Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Change email

Change email

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Friday, June 28, 2013

![]()

Today's Equipment Leasing Headlines

Archives---June 28, 2000

The Good Old Days

Classified Ads---Legal

Mortgage rates soar to 4.46%

- Biggest jump in 26 months

GoBank Goes Live!

Mobile Banking is Here to Stay!

Citizens Business Bank joins “Funder List ‘A’ ”

also “Funders Looking for New Broker Business” lists

New Hires---Promotions

Classified Ads---Help Wanted

Auto lending still a favorite for US banks

By Kevin Dobbs and Zuhaib Gull, SNL Financial

"Just What is an "Alternative Dispute Resolution?"

by Paul Bent, Attorney at Law

Principal, The Alta Group, LLC

Leasing News Advisor

Ed Castagna

IDS Announces Release of InfoLease®10 Featuring

New Advances in Technology, Usability and Reporting

Film/DVD Reviews by Fernando Croce

World War Z/Monsters University

The Incredible Burt Wonderstone/56 Up/things to come

Collector/Collections/Consultant/Communications

Classified ads—

Border Collie/Labrador Retriever Mix

Marshall, Minnesota Adopt-a-Dog

News Briefs---

Capital One laying off 145

Safeway wins top honor for hiring, training veterans

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives---June 28, 2000

The Good Old Days

Announcement

October 9-13, 2000 Training for Success from The Manifest Group

A comprehensive 4 day Sales Training Seminar designed for the NEW Leasing Professional!

-

Vendor and Lessee Qualifying

-

Role Playing Vendor Sales Calls

-

Cold Calls, Scripting and Analysis

-

Introduction to Credit Analysis

-

Introduction to Lease Documentation

-

Introduction to Equipment Niches

-

Negotiating Seminar to help Close Leases

Cost is $850.00 per person or $800.00 per person for two or more attendees. Cost covers food, lodging, materials, and a NEW HP 17B calculator. Airfare to Minneapolis is not included.

For more information contact Jim Stekl or Deb Schnaible at 800-325-2236.

Today

(Not the Same)

[headlines]

--------------------------------------------------------------

Classified Ads---Legal

(These ads are “free” to those seeking employment

or looking to improve their position)

San Diego , CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

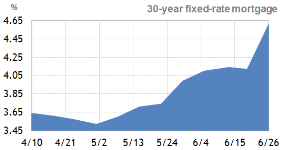

Mortgage rates soar to 4.46%

- Biggest jump in 26 months

(Chart: Bankrate.com)

Perhaps a sign of rate increases in other sectors, Freddie Mac reported that rates on 30-year, fixed rate home loans spiked 0.53 percent to an average of 4.46% for the week.

In May, the 30 year loan rate was 3.35%.

15 year loan rates, more popular with those who refinance their mortgages, is now at 3.5%, almost a half point higher. It also may be a sign that refinancing of higher mortgage is slowing down, while many say you better do it now, as rates are going up.

Pending home sales were up 12.1% compared to last year and new home sales also were up; as well in many areas both home sales have seen increases as well as rent even higher. It may be the Fed is “right on” noting changes are ahead as well as taking some minor turns today.

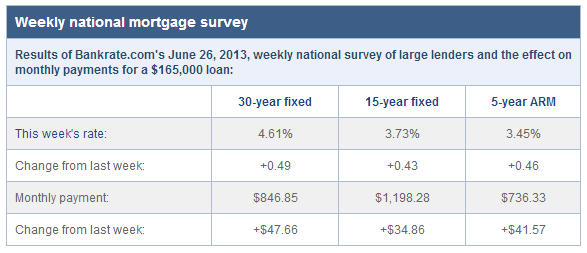

Weekly national mortgage survey

(Chart: Bankrate.com)

Bankrate.com reports:

“How did this happen?

"Rates started climbing slowly in mid-May on speculation that the Federal Reserve was preparing to trim the $85 billion-per-month bond purchase program that has long kept a lid on rates. When the Federal Open Market Committee wrapped up its meeting last week, many observers expected the Fed to calm the markets. Instead, the Fed did the opposite.

"Mortgage rates shot up once Federal Reserve Chairman Ben Bernanke told reporters that the Fed plans to slow the bond purchases this year and end the program in mid-2014, as long as the economy continues to improve. Even analysts who follow rates closely were shocked at how quickly rates have jumped since then."

Full Story:

http://www.bankrate.com/finance/mortgages/mortgage-analysis.aspx?ic_id=Top_Stories_link_1

[headlines]

--------------------------------------------------------------

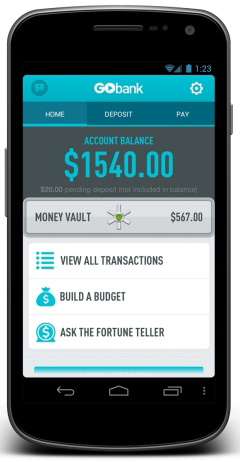

GoBank Goes Live

Mobile Banking is Here to Stay!!!

Similar to Dwolla, GoBank is faster and is advertised as having a "bank in your hand." It may be similar to Dwolla who accepts funds and then waits for a three to five days before recognizing, as well as in sending, waits. The GoBank terms of service state they may wait 10 days before crediting a deposit, but they state making payments is fast once credited. There are also direct deposits accepted.

The web site also states:

"Transfer Money from Another Bank (ACH) – This process varies from bank to bank, but typically, here’s what the process looks like:

-

Go to your bank's website

-

Find the "transfer money to another bank" option

-

Enter your GoBank account info (you can find this in your GoBank Account Settings)

"Each bank will have different requirements for verification and timing for making the transfer. Your bank may also charge a fee.

"Deposit Cash for Free – You can deposit cash for free at more than 3,900 Wal-Mart locations with Rapid Reload nationwide (not available in VT or WY). The cashier will swipe your GoBank card and add cash directly to your account. There's no charge for this, and the money will be available instantly. We allow between $20 (minimum) and $1,100 (maximum) per transaction. The maximum you can deposit in cash in one day is $2,500. Keep a look-out here for new cash deposit locations, which we'll be adding soon."

https://www.gobank.com/faq/

They also offer a low cost Visa Debit Card, ability to make deposits, a free ATM network, and fees are "simple."

https://www.gobank.com/#/send-money

Good news is they advertise they are a member of the FDIC.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Leasing Coordinator

www.dakotafinancial.com |

|

|

Positions Available in Irvine and San Diego

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

Small Ticket Leasing Sales Reps |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Joins Funder List ‘A’

also Funders Looking for New Broker Business lists

Citizens Business Bank 1974 Rob Selway, Asst. Vice President rrselway@cbbank.com 949-581-4444, ext 3203 www.cbbank.com Footnote |

10 |

California only |

$100,000 |

Y |

N |

N |

N |

Y |

A -Accepts Broker Business | B -Requires Broker be Licensed

| C -Sub-Broker Program| D -"Private label Program" |

E - Also "in house" salesmen

Footnote:

Any deals we fund we do the credit review ourselves, document the deal ourselves, and hold the account internally for the duration of the lease. The broker can assist in negotiating the interest rate. We can pay referral fees to the broker, fund the deal ourselves letting the end-user pay a placement fee to the broker, or we can put some basis points on top of our rate for the broker.

Full Funder "A" List

http://www.leasingnews.org/Funders_Only/Funders.htm

Funders Looking for New Broker Business

http://www.leasingnews.org/Funders_Only/New_Broker.htm

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Eleanor Baker was hired as Senior Credit Manager. "(She)...has over 25 years of experience in risk, credit, and assessment of collateral values specializing in motor vehicles and construction equipment.

Most recently, she was Credit Manager for Edson Financial, Inc., the captive finance company for Krystal Enterprises. Previously, Baker held management positions at Orix Financial Services, Inc., with approval authority of $1 million and assisted with collection of both construction and transportation portfolio."

