![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Monday, April 16, 2018

Today's Equipment Leasing Headlines

Post Here a Free Ad for Seeking a New Career

100 Words Reach the Banking, Finance, Leasing Industries

Top Stories -- April 9 - April 13

(Opened Most by Readers)

30th Annual ELFA National Funding Conference

A Huge Success…

By Hugh Swandel, The Alta Group

California Interest Rate Bill for Commercial Loans

l Stripped, But Still Requires APR Disclosure

By Tom McCurnin, Leasing News Legal Editor

Leasing Industry Help Wanted

Positions Available

Tax Affairs

Cartoon

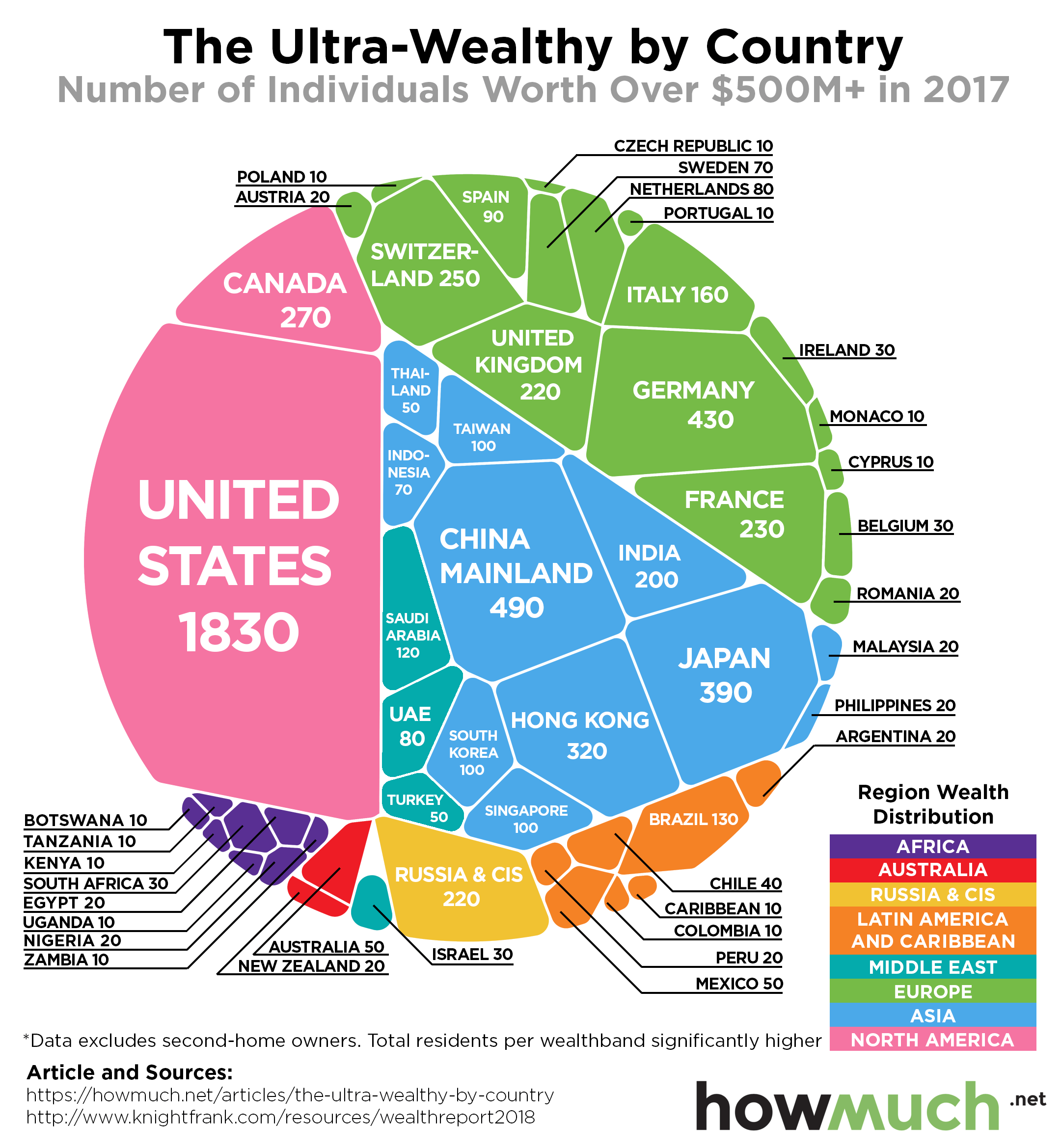

Number of Individuals’ Worth over $500M+ 2017

Chart of the Ultra-Wealthy by Country

Money from tax reform will not go to retail

By Jacqueline Renfrow - FierceRetail.com

2018 Economic Outlook Forecasts 8.5% Expansion

in Equipment and Software Investment/ 2.7% GDP Growth

Terrier/Mix

Dorchester Paws - Summerville, SC 29483

2018 NAELB Annual Conference List of Exhibitors

April 26 -28, Flamingo Las Vegas-Register Now!

News Briefs---

Hackers stole a casino's high-roller database

through a thermometer in the lobby fish tank

Fintech in the US is stymied by old-fashioned regulators

legislation to help smaller, innovative financial companies to grow

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer,

it is considered a “byline.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Post Here a Free Ad for Seeking a New Career

100 Words Reach the Banking, Finance, Leasing Industries

Categories to post:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Please send email to kitmenkin@leasingnews.org

to post your ad.

--------------------------------------------------------------

Top Stories -- April 9 - April 13

(Opened Most by Readers)

(1) Vendors’ Number One Problem, Not the Applicant

By John Kenny, Lease Police

http://leasingnews.org/archives/Apr2018/04_13.htm#vendors

(2) New Hires/Promotions in the Leasing Business

and Related Industries

http://leasingnews.org/archives/Apr2018/04_13.htm#hires

(3) Correction: Most Influential Lawyers

in Equipment Finance and Leasing

http://leasingnews.org/archives/Apr2018/04_11.htm#correction

(4) Don Link to Head New Hitachi Division

Now Part of America Vendor Service

http://leasingnews.org/archives/Apr2018/04_09.htm#don

(5) The Necessity of Landlord Waivers

By Barry M. Marks, Esq., CLFP

http://leasingnews.org/archives/Apr2018/04_11.htm#waivers

(6) Where Home Buyers Need Deep Pockets

Salary Required to Buy a Home in U.S. Cities - Statista

http://leasingnews.org/archives/Apr2018/04_13.htm#where

(7) Alliance Capital Acquires Cardinal Business Financing

Enhances North American Vendor Finance Business

http://leasingnews.org/archives/Apr2018/04_11.htm#alliance

(8) Victims of American Disabilities Act Law Firm Mill

Go on the Offensive

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Apr2018/04_09.htm#victims

(9) A big shift happened in the market for electric cars last year

and it says a lot about the kinds of cars Americans want

http://leasingnews.org/archives/Apr2018/04_11.htm#shift

(10) How One Community Bank Built

a Nationwide Healthcare Equipment Finance Business

https://bankingjournal.aba.com/2018/04/how-one-community-bank-built-a-nationwide-healthcare-equipment-finance-business/

[headlines]

--------------------------------------------------------------

30th Annual ELFA National Funding Conference

A Huge Success…

By Hugh Swandel, The Alta Group

The annual ELFA National Funding Conference was held at the Swissotel in Chicago with well over 600 in attendance. This year’s event broke all previous records for attendance and the level of engagement by attendees was extremely high. Those looking for funding were embraced by many sources of capital looking to deploy their excess liquidity. The exhibit hall was full of exhibitors and the pre-scheduled 20 minute meetings were well attended.

Those in attendance were very upbeat and attendees at the opening reception were in an upbeat mood. There was much discussion about good growth in funding levels but continued concerns about margin compression and relaxed credit standards. A number of parties could be heard stating that “we never learn” and the high liquidity in the marketing has led to a new wave of bad price to risk practices. Our industry seems doomed to repeat past mistakes.

There was cautious optimism about the economy with many sensing that the recent corporate tax cuts were creating a net benefit for the industry. Optimism was tempered by concern regarding the potential for a Presidential misstep to create uncertainty in the business community.

This event has become a high value benefit to ELFA members but it may be time for the ELFA to rethink the location and format of the event. The venue lacks adequate hotel room capacity causing many attendees to have to stay at nearby hotels and make their way back over to Swissotel for meetings. It is also a well-known fact that attendees use their time in Chicago to meet clients in the prescheduled appointments in the exhibit hall but also arrange meetings with non-attendees in the hotel lobby and other spaces. A number of attendees were frustrated by the limited meeting space caused by the record attendance as well as hotel renovations.

The ELFA needs to reconsider the practice of cutting off appointment scheduling a full 5 days before the event is due to begin. There seems to be not apparent reason for having the early cut off and many exhibitors have become frustrated by the need to develop a secondary appointment scheduling system for the many registrants who miss the cut off but need access to the exhibitors.

Many attendees have been coming to the Chicago event for more than a decade and gain great benefit from the ELFA efforts to bring a great community of potential business partners together in one space. The event is a tremendous success but has the potential to be further improved by addressing concerns expressed by regular and new attendees.

Hugh Swandel,

Senior Managing Director, Canada,

The Alta Group

www.thealtagroup.com

204.477.0703 direct

204.996.4844 mobile

hswandel@thealtagroup.com

[headlines]

--------------------------------------------------------------

California Interest Rate Bill for Commercial Loans/

Stripped, But Still Requires APR Disclosure

By Tom McCurnin

Leasing News Legal Editor

Request:

Please send your opinion regarding whether interest rates should be disclosed on commercial loans, capital leases, MCA, in California: tmccurnin@bkolaw.com

SB-1235.

While I’m not a fan of regulation, when the Consumer Finance Protection Bureau (CFPB) policy changed, I knew the States would undertake their own forms of regulation. Sometimes I’d rather deal with the devil I know, than regulations from 50 different states. Today’s development is California Senate Bill 1235, which ostensibly calls for broad commercial interest rate disclosure. The bill goes before the Senate Banking and Financial Institutions Committee this Wednesday, April 18th. (1)

After its first hearing, the author re-wrote the bill, listening to colleagues remarks, and added some well-needed definitions. The definitions cement the idea that all commercial loan products, including merchant cash advances, will require interest rate disclosure. The author threw the industry a bone, limiting such disclosure requirement to $500,000 or less. The details follow.

▪ The Preamble Was Changed. The old preamble recited that a willful violation of the California Finance Law was a crime. While that is true, that sentence was removed. The old preamble recited that the bill would pertain to merchant cash advances. That sentence was taken out, but I believe interest rate disclosures will still apply to a MCA. Of course, the provisions of the California Finance Lenders License do not apply to banks (everyone knows this), but the new preamble makes this clear. It should be noted that the preamble is not part of the bill, but will be included in the bill’s comments, for purposes of interpretation.

The new preamble reads as follows:

“This bill would require a provider who facilitates commercial financing to a recipient, as defined, to disclose specified information relating to that transaction to the recipient at the time of extending a specific offer of commercial financing, and to obtain the recipient’s signature on that disclosure before consummating the commercial financing transaction. The bill would require that disclosure to include specified information, including the total amount of funds provided, information related to the payments to be made, and the total dollar cost of the financing. The bill would provide that the provisions of this bill apply to a provider who consummates or arranges more than 5 commercial financing transactions during a calendar year to a recipient. The bill would specifically provide that the provisions of this bill do not apply to a provider who is a depository institution, which this bill would define to include specified state and federal financial institutions”

▪ There Are New Definitions. The author has included new definitions, which make it clear that commercial equipment financing and MCA are roped into this new law

The law applies to “Providers.” A “Provider” is someone who facilitates more than five Commercial Financing Transactions a year. This definition would now include brokers. This is consistent with California law which exempts those lenders that make five or less loans in a year, the so-called di minimis exception.

The law applies to “Commercial Financing Transactions.” A Commercial Financing Transaction is broadly worded to include, “an accounts receivable purchase transaction, commercial loan, or commercial open-end credit plan intended by the recipient for use primarily for other than personal, family, or household purposes.” Because MCA transactions typically involve the purchase of future accounts, as opposed to a loan, the author seems to loop MCAs into this definition.

The law applies to “Accounts Receivable Purchase Transactions,” which is defined as a transaction in an amount of $2,500 or more, as part of an agreement requiring a recipient to forward or otherwise sell to the provider all or a portion of accounts, payment intangibles, or cash receipts that are owed to the recipient or are collected by the recipient during a specified period or in a specified amount. For those from the east coast, New York has case law, which states that the purchase of receivables is not a loan. California law is the exact opposite, so this provision is not a surprise.

The law applies to “Recipients” of a “Commercial Financing Transactions.” A Recipient is defined as a person who is presented with a specific commercial financing offer by a “Provider” that is equal to or less than $500,000. Thus, this statute has now exempted commercial loans over $500,000. This is understandable, since those types of loans will be taken by sophisticated borrowers.

The law does not apply to “Depository Institutions,” which are broadly defined as a bank operating under a charter, a savings and loan association operating under a charter, or a credit union operating under state law. Presumably, this definition includes subsidiaries of banks, which has been my opinion.

▪ Banks Are Exempt. The previous version was murky whether it applied to banks, so the author added a new definition making sure that banks do not have to comply with this new law. That said, most banks do provide Reg. Z notice.

▪ Disclosure Terms. Disclosure methods remain unchanged from the prior version. The disclosures require the lender or broker to disclose the total loan funds, labeled “Total Amount of Funds Provided,” the total amount payments, labeled “Total of Payments,” and the total cost of the commercial financing, labeled “Total Dollar Cost of Financing.” The annual percentage rate (APR) must be calculated according Regulation Z, labeled “APR.”

▪ Language and Font Size of Disclosures. The original bill had a provision that the disclosures had to be in the same language in which the loan was negotiated. However, that created uncertainty because some lenders may not know what language the broker negotiated the deal. This provision has been removed. The font size was added to 10 point font, which is typical for the California Financial Code.

What are the takeaways from this new legislation?

▪ First, Why Shouldn’t APRs be Disclosed? This is really the elephant in the room. I get it that with daily ACH debits, the APR would be a challenge to figure out. That is actually my point—if it is too complicated for the finance industry to figure out, why should borrower be saddled with this mathematical problem? And if the APRs are simple to figure out, then what’s the problem with disclosing them? I’d like to hear the readers make the case for not disclosing APRs Email me: tmccurnin@bkolaw.com

▪ Second, New York Has Held That MCAs are Purchases, Not Loans, But This Is California. California and New York have historically had different opinions on the subject. I will note that if the advance is truly a purchase of receivables without any recourse to the borrower or guarantor, then MCAs should not be required to disclose APRs because they are not loans. But every reported case I’ve seen in New York, issued judgments against the borrower and guarantors. MCA lenders can’t have it both ways, claiming the transaction is a purchase but then obtaining a deficiency judgment against the borrower. Pick one.

▪ Third, APR Disclosure is Limited to $500,000 Loans or Less. A merchant which borrows $10,000 simply will not have the skill set to figure out an APR. A sophisticated borrower that borrows $500,000 will have “people.”

Therefore, the bottom line to SB-1235 is that it has been significantly re-drafted, cementing the notion that MCA transactions are subject to disclosure, but limiting disclosure to deals between $2,500 and $500,000. Don’t be surprised at this bill, because I saw it coming when present administration saw fit to de-regulate the CFPB. Any such regulation will now be up to the states, a task which the states have now undertaken. I think interest rate disclosure is a good thing and enables borrowers to make better choices. This is consistent with California Financial Code § 22000 which establishes as a policy of California to clarify and simplify loan policies.

If any reader wants to make the case that non-disclosure is a good idea, please feel free to email, and we’ll include your comments in one of the future articles: tmccurnin@bkolaw.com

- Current Bill with revisions:

http://leginfo.legislature.ca.gov/faces/billVersions

CompareClient.xhtml?bill_id=201720180SB1235

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

Now’s the Time to Apply

We are looking for: What sets CoreTech apart from other equipment leasing companies is our team members and impeccable reputation. Are you unhappy with the ethics of your company and the promises made to you? Join our team, positions are available in Newport Beach, CA and remotely. To learn more, please click here www.coretechleasing.com |

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

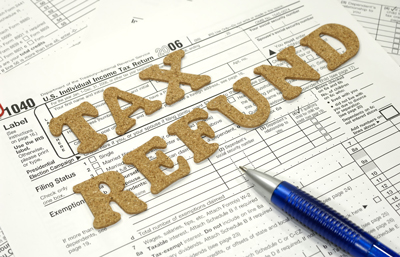

Money from tax reform will not go to retail

By Jacqueline Renfrow - FierceRetail.com

Although money from tax reform is trickling down to consumers, it seems this spending may not extend into retail. That's according to the findings from the 2018 BDO Consumer Beat Survey.

Thirty percent of earners say that their take-home pay has increased since tax reform, but 67% of consumers do not plan to increase their regular spending after tax season. And for those who do plan to spend, 24% will spend their refunds on experiences, not retail products.

Natalie Kotlyar, partner and national leader of BDO’s retail & consumer products practice, says that overall, retailers haven’t seen a spike in sales since the tax reform as consumers haven’t yet felt the benefits of individual tax cuts.

Kotlyar says that these planned expenses are no surprise, "given that consumers today are more prone to spend their discretionary income on experiences, rather than purchases."

According to the survey, consumers will spend their additional paycheck dollars on food, 60%; entertainment and tech, 42%; apparel, 31%; and health and beauty, 23%.

"In the short term, the grocery, entertainment and tech sectors are likely to see some sales increase thanks to the tax overhaul, but it’s not yet clear whether reform will translate into long-term gains for the retail industry," Kotlyar added. "While general U.S. consumer spending has gradually increased in recent months, retailers shouldn’t expect a windfall in sales anytime soon."

Of those consumers expecting a tax refund for 2017, many plan to treat themselves: 24% on experience, 22% on entertainment and tech, 16% on apparel and 15% on food.

In addition, the survey looked at consumers' views of taxes in general. Surprisingly, shoppers are pretty evenly divided on whether they notice online sales tax.

About 51% of consumers consider the sales tax before making a purchase, a figure that is consistent across all ages, regions, income levels and education.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

2018 Economic Outlook Forecasts 8.5% Expansion

in Equipment and Software Investment/ 2.7% GDP Growth

Washington, DC, April 11, 2018 – After solid growth in 2017, investment in equipment and software will likely continue to strengthen in 2018 and is projected to expand 8.5 percent (down slightly from 9.1 percent in the Economic Outlook published in December) according to the Q2 update to the “2018 Equipment Leasing & Finance U.S. Economic Outlook” by the Equipment Leasing & Finance Foundation.

Business investment is expected to expand robustly, and stable credit conditions should foster an environment conducive to growth. Overall, the economy is expected to grow 2.7% in 2018 (unchanged from the previous Outlook). The quarterly report by the Foundation, which is focused on the $1 trillion equipment leasing and finance sector, highlights key trends in equipment investment and places them in the context of the broader U.S. economic climate.

Jeffry D. Elliott, Foundation Chairman and Senior Managing Director of Huntington Equipment Finance said, “Business conditions continue to be favorable and are forecasted to be strong throughout 2018. As businesses implement their capital expenditure strategies in regard to tax reform, many equipment finance organizations are expecting the remainder of 2018 to expand the funding of transactions.”

Highlights from the study include:

- 2018 capital spending should remain on solid footing despite a slight increase in financial stress, and investment in equipment and software is expected to grow by 8.5 percent. Credit market conditions generally remain healthy, though private sector loan growth has moderated in recent months. This is in part due to rising interest rates and increased cash flow from tax reform that have combined to push some businesses toward cash financing.

- Overall, the economy should grow at a relatively steady pace over the course of the year, despite what appears to be a softer-than-anticipated first quarter. The labor market will continue to firm and should result in increased consumer spending, while business investment will likely be a major bright spot in the coming year as tax cuts and a lighter regulatory touch encourage capex

- Sustained economic growth and an increasingly tight labor market are also anticipated and will continue to put upward pressure on inflation, leading the Federal Reserve to lift its benchmark interest rate three more times in 2018, for a total of four rate hikes over the year.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is included in the report, tracks 12 equipment and software investment verticals. In addition, the “Momentum Monitor Sector Matrix” provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength. Overall, investment in most equipment verticals should remain solid in 2018. Over the next three to six months:

- Agriculture machinery investment growth may slow somewhat.

- Construction machinery investment growth should remain strong.

- Materials handling equipment investment growth should remain solid.

- All other industrial equipment investment growth may decelerate.

- Medical equipment investment growth may have peaked and is likely to decline.

- Mining and oilfield machinery investment growth may weaken but remain positive.

- Aircraft investment growth is likely to

- Ships and boats investment growth is expected to decline.

- Railroad equipment investment growth may decline modestly.

- Trucks investment growth is expected to remain positive.

- Computers investment growth should remain

- Software investment growth should remain steady.

The Foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economic and public policy consulting firm Keybridge Research LLC. The annual economic forecast provides a three-to-six-month outlook for industry investment with data, including a summary of investment trends in key equipment markets, credit market conditions, the U.S. macroeconomic outlook, and key economic indicators. The Q2 report is the first update to the 2018 Annual Outlook and will be followed by two more quarterly updates prior to the publication of the 2019 Annual Outlook in December.

Q2 2018 ELFF U.S. Economic Outlook (22 pages)

http://leasingnews.org/PDF/ELFF2018Outlook.pdf

### Press Release ##########################

[headlines]

--------------------------------------------------------------

Terrier/Mix

Dorchester Paws - Summerville, SC 29483

Freya

ID# 35177087

Female

11 Months old

Size: Small

Color: Black/White

Spayed

Declawed: no

Site: Frances R. Willis, SPCA

Location: Starkey Dog Kennels

Intake Date: 3/29/2018

Adoption Price: $350.00

Dorchester Paws

136 Four Paws Lane

Summerville, SC 29483

843-871-3820

Hours

Sunday – Thursday: 12pm – 5pm

Friday: 1pm – 7pm

Saturday: 12pm – 7pm

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

[headlines]

--------------------------------------------------------------

2018 NAELB Annual Conference Planning Committee

Chair

John Boettigheimer, Centra Funding LLC

Board Liaison

Carrie Radloff, CLFP, American Financial Partners

Committee Members

Ron Elwood, Navitas Credit Corp.

Beth Malin, Capflow Funding Group

Taylor Moseley, General Financial

2018 ANNUAL CONFERENCE EXHIBITORS

360 Equipment Finance

4 Hour Funding

Advantage Funding

American Lease Insurance

Amur Equipment Finance

Ascentium Capital

Bankers Capital

BlackRiver Business Capital, LLC

Blue Bridge Financial LLC

BlueVine

Bryn Mawr Funding

BSB Leasing LLC

Business Capital Leads

C.H. Brown Co. LLC

Channel Partners Capital

CLFP Foundation

Cobra Capital

Collateral Only Loans

Commercial Funding Partners, LLC

Crestmark Equipment Finance

Dakota Financial LLC

Equipment Leasing Group Of America, LLC

Expansion Capital Group

Financial Pacific Leasing, Inc.

First Federal Leasing

Fleet Evaluator

Fora Financial

Global Financial & Leasing Services

Hanmi Commercial Equipment Finance

instaCOVER

Investor's Choice Commercial Leasing, LLC

JB&B Capital, LLC

KS StateBank, Baystone Government Finance

Marlin Business Bank

Navitas Credit Corp

NCMIC Professional Solutions

North Mill Equipment Finance, LLC

OnDeck Capital, Inc.

Orange Commercial Credit

Orion First

Paradigm Equipment Finance

Pawnee Leasing Corporation

Quality Leasing Co., Inc.

Quiktrak, Inc.

RapidAdvance

TEAM Funding Solutions

Tetra Financial Group

TradeRiver USA

VFI Corporate Finance

YES Leasing

Your Leasing Solution, LLC

About the Conference

https://www.naelb.org/events/event-description?CalendarEventKey=1a208ca7-ee11-44ee-89c8-3fd7d3550173&Home=%2fhome

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Hackers stole a casino's high-roller database

through a thermometer in the lobby fish tank

http://www.businessinsider.com/hackers-stole-a-casinos-database-through-a-thermometer-in-the-lobby-fish-tank-2018-4

Fintech in the US is stymied by old-fashioned regulators legislation to help smaller, innovative financial companies to grow

https://www.ft.com/content/64e22402-3e38-11e8-bcc8-cebcb81f1f90

We are looking for: What sets CoreTech apart from other equipment leasing companies is our team members and impeccable reputation. Are you unhappy with the ethics of your company and the promises made to you? Join our team, positions are available in Newport Beach, CA and remotely. To learn more, please click here www.coretechleasing.com |

[headlines]

--------------------------------------------------------------

You May Have Missed---

The Multi-Billion Dollar Industry

that Makes Its Living from Your Data

http://www.visualcapitalist.com/personal-data-ecosystem/

[headlines]

--------------------------------------------------------------

|

[headlines]

--------------------------------------------------------------

Sports Briefs---

Reuben Foster won't take part in 49ers' offseason program

http://www.sacbee.com/sports/nfl/san-francisco-49ers/article208975354.html#emlnl=SportsBreakingNewsAlert

Eagles release CB Daryl Worley after he was arrested

tased near team facility

https://www.usatoday.com/story/sports/nfl/eagles/2018/04/15/reports-eagles-cb-daryl-worley-tased-arrested-near-team-facility/518556002/

Pats' Rob Gronkowski will join Tom Brady on sideline

when offseason program starts

https://www.usatoday.com/story/sports/nfl/patriots/2018/04/15/patriots-rob-gronkowski-tom-brady-sideline-offseason-program/518955002/

Seahawks bring in Janikowski on 1-year deal

http://www.theredzone.org/Blog-Description/EntryId/69471/Seahawks-bring-in-Janikowski-on-1-year-deal

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Wine Country burn scars explode with wildflowers:

'It's off the charts'

https://www.sfgate.com/bayarea/article/wildfire-wildflowers-Sonoma-Napa-fire-followers-12832083.php

San Francisco Top City with Financial Savvy in US

Slide-Show

https://www.sfgate.com/news/article/San-Franciscans-are-the-best-when-it-comes-to-12832890.php

Pricey retrofit proposed for sinking Millennium Tower in SF

https://www.sfgate.com/bayarea/matier-ross/article/Pricey-retrofit-proposed-for-sinking-Millennium-12833795.php?t=07693ccce8

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California billionaire buys Oregon wine brand Acrobat

https://www.bizjournals.com/portland/news/2018/04/05/california-billionaire-buys-oregon-wine-brand.html

Connecticut Distributors Inc. Acquires New England Wine & Spirits

https://www.winebusiness.com/news/?go=getArticle&dataid=197769

Good decade for California wine, fresh market grapes

http://www.westernfarmpress.com/grapes/good-decade-california-wine-fresh-market-grapes

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1789 - George Washington left Mount Vernon, VA for the first presidential inauguration in New York.

1813 - The first federal government mandated factory standardization was made with a contract specifying interchangeable parts. The contract was with Colonel Simeon North of Berlin, CT. The contract was for 20,000 pistols at $7 each to be produced within five years. It stipulated that the “component parts of the pistols are to correspond so exactly that any limb or part of one pistol may be fitted to any other pistol of the 20,000.” Colonel North established his pistol factory in 1810 in Saddle Hill, a suburb of Middletown. The factory produced about 10,000 pistols a year.

1818 - The Senate ratified the Rush-Bagot Treaty, establishing the border with Canada, between the United States and the United Kingdom, limiting naval armaments on the Great lakes and Lake Champlain, following the War of 1812. It was confirmed by Canada, following Confederation, in 1867. The treaty provided for a large demilitarization of lakes along the international boundary, where many British naval arrangements and forts remained. The treaty stipulated that the United States and British North America could each maintain one military vessel and one cannon on Lake Ontario and Lake Champlain. The remaining Great Lakes permitted the United States and British North America to keep two military vessels "of like burden" on the waters armed with "like force." The treaty, and the separate Treaty of 1818, laid the basis for a demilitarized boundary between the U.S. and British North America.

1851 - The famous "Lighthouse Storm" raged near Boston Harbor. Whole gales and gigantic waves destroyed Minot Light with its two keepers still inside. The storm resulted in great shipping losses and coastal erosion.

1861 - President Abraham Lincoln made a call for volunteers to serve three months, the day after the surrender of Fort Sumter, South Carolina. His call was for 75,000 volunteers. The first regiment to respond to the call was the Ringgold Light Artillery of Reading, PA, known as the "First Defenders," commanded by Dr. John Keys. Their first engagement took place on September 24, 1861 at Hanging Rocks, West Virginia. When men were not volunteering, a draft was called with a fee if you did not join. More than one hundred thousand soldiers were hired to fight for the North. Many of these were immigrants, expressly brought over, says Shelby Foote, “by companies newly-formed to supply the demand.” More than eighty-five thousand Americans who were drafted in the war got out of going by paying a $300 commutation fee. Among these were banker J.P. Morgan and Theodore Roosevelt, Sr., father of President Theodore Roosevelt. So many young men with means remained civilians that northern universities were able to enroll about as many students from the North during the war as they had before when students came also from the South. No doubt the people who stayed home later suffered guilt feelings, but the fact is they did stay home. And more than two hundred thousand Americans who joined the Union Army subsequently deserted. (Shelby Foote, “The Civil War: A Narrative” trilogy (1958, 1963, 1974)).

1863 - Congress abolished slavery in the District of Columbia. One million dollars was appropriated to compensate owners of freed slaves, and $100,000 was set aside to pay district slaves who wished to emigrate to Haiti, Liberia or any other country outside the US. http://memory.loc.gov/ammem/today/apr16.html

1867 – Aircraft pioneer Wilbur Wright (d. 1912) was born in Millville, IN. The Wright brothers were two American aviators, engineers, inventors, and aviation pioneers who are generally credited with inventing, building, and flying the world's first successful airplane. They made the first controlled, sustained flight of a powered, heavier-than-air aircraft on December 17, 1903, four miles south of Kitty Hawk, NC. In 1904–05, the brothers developed their flying machine into the first practical fixed-wing aircraft. Although not the first to build and fly experimental aircraft, the Wright brothers were the first to invent aircraft controls that made fixed-wing powered flight possible.

1869 - The first Consul who was African-American was Ebenezer Don Carlos Bassett, consul general to Haiti, where he served from this date until November 27, 1877.

1880 - A tornado near Marshall, MO, carried the heavy timbers of an entire home a distance of twelve miles

1881 - In Dodge City, Bat Masterson fought his last gun battle. Masterson moved to Denver and established himself as a leading gambler. He took an interest in prizefighting and became a leading authority on the sport. He knew, and was known by all of the heavyweight champions from John L. Sullivan to Jack Dempsey. He moved to New York City in 1902 and spent the rest of his life there as a reporter and columnist for the New York Morning Telegraph. Masterson's column not only covered boxing and other sports, but also gave his frequent opinions on crime, war, politics, and other topics. He became a close friend of President Theodore Roosevelt and became one of the "White House Gunfighters,” who received federal appointments from Roosevelt. He was known throughout the country as a leading sports writer and celebrity at the time of his death in 1921.

1889 – Charlie Chaplin (d. 1977) was born in London, England. comic actor, filmmaker, and composer who rose to fame in the era of silent film. Chaplin became a worldwide icon through his screen persona "the Tramp" and is considered one of the most important figures in the history of the film industry. His career spanned more than 75 years, from childhood until a year before his death in 1977, and encompassed both adulation and controversy. At 19, he was signed to the prestigious Fred Karno company, which took him to America. Chaplin was scouted for the film industry and began appearing in 1914 for Keystone Studios and Mack Sennett. He soon developed the Tramp persona and formed a large fan base. Chaplin directed his own films from an early stage and continued to hone his craft as he moved to other filmmaking corporations. By 1918, he was one of the best-known figures in the world. In 1919, Chaplin co-founded the distribution company United Artists, which gave him complete control over his films. He refused to move to sound films in the 1930s, instead producing “City Lights” (1931) and “Modern Times” (1936) without dialogue. Chaplin became increasingly political, and his next film, “The Great Dictator” (1940), satirized Hitler. The 1940s were a decade marked with controversy for Chaplin, and his popularity declined rapidly. He was accused of communist sympathies, while his involvement in a paternity suit and marriages to much younger women caused scandal. An FBI investigation was opened, and Chaplin was forced to leave the United States and settle in Switzerland. He abandoned the Tramp in his later films. Chaplin wrote, directed, produced, edited, starred in, and composed the music for most of his films. In 1972, as part of a renewed appreciation for his work, Chaplin received an Honorary Academy Award for "the incalculable effect he has had in making motion pictures the art form of this century". He continues to be held in high regard, with “The Gold Rush,” “City Lights,” “Modern Times,” and “The Great Dictator” often ranked on industry lists of the greatest films of all time.

1908 - The Natural Bridges National Monument was designated a National Monument by President Theodore Roosevelt. It is Utah's first National Monument, located about 50 miles northwest of the Four Corners boundary of southeast Utah, at the junction of White Canyon and Armstrong Canyon, part of the Colorado River drainage. It features the thirteenth largest natural bridge in the world, carved from the white Permian sandstone that gives White Canyon its name. http://www.americansouthwest.net/utah/natural_bridges/national_monument.html

1910 - The oldest existing indoor ice hockey arena still used for the sport in the 21st century, Boston Arena, opens for the first time.

1911 - Birthday of pianist Alton Purnell (d. 1987), New Orleans, LA

1919 - Birthday of Merce Cunningham (d. 2009), dancer, choreographer, born Centralia, WA.

http://www.merce.org/

1924 - Henry Mancini was born Enrico Nicola Mancini (d. 1994) at Cleveland, OH. Often cited as one of the greatest composers in the history of film, he won four Academy Awards, a Golden Globe, and twenty Grammy Awards, plus a posthumous Grammy Lifetime Achievement Award in 1995. His best-known works include the theme to “The Pink Panther” film series, "Moon River" to “Breakfast at Tiffany’s,” and the themes to the “Peter Gunn” and “Mr. Lucky” television series. The Peter Gunn theme won the first Grammy Award for Album of the Year. Mancini also had a long collaboration on film scores with the film director Blake Edwards.

1929 - Birthday of vocalist Ed Townsend (d. 2003), Fayetteville, TN. He performed and composed "For Your Love" and co-wrote "Let’s get it On" with Marvin Gaye. In 1958, he took his ballad, "For Your Love" to Dick Clark who had just started “American Bandstand’s” national show on television and invited Townsend to sing the first month the show aired. He was an overnight success and the song peaked at number 13 in the Billboard Hot 100.

http://www.amazon.com/exec/obidos/ASIN/B0000008V0/ref=ase_avsearch-musicasin-20

/002-9883931-7701629

1929 - The Yankees become first team to wear numbers on uniforms. The numbers correspond to each player's position in the batting order and this explains how Ruth wore #3 and Gehrig #4.

1930 - Jazz flutist Herbie Mann was born Herbert Jay Solomon (d. 2003), Brooklyn.

http://www.herbiemannmusic.com/

http://www.jimnewsom.com/HerbieMann.html

1935 - Birthday of singer Bobby Vinton, born Stanley Robert Vinton, Jr. Canonsburg, PA (Perry Como’s hometown). His most popular song, "Blue Velvet" (a cover of Tony Bennett’s 1951 song), reached No.1 on the Billboard Hot 100 in 1963, and made No.2 in the UK in 1990. His first hit single was titled "Roses Are Red (My Love)." It spent four weeks at #1 on the Billboard Hot 100.

http://www.bobbyvinton.com/

1935 - On snowy day and near freezing day as the band plays Jingle Bells at Boston's Braves Field, Babe Ruth makes his National League debut as he homers and singles off Giants' legend Carl Hubbell. Although the Braves beat New York,4-2, the team will go on to win only 37 more games this season.

1937 - Birthday of vocalist Artie “Blues Boy” White (d. 2013), Vicksburg, MS

1938 - Gene Krupa's first big band debuts at Steel Pier, Atlantic City.

1939 – Dusty Springfield was born Mary Isobel Catherine Bernadette O'Brien (d. 1999), West Hampstead, England. She was an important blue-eyed soul singer and at her peak was one of the most successful British female performers, with six top 20 singles on the US Billboard Hot 100 and sixteen on the UK Singles Chart from 1963 to 1989. She is a member of the US Rock and Roll and UK Music halls of fame. International polls have named Springfield among the best female rock artists of all time. After a time with The Springfields, her solo career began in 1963 with the upbeat pop hit, "I Only Want to Be with You". Among the hits that followed were "Wisih’ and Hopin’ " (1964), "I Just Don’t Know What to Do with Myself" (1964), "You Don’t Have to Say You Love Me" (1966), and "Son of a Preacher Man" (1968).

1940 - Working in 47-degree weather, Bob Feller of the Cleveland Indians hurls the first and only Opening Day no-hitter in Major League history. Feller outduels Eddie Smith of the Chicago White Sox in winning a 1 - 0 decision at Comiskey Park. During one at-bat, White Sox star Luke Appling fouled off 15 straight pitches, but fails to get a hit.

1940 - On Opening Day, Franklin D. Roosevelt's errant ceremonial first pitch smashes a Washington Post camera. The Chief Executive is not charged with a wild pitch as Red Sox hurler Lefty Grove blanks the Senators, 1-0.

1945 - The Boston Red Sox gave tryouts to three Negro League players: Sam Jethroe, Jackie Robinson and Marvin Williams at Fenway Park, but none are signed to contracts. Later this year, Robinson will sign a minor league contract with the Brooklyn Dodgers and, ironically, the Red Sox will be the last Major League team to integrate.

1945 - US 7th Army units reach the outskirts of Nuremberg. The special prisoner of war camp at Colditz is liberated by other Allied units during the day.

1945 - The US 77th Infantry Division lands on the small island of Ie Shima and encounters heavy Japanese resistance.

1945 - BUSH, RICHARD EARL, Medal of Honor

Rank and organization: Corporal, U.S. Marine Corps Reserve, 1st Battalion, 4th Marines, 6th Marine Division. Place and date: Mount Yaetake on Okinawa, Ryukyu Islands, 16 April 1945. Entered service at: Kentucky. Born: 23 December 1923, Glasgow, Ky. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty as a squad leader serving with the 1st Battalion, 4th Marines, 6th Marine Division, in action against enemy Japanese forces, during the final assault against Mount Yaetake on Okinawa, Ryukyu Islands, 16 April 1945. Rallying his men forward with indomitable determination, Cpl. Bush boldly defied the slashing fury of concentrated Japanese artillery fire pouring down from the gun-studded mountain fortress to lead his squad up the face of the rocky precipice, sweep over the ridge, and drive the defending troops from their deeply entrenched position. With his unit, the first to break through to the inner defense of Mount Yaetake, he fought relentlessly in the forefront of the action until seriously wounded and evacuated with others under protecting rocks. Although prostrate under medical treatment when a Japanese hand grenade landed in the midst of the group, Cpl. Bush, alert and courageous in extremity as in battle, unhesitatingly pulled the deadly missile to himself and absorbed the shattering violence of the exploding charge in his body, thereby saving his fellow marines from severe injury or death despite the certain peril to his own life. By his valiant leadership and aggressive tactics in the face of savage opposition, Cpl. Bush contributed materially to the success of the sustained drive toward the conquest of this fiercely defended outpost of the Japanese Empire. His constant concern for the welfare of his men, his resolute spirit of self-sacrifice, and his unwavering devotion to duty throughout the bitter conflict enhance and sustain the highest traditions of the U.S. Naval Service.

1947 - Birthday of Lewis Ferdinand Alcindor, Jr., who later changed his name to Kareem Abdul-Jabbar, great basketball player and Hall of Fame center, born New York, NY. After winning 71 consecutive basketball games on his Power Memorial High School team in New York City, Alcindor attended college at UCLA, where he played for coach John Wooden on three consecutive national championship basketball teams and was a record three-time MVP of the NCAA Tournament. Drafted by the one-season-old Bucks franchise in the 1969 NBA draft with the first overall pick, Alcindor spent six seasons in Milwaukee. After winning his first NBA championship in 1971, he took the Muslim name Kareem Abdul-Jabbar at age 24. In 1975, he was traded to the Lakers. During his career as a center, Abdul-Jabbar was a record six-time NBA MVP, a record 19-time NBA All-Star, a 15-time All-NBA selection, and an 11-time NBA All-Defensive Team member. A member of six NBA Championship teams as a player and two as an assistant coach, Abdul-Jabbar twice was voted NBA Finals MVP. In 1996, he was honored as one of the 50 Greatest Players in NBA History. NBA coach Pat Riley and players Isiah Thomas and Julius Erving have called him the greatest basketball player of all time.

1947 - America's worst harbor explosion occurred in Texas City, Texas, when the French ship Grandcamp, carrying ammonium nitrate fertilizer, caught fire and blew up, devastating the town. Another ship, the Highflyer, exploded the following day. The explosions and resulting fires killed more than 500 people and left 200 others missing.

1947 - Financier and presidential confidant Bernard M. Baruch said in a speech at the South Carolina statehouse, "Let us not be deceived. We are today in the midst of a cold war."

1948 - The future superstation WGN-TV televises a baseball game for the first time. With Jack Brickhouse doing the play-by-play, the White Sox beat the Cubs 4-1 in the first game of the Windy City Classic played at Wrigley Field.

1952 – Bill Belichick was born in Nashville. Arguably the NFL’s greatest coach, he has won 5 Super Bowls, a league record, and has coached in 6 others both as an assistant and as head coach. Belichick has led the New England Patriots to 15 AFC East division titles and 12 appearances in the AFC Championship Game. He was named the AP NFL Coach of the Year for the 2003, 2007, and 2010. He has coached the Patriots to eight Super Bowl appearances and has a 250–118 record plus 28-11 in the playoffs.

1955 - Elvis was the headliner on “The Big D Jamboree,” a live radio show on KRLD in Dallas, Texas. An in-studio audience was admitted for 60 cents apiece.

1955 – SF Giants’ manager, Bruce Bochy was born in France. Prior to joining the Giants for the 2007 season, Bochy was the manager of the San Diego Padres for twelve seasons. He has led the Giants to three World Series championships and led the Padres to one World Series appearance in 1998. In 2017, he became the 15th Major League manager to win 1800 games.

1956 – Buddy Holly’s first single "Blue Days, Black Nights," was released by Decca Records. The up-tempo, Country flavored tune proved to be a poor seller.

1961 – Roger Maris of the Yankees hit the first of his record-breaking 61 homers, a solo shot off Paul Foytack of the Tigers.

1962 - Walter Cronkite succeeded Douglas Edwards as anchorman of "The CBS Evening News."

1962 - Bob Dylan debuted his song "Blowin' in the Wind" at Gerde's Folk City in New York. In 1994, the song was inducted into the Grammy Hall of Fame. In 2004, it was ranked number 14 on Rolling Stone magazine's list of the “500 Greatest Songs of All Time.”

1962 - Top Hits

“Johnny Angel” - Shelley Fabares

“Good Luck Charm” - Elvis Presley

“Slow Twistin'” - Chubby Checker

“She's Got You” - Patsy Cline

1964 - The Mets new home, Shea Stadium, is christened with Dodgers' Holy Water from the Gowanus Canal in Brooklyn and Giants' Holy Water from the Harlem River at the location where it flowed passed the Polo Grounds. Shea Stadium was named in honor of William A. Shea, the man who was most responsible for bringing National League baseball back to New York following the departure in 1958 of the Brooklyn Dodgers and New York Giants.

1970 - Top Hits

“Let It Be” - The Beatles

“ABC” - The Jackson 5

“Spirit in the Sky” - Norman Greenbaum

“Tennessee Bird Walk”- Jack Blanchard & Misty Morgan

1972 - Apollo 16: Astronauts John W. Young, Charles M. Duke, Jr and Thomas K. Mattingly II (command module pilot) began an 11-day mission that included 71-hour exploration of moon (Apr 20-23). Landing module (LM) named Orion. Splashdown in Pacific Ocean within a mile of target, Apr 27.

1978 - St. Louis Cardinals pitcher Bob Forsch pitched a no-hitter beating the Phillies 5-0. His brother, Ken, repeated the feat with the Houston Astros a year later, making them the first brothers in the Major Leagues to throw no-hitters. Bob tossed a second no-hitter in September, 1983, to set a record for Cardinal pitchers.

1978 - Top Hits

“Night Fever” - Bee Gees

“Stayin' Alive” - Bee Gees

“Lay Down Sally” - Eric Clapton

“Someone Loves You Honey” - Charley Pride

1978 - At the first US power-lifting championships held in Nashua, NH, Jan Todd, a teacher from Nova Scotia, broke her own world record with a dead lift of 453 ¼ pounds. Cindy Reinhoudt won the award for best lifter after squatting 385 pounds, bench pressing 205 pounds and dead-lifting 385 pounds for a 975-pound total.

1979 - The first female Coast Guard ship commander was Lieutenant(j.g.) Beverly Gwin Kelley, who was appointed to command the 95-foot cutter Cape Newagen, with a crew of 14, based in Maalaea, Maui, HI. Her assignment included search missions, boating safety, antipollution patrols, and law enforcement.

1983 – Steve Garvey of the Dodgers broke the National League record of Billy Williams for consecutive games played with his 1,118th straight on the way to 1,207.

1986 - Top Hits

“Rock Me Amadeus” - Falco

“Kiss” - Prince & The Revolution

“Manic Monday” - Bangles

“She and I” – Alabama

1987 - A slow moving storm system produced heavy rain over North Carolina and the Middle Atlantic Coast States. More than six inches of rain drenched parts of Virginia, and flooding in Virginia claimed three lives. Floodwaters along the James River inundated parts of Richmond VA.

1992 - The House Ethics Committee listed 303 current and former lawmakers who had overdrawn their House bank accounts. Kinda like the way they manage the budget for the entire country!

1996 - The Chicago Bulls became the first NBA team to win 80 games in the regular season by defeating the Milwaukee Bucks, 86-90. After this game, Chicago's record stood at 70-9. The Bulls finished the year at 72-10 and won their fourth NBA title in six years.

1997 - Extending their losing streak to 12 with a 4-0 loss to the Colorado Rockies, the Chicago Cubs set the record for worst start in league history surpassing the overall NL record of 0-11 established by the Detroit Wolverines 1884.

2003 - Michael Jordan played his last NBA game as his Washington Wizards ended their season with a loss to the Philadelphia 76ers.

2007 – At Virginia Tech, Seung-Hui Cho gunned down 32 people and injured 17 before committing suicide.

2014 - AT&T added an unnamed automaker to its list of car manufacturers using the company's wireless service for mobile connectivity on the road; current customers include Volvo, Tesla and General Motors.

Stanley Cup Champions:

1939 - Boston Bruins

1949 - Toronto Maple Leafs

1953 - Montreal Canadiens

1954 - Detroit Red Wings

1957 - Montreal Canadiens

1961 - Chicago Blackhawks

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()