Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

![]()

Wednesday, June 22, 2011

Today's Equipment Leasing Headlines

LEAF Investor asks what should he do

Classified Ads---Asset Management

Automatic Renewals: The States Respond

by Barry Marks, Esq.

C&J Leasing Convicted $8 million Lease Discount Scheme

Day Trading Lead to his Demise

Classified Ads---Help Wanted

Sales makes it Happen---by Steve Chriest

“Key Receivers---“

Placard---From Pres. Ronald Reagan’s Desk

20 worst areas for car theft

Firestone Financial Unveils New Website

Santa Monica Man Indicted on Federal Tax Charges

Centre Hall, Pennsylvania Adopt a Dog

News Briefs---

Susquehanna to buy 1N Bank parent company

Bank Deal Could Put PNC in Sweet Spot

Airline revenues going up, up and away

Airbus Wins CIT/ TransAsia Deals for 56 A320neo-Family Jets

Pratt & Whitney another Major PurePower CIT Engine Order

Boeing rights a wrong: the flight attendant button

Ford commits $1 billion to Lincoln brand

Amazon offers Texas 5,000 jobs in trade for sales-tax exemption

Gannett laying off 700 more workers amid ad slump

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Public Unions Take On Boss to Win Big Pensions

You May have Missed---

Sports Briefs---

California Nuts Briefs

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

LEAF Investor asks what should he do

by Christopher Menkin

"I am a limited partner in LEAF III and 4. I have followed the downward spiral of this company in Leasing News. They are now asking for a vote to amend the Limited Partnership Agreement. They want to be able to reinvest more of the distributable cash which they are now prohibited from doing until they pay the unpaid cumulative returns.

"They decreased distributions some time back (LEAF III was 8.5%, now 2%-LEAF 4 was 8.5%, now 4%) and now say it is unlikely they will ever be able to catch up on these. I was hoping you might find this interesting and give some insight what the ramifications and implications of this move are should it be approved or rejected.

“Although a personal reply would be greatly valued, I thought it might be newsworthy enough to help and inform others who read Leasing News.

“Either way, thanks and keep up the good work."

(Name With Held)

It is ironic at the same time as the email above, a complaint brought by a company, and its broker who sent the transaction, regarding a security deposit of $2,498.26 not being returned since January, 2011 was received. It spoke of many emails not returned, telephone calls not returned, reportedly being hung up upon, but was resolved by bringing a potential Leasing News Bulletin Board Complaint to be posted to the attention of LEAF Financial and LEAF Commercial Capital. First communication was not from LEAF, but from the party with the complaint: "Somehow, you got through to the CFO Robert Moskovitz who called and spoke to my husband. He was polite and apologetic, but obviously they have some internal problems within their company. He assured us a check is in the mail."

Later came an email with a copy of a U.S. Mail letter to me from the marketing director of LEAF:

"Thank you for bringing the issue with ****** to our attention. We do have a very detailed process in place to handle these types of customer requests. Somehow, this customer's request did not get handled properly and we are very grateful that we were able to rectify the situation for him. We have spoken to the customer and a check has been sent to him for the amount owed. We are currently reviewing our internal process to see how this request got misdirected.

Delivering the highest level of customer service is an integral part of our customer promise and this feedback is taken very seriously. Again, we appreciate you forwarding this customer's concern to us."

This is not the first time I have heard complaints about payments and money, specifically telephone calls not being returned. This has been going on since the reduction in staff that Leasing News has been writing about, including the closing of LEAF Specialty Finance in Columbia, South Carolina.

A copy of this article was sent to management at LEAF Financial and LEAF Commercial Capital, who evidently have received it and discussed with others on staff, but did not return with any comment or statement to Leasing News as requested.

The move to LEAF Commercial Capital (“LCC is a joint venture among LEAF, Resource Capital Corporation and Guggenheim Securities. Resource Capital and Guggenheim committed to investing over $44 million of capital in the form of preferred stock and subordinated debt, respectively, into LCC"—LEAF Press Release) has been described as more a “broker operation.” No comment on this, or the seeming lack of a California Lenders License by LEAF Commercial Capital, but then again, I am told the division is six months behind in processing applications—which you also need to operate in California, and must wait until licensed to do business here as well as with California licensed brokers. According to their own records, LEAF Financial did a lot of business in California and they are licensed to work with other licensed entities (but not those who are not licensed, as per the California law.) It would appear LEAF Commercial Capital is not licensed in California, and perhaps other states. A comment was not received on this question.

A look at the financial statements and the FUND financial statements of LEAF Financial perhaps gives indication for the reasons perhaps why the security deposit was not returned when asked by both the lessee and the discounter who sold the lease to LEAF. It may also contain the answer for the investor who asked for an opinion to perhaps his real message: “They want to be able to reinvest more of the distributable cash which they are now prohibited from doing until they pay the unpaid cumulative returns. So they can lose more money.”

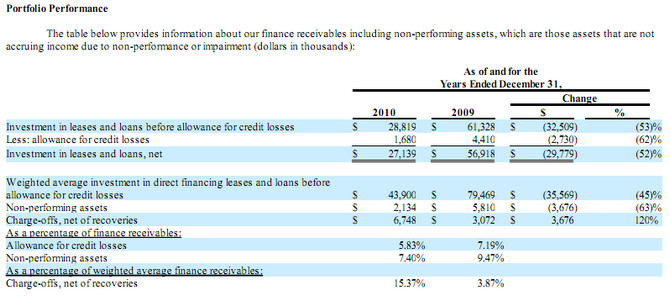

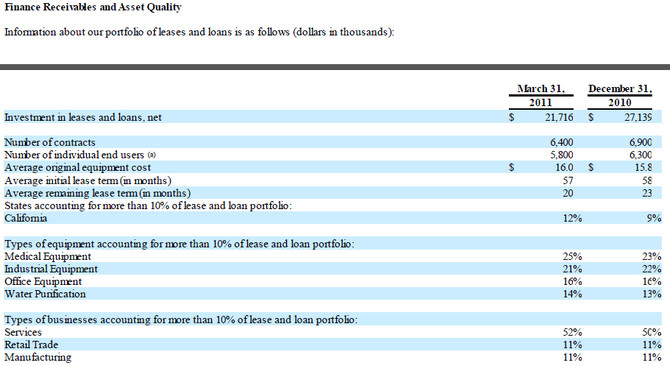

The main 10Q for Fund I in 2009 almost 10% (9.47%) of the portfolio was non-performing. Charge-offs jumped to 15.37% in 2010 and still ended up with 7.4% of the remaining portfolio as non-performing. Obviously trying to hold off charge-offs in 2009 didn’t work and they had to write them off in 2010. The 15.37% number looks like that before the economic downturn started Leaf Fund I was obviously buying junk.

There are two sets of investors, the equity investors in the Leaf Funds and the debt investors in the CDO securitizations. We hear how well the CDO securitizations are protected by loss structuring and asset over-collateralization, but what we don’t hear is that this is at the direct expense of the equity investors.

Because of the fund losses are so massive, the distributions made to the equity investors is a return of capital, not interest. It is obvious to see the equity investors will lose a large hunk of principal and never make any income. This shows that the Leaf Fund model for raising equity may be fundamentally flawed. The reports blame the economy for the losses.

in millions

Fund IIII |

Fund III |

Fund III |

|

| 2008 | -$17.7 |

-$17.7 |

|

| 2009 | -$22.6 |

-$22.6 |

-$22.6 |

| 2010 | -$22.1 |

-$22.1 |

-$22.1 |

| 3/31 | -$7.2 |

-$2.2 |

-$1.5 |

Footnote "A"

Fund IIII went from $526.7 million September 30, 2009 to $293.0 million March 31, 2011

Fund III went from $499.7 million December 31, 2007 to $157.5 million March 31, 2011

Fund II went from $343.3 million December 31, 2007 to $72.2 million March 31, 2011.

Footnote “A”

Fund I raised $17.1 million August 15, 2005 by selling 171,746 investors and commenced operations March, 2003. “Substantially all of the Fund’s leases and loans mature by the end of 2012. Contractually, the Fund will terminate on December 31, 2027, unless sooner dissolved or terminated in the Limited Partnership Agreement…

As of March 31, 2011 and 2010 in addition to its 1% general partnership interest, the General Partner also had invested $0.8 million for a 6% limited partnership in the Fund.

((page 7, Fund 1 quarter ((4))

Lease Equity Appreciation Fund I shows a lost of $742,000 for the period ending March 31, 2011 compared to a net loss of $1.39 million March 31, 2010.

The year-end 10-K shows 1 general partner and 433 limited partners.

(page 6, year-end 10k) showing year-end:

(in millions)

| 2006 | +$1.08 |

| 2007 | -$1.45 |

| 2008 | -$3.64 |

| 2009 | -$27.92 |

| 2010 | -$17.84 |

((page 7, year-end 10k (5))

"We negotiated with our lender to prevent them from foreclosing on any collateral, or requiring a distressed sale of leases that would have badly impaired capital. Additionally, our General Partner has deferred payment of fees and reimbursement of expenses totaling approximately $7.7 million from inception through December 31, 2010 in order to preserve our cash. The General Partner has also waived future management fees. We entered our maturity phase in August 2009, and are prohibited under the Partnership Agreement from acquiring new leases.

"To date, limited partners have received total distributions ranging from approximately 46% to 60% of their original amount invested, depending upon when the investment was made. Our General Partner is working to maximize the amount that can be distributed to our limited partners in the future. The July 2010 distribution was made at the 4.0% rate that has been in effect since 2009. However, beginning in August 2010, distributions were lowered to 2.0% in order to pay down our bank loan faster in order to reduce cash payments for interest as we liquidate the lease and loan portfolio over the next few years."

page 15, SEC filing (4)

"Management Fees. The General Partner is paid a subordinated annual asset management fee equal to 3% or 2% of gross rental payments for operating leases or full payout leases, respectively, or a competitive fee, whichever is less. During the reinvestment period, management fees are subordinated to the payment of distributions to the Funds limited partners of a cumulative annual return of 8% on their capital contributions, as adjusted by distributions deemed to be a return of capital. Effective January 1, 2011, the General Partner has waived all future management fees."

page 13, SEC Filing (4)

"Beginning May 1, 2009, the General Partner waived its asset management fees and reversed certain management fee accruals recorded previously in 2009. Approximately $650,000 of management fees were waived for the three months ended March 31, 2011. The General Partner has also waived all future management fees."

page 18, SEC Filing (4)

“In March of 2009, we faced such a renewal negotiation with our lender. Although we were able to convince our lender to leave the interest rate the same, it would not permit any more borrowings and required that all the excess cash above a 4% distribution to our limited partners be applied to principal - paying down the loan more rapidly and forgoing the last six months of reinvestment opportunity for us. The recession caused increased delinquencies and losses greater than we had projected requiring us to repay our lender the amounts borrowed against delinquent leases in addition to anticipated principal pay down."

page 14, SEC Filing (4)

The most recent quarter showing 10.4% over 91 days and 7.7% 31 to 91 days.

(page 10, SEC Filing (4)

The net charge offs increased from 7.11% at March 31, 2010 to 10.4% at March 31, 2011.

(page 16 & 17, SEC Filing (4)

----

(A) Footnote

"As a result of the foregoing, the Partnership incurred net losses of $22.6 million and $22 1 million for the years ended December 31, 2009 and 2010, respectively, and net losses of $7 2 million for the three months ended March 31, 2011. Accordingly, the Partnership reduced distributions to limited partners from 8.5% annual cumulative return on each limited partner's Adjusted Capital Contribution to 4.0% in August 2010. The Partnership distributed approximately $6.2 million and $8.4 million in 2009 and 2010, respectively.

"As of March 31, 2011, the Unpaid Cumulative Return was an aggregate of approximately $3.7 million Because of the requirement under current Section 11.1(b) that the Unpaid Cumulative Return must be paid before any distributable Cash be used for reinvestment, the existence of the Unpaid Cumulative Return means that, instead of investing any Distributable Cash the Partnership generates in new equipment, equipment leases and loans for the purpose of increasing the total return to the limited partners, it must be distributed (to the extent of the Unpaid Cumulative Return) to the limited partners. As a result of the Partnership's inability to make new investments, its lease portfolio went from $526.7 million at September 30, 2009 to $293.0 million at March 31, 2011."

"If the Partnership does not amend the Limited Partnership Agreement to allow the Partnership to reinvest cash into new equipment, leases and loans, the Partnership will not be able to take advantage of this opportunity.

The General Partner is, accordingly, proposing to amend Section 11.1(b) of the Limited Partnership Agreement to permit the Partnership to reinvest Distributable Cash in new equipment, equipment leases and loans during the continuance of the Reinvestment Period without first having to pay the Unpaid Cumulative Return."

The corresponding SEC financial report for this quarter stated, "To date, limited partners have received total distributions ranging from approximately 7% to 17% of their original amount invested, depending upon when the investment was made. Management is working to maximize the amount that can be distributed to limited partners in the future. However, we could not continue to support 8.5% distributions, and beginning in August 2010, distributions were lowered to 4.0%. Additionally, our General Partner will not earn additional management fees for future services." (1)

FUND III Solicitation

"As a result of the foregoing, the Partnership incurred net losses of $17.7 million, $28.8 million and $26 1 million for the years ended December 31, 2008, 2009 and 2010, respectively, and net losses of $2.2 million for the three months ended March 31, 2011. Accordingly, the Partnership reduced distributions to limited partners from 8.5% annual cumulative return on each limited partner's Adjusted Capital Contribution to 2.0% in August 2010. The Partnership distributed approximately $9.1 million, $10.2 million and $6.9 million in 2008, 2009, and 2010, respectively.

"As of March 31, 2011, the Unpaid Cumulative Return was an aggregate of approximately $5.2 million Because of the requirement under current Section 11.1(b) that the Unpaid Cumulative Return must be paid before any Distributable Cash be used for reinvestment, the existence of the Unpaid Cumulative Return means that, instead of investing any Distributable Cash the Partnership generates in new equipment, equipment leases and loans for the purpose of increasing the total return to the limited partners, it must be distributed (to the extent of the Unpaid Cumulative Return) to the limited partners. As a result of the Partnership's inability to make new investments, its lease portfolio went from $499.7 million at December 31, 2007 to $157.5 million at March 31, 2011." (2)

FUND II Solicitation

"As a result of the foregoing, the Partnership incurred net losses of $7.4 million, $19.4 million and $7.8 million for the years ended December 31, 2008, 2009 and 2010, respectively, and net losses of $1.5 million for the three months ended March 31, 2011. Accordingly, the Partnership reduced distributions to limited partners from 8.0% annual cumulative return on each limited partner's Adjusted Capital Contribution to 2.0% in August 2010.

