Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

![]()

NATIONWIDE SALES POSITIONS AVAILABLE |

Monday, June 13, 20 11

Today's Equipment Leasing Headlines

Ralph Petta, ELFA, Says Menkin doesn't speak the truth

by Christopher "Kit" Menkin

Classified Ads---Credit

Bank Beat---The Good, the Bad, and the Ugly

EverBank, Main Street Bank, First Sound Bank

Classified Ads---Help Wanted

Leasing 102 by Mr. Terry Winders, CLP

"Banks Want to Regulate Size of Broker Fees"

Leasing Companies No Longer Looking for Brokers

or Out of Business

Top Stories June 6---June 10

Super 8/The Trip (A British "Sideways)

Fernando Croce Movie/DVD Reviews

Another Year/True Grit/Hall Pass

LA Attorney to pay $41 Million plus 32 Months in Jail

Kingwood, Texas Adopt-a-Dog

News Briefs---

Best Bank Account Interest Rates

- Summary for Week Ending June 11, 2011

Groupon's 1500% growth makes even Google look lame

Marie Callender's closes suddenly in Santa Rosa

‘Book of Mormon’ and ‘War Horse’ Win Top Tonys

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

For the Executive with Everything, a $230,000 Dog

You May have Missed---

Sports Briefs

California Nuts

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Ralph Petta, ELFA, Says Menkin doesn't speak the truth

by Christopher "Kit" Menkin

"FASB Changes: Out of the Footnotes, Into the Spotlight"

http://online.barrons.com/article/SB50001424053111904210704576357671425081138.html

What follows originally appeared in the Equipment Leasing and Finance Association on-line LinkedIn Group. Since my reply was not posted, it will appear here as I would like to respond publicly.

First, I have the highest respect for Ralph Petta. He was named the 2009 Leasing News Person of the Year for his work, an award of respect and acknowledgment as nominated by the Leasing News Advisory Board.

LinkedIn ELFA Group Posting to Barrons' article:

"Ralph Petta • The statement in the article that indicates that many small business support the proposed changes in the lease accounting rules is simply not true. If the many comment letters and other inputs to the FASB and IASB were not enough, none less than the US Small Business Administration has expressed serious concerns about the impact of the proposed rules on the ability of small businesses to comply with burdensome and complex accounting rules. I urge readers to review these comments, which are filed on the FASB web site, and learn for themselves the accounting and reporting challenges to be heaped upon lessees of all stripes as they struggle to absorb and comply with the changes being contemplated by the standards-setters. Standards, rules and laws need to foster equipment acquisition in the United States, not impair it."

A copy of my exact response was not kept, but here is what I remember my post stating:

It is no secret that ELFA through press releases, meetings, and direct telephone calls has been calling on its members, other associations, and major corporations to oppose the changes as brought forward by both the American Financial Accounting Standards Board and the International Accounting Standards Board.

The campaign for letter writing has been quite public from ELFA and other business associations, including the lobbyists working all angles. Also those professionals paid by corporations for their corporate benefits on blogs and speaking engagements, particularly in behalf of ELFA members such as GE, Bank of America have also been vocal in opposition of the proposed changes.

Leasing News has written about this and published many articles from all sides of the issue. The comment letters are quite one sided, in my opinion, and represent the very large corporations who want to hide their debt and transactions for financial advantage. The AFASB and the IASB have proposed changes to bring these debts out into the open.

It bears mentioning that the Barron's article was not written by Leasing News nor proposed by us. The fact remains I believe the overwhelming majority of our readers, as well as those on various LinkedIn groups, are for transparency, are for change, as it is certain Wall Street and Greed have gotten us into this economic downfall. Changes must be made to bring all debt to the surface for creditors, investors, and business in general to see a true financial "condition."

As to the US Small Business Administration position that Ralph notes in his post, here is their specific position from their web site:

"In particular, Advocacy recommends that FASB and IASB create a de minimis exception to the proposed standard that would exempt lease transactions of less than $250,000 from the proposed standard. The Equipment Leasing and Finance Association (ELFA) recognizes that lease transactions of less than $250,000 are considered “small ticket” leases relative to costlier and more significant lease transactions. (5) Exempting lease transactions of less than $250,000 from the proposed standard would exclude small businesses with “small ticket” leases from administering the costly and complicated proposed standard but would still accomplish the boards’ objective by only requiring those significant, non-small ticket lease transactions of $250,000 or more to comply with the new standard."

They recommend small ticket leasing under $250,000 be exempt from the change. Doesn't sound to me like they are very much against changes over $250,000.

In my opinion, the Small Business Administration position of excluding leases under $250,000 makes this even more confusing, especially when the company reaches $251,000 in leases they all go on the balance sheet. Doesn’t sound like it is making it easier, but more complicated.

It is also naïve, in my opinion, to believe in this day and age of software that the reason to oppose the change is due to the “burden of accounting.” Even Quicken can handle the general ledger work, not counting all the other professional, sophisticated software, including leasing software, available for companies of all sizes.

In reality, most (I believe last year was 91%) small ticket leases were "capital leases" with bargain purchase options or $1.00, according to the Equipment Leasing and Finance Foundation. If this is the case, what is this all about? Let’s look at the example by the writer of the Barrons’ article:

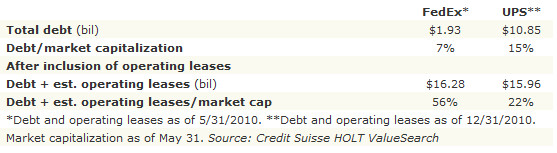

“Under current accounting rules, FedEx has far less debt than rival UPS. If a change in FASB rules requires the companies to add leases to their balance sheets, reported debt at FedEx will balloon.

“To understand the impact of the possible rule change, consider the balance sheets of FedEx and United Parcel Service (UPS). FedEx finished its latest reported fiscal year (ended May 31, 2010) with $1.93 billion of debt, equal to 7% of its market capitalization. UPS, whose fiscal year ended in December, had $10.8 billion of debt, equal to 15% of its market cap, according to HOLT.

“If both companies were forced to add operating leases to their balance sheets, however, total debt at FedEx would jump to $16.3 billion, or 56% of the company's market value. Debt at UPS would edge up to $16 billion, or 22% of its market cap.

"’Although they are regarded as close operating peers, the difference between leasing and owning assets results in significant comparability issues if not properly adjusted,’ states a HOLT report.”

