Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, May 14, 2025

Today's Leasing News Headlines

AEF Advances Large Ticket Platform

Through Deutsche Bank

BriteCap Launches BriteLine™

for On-Demand Business Capital

How One Originator Pivoted to a New Industry

and Reclaimed Her Momentum

By Scott Wheeler, CLFP

Burger King Banks on Better Operators

Remodels to Weather Tough Environment

Balboa Capital Available Position

Program Manager II - Equipment Broker Sales

Linda Kester

"Leave a Message"

Billion Dollar Companies

By Country in 2025

News Briefs---

Softer-than-expected inflation

points to muted tariff fallout

April inflation breakdown: Food, shelter, and

medical care pinch consumers' wallets

States accuse Trump administration of holding emergency

relief hostage over immigration policy

Harvard funding cuts approach $3 billion as addition

federal agencies join Trump’s campaign

Money talks (and listens) at Saudi investment

forum attended by Trump

Newark Airport Had 3 Controllers on Duty

When the Goal Is 14

You May Have Missed ---

Antarctica Gained 200 Billion Tons of Ice During

Recent Two-Year Period, Surprising Scientists

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

######## Press Release ################

Alliance Equipment Finance (AEF), a leading provider of equipment financing solutions, announces the successful closing of a senior credit facility with Deutsche Bank and the formation of a capital partnership with funds managed by Oaktree Capital Management, L.P. (“Oaktree”), a global alternative investment management firm.

This collaboration enhances AEF's large ticket equipment financing strategy by combining Oaktree's asset-backed finance expertise and institutional capital base with AEF's agile platform.

Deutsche Bank served as lead lender in providing the senior credit facility. Robert Sheldon, Managing Director of Structured Products, and Victoria Mason, Director of Structured Products, led the transaction and were instrumental in securing the financial foundation for the initiative.

Randy Hicks, CEO of Alliance Equipment Finance, said, "We are pleased to partner with Oaktree and to have the support of Deutsche Bank. Their deep industry knowledge and financial strength will be invaluable as we continue to grow our large ticket equipment financing portfolio. This partnership underscores our commitment to providing our clients with the best possible financing solutions."

LightBrook Capital played a pivotal role in the transaction, with Executive Partners Prashant Upadhyay and Andrew Carroll leading the capital raise to support AEF's expansion strategy.

Oaktree brings a powerful combination of asset-backed investment experience and equipment industry knowledge, uniquely supporting AEF’s ability to deliver innovative and flexible equipment financing solutions.

Rana Mitra, Managing Director in the Asset-Backed Finance and Structured Credit strategy at Oaktree, commented, “We look forward to working with AEF and their clients in the equipment leasing space to support their long-term success.

Brendan Beer, Portfolio Manager for Oaktree’s Asset-Backed Finance and Structured Credit strategy said, "Oaktree’s expertise and experience in private credit and asset-backed finance, along with our structuring capabilities, enables us to offer tailored capital solutions to our partners and differentiated asset-backed finance opportunities to our investors.”

The partnership is effective immediately. Both companies are focused on accelerating growth and delivering value to clients through enhanced capabilities in the equipment finance sector.

ABOUT AEF

Built on the decades of proven experience of its leadership team, Alliance Equipment Finance delivers custom equipment financing solutions for transactions ranging from $5MM to $50MM. Our extensive expertise spans industries, asset types, and financing structures, enabling us to enhance capital efficiency and support long-term growth. For more information, please visit:

https://allianceef.com/

ABOUT OAKTREE

Oaktree is a leader among global investment managers specializing in alternative investments, with $203 billion in assets under management as of March 31, 2025. The firm emphasizes an opportunistic, value-oriented, and risk-controlled approach to investments in credit, equity, and real estate. The firm has more than 1,200 employees and offices in 25 cities worldwide. For additional information, please visit Oaktree’s website at:

https://www.oaktreecapital.com

######## Press Release ################

[headlines]

--------------------------------------------------------------

######## Press Release ################

BriteCap Launches BriteLine™

for On-Demand Business Capital

BriteCap Financial LLC (“BriteCap”), a leading non-bank lender providing American small businesses with fast, convenient, and affordable working capital, has announced the launch of BriteLine™ — a next-generation capital solution designed to give entrepreneurs and business owners more control, more flexibility, and more peace of mind.

With BriteLine™, business owners no longer need to over borrow or refinance to access additional funds. Instead, eligible customers receive a simple approval that unlocks future access to capital — drawn only when needed and based on how the business performs.

Richard Henderson, CEO of BriteCap, said, “We created BriteLine™ to match how real businesses grow — unpredictably, and sometimes urgently. Our customers shouldn’t have to overextend or wait until they’ve paid down half their loan just to access critically needed working capital. BriteLine™ gives business owners the freedom to move fast when it matters most.”

With BriteLine™, business owners can:

• Take only what you need today

• Access more later — without risky second loans or early refinances

• Make smarter borrowing decisions — without pressure

Unlike traditional loans or rigid credit products, BriteLine™ rewards strong performance and simplifies access to future capital. It’s designed for business owners who want to stay nimble, avoid unnecessary debt, and keep their focus on growth — not financing.

“BriteLine™ is about trust,” said Henderson. “If you’re taking care of your business, we’ll be ready when you need us.”

Now Available

BriteLine™ is now available to eligible customers through BriteCap’s direct application process and our exclusive broker network. For more information, visit www.BriteCap.com/BriteLine

About BriteCap

BriteCap Financial is a modern financial partner for small businesses, delivering fast, flexible capital solutions through powerful technology and personal service. Since 2003, BriteCap has leveraged non-traditional credit algorithms and a streamlined application process to provide accessible working capital directly to business owners and through a trusted broker network. With a mission to simplify the lending experience,

BriteCap empowers small businesses to stay in control — from application to funding and beyond. To learn more about partnering with us, visit britecap.com/partners. BriteCap is majority-owned by a holding company affiliate of

NMEF.

About NMEF

NMEF is a national premier lender who works directly with third-party referral (TPR) sources to finance "mid-ticket" equipment commercial leases and loans ranging from $15,000 to 3,000,000 and up to $5,000,000 for investment grade opportunities. The company accepts A – C credit qualities and finances transactions for many asset categories including but not limited to medical, construction, franchise, technology, vocational, manufacturing, renovation, janitorial, and material handling equipment. NMEF is majority owned by an affiliate of InterVest Capital Partners. The company's headquarters are in Norwalk, CT, with regional offices in Irvine, CA, Voorhees, NJ, and Murray, UT. For more information, visit www.nmef.com.

######## Press Release ################

[headlines]

--------------------------------------------------------------

How One Originator Pivoted to a New Industry

and Reclaimed Her Momentum

By Scott Wheeler, CLFP

Last September, a veteran originator with over 15 years of experience in commercial equipment finance faced an unexpected challenge: her employer made the decision to stop funding deals in her primary industry. This wasn’t just a business inconvenience—it was personal. She had built deep expertise and a strong network in that sector. However, she acknowledged the truth: the industry had been in steady decline since 2023. Delinquencies were up. Opportunities were down. A turnaround, if it came at all, was likely far off.

She had a choice. She could seek a new employer who still served her industry and try to ride out the downturn. But switching jobs carried its own risks—especially with long-term loyalty and support from her current company. Instead, she made a bold decision: stay, but pivot entirely to a new primary industry.

With support from her credit department, she conducted research to identify a promising sector—one that was growing, stable, and aligned with the company’s appetite. From there, she developed a focused marketing plan. She hit the ground running, targeting high-potential vendors and prospects with a sense of urgency and determination.