The Partnership distributed approximately $4.8 million, $2.8 million and $2.5 million in 2008, 2009, and 2010, respectively.

"As of March 31, 2011, the Unpaid Cumulative Return was an aggregate of approximately $5.4 million Because of the requirement under current Section 11.1(b) that the Unpaid Cumulative Return must be paid before any Distributable Cash be used for reinvestment, the existence of the Unpaid Cumulative Return means that, instead of investing any Distributable Cash the Partnership generates in new equipment, equipment leases and loans for the purpose of increasing the total return to the limited partners, it must be distributed (to the extent of the Unpaid Cumulative Return) to the limited partners. As a result of the Partnership's inability to make new investments, its lease portfolio went from $343 3 million at December 31, 2007 to $72.2 million at March 31, 2011." (3)

(1) Fund 4 Solicitation

http://leasingnews.org/PDF/LEAF_Equipment_Finance%20Fund_4_LP_Proxy_2011.pdf

(2) Fund 3 Solicitation

http://leasingnews.org/PDF/LEAF_Equipment_Leasing_Fund_Income_Fund_III_LP_Proxy_2011.pdf

(3) Fund 2 SEC Solicitation

http://leasingnews.org/PDF/FundII.pdf

(4) Fund 1 10-Q 1st Quarter

http://leasingnews.org/PDF/Fund1FirstQuarter.pdf

(5)Fund 1 Filing 10-K 12-31-2010

http://leasingnews.org/PDF/Fund112312010.pdf

LEAF Financial Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/leaf_resource.html

[headlines]

--------------------------------------------------------------

Classified Ads---Asset Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Minneapolis, MN |

Experienced Asset Manager of various portfolio's for a bank, broker and leasing company. Utilized specialized remarketing companies to maximize collateral values. Worked remote two years. geoff.taylor@verizon.net | Resume | Reference 1 | Reference 2 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Automatic Renewals:

The States Respond

by Barry Marks, Esq.

The sleeping dragon of state regulation of equipment finance has stirred several times in the last few years, but there is reason to fear that the beast is about to take flight in response to unethical practices by several lessors. This time, the focus is on automatic renewal clauses and St. George may switch sides

According to ELFA, 25 new bills addressing automatic renewal clauses were introduced in state legislatures in 15 states in 2010. This is nearly twice as many as the year before and over three times as many as in 2008.

As Leasing News has reported, some equipment leasing companies rely on automatic extensions of the terms of their leases for a good portion of their profits. These provisions take many forms and are called, among other things, “evergreens” “automatic renewals” or “return notice requirements.”

In some, the documents simply provide that if the lessee fails or refuses to return the equipment, the term continues on a month-to-month-basis. This is a “holdover” extension and is a good and not-unreasonable provision as it avoids a lessee claim that it should have a court-imposed right (sometimes arising in bankruptcy) to keep using equipment while adjusting the rent to fair market rental for the (now-used) equipment. Other draftsmen provide that the lease term extends for more than a month, allowing the lessor some additional notice before the holdover lessee finds it convenient to return the equipment.

Many lessors, especially banks and financers who are not in a position to remarket used equipment easily, need some notice before the lease term ends. For these lessors, a requirement of a notice of 90, 120 or even 180 or more days before the end of the term that the lessee waives any purchase or renewal option and will be prepared to return the equipment is very helpful. While purists might argue that the leasing company should always assume it we need to remarket equipment as soon as the date for election of a renewal or purchase option runs, practical considerations and real-world experience indicate that requiring a notice is not, in and of itself, unreasonable.

The continuum moves on, however, and soon reaches the realm of questionable practices. For years some lessors have afforded lessees short windows of as little as 30 days to elect to return and in some cases counsel have added draconian penalties, such as long term lease extensions. It should take no explanation to distinguish a month-to-month or quarterly extension for failure to return on time and as required from a full year automatic renewal when the lessee misses a short window several months before the lease term ends; Consider the lessee who called us a few years ago when he discovered that he failed to give written notice more than 240 but less than 270 days before the term ended and faced an additional full year extension.

Still, we could argue that where the lessor needs to remarket successfully to recover part of its investment, or to make a reasonable profit, this is not at all unethical. Even in a full-payout FMV-purchase option lease, the equipment “belongs” to the lessor and it should have rights when the lessee doesn’t give it time to arrange a profitable disposition.

What about the $1-out lease? This is, legally, tax-wise, and in every practical sense a secured loan. Is there any argument in favor of telling a customer that when it pays off its home mortgage it must notify the mortgage company that it will not continue to pay…or it will continue to be invoiced and obligated to pay more than 100% of its loan?

What about other “leases” that requires the lessee to purchase or otherwise fall within the UCC definition of a secured financing and not a lease?

Many of these “gotchas” can be traced to the practice of using the same form document for true leases and $1-outs, a very old, very common and for many reasons, very bad idea that continues in the small ticket world today. (Lessors have been burned for not having their leases updated or converting to EFA’s, but that is another story).

From my own files, there is the sad case of a young CFO who gave oral (not the required written) notice that his company intended to end the lease and return the equipment on a fair market value lease. The lessor acknowledged that it had received the oral notice in a timely manner, but refused to halt the automatic renewal. The young man lost his job.

Then there is the lessee whose lawyer contacted us several years ago. The lessee signed a lease with a $1 purchase option and made all payments. Before the term ended, the lessee’s bookkeeper retired and the new person just kept sending checks in as invoiced, never noticing that there was a 180 day notice of termination required to be sent by the lessee in the lease or that the equipment had been paid for in full, with interest, two and eventually over three times.

When the owner learned of the error, he stopped making payments and demanded a refund. The leasing company not only refused, it sued to enforce the current “renewal period.” The case settled after the judge issued the lessor a stern warning about its conduct.

All of this should be familiar to Leasing News readers. Unfortunately, it has come to the attention of activist state legislators and regulators (translation: people running for re-election or justifying their jobs). The failure to self-regulate in our industry has, as long predicted, begun to result in a real threat of government interference.

Wisconsin’s new law went into effect on May 1 of this year, requiring disclosure and notices. Louisiana has also enacted legislation, but it is limited to consumers due to, among others, the good work of Dennis Brown and ELFA. Rhode Island and New York also have automatic renewal statutes and bills in Indiana, Hawaii, Oregon and Kansas came dangerously close to passage and could be reintroduced next year.

Many of us feel that the time has come to shine a light on practices that are, in all candor, indefensible (anyone care to try?): enforcing automatic renewals in financings that are only nominally “leases”, continuing to invoice after leases have paid out and by there terms (but-for the mythical $1 payment) have ended, creating leases designed to trick the lessee into being forced to renew. These and similar practices beg the government to step in and regulate using its customary blunt-instrument approach. Don’t cry if it happens; the advice at this end is to take action now.

BARRY S. MARKS

MARKS & WEINBERG, P.C.

Financial Center - Suite 1615

505 North 20th Street

Birmingham, Alabama 35203

P. O. Box 11386

Birmingham, Alabama 35202

bmarks@marksweinberg.com

www.leaselawyer.com

205.251.8303

fax 278.8905 (Direct) 251.8305 (Main)

[headlines]

--------------------------------------------------------------

C&J Leasing Convicted $8 million Lease Discount Scheme

Day Trading Lead to his Demise

Clarence Rice, president and controller owner of C&J Leasing, C&J Vantage Leasing, C & J Special Purpose Corp., C &J Management Corp. & C& J Holding, Des Monies, Iowa was convicted on four counts of Wire Fraud by a federal jury for misappropriating $8 million dollars from a variety of sources, primarily Frontier Leasing Corp. and Liberty Bank.

Leasing News readers may remember attorney Tom McCurnin article on the appeal loss and back to trial regarding Royal Links Golf Court Kiosks, many of these leases were held by "C&J" and also sold to Frontier Leasing. He reportedly had over $800,000 in day-trading losses before he filed for bankruptcy.

These were eleven leasing companies involved in the alleged fraud with Royal Links.

C&J Leasing

CFC Investment

Dollar Bank Leasing

Excel Financial

Frontier Leasing

IFC Credit

Key Equipment

Landmark Financial

Pawnee Leasing

Preferred Capital

Susquehanna Patriot

C. Allen Rice told Leasing November 14, 2008 that he had been "...in business since 1982 has let go its 18 employees, stopped funding, and is not taking on any new business," adding he "...has never seen anything like today's financing marketplace.

The article mentions "There are reports about security deposits that were taken and now not given credit... The vendors that did not get paid... The leasing portfolio that was replevined by Liberty Bank Iowa... The servicing that was reportedly taken over by Frontier Leasing, Urbandale, Iowa. Steve Frederick of Frontier Leasing did not return a telephone call to confirm or deny."

"Leasing News was unable to verify that a bank Suspicious Activity Report was filed by Liberty Bank Iowa. This may include: "A transaction includes a deposit; a withdrawal; a transfer between accounts; an exchange of currency; an extension of credit; a purchase or sale of any stock, bond, certificate of deposit, or other monetary instrument or investment security; or any other payment, transfer, or delivery by, through, or to a bank," commonly referred to as a "SAR."

According to the Grand Jury findings:

2. C & J was in the business of leasing commercial equipment to small businesses, such as restaurants, gas stations, golf courses, and grocery stores. The leases typically lasted several years, at the conclusion of which the lessee would become the outright owner of the equipment. C & J obtained financing for its business from a variety of sources, including Frontier Leasing Corporation ("Frontier") and Liberty Bank, N.A. ("Liberty Bank").

3. Under its financing arrangement with Frontier, C & J would sell leases to Frontier in exchange for a payment. As a matter of convenience, C & J would remain the named party on the leases and continue to collect payments from lessees. However, the lease payments did not belong to C & J and instead had to be forwarded in accordance with C & J's agreements with Frontier.

4. After purchasing leases from C & J, Frontier would bundle a number of the leases together as a "securitization" and sell them to investors. This was an important part of how Frontier obtained financing for its business. Frontier also obtained financing from banks, including First American Bank of Iowa, using the C & J leases as collateral. First American Bank of Iowa is a federally-insured financial institution.

5. From the time they started doing business together, C & J and Frontier recognized that some of the leases sold by C & J to Frontier might end up going into default. Default would occur when, for example, the lessee stopped making monthly payments. The agreements between Frontier and C & J contained a limit on the percentage of leases that could be in default at any one time. If the percentage of leases in default went above that limit, C & J had to buy back enough defaulted leases to return the percentage below the limit.

6. At some point no later than the end of 2004, C & J began to experience financial problems as a result of, among other things, an unusually high number of leases going into default. These financial problems prompted RICE to begin committing several forms of fraud against Liberty Bank, Frontier, and Frontier's investors and financing sources, including First American Bank of Iowa. The several forms of fraud had a common goal: allowing C & J to maintain possession and use of money that rightfully belonged to someone else.

7. At all relevant times, RICE participated heavily in "day trading;" that is, the buying and selling of publicly-traded stocks and other financial instruments. RICE had an account at Ameritrade, an online brokerage, that he funded using money from C & J's business accounts. RICE would have the money pass through a personal account controlled by him under the name "C Allen Rice Insurance" prior to being deposited into his Ameritrade account.

10. It was part of the scheme to defraud that RICE would conceal the existence of defaulted leases from Frontier and Frontier's financing sources so as to avoid having to buy back leases under the agreements with Frontier. In many instances when a lease went into default because a lessee had stopped making monthly payments, RICE caused C & J to continue making monthly payments to Frontier anyway and represented that those payments had come from the lessee. This gave the appearance to Frontier and its financing sources that the lease was current when, in fact, it was in default.

11. It was part of the scheme to defraud that RICE unlawfully converted money to his own use, and the use of C & J, when lessees paid off their leases early. These "early payoff' amounts belonged to Frontier and its financing sources because C & J no longer owned the leases. However, RICE would not forward the money as required under C & J's agreements with Frontier. Instead, RICE caused C & J to keep the early payoff money and caused C & J to continue making monthly payments to Frontier for the leases in question, thus giving Frontier and its financing sources the false impression that the lease had not been paid off

13. It was part of the scheme to defraud that RICE caused C & J to conceal from Frontier and its financing sources that certain leases had been canceled by the lessees shortly after being entered. RICE did not notify Frontier that the leases had been canceled and instead caused C & J to continue making monthly payments as if the leases were valid and in effect.

14. It was part of the scheme to defraud that RICE caused C & J to "double finance" certain pieces of leased equipment by: (A) selling the same lease twice, once to Liberty Bank and once to Frontier; or (B) selling a lease to Frontier, renegotiating the lease with the lessee, and selling the renegotiated lease to Frontier as if it was a new lease for a new piece of equipment.

15. It was part of the scheme to defraud that RICE attempted to recoup C & J's business losses by using funds from the C & J business accounts to engage in online day trading. RICE caused funds to be transferred from C & J bank accounts to a personal bank account controlled by him, and then from the personal account to an online Ameritrade account controlled by him.

He is scheduled for sentencing September 16, 2011 in Des Moines before Judge James E. Gritzner

Grand Jury Charges (PDF)

Grand Jury Conviction (PDF)

Royal Links Appeal Rules Back to Trial

by Tom McCurnin

http://leasingnews.org/archives/May2011/5_20.htm#royal_appeal

Why Choose Advanced Property Tax Compliance? Dedicated to the leasing industry

![]()

click here to

learn more.

Hear What Our Clients say about us

click here

Gary DiLillo, President

216-658-5618 or gary@avptc.com

-----------------------------------------------------------------

Leasing Industry Help Wanted

NATIONWIDE SALES POSITIONS AVAILABLE |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Ad Pricing

Help Wanted Web Ad New Programs Classified Ad Section 15 days in a row: 30 days in a row: Design work is free. Logo is free as well as company description not to exceed the number of lines of the ad. Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top in a rotation basis per issue. * Help Wanted” ads appear in each issue on a chronological basis above the top headline as a courtesy. This position is not available as a paid position, but is generally on a rotation basis. At the same time, the ad continues in the classified help wanted section in the news edition and web site, so in effect appears twice. Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

Sales Makes it Happen

by Steve Chriest

Key Receivers---

-

Rule #1 - everyone in an organization is a salesperson.

-

Rule #2 - not everyone believes rule number one.

-

Rule #3 - everyone has customers.

The most successful, customer-centric organizations we encounter work hard to create a culture that champions all customers, including the company's employees - their "key receivers."

Managers in these organizations recognize that they oversee a volunteer workforce, and they realize that their success as managers depends, to a large degree, on their ability to persuade employees to work at fulfilling the company's mission.

We've noticed that these same managers faithfully follow their company's sales process when interacting with subordinates. The methodology they use in working with customers works as well when working with "key receivers."

We don't think it is an accident that companies that are satisfied with their implementation of highly complex CRM (Customer Relationship Management) systems share a common approach to managing their employees.

Instead of simply announcing the arrival of new CRM software, managers solicited input from all affected business units during the project's planning phase, launched modules in stages to promote user adoption, and addressed the cultural shift issues that a major change in software often entails. In short, they approached their employees as customers of the new software system!

A willingness to accept the three rules that apply to all organizations today, and a commitment to treat everyone in the organization as a "customer," helps create a true customer-focused enterprise. In these organizations, providing excellent customer service be-comes the habit of the company's "key receivers."

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

(This placard sat on the oval office desk of Ronald Reagan’s desk when he was president. It can be ordered in gold lettering on brown leatherette from:http://www.reaganfoundation.org/store/prod-_It_Can_Be_Done__Placard-988.aspx )

|

[headlines]

--------------------------------------------------------------

20 worst areas for car theft:

1. Fresno, California

2. Modesto, California

3. Bakersfield-Delano, California

4. Spokane, Washington

5. Vallejo-Fairfield, California

6. Sacramento, California

7. Stockton, California

8. Visalia-Porterville, California

9. San Francisco-Oakland, California

10. Yakima, Washington

11. Laredo, Texas

12. Detroit, Michigan

13. Seattle, Washington

14. Macon, Georgia

15. San Diego, California

16. Myrtle Beach, South Carolina

17. Las Vegas, Nevada

18. San Jose-Sunnyvale-Santa Clara, California

19. Jackson, Mississippi

20. Albuquerque, New Mexico

Full Story

http://autos.yahoo.com/news/auto-theft--worst-cities-for-stolen-cars.html

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

### Press Release ############################

Firestone Financial Unveils New Website

Features Include Online Customer Service, Self-Service Loan Applications, and Video

NEWTON, MA – Firestone Financial Corp. a leading provider of equipment financing, announced today the redesign and launch of its website www.firestonefinancial.com. “For over 45 years, Firestone Financial has been committed to building personal relationships and making it easy for our customers to do business with us,” says company President and CEO David Cohen. “Now, our new website helps us do that 24 /7.”

Cohen pointed to several features of Firestone’s new website:

-

Easy loan applications - Current customers can apply online. New applicants can begin the process with a simple online application.

-

Latest promotions – Improved faster access to low interest loans

-

Online customer service -Answers to questions and the ability to submit requests online

-

Video Library - Industry veterans talk about Firestone Financial

“One of the driving forces for this initiative was to give our distributor, manufacturer and borrowers an improved customer experience, making it easier and faster to get the answers they need,” added Cohen.

In addition to revamping firestonefinancial.com, Firestone has reenergized its social media as well with a new Facebook page -- Facebook.com/firestonefinancial -- and Twitter presence - twitter.com/Firestone_Corp.

“We see Facebook and Twitter as a great way to connect with our customers. This summer we have some fun contests planned that our followers will enjoy,” said Director of Marketing Carol Francis

About Firestone Financial

Since 1965, Firestone Financial has provided equipment financing nationwide. As a direct lender, we have helped our customers acquire billions of dollars worth of assets. Our focus is on cultivating long term relationships in the industries that we serve. Today we provide competitive financing solutions for the carnival, vending, fitness, coin-op, and amusement industries. To learn more, call 1.800.851.1001 or visit www.firestonefinancial.com.

#### Press Release #############################

Santa Monica Man Indicted on Federal Tax Charges

Los Angeles – A Santa Monica man was arrested Friday morning on charges that he committed tax fraud and attempted to interfere with the administration of the Internal Revenue laws.

Howard Hal Berger, 51, appeared Tuesday morning before United States District Court Judge John F. Walter. Berger previously pleaded not guilty to the charges specified in the indictment returned by a federal grand jury late last week.

According to the indictment, Berger filed a partnership income tax return for Lab Holdings LLC for the 2006 tax year which falsely reported a contribution of $1,000,000, substantially reducing his income tax liability.

Additionally, Berger filed an individual income tax return for the 2006 tax year which falsely reported gifts to charity of $991,700 on the attached schedule of itemized deductions.

While under audit by the Internal Revenue Service, Berger submitted a false charitable donation letter in an attempt to substantiate the deduction for gifts to charity taken on the 2006 individual income tax return.

An indictment contains allegations that a defendant has committed a crime. Every defendant is presumed to be innocent until proven guilty in court.

If convicted of all charges specified in the indictment, Berger faces a statutory maximum of nine years in federal prison and fines totaling $750,000. Berger is currently free on bond pending trial. Trial in this matter is scheduled for August 9, 2011, before Judge Walter.

The investigation of Berger was conducted by IRS-Criminal Investigation in conjunction with the United States Attorney’s Office in Los Angeles.

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Centre Hall, Pennsylvania-- Adopt-a-Dog

Delilah

Animal ID 13212889

Species Dog

Breed Retriever, Labrador/Mix

Age 4 years

Sex Female

Size Medium

Color Yellow

Declawed No

Housetrained Yes

Intake Date 5/29/2011

The Pennsylvania SPCA

Centre Hall Adoption Center

2451 General Potter Highway

Centre Hall, PA 16828

814.364.1725

Team Lead: Troy Klinefelter

Cruelty reports: 866.601.SPCA

Hours:

Monday: 11:30AM-4:00PM

Tuesday: 11:30AM-4:00PM

Wednesday: 11:30AM-7:00PM

Thursday: 11:30AM-7:00PM

Friday: 11:30AM-4:00PM

Saturday: 11:30AM-4:00PM

Sunday: 11:30AM-4:00PM

http://pspca.org/adoption_centers

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

|

![]()

--- News Briefs

Susquehanna to buy 1N Bank parent company

http://dailylocal.com/articles/2011/06/21/news/doc4e00e0b563183637890101.txt

Bank Deal Could Put PNC in Sweet Spot

http://www.moneyshow.com/investing/article/39/Jubak_Picks-23501/Bank-Deal-Could-Put-PNC-in-Sweet-Spot/

Airline revenues going up, up and away

http://latimesblogs.latimes.com/money_co/2011/06/airline-revenues-going-up-up-and-away.html

Airbus Wins CIT and TransAsia Deals for 56 A320neo-Family Jets

http://www.airlinesanddestinations.com/airlines/airbus-wins-cit-and-

transasia-deals-for-56-a320neo-family-jets/

Pratt & Whitney Gets another Major PurePower Engine Order from CIT

http://www.courant.com/business/hc-cit-pratt-engine-order-20110621,0,2469724.story

Boeing rights a wrong: the flight attendant button

http://www.chicagotribune.com/business/breaking/chi-boeing-rights-a-wrong-the-flight-attendant-button-20110621,0,1968821.story

Ford commits $1 billion to Lincoln brand

http://www.upi.com/Business_News/2011/06/21/Ford-commits-1-billion-to-Lincoln-brand/UPI-41671308679127/

Amazon offers Texas 5,000 jobs in trade for sales-tax exemption

http://seattletimes.nwsource.com/html/businesstechnology/2015383772_amazontexas22.html

Gannett laying off 700 more workers amid ad slump

http://www.usatoday.com/money/media/2011-06-21-gannett-layoffs_n.htm

You May Have Missed--

Public Unions Take On Boss to Win Big Pensions

http://www.nytimes.com/2011/06/22/business/22union.html?_r=1&ref=business

Sports Briefs----

N.F.L. Set to Proceed Toward Deal with Players

http://www.nytimes.com/2011/06/22/sports/football/nfl-set-to-proceed-toward-deal-with-players.html

![]()

California Nuts Briefs--

Controller says he won’t pay legislators

http://latimesblogs.latimes.com/california-politics/2011/06/controller-says-he-wont-pay-legislators-without-a-budget.html

Oakland names San Jose deputy manager as new city administrator

http://www.contracostatimes.com/news/ci_18327143?nclick_check=1

![]()

“Gimme that Wine”

Alain Juppé: the market decides the price of Bordeaux

http://www.decanter.com/news/wine-news/528954/alain-jupp-the-market-decides-the-price-of-bordeaux

Jean-Michel Cazes Receives Lifetime Achievement Award at Vinexpo

http://www.mastersofwine.org/en/news/index.cfm/id/E9488424-9DE0-4278-AD9EBEF0AC2A7713

No Fear on Wine Pairing

http://www.pressdemocrat.com/article/20110620/LIFESTYLE/110629932?Title=No-fear-at-Lynmar-Estate-Winery

Wineries...In Ohio, there's always one nearby

http://www.mansfieldnewsjournal.com/article/20110620/LIFESTYLE/106200316/Wineries-Ohio-there-s-always-one-nearby?odyssey=mod%7Cnewswell%7Ctext%7CFrontpage%7Cp

India 9th Biggest Grape Producer in World

http://www.indianwineacademy.com/item_2_456.aspx

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

Please send to a colleague---Leasing News is Free

![]()

This Day in American History

1610--In their search for a marketable product, some settlers had begun growing tobacco. 1610. Europeans had acquired a taste for tobacco in the late sixteenth century when the Spanish brought samples from the West Indies and Florida. Initially expensive, it became popular among wealthy consumers. The high price appealed to Virginians, but they found that native Virginia leaf was of poor quality. John Rolfe began experimenting with seeds from Trinidad, which did much better. The first cargo of Virginia-grown tobacco arrived in England in 1617 and sold at a highly profitable 3 shillings per pound. Following Rolfe's success, settlers immediately planted tobacco everywhere- -even in the streets of Jamestown. Company officials, unwilling to base the colony's economy on a single crop, especially one that many people (including King James) considered to be an unhealthy indulgence, tried to restrict annual production to 100 pounds per colonist. Colonists, busy "rooting in the ground about Tobacco like Swine" as one observer reported, ignored these restrictions. But it was only after company rule ended that tobacco planting really surged. Between 1627 and 1669, tobacco exports climbed from 250,000 pounds to more than 15 million pounds. As the supply grew, the price plunged from 13 pence in 1624 to a mere penny in the late 1660s, where it remained for the next half century. What had once been a luxury product thus became affordable for Europeans of average means. Now thoroughly dependent on tobacco for their livelihood, the only way colonists could compensate for falling prices was to grow even more, pushing exports to England to more than 20 million pounds by the late 1670s.

1611 - After spending a winter trapped by ice in present-day Hudson Bay, the starving crew of the Discovery mutinies against its captain, English navigator Henry Hudson, and sets him, his teenage son, and seven supporters adrift in a small, open boat. Hudson and the eight others were never seen again. Two years earlier, in 1609, Hudson sailed to the Americas to find a northwest passage to Asia after repeatedly failing in his efforts to find a northeast ocean passage. The Discovery later returned to England, and its crew was arrested for the mutiny. Although Henry Hudson was never seen again, his discoveries gave England its claim to the rich Hudson Bay region.

1774-The Quebec Act was passed by Parliament. It established a permanent government in Quebec and extended its boundaries south to the Ohio River, to include land contested by several American colonies. For this, it was considered by the colonists to be one of the Intolerable Acts that lead to the Revolutionary War.

http://www.wpi.edu/Academics/Depts/MilSci/BTSI/abs_coer.html

1807 - The crew of the British man-of-war, "Leopold," fired upon and boarded the United States frigate "Chesapeake." The commander of the "Chesapeake," James Barron, was court martialed and convicted for not being prepared for action. Along with some others, this incident led to the War of 1812. Eight years after the war, Stephen Decatur, a judge in the court martial, was killed in a duel. The victor of the duel was James Barron.

1832- John Ireland Howe of Derby, CT, obtained a patent for manufacturing pins. He exhibited it at the American Institute Fair in New York City, receiving a silver medal for his contribution to Manufacturing. He later founded the Howe Manufacturing Company and made improvements on his design. It was a great

boon to the clothing industry, among others.

1846- Adolphe Sax patented his invention - the saxophone. He had invented the instrument early in the decade, and by the time the patent was granted there were 14 different saxophones - seven designed for orchestras and seven for bands. The saxophones designed for bands are the ones in common use today.

1847-The doughnut with a hole was first invented in 1847 by American sea captain Hanson Crocket Gregory.

http://www.etni.org.il/challenge/challenge5.htm

1850--In San Francisco, a 500-pound grizzly bear was caught today near the Mission Dolores.

1851- The California State Capitol moved to Vallejo. The sixth Great Fire destroyed 14 blocks within four hours. Fire broke out in a frame home on the north side of Pacific near Powell and destroyed City Hall at Kearny and Pacific and the Jenny Lind Theatre. All day the fire spread from street to street, and the newly constructed reservoirs were nearly empty. Ten entire blocks were destroyed. This incendiary fire caused $3,000,000 damage. Police arrested Benjamin Lewis for arson, but he later got off on a technicality.

1896- Dr. Mary Stone ( Shih Mai-Yu), graduated from the Medical School of the University of Michigan, Ann Arbor, MI, becoming the first physician who was a Chinese woman. She founded the Women’s Hospital at Kiukiang, China, under the auspices of the Methodist Foreign Mission and served as its head for 25 years.

1894-Legendary magician and escape artist Harry Houdini married Wilhelmina Beatrice Rahne.

(lower part of: http://memory.loc.gov/ammem/today/jun22.html )

1898 - ADM Sampson begins amphibious landing near Santiago, Cuba. Lt. Col. Theodore Roosevelt and Col. Leonard Wood led the Rough Riders, a volunteer cavalry regiment, onto the beach at Daiquiri in the Spanish American War.

1903-Birthday of Ben Pollack, Chicago Dixieland drummer, who owned a “pizza/beer/jazz “ joint on Sunset Blvd in Hollywood, California, with a cover charge. When I was growing up, this was one of best hang outs as those under 18 could get in, and often, we had beer, although we were also not 21. Pollack was a “boom-chick-a-boom” drummer, but played with some of the best and is mentioned in many Chicago jazz era books. Warren Luening, Jr. would sometimes sit in and play trumpet with the band. Pollack really liked his playing, and it may have been one of the reason we were always able to drink beer here.

1910 -- .. Dancer, anthropologist, humanitarian, philanthropist.

Katherine Dunham born, Chicago, Il

http://www.eslarp.uiuc.edu/kdunham/bio.htm

http://www.pbs.org/wnet/freetodance/biographies/dunham.html

1912—The Republican party under President Roosevelt got into a bitter feud between the various faction of the party, starting out in the open with Roosevelt asking a faction to leave the convention; resulting in a split party, basically giving the election to Democratic candidate Woodrow Wilson, who was not that popular but won because of the Republican split party.

http://www.canoe.ca/MusicHistoryAugust/home.html

1918-A Michigan Central Railroad troop train, after several days shuttling soldiers to New York from Chicago, was deadheading back to the Midwest when it struck the rear of the Hagenback-Wallace Circus train. The circus trained has stopped to have its brake box overhauled in Ivanhoe, Indiana. Fifty-three circus performers were killed. Of the circus animals not killed outright, many that were crippled and maimed had to be destroyed by police officers. The performers, of who only three could be identified, were buried in a mass grave. The engineer, A.K. Sargent, who was accused of falling asleep at the throttle, was tried and acquitted.

1919-An F5 tornado struck the town of Fergus Falls, Minnesota. 59 people were killed and 400 buildings were destroyed. Lumber was carried for 10 miles and other debris were found 60 miles away.

1933-Birthday of Diane Feinstein - U.S. Senator from California, former mayor of San Francisco. In 1969, she first woman to be elected president of the San Francisco Board of Supervisors and then succeeded the murdered mayor serving 1978-88. She was defeated in a try for Governor of California but lost and then was elected U.S. Senator in 1992.

1936—Singer, songwriter and actor Kris Kristofferson was born in Brownsville, Texas. His first success as a songwriter came when Roger Miller recorded "Me and Bobby McGee." That song was turned into a million-seller by Janis Joplin in 1971. And Sammi Smith sold a million with "Help Me Make It Through the Night," another Kristofferson song. By this time, Kristofferson had begun his career as a singer, and in 1972, his single, "The Silver-Tongued Devil and I," was certified gold. His other successes have included the single, "Why Me," and the albums "The Silver-Tongued Devil and I" and "Jesus Was a Capricorn." In 1985, Kristofferson, along with Johnny Cash, Waylon Jennings and Willie Nelson, recorded the hugely successful "Highwayman" single and album. There was a "Highwaymen Two" album in 1990 with the same cast.

1937-At Chicago’s Comiskey Park Joe Louis won the World Heavyweight Championship title by knocking out James J. Braddock (eighth round). Louis retained the title until his retirement in 1949. Exactly one year after the Braddock fight, on June 22, 1938, Louis met Germany’s Max Schmeling, at New York City’s Yankee Stadium. Louis knocked out Schmeling in the first round.

1938 -- Joe Louis knocks out "Aryan supremacy claimant Max Schmeling.

http://www.ibhof.com/jlouis.htm

1942 - A Japanese submarine shelled Fort Stevens, Oregon, at the mouth of the Columbia River. In a plan, balloons were launched with bombs that landed in Oregon, but the military along with the news media never mentioned the fires or damaged that occurred.

1944 - The GI Bill of Rights was signed by President Franklin D. Roosevelt. One of the most important governmental measures of the post-World-War-II era, the bill was designed to provide greater opportunities for returning war veterans. An important result of the bill was the training of almost 8 million veterans.

1945- Howard Kaylan, one of the two lead singers of the Turtles, was born in New York City. The Turtles had hit singles with "It Ain't Me Babe" in 1965 and "Happy Together" and "She'd Rather Be With Me," both in 1967. Some members of the Turtles wanted the group to be more than a band that made hit singles. The resulting dissension led to the Turtles' breakup in 1968. Lead singers Howard Kaylan and Mark Volman joined the Mothers of Invention, and then embarked on a duo career as Flo and Eddie.

1947- 12 inches of rain fell in 42 minutes at Holt, Missouri, setting a new rainfall intensity world record. That record was tied on January 24-25, 1956, at the Kilauea Sugar Plantation in Hawaii, as their state record was established with 38 inches of rain in 24 hours.

1949---Top Hits

Again - Gordon Jenkins

Some Enchanted Evening - Perry Como

Bali Ha’i - Perry Como

One Kiss Too Many - Eddy Arnold

1957---Top Hits

Love Letters in the Sand - Pat Boone

Teddy Bear - Elvis Presley

I Like Your Kind of Love - Andy Williams

Four Walls - Jim Reeves

1957-The Quarry Men, consisting of Rod Davis, Eric Griffiths, Colin Hanton and John Lennon, performed on the back of a coal truck during a street party marking Liverpool's 750th anniversary.

1959-Fabian's biggest hit, "Tiger" entered the Billboard chart, where it would top out at #3. In all, the Philadelphia singer, born Fabiano Forte, placed eight songs in the US Top 40.

1959 - Eddie Lubanski bowled 24 consecutive strikes, that is two perfect games, back-to-back, in a bowling tournament in Miami, Florida.

1959-Chuck Berry's "Memphis" is released.

1959 - Starting its fourth week at the top of the Tunedex was "The Battle of New Orleans" by Johnny Horton. The song spent six weeks at number one. It was Horton’s only number one record and million copy seller. He had other big hits with movie music like "Sink the Bismarck" and "North to Alaska" from the film by the same title, starring John Wayne. Horton, from Tyler, Texas, married Hank Williams' widow Billie Jean Jones. On November 5, 1960, Johnny Horton was killed in a car crash.

1962 - St. Louis Cardinal veteran Stan Musial broke the late Ty Cobb's major league record of 5,863 career total bases.

1963 - "Fingertips - Pt 2," by Stevie Wonder, was released, and became his first number one single on August 10th. From 1963 to 1987, Wonder had 46 hits on the pop and R&B music charts, eight of which made it to number one.

1963--The Safaris' "Wipe Out" is released.

1964 - The United States Supreme Court voted that "Tropic of Cancer," Henry Miller’s controversial book, could not be banned.

1965---Top Hits

I Can’t Help Myself - The Four Tops

Mr. Tambourine Man - The Byrds

For Your Love - The Yardbirds

Ribbon of Darkness - Marty Robbins

1968---Mason Williams' "Classical Gas" is released.

1968- the Jeff Beck Group, with Rod Stewart and Ron Wood, made its US debut at the Fillmore East in New York City. Stewart was said to have had such a severe case of stage fright that he hid behind the speakers for the first couple of songs. The band, which had a major influence on the heavy metal groups that followed, broke up after two LPs and several North American tours.

1968-Mason Williams' "Classical Gas" is released. It will enter the Billboard charts three weeks later and reach #2 on the Pop chart and #1 on the Adult Contemporary chart. The record has since received more US radio airplay than any other instrumental in Rock history.

1972- Hurricane Agnes, a category 1 storm, made landfall near Apalachicola, Florida on the 19th, moved northeast, joined up with an upper level disturbance, and unloaded anywhere from 10 to 20 inches of rain across Maryland, Virginia, Pennsylvania, and New York during the period from the 20th to the 25th. Extreme flooding was the result -- the worst in U.S. history. A dike was breached at Wilkes-Barre, Pennsylvania and the resultant wall of water destroyed much of the city. Total damage was $3.5 billion and 122 lives were lost.

1973---Top Hits

My Love - Paul McCartney & Wings

Playground in My Mind - Clint Holmes

I’m Gonna Love You Just a Little More Baby - Barry White

Kids Say the Darndest Things - Tammy Wynette

1974-Gordon Lightfoot started a two-week run at the top of the Billboard album chart with "Sundown". The title track reached #1 on the Pop and Adult Contemporary charts as well as #13 on the Country chart, while "Carefree Highway" reached #10 on the Pop chart, #1 on the Adult Contemporary chart and #81 on the Country chart.

1981 - A young woman from Lubbock, TX, was struck by lightning. The bolt of lightning struck just above her right shoulder near her neck, and passed right to left through her body, tearing her warm-ups, causing her tennis shoes to explode, and lifting her two feet into the air.

1981---Top Hits

Stars on 45 medley - Stars on 45

Sukiyaki - A Taste of Honey

A Woman Needs Love (Just like You Do) - Ray Parker Jr. & Raydio

But You Know I Love You - Dolly Parton

1985 - "People" took count of the deaths in Sylvester Stallone’s "Rambo" movie, finding that 44 people directly killed. Those at "People" figured out this was an average of one person dying every 2.1 minutes. There were also 70 explosions that killed an uncountable number of people.

1987 - Thunderstorms in southern Texas produced wind gusts to 116 mph near Quemado. Thunderstorms in New York State produced 5.01 inches of rain in 24 hours at Buffalo, an all-time record for that location, and produced an inch of rain at Bath, PA. The temperature at Fairbanks AK soared to 92 degrees, establishing a record for the date.

1988 - Sixty-five cities in twenty-four states reported record high temperatures for the date. Tucson AZ reported an all-time record high of 114 degrees, surpassing the previous record of 112 degrees established a day earlier. Highs of 98 degrees at Pittsburgh, PA, and 100 degrees at Baltimore, MD, tied records for the month of June.

1989- White Sox Carlton Fisk surpasses Yogi Berra as the American League leader for career home runs by a catcher as his 307th home run helps to beat the Yanks, 7-3.

1989---Top Hits

I’ll Be Loving You (Forever) - New Kids on the Block

Satisfied - Richard Marx

Buffalo Stance - Neneh Cherry

Love Out Loud - Earl Thomas Conley

1990 - The last-place Atlanta Braves fired manager Russ Nixon and replaced him with GM Bobby Cox, who last managed Toronto in 1985. Good move. Cox led the Braves to a dramatic worst-to-first turnaround, the first of its kind in the National League. In the World Series his team lost to the (also) resurgent Minnesota Twins. Cox was name AP Manager of the Year (the first manager to be so named in both leagues). The Braves followed 1991 with NL East championships in 1992, 1993, 1995, 1996, and 1997, becoming the first team to win division titles in six straight completed seasons. Those division titles also let to NL pennants, except for 1993 and 1997.

1998 - CompUSA announced that it was buying Computer City from Tandy for $275 million. Tandy was selling the sickly chain as part of a turnaround it had started the previous year. Tandy president Leonard Roberts said, “Computer City was a losing operation for the company. The sale will allow us to completely focus on Radio Shack at a time when profits are at an all-time high.”

1990- Billy Joel became the first rock artist to perform at Yankee Stadium.

2001-- Returning to major leagues after a stint with Newark Bears of the independent Atlantic League, Jose Canseco starts as the designated hitter for the White Sox. The former All Star, who has 446 career home runs (23rd all time), didn't get any offers after being released by the Angels in the spring.

2003-- In the 13th inning at Veterans' Stadium, pinch-hitter Todd Pratt hits a two-run giving the Phillies a walk-off 6-5 victory over the Red Sox. Boston's shortstop Nomar Garciaparra's club tying record 6-for-6 (all singles) performance could not prevent the bullpen from blowing three late leads; 2-1 in the 8th (Thome's HR ties it), 3-2 in 12th (Thome's second HR ties it).

2006--California and the rest of the West Coast got hit by a big heat wave. For three days it has been over 100 degrees in the shade.

It was 104 degrees at Los Gatos, California, where I work. The air conditioning could not keep up and when the office hit 83 degrees at 3pm, we closed up and all went home for a cool one.

NBA Finals Champions This Day

1994 Houston Rockets

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Ten Top Stories each week chosen by readers (click here)

Adopt a Pet

Bank Beat

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

The Secret of Our Success

To Tell the Truth

View from the Top

(chronological order)

- Royal Links Appeal Rules Back to Trial

by Tom McCurnin

- More Top Leasing Web Sites

- Top Ten Cities with the Highest Credit Scores

- OneSource Develops Business License Software

- Jeffrey Taylor in Hospital

- Get Linked In---

by Christopher Menkin, Publisher

- The Main Reason to Lease

- John Otto/HL Leasing Alleged Scam---Up-dated

- The Strange Case of Sheldon Player

- Marlin Profit Down due to hiring more sale personnel

- Five Point Capital, San Diego, California

Bulletin Board Complaint

- Goodbye LEAF Financial by Christopher Menkin

- Shivers Secures $25 Million Line with Wells

- Newcourt’s Hudson Controversial Move Back into Leasing

- Franchise Industry Report by Bob Rodi, CLP

- Talk About Chutzpa, Fanghella has more than Trump

- U.S. Bancorp Sunny Days

- Leasing Association Membership Confirms Changing Industry

by Christopher Menkin

- Bank of the West moving more workers to Bishop Ranch

- Key Bank and Leasing---The Numbers

- Leasing Icon Robert Krause Retires

- Allied Health Care Services Charles K. Schwartz Pleads Guilty

- US Bank Manifest More Cut Offs

-

ZRG Leasing Index Posts 33% Increase in Q1

- BBB: Rating Leasing Companies

- Despite Marketplace Losses, Pawnee Year-End $12.4MM Profit

- State of the Leasing Industry

by Christopher Menkin

- Richest Man in Leasing: Steven Udvar-Hazay

- Lease Company vs. Commercial Equipment Finance Company?

- Leasing Gypsies Strike Again in Southern California

Bulletin Board Complaint

- High Risk Lenders Use Native American tribes by Jeffrey Taylor

- Snowflake Financial---A new angle

Bulletin Board Complaint

- From Zero to over $450 Million in One Year

- License Up-Date for Leasing in United States

- Loan/Lease Statute Up-Date

- Church Kiosk Fray---Comes back to bite Balboa on the...

- Tyco Kozlowski Mansion Sold to Direct Capital CEO & Wife

- Business Leasing Northwest, Seattle, Washington

Bulletin Board Complaint

- Brican America---Update

- Bulletin Board Complaint---ACC Capital

- Leasing Brings Resource America to a serious loss

by Christopher Menkin

- Six Years to Name Final Royal Links Scam Principal

-

Vaughn Indicted for defrauding banks, leasing companies

-

Wildwood employees get prison for Leasing Ponzi scheme

- Operation Lease Fleece---2011 Update

- IFC Credit Corporation BK—Up-date

- De Lage Landen: A Teachable Moment

by Bernie Boettingheimer, CLP

- Leasing News Position on Evergreen and Winter Green Leases

- I should have called Lease Police!

by Christopher Menkin

-

PinnFund/PinnLeasing Michael Fanghella Out of Jail

Seeks $150,000 Job

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

-

NorVergence---still going

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses