Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Monday, March 25, 2024

Today's Leasing News Headlines

ELFA's Survey of Economic Activity

February New Business Volume Up 4% YoY

CLFP Foundation

Adds 21 New CLFPs

Help Wanted in the Finance and Leasing Industry

Balboa Capital, Top Mark

Top Ten Leasing News Read by Readers

March 18 - March 20

Dext Capital Upsizes

Corporate Note Financing

Equipment Finance Industry Confidence

Up Third Consecutive Month in March

Labrador Retriever

Concord, California Adopt-a-Dog

News Briefs ---

NYCB and Meridian Rode the Property Boom Together

Now They’re Struggling

A Brazen Yogurt Heist Shows

How Cyber Gangs Are Hijacking U.S. Goods

California insurance commissioner declares 'crisis'

after major State Farm announcement

Pawn shops know something about the US economy

that Biden doesn't: Times are still tough

You May Have Missed ---

The tech headaches of working from home

and how to remedy them

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

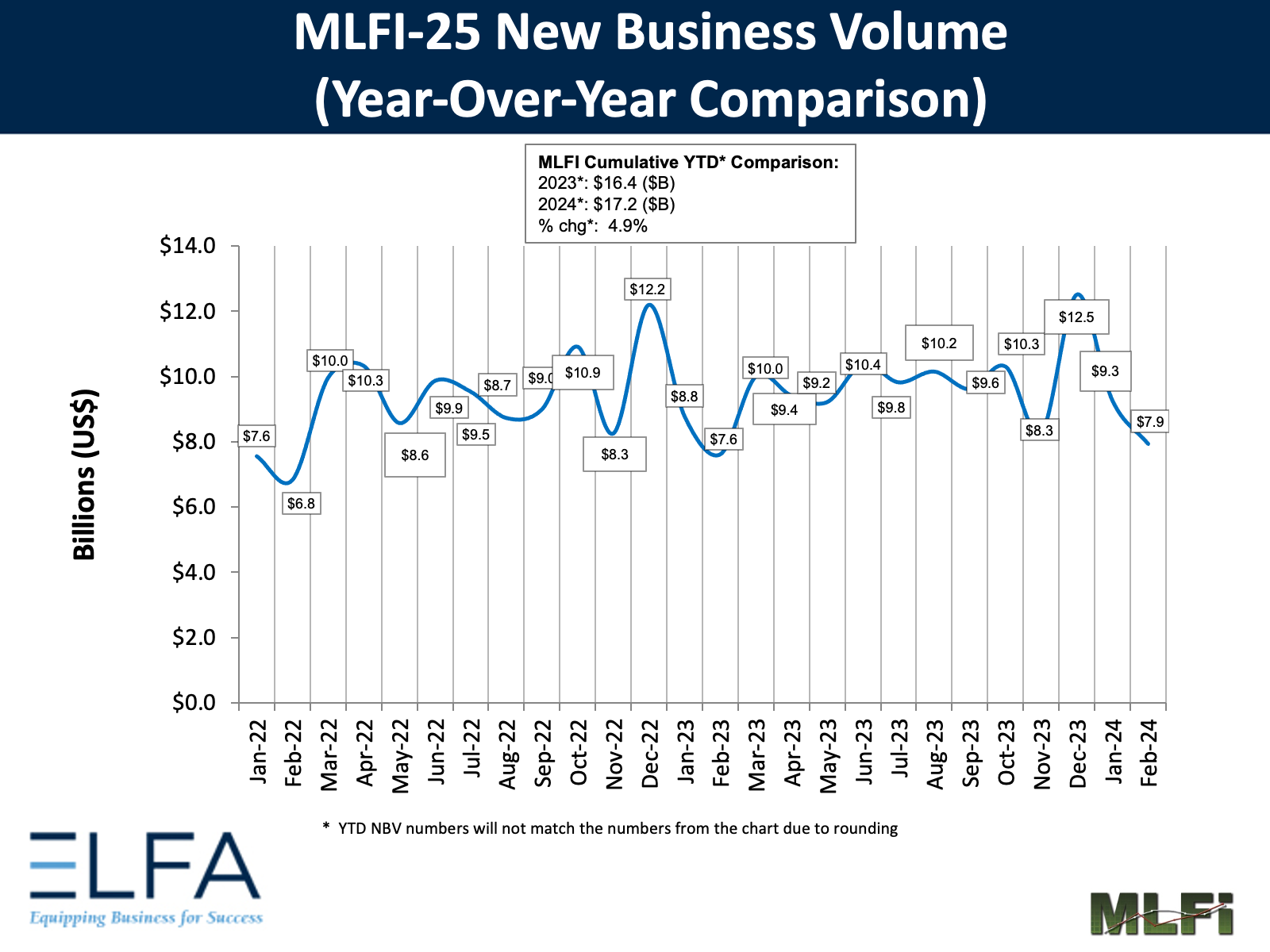

ELFA's Survey of Economic Activity:

Monthly Leasing and Finance Index

February New Business Volume Up 4% Year-over-year,

Down 15% Month-to-month, Up 4.9% Year-to-date

Washington, DC, March 25, 2024—The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for February was $7.9 billion, up 4% year-over-year from new business volume in February 2023. Volume was down 15% from $9.3 billion in January. Year-to-date, cumulative new business volume was up 4.9% compared to 2023.

Receivables over 30 days were 2.2%, down from 2.3% the previous month and up from 1.8% in the same period in 2023. Charge-offs were 0.4%, down from 0.5% the previous month and up from 0.3% in the year-earlier period.

Credit approvals totaled 76%, unchanged from January. Total headcount for equipment finance companies was up 1.8% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in March is 55.2, an increase from the February index of 51.7 and the highest level since April 2022.

ELFA President and CEO Leigh Lytle said, “Given continuing high interest rates and inflationary pressures, new business volume performed well in February. Tightening lending standards at banks are expanding opportunities for independent and captive equipment finance companies to provide critical productive assets that businesses need to operate. Credit quality, while still elevated year over year, showed improvement with delinquencies slowly returning to normal levels and charge-offs moving in a positive direction.”

Stan Walker, Managing Director, Citizens Asset Finance, said, “As we’ve turned to March, the equipment finance industry continues to show its resiliency as evidenced by the second straight month of higher business volume year over year. Despite the continued high interest rate environment and uncertainty around when rates may fall, Citizens is helping clients move forward with new equipment solutions both for growth and replacement needs. After a turbulent 2023, Citizens and most equipment finance groups in the banking sector are targeting growth by focusing on supporting their client base as trusted partners and adding select prospects where we can deliver smart advice and solutions.”

About ELFA’s MLFI-25

The MLFI-25 is the only near-real-time index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/knowledge-hub/mlfi-25-monthly-leasing-and-finance-index .

The MLFI-25 is part of the Knowledge Hub, the source for business intelligence in the equipment finance industry. Visit the hub atwww.elfaonline.org/KnowledgeHub

MLFI-25 Methodology

ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

|

[headlines]

--------------------------------------------------------------

CLFP Foundation Adds 21 New CLFPs

The Certified Lease & Finance Professional (CLFP) Foundation is pleased to announce that 21 individuals who recently sat through the online proctored CLFP Exam, have passed. They are:

1. Amanda Brubaken, CLFP – Group Lead, Mitsubishi HC Capital America, Inc.

2. Rick Bruflat, CLFP – Financial Solutions Specialist, John Deer Financial

3. Adam Carl, CLFP – Underwriting Analyst, Channel

- Headshot.jpg)

4. Marvel D'Souza, CLFP Associate – Staff Accountant, ECS Financial Services, Inc.

5. Surbhi Holani, CLFP – Senior Accountant, ECS Financial Services, Inc.

6. Mitchell Jurius, CLFP – Product Manager, Full Skope LLC

- Headshot.jpg)

7. Chelsea Knutson, CLFP Associate – Account Manager, Business Development - East, Channel

8. Jeremy Koenen, CLFP – Senior Technical Consultant, Tamarack Technology, Inc.

9. Deirdre McLaughlin, CLFP – Credit Analyst, AVP, Univest Capital, Inc.

10. Dylan Porter, CLFP – Business Support Representative, Channel

- Headshot.jpg)

11. Jasmine Rognrud, CLFP Associate – Funding Coordinator, Channel

12. Anthony Schindell, CLFP – Vice President of Underwriting, Trio Capital Solutions

13. Eric Schnoes, CLFP – Litigation & Bankruptcy Specialist, DLL

- Headshot.jpg)

14. Alexis Tauer, CLFP Associate – Underwriting Analyst, Channel

15. Karen Tworek, CLFP – Manager, ECS Financial Services, Inc.

- Headshot.jpg)

16. Nimisha Varghese, CLFP Associate – Staff Accountant, ECS Financial Services, Inc.

17. Justin Villard, CLFP – Credit Manager, First Western Equipment Finance

18. Hoc Vu, CLFP – Senior Underwriting Analyst, Channel\

19. Amy Weum, CLFP – Regional Vice President, CoBank Farm Credit Leasing

20. David Williams, CLFP – Senior Practice Consultant, FIS

21. Matt Williamson, CLFP – Business Development Manager Golf Turf & Recreational Products, DLL

Amy Weum attended the Channel ALFP and shares, “I recently celebrated 25 years in the equipment finance industry, and as I reflected on this big milestone, I wanted to give back to the industry that has given me an incredible career by creating a legacy of continual learning and personal excellence. As the first CLFP at Farm Credit Leasing, I hope that modeling the way will inspire my colleagues to invest in themselves by earning their CLFP, as a cornerstone of continuous education in their career path, and for the overall benefit of building the best and the brightest talent in the

equipment finance industry.”

“I chose to pursue the CLFP designation to build a strong foundation for my career in the equipment finance industry," shares Chelsea Knutson of Channel. “I entered this industry in May 2023 and felt the CLFP was what was going to provide the tools I needed to succeed. I am thrilled to be a part of the CLFP Family!”

The CLFP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the commercial equipment finance industry. There are Certified Lease & Finance Professionals and Associates located throughout the United States (including Puerto Rico), Canada, India, Pakistan, Africa, and Australia. For more information, visit http://www.CLFPFoundation.org.

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

Top Ten Leasing News Read by Readers

March 18 - March 20

(1) "Buckle Up!"

Tri Counties Bank Equipment Finance

Department Shut Down

https://leasingnews.org/archives/Mar2024/03_18.htm#tri

(2) Is Broker Fee Splitting in California Legal?

By Ken Greene, Leasing News Emeritus

https://leasingnews.org/archives/Mar2024/03_20.htm#fee

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Mar2024/03_20.htm#hires

(4) When It's Time to Move On

By Ken Lubin, ZRG Partners

https://leasingnews.org/archives/Mar2024/03_20.htm#when

(5) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Mar2024/03_18.htm#hires

(6} Electric vehicle maker facing bankruptcy

negotiates for lifeline

https://www.thestreet.com/electric-vehicles/electric-vehicle-maker-facing-bankruptcy-risk-negotiates-for-lifeline

(7) Airfares have dropped. Here’s why they

could go even lower in 2024

https://www.eastbaytimes.com/2024/03/15/airfares-have-dropped-heres-why-they-could-go-even-lower-in-2024/

(8) This Hawaii family business sells

100 million of these per year

https://www.sfgate.com/hawaii/article/honolulu-cookie-co-hawaii-18949986.php

(9) Is It Time to Retire the Term

“Women Winemakers?”

https://robbreport-com.cdn.ampproject.org/c/s/robbreport.com/food-drink/wine/women-winemakers-1235546966/a

(10) Top Ten Leasing News Read by Readers

March 11 to March 15

https://leasingnews.org/archives/Mar2024/03_18.htm#top311

[headlines]

--------------------------------------------------------------

Dext Capital Upsizes Corporate Note Financing

Lake Oswego, OR. – March 25, 2023 - Dext Capital (Dext), ), a leading essential-use healthcare equipment lessor, announces the upsize of its investment-grade corporate note. Proceeds will be used for new originations and growth initiatives.

Founded in 2018, Dext specializes in providing financing solutions primarily to the healthcare industry, helping customers acquire and upgrade critical equipment, improve cash flow and manage risk. As a well-capitalized platform with extensive sector expertise and a focus on customer service, Dext has established itself as a trusted partner for hospitals and other healthcare providers throughout the United States.

Brean Capital, LLC served as the Company’s exclusive financial advisor and sole placement agent in connection with the transaction.

“We continue to expand our platform as demand for healthcare equipment remains elevated. We appreciate the support of our capital providers who recognize the value of our solutions to markets that are increasingly underserved by bank lenders.” - Kyin Lok, Dext Capital CEO

About Dext Capital

Dext Capital is a leading provider of equipment financing solutions, committed to supporting businesses across various industries. With a focus on innovation, expertise, and personalized service, Dext Capital empowers its clients to acquire the equipment they need to succeed and grow. As the company expands into new industries, it remains dedicated to its core values of integrity, excellence, and customer satisfaction.

About Sightway Capital

Sightway Capital is a Two Sigma company focused on middle market growth equity investing in financial services and real assets. The company employs a principal mindset and flexible capital approach to building successful business platforms with experienced operators and strategic partners. The team at Sightway Capital thinks long-term, targeting business opportunities that we believe afford both asymmetric risk rewards and enterprise value creation over time. They look for opportunities in and around several asset-intensive industries where our team has significant experience and a network of long-standing relationships. For more information, please visit www.sightwaycapital.com

--------------------------------------------------------------

Equipment Finance Industry Confidence

Up Third Consecutive Month in March

Washington, DC, March 21, 2024 – The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market increased for the third consecutive month to 55.2, up from the February index of 51.7, and the highest level since April 2022.

When asked about the outlook for the future, MCI-EFI survey respondent Keith Smith, President, Equipment & Franchise Finance, Star Hill Financial LLC, said, “Supply chain and demand seemed to have caught up to each other, we are finally seeing equipment ordered and delivered in real time. This has increased the overall activity in the equipment funding space. My biggest concern is the volatility the financial markets, specifically the health of mid-market/regional banks. Historically these institutions have been the backbone of funding in the equipment finance industry, and right now even the deposit-healthy institutions are slowing their lending due to regulatory concerns.”

March 2024 Survey Results:

The overall MCI-EFI is 55.2, an increase from the February index of 51.7.

When asked to assess their business conditions over the next four months, 1 9.4% of the executives responding said they believe business conditions will improve over the next four months, an increase from 10.7% in February. 77.4% believe business conditions will remain the same over the next four months, down from 82.1% the previous month. 3.2% believe business conditions will worsen, a decrease from 7.1% in February.

25.8% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 7.1% in February. 71% believe demand will “remain the same” during the same four-month time period, down from 78.6% the previous month.

3.2% believe demand will decline, a decrease from 14.3% in February.

16.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 14.3% in February. 74.2% of executives indicate they expect the “same” access to capital to fund business, down from 75% last month. 9.7% expect “less” access to capital, down from 10.7% the previous month.

When asked, 19.4% of the executives report they expect to hire more employees over the next four months, a decrease from 21.4% in February. 67.7% expect no change in headcount over the next four months, down from 71.4% last month. 12.9% expect to hire fewer employees, up from 7.1% in February.

None of the leadership evaluate the current U.S. economy as “excellent,” down from 3.6% the previous month. 93.6% of the leadership evaluate the current U.S. economy as “fair,” up from 89.3% in February. 6.5% evaluate it as “poor,” down from 7.1% last month.

25.8% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 17.9% in February. 54.8% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 67.9% last month. 19.4% believe economic conditions in the U.S. will worsen over the next six months, an increase from 14.3% the previous month.

In March, 22.6% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 21.4% the previous month. 64.5% believe there will be “no change” in business development spending, down from 67.9% in February. 12.9% believe there will be a decrease in spending, up from 10.7% last month.

March 2024 MCI-EFI Survey Comments from Industry Executive Leadership:

Bank, Small Ticket

“The borrowers that have navigated through the uncertain economic conditions and higher rates should emerge even stronger as the economy strengthens.” Charles Jones, Senior Vice President, 1st Equipment Finance, Inc. (FNCB Bank)

“I continue to think that 2024 will be a solid growth year for Wintrust Specialty Finance. The year has started off strong with new business originations at double-digit increases over the same period in 2023. Application volume continues to be strong while approval rates are lower due to lower credit quality we are seeing in the market. Portfolio performance remains heightened from recent years and still performing favorably to historic averages. It is important to remain focused on quality and portfolio performance as we wade our way through the transition in the economy.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Bank, Middle Ticket

“The normalization of income in the grains and oilseeds sector of production agriculture has the potential to increase demand for financing. It will also increase credit risk, albeit from exceptionally strong levels.” Jason Lueders, President, Farm Credit Leasing

Captive, Small Ticket

“Inventories are returning to pre-COVID levels and end users need to replace older equipment they were forced to keep in service. A stabilizing rate environment and an election coming up could make 2024 a very good year.” Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc.

Independent, Large Ticket

“I expect conditions to remain stable for the balance of the year due to the upcoming election and the anticipation for interest rates to decrease.” Jonathan Albin, Chief Operating Officer, Nexseer Capital

Independent, Small Ticket

“The net jobs growth is now relatively weak and there are fewer job openings. The Fed may have, or is near, achieving a ‘soft’ landing with the economy.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

--------------------------------------------------------------

Labrador Retriever

Concord, California Adopt-a-Dog

Bruno

Male

2 Years Old

Neutered

75 lbs.

What Bruno's NICST Trainer Says, “Bruno is a goofy, playful, loving boy who loves to play fetch, chew on bones, swim, and nap in the sun. Bruno is food motivated, quick to learn new skills, and engages well with his handlers. He is easily managed by handlers that focus their attention on him. We received Bruno from Golden Gate Lab Rescue -- he was originally an owner -surrender to their rescue organization -- then we evaluated him while he was in his initial foster home. “

What Bruno's Rescue Rep Says, “ Bruno is currently still in the care of NICST. Bruno would do best in a quieter (non-city) environment. A home with another dog that can mentor Bruno would be ideal. No idea how Bruno is with cats. Bruno has had little, if any, exposure to young children. An ongoing rigorous exercise and training program would be great for Bruno.”

Medical: Bruno is in great health. Neutered, microchipped, current on vax, and heartworm negative.

Located In: Concord.

If you are willing to foster (or adopt) Bruno, please contact Rescue Rep Dave at david.c.ely@sbcglobal.net

[headlines]

--------------------------------------------------------------

News Briefs

NYCB and Meridian Rode the Property Boom Together

Now They’re Struggling

https://www.wsj.com/finance/banking/nycb-meridian-trouble-commercial-real-estate-86ae7a34?st=9ddc3y6d9jovvfz&reflink=desktopwebshare_permalink

A Brazen Yogurt Heist Shows

How Cyber Gangs Are Hijacking U.S. Goods

https://www.wsj.com/business/logistics/a-brazen-yogurt-heist-shows-how-cyber-gangs-are-hijacking-u-s-goods-7a8c1843?st=740amunn8oducxn&reflink=desktopwebshare_permalink

California insurance commissioner declares 'crisis'

after major State Farm announcement

https://www.foxbusiness.com/politics/california-insurance-commissioner-declares-crisis-major-state-farm-announcement

Pawn shops know something about the US economy

that Biden doesn't: Times are still tough

https://www.usatoday.com/story/news/politics/elections/2024/03/24/pawnshops-tell-different-economic-story-than-biden/72881561007/

[headlines]

--------------------------------------------------------------

The last days of the Tropicana, a Las Vegas icon

https://www.sfgate.com/travel/article/last-days-of-the-tropicana-18656872.php

[headlines]

--------------------------------------------------------------

Sports Briefs---

Caitlin Clark and Iowa find peace in the process

https://www.espn.com/womens-college-basketball/story/_/id/39740282/caitlin-clark-iowa-2024-ncaa-women-basketball-tournament-ready-march

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Mountain lion kills man in Northern California for first time in 30 years

https://www.sfgate.com/bayarea/article/mountain-lion-kills-man-northern-california-19365657.php

'Cheating' drivers aren't paying Highway 101 express lane tolls

https://www.sfgate.com/travel/article/cheating-drivers-arent-paying-highway-101-tolls-19361399.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Wine of the week: Lucy, 2023 Santa Lucia Highlands,

Monterey County Rosé of Pinot Noir

https://www.pressdemocrat.com/article/lifestyle/wine-of-the-week-lucy-2023-santa-lucia-highlands-monterey-county-rose-of/

10 women making their mark on the Sonoma,

Napa county wine industry

https://www.pressdemocrat.com/article/lifestyle/10-women-making-their-mark-on-the-sonoma-napa-county-wine-industry/

Founding Patz & Hall winemaker repurchases

Sonoma Valley vintner

https://www.pressdemocrat.com/article/industrynews/founding-patz-hall-winemaker-repurchases-sonoma-valley-vintner/

‘It’s like Napa 30 years ago’: Big-name winemakers

are decamping to this lesser-known region

https://www.sfchronicle.com/food/wine/article/napa-winemakers-paso-robles-18696043.php

Boathouse Vineyards' 2022 Cabernet Franc

Outshines 17 International Entries

https://www.winebusiness.com/news/article/284915

The World's Most Wanted Malbecs

Prices

https://www.sfchronicle.com/food/wine/article/napa-winemakers-paso-robles-18696043.phper Bottle

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Mar2020/03_25.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()