Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, May 2, 2025

Today's Leasing News Headlines

Ninth Circuit Affirms Legality Of California

Disclosure Laws

By Ken Greene, Law Offices of Kenneth Charles Greene

New Hires/Promotions in the Leasing Business

and Related Industries

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

It’s good for originators to be busy.

It’s better for originators to be productive.

But it’s essential for originators to generate profit.

By Scott Wheeler, CLFP

Looking for Broker Business

Updates or Changes, Contact

kitmenkin@leasingnews.org

Remember the Good Old Days?

Cartoon

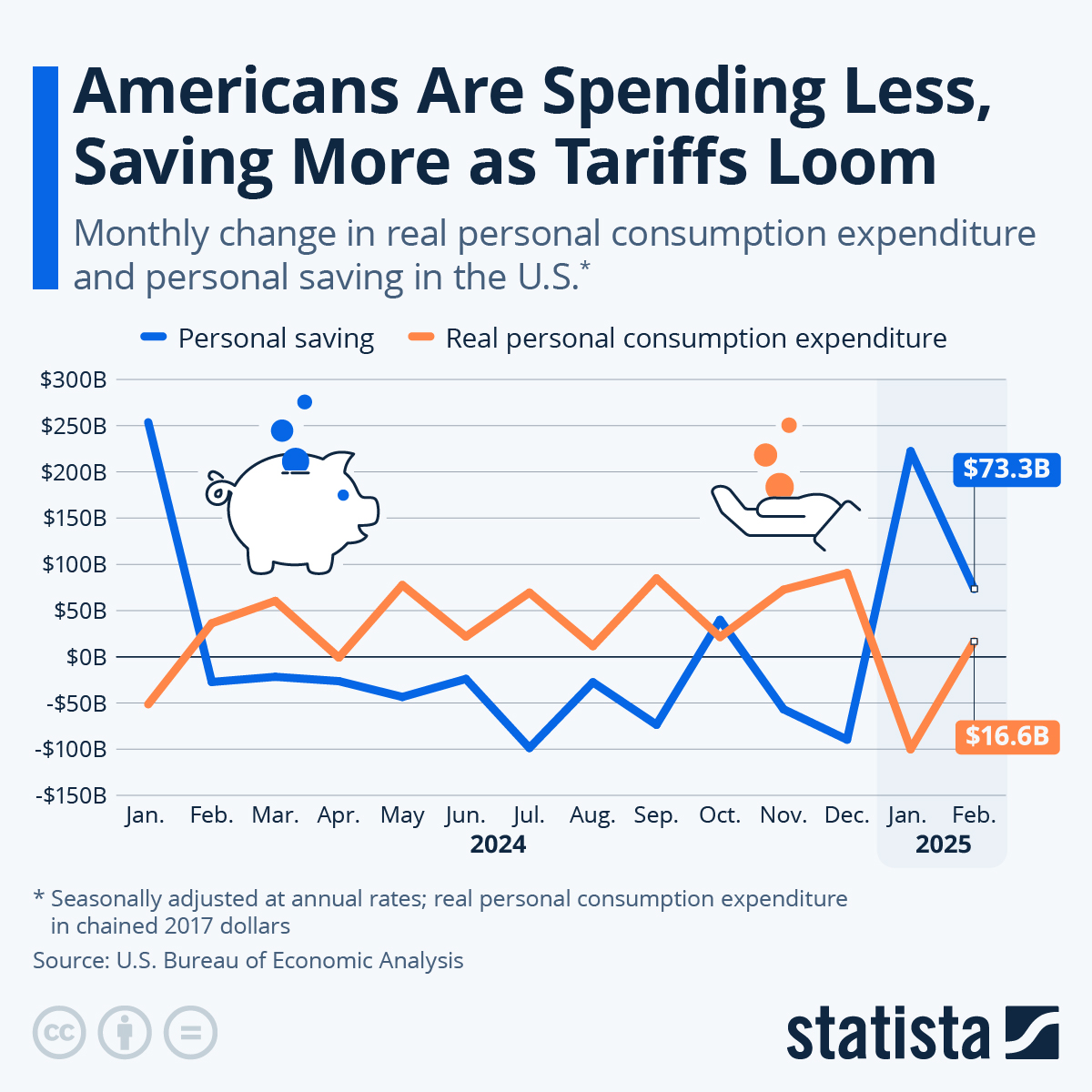

Americans Are Spending Less

Saving More as Tariffs Loom

Leasing News Advisor/Legal Editor

Marshall Goldberg

NEFA Charity Glow Golf Event Raises Over

$28,000 at 2025 Spring Conference

News Briefs---

ADP National Employment Report: Private Sector Employment

Increased by 62,000 Jobs in April

Annual Pay was Up 4.5%

Tesla Aims for Full-Scale Production of Semi in 2026

Updated Model’s Future Touted as ‘Bright and Electric’

The last boats without crippling tariffs from China are

arriving. The countdown to shortages and higher prices has begun

In an Uncertain Economy,

McDonald’s Sees Sales Decline

Kohl’s fires new CEO Ashley Buchanan for

steering business to former romantic partner

You May Have Missed ---

Irreconcilable Differences: How MCA Abuse of

“Reconciliation Rights” Threatens Collateral

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Ninth Circuit Affirms Legality Of California Disclosure Laws

By: Ken Greene, Law Offices of Kenneth Charles Greene

Senate Bill 1235 (the genesis of the California commercial finance disclosure laws) was enacted back in 2018. Four years later, the Office of Administrative Law approved 48 pages of regulations, embodied in California Code of Regulations Title 10, Chapter 3 (see below for link).

Many disgruntled lenders and attorneys talked about mounting a legal challenge. That talk became action when an association called Small Business Finance Association sued the Commissioner of the Department of Financial Protection and Innovation (DFPI) at that time, Mrs. Clothilde Hewlett. Small Bus. Finance Ass'n v. Hewlett, 2023 WL 8711078 (C.D. Cal. Dec. 4, 2024.

Small Business Finance Association claimed that the disclosure regulations violated the First Amendment and that they were preempted in part by the Federal Truth in Lending Act. In December of 2024, U.S. District Judge Gary Klausner granted the DFPI’s motion for summary judgment and ruled that the regulations do not violate the First Amendment under the Supreme Court’s test for compelled commercial speech.

Judge Klausner’s ruling has been confirmed by the Ninth Circuit. For those of you who are not fans of the commercial finance disclosure scheme, this is unwelcome news, as it would appear those regulations and the related laws are here to stay.

CCR Title 10, Chapter 3: https://dfpi.ca.gov/wp-content/uploads/sites/337/2022/06/PRO-01-18-Commercial-Financing-Disclosure-Regulation-Final-Text.pdf

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

David Barson, CFE, CPA, was hired as Director of Credit, NewLane Finance LLC (WSFS Bank), Philadelphia, Pennsylvania. He is located in Greater Philadelphia. Previously, he was Bankruptcy Auditor & Financial Analyst, U.S. Trustee Program (October 2022 - September, 2024); Vice President - Credit Products Officer III, PNC Bank, N.A., (September, 2017 - October, 2022); Certified Public Accountant, RSM US LLP (July, 2013 - March, 2017).

https://www.linkedin.com/in/david-barson-cfe-cpa-237ba821/

James K. Cooke was hired as Sales Support Specialist, NewLane Finance LLC (WSFS Bank), Philadelphia, Pennsylvania. He is located in Greater Philadelphia. Previously, Sales Support Analyst, DLL (February – May, 2024: Equipment Finance Coordinator, Huntington National Bank (September, 2020 – January, 2024); Real Estate Salesperson, Berkshire Sales. He was Bankruptcy Auditor & Financial Analyst, US Trust Program (October, 2022 - September, 2024);Vice President, Credit

Products Officer III (PNC Bank, N.A. (September, 2017 - October, 2022); Certified Public Account, RSM US LLP (July, 2013 - March, 2017).(April, 2016 – June, 2022); Operations Administrator, BB&T Commercial Equipment Capital Corp. (March, 2018 – September, 2020). Temple University, B.A., English.

https://www.linkedin.com/in/james-k-cooke-052871119/

Jamie-Lynn Herron was hired as Senior VP of Operations at Post Road Equipment Finance, formerly known as Encina Equipment Finance. She is located in Danbury, Connecticut. Previously, she was Documentation & Closing Manager, Crossroads Equipment Lease and Finance (November, 2023 - April, 2025). She joined Wells Fargo June, 2022, as Operations Lending Manager, promoted Wholesale Loan Administrator, October, 2019, Lending Operations Manager (June, 2022 - April, 2024). She Joined GE Capital 2009 as Operations Manager, promoted Integration & Simplification Leader, 2012, promoted Integration & Simplification Leader (July, 2012 - September, 2019); Operations Team Leader GE HFS (2002 - 2009).

