EQUIPMENT LEASING SALES

Nationwide- Grand Island, Nebraska

AXIS Capital, Inc. has immediate opportunities in Texas (Houston or Dallas based) for experienced customer direct leasing sales executives with established current end user relationships preferred. AXIS Capital Inc. is a National Independent Leasing company. Our ideal candidate will have the opportunity to utilize their industry expertise with the opportunity to grow their existing equipment lessee customer base.

Position Requirements:

• Candidates will possess exceptional verbal, written and customer service skills.

• Proficient in Excel, Word, Outlook, PowerPoint.

• Self-motivating and organizational skills.

• Travel required

Competitive salary, health insurance, 401K, life Insurance, paid vacations and holidays. If you possess the required experience and feel you have what it takes to succeed, please email your resume to hr@axiscapitalinc.com or send your resume to PO Box 2555, Grand Island, NE 68801.

www.axiscapitalinc.com

|

Monday, August 1, 2011

Today's Equipment Leasing Headlines

Ted Parker Passes Away, age 75

"Chris Walker Lovefest"

Classified Ads---Sales Manager

Financial Pacific is Licensed, Benchmark is Not!

by Christopher Menkin

New Jersey Bankruptcy Court Slams Lender for Usury

by Thomas E. McCurnin & Frank Peretore

Leasing 102 by Mr. Terry Winders, CLP

Lease Structure---Not Fancy Lending

Emily Fitzpatrick---Career Crossroad

Classified Ads---Help Wanted

52 branch bank failure in Indiana, plus two more

'Wait and See' Approach Persists 3rd Month

National Association of Credit Managers

Evansville, Indiana Adopt-a-Dog

Top Stories July 22---July 29

News Briefs---

Obama and Leaders Reach Debt Deal

HSBC to Sell 195 NY Bank Branches for $1 Billion

HSBC to axe 10,000 people, vast majority out of UK

Merck to cut 13,000 jobs

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Number of US homeowners dips

You May have Missed---

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Ted Parker Passes Away, age 75

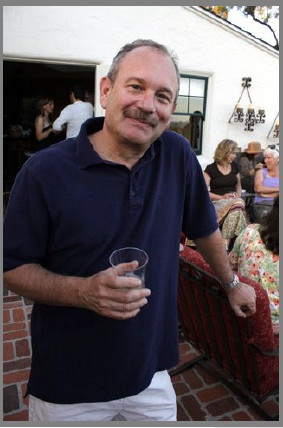

(Photo: December, 1985, WAEL Newsline)

After several heart operations, and a recent stay in the hospital, Ted's heart gave out. He had moved to Hamilton, Montana about five years ago to pursue his passion for fly fishing. He is survived by his son.

Many Leasing News readers may remember his advertising here:

He had books on leasing, CD's, a master book of leasing forms with CD; many became the standard of the industry. He retired in 1996.

Many also may remember he was the 1986 President of the Western Association of Equipment Leasing (WAEL). In a biography it said he had been in leasing for 30 years, add another ten and it was 40 years at the time her retired. He also was one of the first Certified Leasing Professionals.

“Pictured here is some of the Western Association of Equipment Leasing Past President who were honored during special recognition ceremonies in commemoration of WAEL's Fifteenth Anniversary---the Crystal Celebration.

Conference Chairman Peter Eaton, CLP, First National Leasing Corporation(center) joins Past Presidents (l to r) Jim Possehl, CLP, President Republic Financial Corporation(1989), President Steve Dunham, Leasing Associates (WAEL's first President—1974); Bob Jacobson, III, CLP, Consultant (1984 president); Eaton (1994 president); Ted Parker, CLP, LSA West Capital Corporation (1986 President): and Steve Head, Interbank Leasing Corporation (1977 President).”

The WAEL biography states, " Ted was previously Senor Vice President of First Interstate Leasing, Inc., which je joined in 1974 as a regional leasing office...(prior) he was Vice President of Capital Reserve Leasing Corporation, establish their lease discount/brokerage department and developing new sources and techniques for funding the company's lease portfolio (at this time, he was helpful in the West Coast formation of an 25 member lease discounter association that included AJ Batt, Jim Harris, Kit Menkin, Louis Funkenstein, Mont Gates, among many others). He was formerly VP/Secretary of Chanco Leasing and Assistant Vice President/Regional Manager of McGraw Edison Credit.

While he was WAEL president in 1986 he moved from Guarantee Financial Service Lease Division to Charter Equipment Leasing, where the president was Rick Wilbur, CLP, who told Leasing News:

"I met Ted about 35 years ago when I first moved to California. I can’t remember the name of the company he was with but we did a few deals together and worked well with each other. When we formed Charter Capital in 1977, Ted was part of the equation. At the very last minute, he simply couldn’t afford to make a change or take a risk so we proceeded without him. I’ve often wondered what might have happened if he had just jumped in like we did. There was a period of time he was with Charter, but it was really more of an accommodation to provide him a place to hang his hat when he left the bank.

"Ted was a gentile and honorable man without a malicious or mean bone in his body. He was one of the really good guys in this business and I know there will be many old timers that will miss him. Hopefully there’s a fully stocked trout stream and a fully stocked bar wherever he ends up."

After Ted’s stint with Charter Leasing, he formed the equipment leasing division of LCA Capital then formed California Capital Leasing Corp., a small leasing company that serviced a couple of newbie brokers. He then retired after CCL and started the Leasing Library.

Bob Teichman, CLP, Chairman of the Leasing News Advisory Board was there when the Certified Leasing Professional program got underway:

"Ted was always a hero to me. I don't know how often I called him asking for advice when I first entered the equipment leasing business in the early 1970's. He was always a gentleman; one of the really good guys - in or out of the leasing business. I will miss him."

Rosanne Wilson, CLP, who is recovering from cancer, said, "I belonged to WAEL for several years before it became UAEL. He was a very dynamic individual and loved this industry. He will be missed."

[headlines]

--------------------------------------------------------------

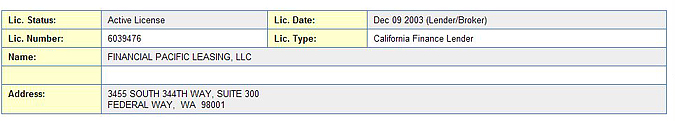

Chris Walker, GreatAmerica Leasing, is president of the Certified Leasing Professional Foundation, on the National Equipment Financial Association Board of Directors, and very much liked and respected in the industry, with many friends, especially among his colleagues at GreatAmerica Leasing, as he fights his battle with inoperative pancreatic cancer.

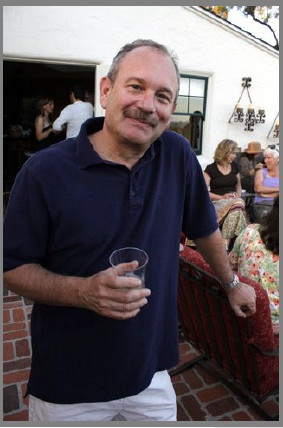

Chris enjoying some downtime at his sister’s house in

Santa Barbara, California overlooking the Pacific.

From Mathew L. Doty, Director, Corporation Communications, GreatAmerica Leasing:

“As Chris Walker’s Journal and Guestbook near 9,000 hits, it’s evident how many lives Chris, Jean and Maddie have touched. With Cedar Rapids at its center, the circle of care and concern for the Walker Family reaches across the United States. To allow your love, support and prayers to be made visible, we are holding the “Chris Walker Lovefest” Saturday evening, August 20, 2011 at Theatre Cedar Rapids. The funds raised will benefit the Chris Walker Family and pancreatic cancer research. For those of you who cannot attend, visit www.chriswalkerlovefest.com or Facebook page “Chris Walker Love Fest 2011” for additional information. Questions? Contact Kathleen Bednar at 319.393.7809 or kmbednar@mchsi.com.”

mdoty@greatamerica.com

For updates on Chris’ fight against pancreatic cancer, or to leave him a message, please see http://www.caringbridge.org/visit/chriswalker

[headlines]

--------------------------------------------------------------

Classified Ads---Sales Manager

(salesman gets a “bonus” check)

(These ads are “free” to those seeking employment

or looking to improve their position)

|

Bayville, NJ

Dedicated individual seeking a account management position, 3 years leasing experience and 15+ years sales experience. Resume furnished upon request,

email Frank at weag4th@gmail.com . |

Fort Myers, Florida

Very experienced and strong skills with both Captive and Specialty Sales Management. Over 25 years , will relocate and travel---successful and team player.

e-mail: tlinspections@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

Gary DiLillo, President

216-658-5618 or gary@avptc.com

Comprehensive personal property tax outsourcing services.

