Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives

Columnists | Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Tuesday, November 25, 2025

Today's Leasing News Headlines

Broad Shoulders

By Scott Wheeler, CLFP

Big Shift at the CFPB:

MCAs May Be Out of Section 1071—for Now

By Marshall Goldberg, Leasing News Legal Editor

CapEx Finance Index October 2025:

Equipment Finance Demand Unfazed by Shutdown

On Track for Second-Best Year on Record

Help Wanted Ad with Excellent Response

Ameris Bank Equipment Finance

Many Excellent Positions Available

Top Ten Most Read by Readers

November 17 to November 21

The Cost of a Thanksgiving Dinner

By Anna Fleck, Statista

How to Prepare a Powerful Performance Review

December 2, 1:00 PM to 2:00 PM ET (Virtual via Zoom)

News Briefs

More Americans are getting their power shut off

as unpaid bills pile up

Can the U.S. Make Big

Nuclear Reactors?

Bitcoin plunges to lowest level in seven months

as digital asset falls to $80K range

Why Crypto’s Slide Is

Rattling Wall Street

Judicial Watch Sues Justice Department

for FBI Records Found in Secret Room

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Broad Shoulders

By Scott Wheeler, CLFP

Professionals in the finance and leasing industry have many to thank for our success. We stand upon the shoulders of others so that we may see opportunity and capture success. It is those who support us that allow true professionals to shine and prosper. Exceptional personal performance is a result of leadership, knowledge, perseverance, and humility. We become successful because of our personal efforts, our ability and willingness to learn, and our willingness to serve others. This Thanksgiving week let's not forget those that have come before us, who continue to support our efforts, and who make us shine.

- Parents who encourage us to succeed

- A college professor who inspired us to learn

- The first boss who took us under their wing

- A loving spouse who gives us confidence

- A mentor who instills integrity and direction

- A child who teaches us "WHY"

- A staff member who goes the extra mile

- A best friend who lends an ear and shoulder

- A customer who confirms the power of value over price

- Our professional teams that celebrate success

- A stranger who asks for our help.

We are truly blessed. Give thanks to those who have supported you by giving to those who need support. Provide your broad shoulders so that others may see the opportunity and capture their success. The greatest gift is the ability and willingness to "GIVE."

Happy Thanksgiving

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Big Shift at the CFPB:

MCAs May Be Out of Section 1071—for Now

By Marshall Goldberg, Leasing News Legal Editor

Glass & Goldberg, A Law Corporation

In a significant and unexpected shift, the Consumer Financial Protection Bureau (CFPB) has released a new proposal that would remove Merchant Cash Advances (MCAs) from the scope of its Section 1071 data-collection requirements. This marks a major reversal from the Bureau’s 2023 final rule, which treated MCAs as a form of “credit” subject to ECOA’s small business lending data-reporting obligations.

The proposal appears in a 198-page rulemaking package that rethinks the CFPB’s prior approach to the MCA industry, particularly in light of the product’s unique structure, the evolving regulatory environment in various States, and the potential operational challenges of collecting MCA-specific data under Section 1071.

The CFPB now believes that, in the initial rollout of Section 1071, it should focus on foundational small-business credit products: loans, lines of credit, and credit cards.

MCAs, the Bureau explains, are structurally different. Traditional lending concepts, such as interest rate and amortization, do not cleanly translate to the sales-based financing model. The CFPB is concerned that including MCAs at the outset might generate confusing or non-comparable data that would not meaningfully advance Section 1071’s statutory purposes.

.

Accordingly, the Bureau proposes adding MCAs to the list of excluded transactions under § 1002.104(b), alongside agricultural lending and certain small-dollar loans.

Why the Change Now?

According to the CFPB, five factors justify its proposed reversal:

- Focus on core lending products first.

- Reassessment of whether MCAs meet ECOA’s definition of “credit.”

- Structural differences between MCAs and traditional loans.

- Significant State-level regulatory developments.

- Risk of low-quality or inconsistent data from MCA reporting.

Taken together, the CFPB concludes that excluding MCAs at this time is “necessary and appropriate” to carry out Section 1071’s purposes.

