|

|

|

|

|

|

SFBI Recruiters |

Need: Contact: Fred St Laurent, Managing Director |

Tuesday, June 7, 2005

Headlines---

Classified Ads---Sales Manager

NorVergence Ruling Appealed by Florida A.G.

The Good, the Bad, and the Ugly:

Leasing Company NorVergence Settlements

Cartoon---

Settlement Costs Vs. Litigation Costs

Leasing Meetings Open to Non-Members

Yes, George Washington was first rose breeder president

Classified Ads---Help Wanted

Alfa/Sale of OFC Capital

Financial Federal Third Quarter Results

Richard R. Rodgers GE Commercial Mgr. Cent.Reg.

Worldwide Tax Implications Published

News Briefs---

"Gimme that Wine"

Top Event in Today's History

This Day in American History

Baseball Poem ---Tim Peeler

######## surrounding the article denotes it is a “press release”

|

Your One stop solution for training and reference material for the Leasing Professional

|

----------------------------------------------------------------

Classified Ads---Sales Manager

Atlanta, GA

30 years in transportation Finance with strong management/ sales background. Represented company on national & region markets. Started two successful operations- produce profits and growth.

Email: pml@mindspring.com

Chicago, IL.

Successful sales manager has 15 years experience with captives and independents. Expertise in re-energizing existing sales teams and territories, also building teams from scratch. True Team Leader looking for new challenge. email: Murph5553@aol.com

Chicago, IL

Senior sales manager seeks Chicago based sales management role with growing, creative, customer focused lessor. Extensive experience/documented results in all aspects of information technology leasing.

Email: belanger@dataflo.net

Dallas/Fort Worth, TX.

Domestic-int'l exp. Small to middle ticket. 24 yrs with Fortune 500 firms(2). Consistently achieves margin/ volume goals.

Email: dptr7300@sbcglobal.net

New York, NY

I have over 25 years owning an independent leasing company that specialized in truck leasing. Tow trucks, Limos, ambulances, tractors, etc..

Email: rfleisher@rsrcapital.com

Pennsauken, NJ.

17 Years Leasing in all capacities from CSR and Collections to National Sales Management and Vice President Vendor Development. Exceptional People Skills. Many industry references.

email: cherfurth1@aol.com

Portland, OR.

18+ yrs w/bank leasing company. Supervised 14- 20 sales people. Willing to relocate for the proper position.

Email: pthygeson@netscape.net

Full listing of all “job wanted ads” at:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

---------------------------------------------------------------

NorVergence Ruling Appealed by Florida A.G.

Florida Attorney General Charles “Charlie” J. Crist, Jr.,(above) who was the first Republican to announce formally his intention to replace Gov. Jeb Bush, who is limited to two terms, lost no time in filing an appeal June 3, Friday, regarding State of Florida Tallahassee Circuit Judge Russell A. Cole Jr., rejection of his office's lawsuit that had accused twelve leasing companies and banks of violating the Florida Deceptive and Unfair Trade Practices Act by purchasing NorVergence lease contracts.

Judge Cole ruled that the three clauses attacked by the attorney general's office were specifically authorized by the laws of the State of Florida and therefore not unconscionable or contrary to public policy. His Court also ruled that because the defendants are regulated by federal and state agencies, and he found Florida's unfair trade practices law does not apply to them. The Court found the equipment leases in question were not consumer leases.

The laws of various states vary as to what is a “consumer” or “commercial” transaction. Many states have various laws regarding this. Some have cross over situations when involving telecommunication equipment, where others consider a “personal guarantee” under consumer law jurisdiction or when the sales of a company are below a certain dollar point.

Judge Cole had ruled the opinion as with prejudice, meaning in legal jargon, it could not be appealed by his court. Obviously it means the next step is a higher court's opinion on the ruling. The issue seems to have become more of a “political” ruling than a “legal” judgment.

It may wind all the way up to the U.S. Supreme Court. Or as the famous baseball catcher Yogi Berra observed, “ It's deja vu all over again.”

Here is a copy of the appeal:

http://leasingnews.org/PDF/NorVStateNoticeofAppeal.pdf

If you are not familiar with the original ruling:

http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_107.htm

----------------------------------------------------------------

The Good, the Bad, and the Ugly---

Leasing Company NorVergence Settlements

Here is a synopsis of the settlements with CIT, USBancorp, Wells Fargo, which is similar to other settlements in terms and conditions.

The NorVergence lessee is called a “Participating Customer” in the legal documents. The lessor is to mail a letter within a 30 day of the date of the agreement with the attorney general's office with documents and outlining the steps to take.

Basically the offer is 15% of the payments owed since July 15, 2004. Wells Fargo works out to be 14% as they could not mechanically use this date, but had to use since July 31, 2004.

USBancorp is 15%, except to previously settled customers, where it will be 20%. Those who have settled with Wells Fargo or CIT, can get it reduced to 15% by joining this settlement.

For quoting purposes, Wells Fargo is called “WFFL” in the documents.

“b. WFFL shall forgive any late fees or penalties assessed on the Participating Customer's account on or after July 31, 2004: and

c. Within thirty (30) days of the delivery of documents by which any State Customer elects to become a Participating Customer, WFFL shall withdraw or cause to be corrected any and all adverse credit information filed by it, if any, as to Participating Customer as a result of not receiving payment from the Customer on its Rental Agreement after July 31, 2004, by providing written notification to each credit bureau to whom WFFL furnished information, if any 20. WFFL shall fully credit each Participating Customer for any payments it has made pursuant to the Rental Agreement after July 31, 2004, including but not limited to monthly payments and charges of insurance, late fees, and taxes. WFFL shall issue refunds to those Participating Customers who post July 31, 2004 payments exceed the Participating Customer's remaining obligation under the Rental Agreement as provided by paragraph 19 of this Assurance.

The above means that all personal property tax and insurance premiums that were charged are included. ( CIT is different, primarily in the insurance aspect as it will include only “...33% of all insurance- related charges (‘Cure Amount.”) It should also be noted that CIT is the only one that will “...forgive 67% of any insurance-related charges on the Participating Customer's account that was paid prior to July 15,2004.)

Another very good feature is:

“22. WFFL agrees that the Settlement Balance shall be paid as follows:

• The Participating Customer shall either elect to:

• Make a lump sum payment of the entire settlement Balance; or

• If the Settlement Balance is less than $5,000, pay the Settlement Balance in up to twelve (12) equal monthly

installment payments. If the Settlement Balance is $5,000 or higher, pay the Settlement Balance in up to twenty-four(24) monthly installment payments.

iii. Nothing in this Assurance shall be construed to preclude SFFL in its sole discretion from entering into mutually acceptable alternative payment schedules with any Participating Customer.”

Part of it also includes releasing all claims and withdrawing for all law suits involving the creditor. It appears not to include claims against NorVergence itself or agents of NorVergence.

23. a “The thirty-five(35) day opportunity to elect to participate in the settlement described herein in exchange for a release of all claims against WFFL relating to NorVergence.

On the bad side, property tax and insurance prior to July 15 or July 30, 2005 for Wells Fargo, is not addressed. As noted earlier, CIT did agree to “...forgive 67% of any insurance-related charges on the Participating Customer's account that was paid prior to July 15, 2004.

There may also be lessees who had to increase their insurance premium to their insurance agent to include the equipment in their coverage. This situation would occur if they did not have “room” to include it. In most cases, it would be a minimal amount.

While the lessor has agreed to inform all credit agencies and correct any reporting to “settled, “ which is neither positive nor negative on a consumer credit report, “settled” may have another connotation to a lender. As important, those who have had to correct business and consumer credit reports know the information is shared. In many cases, when found, these reports will have to be corrected individually following the consumer or business credit procedure. More than likely, by the Participating Customer.

Within sixty days of the effective date, the attorney general is to be informed of the letters sent, providing a list of those whose letter were undeliverable (after making reasonable attempts for correct or new addresses) and an accounting of the Participating Customers, including the Participating Customers' Settlement Balances and payment schedules elected and agreed upon.

There are provisions that the lessors are to report every six months until all are resolved according to the agreement.

Now the ugly: Included in these settlements are lessees who allegedly never received the equipment, who never had it connected; meaning never had service, but only signed a contract that the leasing company funded NorVergence. There were other odds and ends regarding actual claims of not having service or partial service. Due to the complexity of the negotiations, there was no provision for such “separate” issues. It is up to those in this position to decide whether to accept the settlement or seek remedy in a court of law.

The settlement does not resolve issues before the July date regarding personal property tax or insurance premium payments. Note: CIT has made an exception to this in their settlement agreement The settlement most likely will discover differentials in the lease payment schedule that is not addressed in the settlement. For instance, NorVergence may have started the lease 60 days earlier and the bank says there are 38 payments while the lessee records say there are 36 or 34.

It appears to waive any settlements or remuneration in a class action suit.

---

There will be those receiving money back, who have been making payments.

For illustration purposes, here are two numbers:

On a $25,000 lease balance, the cost to the lessee is $3,750.

On a $35,000 lease balance, the cost to the lessee is $5,250.

On a twelve month payment basis ( assuming $5,250 is acceptable:)

$312.50 and $437.50 respectively.

Depending whether the decision is “political,” meaning the Lessee wants to change the laws, challenge the laws, does not have faith with the attorney general's settlement , the dollar amount is not a deciding matter.

Of course, accepting the settlement does not stop the “Participating Customer” from taking part in changing the laws, or challenging the system, but most likely those who don't take the settlement will be utilizing that excuse.

To those who look at the situation as a “business decision,” it gets down to what is the best use of your time for you business and family life ---plus your investment or use of money.

The decision can also be likened to how you collect delinquent accounts, or determine the costs in trying to collect a bad debt.

There are those, mostly new in business, who believe they need to teach someone a lesson, and there are others, who curse the loss of money and view it as a “cost of doing business.”

Leasing News has made an editorial stand that our viewpoint is it is best for both sides to accept the Attorneys Generals settlements, which we think are excellent for the consumer side, well constructed, and accomplished in quite a timely fashion.

Certainly all sides hopefully have learned a lesson from this experience.

http://leasingnews.org/PDF/Wells%20Fargo%20AVC%205-26-05.pdf

http://leasingnews.org/PDF/USB%20AVC%20Final%205-26-05.pdf

http://leasingnews.org/PDF/CIT%20AVC%205-26-05.pdf

----------------------------------------------------------------

----------------------------------------------------------------

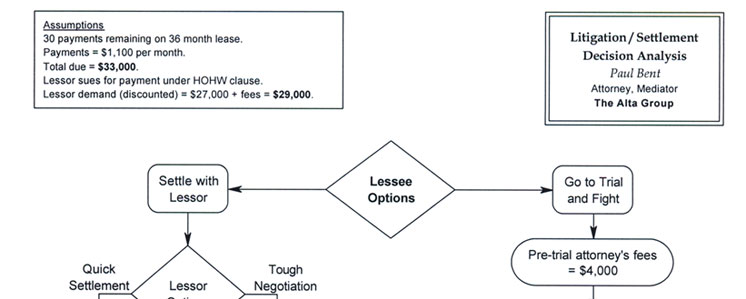

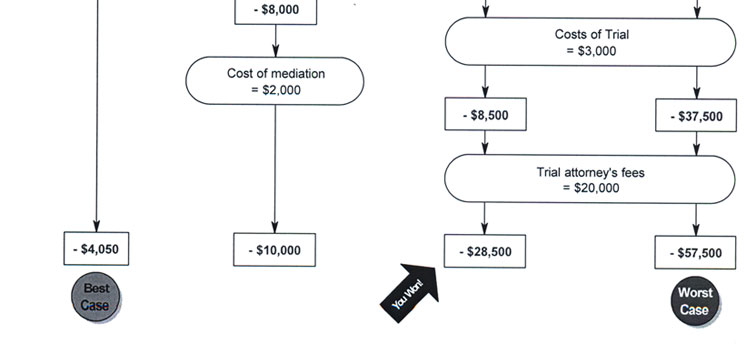

Settlement Costs Vs. Litigation Costs

Leasing News has asked over a dozen well-known leasing attorneys to comment on the prospective costs a lessee may encounter, what the "typical" costs might be in defending their position ( which they should consider along with the 85% settlement many have been offered—many are telling me it is not "enough."

The premise was to find experienced and recognized attorneys who were not representing any NorVergence lessor, so there would not be a “conflict of interest.” While it may be claimed that these attorneys perhaps represent more leasing companies than lessees, which may most likely be true, they do have experience in understanding the costs involved in this type of specific litigation.

Contesting a matter should not be viewed in a “political manner” but in the view of “financial costs.” To understand the requirements of your time, and its value, the first consideration should be on the attorney costs.

One of the first attorneys to respond was Paul Bent of the Alta Group.

He is one of the attorneys who advertises (for free) on our classified ad page of those who specialize in the leasing industry:

“Paul Bent, helping settle deals that have gone bad. Attorney for 20+ years with GoodSmith & Co., now providing mediation and dispute resolution for lessees and lessors.

www.paulbent.com”

His costs were very much on the low side, compared to otherfigures that we received. They also reflected other attorneys who thought figures we started with were too high ( although others said it was not high.)

Paul Bent was kind enough to communicate with this diagram:

“As you can see (and as you already know), the costs and risks of trial are simply not worth it in deals of this size.

“It's interesting to note that the bottom line options for the Lessee are about the same as in the other chart. Whether you analyze the case from the standpoint of Lessee's options or from the standpoint of probabilities, the result for a deal of this size is going to be about the same.

“What the Lessees have to see is that these decisions cannot be based on emotion or anger. There's no “right” or “wrong” in this analysis; there's only an objective financial decision that takes into account all the risks, all the costs, and all the (minimal) potential benefits of fighting big companies with lots of lawyers at their disposal. Remember, even if you win, you're not going to get back to where you started.

“In a perfect world, the bad guys in this situation would be punished and would have to pay everyone back (Lessors and Lessees) for their wrongdoing. But, as they say in the Walgreen's commercials, “we don't live anywhere near Perfect.” The Lessees just have to deal with their anger in some other way.

If they want to save their businesses and move on with their lives, they should sit down with the Lessors and try to make a deal; or, if the Lessors are not willing to talk directly, they should bring in a neutral third party to talk with the Lessors and work out a deal everyone can live with.

“Hope this helps. And I'd be glad to continue the dialog if there's anything else I can do.”

P A U L B E N T

T h e A l t a G r o u p

3715 Lewis Avenue

Long Beach, California 90807

(562) 426-1000 (562) 492-1199 Fax

www.paulbent.com

--Next issue: What other attorneys who specialize in the leasing field think the costs would be---

----------------------------------------------------------------

Leasing Association Meetings Open to Non-Members

![]()

June 9

Famous Crab Feast

I thought I would send you an email in reference to one of the WILDEST, MOST ENJOYABLE, leasing events in the Mid Atlantic area. For the past seven years a group of leasing professional (usually between 100- 120 attendees) kick off the summer season by gathering together in Hanover Maryland, for the annual "EAEL Networking Crab Feast"

Any of your readers within walking, driving, or flying distant of BWI airport in Baltimore should consider attending this leasing event. It is advertised as a social gathering however with most situations where 10 or more leasing people gather together it quickly develops into a Business Opportunity for everyone. This is the type of event where long-term business relationships are strengthened and new ones are established.

And it all happens as people are elbow deep in crab shells, crab soup and pitchers of cold beer. "A REAL BALTIMORE TRADITION"

The event is open to everyone EAEL members and Non- Members. The group is usually made up of brokers, lessors, funders, small ticket, mid market and large ticket leasing professionals, bankers, attorneys and just about anyone else that has the slightest connection to the industry and wants to enjoy a night of fun,great food. and excellent copmpany.

The event is hosted by :

Nancy Pisorio, CLP, Madison Capital LLC

Dennis Horner , The Equipment Leasing Company

Bruce Winter, CLP, FSG Leasing Inc

I highly recommend everyone to mark their calendars for June 9, 2005

and call Dennis Horner to register at 800 365 6566 ext 110

Scott Wheeler C.L.P

V.P Sales and Marketing

The Equipment Leasing Company

Sparks Maryland

800 365 6566

Fax: 410 472 2005

53 Loveton Circle

Sparks Maryland 21152

Here is more information, and it is recommended

that you call, if you want to attend, as mail

registration is closed

-------------------------------------------------------------

![]()

UAEL Oregon Region Presents

An Evening at the Portland Beavers Baseball Game

Call UAEL at 760-564-2227 to REGISTER NOW (before May 16 th ) as this is a first come, first serve event, and tickets are limited!! This is an event you will not want to miss.

When: Thursday, June 09, 2005

Where: PGE Park – Portland OR

http://www.pgepark.com/beavers

Time: The game starts at 7:05 but you are encouraged to come early.

Cost: $35.00 for members, and $40.00 for non-members.

Event: This is the most popular event at the ball park, as Thursday's are considered “Thirsty Thursdays” as beers are only two dollars ($2.00). June 9 th is “Fresh Beer Night with the Budweiser Clydesdales pre-game appearance”. The mighty Beavers will be playing Tucson. We have reserved a LUXURY SUITE at the top level, in the middle, right behind home plate. Simply put, you cannot find better accommodations. It is also important to mention the price covers only the price of the tickets, as this event is not for profit. Food will be provided, and we will rely on sponsors to help pay for food. If you have not been to the PGE Park, ask someone who has, as the food is really good, and a night at the ball park is a great time.

Registration: Simply call UAEL at 760-564-2227 to make payment arrangements. As mentioned, this is first come, first serve, so please REGISTER NOW.

Final Comments: The Oregon Region has always maintained a solid reputation for have a strong region. The suites provide an excellent format to both watch the game, but also provides plenty of room to network, and to get caught up with old friends. We are encouraging early registration , as we have the ability to reserve more than one Suite if we a strong turn out, but you will need to ACT NOW!

For additional information: Please contact Gary Parker, Commercial Equipment Lease, at 800-234-1884 or email gparker@commlease.com .

---------------------------------------------------

![]()

June 14, EAEL, New York

New York Meet & Greet,

Tuesday, June 14, at 12:00PM.

Hosted by Robert Goeller, Sierra Credit Corp., at the Garden City Country Club, Garden City, NY.

for further information, please click here

--------------------------------------------------------------------

![]()

June 14, 2005 Luncheon

United Association of Equipment Leasing

Networking Luncheon

Tuesday June 14, 2005

At 12:00 PM to 2:00 PM

NO HOST

Non-UAEL members invited

Location:

Grand Concourse/Gandy Dancer Saloon

1 Station Square

Pittsburgh, PA 15219

For reservations please contact

Kim at 760-564-2227

or kim@uael.org

or Bill Grohe at 415-681-2234

or bill@uael.org

-------------------------------------------------------------------

![]()

June 23 Dallas, Texas

United Association of Equpment Leasing

Dallas Summer Golf Outing

June Thursday 23, 2005

At 2:30 PM

Cost: $ 45.00 per player

Includes golf, cart and hors d’oeuvres

Where: Plantation Golf Club

4701 Plantation Lane

Frisco, TX 75035

Phone: 972-335-4653

For reservations please contact

Kim at 760-564-2227 or kim@uael.org

-------------------------------------------------------------------

June 23 Lunch, Sacramento, CA

![]()

Sacramento Region

Networking Luncheon

Thursday - June 23, 2005

12:00 p.m. - 2:00 p.m.

$25.00 per person

Includes lunch and John Haenselman of Belvedere Equipment Finance

addressing Lease vs. Loan

Non-UAEL members welcome

Location:

II Fornaio

1179 Galleria Blvd.

Roseville, CA

To reserve your spot please send check to UAEL

78120 Calle Estado, Ste. 201, La Quinta, CA 92253

Please contact Lori Littleford with any questions

(888)-278-1079 ext. 232

![]()

July 15 Chicago, Illinois

Hey, batter, batter, batter.........Swing

Batter!!!

Spring is here and that means

BASEBALL!!!

UAEL Midwest Chapter presents

A day with the Chicago Cubs at the beautiful and

Scenic Wrigley Rooftop!!

July 15, 2005

1:20PM

Chicago vs Pittsburg

Wrigley Rooftop

3639 North Sheffield Ave

Chicago, IL 60613

Tickets are limited so make your reservation today!!

Seats are not guaranteed until payment is received.

Price per Person $118.00

Food & Beverages are included in your ticket price.

Payment will ONLY be accepted by check. Please make all checks payable to UAEL and Remit to Bill Griffith.

For more information please contact

Padco Lease Corp.

Bill Griffith

800-347-5884

100 West Monroe Street

Ste 706 5 th Annual Midwest

Chicago, IL 60603 Regional Cubs Outing

3639 Wrigley Rooftop

<><><><><><><><><><><><><><><><><><><><><><><>

Directions to the Rooftop

Looking for directions? The directions below should help. If not call us at (312) 382-9100 for more assistance.

Wrigley Field is located on the corner of Addison and Clark St. in the City of Chicago.

If you are on the Kennedy Expressway, exit on Addison going east and follow the signs to Wrigley Field.

If you are on Lake Shore Drive, you can exit on Irving Park Road, which is 4000 north, or you can exit on Belmont Ave., which is 3200 north.

If you're going to ride the "L" (elevated rail) get on the red line.

If coming from the Loop: take the State Street Subway (red line) north towards Howard and get off at Addison.

If coming from the North: take the Yellow Line (Skokie Swift) or the Purple Line (Wilmette-Evanston), south to Howard, from there, take the Red Line south (95 th -Dan Ryan) to Addison stop (the train stop is located directly behind the rooftop).

Our address: 3639 North Sheffield Avenue

Entrance is at the rear of the 3639 Sheffield building. Take the rear exterior stairwell to the rooftop.

For more information log on to:

www.3639wrigleyrooftop.com

------------------------------------------------------------

![]()

July 28, 29 & 30, 2005

For more info click here.

-------------------------------------------------------------

![]()

August 3rd, 7:05pm, UAEL So. Calif.

United Association of Equipment Leasing Southern California Region

Presents

Our 4th Annual Angel Game Night

Take me out to the Ball Game!

Date: Wednesday August 3rd, 2005

Time: 7:05 PM (Anaheim Angels vs. Baltimore Orioles)

Place: Angel Stadium, Anaheim, California

Ticket Includes: Field Box Seating

$15.00 per / Ticket

Company Employees are invited to attend. Family and Friends are welcome!

Non-members welcome, too.

Reserve your tickets today by emailing Kim at the UAEL Office: kim@uael.org. Or please contact Kim at 760-564-2227. Please RSVP by July 23rd, 2005.

----------------------------------------------------------------

Yes, George Washington was first rose breeder president

George Washington, our first president, was our first rose breeder as well. Washington laid out his own garden at Mt. Vernon and filled it with his own selections of roses. He named one of his varieties after his mother Mary. Frank L. Ross of Nashville, Tennessee officially registered the rose with the American Rose Society with proof from 1891 documentation. The rose is named “Mary Washington:” flowers white tinted pink, fading to white, double, blooms in clusters of 7-9. It is fragrant and has very vigorous growth.

The World's Largest Rosebush

The world's largest rosebush is located in a city named Tombstone in Arizona. Planted from a slip from another rosebush in the late 18th century, the trunk of “Lady Bank's Rose” is nearly six feet around. Did you know that the rose is really a member of the tree family and traces it back to the apple tree. The true rose will often match the five pink pedals of an apple tree.

When in full bloom, this rosebush has more than 200,000 blossoms - and its branches spread out six feet thick over an arbor under which more than 150 people can be seated comfortably.

http://www.mediterraneangardensociety.org/plants/

Rosa.banksiae.Tombstone.cfm

The Rose in Music

Some 4,000 songs have been written about roses including:

Rose of Tralee

The Last Rose of Summer

Red Roses for a Blue Lady

Everything's Comin' Up Roses

Ramblin' Rose

Moonlight and Roses

Primrose Lane

My Wild Irish Rose

To a Wild Rose

Only a Rose

Yellow Rose of Texas

San Antonio Rose

Second Hand Rose

Rose of Washington Square

Days of Wine and Roses

I Didn't Promise You a Rose Garden

When She Wore a Tulip and I Wore a Red, Red Rose

Mexicalli Rose

The rose is the official National Floral Emblem of the United States. This legislation was signed into law by President Ronald Reagan on October 7, 1986. The rose is also the state flower selected by Georgia, Iowa, New York, North Dakota and the District of Columbia. June in National Rose Month.

Red roses say “I love you” and also stand for respect and courage.

White roses have several meanings: “You're heavenly,” reverence and humility, innocence and purity, “I'm worthy of you,” and secrecy and silence.

Red and white roses together, or white roses with red edges, signify unity.

Pink roses in general symbolize grace and gentility. For more subtle shades of meaning, choose deep pink to stand for gratitude and appreciation. Light pink conveys admiration and sympathy.

Yellow roses usually stand for joy and gladness, but can also say “try to care.”

Coral or orange roses denote enthusiasm and desire.

A deep burgundy rose means “unconscious beauty.”

Red and yellow blends stand for jovial and happy feelings.

(Note: The rose at top is the famous Paul McCarthy rose from England. I was the first to import here. While it is fragrant and very pretty, it is similar to the JFK beautiful white rose: weak head. It means when the flower opens, it often droops as the stem does not support the weight of the open bloom. Most people want the bloom to be up-right. Both are floribunda's and in clusters are beautiful garden roses with fragrance. editor )

----------------------------------------------------------------

Classified Ads---Help Wanted

Sales / Sales Support

SALES: Seeking energetic, self motivated sales pro, nationwide opportunities, equipment/ transportation leasing and financing (buses, livery, limousines, ambulances, paratransit, funeral vehicles). Direct experience helpful/ not required. We are willing to train the right person. Moderate travel /extensive phone work required. Highest commissions paid in the industry. Fax or email resume to 718-392-5427 or dcoolbaugh@advantagefunding.us |

|

SFBI Recruiters |

Need: Contact: Fred St Laurent, Managing Director |

|

|

#### Press Release #####################

Alfa Corporation Reaches Agreement Regarding the Sale of OFC Capital

MONTGOMERY, Ala. & MACON, Ga.----Alfa Financial Corporation, a wholly owned subsidiary of Alfa Corporation (Nasdaq/NM:ALFA), announced that it has signed a definitive agreement to sell a substantial part of the lease portfolio and other assets that comprise its commercial leasing division operating under the name OFC Capital. The purchaser is OFC Servicing Corporation, a wholly owned subsidiary of MidCountry Financial Corp., and the aggregate purchase price is approximately $77 million. OFC Servicing Corporation will pay approximately $5 million of the price at the closing of the transaction, expected to occur during the third quarter of 2005, and will pay the remainder under the terms of a five-year promissory note.

OFC Capital's operations were acquired by Alfa Financial Corporation in 2000. OFC Capital provides leasing and financing services to equipment vendors, manufacturers and end users nationwide.

This transaction is subject to certain regulatory approvals, including approval by the Office of Thrift Supervision.

MidCountry Financial Corp. is a financial services holding company headquartered in Macon, Georgia with two primary subsidiaries, Heights Finance Corporation, a consumer finance company, and MidCountry Bank, a federally chartered thrift. These subsidiaries operate in the Midwestern United States. Alfa Financial Corporation owns approximately 42% of MidCountry Financial Corp.

Alfa Corporation is a financial services holding company headquartered in Montgomery, Alabama, and offers property and casualty insurance, life insurance and financial services products. Alfa Corporation is a member of the Alfa Insurance Group, which has combined assets of approximately $4 billion. Alfa Corporation's property and casualty subsidiaries are rated A++, and its life subsidiary, Alfa Life Insurance Corporation, is rated A+, by the A.M. Best Company.

Alfa Corporation Stephen G. Rutledge, 334-613-4500

### Press Release ######################

Financial Federal Corporation Reports Third Quarter Results

NEW YORK-----Financial Federal Corporation

-- Net Income - $9.2 million (a 15% increase)

-- Diluted EPS - $0.53 (a 20% increase)

-- Receivables Originations - $269 million (a 28% increase)

-- Record Finance Receivables Outstanding - $1.59 billion

-- Loss Ratio - 0.03% (annualized)

-- Efficiency Ratio - 25.6%

Financial Federal Corporation (NYSE:FIF) today announced results for its third quarter ended April 30, 2005. Net income for the quarter was $9.2 million, a 15% increase from the $8.0 million earned in the third quarter of fiscal 2004. Diluted earnings per share increased by 20% to $0.53 from $0.44. Diluted earnings per share increased by a higher percentage than net income because of our repurchase of 1.5 million shares of common stock in April 2004. Finance receivables originated during the quarter were $269 million compared to $211 million in the third quarter of fiscal 2004.

For the first nine months of fiscal 2005 and 2004, net income was $27.0 million and $23.0 million, respectively, an 18% increase. Diluted earnings per share increased by 25% to $1.56 from $1.25. Finance receivables originated increased by 36% to $762 million from $560 million. Finance receivables outstanding grew at an annualized rate of 12% to $1.59 billion at April 30, 2005 compared to $1.46 billion at July 31, 2004.

Paul R. Sinsheimer, CEO, commented: "Financial Federal's third quarter operating results were solid. New business volume continued at record levels and receivables outstanding increased by more than $55 million, a near 15% annual growth rate. Credit quality statistics continued at better than expected levels. We remain encouraged about the Company's near-term prospects notwithstanding the steady climb in short-term interest rates and the continued high cost of energy."

Steven F. Groth, CFO, remarked: "With our $250 million issuance of fixed rate term notes in May 2005, we reduced our exposure to rising interest rates and we increased our liquidity. We have also obtained lower credit spreads on our debt. We returned 11.5% on our equity in the third quarter with a low debt-to-equity ratio of 3.6x. Our liquidity and leverage levels allow for significant growth potential."

Asset Quality Measures

Asset quality remained strong in the third quarter of fiscal 2005:

-- Net charge-offs were $0.1 million or 0.03% (annualized) of average finance receivables compared to $0.3 million and 0.08% in the second quarter, and $1.9 million and 0.54% in the third quarter of fiscal 2004.

-- Non-performing assets were 1.67% of total finance receivables at April 30, 2005 compared to 1.81% at January 31, 2005 and 2.89% at April 30, 2004.

-- Delinquent receivables (60 days or more past due) were 0.70% of total receivables at April 30, 2005 compared to 0.83% at January 31, 2005 and 1.83% April 30, 2004.

For the first nine months of fiscal 2005 and 2004, net charge- offs were $1.2 million or 0.11% (annualized) of average finance receivables and $8.1 million and 0.76%, respectively.

Other Financial Highlights

-- Net interest margin declined to 5.39% in the third quarter from 5.96% in the prior year. The decline reflects increased interest expense caused by higher short-term market interest rates.

-- The provision for credit losses declined to $0.1 million in the third quarter from $2.1 million in the prior year. The decline reflects significantly lower net charge-offs.

-- Salaries and other expenses declined to $5.2 million in the third quarter from $5.6 million in the prior year. The decline reflects costs savings from significantly lower non-performing assets. The efficiency ratio improved to 25.6% from 26.7% and the expense ratio improved to 1.38% from 1.60%.

-- Return on equity for the third quarter improved to 11.53% from 10.34% in the prior year, and for the first nine months improved to 11.36% from 10.05%.

-- Return on assets for the third quarter improved to 2.44% from 2.30% in the prior year, and for the first nine months improved to 2.37% from 2.15%.

About Financial Federal

Financial Federal Corporation is an independent financial services company specializing in financing industrial and commercial equipment through installment sales and leasing programs for dealers, manufacturers and end users nationwide. For more information, please visit the Company's website at www.financialfederal.com.

For Financial Federal Corporation Steven F. Groth, 212-599-8000

#### Press Release #####################

GE Commercial Finance Corporate Lending Names Richard R. Rodgers Managing Director for Central Region

CHICAGO----GE Commercial Finance Corporate Lending named Richard (Rich) Rodgers as Managing Director for its Central Region. He will be responsible for developing origination opportunities and serving existing clients throughout eighteen midwestern states and Canada.

"Rich has been a market leader for us in developing innovative solutions to help clients shape and grow their businesses throughout various economic cycles," said Willie Brasser, General Manager, GE Commercial Finance Corporate Lending. "We are very pleased that he has accepted this opportunity to apply his vision and expertise to the leadership of our Central Region."

Rich joined GE Corporate Lending in 1997 as a Vice President of Originations for the West Region, and in 2001 was promoted to Senior Vice President and Team Leader for the North Central originations team. He most recently served as Managing Director of Originations for the North Central and Canadian regions. Prior to joining GE, Mr. Rodgers held assorted risk, origination and new product development positions for a number of banks on the West Coast, including Bank of America, Wells Fargo and Security Pacific. He holds a Bachelors degree in Business from the University of Northern Colorado.

About GE Commercial Finance Corporate Lending

GE Commercial Finance Corporate Lending offers financing to clients from middle-market companies to large corporations. Products and services include asset-based financing, cash flow lending and corporate restructuring. Corporate Lending is a leading global provider of financing solutions for investment and non-investment grade companies - committed to supporting clients at all stages of the business cycle. For more information on the businesses and products of GE Commercial Finance Corporate Lending, please visit www.gelending.com. GE Commercial Finance, which offers businesses around the globe an array of financial products and services, has assets of over $230 billion and is headquartered in Stamford, Connecticut. GE (NYSE: GE - News) is Imagination at Work -- a diversified technology, media and financial services company focused on solving some of the world's toughest problems. With products and services ranging from aircraft engines, power generation, water processing and security technology to medical imaging, business and consumer financing, media content and advanced materials, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit the company's website at www.ge.com.

Contact:

GE Commercial Finance

Ned Reynolds, 203-229-5717

or

TorranceCo

Mark Prindle, 212-786-6132

### Press Release ######################

Research and Markets: Taxation Implications Across a Range of Asset Finance Transactions Examined in the Latest Leasing and

Asset Finance Publication

DUBLIN, Ireland-- Research and Markets has announced the addition of Leasing and Asset Finance 4th Edition to their offering.

Your complete guide to risk underwriting, documentary issues, cross-border leasing and finance, competition law, state aids and procurement, taxation, lease evaluation, accounting (capitalisation and lessor income accounting), an examination of the issues in purchase and sale of leasing companies and the securitisation of European Lease Receivables.

"Chris Boobyer is passionate about everything to do with asset finance. In this book he has assembled a number of leading authorities from around the world to comment on the factors and policies that drive this industry. If your contribution to the national or global economy is through asset finance, then this book is likely to give you additional insight to help you stay ahead of the game," Digby Jones, Director General, CBI

The fourth edition of this best-selling guide is a complete compendium for everything that you need to know about lease and asset finance around the world. Expanded and fully updated, this edition now includes explanations of:

- The state of the lease and asset finance industry;

- Portfolio management and the impact of Basle capital adequacy provisions for the asset finance industry;

- Transaction structures and synthetic leases;

- Operating leasing;

- Cross-border leasing; and

- International perspectives on current trends in Australia, Europe,

Japan, the UK and US.

The Fourth edition has been completely updated to include:

- Taxation implications across the range of asset finance transactions including cross-border leasing, issues with residual value through to the tax implications of the purchase and sale of leasing companies;

- Due diligence factors from lease evaluation through to the purchase of a leasing companies;

- The current state of the asset finance industry, including future trends and the implications of the expansion of leasing in the EU accession states;

- Cross border legal, accounting, securitisation, lease evaluation and due diligence issues; and

- The impact of international agreements on the asset finance industry, such as Basle II, anti-competition and state aid restrictions.

This book has a strong global emphasis and this fourth edition includes many contributors from the previous edition as well as 11 new authors. Each a specialist in their field, they help guide us around the complex and global asset finance industry. The introductory chapters begin with a review of major leasing markets, selected sectors and some industry trends by Vic Lock. In Chapter 2, Chris Higson considers the contribution of asset finance to national economies and questions the value placed upon them by governments and their exchequers. Chapter 3 provides an explanation by Malcolm Rogers of the importance of thorough risk analysis and examines some of the techniques available. The objectives of the Basle Proposals on Capital Adequacy are explained and analysed by Sally Williams, Richard Smith and Stephen Potts in Chapter 4.

The legal, tax and accountancy section begins with a thorough review of documentation, transaction structures and the legal features of cross-border transactions by Simon Hall in Chapters 5, 6 and 7. These are followed by Dorothy Livingston who considers the competition laws in the European Union and the United Kingdom in Chapter 8, and in Chapter 9 she examines State aid and procurement, which have been the subject of much recent discussion in Europe and of great interest to asset financiers. Chapter 10 reveals the

latest developments in taxation as explained by Philip Marwood. David Maxwell reassesses the techniques of lease evaluation in Chapter 11 and Colin Dowsett, explains the concepts of lease accounting and capitalisation in Chapters 12 and 13.

We then examine some areas of specific business focus; Nicholas Sanderson reviews the dynamic areas of financing leasing companies and some of the related operational and security issues involved in Chapter 14. He then moves on to discuss the purchase and sale of leasing companies in Chapter 15. Sam Geneen follows in Chapter 16 by explaining the principles, problems and opportunities of operating leasing. In Chapter 17, Philip Griffin takes us around the world explaining and challenging the vagaries and some of the mysteries of cross-border leasing from an intermediary's perspective.

In Chapter 18, Bruce Gaitskell reviews the many developments in securitisation and the wide applications for lessors. In Chapter 19, the editor, Chris Boobyer, attempts to provide an explanation of what the European Union is in terms of its construction, powers and future direction as an economic and autonomous semi-state and what this might mean for the development of asset finance in Europe.

The final chapter provides an in-depth look at the leasing industry in Japan and individual reviews by the respective senior lease association officers in the major leasing continents around the world. Their responses to a series of questions provide a comprehensive global picture of the asset finance industry.

For more information visit

http://www.researchandmarkets.com/reports/c18539

Laura Wood

Senior Manager

Research and Markets

press@researchandmarkets.com

Fax: +353 1 4100 980

To order call +44 (0) 20 7779 8999 or toll free in the US +1 800 437 9997 to receive your 10% discount. You can also order on line at |

#### Press Release #####################

News Briefs---

Active week in mortgages as 10-year Tsy moves through 4%

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/2.htm

Washington Mutual to acquire Providian for about $6.45 billion

http://www.signonsandiego.com/news/business/

20050606-1406-washingtonmutual-providian.html

Citigroup Personal Data for 3.9 Million Lost in Transit

http://www.nytimes.com/2005/06/07/business/07data.html ?

Rates Need Not Signal Weakness - Greenspan

http://www.nytimes.com/reuters/business/business-

economy-greenspan.html

http://www.usatoday.com/money/economy/fed/rates/

2005-06-06-greenspan_x.htm

----------------------------------------------------------------

“Gimme that Wine”

Auction Napa Valley 25 Raises in Excess of $10.5 Million

http://www.napavintners.com/auctions/wineauction.html

Leno works wonders at Napa Valley Auction

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/20050605/

NEWS/506050329/1033/NEWS01

Australian wine exports rise for 5th month

http://www.iht.com/articles/2005/06/05/bloomberg/sxozwine.php

Taste: The right time to think pink

http://www.post-gazette.com/pg/05154/515454.stm

----------------------------------------------------------------

Today's Top Event in History

1975-the Sony Corporation released its videocassette recorder, the Betamax, which sold for $995. RCA and other introduced the VHS format, selling originally for $1,295. The Betamax was cheaper and supposedly a better system, but Sony would not release the patent and more manufacturers produced VHS, making it cheaper and cheaper, and perhaps what happened to Apple not releasing its software to programmers and Microsoft giving it to software developers for free, happened as Sony stopped making Betamax. If your remember, people were saying the video tape would put the movie industry out of business---just as they are saying today the internet will put the retailers out of business. In reality, both were enhanced, improved, and the consumers became the winners. The VHS tape is being replaced by DVD.

----------------------------------------------------------------

This Day in American History

1647-The first commercially successful American wines were produced by a Captain William Brocas. He is mentioned as a captain in the Dragoons, where he then became a farmer.” Early colonial dwellings were often no larger than 16 by 20 feet, with one or two rooms. Only at the end of the seventeenth century did prosperous planters begin to construct grander houses with as many as ten rooms. The poorest settlers slept on the floor on straw mattresses and had few other furnishings. In some counties, fewer than half of poor residents owned tables, and many had no chairs or benches to sit on. Even among middling planters, amenities were few: bedsheets, tablecloths, brass cookware, curtains. Rich planters owned more goods, though often of poor quality. In 1655, for instance, William Brocas, a prominent colonial official, owned "a parcell of old hangings, very thin and much worn"; seven chairs, "most of them unusefull"; and seven guns, "most unfixt."

1769-Daniel Boone arrives in Kentucky, celebrated today as “Boone Day.”

http://memory.loc.gov/ammem/today/jun07.html

( as stated by a relative here, many of the stories about Daniel Boone were invented and are not true; however, he was an American pioneer, nevertheless).

1777-The Second Continental Congress voted to replace the phrase “United Colonies” in all legislation with the phrase “ United States of America.” The Congress represented only twelve colonies at this date, Georgia not having sent delegates yet.

1816 -At Danville, Vermont, snow and sleet drifted to a depth of 20 inches. The higher elevations remained white the entire day. snow flurries were reported as far south as Boston, Massachusetts. Waltham, Massachusetts reported a low temperature of 33 degrees and New Haven, Connecticut had a low of 35 degrees.

1862- the first citizen of the United States to be hung for treason was Williams Bruce Mumford, a retired gambler. During the Civil War, Captain Theodorus Bailey was sent by Admiral David Glasgow Farragut to New Orleans, LA, where he hoisted the American flag over the min on April 28, 1862. After the troops left, Mumford tore down the flag. On May 1, General Benjamin Franklin Butler arrived in New Orleans with 2,000 troops and took possession of the St. Charles Hotel. A crowd gathered in front of it, among them Mumford, who boasted of his exploits in humbling the “old rag of the United States.” Mumford was arrested, tried under the direction of the provost marshal of the district of New Orleans, convicted, and hanged on June 7, 1862. We were serious about people who burned the American Flag in those days.

1860-As more Americans could read, the first mass-market paperback book was a fiction entitled: Malaeska: Indian Wife of the White Hunter, by Mrs. Ann S. Stephens. It was the trend then to hire writers, such as done for the Nancy Drew series, give them an outline and flat fee, no royalties. Mrs. Stephens had never left New York City, had never met an Indians. It was published by Irwin P. Beadle and Company, New York, and first advertised this day in the New York Tribune as “Beadle's Dime Novels No. 1.”

1862-Union General Benjamin Franklin Butler was hated in New Orleans and it perhaps started with this incident, which saw the first person hanged for treason, William Bruce Mumford, a retired gamble. During the Civil War, Captain Theodurs Bailey was sent by admiral David Glasgow Farrague to New Orleans, LA, where he hoisted the American flag over the mint on April 28, 1862. After the troops left, Mumford tore down the flag. On May 1, General Butler arrived in New Orleans with 2,000 troops and took possession of the St. Charles Hotel. A Crowd gather in front of it, among them Mumford, who boasted of his exploit in humbling the “old rag of the United States.” Mumford was arrested, tried under the direction of the provost marshal of the district of New Orleans, convicted, and hanged on June 7, 1862.

1887-revolutionizing printed, Tolbert Lanston of Washington, DC, received five patents for a monotype machine. The machine cast new type, letter by letter, from matrices that were used over and over again.

http://www.agfamonotype.co.uk/DynamicPage/View.cfm?

PageName=tl_1844_94

1892-African-American GJ Sampson received patent for clothes dryer.

http://inventors.about.com/library/inventors/blwashingmachines.htm

1892—Wyoming, who recognized women's rights early ( perhaps to attract more women to the state), also became the first women to a national political convention. Therese A. Jenkins of Cheyenne, WY, and Cora G. Carleton of Hilliard, WY, were sent as alternate delegates to the 10 th Republican Party convention at Minneapolis, MN, on June 7-10, 1892.

1892-Homer A. Plessy refuses to move to segregated railroad coach in New Orleans, initiating Plessy v Ferguson.

http://www.watson.org/~lisa/blackhistory/post-civilwar/plessy.html

1906-birthday of bandleader Glen Gray, Roanoke,IL

http://www.lib.neu.edu/archives/collect/findaids/m31find.htm

1909-birthday of Virginia Apgar. Dr. Apgar developed the simple assessment method that permits doctors and nurses to evaluate newborns while they are still in the delivery room to identify those in need of immediate medical care. The Apgar score was first published in 1953 and the Prenatal Section of the American Academy of Pediatrics is named for Dr. Apgar. born at Westfield, NJ. Apgar died Aug. 7, at New York,NY.

1915-William Jennings Bryan resigned as secretary of state in a disagreement withPresident Woodrow Wilson over the wording of a second note to Germany. Robert Lansing was named acting scretary of state.

1917-birthday of Gwendolyn Brooks, poet and first African-American awarded a Pulitzer prize

http://www.math.buffalo.edu/~sww/brooks/brooks.html

1921-Guitarist Tal Farlow birthday

http://www.geocities.com/Bourbo http://www.jazzguitar.com/features/talbook.html nStreet/5563/

http://www.myjazzhome.com/tal_2.htm

http://elvispelvis.com/talfarlow.htm

1930—The New York Times agreed to capitalize the word from n- to Negro.

1930-Gallant Fox, with jockey Earle Sande, became the second horse to win the Triple Crown. Trained by Sunny Jim Fitzsimmons, Gallant Fox won the Belmont Stakes by three lengths over Wichone in 2:31.3

1934-- Country honky-tonk and ballad singer Wynn Stewart was born in Morrisville, Missouri. He is best known for his 1967 country chart-topper, "It's Such a Pretty World Today."

1940-- singer Tom Jones was born in Pontypridd, Wales. After building a reputation in London clubs, Jones was offered a recording contract in 1964. His first records weren't successful, but in 1965 he achieved international success with "It's Not Unusual," a song written by his manager, Gordon Mills.

Jones next reached the top of the charts with the title song from the Peter O'Toole movie "What's New Pussycat?" He followed this with a series of country-flavored pop hits, among them "Green, Green Grass of Home," "Delilah" and "Love Me Tonight." Tom Jones became one of the biggest selling acts in Las Vegas, and had his own US network TV show for a few seasons. He returned with much gusto in 1994 with a new image, a new label and a new record. Titled 'The Lead and How to Swing It', the ZTT (Trevor Horn's label) released disc featured the hit single 'If I Only Knew' and a duet with Tori Amos called 'I want you back'. Tom also covered the early 80s Yaz tune 'Situation'.

1941-Whirlaway won the Belmont Stakes by 2 ½ lengths over Robert Morris to become the fifth horse to win the Triple Crown. Trained by Ben Jones for Calumet Farms and ridden by Eddie Arcaro, Whirlaway finished the Belmont in 2:31.

1942- It is not very well remembered today, but was very important to the building fear of the times when this day in 1942 the Japanese occupied the undefended island of Attu and the island of Kiska in the Western Aleutian, which was American territory. The capture was announced by the Navy on June 13. The islands were retaken by American Forces in May, 1943 is the only battle fought on U.S. soil during World War II.

1944--- guitarist Clarence White of the Byrds was born in Lewiston, Maine. After appearing as a session musician on recordings by such artists as Rick Nelson, the Everly Brothers and the Byrds, he became a permanent member of the Byrds in 1968. White remained with them until the group broke up in 1973. In July of that year, White was killed by a drunken driver in Lancaster, California, while he was loading equipment on to a van following a concert.

1953-Mary Church Terrell, political activist, wins struggle to end segregation in Washington, DC, restaurants.

http://www.npg.si.edu/exh/harmon/terrharm.htm

http://www.africana.com/Utilities/Content.html?&../cgi-bin/

banner.pl?banner=Education&../Articles/tt_1054.htm http://www.americaslibrary.gov/pages/jb_0923_terrell_1.html

1958---Top Hits

The Purple People Eater - Sheb Wooley

Secretly - Jimmie Rodgers

Do You Want to Dance - Bobby Freeman

All I Have to Do is Dream - The Everly Brothers

1958—Birthday of the rock singer formerly known as Prince, whose full name is Prince Nelson Rogers

1963- The Rolling Stones' first record, “Come On”, was released

http://personal.redestb.es/jmunoz/stones/comeon.html

1965-The executive committee of the American Football League met in New Jersey and voted to expand the league from eight teams to nine. Tow months later, the league awarded the expansion franchise to Miami for $7.5 million. The ownership group headed by Joe Robbie and entertainer Danny Thomas named its team the Dolphins.

1966---Top Hits

When a Man Loves a Woman - Percy Sledge

A Groovy Kind of Love - The Mindbenders

Paint It, Black - The Rolling Stones

Distant Drums - Jim Reeves

1969 - The rock group Blind Faith made its British debut at a free concert at London's Hyde Park. Over 100,000 fans attended what was called “the most remarkable gathering of young people ever seen in England.” The group was composed of Eric Clapton, Ginger Baker, Stevie Winwood and Rick Grech.

1969—The Johnny Cash Show premiered on television, CBS.

http://www.johnnycash.com/

1972- the musical Grease opened on Broadway. It had been playing off-Broadway for about 4 months

http://www.geocities.com/TelevisionCity/Studio/8849/Moviemusicals/

Rydell/Grease.htm#stag

1974---Top Hits

The Streak - Ray Stevens

Band on the Run - Paul McCartney & Wings

You Make Me Feel Brand New - The Stylistics

Pure Love - Ronnie Milsap

1974 - "The Entertainer", the original music from the motion picture "The Sting", earned a gold record for pianist and conductor, Marvin Hamlisch

1975-the Sony Corporation released its videocassette recorder, the Betamax, which sold for $995. RCA and other introduced the VHS format, selling originally for $1,295. The Betamax was cheaper and supposedly a better system, but Sony would not release the patent and more manufacturers produced VHS, making it cheaper and cheaper, and perhaps what happened to Apple not releasing its software to programmers and Microsoft giving it to software developers for free, happened as Sony stopped making Betamax. If your remember, people were saying the video tape would put the movie industry out of business---just as they are saying today the internet will put the retailers out of business. In reality, both were enhanced, improved, and the consumers became the winners. The VHS tape is being replaced by DVD.

1976 - "The NBC Nightly News", with John Chancellor and David Brinkley, aired for the first time. The partnership lasted until Brinkley moved to ABC News. Chancellor then held the lone, anchor spot until retiring.

1982---Top Hits

Ebony and Ivory - Paul McCartney with Stevie Wonder

Don't Talk to Strangers - Rick Springfield

I've Never Been to Me - Charlene

Finally - T.G. Sheppard

1984 -42 tornadoes touched down in the upper Midwest with 21 of them occurring in Iowa. An F4 tornado tracked 30 miles through Mahaska and Keokuk counties in Iowa, killing 2 people and injuring 51. The small town of Wright was practically wiped out. Barneveld, Wisconsin was devastated shortly before midnight as a F5 tornado chewed up the town. 90 percent of the town was damaged or destroyed, 9 people were killed, and 197 were injured.

1990---Top Hits

Vogue - Madonna

All I Wanna Do is Make Love to You - Heart

Hold On - Wilson Phillips

I've Cried My Last Tear for You - Ricky Van Shelton

NBA Finals Champions This Date

1978 Washington Bullets

Stanley Cup Champions This Date

1997 Detroit Red Wings

when he throws the

high hard one

it's like a razor

slicing skull

the ball and mitt

slam dancing

to dusty umpired rhythms

the batter

is not wired to his music

and cannot trust

his own instrument

the catcher cradles

a quick leather signal

squatting on new spikes

waiting for the curve

to drop like a head

into his basket.

Written by Tim Peeler

Published in “Touching All the Bases”

Printed by McFarland and Company

|

www.leasingnews.org |