Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Thursday July 24, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Randy Haug, Leasing Person of the Year 2024,

was Appointed Honorary Ambassador of the

Guild of Business Finance Professionals

2025 Monitor 100: Growth Holds Steady Amid

Market Tension and Strategic Shifts

By Rita Garwood, Editor in Chief, MonitorDaily & ABF Journal

Several Top Jobs Available: Balboa Capital

See Availability and Top Benefits

Just Do It!

By Scott Wheeler, CLFP

After $1.1B Q2 Hit, GM Leaders See Tariff Bite

Getting a Bit Worse This Quarter

By Geert DeLombaerde, Senior Editor, Industry Week

List of 2025 AACFB Commercial Finance

Expo Exhibitors: to Plan Your Exhibit Time

Septemnber 10-12, Austin, Texas, Register

Plus Hotel Info, Riverboat Cruise & More

Wintrust Financial Corporation Reports

Record Net Income

News Briefs

Air India Finds ‘No Issues’ After Inspections

of Boeing Fuel Switches

As the Dollar Slides, the Euro Is Picking Up Speed

Supreme Court allows Trump to remove consumer

product safety regulators

U.S. Quietly Drafts Plan to End Program That

Saved Millions From AIDS

Trump Administration Illegally Withheld Head Start Funds,

Watchdog Finds

The internet is a mall, and we are trapped inside it

Canceling ‘The Late Show’ Is Bad News for Late-Night TV,

Not for Stephen Colbert

You May Have Missed ---

Coleman Report’s Bob Coleman is Out With a New Book:

“Easy Money, Hard Time”

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Vince Belcastgro was hired as Group Head Syndications & Capital Markets at Element Fleet Management, Toronto, Canada. He is located in the New York City Metropolitan Area. Previously,

he was Principal Officer, Camley Advisors, starting January, 2024; Group Head Syndications & Capital Markets (February, 2020 – November, 2023); Managing Director/Group Head Corporate Equipment Finance, Santander Bank, N.A. (January, 2015 – February, 2020). Full Bio: https://www.linkedin.com/in/vincebelcastro/details/experience/

https://www.linkedin.com/in/vincebelcastro/

Kacy Daugherty was hired as Chief Operating Officer, FlexPath DXP, Cincinnati Metropolitan Area, to work Remote. Previously she was Operations Manager, Integrity Dealer Solutions (IDS). (August, 2024 – June, 2025); Implementation Project Manager, PureCars (DigAd Platform) Strategic Onboarding (October, 2023 -August, 2024). Full Bio:

https://www.linkedin.com/in/kacydaugherty/details/experience/

https://www.linkedin.com/in/kacydaugherty/

William Houng was hired as Vice President, Dext Capital, He is located in Orange County, California. Previously, he was Managing Director, Business Development, Pathwared (May, 2022 – July, 2025); Vice President, SLR Equipment Finance (July, 2017 – May, 22, 2022).

Full Bio:

https://www.linkedin.com/in/williamhoung/details/experience/

https://www.linkedin.com/in/williamhoung/

Scott Kerner was hired as Vice President, Business Development, Industrial, Mitsubishi HC Capital Ameica, Inc. He is located in Brookfield, Connecticut. Previously he was at Siemens Financial Services, starting as Senior Account Executive, July, 2020, promoted Middle Market Team Manager, Vendor (September, 2021 – July, 2025). Full Bio: https://www.linkedin.com/in/scott-kerner-481b2244/details/experience/

https://www.linkedin.com/in/scott-kerner-481b2244/

[headlines]

--------------------------------------------------------------

Randy Haug, Leasing Person of the Year 2024,

was Appointed Honorary Ambassador of the

Guild of Business Finance Professionals

Randy Haug is the EVP, Vice Chairman, and Co-Founder at LTi. He is responsible for overseeing the market direction and strategies of LTi and serves as an advisor to clients regarding their business issues and strategies. He has spent the majority of his career in the equipment finance industry, working and mentoring LTi’s Executive Management Group, Divisional Managers, Product Managers, Sales, Account Managers, and Marketing team.

He has been appointed Honorary Ambassador of the United Kingdom Guild of Business Finance Professionals.

This prestigious recognition reflects Haug’s enduring leadership, visionary contributions, and unwavering commitment to mentorship, advocacy, and the long-term advancement of the

equipment finance profession.

With over 35 years of deep industry expertise, Randy Haug has played a pivotal role in shaping the future of business finance through strategic innovation and meaningful collaboration. Since

co-founding LTi Technology Solutions in 1989, Haug has helped steer the digital transformation of the industry, guiding financial institutions including banks, captives, and independent finance

companies toward operational modernization and scalable growth. Under his leadership, LTi’s flagship ASPIRE ® platform has become foundational to many of the most respected and forward-thinking finance organizations across North America and the UK.

He is also the Founder of the Chris Walker Education Fund and Co-Founder of the Chris Walker Education Committee of NEFA, initiatives dedicated to empowering the next generation of

professionals through scholarship and access to learning opportunities. A past President of the National Equipment Finance Association (NEFA), he is a recipient of the Industry Advocacy Award from both ELFA and MonitorDaily.

In receiving the award, he said, “Serving as an Honorary Ambassador of the Guild of Business Finance Professionals aligns with everything I have cultivated and valued in my career: mentorship, collaboration, driving innovation, lifelong learning, and elevating the business finance profession,”

“After over 35 years in the industry, it’s an honor to help foster the next generation of leaders who will

carry this legacy forward.”

This appointment as Honorary Ambassador represents a full-circle moment in a career dedicated to both the technological excellence and stewardship of the values that transcend any single organization: wisdom, service, and integrity.

About the Guild of Business Finance Professionals

The Guild of Business Finance Professionals is a distinguished, invitation-only organization that exists to elevate, connect, and support broker intermediary leaders in the UK business finance

ecosystem. Rooted in the values of integrity, mentorship, and lifelong learning, the Guild serves as a beacon of excellence for professionals dedicated to advancing the art and impact of business finance.

About LTi Technology Solutions

For over 35 years, LTi Technology Solutions has been a trusted partner in the delivering full lifecycle leasing and loan finance solutions to equipment finance companies, captives, small ticket, middle market, and independent banks throughout the U.S., UK, and Canada from our Omaha, NE, headquarters. Backed by comprehensive and flexible interfaces, LTi’s powerful technology solutions allow for improved efficiencies and decision making. Our highly configurable platform, ASPIRE®, empowers clients to digitally transform operations, enhance compliance, and accelerate revenue growth scale by streamlining the transaction lifecycle

[headlines]

--------------------------------------------------------------

2025 Monitor 100: Growth Holds Steady Amid

Market Tension and Strategic Shifts

By Rita Garwood, Editor in Chief, MonitorDaily & ABF Journal

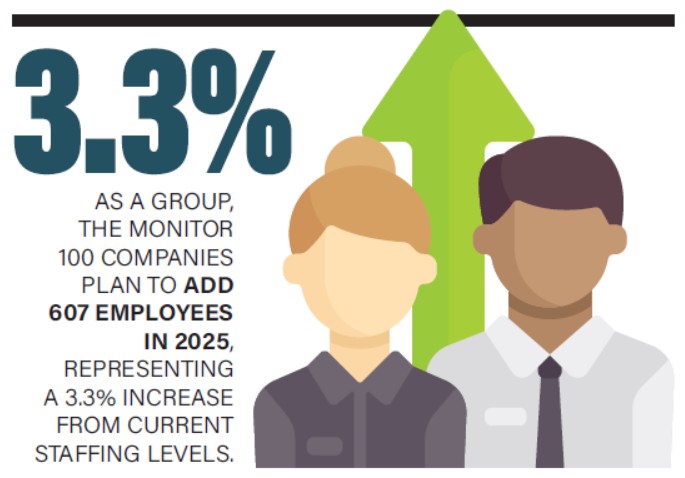

The 2025 Monitor 100 companies reported net assets of $568.1 billion, new business volume of $205.6 billion and 27,128 employees.

The group’s collective net assets grew by 2.0% in 2024, down from the previous year’s 5.8% growth rate. Seventy-seven companies expanded their portfolios, adding a total of $25.4 billion in assets. Meanwhile, 23 companies saw their net assets decline by a combined $14.3 billion. The result: a collective gain of nearly $11.1 billion. New business volume rose by 2.5% in 2024, adding a nearly $5.1 billion year-over-year increase in originations across the Monitor 100 companies. While 38 companies reported a combined decline of $9.2 billion, this was offset by $14.3 billion in gains from the other 62, resulting in another year of modest growth despite headwinds affecting nearly 40% of the group.

STILL FEELING THE SHOCKWAVES OF THE BANKING CRISIS

In 2023, many banks pulled back from the Monitor 100, with nearly 60% reporting smaller equipment finance portfolios and 72% reducing new business volume. By 2024, banks cautiously returned to the space — 63.6% reported increases in net assets and 49.1% reported upticks in originations. Still, the group saw slight year-over-year declines overall in both assets (down 1.6%) and new business volume (down 1.2%). For U.S. Bank Affiliates, 2024 was defined by operational and organizational pressure. Staffing shortages and leadership turnover created friction just as many institutions attempted to modernize outdated systems and accelerate automation. Strategic realignments — such as repositioning business units — added complexity, while compliance demands grew heavier in the wake of the 2023 banking crisis. Liquidity concerns persisted, and many institutions tightened capital management strategies in response to a more conservative regulatory environment. Some of the most challenging credit issues arose in transportation, where rising delinquencies and credit migration led banks to become more cautious. Still, several institutions adapted effectively, shifting toward variable-rate lending, emphasizing pricing discipline and focusing on higher-quality credits to preserve profitability despite a fiercely competitive environment.

Full Article:

https://www.monitordaily.com/article/2025-monitor-100-growth-holds-steady-amid-market-tension-and-strategic-shifts/

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

[headlines]

--------------------------------------------------------------

Just Do It!

By Scott Wheeler, CLFP

Originators are drawn to the commercial equipment finance and leasing industry by one universal promise: unlimited opportunity. That promise is real—but it is also the source of one of the industry’s greatest challenges.

When everything is possible, focus becomes the first casualty. Originators ask, “Where do I begin? Which niche should I pursue? What if I miss out on something better? “ This indecision often leads to scattered efforts, burnout, or stagnation. Some leave the industry, convinced they failed—when in truth, they simply never committed.

The most successful originators have one thing in common: clarity. They choose a niche—an industry, equipment type, or channel—and they dive deep. Their choice is driven not by popularity or ease, but by personal interest, professional alignment, and a hunger to master something meaningful. They commit fully, embracing the nuances of their niche, building lasting relationships, and positioning themselves as experts and leaders.

The niche itself doesn’t determine success. The decision to focus does. Passion fuels learning. Consistency builds reputation. And sustained effort creates momentum. Those who scatter their time across too many possibilities remain average. Those who focus—thrive.

Mastery starts with a choice. Make one.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

After $1.1B Q2 Hit, GM Leaders See Tariff BiteGetting a Bit Worse This Quarter

By Geert De Lombaerde, Senior Editor, Industry Week

The various tariffs imposed by the Trump administration this year weighed on General Motors Corp.’s second-quarter adjusted earnings to the tune of $1.1 billion, and CFO Paul Jacobson told analysts July 22 that that figure will rise this quarter.

GM produced about $3.0 billion in adjusted earnings before interest and taxes in the three months that ended June 30, which was down from $4.4 billion in the same period of 2024. Jacobson and Chair and CEO Mary Barra, are still expecting that tariffs will cost the automotive giant between $4 billion and $5 billion this year and still expect that the company will be able to offset about 30% of that by tweaking its manufacturing footprint, cutting some costs and by holding the line on pricing.

On a conference call to discuss GM’s Q2 results—which showed net income of $1.9 billion on revenues of $47.1 billion, numbers that were down 35% and 2%, respectively, from the same time last year—Jacobson said tariffs’ impact on the company this spring was slightly less than expected because of the timing of some of the Trump team’s trade measures. That’s why Q3’s costs will climb as GM continues to import vehicles from Canada, Mexico and South Korea.

“Over time, we remain confident that our total tariff expense will come down as bilateral trade deals emerge and our sourcing and production adjustments are implemented,” Jacobson added.

Those adjustments include bringing more production to U.S. plants via a $4 billion capital spending push—not all of which is in addition to previously announced investment plans—that will bring online new capacity by the end of next year. Asked if her team is preparing for a worst-case tariff scenario that could end up being better, Barra said “that’s a fair comment.”

“I don’t want to predict what we’re facing but I think, with what we know today, […] there’s potential,” Barra said.

During the second quarter, GM sold nearly 1.54 million vehicles, up from 1.43 million in the same period of 2024. In North America, sales were 878,000 versus 827,000, an increase that lifted the company’s market share by half a point to 16.4%.

Shares of GM (Ticker: GM) were down more than 6% to $49.63 in midday trading July 22. Over the past six months, they have given up about that much ground, which has shrunk the company’s market capitalization to about $51 billion.

[headlines]

--------------------------------------------------------------

List of 2025 AACFB Commercial Finance

Expo Exhibitors: to Plan Your Exhibit Time

September 10-12, Austin, Texas, Register

Plus Hotel Info, Riverboat Cruise & More

[headlines]

--------------------------------------------------------------

### Press Release ############################

Wintrust Financial Corporation Reports Record Net Income

ROSEMONT, Ill., -- Wintrust Financial Corporation (“Wintrust”, “the Company”, “we” or “our”) (Nasdaq: WTFC) announced record net income of $384.6 million, or $5.47 per diluted common share, for the first six months of 2025, compared to net income of $339.7 million, or $5.21 per diluted common share for the same period of 2024. Pre-tax, pre-provision income (non-GAAP) for the first six months of the year totaled a record $566.3 million, compared to $523.0 million for the first six months of 2024.

The Company recorded record quarterly net income of $195.5 million, or $2.78 per diluted common share, for the second quarter of 2025, compared to net income of $189.0 million, or $2.69 per diluted common share for the first quarter of 2025. Pre-tax, pre-provision income (non-GAAP) for the second quarter of 2025 totaled a record $289.3 million, as compared to $277.0 million for the first quarter of 2025.

Timothy S. Crane, President and Chief Executive Officer, commented, “Building on the momentum of a strong first quarter, we are pleased to deliver record results again this quarter, reflecting the underlying strength and momentum of our business. A combination of balance sheet growth and a stable net interest margin drove our record results in the second quarter of 2025.”

Additionally, Mr. Crane noted, “Net interest margin in the second quarter remained within our expected range at 3.54% and we generated record net interest income driven by average earning asset growth. We expect a relatively stable net interest margin coupled with continued balance sheet growth to drive net interest income higher in the third quarter.”

Highlights of the second quarter of 2025:

Comparative information to the first quarter of 2025, unless otherwise noted

- Total loans increased by $2.3 billion, or 19% annualized.

- Total deposits increased by approximately $2.2 billion, or 17% annualized.

- Total assets increased by $3.1 billion, or 19% annualized.

- Net interest income increased to $546.7 million in the second quarter of 2025, compared to $526.5 million in the first quarter of 2025, driven by strong average earning asset growth.

- Net interest margin was 3.52% (3.54% on a fully taxable-equivalent basis, non-GAAP) during the second quarter of 2025.

- Non-interest income was impacted by the following:

Wealth management revenue totaled $36.8 million in the second quarter of 2025, compared to $34.0 million in the first quarter of 2025.

- Mortgage banking revenue totaled $23.2 million in the second quarter of 2025, compared to $20.5 million in the first quarter of 2025. An unfavorable fair value mark of $1.4 million was offset by an increase in operational revenue of $4.1 million driven by higher origination volumes and improved production margin. For more information regarding mortgage banking revenue, see Table 16 in this report.

- Net gains on investment securities totaled approximately $650,000 in the second quarter of 2025, compared to net gains of $3.2 million in the first quarter of 2025.

- Non-interest expense was impacted by the following:

Advertising and Marketing increased by $6.5 million and totaled $18.8 million in the second quarter of 2025. The increase in the quarter was related to planned and primarily seasonal expenses in various sports sponsorships and other summer community sponsorship events.

- Macatawa Bank acquisition-related costs were $2.9 million in the second quarter of 2025, compared to $2.7 million in the first quarter of 2025.

- Provision for credit losses totaled $22.2 million in the second quarter of 2025, compared to a provision for credit losses of $24.0 million in the first quarter of 2025.

- Net charge-offs totaled $13.3 million, or 11 basis points of average total loans on an annualized basis, in the second quarter of 2025 compared to $12.6 million, or 11 basis points of average total loans on an annualized basis, in the first quarter of 2025.

Mr. Crane noted, “Solid loan growth in the second quarter totaled $2.3 billion, or 19% on an annualized basis. We are pleased with our diversified loan growth across all major loan portfolios and strong seasonal growth in our property & casualty insurance premium finance business. Loan pipelines remain strong and we expect loan growth in the mid-to-high single digits in the second half of the year. We continue to be prudent in our review of credit opportunities, ensuring our loan growth adheres to our conservative credit standards. Strong deposit growth totaled $2.2 billion, or 17% on an annualized basis, in the second quarter of 2025. Our loan growth was funded by our deposit growth in the second quarter of 2025 resulting in our loans-to-deposits ratio ending the quarter at 91.4%. We continue to benefit from our customer relationships and unique market positioning to generate deposits, grow loans and enhance our long-term franchise value.”

Commenting on credit quality, Mr. Crane stated, “Disciplined credit management, supported by thorough portfolio reviews, has driven consistent positive outcomes by enabling early identification and resolution of problem credits. We continue to be conservative and diversified in regard to maintaining our strong credit standards. We believe the Company’s reserves are appropriate and we remain committed to sustaining high credit quality as evidenced by our low levels of net charge-offs and non-performing loans as well as our core loan allowance for credit losses of 1.37%.”

In summary, Mr. Crane concluded, “We are proud of our second quarter performance and record results year to date. We expect our strong momentum to continue into the third quarter as our loan growth in the second quarter provides positive revenue momentum. The balance sheet growth in the second quarter highlights our enviable core deposit franchise and multifaceted business model. Our commitment to growing net interest income, disciplined expense control and conservative credit standards should lead to increasing our franchise value.”

The graphs shown on pages 3-7 illustrate certain financial highlights of the second quarter of 2025 as well as historical financial performance. See “Supplemental Non-GAAP Financial Measures/Ratios” at Table 18 for additional information with respect to non-GAAP financial measures/ratios, including the reconciliations to the corresponding GAAP financial measures/ratios.

Business Combination

On August 1, 2024, the Company completed its previously announced acquisition of Macatawa, the parent company of Macatawa Bank. In conjunction with the completed acquisition, the Company issued approximately 4.7 million shares of common stock. Macatawa operates 26 full-service branches located throughout communities in Kent, Ottawa and northern Allegan counties in the state of Michigan. Macatawa offers a full range of banking, retail and commercial lending, wealth management and ecommerce services to individuals, businesses and governmental entities. As of August 1, 2024, Macatawa had fair values of approximately $2.9 billion in assets, $2.3 billion in deposits and $1.3 billion in loans. As of June 30, 2025, the Company recorded goodwill of approximately $142.1 million on the purchase.

Graphs available at the following link: Graphs available at the following link: http://ml.globenewswire.com/Resource/Download/bd030502-a094-4ebe-b02a-3c9bb828b393

### Press Release ###########################

[headlines]

--------------------------------------------------------------

News Briefs

Air India Finds ‘No Issues’ After Inspections

of Boeing Fuel Switches

https://www.nytimes.com/2025/07/22/world/europe/air-india-crash-report-boeing.html

As the Dollar Slides, the Euro Is Picking Up Speed

https://www.nytimes.com/2025/07/22/business/euro-dollar-currency-tariffs.html?smid=nytcore-ios-share&referringSource=articleShare

Supreme Court allows Trump to remove consumer

product safety regulators

https://www.washingtonpost.com/politics/2025/07/23/supreme-court-consumer-product-safety-regulators-trump/

U.S. Quietly Drafts Plan to End Program That

Saved Millions From AIDS

https://www.nytimes.com/2025/07/23/health/pepfar-shutdown.html

Trump Administration Illegally Withheld Head Start Funds,

Watchdog Finds

https://www.nytimes.com/2025/07/23/us/politics/trump-head-start-government-accountability-office.html

-------

The internet is a mall, and we are trapped inside it

https://www.washingtonpost.com/home/2025/07/23/online-shopping-is-miserable/

Canceling ‘The Late Show’ Is Bad News for Late-Night TV,

Not for Stephen Colbert

https://www.nytimes.com/2025/07/20/arts/television/stephen-colbert-the-late-show-canceled-comedy.html

[headlines]

--------------------------------------------------------------

Coleman Report’s Bob Coleman is Out With a New Book:

“Easy Money, Hard Time”

https://debanked.com/2025/07/coleman-reports-bob-coleman-is-out-with-a-new-book-easy-money-hard-time/

[headlines]

--------------------------------------------------------------

Sports Briefs---

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

First-Half 2025 Private Label Report: Sales Rise

4.4% in All Retail Outlets

https://www.winebusiness.com/news/article/305840

Healdsburg chef Dustin Valette and winemaker

Michael Browne team up on Pinot Noir

https://www.pressdemocrat.com/article/lifestyle/valette-wines-winemaker-michael-browne/

Revisiting Napa Valley cabernet sauvignon

https://www.northbaybiz.com/2025/07/21/revisiting-napa-valley-cabernet-sauvignon

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jul2022/07_22.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()