Her hard work paid off quickly. Within months, she had secured several key vendor relationships and was gaining traction. By leveraging her deep knowledge of deal structure, relationship building, and credit strategy—while immersing herself in the nuances of a new industry—she was able to hit the ground running. Her 2025 first-quarter results? Among the best she had seen in over five years.

Even more important than numbers, she found herself re-energized. She was having fun again. She felt a renewed sense of confidence and purpose. Her pivot not only revived her production, it reignited her passion for the business.

This story is a powerful reminder: market conditions may shift, but resilience, creativity, and hard work still open doors.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Burger King Banks on Better Operators

Remodels to Weather Tough Environment

QSR Magazine

Although Burger King saw a decline in U.S. same-store sales in Q1—as did most in the industry—the chain isn’t hanging its head.

Comps dropped 1.1 percent, but the chain reported that it’s still outperforming the broader QSR burger category, which proves to leadership that its ongoing Reclaim the Flame turnaround plan is working.

A major part of the strategy is improving operations. Burger King just completed franchisee road shows where it found strong willingness from operators to raise standards.

The chain also wants to put its corporate restaurants into the hands of smaller, more capable franchisees. That means high-performing existing operators, new entrants into the system, or internal employees who are ready to take ownership.

RBI CEO Josh Kobza said during the company’s Q1 earnings call , “We’re continuing to take steps to transition restaurants into the hands of more engaged operators.

“And we’re seeing those efforts translate into improvements across key metrics, not just at underperforming stores, but across the system. These improvements, coupled with an ongoing effort to expand hours of operation, are driving better guest experiences and contributing to the outperformance we’ve seen relative to the industry.”

At the same time, Burger King is remodeling locations to improve unit economics and drive franchisee profitability. It expects to finish 400 remodels this year, including many in the new Sizzle image, which comes with average sales lifts in the mid-teens. The brand is on track to reach 85 percent modern image by the end of 2028.

RBI chairman Patrick Doyle said, “You’re starting to see enough of those [remodels] being done on a consistent basis, essentially one a day getting remodeled in the U.S., and I think you’re starting to see execution flow through into results.

“And I think that’s the big reason you’ve seen relative outperformance from BK in the U.S.”

Kobza agreed with Doyle, but added that much work is left.

“I think we’ve made significant progress on operations, and we started to make progress on remodels. I would say I still think we have a long way to go,” the CEO said. “We still have a lot of remodels to get done. We’ve got a lot of restaurants that aren’t at the modern image. And while we have some pockets of restaurants that have dramatically improved operations and are doing much better than the average there, we still have some pockets of operations that aren’t where we want them to be, that we need to turn around. And so I think those couple of things will continue to be the undercurrents that can drive relative outperformance.”

[headlines]

--------------------------------------------------------------

Linda Kester

"Leave a Message"

Appearing in Leasing News "Sales Makes it Happen" February 29. 2007, Linda Kester is still active. Since 1996, she has been an author and instructor for several early schools for those in equipment finance and leasing, including early days of what is today "American Association of Commercial Financial Brokers.”

Her article "Just Leave a Message" (https://leasingnews.org/archives/February%202007/02-28-07.htm#sales) is perhaps is more valid today as it also applies to email communication.

Her book, "366 Marketing Tips for Equipment Leasing,” is more popular than ever in Amazon, as well as 373 pages in paperback and e-book.

Readers may do a LinkedIn Biography search or see past articles in Leasing News, or search Amazon to learn more.

Sales Makes it Happen

Leave a Message

Many experts claim that you should not leave a voice mail message when calling a prospect for the first time. The argument is that the prospect may return your call while you are still prospecting. One of two things happens:

- You pick up the phone, have no idea who is on the other line, and the prospect feels stupid for returning your call.

- The prospect gets thrown into your voice mail (because you are on the phone), and you start a frustrating game of telephone tag.

You should leave a message every time you call.

