Midwest Sales Representative

(as far east as Michigan, as far west as Colorado, as far

south as Texas, and as far north as Minnesota)

Construction, Trucking, Machine Tools, Waste Equipment

Credit application only up to $250K, vendor driven, fast approvals

Broker inquiries welcome

contact: Chris Chiappetta at chris@netlease.com

In the last 25 years National Machine Tool Financial has evolved into the premier outsource captive finance company for many major manufacturers.

www.netlease.com

|

Wednesday, November 23, 2011

(Please click on kettle to donate)

Today's Equipment Leasing Headlines

Navitas Gets California License!

Classified Ads---Senior Management

Reaction to Charles K. Schwartz Sentencing

New Business Volume Continues Up!

by Kit Menkin

Cartoon---Thanksgiving

Leasing News Advisors/Contributors:

Celebrating Thanksgiving

BancLease Acceptance Corporation Joins

Companies who notify lessee in advance of lease expiration

and require their discounter to also notify lessee in advance

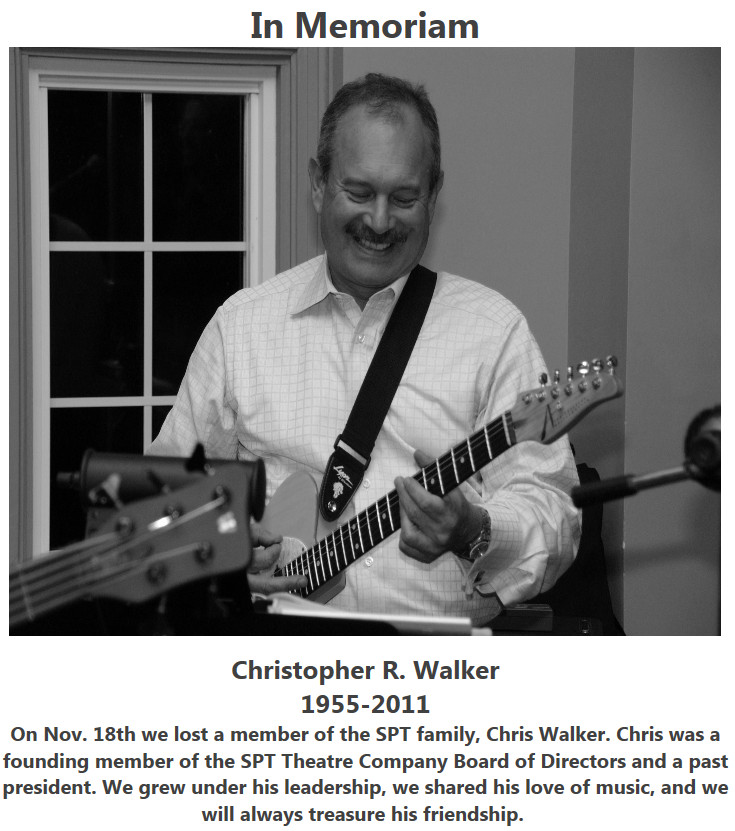

Chris Walker Memorial Fund

Classified Ads---Help Wanted

LEAF Commercial Capital Receives $125 Million of New Capital

Crit DeMent Re-Invents Himself

by Christopher Menkin

FDIC-Insured Institutions Earned $35.3 Billion

in The Third Quarter of 2011

Thanksgiving Movies

DVD Recommendations by Fernando Croce

80% Retail Executives Expect Holiday Sales

Greater Than or Equal to 2010

Larchmont, New York Adopt a Dog

News Briefs---

Revised GDP figures offer hope for final three months of 2011

Canadian retail trade inches up

J.R. Martinez grabs 'Dancing' title

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Steve Jobs fielded some customer service requests

You may have missed

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

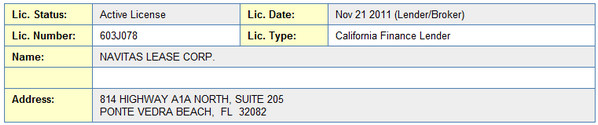

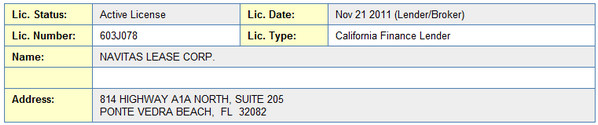

Navitas Gets California License!

Almost eight months since applying, that's how far behind the department is, Navitas Lease Corp. obtains a California Finance Lenders License, making both CEO Gary Shivers and Dwight Galloway, head of the RLC Leasing Division, extremely happy. They now can accept business in California.

This will be a very happy thanksgiving for the company and its employees, adding to this month’s news regarding the investment of Blue Mountain Capital of $22 million and $50 million expansion of its credit facility with Wells Fargo Capital Finance.

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Europe

25+ yrs exper. management roles Chase, AT&T Capital, Heller Financial, SFS. Develop biz from “scratch to success”. Looking for challenging & pioneering job.

Email: frans@alliedproperty.net |

NY, NJ, PA, DE

Proven abilities in Client Management, Business Development, Operational Efficiency, and Asset Management. Results-oriented, develops strategies to build and strengthen business, improve customer experience.

cedenicola15@yahoo.com/ resume |

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Southern CA

20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant.

Email: leasecfo@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Reaction to Charles K. Schwartz Sentencing

Charles K. Schwartz

CEO Allied Health Care Services

Born: September 18, 1953

Weight: 185 Pounds

Hair Color: Gray

Eye Color: Brown

Complexion: Light

(mug shot: Essex County Corrections Facility)

Tuesday morning the news of the sentencing was sent out using Constant Contact to subscriber, plus was added to our web site News Edition: Allied Health Care Service Founder and President Charles K. Schwartz, age 57, sentenced 16 years and three months in prison; ordered Schwartz to pay $80 million in restitution. He and his company are in bankruptcy. We haven't heard from the IRS regarding the fraudulent tax returns and escaped income on accelerated and straight line depreciation for non-existent equipment.

Jacob T. Elberg, Assistant United States Attorney, United States Attorney's Office, District of New Jersey, lead attorney, and his staff did an excellent job, speedy fashion, and they deserve great credit.

Compare it with the Equipment Acquisition Resources or HL Leasing, and maybe even Operation Lease Fleece, going on for years.

As for reaction, I can't print them, as the language is pretty strong and suggestions for what he should do, definitely "X-rated." Many different suggestions.

As for the reality, Schwartz will undoubtedly get 50% for time served (including before trial) and an extra 15% if he contributes extra work while in prison ( working in the library), so he could get out in 1/3 the time sentenced.

Bruce Donner, owner of Donner Medical Marketing, Inc. pleaded guilty to one count of mail fraud before U.S. District Judge Susan D. Wigenton in Newark federal court. Sentencing is scheduled for Jan. 11, 2012.

Leasing Companies and banks are out $80 million.

Kit Menkin, editor

Bloomberg Story on Sentencing:

http://www.bloomberg.com/news/2011-11-22/allied-health-care-founder-charles-schwartz-gets-16-years-in-leasing-fraud.html?cmpid=yhoo#

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

-----------------------------------------

Please send Leasing News to a colleague and ask them to subscribe.

No charge---We are Free!!!

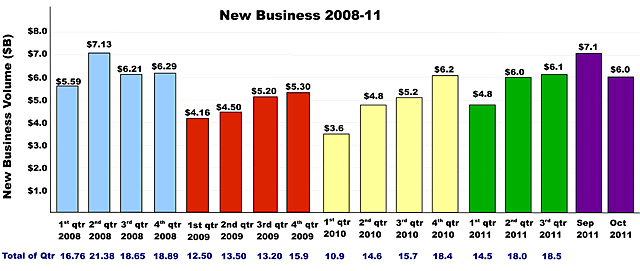

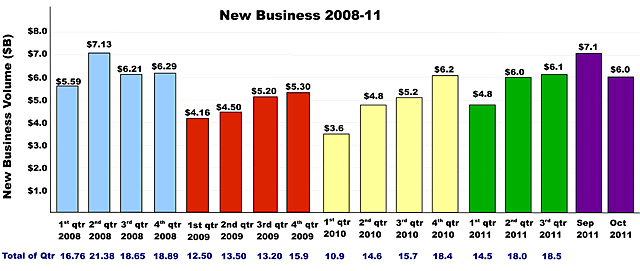

New Business Volume Continues Up!

by Kit Menkin

MLFI-25 New Business Volume

(Year Over Year Comparison)

click to make larger

(ELFA chart)

Despite the large drop from September, 2011 $7.1 billion new business volume, in comparing October with the third quarter, there is not much difference. As important, comparing the previous fourth quarters, and despite Congress trying to kill the economy to elect a new president, I am going to be bold to say the trend continues up, and the fourth quarter of 2011 will be the best in the last four years.

(Leasing News chart)

View the following charts where aging of receives has improved as well as and note credit approvals are steady as well as average losses, credit approval are steady.

From an employee’s viewpoint, the employee numbers are down, but from a management employer view, automation, software, internet applications, just plain efficiency has greatly improved to have so many positive numbers with fewer employees.

ELFA Charts

Aging of Receivables:

click to make larger

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

click image to make larger

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

click image to make larger

Total Number of Employees

(Year Over Year Comparison)

click image to make larger

The ELFA press release quotes Jim McGrane, President, EverBank Commercial Finance, a company grown from Tygris and its acquisitions the last few years.

Jim McGrane, President

“We were pleased to see healthy year over year new business volume growth in October coming off a strong quarter end. Portfolio performance continues to stand out with delinquencies and charge-offs hovering near historical lows—a comforting trend in this uncertain economic environment. Continued growth in investment in equipment and software along with a substantive increase in the Monthly Confidence Index causes us to have confidence in future industry performance.”

The November monthly Equipment Leasing and Finance Foundation reported the confidence level had risen from the October index of 50.7 to 57.4.

Thomas Jaschik, President, BB&T Equipment Finance

When asked about the outlook for the future, survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “For 2011 the industry is doing surprisingly well given the lackluster U.S. economy. The strong 2011 results for the industry can be attributed to historically low interest rates and the availability of 100 percent bonus depreciation.”

Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

“The industry seems to be faring better than most segments of the commercial lending markets. We are beginning to see activity of business expansion for some of our clients. We are also experiencing some level of a stronger cycle of equipment replacement underway. Although there is still much uncertainty, small businesses that are profitable are beginning to move forward at a more aggressive pace than we have seen in the past six months.”

Russell Nelson, President, Farm Credit Leasing Services Corporation

“Cautious optimism on current economic conditions improving modestly over the next 6-18 months, continued pent-up demand/need to replace equipment in the near term, and a favorable interest rate climate should drive continued increases in equipment finance volume."

Executive, Large Ticket, Bank

“Business activity remains steady despite the headline news about a potential double dip and economic head winds.”

ELFA MLFI-25 Participants

ADP Credit

BancorpSouth Equipment Finance

Bank of America

Bank of the West

BB&T Bank

BMO Harris Equipment Finance Company

Canon Financial Services

Caterpillar Financial Services

CIT

De Lage Landen Financial Services

Dell Financial Services

EverBank Commercial Finance

Fifth Third Bank

First American Equipment Finance

GreatAmerica

Hitachi Credit America

HP Financial Services

Huntington Equipment Finance

John Deere Financial

Key Equipment Finance

M&T Bank

Marlin Leasing

Merchants Capital

PNC Equipment Finance

RBS Asset Finance

SG Equipment Finance

Siemens Financial Services

Stearns Bank

Suntrust

Susquehanna Commercial Finance

US Bancorp Equipment Finance

Verizon Capital

Volvo Financial Services

Wells Fargo Equipment Finance

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Please send Leasing News and ask them to subscribe. We are Free!

----------------------------------------------------------------

Leasing News Advisors/Contributors:

Celebrating Thanksgiving

From advisors and contributors, in chronological order as asked for their Thanksgiving plans.

Emily Fitzpatrick, Recruiters International

"Spending time with family in Thanksgiving in Sunny South Florida.

"Recruiters International contributed to local Broward County Homeless Shelter for Thanksgiving meals - a little contribution can mean so much to a few families!"

Terry Winders, CLP

"We have a family gathering at our home in Louisville, Kentucky---and we also invite 6-7 single people that have no relatives."

Ed Castagna, InPlace Auction

"My parents live in Westbury, Nassau County, New York. Around the corner (within walking distance from our house) my sister Denise will be there as well as my dad, and the rest of the family. I’ve been finding some great Spanish wines lately (under $20) and will bring some. Try to find the 2009 Can Blau blend from Mont Sant. $19. It’s really good!

Ken Greene, Hamrick & Evans

"I will be staying home in Westlake Village, Southern California, with my family and our neurotic dogs. Doing nothing really, but in fact looking forward to doing nothing, something I have had far too little of lately. A few days of eating, napping, playing some music, and watching the raindrops, is more than I could ask for.

"Happy Thanksgiving to you, your family, the Board and theirs, and the LN readers."

Ken

Bruce Kropschot, The Alta Group

"We are having good friends from Philadelphia visit us in The Villages, Florida, for the Thanksgiving holiday. As usual, we will eat too much and promise to start dieting on Friday!

"Happy Thanksgiving to my Leasing News friends."

Bruce Kropschot

Tom McCurnin, Barton, Klugman & Oetting

"We had a washer hose break on our washer located on the second floor, and generate about 1,000 gals of water through our home, taking with it 4 ceilings and three floors, including our basement and our two furnaces.

"We will probably spend ThanksGiv huddled around our fireplace in the dark."

Tom

(Lives near USC, Los Angeles, California)

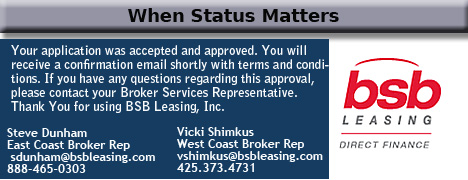

Don Myerson, BSB Leasing

"Tomorrow 11/22 I will hop on a plane from Denver and head to the beautiful island of Kauai to spend Thanksgiving with my beautiful wife and kids who left me stranded all alone for the past 10 days in the cold. I'll arrive just in time to cook up a traditional Thanksgiving meal for my family of 6 and 15-20 waifs and orphans that don't have anything or anyplace better to go. My wife cooks 362 days a year. Me? Thanksgiving, Christmas and Easter!

"While all my friends and co-workers freeze their crescent rolls off in Colorado, the family and I will be stuffing ourselves with all the traditional Thanksgiving fare including Macadamia Nut stuffing, Maui Sweet Potatoes’ Soufle', Turkey and Kailua Pork, my sister’s favorite Sagaponick Corn Pudding.

"After dinner we'll stroll down to Kit's favorite beach, Shipwreck beach to body board and work off dinner in the waves ( okay, I'll probably take a nap on the beach ! ) All this while giving thanks to God for all the blessings he has bestowed on me and my family.

“Have nothing to do? Please stop by. There is always room for one more."

Don

Rosanne Wilson, CLP, B.P.B, 1st Independent Leasing

"My husband told me that we are going to break all traditions this year. He said ‘I won't let you slave at the stove for days and have you fussing over the kids and grandkids and getting yourself all worn out like you do every year.’ Instead, he is taking me to Spirit Mountain Casino, Grand Ronde, Oregon * to enjoy the wonderful Thanksgiving buffet with over 100 items to choose from.

“Thanksgiving has always been in our home so I had to gently tell the kids we won't be home for Thanksgiving this year. They actually took the news well and told us to have a wonderful time. It was easier than I thought! Maybe you folks ought to try it some time. After we finish our buffet, I hope to try my luck on the slot machines and the Blackjack table. I'm feeling lucky!

"Happy Thanksgiving everyone."

Rosanne

Allan Levine, Madison Capital

"My wife and I are headed from Baltimore, Maryland to Westchester, New York, to spend the Holiday with one of my three children, her husband, and 2 of my 6 grandchildren. My son-in-law is a gourmet cook and will slave to get Turkey day food ready for 14 guests. While working away, he and I will analyze the economy, and anything else in the world that needs "FIXIN". In theory, we will solve most of the world problems (or, maybe the vodka will). I will play with the kids, then sit back and watch some football. My wife will charge her batteries and rest up for Black Friday NY shopping. No jealousy here."

“And, for this snap shot in time, I will give thanks for my family’s health and happiness.

Best wishes and be safe. “

Allan

Phil Dushey, Global Financial Services

“Usually every year for the last 15 years or so, my wife and I have gone away for the holiday. Sometimes alone or with friends or even one of my children. This year we have decided to have an old fashioned Thanksgiving dinner. We are going to one of my daughters home in Manhattan, only twenty minutes from home, and all of my children and grandchildren are getting together to celebrate. Everyone is cooking and bringing food and I am sure to gain at least five pounds. We should have about twenty of us.

“This has been a challenging year for me as well as for most of the people I know. I am sixty seven years old and have never seen the world in such an unstable position as we have now and the future is very unsure. For me the only thing that is real is the family I have built and Thanksgiving is a time to reflect and get in touch with the true happiness that surrounds us. This Thanksgiving give everyone in your family extra hugs and kisses. Put any problems you have in life on the side and truly be happy. This is a great time of the year so take a little time out and “ENJOY WHAT IS REALLY IMPORTANT.”

Happy Thanksgiving Phil Dushey

Andrew Lea, NetSol

"My wife Susan and I will be joining with other family members at the home of her sister and brother-in-law. Their place (where Susan and I were married 3-1/2 years ago) is in Inverness, California, on the western edge of Marin County, just north of San Francisco. It overlooks the Point Reyes National Seashore, adjacent to the Pacific. And -- in keeping with local custom -- the meal will be a crab feed -- and a celebration of the opening of the new crab season here in the Bay Area."

Happy Thanksgiving to all,

Andrew

Hugh Swandel, the Alta Group

"The Canadian Thanksgiving was October 10th this year. I plan to avoid all airports and spend some time at home with my family."

Hugh Swandel

Fernando Croce, Motion Picture Critic/Reviewer

“I will be visiting my parents and brothers in Southern California for a big turkey dinner, and hopefully catch up with the platter of Oscar hopefuls opening this weekend."

“Have a marvelous Turkey Day!”

Fernando

Cupertino, California

Shawn Halladay, The Alta Group

"I am returning to SLC (via a day in Toronto) after visiting my son in Auburn, California I will meet my daughter in the airport, as she is flying in from Oregon for the holiday. We will then swing by home and pick up my wife, Karen, and drive to Great Falls, Montana to spend Thanksgiving with her sister and family. Nothing traditional with them, other than good food and fun, but we always stop at Smittie's Pancake House in Idaho Falls on the way and can pretty much count on a blizzard or crazy road conditions between Butte and Helena. No special wine, but we are bringing the Yukon Gold spuds!"

Shawn

Bernie Boettigheimer, CLP, Lease Police

“Three generations of the Boettigheimer family, with the exception of one grandson who will be sorely missed, will congregate at our house in Dallas on Thursday. We have much to be thankful for this year and our mid –day turkey and trimmings will be in celebration that we still live in the greatest country in the world. After the good food, fine wine and lively conversations about all current events we’ll settle down at 3:15 PM to watch the Cowboys play. GO COWBOYS!”

Bernie

Ginny Young, retired Leasing

“My husband and I will be spending Thanksgiving at our second home in Lake Arrowhead, CA. My sister Linda from Three Rivers, CA will join us. Another sister, Loni and 4 of her adult sons and her 17 year old daughter will be with us too. They all live in Lake Elsinore, CA.

We will eat a lot of great food (Linda is a chef), play poker and various board games, and sit in front of the fire and drink very fine California Cabernet. I am still rehabbing from knee replacement surgery, so I don't have to do anything except open the front door and let everyone in. I will be spoiled this long weekend.

“The Happiest of Thanksgivings to all of you.”

Ginny

John Kenny, Receivables Management

"We'll be cooking up a traditional New England Thanksgiving Feast.

(John lives on a farm in Mohawk, New York, upper state, and his barn holds his office. editor)

"The turkey will be soaking in apple cider and sage starting tonight. It ought to be nice and juicy and flavorful after roasting in our wood-fired brick oven. Homemade cornbread for the stuffing.

"The squash, potatoes, onions and herbs will all be home-grown (though there will not be much more than mashed potatoes, gravy and turkey on my plate). We even make the cranberry sauce from scratch.

"Since family will be out of town, we don't have to leave the house and we don't have to entertain, except for one very special friend. I'll be thankful for that. Oh, and I get the couch after dinner.

"Happy Thanksgiving, to you, your family and everyone reading this."

John Kenny

Rick Jones, webmaster

After three years in California, I will be back in Florida with family. For the first time in about 10 years all my brothers and sisters will be celebrating Thanksgiving toghether. Needless to say my mom and dad are very happy.

All told we will have 17 people eating a traditonal Thanksigiving dinner, including a turkey and a ham. My mom will bake three or four pies for the grand feast. The women will do the cooking and the men will watch football....I guess we are stuck in the 60's!

Best of wishes to all on Thanksgiving and thank you for reading Leasing News.

Rick Jones

Kit Menkin

“Thanksgiving is often just the two of us as the kids go to their inlaws. Christmas is the big holiday here, the night before with a traditional fresh San Francisco Dungeness crab dinner, the morning with great Frittata, and evening dinner with roast beef, Yorkshire pudding, garlic mashed potatoes, stuffing, and pumpkin and lemon meringue pie. I can’t wait.

“Sue’s youngest daughter, single, who is an on line chef at a 1 star Los Gatos restaurant, will make Thanksgiving this year, and has invited a very close friend who’s father died of cancer last year, and a friend from New York, who’s family is back east. It will be Gourmet and haven’t decided the wine, perhaps 2001 Paraduxx from Duckhorn Vineyards and French or California Beaujolais Nouveau (the French 2011 didn’t get good reviews, plus the California has more fruit—I’ll buy Wednesday). And yes, beer with Thanksgiving. I let people choose. I like having the young people for dinner as they laugh at my jokes and humor (everyone else has heard the stories or viewpoint before, I am told).”

Happy Thanksgiving

Kit and Family

* Spirit Mountain, Grand Ronde, Oregon is about a one hour drive from where I live & very close to the Oregon Coast. It is owned and operated by the Confederated Tribe of the Grand Ronde Indians. Oregon is big Indian country and has many different tribes here. They are allowed to open Casinos, but private companies cannot. I've visited several of the Casinos in Oregon and they are all fabulous. They have great entertainment shows as good as Las Vegas. The buffet at Spirit Mountain is unbelievable.

http://spiritmountain.com/casino

Rosanne Wilson, CLP

[headlines]

--------------------------------------------------------------

BancLease Acceptance Corporation Joins

Companies who notify lessee in advance of lease expiration

and require their discounter to also notify lessee in advance

Banclease Acceptance Corporation

8200 Springwood Dr., Ste 240

Irving, TX 75063

"The 10% residuals we write are PUT’s which the lessee has to pay/ contractual payment w/ no payment continuation if they miss the date. They are just required to pay the PUT. The pure FMV’s leases we write are just that: pay the then FMV, return the equipment or re-lease for a reduced amount agreed upon by both parties/ not evergreen/ no automatic payment continuation. Most of the FMV leases we write are $1MM+ w/ negative stream rates to large hospitals for tier one medical equipment, who typically return the equipment @ the end of term.

"We are always fair with our lessees & try to notify them on all $1.00 out; however if they miss the day we still honor the $1.00 out. Executing/ enforcing an evergreen clause on a $1.00 out lease in our opinion is just wrong/ unfair."

Ron Mitchell, SVP

(click on name to go to their statement)

Full List:

http://www.leasingnews.org/Pages/lease_expiration.html

|

Gary DiLillo, President

216-658-5618 or gary@avptc.com

Comprehensive personal property tax outsourcing services.

Click here to see what our clients say about us. |

Leasing Industry Help Wanted

Midwest Sales Representative

(as far east as Michigan, as far west as Colorado, as far

south as Texas, and as far north as Minnesota)

Construction, Trucking, Machine Tools, Waste Equipment

Credit application only up to $250K, vendor driven, fast approvals

Broker inquiries welcome

contact: Chris Chiappetta at chris@netlease.com

In the last 25 years National Machine Tool Financial has evolved into the premier outsource captive finance company for many major manufacturers.

www.netlease.com

|

Tempe, Arizona

5 Independent Sales Representatives

Most Aggressive Commission Plan • Supplier Leads

From Distribution & Manufacturer Semi-Captive Programs

• Fantastic Work Environment • Experienced Sales Only

Full Job Description Click Here

www.leasestation.com

|

National Sales Representative

Direct, vendor based, small ticket ($10K-150K) leasing company

looking for experienced sales representatives.

If you need more support, flexibility

and a

stronger source of funds call Falcon.

Want to learn more - click here

www.falconleasing.com

|

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Chris Walker Memorial Fund

"Chris was a past president of the board of this small professional theatre group during its fledgling days. He enjoyed their work, their creativity, and friendship. Chris's widow, Jean, said SPT is aligned with his wishes."

Matt Doty, Vice President, Corporate Communications,

GreatAmerica Leasing

To Donate

(Bottom of page)

http://www.spttheatre.org/Giving.aspx

[headlines]

--------------------------------------------------------------

#### Press Release #############################

LEAF Commercial Capital, Inc. Receives $125 Million of New Capital

LEAF Commercial Capital, Inc. (“LEAF” or the “Company”), a leading independent equipment leasing and finance company, announced the recent closing of a $50 million growth equity investment from Eos Partners, L.P. and its affiliates (“Eos”), a New York based private investment firm. In connection with the Eos investment, LEAF also closed on $75 million of additional debt financing with Versailles Assets LLC, an asset-backed commercial paper conduit sponsored by Natixis, which increases the Company’s securitized and syndicated warehouse facility to $185 million in aggregate. The warehouse facility is managed by Guggenheim Securities, LLC (“Guggenheim Securities”). The $125 million of incremental financing provided by Eos and Natixis will further support the expansion of the LEAF platform and its growing origination volume. FBR Capital Markets & Co. (“FBR”) advised LEAF in connection with the equity financing.

LEAF Commercial Capital, Inc. (“LEAF” or the “Company”), a leading independent equipment leasing and finance company, announced the recent closing of a $50 million growth equity investment from Eos Partners, L.P. and its affiliates (“Eos”), a New York based private investment firm. In connection with the Eos investment, LEAF also closed on $75 million of additional debt financing with Versailles Assets LLC, an asset-backed commercial paper conduit sponsored by Natixis, which increases the Company’s securitized and syndicated warehouse facility to $185 million in aggregate. The warehouse facility is managed by Guggenheim Securities, LLC (“Guggenheim Securities”). The $125 million of incremental financing provided by Eos and Natixis will further support the expansion of the LEAF platform and its growing origination volume. FBR Capital Markets & Co. (“FBR”) advised LEAF in connection with the equity financing.

Headquartered in Philadelphia, PA, LEAF was launched in January 2011 with initial funding from Resource America, Inc., Resource Capital Corp., and Guggenheim Securities. The Company works closely with leading commercial equipment vendors and manufacturers to help them maximize revenues by offering competitive small- and mid-ticket financing solutions to their customers. LEAF currently has over $640 million of assets under management and recently closed a $105 million term securitization which was underwritten by Guggenheim Securities and rated by Moody’s and DBRS. Resource America, Inc. and Resource Capital Corp. continue to maintain a significant investment in LEAF and, together with Eos, are committed to supporting LEAF’s long-term business objectives.

Crit DeMent, LEAF’s Chairman and CEO, stated, “We are delighted to have closed this financing and are excited about the opportunity to partner with Eos. The investment that Eos has made in our company is a validation of our management team, corporate capabilities and creative marketing strategies. We value their sponsorship of our business and look forward to leveraging their experience with growth companies and their expertise in the capital markets. We believe that the additional financing provided by Eos and Natixis significantly strengthens our leasing platform and will enable us to continue providing the equipment financing industry with a strong and forward thinking resource, one that will transform the way the market perceives the value of a financing partner.

Brendan Moore, a Principal of Eos, said, “We believe that LEAF represents a compelling opportunity to leverage an established platform with an experienced and proven management team and help build a market leading independent commercial finance company. Our investment will enhance LEAF’s ability to execute on its growth strategy and expand its offering to meet the ever changing demands of the markets and the customers that the Company serves.”

About LEAF Commercial Capital, Inc.

LEAF Commercial Capital, Inc. ("LEAF") is a national equipment leasing and finance company headquartered in Philadelphia, PA, with a sales and service center in Moberly, MO and a call center in Orange County, CA. LEAF's core competency is the ability to assist vendors and manufacturers in maximizing financing as a revenue generating strategy. For more information, please visit http://www.LEAFnow.com.

About Eos Partners

Formed in 1994, Eos is a private investment partnership with approximately $1.6 billion of capital under management. In its private equity activities, Eos focuses on working closely with management teams and committing its understanding of strategic alternatives and the financial markets to help grow these businesses into larger scale enterprises. For more information, please visit http://www.eospartners.cm.

About Natixis

Natixis is the corporate, investment and financial services arm of Groupe BPCE, the second-largest banking group in France. With around 22,000 employees, Natixis specializes in three main business lines: Corporate and Investment Banking, Investment Solutions (asset management, insurance, private banking, private equity), and Specialized Financial Services. Versailles Assets LLC is an asset-backed commercial paper conduit administered by Natixis. Versailles Assets LLC is rated A-1/P-1 and provides securitized funding to a wide variety of US clients.

About Guggenheim

Guggenheim Partners, LLC, the parent of Guggenheim Securities, LLC, is a privately held global financial services firm with more than $125 billion in assets under management. The firm's businesses include investment management, investment advisory, insurance, investment banking and capital markets services. The firm is headquartered in Chicago and New York with a global network of offices throughout the United States, Europe and Asia. For more information, please visit http://www.guggenheimpartners.com.

About FBR

FBR & Co. (FBR) provides investment banking, merger and acquisition advisory, institutional brokerage, and research services through its subsidiary FBR Capital Markets & Co. FBR focuses capital and financial expertise on the following industry sectors: consumer; diversified industrials; energy & natural resources; financial institutions; insurance; real estate; and technology, media & telecom. FBR Fund Advisers, Inc., a subsidiary of FBR, provides clients with a range of investment choices through The FBR Funds, a family of mutual funds. FBR is headquartered in the Washington, D.C. metropolitan area with offices throughout the United States and in London. For more information, please visit http://www.fbr.com.

About Resource America, Inc.

Resource America, Inc. is a specialized asset management company that uses industry specific expertise to generate and administer investment opportunities for its own account and for outside investors in the real estate, commercial finance, and financial fund management sectors. For more information please visit our website at http://www.resourceamerica.com or contact Marketing and Investor Relations at pkamdar@resourceamerica.com.

About Resource Capital Corp.

Resource Capital Corp. is a commercial real estate specialty finance company that qualifies as a real estate investment trust, or REIT, for federal income tax purposes. RSO's investment strategy focuses on commercial real estate-related assets and, to a lesser extent, higher-yielding commercial finance assets. RSO invests in the following asset classes: commercial real estate-related assets such as whole loans, A-notes, B-notes, mezzanine loans, mortgage-related securities and real estate joint ventures, and commercial finance assets such as other asset-backed securities, senior secured corporate loans, lease receivables, trust preferred securities, structured notes and debt tranches of collateralized debt obligation

##### Press Release ############################

[headlines]

--------------------------------------------------------------

Crit DeMent Re-Invents Himself

by Christopher Menkin

Crit DeMent

CEO, LEAF Business Capital

Chairman, LEAF Financial Corp.

CEO, LEAF Commercial Capital

CEO, LEAF Dealer Solutions

Sr. VP, Resource America

Sr. VP, Resource Capital Corp.

ELFA Chairman

The announcement above of $125 million in new capital for LEAF Commercial Capital, Inc, the successor of LEAF Financial and its funds, show Leaf may be expanding its sub-debt facilities. Sure a lot of companies in a very long press release as if there is “meat” in it, rather than the long time fluff and artificial flavorings.

LEAF doesn’t communicate with Leasing News, as we see through the press releases and bring up the facts. It appears to me the sub-debt loans will be used to park transactions until they can be tranched into the take-out facilities provided by Guggenheim. Being LEAF Commercial has no real equity, it has to borrow equity in the form of structured sub-debt. Although it appears they have the Cohens of Resource America behind them, the situation is all the assets are secured, except for new business. All the equity is spoken for. They have to re-invent themselves. DeMent is a genius at this, and has done it before as noted in Leasing News.

Through LEAF 2010-4, LEAF securitized approximately $200 million of leases, term funded by the issuance of Contract Backed Notes on behalf of LEAF Equipment Leasing Income Fund III, L.P. ("LEAF III"), one of the investment partnerships it manages. Guggenheim Securities, LLC, was the arranger of the notes and LEAF will continue to be the servicer for the assets.

The new announcement shows LEAF Commercial has at least $125M of capacity to buy deals and park them temporarily, but their portfolio capacity is limited to their Guggenheim take-out facilities.

Will they or can they secure other take-out facilities? The contacts that Crit DeMent has at Equipment Leasing and Finance Association (ELFA) may make it a real possibility. If there is one thing you can learn, EFLA executives help each other out in many ways, and like the two other leasing associations, they establish not only networking but friends who know and help each other as they have gotten to know each other. This is perhaps one of the best reasons to join a leasing association, particularly ELFA.

The Monitor magazine (1) shows 2010 new business volume for LEAF at $115,700,000, below the volume of Financial Pacific at $122 million and Marlin at $134 million. The gross may be impressive, but the net profit is not shown here for LEAF (Marlin was all in Evergreen, as stories written and not that impressive, even then.)*

Looking at LEAF, the LEAF Financial main 10Q for Fund I in 2009 almost 10% (9.47%) of the portfolio was non-performing. Charge-offs jumped to 15.37% in 2010 and still ended up with 7.4% of the remaining portfolio as non-performing. Obviously trying to hold off charge-offs in 2009 didn’t work and they had to write them off in 2010. The 15.37% number shows that before the economic downturn started Leaf Fund I was obviously buying junk.

| (in millions) |

Fund IIII |

Fund III |

Fund II |

| 2008 |

|

-$17.7 |

-$7.4 |

| 2009 |

-$22.6 |

-$28.8 |

-$14.4 |

| 2010 |

-$22.1 |

-$26.1 |

-$7.8 |

| 3/31 |

-$7.2 |

-$2.2 |

-$1.5 |

| |

|

|

|

Footnote "A"

Fund IIII went from $526.7 million September 30, 2009 to $293.0 million March 31, 2011

Fund III went from $499.7 million December 31, 2007 to $157.5 million March 31, 2011

Fund II went from $343.3 million December 31m 2007 to $72.2 million March 31, 2011.

The year-end 10-K shows 1 general partner and 433 limited partners.

(page 6, year-end 10k) showing year-end:

(in millions)

2006 +$1.08

2007 -$1.45

2008 -$3.64

2009 -$27.92

2010 -$17.84

((page 7, year-end 10k (5))

http://leasingnews.org/archives/Jun2011/6_22.htm#leaf_investor

The press releases now being issued attempt to show activity, how much there is will know in nine months, as the Resource America statements lag ( September Year-End SEC in September).

It is certainly a plus that Crit DeMent is the incoming chairman of the Equipment Leasing and Financial Association, where he has made many relationships with other executives and opened many doors.

The marketplace appears to be warming up, too, and the time is "right on" for LEAF to become more active in the marketplace, marketplace, joining veteran Tom Depping's Ascentium Capital, former Marlin President' Gary Shiver's Navitas Lease (teamed with Dwight Galloway and his broker following, even Steve Hudson Element Financial on the hunt. It also does not reflect the many "middle market" companies formed the last six months, or the entrance of small banks wanting to obtain leasing as one of the products they can offer to their business customers (or help in obtain more good business customers).

There has been a void in the small ticket marketplace, especially with the so-called limiting of broker business, meaning most of the new companies want to limit their indirect production (this is not true with all, but is a "face" that they put on.)

The changes by US Manifest, Pentech, and other such company void have changed the broker small ticket market place.

Bud Callahan, President, of the National Association of Equipment Leasing Brokers believes brokers at their associating complete a total of $1.5 to $2 billion a year. Using the Equipment Leasing and Finance Association number of $581 billion in yearly sales, it appears to be a very small percentage. **

The Monitor magazine showed 100 top financial industries new business volume doing $164.5 billion in new business originations. In this group, GE Capital showed (in billions) $30.1 John Deere Financial, showed $20.7, IBM Global Financing $10.6, and Bank of America Leasing $9.8., Caterpillar Financial, $9.4, CNH Capital, $7, wells Fargo Equipment Finance $6, Hewlett-Packard Financial $5.9, Volvo $4.8, most captives.

In the top 5 segment leaders, Captives lead by $55.8 billion with bank and foreign affiliates $5.9 ( a auto fleet, a truck fleet, a train fleet and then Great America Leasing $516 million and CSI Leasing, $511 million. The Monitor magazine reported captives up 11.2% in originations, leading the segments by 46%.

Compared to these numbers, there is definitely room for LEAF to expand.

As for the disparity with GE or John Deere, the disparity is not unusual to the financial community as in 2010, 19 banks held more than $100 billion in assets, with the top five holding 60. (2) In addition, these are captives leasing the products they product such as Caterpillar, GE, HP, John Deere, to name a few, as well as many of the others are auto and truck fleet companies leasing their products.

The question then becomes can LEAF overcome its Evergreen reputation, former treatment of brokers and others, and turn a new leaf? Have they burned too many bridges? Dement has done it before, but does he have the energy to do it again?

* http://www.leasingnews.org/Conscious-Top%20Stories/Marlin_Leasing_2008.htm

**Bud Callahan projected this on having 500 members, and added previous years it may have been more. It also should be noted that the number did not reflect “all” brokers. The number is difficult to compute and may be as many as 5,000 or more in one manner or another. Chambers of Commerce rarely have more than a very small percentage of businesses in their community as members; however, they often have almost all the leading businesses.

(1) Monitor Industry Top Companies, Special Issue, Volume 38, No.4

(2) Growth of Large Banks

http://leasingnews.org/archives/Sep2011/9_19.htm#bank_beat

Top 50 banks—Current

http://leasingnews.org/archives/Oct2011/10_14.htm#banks

John Kenny Receivables Management

www.jrkrmdirect.com

• End of Lease Negotiations & Enforcement

• Fraud Investigation

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

The Solution to Your Credit & Accounts Receivable Needs

John Kenny

315-866-1167 | John@jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations and

background information provided by John Kenny)

#### Press Release ##############################

FDIC-Insured Institutions Earned $35.3 Billion

in The Third Quarter of 2011

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported an aggregate profit of $35.3 billion in the third quarter of 2011, an $11.5 billion improvement from the $23.8 billion in net income the industry reported in the third quarter of 2010. This is the ninth consecutive quarter that earnings registered a year-over-year increase.

Acting Chairman Martin J. Gruenberg

"We continue to see income growth that reflects improving asset quality and lower loss provisions," said FDIC Acting Chairman Martin J. Gruenberg. "U.S. banks have come a long way from the depths of the financial crisis. Bank balance sheets are stronger in a number of ways, and the industry is generally profitable, but the recovery is by no means complete.

"Ongoing distress in real estate markets and slow growth in jobs and incomes continue to pose risks to credit quality," Acting Chairman Gruenberg added. "The U.S. economic outlook is also clouded by uncertainties in the global economy and by volatility in financial markets. So even as the banking industry recovers, the FDIC remains vigilant for new economic challenges that could lie ahead."

As was the case in each of the last eight quarters, lower provisions for loan losses were responsible for most of the year-over-year improvement in earnings. Third-quarter loss provisions totaled $18.6 billion, almost 50 percent less than the $35.1 billion that insured institutions set aside for losses in the third quarter of 2010.

A majority of all institutions (63 percent) reported improvements in quarterly net income from a year ago. Also, the share of institutions reporting net losses for the quarter fell to 14.3 percent, down from 19.5 percent a year earlier. The average return on assets (ROA), a basic yardstick of profitability, rose to 1.03 percent, from 0.72 percent a year ago.

Asset quality indicators continued to improve as noncurrent loans and leases (those 90 days or more past due or in nonaccrual status) fell for a sixth consecutive quarter. Insured banks and thrifts charged off $26.7 billion in uncollectible loans during the quarter, down $17.2 billion (39.2 percent) from a year earlier.

Financial results for the third quarter and the first nine months of 2011 are contained in the FDIC's latest Quarterly Banking Profile, which was released today. Also among the findings:

Loan portfolios grew slowly for the second consecutive quarter. Loan balances posted a quarterly increase for the second quarter in a row and for only the third time in the last 12 quarters. (The first increase, in the first quarter of 2010, reflected the rebooking of securitized loans onto banks' balance sheets as a result of new accounting rules, not an actual increase in lending.) Total loans and leases increased by $21.8 billion (0.3 percent), as loans to commercial and industrial borrowers increased by $44.8 billion and residential mortgage loan balances rose by $23.7 billion. Loans to other depository institutions declined by $37.1 billion (25.3 percent), reflecting the elimination of intra-company loans reported in the second quarter between two related institutions that merged in the third quarter.

Large institutions again experienced sizable deposit inflows. Deposits in domestic offices increased by $279.5 billion (3.4 percent) during the quarter. Almost two-thirds of this increase ($183.8 billion or 65.8 percent) consisted of balances in large noninterest-bearing transaction accounts that have temporary unlimited deposit insurance coverage. The 10 largest insured banks accounted for 75.7 percent ($139.1 billion) of the growth in these balances.

The number of institutions on the FDIC's "Problem List" fell for the second quarter in a row. The number of "problem" institutions declined from 865 to 844. This is the second time since the third quarter of 2006 that the number of "problem" banks has fallen. Total assets of "problem" institutions declined from $372 billion to $339 billion. Twenty-six insured institutions failed during the third quarter, four more than in the previous quarter, but 15 fewer than in the third quarter of 2010. Through the first nine months of 2011, there were 74 insured institution failures, compared to 127 failures in the same period of 2010.

The Deposit Insurance Fund (DIF) balance continued to increase. The DIF balance — the net worth of the fund — rose to $7.8 billion at September 30th from $3.9 billion at June 30th. Assessment revenue and fewer expected bank failures continued to drive growth in the fund balance. The contingent loss reserve, which covers the costs of expected failures, fell from $10.3 billion to $7.2 billion during the quarter. Estimated insured deposits grew 3.6 percent in the third quarter. Much of this increase is attributable to the growth in balances exceeding $250,000 in noninterest-bearing transaction accounts, for which the Dodd-Frank Act temporarily extended unlimited insurance coverage through the end of 2012.

The complete Quarterly Banking Profile is available at http://www2.fdic.gov/qbp on the FDIC Web site.

# # #

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation's banking system. The FDIC insures deposits at the nation's 7,437 banks and savings associations, and it promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars — insured financial institutions fund its operations.

### Press Release ###############################

Leasing News:

Special Thanksgiving Edition

By Fernando F. Croce

As end-of-year holidays quickly pile up, it’s important to not lose track of the things that really matter, like health, family, and a good movie. So for this upcoming Thanksgiving, we’re recommending a slew of savory cinematic treats to go with your turkey gravy and pumpkin pie. Enjoy!

A Charlie Brown Thanksgiving (Bill Melendez & Phil Roman, 1973): No holiday gathering is complete without a visit from the Peanuts gang. In this short but delightful animated TV special, Charles M. Schultz’s characters come to face such Turkey Day challenges as getting the family together and getting the right meals cooked. When Peppermint Patty and friends invite themselves over to Charlie Brown’s house, he must whip up a holiday special even though he’s supposed to be going to his grandmother’s house. Throw in lessons about what Thanksgiving really stands for and Snoopy and Woodstock in pilgrim costumes, and you have a tip-top Peanuts feature.

Planes, Trains & Automobiles (John Hughes, 1987): Steve Martin and John Candy make a n unbeatable odd couple in this hilarious and ultimately poignant comedy from director John Hughes (“The Breakfast Club”). Smooth advertising exec Neal (Martin) and brash salesman Del (Candy) make unlikely traveling companions, but when their flight is grounded by snow, the two are stuck on a madcap road trip. Can they make it home in time for Thanksgiving—or, more to the point, before they kill each other? There are several unforgettable jokes and characters along the way, but what makes the movie such an enduring treat is the warm and expert chemistry between Martin and Candy.

Scent of a Woman (Martin Brest, 1992): Al Pacino won a long-overdue Best Actor Oscar for his fierce portrayal of Lt. Col. Frank Slade, a crotchety and unpredictable blind man who teaches his naïve guide Charlie (Chris O’Donnell) about life while on a holiday trip. Several of the scenes, such as Frank’s tango session with a young woman and his climatic speech to a college of preppies, are often seen as modern classics. Even more memorable, however, is his tension-cracked Thanksgiving dinner with estranged relatives, a terrifically handled bit of familial hostility that’s sure to make audiences appreciate their own holiday gatherings.

The Ice Storm (Ang Lee, 1997): Family has always been one of versatile director Ang Lee’s concerns, a concern that he examines in this sensitive, beautifully acted portrait of tensions and secrets emerging in suburban Connecticut during the Thanksgiving weekend. The year is 1973, and the Hood and Carver families are struggling not to spin out of control in the face of national crisis. Will the festivities bring them together, or will their troubles merely grow larger? A melancholy but thoughtful and ultimately hopeful tone and splendid performances from a first-rate cast (including Kevin Kline, Joan Allen, Sigourney Weaver and Christina Ricci) make this a must.

The New World (Terrence Malick, 2005): No film more movingly depicts the first interactions between Native Americans and European settles than this beautiful epic from master director Terrence Malick (“Days of Heaven,” “The Thin Red Line”). Offering a sweeping panorama of the nation’s nascent period, it sensitively depicts the relationship between explorer John Smith (Colin Farrell) and young native princess Pocahontas (Q’Orianka Kilcher), who develop a profound love for each other despite the many and often violent differences between their cultures. Offering an emotional, visually sublime vision of hope between human beings and nature, this masterpiece is certainly something for every movie lover to be thankful for.

### Press Release ############################

Eighty Percent of Retail Executives Expect Holiday Sales

Greater Than or Equal to 2010

More Than One Third Expect Sales To Increase On Black Friday

Social Media Will Help Drive Consumers To Stores

NEW YORK----According to the third annual Retail Finance Outlook (taken in September) study released by CIT Group Inc. (NYSE: CIT) 80% of retail executives expect their Holiday sales to increase or remain the same as last year.

“In what has been an otherwise mixed season thus far, retailers are doing whatever they can to maximize their holiday sales season”

Among the notable shopping days this Holiday Season, more than one-third of executives expect Black Friday sales to increase this year; more than a quarter expect Cyber Monday (November 28) sales to be up and nearly a quarter expect Super Saturday (December 24) sales to increase. In addition, sensing that price-conscious consumers will again be on the look-out for bargains, 37% predict an increase in last-minute shopping, while 38% expect post-Christmas shopping days to be stronger.

One way retailers hope to draw consumers to their stores is through social media. The CIT study also found that nearly 60% of executives are shifting marketing dollars away from old media toward new media, such as social media campaigns. As part of that shift, 68% report increases in marketing and deals through social media channels, including Facebook and Twitter. In addition, 63% report that their Web sales are growing (28%) or growing faster than other channels (35%).

“In what has been an otherwise mixed season thus far, retailers are doing whatever they can to maximize their holiday sales season,” said Burt Feinberg, Group Head of CIT Commercial & Industrial. “This preparation includes shifting marketing dollars away from old media toward new media to get the consumer in the door or on their Web site.”

About the Study

The information in this study is based on the results of a September 2011 survey of 100 executives at U.S. middle market retail companies (annual revenues of $25 million to $1 billion) conducted by Forbes Insights the strategic research practice of Forbes Media. Almost half (49%) of the companies had revenues of less than $100 million; 29% had revenues of $500 million or more. Almost three-quarters of respondents (73%) had titles of director or above; 41% were owners or C-level executives (CEO, CFO, CTO, CIO, etc.). forbes.com/forbesinsights

About CIT

Founded in 1908, CIT (NYSE: CIT) is a bank holding company with more than $34 billion in finance and leasing assets. A member of the Fortune 500, it provides financing and leasing capital to its more than one million small business and middle market clients and their customers across more than 30 industries. CIT maintains leadership positions in small business and middle market lending, factoring,retail finance, aerospace, equipment and rail leasing, and global vendor finance. cit.co,

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Larchmont, New York -- Adopt-a-Dog

“Foxy is a 2 year old beagle mix. She is a cute as they come. She loves kids, dogs and does not pay much attention to cats. Foxy loves laying in the sun and lounging around. She is housebroken and sleeps through the night in her dog bed in her foster parents room. Foxy is very much a people person and would do best in a home where someone is home most of the day. If you are looking for a loyal companion this is the dog for you.”

Video:

http://www.youtube.com/watch?v=6BrsAYfOIcI

Pet Rescue

P.O. Box 393

Larchmont, NY 10538

Phone: (914) 834-6955

Fax: (914) 834-0713

Email us: petrescueny@aol.com

Pet Rescue is not a shelter.

Our rescues live in foster homes until they are ready for adoption.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

----------------------------------------------------------------

This Day in History

1718 - English pirate Edward Teach -- known as "Blackbeard" -- was captured off the Outer Banks of North Carolina near Ocracoke, taken to England and hanged.

1749- birthday of Edward Rutledge, youngest signer of the Declaration of Independence, governor of South Carolina, born at Charleston, SC. Died there Jan 23,1800. Ironically he was against independence, but was a recognized leader at the first Continental Congress and was the deciding vote to have South Carolina join the Union.

http://www.edwardrutledge.com/

1785 - John Hancock was elected President of the Continental Congress for the second time.

1800-Birthday of Edward Rutledge, singer of the Declaration of Independence, governor of South Carolina, born at Charleston, SC. Died there Jan 23, 1800.

http://www.colonialhall.com/rutledge/rutledge.php

1804- birthday of Franklin Pierce, the fourteenth president of the US was born at Hillsboro, NH. Term of office: Mar 4,1853—Mar 3, 1857. Not nominated until the 49th ballot at the Democratic party convention in 1852, he was refused his party's nomination in 1856 for a second term. Pierce died at Concord, NH, Oct 8,1869.

( lower half of: http://memory.loc.gov/ammem/today/nov23.html)

1835- Henry Burdon of Troy, NY, received a patent for a horseshoe manufacturing machine. His machine produced a completed horseshoe from a rod of iron that was fed into it. It produced shoes more rapidly and uniformly than the rational method of hand production on a forge.

1852-- Just past midnight, a sharp jolt causes Lake Merced to drop 30' (9m)

http://www.outsidelands.org/lake-merced.html

http://www.sfgenealogy.com/sf/history/hgoe31.htm

http://www.lakemerced.org/homepage.html

1857-Birthday of Katharine Coman - U.S. economic historian, whose Industrial History of the United States (1905) was widely used as a textbook and her Economic Beginnings of the Far West (1912) was a major historical work. She researched her books by going into the field and interviewing personally as well as seeing things for herself. She was professor of political economy and history at Wellesley College where she lived with Katharine Lee Bates for many years.

1859- Birthday of legendary outlaw of western US. Probably named Henry McCarty at birth (New York, NY), he was better known as William H. Bonney a.k.a. “Billy the Kid.”. He was a ruthless killer, a failure at everything legal, he escaped from jail at age 21 while under sentence of hanging. Recaptured at Stinking Springs, NM, and returned to jail, he again escaped, only to be shot through the heart by pursuing Lincoln County Sheriff Pat Garrett at Fort Sumner, NM, during the night of July 14,1881. His last words, answered by two shots, reportedly were “Who is there?”

1860— Abraham Lincoln had inherited not only a country divided, but in great financial difficulty. On this day, the Clearing House handed out its first loan, issuing $7.375 million worth of certificates to the nation's ailing banks. Abraham Lincoln was elected president on February 27 with a population of 31,443,321; 448,070 free blacks and 3,953,760 slaves. The Union was 33 states, 18 of them free and 15 slave. To top this off, the economy was not in very good shape and the banking of 1857 stretching into another decade and showing few signs of lifting. One of Lincoln’s moves to get the economy going was helping the ailing banks. By April 21, the next year, the Civil War would begin when Confederate forces at Charleston, SC, open fire on the federal garrison at Fort Sumter in Charleston harbor.

1863-The historic Battle of Chattanooga begins.

http://www2.cr.nps.gov/abpp/battles/tn024.htm

http://www.aotc.net/Chattanooga.htm

http://www.collectorsnet.com/cwtimes/chattano.htm

http://memory.loc.gov/ammem/today/nov23.html

1878 - Ernest King, Commander-in-Chief of the U.S. fleet who reportedly designed the United States' winning strategy in World War II. Promoted to vice admiral he insisted that his pilots trained for night operations. In January 1941 King was made commander of the Atlantic Fleet and after the Pearl Harbor disaster King was given the post of Commander in Chief of the US Fleet. King developed a reputation for being abrasive and argumentative. As a member of the Joint Chief of Staffs he often clashed with General George Marshall. King opposed plans to land the US Army in North Africa. He thought the most important area of concern was the Pacific War. What is more, he thought that the US Navy should play the decisive role in this as long as it was given adequate resources. King, General Douglas MacArthur the Supreme Commander of the Southwest Pacific Area, and Chester Nimitz, Commander in Chief of the US Pacific Fleet, decided that their first objective should be to establish and protect a line of communications across the South Pacific to Australia. This resulted in the battles of Coral Sea and Midway, where the Japanese Navy lost all four of her carriers. King insisted on launching the Guadalcanal campaign although General Douglas MacArthur claimed that the US Army was not ready yet for a major offensive. MacArthur also disagreed with invasion of the Solomon Islands. There was also conflict over King's view that American forces should bypass the Philippines. King also opposed Russian involvement in the Pacific War. He also objected to the idea that the Royal Navy should be moved to Pacific after gaining control of the Atlantic. In December 1944, King, along with William Leahy and Chester Nimitz, was given the five-star rank of Fleet Admiral. After retiring in December, 1945

1889- Louis Glas invented and this day installed a coin-operated phonograph player in the Palais Royale, San Francisco, Ca. There were many such machines made, generally called “coin graphs.” The first widely successful “jukebox” manufacture was the Rudolph Wurlitzer Company of North Tonawanda, NY. Its most popular model was made of curved plastic tubes containing a fluid with a low boiling point. Small heaters kept the fluid bubbling. Wurlitzer sold 56,246 of the Model 1015 in 1946 at $750 each. In reality, the juke boxes never became as widely distributed until the 1950's with the invention of the 45rpm record.

http://www.knowmadz.org/library/ref/soundcap.htm

1897-Jazz pianist Willie “ the Lion” Smith Birthday

http://www.redhotjazz.com/thelion.html

1897-- Eli Olds of Lansing, Michigan, is issued a U.S. patent for his "motor carriage," a gasoline-powered vehicle that he constructed the year before.

1903-Birthday of 1903, one of the most popular U.S. singers from the 1920's through most of the 1940's, had more than 60 big hits. Best known today for her gangster connections because of the movie about her life Love Me or Leave Me, (

1912- Trombonist Tyree Glenn born Corsicana, Texas.

http://www.harlem.org/people/glenn.html

http://www.jazzmanrecords.com/tyreeglenn.html

1914- Emmett Littleton Ashford, born at Los Angeles, CA, was the first black to officiate at a major league baseball game. Ashford began his pro career calling games in the minors in 1951 and went tothe majors in 1966. He was noted for his flamboyant style when calling strikes and outs as well as for his dapper dress which included cuff-links with his uniform. He died Mar 1,1980, at Marina del Hey, CA.

http://www.tvtome.com/tvtome/servlet/PersonDetail/personid-308006

1925- birthday of composer Johnny Mandel.

http://www.ascap.com/filmtv/mandel.html

http://www.thegoldenglobes.com/welcome.html?nominee/mandel_johnny.html

http://encyclopedia.thefreedictionary.com/Johnny%20Mandel

1936- The illustrated magazine “Life” debuted on this day.

http://www.otal.umd.edu/~vg/amst205.F97/vj22/history.html

http://www.life.com/Life/covers/1936/cv112336.html

http://www.life.com/Life/aboutlife/lifefaqs01.html

1938--~ Bob Hope and Shirley Ross recorded a song for the film, The Big Broadcast of 1938. Thanks for the Memory became Decca record number 2219. It also became Hope's theme song.

1940-the first US Army general who rose from a draftee was Keith L. Ware, who was drafted on November 23, 1940. He attended Officer's Candidate School, Fort Benning, GA, and rose to commander of the 1st Infantry Division in Vietnam, becoming brigadier general on November 28, 1967. He, his staff of three, and four helicopter crewmen were killed on September 13, 1968, when his helicopter was shot down about 60 miles north of Saigon during the battle of Locmnh. He was the fourth general killed in the Vietnam War.

http://www.arlingtoncemetery.net/klware.htm

http://distantcousin.com/Military/MedalofHonor/WWII/5/006.html

1943-The US Second Marine Division took control of the Gilbert Islands after fierce fighting on the heavily fortified Tarawa Atoll in the 76-hour battle the Marines beat back a “death charge” in which the Japanese ran directly at the American guns. American troops sustained 3,500 killed and wounded. The Japanese suffered 5,000 killed and 17 wounded and captured. ( The Gilbert Islands are the westernmost of the Polynesians, midway between Australia and Hawaii and today are part of the nation of Kirbati.

1943 - Randolph in Coos County, NH receives 56 inches of snow, a record for the state. Berlin received 55 inches and many other locations over 40 inches

1944--SILK, EDWARD A. Medal of Honor

Rank and organization: First Lieutenant, U.S. Army, Company E, 398th Infantry, 100th Infantry Division. Place and date: Near St. Pravel, France, 23 November 1944. Entered service at: Johnstown, Pa. Born: 8 June 1916, Johnstown, Pa. G.O. No.: 97, 1 November 1945. citation. 1st Lt. Edward A. Silk commanded the weapons platoon of Company E, 398th Infantry, on 23 November 1944, when the end battalion was assigned the mission of seizing high ground overlooking Moyenmoutier France, prior to an attack on the city itself. His company jumped off in the lead at dawn and by noon had reached the edge of a woods in the vicinity of St. Pravel where scouts saw an enemy sentry standing guard before a farmhouse in a valley below. One squad, engaged in reconnoitering the area, was immediately pinned down by intense machinegun and automatic-weapons fire from within the house. Skillfully deploying his light machinegun section, 1st Lt. Silk answered enemy fire, but when 15 minutes had elapsed with no slackening of resistance, he decided to eliminate the strong point by a l-man attack. Running 100 yards across an open field to the shelter of a low stone wall directly in front of the farmhouse, he fired into the door and windows with his carbine; then, in full view of the enemy, vaulted the wall and dashed 50 yards through a hail of bullets to the left side of the house, where he hurled a grenade through a window, silencing a machinegun and killing 2 gunners. In attempting to move to the right side of the house he drew fire from a second machinegun emplaced in the woodshed. With magnificent courage he rushed this position in the face of direct fire and succeeded in neutralizing the weapon and killing the 2 gunners by throwing grenades into the structure. His supply of grenades was by now exhausted, but undaunted, he dashed back to the side of the farmhouse and began to throw rocks through a window, demanding the surrender of the remaining enemy. Twelve Germans, overcome by his relentless assault and confused by his unorthodox methods, gave up to the lone American. By his gallant willingness to assume the full burden of the attack and the intrepidity with which he carried out his extremely hazardous mission, 1st Lt. Silk enabled his battalion to continue its advance and seize its objective.

1946---Top Hits

Rumors are Flying - Frank Sinatra

Ole Buttermilk Sky - The Kay Kyser Orchestra (vocal: Mike Douglas & The Campus Kids)

The Whole World is Singing My Song - The Les Brown Orchestra (vocal: Doris Day)

Divorce Me C.O.D. - Merle Travis

1947- E. L. Sukenik of Jerusalem's Hebrew University first received word of the existence of the Dead Sea Scrolls. The documents, dating between 200 BC and AD 70, had been accidentally discovered the previous winter (1946_47) by two Bedouin shepherds in the vicinity of Qumran.

1948 - Dr. Frank G. Back of New York City patented the Zoom lens, which was first used by NBC television in April of 1947. It was not mass produced until 1959 when it became very popular with usage on a 35mm camera.

http://www.cameraquest.com/ekzoom.htm

1952-Birthday of Francie Larrieu Smith - perhaps the greatest runner in U.S. history in a career that spanned four decades and 35 American records in distances from 1,000 meters to two miles. During an international career that lasted from 1969 until 1992, Larrieu Smith was on 28 national teams and won 21 national titles. She was a member of five Olympic teams, starting in 1972 when she ran the 1,500 meters. She also ran the 1500 at the 1976 Games and was a team member at the same distance in 1980.

1954---Top Hits

I Need You Now - Eddie Fisher

Mr. Sandman - The Chordettes

Teach Me Tonight - The De Castro Sisters

More and More - Webb Pierce

1962---Top Hits

Big Girls Don't Cry - The 4 Seasons

Return to Sender - Elvis Presley

Next Door to an Angel - Neil Sedaka

I've Been Everywhere - Hank Snow

1963- "I'm Leaving it up to You" by Dale & Grace topped the charts and stayed there for 2 weeks.

1963 –President John F. Kennedy, Jr.'s body lay in repose in East Room of White House.

http://www.multied.com/Sixties/Funeralrites.html

http://www.fiftiesweb.com/kennedy/kennedy-assassination-23.htm

http://www.mdw.army.mil/fs-m01.htm

1963-First episode of “Dr. Who” premiered on British TV with William Hartnell as the first doctor. Traveling through time and space in the TARDIS (an acronym for Time and Relative Dimensions in Space), the doctor and his companions found themselves in mortal combat with creatures such as the Daleks. “Dr. Who” didn't air in the US until Sept 29, 1975.

1964 --The US Supreme Court refuses to strike the phrase "under God," instituted in 1954, from the Pledge of Allegiance

1966- Elvis Presley's 22nd film, "Spinout," premieres in Los Angeles. The movie is another box-office success and critical disaster for Elvis.

1968- It's the end of an era: Rolling Stone reports San Francisco's Family Dog has lost its license to operate out of the Avalon Ballroom, site of the marathon dance concerts featuring the Grateful Dead, Jefferson Airplane, Moby Grape, Quicksilver Messenger Service and other psychedelic groups.

1970---Top Hits

I Think I Love You - The Partridge Family

The Tears of a Clown - Smokey Robinson & The Miracles

Gypsy Woman - Brian Hyland

Fifteen Years Ago - Conway Twitty

1974-- Billy Swan reached the #1 spot on the singles charts for the first and only time. I Can Help was the most popular song in the U.S. for two weeks.

1975 -- Minnesota quarterback Fran Tarkenton becomes the NFL's all-time completions leader when he completes his 2,840th pass in the Vikings' 28-13 victory over San Diego.

http://images.nfl.com/history/images/1123.jpg

http://www.tarkentonsports.com/

1978---Top Hits

MacArthur Park - Donna Summer

Double Vision - Foreigner

How Much I Feel - Ambrosia

Sleeping Single in a Double Bed - Barbara Mandrell

1981 - President Ronald Reagan signs off on a top secret document, National Security Decision Directive 17 (NSDD-17), which gives the Central Intelligence Agency the power to recruit and support a 500-man force of Nicaraguan rebels to conduct covert actions against the leftist Sandinista regime in Nicaragua. In the years to come, U.S. support of the Contras became a highly charged issue among the American public. Congressional and public criticisms of the program eventually drove the Reagan administration to subvert congressional bans on aid to the Contras. These actions resulted in what came to be known as the Iran-Contra scandal of 1986.

1983 - a 24 hour snowfall record for Duluth, MN was broken with 16.9 inches. 19.7 inches fell during the entire storm, also a record

1984- Quarterback Doug Flutie of Boston College (my cousin on my mother's side) passed for 472 yards and led the Eagles to a 47-45 upset of the Miami University Hurricanes. Flutie won the game with a desperation “Hail Mary” touchdown pass that end Gerald Phelan caught in the end zone.

1986---Top Hits

Human - Human League

You Give Love a Bad Name - Bon Jovi

Word Up - Cameo

You're Still New to Me - Marie Osmond with Paul Davis

1987 - Box office sales began for the spectacular musical, The Phantom of The Opera. Phantom took in a record-setting amount of $920,272 in seventeen hours. The incoming hit from London made a Broadway record in advance sales of over $12 million two months before its grand opening the following January.

1988- Wayne Gretzky scores his 600th NHL goal

http://www.upperdeck.com/athletes/waynegretzky/profile.aspx

1989 - Low pressure tracking across the Carolinas brought heavy rain to parts of the Southern Atlantic Coast Region for Thanksgiving Day, and blanketed the Middle Atlantic Coast States and southern New England with heavy snow. The storm produced up to nine inches of snow over Long Island NY, and up to 14 inches over Cape Cod MA, at Yarmouth. Totals of 4.7 inches at New York City and 6.0 inches at Newark NJ were records for Thanksgiving Day, the 8.0 inch total at Providence RI was a record for any given day in November, and the 6.5 inch total at Strasburg CT was a record for the month of November as a whole.

1991- "When a Man Loves a Woman" by Michael Bolton topped the charts and stayed there for a week.

1991 - La Crosse, WI set a new record for 24 hour snow with 13 inches. This storm brought the monthly total to 28.2 inches, also a record

1992 - Early morning severe thunderstorms spawned two F3 tornadoes in North Carolina resulting in 2 deaths and 59 injuries. This was the last day of the three day outbreak in which 93 tornadoes touched down claiming 25 lives.

1992 - Alta, UT was buried under 45 inches of snow in 24 hours to set an all-time 24 hour record for that location

1994---Top Hits

I ll Make Love To You- Boyz II Men

Here Comes The Hotstepper (From "Ready To Wear")- Ini Kamoze

On Bended Knee- Boyz II Men

Another Night- Real McCoy

1996--Actor Woody Harrelson and others clogged traffic for hours on the San Francisco Golden Gate Bridge in a protest on behalf of the Headwaters forest.

1998- The world's first portable mp3 player goes on sale, despite strenuous objections from the RIAA (Recording Industry Association of America). The Diamond Rio PMP300, which cost $200, could play about a dozen songs.

2004 - An outbreak of severe thunderstorms produced reports of 54 tornadoes across portions of Texas, Louisiana, Arkansas and Alabama. In Texas's Hardin county, one person was killed with three injured when a tornado struck during the afternoon.

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()