|

|

|

|

|

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Wednesday, July 13, 2005

Headlines---

Classified Ads-----Doc .Manager/ Finance / Legal

Our ”On Line” Anniversary

Classified Ads—Help Wanted

Reader Finds CMC's Hanson and Fisher

Placard—“Cookie Crumbles” in Latin

Unrelenting Mortgage Growth Seen Rest of Year

Neptune to lead NorVergence Panel-Lessors Conf.

Leasing Association Fall Conference--Up-Date

Commerce Bank Five-Year Growth Plan/Leasing

E-Commerce/StrikeIron's Sales & Use Tax

News Briefs---

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

Baseball Poem-- Paul B. Janeczko

######## surrounding the article denotes it is a “press release”

|

Documentation Manager / Finance / Legal

| Documentation Manager: New York, NY. 10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic. Email: dln1031@nyc.rr.com |

Finance: Austin, TX. |

||

|

Email: pal108381@comcast.net Transaction Summary Website: www.tlgattorneycpa.com |

Finance: Orange County, CA |

||

Finance: San Jose, CA. |

Legal: Los Angeles, CA Experienced in-house corporate and financial services attorney seeks position as managing or transactional counsel. Willing to relocate. Email: sandidq@msn.com |

full posting of all ads at:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

|

|

----------------------------------------------------------------

![]()

Our “On Line” Anniversary

by Kit Menkin

July 10,2000 Leasing News started on line in text format.

This originally was more of a “e-mail” to friends and acquaintenances that was sent to a relatively small mailing list, but passed around. As the address book grew, all from referrals, when it got to over a 1,000 readers, it was time to make it more “serious.” Sometimes it was more fun, such as asking readers what year and kind of car they drove, or the so-called wrestling match between Ken Goodman and Bob Rodi, and often the language was of the street.

Due to the liabilities, we incorporated, built a web site, and on July 10,2000, placed our first edition “on line:”

Our mission has been: Independent, unbiased, and fair news about the leasing industry.

Our ideals are from Joseph Pulitzer's retirement speech on April 10,1907:

(The Mission of “The World” newspaper)

“An institution which should always fight for progress and reform; never tolerate injustice or corruption; always fight demagogues of all parties; never belong to any party; always oppose privileged classes and public plunder; never lack sympathy with the poor; always remain devoted to the public welfare; never be satisfied with merely printing the news; always be drastically independent; never be afraid to attack wrong, whether by predatory plutocracy or predatory poverty.”

http://two.leasingnews.org/archives/July/7-10-00.htm

You will find in the above URL our first edition on line edition, which also announced the members of our Advisory Board:

Bob Baker , Wildwood Financial

Phil Dushay , Global Leasing

Mike Graneri , Graneri and Associates

Ken Greene , Attorney

Bob Rodi , LeaseNow

Bob Teichman , Teichman & Associates

Andrew Thorn , Thalman Finance

Rob Yohe , Yohe and Associates

“The List” then was composed of 36 companies.

The top story of the day:

“First Sierra Stock (Sierra Cities) Monday Hits All Time Low of 2 7/8 “

On the Complaint Bulletin Board:

“Universal Capital Service 7/5

Parker Leasing and Financing 6/16

Dodson Group complaint 6/15

Universal Capital Service 6/12

Metropolitan Group Question 6/12”

We had other news that day such as:

“(The popular former Colonial Pacific Leasing) Dennis Doyon leaving

(the ebroker company of) Total Funding to go to work at Commercial Money Center.”

Here is a recap: This started as e-mail to friends, then was passed around, and we came on line July 10,2000.

August 9,2002: we went from “text” to an “HTML” web edition. January 6,2003: classified ads. They were all free in the beginning

until we had over 110 “help wanted” ads, almost all from brokers looking for independent, mostly commissioned sales personnel.

June,2004, in addition to the text version, we started sending out an “HTML” version with graphics and sound. We experimented also with a “live” e-mail program, along with a “chat forum.”

July, 2004 the text editon ended as keeping the address book for both was too much work.

April 24,2005 started Constant Contact edition via eMail, which relieved us of taking care of the address book, plus gave us other graphic abilities.

May 20,2005, we started banner ads.

We have come a long way from the start.

We continue to make improvements, other features and projects---all we need is the time to complete them, as this continues to be a “part-time” operations for all those involved.

A special thanks to Maria Martinez-Wong ( who does all the graphics, plus designs the help wanted and banner ads) and Brian Wong, both who have been with Leasing News since the start (Brian now posts the web site edition at 1am PDT. plus verifies the “free” classified ads every 30-to 45 days, and does Web Trend analysis.)

I would also like to thank our previous advisory board members, and especially our current advisors:

Leasing News |

|

Advisory Board |

|

| Bob Baker, CLP. | Wildwood Financial Group, Ellisville, Missouri |

| Edward Castagna | Nassau Asset Management, Westbury, NY. |

| Steve Crane, CLP | Bank of the West, Walnut Creek, CA. |

| Phil Dushay | Global Financial Services, Manhattan, NY. |

| Ken Greene, Esq. | Larkspur, California |

| Theresa M. Kabot, CLP | Kabot Commercial Leasing, Seattle, WA. |

| Robert S. Kieve | Empire Bradcasting, San Jose, CA. |

| Bruce Kropschot | Kropschot Financial Services, Vero Beach, FL. |

| Fred St. Laurent | SFBI Recruiters, Atlanta, GA. |

| Andrew Lea, M.A. | McCue Systems, Inc. Burlingame, CA. |

| Armon L. Mills, CPA | San Diego Business Journal, San Diego, CA. |

| Steve Reid, CLP | Santa Barbara Bank & Trust, Santa Barbara, CA. |

| Bob Teichman, CLP | Teichman Financial Training, Sausalito, CA. |

| Paul B. Weiss | ICON Securities, New York, N.Y./San Francisco, CA. |

| Ginny Young | Brava Capital, Orange, CA. |

| Steve Gabriel | Porter Novelli-Advanced Tech Division, Campbell, CA |

Publisher/Editor |

|

| Christopher "Kit" Menkin | |

--------------------------------------------------------

Classified—Help Wanted

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

|

Learn more www.providentleasing.com |

Account Representatives & Sales Coaches

|

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

Lease Administrator

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Lease pricing division economic analysis / analytical support

| San Francisco Office

Two openings lease pricing division |

|

SFBI Recruiters |

|

Contact: Fred St Laurent, SFBI Professional Recruiting. Email: Fred@sfbirecruiter.com |

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Tax Manager

|

|

For complete description and application, click here. |

----------------------------------------------------------------

Reader Finds CMC's Hanson and Fisher

Leasing News had an “alert” and also asked readers

for the address of Bill Hanson, formerly of Commercial

Money Center, headed by Ron Fisher, DCC.

“Any info on Ty & Bill Hanson of Conrad & Associates, Carlsbad Ca. 92008. I think my investment of 50k is no more. Got $500 a month or 12% return for 2004. Got January 05, but none for this month. All phones etc off!!! Sold me a Promissory note.

“Can you recommend any authority to call?”

(copy of letter)

http://leasingnews.org/PDF/Conrad&Associates.pdf

Leasing News in February and March asked readers if they knew where they were located so we could hear their side of the story.

We attempted to contact them. We have confirmed the telephone numbers, including Bill Hanson's personal cell telephone, are disconnected or do not answer also. We contacted old associates who knew Bill and his “unofficial adopted” son. One person told us he may have moved back East. He reportedly was last working out of Ty Hanson's apartment, where he was also living.

Many may remember him as vice-president of Commercial Money Center, in charge of sales and broker relationships:

http://www.leasingnews.org/Conscious-Top%20Stories/CMC_stories.htm

The List published on Friday brought this communication

(and permission was given to print in entirety.)

“Name = Janice Berner

Address = PO Box 46651

City = St. Pete Beach

State = FL

Zipcode = 33741

Phone = 727-244-5316

Fax = 727-865-3643

Email =Janiceberner@aol.com

Comments or Questions= You have had some complaints about \"Conrad & Associates\" scamming people out of 50K investments on leases, and people have not been able to find Mr. Hanson or Mr. Fischer.

FYI, Mr Fisher keeps a condo at the \"Sterling\" on Tierra Verde, Florida (in my neighborhood) and visits here monthly. If anyone would like to look for him, he is very easy to find! He also scammed my father out of 50K so I am happy to help anyone make Ron Fisher held responsible for his debts.

“For anyone who wants to find them, Mr. (NOT Dr - he is a fake) Fisher spends a lot of his time at his Gulf front Condo in Florida, 1100 Pinellas Bayway, #H4, St. Petesburg, FL 33715. He and Mr. Hanson are easily found while they live in luxury, keeping a large yacht while scamming others out of millions. Go find them!”

----------------------------------------------------------------

----------------------------------------------------------------

|

Unrelenting Mortgage Growth Seen for Rest of Year

ABSnet

Worldwide issuance of asset- and mortgage-backed securities remained on a tear throughout the first half of 2005, and market players see no signs of a slowdown.

The bullish expectations contradict early-year predictions by industry participants, who believed that a two-year blitz of deals from mortgage and home-equity lenders would finally taper off during the latter part of 2005. The reason they're backtracking now: Interest rates on home loans remain incredibly low, even through the Federal Reserve has been boosting short-term rates.

"I don't see anything that's going to change in the second half," said Adam Garfinkle, head of Banc of America's securitization-underwriting group. "Our clients' pipelines still appear to be strong and robust."

Across-the-board growth for issues of asset-backed securities, residential and commercial mortgage bonds, and collateralized debt obligations propelled worldwide securitization volume to $922 billion during the January-June stretch, up 33% from $693 billion a year earlier and roughly equal to the full-year tally from 2002, according to Asset-Backed Alert's ABS database. At that rate, the 2005 issuance count should easily eclipse the record $1.4 trillion of structured-finance transactions completed last year.

So when will the market's expansion fizzle? Some say when long-term interest rates rise or home prices fall - both of which are bound to happen eventually. Outside forces such as unemployment, oil prices or terrorism could also have an effect. Nonetheless, "we're figuring that things are going to keep on pace [until yearend]," said Mark Adelson, Nomura's head of asset-backed research.

As was the case last year, various home-loan securitizations were at the center of the action - with $568 million of first-half volume. And it's no coincidence that Lehman Brothers, one of the most active underwriters of such deals, leads the global bookrunning race (see table on Page 7).

The bank had managed $85.6 billion of securitizations around the world as of June 30, widening a slim lead it held over its rivals at yearend 2004. Citigroup, last year's fourth-place underwriter, now trails Lehman by $15.3 billion. Royal Bank of Scotland, Morgan Stanley, Credit Suisse, Bear Stearns, and Merrill Lynch are running close behind, each with at least $60 billion of first-half assignments.

Lehman is also dominating the growing U.S. asset-backed market, which is heavily driven by home-equity loan and subprime-mortgage securitizations. It managed $45.3 billion of the $409 billion of deals that registered for that portion of the league table, which excludes CDOs, prime-quality mortgage deals and commercial MBS.

Citi was also Lehman's closest rival in the U.S., followed by Morgan Stanley, Credit Suisse and Countrywide Securities. If those banks didn't receive credit for deals that they underwrote for affiliates, however, Citi would be the number-one underwriter in the U.S. Lehman would fall to second place. Credit Suisse and BofA, on the other hand, would fare better (see tables on Page 9).

Growth was also substantial for U.S. deals backed by prime-quality mortgages, where Bear Stearns maintained its traditional lead by underwriting $31.6 billion of the $220 billion of offerings that hit the market. Number-two RBS Greenwich Capital, however, is rapidly advancing (see table on Page 10).

Morgan Stanley, meanwhile, is sitting on a commanding lead in Europe, where mortgage-related activity actually decreased but overall volume rose marginally to $138 billion. The bank, which racked up $14.8 billion of year-to-date league-table credit in the region, was in fifth place at yearend. Deutsche Bank is now in second place, while last year's market leader, Citi, is in the number-seven slot. Barclays Capital and J.P. Morgan Chase also dropped out of the top five, leaving room for Lehman, Societe Generale and Merrill to move in (see table on Page 11).

In the global CDO market, Merrill was tops. It led $13.4 billion of new deals, just edging out Citi. They were among 27 underwriters that completed $82.4 billion of CDOs during the first half, up from $49.1 billion a year ago (see table on Page 13).

Growth was strong in the global commercial MBS market as well, where $115 billion of deals hit the market.

Asset-Backed Alert's structured-finance tally accounts for all securitizations worldwide. It excludes securities sold through commercial-paper conduits and the derivative portions of synthetic deals.

----------------------------------------------------------------

Robert C. Neptune, President, De Lage Landen Public Finance To Participate in Lessors Network Annual Showcase

Robert C. Neptune, President, De Lage Landen Public Finance (DLLPF) has been scheduled to participate in the Lessors Network Annual Showcase on August 24-25 from the Ritz-Carlton, Buckhead hotel in Atlanta, GA.

Roundtable - Norvergence - What Have We Learned?

Moderator - Robert C. Neptune | President | De Lage Landen Public Finance

What have lessors learned from the collapse of Norvergence, Inc.? Panelists will address relevant facts about the Norvergence debacle, the history and role of critical legal principles embodied in traditional lease procedures and the prospect of legislative oversight of the equipment leasing industry.

The Lessors Network Annual Showcase

The Power of Unconventional Thinking

August 24-25 | The Ritz-Carlton, Buckhead | Atlanta, GA Return

For additional information, visit www.lessors.com

-----------------------------------------------------------------

Leasing Association Conferences—Fall, 2005

![]()

Eastern Association of Equipment Lessors

September 19th, Teaneck, New Jersey

Information on the key speakers:

http://www.eael.org/keymote-speakers-sept2005.asp

------------------------------------------

National Assocation of Equiment Leasing Brokers

joins with Eastern Association of Equipment

Lessors for Fall Expo 2005

September 19th, Teaneck, New Jersey

-----------------------------------------

![]()

United Association of Equipment Leasing

September 22-25, Lake Tahoe, California

for more information, please go here:

-----------------------------------------

![]()

Equipment Leasing Association

October 23-24

44th Annual Convention

Boca Raton Resort & Club

Boca Raton, Florida

A non-member who has not attended the conference before is invited

to attend.

Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/

---------------------------------------

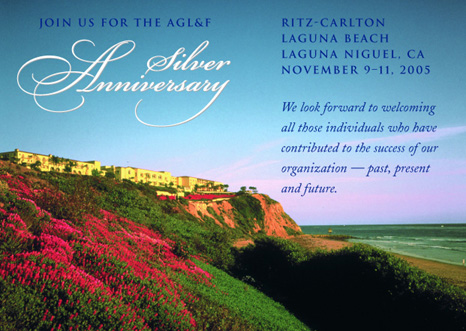

Association of Government Leasing & Finance

November 9, 2005

Dana Point, California

-----------------------------------------------------------------

#### Press Release #####################

Commerce Bank Announces Five-Year Growth Plan; Bank sets goal of

55 stores, $4 billion in deposits by 2010

EAST PENNSBORO TOWNSHIP, Pa.--( Commerce Bank/Harrisburg, NA, the sole banking subsidiary of Pennsylvania Commerce Bancorp Inc. (NASDAQ:COBH), announced a five-year growth plan to more than double its branch network to as many as 55 stores and increase its deposits to more than $4 billion by 2010.

Commerce Bank/Harrisburg currently has 25 stores in five Pennsylvania counties and plans to expand its network to 28 offices by year-end, with openings in North Cornwall Township in Lebanon County, and Wyomissing Borough and Cumru Township in Berks County. Thereafter, the bank plans to open four to six new stores in each of the next five years. Like all Commerce offices, the stores will offer seven-day branch banking and free checking, along with other amenities like Commerce's free interactive Penny Arcade coin-counting machine.

"As we look ahead, we will adhere to the retail model that has driven our growth and success for the past 20 years," said Chairman, President and CEO Gary L. Nalbandian. "We will keep working relentlessly to deliver an unsurpassed service experience. We will continue to pioneer new ways to make banking even more convenient. We've never considered ourselves a conventional bank, and we aim to prove that to the people and organizations we serve every day.

"We are tremendously excited about our plans for growth. In the coming years, we expect to further fill in areas between existing stores and expand our footprint into neighboring counties and regions. The next new area for us will be Lancaster beginning in 2006."

A Commerce Bank retail store generally requires as many as 20 full- and part-time employees. In conjunction with the bank's growth plans, other new hires will include lending officers and operations personnel. Commerce currently employs more than 740 people throughout Central Pennsylvania and Berks County.

To accommodate the bank's growth, a new headquarters, operations and training center, "Commerce Center," is under construction at the TecPort Business Center in Swatara Township, Dauphin County. When completed, the 56,000 square foot, two-story facility will house operations and support services departments including the bank's 24/7 live customer service call center. The building also will house consumer, commercial and mortgage lending operations for the bank's East Shore and West Shore regions in Harrisburg. Additionally, it will be home to Commerce University, the bank's in-house training and education program, which offers more than 50 courses and last year topped 2,900 enrollees.

Pennsylvania Commerce Bancorp's performance is marked by rapid growth, increasing profitability and excellent financial returns to shareholders. Over the last five years, assets, deposits and loans have grown on average 28%, 27% and 23% respectively. Total revenues, net income and net income per share have increased 26%, 23% and 18% respectively.

Commerce Bank/Harrisburg, "America's Most Convenient Bank," opened its first office in Camp Hill, PA, in June of 1985. In the 20 years since, the bank has cultivated a unique retail model that has produced continuous strong growth. The bank has doubled its number of branches in Pennsylvania in recent years, growing a network of 25 stores in Berks, Cumberland, Dauphin, Lebanon and York counties.

Commerce's hallmark products and services include seven-day branch banking, totally free checking, no-fee instant-issue ATM/Visa check card, free interactive Penny Arcade coin-counting machines, free online banking and 24/7 Bank-by-Phone.

In addition to retail banking, Commerce offers a diverse portfolio of commercial banking services including installment and term loans, commercial mortgages, commercial leasing and lines of credit, and cash management services.

Commerce Bank/Harrisburg currently has assets of $1.4 billion. For more information about Commerce Bank/Harrisburg, visit the bank's web site at commercepc.com.

Pennsylvania Commerce Bancorp Inc. Jason S. Kirsch, APR, 717-612-3537 jason.kirsch@commercepc.c

#### Press Release #####################

|

Your One stop solution for training and reference material for the Leasing Professional

|

E-Commerce Web Sites Use StrikeIron's Sales & Use Tax Web Service to Improve Customer Service; Real-Time Access to Sales Tax Information Ensures Accurate Results Saving Companies Time and Money

RESEARCH TRIANGLE PARK, N.C.--( StrikeIron Inc., developer of the innovative StrikeIron Web Services Business Network(TM) (WSBizNet(TM)) to simplify working with Web services, today announced that Ontario Credit Corporation, a leasing company and Minigrip/Zip-Pak(R), a manufacturer of plastic bags, are saving time and money by taking advantage of StrikeIron's Sales & Use Tax Premium Web service. The StrikeIron Sales & Use Tax Premium Web service allows users to instantly receive the rates for any zip or postal code in the United States.

Technotribe, the Web development company for Minigrip/Zip-Pak(R), was in the process of implementing the e-commerce site to allow the manufacturer to sell their resealable bags online directly to the consumer and learned that their shopping cart could not address the sales and tax issue for all 50 states. StrikeIron's Premium Web service was able to conveniently integrate into their shopping cart with only minor modifications.

"Minigrip/Zip-Pak would not have been able to sell their standard and special-use bags online if we weren't able to manage the taxes in real-time through the use of StrikeIron's Sales & Use Tax Web service," said Jack Clark, project manager at Technotribe. "StrikeIron's support was excellent in helping us to work through technical issues on our end during integration."

Ontario Credit Corporation faced a similar problem. With sales tax rates constantly changing all over the United States they faced the challenge of constantly updating this information. The company subscribed to another monthly download tax update service but found that the tax rates seemed to at least 30 days behind. Since Ontario sells equipment all over the U.S. they needed an instant and accurate service that was easy to use.

"With StrikeIron's Sales & Use Tax Web service, I enter the zip code and instantly receive the accurate sales tax rate," said Robin McMillen, controller at Ontario Credit Corporation. "We are able to charge our customer the correct tax, saving our company time, effort, and money. StrikeIron has enabled our sales tax department to provide accurate reporting to the sales tax jurisdictions."

The StrikeIron Tax Data Systems Sales and Use Tax Premium Web Services provide a programmatic interface to live sales and use tax data provided by Tax Data Systems. Simply supply a zip or postal code and it will be instantly matched to the general sales and use tax rate levels for the state, county, city, MTA, SPD and more. The tax data is then delivered live via an XML-based Web service directly into any application, platform, product, or Web site. In addition, StrikeIron handles all the tax updates and the changes are seamless to the user. For more on this service, visit

http://www.strikeiron.com/htmls/pws_taxdata_combined.aspx

"We are dedicated to providing the most reliable and trusted commercial Web services on the market today," said Bob Brauer, president and co-founder at StrikeIron. "These customer success stories are the very reason that our team works hard everyday to ensure that we continue to provide valuable data via Web services."

About StrikeIron

Based in Research Triangle Park, NC, StrikeIron, Inc. is the leader in Web services commercialization with its break-through StrikeIron Web Services Business Network(TM) (WSBizNet(TM)). WSBizNet provides an online commerce marketplace for providers and users to come together and easily publish, find and subscribe to commercial Web services. The WSBizNet Web services directory is the world's largest and includes the StrikeIron Premium Web Services providing the most reliable and trusted commercial Web services available in the market. The Aurora Funds, Inc. provided funding for StrikeIron after recognizing the significant opportunity presented by Web services and this unique management team. For more information, visit www.strikeiron.com.

StrikeIron, StrikeIron OnDemand Web Services, Web Services Business Network and WSBizNet are trademarks of StrikeIron, Inc. All other brands or product names are the property of their respective holders. Windows, MS Excel and all related Microsoft software and logos are registered trademarks, property of Microsoft.

StrikeIron, Inc. Jane Foreman, 919-405-7010 news@strikeiron.com or SRK Communications Kristi Lee, 919-754-9511 kristi@srkcommunications.com

###### Press Release ##################

----------------------------------------------------------------

![]()

News Briefs----

Sharp Increase in Tax Revenue Will Pare U.S. Deficit

http://www.nytimes.com/2005/07/13/business/13deficit.html?hp&ex=

1121227200&en=668092deba231054&ei=5094&partner=homepage

Big Shift in China's Oil Policy

With Iraq Deal Dissolved by War, Beijing Looks Elsewhere

http://www.washingtonpost.com/wp-dyn/content/article/

2005/07/12/AR2005071201546.html

Fla. residents assess hurricane damage

http://www.usatoday.com/weather/stormcenter/

2005-07-12-Dennis-damage_x.htm

HP Improved printers part of revenue-raising plan

http://www.signonsandiego.com/news/business/

20050712-9999-1b12hp.html

American Airlines plans its longest nonstop route, to India

http://www.signonsandiego.com/news/business/

20050712-1325-americanairlines-delhi.html

Amtrak restores limited high-speed service

http://www.boston.com/business/articles/2005/07/12/

amtrak_restores_limited_high_speed_service/

Law could trigger Chapter 11 surge

http://www.usatoday.com/money/companies/management/

2005-07-11-bankruptcy-usat_x.htm

Survey: Mo. is No. 1 in slacking at work

http://www.usatoday.com/money/workplace/2005-07-12-mo-slackers_x.htm

25 years later, 'Pac-Man' chomps on

http://www.ajc.com/news/content/living/0705/13pacman.html

----------------------------------------------------------------

Sports Briefs----

Armstrong Starts Ascent to Another Title

http://www.nytimes.com/2005/07/13/sports/sportsspecial/13Tour.html ?

Nicklaus Seeks Surprise Finish to Close the Book

http://www.nytimes.com/2005/07/13/sports/golf/13golf.html

----------------------------------------------------------------

![]()

California News Briefs---

Governor signs $117 billion budget

http://www.mercurynews.com/mld/mercurynews/news/

breaking_news/12107558.htm

----------------------------------------------------------------

![]()

“Gimme that Wine”

Chardonnay, Wine's whipping boy is top seller

http://www.napanews.com/templates/index.cfm?template=

story_full&id=FEBB7DD8-AB0D-4B01-8852-06E22D687E35

Grape scientists descend on St. Louis for wine summit

http://www.belleville.com/mld/belleville/news/12107519.htm

Iowa Has 42 Licensed Wineries

http://www.press-citizen.com/apps/pbcs.dll/article?AID=

/20050711/NEWS01/507110321/1079

Alexander Valley Vineyard

Healdsburg, California

(Great priced Pinot Noir, other wines of quality, too)

http://www.avvwine.com/fr_wineclub.html

----------------------------------------------------------------

This Day in American History

1729—Birthday of Minuteman John Parker. “Stand your ground. Don't fire unless fired upon, but if they mean to have a war, let it begin here.” Captain John Parker to the company assembled on Lexington Green.

http://memory.loc.gov/ammem/today/jul13.html

1787- The Continental Congress enacted a slavery ban for a territory of the United States. The law prohibited slavery forever within the borders of the Northwest Territory, a region east of the Mississippi River, north of the Ohio River, south and west of the Great Lakes, and west of Pennsylvania.

1821--I am sorry to report this is an official holiday in the State of Tennessee, where they celebrate the birthday (1821) of Forrest Nathan Bedford. He is a Confederate cavalry commander who was also one of the founders of the original Klu Klux Klan. The KKK was composed of many ex-Southern Civil War soldiers, almost as if it were a “veterans organization.”

1832 - Ethnologist Henry R. Schoolcraft was the first white person to arrive at the source of the Mississippi River at Lake Itasca, Minnesota. A pioneer in Native American studies, Schoolcraft conducted ethnological research among the Ojibwa in the Great Lakes region.

1863-starting today and lasting until July 16, antidraft riots broke out in New York City. Modern history's bloodiest riot began when a mob of 50,000 Civil War draft protesters burn buildings (including an orphan asylum), stores and draft offices, attack police. Some club, lynch and shoot large numbers of blacks, who they blamed for the war. Rioters were protesting the provision allowing true red-blooded flag-waving Americans to make cash payment in place of serving in the army. When troops returning from Gettysburg finally restored order, 1,200 were dead.

1863-- Mary Emma Woolley birthday, president of Mt. Holyoke College (1900- 1937) who under strong leadership expanded it to a major learning institution. She was voted one of the 12 most influential women in America. Jeannette Marks, head of the Holyoke English Literature Department lived with her for 52 years; they'd met at Wellesley.

1865 Horace Greeley advises his readers to "Go west young man.”

1868 --Oscar J Dunn, former slave, installed as lieutenant governor of Louisiana.

http://www.famousamericans.net/oscarjamesdunn/

1869 -- Street riots against Chinese laborers begin in San Francisco

1886--- Birth of Father Edward Flanagan, American Catholic parish priest. Believing there was 'no such thing as a bad boy,' in 1922 he organized Boys Town near Omaha, Nebraska.

1895-Cherry Hill, NJ tornado kills 3, while a tornado touches down in New York in Harlem and Woodhaven where 1 is killed.

1915- Baltimore, MD, became the first city to support a City orchestra ($6,000).

1936 112ø F (44ø C), Mio, Michigan (state record)

1936 114ø F (46ø C), Wisconsin Dells, Wisc. (state record)

1938 - When the first television theatre opened in Boston, Massachusetts, spectators paid 25 cents to witness the event. Attended by 200 people, the variety show included dancing and singing, and lasted 45 minutes. The acts were transmitted to the room, by television, while the were being performed on the floor above the theatre.

1939 - Making his recording debut with the Harry James band was Frank Sinatra, who sang "Melancholy Mood" and "From the Bottom of My Heart."

(lower half of: http://memory.loc.gov/ammem/today/jul13.html )

1940 Captain Jean-Luc Picard Birthday.

1946---Top Hits

They Say It's Wonderful - Frank Sinatra

The Gypsy - The Ink Spots

I Don't Know Enough About You - The Mills Brothers

New Spanish Two Step - Bob Wills

1954---Top Hits

Little Things Mean a Lot - Kitty Kallen

Hernando's Hideaway - Archie Bleyer

The Little Shoemaker - The Gaylords

Even Tho - Webb Pierce

1959 - The Shirelles song, "Dedicated To The One I Love", was released. The song only hit number 83 on "Billboard" magazine's Top 100 chart. When the song was re- released in 1961, it went to number three on the charts.

1960 --Democratic National convention nominates Senator John F Kennedy for president.

1962---Top Hits

The Stripper - David Rose

Roses are Red - Bobby Vinton

Al Di La' - Emilio Pericoli

Wolverton Mountain - Claude King

1963--- At the age of 43, Early Wynn pitches the first five innings to register his 300th win as the Indians down the Kansas City A's, 7-4. It will be his last major league win.

1968-Paul Simon and Art Garfunkel's album, "Bookends" is #1 for the third week in a row. That album along with the "Mrs. Robinson" soundtrack will give the duo 16 straight weeks at #1 on the L.P. charts.

1968-Steppenwolf's "Born To Be Wild" is released.

1970---Top Hits

Mama Told Me (Not to Come) - Three Dog Night

Ball of Confusion - The Temptations

Ride Captain Ride - Blues Image

He Loves Me All the Way - Tammy Wynette

1971 - At the All-Star Game at Tiger Stadium at Detroit, Michigan, Reggie Jackson hit a home run off Doc Ellis. The ball bounced off a light tower deep in right field. With a score of 6-4, the American League won the game.

1972 - Baltimore Colts owner Carroll Rosenbloom and Los Angeles Rams owner Robert Irsay proposed a unique trade to the NFL, when the wealthy businessmen traded teams.

1973 - During a concert at the John Wayne Theatre in Buena Park, California, the Everly Brothers broke up. Right in the middle of the concert Phil Everly walked off the stage, brother Don said, “The Everly Brothers died ten years ago.” They recently joined together to sing with the “Simon and Garfunkle” Tour, as both Paul Simon and Art Garfunkle have acknowledged they started singing together to become just like their idols, the Everly Brothers.

http://www.everly.net/

1974---George McCrae's "Rock Your Baby" begins the first of two straight weeks at #1.

1975---Dover, DE deluged with 8.5 inches of rain to establish a new 24 hour

record for the state

1974--Eric Clapton's "I Shot the Sheriff" is released.

1977 -- A key transmission line near Indian Point, NY took a lightning strike which resulted in a massive 24 hour blackout in New York City. Looting resulted in $1 billion loss.

http://sloan.stanford.edu/Blackout/archive/curvin_porter/

curvin_porter_toc.html

1978---Top Hits

Shadow Dancing - Andy Gibb

Baker Street - Gerry Rafferty

Take a Chance on Me - Abba

I Believe in You - Mel Tillis

1980 - Afternoon highs of 108 degrees at Memphis, TN, 108 degrees at Macon, GA, and 105 degrees at Atlanta, GA, established all-time records for those three cities. The high of 110 degrees at Newington, GA, was just two degrees shy of the state record

1982 - In Montreal, Canada, the first All-Star Game to be played outside the United States took place. For the eleventh consecutive year, the National League won when it defeated the American League 4-1.

1984- The Yankees retire Roger Maris (#9) and Elston Howard (#32) uniform numbers. The team also erect plaques in their honor to pay tribute to their achievements as Bronx Bombers..

1984 - When sportscaster Howard Cosell asked to leave "Monday Night Football," saying he was “tired of being tied to the football mentality." Roone Arledge gave him what he wanted, and a year later, Cosell was removed from television altogether.

1985 - Simultaneously, the "Live Aid" concert, for African famine relief, occurred in Philadelphia, Pennsylvania and London, England. Performances from JFK Stadium in Philadelphia, London's Wembley Stadium and other venues were broadcast world-wide and raising over $70 million. The all-day and most-of-the-night concert showcased some of rock 'n' roll's biggest names including Mick Jagger, Tina Turner, Madonna, Bob Dylan and Paul McCartney. The concert was attended by 162,000 people, while 1.5 billion people watched the show from their televisions. Bob Geldorf, singer for Boomtown Rats organized the "Live Aid" concert and was responsible for gathering the big name stars, all of agreed to perform without pay.

1985 - "A View to a Kill," from the James Bond movie of the same name, performed by Duran Duran, went to the top of the record charts, staying on top for two weeks. Both themes from James Bond movies, "Live and Let Die" by Wings and "Nobody Does It Better" by Carly Simon only reached number two on the record charts.

1986---Top Hits

Holding Back the Years - Simply Red

Invisible Touch - Genesis

Nasty - Janet Jackson

Hearts aren't Made to Break (They're Made to Love) - Lee Greenwood

1986 - Philadelphia Phillie Kent Tekulve broke the National League record for relief appearances for his 820th performance. He helped his team win in the 11-inning over the Houston Astros 5-4. The old record holder was Elroy Face of Pittsburgh.

1989 - A thunderstorm at Albany, GA, produced 1.40 inches of rain in forty minutes, along with wind gusts to 82 mph. Afternoon highs of 98 degrees at Corpus Christi, TX, 110 degrees at Tucson, AZ, and 114 degrees at Phoenix, AZ, equaled records for the date. Greenwood, MS, reported 55.65 inches of precipitation for the year, twice the amount normally received by mid July.

1995-Rush vocalist Geddy Lee sings "Oh Canada" before the All-Star Game at Baltimore's Camden Yards.

1995 - The temperature in Chicago, Illinois reached its all-time high -- 106 degrees (Fahrenheit) -- recorded at Midway Airport.

http://www.press.uchicago.edu/Misc/Chicago/443213in.html

1999 - Boston Red Sox pitcher Pedro Martinez became the first pitcher to open an All-Star Game with four strikeouts and fanned five in two dazzling innings to lead the American League to a 4-1 victory over the National League at Fenway Park.

|

----------------------------------------------------------------

![]()

Baseball Poem

|

Bases yanked.

Infield groomed.

Tarp pulled

to the edge of the outfield grass,

smoothed.

Lowered flags folded.

Hisst, hisst, hisst of brooms

sweeping aisles and ramps.

Section by section,

the lights go out

until the field is dark,

and the ghosts of players

gone

to other lives

long

for another game

on that sweet diamond.

-------------------------------------------------------------------------------

|

www.leasingnews.org |