Why? I was training sales people at a leasing company the day one of their competitors stopped accepting originations. All of a sudden a whole group of loyal vendors needed a new funding source.

Guess who got the calls?! The reps that had been leaving well thought-out voice mail messages. The salesperson may have never even talked directly with the vendor but had nonetheless built up goodwill by leaving messages.

Leave a value-added message every time you call a prospect. You want them to know how hard you are working to earn their business.

Linda Kester helps leasing companies increase volume. For more information visit www.lindakester.com. Questions, contact: Linda@lindakester.com

[headlines]

--------------------------------------------------------------

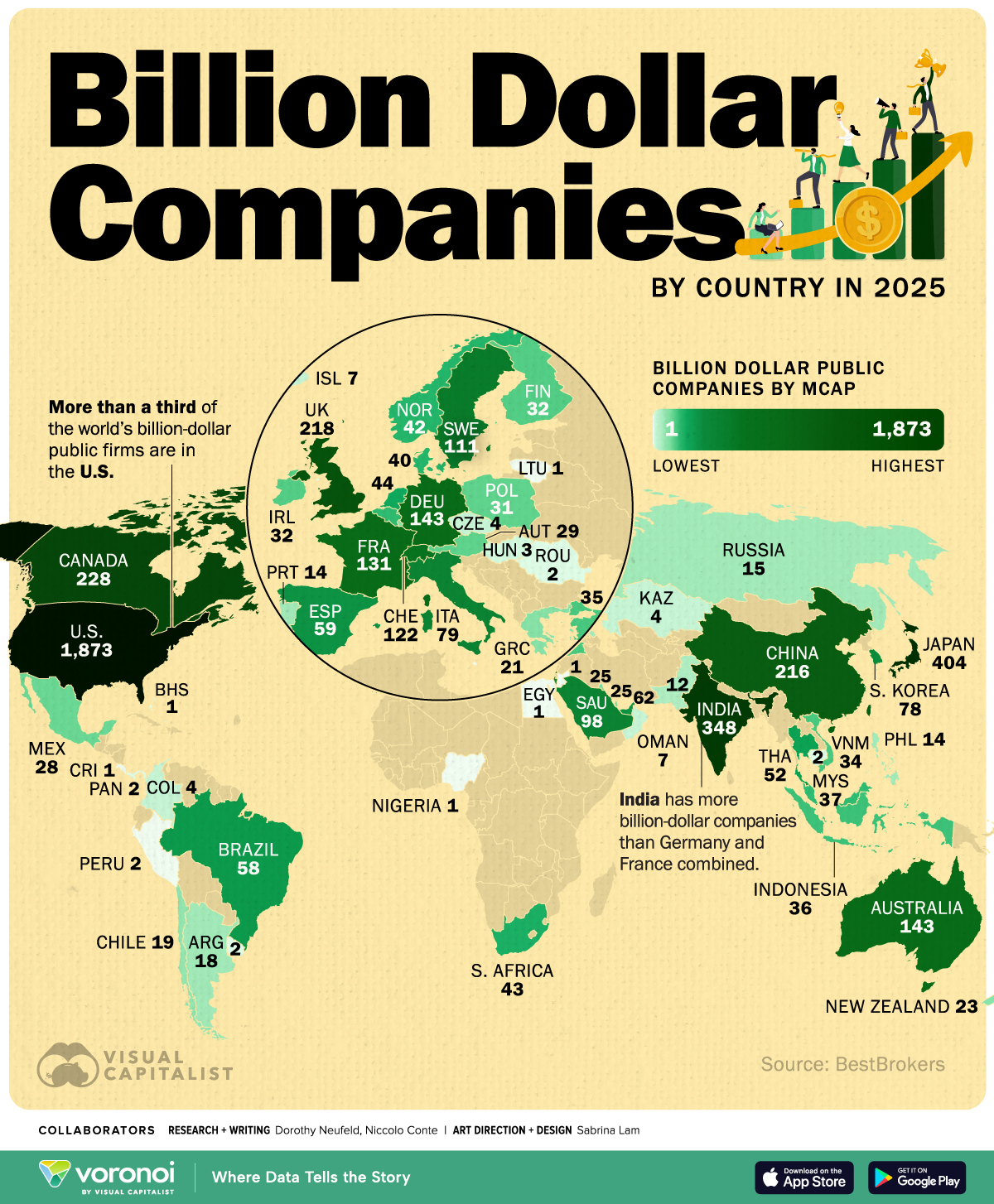

The U.S. is home to 1,873 billion dollar firms by market cap, more than a third of the global total. Japan ranks in second worldwide, at 404 billion dollar publicly-listed firms.

Since 2000, the number of companies in India valued at $1 billion or more has jumped from 20 to 348. Globally, there are 5,522 publicly-listed firms valued at $1 billion or more.

With a $60.1 trillion market cap, the U.S. stock market commands 49% of the global market share—and the highest concentration of billion-dollar firms.

To look at it another way, the U.S. has about five billion-dollar companies per million residents. This strength can be attributed to America’s technological progress, significant venture capital flows, and economic competitiveness.

Source: Visual Capitalist

[headlines]

--------------------------------------------------------------

News Briefs

Softer-than-expected inflation

points to muted tariff fallout

https://equipmentfinancenews.com/news/transportation/softer-than-expected-inflation-points-to-muted-tariff-fallout/

April inflation breakdown: Food, shelter, and

medical care pinch consumers' wallets

https://finance.yahoo.com/personal-finance/banking/article/april-inflation-breakdown-food-shelter-and-medical-care-pinch-consumers-wallets-181129182.html

States accuse Trump administration of holding emergency

relief hostage over immigration policy

https://www.courthousenews.com/states-accuse-trump-administration-of-holding-emergency-relief-hostage-over-immigration-policy/

Harvard funding cuts approach $3 billion as addition

federal agencies join Trump’s campaign

https://www.bostonglobe.com/2025/05/13/metro/trump-administration-announces-450-million-new-harvard-funding-cuts/

Money talks (and listens) at Saudi investment

forum attended by Trump

https://www.bostonglobe.com/2025/05/13/business/saudi-investment-forum-trump/

Newark Airport Had 3 Controllers on Duty

When the Goal Is 14

https://www.nytimes.com/2025/05/12/business/newark-airport-delays-staffing-shortage.html

[headlines]

--------------------------------------------------------------

Antarctica Gained 200 Billion Tons of Ice During

Recent Two-Year Period, Surprising Scientists

https://www.goodnewsnetwork.org/scientists-shocked-eastern-antarctica-gained-216-billion-tons-of-ice-over-recent-two-year-period/

[headlines]

--------------------------------------------------------------

Sports Briefs---

'This is new': Steph Curry's injury timeline

vs. Wolves is getting worrisome

https://www.sfgate.com/warriors/article/steph-curry-injury-timeline-wolves-worrisome-20318191.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

California insurance commissioner approves

State Farm emergency rate hike

https://www.sacbee.com/news/politics-government/capitol-alert/article304437311.html

ICE raids have 'overwhelmed' coastal

California communities

https://www.sfgate.com/centralcoast/article/ice-raids-overwhelm-california-communities-20319412.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Pope's Special Burgundy Supply

https://www.wine-searcher.com/m/2025/05/popes-special-burgundy-supply

Robert Mondavi's Grandchildren's Sentium

Sauvignon Blanc Is Stellar - Robb Report

https://robbreport.com/food-drink/wine/sentium-sauvignon-blanc-mondavis-1236733221/

Rosé rises to the top - Nearly as surprised were the

judges, who had tasted every wine blind.

https://www.pressdemocrat.com/article/lifestyle/best-rose-north-coast/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/May2021/05_14.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()