![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Wednesday, January 25, 2017

Today's Equipment Leasing Headlines

Position Wanted – Operations

Work Remotely or Relocate for Right Opportunity

Look Out! Time for Community Banks

By Christopher Menkin

Leasing Industry Ads---Help Wanted

Join a Leading Organization

“How Do I Present My Successes?”

Career Crossroad---By Emily Fitzpatrick/RII

Saluting Leasing News Advisor

Ben Carlile

Loan Assignment from National Bank Upheld

as Exempt from Usury

By Tom McCurnin, Leasing News Legal Editor

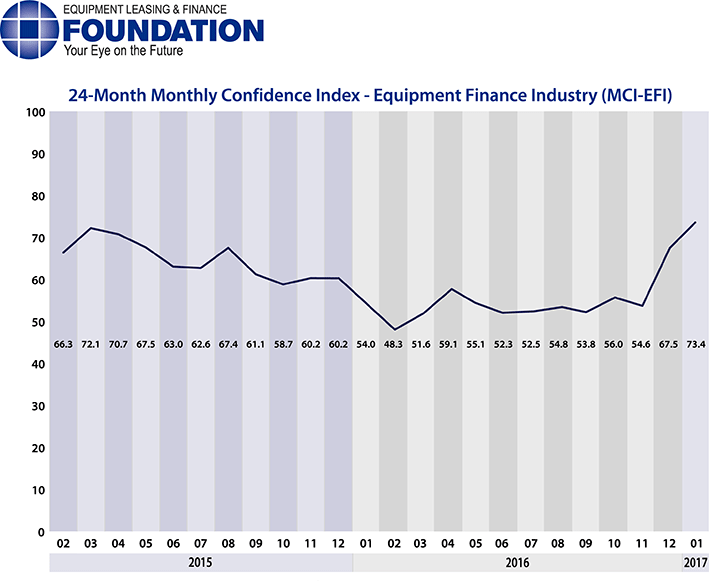

ELFF Monthly Confidence Index Reaches Highest Index

Jan. 73.4 over Dec. 67.5, Highest since 2009 when launched

Shepherd

Milpitas, California Adopt-a-Dog

Leasing News Free News Classified

Back Office

News Briefs---

US ruling a warning to motor carrier's owner-operator model

"Drivers Who Leased are not Ind. Contractors but Employees"

The New Normal: Automated, No Manual Touch Funding

By: Jeremy Brown, Chairman, RapidAdvance

Ascentium Capital Makes

The Top Small Business Lending Platform Finalists Named By LendIt

Doubts Arise as Investors Flock to Crowdfunded Start-Ups

Low Level of Compliance

U.S. Bancorp CEO Richard Davis leaves post

Laud, Praise and Thanks to Davis, Andy Cecere Taking Over

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

American Football Poem---

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free.

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Position Wanted – Operations

Work Remotely or Relocate for Right Opportunity

Each Week Leasing News is pleased, as a service to its readership, to offer completely free ads placed by candidates for jobs in the industry. These ads also can be accessed directly on the website at:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Each ad is limited to (100) words and ads repeat for up to 6 months unless the candidate tells us to stop. Your submissions should be received here by the end of each week.

Operations

|

|

|

[headlines]

--------------------------------------------------------------

Look Out! Time for Community Banks

By Christopher Menkin

(Community Bank information from Mr. Terry Winders, CLFP, and Ralph Mango, Volunteer Associate Editor)

It is obvious the financial community is facing major shifts in both the economy and financing. While Zig Ziglar said there are no red lights, only green, there are yellow lights.

As the economy changes, access to funds will dry up, affecting alternate financing and those companies who have not built up their cash reserves.

Now is the time to build up cash reserves. It is also the time to find new funding sources who will be around the next few years. One of the best funding sources I have found are community banks with assets around $500 million. They usually are looking for good commercial loans, which mean they prefer non-tax leases with no residual requirements. If you have the capital to invest in some equity, perhaps you could sell them the payment stream and retain the right to collect a fixed purchase option.

Community banks do not have the ability to handle the lease accounting requirement, so they will prefer to have you borrow the equipment cost and pledge the lease as collateral on the loan. Then they can use their loan accounting system. Some may think they can use loan accounting for non-tax leasing, but too many items are ignored. Loan accounting is customer-based whereas lease accounting is asset-based because location is key for sales tax, property tax and any other applied tax. It is simple if it is only one piece of equipment, but if there are multiple pieces of equipment, and they are in different counties or States, it becomes very difficult very fast.

Community banks usually like to have transactions in their own foot print, so they can have an opportunity to sell other bank products. That is one of the conversations you should have with the bank when you are asking them to fund your deals. If they think you are bringing them new customers, they will be more acceptable to leases. In addition most community banks are State Chartered Banks and are not qualified to do business out of State.

On occasion, if you handle the relationship with the bank by servicing your deals with collection help and lease education, they may refer you to their customers that ask for lease financing. It can be a favorable partnership, if all the requirements of lease operations are handled correctly.

Community banks usually have to be sold on the benefits of leasing because they do not offer it, so their customers never ask for it, so they assume no one wants it. In addition, they usually like small deals to begin with, and then, as they become more comfortable with leases, the size can increase.

They are very sensitive to their legal lending limit for specific industries and equipment, so you need to discover the size parameters to avoid offering something they are not prepared to accept.

Bankers have very long memories, so if they lost money on a loan with specific equipment as collateral, they will always shy away from any deal with that kind of equipment regardless of the good credit. It would be wise to ask what kind of equipment they do not like.

Some banks think their customers are not interested in leasing because they have never asked for it, so a good idea is to ask for the name of 5 or 6 of their best customers and run a UCC search looking for liens from leasing companies. It never fails to surprise them when they see that there customers are leasing but have never said so.

Community Banks are a good funding source however it takes some time to cultivate a good relationship, so do not expect a quick response. Don’t be surprised if they want not only a business plan, but financial statements on your company and you as the personal guarantor.

From Ralph Mango, Associate Editor:

I would add that the sales cycle to convince them (1) to add leasing to their sales calls, (2) to bring you in at the earliest as a joint call, (3) that leasing is not just for garbage credits, (4) this is a legitimate source of fee income, is lengthy and sometimes painful.

My experience across several such external originator programs as an employee of several lessors is that the education process is often as difficult as implementing the calling and referral process. Bankers do not like joint calls and it takes them forever to get comfortable with you and your process. Usually, the first prospect is one they cannot get through their own credit approval process, and if you can’t approve, your momentum is set back almost irreparably.

Anticipate a lengthy courtship and set expectations accordingly. Alternatively, there were several that turned out to be excellent sources of decent steady volume with solid credits.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

[headlines]

--------------------------------------------------------------

“How Do I Present My Successes?”

Career Crossroad---By Emily Fitzpatrick/RII

How can I demonstrate to a current or future employer my successes? It is important to make sure you keep and “collect” your successes in a way that can be presented to current employers (for promotions, reviews, and salary increases) and future employers (new positions). It is necessary to make sure you keep these accomplishments updated and at your fingertips because you never know what the future will bring. This is being proactive (view archives for other ways to be proactive in your career).

When

There are many situations when you can benefit from a review of your accomplishments. Examples:

- Resume creation or updates.

- For performance evaluations or an annual review.

- Tracking the progress of projects.

- When you want to make a case for a raise or a promotion.

- When applying for recognition (awards or scholarships).

Tracking

Online, Examples:

- Create a file to document your achievements.

- In email, create a folder for accomplishments and send yourself/emails to store in that folder.

- When you receive a “congrats” email, forward a copy to your personal email.

- Use an app like Evernote.

Offline, Examples:

- Notebooks or file folders can be used to track your achievements.

- When you receive notes of appreciation keep them or keep a digital copy.

- Create a portfolio of successes.

Make sure to update your accomplishments weekly (working on a series of projects), monthly or quarterly. Do so an ongoing basis.

Presenting in Writing

It will be impactful if you quantify the scope and scale of achievements in terms of percentages, numbers, and dollars and make statements as powerful as possible using such words as:

Accelerated | Balanced | Championed | Decentralized | Featured | Influenced | Leveraged | Maximized | Piloted |Rebuilt

For an additional listing, connect with us on LinkedIn and note you would like the “accomplishments-verb list.” Include your accomplishments as a separate document and concisely within your resume.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

www.riicareer.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

https://www.pinterest.com/recruitersinter/rii-career-services/

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Ben Carlile

Ben Carlile

Marin County, California

bencarlile9@gmail.com

Ben is a commercial lending consultant providing expertise in creating operational effectiveness in portfolio management, employee development and credit underwriting.

Ben joined the Leasing News Advisory Board in 2014, bringing his 26 years of management and lease operation experience as well as his desire to provide his insight and expertise toward a good cause. He is a strong ethical leader with an enduring commitment to the success of our industry.

Previously, Ben was Managing Director and President of Allegiant Partners Inc., an independent equipment finance company in San Rafael, CA. He was Chief Credit Officer, Board of Directors member, and shareholder since 2000, involved in strategic planning and pricing, developing access to capital and bank relationships, hiring, training and managing personnel, implementing processes and growing revenues. His skills in underwriting and portfolio management drove the performance of Allegiant’s non-prime and near-prime small business leases and loans to a level comparable to the “A-Grade” portfolios of the best-managed banks.

Prior to Allegiant, Ben spent 11 years as Vice President of Credit Administration for Trinity Capital Corporation, San Francisco, California. At Trinity, he managed strong portfolio growth and performance that led to excellent bank relationships, low cost credit facilities, a lucrative servicing business and a profuse interest in optimizing Trinity’s valuation, which ultimately led to Trinity’s successful acquisition by Bank of the West in 2002.

His earlier experience includes management positions at Bank of America, and CIT. He also served on the Novato Charter School Board (2008-2011), including a term as President. He is a Rosarian and shares an interest in financial innovation and data intensive technologies.

Ben is currently serving his fourth year as a member of the Equipment Leasing and Finance Association (ELFA) Credit and Collections Conference Planning Committee. He and his wife and sons live in Marin County, CA.

[headlines]

--------------------------------------------------------------

Loan Assignment from National Bank

Upheld as Exempt from Usury

By Tom McCurnin

Leasing News Legal Editor

The Practice of National Banks Assigning High Interest Loans to Obtain Usury Exemption is Blessed by California Federal Court

Beechum v Navient Solutions, 2016 WL 5340454 (C.D. Cal. 2016).

One week ago, I reported about unlicensed on-line pay day lenders and the dilemmas they had, when trying to foster an exemption to usury using business affiliations with Indian tribes. (1) Called “rent-a-tribe,” the State of California squarely rejected the practice of using tribal affiliations to obtain a usury exemption.

All that said, there is another avenue that some pay day lenders use, which is to “rent-a-charter,” the practice of having national banks make the loans, but having them immediately assigned to the pay-day lender. This practice has been criticized by borrowers because the lender really isn't the bank and therefore the lender should not be exempt.

In today's case, a federal judge passed judgment on the practice, blessing the assignment from a national bank as an exemption to usury. The facts follow.

Jamie Beechum applied to SLM Corporation for a student loan in 2003. SLM processed the application, underwrote the loan, allegedly funded the loan, and purchased the loan from Stillwater National Bank. The actual note was made in favor of the bank. The bank only held the loan for a matter of days and assigned it to a wholly-owned subsidiary of SLM and serviced by Navient. In short, SLM had entered into a relationship with Stillwater Bank to essentially table fund these loans, either on a one-off basis or in bulk. Presumably, SLM also had a warehouse line with the Bank, but that was not discussed.

The Plaintiff Borrower alleged that the transaction was sham and that the real lender was SLM not the bank. Since the loans were high interest obligations and the lender had no usury exemption, the plaintiff alleged the loans were usurious. At least partially, the Plaintiff was correct—many of these high interest loans are owned by the national bank for a matter of minutes or days.

The servicer filed a motion to dismiss the action arguing that since the complaint alleged that the loan was made by a national bank, albeit for a fleeting moment, the defendants enjoyed a statutory exemption, because national banks are exempt from usury. The servicer argued that it mattered not how long the national bank owned the loan.

The plaintiff opposed the motion, arguing that the court can look behind the documents to determine whether the lender structured the loan to avoid usury.

The court granted the motion to dismiss, making the following holdings.

--When the loan meets the requirements of a statutory exemption, courts should not look behind those requirements. There is no magic number or hours or days that the bank should be required to own the paper, and the court should resist setting an artificial deadline, not present in the statutes.

--So long as the loan meets the requirements for exemption, there is no duty to determine whether there is intent to evade usury laws.

--If there is a statutory exemption, that fact obviates the need for inquiry into intent.

As a result of these holdings, the court dismissed the Plaintiffs' complaint. The lender won, and the borrower lost.

What are the takeaways here?

• First, This puts to rest the common practice of lenders utilizing national bank charters to comply with usury exemptions. Because national banks are exempt from usury, many high interest lenders, without their own license or exemption, flocked to smaller national banks for this type of program. Smaller national banks like this type of program because of the risk-free fees they earn. This is good for the lending community in general.

• Second, So long as the note is made to a national bank, the lender to which the note is assigned will have a usury exemption. If a lender can produce a note payable to a national bank, assigned to the lender, that is all that is required to bullet-proof the transaction. Courts will not measure how long the bank actually holds the note.

• Third, courts will not engage in investigating the witch hunt of whether the lender is attempting to evade usury. The cases discussing the examination of the intent to avoid usury were held to be inapplicable if the lender claims a valid statutory exemption. The analysis ends at the promissory note.

• Fourth, why is rent-a-tribe bad, and rent-a-charter acceptable? The answer is easy; banks are highly regulated and the loans they assign must meet the criteria set forth by statute and regulation. Indian tribe loans are virtually unregulated. Assuming the borrowers want to use high interest loans, isn’t it better to have the lender answer to a regulatory body? I think so.

The bottom line to this case is that this holding is great news for high interest lenders and the banks which finance and assign loans for them.

- California Supreme Court Scalps Pay Day Lenders Using Indian Tribes as Surrogate Lenders

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Jan2017/01_17.htm#california

Usury Case (8 pages)

http://leasingnews.org/PDF/usury_case2017.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

##### Press Release ############################

ELFF Monthly Confidence Index Reaches Highest Index

Jan. 73.4 over Dec. 67.5, Highest since 2009 when launched

The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 73.4, an increase from the December index of 67.5, and the highest index since the MCI was launched in May 2009 to track recovery after the 2008 downturn. (Poll taken before Presidential Inauguration).

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “The outlook for U.S. companies has become much more positive since the presidential election. Lower taxes, less regulation and rising interest rates will be the catalyst to spur capital asset acquisitions. This will undoubtedly set the stage for robust equipment finance activity.”

January 2017 Survey Comments from Industry Executive Leadership:

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Bank, Small Ticket

“December new business volume and opportunity pipeline growth indicate increased capital investment activity and utilization of financing for acquisition. I view the rising rate environment as a positive indication and a shift from stagnation to a more normal economic cycle.” Robert Boyer, President, Susquehanna Commercial Finance, Inc.

Independent, Small Ticket

“Small business confidence is very high and we are optimistic that this will equate to more demand for capital expenditures. Hopefully, tax reform doesn’t create too much uncertainty.” David T. Schaefer, CEO, Mintaka Financial, LLC

Bank, Middle Ticket

“We continue to manage through a down cycle in the agriculture industry. We expect the cycle to bottom out in 2017, but do not expect improvement until mid-year 2018 or later. We continue to serve our mission and provide options to customers to help them work through the cycle.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Bank, Large Ticket

“Hope centers around regulatory reform in Washington. Concerns include the rise in the dollar, which could impact exports.” Thomas Partridge, President, Fifth Third Equipment Finance

January 2017 Survey Results:

The overall MCI-EFI is 73.4, an increase from the December index of 67.5.

- When asked to assess their business conditions over the next four months, 74.2% of executives responding said they believe business conditions will improve over the next four months, an increase from 48.4% in December. 22.6% of respondents believe business conditions will remain the same over the next four months, a decrease from 45.2% in December. 3.2% believe business conditions will worsen, a decrease from 6.5% the previous month.

- 71.0% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 38.7% in December. 25.8% believe demand will “remain the same” during the same four-month time period, down from 54.8% the previous month. 3.2% believe demand will decline, down from 6.5% who believed so in December.

- 19.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 22.6% who expected more in December. 80.6% of executives indicate they expect the “same” access to capital to fund business, an increase from 77.4% the previous month. None expect “less” access to capital, unchanged from last month.

- When asked, 35.5% of the executives report they expect to hire more employees over the next four months, a decrease from 41.9% in December. 61.3% expect no change in headcount over the next four months, an increase from 48.4% last month. 3.2% expect to hire fewer employees, down from 9.7% in December.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from December.

- 61.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 71% in December. 38.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 25.8% the previous month. None believe economic conditions in the U.S. will worsen over the next six months, a decrease from 3.2% who believed so last month.

- In January, 58.1% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 48.4% in December. 41.9% believe there will be “no change” in business development spending, a decrease from 51.6% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Survey Respondent Demographics:

Market Segment:

Bank: 71.0%

Captive: 6.5%

Financial Services: 3.2%

Independent: 19.4%

Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 19.4%

Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 - $5 Million): 38.7%

Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 - $249,999): 41.09%

Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

Under $50 Million: 6.5%

$50 Million - $250 Million: 16.1%

$250 Million - $1 Billion: 29.0%

Over $1 Billion: 48.4%

### Press Release ############################

(Leasing News provides this ad as a trade for appraisals and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

Shepherd

Milpitas, California Adopt-a-Dog

LaLa

Female

5 Years old

Spayed

Hi! I'm new here. Everyone's still getting to know me. Once they do, this space will have all kinds of information about me. I am available now, so come down, see me, and ask my Adoption Counselor friends to meet me.

Humane Society Silicon Valley

901 Ames Ave. Milpitas, CA 95035

Ph: 408-262-2133

comments@hssv.org

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing News Free Classified Ads

Back Office

| Back Office: Atlanta, GA Let Tax Partners handle your sales and use tax compliance duties w/less risk and cost than in-house. Largest tax compliance firm in US E-mail:sales@taxpartners.com |

Back Office: 58 Calif. counties Property tax, assessment appear representation and consulting, including hearing appearances. www.rpcpropertytax.com Ken Sullivan 800-540-3900 |

| Backoffice: Dallas, TX Property Tax and sales and use tax administration services performance is guaranteed and we will save you time and money or our service is free. E-mail: info@osgsolutions.com |

|

| Back Office: Gig Harbor, WA Orion First Financial provides comprehensive lease/loan account servicing, collection/workout solutions and strategic advisory services. Contact David T. Schaefer 253-857-9610 dtschaefer@orionfirst.com |

Back Office: Laughlin, NV 20 years experience on funder/broker sides. Looking for a relationship where I act as credit shop for smaller brokers when financial statements are involved. E-mail:batarista@laughlin.net |

| Back Office: National Property Tax Compliance Services to the leasing industry. Over 60-years experience and fifty Lessors as clients. References and free quotes available, 440-871-5484, E-mail gary@avptc.com |

Back Office – National Spending too much time on processing credit applications, preparing lease documents and other administrative tasks and not enough time marketing and growing your business? Call us! 407.964.1232 dee@leasebrokerassistant.com |

| Backoffice: New Rochelle, NY Proactive management/administration of commercial/consumer vehicle lease/finance portfolios covering insurance, titles, registrations, sales/property taxes, tickets, collections, accounting, vehicle disposition. Since 1975 E-mail: Barrett@BarrettCapital.com |

Back Office: Northbrook, IL Our staff of CPA's and lease professionals can handle any or all portfolio responsibilities incl. portfolio mgmt, invoicing, sales/property/income tax, accounting, etc. 800-826-7070 E-mail: ngeary@ecsfinancial.com |

| Back Office: San Rafael, CA We can run your back office from origination to final payoff. 30 years experience in commercial equipment lease and loan portfolio management. E-mail:gmartinez@phxa.com |

Back Office - Portland, OR Keep more of your hard-earned commissions! Middle-Market, Small-Ticket for brokers, nationwide, 20+years experience, negotiable splits. Contact us for more information at (888)745-9481 or bev@alliedpacific.net |

| Back Office: Portland Portfolio Financial Servicing Company provides private label servicing, backup servicing and sales/property tax filings for commercial and consumer leases and loans in the U.S. and Canada. With over $20 Billion in assets under management we have serviced the lending community since 1982. PFSC is engaged with over 52 securitizations.clysne@pfsc.com |

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

US ruling a warning to motor carrier's owner-operator model

"Drivers Who Leased are not Ind. Contractors but Employees"

http://www.joc.com/trucking-logistics/truckload-freight/swift-transportation/us-ruling-warning-motor-carriers-owner-operator-model_20170113.html

The New Normal: Automated, No Manual Touch Funding

By: Jeremy Brown, Chairman, RapidAdvance

http://debanked.com/2017/01/the-new-normal/

Ascentium Capital Makes

The Top Small Business Lending Platform Finalists Named By LendIt

http://debanked.com/2017/01/the-top-small-business-lending-platform-finalists-named-by-lendit/

Doubts Arise as Investors Flock to Crowdfunded Start-Ups

Low Level of Compliance

https://www.nytimes.com/2017/01/24/business/dealbook/crowdfunding-fraud-investing-startups.html

U.S. Bancorp CEO Richard Davis leaves post

Laud, Praise and Thanks to Davis, Andy Cecere Taking Over

https://management-change.com/u-s-bancorp-ceo-richard-davis-leaves-post-2/6763?ct=t

Receivables Management LLC has built their reputation spanning two decades with unmatched Professionalism, Honesty, Integrity and the ability to earn its Equipment Leasing clients an average of 30% on residual income • End of Lease Negotiations & Enforcement john@jkrmdirect.com | ph 315-866-1167 |

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

‘Chinese Dragons’ Overtake U.S. in Financial Tech Investment

http://fortune.com/2017/01/23/china-fintech-invest-citi-report/

[headlines]

--------------------------------------------------------------

Sports Briefs----

Big Ben not guaranteeing he will return in 2017

http://www.theredzone.org/BlogDescription/tabid/61/EntryId/61364/Big-Ben-not-guaranteeing-he-will-return-in-2017/Default.aspx

Why Atlanta deserves this Super Bowl shot, and why Boston fans better be nervous

https://www.yahoo.com/sports/news/why-atlanta-deserves-this-super-bowl-shot-and-why-boston-fans-better-be-nervous-171912473.html

49ers GM search may be compromised by Jed York’s impulsivity

https://www.yahoo.com/sports/news/49ers-gm-search-may-compromised-110030687.html

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Jerry Brown: ‘California is not turning back, not now, not ever’

http://www.sacbee.com/news/politics-government/capitol-alert/article128432759.html

What’s behind the spate of recent Bay Area restaurant closures?

http://www.eastbaytimes.com/2017/01/24/whats-behind-the-spate-of-recent-bay-area-restaurant-closures/

Michelin stars given to San Francisco Bay Area restaurants for 2017

http://www.sfgate.com/food/article/Michelin-awards-given-to-San-Francisco-Bay-Area-10344970.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Half of U.S. Wineries Might Be Sold in the Next Five Years

https://www.bloomberg.com/news/articles/2017-01-18/half-of-u-s-wineries-might-be-sold-in-the-next-five-years

Chinese food giant buys Bordeaux wine estate

http://www.decanter.com/wine-news/chinese-food-giant-buys-bordeaux-wine-estate-353572/

Is California Syrah Misunderstood?

http://www.winemag.com/2017/01/20/is-california-syrah-misunderstood/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1704 - The Battle of Ayubale destroyed most of the Spanish missions in Florida. In 1703, ex-Governor Moore presented to the Carolina assembly a plan for an expedition against the Spanish towns in Apalachee Province, near present-day Tallahassee. After recruiting 50 colonists, he traveled to the upper waters of the Ocmulgee River, where he recruited 1,000 Creek Indians to join the expedition against their traditional enemies. On January 25, 1704, Moore's force arrived at Ayubale, one of the larger mission towns in Apalachee. While most of the Creeks raided the surrounding villages, Moore took most of the whites and 15 Creek into Ayubale itself around 7:00 am. The only resistance was organized by Father Angel Miranda, who retreated into the town's church compound, which was surrounded by a mud wall. With 26 men he successfully held the English at bay for nine hours, and only surrendered himself, his men, and 58 women and children after they ran out of arrows. According to one Spanish account, Miranda threw himself and his followers on Moore's mercy. He was, according to this account (but apparently not others), then summarily slain in cold blood by Moore's Indian allies, and some of his followers were then tortured and killed.

1775 – Americans dragged cannon up a hill to fight the British at Gun Hill Road, The Bronx. When the British navy landed on Staten Island in 1775, New York City Patriots feared an imminent invasion. They did not want the precious cannon at the Battery to fall into enemy hands. Thus, in December, 1775, they took the cannon to the mainland and scattered them roughly along present-day Gun Hill Road from today’s Jerome Avenue across the Bronx River to modern White Plains Road.

1783 – Birthday of William Colgate (d. 1857), Kent, England. He founded what became the Colgate Toothpaste Company in 1806, a starch, soap and candle business in Manhattan, on Dutch Street. In 1820, he started a starch factory across the Hudson in Jersey City, leading to a long and current involvement of the company in Jersey City.

1787 – Small farmers in Springfield, Massachusetts led by Daniel Shays continued their revolt against tax laws. Federal troops broke up the protesters of what became known as Shays’ Rebellion. Shays’ Rebellion suffered a setback when debt-ridden farmers led by Capt. Daniel Shays failed to capture an arsenal at Springfield, Mass.

1821 – The Hudson River was frozen solid during the midst of the coldest winter in forty-one years. Thousands of persons crossed the ice from New York City to New Jersey, and refreshment taverns were set up in the middle of the river to warm pedestrians.

1825 – The first engineering college in the US opened, Rensselaer Polytechnic Institute, Troy, NY.

1825 – CSA Gen. George Pickett (d. 1875) was born in Richmond, VA. He is best remembered for his participation in the futile and bloody assault at Gettysburg that bears his name, Pickett’s Charge. Pickett's division arrived at the battle after guarding the Confederate lines of communication through Chambersburg, PA. Lee’s Army of Northern Virginia, which had initially driven the Union Army of the Potomac to the high ground south of Gettysburg, had been unable to dislodge the Union soldiers from their position. Lee's plan for July 3 called for a massive assault on the center of the Union lines on Cemetery Ridge, calculating that attacks on either flank the previous two days had drawn troops from the center. He directed General Longstreet to assemble a force of three divisions for the attack—two exhausted divisions and Pickett's fresh division from Longstreet's own corps. The three divisions stepped off across open fields almost a mile from Cemetery Ridge. Pickett's division was on the right flank of the assault. It received punishing artillery fire, and then volleys of massed musket fire as it approached its objective. Pickett's Charge was a bloodbath. While the Union lost about 1,500 killed and wounded, the Confederate casualties were several times that. Over 50% of the men sent across the fields were killed or wounded. Pickett's three brigade commanders and all thirteen of his regimental commanders were casualties.

1831 – Birthday of Jane Goodwin Austin (d. 1894), Worcester, MA. Novelist, essayist, and short story writer. Most of her novels were authentically accurate depictions of the Pilgrims which she carefully researched.

1837 – At 7 PM, a display of the Northern Lights danced above Burlington, VT. Its light was equal to the full moon. Snow and other objects reflecting the light were deeply tinged with a blood red hue. Blue, yellow and white streamers were also noted.

1840 – US naval expedition under Charles Wilkes became the first to identify Antarctica as a new continent. European maps showed a hypothesized land at the bottom of the Southern hemisphere until Captain James cook’s ships, crossed the Antarctic Circle on 17 January 1773, in December 1773 and again in January 1774. Cook came within about 75 miles of the Antarctic coast before retreating in the face of field ice in January 1773. The first confirmed sighting of Antarctica can be narrowed down to the crews of ships captained by three individuals: von Bellingshausen (a captain in the Imperial Russian Navy, Edward Bransfield, a captain in the Royal Navy, and Nathaniel Palmer of Stonington, CT. The first documented landing on Antarctica was by the American sealer John Davis on 7 February 1821, although some historians dispute this claim. The first recorded and confirmed landing was at Cape Adair in 1895. In December 1839, as part of the US Exploring Expedition of 1838–42 conducted by the US Navy (sometimes called the "Ex. Ex.", or "the Wilkes Expedition"), the expedition reported the discovery "of an Antarctic continent west of the Balleny Islands" on 25 January 1840. That part of Antarctica was later named "Wilkes Land", a name it retains to this day.

1856 – Marines and seamen from the U.S. sloop DECATUR went ashore at the village of Seattle, Washington, to protect settlers from Indian raids. The Indians launched a seven-hour attack but were driven off later that day after suffering severe losses. Incredibly, only two civilian volunteers were killed and no Marines or sailors were lost.

1871 – Unveiled in the U.S. Capitol Rotunda, Vinnie Ream’s statue of Abraham Lincoln that was authorized by Congress.

1871 – Birthday of Maud Wood Park (d. 1955), Boston. Directed congressional lobbying and was one of the key women implementing Carrie Chapman Catt’s winning strategy to get women’s suffrage passed. Instrumental in getting congressional approval for many child labor, maternity, and child health reforms as well as the Cable Act of 1922 which granted married women US citizenship independent of their husband’s status. Before the Cable Act, an American-born woman AUTOMATICALLY lost her citizenship when she married a non-American citizen.

1879 – The Arrears of Pensions Act is passed by Congress. It authorizes back-payment of military pensions beginning from the day of discharge. If the veteran is dead, payments will be made to the family.

1890 – Nellie Bly circled the world in 72 days, stepping into history. Newspaper reported Nellie Bly, the pen name used by Elizabeth Cochrane Seaman, set off from Hoboken, NJ on Nov. 14, 1889, to attempt to break Jules Verne's imaginary hero Phileas Foggs’ record of voyaging around the world in 80 days. She did beat Fogg's record, taking 72 days, 6 hours, 11 minutes and 14 seconds to make the trip, arriving back in New Jersey on January 25, 1890.

http://memory.loc.gov/cgi-in/query/D?amtoday:1:./temp/~ammem_Kaeh ::

1896 - Birthday of the leading black American singer and dancer of the Jazz Age, and the Harlem Renaissance, Florence Winfree (d. 1927), Washington, DC. She appeared in Langston Hughes's “Shuffle Along”in 1921 and “Plantation Review”on Broadway in 1922, then at the London Pavilion in “Dover Street to Dixie”in 1923. Offered a spot in the “Ziegfeld Follies,” she turned it down and joined in creating a rival show with an all-black cast. Winfree was the first black woman to appear as a headliner at the Palace Theatre. She was so revered for her efforts to create opportunities for black entertainers and to bring the unique culture of blacks to Broadway that more than 150,000 people filled the streets of Harlem to mourn her when she died at New York City, Nov 1, 1927, at age 31.

1900 - Birthday of tenor sax player Captain John Handy (d. 1971), Pass Christian, MS.

1903 - (Sleepy) John Estes (d. 1977), an important early bluesman, was born in Ripley, Tennessee. He played on the streets of Memphis in the 1920's, supporting himself by working the night shift at a train yard. His tendency to doze off on the job earned him his nickname. He returned to Brownsville, Tennessee, in the 1940's, where he remained in obscurity for more than 15 years. Estes was rediscovered by a documentary filmmaker. He signed a recording contract and appeared at folk festivals in the US and Europe. One of Estes's LPs included a guest spot by guitarist Mike Bloomfield, and Estes later appeared on an LP by Ray Cooder. The rock group Joy of Cooking had a minor hit in 1971 with a song written by Estes, "Going to Brownsville."

1915 - Alexander Bell in New York calls Thomas Watson in San Francisco, inaugurating transcontinental telephone service.

1918 – Broadcaster Ernie Harwell, (d. 2010) was born in Washington, GA. For 55 seasons, 42 of them with the Detroit Tigers, Harwell called the action on radio and/or TV. In January 2009, the American Sportscasters Association ranked Harwell 16th on its list of Top 50 Sportscasters of All Time.

1919 - The League of Nations, forerunner of the United Nations, was founded.

1924 - The first Winter Olympic, opened in Chamonix, France, with athletes representing 16 nations. The ski jump, previously unknown, thrilled spectators. The Olympics offered a boost to skiing, which would make enormous strides in the next decade.

1937 - Trumpeter Buck Clayton cuts his first record, accompanying Billie Holiday, on “Why Was I Born?”

1937 – “The Guiding Light” debuted on NBC radio from Chicago. In 1952, it moved to CBS television, where it remained until September 18, 2009.

1938 - Etta James (d. 2013) was born Jamesetta Hawkins in Los Angeles. James is regarded as having bridged the gap between rhythm and blues and rock and roll, and was the winner of six Grammys and 17 Blues Music Awards. In early 1961, James released what was to become her signature song, "At Last", which reached number two on the R&B chart and number 47 on the Billboard Hot 100. Though the song was not as successful as expected, it has become the most remembered version of the song. She was inducted into the Rock and Roll Hall of Fame in 1993, the Blues Hall of Fame in 2001, and the Grammy Hall of Fame in both 1999 and 2008. “Rolling Stone” ranked James number 22 on their list of the 100 Greatest Singers of All Time and number 62 on the list of the 100 Greatest Artists.

http://www.forgetmenotantiques.com/CD/jamesback.htm

http://www.delafont.com/music_acts/Etta-James.htm

1940 - The biggest snowstorm on record for Richmond, Virginia came to an end. 21.6 inches of snow fell over a 3 day period.

1940 - Mary Martin, "My Heart Belongs to Daddy"

1941 – Pope Pius XII elevates the Apostolic Vicariate of the Hawaiian Islands to the Roman Catholic Diocese of Honolulu.

1944 - The character of Beulah, a black maid who was played by a white man, Marlin Hunt, first aired on radio's "Fibber McGee and Molly". In 1945, the spin-off, "Beulah", became a radio series.

1945 - In New York, Richard Tucker debuted at the Metropolitan Opera House in "La Gioconda". As a note of trivia, I went to the summer camp with his son in New Hampshire, who we became fast friends during this time period.

1945 - The first water supply to be fluoridated in order to reduce tooth decay was the water system of Grand Rapids, MI. Fluoridation started with the addition of one part of fluoride ion to each million parts of water passing through the water treatment plant.

1945 - Top Hits

“Don't Fence Me In” - Bing Crosby & The Andrews Sisters

“There Goes that Song Again” - Russ Morgan

“I'm Making Believe” - Ella Fitzgerald & The Ink Spots

“I'm Wastin' My Tears on You” - Tex Ritter

1945 - VALDEZ, JOSE F., Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company B, 7th Infantry, 3d Infantry Division. Place and date: Near Rosenkrantz, France, 25 January 1945. Entered service at: Pleasant Grove, Utah. Birth: Governador, N. Mex. G. O. No.: 16, 8 February 1946. Citation: He was on outpost duty with 5 others when the enemy counterattacked with overwhelming strength. From his position near some woods 500 yards beyond the American lines he observed a hostile tank about 75 yards away, and raked it with automatic rifle fire until it withdrew. Soon afterward he saw 3 Germans stealthily approaching through the woods. Scorning cover as the enemy soldiers opened up with heavy automatic weapons fire from a range of 30 yards, he engaged in a fire fight with the attackers until he had killed all 3. The enemy quickly launched an attack with 2 full companies of infantrymen, blasting the patrol with murderous concentrations of automatic and rifle fire and beginning an encircling movement which forced the patrol leader to order a withdrawal. Despite the terrible odds, Pfc. Valdez immediately volunteered to cover the maneuver, and as the patrol 1 by 1 plunged through a hail of bullets toward the American lines, he fired burst after burst into the swarming enemy. Three of his companions were wounded in their dash for safety and he was struck by a bullet that entered his stomach and, passing through his body, emerged from his back. Overcoming agonizing pain, he regained control of himself and resumed his firing position, delivering a protective screen of bullets until all others of the patrol were safe. By field telephone he called for artillery and mortar fire on the Germans and corrected the range until he had shells falling within 50 yards of his position. For 15 minutes he refused to be dislodged by more than 200 of the enemy; then, seeing that the barrage had broken the counter attack, he dragged himself back to his own lines. He died later as a result of his wounds. Through his valiant, intrepid stand and at the cost of his own life, Pfc. Valdez made it possible for his comrades to escape, and was directly responsible for repulsing an attack by vastly superior enemy forces.

1945 – Larry MacPhail, Dan Topping and Del Webb purchased the New York Yankees for $2.8 million from the heirs of previous owner Jacob Ruppert. The new owners announced that Ed Barrow will remain in place as general manager, but a month later they installed MacPhail as GM. Under this ownership team, until 1964, the Yankees would achieve their greatest success: 16 World Series appearances with 12 championships.

1946 – The United Mine Workers rejoined the American Federation of Labor.

1947 – Thomas Goldsmith, Jr. filed a patent for a "Cathode Ray Tube Amusement Device", the first ever electronic game. A television pioneer, after graduating from Cornell, became director of research for DuMont Laboratories in NJ, and (after 1953) vice president. He chaired the Synchronization Panel of the National Television System Committee and the Radio Manufacturers Association Committee on Cathode-Ray Tubes. He also became the chief engineer for the DuMont Television Network.

1947 – Al Capone (b. 1899) died in Florida at age 48. After a seven-year reign of terror as the head of Chicago’s organized crime gangs, he was finally convicted of income tax evasion and sentenced to prison from which he was paroled in 1939. By then, the deterioration from syphilis and gonorrhea deepened. He spent his final years in his Palm Island, FL mansion with what doctors described as the mind of a 12-year old.

1949 – At the Hollywood Athletic Club, the first Emmy awards were presented.

1950 - Birthday of Gloria Naylor, author of “The Women of Brewster Place” (1982) and “Bailey's Café” (1992).

1950 - Highest January temperature ever recorded in Cleveland, Ohio:

73ºF (23ºC).

1951 - Steve Roland “Pre” Prefontaine (d. 1975), long distance runner, born at Coos Bay, OR. Prefontaine was an outstanding athlete whose grit, determination, and activism personified Americans' growing interest in physical fitness, jogging, and running. Although never an Olympic Champion or world record holder, he set 14 US records during his career cut short by a fatal automobile accident on a road where he often trained.

1953 - Top Hits

“Why Don't You Believe Me” - Joni James

“Don't Let the Stars Get in Your Eyes” - Perry Como

“Keep It a Secret” - Jo Stafford

“I'll Go On Alone” - Marty Robbins

1953 - The Cincinnati Mohawks and the Troy (OH) Bruins played the only doubleheader in the history of the International Hockey League, with one game being played in each team's home city. The Bruins won the first game in Troy, 3-0. The Mohawks won the nightcap in Cincinnati, 2-1.

1958 - Elvis Presley's "Jailhouse Rock" becomes the first single ever to enter the U.K. pop chart at Number One

1959 - American Airlines opened the jet age in the US with the first scheduled transcontinental flight on a Boeing 707 nonstop from California to New York.

1960 - Sam Cooke, "Chain Gang"

1960 - The National Association of Broadcasters reacted to the "payola" scandal by threatening fines for any disc jockeys who accept money for playing particular records.

1961 - Beginning a tradition that survives to this day, John F. Kennedy held the first televised presidential news conference five days after being inaugurated as the 35th president.

1961 - President John F. Kennedy appointed the first female presidential physician, Dr. Janet Graeme Travell of New York City. Several previous Presidents had received treatment from a female medical practitioner. The one of most note was Dr. Susan Ann Edison, who graduated from the Cleveland Homeopathic Medical College and who treated President James Garfield from July 2, 1881, the day he was shot by an assassin, to September 19, 1881, when he died.

1961 - The Disney animated cartoon classic, “101 Dalmatians”, was released to theaters. It took an animation staff of three hundred to complete the film in three years, at a cost of $4 million. It was a huge success at the box office.

1961 - Top Hits

“Wonderland by Night” - Bert Kaempfert

“Exodus” - Ferrante & Teicher

“Calcutta” - Lawrence Welk

“North to Alaska” - Johnny Horton

1962 - Sam Cooke's "Twistin' the Night Away," later done by Rod Stewart, is released on RCA Records. It will make it up to #9 on the pop chart.

1964 - The Beatles reached #1 on the music charts for the first time, with their single, "I Want to Hold Your Hand" which took the top position not only in "Cash Box" magazine, but also on the hit lists of radio stations. "Billboard" magazine listed the song at #1 on February 1. The group's second #1 hit, "She Loves You" was released on Swan Records, and not Capitol. Other Beatles songs were released on Vee Jay ("Please, Please Me"), M-G-M ("My Bonnie" with Tony Sheridan), Tollie ("Twist and Shout"), Atco ("Ain't She Sweet") and the group's own label, Apple Records, as well as Capitol.

1965 - Alta, UT, was in the midst of a storm that left the town buried under 105 inches of snow establishing a record for the state.

1969 - Top Hits

I Heard It Through the Grapevine - Marvin Gaye

Crimson and Clover - Tommy James & The Shondells

Everyday People - Sly & The Family Stone

Daddy Sang Bass - Johnny Cash

1969 - The Beatles release "Two Of Us," "For You Blue," "Let It Be"

1969 - Creedence Clearwater Revival's "Proud Mary" enters the pop charts

1971 - Charles Manson was found guilty of masterminding the killings of actress Sharon Tate and six others. He and three female members of his "family" were found guilty of one count of conspiracy to commit murder and seven counts of murder in the first degree and are sentenced to life imprisonment. During one of the most sensational trials in history, it was revealed that Manson regarded the Beatles as angels who communicated to him through their music. In particular, "Helter Skelter," "Piggies," "Revolution 9" and other songs on the "The White Album. He remains in jail today, although he asks for parole each year.

1975 - The Cars win the Rolling Stone magazine annual readers' poll as the best new band of the year.

1975 - The Carpenters' "Please Mr. Postman" hits #1

1977 - Top Hits

“I Wish” - Stevie Wonder

“Car Wash” - Rose Royce

“Dazz” - Brick

“I Can't Believe She Give It All to Me” - Conway Twitty

1981 - Super Bowl XV: Oakland Raiders beat Philadelphia Eagles, 27-10 in New Orleans; Super Bowl MVP: Jim Plunkett, Oakland QB. Plunkett won another Super Bowl with the Raiders in 1983 and he is the only two-time Super Bowl-winning QB NOT in the Pro Football Hall of Fame.

1981 – Singer Alicia Keys was born in Hell’s Kitchen, NYC.

1984 - Apple's Macintosh computer went on sale this day for $2,495. It wasn't until mid-1985, however, that sales began to take off and this computer began to replace the Apple II model.

1985 - Top Hits

“Like a Virgin” - Madonna

“All I Need” - Jack Wagner

“You're the Inspiration” - Chicago

“How Blue” - Reba McEntire

1986 - Dionne Warwick's single "That's What Friends Are For" topped the R-P-M magazine singles chart in Canada. Profits from the sale of the disc were donated to AIDS research.

1986 - Bruce Springsteen's "My Hometown" peaks at #6 on the chart.

1987 - The New York Giants defeated the Denver Broncos, 39-20, to win Super Bowl XXI. The victory gave New York its first NFL title in 30 years. Giants quarterback Phil Simms completed 22 of 25 passes for 268 yards and three touchdowns to win the game's Most Valuable Player Award. Neil Diamond performs the US national anthem.

1987 - The second major storm in three days hit the Eastern Seaboard producing up to 15 inches of snow in Virginia, Maryland and Delaware. Up to 30 inches of snow covered the ground in Virginia following the two storms

1988 - Guard Rickey Green of the Utah Jazz scored the 5,000,000 point in NBA history to a game against the Cleveland Cavaliers. Green made a three-point shot at the buzzer ending the third quarter. The Jazz won, 119-96.

1988 - Vice President George H.W. Bush and Dan Rather clashed on "The CBS Evening News" as the anchorman attempted to question the Republican presidential candidate about his role in the Iran-Contra affair.

1990 - Low pressure developed explosively over east central Missouri and moved into Lower Michigan producing high winds and heavy snow across parts of Iowa, Illinois and Wisconsin. Wind gusts to 60 mph and up to a foot of snow created near blizzard conditions in southeastern Wisconsin and northern Illinois. Wind gusts in Indiana reached 76 mph at Wabash. Thunderstorms associated with the storm produced wind gusts to 54 mph at Fort Madison, IA.

1993 - A gunman shot and killed two CIA employees outside agency headquarters in Virginia. A Pakistani national was later convicted and was executed in 2002.

1995 - Top Hits

“Creep” - TLC

“On Bended Knee” - Boyz II Men

“Another Night” - Real McCoy

“Always” - Bon Jovi

1998 - Denver beats Green Bay 31-24 in Super Bowl XXXII at San Diego behind Terrell Davis' 157 yards rushing and a Super Bowl-record three touchdowns. A record worldwide audience of 800 million in 147 countries views the game on television.

1999 - The Rolling Stones open their “No Security Tour” in Oakland, CA. It is the band's first arena tour in more than two decades. Sue and I were there, four rows from the stage, center right, in the aisle as the usher could not find my site as noted on my ticket. The band was never better, full of energy, spirit, and showmanship. Afterwards, on BART going back to our car, I noted that the tickets I had shown to the usher to find our seats were from the Barry Manilow Show the previous week where we had up-front seats. They were the same color tickets and same style printing. In the dark, the usher using a small flashlight, neither of us had noticed they were not the Rolling Stone tickets (that I had placed in my other pocket after the last ticket check and drawn the Manilow tickets out in error, basically only showing the seating numbers.)

2015 – Rob Manfred assumed the title of Commissioner of MLB from the retired Bud Selig.

Super Bowl Champions:

1981 - Oakland Raiders

1987 - New York Giants

1998 - Denver Broncos

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()

Dallas/Fort Worth or Will Work Remotely

Dallas/Fort Worth or Will Work Remotely