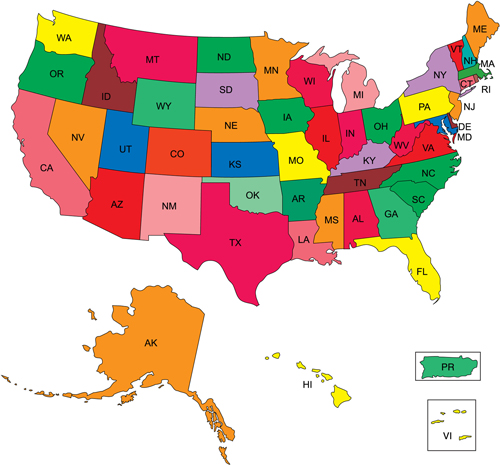

License and Registration United States

A State-by-State Analysis of License Requirements for Lenders and Brokers

- Virginia sales-based financing disclosure law – Went into effect July 1, 2022

- California commercial financing disclosures – Went into effect December 9, 2022

- Utah commercial financing disclosures – Went into effect January 1, 2023

- Florida disclosure law and broker law - Went into effect July 1, 2023

- New York commercial financing disclosure law – Went into effect August 1, 2023

- Connecticut commercial financing disclosure law – Went into effect January 1, 2024

- Georgia commercial financing disclosure law – Went into effect January 1, 2024

- Kansas Commercial Financing disclosure law - Went into effect July 1, 2024

Six States Reintroduce Commercial Disclosure Financing Bills

- North Carolina – Small Business Truth in Financing Act

- Missouri – Commercial Financing Disclosure Law

- New Jersey – An Act concerning commercial financing

- Illinois – Small Business Truth in Lending Act

- California – Commercial Financing Bill

- New York – An Act to amend the banking law and the administrative code of the city of New York, in relation to regulating commercial finance licensing

ELFA Interactive State Map to Track Financial Disclosure Regulation Activity

Free to Non-Members --- PDF Required

https://www.elfaonline.org/advocacy/state-issues/lenders-license

https://leasingnews.org/archives/Jul2024/07_15.htm#why

Illinois Disclosure, Licensing, and Database Bills

A significant shift in the state's financial landscape

https://leasingnews.org/archives/Jun2024/06_28.htm#ill

1) ALABAMA: Under the Alabama Small Loan Act, Ala. Code 5-18-4(a), a license is required for anyone in the business of lending amounts of less than $1500. Anyone who makes such loans without a license is guilty of a misdemeanor. I imagine this does not apply to most commercial transactions, which typically involve much more than $1500.

Alabama Small Loan Act (2017)

https://www.banking.alabama.gov/pdf/Laws/Small_Loans_Act.pdf

2) ALASKA: A person may not engage in the business of making loans of money, credit, goods, or things in action in the amount or of a value of $25,000 or less and charge, contract for, or receive on the loan a greater rate of interest, discount, or consideration than the lender would be permitted by law to charge if the person were not a licensee under this chapter, without first obtaining a license from the department.

As is often the case, banks, savings and loans, trust companies, building and loan associations and credit unions are exempt for the licensing requirement.

Alaska Small Loans Act (2019)

https://law.justia.com/codes/alaska/2019/title-6/chapter-20/

3) ARIZONA: Like many other states, Arizona considers small loans, in this case those under $10,000, to be consumer loans, regardless of whether the money is used for personal or business purposes. There is an exemption in Arizona, however, for a “person who is not regularly engaged in the business of making consumer loans”.

Arizona Revised Statute 6-602(A)(3) (2021). Consumer lenders and brokers need licenses, and, as always, banks, saving and loans, credit unions, and the like are exempt. Seems unlikely that any commercial lender or loan broker will be “regularly engaged in the business of consumer loans”, so it would appear that a license is unnecessary.

There are Arizona laws requiring that you “register” with the superintendent if you are an “advance fee loan broker” making consumer loans (i.e. those under $10,000).

Arizona Revised Statute 6-1302 (2021)

Any person who acts as an advance fee loan broker shall register with the superintendent as provided in this chapter. A person who is not exempt under subsection B of this section and who advertises for, solicits or purports to be willing to make or procure a loan or extension of credit for an advance fee is presumed to be engaged in the business of an advance fee loan broker.

So, what is an “advance fee”?

Arizona Revised Statute 6-1301 (2021)

Advance fee" means a fee, interest or other consideration directly or indirectly received by a person prior to a loan of money or extension of credit or a commitment to loan money or extend credit being made by the person. Advance fees do not include the actual cost of charges paid to a third party which are incurred in making real estate loans secured in whole or in part by a mortgage deed of trust or other security instrument on real estate, including charges for a preliminary title search, title examination and report, title insurance premiums, property survey and appraisal fees.

It appears likely that these rules only apply to real property secured transactions, given the language of the rules, regulations, opinions and documents I have reviewed. It is also unlikely that this will be an issue if the transaction is commercial, for the “registration” instructions state that the “license” provided by registering authorizes “consumer loan brokering, consumer loan lending, private student loan lending, debt management/counseling and debt negotiation”. It does not mention commercial transactions. But if your transaction is under $10,000, and deemed a “consumer loan”, and you take what is clearly an advance fee, you should consider registration. The process is fairly inexpensive and simple. Here’s the link:

Arizona Revised Statutes (2021)

https://www.azleg.gov/arsDetail/?title=6#:~:text=Article%201-,Mortgage%20Brokers,Noncompliance%20not%20to%20affect%20validity%20of%20loan,-Chapter%2010

4) ARKANSAS: Interestingly, Arkansas defines “advance fee” broadly as ‘‘any consideration which is assessed or collected prior to the closing of a loan by a loan broker.’’ Arkansas Code Annotate § 23-39-401(2019) (emphasis added). However, that statute is nestled in a series of laws relating to “Mortgage Loan Companies and Loan Brokers”. Query whether the word “mortgage” modifies “loan companies”, “loan brokers”, or both. If the latter, this is a mortgage loan statute with no application to personal property loans. Even if it more broadly interpreted to relate to personal property/equipment loans, one significant exemption is found in §23-39-401(5)(B)(iii) which exempts “a person extending or arranging credit, or offering to extend or arrange credit, to a partnership or corporation exclusively for commercial of business purposes.

I have read and re-read these statutes, conducted a few hours of online research, and spoken with several individuals in various departments in the Arkansas government, and not a single person knew anything about this. I believe that in all likelihood the advance fee statutes pertain to real estate loans only, and, further that no license is required in this state to make or broker personal property or unsecured loans. However, if anyone has any different information about the laws in Arkansas, I would appreciate it if you would let me know.

Arkansas Mortgage Loan Companies and Loan Brokers Laws (2019):

https://law.justia.com/codes/arkansas/2019/title-23/subtitle-2/chapter-39/

5) CALIFORNIA:

(9/25/23) Yet Another California

Commercial Financial Bill Signed into Law/Effectove 1/1/24

https://leasingnews.org/archives/Sept2023/09_25.htm#yet

(9/1/23) New California Annual Reporting Requirements and Law

Prohibiting Unfair, Deceptive or Abusive Acts or Practices

https://leasingnews.org/archives/Sept2023/09_01.htm#ca

California Disclosure Law Survey: Part One

https://leasingnews.org/archives/Jun2023/06_20.htm#ca

California Disclosure Law Survey: Part Two

https://leasingnews.org/archives/Jun2023/06_22.htm#2

March 2, 2023

Financial Protection and Innovation Proposed Regulations

Modifying the California Consumer Financial Protection Law.

by Marshall Goldberg, Esq.

https://leasingnews.org/archives/Mar2023/03_01.htm#proposed

(This would give the DFPI the power to enforce fraud claims against non-licensed entities, including MCA and other commercial transactions).

January 5, 2023

Leasing Person of the Year 2022

California State Senator Steve Glazer

https://leasingnews.org/archives/Jan2023/01_05.htm#poy

January 3, 2023

Happy New Year: California CFL Lenders and Originators

Can Work at Home if Computer/Cellphone are Encrypted

https://leasingnews.org/archives/Jan2023/01_03.htm#happy

November 21, 2022

Search for Licensed Financial Services State of California

https://leasingnews.org/archives/Nov2022/11_21.htm#search

June 20, 2022

Legally, a Loan Again, Naturally

https://leasingnews.org/archives/Jun2022/06_20.htm#legally

June 2022:

California (Finally) Approves Disclosure Regulations

Senate Bill 1235 was introduced by Senator Steve Glazer and signed into law in 2018 by then-Governor Jerry Brown. After four years, five rounds of comment solicitations and four sets of proposed or modified regulations, the regulations became final on June 9, 2022. The effective date is December 9, 2022.

