|

Marketing Genius

Riverside, California

Create, Design, Coordinate convention/trade shows

marketing calls, remarketing assets/website

Send resume: Dreynolds@a-zresources.com

www.a-zresources.com

A-Z Resources captive affiliate to a major business distributor founded in 1975,

join our staff, generating over $120 million in combined sales.

|

Thursday, April 14, 2011

Share Leasing News

Up-Date--Looking for information on Scientific Imaginetics

Classified Ads---Senior Management

Allied Health Care Services Not Over

FBI Press Release on Guilty Plea

Classified Ads---Help Wanted

Leasing Association Membership Confirms Changing Industry

by Christopher Menkin

Leasing Conferences Up-date

Charlie Chan Saying…..

April Beige Report---Business in Your Area

Madison Capital: How Did We get here?

by Allan Levine, COO, Madison Capital

The Conspirator/Rio

Movie/DVD Reviews by Fernando Croce

The King’s Speech/The Way Back/Kes

Beaverton, Oregon---Adopt-a-Pet

News Briefs---

Schwartz Ex-Marine lets Marines get Evicted---Semper Fi

Bank of the West moving more workers to Bishop Ranch

Senate panel concludes Goldman Sachs profited from financial crisis

U.S. banks still face big foreclosure risks

World medical equipment rentals, leasing to reach $56 billion

Winmark Corporation Announces First Quarter Results

American Airlines sues online travel giant Orbitz

Viewers knock out Sugar Ray Leonard from 'Dancing with the Stars'

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Sports Briefs

California Nuts Briefs

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Up-Date--Looking for information on Scientific Imaginetics

This is a follow-up to the request to readers regarding information concerning Scientific Imaginetics, 124 S. Lasky Drive, Beverly Hills, Ca. 90212. Information regarding the company has been gained by Lease Police and sent out to their subscribers.

"Dear Lease Police Subscriber

"The management of Scientific Imaginetics has made it known to us that we need to correct our previous statement that their corporation New Life Sciences, LLC is not registered in California. They are registered under their correct name of NewLife Sciences, LLC. The California Secretary of States shows this New Hampshire Corporation was registered as a foreign corporation in California on 4/5/07. New Hampshire Secretary of State Records show that corporation was chartered 11/22/06 and is in good standing this date. The Trade Name, Scientific Imaginetics was registered by NewLife Sciences, LLC in New Hampshire 5/30/07. There is no assumed name filing in Los Angeles County but management has provided us with a Business Property statement filed with the Los Angeles Assessor’s office and filed by NewLife Sciences, LLC dba Scientific Imaginetics.

Unfortunately this misspelling of Imaginetics was recently discovered by management."

Bernie Boettigheimer, CLP

President

Lease Police, Inc

1400 Preston Rd.

Suite 400

Plano, Texas 75093

214-549-3426

www.leasepolice.com

It appears the original inquiry started with equipment purchased by Dr. William "Bill" O'Brien III and his company East Coast TMR, Inc. and WJO, Inc.

NewLife Sciences., Inc. dba Scientific Imaginetics is also one of the victims as the President and Chairman of the Board John Crosson told Leasing News money for the equipment is owed to his company by Dr. O'Brien. Pacer shows a 4/27/09 filing for $4 million dollars and then a settlement 10/27/09, but Mr. Crosson was not able to collect much of it.

Reportedly WJO, Inc. main stockholder in Dr. William J.O 'Brien, III, was leasing the $150,000 units through this company and East Coast TMR. WJO, Inc filed on 11/15/2010 Chapter 11 Voluntary bankruptcy.

It also was confirmed by one source "The TMR (Therapeutic Magnetic Resonance) is an insurance and FDA cleared device that Dr. O'Brien had in several offices."

Reportedly several leasing companies are suing various companies controlled by Dr. O'Brien, and one unconfirmed report has him filing a personal bankruptcy, which Leasing News could not confirm.

Copies of the case follows a statement from him regarding the original request by Lease Police for information on the company (it also seems Mr. Crosson was on vacation during this period and when he came home, was very cooperative, and supplied Leasing News with a statement which was easily verified with a search on Pacer Legal Documents:)

"Notwithstanding Bernie's early claims otherwise, NewLife Sciences is properly registered to do business both nationally and locally. Our dba Scientific Imaginetics, which is a registered trademark with the United States Patent and Trademark office is likewise properly registered for use in commerce as required by national and local law. Our TMR device is cleared by the FDA for manufacturing and marketing in the United States.

"We have been subject to a random audit that the FDA periodically conducts on all manufacturers to ensure compliance with their Good Manufacturing Policies and we passed such audit. As already stated, our only lease defaults in four years are solely and uniquely confined to this one bankrupt customer (O'Brien). It is true that as a result of his defaulting on agreements made, some companies repossessed our TMR devices from him and that the secondary market for those devices has been challenging. The primary reason for such is that all the devices in question are long discontinued models: most are two generations old technology-wise and in a few cases one-generation old and with our current, third generation device, our technological improvements were so dramatic as to render these old devices far less desirable and marketable. The current, third generation device has been on the market for over a year and none of the devices repossessed are this current model.

"Additionally, the in-house leasing package we offer our customers--a package that was also offered to O'Brien but he decided he preferred to purchase with his own procured financing instead--has a lower cost of entry and a return anytime option. For that lease choice, the customer may ultimately pay more to us, but they prefer this option for the nominal commitment and flexibility that it offers them.

"I would also add that to the lease companies who have repossessed TMRs from O'Brien and have contacted me, I have offered assistance in re-marketing these devices. To those who have inquired, I have offered to train new customers on the secondary market as well as offered extended warranties and service contracts to support the device. As the device cannot be used to optimal effectiveness without proper training, this cooperation from us is critical to the re-marketing effort.

"Finally, I would add that to any company who was considering a request/application from O'Brien to finance a purchase of our equipment for him, we provided any information such company asked of us. This included information on where the device is manufactured, who the contract manufacturer is, their qualifications and certifications, etc. On the other hand, I was not privy to the application that O'Brien supplied these companies, the financial information he gave them to qualified for credit, nor anything else between he and these companies. These were relationships he established directly with them. We were not a named party to any of the credit agreements."

John Crosson

Scientific Imaginetics

jcrosson@scientificimaginetics.com

-

Complaint Against East Coast TMR, Inc. and Dr. William O’Brien III

PDF file

Form Synopsis of Case:

PDF File

California Business Entity Identification:

http://leasingnews.org/PDF/newlife.pdf

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment or looking

to improve their position)

Europe

25+ yrs exper. management roles Chase, AT&T Capital, Heller Financial, SFS. Develop biz from “scratch to success”. Looking for challenging & pioneering job.

Email: frans@alliedproperty.net |

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Philadelphia Metro Area - 30 Years experience Healthcare sales/ management- 3 years experience newly create "small-ticket" healthcare division.

Good success - Mitch Utz

215-460-4483

Email: mitutz@msn.com

|

Southern CA

20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant.

Email: leasecfo@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Allied Health Care Services Not Over

February 19, 2010

(Mug shot: Essex County Corrections Facility)

Plea negotiations were in works officially by court documents since November, 2010, before Charles K. Schwartz of Allied Health Care Services found himself still in Essex County jail for thanksgiving. There were several extensions until yesterday when the FBI Division in Newark announced he had pleaded guilty to the $130 million Ponzi scheme that defraud banks and many leasing companies. Reportedly the vendor, Bruce Donner, Donner Medical, New Jersey was the first to make a deal with the FBI. He was not named in any of the press releases, nor has the print media picked up his involvement, the invoices, but they did report how it worked...and it obviously did not come from Schwartz.

There is a court case from De Lage Landen against the vendor as a company and individual, there are the assets of Schwartz and his company to address, and finally a meeting with the Internal Revenue Service. So is it over?---not yet.

In addition, if the penalty is correct, up to a maximum 20 years, less time served, as well as “good behavior,” he could be out in eight years, or less. Then again, we don’t know the “plea” deal, which would make a difference, most likely, such as five year, and with time served, knock off another two years, perhaps. The bankruptcy will protect him from the creditors, and the court will decide his cash fine (from an “off shore” bank?). He will lose his horse stable, or will it be in his wife’s name as his New Jersey estate is in her name.

Ex-Convict Sheldon Player et. al. at Equipment Leasing Acquisition are still free, as well as the bookkeepers and officers of John Otto’s HL Leasing. Evidently “guilty” pleas are not as easy as it appears. However, at taking $130 million and working on a plea deal, Schwartz certainly must think crime pays.

It was a rough ride for me since the posting about Chuck Schwartz and Allied Health Care Services, with many claiming Leasing News was going the wrong direction; over fifty telephone calls, too many emails to count, and when Leasing News found out new information, everyone was telling us we were wrong. I made new enemies. There also were several who were of a great help, who want to remain anonymous, and without them, the story would have not gone forward and played a roll in warning others. These are the people who make Leasing News as well read as it is and deserve much of the credit. They all would like to be anonymous and information kept confidential that they provided. Without them, the story would never have developed as far as it did.

The FBI press release follows, as well as a collection of previous stories.

Kit Menkin, Editor

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

[headlines]

--------------------------------------------------------------

### Press Release ############################

Owner and President of Allied Health Care Services, Inc. Pleads Guilty

in $135 Million Medical Equipment Lease Scheme

Over 50 Financial Institutions Victimized

NEWARK, NJ—The owner and president of Allied Health Care Services, Inc., an Orange, N.J., durable medical equipment corporation, admitted today (Wednesday, April 13, 2011) to organizing and executing a $135 million phony lease scheme that caused losses of more than $80 million and victimized more than 50 financial institutions, U.S. Attorney Paul J. Fishman announced.

Charles K. Schwartz, 57, of Sparta, N.J., pleaded guilty before U.S. District Judge Susan D. Wigenton to one count of mail fraud. Schwartz was previously charged by complaint and arrested by special agents of the FBI on September 2, 2010. He has been in federal custody since that time.

U.S. Attorney Fishman stated: “Charles Schwartz turned phantom medical equipment into very real profits by tricking financial institutions out of tens of millions of dollars. Also victimized in this scheme were his employees, who watched his greed bankrupt the company that signed their paychecks. New Jersey is a hub for health care and financial industry, and we have no room for bad actors who criminally exploit our success.”

According to documents filed in this case and statements made in Newark federal court:

From at least 2002 through July 2010, Schwartz, through Allied Health Care Services, Inc. (“Allied”), convinced financial institutions to pay more than $135 million by telling them that the money would be used to lease valuable medical equipment. In reality, the purported medical equipment supplier did not provide Schwartz and Allied with any equipment during that time. Instead, the “supplier” created phony invoices which appeared to reflect legitimate transactions.

As part of the scheme, Schwartz approached various financial institutions and informed them that Allied needed to lease particular medical equipment. Using the phony invoices from the “supplier,” Schwartz convinced the financial institutions to enter into leasing arrangements. Pursuant to these arrangements, the financial institutions purchased the medical equipment—which they immediately leased to Schwartz and Allied—and sent payment for the medical equipment to the purported supplier. The “supplier” then sent the money received from the financial institutions (minus his 3-5 percent payment) to an entity created by Schwartz to facilitate the fraud.

In addition to spending millions of dollars on properties in New Jersey and New York, including a horse farm, Schwartz used the money in Ponzi-scheme fashion to repay earlier bank loans that were a part of the scheme. By August 2010, several financial institutions from which Schwartz had obtained loans filed lawsuits against Schwartz and Allied, claiming he owed them at least $20 million. Allied and Schwartz were forced into involuntary bankruptcy in August 2010 and September 2010, respectively. Losses from the scheme now total at least $80 million. Schwartz admitted that more than 50 victim financial institutions lost a total of between $50 and $100 million as a result of the scheme.

Schwartz and the medical equipment “supplier” undertook efforts throughout the scheme to deceive bank examiners who wanted to inspect the non-existent medical equipment, which had been purchased by the financial institutions. Schwartz admitted that in advance of expected inspections by financial institutions, he directed others to alter serial numbers or create fraudulent serial numbers on existing ventilators to match fraudulent invoices he had supplied to the various financial institutions. At times, when financial institutions sought to review documentation regarding Allied’s leasing of the ventilators to its customers, Schwartz falsely told the financial institutions that the information was protected by Health Insurance Portability and Accountability Act regulations. At one point during an August 2010 conversation between Schwartz and the “supplier,” Schwartz commented that the financial institutions had fallen “hook, line and sinker” for the false explanation given to bank examiners who asked why the purported supplier used his home address on certain invoices.

The mail fraud charge to which Schwartz pleaded guilty carries a maximum penalty of 20 years in prison and a fine of $250,000, or twice the gross gain or loss from the offense. Sentencing is scheduled for July 18, 2011.

U.S. Attorney Fishman credited special agents of the FBI, under the direction of Special Agent in Charge Michael B. Ward, for the continuing investigation which led to today’s guilty plea.

The government is represented by Assistant U.S. Attorneys Jacob T. Elberg and Joseph Mack of the U.S. Attorney’s Office Health Care and Government Fraud Unit in Newark.

Defense counsel: John Whipple, Esq., Chatham, N.J.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

High Compensation to High Achievers

Leasing Subsidiary of a National Bank Holding Company looking for experienced professionals (10+ years of experience in commercial finance industry) who can originate a volume of bank-qualified credits (primarily SEC reporting companies). Average transaction size from $1-20MM. Enjoy private

office in our Southern California location.

We offer excellent commission with a draw.

Send resume in strictest confidence to:

rose.jones98@yahoo.com

|

Documentation Administrator

Los Angeles, CA

Join one of the Monitor's Top Ten Independent

Finance and Leasing Companies doing middle

and large ticket transactions. Going on 22 years

of successful, repeat business with an excellent

reputation in the finance/lease community. Please email resume to: operations@julesandassociates.com

We will contact you for a personal interview

at our office in the financial district

www.julesandassociates.com

Jules and Associates, Inc. has been

in

business for over 20 years.

|

Syndication Manager

Rancho Cucamonga, CA

Knowledge of transportation industry a plus,

but not required. Compensation commensurate

with experience

contact: wdalton@crlease.com

We can finance or lease any make or model

of truck, bus, or equipment

|

Marketing Genius

Riverside, California

Create, Design, Coordinate convention/trade shows

marketing calls, remarketing assets/website

Send resume: Dreynolds@a-zresources.com

www.a-zresources.com

A-Z Resources captive affiliate to a major business distributor founded in 1975,

join our staff, generating over $120 million in combined sales.

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing Association Membership Confirms Changing Industry

by Christopher Menkin

| 566 |

National Association of Equipment Leasing Brokers (NAELB) |

| 515 |

Equipment Leasing and Finance Association (ELFA) |

| 450 |

National Funding Association (NFA) |

| 268 |

Association of Government Leasing and Finance (AGLFA) |

| 144 |

National Equipment Finance Association (NEFA) |

| |

3/31/11 |

2011 |

3/31/10 |

2010 |

2009 |

2008 |

2007 |

2006 |

2005 |

2003 |

2002 |

2001 |

2000 |

| AGLFA |

268 |

250 |

215 |

238 |

265 |

277 |

255 |

255 |

255 |

203 |

263 |

343 |

250 |

| EAEL |

* |

* |

* |

* |

183 |

181 |

196 |

198 |

180 |

191 |

216 |

227 |

240 |

| ELFA |

515 |

582 |

490 |

604 |

700 |

741 |

768 |

817 |

780 |

732 |

862 |

873 |

850 |

| NAELB |

566 |

696 |

640 |

847 |

1021 |

1089 |

950 |

731 |

648 |

480 |

433 |

415 |

475 |

| UAEL |

* |

* |

* |

* |

289 |

314 |

314 |

314 |

297 |

248 |

378 |

379 |

589 |

| NEFA |

144 |

210 |

184 |

274 |

|

|

|

|

|

|

|

|

|

| NFA |

450 |

400 |

|

|

|

|

|

|

|

|

|

|

|

It appears the two growing associations are the Association of Government Leasing and Finance and National Funding Association, reflecting the changing status of the equipment leasing and finance industry. The Equipment Leasing and Finance Association is holding its own, perhaps moving back to gaining membership, and the mix also gives a sign of the economic change, as does the declining National Association of Equipment Brokers membership. The association losing the most is one who combined with the former Eastern Association of Equipment Lessors, who when taking those members, less than those who belonged to both in consideration, has the most dramatic decline.

There are many who won’t talk to me as I made the observation the merger between UAEL and EAEL was not a good idea as it would dissolve the camaraderie and identity of both groups. The opinion looks more valid each year since the merger. Is NEFA moving toward extinction? Don’t blame me for the question. Look at the numbers above! And if the board of directors and membership expect Gerry Egan all by himself to turn it around, you are more delusional than I thought.

In reviewing the first quarter membership numbers of all the associations, it certainly gives an indication to the changing leasing and finance environment. Networking, obtaining business, and now growing by portfolio acquisitions, and working from where you live for credit, collections, operations, as well as sales. Of course, there is more to the story including membership mix and direction.

Let's start with the newest comer to the group, which would have been larger than it is today.

The National Funding Association

Chairman H. Walker Everett, Jr.

National Funding Association (NFA) Chairman H. Walker Everett, Jr. states the association is in re-organization since the death of its co-founder, former Chairman and President Arthur H. (Bud) Wilson, Jr. They will be considering a management group to help administration the many regional branches who independently meet. He states there may have been up to 2,500 going to the branch meetings before the untimely death of Bud Wilson.

Vice-Chairman Barry D. Yelton

Vice-Chairman Barry D. Yelton, North Mill Capital, guesses there are any are between 1,000 to 1,200 who have attend various chapter meetings last year, who were primarily networking, trading leads and sources, not actual "education," as he calls it, but informative speakers and meetings for those in the financial marketplace. He states there are not many members of NFA on the West Coast and they are in the process of getting a Los Angeles branch going. All the work today is by volunteers, who not only have their own business, but families that also need their time. They need the jump to get "organized" with a staff or management group.

While NEFA has a relatively small leasing group, they have many who were involved in leasing going over to the working capital loans, cash advance, factoring, and other financial activities that are of great interest to their members.

http://www.nationalfunding.org/events-calendar/calendar/ shows meetings each month, and they are having their "First Annual Conference” May 4-6 at the Grand Hyatt Atlanta in Buckhead, Georgia.

Yelton says if we could get all who attend our meetings to pay membership dues, there would be no debate on moving ahead with a management association to take over the work now being done by volunteers.

NFA members provide services including working capital, commercial finance, factoring, commercial lending, equipment lending, bridge financing, mezzanine lending, equity, and financial services of other types as well, including lease financing.

The group has the potential to be the largest association that includes leasing and finance.

Association of Government Leasing and Finance

"We have seen a slight increase in membership

and currently have 268:

"100 Basic

115 Industry Leaders

24 Individual & Government

25 Limited

4 Emeritus

"These are not final for the year. We should know more

within one month. Not all have renewed yet."

-

AGLF David Wright, Executive Director

-------------

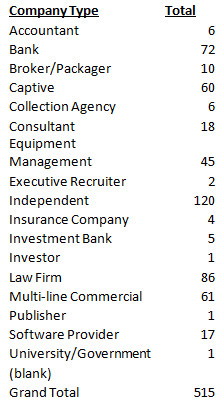

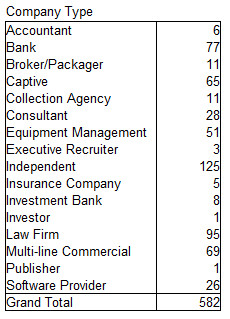

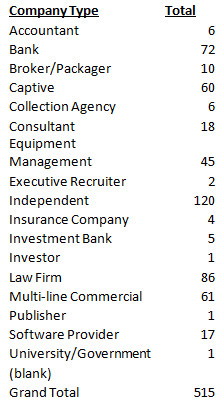

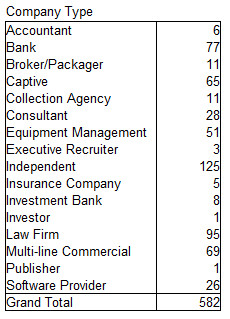

The Equipment Leasing and Finance Association (ELFA) membership problems continue major leasing companies and banks involved in leasing and other financing have gone out of business, merged, or no longer are active or believe they have the necessity to join. An interesting mix can be observed by the changes in comparing the 2010 year-end mix of membership with the first quarter of 2011.

|

|

Since the loss of former Congressman Ken Bentsen, ELFA had several cutbacks of staff, then hired former Rear-Admiral William G. Sutton, CAE. In his watch, Ralph Petta continues as COO. ELFA has added personnel back, including Amy Vogt, vice-president, Communication and Marketing. While keeping long time Vice-President State Government Relations Dennis Brown, CAE, David Fenig was hired as Vice-President Government Relations, and recently Am M. Gross to Senior Vice President, Municipal Finance. She previously was vice president of federal sales for Key Equipment Finance. The trend appears to get back active in local, state, and federal legislation that affects the finance and leasing industry.

Unfortunately the advocacy has added to the demise of leasing, in my opinion, perhaps the reason finance was added to the associations name. The opposition of required notices for Evergreen and Winter Green leases has resulted in the continuation of a practice notably in small ticket leases turning customers away from going back to leasing, the SILO Tax haven hurt banks and also gave Congress the attitude leasing was a "trick," and the backing of their member NorVergence as well as appearing in attorney general offices resulted in a backlash that has turned the tide in "hell and high water" contracts, as well as giving the government officials a faster method to cooperate with each other.

There any many more such examples and as ELFA is getting more aggressive, it appears there will be more of the same as they chase end users away from lease financing.

More and more customers are going to "equipment finance agreements" and "working capital loans," “Cash Advance” and other financial instruments. ELFA leadership may not be aware but they are taking the "sizzle" of the once popular way for business to acquire equipment using the advantages of leasing, especially supporting non-notification in Evergreen leases.

------------------

The association tried its former president Joe Woodley, CLP, outstanding as executive director as well as Bill Grohe, dynamite on the telephone, then decided to try a management firm, which they evidently were not satisfied with. The new board most likely found the results that Joe Woodley, CLP, brought to the group, now not available, so brought in ex-National of Equipment Leasing Broker President Gerry Egan. It will be a rough road for him, as being a president is quite different than being an association executive director. The CAE after the title has more than prestige, but means training and experience in this profession. His main role is not making press releases but getting the membership involved. Lotsa luck, Gerry, NEFA is quite different than NAELB. I know personally as serving on the membership committee for several years, the board twice, and membership director for three years.

The Scottsdale Conference had less than 100 attending, once the speakers and exhibitors are removed from the list. It was basically the same number as the previous year, with the long time, dedicated members in attendance. The location and date were chosen before Gerry Egan came on board, as is the Fall Conference, September 15-17 in Minneapolis, Minnesota. The conflict will be the National Association of Equipment Leasing Brokers Conference September 16-17 in Atlanta, Georgia, which always has a good turn out, and may draw many of the former Eastern Association of Equipment Lessors who joined NEFA, but have a better allegiance for the Atlanta Conference happening in the same time period. It is also difficult for Gerry Egan, being past president of the NAELB, as he certainly knows you can't be at both locations at the same time. In the past, conferences with exhibitor fees and attendance were very good money makers; however, it appears all associations are having similar problems with their budgets.

Gerry Egan told Leasing News:

"We are still in the midst of our member renewal process.

"Currently we list 144 fully paid members, almost exactly where we were at this point last year. Last year we ended the year with 210 members.

"Interestingly, our active membership is actually slightly more. In order to accommodate those members whose cash flow may have been restricted in recent years, some of our members renew in monthly installment payments. Our accounting system doesn't actually report them as paid members, though, until the membership is fully paid. Based on prior year's experience, we expect virtually all of them to be reported as fully paid members by year end.

"We have added 9 new members since the first of the year and 4 returning members, (members who were not paid members last year, but had been in prior years). We are currently processing several new member applications.

"The breakdown of our membership is virtually identical to what it was last year. About 55% of our members are Regular Members, (brokers and/or lessors), and the rest are Services Members, (providers of funding or other services). That breakdown continues to be reflected in our new members this year and our currently applying members.

"While size for size sake is not a goal of NEFA, we do expect to add some members this year and next as a result of some educational programs that are currently in development and will begin to roll out soon."

-----

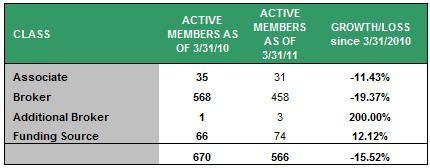

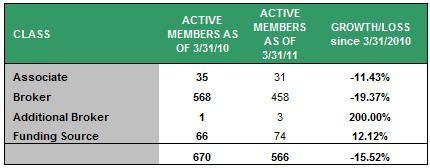

Perhaps the most indicative sign of the change in the leasing and finance industry comes from the National Association of Equipment Leasing Brokers:

Note the broker membership is down almost 20%. In 2008, perhaps the last great year for the leasing industry, they had 1089 members including 815 broker members;, in contrast with 458 broker members as well as 113 funder members today. While the funder numbers have improved from the last count, the overall membership count is down almost 16%.

With "Meet the Funder" and many education programs, new efforts have been good ideas, but have not taken off. The "Broker to Broker" is about the same as it was in real life and the "equipment for sale" has not grown or produced any real positive effects, according to reliable sources. New programs and benefits for members is still the number one effort with volunteers getting involved for their group benefit.

The dedication remains and perhaps back to the core efforts of the original group has never been doubted. Sonia v.M. Stoddard, BPB, immediate past president, did an excellent job and also had a hard working board. The Austin, Texas conference brought in 220 in attendance and was talked about as a great success for those who attended. Members who remain are "gung ho," as my son would say.

------------------------

Certified Leasing Professionals

2007: |

204 |

2008: |

179 |

2009: |

182 |

2010: |

159 |

2011: |

174 |

3/31: |

164 |

"The total number of CLPs in Good Standing as of 3/31/2011 was 164. We have had quite a few officially retire and several have left the industry.

"Hope all is well with you."

Cindy

Cynthia W. Spurdle

Executive Director

Again, this may be a reflection of the National Equipment Leasing Association and their involvement. It seems only the National Association of Equipment Leasing Brokers is also promoting this program. Will the group continue to get smaller, despite new members joining? Again, it takes an active board of directors.

-----------

Arizona Equipment Leasing Association at one time has an estimated 25 members. No official count is available at this time. The group is active. They get together for social and business meetings during the year, even invite speakers.

Why Choose Advanced Property Tax Compliance?

|

|

Dedicated to the leasing industry

click here to

learn more.

Hear What Our Clients say about us

click here

Gary DiLillo, President

216-658-5618 or gary@avptc.com |

[headlines]

--------------------------------------------------------------

Leasing Association 2011 Conferences

April 12--April 14

Equipment Leasing and Finance Association

23rd Annual National Funding Conference

Fairmont Hotel

Chicago, Illinois

Funding Source Exhibitors as of March 25, 2011

-

AIG Commercial Asset Finance, Inc.

-

ATEL Capital Group

-

Banc of America Leasing

-

Bank Financial, FSB

-

Bank of the West

-

BB&T Equipment Finance

-

Boston Financial & Equity Corporation

-

CapitalSource, Inc.

-

Fifth Third Leasing Company

-

Financial Pacific Leasing, LLC

-

First Bank of Highland Park

-

First Eagle Bank

-

First Financial Corporate Services Inc.

-

GE Capital Corporate Finance

-

GE Capital Markets Group

-

Huntington Equipment Finance

-

Key Equipment Finance

-

M&I Equipment Finance

-

MB Financial Bank

-

Nations Equipment Finance

-

Northland Capital Financial Services, LLC

-

OneSource Financial/One World Business Finance

-

Panthera Leasing, Inc.

-

People's Capital and Leasing Corp.

-

RBS Asset Finance

-

SCG Capital Corporation

-

Sentry Financial Corporation

-

SG Equipment Finance

-

Sterling National Bank Equipment Finance Division

-

SunTrust Equipment Finance & Leasing Corp.

-

TimePayment Corp.

-

Varilease Finance, Inc.

-

Wells Fargo Equipment Finance, Inc.

Event Schedule and Exhibit Information:

http://www.elfaonline.org/pub/events/2011/NFE/NFE11_ExhibBrochure.pdf

Member Attendee: $750

Additional $700

Non-Member Attendee: $1500

May 4-6, 2001

Grand Hyatt Hotel, Buckhead

Atlanta, Georgia

Contact:

Everett H. Walker, Chairman

1449 Green Hill Road

Blowing Rock, NC 28605

everetthwalker@gmail.com

(828) 295-4377

"The National Funding Association is the premier financial networking organization in the country. Founded in 1991, the NFA has been networking financials professionals across America, and with nine chapters serving twelve metropolitan areas, the NFA continues to grow and expand! Our members include asset based lenders, factors, investment bankers, attorneys, CPA's, bankers, consultants, brokers, and other financial professionals."

"The NFA conference kicks off on Wednesday, May 4 with a Golf Tournament at a noted Atlanta area course. An opening reception starts the evening’s festivities from 6:00 to 8:00 PM! Following his presentation are attendee sponsored receptions and hospitality rooms."

"On Thursday, May 5, the conference formally begins with an opening session at 8:30 AM, with a welcome by Atlanta Mayor Kasim Reed, followed by a day long line-up of prominent speakers, including a luncheon, a networking exhibit hall, evening reception, and a banquet with an entertaining dinner speaker."

Our presenters include:

Dennis Lockhart, President, Federal Reserve Bank of Atlanta

Hon. Nathan Deal, Governor of the State of Georgia

Richard Hastings, Global Hunter Securities, Speaker, Author, Retail Economic Expert

Atlanta Mayor Kasim Reed

Kenneth Marks, High Rock Partners

Rob Slee, Robertson & Foley Investment Bankers

Charles Green, Speaker and Author

Nancy Halwig, UPS Capital, leading a panel discussion on the State of the Lending Industry

| Member after February 15 |

$375.00 |

| Non-Member After February 15 |

$475.00 |

| Member After April 15 |

$450.00 |

| Non-Member After April 15 |

$550.00 |

Registration is open for the AGLF/ELFA Public Sector Finance Forum. The agenda is designed to help equipment-finance professionals understand trends in the municipal-leasing marketplace and explore opportunities with public-sector equipment leasing.

Program highlights

-

Keynote speaker Beth Ann Bovino, senior economist at Standard & Poor's

-

Keynote speaker Eugene L. Munin, budget director for Chicago

-

Lease Accounting Issues for Lessors and Lessees

-

Federal Government: Termination Rights and Federal Services Contract

-

State and Local Bankruptcy, Defaults and Workouts in Governmental Leasing

-

A Road Trip From California to Illinois: Financing Situations

Who should attend

Experienced municipal lessors, as well as those seeking insight into the municipal-leasing market, plus business executives, document-management specialists, syndicators, credit rating agencies, municipal bond insurers, investment bankers, government officials, manufacturers, vendors, third-party lessors, attorneys, credit and sales personnel, and individuals interested in pursuing a business-development opportunity.

See additional conference details. If you have questions about the conference, contact aglfmtg@talley.com.

Members register here:

http://secure.aglf.org/core/events/events.aspx

May 11-May 13

National Vehicle Leasing Association

The Allerton Hotel on Magnificent Mile

Chicago, Illinois

Members (before March 16) $495

each additional $395

Non-Members (before March 16 $625

(each additional $595)

After March 16th-Members $595

After March 16th-Non-Members $895

More Information:

http://www.nvla.org/Events/AnnualConference.aspx

September 15-17

Minneapolis, Minnesota

September 16-17

Atlanta, Georgia

October 23-25

Equipment Leasing and Financial Association

50th Annual Convention

JW Marriott Hill Country

San Antonio, Texas

November 11-12

Costa Mesa, California

-------------------------------------------------------------------

To view Leasing Association Events-Meetings Open to All, please click here.

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

April Beige Report---Business in Your Area

All twelve Districts reported that manufacturing activity increased since their previous reports.

Real estate markets for single family homes for the most part either were little changed from low levels or continued to weaken across all Districts.

Most Districts reported that labor market conditions were generally stronger than in their last reports. New York, Richmond, Chicago, Minneapolis, Kansas City, and Dallas all noted increased employment activity, while Boston and Atlanta reported modest or gradual improvement. However, Philadelphia, Cleveland and San Francisco mentioned limited or delayed hiring, while labor market conditions were mixed in the St. Louis District. Boston, New York, Cleveland, Richmond, and Dallas cited noticeable improvements in the manufacturing sector, and Boston and Kansas observed increased labor demand in the technology sector.

Most Districts cited loan demand as either unchanged or slightly improved since the last report, although many of the Districts citing improvements noted weak demand in some market segments. Banks in the Chicago District noted that their pipeline was still not robust, although manufacturing, food processing, and healthcare experienced some growth. Cleveland reported that business lending was strongest in healthcare and in energy. Consumer loan demand showed some improvement in the Richmond and San Francisco Districts, but was little changed in the Chicago District. Overall loan demand was weak or little changed in the Philadelphia and Kansas City Districts, although Philadelphia noted some improvement in commercial and industrial loans and in some types of commercial real estate loans. However, New York described household demand (for both consumer loans and mortgages) as weakening in its District, and St. Louis noted declines across most segments of its market, including real estate, commercial and industrial, and personal loans.

Several Districts reported that credit standards were unchanged or slightly tighter and that competition for quality loans was intense. For example, Cleveland described credit standards as unchanged, while New York noted no change for consumer loans but tightening for other categories in its District. San Francisco noted that credit standards remained somewhat restrictive. Cleveland characterized loan quality as stable or slightly improved and delinquency rates as stable or trending down. However, New York mentioned an uptick in delinquency rates for commercial and industrial loans. Competition for quality loans was described as intense in the Chicago, Dallas, and San Francisco Districts, putting downward pressures on rates and fees.

Boston

www.federalreserve.gov/fomc/beigebook/2011/20110413/1.htm

New York

www.federalreserve.gov/fomc/beigebook/2011/20110413/2.htm

Philadelphia

www.federalreserve.gov/fomc/beigebook/2011/20110413/3.htm

Cleveland

www.federalreserve.gov/fomc/beigebook/2011/20110413/4.htm

Richmond

www.federalreserve.gov/fomc/beigebook/2011/20110413/5.htm

Atlanta

www.federalreserve.gov/fomc/beigebook/2011/20110413/6.htm

Chicago

www.federalreserve.gov/fomc/beigebook/2011/20110413/7.htm

St. Louis

www.federalreserve.gov/fomc/beigebook/2011/20110413/8.htm

Minneapolis

www.federalreserve.gov/fomc/beigebook/2011/20110413/9.htm

Kansas City

www.federalreserve.gov/fomc/beigebook/2011/20110413/10.htm

Dallas

www.federalreserve.gov/fomc/beigebook/2011/20110413/11.htm

San Francisco

www.federalreserve.gov/fomc/beigebook/2011/20110413/12.htm

Full report:

http://www.federalreserve.gov/fomc/beigebook/2011/20110413/FullReport.htm

John Kenny Receivables Management

www.jrkrmdirect.com

• End of Lease Negotiations & Enforcement

• Fraud Investigation

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

The Solution to Your Credit & Accounts Receivable Needs

John Kenny

315-866-1167 | John@jkrmdirect.com

|

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Madison Capital: How Did We get here?

by Allan Levine, Chief Operating Officer

MADI$ON CAPITAL

(Originally appearing in the National Vehicle Leasing Association magazine,

but reprinted with permission of the author)

This is going to be a general chronicle of the last 40 years in the vehicle leasing business. That is, how much can I fit it all into a long page? Here ya go. If one was the average independent in 1971, you saw a few large lessors who were not your competition, but were evolving in the market place.

Some auto dealers were thinking about being in the business, but generally, never mustard up the guts. In short, independents were doing small fleets, consumer leases, with and without maintenance, and pickup and delivery for service for your best customers. One could have a thousand (10000) units out, with a combo of closed and open end leases, and make a good living. Maybe, you even had insurance in the package. This kept up for a number of years feeding off the investment tax credit. For those too young to remember, it was a 10% tax credit right off the top and you never had to give it back. That tax credit migrated to a 6% credit with IRS rules about guarantees rules, and recapture terminology.

In October, 1974, there was the first of the gas shortages, and lessors saw, in a day, their large gas guzzlers, lose a chunk of value. If one had staying power (Cash), you could hold the vehicles and talk their clients in to not turning vehicles in, and the values came back quickly as short memorized US buyer (lessees), came back to the large vehicle market.

In the late 70’s and 80’s, leasing companies began to get larger with mergers and acquisition’s setting the tone. The consumer lessor market changed a bit away from the mom and pop lessor operator as manufacturers figured out leasing was a way to move product, especially with inflated residuals, and cheap money. In 1983, interest rates went through the roof, business stalled a bit, and many dropped out, or saw the larger companies compete for the smaller fleets, while gobbling up some good size independents.

In the early 90’s, it was about that time, one saw competition a bit scary as manufacturers and larger independents were aggressively beating up the smaller independents. As an FYI, I figured out the equipment leasing business, and picked up equipment leases to make up for the 20% I lost in the auto side to larger companies. After all, if one had a good model, the90’s were good times for the survivors of the 80’s. So, the 90’s saw, the little guys fading, the large independents doing well, and the public companies making progressive noise. Fatalities occurred, but overall, a good time was there for the survivors. In the 90’s, funds were available, and there was plenty of business for all. That is, whether you were a manufacturer, an independent, or public companies, the late 90’s, if you survived, were a windfall.

In short, with a good credit history, banks were readily loaning money to the smaller lessors at rates where one could compete and make a good living. The big guys securitized, or floated their own paper. The industry was truly matured with manufacturers moving product with excellent lease pricing, confidence in residuals, and a public willing, for many, to view having the use of a vehicle as an option to owning. The large independents, found growth as business and the economy grew, and the public companies, battled each other and the large independents. Money was priced so all could stay in the game. Many began to get in the large truck leasing business. That turned out to be a death knoll for many bank leasing/funding sources in the 2008 economy collapse. There were many credit decision makers thinking nothing would go wrong. Plenty went wrong. Manufacturers took hits on inflated residuals and independents took hits on wrong credit decisions based on wishful thinking rather than prudent judgment , and companies went out that we all thought were perfect.

If you had too many closed end”over-residualized” vehicles, you lost money. To those who want to say, we did fine, that’s OK. Let us remember, whether you were a vehicle or equipment leasing company, 50% went out.

So, here we are. If you had cash, weren’t real leveraged, had the proper bad debt reserves, and never got carried away with dreams vs. good business planning, you are still here. You will fight another day, with the proper bad debt reserves, cash in your business, not leveraged more than 5 or 6 to 1, and have a good book, you will survive and grow.

Now, don’t take shots at me. Remember this is a snap shot. It applies to the industry as a whole and does not account for the absolute best or absolute worst. What is does want to do, is make you think about how you survived or failed. If you survived all this, you had a good client base, made good credit decisions, had mostly finance leases, or closed end with realistic residuals. If you didn’t follow the good credit and residual proper guidelines, you were an industry fatality. If one stretched your credit decisions or policies, took risks, then you saw many of your clients fold in the 2008 and 2009 mess. For the record, we are not exactly finished. Your real test is how you grow your company, large or small, over the next few years.

Keep your head down and stay within your model. Whether small, medium, or large, your need a business plan, with a profitability model that will make you successful. GOOD LUCK.

Biography of Leasing News Advisory Board member Allan Levinehttp://www.leasingnews.org/Advisory%20Board/Allan_Levine.htm

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

Historical dramas (“The Conspirator”) and animated features (“Rio”) hit theaters, while DVD releases get Oscar winners (“The King’s Speech”), harrowing adventures (“The Way Back”) and at least one masterpiece waiting to be rediscovered (“Kes”).

In theaters:

The Conspirator (Lionsgate): One of the darker chapters of American history is brought to the big screen in this eloquent period dramatization, directed by Robert Redford. Covering the events following the assassination of President Lincoln after the Civil War, it centers on the trial of Mary Surratt (Robin Wright), the boardinghouse owner whose own son took part in the crime and who is now facing charges of conspiracy. Frederick Aiken (James McAvoy) is the idealist young lawyer who’s assigned to defend her in court, a task that he takes on reluctantly at first but with increasing passion as he becomes aware of the political games threatening to bend the U.S. Constitution to their own goals. Sober-minded and strongly acted, the film is solid entertainment for fans of both historical dramas and courtroom thrillers.

Rio (20th-Century Fox): Blue Sky Studios, the animation unit responsible for “Robots” and the “Ice Age” movies, delivers another gem with this lush animated adventure, directed by Carlos Saldanha and set in the vibrant landscapes of Brazil. Our guide is Blu (voiced by “The Social Network’s” Jesse Eisenberg), a Maca bird who, after years of domesticated leisure, doesn’t even bother to spread his wings anymore. Suddenly paired up with a sassy, independent-mind female Maca named Jewel (Anne Hathaway), he finds himself back in his South American homeland, embarking on a quest that brings them face to face with a colorful menagerie of tropical critters hilariously voiced by the lies of Jamie Foxx, George Lopez and Tracy Morgan. Full of breezy characters and breathtaking vistas, the movie is heartfelt and eye-catching family fun.

Netflix Tip: Though best remembered as the superstar of such films as “Butch Cassidy and the Sundance Kid” and “All the President’s Men,” Robert Redford has also led a respectful second career as a maker of solid, serious dramas. The release of “The Conspirator” is a perfect occasion to get acquainted with Redford the director, with the Oscar-winning “Ordinary People” (1980), “A River Runs Through It” (1992), “Quiz Show” (1994) and “The Horse Whisperer” (1998) all available on Netflix. |

On DVD:

The King’s Speech (Weinstein Co.): Fresh from its Oscar-winning triumph, this acclaimed period piece reaches DVD shelves to cement its status as an audience favorite. Based on a true story, Tom Hooper’s film follows the unusual yet affecting bond that develops between two wildly different men during one of England’s most decisive periods. Having always suffered from a chronic stutter, the Duke of York (Best Actor winner Colin Firth) watches in horror as he’s suddenly crowned King George VI just as World War II looms ahead. In order to get rid of a speech impediment that could cost him the throne, he turns to an eccentric Australian speech therapist (Geoffrey Rush) for help. Full of award-caliber performances and warm vignettes, it’s prestige filmmaking that reworks British history for crowd-pleasing purposes.

The Way Back (Image): Acclaimed Australian filmmaker Peter Weir (“Dead Poets Society,” “The Truman Show”) offers a journey to remember in this visually arresting period drama, set in 1940 Siberia. Rather than remaining isolated from the rest of the world in a harsh labor camp, a group of prisoners try their chance by escaping and undergoing a grueling trek across the pitiless terrain. Among them are brooding thief Valka (Colin Farrell), Polish rookie Janusz (Jim Sturgess), and American veteran Smith (Ed Harris). As temperatures drop and their supplies dwindle, the men grapple with their greatest challenge: hanging on to their humanity in the face of overwhelming odds. Making splendid use of icy landscapes, Weir crafts an involving adventure about the ecstasy and agony of survival.

Kes (Criterion): Ken Loach, one of England’s most prestigious directors, scored an early triumph with this highly affecting drama from 1969, finally available in a polished DVD release from Criterion. Set in a working-class district of Yorkshire, the film follows 15-year-old Billy (David Bradley), a scrawny student struggling with bullying peers and teachers at school and with an indifferent family life at home. Things start to look up when he comes across a hurt kestrel falcon, which he nurses back to health and tames, naming his majestic new pet Kes. It’s the first flicker of hope in Billy’s otherwise dreary life, but can this newfound positive element survive its dismal surroundings? Using gritty locations and non-professional actors, Loach paints a raw yet at times poetic portrait of humanistic struggle.

[headlines]

--------------------------------------------------------------

Beaverton, Oregon-- Adopt-a-Pet

BARN/OUTDOOR CATS!

Domestic Short Hair Mix

GOT MICE??! WE OFTEN HAVE CATS NEEDING AN OUTDOOR HOME OR BARN HOME. THESE CATS ARE HAPPIEST WHEN THEY ARE OUTSIDE WITH A JOB TO DO! WE DO REQUIRE SUPPLEMENTAL FEEDING AND SOME TYPE OF SHELTER IN EXCHANGE FOR THEIR EXPERT MOUSING SERVICES! ALL CATS WILL BE SPAYED OR NEUTERED PRIOR TO PLACEMENT...NO EXCEPTIONS!! PLEASE EMAIL TO INQUIRE ON WHAT WE HAVE AVAILABLE OR TO PUT YOUR NAME ON A LIST TO BE CONTACTED

FATE from the Heart Animal Rescue

Beaverton, OR

Phone: Please use email

fateanimalrescue@yahoo.com

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

--- News Briefs

Schwartz Ex-Marine lets Marines get Evicted---Semper Fi

http://blog.nj.com/njv_mark_diionno/2011/04/nj_marine_corps_league_faces_e.html

Bank of the West moving more workers to Bishop Ranch

http://www.mercurynews.com/breaking-news/ci_17837482

Senate panel concludes Goldman Sachs profited from financial crisis

http://www.latimes.com/business/la-fi-crisis-probe-20110414,0,6709903.story

http://www.nytimes.com/2011/04/14/business/14crisis.html?_r=1&ref=business

U.S. banks still face big foreclosure risks

http://www.reuters.com/article/2011/04/13/us-financial-regulation-foreclosures-ana-idUSTRE73C72G20110413

World medical equipment rentals, leasing to reach $56 billion

http://www.dotmed.com/news/story/15799/

Winmark Corporation Announces First Quarter Results

http://finance.yahoo.com/news/Winmark-Corporation-Announces-bw-1536369863.html?x=0&.v=1

American Airlines sues online travel giant Orbitz

http://www.usatoday.com/money/industries/travel/2011-04-13-online-travel-wars-orbitz.htm

Viewers knock out Sugar Ray Leonard from 'Dancing with the Stars'

(He was my favorite, this show sucks)

http://www.contracostatimes.com/bay-area-news/ci_17832719?nclick_check=1

Sports Briefs----

Lakers spoil season finale in overtime 116-108

http://www.sacbee.com/kings/

Blackhawks can't solve Luongo, lose 2-0 in Game 1

http://www.chicagotribune.com/sports/hockey/blackhawks/ct-spt-0414-blackhawks-canucks-chicag20110413,0,764241.story

Barry Bonds guilty of obstruction of justice

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/04/13/MN491J01BR.DTL

Mark Purdy on Bonds Judgment

http://www.mercurynews.com/giants-headlines/ci_17840652?nclick_check=1

Kobe Bryant fined $100,000 for gay slur to official

http://www.bloomberg.com/news/2011-04-14/kobe-bryant-fined-100-000-for-derogatory-comments-to-official-nba-says.html

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

California Nuts Briefs---

BART Manager resigns, will get nearly $1 million

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/04/13/MN491IVQ4R.DTL&tsp=1

“Gimme that Wine”

Sixty Chefs in the Palace, and Still ‘Just Average’

http://dinersjournal.blogs.nytimes.com/2011/04/08/sixty-chefs-in-the-palace-and-still-just-average/?ref=dining

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

This Day in American History

1775- the first abolition organization was formed today as the Society for the Relief of Free Negroes Unlawfully Held in Bondage in Philadelphia, PA. The first president was John Baldwin.

1828- Noah Webster published his American Dictionary of the English Language. 22 years in preparation. It introduces "Americanisms" — 12,000 words never before in any dictionary.

1849- Isabella Stewart Gardner, art collector, began collecting art with her husband. Continued collecting after his death, designed the mansion to house it and then donated the finished museum which bears her name to the people of Boston in 1903. It houses one of the world's great collections of Dutch and Renaissance paintings. Her will specifies the collection remain exactly as she placed it. An absolutely fascinating place and this tourist loved it!

1865- President Abraham Lincoln was shot by John Wilkes Booth at Ford's Theater in Washington,D.C. He died the following morning. John Wilkes Booth, a well-known actor, was allowed upstairs at Ford's Theatre; giving him access to United States President Abraham Lincoln's private box as Lincoln watched "Our American Cousin". Just after 10 p.m., Booth, a Confederate sympathizer, shot Lincoln in the head, leaped to the stage below, and shouted, “Sic semper tyrannis!” Which means, "Thus always to tyrants!" the state motto of Virginia. In the fall, he broke his leg, but managed to escape the Washington, D.C. theatre, mount a horse, and flee to Virginia. Booth was tracked down and shot as he hid in a barn near Port Royal, Virginia. The next day, Lincoln died at 7:22 a.m.

http://memory.loc.gov/ammem/today/apr14.html

1865-The first National Bank to fail was First National Bank of Attica, New York, placed in receivership for injudicious banking and failure of large debtors.

1886 -an F4 tornado struck St. Cloud and Sauk Rapids, Minnesota. 61 people were killed an total damage was around $400,000. Over 200 homes were destroyed by this "spiral apparition".

1894 - In New York City, Thomas Edison demonstrated his kinetoscope. A viewer held 50 feet of film , about 13 seconds worth, that showed images of Annie Oakley and Buffalo Bill. The demonstration was called the first peep show, since you had to peep into the device to see the film. At that time, movies were not projected on a screen.

1897—Birthday of Horace McCoy, born Pegram Station, Tennessee, (some sources say Nashville) spent most of his adult life in Dallas, Texas. "Hard-boiled" American mystery writer and Hollywood scriptwriter. Contributor to "Black Mask" along with Raymond Chandler, James M. Cain, Dashiell Hammett, et al. His best known novel is the 1930s Depression drama They Shoot Horses, Don't They, filmed and directed by Sydney Pollack. Also wrote Kiss Tomorrow Goodbye; Corruption City.

http://www.tsha.utexas.edu/handbook/online/articles/view/MM/fmcbc.html

http://www.kirjasto.sci.fi/hmccoy.htm

1902 - J.C. (James Cash) Penney opened his first store -- in Kemmerer Wyoming. In partnership with Thomas M. Callahan and William Guy Johnson, Penney named the store "Golden Rule". The dry goods and clothing store had a first-year profit of $8,514.36 on sales of $28,898.11.

1910-. President William Howard Taft began a sports tradition by throwing out the first baseball of the season at an American League game between Washington and Philadelphia. Washington won 3-0.

1910- Dr. Elinor McGrath graduated from the Chicago Veterinary College to become the first woman veterinarian in the United States.

1912- RMS Titanic hits iceberg Just before midnight in the North Atlantic, the RMS Titanic fails to divert its course from an iceberg, ruptures its hull, and begins to sink. Twenty-one-year-old David Sarnoff picked up the Titanic's distress call on this day in 1912. Sarnoff, a telegraph operator running the world's most powerful radio telegraph station on top of Wannamaker's department store in New York, stayed at his post for seventy-two hours, receiving and transmitting information. Sarnoff went on to become a pioneer in radio and television broadcasting: He founded NBC in 1926, created an experimental television station for NBC in 1928, and eventually became president and chairman of RCA.

1912-famed band leader Les Brown born Reinerton, Pa.

1918- Lieutenant Douglas Campbell became the first American pilot to achieve the designation of ACE when he shot down his fifth German aircraft.

1925- The Cleveland Indians defeated the St. Louis Browns, 21-14, in their season opener. Cleveland scored 12 runs in the eight inning, thanks to five errors by the Browns.

1924 Shorty Rogers (Milton Rajonsky) Birthday

http://www.theiceberg.com/artist/25352/shorty_rogers/

http://www.spaceagepop.com/rogers.htm

http://www.vh1.com/artists/az/rogers_shorty/bio.jhtml

http://www.musicweb.uk.net/encyclopaedia/r/R129.HTM

(perhaps one of the best album covers was “Shorty Rogers Swings” with this girl in tight Capri pants, a first for its day.)

1925-birthday of tenor sax player Gene “Jug” Ammons, Chicago, Il.

http://www.thejazzfiles.com/JazzAmmons.htm

http://www.findagrave.com/cgi-bin/fg.cgi?page=gr&GRid=

6720676&pt=Gene%20'Jug'%20Ammons

http://www.amazon.com/exec/obidos/ASIN/B000000ZDD/

inktomi-musicasin-20/ref%3Dnosim/104-3995378-9027112

1928-Jack Teagarden cuts first solo, “She's a Great, Great Girl (Vi 21326)

1933- singer Buddy Knox was born in Happy, Texas. He was one of a number of southern country singers who broke into rock 'n' roll in the 1950's. "Party Doll" and "Hula Love" were his two big hits, both in 1957. Knox now makes his home in Dominion City, Manitoba, and still tours extensively. Like many rockabilly performers, he has a substantial following in Europe.

1935 - Babe Ruth played his first National League game in Fenway Park in Boston, Massachusetts. He was playing for the Boston Braves, not his old team the Red Sox, in this, his last year of pro ball in the major leagues. In this season, Ruth played 28 games, getting 13 hits and six home runs, before retiring.

1935 --A windstorm moves from the Dakotas into the southern plains, lifting powdery soil into a 1,000-foot-high cloud — a blizzard of black dust and muddy rain hundreds of miles wide. With winds of 60 miles per hour, the storm moves quickly, engulfing whole towns in total darkness by early afternoon. Motorists are stranded on highways; farmers can't find their way home; families cower in houses, watching the dust pack so thickly against windows it seems they are being entombed. In 1935 alone, the winds took an estimated 850 million tons of topsoil. By the time the drought ends in 1940, the Dust Bowl states lost one-third of their population.

http://www.usd.edu/anth/epa/dust.html

1939- "Grapes of Wrath" by John Steinbeck was published. He was considered very controversial by the people of Salinas and Monterey, actually moved to my home town of Los Gatos, due to all the people "giving me a hard time." Today he is very well regarded on the Monterey Peninsula and has become a tourist icon.

1941-Birthday of former baseball player Peter Edward “Pete” Rose, Cincinnati, Ohio.

1952---Top Hits

Wheel of Fortune - Kay Starr

Anytime - Eddie Fisher

Tell Me Why - The Four Aces

(When You Feel like You're in Love) Don't Just Stand There - Carl Smith

1955-The first Four Freshman album “Voices in Modern” released on Capitol.

1955-Fats Domino's "Ain't That A Shame" is released.

1955- Elston Howard, who will be named the American League's MVP in 1963, becomes the first black to play for the Yankees. The former Monarchs' catcher will appear in nine All-Star Games and 54 World Series games, compiling a .274 batting average during his 12-year playing career.

1956- the first video tape recorder for sounds and pictures was manufactured by Ampex Corporation, Redwood City, California, which could accommodate a 65-minute recording. The Columbia Broadcasting System purchased three of the video tape recorders at $75,000 each.

1960---Top Hits

The Theme from "A Summer Place" - Percy Faith

Greenfields - The Brothers Four

Mama - Connie Francis

He'll Have to Go - Jim Reeves

1960 - In New York City, the musical "Bye Bye Birdie" opened at the Martin Beck Theatre, starring Chita Rivera and Dick Van Dyke. It ran for 607 performances.

1962 - Elgin Baylor of the Los Angeles Lakers scored 61 points in the NBA Playoffs against the Boston Celtics.

1967- At Yankee Stadium, Billy Rohr, 21, is one out from pitching a no-hitter in his major league debut when Elston Howard singles on a 3-2 pitch ruining the rookie's shot at immortality. A heartbroken six year-old fan, John-John, sitting near the Red Sox dugout has to be consoled by his mother, Jackie Kennedy.

1968---Top Hits

Honey - Bobby Goldsboro

Young Girl - The Union Gap

Cry like a Baby - The Box Tops

You are My Treasure - Jack Greene

1968-De Vicenzo Signs Incorrect Card. After concluding the final round of the Masters with a magnificent 66, Argentinean Roberto de Vincenzo signed an incorrect scorecard that mistakenly recorded a par four on the 17 th hole instead of a birdie three. Under the rules of golf, de Vicenzo was penalized one stroke, and Bob Goolby declared the winner. Said de Vincenzo, “ What a stupid I am.”

1969 - At the Academy Awards ceremony, Best Actress winner Barbra Streisand shocked the viewing audience with her see-through, bell-bottomed Scaasi pajamas. Opinions about her revealing outfit were mixed, but Streisand then angered some Academy members when she left the Governors' Ball after the ceremony to host a party at her house. Streisand, who had tied for the award with Katharine Hepburn, won for her electrifying film debut performance as Fanny Brice in Funny Girl.

http://www.infoplease.com/ipa/A0149117.html

1969-The first major league baseball game played outside the US occurred as the Montréal Expos hosted the St. Louis Cardinals at Jarry Park. The Expos, an expansion team, won 8-7.

1970 - Milwaukee Buck basketball player Lew Alcindor was named NBA Rookie of the Year. Alcindor later changed his name to Kareem Abdul-Jabbar.

1975- Having already received two gold records for the albums, "The Captain and Me" and "What Once Were Vices Are Now Habits," the Doobie Brothers pick up their first gold single for their country flavored "Black Water."

1976---Top Hits

Disco Lady - Johnnie Taylor

Let Your Love Flow - Bellamy Brothers

Right Back Where We Started From - Maxine Nightingale

'Til I Can Make It on My Own - Tammy Wynette

1980 - Kramer vs. Norma, Apocalypse vs. Jazz. That's how the honors were divided at the 52nd Annual Academy Awards ceremony at the Dorothy Chandler Pavilion in Los Angeles. Johnny Carson was hosting quite a contest! But the Oscar for Best Actor in a Supporting Role went to Melvyn Douglas for his performance in "Being There". Was it going to be an upset? "Being There" was a long shot to win Best Picture and this was its first award all evening. "All That Jazz" had already won four of the golden statuettes and "Apocalypse Now", two. Next, it was Meryl Streep who picked up the Best Supporting Actress Oscar and Dustin Hoffman, Best Actor, for their roles in "Kramer vs. Kramer", making it a trio of Oscars for "Kramer", so far. Then "Norma Rae" picked up two awards: Best Music/Song, "It Goes like It Goes", David Shire (music), Norman Gimbel (lyrics) and Best Actress, Sally Field. But it was in the cards for "Kramer vs. Kramer" as it won for Best Director (Robert Benton), and then, Best Picture (Stanley R. Jaffe, producer). Going into the evening, "All That Jazz" and "Kramer vs. Kramer" each had nine Oscar nominations, "Apocalypse Now" had eight, and "Norma Rae", four.

1984---Top Hits

Footloose - Kenny Loggins

Against All Odds (Take a Look at Me Now) - Phil Collins

Hello - Lionel Richie

Thank God for the Radio - The Kendalls

1985 -record early season warmth occurred in the west. The temperature at Phoenix, Arizona reached 100 degrees which tied the record for the earliest in the season the mercury climbed to the 100 degree mark. The previous date was back in 1925 on this same day. At Lander, Wyoming, a high reading of 77 degrees was the warmest for so early in the spring season.

1985 - The once-notorious Lexington Hotel in Chicago, Illinois was visited by Geraldo Rivera and a camera crew. A record television audience watched as the long-sealed vault of racketeer, Al Capone was opened during an overly advertised television special. Geraldo found broken bottles and no hint that Capone and his gang had ever stashed anything there.

1986- the United States launches air strikes against Libya in retaliation for the Libyan sponsorship of terrorism against American troops and citizens. The raid, which began shortly before 7 p.m. EST (2 a.m., April 15 in Libya), involved more than 100 U.S. Air Force and Navy aircraft, and was over within an hour. Five military targets and “terrorism centers” were hit, including the headquarters of Libyan leader Muammar al-Qaddafi. During the 1970s and '80s, Qaddafi's government financed a wide variety of Muslim and anti-U.S. and anti-British terrorist groups worldwide, from Palestinian guerrillas and Philippine Muslim rebels to the Irish Republican Army. In response, the U.S. imposed sanctions against Libya, and relations between the two nations steadily deteriorated. In 1981, Libya fired at a U.S. aircraft that passed into the Gulf of Sidra, which Qaddafi had claimed in 1973 as Libyan territorial waters. That year, the U.S. uncovered evidence of Libyan-sponsored terrorist plots against the United States, including planned assassination attempts against U.S. officials and the bombing of a U.S. embassy-sponsored dance in Khartoum, Sudan. Today he has agreed to peace in the Middle East, perhaps due to the military action in Iraq.

1988 - A weather disturbance off the southern coast of California brought parts of southern California their first rain in six weeks. Rain- slickened roads resulted in numerous accidents in southern California, including a ten car pile-up at Riverside

1994---Top Hits

Bump N Grind- R. Kelly

The Sign- Ace Of Base

Without You/Never Forget You- Mariah Carey

Mmm Mmm Mmm Mmm- Crash Test Dummies

1999- In a 7-6 loss to the Blue Jays, Devil Ray Jose Canseco becomes the 28th player in major league history to hit 400 home runs.

1999---Top Hits

No Scrubs- TLC

Believe- Cher

What s It Gonna Be?!- Busta Rhymes Featuring Janet

Every Morning- Sugar Ray

2001- By scoring in their 175th consecutive game, the Reds set the modern National League record for not being shut out by an opponent. Ironically, to break the record, Cincinnati beats Al Leiter and the Mets, 1-0, the last team and pitcher to blank the franchise.

Stanley Cup Champions This Date

1928 New York Rangers

1931 Montereal Canadiens

1948 Toronto Maple Leafs

1955 Detroit Red Wings

1960 Montreal Canadiens

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()