Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Monday, January 22, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

SBA Office of Advocacy Reports Weak Small Business

Loan Supply and Demand

Losses in Securities Portfolios Remain Historically High

according to the Federal of Kansas City

Leasing News Advisor

Randy Haug

Help Wanted Ads with Career Opportunities

Balboa Capital/Top Mark

Starbucks has 38,000 Locations Globally

Global Presence Graphic and Article

Update on Compliance Under The Small

Business Data Collection Rule

By Sloan Schickler, Esq.

Top Ten Leasing News Read by Readers

December 15 - December 19

Mexican Whiskey Is on the Rise,

Powered by Ancient Corn Recipes

Mixed Breed

Brandywine Valley, Pennsylvania – Adopt-a-Dog

Registration is Live! 2024 AACFB Conference

Book Your Room Now Before Block Sold Out

News Briefs ---

Home sales in 2023 were worst since 1995

as high mortgage rates slammed market

Delta reports record 2023 revenue

$4.6 billion profit for the year

Teslas crash more than gas-powered cars

Here’s why

Why Does Coca-Cola Taste Better at McDonald's?

The Fast Food Chain Answers

You May Have Missed ---

KeyBank to pay $190 million because of

Silicon Valley Bank, Signature Bank failure

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Ashley Hayes was hired as Lease Administrator, PEAC Solutions, Mount Laurel, New Jersey. She is located in Conroe, Texas. Previously, she was Lease Administrator, Xerox Financial Services at Xerox Corporation (March, 2017). She joined MRC Smart Technology Solutions, a Xerox Company, August 2008, Dispatch, promoted Order Administration, March 2010, promoted Operations Manager (April, 2013 February, 2017).

https://www.linkedin.com/in/ashley-hayes-1673a645/

Paul "PJ" McElroy was hired as Senior Vice President, East Region, DLL, Philadelphia, Pennsylvania. Previously, he was Vice President, Equipment Finance Officer, KeyBank Commercial (March, 2022 - January, 2024); SVP, Direct Sales, DLL (September, 2019 - April, 2022); Business Development Manager, Siemens (September, 2015 - September, 2019); Vice President, Key Equipment Finance (August, 2015 - August, 2015); Business Development Manager, Siemens (September 2016): Vice President, Key Equipment Finance (August, 2015 - August, 2016). He began his career at GE Capital, starting April, 2004, Sales Representative, promoted June, 2009, Dealer Support, Senior Vice President (March 2011 - July, 2015) 11 years, 4 months.

https://www.linkedin.com/in/pjmcelroy/

Steve Nippak was hired as Senior Vice President of Sales, Odessa, Toronto, Ontario. Previously he was Executive VP of Sales, Country Manager, Canada & Europe, UPTIQ (November, 2021 - January, 2024); Vice President, Business Development ARGO (February, 2019 - October, 2021). Full Bio:

https://www.linkedin.com/in/stevenippak2020/details/experience/

https://www.linkedin.com/in/stevenippak2020/

Deana Redmond was promoted to Assistant Vice President, Asset Recovery, North Mill Equipment Finance, LLC., Norwalk, Connecticut. She is located in Salt Lake City Metropolitan Area. She joined North Mill September, 2021, Repossession Manager; Lease Return Manager, Aztec Financial (October 2020 - September, 2021). She joined Marlin Capital Solutions September, 2016, as Program Manager, Business Development Manager (July, 2018 - October, 2020); Finance Manager, Rush Enterprises, Inc. (May, 2010 - September, 2016); Sales Coordinator, Lake City International Trucks (October, 1991 - May, 2010) 18 years, 8 months.

https://www.linkedin.com/in/deanaredmond

[headlines]

--------------------------------------------------------------

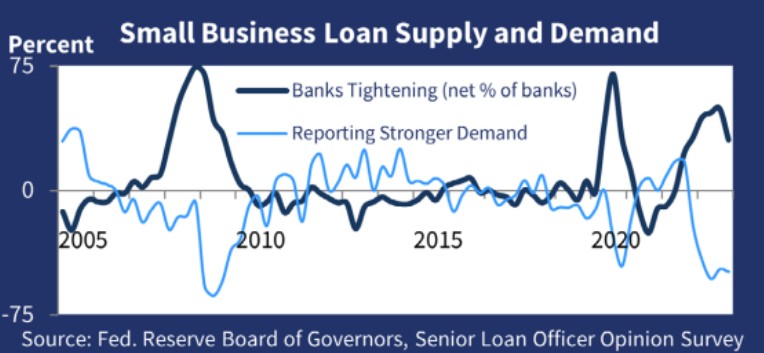

SBA Office of Advocacy Reports Weak Small Business

Loan Supply and Demand

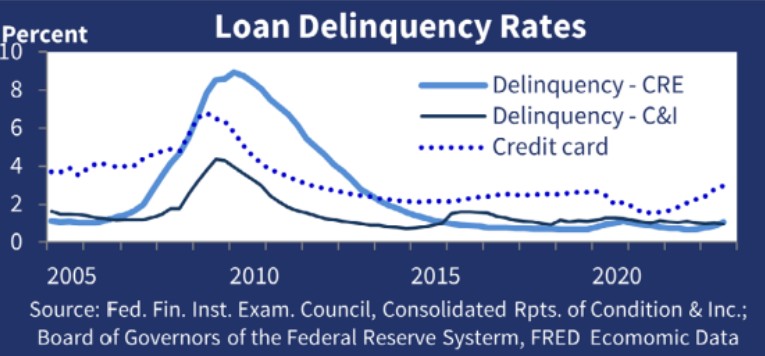

In the last year and a half, bankers have been reporting tightened credit standards and weaker demand for C&I (commercial and industrial) and CRE (commercial real estate) loans. The SBA Office of Advocacy reports that loan demand has dropped more than it did around the pandemic.

Business lending grew between June 2022 and June 2023. Total C&I loans grew at a slower rate from the previous year; from 2.1% to 5.9% growth. Small business C&I loans ($1 million or less) grew by 2.6% after two consecutive declines. Outstanding bank lending to businesses.

The Office of Advocacy states that bank delinquency rates for both C&I and CRE loans remain near historic lows. For the first time since 2015, CRE loan delinquency rates surpassed C&I rates in the last quarter. Typically higher than C&I and CRE rates, credit card delinquency rates have been steadily increasing since 2021.

Among all lenders, small business loan approval rates have yet to fully rebound back to pre-pandemic rates. Traditional lenders have relatively flat approval rates between 2021 and 2023. Alternative lenders have had a slight increase in approval rates.

Source:

SBA Office of Advocacy Economic Bulletin

Coleman Report

28081 Marguerite Pkwy.

#4525, Mission Viejo, CA 92690

bob@colemanreport.com

|

[headlines]

--------------------------------------------------------------

Losses in Securities Portfolios Remain Historically High

according to the Federal Reserve of Kansas City

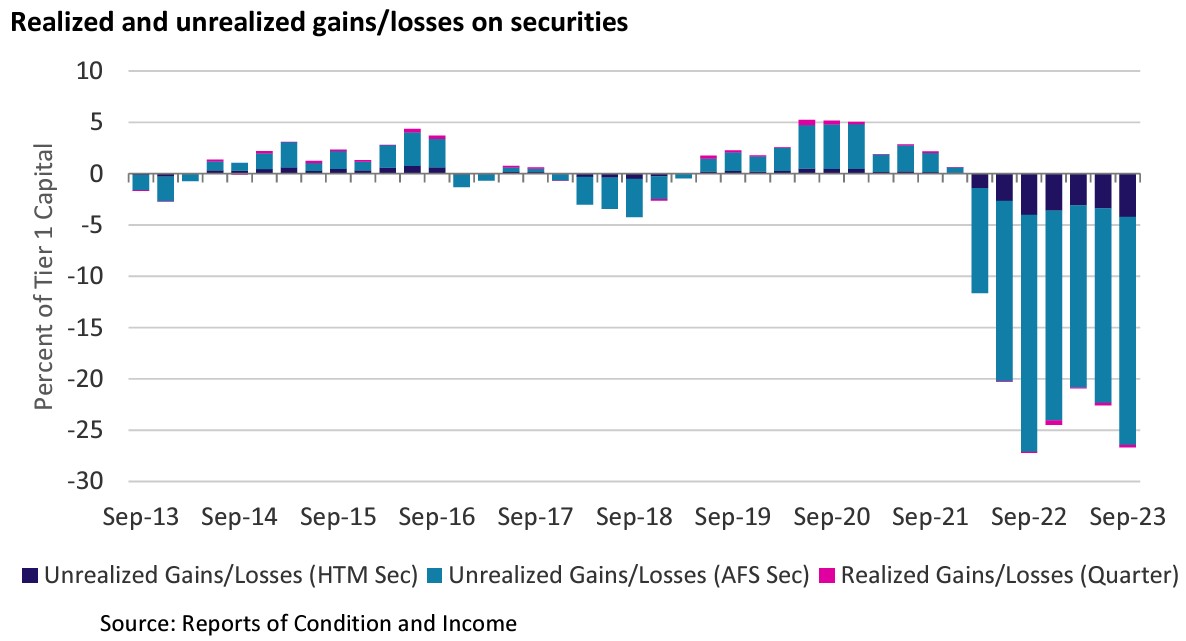

• Unrealized losses in securities portfolios at community banking organizations (CBOs) have remained at historic levels since the Federal Open Market Committee began raising rates in 2022. As of 3Q 2023, few CBOs have realized these losses through selling securities. These heightened levels of unrealized losses in the available-for-sale (AFS) securities portfolio, reflected in accumulated other

comprehensive income2, has caused tangible equity capital to remain at depressed levels compared to historical norms, though improved from the record low in 3Q 2022.

• Recent filings of large, publicly traded financial institutions have indicated more institutions are beginning to sell securities and realize losses as a strategic move to restructure the balance sheet and improve future earnings by reinvesting in higher yielding assets or paying down more expensive wholesale funding.

• While realized losses at CBOs from the sale of securities remain at historic norms and overwhelmingly within the AFS securities portfolio, more CBOs may begin to consider strategic restructuring, similar to larger banks.

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Randy Haug

Randy Haug | EVP/ Co-Founder

LTi Technology Solutions

w: 402.493.3445 ext. 1014

Mobile: 402-981-3155

rhaug@ltisolutions.com

www.ltisolutions.com

Randy Haug is the EVP, Vice Chairman, and Co-Founder at LTi. He is responsible for overseeing the market direction and strategies of LTi and serves as an advisor to clients regarding their business issues and strategies. He has spent the majority of his career in the equipment finance industry, working and mentoring LTi’s Executive Management Group, Divisional Managers, Product Managers, Sales, Account Managers, and Marketing team.

He is widely considered an industry thought leader and uses his consultative problem-solving and mentoring skills set to improve the lives of those at LTi as well as those in the industry with whom he collaborates with.

He also enjoys working with both of his sons in the business, who have become Subject Matter Experts and leaders in their own right. While EVP, Vice Chairman, and Co-Founder is his primary job function by day, Randy also loves traveling, as well as spending time with his family, friends, his grandson, and new granddaughter.

He is a member of the Equipment Leasing and Finance Association Board of Directors. He has participated in a number of different industry associations, including as a member of the Equipment Leasing and Finance Association, Advocacy Advisory Committee; Executive Committee Board Member & Development Committee Chair for Equipment Leasing and Finance Foundation (ELFF); Board of Trustee to ELFF; Past President of the National Equipment and Finance Association (NEFA); and Current Chair and Co-Founder of the Chris Walker Education Committee of NEFA. He has also participated in a number of different industry association committees in both the ELFA and NEFA associations and has been an industry speaker and panelist at a number of educational events within those associations.

Randy is a servant leader and has sat on board level positions in many industry companies and organizations. Randy had been involved in the Equipment Finance industry for 34 years while at LTI Technology Solutions, Inc. and its previously named LeaseTeam, Inc. company.

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

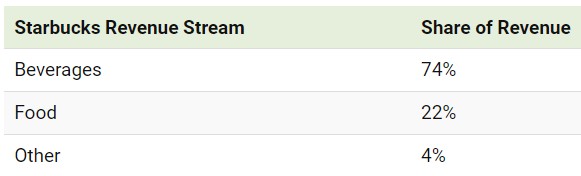

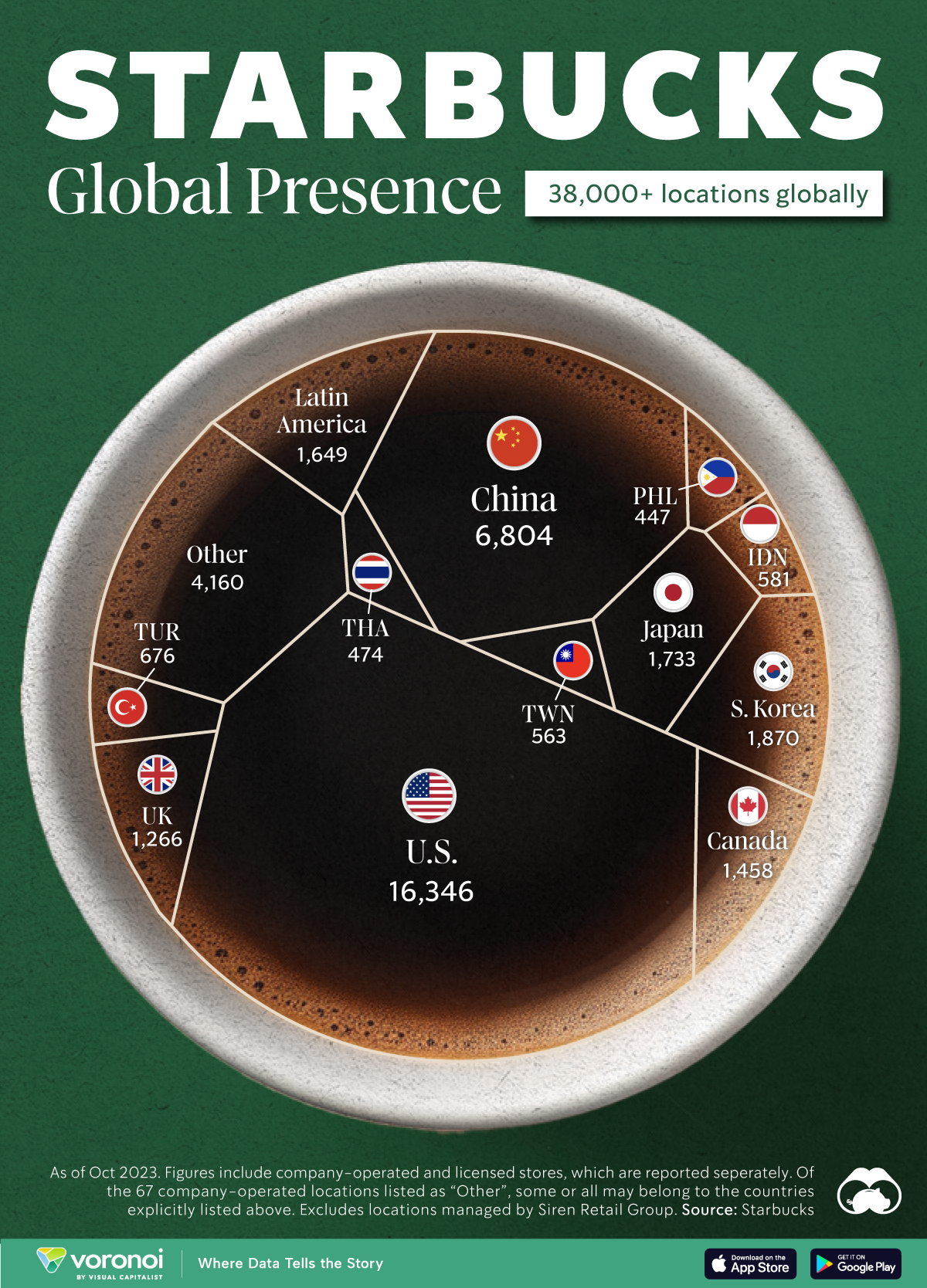

Starbucks has 38,000 Locations Globally

Started in 1971 in Seattle, Washington, Starbucks is the second-most prolific quick-service brand in the United States.

Since then, Starbucks has spread to over 80 different countries in its mission to serve coffee (or another beverage of choice) to everyone who walks through their doors.

After all, that’s their primary revenue stream:

[headlines]

--------------------------------------------------------------

Update on Compliance Under The Small

Business Data Collection Rule

By Sloan Schickler, Esq.

As previously reported, the the final Small Data Collection Rule promulgated under Section 1071 of the Dodd-Frank Act on March 30, 2023 (Rule 1071). Under this final rule, covered financial institutions are required to collect certain specific data points for reporting to the CFPB to determine practices related to lending to minority, women and LGBTQ+ owned small businesses.

Compliance dates under the rule are staggered commencing in October of 2024 for institutions with 2500 or more transactions to January 2026 for institutions with 100 such transactions in 2024 and 2025. However, on October 26, 2023, the United States District Court for the Southern District of Texas issued an injunction preventing the CPFB from enforcing the 1071 Rule. The stay was issued in a case brought by a consortium including the American Bankers Association. Several additional institutions intervened and succeeded in convincing the court that enforcement of Rule 1071 had to be delayed until the United States Supreme Court decides a pending case challenging the constitutionality of the CFPB. The Supreme Court will make its decision by about June of 2024. Until that time, the CFPB will not be able to enforce Rule 1071.

A covered financial institution is one that engages in financial activity and includes both depository and non-depository institutions such as online lenders, platform lenders, independent and captive equipment and vehicle finance companies and commercial finance companies. Motor vehicle dealers are exempt from compliance under the rule. Depending on your company’s activities it may be exempt.

Covered credit transactions are extensions of credit for business, commercial or agricultural purposes such as lines of credit and loans. True leases are among the transactions exempt from coverage.

Generally, the rule requires collection of data from businesses with $5 million or less in gross annual revenue for the preceding fiscal year.

Financial institutions are breathing a sigh of relief that the CFPB cannot enforce Rule 1071 for now. Some are asking whether they can postpone the compliance preparations which are complex. Depending on what happens with the Supreme Court case pending, it is very possible that Rule 1071 compliance will be necessary even if it is delayed. For this reason, you should not delay consulting legal counsel to determine whether Rule 1071 compliance is applicable to your company and the transactions it generates.

Originally appeared in NVLA LeaseWire

Sloan Schickler is a partner in the commercial finance law firm, Schickler & Schickler PLLC. Schickler, a veteran vehicle leasing, finance and bank attorney and the attorneys in her firm have decades of experience representing and protecting lessors, banks, captive and independent finance companies in all facets of the vehicle leasing and financing business. She has served as the NVLA Legal and Legislative counsel since 2017, is currently the only woman on the board of directors and is a supporter of Leasing News and sits on its Advisory Board. Sloan can be reached at sloan.schickler@schicklerlaw.com or 212-262-5297.

[headlines]

--------------------------------------------------------------

Top Ten Leasing News Read by Readers

December 15 to December 19

(1) Equipment Finance Cares Announces

2024 Dates and Locations

https://leasingnews.org/archives/Jan2024/01_16.htm#cares

(2) Edward P. Kaye

Leasing News Advisor

https://leasingnews.org/archives/Jan2024/01_16.htm#kaye

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Jan2024/01_16.htm#hires

(4) New Hires/Promotions in the Leasing Business

and Related Industries https://leasingnews.org/archives/Jan2024/01_19.htm#hires

(5) A Look at the Funding Dilemma Caused by Accounting

Which Affects Banks and Use of Funds Available

By Dale R. Kluga, CPA, Experienced Funder

https://leasingnews.org/archives/Jan2024/01_19.htm#look

(6) Mexican Whiskey Is on the Rise,

Powered by Ancient Corn

https://www.nytimes.com/2024/01/11/dining/drinks/mexican-whiskey.html

(7) Macy’s to Cut About 2,350 Jobs

Close Five Stores

https://www.wsj.com/business/retail/macys-to-cut-about-2-350-jobs-close-five-stores-f7daac9d

(8) Latest batch of Criterion releases

By Leasing News' Fernando Croce

https://leasingnews.org/archives/Jan2024/01_19.htm#fernando

(9) Archives for the Current Month

(following the current archives, previous issues are filed by year,

then month, and day. You may also use the "search" feature

t o find a specific article in our archives.)

https://leasingnews.org/archives.htm

(10) Story Credit Financing

Business Loans, SBA Loans, Working Capital

https://leasingnews.org/archives/Jan2024/01_16.htm#sc

Special Editions

Dr. Martin Luther King JR.

Film Review/Movies, Watch at Home

by Fernando Croce, Leasing News Movie Reviewer

https://leasingnews.org/Pages/jan152024.html

Ken Greene, Leasing Person

of the Year for 2023

https://leasingnews.org/archives/Jan2024/01_17.htm

[headlines]

--------------------------------------------------------------

Mexican Whiskey Is on the Rise,

Powered by Ancient Corn Recipes

There are 59 varieties of native corn in Mexico. It grows so fast the ancient Mayans name for it was "rooster corn".Perhaps the most available in the reunited sates is Grand Maizai. It can be found in most major wine-liquor stores and a Google search will find one near you.

The Gran Maizal Whiskey is available in certain stores plus online for $56.99, 43% akc/Vol.750ml

The website states:

The company’s purpose:

--------------------------------------------------------------

Mixed Breed

Brandywine Valley, Pennsylvania

Bailey

ID: 55101230

Female

1 Year old

24 kbs'

Spayed: No

Location: Brandywine Valle

SPCA, Pennsylvania

Bailey is a sweet, snuggly, young adult dog who just wants to cuddle and loves to be near you. She is currently living her best life with one of our awesome foster homes, but is open for adoption meets. Please call, email, or stop by the shelter and our staff would be happy to schedule an appointment to meet Bailey.

*This pet qualifies for our Sponsored by Simba program's Pets for Veterans: no adoption fee for any military veteran adopting a pet 1 year and older."

About Bailey and "What's Included)

https://bvspca.org/adopt/bailey-2

Brandywine Valley SPCA

1212 Phoenixville Pike

West Chester, PA 19380

PA Kennel License #01647

[headlines]

--------------------------------------------------------------

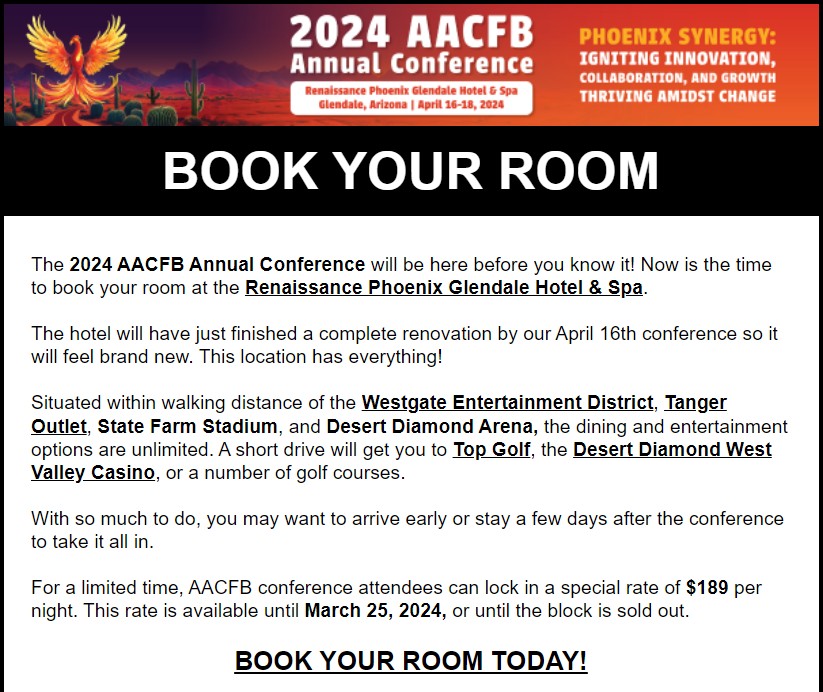

Registration is Live! 2024 AACFB Conference

Book Your Room Now Before Block Sold Out

[headlines]

--------------------------------------------------------------

News Briefs

Home sales in 2023 were worst since 1995

as high mortgage rates slammed market

https://nypost.com/2024/01/19/business/existing-home-sales-in-2023-sank-to-lowest-levels-since-1995/

Delta reports record 2023 revenue,

$4.6 billion profit for the year

https://www.ajc.com/news/atlanta-airport-blog/delta-reports-record-2023-revenue-46-billion-profit-for-the-year/PC2BN3PHZJGMVDYOIFWUP4WPIE/

Teslas crash more than gas-powered cars

Here’s why

https://www.cnn.com/2024/01/18/business/why-do-people-keep-crashing-teslas/index.html

Why Does Coca-Cola Taste Better at McDonald's?

The Fast Food Chain Answers

https://www.yahoo.com/entertainment/why-does-coca-cola-taste-150848588.html

|

[headlines]

--------------------------------------------------------------

KeyBank to pay $190 million because of

Silicon Valley Bank, Signature Bank failure

https://www.cleveland.com/news/2024/01/keybank-to-pay-190-million-because-of-silicon-valley-bank-signature-banks-failures-in-2023.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Christian McCaffrey’s 2nd TD rallies 49ers

to 24-21 playoff win over Jordan Love and Packers

https://www.pressdemocrat.com/article/sports/christian-mccaffreys-2nd-td-rallies-49ers-to-24-21-playoff-win-over-jordan/

Stanford's Tara VanDerveer becomes winningest coach

in college basketball, passing Mike Krzyzewski

https://www.pressdemocrat.com/article/sports/stanfords-tara-vanderveer-becomes-winningest-coach-in-college-basketball/

Dusty Baker explains why he joined SF Giants:

‘The prodigal son wanted to come back home https://www.eastbaytimes.com/2024/01/21/dusty-baker-explains-why-he-joined-sf-giants-the-prodigal-son-wanted-to-come-back-home/’

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Oakland’s surging violence is

driving this In-N-Out at epicenter to close

https://www.sfchronicle.com/crime/article/oakland-in-n-out-18610993.php

End of a Bay Area era? Pittsburg’s steel mill idles

amid sale to Japanese company

https://www.mercurynews.com/2024/01/20/end-of-a-bay-area-era-pittsburgs-steel-mill-idles-amid-sale-to-japanese-company/

Half Moon Bay massacre: A year later, struggle

for better farmworker housing drags on

https://www.eastbaytimes.com/2024/01/21/half-moon-bay-massacre-a-year-later-struggle-for-better-farmworker-housing-drags-on/

Two centuries ago, 3 Californians crossed an ocean

and changed Hawaii forever

https://www.sfgate.com/hawaii/article/hawaii-cowboy-paniolo-history-18615187.phpr

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Wine & Grape Conference Season

East of the Rockies = Dates and Places

https://www.winebusiness.com/news/article/281992

California Wine Players See More

Consolidation Ahead

https://www.shankennewsdaily.com/2024/01/18/34690/california-wine-players-see-more-consolidation-ahead/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Sep2021/09_22.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()