What Happens Next? The CFPB Wants Comment—Especially from MCA Providers

The CFPB is seeking comment on:

- How MCAs differ from or resemble traditional loans;

- The diversity of MCA structures and whether some subsets should be treated differently;

- Whether certain MCA types are more appropriate for inclusion or exclusion;

- Whether alternative definitions of MCA should be used in § 1002.104(b)(7); and

- If MCAs are not excluded, how the 2023 rule should be modified to account for them.

Importantly, the CFPB states that it will continue to monitor the MCA and sales-based financing markets to determine whether a subset of products may eventually be included in the definition of “covered credit transaction.”

Bottom Line

This is a major development for MCA providers and for financial institutions navigating Section 1071 implementation. If the proposal is finalized, MCA companies would not need to collect or report small-business lending data during the initial rollout of the rule.

Given the CFPB’s request for feedback, the industry now has a critical opportunity to shape how MCAs are treated under federal law going forward, whether as sales-based financing, credit, or something in between.

Marshall Goldberg

Glass & Goldberg, A Law Corporation

22917 Burbank Blvd.

Woodland Hills, CA 91367-4203

(818) 474-1532 Direct

(818) 888-2220 Main

(818) 888-2229 Facsimile

mgoldberg@glassgoldberg.com

www.glassgoldberg.com

[headlines]

--------------------------------------------------------------

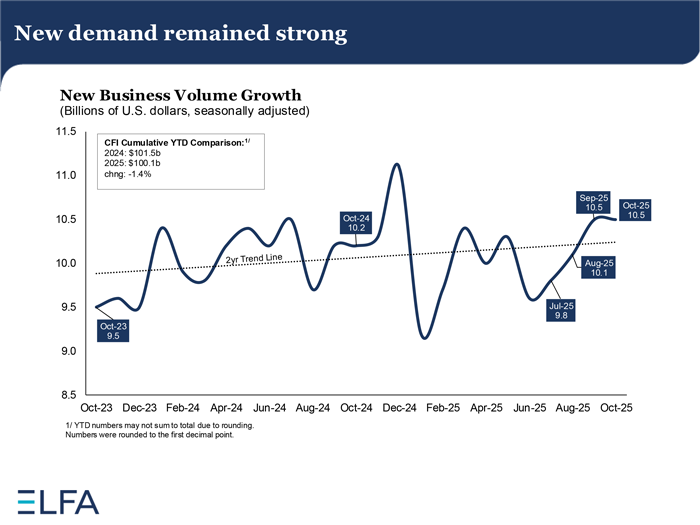

CapEx Finance Index October 2025:

Equipment Finance Demand Unfazed by Shutdown

On Track for Second-Best Year on Record

The latest CapEx Finance Index (CFI) released today by the Equipment Leasing & Finance Association (ELFA) showed that new equipment demand in October hovered near its 2025 high, demonstrating resilience despite heightened market volatility. Growth in total new business volumes (NBV) is expected to exceed $117 billion this year, positioning 2025 as one of the strongest years on record. We expect the Fed’s recent policy easing to foster additional momentum into next year, even if policymakers decide to pause cuts in December. Financial conditions remain healthy across the industry.

- Total NBV among surveyed ELFA member companies was $10.5 billion on a seasonally adjusted basis, the same amount as in the prior month.

- Year-to-date NBV contracted by 1.4% relative to the same period in 2024.

- Year-over-year, NBV increased by 5.7% on a non-seasonally adjusted basis.

“Equipment demand was unfazed by the government shutdown in October. The latest data showed businesses continue to invest despite a volatile and unpredictable fall,” said Leigh Lytle, President and CEO at ELFA. “At the current pace, 2025 will end up as the second-best year for equipment demand in the history of our CFI survey, which goes back to 2006. We’re going to see momentum really build as we put the government shutdown further in the rearview. The path for interest rates remains uncertain, but that doesn’t change the fact that our industry is financially healthy, setting us up for a strong start to 2026.”

Equipment demand remained strong. Total NBV grew by $10.5 billion in October, the same increase as in the prior month, which tied the fastest pace in 2025. The total new volume series tracks the amount of new activity that banks, independents, and captives added in a given month. The strong October increase pushed the forecast for total new volume growth in 2025 to just over $117 billion, down from last year's record pace, but above the total amount recorded in 2023.

Small ticket volume growth tracks broader economic conditions and is an important barometer of aggregate demand for equipment. Small ticket deals grew by $3.7 billion, the largest increase since July of 2024, and an increase of 13.0% from the prior month.

Of the three institution types, banks experienced the largest increase in new volumes in October, rising by $4.8 billion. Growth at captives and independents rose by $3.3 billion and $2.2 billion, respectively. Year-to-date new volume growth was up by 6.5% at banks relative to the first nine months of 2024, but down by 15.6% and 2.4% at captives and independents, respectively.

The overall credit approval rate hovered around its decade high. The industry-wide average ticked down to 79.0% in October, the second-highest reading since 2016. The average small ticket approval rate dropped to 81.2%. It has declined for two consecutive months but remains above the average of 79.7% recorded during the first half of the year. The rate at banks rose to a record of 82.1%. The rate at captives fell to 82.0%, while the rate at independents rose to 70.7%.

Delinquencies rise, but losses fall. The overall delinquency rate rose by 0.24 percentage points to 2.2%. The October increase more than offset the 0.19 percentage point decline in September. However, the overall rate has been holding in a narrow range since July of last year, and the October data remained in that narrow band. Delinquencies at independents rose sharply, while the average rate at banks rose, but was essentially unchanged at captives.

The overall loss rate declined by 0.04 percentage points to 0.44% in the latest data. It was the second decline in as many months and the lowest reading since May. The average loss rate for small ticket deals dropped to 0.57%. Loss rates declined slightly at all three major institution types.

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, tracks the sentiment of executives in the industry. The index remains at a heightened level for the sixth consecutive month, relatively unchanged at 59.9 in November, from 60.1 in October.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released monthly from Washington, D.C., generally one day before the U.S. Department of Commerce's durable goods report. More detail on the data and methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing & Finance Association (ELFA) represents financial services companies and manufacturers in the $1.3 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org.

[headlines]

--------------------------------------------------------------

Help Wanted Ad

Ameris Bank Equipment Finance

--------------------------------------------------------------

Top Ten Most Read by Readers

November 17 to November 21

(1) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Nov2025/11_17.htm#hires

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Nov2025/11_19.htm#hires

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Nov2025/11_21.htm#hires

(4) Looks like BMO is in trouble with one major problem: Numero Uno in Truck Financing

https://leasingnews.org/archives/Nov2025/11_21.htm#looks

(5) Thousands turn out for opening of California's

new mega casino

https://www.sfgate.com/centralcalifornia/article/hard-rock-casino-tejon-opening-21185144.php

(6) What is No Longer Relevant in My Resume?”

Career Crossroads---By Emily Fitzpatrick RII

https://leasingnews.org/archives/Nov2025/11_17.htm#what

(7) Maxim Joins with Footnotes Funders Taking

"New Brokers" with Five Not Requiring

Brokers be Licensed

https://leasingnews.org/archives/Nov2025/11_17.htm#maxim

(8) SLIM Capital, LLC Acquires

Capital Finance Solutions, LLC to Accelerate

Vendor and End-User Growth Channels

https://leasingnews.org/archives/Nov2025/11_21.htm#slim

(9) Help Wanted Ad

Ameris Bank Equipment Financehttps://recruiting.ultipro.com/AME1062AMERI/JobBoard/eb04fcfa-9141-457f-ac1c-41b41f2682ad/OpportunityDetail?opportunityId=0b5705f6-f390-4962-b285-1cfac9730407

(10) Now is the Time for the December Push

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Nov2025/11_17.htm#now

--------------------------------------------------------------

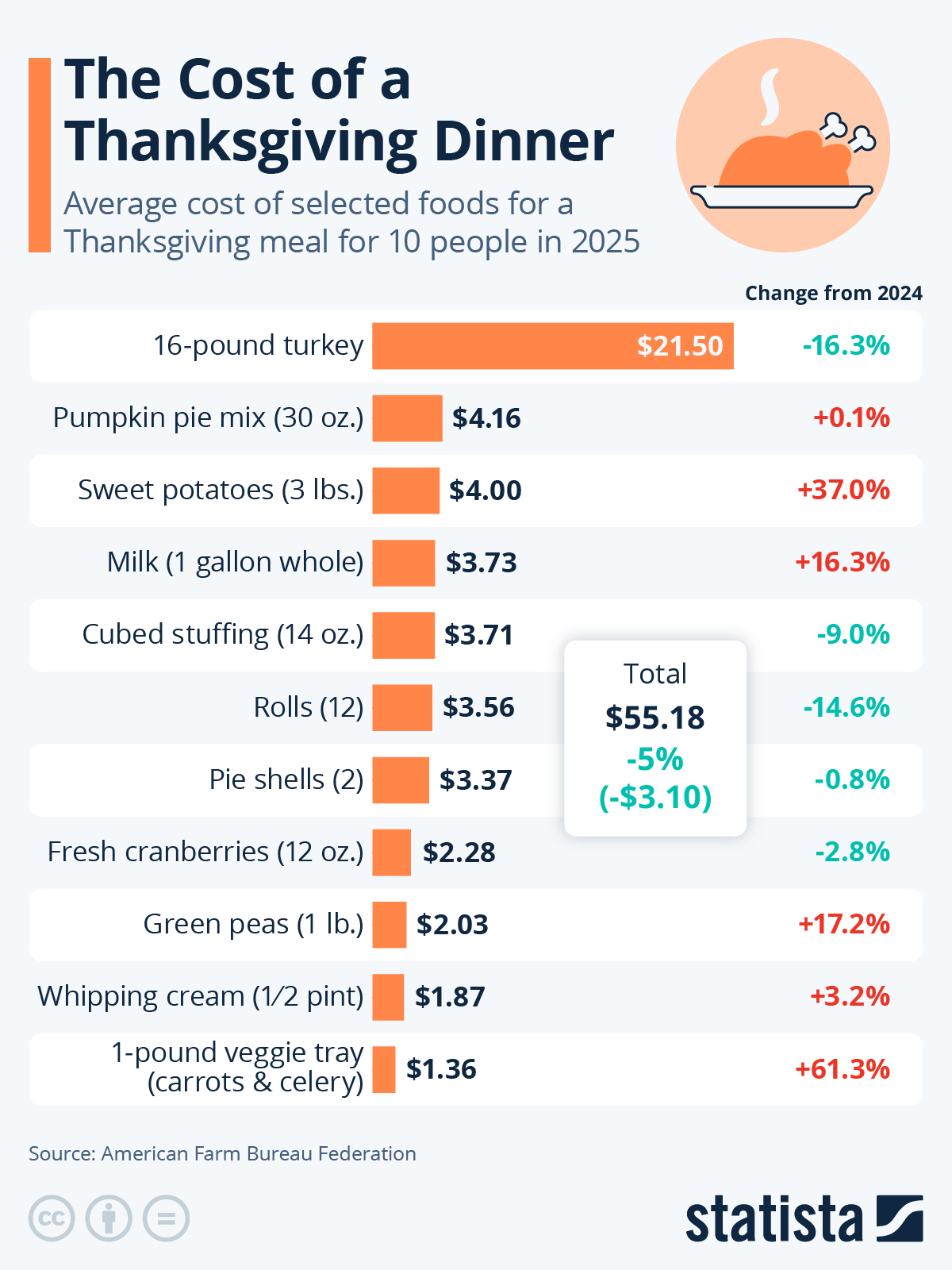

The Cost of a Thanksgiving Dinner

By Anna Fleck, Statista

Each year the American Farm Bureau Federation releases a price survey of classic items found on the Thanksgiving dinner table. This year, the average cost of feasting stands at $55.18, which is 5 percent less than last year but still constitutes a $5.75 increase from before the pandemic.

The most expensive item by far on the menu is the turkey, which this year costs an average of $21.50. This represents, however, an impressive 16.3 percent decrease from 2024 levels. While the wholesale price for fresh turkey is up from 2024, largely due to farmers still trying to rebuild turkey flocks devastated by avian influenza, grocery stores have lowered their prices with Thanksgiving deals, leading to lower retail prices for a holiday bird.

As the following chart shows, where several staple ingredients have decreased somewhat, including stuffing mix (down 9 percent), dinner rolls (down 14.6 percent) and fresh cranberries (down 2.8 percent), other ingredients have risen in value since last year, such as frozen peas (up 17.2 percent), whole milk (up 16.3 percent) and whipping cream (up 3.2 percent).

2025 marks the third consecutive year that the average price of a Thanksgiving dinner in the United States has decreased. However, this does not fully offset the increases seen between 2020 and 2022, when the meal rose from an average of $46.90 to $64.05 thanks to the impacts of inflation on food prices and farmers’ costs.

The AFBF also discovered regional differences in the average cost of a Thanksgiving meal, with the most affordable prices found in the South at $50.01 and the most expensive in the West at $61.75.

The shopping list of the survey includes all ingredients and foods in quantities sufficient to serve a feast for 10. Volunteers checked prices in grocery stores in all 50 states and Puerto Rico for the Farm Bureau during the first week of November.

--------------------------------------------------------------

December 2, 2025 from 1:00 PM to 2:00 PM ET (Virtual via Zoom)

How to Prepare for a Powerful Performance Review

Performance reviews don’t just reflect your past year — they shape your next one. Yet many women still struggle with how to clearly and confidently articulate their impact. In this interactive session, leasing industry veteran and former Chief HR Officer Lori Frasier shares hard-won wisdom on how to overcome common performance review jitters and reframe self-advocacy as a leadership skill.

You’ll walk away with a practical storytelling framework, peer practice, and the confidence to tell your story with clarity, credibility, and purpose — no awkward self-promotion required.

Don’t miss out! Registration will close at 5:00 pm ET on Monday, December 1, 2025! Registrants will receive an email with connection instructions. This event will be held on Zoom, and attendees will have the chance to breakout into smaller groups to practice their new skills.

[headlines]

--------------------------------------------------------------

News Briefs

More Americans are getting their power shut off,

as unpaid bills pile up

https://www.washingtonpost.com/business/2025/11/24/power-shutoffs-surge-electric-bills/

Can the U.S. Make Big Nuclear Reactors?

https://www.wsj.com/business/energy-oil/can-the-u-s-make-big-nuclear-reactors-1ab24db9?mod=business_lead_pos5

Bitcoin plunges to lowest level in seven months

as digital asset falls to $80K range

https://nypost.com/2025/11/21/business/bitcoin-plunges-to-lowest-level-in-seven-months-as-digital-asset-falls-to-80k-range/

Why Crypto’s Slide Is Rattling Wall Street

https://www.nytimes.com/2025/11/24/business/dealbook/bitcoin-crypto-wall-street.html

Judicial Watch Sues Justice Department for FBI Records

Found in Secret Room

https://www.judicialwatch.org/fbi-records-secret-room

[headlines]

--------------------------------------------------------------

Justice Department to Settle Lawsuit

Over Apartment Rental Pricing

https://www.wsj.com/business/justice-department-to-settle-lawsuit-over-apartment-rental-pricing-14f81b50?mod=business_lead_story

[headlines]

--------------------------------------------------------------

Sports Briefs---

How the 49ers, Brandon Aiyuk went from $120 million deal

to divorce in 15 months

https://www.sfgate.com/49ers/article/49ers-brandon-aiyuk-120m-deal-divorce-15-months-21205670.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Up to 61,000 Truck Drivers in California Could Soon

Lose their Licenses. Here's Why

https://calmatters.org/economy/2025/11/immigrant-drivers/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Sonoma County Vintners Making Organizational

and Strategic Changes

https://www.winebusiness.com/news/article/310839

Why America’s Vineyards Are In Crisis—And

How Growers Are Responding

https://www.forbes.com/sites/lizthach/2025/11/13/crisis-in-us-vineyards-whats-next-for-american-wine-growers/

Retailers Ready For Online Holiday Rush

https://www.marketwatchmag.com/retailers-ready-for-online-holiday-rush/

Stewart Cellars co-owner Blair Guthrie assembled a

supergroup of winemakers to source grapes

from his 51-acre Montecillo Vineyard

https://www.sfchronicle.com/food/wine/article/montecillo-vineyard-winery-california-21143463.php

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Nov2020/11_25.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()