If you would like to read the entire report, you may use the URL link at the beginning of the story, or PDF that follows:

http://www.leasingnews.org/PDF/FASB_ChangeBarrons.pdf

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Proven results Credit Manager-Strong vendor/broker/funding Learned from BEST - Schiell & Galtelli, Centerpoint, Affiliated, Heritage Pacific. ulrich_elizabeth@yahoo.com http://www.linkedin.com/pub/elizabeth-ulrich/8/a26/240 |

Seasoned Ops, Broker Development, Credit, Legal, Strategy, P & L Management detail oriented team player seeks position with Small ticket direct lender. Wgriffith61@yahoo.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Why Choose Advanced Property Tax Compliance? |

|

Dedicated to the leasing industry |

[headlines]

--------------------------------------------------------------

Bank Beat---The Good, the Bad, and the Ugly

EverBank, Main Street Bank, First Sound Bank

by Christopher Menkin

![]()

EverBank, Jacksonville, Florida has grown to 22 branches in their state, as of March 31, 2011, with 2,342 full time employees. Total equity capital $1.127 trillion current to $1.117 trillion year-end 2010.

February, 2010 EverBank purchased Tygris Commercial Finance (formerly USXL who later bought MarCap) in an all-stock transaction. As part of the transaction, Tygris, which is owned by a consortium of private-equity firms, would inject $65 million of cash into its buyer before closing. Taking over Tygris would also add $470 million to EverBank’s capital base. This covered the NetBank trial and declining Florida real estate and gave the bank a shot in the arm, as well as a new product to increase sales and serve their customer base.

Profit year-end: 2009 $59.2 million; 2010 $122.6 million, and March 31, 2011: $14.2 million.

Tier risk-based capital 2009: 14.53%; 2010: 15.78%; March 31, 2011: 16.01%

Non-current loans: 2009, $786.1 million; 2010, $964.7 million; March 31, 2011: $888.1 million.

Year-end 2009 Charge Offs: $77.1 million ($40.3 million in construction and land development, $15.5 million in non-farm non-residential property, $13.2 million in 1-4 family residential properties, $469,000 commercial and industrial loans.

Year-end 2010 Charge Offs: $65.4 million in charge offs ($27.2 million 1-4 family residential property, $16.2 million secured by non-farm nonresidential property, $11.2 million construction and land development, $5.99 commercial and industrial loans (no lease financing receivable noted).

March 31, 2011 charge offs: $16 million, $6.9 million in 1-4 family residential property, $4 million in commercial and land development, $516,000 in loans secured by nonfarm nonresidential property.

Home of Tom Depping, formerly head of Sierra Cities-Financial (sold to American Express, then sold to Key Equipment Finance) and Main Street Bank once very active in equipment leases and medical loans, after an order from the FDIC to make changes, lets go most of the leasing department including head Bob Fisher, but keeps a limited Studebaker-Worthington group… things have settled down, including down to 77 full time employees from 2009 where there were 120 full time employees.

Bank total equity capital is up from $43.5 million year-end 2010 to $47.5 million March 31, 2011.

Profit was $1.5 million year-end 2010 and the first quarter $620,000, definitely headed in the right direction, also with a current Tier 1 risk-based capital ratio of $23.5% (under 5% is to be watched, 10% considered very good, and over 20% is just plain excellent (and may also reflect a more conservative position.)

On the negative side, the noncurrent loans were almost $2 million year-end 2010, but the first quarter stand at $4.9 million, more than double for the first quarter; charge offs are also up from year-end $445,000 ($320,000 in commercial and industrial loans and $125,000 in lease financing receivables) to a first quarter charge offs of $674,000 ($345,000 in commercial and industrial loan) and $325,000 in lease financing receivables.)

Except for the rise in noncurrent loans, nothing to be overly concerned about, especially with the capital available and seeming more conservative control; remember 2009 saw $2.7 million in lease financing charge offs and $4.2 million in commercial and industrial loans.

While one of the FDIC orders was for Depping to step aside as CEO and President of the bank, which he has, the web site does not show the position being filled, although Tom Depping is Chairman of the Bank and Chairman and Chief Executive Officer of MS Financial

https://www.msbanktx.com/Pages/Public/Management.aspx

First Sound Bank, Seattle, Washington

Parent of Puget Sound Leasing, Bellevue, Washington, originally owned by Larasco controlled by the Secord brothers, who were sued and then filed bankruptcy, which ended the original complaint by the bank as to the value of the leasing company they had purchased.

Federal Deposit Insurance Corporation Reports

| Number of Employees | |

| Year-end 2008 | 83 |

| Year-end 2009 | 61 |

| Year-end 2010 | 31 |

| 3/31/2011 | 31 |

| Bank Equity | |

| Year-end 2008 | $24.8 million |

| Year-end 2009 | $5.8 million |

| Year-end 2010 | $4.5 million |

| 3/31/2011 | $6.0 million |

| Tier 1 Risk Capital Ratio | |

| Year-end 2008 | 10.02% |

| Year-end 2009 | 3.02% |

| Year-end 2010 | 3.61% |

| 3/31/2011 | 5.05% |

| Net Profit | |

| Year-end 2008 | - $20 million |

| Year-end 2009 | - $18.9 million |

| Year-end 2010 | - $7.9 million |

| 3/31/2011 | - $2.5 million |

| Non-Conforming Loans | |

| Year-end 2008 | $9.2 million |

| Year-end 2009 | $44.5 million |

| Year-end 2010 | $14.3 million |

| 3/31/2011 | $15.4 million |

Charge Offs

Year-end 2008: $1.7 million: $300,000 commercial and industrial loans, $1.1 lease finance receivables.

Year-end 2009: $10.3 million: $4.37 million commercial and industrial loans, $5.3 million lease finance receivables, $504,000 construction and land development.

Year-end 2010: 2010 $12.4 million: $3.9 million commercial and industrial loans, $3.6 million construction and land development, $2.7 million in lease financing receivables, $2.1 million nonfarm nonresidential properties 3/31/2011 $2.9 million: $1.6 million nonfarm nonresidential properties, $518,000 commercial and industrial loans, $350,000 construction and land development, $239,000 loans to individuals, $227,000 lease financing receivables.

March 31, 2011: $2.95 million: $1.6 million loans secured by nonfarm nonresidential property, $518,000 commercial and industrial loans, $350,000 construction and land development, $239,000 loans to individuals, $239,000 "other consumer loans," $227,000 lease financing receivables.

On March 1, 2008, First Sound Bank purchased a majority of the assets of Puget Sound Leasing Company, Inc. - a small ticket, business-to-business leasing company with a prior 23-year history - and established Puget Sound Leasing as a division of First Sound Bank.

On November 19, 2008, however, First Sound Bank relieved Louis Secord and Richard Secord of all responsibilities relating to the leasing business, and First Sound Bank President Steve Shaughnessy assumed management of Puget Sound Leasing operations.

January 14, 2009 First Sound filed suit in federal court for fraud and breach of contract in connection with its "...March 1, 2008 purchase of certain assets from Puget Sound Leasing Co., Inc. The defendants to the suit are the sellers of the assets: Larasco, Inc. (the business formerly known as Puget Sound Leasing Co., Inc.) and its owners, Richard Secord and Louis Secord."

May, 2009: "Our situation is different from other banks," Don Hirtzel, chairman and CEO, said in a press release. "Our increased losses and reserves are primarily the result of alleged misrepresentations made by the owners of Puget Sound Leasing in how they portrayed their assets to us."

Of the 2009 charge offs, $5.2 million were lease receivables, but it did not add up to the $44.5 million year loss as the reality is real estate loans as the rest of the banks in the area were taking its toll and created many bank failures in Washington. July, 10 First Sound Bank raised $3.2 million in capital. The break out of the profit from the leases and their residuals were not disclosed in any of the FDIC financial statistics.

The court case with Larasco, the other banks who had signed with Larasco, as well as the Secords was closely and the outcome came when Louis and Richard Secord filed Chapter 11 bankruptcy on May 29, 2010. This became a consolidation of both brothers and Larasco, Inc, too, with monthly financial reports being filed electronically until May 19, 2011: "Request for No Future Electronic Notice. Attorney no longer requires notice of action in this case. Filed by Amy Phillips on behalf of First Sound Bank. (Phillips, Amy) (Entered: 05/19/2011 at 15:57:36)"

There is much more to the story, which can found below:

First Sound Bank and Puget Sound Leasing

http://www.leasingnews.org/Conscious-Top%20Stories/puget.htm

Financial Numbers from the Federal Deposit Insurance Corporation

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

|

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Banks Want to Regulate Size of Broker Fees

(Kit: The reason that I wrote this article is the criticism some of the banks have had from the regulators on lease charge-offs that contained large broker fees.

(It was the banks that asked me to write an article putting the brokers on notice that large fees are going to be looked at differently in the future.TW)

The recent economy caused some lease charge-offs that were higher than normal because of higher than normal front end broker fees. The regulatory authorities are looking for the banks to place a procedure in their lease policy to regulate the size of broker fees.

Transactions in the small ticket market are the most flexible because they do not represent that much money; however as you move up into the middle market rates will begin to get scrutinized.

In the middle market, the so called “buy rate” does not give you the license to add on a lot of rate, to increase your fee. There is a limit or comfort zone for funders that usually means they will only go so far without support from you like recoursing your fee if they suffer a loss.

A good yardstick is to take the funders cost of money and add two points to cover operating costs and then subtract it from the buy rate to determine the neighborhood of their earnings. If your fee exceeds this amount, then you need to make some compromises or look for ways to support the funder’s risk.

The broker/packager has marking cost to offset but please remember the funder has to live with the lessee for the full lease term and suffer the losses. One loss offsets more than five good deals. If your transactions are squeaky, clean and little or no collection work is necessary, then a larger fee is possible, however, the funding sources know that the better the credit--- the tighter the rate so higher fees are suspect. Therefore the higher your fees, the closer the funder will look at the credit and often asked for more financial information.

Fees are a direct result of the term. If you want higher fees look for equipment that has longer lease terms. An example of the effect on fees from lease terms would be a transaction for $50,000 over 38, 50, or 62 months with a buy rate of 10% and a lessee rate of 14%. The fee earned would be $2,939, $7,008, or $12,389.82 respectfully. This is due to the increase in earnings as the term gets longer.

In the “old days” (I wish we could get them back) 84 months was common in many hard equipment markets. Now it seems difficult to get pass 62 months. You will notice I did not use 36, 48, 60 in the example because leasing is for the term of the equipments “use” not a loan term. Also a good excuse to lengthen any term is to take it to the end of the customer’s fiscal year.

If you decide to retain a few months payment to increase your fee then try and extend the term beyond the loan terms of 36, 48, or 60 so the funder sees the standard term for discounting. However, remember what I presented on the problems of sales tax on retained payments.

Recourse is a tough problem for broker/packagers and many funders are not interested in accepting it for excess fees because they question the strength of the recourse when the transaction hits the fan. A better procedure is each time when you are successful in negotiating a larger than normal fee put part of it in a reserve at the funding source to help the strength of your fee recourse. The longer it stays there and is not needed, the stronger your relationship with the funder will grow and you will get more accommodations as your portfolio with them is looked upon favorably.

In times like these we all are looking to increase our earnings any way we can, but it cannot be at the expense of our life blood, the funding source. Earn what is necessary but look to increase the number of transactions and the lease term, not the size of the fee to survive.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

NATIONWIDE SALES POSITIONS AVAILABLE |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing Companies Out of Business

plus No Longer taking Broker/Discounting Business

Companies with an * are no longer in business. The others are companies that were taking broker business, but announced that they no longer are accepting broker business. Many have also down-sized or are managing an existing portfolio.

More details are available in this list by company name:

http://www.leasingnews.org/list_alpha_new.htm

*ACC Capital, Midvale, Utah (lenders running off portfolio residuals)

Advantage Business Capital, Lake Oswego, Oregon

AEL Financial, Buffalo Grove, Illinois

(No longer taking new broker business)

Alliance Financial, Syracuse, New York

Balboa Capital, Irvine, Ca

Bankers Healthcare Group, Weston, FL.

*C and J Leasing Corp, Des Moines, Iowa

*Carlton Financial Corporation, Wayzata, Minnesota

*Chesterfield Financial, Chesterfield, Missouri

*Churchill Group/Churchill Leasing, Jericho, NY

CIT Group (limited)

Columbia Bank Leasing, Tacoma, WA

Commercial Equipment Lease, Eugene, Oregon

Concord Financial Services, Long Beach, California

Court Square, Malvern, Pennsylvania

*Creative Capital Leasing Group, LLC, San Diego, CA

Direct Capital, Portsmouth, New Hampshire

Diversified Financial Service, Omaha, NE

Dolsen Leasing, Bellevue/Yakima, Washington

Equipment Finance Partners, a division of Altec, Birmingham, Alabama

Evans National Leasing, Inc., Hamburg, NY

Enterprise Funding, Grand Rapids, Michigan

*Excel Financial Leasing, Lubbock Texas

*First Corp.(IFC subsidiary), Morton Grove, Illinois

First Federal Financial Services, Inc., Menomonee Falls, Wisconsin

First Republic Bank, San Francisco, CA

Frontier Capital, Teaneck New Jersey

*GCR Capital, Safety Harbor, Florida

GE Capital, Conn (limited)

Global Funding LLC., Clearwater, FL

*Greystone, Burlington, MA

*Heritage Pacific Leasing, Fresno, CA

Hillcrest Bank Leasing, Overland Park, KS (Parent bank sold)

Huntington Equipment Finance, Vendor Finance Group, Bellevue, Washington

*IFC Credit Corp., Morton Grove, Illinois

Irwin Financial (Irwin Union Bank), Columbus, Indiana

Irwin Union Bank, F.S.B. (Louisville, Kentucky)

Lakeland Bank, Montville, NJ

LaSalle Systems Leasing

*Latitude Equipment Leasing, Marlton, New Jersey

*Leaf Specialty Finance, Columbia, South Carolina

*LEAF Third Party Funding, Santa Barbara, Ca.

Lombard, part of Royal Bank of Scotland, worldwide

Marlin Business Services, Mount Laurel, NJ (accepting no new brokers, they may have opened for a select fee, but no more at this time, they say.)

M&T Credit (Bank)

*MericapCredit, Lisle, Illinois

Merrill Lynch Financial

Midwest Leasing Group, Livonia, Minnesota

National City, Cleveland, Ohio

*Navigator (Pentech subsidiary) San Diego, California

OFC Capital, Roswell, Georgia

Old National Bank, Evansville, Illinois

Pentech Financial, Campbell, CA

*PFF Bancorp, Inc, Pomona, CA

Pinnacle Business Finance, Fife, Washington

*Pioneer Capital Corporation, Addison, Texas

PredictiFund, a subsidiary of Capital Access Network, Inc

Popular Finance, St. Louis, Missouri

Radiance-Capital, Tacoma, WA

Rational Technology Solutions, Rolling Meadows, IL

*Reliant National Finance, Jacksonville, Florida

Sandy Springs, Olney, MD

Sovereign Bank, Melville, New York

Specialty Funding, Albuquerque, NM

Sun Trust Equipment Finance & Leasing, Baltimore, Maryland

*SunBridge Capital, Mission, Kansas

Suncoast Equipment Funding Corp., Tampa, Florida

TCF Equipment Finance, Minnetonka, Minnesota

TechLease, Morgan Hill, California

Textron Financial

*Triad Leasing & Financial, Inc., Boise, Idaho

*Union Capital Partners, Midvale, Utah

US Bank, Manifest Funding, Marshall, Minnesota

(new requirement: large yearly funding)

US Bank, Middle-Market, Portland, Oregon

Velocity Financial Group, Rosemont, Illinois

VenCore, Portland, Oregon (former company Len Ludwig)

*Vision Capital, San Diego, California

Wachovia Bank Leasing

*Washington Mutual Financial

Western Bank, Devils Lake, ND

*Westover Financial, Inc., Santa Ana, California

(Note: Should a company policy have changed, please contact kitmenkin@leasingnews.org)

Funders looking for new Brokers:

http://www.leasingnews.org/Funders_Only/New_Broker.htm

"Broker/Lessor" looking for broker business:

http://www.leasingnews.org/Brokers/brokerlessor_bussiness.html

NAELB Broker Exchange

http://www.leasingnews.org/Pages/broker_exchange.html

[headlines]

--------------------------------------------------------------

Top Stories June 6---June 10

Here are the top ten stories opened by readers:

(1) Galloway and Shivers to Influence

the Small Ticket Marketplace

http://leasingnews.org/archives/Jun2011/6_06.htm#galloway_shivers

(2) ACC Capital in Outer Space

http://leasingnews.org/archives/Jun2011/6_10.htm#acc_capital

(3) "Vendor Verification" hits Pay dirt on First Inspection

http://leasingnews.org/archives/Jun2011/6_08.htm#vendor_verification

(4) Leasing 102 by Mr. Terry Winders, CLP

“Interim Rent”

http://leasingnews.org/archives/Jun2011/6_06.htm#interim

(5) Balboa Capital: Court Bypasses Lessor's Forum Clause

as a Result of Forgery

http://leasingnews.org/archives/Jun2011/6_08.htm#balboa_capital

(6) Florida couple threatens Bank of America

branch with foreclosure

http://www.nydailynews.com/news/national/2011/06/05/2011-06-05_florida_couple_threatens_bank_of_america_branch_with_foreclosure_after_they_were.html

(7) New Hires--Promotions

http://leasingnews.org/archives/Jun2011/6_10.htm#hires

(8) $30 MM plus Law Suit re: CPA Firm,

E.A.R , Sheldon Player Et. Al.

http://leasingnews.org/archives/Jun2011/6_10.htm#lawsuit

(9) May---"The List"---- Mergers, Acquisitions & Changes

"The Good, the Bad and the Ugly"--

http://leasingnews.org/archives/Jun2011/6_08.htm#may11_list

(10) CoActiv Launches a New Office Products Group

http://www.marketwire.com/press-release/coactiv-launches-new-office-products-group-immediately-secures-position-strength-marketplace-1524615.htm

|

Fernando's View

By Fernando F. Croce

Full-throttled action (“Super 8”) and full-throated laughs (“The Trip”) dominate theaters this weekend, while two of the last year’s best films (“Another Year,” “True Grit”) and one of this year’s funniest (“Hall Pass”) debut on DVD.

In theaters:

Super 8 (Paramount Pictures): Producer Steven Spielberg’s fingerprints are all over this highly anticipated science-fiction thriller, which bears traces of such past smashes as “Close Encounters of the Third Kind” and “E.T—The Extraterrestrial.” Set in a small Ohio town in the summer of 1979, it centers on Joe (Joel Courtney) and Alice (Elle Fanning), movie-loving kids who, along with their friends, are suddenly thrust into an adventure of cosmic proportions after accidentally filming a disastrous train crash. The strange events that take place afterwards hint at larger and darker forces at play, especially when it is revealed that something top-secret got loose after the accident. J.J. Abrams, who last directed the “Star Trek” rebook, brings enough action, humor and wonderment to this sure-to-please story to make Spielberg proud.

The Trip (IFC Films): A remarkably prolific and versatile filmmaker, Michael Winterbottom follows last year’s dark drama "The Killer Inside Me" with this chummy, hilarious road-trip comedy, which reteams the excellent odd couple from his previous comedy "Tristram Shandy: A Cock and Bull Story." Playing themselves (or, rather, a jokey version of themselves), Steve Coogan and Rob Brydon go on a culinary holiday around England, trying out expensive dishes at fancy restaurants. But that's just an excuse for the two friends to hang out, match their Michael Caine impersonations, make fun of each other's careers, and contemplate the course of their lives. Seemingly slight on its surface but filled with moments of improvised, bittersweet insight, it's like a British version of "Sideways." Keep an eye out for some surprise cameos.

Netflix Tip: Like Steven Soderbergh (“Traffic”) and Richard Linklater (“Slacker”), “The Trip” director Michael Winterbottom is a cinematic chameleon who keeps surprising viewers with the range of his projects. Before settling down with his latest, check out Netflix to catch up with his varied previous projects, which range from hot-button dramas (“Welcome to Sarajevo”) and provocative science fiction (“Code 46”) to mind-bending comedies (“Tristan Shandy: A Cock and Bull Story”) and brutal noir thrillers (“The Killer Inside Me”). |

On DVD:

Another Year (Sony): A specialist in bittersweet human tragicomedies, British master Mike Leigh (“Secrets and Lies,” “Vera Leigh”) is in top form with this deeply affecting tale of grieving and generosity. Weaving a rigorous yet tender web of relationships, the picture centers on Tom (Jim Broadbent) and Gerri (Ruth Sheen), a London couple whose five decades of serenely happy marriage contrast with the emotional troubles of the friends who drop by their cottage over the course of several seasons. And chief among their dysfunctional guests is Mary (Lesley Manville), an alcoholic acquaintance whose miserable stories engages with the couple’s compassion. Brimming with splendidly lived-in performances and showcasing Leigh’s masterly blend of devastating feeling and humor, this piercing film sneaks up on the viewer.

True Grit (Warner Bros.): Best known for their mordant crime tales, Oscar-winning filmmakers Ethan and Joel Coen ("No Country for Old Men") play it affectingly straight in this stirring remake of the classic 1969 Western. Playing grizzled, drunken frontier marshal Rooster Cogburn (the role that won John Wayne his only Oscar), Jeff Bridges dons a deceptively bumbling eye-patch in his journey to help Mattie (Hailee Steinfeld, in a terrific breakout performance), a willful girl looking for revenge after the killing of her father. But will their mission lead to vengeance, or to something deeper and sadder? Wondrously shot and featuring a gallery of memorable performances, this is a sturdy old-fashioned Western, and one of the Coen brothers' finest, most loving achievements.

Hall Pass (Warner Bros.): Nobody mixes raunchiness and heart quite like Bobby and Peter Farrelly. Continuing to mine the unique vein they kicked off with “Dumb and Dumber” and “There’s Something About Mary,” the brothers introduce another hilarious protagonist in Rick (Owen Wilson), a happily married suburbanite who nevertheless can’t seem to keep his eyes off other women. That’s when his wife Maggie (Jenna Fischer) tests his faithfulness by giving him a “hall pass,” a week in which he’s free to do whatever he wants. Overjoyed at the thought of a second bachelorhood, however, Rick and his pal Fred (Jason Sudeikis) soon rediscover how hard it is to get girls, as well as how they feel about their wives. A sometimes warm, sometimes gross, wholly enjoyable comedy.

### Press Release ############################

LA Attorney to pay $41 Million plus 32 Months in Jail

MATTHEW G. KRANE, 56, of Los Angeles, California, was sentenced Friday by United States District Court Judge Ricardo S. Martinez in U.S. District Court in Seattle to 32 months in prison and two years of supervised release for Tax Evasion and False Statement in a Passport Application. KRANE has also agreed to forfeit approximately $23.1 million to the U.S. Treasury in back-taxes and return approximately $17.9 million in illegal fees to his former client, Haim Saban.

In June 2009, KRANE was indicted along with the former Chief Executive Officer of Quellos Group L.L.C. (“Quellos”), Jeffrey I. Greenstein, 48, of Mercer Island, Washington, and an attorney and principal of the investment firm, Charles H. Wilk, 52, of Seattle, in connection with a fraudulent tax shelter scheme. KRANE pleaded guilty in December 2009 and agreed to cooperate with the government in its prosecution of Greenstein and Wilk. Subsequently, in January 2011, Wilk and Greenstein pleaded guilty, paid $7 million in penalties to the IRS, and were each sentenced to 50 months in prison in January 2011.

“Our system of tax reporting and collection depends in substantial part on tax professionals following our tax laws,” said Chief of the Criminal Division Robert Westinghouse. “When they fail to do so, it hurts all law-abiding citizens. The criminal conviction and sentence in this case justly punishes this kind of wrongdoing. Collecting more than $23 million in back taxes, interest, and penalties places an exclamation point on this important law enforcement effort.”

“Tax evasion is a classic symptom of overarching greed,” said Kevin Hanff, Assistant Special Agent in Charge of the IRS Criminal Investigation for the Pacific Northwest. “As this case demonstrates, no matter how you earn the money, you still have to pay taxes on it.”

Greenstein and Wilk agreed to secretly split Quellos’ fees with KRANE in exchange for KRANE’s assistance in enrolling a wealthy client in the tax shelter scheme. The client, Haim Saban, had more than $1 billion in capital gains in 2001, and Greenstein and Wilk promised KRANE a cut of the fees if Saban purchased the tax shelter scheme. Saban was never informed of the fee arrangement, or illegal nature of the scheme. Between March 2001, and October 2001, the men drafted false fee agreements that made it appear that Saban was paying $46 million to Quellos to participate in the tax shelter strategy.

In fact, nearly $36 million of that fee was actually diverted by Wilk and Greenstein to an offshore account controlled by KRANE. KRANE failed to pay taxes on the income. In addition, when KRANE learned of the criminal investigation of Quellos in February 2008, he applied for a passport in a false name, using a false Social Security Number and California Driver’s License number.

The Saban family issued a statement through their attorney regarding the funds that will be returned to them: “Cheryl and Haim Saban are gratified that through the efforts of the United States Attorney's Office, the IRS and their counsel, they have recovered the funds held in a foreign bank, and justice has been done. To show their appreciation they have decided to donate these funds to the Saban Foundation for use by the following charitable groups, among others: Children’s Hospital of Los Angeles, The Saban Free Clinic, Operation Home front, and Para Los Ninos. The monies will help those most in need.”

The case was investigated by the Internal Revenue Service Criminal Investigation (IRS-CI).

The case was prosecuted by Assistant United States Attorneys Kathryn Kim Frierson, Robert Westinghouse, Jerrod Patterson and Mike Dion

About Haim Saban:

(With an estimated current net worth of $3.5 billion, he is ranked by Forbes as the 104th richest person in America)

http://www.saban.com/html/team/saban.html

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Kingwood, Texas-- Adopt-a-Dog

Dallas

Labrador Retriever/Shar Pei Mix

Male

Six Months Old

Primary color: Red, chestnut or orange

Coat Length: short

Neutered

Up-to-Date with shots

“DOB 12-10... Super cute, green-eyed DALLAS was rescued at 8 weeks old with his brother Austin. They were found with their doggy caretaker (not mom!) Bubbles on a night that was well below freezing. Happy and healthy, Dallas loves to play with his toys, his brother and his foster family and is working on crate training, house training, and basic puppy commands. If you have room in your heart and home for Dallas, he promises you lots of love, fun, and sloppy puppy kisses!”

Contact Michelle at pitchick44@yahoo.com

*****If you would like more information about the dog featured above, be sure to send a note to the "Contact Person." This is the person fostering the dog and they will be happy to answer any questions you have.

Also, in sending your note to the Contact Person, be sure to include information about yourself, family, home, yard, fence, other pets, work situation, and pet accommodations. This information will help us make the best match between you and one of our dogs***

Twyla's Friends

pitchick44@yahoo.com

http://www.petfinder.com/pet-search?shelter_id=TX205

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

![]()

--- News Briefs

Best Bank Account Interest Rates

- Summary for Week Ending June 11, 2011

http://www.depositaccounts.com/blog/2011/06/best-bank-account-interest-rates-summary-for-week-ending-june-11-2011.html

Groupon's 1500% growth makes even Google look lame

http://www.usatoday.com/money/markets/2011-06-11-cnbc-groupon-bubble_n.htm

Marie Callender's closes suddenly in Santa Rosa

http://www.pressdemocrat.com/article/20110612/NEWS/110619861/1350?Title=Marie-Callender-s-closes-suddenly-in-Santa-Rosa

‘Book of Mormon’ and ‘War Horse’ Win Top Tonys

http://www.nytimes.com/2011/06/13/theater/theaterspecial/war-horse-is-best-play-and-mormon-has-strong-showing-in-early-tonys.html?hp

You May Have Missed--

For the Executive with Everything, a $230,000 Dog to Protect It

http://www.nytimes.com/2011/06/12/us/12dogs.html?_r=1&src=me&ref=general

Sports Briefs----

Dallas Mavericks beat Miami Heat to win first NBA title in franchise history

http://www.dallasnews.com/sports/dallas-mavericks/headlines/20110612-dallas-mavericks-beat-miami-heat-to-win-first-nba-title-in-franchise-history1.ece

http://www.sacbee.com/2011/06/12/3695409/terrys-19-points-send-mavs-into.html

http://www.nytimes.com/2011/06/13/sports/basketball/nba-finals-mavericks-defeats-heat-for-first-championship.html?_r=1&hp&gwh=679258863009C8F3AE760933F1866407

![]()

California Nuts Briefs---

Steve Jobs' first dream for an Apple headquarters: Coyote Valley, San Jose

http://www.mercurynews.com/business/ci_18255200?source=most_emailed&nclick_check=1

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

![]()

“Gimme that Wine”

Virginia Winemakers Come On Strong

http://www.voanews.com/english/news/usa/Virginia-Wine-Makers-Come-on-Strong--123555689.html

Northern California: Not reported, many grape growers are quiet over the low temperatures; several report losing 50% of their harvest, but seems no one wants to talk about it yet. Weather has been goofy in California.

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

Please send to a colleague---Leasing News is Free

![]()

This Day in American History

1774- Rhode Island becomes 1st colony to prohibit importation of slaves. The Rhode Island General Assembly in Newport, RI, passed this legislation, banning slave importation: “ No Negro or mulatto shall be brought in to this colony, and in case any slave shall be brought in , he or she shall be, and are hereby, rendered immediately free, so far as respects personal freedom, and the enjoyment of private property, in the same manner as the native Indians.”

1789 - General George Washington was served a new dessert by Mrs. Alexander Hamilton, ice cream.

1798-The Mission San Luis Rey de Francia was founded. It was abandoned in 1846. Restoration began in 1892.

http://www.californiamissions.com/cahistory/sanluisrey.html

http://www.sanluisrey.org

1786-birthday of Winfield Scott, American army general, negotiator of peace treaties with Indians and twice nominated for president (1848 and 1852). Leader of brilliant military campaign in Mexico in 1847. Scott was born at Petersburg, VA and died at West Point, NY, May 29,1866.

http://www.civilwarhome.com/scottbio.htm

http://www.npg.si.edu/exh/brady/gallery/77gal.html

http://www.ngeorgia.com/other/scottinmexico.html

http://home.att.net/~Rebmus/SCOTTSTACTICS.htm

1868-African-American Oscar J. Dunn elected Lieutenant Governor

of Louisiana Ran away from slavery; finally bought his freedom; began his education prior to his freedom; State Senator in 1868 ;Lt. Governor from 1868 to 1870; reputed to be firm, courageous and incorruptible, died suddenly in November, 1871. Ironically, his death brought the first African American to serve as governor of a state: P.B.S. Pinchbeck. He had been elected president pro tempore of the Louisiana senate in 1871, and promoted to lieutenant governor upon the death of Oscar J. Dunn. Pinchback was educated in Cincinnati, was a captain in the army. When Governor Warmoth was impeached in December 1872; he became governor for a few days.

http://www.sec.state.la.us/45.htm

1875—Birthday of Mariam Amanda Wallace "Ma" Ferguson - two-time Governor of Texas. In November 1924, she and Nellie Ross of Wyoming were elected the nation's first female governors. Her husband had been impeached, convicted and removed from the Governors office to which he had been elected 1916. She ran to clear the family name under the motto "two Governors for the price of one." She said, up front, that she would be just a stand-in for her husband, but when elected, she did a lot of things her way. Although “Ma” Ferguson did fulfill a campaign promise to secure an antimask law against the Ku Klux Klan, the courts overturned it. State expenditures were slightly increased, despite a campaign pledge to cut the budget by $15 million. The focal point of discontent centered upon irregularities both in the granting of pardons and paroles and in the letting of road contracts by the state highway department. Ma Ferguson pardoned an average of 100 convicts a month, and she and "Pa" were accused by critics of accepting bribes of land and cash payments. Critics also charged that the Ferguson-appointed state highway commission granted road contracts to Ferguson friends and political supporters in return for lucrative kickbacks. She won re-election and then retired from politics until she was 65 years, running for governor in 1940, but did not win. She died June 21, 1961.

http://www.tsl.state.tx.us/governors/personality/mferguson-p01.html

http://www.reaganadv.com/ma/biography.html

1889 - Forest fires in northern Wisconsin and northeast Minnesota were in the process of destroying millions of dollars of board feet of timber.

1905-Trumpet player Doc Cheatham birthday

http://www.riverwalk.org/profiles/cheatham.htm

1907 --The temperature at Tamarack, California dipped to 2 degrees above zero, the lowest reading of record in June for the U.S. after 42 inches of snow fell between the 10th and the 13th, the snow depth on this date was 130 inches.

1921 - "The Sultan of Swing," Babe Ruth, made a 460 foot homerun into the center field bleachers at New York City's Polo Grounds. It was the longest homerun Ruth made in his career.

1927 - Aviation hero Charles Lindbergh was honored with a ticker-tape parade in New York City. He was the most popular man of his era, considered a presidential candidate, but the kidnapping of his son changed his life. While the man who asked for ransom was caught, it is believed by many that it was Lindbergh’s own sister who killed the infant as she suffered from mental illness and had harmed the baby earlier.

1933-In an effort to get the economy going again, the Federal Savings and Loan Association was authorized with the passage of the Home Owners Loan Act. The purpose of the legislation was to provide a convenient place for investment and to lend money on first mortgages. The first association was the First Federal Savings and Loan Association of Miami, Florida, which was charted on August 8, 1933.

1935 - In a 15 round match, Jim Braddock defeated Max Baer in a. With the win, Braddock captured the world heavyweight boxing title in New York City.

1937--- Joe DiMaggio hits 3 consecutive HRs against St Louis Browns

1939 - Victor Records artist Lionel Hampton and his band recorded "Memories of You." He had played the song with the Benny Goodman

Quartet at Carnegie Hall in 1937.

1940- R'n'B singer Bobby Freeman was born in San Francisco. He is best known for "Do You Wanna Dance," which became a number five hit for him in 1958. The song was later covered by the Beach Boys - in 1965 - and the Ramones - in 1978.

1942 - John C. Cullen, Seaman 2/c discovered Nazi saboteurs landing on beach at Amagansett, Long Island. He reported this to his superiors. The FBI later captured the Nazis and Cullen was awarded the Legion of Merit. The four men had plans to sabotage NYC’s water system and industrial sites across the Northeastern US.

1942-The Office of War Information was created.

http://memory.loc.gov/ammem/today/jun13.html

1944-Marvin Camras, who was a student at the Armour Institute of Technology, Chicago, Il, patented a wire recorder for sound recordings. He had actually invented it in the 1930’s, and it was used experimentally in 1939 and 1940, with several models in use by the US Navy in 1941. When I first went to work for KFRC Radio in 1963, we were using wire to record interviews, including telephone interviews ( several times a week I would interview Governor “Pat” Brown, who was a long time fan of the radio station when he was San Francisco district attorney).

1944 - Only one week after the Normandy invasion, the first German V-1 buzz bomb, also called the doodlebug (Fieseler Fi-103), was fired at London. The first guided missile to be used in force, the V-1 was powered by a pulse-jet engine and resembled a small aircraft. Only one of the four missiles London saw that day caused any casualties, but a steady stream of V-1s causing severe damage and casualties fell on London in coming months. At times, nearly 100 bombs fell each day. Many German buzz bombs never reached their targets because of primitive guidance systems or because they were destroyed in flight by anti-aircraft fire or intercepting Allied fighters.

1948---Top Hits

Nature Boy - Nat King Cole

Toolie Oolie Doolie - The Andrews Sisters

Baby Face - The Art Mooney Orchestra

Texarkana Baby - Eddy Arnold

1948 - During farewell ceremonies for Babe Ruth, his Uniform #3, was retired. The emotional ceremony at Yankee Stadium came two months before the baseball legend died.

1956---Top Hits

The Wayward Wind - Gogi Grant

I’m in Love Again - Fats Domino

I Want You, I Need You, I Love You - Elvis Presley

Crazy Arms - Ray Price

1963-President John F. Kennedy and other leaders condemned the assassination by a sniper of civil rights leader Medgar Evers in the back outside of his home in Jackson, Mississippi on June 12. The crime sparked numerous demonstrations this day as an outrage of the killing. The reaction to this killing spurred the Civil Rights Act of 1964.

Ten years after Medgar Evers’s death the national office of the NAACP reported that Mississippi had 145 black elected officials and that blacks were enrolled in each of the state’s public and private institutions of higher learning.... In 1970, according to statistics compiled by the Department of Health, Education, and Welfare, more than one-fourth or 26.4 percent of black pupils in Mississippi public schools attended integrated schools with at least a 50 percent white enrollment. When Medgar died in 1963, only 28,000 blacks were registered voters. By 1971, there were 250,000 and by 1982 over 500,000.

http://www.olemiss.edu/depts/english/ms-writers/dir/evers_medgar/

http://www.cr.nps.gov/nr/travel/civilrights/mainmap1.htm

1964---Top Hits

Chapel of Love - The Dixie Cups

A World Without Love - Peter & Gordon

Love Me with All Your Heart - The Ray Charles Singers

Together Again - Buck Owens

1966- The US Supreme Court rendered a 5—4 decision in the case of Miranda v Arizona, holding that the Fifth Amendment of the Constitution “required warnings before valid statements could be taken by police.” The decision has been described as “providing basic legal protections to persons who might otherwise not be aware of their rights.” Ernesto Miranda, the 23-year-old whose name became nationally known, was retried after the Miranda Decision, convicted and sent back to prison. Miranda was stabbed to death in a card game dispute at Phoenix, AZ, in 1976. A suspect in the killing was released by police after he had been read his “Miranda rights.” Police procedures now routinely require the reading of a prisoner’s constitutional rights (‘Miranda”) before questioning.

1967- President Lyndon Baines Johnson appointed Thurgood Marshall of Maryland to the Supreme Court, making him the first African-American appointed to this position.

1968 --* KEDENBURG, JOHN J. Medal of Honor

Rank and organization: Specialist Fifth Class, U.S. Army, 5th Special Forces Group (Airborne), 1st Special Forces. place and date: Republic of Vietnam, 13 June 1968. Entered service at: Brooklyn, N.Y. Born: 31 July 1946, Brooklyn, N.Y. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Sp5c. Kedenburg, U.S. Army, Command and Control Detachment North, Forward Operating Base 2, 5th Special Forces Group (Airborne), distinguished himself while serving as advisor to a long-range reconnaissance team of South Vietnamese irregular troops. The team's mission was to conduct counter-guerrilla operations deep within enemy-held territory. prior to reaching the day's objective, the team was attacked and encircled by a battalion-size North Vietnamese Army force. Sp5c. Kedenburg assumed immediate command of the team which succeeded, after a fierce fight, in breaking out of the encirclement. As the team moved through thick jungle to a position from which it could be extracted by helicopter, Sp5c. Kedenburg conducted a gallant rear guard fight against the pursuing enemy and called for tactical air support and rescue helicopters. His withering fire against the enemy permitted the team to reach a preselected landing zone with the loss of only 1 man, who was unaccounted for. Once in the landing zone, Sp5c. Kedenburg deployed the team into a perimeter defense against the numerically superior enemy force. When tactical air support arrived, he skillfully directed air strikes against the enemy, suppressing their fire so that helicopters could hover over the area and drop slings to be used in the extraction of the team. After half of the team was extracted by helicopter, Sp5c. Kedenburg and the remaining 3 members of the team harnessed themselves to the sling on a second hovering helicopter. Just as the helicopter was to lift them out of the area, the South Vietnamese team member who had been unaccounted for after the initial encounter with the enemy appeared in the landing zone. Sp5c. Kedenburg unhesitatingly gave up his place in the sling to the man and directed the helicopter pilot to leave the area. He then continued to engage the enemy who were swarming into the landing zone, killing 6 enemy soldiers before he was overpowered. Sp5c. Kedenburg's inspiring leadership, consummate courage and willing self-sacrifice permitted his small team to inflict heavy casualties on the enemy and escape almost certain annihilation. His actions reflect great credit upon himself and the U.S. Army.

1969 --An unusual late season snowfall covered parts of South Dakota, Wyoming, Montana, and Nebraska. 10 inches of snow fell at Deerfield, South Dakota and 5 inches was measured at Great Falls, Montana.

1970- the Beatles' "Long and Winding Road" reached number one on the Billboard Hot 100 chart. The song was never released as a single in Britain, and Paul McCartney disowned the record after producer Phil Spector added a background chorus of women's voices. Nonetheless, it was reported to have sold 1.2 million copies in its first two days of release.

1971 - The New York Times began publishing the Pentagon Papers, a secret study of America's involvement in Vietnam.

1972---Top Hits

The Candy Man - Sammy Davis, Jr.

Song Sung Blue - Neil Diamond

Nice to Be with You - Gallery

The Happiest Girl in the Whole U.S.A. - Donna Fargo

1976-Don Bolles, investigative reporter for the Arizona Republic, died as a result of injuries received when a bomb exploded in his automobile, June 2, 1976, while he was engaged in journalist investigation of an alleged Mafia story. Bolles was awarded posthumously the University of Arizona’s John Peter Zenger Award, December 9, 1976.

1980---Top Hits

Funkytown - Lipps, Inc.

Coming Up - Paul McCartney & Wings

Biggest Part of Me - Ambrosia

My Heart - Ronnie Milsap

1984-- Severe thunderstorms produced large amounts of hail in the Denver, Colorado metro area. Hailstones as large as 4 inches in diameter fell. Homes and other buildings sustained around 200 million dollars in damage. Thousands of cars were battered with total damage to vehicles estimated at 150 million dollars. In some areas, golfball size hail fell continuously for 30 to 40 minutes. 20 people were injured by the giant hailstones. Torrential rains as much as 4.75 inches in Lakewood clogged drains and caused widespread damage from flooding.

1984 - The Jacksons' ``State of Shock,'' with Mick Jagger doing guest vocals, is released. The million-seller reaches No. 3 on Billboard's Hot 100.

1987 - Fifteen cities in the north central U.S. reported record high temperatures for the date, including International Falls, MN, with a reading of 92 degrees. Mason City IA and Waterloo IA reported record highs of 100 degrees. Thunderstorms in the northeastern U.S. produced golf ball size hail around Hamilton Square NJ, along with high winds which tore the roof off a hospital causing a million dollars damage. Averill Park NY was deluged with 1.64 inches of rain in fifteen minutes.

1988---Top Hits

One More Try - George Michael

Together Forever - Rick Astley

Everything Your Heart Desires - Daryl Hall John Oates

I Told You So - Randy Travis

1988- Afternoon thunderstorms produced severe weather in the Southern and Central Plains Region. Forrest NM was deluged with 5.5 inches of rain in ninety minutes. Temperatures soared into the 90s across much of the eastern half of the nation, including New England. Northern Illinois reported a record twenty straight days of dry weather.

1990---Top Hits

Please Hammer Don t Hurt Em, M.C. Hammer

I Do Not Want What I Haven t Got, Sinead O Connor

I m Breathless, donna,

Pretty Woman, Soundtrack

1994-- At the age of 34, Cub second baseman Ryne Sandberg suddenly retires walking away from $16 million (due to personal problems, he said.) While he had been a notoriously slow starter throughout his entire career, his 1994 start was disastrous. Later, he admitted that he had been distracted at the time while going through a messy divorce. He came back for the 1996 and 1997 seasons, retiring permanently at the age of 37 with a career batting average of .285, and a record 277 home runs as a second baseman; this record was surpassed in 2004 by Jeff Kent.http://www.thebaseballpage.com/past/pp/sandbergryne/

http://www.geocities.com/Colosseum/Arena/6113/

2000---Top Hits

The Marshall Mathers ,Eminem

The History Of Rock , Kid Rock

Oops!...I Did It Again , Britney Spears,

Mad Season, matchbox twenty

2003 --On his fourth attempt, Roger Clemens becomes the 21st pitcher and the first since 1990 to record 300 career wins as the 40-year-old righty goes 6 2/3 innings in the Yankees' 5-2 inter-league victory over the Cardinals. In the second inning when Edgar Renteria swings through full-count fastball, the 'Rocket' also joins Nolan Ryan (5,714) and Steve Carlton (4,136) as just the third hurler to record 4000 career strikeouts.

2004---Top Hits

Confessions ,Usher

Under My Skin, Vvril Lavigne,

Here For The Party , Gretchen Wilson,

Musicology, Prince

2005 - Pop superstar Michael Jackson is found not guilty on all counts of his child molestation trial in Santa Maria, Calif. Jackson, 46, had been charged with molesting a 13-year-old cancer survivor in 2003, serving him wine and conspiring to hold the boy and his family hostage at his Neverland estate in order to get them to rebut a television documentary.

NBA Finals Championship This Date

1989 Detroit Pistons

1997 Chicago Bulls

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Ten Top Stories each week chosen by readers (click here)

Adopt a Pet

Bank Beat

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

The Secret of Our Success

To Tell the Truth

View from the Top

(chronological order)

- Royal Links Appeal Rules Back to Trial

by Tom McCurnin

- More Top Leasing Web Sites

- Top Ten Cities with the Highest Credit Scores

- OneSource Develops Business License Software

- Jeffrey Taylor in Hospital

- Get Linked In---

by Christopher Menkin, Publisher

- The Main Reason to Lease

- John Otto/HL Leasing Alleged Scam---Up-dated

- The Strange Case of Sheldon Player

- Marlin Profit Down due to hiring more sale personnel

- Five Point Capital, San Diego, California

Bulletin Board Complaint

- Goodbye LEAF Financial by Christopher Menkin

- Shivers Secures $25 Million Line with Wells

- Newcourt’s Hudson Controversial Move Back into Leasing

- Franchise Industry Report by Bob Rodi, CLP

- Talk About Chutzpa, Fanghella has more than Trump

- U.S. Bancorp Sunny Days

- Leasing Association Membership Confirms Changing Industry

by Christopher Menkin

- Bank of the West moving more workers to Bishop Ranch

- Key Bank and Leasing---The Numbers

- Leasing Icon Robert Krause Retires

- Allied Health Care Services Charles K. Schwartz Pleads Guilty

- US Bank Manifest More Cut Offs

-

ZRG Leasing Index Posts 33% Increase in Q1

- BBB: Rating Leasing Companies

- Despite Marketplace Losses, Pawnee Year-End $12.4MM Profit

- State of the Leasing Industry

by Christopher Menkin

- Richest Man in Leasing: Steven Udvar-Hazay

- Lease Company vs. Commercial Equipment Finance Company?

- Leasing Gypsies Strike Again in Southern California

Bulletin Board Complaint

- High Risk Lenders Use Native American tribes by Jeffrey Taylor

- Snowflake Financial---A new angle

Bulletin Board Complaint

- From Zero to over $450 Million in One Year

- License Up-Date for Leasing in United States

- Loan/Lease Statute Up-Date

- Church Kiosk Fray---Comes back to bite Balboa on the...

- Tyco Kozlowski Mansion Sold to Direct Capital CEO & Wife

- Business Leasing Northwest, Seattle, Washington

Bulletin Board Complaint

- Brican America---Update

- Bulletin Board Complaint---ACC Capital

- Leasing Brings Resource America to a serious loss

by Christopher Menkin

- Six Years to Name Final Royal Links Scam Principal

-

Vaughn Indicted for defrauding banks, leasing companies

-

Wildwood employees get prison for Leasing Ponzi scheme

- Operation Lease Fleece---2011 Update

- IFC Credit Corporation BK—Up-date

- De Lage Landen: A Teachable Moment

by Bernie Boettingheimer, CLP

- Leasing News Position on Evergreen and Winter Green Leases

- I should have called Lease Police!

by Christopher Menkin

-

PinnFund/PinnLeasing Michael Fanghella Out of Jail

Seeks $150,000 Job

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

-

NorVergence---still going

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses