Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Thursday, February 13, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Understand the Regulations

- Appoint a Compliance Officer

By Tom McCurnin, Retired Attorney

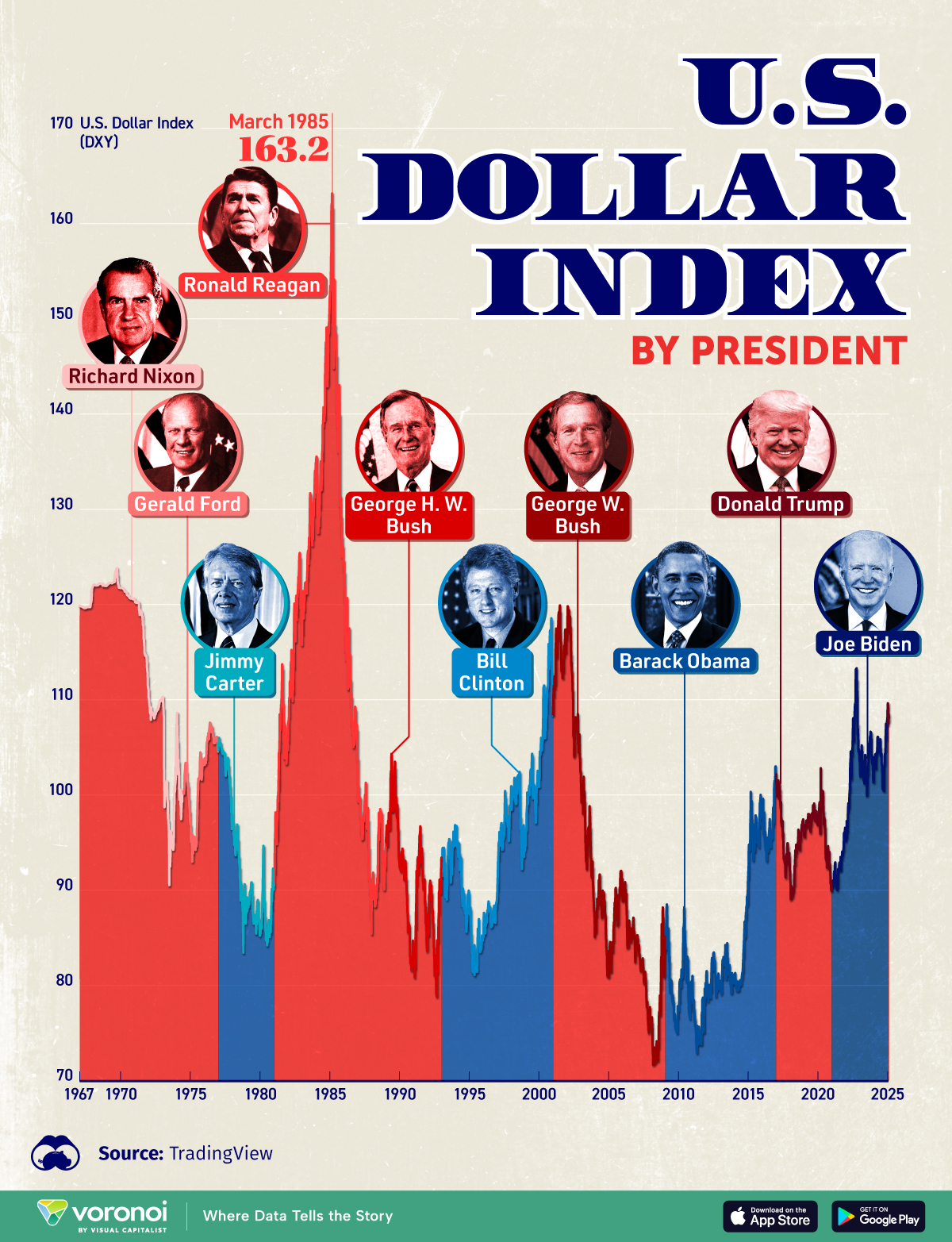

The U.S. Dollar Under Every President Since 1967

Visual Capitalist

Balboa Capital Available Position

Program Manager II-Equipment Broker Sales

Full Job Details - Benefit

Rates

By Scott Wheeler, CLFP

Reid Raykovich, CLFP, CAE

Leasing News Advisor

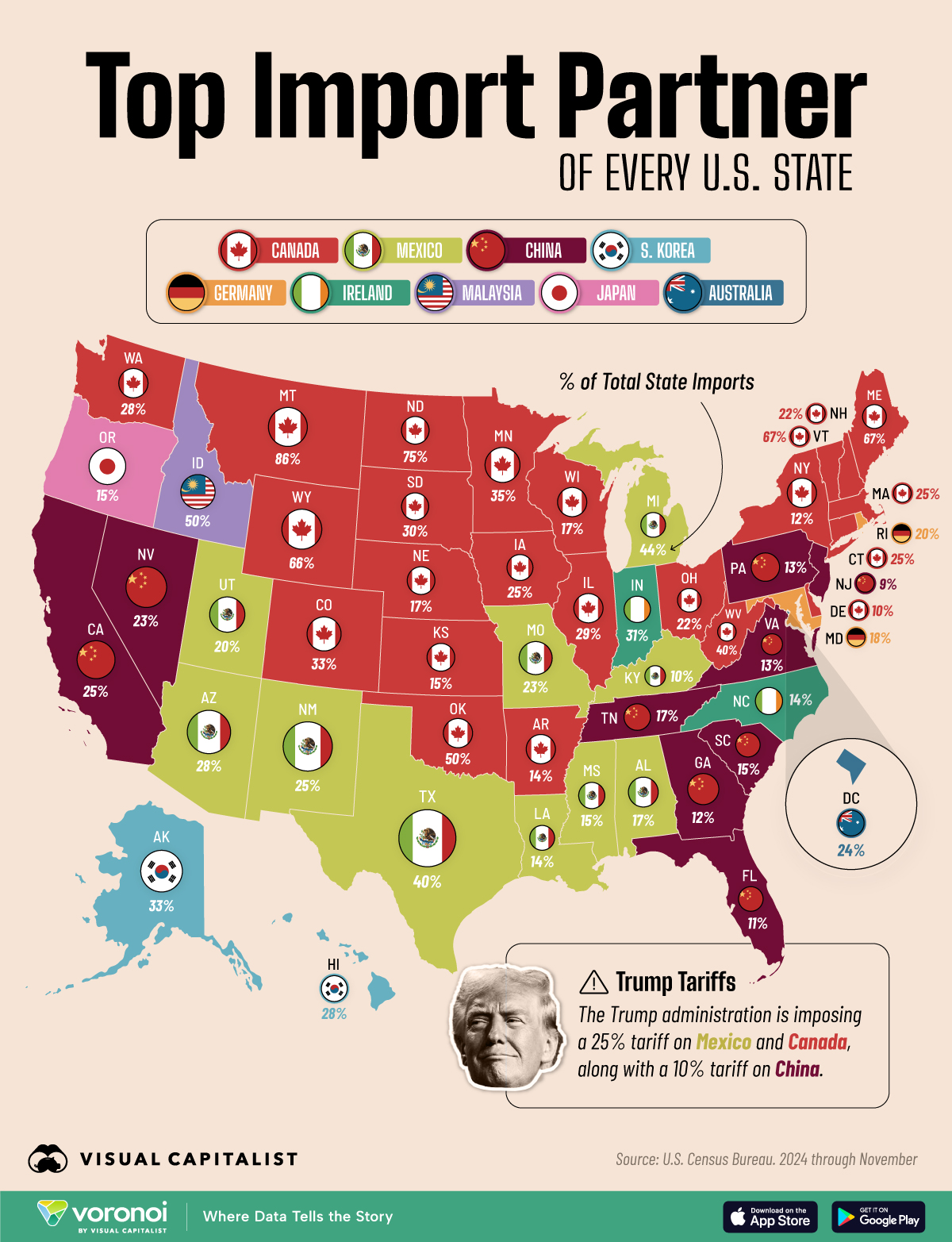

The Top Import Partner of Every U.S. State

Graphic - Visual Capitalist

Judge Refuses to Release Roglieri on

Bond Due to Angry, Vengeful Threats

By Bob Coleman, Coleman Report

News Briefs---

Trump Vows to Remove Bike Lanes in NYC

Also City Should Get Rid of Its Bike Lanes

Millions flow to wealthy families, pricey private

schools under Florida’s supercharged voucher program

Is It Made of Metal? It Could Get More Expensive

Under Trump’s Latest Tariffs

U.S. Economic Optimism Isn’t Converting Into Hiring Yet,

Randstad CEO Says

How Flunking a Personality Test

Can Cost You Your Dream Job

You May Have Missed ---

Inflation Rises Unexpectedly,

Complicating Picture for the Fed

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Lisa DeSantis Adams was hired as Business Development Specialist, TBD. She is located in Portland, Oregon. Previously, she was Senior Vice President, Business Development, Gibraltar Business Capital (September, 2022 - February, 2025); Senior Vice President, UMB Bank (August, 2019 - September 2022). Full Bio:

https://www.linkedin.com/in/lisa-desantis-adams-694109b/details/experience/

https://www.linkedin.com/in/lisa-desantis-adams-694109b/

Krishna Agrawal, CLFP, was hired as Regional Account Manager, West, Auxilior Capital Partners, Inc., Las Vegas Metropolitan Area, where he is located. Previously, he was at DLL, starting October, 2021, Account Manager, Construction; promoted Business Development Manager, Food & Agriculture (October, 2022 - December, 2024)'

Full Bio:

https://www.linkedin.com/in/krishna-agrawal-clfp-11b7b77/details/experience/

https://www.linkedin.com/in/krishna-agrawal-clfp-11b7b77/

Clint Johnson was promoted to Vice President of VFI Corporate Finance, Salt Lake City, Utah. where is located. He joined VFI February, 2018, Business Development Officer; promoted February, 2021, Business Development Officer & BDA Manager; promoted ACP of Sales (August, 2023 - February, 2025).

https://www.linkedin.com/in/clint-johnson-6945957a/

Ryan Ledden, CLFP, promoted to to SVP/Chief Operating Officer. LTi Technology Solutions, Omaha, Nebraska, where he is. He joined LTi May, 2014, Implementation Specialist, promoted September, 2016, Implementation Team Lead, promoted Implementation Manager, January, 2017; promoted Director, Release Management October, 2020; promoted VP of Deployment Operations (December, 2023 - February, 2025). Full Bio:

https://www.linkedin.com/in/ryanjledden/details/experience/

https://www.linkedin.com/in/ryanjledden/

Glenn Trovato was hired as Sales Manager, CapFront, He is located in the New York City Metropolitan Area. Previously, he was at Lendio, starting February, 2017, Senior Funding Manager; promoted November, 2017- February, 2025); Account Executive. National Business Capital (April, 2016 - February, 2018).

https://www.linkedin.com/in/glenntrovato/

Emily Zwach was hired as President, Synergy Financial Resources, Sioux Falls, SD. She is located in Alexandria, Minnesota. Previously, she was VP of Business Development, American Financial Partners (October, 2004 - February, 2025).

https://www.linkedin.com/in/emily-zwach-2a147414

[headlines]

--------------------------------------------------------------

Understand the Regulations - Appoint a Compliance Officer

By Tom McCurnin, Retired Attorney

(This is a 2019 article by Tom, but fits today’s laws and politics. Editor)

I don’t want to dive into politics but since the election of Donald Trump, the present administration has abandoned federal regulations for financial institutions. At first blush, this sounded like a great idea but there were unintended consequences. The abject failure of the Consumer Financial Protection Bureau (CFPB) to regulate the explosion in finance companies has caused two states (California and New York) to undertake their own regulation of the financial services industry.

