Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, October 2, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Now is the time to take advantage of

Higher Bonus Depreciation Before End of 2024

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Show Up

By Scott Wheeler, CLFP

License and Registration United States

A State-by-State Analysis of License Requirements

for Lenders and Brokers

Usury

Various Laws Subject to Disclosure

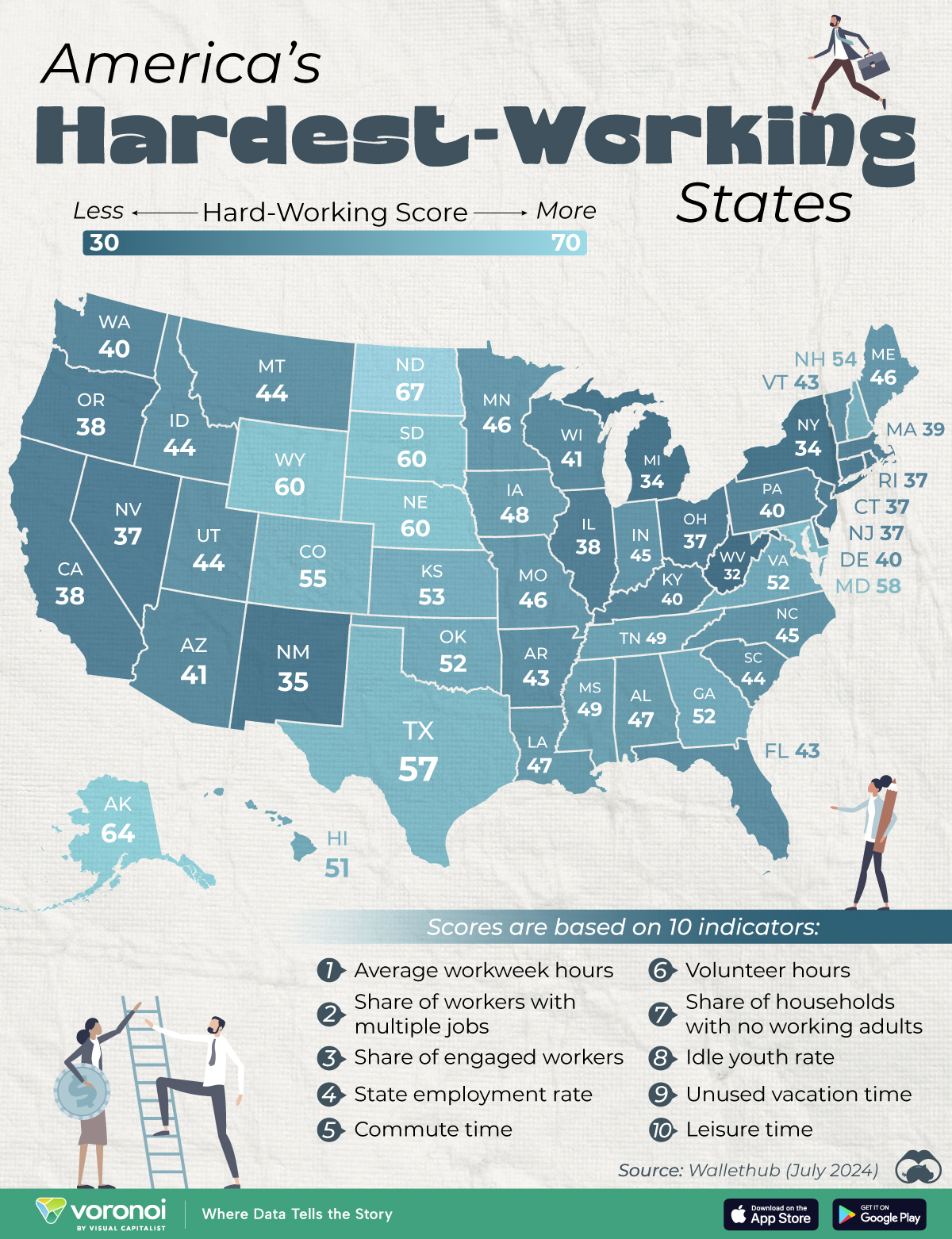

The States that Work the Hardest

by Wallet Hub

SFNet: Asset Based Lending Deals Activity

Surged in Second Quarter, 2024

News Briefs

Jeep recalls 194,000 plug-in hybrid

SUVs over fire risk

Hurricane Helene May Have Given Intel

a Death Blow

Extreme Weather Is Taxing Utilities More Often

Can A.I. Help?

Fed’s Powell Says Rate Cuts Can Sustain

Soft Landing, but Sees No Need to Rush

Where the Dockworkers’ Union and Port

Stand on Key Issues

You May Have Missed ---

A.I. Headshot Generator – Use Your Smartphone

Stunning Headshots for Successful Professionals

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Larry Artman was hired as Senior Vice President, Business Development, Atlanta Georgia. He is located in Marietta, Georgia. Previously, he was Vice President & Factoring Business Development Officer, Ocean Bank (July, 2023 - September, 2024); Senior Vice President, Magnolia Financial, Inc., (December, 2021 - July, 2023); Sales Director, Southeast, Prestige Capital Corporation (July, 2019 - December, 2021). Full Bio:

https://www.linkedin.com/in/larry-artman-48108122/details/experience/

https://www.linkedin.com/in/larry-artman-48108122/

Alyssa Lawrence, CLFP, was hired as Chief Operating Office, Marshall Capital Group, Cuero, Texas . She is located in Anderson, Indiana. Previously, she was Funding Administrator and Accounting Assistant, Quality Equipment Finance (April, 2024 - September, 2024).

https://www.linkedin.com/in/alyssa-lawrence-clfp-0b7608114/

Robert Kelso was hired as Portfolio Account Manager, North Mill Equipment Financing, Norwalk, Connecticut. He is located in Wilton, Connecticut. Previously, he was Senior Accountant, BREITLING (June, 2021 - September, 2024); Controller, Qualitest US (April, 2015 - October, 2020).

https://www.linkedin.com/in/robert-kelso-55920410/

Zacchary Lee was hired as a Senior Analyst, North Mill Equipment Finance, Norwalk, Connecticut. He is located in Brooklyn, New York. Previously, he was Analyst, McCabe Pension (2020 - 2022); Investment Analyst, Merit Hill Capital, LP (2018 - 2019). He began his career May, 2018, Real Estate Summer Analyst, Greysteel, promoted Real Estate Financial Analyst (August, 2017 - November, 2017).

https://www.linkedin.com/in/zacchary-lee-338470105/

Steve Scheuble was hired as Vice President, Blue Owl Capital, New York, New York. Previously, he was Director of Business Development, Atalaya Leasing, Atalaya Capital Management, New York, New York; C&IB PNC (August 2011 - December, 2020).

https://www.linkedin.com/in/steve-scheuble-6a581b1b/

[headlines]

--------------------------------------------------------------

Now is the Time to Take Advantage of

Higher Bonus Depreciation Before End of 2024

True Leasing has several advantages, including taking care of bonus depreciation.

The rules allowed Bonus Depreciation to 100% for all qualified purchases made between September 27, 2017 and January 1, 2023. Bonus Depreciation now ramps down to 80% for the year of 2023. Bonus depreciation will continue to ramp down for ensuing years: 60% for 2024, 40% for 2025, 20% for 2026, and 0% beginning in 2027.

Note: Several states do not conform with the federal guidelines and cap the deduction.

Section 179 allowed for the immediate expensing of 100% of the asset cost up to $1,160,000 for 2023. The full deduction can be taken unless the total equipment purchases are greater than $2,890,000 for the tax year, in which case the deduction will reduce dollar for dollar by the amount above the threshold. The deduction will also only apply if the business is profitable as it cannot be used to create a tax loss. Section 179 may be more flexible than bonus depreciation, as it allows the taxpayer to take the deduction on specific assets rather than an entire class of assets.

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

Show Up

By Scott Wheeler, CLFP

Top originators in the commercial equipment finance and leasing industry understand that showing up is 90% of the game. Success is a result of hard work and commitment. Below are a few comments shared by successful originators:

- Being the first to arrive in the morning and last to leave in the evening is a sure sign of commitment. Anyone that believes originating high-quality equipment assets in 2024 is a less than forty-hour a week job is kidding themselves. This applies also to working remotely: Getting up early, planning your day. If in California, remember you are three hours behind the East Coast.

- Taking the extra effort to meet in person with a vendor or end-user is essential in 2024. Successful originators make the effort to solidify their best relationships. This includes going to trade conferences.

- Taking the time to properly prepare for a call, meeting, tradeshow, or conference requires time. Top originators show up properly prepared to close the deal.

- Dressing for success is a concept that has been lost over the last few years. There is no need to wear a three-piece suit while making calls from home. However, business attire can enhance your personal attitude… A sales manager encouraged his team to show up ready to succeed and to wear attire that conveys success (no T-shirts or shorts). Several originators have voluntarily started to wear dresses and ties (wow).

- Leadership matters in showing up for success. An independent owner noticed that his staff was following his lead. The company offers flex time and a hybrid work environment. However, the owner and his management team are always in the office (unless they are out visiting clients). The local staff is currently choosing to be in the office almost 100% of the time. Success in 2024 requires strong collaboration. By showing up in person, their internal collaboration has been greatly enhanced.

Showing up on time, prepared, and ready for success is crucial in moving your career forward.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

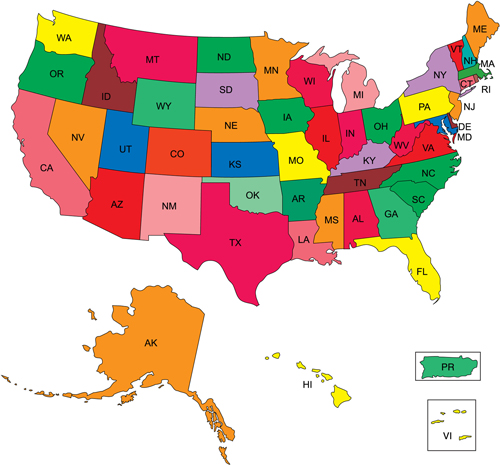

License and Registration United States

A State-by-State Analysis of License Requirements for Lenders and Brokers

- Virginia sales-based financing disclosure law – Went into effect July 1, 2022

- California commercial financing disclosures – Went into effect December 9, 2022

- Utah commercial financing disclosures – Went into effect January 1, 2023

- Florida disclosure law and broker law - Went into effect July 1, 2023

- New York commercial financing disclosure law – Went into effect August 1, 2023

- Connecticut commercial financing disclosure law – Went into effect January 1, 2024

- Georgia commercial financing disclosure law – Went into effect January 1, 2024

- Kansas Commercial Financing disclosure law - Went into effect July 1, 2024

Six States Reintroduce Commercial Disclosure Financing Bills

- North Carolina – Small Business Truth in Financing Act

- Missouri – Commercial Financing Disclosure Law

- New Jersey – An Act concerning commercial financing

- Illinois – Small Business Truth in Lending Act

- California – Commercial Financing Bill

- New York – An Act to amend the banking law and the administrative code of the city of New York, in relation to regulating commercial finance licensing

ELFA Interactive State Map to Track Financial Disclosure Regulation Activity

Free to Non-Members --- PDF Required

https://www.elfaonline.org/advocacy/state-issues/lenders-license

https://leasingnews.org/archives/Jul2024/07_15.htm#why

[headlines]

--------------------------------------------------------------

Usury

Various Laws Subject to Disclosure

Definition: Usury is defined as the act of lending money at an unreasonably high interest rate; this rate is defined at the state level. Repayment of loans or capital leases (under Article 9) at a usurious rate makes repayment excessively difficult to impossible for borrowers. This is also called "loan sharking" or "predatory lending".

Usury has recently come back into legal conversations due to the emergence of payday loans and sub-prime lending as well as new state disclosure laws. These types of loans are aimed at those who are at greater risk of defaulting, those with lower incomes. However, usury is beginning to be applied in many states to capital leases that fail to be true leases under Article 2A and fall into Article 9.

The usury laws, predatory lending, and loan sharking rules use to apply more to local banks. Since the passing of a federal law stating that the state usury laws do not apply to banks that label themselves with the words "national", these banks have been able to offer loans above the state usury limit. These "national" banks are allowed to apply interest rates a number of points higher than the Federal Reserve Discount Rate. The Federal Reserve Discount Rate is the rate banks get when borrowing directly from the Federal Reserve Bank for short term funds.

There are a number of different lending tactics that are considered predatory lending or leasing. Some lessors dispute whether these are unethical, often citing that lessees have choices of who they get their capital leases from.

Below are the most common practices labeled "predatory".

Fees & lease rate: Common complaints on predatory lending and leasing involve fees incurred which are not included in the transaction. Lessees may not know they have a no-fee lease or loan line of credit, or may not be able to get a no-fee capital lease or loan line of credit. Lessors may take advantage of this by offering a reasonable rate but tacking on a fee. The capital lease or loan rate may appear attractive but the fee is not considered in the transaction; if it were, the rate would appear significantly higher. Many state disclosure laws require the disclosure.

Risk-based leasing: (This also applies to Equipment Finance and Business Loans). This is the practice of charging higher rates to the lessees or borrowers who are labeled as high-risk, meaning there is a higher risk that they will not be able to pay back the capital lease or loan and thus default. Creditors and Lessors argue they need the higher lease rates in order to offset the losses from those that default. Business groups, however, counter that the higher capital lease rates themselves make it more difficult for the individuals to pay back the lease and the lessors are simply price-gouging.

Key Man Insurance: Lessors will push single premium key man insurance stating that the insurance will pay off the capital lease or loan if the owner passes away. The cost of the insurance is often added to the transaction, making it more appealing since it does not have to be paid in one lump sum. This actually makes the transaction more expensive, and compounds the interest of the insurance over the life of the capital lease.

It is difficult to understand the usury laws of most states but it is becoming imperative that commercial equipment leasing and finance companies check with legal counsel on the limits and requirements it the states that they operate, especially the states with new disclosure laws.

[headlines]

--------------------------------------------------------------

The States that Work the Hardest

by Wallet Hub

With a 67/100 score, North Dakota is the hardest-working American state, according to WalletHub. The state's 98% employment rate helped boost its performance.

Wallethub analyzed all states on ten indicators, some of which include: average workweek hours, employment rates, and unused vacation hours.

From these, a weighted score out of 100 was calculated upon which all states were ranked. For the full list of indicators please visit the footnotes section of this post.

Indicators: Average workweek hours. Share of workers with multiple jobs. Share of engaged workers. State employment rate. Commute time. Volunteer hours. Share of households with no working adults. Idle youth rate. Unused vacation time. Leisure time.

https://wallethub.com/edu/hardest-working-states-in-america/52400

[headlines]

--------------------------------------------------------------

##### Press Release #######################

SFNet Releases Second Quarter

Asset Based Lending Deals Activity

Surged in Second Quarter, 2024

Secured Finance Network releases survey results

for bank and non-bank lenders

NEW YORK, NY ─ Cautious optimism marked the second quarter in the asset-based lending market as banks and other lenders saw a rise in new-deal activity, according to data released by the Secured Finance Network. They continued to monitor signs of cooling in the U.S. economy, however, including a contraction in the manufacturing sector.

SFNet surveyed bank and non-bank asset-based lenders (ABLs) on key indicators for its quarterly Asset-Based Lending Index and SFNet Confidence Index.

SFNet CEO Richard D. Gumbrecht, reported, “Portfolios are generally healthy by historical standards, and the ABL industry is ready to meet new demand in Q3 and beyond as borrowing costs begin to fall.”

Survey highlights

For banks, asset-based loan commitments (total committed credit lines) were mostly unchanged in the second quarter. It was the same for outstandings (total asset-based loans outstanding).

“Deal activity surged this quarter, with notable (quarterly) increases in new commitments with new clients (+89%), but commitment runoff also increased (+69%),” the report said.

Net commitments spiked from $270 million to $728 million. Also up significantly were new outstandings and outstandings runoff.

Banks reported more extensions or expansions with existing clients than deals with new clients in the second quarter. However, the new client deals were larger on average than those with existing clients.

“Continuing a long-standing trend, the vast majority of total commitments came from revolver loans,” the report said.

Non-banks, meanwhile, saw slightly stronger but still modest growth for total commitments, up just 1.5%, and total outstandings inched up 2.9%. They reported more new deals than banks with new commitments with new clients jumping 253% over the previous quarter. Commitment runoff fell 19% and net commitments were solidly positive with an increase of $473.5 million in the second quarter.

New outstandings spiked 196% while outstandings runoff fell by 12%. That led to an increase last quarter of more than $314 million in net outstandings.

“Non-banks reported more deals this quarter with new clients than expansions or extensions with existing clients,” the report said. “As in past quarters, the vast majority of total commitments among non-bank lenders came from revolver loans. The proportion of total commitments held in revolver loans remained essentially flat.”

In terms of credit-line utilization rates, both lender groups reported slight increases from the first to second quarters.

“Bank utilization remained below the long-term historical average (39.9%),” the report said, “while non-bank utilization remained above average (48.6%).”

ABL portfolio performance was a mixed bag but still strong in the most recent Lending Index. While it declined for banks, it held within the historical range. Criticized and classified loans were slightly down overall, even though the majority of banks reported an increase in such loans. Non-accruals increased 35% over the previous quarter as more banks reported increases than decreases. Write-offs, meanwhile, were down 35% as a share of outstandings.

Portfolio performance was stronger in the other lender group, the report said.

“Performance generally improved for non-banks, with non-accruals falling 56%. Write-offs were flat for most banks but increased as a share of total outstandings, the report said. “Despite the increase, write-offs remain well below the high point for the past five years.”

### Press Release #########################

[headlines]

--------------------------------------------------------------

News Briefs

Jeep recalls 194,000 plug-in hybrid

SUVs over fire risk

https://www.npr.org/2024/10/01/nx-s1-5134998/jeep-recall-plug-in-hybrids-fire-risk-suv

Hurricane Helene May Have Given Intel

a Death Blow

https://www.tipranks.com/news/hurricane-helene-may-have-given-intel-nasdaqintc-a-death-blow

Extreme Weather Is Taxing Utilities More Often

Can A.I. Help?

https://www.nytimes.com/2024/09/27/climate/power-outages-utilities-ai.html

Fed’s Powell Says Rate Cuts Can Sustain

Soft Landing, but Sees No Need to Rush

https://www.wsj.com/economy/central-banking/feds-powell-says-rate-cuts-can-continue-to-support-soft-landing-8792c77a

Where the Dockworkers’ Union and Port

Stand on Key Issues

https://www.nytimes.com/2024/10/01/business/port-workers-strike-demands-union.html

[headlines]

--------------------------------------------------------------

Headshot Generator – Use Your Smartphone

Stunning Headshots for Successful Professionals

https://instaheadshots.com/

[headlines]

--------------------------------------------------------------

Sports Briefs---

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

San Jose approves incentive plan to lure

office tenants back downtown

https://www.eastbaytimes.com/2024/10/01/san-jose-approves-incentive-plan-to-lure-office-tenants-back-downtown/

Newsom Vetoes Bill Requiring Cars to

Warn Speeding Drivers

https://www.nytimes.com/2024/09/28/business/california-speeding-car-alert.html

Highway 1 won't reopen in 2024. It's decimating

this once-bustling Calif. coastal town

https://www.sfgate.com/centralcoast/article/highway-1-not-reopening-2024-san-simeon-19797994.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

United Expands Economy Cabin Wine Offerings

with Debut of New Rosé

https://www.winebusiness.com/news/article/293193ce_amid_challenges.html

The Most Expensive Napa Wines of 2024

A decade ago, $1000 bottles seemed a

distant dream for Napa winemakers – not anymore

https://www.wine-searcher.com/m/2024/10/the-most-expensive-napa-wines-of-2024

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Oct2023/10_02.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()