https://www.linkedin.com/in/herron-jamie-lynn-6502545/

Michael Lefkowitz, CLFP, was promoted to Vice President of Credit, Credit Manager, Civista Leasing & Finance, Pittsburgh, Pennsylvania. He is located in Swedesboro, New Jersey. He joined Civista as Senior Credit Analyst (March, 2023 - April, 2025). Previously, he was Small Business Credit Manager, WSFS Bank (March, 2019 - October, 2022). He joined Marlin Business Services as Senior Credit Analyst, June, 2013, promoted to Credit Manager, May, 2016, AVP, Mid-Ticket Credit Leader (January, 2018 - March, 2019). He was at TD Bank, starting July, 2008, AVP, Small Business Underwriter 1 & 2.

Full Bio:

https://www.linkedin.com/in/michaellefkowitzclfp/details/experience/

https://www.linkedin.com/in/michaellefkowitzclfp

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

It’s good for originators to be busy

It’s better for originators to be productive

But it’s essential for originators to generate profit

By Scott Wheeler, CLFP

The most successful originators understand that their core responsibility is to produce assets that maximize profitability—for themselves, their companies, and their funding partners.

For much of the past decade, the industry prioritized growth and compensated originators primarily based on volume. “Bigger is better” was the prevailing mindset. However, over the past 18 months—and definitively in 2025—the industry has shifted. We’ve returned to fundamentals and rediscovered a key truth: bigger is not always better. Sustainable success is driven by strong, high-performing assets that contribute meaningfully to the bottom line.

Here are three examples that illustrate different approaches and outcomes:

Originator A: The Hustler – Busy, but Questionably Profitable

This originator works long and hard hours every day. He leads the team in call volume and meetings. He’s enthusiastic about every opportunity and generates the most applications.

However, his funding-to-application ratio is low, and he consumes internal resources heavily. While he is an above-average producer by volume, his weighted average yield is slightly below the company average. His portfolio performance—with higher delinquency and write-offs—lags behind peers.

He is a valued team member, but his efficiency and profitability are inconsistent.

Originator B: The Relationship Builder – Efficient, but Yield-Challenged

This originator works with focus and intention. She nurtures her top relationships and is excellent at prequalifying opportunities.

Her application volume is strong, and her funding-to-application ratio is high. She is highly efficient with internal resources. She’s a top-tier producer—though not number one—and a strong cultural ambassador for the company.

However, her average yields are consistently below target, and while her portfolio is historically solid, recent performance has seen some issues. She is a key contributor, but profitability from her deals could be improved.

Originator C: The Strategist – High Performing and Highly Profitable

This originator is both strategic and efficient. He aligns his efforts with company goals, focusing on vendors and end-users that match his strengths. He maintains a strong book of business while continually prospecting for future opportunities.

His application volume is among the highest, and his funding-to-application ratio leads the company. A consistent top producer, he balances pricing decisions with market awareness and risk. He knows when to trim yields to win key accounts and when to price for risk, resulting in a wide but strategic yield spread. He achieves the highest weighted average yield in the company, and his portfolio is the most profitable.

He delivers true value, consistently contributes to the bottom line, and is a recognized leader within the organization.

Now more than ever, originators must go beyond just being busy or productive—they must be profitable. As a company, it’s time to recalibrate what we reward, recognize, and replicate. High volume alone does not drive sustainability. High-performing, well-structured, and profitable assets do.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Looking for Broker Business

Updates or Changes, Contact kitmenkin@leasingnews.org

There is no advertising fee or charge for a listing. They are “free.” Leasing News makes no endorsement of any of the companies listed, except they have qualified to be on this specific list.

We encourage companies who are listed to contact us for any change or addition they would like to make. We encourage adding further information as an "attachment" or clarification of what they have to offer would be helpful to readers.

Please send company name, contact/email or telephone number as well as a URL to attach or description to kitmenkin@leasingnews.org

Alphabetical list - click on company name to view more details |

Leasing Associations: All non-profit leasing associations are abbreviated. To see the full name and learn more about the association, please click here.

BBB - Better Business Report | CBB - Leasing News Complaint Bulletin Board

| CNI - Current News Information

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

N/R (not reported)

* (no response---these listing do not come from the company directly, but from our research from many sources. It is our policy not to put anything in this section without confirmation.)

Name |

Employees

|

Geo

Area |

Dollar

Amount |

A

|

B

|

C

|

D

|

E

|

Clicklease |

274 |

National |

$5,00 to $25,000 |

Y |

N |

N |

N |

Y |

Balboa Capital Corp. 1988 A Division of Ameris Bank since December 2021 Robert J. Rasmussen Chief Operating and Risk Officer 949-399-6344 robertjr@balboacapital.com https://www.balboacapital.com AACFB, ELFA, NEFA |

229 |

USA |

$3,000 - $5,000,000 |

Y |

Y |

N |

N |

Y |

TimePayment Burlington, Massachusetts 1989 Caitlin Keefe Broker Channel Manager caitlin.keefe@timepayment.com 855-259-1034 Broker Desk brokerdesk@timepayment.com 866-994-7260 https://timepayment.com/brokers AACFB, ELFA, NEFA (Footnote) |

200 |

National

|

$500 to

$1 million+ |

Y |

N |

N |

Y |

Y |

Financial Pacific Leasing |

140 |

USA and Canada |

$5,000-$500,000 |

Y |

Y |

Y |

Y |

Y |

North Mill Equipment Finance |

110 |

National |

App Only: $15k to $250k |

Y |

Y |

Y |

Y |

N |

NewLane Finance Philadelphia, Pennsylvania 2017 George Pelose, Pesident 267-768-3301 gpelose@newlanefinance.com www.newlanefinance.com AACFB, ELFA, NEFA (more) |

75 |

Nationwide |

$25,000 to $500,000 |

Y |

N |

N |

Y |

Y |

Blue Bridge Financial, LLC 2009 Steven Elbridge seldridge@bluebridgefinancial.com www.bluebridgefinancial.com AACFB, NEFA, ELFA (more) |

35 |

United States |

$20,000-$500,000 avg. size: $85,000 |

Y |

Y |

Y |

Y |

Y |

First Midwest Equipment |

33 |

48 |

App Only Machine Tools Financial Statement Transaction |

Y |

Y |

N |

Y |

Y |

Maxim Commercial Capital, LLC |

30 |

Nationwide |

$5,000 - |

Y |

Y |

Y |

N |

Y |

Navitas Credit Corp. - Partner Funding 2011 Ron Elwood 800-516-0761 partnerfunding@navitascredit.com pf.navitascredit.com AACFB, ELFA, NAELB |

200 |

National |

$10,000 plus |

Y |

Y |

N |

Y |

Y |

24 |

United States

|

$20,000 - $500,000

|

Y |

Y |

N |

N |

Y |

|

1st Enterprise Bank Leasing 2006 Los Angeles, California Robert Selway Relationship Manager rselway@1stenterprisebank.com 213-430-7061 Cell: 213-500-0181 (click for more info) |

21 |

CA only- Los Angeles, Orange County, Inland Empire |

$100,000 |

Y |

Y |

N |

N |

Y |

C.H. Brown Company a Subsidiary of Platte Valley Bank Wheatland, Wyoming Kit West Business Development Director/Broker Relations (307) 241-7005 kwest@chbef.com www.chbef.com AACFB, NEFA, & NAFA (National Aircraft Financing Association) (click for more info) |

23 |

National

|

$15,000 Minimum* |

Y |

N |

Y* |

N |

N |

National Equipment Finance Norwalk, Conneticut 2010 Michael B. Tornichia Vice President – Business Development T 201-248-0496 F 415-520-5535 mtornichia@nationsequipmentfinance.com www.nationsequipmentfinance.com *Will work with other lenders/lessors (see footnote for more information) |

20 |

USA and Canadal |

500k-25mm + |

Y |

N |

N |

N |

Y |

First Federal Leasing 1989 Kristi S Herig President, First Federal Leasing Sr. Vice President, First Bank Richmond kherig@firstbankrichmond.com 765-962-3881 x 526 www.firstfederalleasing.com NAELB (Q) |

18 |

Nationwide |

$5,000 min. |

Y |

N |

N |

N |

N |

BSB Leasing, Inc. 1992 Colorado, Hawaii Don Meyerson, Pres. DMyerson@bsbleasing.com Vicki Shimkus,CLFP West Coast Brokers vshimkus@bsbleasing.com www.bsbleasing.com NAELB (click here for further description) |

16 |

National |

$10,000 Minimum Application Only to $250,000 Financial Statement Transaction Up to $1MM Business Loans Up to $500K |

Y |

N |

N |

Y |

Y |

NFS Leasing, Inc. Beverly, Massachusetts 2001 Dean Oliver deano@nfsleasing.com 978-767-2353 www.nfsleasing.com NEFA (Footnote) |

15 |

US and Canada |

$50,000 to $3MM |

Y |

Y |

N |

N |

Y |

Targeted Lending Co., LLC 2015 Brian Gallo bgallo@targetedlending.com Renee Hazard rhazard@targetedlending.com 716-266-6700 www.targetedlending.com ELFA, NEFA |

15 |

National |

$5,000 to $250,000 |

Y |

Y |

N |

Y |

N |

TEAM Funding Solutions 1992 Ted Reynolds – Owner and President Jeff Deskins – Credit Manager App Submittal: Lynn Smith – Senior Broker Development Manager 888-457-6700 x115, Bill Baskerville – Broker Development Manager 888-457-6700 x114, Funding: Stephen Stuesser – CFO Jamie Moore – Marketing Manager Phone: 888-457-6700 x109, Enrollment Fax: 512-258-2322 www.teamfundingsolutions.com NAELB, NEFA (click here for further description) |

13 |

48 States |

$20,000-$200,000 |

Y |

Y |

Y |

N |

N |

360 Equipment Finance Austin, Texas 2001 Ann Smithson ann@360equipmentfinance.com 512-263-7235 x110 www.360equipmentfinance.com AACFB, NEFA (More) |

12 |

48 States, Except Hawaii, Louisiana |

$5,000 - $50,000 / |

Y |

N |

N |

N |

N |

12 |

National |

$100,000 to $1,500,000 |

||||||

Global Financial & |

12 |

National |

$25,000 to $1 Million |

Y |

N |

N |

Y |

Y |

Dedicated Funding |

10 |

National |

$15,000 to $250.000 |

Y |

Y |

Y |

Y |

Y |

Calfund, LLC 2000 Harry Saghian harry@calfundllc.com calfundllc.com (click here for further description) |

10 |

Western States |

$15K Does Subprime Leases |

|||||

International Financial Services |

10 |

Nationwide |

$100,000 - |

Y |

N |

Y |

N |

Y |

Dakota Financial 2001 Charla Laird Sales & Marketing Manager 310-432-2935 Direct 858-212-4994 Cell 310.696.3035 fax charla@dakotafin.com www.dakotafinancial.com NAELB, NEFA |

9 |

Nationwide |

$10,000 to $1MM |

Y |

N |

Y |

N |

N |

Forum Financial Services, Inc. 1996 Tim O'Connor 972-690-9444 ext. 225 tim@forumleasing..com 275 West Campbell Road Suite 320 Richardson, Texas 75080 Fax: 972-690-9464 www.forumleasing.com NAELB & NEFA |

7 |

Nationwide |

$50,000 to $1.0 million. Our average size transaction is $250,000. Does Subprime Leases |

|||||

Bankers Capital 1990 James Aiksnoras President 508-351-6000 Jamesa@bankers-capital.com www.bankers-capital.com AACFB, NEFA (footnote) |

6 |

Nationwide |

$40,000 + |

Y |

Y |

N |

N |

N |

Celtic Bank |

5 |

Contiguous US |

$100,000 to $2 million |

Y |

N |

N |

N |

N |

SLIM Capital, LLC |

<5 |

Nationwide |

$25,000 to $2 million(Avg $200,000) |

Y |

Y |

Y |

N |

N |

Standard Professional Services, LLC 1976 Mr. Raphael Lavin, CLFP JWhalen@spsllc.net 847-291-7858 www.spsllc.net EAEL, NAELB, NEFA (click here for further description) |

4 |

Nationwide & some offshore |

$10,000 - 250,000 ($25,000 - $150,000 desired) |

|||||

Gonor Funding 2001 Norman J. Gonor ngonor@gonorfunding.com 818.784.5444 Jason Gonor 818.402.6999 www.gonorfunding.com (click here for further description) |

3 |

USA |

USA

Does Subprime Leases |

|||||

Northwest Leasing Company, Inc. Bellevue, Washington 1992 Tad Rolfe 425-827-8386 tad@nwleasing.com www.nwleasing.com (more info) |

3 |

Washington, Oregon, and Idaho |

$10,000 to $75,000 (Avg. $25K) |

Y |

N |

N |

N |

Y |

Mesa Leasing, Inc. |

3 |

California |

$10,000 to $100,000 |

Y |

N |

N |

N |

N |

Allegheny Valley Bank Leasing Pittsburgh, Pennyslyvania P. 412.781.1465 C. 412.475.1727 www.avbpgh.com (click here for further description) |