California has a comprehensive licensing statute with interest rate disclosure, to be further developed this year by the California Department of Business Oversight. New Jersey is to follow. New York may have interest rate disclosure by 2020.

The California Department of Business Oversight (DBO) has enacted licensing requirements and interest rate disclosure. It is aggressively policing its requirements as a direct result of the federal government backing out of the space. With licensing, there are a number of other regulations which must be understood by licensees.

▪ Appoint a Compliance Officer. Most financial institutions have appointed a person to be in charge of regulatory compliance. It is this person’s job to make sure that the company complies with all regulations. Of course, this person should consult appropriate lawyers who know regulations and should attend conferences on the subject.

▪ Timely File Annual Reports In California, these reports are due in March. If you’ve moved or not received your reminder card, you still have to renew your license. There may be significant fines for letting the license expire.

▪ Deals Done Without a License Will Subject You To Fines. If your company has done California loans without a license or while the license was expired, expect to be fined. The fine can be as large as $2,500 but is usually significantly less. Nevertheless doing a couple hundred deals will probably warrant a five figure fine.

▪ Understand the Regulations. Along with your license, the DBO has enacted about 20 pages of regulations. They are not difficult to read and understand. Somebody at your company should read them and report back to management. The current trip wires for the DBO are paying commissions to unlicensed brokers or if you are a broker, receiving commissions while not being licensed.

▪ Understand the Regulations of Other States. Most good leasing attorneys can conduct a 50 state survey of licensing requirements. Some states have no lending license requirements, except for small dollar, less than $10,000 commercial loans. Other states have that threshold at $5,000. Your compliance officer should know all the requirements for loans and leases made by your company in the states you operate.

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

Full Job Details - Benefits

[headlines]

--------------------------------------------------------------

The U.S. Dollar Under Every President Since 1967

Visual Capitalist

These high rates made holding U.S. dollars more attractive and America’s relative economic strength played a role in driving investor sentiment.

At the time, the sharp appreciation of the dollar contributed to a substantial trade deficit as American goods became increasingly expensive while imports were cheap. To curb the dollar’s rise, global leaders struck a deal in 1985 called the Plaza Accord, which contributed to its 40% decline over the next two years.

By contrast, the dollar hit all-time lows in 2008 during the global financial crisis under George W. Bush. At the end of 2008, the Federal Reserve cut interest rates to near-zero amid deteriorating labor market conditions. Amid concerns of a slow economic recovery, investors looked to gold and other higher-yielding currencies.

[headlines]

--------------------------------------------------------------

Rates

By Scott Wheeler, CLFP

Top originators in the commercial equipment finance and leasing industry embrace rate questions because they fully understand that:

- Industry yields are determined by the correlation between risk and reward. The market sets the rate - not individual originators. The industry provides a broad range of yields based upon the strengths of each opportunity.

- If the originator's offered yield is significantly above market, for the risk they are willing to assume, then their business activity will quickly be reduced to near zero activity.

- If the originator's offered yield is significantly below market for the risk they are willing to assume, then their business activity will quickly increase. However, profits will be reduced and potential write-offs may increase over time.

- There will always be competitors with lower rates or lower credit requirements, but rarely do competitors have both. If they do, it will usually be for a temporary period. (The market does not allow absurdity.) The market works.

- Industry participants have minimum yield requirements and maximum risk tolerance matrices which originators must work within. Not every opportunity will fit properly within the specified box. The originator's responsibility is to fully understand their tolerance box and to find, win, and fund transactions within those parameters.

- Rates are important. However, cash flow considerations are also influential in an end-user's decision-making process. Structure can often be of greater cash-flow savings than the rate. As market rates have increased from historical lows, structure has re-emerged as a primary factor in winning or losing transactions. Top originators understand the market (and competition) and often suggest structures which address cash-flow benefits.

It is the originator's responsibility to maximize returns by providing a superior, value-added service. It is the originator's responsibility to provide the best program that the client deserves based upon the strength of the transaction (including the financial strength of the client, the collateral being acquired, the term being requested, and the current market conditions).

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

--------------------------------------------------------------

Reid Raykovich, CLFP, CAE

Leasing News Advisor

Reid Raykovich, CLFP, CAE

Chief Executive Officer

Certified Lease & Finance Professional Foundation

(206) 535-6281

(866-795-5839

reid@CLFPFoundation.org

www.CLFPFoundation.org

Reid was appointed to the Leasing News Advisory Board January 1, 2019

Reid Raykovich, CLFP, CAE, is the CEO of the Certified Lease & Finance Professional Foundation. Under her leadership since 2012, the Foundation has experienced remarkable growth, increasing membership by over 1,000%. In 2014, she was honored with the Foundation's prestigious Cindy Spurdle Award of Excellence.

Reid's career in commercial equipment finance began at Great American Insurance, where she earned her CLFP designation. Her industry experience includes roles at McCommon Leasing, Irwin Commercial Finance, and Financial Pacific Leasing, where she received the "Above and Beyond Leadership" Award. Her contributions to the industry have been widely recognized - she was named Leasing News Person of the Year in 2016, selected as one of Monitor magazine's top 50 most powerful and influential women in 2019, and honored as the 2020 Pioneer Icon by Monitor.

A thought leader in the field, Reid has authored and co-authored numerous articles on certification and continuing education. She is a frequent speaker at industry conferences and has presented internationally, including a 2018 speaking tour across three Australian cities focusing on certification.

Reid holds a Bachelor of Arts in Psychology with minors in Classics and Business from the University of Washington, where she graduated magna cum laude in just two and a half years. She further enhanced her credentials by earning her Certified Association Executive (CAE) designation in June 2023.

Outside of work, Reid is an avid crafter who enjoys making gifts for others. She shares her home with her daughter, Milla, and her cat, Toonces, who keep her life full of joy and adventure.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Judge Refuses to Release Kris Roglieri on

Bond Due to Angry, Vengeful Threats

By Bob Coleman, Colemen Reports

The accused $100 million Ponzi schemer was ruled a danger to himself and to the community.

On January 29, the federal appeals court denied Kris Roglieri's appeal for bond and ruled he is to be jailed until his trial on five counts of loan defaults.

The judge writes: "The court has rarely seen such degrading, threatening, and worrisome communications in the context of a financial fraud case. Defendant did not mince words in his text messages; he communicated precisely how he was feeling: angry and vengeful. He stated he did not care about authority and discussed the use of guns and physical violence against the specific individuals he was angry toward."

The former concealed gun carrying permit holder has been held in a county jail since May of last year. He is also facing additional New York state weapons charges after the FBI seized an AR-15 assault rifle with a high-capacity ammunition magazine.

The specific loan fraud charges stem from a $5 million cash deposit that was supposed to be used as prepaid interest for the construction of a $100 million Minnesota egg farm. Prosecutors have alleged Kris diverted millions of customer deposits to support his lifestyle:

$11 Million in Luxury Vehicles

$4.4 Million in Luxury Watches, Jewelry and Antiques

$835,000 in Private Jet Travel

They petitioned, “How can uncorroborated claims of unrecorded statements from an antagonistic witness overcome Mr. Roglieri’s 44 years of consistent history of non-violent behavior and having been professionally assessed by two psychiatrists who found that he represents, at most, a minimum risk of violent behavior?”

Says the judge, “The answer is simple: the Court is taking Defendant at his word."

Kris Roglieri's word includes threatening to kill an FBI agent. A trial date has not.

[headlines]

--------------------------------------------------------------

News Briefs

Trump Vows to Remove Bike Lanes in NYC

Also City Should Get Rid of Its Bike Lanes

https://cyclingmagazine.ca/sections/news/president-trump-vows-to-remove-bike-lanes-in-nyc/

Millions flow to wealthy families, pricey private

schools under Florida’s supercharged voucher program

https://www.sun-sentinel.com/2025/02/12/floridas-supercharged-voucher-program-sends-billions-to-wealthy-families-pricey-private-schools

Is It Made of Metal? It Could Get More Expensive

Under Trump’s Latest Tariffs.

https://www.nytimes.com/2025/02/11/business/economy/tariffs-steel-aluminum-manufacturing.html

U.S. Economic Optimism Isn’t Converting Into Hiring Yet,

Randstad CEO Says

https://www.wsj.com/economy/jobs/u-s-economic-optimism-isnt-converting-into-hiring-yet-randstad-ceo-says-3a72d230?st=iDGrth&reflink=desktopwebshare_permalink

How Flunking a Personality Test

Can Cost You Your Dream Job

https://www.wsj.com/lifestyle/careers/jobs-hiring-personality-test-5cd8b25c?st=dZXyq5&reflink=desktopwebshare_permalink

|

[headlines]

--------------------------------------------------------------

Inflation Rises Unexpectedly,

Complicating Picture for the Fed

https://www.nytimes.com/2025/02/12/business/inflation-cpi-report-january.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

In his first Super Bowl as an analyst, Tom Brady caps

an uneven season with a fittingly similar performance

https://www.bostonglobe.com/2025/02/10/sports/tom-brady-super-bowl-broadcast-review/

Patrick Mahomes’ legacy, a shaken Chiefs dynasty

and what comes next: Sando’s Pick Six

https://www.nytimes.com/athletic/6120617/2025/02/10/patrick-mahomes-chiefs-super-bowl-loss/

Warriors don’t expect Jonathan Kuminga

back before All-Star break

https://www.pressdemocrat.com/article/sports/warriors-dont-expect-jonathan-kuminga-back-before-all-star-break/

Why Brock Purdy probably won’t get one big wish

in contract negotiations with 49ers

https://www.eastbaytimes.com/2025/02/09/why-brock-purdy-probably-wont-get-one-big-wish-in-contract-negotiations-with-49ers/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

San Francisco is sinking, scientists say

Other Cities Also Sinking

https://www.sfgate.com/local/article/san-francisco-sinking-sea-level-rise-20161334.php

Bloomingdale’s to close flagship store

in San Francisco’s biggest mall

https://www.sfchronicle.com/sf/article/sf-bloomingdales-westfield-mall-20047347.php

Chevron to lay off thousands after relocating

headquarters from the San Francisco Bay Area

https://www.sfchronicle.com/bayarea/article/chevron-layoffs-20163221.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

North Coast wine grape crop value

falls nearly 21% in 2024

https://www.northbaybusinessjournal.com/article/industrynews/napa-sonoma-wine-crop-2024

California winery behind Trader Joe's

'Two Buck Chuck' to lay off 81 workers

https://www.sfgate.com/food/article/california-winery-two-buck-chuck-layoffs-20163619.php

The State of Distribution in 2024 - interest Rates,

Increased Costs Force Some to Cut Operations

https://www.winebusiness.com/wbm/article/297351

Beaulieu Vineyard Donates Historic Archives

to UC Davis Library

https://www.winebusiness.com/news/article/298260

Dolly Parton Launches Dolly Wines Pinot Noir

for Valentine's Day

https://www.winebusiness.com/news/article/298239

Founded in 1879, Inglenook Receives Napa Green Vineyard

Certification as The Estate Celebrates 50

of Coppola Family Stewardship

https://www.winebusiness.com/news/article/298241

Vida Valiente Winery and Foundation Raises Over

$2.34 Million for Low-Income Undergraduates

at Third Annual Napa in Cabo Auction

https://www.winebusiness.com/news/article/298258

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Feb2019/02_13.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()