Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Monday, August 25, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

CapEx Finance Index (CFI) July 2025:

Demand Ticked Up Despite YTD Contraction

Business Finance Brokers in 2025

By Sean Murray, Chief Editor at deBanked

(originally appeared debanked.com)

Leasing and Finance Industry Help Wanted

Balboa Capital – Several Positions Available

Top Salaries and Benefits

Leave Your Ego at the Door: Why

Humility Outperforms Ego in Leadership

By Ken Lubin, ZRG Partners, Managing Director

Top Ten Most Read by Readers

August 11 to August 15

Conferences and Forums - Updated

Commercial Finance/Leasing Finance

News Briefs

As Troops Walk the Streets, Washington

Restaurants Report a Slump

The Plan to Make Hooters

‘Delightfully Tacky’ Again

ICE Is Constantly Using Coast Guard Planes

to Move Immigrants

Damages mount as Spain

battles massive wildfires

As Trump's trade war continues,

Canadians continue to stay away

Buyers Backing Out: July Home Deal

Cancellations Reach Eight-Year High

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Scott Gojkovich was promoted to Senior Vice President of Insurance, NCMIC, Clive, Iowa. He is located Urbandale, Iowa. Full Bio: https://www.linkedin.com/in/sagojkovich/details/experience/

https://www.linkedin.com/in/sagojkovich/

Jennifer Lawrence was hired as Account Executive, Sallyport Commercial Finance, LLC. Houston, Texas. She is located in St. Augustine, Florida. Previously, she was Portfolio Manager, Iron Horse Credit (April, 2019 - August, 2025); Senior Executive Assistant, Citi (October, 2010 - April, 2019).

https://www.linkedin.com/in/jennifer-lawrence-93007a1b1/

Melissa A. Knutson, CLFP was promoted to Chief Strategy Officer, NCMIC Group, Ink, Clive, Iowa. She is located in Johnston, Iowa. She joined NCMIC January, 2004, as Vice President & General Manager, Equipment Finance.

https://www.linkedin.com/in/melissa-a-knutson-clfp-313a5332/

Melissa McGuire was hired as Vice President, Business Development, Sallyport Commercial, Houston, Texas. Finance. Previously, she was at LAQ for 15 years, 2 months, Director, Supply Chain Finance. Full Bio: https://www.linkedin.com/in/melimcguire/details/experience/

https://www.linkedin.com/in/melimcguire/

Tearinea Singleton, CLFP, promoted to Director, Portfolio Management, JDR Solutions, Inc., Indianapolis, Indiana. She is located in Woodbury, New Jersey. She joined JDR as Portfolio Management Specialist (March, 2025 - August, 2025); She was Human Resources Specialist, Glass Soldier (January, 2025 to Present); Operations Analyst, Tamarack Technology, Inc. (April, 2022 - June, 2023); Audit Supervisor, Cannon Financial Services, Inc. (January, 2017 - April, 2022); Full Bio:

https://www.linkedin.com/in/tearinea-singleton-clfp-27291a125/details/experience/

https://www.linkedin.com/in/tearinea-singleton-clfp-27291a125/

Jeremy Thompson was hired as Vice President, Asset Management, Investor Relations, External Partnerships, Savoy Equity Partners, Dallas, Texas. He is located in Richardson, Texas. Previously, he was Managing Principal, Convolo Capital, Richardson, Texas (November, 2020 - Present); Founder, Refuge Consulting/JARS Partners Uerlar Venture (January, 2012 - Present). Full Bio:

https://www.linkedin.com/in/jeremyjthomason/details/experience

https://www.linkedin.com/in/jeremyjthomason/

[headlines]

--------------------------------------------------------------

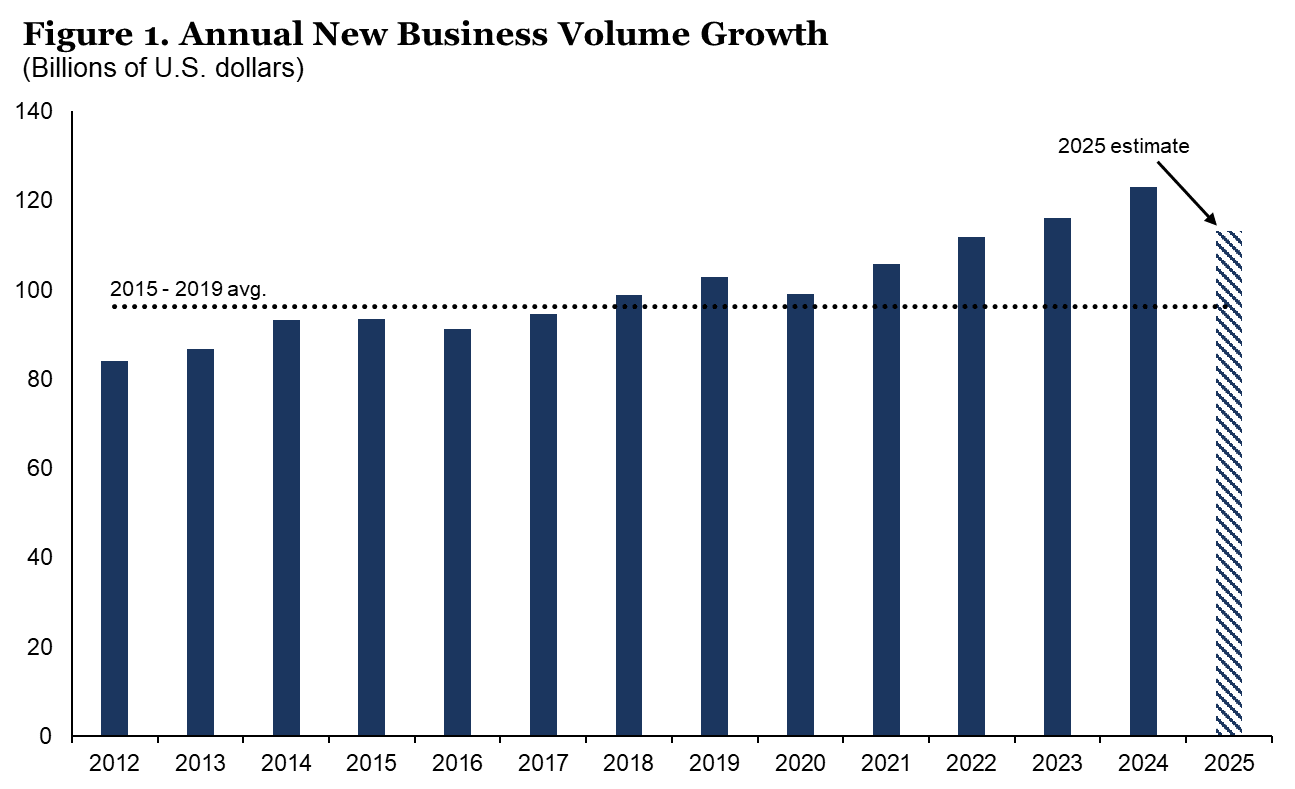

CapEx Finance Index (CFI) July 2025:

Demand Ticked Up Despite Year-to-Date Contraction

FORECAST: The change in new business volumes (NBV) suggests a 0.1% increase in new durable goods orders in July.

- Total NBV among was on a seasonally adjusted basis in July, an increase of 1.7% from June.

- NBV year-to-date contracted by 3.8% relative to the same period in 2024.

- Year-over-year, NBV declined by 6.8% on a non-seasonally adjusted basis.

Leigh Lytie, President and CEO at ELFA said, “The latest CapEx Finance Index data showed that conditions in the equipment finance industry continue to be steady, even as economic and financial volatility remains high.

Equipment demand ticked up Total new business volumes grew by $9.7 billion in July, a similar pace as the average over the first six months of 2025. As shown in Figure 1, total new activity is on pace to exceed $110 billion in 2025, less than the record of $123.2 billion set in 2024, but above the $96.3 billion average in the five years before the pandemic. Small deal activity rose by 8.3% and the pace of new volumes picked up at banks, captives, and independents. Volumes at banks rose by $4.6 billion, a change of 0.3% from June. The $2.9 billion in new volumes at captives was the highest dollar amount in 2025, and new activity at independents has been stable over the last year, rising by $2.0 to $2.1 billion every month since August 2024.

The credit approval rate jumped. The average credit approval rate rose to 78.2% in July, its highest reading in the last two years. The overall approval rate has been trending up since November 2024. The rate at banks was up by 5.4 percentage points, but down by 4.6 and 2.3 percentage points at captives and independents, respectively.

Losses dropped and delinquencies remained stable. The overall delinquency rate edged up to 2.0% in July but remained below its trailing six-month average of 2.1%. The delinquency rate on small ticket deals dropped to 2.2%, tying its lowest reading of the year. The rate at banks rose to 1.5%, an increase of 0.44 percentage points, while the rate at captives dropped to 2.0%, the lowest rate since December 2024. The delinquency rate at independents declined modestly to 3.2%.

The overall loss rate ticked down to 0.50% in the latest data. The rate at banks dropped 0.13 percentage points to 0.39%. The loss rate at captives rose modestly to 0.41%, while the rate at independents increased by 0.14 percentage points to 0.80%.

Keith Duggan, CEO of First National Capital Corporation

remarked, “July’s CFI results underscore the continued strength and resilience of the equipment finance industry, Demand for equipment edged higher, approval rates reached a two-year high, and loss rates declined—clear indicators of a healthy financial environment. In our personal experience, overall volumes are tracking toward a solid year. We believe that the trend to ‘onshoring’ of manufacturing driven by tariffs will ultimately be good, but it is very early to see the demand develop yet. Of course, the recent increase in the Producer Price Index at 0.9% was a bit concerning on the ‘inflation front,’ but we're confident the economy will digest these changes and continue a steady march forward. Overall, at First National, we view the current economic indicators and business environment as evidence that our sector is well-positioned to support business investment and stability."

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation tracks the sentiment of executives in the industry. The index dipped to 60.2 in August, after three consecutive months of increases.

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

[headlines]

--------------------------------------------------------------

Business Finance Brokers in 2025

By Sean Murray, Chief Editor at deBanked

(originally appeared debanked.com

We’re now ten years out from the original “Year of the Broker” article in deBanked Magazine. Brokers are still here, the business has just changed slightly. Here’s some of the top line differences vs. 2015:

Cold Calling: 12% of merchants say they started their search for business funding options from a cold call.

Google Search: Organic search rankings beginning to diminish in favor of AI Q&As.

Training: AI can now listen to every call and grade you on every component of it.

CRMs: Pen and paper are over. Every touch on a deal should be traced and automated and deal tracking organized in a system.

Competition: Every POS solution and merchant Fintech software now has a funding button embedded into it.

Commissions: Still high.

Funding Options: Lines of credit, term loans, MCAs, SBA, equipment financing, real estate lending, and more.

Regulations: There are now numerous state registration and disclosure requirements. (See the map here).

Leads: Referral networks are now more valuable than ever. Referrals from CPAs, lawyers, trade associations, chambers of commerce, and more.

Gates: You may have to go through a super broker to get access to a top tier funder.

Startup Costs: The registration requirements in several states has significantly increased the cost of starting a new broker shop today.

[headlines]

--------------------------------------------------------------

Leave Your Ego at the Door: Why

Humility Outperforms Ego in Leadership

By Ken Lubin, ZRG Partners, Managing Director

After 26 years in executive recruiting, I’ve seen the brightest careers stall, or worse, come undone because of unchecked ego. The harsh reality is that in the world of leadership, ego is often a silent saboteur. It may give a temporary confidence boost but it ultimately undermines success in ways that become painfully obvious when performance suffers and relationships strain. Here’s how ego can hold you back in ways that experience has proven again and again:

- Undermines Collaboration and Team Success: Ego can be a powerful barrier to effective collaboration. I’ve seen leaders walk into meetings with all the answers, convinced their approach is best, only to miss out on the insights and innovation others bring to the table. When leaders prioritize their own voices over team input, they shut down ideas before they even surface. The best leaders, the ones who drive real results, are the ones who check their ego, bring out the strengths in others, and cultivate a team where every idea is valued.

- Shuts Down Self-Awareness and Growth: One thing I’ve learned over decades is that growth demands self-awareness. But ego resists any feedback that challenges it, leading professionals to disregard areas where they could improve. I’ve seen talented people plateau because they chose ego over self-reflection. Leaders who are open to learning—and willing to recognize when they don’t have all the answers—continue to evolve, and that adaptability keeps them valuable as they move up the ladder.

- Clouds Judgment and Decision-Making: Ego-driven decisions are short-sighted. When leaders make choices to reinforce their self-image rather than focusing on what’s best for the organization, it often backfires. I’ve seen it time and again: leaders who prioritize their reputation or pride over thoughtful analysis make decisions that harm the organization and their standing in the long run. The smartest leaders set ego aside, assess situations objectively, and make decisions that support the team and the business.

- Damages Relationships and Reputation: Ego can strain, and even destroy, professional relationships. It’s difficult to lead effectively if your colleagues view you as unapproachable or arrogant. Respect, trust, and empathy are the cornerstones of strong working relationships, and I’ve seen how ego can erode these fundamentals. A strong reputation takes years to build, but ego can tear it down in a matter of months.

- Blocks Adaptability: The world of business isn’t static, and neither should be a leader. Ego can create a false sense of certainty, preventing leaders from pivoting when market demands shift or new strategies are needed. The best executives I’ve recruited are those who embrace change, know when to let go of their initial approach, and adapt to what the moment demands.

Final Thoughts: Ego and confidence are not the same things. Real confidence doesn’t need to push others down to feel strong. In my experience, the most effective leaders are those who leave ego out of the equation and are willing to learn, adapt, and grow. When leaders let go of ego, they open themselves to new opportunities, stronger teams, and lasting success.

Ken Lubin, Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

Top Ten Most Read by Readers

August 11 to August 15

(1) NMEF Closes $525 Million Securitization,

Marking Continued Growth at $3.3 Billion

and Market Confidence

https://leasingnews.org/archives/Aug2025/08_18.htm#nm

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Aug2025/08_18.htm#hires

(3) New Hires/Promotions in the Leasing Business

nod Related Industries

https://leasingnews.org/archives/Aug2025/08_20.htm#hires

(4) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Aug2025/08_22.htm#hires

(5) Integra Capital Notifies Brokers

Ceasing Operations

https://leasingnews.org/archives/Aug2025/08_22.htm#entegra

(6) ELFF Reports August Drops to 60.2 in August

From 61.6 in July Monthly Confidence Index

https://leasingnews.org/archives/Aug2025/08_22.htm#elff

(7) Winning with Purpose

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Aug2025/08_20.htm#win

(8) CLFP Foundation Adds 13 New CLFPs

With Photograph

https://leasingnews.org/archives/Aug2025/08_18.htm#clfp

(9) Funder List "A"

Page 1 of 2

https://leasingnews.org/archives/Aug2025/08_22.htm#fundera

(10) Answering the Question "Tell Me About Yourself"

By Ken Lubin, Managing Partner, ZRG Partners

https://leasingnews.org/archives/Aug2025/08_20.htm#answer

[headlines]

--------------------------------------------------------------

Conferences and Forums - Updated

Commercial Finance/Leasing Finance

September 10-12: AACFB Commercial Financing Expo, Austin, Texas

Hotel Details: AT&T Hotel and Conference Center 1900, University Avenue, Austin, TX 78705.

We’re thrilled to announce that seasoned speaker and business consultant, Rory Rowland, will take the main stage as the 2025 AACFB Commercial Financing Expo keynote speaker this September 11th in Austin, Texas! We have a pre-registered attendee list of 3,628 contacts to help you connect with key industry professionals.

List Includes: Contact information, Email address, Company Title, Mobile number, Website URL, Job title/designation, and more.

Could you let me know if you want to receive the Attendee List with the Exclusive fee?

Hotel: AT&T Hotel and Conference Center

Special Rate: $199/night (plus a bonus night at

$299 for Friday, Sept 12)

Meet the Funders

https://www.aacfb.org/events/calendar

List of Exhibitors

https://members.aacfb.org/Expo/Expo/Exhibitors.aspx

Women in Finance Breakfast

https://members.aacfb.org/Expo/

Charity Cruise in Austin

Sept. 10: 6pm - 8pm - $85.00

Dinner, drinks, Riverboat Cruise

https://conta.cc/40Oqh9J

Mel Vinson, CLFP, Vice President of Marketing and Development, CLFP Foundation, will be covering The conferences for Leasing News reads.

September 17: Brokers Expo NYC Center, 415 Fifth Avenue in Midtown -

Full Information: https://thefundersforumbrokerexpo.com/ny/?utm_source=BENY&utm_medium=email&utm_term=button

- The Experts Want to Hear from You: https://myemail.constantcontact.com/---Don-t-Miss-Out--Game-Changing-Panels---Power-Networking-at-Brokers-Expo-NYC-2025---Register-Now-------.html?soid=1133130637774&aid=prP58Y9ItbQ

🌟 Sales Strategies That Convert in a Tight Market

🌟 What Funders Look for in a Top-Tier Broker

🌟 The Future of the RBF Industry

…and more on trends, tools, and tactics shaping the world of small business finance.

Don Cosenza, CLFP, will cover the conference for Leasing News. Public Relations and spokesman for North Mill Equipment Finance for 10-Years, plus past National Equipment Finance Association past board member.

Network with Women in

National Vehicle Leasing Association

Wednesday, September 17, 2025

11:00 AM - 12:00 PM CT

https://www.nvla.org/events/EventDetails.aspx?id=1909329

October 14-16: National Equipment Finance Association Fall Conference, Renaissance Hotel, Minneapolis, Minnesota

Registration and Information

https://members.nefassociation.org/Online/iCore/Events/Event_display.aspx?

EventKey=FLCONF25&hkey=4aadd378-30dd-4c01-ad48-05e0ecaace0c

Vicki Shimkus, CLFP, Balboa Capital Relationship Manager, will be covering the conference for Leasing News readers.

October 26-28: ELFA 64th Annual Convention, Marco Island, Florida

https://www.elfaonline.org/events-new/event-detail/elfa-64th-annual-convention

Schedule:

https://www.elfaonline.org/education-networking/2025/annual-convention/schedule

Talent Pipeline Opportunity Fund awarding grants to attend ELFA Annual Convention

ELFA's Talent Pipeline Opportunity Fund to cultivate and support the next generation of leaders in the equipment finance industry will award seven grants to individuals to attend the ELFA 64th Annual Convention Oct. 26–28 in Marco Island, Fla. Each grant will cover registration, travel and hotel accommodations. The application deadline is Sept. 8. For more information about the grant or to submit an application visit here.

Randy Haug, LTi Technology, will be covering the conference for Leasing News

October 28-29: DeBanked B2B Finance Expo, Wynn, Las Vegas, Nevada

B2B Finance Expo is back for its highly anticipated second edition at the Wynn Las Vegas! We're thrilled to once again partner with the Small Business Finance Association (SBFA) to deliver an even bigger and better experience, uniting top professionals in the commercial finance industry.

Bob Coleman, Coleman Reports, will be a speaker. He us out with a new book Book: “Hard time, Easy Mone”

https://debanked.com/2025/07/coleman-reports-bob-coleman-is-out-with-a-new-book-easy-money-hard-time/

Questions? Email us at events@debanked.com

To Update, please email: kitmenkin@leasingnews.org

RISING To the Challenge

SFNet's 81st Annual Convention

November 11-13, 2025

Los Angeles, California

https://www.sfnet.com/home/81st-annual-convention

https://myemail.constantcontact.com/

For Updates, email: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

News Briefs

As Troops Walk the Streets, Washington

Restaurants Report a Slump

https://www.nytimes.com/2025/08/23/dining/washington-restaurants-national-guard.html

The Plan to Make Hooters ‘Delightfully Tacky’ Again

https://www.wsj.com/business/retail/hooters-hotpants-tacky-bankruptcy-4520d4b9?mod=business_lead_pos5

ICE Is Constantly Using Coast Guard Planes

to Move Immigrants

https://www.rollingstone.com/politics/politics-features/trump-ice-coast-guard-planes-immigrant1e23d7b5e501722d1ef586e79e

2c78687a4f90db93d96edefe96a93c356ffc&recipient_salt=0492a016c98afe7d37c

2b67ce07a11f38e0f03dbd811f7aeb3cb0a597b8e7

Damages mount as Spain battles massive wildfires

https://www.courthousenews.com/damages-mount-as-spain-battles-massive-wildfires/

As Trump's trade war continues,

Canadians continue to stay away

https://www.timesunion.com/business/article/trump-s-trade-war-continues-canadians-continue-20827523.php?cmpid=115195&utm_content=hed&sid=65cc575c39f1f1f761046d83&ss=A&st_

rid=7101055c-671b-41dc-ae6a-c31487cd5dd1&utm_source=newsletter&utm_medium=email&

utm_term=headlines&utm_campaign=altu%20%7C%20daily%20headlines

Buyers Backing Out: July Home Deal

Cancellations Reach Eight-Year High

https://themortgagepoint.com/2025/08/21/record-number-of-home-purchases-canceled-in-july/?utm_campaign=MP%20Subscribers%20-%20Essentials%2C%20Access%2C%20Insider&

utm_medium=email&utm_content=377038678&utm_source=hs_email

[headlines]

--------------------------------------------------------------

Experts issue warning over growing crisis

reshaping US housing market: 'A new market reality'

https://www.yahoo.com/news/articles/experts-issue-warning-over-growing-213000828.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Kurtenbach: The 49ers are panic-buying to cover

their roster-building mistakes

https://www.eastbaytimes.com/2025/08/22/kurtenbach-the-49ers-are-panic-buying-to-cover-their-roster-building-mistakes/?campaign=ebtbreakingalert&utm_email=44CB2489F5F4B4CD94A5B48E

AB&active=yesP&lctg=44CB2489F5F4B4CD94A5B48EAB&content=alert&utm_sourc

e=listrak&utm_medium=email&utm_term=https%3a%2f%2fwww.eastbaytimes.com

%2f2025%2f08%2f22%2fkurtenbach-the-49ers-are-panic-buying-to-cover-their-roster-building-mistakes%2f&utm_campaign=bang-east_bay_times-breaking_news_alerts-nl&utm_content=alert

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

San Francisco Bay Area prosecutors charge 1,200

theft felonies under Proposition 36.

Will it help curb crime?

https://www.mercurynews.com/2025/08/24/prop-36-bay-area-crime-theft/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Basically a monster’: The Pickett Fire is

threatening these Napa Valley wineries

https://www.sfchronicle.com/food/wine/article/pickett-fire-napa-wineries-20875344.php

Tariffs: Quebec liquor board prepares to destroy

$300,000 worth of American alcohol

https://ca.finance.yahoo.com/news/tariffs-quebec-liquor-board-prepares-163128323.html

Lovers Access to the Best of the Wine Web

Free Daily Email Newsletter Curated by Editors,

Not AI --- by The Spill

https://www.winebusiness.com/news/article/307140

Alliance awards $18,000 in scholarships

https://pasoroblesdailynews.com/paso-robles-wine-country-alliance-awards-18000-in-scholarships/213883/?utm_source=rss&utm_medium=rss&utm_campaign=paso-robles-wine-country-alliance-awards-18000-in-scholarships

US drinking drops to new low, poll finds

https://www.pressdemocrat.com/article/lifestyle/drinking-less-us/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Aug2021/08_25.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()