Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Thursday, June 13, 2013

![]()

Today's Equipment Leasing Headlines

Archives---June 13, 2006

Bob Fisher Promoted to Executive Vice President

Classified Ads---Sales

On Deck Crosses $500 Million Lending Mark

Increases Loan Amount & Funding Process One Day

Capital One Equipment Finance Terminates Specialty Vehicle

More on Capital One Raid SunTrust Staff

by Kit Menkin

New Hires---Promotions

Classified Ads---Help Wanted

Sales Makes it Happen by Steve Chriest

Vendor Hidden Issues

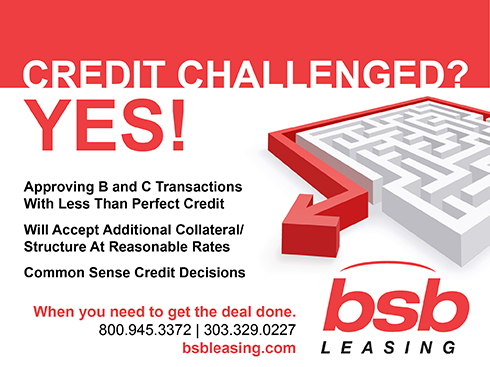

Transportation Deals Funded Last 30 Days

Channel Partners

Short Sighted Equipment Lessors Which Repossess

Prior to Bankruptcy Filing But Do Not Return Vehicle

Tagged for Damages

By Tom McCurnin

Mortgage Rates Radar: Upward Trend for Rates Continues

Stellus Capital Invests $25 Million

in Colford Capital

To Kill a Mockingbird/Kramer vs. Kramer

Mr. Mom/Parenthood/The Fantastic Mr. Fox

Father's Day DVD specials by Fernando Croce

Pointer Mix

Manhattan, New York Adopt a Dog

News Briefs---

Big storm threat brewing from Iowa to Mid-Atlantic

RailroadAge: Equipment leasing: The best of times?

GE has begun training medical staff, commenced aircraft leasing in...

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives---June 13, 2006

Bob Fisher Promoted to Executive Vice President

KINGWOOD, TEXAS , – Main Street Bank, Kingwood, Texas , announced the promotion of Bob Fisher, CLP, to Executive Vice President of the Equipment Leasing Division. Fisher will have responsibility for all the operational aspects of the lease finance division including credit, lease documentation, funding, syndications and the call center. Additionally, he will continue to manage the wholesale originations and the sales offices.

Ex-U.S. Marine Bob Fisher

Fisher, a nationally recognized leader in the equipment finance industry, has a 25-year background in credit, sales and management in the equipment financing industry. Beginning his career with the CIT Group/Sales Financing Inc, he has held various sales, credit and management positions throughout his career. Fisher has been active in numerous professional organizations, including UAEL, EAEL, ELA and NAELB, and served as UAEL President in 2002. Fisher was graduated from Trenton State College, Trenton , New Jersey .

Tom Depping, Chairman of Main Street Bank stated: “We are very pleased to have Bob on our team as Main Street continues to develop a strong and dynamic, customer oriented equipment leasing group.”

Fisher said: “It is a pleasure to be part of Main Street Bank and its dynamic leasing team. I look forward to continuing working in my newly expanded role to bring innovative financial solutions to our customers.”

Main Street Bank maintains retail-banking offices in the Houston , Texas market and is a national leader in commercial equipment lease financing.

Fisher can be contacted at rfisher@msnbank.com

(Mr. Fisher began his career with The CIT Group/Sales Financing Inc. holding various sales, credit and management positions throughout his 20 plus year tenure. He was with New Era in Illinois , who became Datronics, and when they went out of business due to some improprieties of their president, started Fisher-Anderson in Des Moines , Iowa .

(When Marcap ended funding and then took of the portfolio, he started Firerock Financial, then moved to Houston , Texas , and joined the management team of Douglas-Guardian. He missed the excitement of “putting deals together,” which his good friend Bruce Lurie understood, and joined Main Street to help put the small business bank on the map. Fisher is considered by his peers to be one of the best credit decision makers in the equipment leasing industry. Editor)

Today

Senior Vice President of Business Development

Ascentium Capital, Kingwood, Texas

(Thomas Depping, founder of Main Street Bank, is also

the founder of Ascentium where he serves as Chief Executive Officer)

Contact Bob through: www.linkedin.com/pub/bob-fisher/1b/496/82b

Bookmark us

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment

or looking to improve their position)

| Central Valley, California 6 years sales, management, marketing, business development, budget planning, finance. Proven track record challenging and competitive situations. Expert: healthcare, banking, and entrepreneurship. dsp559@outlook.com| Resume |

| Garfield, NJ 15 years experience small to large ticket sales exp. All types of equipment industries. Vendor & direct. Self motivated. Work with leasing company or broker. Tony Lio tonylio@optonline.net |

| Montgomery, AL Individual with 10 years advertising sales exp. & 7 years insurance sales exp. Wants independent contractor situation in Alabama. Work with leasing company or broker. 334-590-5133 E-mail: billmcneal2003@yahoo.com |

Orange County, CA |

San Francisco Bay Area: |

| Texas/Oklahoma 15 year lease vet looking for plact to take business.great references. all major equipment types. open to compensation. please contact if interested. E-mail: bankingdallas@yahoo.com |

| Remote MBA, CLP, 20 yrs. experience, highly energy. Ethics, high volume producer Work from remote sales location, for national, independent Lessor/broker Commission only preferred. E-mail: stefitony@yahoo.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

#### Press Release #############################

On Deck Crosses $500 Million Lending Mark

Increases Loan Amount & Funding Process One Day

NEW YORK, -- On Deck (www.ondeckcapital.com), the technology-powered Main Street lender, announced today a number of product expansions to better serve the growing needs of small businesses nationwide. These enhancements will increase the amount of growth capital and speed of funding to a market that’s historically been underserved by banks. On Deck also announced that it has crossed the $500 million mark of capital deployed to these businesses, a 25% increase in just three months.

The enhancements include: increased loan size to $250,000 up from $150,000; Fund by Wire transfers for instant funding issued four times daily at 11am, 1pm, 3pm and 4:30pm; and 6 days a week Sales and Operations support with Saturday service from 8am – 8pm EST. Collectively, these new features will better meet the needs of small business owners pursuing short term growth initiatives such as inventory purchasing, marketing and facility expansion.

Noah Breslow, CEO

“We actively listen to our customers, and they have told us that they want speed, convenience and quality service. We’re confident these new features will give them more capital, faster, and with our hallmark customer experience,” said Noah Breslow, chief executive officer, On Deck. “Our ultimate objective is to reinvent the entire lending system to provide Main Street the capital they need and a process that is more empowering than other lending offerings, such as banks and cash advance products.”

On Deck’s platform leverages big data to better evaluate the credit worthiness of businesses, and through its technology has transformed small business lending, essentially making the process exponentially faster, easier, and more transparent for the business owner. The typical On Deck customer is a "Main Street" business (retailer, restaurant, salon, dentist, florist, etc.) that has been in business more than one year and has revenue between $100,000 and $5,000,000. On Deck has dispersed capital to tens of thousands of businesses across 700 different industry verticals.

This year alone, On Deck has achieved several major accomplishments; including being named to Forbes’ 100 List of America’s Most Promising Companies; moving to new headquarters to accommodate rapid growth; opened a new Western regional office in Denver; expanded bank partnerships; new executive hires; and a completed Series D financing totaling $59M, led by Institutional Venture Partners (IVP) and Google Ventures.

About On Deck

Launched in 2007, On Deck uses data aggregation and electronic payment technology to evaluate the financial health of small and medium sized businesses and efficiently deliver capital to a market underserved by banks. Through the On Deck platform, millions of small businesses can obtain affordable loans with a fraction of the time and effort that it takes through traditional channels. The company's proprietary credit models look deeper into the health of businesses, focusing on overall business performance, rather than the owner's personal credit history. The On Deck system also provides a critically needed mechanism for financial institutions and other business service providers to efficiently reach the Main Street small business market.

On Deck has deployed over $500 million in capital to tens of thousands of businesses in 700 different industries. The company is growing at greater than 100% annually, and was recently named to Forbes' 100 Most Promising Companies in America list and the Inc. 500. On Deck is financed by some of the nation's leading venture capital firms, including Google Ventures, SAP Ventures, RRE Ventures, and Institutional Venture Partners.

For more information, please visit: www.ondeckcapital.com. For more information, follow On Deck capital on Twitter @OnDeckCapital

##### Press Release ############################

[headlines]

--------------------------------------------------------------

Capital One Equipment Finance Terminates Specialty Vehicle

Letter Sent to Brokers/Discounters/Funder Sources

Letter from Paul Dell’Aquilo, Senior Vice President Capital One, N.A.:

"After a great deal of thought and consideration, Capital One Equipment Finance Corp. (formerly known as All Points Capital Corp. and / or dba Capital One Equipment Leasing & Finance) (“Capital One”) has made the decision to terminate its Specialty Vehicle Finance business. As a valued client, I am writing to make you aware of this decision and its impacts to you.

"In light of this development, this letter serves as formal written notice that, aside from any additional advances under the Loan Agreement that were agreed to in writing prior to the date of this letter, Capital One cease making Advances or accepting additional applications." (1)

The letter ends:

"Capital One greatly appreciates your business, and it is with regret that we end this relationship with you. We wish you the best and it is our hope that we may serve your banking needs in another area in the future." (1)

(1) Capital One Goodbye Letter

http://www.leasingnews.org/PDF/GoodByeLetter_62013.pdf

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

Help Wanted Classified Ads Cost The classified ad will appear for 21 days. The idea is to attract an applicant to learn more, either to click to a full description on your web site or to a full job description attachment (free, no charge). All "Help Wanted" ads go into the "Help Wanted" classified ad section, which appears in each news edition, and is well read. The ad will also appear on the web site for those who go directly to the web site section. A "Help Wanted" ad appears at the top of the headlines in each edition in a chronological basis with other help wanted ads. The position cannot be purchased. The ad also continues to appear in the classified ad section in the news edition as well as the web site in addition to appearing above the headlines. If there is only one help wanted ad, a display ad may be utilized in the rotation basis as this position, meaning the one help wanted ad is not going to be on top in every edition. Contact kitmenkin@leasingnews.org for more Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

More on Capital One Raid of SunTrust

by Kit Menkin

In Monday's Leasing News edition the American Banker article "Capital One Raids SunTrust to Beef Up Leasing Unit" was in News Briefs. It basically stated Capital One Financial had hired 21 "professionals", doubling the size of its unit, and announced "...the expected hiring of 13 more equipment financing specialists, 11 of whom came from rival SunTrust Banks .(1)

Tuesday the announcement was made. The American Banker magazine quoted Dan McKew, Senior Vice President, Capital One Bank, who was leading the crew.

"If we hire experts in these fields who know more about this business both from a servicing the customer perspective and a protecting the bank standpoint, we'll be able to lessen our losses and give better service," McKew said. "And when you have fewer losses you can offer better pricing and service because you know you won't have to support those losses with prices you pay."

"These are people who know how I like to have thing run and who are excited to come in and make this happen."

(LinkedIn photo)

June 18, 2012: Dan McKew, former President of SunTrust Leasing, will take over Walter Rabin’s old job as President of Capital One Commercial Lending. Rabin left after 13 years, the last as senior vice-president, to head Signature Financial, a division of Signature Bank, New York. According to the press release announcement he "...will join Signature Financial as President in June 2012, after a 90-day waiting period.

McKew was previously president of CFG Community Bank, Baltimore Maryland (November, 2011--Present), president, 1st Mariner Bank (October, 2010-November, 2011), Principal, management consulting (May, 2010-September, 2010), president/ceo, SunTrust Equipment Finance and Leasing Corporation (July, 1997-March, 2010), chairman of the board, Inured Workers Insurance Fund (November, 1997-May, 2008), president, Signet Leasing Corporation (March, 1991-May, 1997), vice-president, PHH (March, 1983-February, 1991),Loyola College in Maryland MBA, Finance (1981 – 1983) Loyola College in Maryland BA, Accounting (1975 – 1979)

http://www.linkedin.com/in/danmckew

Capital One Bank’s equipment finance solutions include term loans, finance leases, tax leases, and terminal rental adjustment clause (TRAC) leases with a focus on transactions that range from $500,000 to $50,000,000.

It appears there have been several new leasing companies in this market place, and the Tuesday announcement of the 13 new hires show several joined in April and May, one in March of this year, according to both LinkedIn as well as Leasing News “New Hires”. (2)

New to the trend in the growth of the middle-marketplace is all the new hires will be based at the headquarters in Towson, Maryland:

Lorraine Carpenter, Assistant Vice President – Lorraine brings more than 37 years of banking experience. She was vice-president at SunTrust Equipment Finance and Leasing, joining the firm in 2001 She will be responsible for documenting direct commercial transactions.

www.linkedin.com/pub/lorraine-carpenter/41/860/164

Rich Cumbers, Vice President – He previously was vice president at SunTrust Equipment Financing and Leasing, joining the company in 2003. " (He)..has 30 years of experience in the commercial banking industry... will be responsible for the underwriting of equipment finance requests for commercial customers.

www.linkedin.com/pub/rich-cumbers/20/23a/582

Rick Dusek, Vice President – He previously was equipment manager at SunTrust Equipment Finance & Leasing, joining the firm in 1999. Previously he was equipment manager at GE Capital Markets (1990-1999).Boston University, Economics (1979 – 1983). Accredited Senior Certified Appraiser with ASA.

www.linkedin.com/pub/rick-dusek/25/85b/279

Melissa Espey, Associate (She will be the Equipment Finance team as a Booking and Funding Associate.) She was AVP Operations at SunTrust Equipment Finance & Leasing, joining the firm in July, 2008. (She has over)... 15 years of experience in banking and leasing. www.linkedin.com/pub/melissa-espey/5a/932/416

Greg Faherty, Vice President – "(He)... has more than seven years of experience working in the equipment finance industry. He joins Capital One Bank from SunTrust Equipment Finance & Leasing Corp. Greg is responsible for handling air-, rail- and vessel-related financings."

Mary Geiger, Assistant Vice President –"...will be responsible for funding and booking transactions." She previously was VP, accounting operations manager, SunTrust Equipment Finance & Leasing, joining the firm in February, 2004. CPA. Loyola College in Maryland, MBA, Concentration Finance, Towson University BS Business Administration, Concentration Accounting.

www.linkedin.com/pub/mary-geiger/43/620/b10

Annette Grzymala, Assistant Vice President –"...responsible for the documentation and closing of funded transactions." Previously she was vice president, credit analyst, United Capital business Lending (April, 2011-Present), credit manager, Correspondent business Credit, LLC (February, 2009-May, 2001), risk analyst, GE Commercial Finance (October, 2004-Fe3bruary, 2009), operations manager, GE Commercial Finance (June, 1995-October, 2004), senior transaction coordinator, GE Capital (1995-1998). University of Phoenix MBA, Global Management (2009 – 2012), University of Phoenix, B.S, Accounting (2005 – 2009).

www.linkedin.com/pub/annette-grzymala/11/b81/bb1

Andrew Henry, Assistant Vice President – "...will be responsible for Pre-Fund Audit. He joined Sun Trust Bank in 2003 as manager of collateral support team within the Leasing LOB, was promoted to financial analyst, April, 2005, then became leasing controller, January, 2013-Present. Prior he was a staff accountant, Spherion Professional Services (June, 2001-April, 2003).Towson University, Master of Arts (M.A.), Business Management and Leadership Development,(Towson University Master of Arts (M.A.), Business Management and Leadership Development, (2009 – 2011). Original individual graduate research focused on the Global Financial Crisis of 2008, its' effects, causes and measures adopted by the leasing industry in general and specifically SunTrust to ensure survival. Morgan State University, Bachelor of Applied Science (B.A.Sc.), Accounting (1999 – 2003), Northern Caribbean University, Associate of Science (A.S.), Business Administration and Management, General (1993 – 1995)

www.linkedin.com/pub/andrew-henry/63/9a8/5a9

Chad Kolb, Vice President – "...will be working as a commercial underwriter. "(He)...joins the Equipment Finance team with eight years in the equipment leasing industry. He previously worked at SunTrust Equipment Finance and Leasing.

Eric Moore, Senior Vice President –"... responsible for supporting Capital One Equipment Finance in the evaluation of new credits and portfolio management. He previously was senior vice-president, regional commercial credit officer at SunTrust Equipment Finance & Leasing. He joined the firm in April, 2010 as managing direct, senor credit officer, and was promoted in SVP April, 2013. Previously he was vp & Director, Chief Credit Officer, The CIT Group, Inc. (July, 2004-april, 2010), vp Investment Risk Management, GATX Technology (November, 2000-June, 2004), vp credit, Wachovia Leasing (September, 1999-October, 2000), assistant vice president, The CIT Group Equipment Finance (May,19095- September, 1999), Georgia Southern University - College of Business Administration, Bachelor of Business Administration, Finance, (1985 – 1990).www.linkedin.com/pub/eric-moore/5/593/58a

Candice (Miranda) Sjolander, Assistant Vice President – "...will be responsible for the documentation of direct and indirect commercial equipment leases and loans." Previously she was vice-president SunTrust Equipment & Leasing Corp (2000-March, 2013), transaction coordinator, General Electric Capital Solution (March, 2005-September, 2005). www.linkedin.com/pub/candice-sjolander/21/472/256

Maddy Small, Administrative Assistant – "...support (to) the Senior Vice Presidents of the Capital One Equipment Finance Corp. Previously with SunTrust Equipment Finance & Leasing, she "...has more than 13 years of experience supporting executives."

Joan Templeton, Assistant Vice President – "... will be responsible for managing customer payoffs, renewals and remarketing of off-lease equipment. Previously she was assistant vice president at SunTrust Equipment Finance & Leasing Corp (April, 2001-Present). www.linkedin.com/pub/joan-templeton/32/54a/900

- Capital One Raids SunTrust to Beef Up Leasing Unithttp://www.americanbanker.com/issues/178_110/capital-one-raids-suntrust-to-beef-up-leasing-unit-1059721-1.html

see New Hires: http://leasingnews.org/archives/May2013/5_17.htm#hires

| Please send Leasing News to a colleague and ask them to subscribe. We are Free! Contact: kitmenkin@leasingnews.org |

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Lee A. Anderson has been promoted to senior vice president, credit, for Nations Equipment Finance, Norwalk, Connecticut. He joined the company in June, 1996.

Raymond Buckley was named director, equipment finance originations for the western region, NXT Capital, Chicago, Illinois ; working out of Walnut Creek, California. Previously he was senior vice president, GE Capital (June 2006-April, 2013), northwest branch manager & svp, Balboa Capital (May, 1995 -May, 2006). Babson College, Bachelor of Science, Entrepreneurial Studies/Marketing (1990 – 1994) Activities and Societies: Tau Kappa Epsilon Foothill High School - Pleasanton, CA (1986-1990). Member: Commercial Finance Association's Northern California Chapter

www.linkedin.com/in/raymondbuckley

Douglas Peck was hired by Nations Equipment Finance, Norwalk, Connecticut, as senior vice president of direct originations; working out of Nations' Dallas, Texas sales office. Previously he was president, TS Lighting (June, 2012-May, 2012), chief operating officer, TS Sports (September, 2009-May, 2013), manager, Douglas T. Peck & Assoc., LLC (February, 2009-Setpember, 2009) vp/marine specialist, CIT Group (February,2008-October, 2008), vp/senior account executive, Merrill Lynch Capital (May, 2002-January, 2008), vp/senior account executive, Heller Financial Services (May, 2000-May, 2002), vp, Dana Commercial Credit Corporation (1989-1995). Rice University BA, History & Political Science. www.linkedin.com/in/douglaspeck

Jeff Rathjen has been promoted to vice-president, sales manager healthcare segment at TCF Equipment Finance, Minnetonka, Minnesota. He joined the firm in September, 2005. Previously he was director of golf, VGM Financial Services (September, 2002-September, 2005) vp operations, Western Finance & Lease (May, 1997-September, 2002), regional sales manager, Amerus Leasing (1994-1996). University of Iowa, Bachelor of Science, Liberal Arts/Business

(1981 – 1986). www.linkedin.com/pub/jeff-rathjen/46/60a/a84

Anthony Sedotto appointed to the EverBank Commercial Finance Office Product group as Relationship Manager, Parsippany, New Jersey, to serve the company's New England region. “ 'Anthony’s extensive expertise in the office products sector, coupled with his established relationships across New England, will be an asset in the continued growth of our Office Products team,' said Jeff Stellinga, EverBank’s Eastern Sales Manager. 'Anthony’s appointment also helps ensure that we are able to continue providing our clients with new and innovative products, supported by the best possible customer service.’ Previously, Sedotto spent 12 years at GE Capital serving in a number of roles with increasing responsibilities and oversight, including a business development representative, north east sales manager, major account representative and regional sales manager. Prior to working at GE Capital, Sedotto was a business development manager for First Sierra Financial where he secured new vendors and increased sales on existing accounts by five percent. Sedotto also served in the U.S. Army 18th Airborne where he was responsible for marketing and supply inventory."

Keith Sherin appointed chairman and chief executive of GE Capital

http://www.marketwatch.com/story/ge-appoints-keith-sherin-to-run-financial-arm-2013-06-12

Joseph Upson was named senior vice president of direct originations by Nations Equipment Finance, Norwalk, Connecticut; working out of Nation's Atlanta, Georgia sales office. Previously he was managing director, Commenda Capital (July,2011-Mya, 2013). founder & BDO, Companionway Capital (March, 2011-May, 2013), managing member, DeNova Capital (November, 2008-March, 2011), v.p. business development, Textron Financial (October, 2008-October, 2008), managing member, DeNova Capital (January, 2002-October, 2008), senior account executive, GMAC Financial (January, 2000-January, 2002) vice president, Transamerica (1998-2000), V.P. Business Development, SunTrust Leasing (November, 1996-January, 19998), leasing officer, Bank of Boston (1989-1996). The University of Georgia, BBA, Finance. Activities and Societies: Member Sigma Nu Fraternity.

www.linkedin.com/pub/joseph-upson/11/373/701

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Steve Chriest

Vendor Hidden Issues

You've just delivered a killer proposal to a prospective vendor you desperately want to count as a new customer for you and your company. Your company has offered the vendor special pricing and relaxed credit parameters designed to increase the percentage of his customers who qualify for financing. Your proposal, as far as you know, addresses all of the vendor's needs, and it makes perfect sense.

After you present your proposal, the vendor thanks you for your time and the work you did to develop your proposal and deliver an excellent presentation. He then tells you that his company has decided to remain a customer of their present financing source. Shocked, you thank the vendor for his time, and you make your exit, asking yourself what happened?

First, you should probably revisit your proposal and assure yourself that the deal you offered was indeed as good as you thought. If you are then still convinced that a prudent man in the same situation as the vendor wouldn't think twice about accepting your proposal, you may be the victim of a "Hidden Issue."

Hidden Issues are negative feelings or perceptions about you, your company, your industry, and maybe salespeople in general. It also could be something wholly unrelated to business. The buyer may carry some resentment toward your company for the way he was treated in the past by a former salesperson. Perhaps during a previous time of need your company refused to consider the type of deal you are now proposing, and the vendor is in no mood to forget the past.

A buyer who harbors resentment toward you or your company for past missteps can be tough to deal with. Worse is the buyer whose dislike of you or your company is irrational. During your presentation, for example, you may have reminded the buyer of the uncle that used to embarrass him when he was a child. As the buyer watched you present, and listened to you speak, his identification of you with his uncle made it emotionally impossible for him to want to associate with you! Irrational? Yes. And it happens to salespeople more often than you might guess.

It could also be some question you didn't think much about and glossed over, but was very important to your vendor. It becomes hidden in your presentation as you are really not talking to your prospective account, but enjoying your excellent presentation so much you are really only listening to yourself.

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

[headlines]

--------------------------------------------------------------

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Short Sighted Equipment Lessors Which Repossess

Prior to Bankruptcy Filing But Do Not Return Vehicle

Tagged for Damages

By Tom McCurnin

Leasing News Legal News Editor

Series of Bankruptcy Cases Have Familiar Pattern, Where Borrower Defaults, Creditor Repossess and Borrower Files Bankruptcy Before Foreclosure Sale is Completed. Creditors Refuse to Return Vehicles And Are Assessed Damages

In re McBride 473 B.R. 813 (S.D. Ala. 2012) [Lease}.

In re Sauls 2012 WL 1224379 (Bankr. M.D. N.C. 2012) [Automobile Finance Company]

In re Velichko, 473 B.R. 64 (Bankr. S.D. N.Y. 2012) [Credit Union]

I don’t know what it is about equipment lessors and finance companies—once they repossess equipment, they don’t want to give it back, even after the debtor files bankruptcy.

Today’s case, actually three cases, involves the same basic set of facts. In each case, the creditor finances a vehicle, the debtor defaults, the creditor repossesses, and then, before there is a foreclosure sale, the debtor files bankruptcy. And just in case the reader doesn’t know this fairly obvious point of law, up until the point the creditor conducts its foreclosure sale, the equipment, even though repossessed, remains the property of the debtor, and upon the bankruptcy filing, the creditor must return the vehicle to the debtor.

The point of law seems obvious to me, but apparently not so obvious to these three creditors, which, within a time span of few months, each decided that it didn’t have to return the repossessed equipment, and decided to play tough with a Federal Bankruptcy Judge.

Each creditor was required to return the equipment, each creditor was tagged with compensatory damages and attorney fees, and two of the three creditors were swatted with punitive damages. Interestingly, it was the equipment lessor which escaped punitive damages, disingenuously arguing that the lease, with a nominal purchase option was a true lease.

For those readers unfamiliar with this area of the law, the United States Supreme Court has ruled that the debtor’s “property of the estate” includes property taken by a creditor in a repossession, but not yet foreclosed. United States v. Whitting Pools, 462 U.S. 198 (1983). Most circuits have adopted this ruling, and have required repossessing creditors to return the repossessed equipment. I’m not sure how these creditors missed a clear decision by the United States Supreme Court and why the creditors chose to fight this rule of law, but fight they did, and most got severely bloodied by the encounter.

The lessons for the equipment lessor here are two fold.

First, assuming the reader has been living in a cave for 30 years—I point out this rule of law—the repossessing creditor must, if requested by the debtor, return equipment which has been repossessed, but not yet foreclosed. I don’t get it why the secured creditors decided to fight this issue.

Second, assuming the reader wishes to remain uninformed, when a bankruptcy debtor makes a demand to do something, consult a good lawyer. It would seem to me that a quick consultation and $500 in attorney fees might have saved thousands of dollars for the repossessing creditors here.

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Lease Case

http://www.leasingnews.org/PDF/Lease_62013.pdf

Finance Case

http://www.leasingnews.org/PDF/Finance_62013.pdf

Credit Union Case

http://www.leasingnews.org/PDF/CreditUnion_62013.pdf

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Mortgage Rates Radar: Upward Trend for Rates Continues

(Foster City, Calif.) – Rates on the most popular types of mortgages continued their upward march according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages rose by nine basis points (0.09 percent) to 4.08 percent. Conforming 5/1 Hybrid ARM rates increased by six basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 2.80 percent.

"The rise in mortgage rates continues unabated again this week," said Keith Gumbinger, vice president of HSH.com. "Although the size of the increase was smaller, it is still unwelcome as the housing market tries to gain momentum."

Despite increases over the past month and a half, mortgage rates remain very favorable. "With a $200,000 loan amount, the difference in monthly payment from recent fixed-rate lows to today's average amounts to about $66 more each month," notes Gumbinger. "That may be enough to quash a refinance, but shouldn't be a major setback for a home purchase transaction."

Borrowers wishing to see how the recent rate increase might affect their costs are encouraged to use HSH.com's mortgage payment calculator.

The Federal Reserve meeting next week is likely to impact future rates, says Gumbinger. "If the Fed signals that QE programs are coming to an end soon, mortgage rates may rise some more, but soothing words about a longer continuation of the programs or a very slow tapering process would provide some space for them to retreat a little."

Average mortgage rates and points for conforming residential mortgages for the week ending June 11, according to HSH.com:

Conforming 30-year fixed-rate mortgage

Average rate: 4.08 percent

Average points: 0.26

Conforming 5/1-year adjustable-rate mortgage

Average rate: 2.80 percent

Average points: 0.17

Average mortgage rates and points for conforming residential mortgages for the previous week ending June 4 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

Average Rate: 3.99 percent

Average Points: 0.23

Conforming 5/1-year adjustable-rate mortgage

Average Rate: 2.74 percent

Average Points: 0.17

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com’s survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar’s inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.

About HSH.com

HSH.com is a trusted source of mortgage data, trends, news and analysis. Since 1979, HSH’s market research and commentary has helped homeowners, buyers and sellers make smart financial choices and save money on mortgage and home equity products. HSH.com, of Riverdale, N.J., is owned and operated by QuinStreet, Inc. (NASDAQ: QNST), one of the largest Internet marketing and media companies in the world. QuinStreet is committed to providing consumers and businesses with the information they need to research, find and select the products, services and brands that best meet their needs. The company is a leader in ethical marketing practices. For more information, please visit QuinStreet.com.

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

### Press Release ############################

Stellus Capital Invests $25 Million

in Colford Capital

Colford Capital Holdings LLC (“Colford”), a holding company that owns and manages specialty finance businesses, announces that Stellus Capital Investment Corporation (“Stellus”) has provided Colford $25 million in the form of senior secured notes. Colford plans to deploy the funds into its operating subsidiaries tosupport their continued growth and to facilitate future lending platform acquisitions as part of Colford’s strategy to build a diversified, industry-leading specialty finance and asset management business.

A portion of the proceeds will be used to fuel the expansion of Colford’s existing lending platforms, North Mill Capital, a leading provider of asset-based loans and invoice based factoring, and North Mill Equipment Finance, a national provider of small and middle ticket equipment financing solutions.

David C. Lee

President/CEO, Colford

David C. Lee, President and CEO of Colford, stated “We are excited to partner with Stellus, who shares our enthusiasm regarding the growth potential of the Colford platform and our operating subsidiaries. This capital will allow us to continue to execute on our strategic plan and leverage our existing lending platforms while continuing to pursue acquisitions of complimentary specialty finance platforms and lease and loan portfolios.”

About Colford

Colford is a New York City based holding company seeking to build a diversified and industry leading specialty finance and asset management business through acquisitions, strategic partnerships and new business development and currently manages two majority owned operating subsidiaries, North Mill Capital, a leading provider of asset-based loans and invoice based factoring based in Princeton, NJ, and North Mill Equipment Finance, a Norwalk, CT based national provider of small and middle ticket equipment financing solutions. Colford is majority owned by Monitor Clipper Partners, a private equity firm that targets growth-oriented businesses with strong management teams and currently manages over $2 billion in capital. For more information, visit www.colfordcapital.com.

About Stellus Capital Investment Corporation

Stellus is an externally-managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. The Company’s investment objective is to maximize the total return to its stockholders in the form of current income and capital

appreciation by investing primarily in private middle-market companies (typically those with $5.0 million to $50.0 million of EBITDA (earnings before interest, taxes, depreciation and amortization)) through first lien, second lien, unitranche and mezzanine debt financing, and corresponding equity investments. The Company’s investment activities are managed by its investment adviser, Stellus Capital Management. To learn more about Stellus Capital Investment Corporation, visit www.stelluscapital.com under the Stellus Capital Investment Corporation link.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Pointer Mix

Manhattan, New York Adopt a Dog

SABASTIAN - ID#A0967749

I am an unaltered male, brown and white Pointer mix.

The shelter staff think I am about 8 years old.

I weigh 60 pounds.

I was found in NY 10456.

I have been at the shelter since Jun 07, 2013.

This information is 1 hour old.

Shelter Staff made the following comments about this animal:

A volunteer writes:”Sebastian is an elegant gentleman. Long legs, trim body and proud face. He has "class" although his coat is not well groomed. He could have been a yard dog. I like his brown eyes looking directly into mine. He prances like a pony in the street, avoiding a river as we leave the building. He meets other dogs in a very civil way , even those who bark at us and ignores completely the cats in the park nearby. He seems to enjoy his stroll in the grass.

“Back at the care center, Sebastian and I cool off in a large pen. He does a lot of sniffing around. He is a bit aloof but slowly, shows some interest in me, rubs himself onto me, comes to sit next to me and even grants me with a small kiss as I am petting him.

“Sebastian returned to his kennel where he remained calm for a few hours after our long walk. Although thin, Sebastian is a big dog who was probably used to be outside most of the time (my guess at least..). He prefers not to be in his kennel and gets very enthusiastic when on the leash outside.

“ Sebastian is having a hard time adjusting to the atmosphere, but I know from my initial time with him that he can be a very pleasant companion to be with.

“There is only one prescription to help Sebastian...Going home with a caring and loving forever new owner. Sebastian is at the Manhattan Care Center waiting for a lucky star to shine above him..."

For more information about this animal, call:

Animal Care and Control of New York City –

Manhattan at (212) 788-4000

Ask for information about animal ID number A0967749

Animal Care and Control of New York City - Manhattan

www.nycacc.org

326 East 110 Street

New York, NY 10029

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

![]()

News Briefs----

Big storm threat brewing from Iowa to Mid-Atlantic

http://news.yahoo.com/midwest-pelted-rain-wind-hail-tornadoes-030948081.html

RailroadAge: Equipment leasing: The best of times?

http://www.railwayage.com/index.php/finance-leasing/equipment-leasing-the-best-of-times.html

GE has begun training medical staff, commenced aircraft leasing in ...

http://www.irrawaddy.org/archives/37193

[headlines]

--------------------------------------------------------------

---You May Have Missed

Who Owns the Content of Your Phone Calls?

rushlimbaugh.com/daily/2013/06/12/who_owns_the_content

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

The Healthy Vacation Guide

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=231

[headlines]

--------------------------------------------------------------

Baseball Poem

- from: Songs Of The Out-o'-doors

If you've never sat in the blazing sun

and prayed the gods for another run,

If you're not clean daft till the season's done

and the talk of the game is through,

If you've never joined in the bleachers' roar

at a double play or a daring score,

Don't listen to this a minute more,

this ballad is not for you!

But if the sound of the ball that's hit

or the thump of a strike in the catcher's mitt,

And the umpire's voice and the coacher's wit

are spells that hold you sure,

If you're one of the faithful, cheering throng

that follows the fate of the team along

Maybe you'll join in the swinging song,

the song of the baseball lure!

Chuck-full of glamour,

Tumult and clamor,

Sparkling with vigor and zipping with zest.

Gingery, tangy,

Flippant, and slangy,

Brimful of action and banter and jest.

Sport of the multitude--held by its joys again,

Steadiest of people are nothing but boys again!

In every city or country spot,

in every corner or vacant lot,

In any old weather, cool or hot,

from earliest spring to fall,

The young and lively, old and gray

are there to join or watch the play,

The game that wields its royal sway

and keeps the land in thrall.

And if you're watching the players sweat,

down on the field where the scene is set,

You feel its ,magic and you forget your age

and your sense as well,

For the game--it turns your face to tan,

it makes a boy of the oldest man,

It turns the sane to a crazy fan

with nothing to do but yell!

Calling for muscle,

Hurry, and hustle,

Baseball's a tussle that's vivid with vim,

Heated but happy,

Peaceful but scrappy,

Evermore snappy and nevermore grim!

Sport of the multitude--every one's wild again,

Every true fan is as young as a child again.

Oh, the silence tense and the hush of doubt

with the bases full and two men out,

And the clean, sharp hit, and the rooters' shout

as the runners cross the plate,

Or the long-drawn "Ah!" as the ball soars high

and the fielder shields his sun dazed eye

And waits and gathers the falling fly

as certain and as sure as fate,

Oh, the jeers, the cheers, an the throbbing thrill,

the batter's might and the pitcher's skill.

The crowd that never is wholly still

but shouting its joy or woe,

These are the things that fan the flame,

that lend their wonder to the game,

That make it glorious in its fame.

the king of all games we know!

Free of the grafter,

Lighted with laughter,

Full of the spirit of never say die!

Action is in it!

Every sharp minute,

Something is doing to capture the eye!

Then--and the reason can never be hid again--

Best of it is--that it makes you a kid again!

Published in: The Popular Magazine - April 7, 1912

[headlines]

--------------------------------------------------------------

Sports Briefs----

Hawks win epic 3 OT game

http://www.chicagotribune.com/sports/hockey/blackhawks/ct-spt-0613-blackhawks-bruins-chicago-20130613,0,1855311.story

Jason Kidd hired as Brooklyn Nets head coach

http://www.usatoday.com/story/sports/nba/nets/2013/06/12/jason-kidd-head-coach-brooklyn/2417505/

Craig Dahl: The Rams knew the 49ers' tell last season

http://blogs.sacbee.com/49ers/archives/2013/06/craig-dahl-the-rams-knew-the-49ers-tell-last-season.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Foreclosure sales drop in Bay Area in May

http://www.mercurynews.com/business/ci_23445336/foreclosure-sales-drop-bay-area-may

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California Wine Month begins Sept. 1

http://westernfarmpress.com/grapes/california-wine-month-begins-sept-1

Wine Buzz: Judging California's best wines at State Fair competition

http://www.sacbee.com/2013/06/12/5488528/wine-buzz-judging-californias.html

Fine Wine as Collateral? Goldman Sachs Loan Backed by 15K Bottles of Wine

http://www.foxbusiness.com/industries/2013/06/11/fine-wine-as-collateral-goldman-loan-backed-by-wine/

Aglianico Emerges From the Bottom of Italy’s Boot

http://www.nytimes.com/2013/06/12/dining/reviews/aglianico-emerges-from-the-bottom-of-italys-boot.html?ref=dining&_r=0

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1774- Rhode Island becomes 1st colony to prohibit importation of slaves. The Rhode Island General Assembly in Newport, RI, passed this legislation, banning slave importation: “ No Negro or mulatto shall be brought in to this colony, and in case any slave shall be brought in , he or she shall be, and are hereby, rendered immediately free, so far as respects personal freedom, and the enjoyment of private property, in the same manner as the native Indians.”

1789 - General George Washington was served a new dessert by Mrs. Alexander Hamilton, ice cream.

1798-The Mission San Luis Rey de Francia was founded. It was abandoned in 1846. Restoration began in 1892.

http://www.californiamissions.com/cahistory/sanluisrey.html

http://www.sanluisrey.org

1786-birthday of Winfield Scott, American army general, negotiator of peace treaties with Indians and twice nominated for president (1848 and 1852). Leader of brilliant military campaign in Mexico in 1847. Scott was born at Petersburg , VA and died at West Point , NY , May 29,1866.

http://www.civilwarhome.com/scottbio.htm

http://www.npg.si.edu/exh/brady/gallery/77gal.html

http://www.ngeorgia.com/other/scottinmexico.html

http://home.att.net/~Rebmus/SCOTTSTACTICS.htm

1868-African-American Oscar J. Dunn elected Lieutenant Governor of Louisiana Ran away from slavery; finally bought his freedom; began his education prior to his freedom; State Senator in 1868 ;Lt. Governor from 1868 to 1870; reputed to be firm, courageous and incorruptible, died suddenly in November, 1871. Ironically, his death brought the first African American to serve as governor of a state: P.B.S. Pinchbeck. He had been elected president pro tempore of the Louisiana senate in 1871, and promoted to lieutenant governor upon the death of Oscar J. Dunn. Pinchback was educated in Cincinnati , was a captain in the army. When Governor Warmoth was impeached in December 1872; he became governor for a few days.

http://www.sec.state.la.us/45.htm

1875—Birthday of Mariam Amanda Wallace "Ma" Ferguson - two-time Governor of Texas. In November 1924, she and Nellie Ross of Wyoming were elected the nation's first female governors. Her husband had been impeached, convicted and removed from the Governors office to which he had been elected 1916. She ran to clear the family name under the motto "two Governors for the price of one." She said, up front, that she would be just a stand-in for her husband, but when elected, she did a lot of things her way. Although “Ma” Ferguson did fulfill a campaign promise to secure an antimask law against the Ku Klux Klan, the courts overturned it. State expenditures were slightly increased, despite a campaign pledge to cut the budget by $15 million. The focal point of discontent centered upon irregularities both in the granting of pardons and paroles and in the letting of road contracts by the state highway department. Ma Ferguson pardoned an average of 100 convicts a month, and she and "Pa" were accused by critics of accepting bribes of land and cash payments. Critics also charged that the Ferguson-appointed state highway commission granted road contracts to Ferguson friends and political supporters in return for lucrative kickbacks. She won re-election and then retired from politics until she was 65 years, running for governor in 1940, but did not win. She died June 21, 1961.

http://www.tsl.state.tx.us/governors/personality/mferguson-p01.html

http://www.reaganadv.com/ma/biography.html

1905-Trumpet player Doc Cheatham birthday

http://www.riverwalk.org/profiles/cheatham.htm

1907 --The temperature at Tamarack, California dipped to 2 degrees above zero, the lowest reading of record in June for the U.S. after 42 inches of snow fell between the 10th and the 13th, the snow depth on this date was 130 inches.

1921 - "The Sultan of Swing," Babe Ruth, made a 460 foot homerun into the center field bleachers at New York City 's Polo Grounds. It was the longest homerun Ruth made in his career.

1927 - Aviation hero Charles Lindbergh was honored with a ticker-tape parade in New York City . He was the most popular man of his era, considered a presidential candidate, but the kidnapping of his son changed his life. While the man who asked for ransom was caught, it is believed by many that it was Lindbergh's own sister who killed the infant as she suffered from mental illness and had harmed the baby earlier.

1933-In an effort to get the economy going again, the Federal Savings and Loan Association was authorized with the passage of the Home Owners Loan Act. The purpose of the legislation was to provide a convenient place for investment and to lend money on first mortgages. The first association was the First Federal Savings and Loan Association of Miami, Florida, which was charted on August 8, 1933.

1935 - In a 15 round match, Jim Braddock defeated Max Baer in a. With the win, Braddock captured the world heavyweight boxing title in New York City .

1937--- Joe DiMaggio hits 3 consecutive HRs against St Louis Browns

1939 - Victor Records artist Lionel Hampton and his band recorded "Memories of You." He had played the song with the Benny Goodman Quartet at Carnegie Hall in 1937.

1940- R'n'B singer Bobby Freeman was born in San Francisco . He is best known for "Do You Wanna Dance," which became a number five hit for him in 1958. The song was later covered by the Beach Boys - in 1965 - and the Ramones - in 1978.

1942-The Office of War Information was created.

http://memory.loc.gov/ammem/today/jun13.html

1944-Marvin Camras, who was a student at the Armour Institute of Technology, Chicago , Il , patented a wire recorder for sound recordings. He had actually invented it in the 1930's, and it was used experimentally in 1939 and 1940, with several models in use by the US Navy in 1941. When I first went to work for KFRC Radio in 1963, we were using wire to record interviews, including telephone interviews ( several times a week I would interview Governor “Pat” Brown, who was a long time fan of the radio station when he was San Francisco district attorney).

1948---Top Hits

Nature Boy - Nat King Cole

Toolie Oolie Doolie - The Andrews Sisters

Baby Face - The Art Mooney Orchestra

Texarkana Baby - Eddy Arnold

1948 - During farewell ceremonies for Babe Ruth, his Uniform #3, was retired. The emotional ceremony at Yankee Stadium came two months before the baseball legend died.

1956---Top Hits

The Wayward Wind - Gogi Grant

I'm in Love Again - Fats Domino

I Want You, I Need You, I Love You - Elvis Presley

Crazy Arms - Ray Price

1963-President John F. Kennedy and other leaders condemned the assassination by a sniper of civil rights leader Medgar Evers in the back outside of his home in Jackson, Mississippi on June 12. The crime sparked numerous demonstrations this day as an outrage of the killing. The reaction to this killing spurred the Civil Rights Act of 1964. Ten years after Medgar Evers's death the national office of the NAACP reported that Mississippi had 145 black elected officials and that blacks were enrolled in each of the state's public and private institutions of higher learning.... In 1970, according to statistics compiled by the Department of Health, Education, and Welfare, more than one-fourth or 26.4 percent of black pupils in Mississippi public schools attended integrated schools with at least a 50 percent white enrollment. When Medgar died in 1963, only 28,000 blacks were registered voters. By 1971, there were 250,000 and by 1982 over 500,000.

http://www.olemiss.edu/depts/english/ms-writers/dir/evers_medgar/

http://www.cr.nps.gov/nr/travel/civilrights/mainmap1.htm

1964---Top Hits

Chapel of Love - The Dixie Cups

A World Without Love - Peter & Gordon

Love Me with All Your Heart - The Ray Charles Singers

Together Again - Buck Owens

1966- The US Supreme Court rendered a 5—4 decision in the case of Miranda v Arizona, holding that the Fifth Amendment of the Constitution “required warnings before valid statements could be taken by police.” The decision has been described as “providing basic legal protections to persons who might otherwise not be aware of their rights.” Ernesto Miranda, the 23-year-old whose name became nationally known, was retried after the Miranda Decision, convicted and sent back to prison. Miranda was stabbed to death in a card game dispute at Phoenix , AZ , in 1976. A suspect in the killing was released by police after he had been read his “Miranda rights.” Police procedures now routinely require the reading of a prisoner's constitutional rights (‘Miranda”) before questioning.

1967- President Lyndon Baines Johnson appointed Thurgood Marshall of Maryland to the Supreme Court, making him the first African-American appointed to this position.

1969 --An unusual late season snowfall covered parts of South Dakota , Wyoming , Montana , and Nebraska . 10 inches of snow fell at Deerfield , South Dakota and 5 inches was measured at Great Falls , Montana .

1971 - The New York Times began publishing the Pentagon Papers, a secret study of America 's involvement in Vietnam .

1972---Top Hits

The Candy Man - Sammy Davis, Jr.

Song Sung Blue - Neil Diamond

Nice to Be with You - Gallery

The Happiest Girl in the Whole U.S.A. - Donna Fargo

1976-Don Bolles, investigative reporter for the Arizona Republic , died as a result of injuries received when a bomb exploded in his automobile, June 2, 1976, while he was engaged in journalist investigation of an alleged Mafia story. Bolles was awarded posthumously the University of Arizona 's John Peter Zenger Award, December 9, 1976.

1980---Top Hits

Funkytown - Lipps, Inc.

Coming Up - Paul McCartney & Wings

Biggest Part of Me - Ambrosia

My Heart - Ronnie Milsap

1984-- Severe thunderstorms produced large amounts of hail in the Denver , Colorado metro area. Hailstones as large as 4 inches in diameter fell. Homes and other buildings sustained around 200 million dollars in damage. Thousands of cars were battered with total damage to vehicles estimated at 150 million dollars. In some areas, golfball size hail fell continuously for 30 to 40 minutes. 20 people were injured by the giant hailstones. Torrential rains as much as 4.75 inches in Lakewood clogged drains and caused widespread damage from flooding.

1988---Top Hits

One More Try - George Michael

Together Forever - Rick Astley

Everything Your Heart Desires - Daryl Hall John Oates

I Told You So - Randy Travis

1988- Afternoon thunderstorms produced severe weather in the Southern and Central Plains Region. Forrest NM was deluged with 5.5 inches of rain in ninety minutes. Temperatures soared into the 90s across much of the eastern half of the nation, including New England . Northern Illinois reported a record twenty straight days of dry weather.

1990---Top Hits

Please Hammer Don t Hurt Em, M.C. Hammer

I Do Not Want What I Haven t Got, Sinead O Connor

I m Breathless, donna,

Pretty Woman, Soundtrack

1994-- At the age of 34, Cub second baseman Ryne Sandberg suddenly retires walking away from $16 million ( due to personal problems, he said.) While he had been a notoriously slow starter throughout his entire career, his 1994 start was disastrous. Later, he admitted that he had been distracted at the time while going through a messy divorce. He came back for the 1996 and 1997 seasons, retiring permanently at the age of 37 with a career batting average of .285, and a record 277 home runs as a second baseman; this record was surpassed in 2004 by Jeff Kent.

http://www.thebaseballpage.com/past/pp/sandbergryne/

http://www.geocities.com/Colosseum/Arena/6113/

2000---Top Hits

The Marshall Mathers ,Eminem

The History Of Rock , Kid Rock

Oops!...I Did It Again , Britney Spears,

Mad Season, matchbox twenty

2003 --On his fourth attempt, Roger Clemens becomes the 21st pitcher and the first since 1990 to record 300 career wins as the 40-year-old righty goes 6 2/3 innings in the Yankees' 5-2 inter-league victory over the Cardinals. In the second inning when Edgar Renteria swings through full-count fastball, the 'Rocket' also joins Nolan Ryan (5,714) and Steve Carlton (4,136) as just the third hurler to record 4000 career strikeouts.

2004---Top Hits

Confessions ,Usher

Under My Skin, Vvril Lavigne,

Here For The Party , Gretchen Wilson,

Musicology, Prince

2005 - Pop superstar Michael Jackson is found not guilty on all counts of his child molestation trial in Santa Maria, Calif. Jackson, 46, had been charged with molesting a 13-year-old cancer survivor in 2003, serving him wine and conspiring to hold the boy and his family hostage at his Neverland estate in order to get them to rebut a television documentary.

NBA Finals Championship This Date

1989 Detroit Pistons

1997 Chicago Bulls

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Editorials (click here)

www.leasingcomplaints.com

Ten Top Stories each week chosen by readers (click here)

(chronological order)

- Cobra Capital Back in Business

- Marlin Leasing Officers Exercises Stock Options

- Commonwealth Capital Answers

Finra Charges Misuse Leasing Funds

- Four New CLP's from First American Equipment Finance

- Bentsen-Gregg named to new posts

- Public Sector Finance Forum Report

By Darrel Peters, CLP, Arvest Bank

- Western Equipment Finance Parent

Takes over Central Arizona Bank

- Lovely Ladies of Leasing

- FASB/IASB Leasing Accounting Coming Down the Tracks

- Vehicle Leasing Conference Finds Daylight

By Edward P. Kaye, Advantage Funding

- Abbott and Costello Prediction- An Update

- Sterling Financial Purchases Commerce National

- Vegas Conference Biggest Turnout since 2006

by Dwight Galloway, CLP

- Alexa Report---Leasing News Pulls Ahead of Competition

- Steve Jobs---The Best Advice on Success and Failure

- US Hiring Index retreats 8.8% in Q1 2013

- www.leasingcomplaints.com

Leasing News Kicks it up a Notch!

- “What To Expect When Seeking Business Financing”

- Twitterverse--Are you a "Tweep" or "Twitterati"?

- Paul Menzel, CLP, Reports on ELFA Funding Conference

- Huntington Bank Hit with $81 Million Judgment

Check Kite Crashes into El Camino Resources

- Leasing Association Membership Echoes Economy

by Christopher Menkin

- Why Networking Doesn't Work

by Eric V. Holtzclaw, www.inc.com

- New York City Investors’ Conference Equipment Finance

By Bruce Kropschot, The Alta Group

- Banks Lending or Not Lending?

Conversation with Deborah Monosson

- Pacific Western Bank Responds to Evergreen Non-Notification

- In-N-Out’s Burger Ranked Top Fast-Food Burger in US

- Media Tips - Learning from the Reporter’s Perspective

- Northern Leasing Systems Says "It isn't so!"

- Los Angeles BBB Expelled from National Association

- Female Lease Finance Association Presidents

- Odyssey Merges with Pinnacle Capital!

--- Brent Hall, CLP, on Growth Mode

- Working Out of Your Residence or Company Hq.

- Terry Winders, CLP, Custom Built Poker Tables

---Order One for Father’s Day

- Leasing News Alexa Rating Improves Since Feb. 3

- Pacific Capital Chooses Orion First Financial

- Broker’s Responsibility to Obtain

California Lender’s License

- CLP 2012 Accomplishment Report

Many "fresh faces" Become CLP's

- McQuitty Gets 24 Months Prison

---then 3 Years’ Probation

- Most Popular Dog Breeds in America 2012

- Pacific Western Joins “Extra Lease Payment” Group

- The Matrix-Utah Connection

- Current License Regulations and Advice

- The House that Jerry Built

- Loan/Lease Statute Up-Date

- The Day that Albert Einstein Feared May Have Finally Arrived

-

The Aberdeen Kid—Yahoo Blog

NorVergence

- Brican America---End of year 2012 Update

- Equipment Finance Agreements Explained/Barry S. Marks

- Sheldon Player's E.A.R. Ropes 18 Equipment Lessors

- Chat Acronymns and Keyboard Smilies

- Royal Links "True Lease" Court Ruling

- Element Financials’ Hudson Changing His Image

- Newport Financial Partners, Newport Beach, California

Bulletin Board Complaint

- Reach Potential Customers and Vendors/Find Your Niche

- On Deck reaches $300 Million/1500 distribution partners

- "The Memory Shock" –New Book by Barry Reitman

- Third-IFC Credit Trustee, Northfield, Illinois

Bulletin Board Complaint

- Four Software Solutions

re: Digital device/Laptop Lost or Stolen!

- Excellent Tips by Warren Buffet

- Take Your Banker to Lunch

- Meridian Finance Group Looking Brokers for Europe Biz

- Is Leasing Securitization Dead or Alive?

- "My Three Years with Sheldon Player"

- Why Leasing News is Different

- Mazuma and Republic Bank Get Snared on PRR Provision

by Tom McCurnin, Esq.

- Companies who utilize Evergreen Clauses for Extra Lease Payments

- Jeff Taylor's Leasing Predictions, Spring, 2006

- Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

Purchase Option on EFA, Won’t Return $5,000 S.D.

- New Case against Mazuma Capital and Republic Bank

---Automatic Evergreen Payment---PPR

-

Ten Lawyers Against Evergreen Clause Abuse

- Republic Bank out of leasing?

- Ladco Leasing/Elavon Fined $418,601

- John Otto's HL Leasing Ponzi Scheme Update

- IFC Credit--Rudy Trebels June 2012 Update

-

Future of Mobile Devices

- Charles Schwartz and Allied Health

- Why I became a CLP

- Copier Wars---It's more than the lease payment

by Christopher Menkin

- Results Are In---

"Application Only" versus Financial Statements?

- A California Leasing Gypsy Arrested by Costa Mesa Police

- Survey of Evergreen Clauses

-

Responses to Working with a Smaller Bank Question

- Leasing Gypsies

- OneSource Develops Business License Software

- Talk About Chutzpa, Fanghella has more than Trump

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses

-

Settlement Costs Vs. Litigation Costs