Click here to see what our clients say about us. |

[headlines]

--------------------------------------------------------------

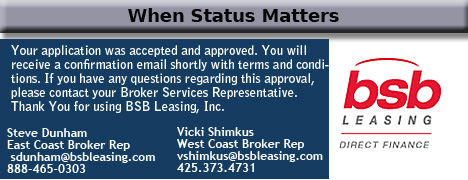

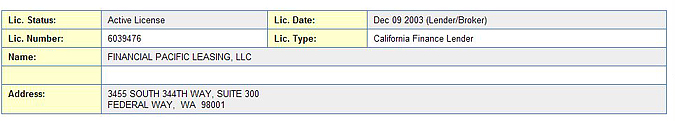

Financial Pacific is Licensed, Benchmark is Not!

by Christopher Menkin

In the Leasing News article of July 20, 2011 a reader was quoted, "I am just shocked that he can keep doing business this way, the lenders keep buying the paper (the deals he actually funds) they are assisting in keeping him in business. This is bad for the industry and there are lenders helping him." (1)

Here is a case compounded by a licensed California lender doing business with an unlicensed California broker.

In California, a licensed lender can only do business with a licensed broker.

In California, it would be a violation of the license regarding usury.

If the licensed--but out of state company--- does business with the unlicensed broker in California, no matter where the lessee is located, that would violate the license provision and the lease(s) then would be subject to usury in applicable states. After all, the broker is earning a commission from a licensed lender in the State of California. He is paid in the State of California by the licensee. The out of state licensee therefore is doing business with the unlicensed broker in California. Often the broker retains the residual, and after the initial term of the lease is completed, collects the residual. The licensed out of state lender contributes to this at the end of the lease, returning the equipment option to the broker. If the transaction is non-recourse, no matter if the residual is “fair market value,” it is not a true lease, but a capital lease. The basic fact remains, it doesn't matter where the lessee is located if there is an exchange of money from a licensed party to an unlicensed party.

You can argue that if the funder was not licensed in California and the lessee was located not in California, then they can pay the commission to the unlicensed broker---but if they are licensed and they pay an unlicensed broker in California that is doing business with an unlicensed broker no matter where the lessee is located, that is a violation of their license.

From the very first complaint printed in Leasing News, the fact that Benchmark Financial Group nor any of Marcus Davin companies were licensed in California were so noted in the complaints, which Financial Pacific was quite aware, particularly in lieu of the many emails and telephone discussions.

In "All the President's Men, Bob Woodward is told to "Follow the Money." That's what Leasing News did here. From UCC filings and D&B records, the former funders for Benchmark Financial Group, Aliso Viejo, California MD Capital Partners, Newport Beach, California (not counting the two new companies both in the same building and same door as Benchmark, when this was written, Aliso Viejo, California), the funders of discounted leases were Lakeland Bank and LEAF Financial. But it appears to stop in 2009 and 2010.

Leasing News followed up with several leads, verified with a number of leasing funders that they would never do business with Marcus Davin or one of his companies.

Leasing News was able to confirm the two leasing funders who appear to be doing the most business with Marcus Davin and his company:

Bryn Mawr Funding, is part of Byrn Mayr Bank and Trust out of Pennsylvania, who are not licensed in California (whether as a foreign bank to the state or not doing actual leases in California issues are not known.)

Stephanie Hall confirmed, and asked why Leasing News was asking.

The others is:

Other funders told Leasing News they would never entertain a transaction from a company with so many complaints, a BBB “F” and court records as noted in Dun & Bradstreet and in Pacer, why Financial Pacific Leasing with Paul Menzel, CLP, President & CEO and Terry Jennings, CLP, Senior Vice President, Business Development, are doing business with a reportedly unlicensed company with a BBB “F” and many complaints, let alone not following the Certified Leasing Professional high standards is not known. (2)

While Financial Pacific did not return any communication, Leasing News was able to obtain copies showing that Benchmark was consistently in the top three in submitting business to them; almost in the top three, many times 1 or 2, in the Western Region, according to brokers who receive the reports (here are a few from the last year):

From: Dave Anderson [mailto:davea@finpac.com]

Sent: Friday, July 02, 2010 9:30 AM

Subject: Month End Results for June

Congratulations everyone on a great June.

Our Region ended up with 113.4% of goal and I missed my personal objective by only $30k. Thanks for all your continued support during these trying times.

For the month of June the top 3 Brokers were:

1) Benchmark Financial Group

2) Northstar Funding

3) Taycor

As you know, we have a new pricing tier of 12% and in conjunction with this we are running a contest to give away (1) Apple I-Pad per month for 3 months.

So far our region is in the lead with 11 approvals at 12%. And that is just for a little over a week. So it is possible to get better rates from FinPac.

Now we need to close all those deals.

----

From: Dave Anderson [mailto:davea@finpac.com]

Sent: Tuesday, June 01, 2010 9:03 AM

Subject: May Results

I hope everyone had a restful Memorial Day weekend and are now ready to ramp it up for June.

May was a fantastic month for our region as we ended up with 130% of goal. Not bad for a short month and it put us squarely in 2nd place of all the regions for our company. (both for May and YTD). Thanks so much for all your efforts and I truly appreciate your continued support.

The top 3 Brokers for the month of May were:

1) Benchmark Financial Group

2) Providence Capital Funding

3) Taycor, LLC

Unfortunately, my goal has gone up another $200k for the month of June, so I am looking for all I can get, early and often.

Damn, I sound like a street walker! Hmmmm.

Call me if you need any help

----

From: Dave Anderson [mailto:davea@finpac.com]

Sent: Friday, July 02, 2010 9:30 AM

Subject: Month End Results for June

Thanks for all your continued support during these trying times.

For the month of June the top 3 Brokers were:

1) Benchmark Financial Group

2) Northstar Funding

3) Taycor

As you know, we have a new pricing tier of 12% and in conjunction with this we are running a contest to give away (1) Apple I-Pad per month for 3 months.

So far our region is in the lead with 11 approvals at 12%. And that is just for a little over a week. So it is possible to get better rates from FinPac.

Now we need to close all those deals.

----

From: Dave Anderson [mailto:davea@finpac.com]

Sent: Monday, November 01, 2010 9:12 AM

Subject: October Month End Results

Wow!

On the last day of the month we booked $372,825 to end the month at 105% of goal for our Region.

This was the best Halloween treat ever and we beat every other region for top honors this month.

The top 3 Brokers for October were: Drum roll please……..

1) Providence Capital Funding

2) Taycor

3) Benchmark Financial Groups

---

From: Dave Anderson [mailto:davea@finpac.com]

Sent: Tuesday, February 01, 2011 9:44 AM

Subject: January Results

What a terrific month! We ended up the month at 128% of goal for our region and beat everyone except for ASAP. Congratulations to all of you.

The top 3 Brokers for January were:

1) Providence Capital Funding

2) Benchmark Financial Groups

3) Envision Capital Group

Thanks to everyone for making our region the best region in the country.

----

From: Dave Anderson [mailto:danderson@finpac.com]

Sent: Wednesday, June 01, 2011 6:53 AM

Subject: May Results

May is in the bag and we ended the month at 98% of goal. Not bad considering the fact that the last day of the month was after the Memorial Day Weekend.

A special thanks this month goes out to Providence Capital Funding. They shattered their old funding record and set a new funding high water mark of $589,058.

I would like to personally thank Davie Lee, Ofer Horn, Steve Ward, Chooney Pak and all the sales team for making a huge impact in our region.

The top 3 Brokers for our region for the month of May were:

1) Providence Capital Funding

2) Alliance Funding Group

3) Benchmark Financial Groups

June is usually a huge month for us and I look forward to helping you fund as much as you can at FinPac.

If you haven’t sent us much business lately, give us another try. Let us show you the new FinPac.

-

10,000 Leases since 4/10/2011-Date on Factious Name Filing

caption from their web site: http://www.cobaltfunding.com/

http://leasingnews.org/archives/Jul2011/7_20.htm#name_filing

CLP Standards of Professional Conduct: “A Certified Lease Professional will act in a leadership role in the industry and always be held to the highest standards of conduct applicable to the industry.”

http://www.clpfoundation.org/requirements/standards.php

[headlines]

--------------------------------------------------------------

New Jersey Bankruptcy Court Slams Lender for Usury

By Thomas E. McCurnin, Esq. and

Frank Peretore, Esq.

(Readers may find it amazing after reading this article that lessors are doing deals with dba's in New Jersey. Editor)

A New Jersey Bankruptcy Judge invalidated a hard money loan on the grounds of usury resulting in a $30 million forfeiture of interest. The case demonstrates that creditors ought not rely on lawyer’s language in documents. The case also probably taught the lawyers a lesson that the best resolution of any contested case just might be a settlement. Given my personal knowledge of the Judge in question, I am confident that the Court tried to resolve the matter.

By way of introduction, anyone familiar with lending probably knows that New Jersey is a creditor’s paradise where civil usury does not exist and corporations may not assert usury in any event. There is, however, a criminal usury provision in New Jersey, with a fairly high threshold of 50% for entities and 30% for individuals. N.J.S.A. 2C:21–19(a).

By way of further introduction many lenders making hard money loans often insert a “Usury Savings Clause” which basically says that if the loan is found to be usurious, the Court may modify the terms to reduce the interest rate to something legal.

Global Outreach was the borrower who borrowed $41 million dollars to construct a resort in Costa Rica. Its lender was Global Investments. Global Outreach was the epitome of a poor credit risk, because its president was a convicted felon, had filed personal bankruptcy, and had numerous judgments against him. Nevertheless, the lender saw the resort as a good loan, if the loan servicing payments could be significant.

The lender documented the transaction as an “equity sharing” agreement, with the loan payments documented as equity participation payments, and added further payments in the form of origination fees. To further insulate the lender from usury claims, the lender’s documents contained a “Usury Savings Clause.”

The effective interest rate was in excess of 50%.

The borrower defaulted, and the lender sued in New Jersey State Court and prior to any judgment being rendered, the borrower filed a Chapter 11 in New Jersey Bankruptcy Court, a Creditor’s Committee was appointed, and the State Court action was removed to the Bankruptcy Court. The Creditors’ Committee (the bane of most secured lenders) prosecuted a usury claim against the lender under New Jersey’s criminal usury statute.

The Bankruptcy Court faced a number of issues, as to whether the transaction was a loan or an equity sharing agreement. If it was construed as a loan, the Court had to consider the “Usury Savings Clause.” Finally, the Court also considered the nature of sizable fees paid by the borrower, and whether they were disguised loan payments.

The Bankruptcy Court quickly tossed out the argument that the loan was really an equity sharing transaction, and also construed the equity and origination fees as loan payments, reaching an alleged effective interest rate of 50%. The decision also held that the Usury Savings Clause was void as against public policy.

The remedy for a violation of a criminal usury statute in New Jersey was deemed to be the forfeiting of all interest. The lenders $80 million dollar claim was reduced to $38 million a sizeable sanction.

The case has many lessons for hard money lenders. First, a hard money loan to a borrower where interest rates exceed the jurisdiction’s maximum amount are fraught with both judicial and credit risks. Although the lenders’ documents may be considered “iron clad” by the lender and its counsel, the reality in Bankruptcy Court is that the forum is unpredictable.

Faced with an outrageous interest rate, courts are reluctant to uphold transactions like these, and certainly Bankruptcy Courts are less likely to bless the loan. Moreover, Bankruptcy Courts tend to ignore the subtle distinctions of loan terms and tend to focus on the substance, not the form, of the transaction.

For those lenders operating in States with a usury exemption for licensing, the decision again demonstrates that lenders can take judicial cover using a lenders license. For example, in California, if a lender is licensed, there is an absolute exemption from usury and California, unlike New Jersey, has no criminal usury statute. New Jersey has no such licensing statute.

The lenders in this case might have been well served to analyze the transaction under the theory “what if” a court construed this transaction as a loan.

Finally, leasing lawyer Frank Peretore and I actually litigated a 50% usury case in front of this same Bankruptcy Judge several years ago. The one thing I learned was in these bad fact cases, it is wiser to resolve the matter on some basis than push the Court for what might be an embarrassing decision. Although the lender in our case had a California license, Judge Steckroth implored the lawyers to settle the case.

At one point I recall him saying to the Debtor’s lawyers, that if he invalidated this licensed loan, the New Jersey Bankruptcy Journal will have his decision on the front page and he will be lambasted by creditors counsel all over the State. He told us that he did not want this to happen.

Judge Steckroth told us the creditor’s lawyers that if he upheld this 50% interest loan, this case will also make the front page of the same publication, and he will criticized by the debtors’ counsel. So he told us to go into the jury room and settle this before he really disappoints all of us.

Judge Steckroth took the better part of a day, and into the night to help us resolve the matter without reaching the draconian result reached here. He is a very wise, cautious Judge who really does not want to make his decisions news items.

In this case, the two sides obviously couldn’t reach a resolution.

For a copy of the actual decision, the citation is as follows: In re Global Outreach, S.A., Slip Copy, 2010 WL 3957501 (Bankr. N.J. 2011).

As an aside, it should be noted that New Jersey’s civil usury statute also contains a trap for the unwary. While incorporated entities cannot assert usury, sole proprietorships may assert usury even for business loans. Under New Jersey civil usury law, for loans under $50,000, the usury rate is 6% unless there is a contract specifying a rate of interest, in which case the maximum rate is 16%.

Since most equipment finance agreements and non-true leases generally don’t include a specified rate of interest, these transactions often violate the civil usury rate of 6%, at least in the smaller deals, to wit, under $50,000. In other words, if a leasing company does a smaller deal with a New Jersey Doctor as a dba, and the finance agreement does not have a stated interest rate, which is usually the case, any interest rate over 6% would be usurious!

Thomas E. McCurnin

Barton, Klugman & Oetting

Los Angeles, CA 90071

P: (213) 617-6129

F: (213) 625-1832

tmccurnin@bkolaw.com

|

Frank Peretore

Peretore & Peretore, P.C.

Sparta, New Jersey 07871

P: (973) 729-8991

F: (973) 729-8913

frank@peretore.com |

Global Outreach Case:

http://leasingnews.org/PDF/GlobalOutreachCase.pdf

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Lease Structure---Not Fancy Lending

New structures are beginning to show up on the street in response to the new proposed accounting classification rules. Even though the International Accounting Standards Board has changed the effective date of IFRS 9 Financial Instruments (both the 2009 and 2010 phases) from 1 January 2013 to 1 January 2015, certain decisions have been made, they stated they had enough information to decide that they would re-expose the lease accounting proposals.

In the past one of the most popular reasons for operating leases was the ability to charge the rent, as paid, if it conformed to the actual use of the equipment and put the actual monthly expense for equipment use closer to the revenue stream and the cash required to pay the lease payment. Usually this required equipment that had a method of registering use like the number of hours, miles, rotations, shifts of use, etc. However the new rules that will require estimating the use to place everything on the balance sheet and straight line the net present value of the rent stream over the lease term and it would appear to take the “use” of the equipment out of the equation. The accountants do not understand leasing and continue to look at it like fancy lending.

Irregular or variable rent streams have been around the leasing industry for a long time, but I now feel that tying the rent to the equipments actual use will open the residual game again because if the lease is properly drafted, and you have an accounting software package that can handle it, residuals will be protected by the extra rent. Because of this, I believe there will be lease structures that defy the guessing game the accountants want to impose to establish a level amortization over the lease term.

Accountants may like their accrual world for expenses, but the leasing industry has been providing structures for years to bring the actual expenses closer to the revenue so business can see the “real” margin” in real time. It is amazing to see the differences between the cash required to pay debt and the accrual expense for accounting and the IRS depreciation tax deductions.

I think a new way to make some adjustments along the way would be to create a lease in one of two ways. First let’s establish a 60 month lease on a $100,000 piece of equipment with one payment in advance, a 10% lease rate and a lessor residual assumption of 20%. I will leave the tax issues out for this base case. Payments would be 60 x $1851.

First issue, the lease will be booked based on the present value of the lease stream at the lessee’s incremental borrowing rate (IBR) of 8%. The discounted rent is $91,897 and when divided by the lease term is $1,532 a month amortized over the lease term. The difference between the total rent and the discount amount will be charged as interest expense on the interest method over the lease term.

Let’s say, the lessee completed an equipment description and use form that reported a useful life of 8,000 hours with plans to use it only 6,000 hours over the term. The lessor allows the use up to 100 hours per month with a requirement for an increase of $21.84 per hour for additional use. This amount is determined by dividing the total rent plus residual by the 6,000 hours. In the sixth month the lessee used the equipment an additional 10 hours or a 10% increase in use.

Now there are two accounting issues about this addition use, is it just an unusual occurrence or is it something that comes from addition business and is expected to be permanent. If it is an unusual occurrence the additional rent will be an additional expense that month and will be additional revenue for the lessor and reduce the residual assumption. If it is permanent then a modification to the lease should be made with an addendum requiring some accounting adjustments. However it may be a recurring increase in use that would require a lot of modifications so a new structure is considered and the lease should be written for a lease of 6000 hours not 60 months. This would require a method to report use on a periodic basis. If the business increases 10% every six months then the 6000 hours of use may be reached in four years instead of five. To account for this type of lease has not been covered by the new rules at this time.

It is hard enough to run a business today and knowing how the margins are affected by equipment use is of great importance. Level expenses my fit accrual accounting but miss the cost of doing business. Leasing must come up with structures that help business understand how to put the expense in the correct time period to be able to manage cash and expenses.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Emily Fitzpatrick---Career Crossroad

Question: I am currently employed and I am interested in pursuing new opportunities; I believe my colleague has caught wind of this. I consider this colleague a friend. Do you think I can share this information with my colleague?

Answer: In short, NO. Many of us have made “friends” in the workplace, but keep in mind they are work colleagues. You should never share your intentions until you have secured your new role and given proper notice to your employer. Not only is the job market competitive, but your current employment could be jeopardized due to an unintentional (or intentional – I hate to say) “leak”. Keep your intentions close to the vest ….

After you have secured your new role and given proper notice, then and ONLY then should you share your good news.

Please let Emily know in submitting your questions or inquiry, if you would not like to be named as asking the question. She invites all questions or inquiries be addressed to: emily@riirecruit.com

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

www.riirecruit.com

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

EQUIPMENT LEASING SALES

Nationwide- Grand Island, Nebraska

AXIS Capital, Inc. has immediate opportunities in Texas (Houston or Dallas based) for experienced customer direct leasing sales executives with established current end user relationships preferred. AXIS Capital Inc. is a National Independent Leasing company. Our ideal candidate will have the opportunity to utilize their industry expertise with the opportunity to grow their existing equipment lessee customer base.

Position Requirements:

• Candidates will possess exceptional verbal, written and customer service skills.

• Proficient in Excel, Word, Outlook, PowerPoint.

• Self-motivating and organizational skills.

• Travel required

Competitive salary, health insurance, 401K, life Insurance, paid vacations and holidays. If you possess the required experience and feel you have what it takes to succeed, please email your resume to hr@axiscapitalinc.com or send your resume to PO Box 2555, Grand Island, NE 68801.

www.axiscapitalinc.com

|

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Bank Beat—52 branch bank failure in Indiana, plus two more

Integra Bank, NA., Evansville, Indiana is the nation's second largest banking failure this year. It is the 61st bank to fail, but the good news is last year the regulators had closed 108 banks by this date.

The 52 branches of Integra Bank were closed with Old National Bank, Evansville, Indiana, to assume all of the deposits. This is a very old bank founded July 4, 1850 and survived the depression. Its history shows it helped finance the Erie Canal, but the direction changed dramatically when in 2006 it was acquired by Prairie Financial Group for $122 million and the bank then went on a very aggressive real estate lending spree just as the bubble was about to burst, extremely poor timing.(1)

Prairie Financial Corporation is the holding company of Prairie Bank & Trust Co., an Illinois chartered bank, a relatively small bank. with 20 full time employees with an office in Effingham in Stewardson, Illinois, Its 2010 year-end profit was $270,000 and June 30, 2011 net equity $5.2 million.

Integra Bank had a high of 802 full time employees when purchased by the Prairie Financial Group in 2006, but by March 31, 2011 it had only 516 full time employees with 13 offices in Illinois, 30 in Indiana, and 12 in Kentucky. June 30, 2011 Tier 1 risk-based capital ratio: 1.48%

The numbers below show the bank has had serious problems since 2008. In May, 2009 the Office of the Comptroller took enforcement action, also ordering the bank to raise additional capital of $120 million. It became one of the few remaining large banks unable to repay the $83.6 million TARP money.

As of March 31, 2011, Integra Bank, National Association had approximately $2.2 billion in total assets and $1.9 billion in total deposits. Old National Bank will pay the FDIC a premium of 1.0 percent to assume all of the deposits of Integra Bank, National Association. In addition to assuming all of the deposits of the failed bank, Old National Bank agreed to purchase essentially all of the assets.

The FDIC and Old National Bank entered into a loss-share transaction on $1.2 billion of Integra Bank, National Association's assets.

(in millions, unless otherwise)

Net Equity |

|

| 2006 |

$288.3 |

| 2007 |

$433.0 |

| 2008 |

$309.1 |

| 2009 |

$196.5 |

| 2010 |

$84.6 |

| 3/31 |

$40.5 |

| 6/30 |

$20.9 |

Profit |

|

| 2006 |

$23.5 |

| 2007 |

$36.7 |

| 2008 |

-$106.3 |

| 2009 |

-$175.8 |

| 2010 |

-$115.9 |

| 3/31 |

-$45.0 |

| 6/30 |

-$69.0 |

Non-Current Loans |

|

| 2006 |

$8.8 |

| 2007 |

$22.6 |

| 2008 |

$150.9 |

| 2009 |

$214.8 |

| 2010 |

$197.0 |

| 3/31 |

$189.7 |

Charge Offs

2006 $23.5 ($20.5 commercial and industrial loans, $1.3 consumer loans, $984,000 1-4 houses,)

2007 $4.0 ($1.4 consumer loans, $877,000 1-4 fam., $519,000 commercial & industrial

2008 $28.6 ($12.4 L&C, $5.3 commercial & industrial, $3.8 1-4 fam., $2.5 multifamily, $2.2 individuals)

2009 $89.1 ($29.8 L&C, $18.3 other loans, $14.9 1-4 fam., $10 multifam., $5.5 commer, $2.6 indiv.)

2010 $114.5 ($47.9 L&C, $22.1 nonfarm, $19.6 1-4 fam., $11.5 commercial, $7.4 multifam., $3.8 lease financing receivables, $1.2 indiv.)

3/31 $19.9 ($8.2 L&C, $6.2 nonfarm, $3.4 1-4 family, $2 commercial (-$577,000 lease financing receivables. Land and Construction, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $170.7 million.

(1) Integra expansion proved to be ultimate downfall

http://www.indianaeconomicdigest.net/main.asp?SectionID=31&subsectionID=235&articleID=61091

http://www.fdic.gov/news/news/press/2011/pr11128.html

The three branches of BankMeridian, N.A., Columbia, South Carolina, were closed with SCBT, National Association, Orangeburg, South Carolina, to assume all of the deposits. Formed May 18, 2006 after raising $31.5 million in capital, the bank had a high of 46 full time employees in 2007, but by March 31, 2011 was down to 34 full time employees at their offices in Columbia, Hilton Head island, and Spartanburg. Tier 1 risk-based capital ratio: 1.88%

It is interesting to note the www.problembanklist noted that BankMeridian in April, 2009 said it would not participate in the US Treasury's Troubled Asset Relieve Program (TARP.)

"In a press release Bank President Ashley Houser said that although “the bank recognizes the Treasury’s programs are important for strengthening the overall US financial system, the bank’s Board of Directors found the imposed limitations were not in the best interests of shareholders”. President Houser also stated that “Our confidence in our capital position is one of the main reasons that we chose not to participate in the TARP CPP”.

Obvious he didn’t know what he was doing as the capital of BankMeridian thereafter quickly vanished as loan defaults continued to soar."

http://problembanklist.com/bankmeridian-columbia-sc-closed-by-regulators-0381/

(in millions, unless otherwise)

Net Equity |

|

| 2006 |

$30.2 |

| 2007 |

$30.7 |

| 2008 |

$29.3 |

| 2009 |

$20.3 |

| 2010 |

$7.7 |

| 3/31 |

$2.98 |

Profit |

|

| 2006 |

-$1.3 |

| 2007 |

$302,000 |

| 2008 |

-$1.1 |

| 2009 |

-$8.9 |

| 2010 |

-$12.5 |

| 3/31 |

-$4.8 |

Non-Current Loans |

|

| 2006 |

0 |

| 2007 |

0 |

| 2008 |

$5.7 |

| 2009 |

$19.7 |

| 2010 |

$35.6 |

| 3/31 |

$38.4 |

Charge Offs

2006 0

2007 0

2008 $1.4 ($543 commercial and industrial, $540,000 L&C, $190,000 nonfarm, $170,000 1-4 fam.)

2009 $4.4 ($2.1 commercial and industrial, $1 1-4 fam., $895,000 L&C, $100,000 other loans)

2010 $7.98 ($3 1-4 family homes, $2.6 L&C, $1 commercial and industrial primarily)

3/31 $2.3 ($1 1-4 family homes, $652,000 L&C, $485,000 non farm)

Land and Construction, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As of March 31, 2011, BankMeridian, N.A. had approximately $239.8 million in total assets and $215.5 million in total deposits. The FDIC and SCBT, National Association entered into a loss-share transaction on $179.0 million of BankMeridian, N.A.'s assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $65.4 million.

http://www.fdic.gov/news/news/press/2011/pr11127.html

Virginia Business Bank, Richmond, Virginia, was closed with Xenith Bank, Richmond, Virginia, to assume all of the deposits. The small bank was founded April 3, 2006 and had a high of 18 full time employees in 2008, but by March 31, 2011 was down to 11 full time employees. March 31, 2011: Tier 1 risk-based capital ratio: 1.13%.

August, 2009 Virginia Business Bank signed a consent decree to "restore and maintain the Bank to a safe and sound condition."

October 10, 2010 regulators informed the state chartered bank, that they were in serious default and had to raise capital, but basically at the same time, the offer to raise $30 million common stock failed, as the numbers certainly were scaring off investors. The bank reportedly became the first state chartered to fail in 20 years.

(in millions, unless otherwise)

Net Equity |

|

| 2006 |

$14.8 |

| 2007 |

$13.3 |

| 2008 |

$11.5 |

| 2009 |

$9.4 |

| 2010 |

$3.3 |

| 3/31 |

$796,000 |

Profit |

|

| 2006 |

-$2.4 |

| 2007 |

-$1.7 |

| 2008 |

-$2.3 |

| 2009 |

-$4.2 |

| 2010 |

-$3.3 |

| 3/31 |

$796,000 |

Non-Current Loans |

|

| 2006 |

0 |

| 2007 |

0 |

| 2008 |

$1.1 |

| 2009 |

$6.9 |

| 2010 |

$11.3 |

| 3/31 |

$9.9 |

Charge Offs

2006 0

2007 0

2008 N/A

2009 $2.5 ($906,000 L&C, $629,000 1-4 Fam., $858,000 commercial and industrial loans)

2010 $5.3 ($3.3 L&C, $1.2 1-4 fam., $1.3 commercial & indust., $1 non-farm, $634,000 indiv.)

3/31 $921,000 ( $585,000 non-farm, $254,000 1-4 famil, $82,000 L&C)

Land and Construction, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As of March 31, 2011, Virginia Business Bank had approximately $95.8 million in total assets and $85.0 million in total deposits.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.3 million.

http://www.fdic.gov/news/news/press/2011/pr11126.html

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

### Press Release ############################

'Wait and See' Approach Persists for Third Month

National Association of Credit Managers

Columbia, Maryland: The best that can be said about this month’s National Association of Credit Managers’ Index (CMI) is that things did not get appreciably worse. The latest data suggest a third month of slump, and it appears the economy is languishing in a state that is not quite in crisis but which isn’t showing energy either.

“If there is anything to be somewhat encouraged by it is that manufacturing improved over the really down month last July, but at the same time there was weakness in the service sector that didn’t appear the previous month,” said Chris Kuehl, PhD, managing director of Armada Corporate Intelligence and economic advisor to the National Association of Credit Management (NACM).

“In comparing the CMI readings to other indices, it is apparent the economy has still not committed to either continued growth or a real decline,” said Kuehl. “There have been some positive signs from the latest set of leading economic indicators released from the Conference Board, but there have also been renewed signs of distress as far as consumer confidence is concerned. Not surprisingly there is a sense that much has stalled in the economy as uncertainty has been the rule of the day.”

The overall index barely changed and the manufacturing and service sectors have simply swapped positions again as far as stress is concerned. The CMI numbers for the last three months show a general slowdown in business activity. There has been a slump in sales, a reduction in the number of new credit applications and a slowdown in the collection process. The economy is essentially stalled and the question is whether this is a reaction to something short term or a reflection of some greater underlying trend. The CMI data hint that the situation is temporary and related to uncertain factors gripping the economy. Much of this information is more anecdotal than anything that can be pinned onto hard data. The majority of the information from the banking sector suggests there is money to borrow. There is available trade credit according to most sources. Businesses are sitting on more cash than they have in a long time and most companies are not having issues paying their bills. The problem is that almost everybody is worried about contingency plans and are sitting back as they wait for something to change.

The demand needed is not there yet and nobody is quite sure why. The jobless situation is certainly a worry, but the fact is that 91% of the workforce is employed. They are nervous about spending and as long as they stay on the sidelines, the manufacturing community does as well. “There are few in the mood to leverage themselves until they have a better sense of what to expect from the government and from the economy as a whole. Everything is more or less in place for expansion, but there has been no trigger thus far and there is plenty to make people more nervous about the future,” said Kuehl.

About the National Association of Credit Management

The National Association of Credit Management (NACM), headquartered in Columbia, Maryland, supports approximately 17,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of Affiliated Associations are the leading resource for credit and financial management information and education, delivering products and services, which improve the management of business credit and accounts receivable. NACM’s collective voice has influenced legislative results concerning commercial business and trade credit to our nation’s policy makers for more than 100 years.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Top Stories July 23---July 29

Here are the top ten stories opened by readers:

(1) CFA to Merge with NFA

http://leasingnews.org/archives/Jul2011/7_28.htm#merge

(2) Five Point Capital joins Evergreen Notification List

http://leasingnews.org/archives/Jul2011/7_25.htm#five

(3) Tom Price/Hyun Um $200/$400 Million BK with charges of Scam

by Kit Menkin

http://leasingnews.org/archives/Jul2011/7_28.htm#scam

(4) New Hires---Promotions

http://leasingnews.org/archives/Jul2011/7_28.htm#hires

(5) 3700 Post Offices to Close--by State/Location

3,000 postmaster/500 station managers, up to 1,000 postal clerks

http://about.usps.com/news/electronic-press-kits/expandedaccess/statelist.htm

(6) Subway boss pares sales force; IPO possible

http://www.nypost.com/p/news/business/trimming_the_menu_I0kx5rNwpq8eAx9qZtTV9O

(7) June---The List

-- Mergers, Acquisitions & Changes

http://leasingnews.org/archives/Jul2011/7_28.htm#list_june

(8) Emily Fitzpatrick---Career Crossroad

http://leasingnews.org/archives/Jul2011/7_25.htm#crossroad

(9) Microfinancial (TimePayment) Almost Double Earnings

http://leasingnews.org/archives/Jul2011/7_25.htm#micr

(10) U2 gave an 'out of this world' performance at the TCF Bank Stadium

http://www.examiner.com/arts-in-minneapolis/u2-gave-an-out-of-this-world-performance-at-the-tcf-bank-statement-1

[headlines]

--------------------------------------------------------------

Evansville, Indiana-- Adopt-a-Dog

Mindy

Labrador Retriever Mix

Young Female

This is Mindy! She is a very sweet and young Labrador Retriever mix who came to us as a stray on 7/18/11. Mindy is a very pretty girl! Please consider saving a life today through adoption or even fostering her! Mindy is available for adoption or foster on 7/26/11. Stop by Evansville Animal Control and see Mindy in person! She is waiting for her forever home!

Adoption fee: $90

Adoption fees include Neuter/Spay and Rabies Vaccination vouchers, and a microchip.

Residents within the city limits of Evansville are required to buy a City License for an additional $10.

Evansville Vanderburgh Animal Care and Control

Evansville, IN

812-604-0088

anotherchanceforanimals@gmail.com

Evansville Vanderburgh Animal Care and Control

815 Uhlhorn St

812-604-0088

Evansville, IN 47710 US

www.petfinder.com/shelters/IN188.html

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

----------------------------------------------------------------

Please send to a colleague---Leasing News is Free

This Day in American History

1498 - Italian explorer Christopher Columbus sets foot on the American mainland for the first time, at the Paria Peninsula in present-day Venezuela. Thinking it an island, he christened it Isla Santa and claimed it for Spain. He entered the Gulf of Paria in Venezuela and planted the Spanish flag in South America on August 1, 1498. He explored the Orinoco River of Venezuela and, given its scope, soon realized he had stumbled upon another continent. Columbus, a deeply religious man, decided after careful thought that Venezuela was the outer regions of the Garden of Eden. Returning to Hispaniola, he found that conditions on the island had deteriorated under the rule of his brothers, Diego and Bartholomew. Columbus' efforts to restore order were marked by brutality, and his rule came to be deeply resented by both the colonists and the native Taino chiefs. In 1500, Spanish chief justice Francisco de Bobadilla arrived at Hispaniola, sent by Isabella and Ferdinand to investigate complaints, and Columbus and his brothers were sent back to Spain in chains. He was immediately released upon his return, and Ferdinand and Isabella agreed to finance a fourth voyage, in which he was to search for the earthly paradise and the realms of gold said to lie nearby. He was also to continue looking for a passage to India. In May 1502, Columbus left Cýdiz on his fourth and final voyage to the New World. After returning to Hispaniola, against his patrons' wishes, he explored the coast of Central America looking for a strait and for gold. Attempting to return to Hispaniola, his ships, in poor condition, had to be beached on Jamaica. Columbus and his men were marooned, but two of his captains succeed in canoeing the 450 miles to Hispaniola. Columbus was a castaway on Jamaica for a year before a rescue ship arrived. In November 1504, Columbus returned to Spain. Queen Isabella, his chief patron, died less than three weeks later. Although Columbus enjoyed substantial revenue from Hispaniola gold during the last years of his life, he repeatedly attempted (unsuccessfully) to gain an audience with King Ferdinand, whom he felt owed him further redress. Columbus died in Valladolid on May 20, 1506, without realizing the great scope of his achievement: He had discovered for Europe the New World, whose riches over the next century would help make Spain the wealthiest and most powerful nation on earth.

1619-First black Americans (20) land at Jamestown, Virginia.

http://www.pbs.org/wgbh/aia/part1/1h289.html

http://www.pbs.org/wgbh/aia/part1/1p263.html

http://www.pbs.org/wgbh/aia/part1/1i2991.html

http://www.historian.org/local/jamstwnva.htm

1764-Birthday of Anne Willing Bingham conducted social salons for leaders of the newly born United States such as Jefferson, Washington, etc., and had a lot to say to them. AWB is one of the largely unrecognized cadre of early American women who along with Abigail Adams, Mercy Otis Warren, and others attempted to gain human rights for women from the framers of the U.S. Constitution.

She reported was used as the model for “ liberty” on US coins.

http://mywebpages.comcast.net/reidgold/draped_busts/debate.html

http://mywebpages.comcast.net/reidgold/draped_busts/pics.html

http://odur.let.rug.nl/~usa/P/tj3/writings/brf/jefl69.htm

1776- the first Jew to die in the American Revolution, Francis Salvador, was killed in a skirmish with the British loyalists. He was also the first Jew selected to office in colonial America. He was voted a member of the South Carolina Provincial Congress in January, 1775. He was known as the Southern Paul Revere for having warned of the approach of the British fleet at Charleston, SC. On August 1, 1776, while he was leading the militia under the command of Major Andrew Wilinson, his group was ambushed by Native Americans and loyalists near Esseneka (Seneca). Salvador was shot through the body and the left leg and was scalped by a group of Cherokees who sided with the British.

http://www.fau.edu/library/brody3.htm

1781 - English army under Lord Cornwallis occupied Yorktown, Virginia.

1779-Birthday of Francis Scott Key ( and if you don’t know who he was, turn in your citizenship papers). American attorney, social worker, poet and author of the US national anthem. Key was on shipboard off Baltimore during the British bombardment of Fort McHenery on the nights of September 13-14, 1814. Thrilled to see the American flag still flying over the fort at daybreak, Key wrote the poem “ The Star-Spangled Banner.” Born at Frederick County, MD., he died at Baltimore, MD, January 11, 1842.

http://www.marylandtheseventhstate.com/article1014.html

1790- The first census revealed that there were 3,939,326 citizens in the 16 states and the Ohio Territory. Virginia, with 747,610, was the most populous state; Rhode Island, with 68,825, the least. New York City had a population of 33,131, Philadelphia had a population of 28,522, and Boston had a population of 18,320. The US has taken a census every 10 years since 1790.

1791- Virginia planter Robert Carter Ill confounded his family and friends by filing a deed of emancipation for his 500 slaves. One of the wealthiest men in the state, Carter owned 60,000 acres over IS plantations. The deed included the following words: “I have for some time past been convinced that to retain them in Slavery is contrary to the true principles of Religion and Justice and therefore it is my duty to manumit them.” The document established a schedule by which 15 slaves would be freed each Jan 1, over a 21-year period, plus slave children would be freed at age 18 for females and 21 for males. It is believed this was the largest act of emancipation in US history and predated the Emancipation Proclamation by 70 years.

1794- Whiskey Rebellion begins.

http://www.whiskeyrebellion.org/rebell.HTM

1812- A rare tornado hits Westchester County, NY.

http://www.rootsweb.com/~nylnphs/HH/2.htm

1818-Birthday of Maria Mitchell. An interest in her father’s hobby and an ability for mathematics resulted in Maria Mitchell’s becoming the first female professional astronomer. In 1847, while assisting her father in a survey of the sky for the US Coast Guard, Mitchell discovered a new comet and determined its orbit. She received many honors because of this, including being elected to the American Academy of Arts and Sciences---its first woman. Mitchell joined the staff at Vassar Female College in 1865---the first US female profession of astronomy—and in 1873 was a cofounder of the Association for the advancement of Women. Born at Nantucket, MA. Mitchell died June 28, 1889, at Lynn, MA.

http://womenshistory.about.com/library/bio/blbio_mit

http://209.68.19.123/

http://ne.essortment.com/biographyofmar_rhff.htm

1838-Abolition of slavery in Jamaica. Spanish settlers introduced the slave trade into Jamaica in 1509 and sugar cane in 1640. Slavery continued until this day when it was abolished by the British.

http://www.spartacus.schoolnet.co.uk/Lslavery33.htm

1861-for trivia fans, John Tyler of Virginia, president of the United States from 1841 to 1845, became a delegate to the Provisional Congress of the Confederate States. He was elected a member of the House of Representatives of the permanent Confederate Congress on November 7, 1861, but died on January 18, 1862, before taking his seat. he is the only former president to serve as an official of an “enemy government.”

http://www.whitehouse.gov/history/presidents/jt10.html

http://www.americanpresidents.org/presidents/president.asp?PresidentNumber=10

1870 - Norton I is listed by the US Census taker with the occupation of “Emperor,” living at 624 Commercial Street, San Francisco

1873- The first cable car ran at 5am on Clay Street Hill , San Francisco, CA, while the City slept. It was ready to run its trails, and pictures were allowed to be taken on August 2. Revenue service did not take place until September 1. The ride cost five cents. This was the first cable car put into service anywhere in the world. It was invented by Andrew Smith Hallidie, who obtained a patent on January 17, 1871, on an “endless-wire rope way.” Today only three lines of the original lines operate.

http://www.americahurrah.com/Postcards/SFCC1.html

http://www.sfmuseum.org/bio/hallidie.html

http://www.americahurrah.com/Postcards/SFCC1.html

1876- Colorado admitted to the Union as the 38th state.

http://memory.loc.gov/ammem/today/aug01.html

http://www.sfcablecar.com/hist1.html

1903 –Birthday of Calamity Jane, who’s real name was Martha Jane Cannary Burk, born Princeton, Missouri. Between legend and the usual misrepresentations, the true life of this frontier woman is shrouded. She usually dressed as a man, yet historians claim she was a prostitute. She claimed to have scouted for the army, including for Gen. George Custer while others say that was impossible. She was part of a geological expedition to the Black Hills and stayed after gold was discovered. History says she also was a "companion" of Wild Bill Hickok who died 27 years and one days before she did, and is buried next to him, not his wife. She lived her last years in poverty. How she earned her living appears to be a mystery as many historians claim that she was not a stage driver, a scout, nor anything else like that. She was in El Paso for a time where she married a Clinton Burke who soon deserted her. She was believed to have been a mail carrier in Deadwood, but her exact ways of earning a living are just not known. In reality, most of what we think we know of Calamity Jane is the product of dime novels of the era that portrayed her as beautiful and daring as well as Hollywood movies.

http://www139.pair.com/read/Marthy_Cannary_Burk/Life_and_Adventures_of_Calamity_Jane

/Life_And_Adventures_Of_Calamity_Jane_p1.html

1916-Hawaii Volcanoes National Park Established. Area of Hawaii Island, including active volcanoes Kilauea and Manua Loa, were established as Hawaii National Park in 1916.

http://www.nationalgeographic.com/destinations/Hawaii_Volcanoes_National_Park/

1933- California introduces sales tax due to the devastating depression.

http://www.salestaxcpa.com/id50.htm

1939-Glenn Miller Band records “ In the Mood,” ( Bluebird 104150 Non-royalty contract gives him only $175.

1941---Willy’s introduces the “jeep.” General Dwight D. Eisenhower said that America could not have won World War II without it.

http://jeepin.com/history.shtml

1941-Birthday of Ronald H. Brown, born Washington, DC., grew up in Harlem and studied at Middlebury College in Vermont. After graduating from St. John’s University law school, Brown served as chief council for the Senate Judiciary Committee. He went on to become the first African-American partner at the law firm of Patton Boggs & Blow, the first African-American leader of the Democratic National Committee and later served as the US Secretary of Commerce during the Clinton administration. Brown died in a plane crash at Dubrovnik, Croatia, Apr 3,1996, while on government business. Some say the death was not an accident.

http://www.rhbf.org/aboutron.asp

1941- Yankee Lefty Gomez breaks the major league mark for walks in a shutout by issuing 11 walks in a 9-0 victory over the Browns.

1942- Birthday of Jerry Garcia, lead guitarist and driving force behind the Grateful Dead, was born in San Francisco. The Dead were the only psychedelic band of the 1960's to survive into the '90s. They had been better known for their 4 - 5 hour concerts than for their recordings, until 1987's "In the Dark." It was the Grateful Dead's biggest seller, and a single from it, "Touch of Grey," became their first top-ten hit. Garcia died of a heart attack on August 9th, 1995, at a residential treatment center in Forest Knolls, California. He had reportedly gone there to battle his heroin addiction.

http://www.jerrygarcia.com

1942-- In response to what it sees as a threat from the new fad, phonograph records, the American Federation of Musicians goes on strike (but only for recording, not live, gigs).

1943 HUGHES, LLOYD H. (Air Mission) Medal of Honor

Rank and organization: Second Lieutenant, U.S. Army Air Corps, 564th Bomber Squadron, 389th Bomber Group, 9th Air Force. Place and date: Ploesti Raid, Rumania, 1 August 1943. Entered service at: San Antonio, Tex. Born: 12 July 1921, Alexandria, La. G.O. No.: 17, 26 February 1944. Citation: For conspicuous gallantry in action and intrepidity at the risk of his life above and beyond the call of duty. On August 1943, 2d Lt. Hughes served in the capacity of pilot of a heavy bombardment aircraft participating in a long and hazardous minimum-altitude attack against the Axis oil refineries of Ploesti, Rumania, launched from the northern shores of Africa. Flying in the last formation to attack the target, he arrived in the target area after previous flights had thoroughly alerted the enemy defenses. Approaching the target through intense and accurate antiaircraft fire and dense balloon barrages at dangerously low altitude, his plane received several direct hits from both large and small caliber antiaircraft guns which seriously damaged his aircraft, causing sheets of escaping gasoline to stream from the bomb bay and from the left wing. This damage was inflicted at a time prior to reaching the target when 2d Lt. Hughes could have made a forced landing in any of the grain fields readily available at that time. The target area was blazing with burning oil tanks and damaged refinery installations from which flames leaped high above the bombing level of the formation. With full knowledge of the consequences of entering this blazing inferno when his airplane was profusely leaking gasoline in two separate locations, 2d Lt. Hughes, motivated only by his high conception of duty which called for the destruction of his assigned target at any cost, did not elect to make a forced landing or turn back from the attack. Instead, rather than jeopardize the formation and the success of the attack, he unhesitatingly entered the blazing area and dropped his bomb load with great precision. After successfully bombing the objective, his aircraft emerged from the conflagration with the left wing aflame. Only then did he attempt a forced landing, but because of the advanced stage of the fire enveloping his aircraft the plane crashed and was consumed. By 2d Lt. Hughes' heroic decision to complete his mission regardless of the consequences in utter disregard of his own life, and by his gallant and valorous execution of this decision, he has rendered a service to our country in the defeat of our enemies which will everlastingly be outstanding in the annals of our Nation's history.

1943---JERSTAD, JOHN L. (Air Mission) Medal of Honor

Rank and organization: Major, U.S. Army Air Corps, 9th Air Force. Place and date: Ploesti Raid, Rumania, 1 August 1943. Entered service at: Racine, Wis. Born: 12 February 1918, Racine, Wis. G.O. No.: 72, 28 October 1943. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty. On 1 August 1943, he served as pilot of the lead aircraft in his group in a daring low-level attack against enemy oil refineries and installations at Ploesti, Rumania. Although he had completed more than his share of missions and was no longer connected with this group, so high was his conception of duty that he volunteered to lead the formation in the correct belief that his participation would contribute materially to success in this attack. Maj. Jerstad led the formation into attack with full realization of the extreme hazards involved and despite withering fire from heavy and light antiaircraft guns. Three miles from the target his airplane was hit, badly damaged, and set on fire. Ignoring the fact that he was flying over a field suitable for a forced landing, he kept on the course. After the bombs of his aircraft were released on the target, the fire in his ship became so intense as to make further progress impossible and he crashed into the target area. By his voluntary acceptance of a mission he knew was extremely hazardous, and his assumption of an intrepid course of action at the risk of life over and above the call of duty, Maj. Jerstad set an example of heroism which will be an inspiration to the U.S. Armed Forces.

1943--JOHNSON, LEON W. (Air Mission) Medal of Honor

Rank and organization: Colonel, U.S. Army Air Corps, 44th Bomber Group, 9th Air Force. Place and date: Ploesti Raid, Rumania, 1 August 1943. Entered service at: Moline, Kans. Born: 13 September 1904, Columbia, Mo. G.O. No.: 54, 7 September 1943. Citation: For conspicuous gallantry in action and intrepidity at the risk of his life above and beyond the call of duty on 1 August 1943. Col. Johnson, as commanding officer of a heavy bombardment group, let the formation of the aircraft of his organization constituting the fourth element of the mass low-level bombing attack of the 9th U.S. Air Force against the vitally important enemy target of the Ploesti oil refineries. While proceeding to the target on this 2,400-mile flight, his element became separated from the leading elements of the mass formation in maintaining the formation of the unit while avoiding dangerous cumulous cloud conditions encountered over mountainous territory. Though temporarily lost, he reestablished contact with the third element and continued on the mission with this reduced force to the prearranged point of attack, where it was discovered that the target assigned to Col. Johnson's group had been attacked and damaged by a preceding element. Though having lost the element of surprise upon which the safety and success of such a daring form of mission in heavy bombardment aircraft so strongly depended, Col. Johnson elected to carry out his planned low-level attack despite the thoroughly alerted defenses, the destructive antiaircraft fire, enemy fighter airplanes, the imminent danger of exploding delayed action bombs from the previous element, of oil fires and explosions, and of intense smoke obscuring the target. By his gallant courage, brilliant leadership, and superior flying skill, Col. Johnson so led his formation as to destroy totally the important refining plants and installations which were the object of his mission. Col. Johnson's personal contribution to the success of this historic raid, and the conspicuous gallantry in action, and intrepidity at the risk of his life above and beyond the call of duty demonstrated by him on this occasion constitute such deeds of valor and distinguished service as have during our Nation's history formed the finest traditions of our Armed Forces.

1943--KANE, JOHN R. (Air Mission) Medal of Honor

Rank and organization: Colonel, U.S. Army Air Corps, 9th Air Force. Place and date: Ploetsi Raid, Rumania, 1 August 1943. Entered service at: Shreveport, La. Birth: McGregor, Tex. G.O. No.: 54, 9 August 1943. Citation: For conspicuous gallantry in action and intrepidity at the risk of his life above and beyond the call of duty on 1 August 1943. On this date he led the third element of heavy bombardment aircraft in a mass low-level bombing attack against the vitally important enemy target of the Ploesti oil refineries. En route to the target, which necessitated a round-trip flight of over 2,400 miles, Col. Kane's element became separated from the leading portion of the massed formation in avoiding dense and dangerous cumulous cloud conditions over mountainous terrain. Rather than turn back from such a vital mission he elected to proceed to his target. Upon arrival at the target area it was discovered that another group had apparently missed its target and had previously attacked??and damaged the target assigned to Col. Kane's element. Despite the thoroughly warned defenses, the intensive antiaircraft fire, enemy fighter airplanes, extreme hazards on a low-level attack of exploding delayed action bombs from the previous element, of oil fires and explosions and dense smoke over the target area, Col. Kane elected to lead his formation into the attack. By his gallant courage, brilliant leadership, and superior flying skill, he and the formation under his command successfully attacked this vast refinery so essential to our enemies' war effort. Through his conspicuous gallantry in this most hazardous action against the enemy, and by his intrepidity at the risk of his life above and beyond the call of duty, Col. Kane personally contributed vitally to the success of this daring mission and thereby rendered most distinguished service in the furtherance of the defeat of our enemies.

1944-Warsaw Uprising. Having received radio reports from Moscow promising aid from the red Army, the Polish Home army rose up against the Nazi oppressors. At 5pm, thousands of windows were thrown open and Polish patriots, 40,000 strong, began shooting at German soldiers in the streets. The Germans responded by throwing eight divisions into the battle. Despite appeals from the London-based Polish government-in exile, no assistance was forthcoming from the Allies, and after two months of horrific fighting the rebellion was quashed.

1944- Anne Frank makes the last entry into her diary. To escape deportation to concentration camps, the Jewish family of Otto Frank hid for two years in the warehouse of his food products business at Amsterdam. Gentile friends smuggled in food and other supplies during their confinement. Thirteen-year-old Anne Frank, who kept a journal during the time of their hiding, penned her last entry in the diary Aug 1,1944: ‘[I] keep on trying to find away of becoming what I would like to be, and what I could be, if . . . there weren’t any other people living in the world.” Three days later (Aug 4,1944) Grune Polizel raided the ‘Secret Annex” where the Frank family was hidden. Anne and her sister were sent to Bergen-Belsen concentration camp where Anne died at age 15, two months before the liberation of Holland. Young Anne’s diary, later found in the family’s hiding place, has been translated into 30 languages and has become a symbol of the indomitable strength of the human spirit.

1944---Top Hits

Amor - Bing Crosby

I’ll Be Seeing You - Bing Crosby

Long Ago and Far Away - Helen Forrest & Dick Haymes

Is You is or is You Ain’t (Ma’ Baby) - Louis Jordan

1951-Neal Hefti Band records his “Coral Reef.” Great trumpet player, greater arranger for Basie, Sinatra, and many others.

http://www.spaceagepop.com/hefti.htm

http://us.imdb.com/Name?Hefti,+Neal

1952---Top Hits

I’m Yours - Don Cornell

Delicado - Percy Faith

Auf Wiedersehn, Sweetheart - Vera Lynn

Are You Teasing Me - Carl Smith

1953-Birthday of guitarist Robert Cray, Columbus, GA

http://www.blueflamecafe.com/index.html

1954-- Alan Freed presents his first Moondog Jubilee of Stars under the Stars revue at Ebbets Field in Brooklyn, New York, featuring Fats Domino, The Clovers, The Orioles, Muddy Waters, and Little Walter. It is the first large racially mixed crowd at a concert of this size.

1957- Dodger first baseman Gil Hodges hits his 13th career grand slam and the last grand slam in Brooklyn Dodger history. The bases-loaded shot establishes a new National League record.

1958-- Feeling that label head Sam Phillips is spending too much time promoting Jerry Lee Lewis and not enough promoting him, Johnny Cash leaves Sun Records and signs with Columbia.

1959- Paul Anka's "Lonely Boy" hits #1

1960- Chubby Checker's recording of "The Twist" was released by Cameo-Parkway Records. Checker wasn't the originator of the song that spawned the '60s greatest dance craze. That honor belonged to Hank Ballard, who wrote and recorded the tune as the "B" side of his 1958 hit "Teardrops on My Letter." But it was Chubby Checker who rode "The Twist" to stardom. His recording went to number one on the Billboard pop chart twice - in 1960 and again in 1962.

http://www.send4fun.com/twist.htm

http://www.chubbychecker.com/

1960- 18 year-old singer Aretha Franklin made her first secular recordings for producer John Hammond at Columbia Records. She had recorded some gospel songs at her father's church in Detroit four years earlier.

http://www.aretha-franklin.com/bio.htm

http://www.artistdirect.com/showcase//urban/arethafranklin.html

1960---Top Hits

I’m Sorry - Brenda Lee

Itsy Bitsy Teenie Weenie Yellow Polkadot Bikini - Brian Hyland

It’s Now or Never - Elvis Presley

Please Help Me, I’m Falling - Hank Locklin

1963-Arthur Ashe, first Black male to win Wimbledon, becomes first Black person named to the US Davis Cup team.

http://sportsillustrated.cnn.com/tennis/features/1997/arthurashe/biography.html

1964-- The Beatles' "A Hard Day's Night" hits #1

1964-- A report in Billboard claims that the harmonica is hip again thanks to the Beatles, Dylan, the Stones and Stevie Wonder.

1964-- A brand new group called "The Steampacket," featuring lead vocals by one Rod Stewart, opens for the Rolling Stones at the London Palladium

1966 - Charles Whitman takes a stockpile of guns and ammunition to the observatory platform atop a 300-foot tower at the University of Texas and proceeds to shoot 46 people, killing 16.Whitman, who had killed both his wife and mother the night before, was eventually shot to death after courageous Austin police officers, including Ramiro Martinez, charged up the stairs of the tower to subdue the attacker.Packing food and other supplies, he proceeded to the observation platform, killing the receptionist and two tourists before unpacking his rifle and telescope and hunting the people below. An expert marksman, Whitman was able to hit people as far away as 500 yards. For 90 minutes, he continued firing while officers searched for a chance to get a shot at him. By the end of his rampage, 16 people were dead and another 30 were injured. The University of Texas tower remained closed for over 30 years before reopening in 1999.

1968---Top Hits

Grazing in the Grass - Hugh Masekela

Stoned Soul Picnic - The 5th Dimension

Hurdy Gurdy Man - Donovan

Folsom Prison Blues – Johnny

1969 - The U.S. command in Saigon announces that 27 American aircraft were lost in the previous week, bringing the total losses of aircraft in the conflict to date to 5,690.

1970-- Chicago's "25 or 6 to 4" hits #1

1971-The two Concerts for Bangladesh, organized by George Harrison, were held at Madison Square Garden in New York. Among the other performers were Bob Dylan, Ravi Shankar, Leon Russell and Ringo Starr. A three-record set, which won a Grammy Award, and a documentary film were made of the event. The concerts, album and film raised nearly $11 million US for the impoverished people of the newly-independent nation of Bangladesh, formerly East Pakistan. But much of the money was impounded by the US Internal Revenue Service during a nine-year audit of the Beatles' Apple Corps Limited. $2 million was sent to UNICEF before the audit began, but it wasn't until 1981 that a check for the remainder was issued.

1972-- Chicago's Chicago V LP is certified gold

1972-- Elvis Presley "Burning Love" is released

1976---Top Hits

Kiss and Say Goodbye - Manhattans

Love is Alive - Gary Wright

Moonlight Feels Right - Starbuck

Teddy Bear - Red Sovine

1977-Willie McCovey of the San Francisco Giants hit the 18th and last grand slam of his career. His total still stands as the National League record. Lou Gehrig holds the major league record with 23.

http://www.eteamz.com/hallfame/files/AA06.txt

1977- Giant Willie McCovey establishes a National League record by hitting his 18th career grand slam.

1977- "Elvis - What Happened," an expose by two of Presley's former bodyguards, was published. It sat in bookstores almost unnoticed until Presley's death two weeks later. Then it sold more than three-million copies. It is not available at Amazon, Barnes and Noble, nor other on line used book stores at this time. Try the library in your neighborhood, and order by telephone or internet for a copy via the library system ( you must have a library card and internet pin number---it is free ).

1979- Following her graduation from rabbinical college in Philadelphia, Linda Joy Holtzman was appointed spiritual leader of the Conservative Beth Israel congregation in Coatesville, Pennsylvania, making her the first female rabbi to head a Jewish congregation in America.