume in the small-ticket space increased by 2.9% in 2023. Just under 52% of respondents had their volume grow in 2023, down from 64.8% in 2022.

The 2024 SEFA data are available in a variety of formats at www.elfaonline.org/SEFA. PricewaterhouseCoopers LLP administers the SEFA. For more information, contact Bill Choi, ELFA VP of Research and Industry Services, at bchoi@elfaonline.org.

### Press Release #########################

[headlines]

--------------------------------------------------------------

News Briefs

TSA readies for busiest Labor Day travel period

on record, provides top travel tips to help

airline passengers prepare

https://www.prnewswire.com/news-releases/tsa-readies-for-busiest-labor-day-travel-period-on-record-provides-top-travel-tips-to-help-airline-passengers-prepare-302227954.html

Self-driving trucks are thriving in Singapore,

thanks in part to this Boston company

https://www.bostonglobe.com/2024/08/25/business/self-driving-trucks-venti-technologies-singapore-port/

U.S. Tightens Technology Controls to Target

Russian War Machine

https://www.nytimes.com/2024/08/23/us/politics/us-russia-technology-penalties.html

Small grocers feel squeezed by suppliers,

and shoppers bear the pain

https://www.washingtonpost.com/business/2024/08/25/grocers-prices-chains/

Telegram Becomes Free Speech Flashpoint

After Founder’s Arrest

https://www.nytimes.com/2024/08/25/technology/pavel-durov-telegram-detained-france.html

The secret meaning behind this common sound

you hear at Trader Joe's

https://www.sfgate.com/food/article/trader-joes-bell-system-19717249.php

Hundreds of cats roam freely on this

remote Hawaii island

https://www.sfgate.com/hawaii/article/hawaii-kahoolawe-cats-19716949.php

[headlines]

--------------------------------------------------------------

TikTok Part 2: One Winery's Journey

and Tips on Getting Started, plus Ordering Wine Direct

https://www.winebusiness.com/news/article/291535

[headlines]

--------------------------------------------------------------

Sports Briefs---

Teams Leave, but Oakland Still Finds Reasons

to Cheer

https://www.nytimes.com/2024/08/24/business/oakland-sports-teams-roots-ballers.html

The final play of the 49ers preseason

was pure chaos

https://www.sfgate.com/49ers/article/final-play-49ers-preseason-pure-chaos-19720233.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Orange County faces a population exodus.

Its housing market couldn't care less.

https://www.sfgate.com/la/article/orange-county-exodus-housing-boom-19717302.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

New Jersey’s 29 best vineyards

and wineries for 2024

https://www.nj.com/food/2024/08/new-jerseys-29-best-vineyards-and-wineries-for-2024.html

Winesong! Weekend September 6 and 7

Mendocino Little River Inn

https://www.eventbrite.com/e/winesong-weekend-september-6-and-7-tickets-862463460427?

Visiting Napa Valley? Here’s how much

it could cost you per day

https://www.sfchronicle.com/food/wine/article/napa-visitor-spend-expensive-19659561.php

Update from Ste. Michelle Wine Estates: Part II

David Bowman, Ste. Michelle Wine Estates

https://www.northwestwinereport.com/2024/08/ste-michelle-wine-estates-update-part-ii.html

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Aug2021/08_23.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()