Michael Chard joins EverBank Commercial Finance’s Office Products Team as Relationship Manager for the firm's Mountain States and Minnesota Region. "Mr. Chard has spent more than 23 years in the office equipment financing sector, with a breadth of experience in the leasing industry. Prior to his appointment as the Mountain States and Minnesota Relationship Manager for EverBank Commercial Finance, Chard served as regional sales manager for GE Capital....Chard also served with Marlin Financial Service Corp., as a national account manager for the western region and as a regional sales manager for Key Equipment Finance for seven years, supervising seven different regions. In addition, Chard has held multiple board positions, having founded Inet Holdings Inc., and later Image Systems, LP. "

www.linkedin.com/pub/darrick-holt/28/51/b81

Robert Filaski appointed Vice President and Managing Director of the Healthcare Practice, ePlus, working out of the New York City office. Previously he was vice president of sales & marketing, Peoples United Bank, (July, 2010-President), svp of sales & marketing ,HCS & CapFit (January, 2006-Present), v.p. sales & marketing (Siemens Medical Financial services (September, 1997-April, 20060, svp of sales & marketing, Marie Albert (October, 1995-September, 1997), district sales manager (lucent Product Finance (1995-1997), director of sales, ADP Credit Corporation (September, 1988-August, 1995), district sales manager, U.S. Leasing (July, 1986-July, 1988), client service manager, Dun & Bradstreet (June, 1984-July, 1986), national account representative, Xerox Corporation (May,1984-June, 1984).Allegheny College BA, Political Science (1978 – 1982).Who's Who in America, 2010.Siemens Management Award (Tops+) 3 Time Recipient. ADP Crystal Award for Management 3 time Recipient. ADP 8 time Presidents Club Award Winner' Xerox 2 time Presidents Club Award Winner.

www.linkedin.com/pub/robert-filaski/8/b07/145/

Darrick Holt named business development officer for Fleet Financing Resources, Riverside, California. Previously he was outside sales agent, National merchants association (August, 2012-Present), sales consultant, CarMax (July,2011-August, 2012), federal work study, California College San Diego Avid tutor, Temecula valley Unified School District (August, 2009-Augunst, 2010), freshman baseball coach, Temecula Valley Unified School District (February, 2008_June, 2008) .Stevens-Henager College-Murray, B.S, Business Administration (2010 – 2012). Activities and Societies: -Student Ambassador -Dean's List.

Glenn R. Mason appointed senior vice president at Berkshire Bank, Pittsfield, Massachusetts, new equipment leasing group. "Mason has 25+ years of experience in all aspects of middle market equipment leasing. He previously established, and served as president of First Litchfield Leasing Corporation from 2006 to 2012. Prior to that, he was senior vice president of TD Equipment Leasing. Mason holds a B.S. in finance from the University of Maine."

Joe Mazzoni named west coast sales manager for Key Equipment Finance, Superior, Colorado. "Prior to joining Key Equipment Finance, Mazzoni was western region manager for Hewlett Packard Financial Services, which followed a position as president and CEO of North American Funding. Previously, he served as vice president of sales and marketing for ManDahl Corporation in San Francisco, and as western regional vice president of sales for Datronic Corporation. University of Oregon BS, Finance (1981 – 1984).www.linkedin.com/pub/joe-mazzoni/8/2b3/182

Linda Parady appointed Vice President-Operations for Berkshire Bank, Pittsfield, Massachusetts, new equipment leasing group. Previously she was vice president, Union Savings Bank, CT (May, 2012-Present), vice president, First Litchfield Leasing Corporation (November, 2006-April, 2012)., vice president, Business Lenders (July, 2005-November, 2006), business analyst-international finance dept. (UPS Capital corporation, May, 2003-July, 2005), asst. vice president, Finova Capital Corporation (October, 1998-April, 2001), asst. vice president, New England Capital Corporation (188-1998).Post University, BS, Management (1975 – 1977).

www.linkedin.com/pub/linda-parady/13/298/652

John Reilly named Vice President of the Western Region for ePlus, working out of the Sunnyvale, California office. Previously he was an independent trader (March, 1998-Present), equipment leasing, independent contractor, Merrimak Capital (1998-2010), senior account manager, GE Capital Computer Leasing (1995-1997), director/technology management services, GE Capital Computer Leasing (1994-1995), senior account executive, Chrysler Systems Leasing (1989-1994), account executive, telecommunications vertical market specialist (CIS Corporation (1987-1989). University of San Francisco, BA, Political Science and International Government.

www.linkedin.com/pub/john-reilly/5/891/9a7/

Jeff Schubert was named regional leasing manager for element Financial corporation (formerly CoActive Capital Partners), working out of the Greater Atlanta Area. Previously he was president and owner American Bank Leasing Corp (July, 2002-June, 2012), executive vice president/owner, bulldog Asset Management (November, 2007-June, 2011), vice president, division manager, CitiCapital (July, 2001-June, 2002), vice president, division manager, American Equipment Leasing (January, 2000-July, 2001), vice president, syndications manager, Lease Plan USA (July, 1995-December, 2000), vice president, syndications manager, lease Plan USA (July, 1995-December, 2000), regional leasing manager, Eastman Kodak Credit Corporation (January, 1992-July, 2995), multiple positions: sales, sales management, marketing staff, credit manager, leasing manager (Eastman Kodak Company (1981-1992).Boston University - School of Management, BSBA, Concentration in Marketing (1977 – 1981) Graduated Magna Cum Laude University of Lancaster (UK), Junior Year Abroad Program, Marketing (1979 –1980). www.linkedin.com/in/jeffschubert

[headlines]

--------------------------------------------------------------

Auto lending still a favorite for US banks

By Kevin Dobbs and Zuhaib Gull

SNL Financial

Auto lending continues to advance in 2013, picking up on momentum gathered last year, and analysts anticipate that demand for such credit will remain strong in tandem with demand for new cars and trucks.

The average age of U.S. cars and trucks has hovered near 11 years over the past couple years, according to the Polk auto research firm, making for the oldest stock of autos on the nation's roads on record. This was fed by the fact that would-be buyers shied away from auto purchases in the wake of the 2008 recession, preferring to put more miles on their used vehicles amid concerns about the job market and hits to personal wealth from slumping housing markets.

But as the economy has recovered and confidence has gradually returned, more buyers have returned to the market and capitalized on historically low interest rates to drive up sales and loan demand. An SNL Financial analysis found that aggregate auto loans at U.S. commercial banks have climbed every quarter since the beginning of 2011, reaching $306.67 billion at the close of the first quarter of this year.

"The cars on the road today are the oldest they've ever been, so we're seeing that inventory needing to be replaced at the same time that the economy is healing, so there is a bullish long-term view on autos," Jefferson Harralson, a bank analyst at Keefe Bruyette & Woods Inc., told SNL.

Harralson also pointed out that, while residential real estate and other asset classes were badly bruised in the wake of the last recession, auto loans held up relatively well for many banks in terms of their credit performance. "And that makes autos a class that banks want to continue to lend to," he said. "The loans hold up and they are relatively short in duration" — limiting risk tied to shifts in interest rates — "so it's almost a perfect asset class."

What's more, SNL data show, interest rates on auto loans have come down substantially over the past two years, making loans appealing to customers and helping to fuel demand.

All of that noted, Harralson said, "the bad news about being the perfect asset class is that everyone wants in and pricing gets very competitive."

Indeed, in recent conference presentations, bankers have cited pricing as an issue important to track.

"Competition continues to be very strong, due to the attractive credit and duration profile of the paper," Fifth Third Bancorp Treasurer Tayfun Tuzun, for one, said while speaking at a June conference.

Changes to the regulatory framework could also complicate matters for lenders.

The fledgling Consumer Financial Protection Bureau, created in the aftermath of the financial crisis of the past decade to help guard against predatory lending, is looking to ensure auto dealers, who often act as brokers between customers and lenders, are not taking advantage of car buyers.

The CFPB is targeting the so-called dealer reserve, which is the difference between the rate a bank will quote on a loan and the quote that the dealer provides the customer. The dealer keeps the difference and pads the income it makes on an auto sale. The CFPB has said that, since it cannot directly regulate dealers, it intends to put the onus on banks to ensure that fair lending rules are not violated during this process.

"And so what we did in response — and a couple other banks have done similar things — is we've narrowed the possible gap in that discretion that the dealer has," U.S. Bancorp CFO Andrew Cecere said at a conference this month. "So we compressed their ability — they still have some room, but it's less than it used to be. … [W]hen the CFPB came out with its guidance, we were quick to react to try to limit that fair-lending issue."

So far, Cecere said, dealers have responded favorably and loan volumes have held steady. But time will tell if dealers migrate toward other lenders that are not quick to react to the CFPB's guidance.

Separately, there is the matter of the Federal Reserve signaling that it could begin to pull back on its quantitative easing efforts as soon as the second half of this year as the economy continues to improve. This could lead to higher interest rates. Already, some rates have climbed in recent weeks in anticipation of this. Over time, higher rates could crimp auto loan demand, particularly if rates climb fast, analysts say.

But in the short term, Harralson said the higher rate possibility might actually lead to a surge in sales, as consumers may see reason to rush out this summer to buy before rates shoot up.

J.D. Power and LMC Automotive estimated that June sales will hit a seasonally adjusted annualized rate of 15.7 million, according to a Reuters report. That would be a 7.6% increase from a year earlier and mark the highest level since the final month of 2007.

Against that evolving backdrop, most major auto lenders are optimistic.

"One of the primary drivers of consumer lending growth nationwide has been auto lending," SunTrust Banks Inc. CFO Aleem Gillani said while presenting at a June conference. "And we certainly have seen this trend in our own auto portfolio."

[headlines]

--------------------------------------------------------------

"Just What is an "Alternative Dispute Resolution?"

by Paul Bent, Attorney at Law

Principal, The Alta Group, LLC

Everyone’s heard about it, many people have strong opinions about it, some people have actually used it, but no one seems to understand exactly what it is. I’m talking about ADR – Alternative Dispute Resolution. This is the blanket term used for mediation, arbitration, and a few other things you may have heard of. In a nutshell, these are methods for dealing with problems and disputes in leases or transactions without going to court. Hence the name “alternative”; they are alternatives to litigation, or lawsuits and courtrooms.

In general, ADR comprises two ways of dealing with disputes outside the courtroom. One is arbitration, which is pretty well understood by most leasing folks. In this process, a neutral third person (the arbitrator) is selected by the disputing parties to hold a hearing, to hear the respective claims or defenses of the parties, to review the evidence presented by them, and to make a ruling about who owes what to whom. You can think of an arbitrator as something like a private judge; a neutral and objective person who hears all the facts and evidence and makes a ruling.

Arbitration is a creation of the contract between the parties. Everything that happens in arbitration is controlled by the “arbitration clause” in the lease or other agreement, including how the arbitrator is selected, what rules are followed regarding evidence, and all the other details. The arbitration clause can be only one sentence long, or it can run to pages. The important thing to know is that the parties themselves control the entire process; they make their own rules for the arbitration (or they incorporate existing rules, such as those from the National Arbitration Forum or the American Arbitration Association).

One other thing to remember about arbitration (and one that is frequently misunderstood) is that arbitration can be binding or non-binding, and an arbitration ruling can be appealable or not appealable, all as decided ahead of time by the parties themselves. You may hear people complain that they don’t like arbitration because the arbitrator’s ruling is final and non-appealable; so, if they lose, they’re stuck. But that is only the case if the parties agree to that ahead of time. There are many contracts and arbitration clauses under which an arbitration ruling is non-binding (advisory in nature, or binding only as to certain issues). Actually, the beauty of arbitration is that it can be crafted to whatever the parties desire it to be; they simply need to specify in the arbitration clause how they want it to work.

Then what about mediation? How does that work? Well, it seems that mediation is even more misunderstood than arbitration. Mediation is not like an arbitration (or a trial) at all. The mediator, who is a neutral person selected mutually by the parties, does not make any ruling, does not make any award, does not hear evidence and testimony, and does not decide who’s right and who’s wrong. Rather, the purpose of the mediator (and the mediation) is simply to talk about the dispute with the parties and to see if there is some way to work out a settlement of the problem. The mediator sometimes meets with everyone together and sometimes meets with the parties alone, in separate rooms, so that everyone can express their view of the matter and talk candidly about what they want out of the deal.

In all cases, everything that everyone says is completely confidential. Here in California, where I practice, and in many other states the confidentiality of mediations is built right into the state law. No one can use anything said during mediation as evidence later, and no one can require the mediator to testify about what was said during the mediation. So nothing you say in trying to settle the dispute in mediation can be used against you later, if you’re not able to settle and you go on to arbitration or litigation.

What’s most important (and most often misunderstood) is that, by definition and by nature, a mediation is never binding. It cannot be. The mediator cannot make any kind of ruling or award, binding or otherwise, and the parties don’t have to agree to anything they don’t want to. The mediator is there simply as a facilitator of the parties’ discussions, not as a decision maker.

The only binding thing that can come out of mediation is a settlement that all parties agree on. If there is not a mutually acceptable settlement and a final agreement among all parties (which, once signed, is of course binding, just like any contract), then the mediation is finished and everyone ends up right where they started. They haven’t given away any rights or benefits (thanks to the confidentiality rules), and they are free to pursue whatever other avenues they choose in connection with the dispute.

It’s not unusual for mediation to take place before an arbitration or a trial. That’s when it is most likely to help. It gives the parties a chance to see if they can work something out with each other without giving anything away or committing to a binding procedure, and before they spend a lot of money, time, and heartburn on a trial. That’s why mediation is such a useful and important tool in dispute resolution; and it should be seriously considered by any leasing company or lender faced with a legal or contractual dispute.

ADR, whether as arbitration, mediation, or some other non-judicial method of dealing with business disputes, is worth knowing more about and making a part of every company’s arsenal of problem solving approaches.

Paul Bent

Senior Managing Director

Legal Support Services

+1 562 426 1000

+1 562 492 1199 fax

pbent@thealtagroup.com

Biography:

http://thealtagroup.com/north-america/about/paul-bent

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Ed Castagna

Ed joined the Leasing News Advisory Board on February 4, 2004. His contributions have been centered not only on his knowledge of leasing companies or their “assets,” but his design, understanding, and informational coordination on the World Wide Web.

Edward Castagna, CEO

InPlace Auction

68 South Service Road, Suite 100

Melville, New York 11747

Tel. (516) 229-1968

Cell (516) 297-7775

Fax. (516) 882-7924

ecastagna@inplaceauction.com

www.inplaceauction.com

Over 25 years ago, used equipment dealers and mechanics taught him what to look for and which questions to ask when evaluating machinery and equipment for resale. Since then, he's honed his appraisal skills through hands on experience and continuing education. InPlace Auction's appraisals contain insightful and common sense values delivered professionally. He has been an expert witness with a 100% rate of success in courtroom defense of challenged value. He has been retained as the face-to-face contact with defaulting business owners by a variety of Fortune 100 creditors, relying on his tact, expertise, and determination to resolve uncomfortable and potentially dangerous situations.

Ed has been trusted and charged with the difficult task of liquidating distressed companies to the bare walls. He's helped turn off the lights of thousands of companies in industries as varied as television, manufacturing, transportation, medical, municipal, financial, textile, automotive and commercial real estate just to name a few. "It's my responsibility to treat everyone with respect, regardless of their circumstances. That's how I've been able to successfully and peacefully defuse even the most precarious of situations. I know exactly how to resolve most situations, but also know when it's time to walk away and return promptly with a court order and appropriate authorities."

An early adopter of web based technology in 1988, he was the first in the industry to create a high volume internet enhanced recovery, remarketing and reporting web based service. He is now applying this experience in conjunction with the latest technology to the auction business and currently holds live and on line auctions. His latest auctions sold Intellectual Property, Real Estate, Machinery, & Building materials

He earned a B.A. in Psychology from Syracuse University, and is a graduate of the Mendenhall School of Auctioneering. He has been educated in appraisal procedure and ethics by The American Society Of Appraisers. Ed served on the Equipment Leasing and Finance Association (ELFA) Board of Directors from 2006-2009 representing its service provider members; is on the service providers business council of the ELFA; is a member of the fair Business Practices Committee.

He is one of the founding members, and serves as the current President, of the Tender Loving Care Foundation (www.tenderlc.com); is an advisory board member to South Bronx Education Foundation (www.sbef.org) and most recently was tapped to join the board of directors of the Stewart Fund. He is also a Steward of St. Brigid's R.C. Church (www.saintbrigid.net) and he says his favorite place to be is anywhere with his wife Jeanine and their two boys.

Chairman, Advisory Board |

|

| Bob Teichman, CLP | Teichman Financial Training, Sausalito, CA. |

Advisory Board |

|

| Ed Castagna | InPlace Auction, Melville, NY |

| Steve Crane, CLP | CLP, Bank of the West, San Ramon, CA |

Endeavor Financial Services, Costa Mesa , CA |

|

| Phil Dushey | Global Financial Services, Manhattan, NY |

| Ken Greene, Esq. | Hamrick & Evans, Universal City, CA |

| Shawn D. Halladay | The Alta Group, Salt Lake City, UT |

| Robert S. Kieve | Empire Broadcasting, San Jose, CA |

| Bruce Kropschot | Kropschot Financial Services, The Villages, FL |

| Bruce Lurie | Douglas-Guardian Services Corporation, Houston, TX |

| Andrew Lea | HCL CapitalStream, Pt. Richmond, CA |

| Allan Levine | Madison Capital, LLC., Owings Mills, MD |

| Ralph Mango | ComScore, Reston, Virginia |

| Don Myerson | BSB Leasing, Colorado, Hawaii |

| Armon L. Mills, CPA | J.H. Cohn, LLP, San Diego, CA |

| Tom McCurnin | Barton, Klugman & Oetting, Los Angeles, CA |

| Hugh Swandel | The Alta Group, Canada |

| Paul Weiss | Panthera Leasing, San Francisco, CA |

| Rosanne Wilson, CLP | 1st Independent Leasing, Beaverton, OR |

| Ginny Young | former Brava Capital, Orange, CA |

Editor/Publisher |

|

| Christopher Menkin | Saratoga, California |

[headlines]

--------------------------------------------------------------

##### Press Release ############################

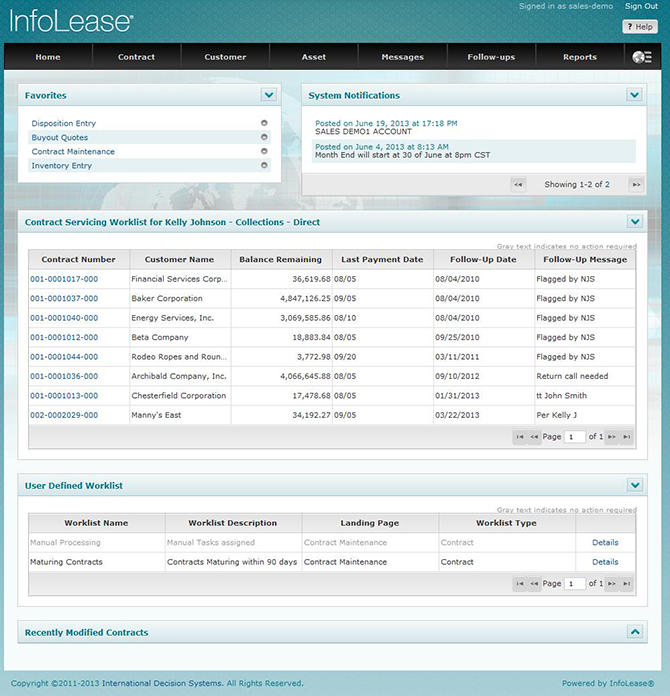

IDS Announces Release of InfoLease®10 Featuring New Advances in Technology, Usability and Reporting

Minneapolis, MN — International Decision Systems (IDS), the leading provider of equipment and asset finance software, today announced the release of InfoLease 10, which combines a new open architecture with best-in-class InfoLease functionality that is trusted by customers worldwide to manage their mission-critical portfolios.

InfoLease 10 features:

-

New web interface with a faster, more intuitive user experience

-

Extensive built-in web services, enabling integration with core business functionality

-

Advanced reporting capabilities, giving business users easy access to critical data

-

Choice of Oracle or SQL Server relational database technologies

Michael Campbell, CEO

“I am thrilled to announce the release of InfoLease 10, our flagship solution,” said Michael Campbell, CEO of IDS. “We retained InfoLease’s wealth of functionality while enhancing its world-class usability and scalability to support the rapidly evolving business and regulatory environment of equipment finance. The revolutionary improvements in InfoLease 10 will enable customers to conduct business more efficiently and profitably than ever.”

Pictured below is the new InfoLease 10 home page.

The new design was developed through extensive research and customer involvement for a highly intuitive user-centered design.

InfoLease 10 provides business users with greater ease-of-use and simplifies access to data so leases and loans can be managed more efficiently and organizations can achieve a higher return-on-investment. New InfoLease 10 business intelligence and reporting tools enable the presentation of data from simple ad-hoc queries to sophisticated cross-platform analysis.

InfoLease 10 is even more powerful when used in conjunction with the IDS Rapport® origination solution. InfoLease 10 and Rapport together provide companies with a full lifecycle software solution capable of handling all lease and loan management needs from application origination through asset disposition or loan maturity.

“Every customer makes unique use of InfoLease,” said Campbell. “InfoLease 10 is architected to preserve the vast majority of customizations and integrations that our customers have invested in over the years. IDS has also developed comprehensive upgrade-specific tools and services as an essential part of the upgrade path to help minimize customer expense and risk.”

IDS plans to showcase InfoLease 10 and Rapport this fall at its annual ConnectionPoint user conference October 9-11, 2013 in Minneapolis, MN, and during the Equipment Leasing & Finance Association (ELFA) Annual Conference October 20-22, 2013 in Orlando, FL.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croc

Fast-paced thrills (“World War Z”) and clever animation (“Monsters University”) come to theaters, while DVD releases offer comedy (“The Incredible Burt Wonderstone”), documentary (“56 Up”), and classic sci-fi (“Things to Come”).

In Theaters:

World War Z (Paramount Pictures): Brad Pitt teams up with director Marc Forster (“Monster’s Ball”) for this highly-anticipated, action-packed blockbuster. Pitt stars as Gerry Lane, a retired United Nations operative who finds himself in a nightmare scenario when the world is suddenly in the grip of a surge of zombie creatures. As order crumbles in every corner of the planet, Gerry must protect his family as they make their way out of the dangerous zones, with the ghouls constantly snapping not far behind them. Though zombie movies have a long and distinguished tradition of gore, Forster instead opts for suspense over blood, serving up a global apocalypse that’s long on kinetic thrills rather than gruesome spills. The result is a rollicking, smart summer rollercoaster ride with equal elements of action and horror.

Monsters University (Walt Disney Motion Pictures): The characters from Pixar’s 2001 hit “Monsters Inc.” return in this very enjoyable prequel, directed by Dan Scanlon. Taking place in the earlier film’s same alternative reality of animated beasties, the plot rewinds several years to reveal the origins of the friendship between one-eyed Mike (voiced by Billy Crystal) and furry behemoth Sullivan (John Goodman). Back in their younger days, Mike is a bookish freshman and Sullivan is a sluggish jock making their way through classes in order to find jobs scaring children in dreams. Though their differences hardly make them friends at first sight, the twosome soon realize they have to help each other to sidestep the school’s stuffy dean (Helen Mirren). Stuffed with clever gags and lovable characters, this is another Pixar homerun for all audiences.

Netflix Tip: Though “World War Z” offers plenty of PG-13 rated kicks for audiences, horror fans can still get their zombie fix from Netflix. Prime options include the graceful classic “I Walk With a Zombie” (1943), the great, original “Night of the Living Dead” (1968), and the hilarious send-up “Shaun of the Dead” (2004). |

On DVD:

The Incredible Burt Wonderstone (Warner Bros.): Ten years after "Bruce Almighty," Steve Carrell and Jim Carrey team up again for this lightweight comedy about rivalry among professional magicians. Carrell stars as the titular Burt Wonderstone, who with his friend Anton Marvelton (Steve Buscemi) dazzles Las Vegas audiences with conjuring tricks. Their success, however, is threatened when the daring stunts of an eager street magician named Steve Gray (Carrey) make them look increasingly stale. Things look grim for Burt and Anton, until they meet Rance Holloway (Alan Arkin), the old-school illusionist who first introduced them to the thrills of magic. Directed by TV veteran Don Scardino, the film is an affable affair that benefits greatly from the likable personalities of its zany cast members.

56 Up (First Run Pictures): Back in 1964, filmmaker Michael Apted embarked on an unique cinematic project: To follow the lives of an assorted group of British people, interviewing them once every seven years to see how their lives and dreams have been shaped by their class and surroundings. Seven documentaries later and here we are with these former children now past middle-age, looking back in nostalgia and ahead in hope as Apted catches up with them. Among the subjects is Sue, now a cheerful legal faculty administrator; insecure Paul, living in Australia with his wife and grandchildren; Neil, who was last seen as a homeless person but is now involved in politics; and Peter, who'd skipped the last couple episodes but now returns with a band to plug. Continuing his remarkable experiment, Apted serves up an inspired, humanistic portrait the way only the best documentaries can.

Things to Come (Criterion): Science-fiction buffs will definitely want to check out this striking, unfairly forgotten 1936 British classic, an adaptation of a futuristic novel by the legendary H.G. Wells. Taking place over a period of 100 years, the story envisions a future in which civilization must struggle for its own survival with dangers like wars and plagues. A close encounter with space visitors leads the human race to rise from the ashes and construct a new world, culminating in a trip to the moon. Directed by legendary set designer William Cameron Menzies ("Gone With the Wind") and featuring charming early special effects and a cast that includes Raymond Massey and Ralph Richardson, this is a fascinating sci-fi vision that would make an intriguing double-bill with Fritz Lang's "Metropolis."

[headlines]

--------------------------------------------------------------

Classified ads—

Leasing Industry Outsourcing

(Providing Services and Products)

Collector / Collections / Consultant / Communications

| Collector: Atlanta, GA Asset Recovery Specialist. We get your money or we get your > equipment back for you. Physical Asset Recovery Experts! mcrouse911@joimail.com |

Collector: Cleveland, OH Huntley Capital & Associates is your solution to late payments, no payments, and asset recovery. Call 216-337-7075. Email: ghpatey@msn.com |

||

| Collections: Dallas, Texas Contingency Fee basis. Receivables Outsourcing. We are a fully bonded nationwide licensed agency. We collect for nationally known banks and leasing companies. 800-886-8088. |

Collector: Los Angeles, CA Expert skiptracers covering Southern California. We locate skips, judgment debtors and collateral. When you can't get the job done in house, give us a call at 1-800-778-0794. E-mail: ceo@interagencyLA.com |

||

| Collector: Louisville, KY We are a full service collection agency with attorney network. 21 years experience. Please call Jon Floyd, VP at 1-800-264-6850 email: jfloyd@collectcsg.com |

Collector: Louisville, KY Euler Hermes/UMA 92 year old Global Receivables Outsourcing. Presence in 143 Countries. Work w/ 4 out of 5 Fortune 500 firms. Contingency Fee Structure. 20% off first time clients.! Andrew.Newton@eulerhermes.com 1-800-237-9386 x 205. |

||

| Collector: Mandeville, MI International commercial collection services all fees are on contingency on line access. E-mail: rmelerine@collect-now.com www.drspay.com www.collect-now.com |

|

||

Collector: Nationwide |

Collector: Saint Louis, MO Complete commercial collection agency. Licensed bonded in all states and will out performed any other agency! Call 1-800-659-7199 ext.315 E-mail: jfloyd@lindquistandtrudeau.com |

||

| Consultant: Nationwide 25 yrs. experience: Creating/Refining Business Plans to raise capital· Credit Underwriting support/policy/procedure development · Operations Support/policy/procedure development. Call: 610-246-2178, McCarthy Financial, LLC,David.mccarthy@mccarthy-financial.com |

Consultant: Burlington, CT We provide our clients with a full range of consulting services such as portfolio conversions, reconciliation, custom programming and leasing operations utilizing InfoLease. Email: info@new-millennium-assoc.com |

||

| Consultant: Europe 15 years doing deals/running own technology leasing company – looking to advise/ lead new entrants to take advantage the European market opportunity. www.clearcape.co.uk kevin.kennedy@clearcape.co.uk |

Consultant: Henderson, NV Focus on new business development and process efficiencies to create incremental revenue and profitability. Executive level vendor experience, and satisfied outsourcing clients. Incredible track record. E-mail: rbutzek@cox.net |

||

Consultant: Sausalito, CA |

Consultant: North of Detroit, MI |

||

Consultant: Ridgefield CT. |

Email: dan@danscartoons.com http://www.danscartoons.com

|

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

Border Collie/Labrador Retriever Mix

Marshall, Minnesota Adopt-a-Dog

Popo, JoJo, Po

(nicknames)

Sex: Male

Age: 5 months, 15 days

Rescue ID: 13-0009

General Color: Black with White

Eye Color: Black

Ear Type: Droopy

Tail Type: Long

Current Size: 31 Pounds

Potential Size: 60 Pounds

Current Age: 5 Months 15 Days

Microchipped: Yes

Fence Required: No

Housetrained: Yes

Obedience Training Needed: Needs Training

Exercise Needs: Moderate

Grooming Needs: Low

Shedding Amount: Moderate

Owner Experience Needed: Species

Reaction to New People: Friendly

More about Sir Pontiff PoPo Joe

Good with Dogs, Good with Cats, Good with Kids, Good with Adults, Somewhat vocal, Does Good in the Car, Does not require a yard, Likes to play with toys, Playful, Affectionate, Intelligent, Goofy

More Detail:

Good with Dogs: Yes

Good with Cats: He won’t kill them, but they’re in for a life time of surprise attacks!

Good with Kids: A little tentative, but warms up quickly.

Name/Nicknames: PoPo, JoJo, Po.

How did I get to ARLP: I was handed over from another rescue who needed help. I was rescued from the Red Lake reservation.

Hobbies: I’m good at barking and bossing bigger dogs around, I enjoy a relaxing bone chewing, and I’m a great help with the gardening with my skills as a hole digger. I also love to un-plant flowers

I love and excel at training sessions, I’m a really good worker! I rarely get distracted. I appreciate nap-time though I need reminding that its time to rest. I love to drink water, it’s so delicious. And finally, I love lazy afternoons on the guest bed lounging in front of the open window and watching the world go by.

Tricks/Commands: Well I’m still learning, but heel and front came really easy for me, as well as sit. Down is still a little clumsy.

Crate Trained: I like going into my kennel, but there is a limit to my patience as to how long you want me to stay on there. When your home, its time to let me out!

Potty Trained: YES! Though I have been known to mess up and go in the house when it’s raining.

Size in pounds: 31

Activity Level: I’m fairly active. I’m young for god’s sakes!

Fun things I do: See hobby’s. I have a sneaking suspicion I’d be a good swimmer, but this spring has been a chilly and wet one so who has had the time to find out! I love chasing soft squishy balls inside and out. (they’re soft so it’s okay to play inside with them) and though it can come out of the blue, I LOVE jumping! And high! Really HIGH!

General information requests: info@arottalove.org

You can leave us a voicemail message at 651.649.4451, but this is a voicemail-only number and is never answered by a human being. The fastest way to reach us is by e-mail.

Mailing Address:

A Rotta Love Plus

1710 Douglas Dr., Ste. 100

Golden Valley, MN 55422

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Capital One laying off 145

www.bizjournals.com/washington/blog/2013/06/capital-one-cuts.html

Safeway wins top honor for hiring, training veterans

http://www.mercurynews.com/business/ci_23546936/safeway-wins-top-honor-hiring-training-veterans

[headlines]

--------------------------------------------------------------

---You May Have Missed

Revamped Yahoo News aims to pull readers, ad dollars from rivals

http://www.mercurynews.com/business/ci_23553978/revamped-yahoo-news-aims-pull-readers-ad-dollars

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

The Sleep Quiz SparkPeople Health & Wellness Quiz

http://www.sparkpeople.com/resource/quizzes_start.asp?quizid=43

[headlines]

--------------------------------------------------------------

Baseball Poem

WHEN THE YANKEES WIN

WHEN THE YANKEES WIN IT'S PURE DELIGHT,

I CAN SUFFER FOOLS I CAN SLEEP AT NIGHT

I CAN SIT IN TRAFFIC ULCER-FREE

EVEN LETTING CARS IN FRONT OF ME.

I'VE A QUICKER STEP I'VE A BROADER GRIN

WHEN THE LAST OUT'S MADE AND THE YANKEES WIN.

ELOQUENT I WAX, CLEVERLY I PUN

WHEN WE'VE GOT TORONTO ON THE RUN

AND WHEN THE RED AND WHITE SOX SLIP,

MY HEART FILLS UP WITH FELLOWSHIP

AND PRIDE AS I REFLECT THEIR GLORY,

WATCHING SCOTT PUNCH FISTS WITH TORRE.

JOYFULLY I'M GIVING THANKS

AS EMPTY BASES FILL WITH YANKS

AND WHEN AND IF THEY'RE CLEARED BY JETER

STARS ARE BRIGHTER AIR IS SWEETER,

RICH THE COFFEE CRISP THE BAGEL

WINNING GAMES WITH CONE AND NEAGLE.

HOW MY FORTUNES RISE AND FALL

WITH BERNIE, TINO, CHUCK AND PAUL

GOODEN, JUSTICE, JORGE, ROCKET,

PUTTING PENNANTS IN THEIR POCKETS,

EL DUQUE, MARIANO, HILL,

PETTITTE, OH MY HEART BE STILL !

HOW LIGHT THAT HEART, HOW FREE OF CARES

WHEN OUR SHOES TOUCH HOME MORE THAN THEIRS !!

NO NEED FOR THEM TO WIN EACH DAY,

JUST LET THEM WIN ON DAYS THEY PLAY !

Carol P, Yankee Poet Laureate (self-proclaimed)

[headlines]

--------------------------------------------------------------

Sports Briefs----

U.N.L.V.’s Bennett Is Surprising First Pick in N.B.A Draft

http://www.nytimes.com/2013/06/28/sports/basketball/nba-draft.html?hp&_r=0

International soccer returns to St. Louis

http://www.stltoday.com/sports/soccer/international-soccer-returns-to-st-louis/article_6c3f75ba-82ee-56ac-95a4-baeb06c17b33.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Top 100 Restaurants comes to SFGate---along with new restaurants that should be included

http://insidescoopsf.sfgate.com/blog/2013/06/25/top-100-restaurants-comes-to-sfgate-along-with-new-restaurants-that-should-be-included/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Charles Shaw Wins Triple Gold in Orange County

http://www.winebusiness.com/news/?go=getArticle&dataid=118518

Caymus proposes large Cordelia Road winery

http://www.dailyrepublic.com/news/solanocounty/caymus-proposes-large-cordelia-road-winery/

WORLD’S FIRST COLA-FLAVOURED WINE LAUNCHED

http://www.thedrinksbusiness.com/2013/06/worlds-first-cola-flavoured-wine-launched/

Wine trolley to roll in Napa Valley

http://napavalleyregister.com/news/local/wine-trolley-to-roll-in-the-valley/article_2e82c7aa-ddf2-11e2-8df4-0019bb2963f4.html

Vinho Verde: Portuguese for ‘Cheap and Cheerful’

http://www.nytimes.com/2013/07/03/dining/vinho-verde-portuguese-for-cheap-and-cheerful.html?ref=dining

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1451 - An eclipse occurred that allegedly prevented the outbreak of war between the Mohawk and the Seneca Indians.

1687-The first Knighthood conferred on a person born in America was awarded at Windsor Castle, England, by King James II to William Phips(Phipps), for his fair distribution of 34 tons of silver, gold, and jewels valued at $1,350,000 that he salvaged from a sunken Spanish ship that had lain in the sea near the Bahamas Islands for 44 years. Phips was born on February 2, 1651, at Pemaquid (now Bristol), ME.

1776 - Jefferson's document was placed before the Congress after some minor changes by Adams and Franklin. This event was immortalized in the painting by John Trumball.

1776 - Colonists repulsed a British sea attack on Charleston, South Carolina.

1776 - Thomas Hickey, American sergeant convicted of treason, was hanged.

1778 - "Molly Pitcher," Mary Ludwig Hays McCauley, wife of an American artilleryman, carried water to the soldiers during the Revolutionary War Battle of Monmouth, N.J. and, supposedly, took her husband's place at his gun after he is overcome with heat.

1770-Quakers open school for Blacks in Philadelphia

1778-History records the first Revolutionary War conflict in which American and British troops met on equal terms was the Battle of Monmouth Courthouse, Freehold, NJ, this day in 1778. The Americans under General George Washington lost 69 killed and 160 wounded. The British under Sir Henry Clinton lost 300 killed and 100 wounded or captured. The Battle of Monmouth in central New Jersey was fought in sweltering heat. The temperature was 96 degrees in the shade, and there were more casualties from the heat than from bullets.

http://users.rcn.com/gvalis/ggv/battles/Monmouth.html

1812-A after much debate in Congress between “hawks” such as Henry Clay and John Calhoun, and “doves” such as John Randolph, Congress issued a declaration of war on Great Britain. The action was prompted by Britain's violation of America's rights on the high seas and British incitement of Indian warfare on the frontier. War was seen by some as a way to acquire Florida and Canada. The hostilities ended with the signing of Treaty of Ghent on December 24, 184, at Ghent, Belgium.

1862-The siege of the Confederate city of Vicksburg, MS, began in earnest when Admiral David Farragut succeeded in taking a fleet past the Mississippi River stronghold on this date.

http://battlefieldvacations.com/miss/vicksb.asp

http://www.nps.gov/vick/vcmpgn/siege.htm

http://www.proseandphotos.com/vicksburg,_ms.htm

http://www.henry.k12.ga.us/pges/kid-pages/cw/farragut.html

http://bulldog2.berwick-academy.so-berwick.pvt.k12.me.us/projects/

history/David_Farragut.html

http://www.us-civilwar.com/farragut.htm

(He is best remembered as being the Union's only Admiral and for saying “Damn the torpedoes. Full speed ahead.” He did say this. In those days, by the way, a torpedo was a mine in the water. To halt ships entrance in the water, especially around harbors, floating mines or tied to a chain were very commonly deployed.)

1888 -- Robert Louis Stevenson leaves San Francisco on his first voyage to the South Seas.

1902—birthday of songwriter Richard Rodgers, New York City, NY

http://home.istar.ca/~townsend/_private/composer/rodgers.htm

http://www.nodanw.com/biographies/rodgers_hart.htm

http://www.kennedy-center.org/programs/specialevents/honors/

history/honoree/rodgers.html

1902-The Isthmian Canal Act was passed by Congress. It authorized financing, and building of a canal across the Isthmus of Panama, and also authorized an alternative route across Nicaragua in the event the president could not obtain a concession from the Panama Canal Company of France ( which he eventually did for $40,000,000) and negotiate a proper treaty with Colombia. Treaty difficulties were obviated by the successful rebellion and separation of Panama from Colombia in November, 1903. the new republic immediately granted a ten-mile-wide strip of land for the canal.

1907-birthday of composer-arranger Jimmy Mundy, Cincinnati, Ohio. He died in 1983.

http://www.centrohd.com/biogra/m2/jimmy_mundy_b.htm

http://www.loc.gov/rr/perform/basiestocks.html

(we boasted a book of 70 Basie arrangements)

1909 -- Eric Ambler born (1909-1998). English author, widely regarded, with Somerset Maugham & Graham Greene, as a pioneer of espionage & crime fiction. Used the pseudonym Eliot Reed on four novels written with Charles Rodda. 1964 Edgar-winner, later named a Grand Master by the Mystery Writers of America.Wrote a series of great spy novels. One of my favorites, so he gets listed here.

http://www.kirjasto.sci.fi/eamber.htm

1914-Archduke Ferdinand of Austria and his wife Sofia were assassinated in Sarajevo by a Bosnian Serb, setting of a chain of events that lead to World War I.

http://memory.loc.gov/ammem/today/jun28.html

1914-Birthday of bluegrass musician and singer Lester Flatt.was born in Overton County, Tennessee. Flatt, his partner Earl Scruggs and their band, the Foggy Mountain Boys, did more than any other group to bring bluegrass music to the attention of the mass audience in the 1960's. Flatt and Scruggs' "The Ballad of Jed Clampett" from "The Beverly Hillbillies" TV show was a hit in 1962. And their recording of "Foggy Mountain Breakdown," which they had originally waxed in 1949, reached the Billboard Hot 100 chart in 1968 after it was used in the film "Bonnie and Clyde." When Lester Flatt and Earl Scruggs' musical partnership ended in 1969, they had been together for more than 20 years. Flatt died on May 11th, 1979 at the age of 64. ![]()

1922- birthday of Dean Benedetti, recorder of Bird solo's, Ogden, Utah.

http://www.mosaicrecords.com/DisplaySelectionDetail.asp?SelectionID=1

http://jazzinstituteofchicago.org/index.asp?target=/jazzgram/people/benedetti.asp

http://www.grafik-tips.org/weblog/texte/bird.html

http://www.kyushu-ns.ac.jp/~allan/Documents/CP_S_48-50.html

1923 -Birthday of trumpet player Pete Condoli

http://www.srirecords.com/condoli.html

1924 -A massive F4 tornado hit Sandusky, Ohio, moved across Lake Erie, and then tore through Lorain, Ohio. 85 people killed and total damage was 12.5 million dollars.

1925-Birthday of George Morgan, one of country music's earliest crooners, born in Waverly, Tennessee. He was the writer and singer of "Candy Kisses," the biggest country song of 1949. Morgan's recording went to number one and sold a million copies, while a cover version by Elton Britt was number three on the country chart. Morgan's smooth, easy style was featured on such early '50s country hits as "Room Full of Roses," "Cry Baby Heart" and "I'm in Love Again." He died of a heart attack in July 1975 just as his career was beginning to rebound.

1928-Louis Armstrong records the classic, “ West End Blues,” (Okey 87597)

http://www.libertyhall.com/stamp/westend.html

http://www.pbs.org/jazz/biography/artist_id_armstrong_louis.htm

1940- Congress approved the Alien Registration Act. During the period from August 27, 1940 to December 26, 1940, the number of non-citizens who registered was 4,741,971.

1944 - "The Alan Young Show" debuted on NBC radio. It was a summer replacement for the popular Eddie Cantor. The show became a regular in the fall NBC lineup. Young, incidentally, made the switch to TV in 1961. He became a CBS star with a talking horse, of course, of course, named "Mister Ed".

http://www.mister-ed.tv/Alan%20Young's%20Bio.htm

http://www.colemanzone.com/Time_Machine_Project/filby.htm

1949- All 12 of the women who were the first to be admitted to Harvard Medical School in 1945 (YES, 1945 and then only because there weren't enough young men around because of World War II enlistments), graduated, two as cum laude. None flunked out as predicted and the walls did not tumble in, nor was the future of the medical profession irreparably harmed.

1948 - No. 1 Billboard Pop Hit: "Woody Wood-Pecker," Kay Kyser Orchestra. The song tops the Billboard singles chart for six weeks and sells more than 1 million copies.

1951- “Amos and Andy” premiered on TV; based on the popular radio show about black characters played by white dialecticians Freeman Gosden and Charles Correll. It became the first dramatic series with an all-black cast to appear on television. The cast included Tim Moore, Spencer Williams, Alvin Childress, Ernestine Wade, Amanda Randolph, Johnny Lee, Nick O'Demus and Jester Hairston. The series was widely syndicated until pressure from civil rights groups, who claimed the show was stereotypical and prejudicial, caused CBS to withdraw it from syndication Today it is considered derogatory and re-runs are rare. It was one of the most popular radio and television shows of all time.

1955---Top Hits

Cherry Pink and Apple Blossom White - Perez Prado

Rock Around the Clock - Bill Haley & His Comets

Unchained Melody - Al Hibler

Live Fast, Love Hard, Die Young - Faron Young

1960-birthday of Denver Bronco quarterback John Albert Elway, Port Angeles,WA.

1963---Top Hits

Sukiyaki - Kyu Sakamoto

Blue on Blue - Bobby Vinton

Those Lazy-Hazy-Crazy Days of Summer - Nat King Cole

Act Naturally - Buck Owens

1964 - No. 1 Billboard Pop Hit: "I Get Around," The Beach Boys.

1965-Dick Clark's Rock and Roll TV show, Where the Action Is premieres on ABC-TV. Guests include Jan and Dean, Dee Dee Sharp and newcomers Paul Revere and The Raiders, who steal the show with their stage antics and Revolutionary War costumes.

1968-President Lyndon B. Johnson approved Public Law 90-363, which amended section 6103(a) of title 5, United States Code, establishing Monday observance of Washington's Birthday, Memorial Day, Labor Day, Columbus Day and Veterans Day. The new holiday law took effect Jan 1,1971. Veterans Day observance subsequently reverted to its former observance date, Nov 11.

1968-The Rascals claim gold record number three for their hit, "A Beautiful Morning".

1968-SANTIAGO-COLON, HECTOR Medal of Honor

Rank and organization: Specialist Fourth Class, U.S. Army, Company B, 5th Battalion, 7th Cavalry, 1st Cavalry Division (Airmobile). Place and date: Quang Tri Province, Republic of Vietnam, 28 June 1968. Entered service at: New York, N.Y. Born: 20 December 1942, Salinas, Puerto Rico. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Sp4c. Santiago-Colon distinguished himself at the cost of his life while serving as a gunner in the mortar platoon of Company B. While serving as a perimeter sentry, Sp4c. Santiago-Colon heard distinct movement in the heavily wooded area to his front and flanks. Immediately he alerted his fellow sentries in the area to move to their foxholes and remain alert for any enemy probing forces. From the wooded area around his position heavy enemy automatic weapons and small-arms fire suddenly broke out, but extreme darkness rendered difficult the precise location and identification of the hostile force. Only the muzzle flashes from enemy weapons indicated their position. Sp4c. Santiago-Colon and the other members of his position immediately began to repel the attackers, utilizing hand grenades, antipersonnel mines and small-arms fire. Due to the heavy volume of enemy fire and exploding grenades around them, a North Vietnamese soldier was able to crawl, undetected, to their position. Suddenly, the enemy soldier lobbed a hand grenade into Sp4c. Santiago-Colon's foxhole. Realizing that there was no time to throw the grenade out of his position, Sp4c. Santiago-Colon retrieved the grenade, tucked it in to his stomach and, turning away from his comrades, absorbed the full impact of the blast. His heroic self-sacrifice saved the lives of those who occupied the foxhole with him, and provided them with the inspiration to continue fighting until they had forced the enemy to retreat from the perimeter. By his gallantry at the cost of his life and in the highest traditions of the military service, Sp4c. Santiago-Colon has reflected great credit upon himself, his unit, and the U.S. Army.

1971-The Us Supreme Court voted 8-0 to overturn the 1967 conviction of Muhammad Ali for draft evasion. The World Champ had has his title stripped for refusing to participate in the View Nam war, declaring himself a conscientious objector.

1971---Top Hits

It's Too Late/I Feel the Earth Move - Carole King

Indian Reservation - Raiders

Treat Her Like a Lady - Cornelius Brothers & Sister Rose

When You're Hot, You're Hot - Jerry Reed

1974-brithday of Karim Abdul-Jabbar ( formerly known as Sharman Shah) football player, born Los Angels, CA.

1974 - No. 1 Billboard Pop Hit: "Sundown," Gordon Lightfoot. 1975 - Lee Trevino and two other golfers are struck by lightning at the Western Open golf tournament in Oak Brook, IL.

1976---One hundred, fifty-seven women cadets reported for training at U.S. Air Force Academy, Colorado Springs, Colorado. 1,200 women applied. In May, 1980, 98 of the original 157 graduated. For the women's personal training, the Air Force only supplemented the male staff with regular Army women officers for the first year and then demanded the women train their lower classmates in protocol, etc., while the male cadets continued to have professional instructors.

1978-The concept of racial quotas came under fire when the Supreme Court ruled in the case of Bakke v. the University of California that the university had to admit Allan P. Bakke to its medical school. Bakke, who was white, claimed his civil rights had been violated when he was refused admission because of racial quotas designed to increase the number of minority students in the medical school.

1979---Top Hits

Hot Stuff - Donna Summer

Ring My Bell - Anita Ward

The Logical Song - Supertramp

Nobody Likes Sad Songs - Ronnie Milsap

1980 - The temperature at Wichita Falls, TX, soared to 117 degrees, their hottest reading of record. Daily highs were 110 degrees or above between the 24th of June and the 3rd of July.

1981 - "Variety", the movieland trade paper, reported that the biggest single weekend in box-office history saw American moviegoers spending a blockbusting $56,101,095 at the box office. The popular movies bringing in the bucks were "Superman II" with Christopher Reeve, "Raiders of the Lost Ark" with Harrison Ford and "The Great Muppet Caper" with Kermit the Frog and Miss Piggy.

1985 - Route 66, the 59-year-old highway of 2,200 miles of blacktop, was decertified as a U.S. highway. The highway that was a legendary part of Americana saw highway crews removing the classic roadway shield-markers that designated it as the highway west. Route 66 started in Chicago, Illinois and continued into Santa Monica, California. To travel from one end of Route 66 to the other, one would go through eight states and three time zones. Bobby Troup was disappointed.

http://www.emergencyfans.com/people/bobby_troup.htm

1986-Don Sutton of the California Angeles and Phil Niekro of the Cleveland Indians became the first pair of 300-game winners in the 20 th century to start against each other. The Angeles scored six runs in the bottom of the eight inning to win the game, 9-3. Neither started figured in the decision.

1987---Top Hits

I Wanna Dance with Somebody (Who Loves Me) - Whitney Houston

In Too Deep - Genesis

Alone - Heart

Forever and Ever, Amen - Randy Travis

1988 - Founder Berry Gordy Jr. sold Motown Records to MCA Records and Boston Ventures, an investment firm, for $61 million.

1992 - A very strong earthquake shook the high desert of Southern California at 4:57 a.m. The M7.3 earthquake was centered on the eastern side of the San Bernardino Mountains near the town of Landers. The quake was the largest to strike California since the Kern County M7.7 earthquake in 1952. Vigorous rocking and rolling was felt 100 miles away in L.A. and the quake was felt as far away as Central California and Las Vegas, Nevada. Property damage: $56 million, including collapsed buildings, ruptured utility lines and widespread nonstructural damage. Human toll: One killed, 25 seriously injured, 372 treated for some sort of earthquake-related injuries, millions awakened with nightmares for weeks.

1992 -A slow moving tropical depression produced excessive rains across southwest Florida. Four day totals ending on the 28th, ranged up to 25 inches in the Venice area, with a general 8 to 14 inches over Sarasota and Manatee counties. Two deaths resulted from the flooding.

1994 - The U.S. EPA (Environmental Protection Agency) announced it would begin experimenting with a UV (ultraviolet) Index, “To enhance public awareness of the effects of overexposure to the sun's ultraviolet rays, and to provide the public with actions they can take to reduce harmful effects of overexposure, which may include skin cancer, cataracts and immune suppression.”

1996-- Darryl Strawberry's 300th career round-tripper is a dramatic ninth inning, two-run dinger which gives the Yankees a come-from-behind 3-2 win over the Royals.

1997-In a fight for the WBA heavyweight championship in Las Vegas, challenger Mike Tyson was disqualified in the third round by referee Mills Lane for twice biting the ear of champion Evander Holyfield. After the fight, Tyson claimed the he had been upset that Holyfield head-butted him in the second round. The bits, which precipitated a near-riot in and about the ring, were an attempt at retaliation. Only July 9, the Nevada Boxing Commission fined Tyson $3 million and revoked his boxing license.

2000-- The Rockies draw their 20 millionth fan to one ballpark faster than any other team in major league history. Taking less than six years, Colorado eclipses the Dodgers' mark of taking nine years in two stadiums to reach the milestone.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Editorials (click here)

www.leasingcomplaints.com

Ten Top Stories each week chosen by readers (click here)

(chronological order)

- Cobra Capital Back in Business

- Marlin Leasing Officers Exercises Stock Options

- Commonwealth Capital Answers

Finra Charges Misuse Leasing Funds

- Four New CLP's from First American Equipment Finance

- Bentsen-Gregg named to new posts

- Public Sector Finance Forum Report

By Darrel Peters, CLP, Arvest Bank

- Western Equipment Finance Parent

Takes over Central Arizona Bank

- Lovely Ladies of Leasing

- FASB/IASB Leasing Accounting Coming Down the Tracks

- Vehicle Leasing Conference Finds Daylight

By Edward P. Kaye, Advantage Funding

- Abbott and Costello Prediction- An Update

- Sterling Financial Purchases Commerce National

- Vegas Conference Biggest Turnout since 2006

by Dwight Galloway, CLP

- Alexa Report---Leasing News Pulls Ahead of Competition

- Steve Jobs---The Best Advice on Success and Failure

- US Hiring Index retreats 8.8% in Q1 2013

- www.leasingcomplaints.com

Leasing News Kicks it up a Notch!

- “What To Expect When Seeking Business Financing”

- Twitterverse--Are you a "Tweep" or "Twitterati"?

- Paul Menzel, CLP, Reports on ELFA Funding Conference

- Huntington Bank Hit with $81 Million Judgment

Check Kite Crashes into El Camino Resources

- Leasing Association Membership Echoes Economy

by Christopher Menkin

- Why Networking Doesn't Work

by Eric V. Holtzclaw, www.inc.com

- New York City Investors’ Conference Equipment Finance

By Bruce Kropschot, The Alta Group

- Banks Lending or Not Lending?

Conversation with Deborah Monosson

- Pacific Western Bank Responds to Evergreen Non-Notification

- In-N-Out’s Burger Ranked Top Fast-Food Burger in US

- Media Tips - Learning from the Reporter’s Perspective

- Northern Leasing Systems Says "It isn't so!"

- Los Angeles BBB Expelled from National Association

- Female Lease Finance Association Presidents

- Odyssey Merges with Pinnacle Capital!

--- Brent Hall, CLP, on Growth Mode

- Working Out of Your Residence or Company Hq.

- Terry Winders, CLP, Custom Built Poker Tables

---Order One for Father’s Day

- Leasing News Alexa Rating Improves Since Feb. 3

- Pacific Capital Chooses Orion First Financial

- Broker’s Responsibility to Obtain

California Lender’s License

- CLP 2012 Accomplishment Report

Many "fresh faces" Become CLP's

- McQuitty Gets 24 Months Prison

---then 3 Years’ Probation

- Most Popular Dog Breeds in America 2012

- Pacific Western Joins “Extra Lease Payment” Group

- The Matrix-Utah Connection

- Current License Regulations and Advice

- The House that Jerry Built

- Loan/Lease Statute Up-Date

- The Day that Albert Einstein Feared May Have Finally Arrived

-

The Aberdeen Kid—Yahoo Blog

NorVergence

- Brican America---End of year 2012 Update

- Equipment Finance Agreements Explained/Barry S. Marks

- Sheldon Player's E.A.R. Ropes 18 Equipment Lessors

- Chat Acronymns and Keyboard Smilies

- Royal Links "True Lease" Court Ruling

- Element Financials’ Hudson Changing His Image

- Newport Financial Partners, Newport Beach, California

Bulletin Board Complaint

- Reach Potential Customers and Vendors/Find Your Niche

- On Deck reaches $300 Million/1500 distribution partners

- "The Memory Shock" –New Book by Barry Reitman

- Third-IFC Credit Trustee, Northfield, Illinois

Bulletin Board Complaint

- Four Software Solutions

re: Digital device/Laptop Lost or Stolen!

- Excellent Tips by Warren Buffet

- Take Your Banker to Lunch

- Meridian Finance Group Looking Brokers for Europe Biz

- Is Leasing Securitization Dead or Alive?

- "My Three Years with Sheldon Player"

- Why Leasing News is Different

- Mazuma and Republic Bank Get Snared on PRR Provision

by Tom McCurnin, Esq.

- Companies who utilize Evergreen Clauses for Extra Lease Payments

- Jeff Taylor's Leasing Predictions, Spring, 2006

- Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

Purchase Option on EFA, Won’t Return $5,000 S.D.

- New Case against Mazuma Capital and Republic Bank

---Automatic Evergreen Payment---PPR

-

Ten Lawyers Against Evergreen Clause Abuse

- Republic Bank out of leasing?

- Ladco Leasing/Elavon Fined $418,601

- John Otto's HL Leasing Ponzi Scheme Update

- IFC Credit--Rudy Trebels June 2012 Update

-

Future of Mobile Devices

- Charles Schwartz and Allied Health

- Why I became a CLP

- Copier Wars---It's more than the lease payment

by Christopher Menkin

- Results Are In---

"Application Only" versus Financial Statements?

- A California Leasing Gypsy Arrested by Costa Mesa Police

- Survey of Evergreen Clauses

-

Responses to Working with a Smaller Bank Question

- Leasing Gypsies

- OneSource Develops Business License Software

- Talk About Chutzpa, Fanghella has more than Trump

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses

-

Settlement Costs Vs. Litigation Costs