Note that the primary “beneficiary” of this legislative gift is the funder, not the broker, as the funder is generally responsible for the content, and the broker’s responsibility merely to ensure that the disclosures are signed before the transaction is consummated.

Here is the link to the 48 pages of final regulations: https://dfpi.ca.gov/wp-content/uploads/sites/337/2022/06/PRO-01-18-Commercial-Financing-Disclosure-Regulation-Final-Text.pdf

The approved regulations are not much different from the fourth round. Here are some of the important takeaways:

- These rules apply to transactions in which the borrower’s business is principally directed or managed from California. CFR §954(a)

- SB1235 defines “provider” more broadly than the definition of a broker under the California Financing Law (“CFL”). The new rules appear to apply to any non-bank lender or broker whether they are CFL licensees or not. I have yet to find precise authority on this subject, but I do not see anything in the law or regulations that suggest that the disclosure laws can only be enforced against licensed entities. Since bank subsidiaries are not required to be licensed, but are required to comply with the disclosure laws, my guess is that is equally applicable to other non-licensed lenders and brokers.

- Banks and other federal or state-chartered depository institutions are exempt, but their subsidiaries and affiliates are not. Subs and affiliates must still comply with the disclosure laws.

- The disclosures are only necessary for transactions equal to or less than $500,000. CFR §921.

- True leases are exempt from the disclosure requirements. CFR §900(a)(1)(G)

- Disclosures must be made “any time a specific commercial financing offer is quoted to a recipient,” either with the offer or separately, but absolutely before funding. CFR §900(a)(5)

- The disclosures must be contained in a separate document but may be mailed or transmitted in a package that contains other documents. CFR §901(a)(6)

- If disclosures are provided to a recipient electronically, the provider shall include a method for the recipient to submit an electronic signature and automatic date stamp and provide the recipient with the ability to receive a copy of the disclosure in a format that the recipient may keep. CFR §901(a)(11)

- Financers must provide compliant disclosures to recipients whenever a financer provides the recipient with a specific commercial financing offer or whenever the terms of a consummated commercial financing contract are amended. CFR §952(a)(1).

- Financers must provide compliant disclosures to a broker whenever a financer provides the broker with a specific commercial financing offer. CFR §952(a)(1).

- Brokers must then transmit the disclosures to the prospective borrower. CFR §952(b)

- Evidence of transmission must be maintained for at least four years. CFR §952(a)(2)

- Financers must develop procedures to ensure that borrowers receive the disclosures (i.e., a provision in the broker agreement). CFR §952(a)(3)

- Brokers are not responsible for the content of the disclosures. They do not have to review the disclosure statements for accuracy. CFR §952(f) Liability, if any, will generally rest upon the shoulders of the party actually providing the financing the transaction.

- Funders may not consummate a transaction until the disclosures are signed and returned. CFR §920. SB1235 does not address what the responsibilities are for someone who buys the payment stream or is assigned the contract. If funding has already occurred, it is obviously too late for the buyer or assignee to provide pre-funding disclosures. The buyer/assignee may argue that it is a holder in due course as a defense to a claim of non-disclosure by the borrower or the DFPI, but due diligence on the part of the buyer/assignee would probably reveal that defect and potentially obviate the defense. It is difficult to predict the outcome of such a dispute, but it could very well open a can of worms down the road. So, buyers/assignees, my advice is to ensure that your sellers/assignors have complied with the disclosure laws as part of your due diligence before you acquire the deal.

- General requirements as to form, format, fonts, etc. can be found in CFR §901. There are many, and they vary according to the type of financing.

- Specifics for closed-end transactions are found in CFR §910.

- Specifics for open-end credit plans are found in CFR §911.

- Specifics for factoring are found in CFR §912 and §913

- Specifics for sales-based financing are found in CFR §914.

- Specifics for lease financing (excluding true leases) are found in CFR §915.

- Specifics for general asset-based lending transactions are found in CFR §916.

- APR’s may be calculated using either the United States Rule or the actuarial method as set forth in Appendix J, 12 CFR Part 1026 (both part of the Truth in Lending Act/Reg Z). CFR §940. The formulae are very complicated and the precise elements beyond the scope of this article. All non-avoidable expenses should be included in the APR, including interim rent and the like, but no avoidable expenses such as late charges or prepayment charges must be included.

Clearly this is a lot to digest. I highly recommend that anyone impacted by these new regulations contact an attorney familiar with these rules to ensure compliance. You have six months to do this, but this is a 48-page set of very complex regulations. It is not too soon to begin.

--------Change in Law for Unlicensed (May 9, 2022)

The California Financing Law (“CFL”) historically exempted from its licensing provisions a person who makes only one commercial loan in a 12-month period. That exemption ended on January 1, 2022. However, on April 28, Governor Newsom signed Senate Bill 577, which reenacted that exemption and made the provision remain operative indefinitely.

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202120220SB577

This really does little for the commercial finance industry, though it may be helpful if you have applied for your CFL license, are waiting for the Department of Financial Protection and Innovation (“DFPI”) to issue it, and you are presented with an opportunity that can’t wait the three months or so for the review process to conclude.

As an aside, the CFL law still permits a person to make 5 or fewer loans in a rolling 12-month period without a license as long as those loans are “incidental to the business of the person relying on the exemption.” CFL Section 22050(e).

This exemption from licensing is also of limited utility, as it is not available to persons or companies whose business is making loans. It would be useful for, say, a Burger King franchisor who might loan money to its franchisee to assist in its start-up, but that is only because the franchisor’s business is making cheeseburgers, not loans.

In other recent developments in California, on May 4, 2022, Gov. Newsom signed an executive order which lays the groundwork for the regulation of cryptocurrency, a three trillion dollar industry, in the state. Newsom’s goal, as outlined in the order, is to “create a transparent and consistent business environment for companies operating in blockchain” that balances “the risks and benefits to consumers.” The Governor’s Office of Business and Economic Development will be working with the DFPI to devise “potential blockchain applications and ventures.” It also calls for the DFPI to “shape a regulatory approach to cryptocurrency, create consumer protections” and more. One can only wonder whether part of that “regulatory approach” will be mandatory licensing for crypto dealers. Either way, this is sure to increase the workload at the DFPI.

Gov. Newsom’s bill is consistent with President Biden’s recent executive order requiring oversight of the burgeoning cryptocurrency industry. According to the Wall Street Journal, and The Hill, New York and Wyoming have also narrowly passed laws addressing this industry.

Pursuant to the California Financing Law, Ca. Fin. Code §22000 et seq., a license is required forlenders and brokers making and/or brokering consumer and commercial loans. There are the usual exemptions for state and federally chartered banks, trust companies, insurance premium finance agencies, savings and loans, credit unions and the like. There are also exceptions for bona fide (true) leases, which do not require a license for the lessor. There are other exemptions for companies that make or broker five or fewer loans in a twelve-month period if the loans are “incidental to the business of the person” making the loan (which I interpret to mean that the exemption is not available to a company that is in the business of finance), and anyone can make or broker one loan in any given twelve-month period, incidental or not. Fin. Code §§22050(e) and 22050.5(a).

California Financing Law (2020):

https://law.justia.com/codes/california/2020/code-fin/division-9/

CFL application form and instructions:

https://dfpi.ca.gov/wp-content/uploads/sites/337/forms/cfl/DFPI-CFL-1422.pdf

California has a fairly comprehensive scheme exempting pure referral sources from any licensing requirements as long as the referral source and the actual lender adhere to a strict set of guidelines. Fin. Code §22602(a) et seq.

Referral Law Statutes (2020):

https://law.justia.com/codes/california/2020/code-fin/division-9/chapter-3/article-3/section-22602/

https://law.justia.com/codes/california/2020/code-fin/division-9/chapter-3/article-3/section-22603/

https://law.justia.com/codes/california/2020/code-fin/division-9/chapter-3/article-3/section-22604/

In addition, you should be aware of the new California disclosure statutes, which are still being finalized by the DFPI, but should become effective by 2022.

California Disclosure Statutes (2020): (Note: For reference only. These regulations are still being fine-tuned.)

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201920200SB1235

Revised (9/22/21)

California, always a “leader” when it comes to business oversight, passed Senate Bill 1235 in 2018. To date, however, it has not yet taken effect. The law requires the newly named Department of Financial Protection and Innovation (DFPI), formerly known as the Department of Business Oversight (DBO), to promulgate rules and regulations that businesses can use to effect compliance with the new law. There have been six rounds of commentary from the public, the last ending a few weeks ago. It is my expectation that the rules will become final in short order and that the law will actually take effect in the beginning of 2022. Curiously, and perhaps disturbingly, although the law is only about four pages long, the most recent version, including commentary and revisions, is 53 pages!

Here is the body of that text, including the most recent modifications:

https://dfpi.ca.gov/wp-content/uploads/sites/337/2021/08/2021-08-09-Commercial-Financing-Disclosures-Second-Modified-Text.pdf (2021)

6. COLORADO: Colorado law requires that consumer lenders obtain a “supervised lender’s license”. A “supervised loan” is a consumer loan with an APR greater than 12%. You should also be aware that, in Colorado, excessive loan rates or predatory loan practices may constitute criminal usury, a felony, with penalties including 12 to 18 months in prison and a fine up to $100,000. This law does not distinguish between consumer and commercial transactions. So, though no license is needed to make or broker commercial loans, you should still be aware of the usury limitations, the violation of which has serious penalties attached, and, generally speaking, is any APR in excess of 45% per annum. That, in Colorado, is clearly Rocky Mountain HIGH!

Colorado Uniform Consumer Credit Code (2021)

https://coag.gov/licensing/uniform-consumer-credit-code/

Colorado Supervised Loan Memo and Application (2021)https://coag.gov/app/uploads/2020/12/SupervisedLender_MASTER_A pplication_Packet_2021.pdf

Colorado Criminal Usury Statute (2016)

https://law.justia.com/codes/colorado/2016/title-18/article- 15/section-18-15-104/

7. CONNECTICUT:

July 12, 2023

Connecticut Governor Ned Lamont has signed the law which goes in to effect July 1, 2024

https://leasingnews.org/archives/Jul2023/07_12.htm#ct

09/22/21

Their new Truth-in-Lending Act also mimics the Federal TILA. Committee Bill No. 745 was referred to the Committee on Banking in January 2021. If the bill passes, it will go into effect in October of this year.

https://www.cga.ct.gov/2021/TOB/S/PDF/2021SB-00745-R01-SB.PDF (2021)

Connecticut does not require a license for a commercial transaction, but it does have a Small Loan Company license requirement, similar to Alabama and Alaska, which

requires that a lender or broker obtain a license for loans of $15,000 or less for which the interest rate exceeds 12%.

Presumably, this is a consumer statute, though, of course, that’s not what it says. You probably are not doing deals in that range. Just something for you to be aware of.

Connecticut Small Loan Lending Statute (2018)

https://codes.findlaw.com/ct/title-36a-the-banking-law-of-connecticut/ct-gen-st-sect-36a-556.html

8. DELAWARE: Every person desiring to transact the business of lending money in Delaware shall be required to obtain a license under this chapter; provided, however, that a person that makes not more than 5 loans within any 12-month period shall be deemed not to be transacting the business of lending money.5 Del. C. 2202.

But, under 5 Del. C. §§2210(e) and 2202(b), the preceding statute only applies to “consumer credit transactions, including, but not limited to, extensions of credit secured by one to four family residential, owner occupied property located in this State intended for personal, family or household purposes. There are statutes governing the conduct of exempt lenders, but they are not much different than those of any other state. Based on §2210(e), it does not appear that a lender or broker engaged solely in commercial transactions needs a license to do so.

Delaware Banking/Licensed Lender Statute (2016)

https://delcode.delaware.gov/title5/c022/sc01/index.html

Delaware Administrative Code (2016)

https://regulations.delaware.gov/AdminCode/title5/2200/22 07.shtml

Delaware Exemption Statutes (2014)

https://regulations.delaware.gov/AdminCode/title5/2200/22 07.shtml

9. FLORIDA:

(July 1, 2023)

Florida Governor Ron DeSantis Signs Florida Disclosure

and Broker Law which goes into effect on July 1, 2023

https://leasingnews.org/archives/Jun2023/06_28.htm#fla

Florida Commercial Financing Disclosure Law (5/23)

https://leasingnews.org/archives/May2023/05_22.htm#fla

Florida Commercial Finance Disclosure Law (4/23)

https://leasingnews.org/archives/Apr2023/04_10.htm#fla

A person may loan money to others, when the per annum percentage rate does not exceed 18 percent, without having a consumer finance license. If a mortgage is placed against real property, as collateral for such a loan, a person may need to be licensed as a mortgage lender pursuant to Chapter 494, Florida Statutes. There are no license requirements for commercial lenders, brokers or lessors. Florida does, however, impose criminal as well as civil penalties for usury and loan sharking.

In addition, Florida also has a law prohibiting loan brokers from assessing or collecting an advance fee from a borrower. Florida Statutes Chapter 687.141.

Finally, Florida has an interesting set of laws entitled “Financial Technology Sandbox”. Florida Statutes Chapter 559.952. These laws generally permit a FinTech company with a new product to test new services and products in a “supervised, regulatory sandbox using exceptions to specified general law and waivers of the corresponding rule requirements under defined conditions”. Although basically a consumer statute, with a licensing requirement, it is an interesting development in the world of financial technology, and, in my opinion, will become more and more common to nurture the creation and use of innovative financial products throughout the country.

Florida Financial Technology Sandbox Statute (2020)

http://www.leg.state.fl.us/Statutes/index.cfm05000599/0559/Sections/0559.952.html

10. GEORGIA:

GA Commercial Finance Disclosure Laws Submitted to Governor (04/23)

https://leasingnews.org/archives/Apr2023/04_14.htm#ga

10. GEORGIA: Finance companies and small loan companies that make consumer loans of $3,000 or less are regulated by the Department pursuant to the Georgia Installment Loan Act. For finance companies that make consumer loans over $3,000, the Federal Trade Commission along with the Consumer Financial Protection Bureau have regulatory authority over certain aspects of these loans pursuant to Regulation Z (Truth in Lending).

It also appears that Georgia has an “advance fee broker” law, not dissimilar to the one in Arizona, which might require that you obtain a license if that’s part of your business model. This, like Arizona, seems to me to be a prohibition against unlicensed lenders promising loan modifications on mortgages. But, again, this is what the statute says.

Bottom line, no license needed unless you routinely collect advance payments. Once again, the definition of an “advance fee loan broker”:

(3) "Loan broker" means any person, firm, or corporation who does not operate or maintain an office that is open regularly to the public for the transaction of business and where potential borrowers actually visit to transact, discuss, or negotiate potential loans and:

A) For or in expectation of consideration, arranges or attempts to arrange or offers to fund a loan of money, a credit card, or a line of credit;

B) For or in expectation of consideration, assists or advises a borrower in obtaining or attempting to obtain a loan of money, a credit card, a line of credit, or related guarantee, enhancement, or collateral of any kind or nature;

C) Acts for or on behalf of a loan broker for the purpose of soliciting borrowers; or

D) Holds himself out as a loan broker.

"Loan broker" does not include any regulated lender or any third-party soliciting borrowers for a regulated lender pursuant to a written contract with the regulated lender or any mortgage banker or mortgage broker approved by a regulated lender or the federal Department of Housing and Urban Development, the Veterans' Administration, the Federal National Mortgage Corporation, or the Federal Home Loan Mortgage Corporation.

Georgia Code re Prohibited Practices by Loan Brokers (2019)

https://law.justia.com/codes/georgia/2019/title-7/chapter-7/section-7-7-2/

11. HAWAII: Duty bound by my obsession with accuracy, I felt it critical to actually visit this beautiful state to ensure that I had a thorough understanding of the cultural implications upon its statutory framework, one centered on principles of Aloha ‘?ina, commonly translated as “love of the land.” I discovered was that “love of the land” does not necessarily translate to “love of the lender.” Here’s what I learned:

Much to my surprise, a nondepository financial institution must have a license to engage in commercial lending in the State of Hawaii.

Hawaii Code of Financial Institutions Chapter 412:9-101 (2013). That exempts most federal and state-chartered banks, savings and loan companies, credit unions, and the like, but would appear to require a license to lend or broker loans if you don’t fall within one of those exempt categories.

https://law.justia.com/codes/hawaii/2019/title-22/chapter-412/section-412-9-101/

The requirements for filing an application are set forth in Hawaii Code of Financial Institutions Chapter 412:3-301 (2013).

https://files.hawaii.gov/dcca/dfi/Laws_html/HRS0412/HRS_0412-0003-0301.htm

Here is a link to the form. Note that the investigation fee for an Application for Nondepository Financial Services Loan Companies is $10,000!

https://cca.hawaii.gov/dfi/files/2020/02/DFI_Form_412-3-301_FSLC_Appln_Rev_09-2007-1-_Fill-11.pdf

There is also a surprising requirement that a nondepository loan company maintain paid-in capital of not less than $500,000! The paid in capital shall be in money!! Hawaii Code of Financial Institutions Chapter 412:3-306 (1996). And you thought California was rough.

https://law.justia.com/codes/hawaii/2019/title-22/chapter-412/section-412-3-306/

Finally, a person who commits a violation of the rules governing nondepository lenders may be subjected to serious penalties of up to $100,000 a day.

https://law.justia.com/codes/hawaii/2019/title-22/chapter-412/section-412-2-609-5/

For a state known for its laid-back people and welcoming climate, these are certainly not welcome laws for lenders. In fact, I was somewhat shocked to find these laws, after quite a time-consuming search through the Hawaii statutes. Perhaps that is why there are so few Nondepository lenders in Hawaii. If anyone has any information that is contrary to my interpretation of those statutes, please let me know so I can revisit the issue. And Hawaii. In the meantime, we will move to the next state.

12. IDAHO: Commercial lenders and brokers do not need a license. Consumer lenders, including certain mortgage brokers, are governed by the Idaho Credit Code, which requires a “Regulated Lender License”. Payday lenders need a special “Payday Lender License”, though this type of loan is not illegal, although they are in many states (27 at last count).

https://www.csbs.org/sites/default/files/2020-02/Idaho%20Final.pdf

Loan brokers may not, directly or indirectly, receive a fee or any other compensation until a loan is made or a written commitment to loan or extend credit is made by an exempt person or entity. Idaho Title 26, Chapter 25, §26-2503 (1992). Violation of this law is a felony! Idaho Title 26, Chapter 25, §26-2506 (1981).

https://legislature.idaho.gov/wp-content/uploads/statutesrules/idstat/Title26/T26CH25.pdf

My advices, if you want to help the Idaho economy, don’t take advance fees until you have a written commitment. Instead, just buy their wonderful potatoes.

13. ILLINOIS

Illinois Disclosure, Licensing, and Database Bills

A significant shift in the state's financial landscape

By Ken Greene, Leasing News Emeritus (6/2024)

https://leasingnews.org/archives/Jun2024/06_28.htm#ill

Consumer lenders need to be licensed under the Consumer Installment Loan Act 205 ILCS 670. The Act does not apply to business loans. 205 ILCS 670/21.

As a general rule, loan brokers do need to be licensed. Illinois Loan Brokers Act of 1995 ILCS 175. (1996). There is an exemption, however, for “any person whose fee is wholly contingent on the successful procurement of a loan from a third party and to whom no fee, other than a bona fide third-party fee, is paid before the procurement.” ILCS 175/15-80(a)(5) (2017).

"Bona fide third-party fee" includes fees for credit reports, appraisals and investigations and, if the loan is to be secured by real property, title examinations, an abstract of title, title insurance, a property survey and similar purposes. ILCS 175/15-80(b) (2017). If you do qualify for this exemption, you will want to make sure you conform to the statutory guidelines as the penalties for failing to do so can be steep (up to $10,000 for each violation). ILCS 175/15-55 (1997). In addition, willful violation of these laws is a Class 4 felony. ILCS 175/15-65 (1996).

Illinios Loan Brokers Act of 1995:

https://ilga.gov/legislation/ilcs/ilcs5.asp?ActID=2319&ChapterID=67

14. INDIANA: Consumer lenders need to be licensed under the Uniform Indiana Consumer Credit Code. IUCCC, Ind. Code. §24-4.5-2-201 2017). Indiana may indeed want you, but you can’t go back there if you make an unsupervised consumer loan under $50,000 with an interest rate that exceeds 21% (apologies to R. Dean Taylor), since a person who charges excessive interest is guilty of a misdemeanor. That’s not how you want to be wanted!

15. IOWA: Under the Iowa Regulated Loan Act, registration is required of any company or sole proprietorship that makes “supervised loans” to Iowa residents. Iowa Code Chapter 536.1 (2014) Companies making, servicing or brokering business purpose loans, or companies that are “supervised financial organizations” do not need to register. Iowa Code Chapter 537.1301 (2021).

“Supervised loans” are consumer loans in which the interest rate is calculated according to a fairly complex actuarial method. It would be impossible to dig any deeper into the statute in this article, but here it is for your reading pleasure.

Iowa Money and Interest: Iowa Code Chapter 535

https://www.legis.iowa.gov/docs/code//535.pdf

“Supervised financial organizations” are defined as “a person, other than an insurance company or other organization primarily engaged in an insurance business . . . or pursuant to the laws of any other state or of the United States which authorizes the person to make loans and to receive deposits, including a savings, share, certificate or deposit account, and which is subject to supervision by an official or agency of this state, such other state, or of the United States.” This is probably inapplicable to any non-bank lender, but the “business purpose” exemption is helpful for anyone who is not a bank.

Iowa Consumer Credit Code: Iowa Code Chapter 537.1301(45)

https://www.legis.iowa.gov/DOCS/ACO/IC/LINC/Section.537.1301.pdf

In addition, companies, including sole proprietorships, who enter into less than ten supervised loans per year in Iowa and have neither an office physically located in Iowa nor engage in face-to-face solicitation in Iowa does not need to register.

The bottom line is that under certain circumstances, namely smaller transactions, you might need a license to be a lender or broker in Iowa. But if you do mainly larger transactions (more than $58,300, as of 2020), or you do make fewer than ten transactions a year, you won’t need to register.

One other noteworthy item: a loan broker may not assess or collect an advance fee until the broker successfully procures a loan for the borrower. Iowa Code Chapter 535C.2A (2021). Violation of this law is a “serious misdemeanor”. Iowa Code Chapter 535C.6 (2021). If you’re fined, you might find yourself thinking “Iowa lot of money to Iowa”. Best to avoid that!

Iowa Loan Brokers Law

https://www.legis.iowa.gov/docs/ico/chapter/535C.pdf

16. KANSAS:

(December, 2024) Kansas enacted Senate Bill 345 on April 12, 2024.It took effect on July 1 and the state is ready for enforcement.

https://leasingnews.org/archives/Dec2024/12_06.htm#ka

(June 2024)

New Kansas Disclosure Law

https://leasingnews.org/archives/Jun2024/06_18.htm#kan

Kansas: Bill (April, 2023)

https://leasingnews.org/archives/Apr2023/04_24.htm#toto

No license is required for commercial lenders. A license is only required for mortgage lenders and “supervised loans”, defined in Kansas as a loan in which the APR exceeds 12%, as to which the debtor is a person other than an organization, the debt is primarily incurred for personal, family or household purposes, and the loan amount does not exceed $25,000. Kansas S.A. 16a-1-301(17) (2019). Banks and other regulated depository institutions are exempt from this licensing requirement. Kansas S.A. 16a-1-301(44).

As is the case with a few other states, loan brokers must register for a license unless the broker’s fee is wholly contingent on the successful procurement of a loan from a third party and to whom no fee, other than a bona fide third-party fee, is paid before the procurement.Kansas S.A. 50-1016(a) (5) (2019).

Here is the statutory definition of “bona fide third-party fee:”

- Credit reports, appraisals and investigations; and

- If the loan is to be secured by real property, title examinations, an abstract of title, title insurance, a property survey and similar purposes.

Kansas S.A. 50-1016(b)

Here is the loan broker exemption provision in its entirety:

https://law.justia.com/codes/kansas/2019/chapter-50/article-10/section-50-1016/

17. KENTUCKY: A consumer loan company making loans of $15,000 or less, for personal, family, or household use, at an interest rate greater than the usury rate (8%) does need a license. KRS 286.4-420 (2021).

Interestingly, Kentucky is one of the few states which clearly delineates that there is no need for a foreign financial institution to register in the state in order to make loans from out of state, or even to maintain an action in Kentucky to prosecute or defend a lawsuit. KRS 286.2-670 (2009). Here’s the statute:

https://apps.legislature.ky.gov/law/statutes/statute.aspx?id=14517

It is one of the few states that clearly and indisputably gives lenders and brokers the right to do business from out-of-state. Many other states have “similar” laws, but this, based on my research, is unequivocal. Blue grass bourbon, horses and no license required. What more can you ask for?

18. LOUISIANA:

Louisiana Passes Commercial

Financing Disclosure Bill

By Ken Greene, Leasing News Emeritus

Another state that does not require a license to make commercial loans. Loan brokers, similarly, do not need a license unless they are making consumer loans. La. Revised Statute §§3572.2 and 3572.3 (2019). As one might expect of a unique, indigenous state like Louisiana, they are extremely protective of their consumers.

Louisina Consumer Credit Law

http://www.ofi.state.la.us/LicensedLendersStatutes.pdf

19. MAINE: Maine is strict in its licensing requirements, but, happily, it does not require licenses for commercial lenders. Many other financial companies, like consumer loan servicers, payday lenders, and supervised lenders (again, those who lend to consumers), do indeed need licenses. Maine Consumer Credit Code, Title 9, Article 2, Part 3.

Loan brokers need licenses as well, but only those who engage in the arrangement of consumer loans in Maine.

Maine Consumer Credit Code

https://legislature.maine.gov/statutes/9-A/title9-Asec10-102.html (2011)

20. MARYLAND: Nor does Maryland require a license for commercial lenders. However, consumer lenders do need licenses. Md. Code Ann., Fin. Inst. §11-301(b)(5) (2018). The usury rate is 6% or 8% if there is a written agreement. Md. Code. Ann. Comm. Law §12-103(a)(1), but this is inapplicable, and a lender may charge interest at any rate if the loan is:

(i) A loan made to a corporation;

(ii) A commercial loan in excess of $15,000 not secured by residential real property; or

(iii) A commercial loan in excess of $75,000 secured by residential real property.

Md. Code. Ann. Comm. Law §12-103(e)(1)

https://codes.findlaw.com/md/commercial-law/md-code-com-law-sect-12-103.html

21. MASSACHUSETTS: Massachusetts does not require a license for commercial finance companies. A license is required of any company or sole proprietorship that directly or indirectly engages in the business of making loans or engages, for a fee, commission, bonus or other consideration, in the business of negotiating, arranging, aiding or assisting a borrower or lender in procuring or making loans for personal, family or household purposes of $6,000 or less, and an interest rate that exceeds 12%, regardless of whether such loans are actually made by that company/ sole proprietorship or by another party (i.e. brokers are included).

22. MICHIGAN: Nor does Michigan require a license for commercial finance companies. It does require both a license and registration, which appear to be to different protocols, for first and second mortgage brokers. Michigan also requires licenses for consumer and/or “regulatory loans” under the Regulatory Loan Act, which defines “loan” or “regulatory loan” as a loan made by a licensee to an individual for personal, family, or household use.

Michigan Regularatory Act:

http://www.legislature.mi.gov/(S(mgrkqh50igskw1atedvy1zzd))/mileg .aspx?page=GetObject&objectname=mcl-Act-21-of-1939 (1939)

You should be aware that the penalties for usury are severe in Michigan. Pursuant to Section 438.41, Act 259, §1 of the Michigan Statutes (1968):

A person is guilty of criminal usury when, not being authorized or permitted by law to do so, he knowingly charges, takes or receives any money or other property as interest on the loan or forbearance of any money or other property, at a rate exceeding 25% at simple interest per annum or the equivalent rate for a longer or shorter period. Any person guilty of criminal usury may be imprisoned for a term not to exceed 5 years or fined not more than $10,000.00, or both. [emphasis added]

Definitely not a good idea in Michigan, or anywhere for that matter. The legislatures, and the courts, consider usury a profoundly serious matter. This is possibly the primary reason for getting a license in those states, like California, that fairly exempt lenders and brokers from usury claims.

23. MINNESOTA: Minnesota does not require a license for commercial lenders. Mortgage and consumer lenders do need licenses. Any corporation that engages in the making of consumer loans for personal, family or household use must be licensed. Minnesota Statutes §§56.0001-56.26 (1984) and Minnesota Regulation 2675.4100 – 2675.4170 (2007). Regulated (consumer) lenders can make loans up to $100,000, higher if capitalized (see statute below for details as to what “capitalized” means in this context).

Minnesota Maximum Rates And Charges (Consumer Loans)

https://www.revisor.mn.gov/statutes/cite/56.131 (2014)

24. MISSISSIPPI: Mississippi is another state in which a commercial finance company does not need to be licensed. A person who, for compensation from borrowers, finds and obtains consumer loans or credit cards for borrowers from third party lenders does need a license. No person shall engage in the business of being a consumer loan broker before posting the bond and obtaining the license as required by this chapter. Any person violating this section is guilty of a misdemeanor and, upon conviction thereof, shall be punished by a fine of not more than One Thousand Dollars ($1,000.00) or by imprisonment in the county jail for not more than six (6) months, or by both such fine and imprisonment. Mississippi Statutes § 81-19-5 (2019). I’m quite certain none of us would be comfortable in a Mississippi prison.

A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-23 (2019).

Mississippi Consumer Loan Broker Act (2019)

No consumer loan broker may:

(a) Charge or collect any service charge or advance fee from a borrower unless and until a loan is actually found, obtained and closed for that borrower, and in no event shall a service charge exceed three percent (3%) of the original principal amount of the loan or a fee of Twenty-five Dollars ($25.00), whichever is greater;

https://law.justia.com/codes/mississippi/2019/title-81/chapter-19/section-81-19-23/

Violation of this statute is a felony punishable by a fine of not more than $1000 and commitment to the custody of the State Department of Corrections for up to three years. Again, not a good place to be.

25. MISSOURI:

Missouri’s Third Attempt: The Persistent (12/15/23)0

Push For Commercial Financing Disclosures

https://leasingnews.org/archives/Dec2023/12_15.htm#mo

(8/14/2023) Missouri Joins Other States Legislative

Debates Concerning Commercial Finance Disclosure

https://leasingnews.org/archives/Aug2023/08_14.htm#mo

Critical News About Utah and Missouri Disclosure Laws (12/14/22)

https://leasingnews.org/archives/Dec2022/12_14.htm#utah

Missouri also elected to exclude commercial finance companies from any licensing requirement. Similar to many other states, mortgage lenders and consumer lenders need a license and need to be registered with. Once again, mortgage and consumer lenders need to be registered. Consumer loans are those in excess of $500 made for personal, family or household purposes. Missouri Rev. Statute §367.110 (2019)

A broker of loans of "money or property" may not assess or collect an advance fee. No loan broker shall charge, assess, collect or receive an advance fee from a borrower to provide services as a loan broker. The knowing charging, assessment, collection or receipt of an advance fee, in violation of this section, is a class A misdemeanor. Missouri Revised Statutes §367. 305 (1992). "Advance fee" includes any consideration which is assessed or collected prior to the closing by a loan broker. Missouri Revised Statutes §367. 300(1) (1992).

26. MONTANA: True to form for the “M” states, no license is needed for a commercial loan broker or lender. Mortgage lenders and consumer lenders do need licenses. A consumer license is required for any person that engages, directly or indirectly, in the business of making consumer loans in any amount. Montana limits interest on consumer loans to 36% per year, exclusive of the fees authorized by Mont. Code Ann. 32-5-301(3) and (4) (2019). A consumer loan means credit offered or extended to an individual primarily for personal, family, or household purposes, including loans for personal, family, or household purposes that are not primarily secured by a mortgage, deed of trust, trust indenture, or other security interest in real estate. Any loan made or collected in violation of Mont. Code Ann. § 32-5-103(1) by a person other than a licensee or a person exempt under Mont. Code Ann. § 32-5-103(5) is void, and the person does not have the right to collect, receive, or retain any principal, interest, fees, or other charges. Pretty fierce penalty, so best to heed that law.

27. NEBRASKA: Nor doesNebraska require a license for commercial lenders or brokers. And, as in many states, consumer and mortgage lenders must be licensed. Any person that makes, holds, services, or otherwise participates in consumer loans made to Nebraska residents with an interest rate greater than 16% per annum, a principal balance of less than $25,000, and a duration ranging from 6 to 145 months must obtain this license. Nebraska Installment Loan Act Chapter 45, Article 10 §§45-1001 et seq. (2010). That clearly includes consumer loan brokers. Under the Nebraska Loan Broker Act, Chapter 45, Article 1, Section f, “Loan broker” means any person who:

(i) For or in expectation of consideration from a borrower, procures, attempts to procure, arranges, or attempts to arrange a loan of money for a borrower;

(ii) For or in expectation of consideration from a borrower, assists a borrower in making an application to obtain a loan of money;

(iii) Is employed as an agent for the purpose of soliciting borrowers as clients of the employer; or

(iv) Holds himself or herself out, through advertising, signs, or other means, as a loan broker.

Loan brokers are not allowed to arrange or help obtain a loan secured by residential property in Nebraska without a mortgage banker license.

In addition, loan brokers, whether commercial or consumer, may not collect advance fees from borrowers. Neb. Rev. Statutes Chapter 45-191 (1993). Advance fee includes any fee, deposit, or consideration which is assessed or collected, prior to the closing of a loan, by a loan broker and includes, but is not limited to, any money assessed or collected for processing, appraisals, credit checks, consultations, or expenses. Neb. Rev. Statutes Chapter 45-190 (1993)In addition, loan brokers must provide prospective borrowers with written disclosure statements.

Nebraska Loan Broker Disclosure Requirements:

https://www.nebraskalegislature.gov/laws/statutes.php?statute=45-191.01

https://www.nebraskalegislature.gov/laws/statutes.php?statute=45-191.02

Violations of these laws can be misdemeanors or felonies, so it would be wise to observe them!

28: NEVADA: Update: Out of State Do Not Need to be Licensed (May 9, 2022)

Nevada: After my article on Nevada was published, I was reminded by my erudite colleague Sloan Schickler at Schickler Kaye to point out that there is an exemption from licensing in Nevada that permits an “internet business lender” to do business without a physical location in the state under NR §675.090. However, if a lender is either (a) making loans to consumers or (b) making commercial loans by physically conducting business within the state, it will require a physical location under Section 675.060 and thus a license.

How this affects those at a conference from out of state making a commercial law needs more investigation, as there does not seem to be any case law regarding its enforcement. Stay tuned.

NR §675.090

https://law.justia.com/codes/nevada/2021/chapter-675/statute-675-090/

NR §675.060.

https://law.justia.com/codes/nevada/2021/chapter-675/statute-675-060/

Nevada Requires T Commercial Finance Law (April, 2022)

The Nevada Installment Loan and Finance Act, Nev. Rev. Stat. §§675.10 through 675.490 (2019).

No person may engage in the business of lending in this State without first having obtained a license from the Commissioner pursuant to this chapter for each office or other place of business at which the person engages in such business…

Here is a link to the law: https://www.leg.state.nv.us/nrs/nrs-675.html

Here are the highlights:

- Applications are filed, under oath, with the Commissioner of Financial Institutions. NRS 675.060. The application fee is $1000. NRS 675.100. There is also an annual fee of up to $1000.

- Licensees need a minimum assets of $50,000. NRS 675.180

- Banks are exempt; bank holding companies are not. NRS 675.040 AND 675.035.

- Annual reports must be filed by April 15 of each year. NRS 675.260.

- Confessions of judgment are prohibited. NRS 675.350(1)

- Penalties for making or brokering loans without a license can be fined up to $10,000. NRS 675.490. It is also a misdemeanor. NRS 675.470.

- This statute does not have specific commercial disclosure language as we’ve seen in other states. That may change now that so many other states and even the feds (see below) have moved in that direction.

- Finally, for those who wish to do business there, the legal rate of interest if 12%. There is no usury limit. Nevada Statutes 99.040 et. seq.

How to Register, Rules, Requirements, Advice (May 6, 2022)

https://leasingnews.org/archives/May2022/05_06.htm#what

29: NEW HAMPSHIRE: Neither doesNew Hampshire require a license for commercial lenders. Mortgage lenders do need licenses, as do persons or companies engaged in the business of making small loans, title loans, and payday loans. This includes acts or offers to act as an intermediary, finder or agent for the purpose of negotiating, arranging, finding or procuring loans or commitments for loans (aka loan brokers). A “small loan” is a title loan, payday loan, open-end loan, or closed-end loan that:

- Is $10,000 or less;

- Has an annual percentage rate of 10 percent or more except for the lawful fees, if any, actually and necessarily paid out by the lender to any public officer, for filing or recording in any public office any instrument securing such loan and except for the reasonable costs, charges, and expenses, including court costs actually incurred in connection with a repossession of the security or an actual sale of the security; and

- Is for personal, family, or household use.

New Hampshire Statute Title XXXVI, Chapter 399-A:1(XX)

30: NEW JERSEY: New Jersey, at the moment, does not require a commercial lenders license. A consumer lender license is required for the making of a loan that is to be used primarily for personal, family or household purposes in an amount of $50,000 or less and that is payable in one or more installments. New Jersey Consumer Finance Licensing Act, N.J.S.A 17:11C-1 et. seq. Mortgage lenders need licenses as well.

What is critical for anyone in the industry to know is that New Jersey is almost definitely about to enact disclosure laws, similar to those in California and New York (though, naturally, not identical, as that would be too easy). New Jersey's disclosure Bill S2262 (now, S233 in its latest iteration) was introduced in 3/18 but is not law yet, but probably will be after the session this year.

Some highlights from the bill, though not finalized yet, are disclosures on loans, factoring, and merchant cash advances on transactions less than $500,000. In addition to APR requirements, brokers who arrange such financing would be required to disclose their fee to prospective applicants separately from the financing contract and prior to the consummation of the transaction.

DeBanked.com has been concerned particularly about one of the features, writing:

“The New Jersey’s bill is similar to the law that New York is putting into effect on January 1st. As part of it, non-loan products will be required to calculate an APR even if one cannot be mathematically calculated by ‘estimating’ one.

“Brokers would be impacted too:

“A broker who charges any fees or commission that would be paid by the recipient of the financing shall provide, at the time of extending a specific offer for a commercial financing transaction and in a form and manner prescribed by the commissioner, a written disclosure, in a document separate from the provider’s contract with the recipient, stating the following, if the information is not contained within the disclosure offered by the provider directly to the recipient:

“(1) a list of all fees or commissions that would be paid to the broker by the recipient in connection with the commercial financing;

“(2) the total dollar amount of charges listed pursuant to the bill;

“and (3) any increase to the annual percentage rate due to the charges listed above and the resulting dollar cost.

“You can read the Senate Commerce Committee’s report here:

https://www.njleg.state.nj.us/2020/Bills/S0500/233_S1.PDF“

Revised (09/22/21)

New Jersey: A small business finance disclosure bill has languished there for a few years now, but there appears to be a renewed interest in enacting it into law. It is similar in scope to the law recently passed in New York.

Here is the link to the most recent iteration of that bill:

https://www.njleg.state.nj.us/2020/Bills/S0500/233_I1.HTM (2020)

31. NEW MEXICO: As a general rule, out-of-state commercial lenders and equipment lessors are not required to obtain licenses to engage in commercial lending and leasing activities in New Mexico. Mortgage loan companies and loan brokers must register with the Director of the Financial Institutions Division of the Regulation and Licensing Department (“FID”). NMSA 1978, § 58-21-3 (2020) Exempt from this requirement, as usual, are banks, trust companies, savings and loan associations, credit unions, insurance companies, certain real estate investment trusts, and certain other persons. NMSA 1978, § 58-21-6. (2020).

Usury is generally not a concern for most commercial lenders. New Mexico caps interest rates, but only for loans of $5,000 or less. N.M. Stat. Ann. § 58-15-2(F). The general usury statute, former NMSA 1978, § 56-8-11.1, was repealed in 1991. The result is that, with a few exceptions, the maximum rate of interest for commercial loans is the rate agreed to in writing by the parties. Absent such an agreement, the rate “shall be not more than fifteen percent.” NMSA 1978, § 56-8-3. (2020)

I mentioned in our last segment that certain states require licenses for vehicle financiers, and that is true of New Mexico. Persons purchasing motor vehicle retail installment sales contracts from retail sellers in the state must obtain a license from the FID. NMSA 1978, § 58-19-3.(2020) Banks authorized to do business in the state are exempt from the licensing requirement but must comply with the other provisions of the Motor Vehicle Sales Finance Act. Id.

32. NEW YORK:

(June 30, 2023)

Bill in New York to Put Vehicle Brokers and

Independent Leasing Companies Out of Business

https://leasingnews.org/archives/Jun2023/06_30.htm#bill

February 16, 2023

Not Noted in Leasing News New York Disclosure

Article: Date Law Goes into Effect—Full Law

By Sloan Schickler, Esq.

https://leasingnews.org/archives/Feb2023/02_16.htm#not

(February 21, 2023)

New York Disclosure Date Law Goes into Effect

https://leasingnews.org/archives/Feb2023/02_16.htm#not

“New York State of Mind” September 2022

Completes Disclosure of New Commercial Finance Law

https://leasingnews.org/archives/Sep2022/09_19.htm#ny

New York Commercial Finance Bill Dies in Committee June, 2022

The New York bill that would have required licensing for commercial finance providers has died in Committee. SFNet will continue to update members if this issue resurfaces. For details on S1061, see below: https://www.nysenate.gov/legislation/bills/2021/S1061

In general, under the New York Licensed Lenders Law, lenders making commercial loans of $50,000 or less, with an annual interest rate in excess of 16 percent, are required to be licensed.

New York Licensed Lender Law

https://law.justia.com/codes/new-york/2013/bnk/article-9/

Individual borrowers receive significantly more protection under civil and criminal usury laws than corporations and LLCs in New York. Loans under $250,000 to individuals must comply with both the 16% civil and 25% criminal usury rates. Violation of the latter can be a Class C felony. However, loans between $250,000 and $2,500,000 are only subject to the 25% criminal usury rate.

Rules for corporate borrowers are slightly more complicated. Generally, corporations and LLCs can be charged more than 16% interest. Under the New York General Obligations Law §340 (2014) loans to businesses under $2,500,000 are generally exempt from the 16% civil usury cap, but are subject to a 25% cap.

New York General Obligations Law §340

https://www.nysenate.gov/legislation/laws/BNK/340

In addition, certain loans which fall under New York’s Uniform Commercial Code (UCC) are exempt from usury laws. Loans made to corporations for business purposes in amounts of $100,000 or more that are secured under the UCC are exempted from New York’s criminal usury laws if on the date when the interest is charged or accrued, such interest is not greater than eight percentage points above the prime rate.

Finally, all loans over $2,500,000 are exempt from civil and criminal usury laws regardless of whether the borrower is an individual or corporation.

These complex rules may be the reason so few commercial lenders and brokers are licensed in New York. I have also heard anecdotal yet reliable stories from my New York colleagues suggesting that no license is required of a lender or broker making loans to New Yorkers unless the lender or broker has a brick-and-mortar presence in the state, or, at a minimum, employs or otherwise utilizes a salesforce in the state. This seems to be supported by a banking interpretation issued by the Department of Financial Services (DFS) on October 15,2005.

https://www.dfs.ny.gov/legal/interpret/lo051014a.htm

If that isn’t uncertain enough for you, you should be aware that the New York legislature has been discussing a bill (Senate Bill S6688) which would greatly expand the licensing requirements. Most importantly, if the bill becomes law, a loan from an unlicensed, non-exempt lender would be void, and the provider would have “no right to collect or receive any principal, interest, fees or charges whatsoever”. At the moment, this bill is still in committee, but the consensus is that it will pass and become law fairly soon. There are also new disclosure laws which are soon to take effect, which I will discuss in a later series. For now, my advice for those who want to broker or make commercial loans, and possibly offer any other financial product in the State of New York, is to consult experienced New York counsel before you proceed, especially with the disruption of Gov. Cuomo’s impeachment.

Revised (9/22/21)

New York: At the end of 2020, New York enacted Senate Bill 5470-B, imposing federal Truth-in-Lending (TIL) type disclosure obligations on lenders and brokers making certain commercial loans of $500,000 or less. Shortly thereafter, former Governor Andrew Cuomo modified what is now known as the New York “Commercial Loan Disclosure Law”. That law became operative on June 21, 2021. Here is a link to the original statute: https://legislation.nysenate.gov/pdf/bills/2019/s5470b (2020)

It appears the commercial financial disclosure law is going forward for a January 1, 2022 deadline.

Acting Superintendent Adrienne A. Harris released a copy of the proposed regulations to receive comment within 60 days.

Among its provisions, the regulation:

- Provides detailed definitions for terms used in the CFDL, and in the regulation itself;

- Explains how providers should calculate the finance charge and annual percentage rate;

- Sets forth formatting requirements for disclosures required by the CFDL, both generally and specifically for the following types of financing:

- Sales-based financing;

- Closed-end financing;

- Open-end financing;

- Factoring transaction financing;

- Lease financing; and

- General asset-based financing;

- Describes how the CFDL’s disclosure threshold of $2,500,000 is calculated;

- Details certain duties of financers and brokers involved in commercial financing; and

- Prescribes a process under which certain providers calculating estimated annual percentage rates will report data to the Superintendent relating to the actual retrospective annual percentage rates of completed transactions, in order to facilitate accurate estimates for future transactions.

Proposed Regulations (45 pages):

https://www.dfs.ny.gov/system/files/documents/2021/09/pre_proposed_fs_sect600.pdf

Anyone wishing to provide commentary about the modifications is invited to send their comments to:

George Bogdan

Senior Attorney

Department of Financial Services

One State Street

New York, New York 10004-1417

FAX: (212) 709-1655

(212) 480-4758

george.bogdan@dfs.ny.gov

33. NORTH CAROLINA: North Carolina does not require a license to make a commercial loan. Loan brokers do need a license, as do mortgage lenders and mortgage loan brokers. N.C.G.S. §§ 66-107, 66-108, 66-109.

Under the North Carolina Loan Broker Act (1979), loan brokers must provide prospective borrowers with a disclosure statement, obtain a $10,000 surety bond or establish a trust account, and file certain disclosures with the North Carolina Department of the Secretary of State (see below). There is no cost to register with the SOS, but you do need to pay for the surety bond.

Additionally, loan brokers may not collect any advance fee or other valuable consideration from a borrower prior to the closing of the loan. This does not preclude the loan broker from collecting reasonable and necessary fees payable to third parties for appraisal, property survey, title examination, and credit reports.

The disclosures, penalties for failing to properly register, and other Information are in the statute and the following links:

North Carolina Loan Broker act

https://www.ncleg.net/EnactedLegislation/statutes/HTML/ByArticle/Chapter_66/Article_20.html

North Carolina Loan Broker Act Faq’s

https://www.sosnc.gov/frequently_asked_questions/by_title/_loan_broker_registration

34. NORTH DAKOTA: Commercial lenders do not need licenses to make commercial loans in North Dakota. However, as in North Carolina, commercial loan brokers do. North Dakota Century Code (NDCC)§13-04.1-02 (2021) requires a money broker license for any person engaging in money brokering activities with a borrower who resides in North Dakota. NDCC §13-04.1-01.1 (4) (2021) defines money brokering as "...the act of arranging or providing loans or leases as a form of financing, or advertising or soliciting either in print, by letter, in person, or otherwise, the right to find lenders or provide loans or leases for persons or businesses desirous of obtaining funds for any purposes."

North Dakota Century Code: Money Brokers

https://www.lawserver.com/law/state/north-dakota/nd-code/north_dakota_code_chapter_13_04-1

Additionally, money broker may not take any type of fee in advance before the funding of the loan or lease unless the money broker is licensed under this chapter.N.D. Admin. Code 13-05-01-01(2021)

35. OHIO: Ohio does not require a license for commercial lenders. There are statutes which require licenses for small loan lenders, defined as $5000 or less.Ohio Rev Code § 1321.02 (2019).

The maximum interest rate for a loan up to $100,000 is 8%, but commercial transactions are not subject to this limitation.

Ohio Revised Code: Maximum Rate Of Interest

https://codes.ohio.gov/ohio-revised-code/section-1343.01 (1988).

B) Any party may agree to pay a rate of interest in excess of the maximum rate provided in division (A) of this section when:

…

(6)(a) The loan is a business loan to a business association or partnership, a person owning and operating a business as a sole proprietor; any persons owning and operating a business as joint venturers, joint tenants, or tenants in common; any limited partnership; or any trustee owning or operating a business or whose beneficiaries own or operate a business…

36. OKLAHOMA: No license is required for persons or companies making or brokering commercial loans. Beginning on August 1, 2020, no person shall engage in the business of making small loans (as defined in this act cited below), unless the person is licensed by the Department of Consumer Credit as provided by this act. A person shall be deemed to be engaged in the business of making small loans in this state if the person regularly makes loans for a fee or induces a consumer, while located in this state, to enter into a small loan in this state through the use of facsimile, telephone, Internet or other means. A separate license shall be required for each location from which the business of making small loans is conducted. Oklahoma Statute: Title 59 O.S. §3150.2 (A)(2019)Oklahoma has some fairly stringent protective rules and regulations for its resident consumers, even those who do business with out-of-state lenders but, since most, if not all, of you are primarily focused on commercial borrowers, I will not go into those laws here. If anyone is further interested in the consumer side of things, here is the relevant statute.

Oklahoma Consumer Credit Code (1969)

https://www.oscn.net/applications/oscn/index.asp?level=1&ftdb=STOKSTA4#Part1-ShortTitleandOtherGeneralProvisons

37. OREGON: No consumer finance license is required for business loans, commercial loans, purchase money loans, or retail installment sales contracts. Any person who makes a loan to an Oregon consumer which is for $50,000 or less, with a term of more than 60 days and at an interest rate greater than 12%, is required to have a consumer finance license. Anyone who acts as an agent, broker or facilitator in which, for a fee or consideration from a person that makes a consumer finance loan to an Oregon consumer, is also required to have a consumer finance license. No license is required for business purpose loans, commercial loans, purchase money loan or retail installment sales contracts.

38. PENNSYLVANIA: Pennsylvania Hops Aboard the Disclosure Bandwagon (10/13/23) https://leasingnews.org/archives/Nov2023/11_13.htm#pa

No license required of commercial lenders and brokers. Mortgage lenders and brokers and consumer loan brokers do need to be licensed. Consumer lenders and brokersshall be registered with the Department of Banking pursuant to regulations promulgated by the Department. PA. Credit Services Act, P.L.1144, No. 150, Section 8 (1992).

Pennsylvania Credit Service Act (1992)

https://www.legis.state.pa.us/CFDOCS/LEGIS/LI/uconsCheck.cfm

Note the prohibition against advance fees found in Section 3.

Pennsylvania has also grappled with a relatively new issue, called the “True Lender Rule”. Certain companies had elected to hide behind the shield of exempt banks and other exempt institutions by entering into “partnership agreements” to avail themselves of an exemption for which they would not ordinarily qualify. In 2016, a federal court found in favor of a borrower whose loan exceeded the Pennsylvania usury cap, rejecting the lender’s argument that its “partnership” with First Bank of Delaware afforded it free rein to charge excessive interest rates. The Court disagreed. Commonwealth of Pennsylvania v. Think Finance, Inc. Civil Action No. 14-cv-7139 (January 14, 2016).

But the battle is far from over. This law is the subject of continuing fierce debate. In the Think Finance case, the Office of the Comptroller of the Currency (a federal agency that oversees banks) has intervened in an amicus curiae (friend of the court) capacity attempting to convince the court to reverse course. This issue is also being litigated and legislated elsewhere. More on that perhaps in a future article.

39. RHODE ISLAND: No license is required for commercial lenders or brokers. A license is required for mortgage and consumer lending, as well as “small loans” under $5000. RI Gen. Laws § 19-14.2 et seq. (1995)

Loan brokers do need licenses, but the exceptions render this requirement more or less moot in the commercial sector. Exceptions include, inter alia:

- Regulated institutions and banks or credit unions organized under the laws of the United States;

- Loans to corporations, joint ventures, partnerships, limited liability companies or other business entities;

- Loans over twenty-five thousand dollars ($25,000) in amount to individuals for business or commercial, as opposed to personal, family or household purposes.

- Loans principally secured by accounts receivable and/or business inventory

40. SOUTH CAROLINA: Nor do you need a license to make commercial loans in South Carolina. You do, once again, need a license to make “supervised loans”. A “supervised loan” is defined as “a consumer loan in which the rate of the loan finance charge exceeds twelve percent per year as determined according to the provisions on the loan finance charge for consumer loans”. South Carolina Consumer Protections Code §§ 37-3-501 and 301. (2010)

You do not need a license to broker loans, but there are specific laws governing the conduct of brokers. For instance, no loan broker may “assess or collect an advance fee from a borrower to provide services as a loan broker. South Carolina Consumer Protections Code § 34-36-20. (1992) The Department of Consumer Affairs would appear to have oversight akin to the California Department of Financial Innovation and Protection, even though it is labelled a “consumer” agency. That includes the power to investigate, examine, audit, and issue injunctions to any broker found to have violated the loan broker laws. This seems anomalous to me, so if any reader has any additional information to shed further light on this issue, please let us know.

South Carolina Loan Broker Law (1992)

https://www.scstatehouse.gov/code/t34c036.php

You also need a license to make or broker real estate mortgages. In a unique twist, in South Carolina, if a real estate mortgage is being used to secure real property as part of the commercial loan, an attorney licensed to practice law in South Carolina must handle the loan closing.

South Carolina also has a Consumer Protection Code. S.C. Consumer Protection Code §37. These laws only apply to consumer credit transactions made in South Carolina, but there are various definitions (see below) as to what constitutes “made in South Carolina”

South Carolina Consumer Protection Code (1962)

https://www.scstatehouse.gov/code/t37c001.php

The state also has a Consumer Finance Law but it applies only to loans of $7500 or less. SC Code § 34-29-20(a) (1962)

41. SOUTH DAKOTA: At the moment, this is a bit of an enigma to me. According to the general information on the NMLS website about South Dakota:

Anyone engaged in the business of lending money, includes (sic) the originating, selling, servicing, acquiring, or purchasing of any loan involving a borrower who is a person other than a family member, or the servicing, acquiring, or purchasing of a retail installment contract a party to which is a person other than a family member (sic) to be a Money Lender and subject to the licensing requirement of South Dakota Codified Law (SDCL) 54-4.

However, S.D. Codified Laws §54-4-44.4 (2021) actually states:

The provisions of § 54-4-44 that place limitations on licensees that are engaged in the business of making loans do not apply to a licensee engaged in business-to-business lending. For purposes of this section, the term, business-to-business lending, means any lending to or in furtherance of a business, commercial, or agricultural venture that is not for personal, family, or household use and is not secured by a nonpurchase money security interest in a motor vehicle. Any business-to-business lending subject to the provisions of this section shall be in an amount not less than five thousand dollars and only to a borrower with a federal employer identification number.

In addition, the NMLS Application Checklist for a Money Lender License states that it authorizes the following activities:

· Accounting/Billing servicing · Consumer loan brokering · Consumer loan lending · Consumer loan servicing · Industrial loan lending companies · Non-private student loan lending · Non-private student loan servicing · Payday lending - online · Payday lending - storefront · Premium finance company activities · Private student loan lending · Private student loan servicing · Property Tax Lending · Refund anticipation lending · Retail installment selling · Sales finance company activities - general · Sales finance company activities - motor vehicles · Title lending

Based on the statute, and the application instructions, I am of the opinion that South Dakota does not require a license for commercial lenders. This appears to be equally true of commercial brokers. If anyone has any information to the contrary, please let us know. Mortgage lenders and consumer lenders do need licenses. S.D. Codified Laws §§54-14 (2007) and 54-4-52 (1998), respectively.

42. TENNESSEE: As a general rule, out-of-state commercial lenders, equipment lessors and brokers transacting business in Tennessee are not subject to licensing requirements, nor are they required to register with the Tennessee Department of Financial Institutions. Licenses from the Department of Financial Institutions are required for:

• Tennessee Industrial Loan and Thrift Company. Tenn. Code Ann. § 45- 5-101 et seq.(2020) The Department of Financial Institutions views these as consumer lenders, yet there is no prohibition against them making commercial loans.

• Tennessee’s Premium Finance Company Act of 1980. Tenn. Code Ann. § 56-37-101 et seq.(2019). While a license is not required for financing insurance premiums in connection with another lending transaction, this act should be read carefully.

Mortgage lenders and brokers must also be licensed. Tennessee Residential Lending, Brokerage and Servicing Act, Tenn. Code Ann. §§ 45-13-201 et seq.(2019)

43. TEXAS: Generally, non-Texas based lenders, equipment lessors and brokers are not required to obtain licenses in order to engage in permissible commercial lending and leasing activities in Texas. The Texas Finance Code defines “commercial loan” to mean a loan that is made primarily for business, commercial, investment, agricultural, or similar purposes. The term does not include a loan made primarily for personal, family, or household use. Texas Finance Code Ann. § 306.001(5) (2021).

Some “Regulated Lenders” do need licenses. Regulated lenders offer consumer loans with rates of interest greater than 10%. Non-depository lenders who engage in making, transacting, or collecting loans with a rate of interest greater than 10% must be licensed by the Texas Office of Consumer Credit Commissioner (OCCC).

44. UTAH:

Good News for Brokers Doing Business in Utah

However, Broker Compensation Needs to be Disclosed (12/19/22)

Critical News About Utah and Missouri Disclosure Laws (12/14/22)

https://leasingnews.org/archives/Dec2022/12_14.htm#utah

Utah Update – November 9, 2022

https://leasingnews.org/archives/Nov2022/11_09.htm#utah

Time to Get Ready for New Utah Disclosure Law Sept. 2022

https://leasingnews.org/archives/Sep2022/09_12.htm#time

On March 24, 2022 Utah passed SB183 into law. The law not only mandates specific disclosures in commercial loan transactions, but also requires that finance providers register with the State. Highlights of the new legislation are as follows:

- Exemptions:

- Depository institutions;