2 (plus bank assistance) |

PA, OH, WV, MD, Western NY |

$5K to $50K " app only" Over $50k to $3M full financials |

Y |

N |

N |

Y |

Y |

Baystone Government Finance/ |

2 |

Nationwide |

$5,000 to $2 million |

Y |

N |

N |

N |

Y |

C.H. Brown Company

Application +Banks to $150,000

Over $150,000 Full Financials to $325,000 Max Funding

Average Deal size is $60,000 to $70,000

B/C credits w/%10 to %23 interest rates

Zero Down and Startup Programs

in the list, for C, Yes w/established relations

Kit West added to sub-broker, "with establishedd relations. We also only do EFA's so the disclosures put an end to that.

"We are looking for some new business avenues. We are like everyone today… cautious yet we are somewhat optimistic about the future. We presently have 6 approved regional brokers and a 4 direct vendor programs. 2 small ticket and 2 larger ticket (average ticket size of $250k). We like medical business of all types and can be very responsive to brokers / vendors that work with us closely. We are looking for relationships not just transactions."

"Out of Market transactions must be at or near Investment Grade."

BSB Leasing, Inc is a direct funding source. In addition we offer an experienced Syndication Desk that can place transactions that fall outside of credit, equipment, geographic or dollar amount appetite.

Exchange Bank Leasing--We are an "A" credit lender working with professional lease brokers who originate leases and loans for companies located in California. We are credit driven and our list of industries and list of equipment we will not lease for a qualified client is very short. Our credit managers are available to the lease professionals we work with. We like to know the lease professionals we work with very well - visiting with them often.

First Midwest Equipment Finance Co.

Provides financing, leasing, and lending services to businesses and municipalities with “A” through “D” credit profiles throughout the United States, Canada, Mexico, and South America. Since inception, FMEF has provided nearly $1 billion in financing to over ten thousand customers. Also seeks third party originations.

Financing programs, leases, and loans for equipment costing from $10,000 to $10,000,000+. “Application only” programs (No financials or tax returns required) for equipment up to $350,000 and we generally make a credit decision on these transactions within 24 hours.

www.netlease.com

Target Transaction: Individual transaction size: $500k - $25MM+ Structures: Term Loan, (True) Lease, Sale Leaseback

Collateral: Generally critical use equipment such as manufacturing, construction, transportation, energy/mining, marine, aircraft, and up to $2MM of owner occupied real estate. No: FF&E, telecomm, IT, high tech.

Term: 2 – 7 years

Advance rates: Generally 75% -> 100% of OLV/FMV

Club Deals: We will work with other lenders/lessors Books $36 Million First Six Months in Business http://www.nationsequipmentfinance.com/article3.html

We focus on transportation and construction industry equipment leasing.

Business Reports: Companies listed may make any netiquette comment about their company or reports or other information in the footnote section of their listing. Leasing News recommends readers also view the footnote as well as the section itself or searching reports on the business.

It also should be noted that if a BBB report listing is found by a reader, as there may not have been one when this was last up-dated, please send the link to kit@leasingnews.org so Leasing News may up-date this section.

Leasing Associations: All non-profit leasing associations are abbreviated. To see the full name and learn more about the association, please click here.

BBB - Better Business Report | CBB - Leasing News Complaint Bulletin Board

| CNI - Current News Information

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

N/R (not reported)

* (no response---these listing do not come from the company directly, but from our research from many sources. It is our policy not to put anything in this section without confirmation.)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

(March 31, 2025) - After years of seemingly defying inflation and driving U.S. GDP growth, U.S. consumer spending showed signs of weakness in the first two months of 2025. After dropping more than 0.6 percent in January, real personal consumption expenditure barely bounced back in February, edging up just 0.1 percent or $16 billion on a seasonally adjusted, annualized basis.

The weaker-than-expected spending increase was driven by a decline in service spending - the first since January 2022 -and a warning sign that consumers may be starting to cut back on discretionary spending. At the same time, consumers increased spending on durable goods, possibly making purchases earlier than planned to avoid higher prices widely expected as a consequence of new tariffs.

The latest report on Personal Income and Outlays also revealed that personal saving increased sharply for the second month in a row, as the personal saving rate, i.e. savings a s a percentage of disposable income, climbed to 4.6 percent in February from 3.3 percent in December.. While high personal savings can be a sign of excess disposable income, they can also be a sign of growing uncertainty. Consumers wary about the short-term economic outlook are more likely to postpone big purchases and shore up their savings, while confidence typically boosts spending.

By Felix Richeter, Statista

[headlines]

--------------------------------------------------------------

Leasing News Advisor/Legal Editor

Marshall Goldberg

Marshall Goldberg

Glass & Goldberg, A Law Corporation

22917 Burbank Blvd.

Woodland Hills, CA 91367-4203

(818) 474-1532 Direct

(818) 888-2220 Main

(818) 888-2229 Facsimile

mgoldberg@glassgoldberg.com

www.glassgoldberg.com

Marshall F. Goldberg is the Managing Partner and a founder of Glass & Goldberg. He has served as lead counsel in well over one hundred major trials. He has been an active member and leader for over 40 years in financial institution associations, including the Equipment Leasing and Finance Association ("ELFA"), the National Vehicle Leasing Association ("NVLA"), The Alternative Finance Bar Association, and the National Equipment Finance Association (“NEFA”), and its predecessors.

Marshall has been selected for the past fourteen (14) consecutive years for inclusion in “Super Lawyers Magazine,” which represents only 5 percent of the lawyers in the State of California. Super Lawyers is a listing of outstanding lawyers, chosen from a rigorous, multiphase process, who have attained high peer recognition and professional achievement.

Marshall has served on the Equipment Leasing and Finance Association Legal Committee and the Credit and Collections Management Committee. He also served as a member of the Editorial Review Board of the Journal of Equipment Lease Financing. He has been the Chairman of the Professional Development, Education and Information Sub-Committee for the ELFA Legal Committee. He was responsible for developing, organizing, managing and editing the Legal Website, which includes an online compendium of legal issues pertaining to the 50 States, "What's New in the Law", and the "Catalogue of Legal Information".

With the assistance of the ELFA staff, Marshall developed, chaired and monitored the Legal Listserve, an online forum for attorneys to discuss pertinent legal issues on a daily basis. Marshall is co-author and co-editor of the Executive Guide to Remedies, and the Executive Guide to Lease Documentation. Marshall also serves on the ELFA Legislative and Regulatory Subcommittee.

He is the recipient of the annual “Edward A. Groobert Award for Legal Excellence” presented on behalf of the ELFA Lawyers. This is the highest award given to an attorney by a peer group of hundreds of both in house and outside counsel.

Marshall is married to Patti for 45 years, who is also an attorney and is now the administrator of Glass & Goldberg. They name and they have three boys, Daniel, a partner and chair of the privacy department for the law firm of Frankfurt Kurnit, Justin, an executive consultant for IBM and Ethan, a software engineer for Samsara, an Internet of Things company that develops objects with sensors, processing ability, software and other technologies to connect and exchange data with other devices and systems over the Internet.

[headlines]

--------------------------------------------------------------

##### Press Release #######################

NEFA Charity Glow Golf Event Raises Over $28,000 at 2025 Spring Conference

The National Equipment Finance Association (NEFA) Foundation Committee is proud to announce that its 2025 Spring Conference charity event raised more than $28,000 in support of the Tam Kỳ Project’s fire recovery efforts in Los Angeles and the Chris Walker Education Fund.

Originally planned as an outdoor glow golf experience, the event was quickly adapted to an indoor format due to inclement weather. But that didn’t stop over 110 participants from showing up ready to compete, connect, and contribute. The evening featured a lively mix of mini-golf, music, food, and drinks.

This impactful fundraiser was made possible thanks to the generous support of NEFA members including: Dakota Financial, LLC, Asset Compliant Solutions (ACS), Dedicated Financial GBC, Wintrust Specialty Finance, North Mill Equipment Finance, LTi Technology Solutions, InstaCOVER, LLC, First Commonwealth Equipment Finance, Hanmi Bank, Oakmont Capital Services, Channel Partners, Alliance Funding Group, Leasepath, Northland Capital, Dressler & Peters, LLC, APEX Commercial Capital, Navitas Credit Corp, Star Hill Financial LLC, and Universal Finance Corp.

Chad Sluss, CEO of NEFA, remarked, “The commitment of our members and sponsors to come together for a greater cause is what makes NEFA truly special.” said.

Dave Gruber, Chair of the NEFA Foundation Committee, added, “It was incredible to see our community rally around these two meaningful causes. The funds raised will have a real and lasting impact, not just for those recovering from the devastating fires in Los Angeles, but also for future leaders of our industry through the Chris Walker Education Fund. We are deeply grateful to everyone who made this possible.”

NEFA extends heartfelt thanks to all who participated, donated, and helped make the evening a glowing success—rain or shine

About the National Equipment Finance Association

The National Equipment Finance Association (NEFA) is a professional organization dedicated to serving the equipment finance industry through education, advocacy, and networking opportunities. The NEFA Foundation supports initiatives that promote education, professional development, and community engagement.

About Tam Kỳ Project

Tam Kỳ Project improves the quality of life for children and families in need — victims of natural disasters, extreme poverty, and those with disabilities. When the wildfires struck in California, the Tam Kỳ Project sprang into action to help provide for people who lost everything.

About the Chris Walker Education Fund

The Chris Walker Education Fund honors the legacy of Chris Walker, a dedicated NEFA member and industry advocate for education and professional development in the equipment finance industry. Established to continue his passion for supporting others, the fund provides grants to NEFA members seeking educational opportunities.

### Press Release ########################

[headlines]

--------------------------------------------------------------

News Briefs

ADP National Employment Report: Private Sector Employment

Increased by 62,000 Jobs in April;

Annual Pay was Up 4.5%

https://www.prnewswire.com/news-releases/adp-national-employment-report-private-sector-employment-increased-by-62-000-jobs-in-april-annual-pay-was-up-4-5-302442587.html

Tesla Aims for Full-Scale Production of Semi in 2026

Updated Model’s Future Touted as ‘Bright and Electric’

https://www.ttnews.com/articles/tesla-aims-semi-2026

The last boats without crippling tariffs from China are

arriving. The countdown to shortages and higher prices has begun

https://www.cnn.com/2025/05/01/business/ports-shelves-tariffs-shipping

In an Uncertain Economy,

McDonald’s Sees Sales Decline

https://www.nytimes.com/2025/05/01/business/mcdonalds-earnings.html

Kohl’s fires new CEO Ashley Buchanan for

steering business to former romantic partner

https://nypost.com/2025/05/01/business/kohls-fires-new-ceo-ashley-buchanan-after-probe-finds-he-violated-conflict-of-interest-policies/

[headlines]

--------------------------------------------------------------

Irreconcilable Differences: How MCA Abuse of

“Reconciliation Rights” Threatens Collateral

https://www.abfjournal.com/irreconcilable-differences-how-mca-abuse-of-reconciliation-rights-threatens-collateral/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Warriors accuse Rockets of targeting Curry’s injured

thumb: It’s pretty obvious’

https://www.pressdemocrat.com/article/sports/warriors-accuse-rockets-of-targeting-stephen-currys-injured-thumb-its-p/

Kezar Stadium is a San Francisco icon.

It was never supposed to exist

https://www.sfchronicle.com/totalsf/article/kezar-stadium-san-francisco-20293438.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Salary to afford a typical SF Bay Area home

has increased 54% since 2019

https://www.eastbaytimes.com/2025/05/01/income-bay-area-home-afford/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Carl Doumani, the vintner who built Napa’s only wavy

winery and won the apostrophe war, dies at 92

https://www.pressdemocrat.com/article/napa/carl-doumani-napa-stags-leap-quixote-winery/

Grocery Outlet wants to create the next Two Buck Chuck.

Here’s how it tastes

https://www.sfchronicle.com/food/wine/article/grocery-outlet-second-cheapest-wine-20279322.php

Drinking Wine Really is Good for You

https://www.wine-searcher.com/m/2025/05/drinking-wine-really-is-good-for-you

Report Offers More than Just Hope in Tough Market

https://www.winebusiness.com/news/article/301246

The real reasons Generation Z is drinking less alcohol

https://www.rabobank.com/knowledge/q011475715-the-real-reasons-generation-z-is-drinking-less-alcohol

A fire nearly destroyed this famous Napa winery.

Then an investment firm took over

https://www.sfchronicle.com/food/wine/article/spring-mountain-vineyard-hedge-fund-20283268.php

Sixth Annual Inspire Napa Valley Raises More Than

$1.1 Million for the Alzheimer's Association

https://www.winebusiness.com/news/article/301482

It looked like Napa's most promising wine empire.

What happened?

https://www.sfchronicle.com/food/wine/article/lawrence-wine-estates-winery-20275913.php

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/May2022/05_02.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()