|

|

|

|

|

BALTIMORE-BASED ACCOUNT REPRESENTATIVE - In this position, you will develop and maintain relationships with lease brokers, leasing companies, equipment vendors and direct leases throughout Maryland and Virginia. Must be knowledgeable in indirect/third party transactions ranging $15K and up. |

Friday, November 5,2004

Headlines

Correction: Lease One

Classified Ads----Leasing Industry Attorneys

A Leasing Country Still Divided

Power Tools for Leasing for Christmas, Hanukah Presents

Classified---Help Wanted

CIT Added to the S&P 500 Index

Growth of Syndicated Loan Market in U.S

Illinois AG Files Suit Against NorVergence

FTC Gets into NorVergence

Help Wanted Newsletter Advertising

Help Wanted Advertising Rates

News Briefs---

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

American Football Poem

----Weekly Complaint Bulletin Board Report on Monday

######## surrounding the article denotes it is a “press release”

---------------------------------------------------------------------

|

Your One stop solution for training and reference material for the Leasing Professional

|

Correction: Lease One

“Hey Kit, thanks for the free press however we are not Source One.....we are Lease One....Thanks Joe>”

(That was my error. I started that story in-between watching the election returns, staying up until Tom Brokaw and Tim Russert went off the air. I was too tired to finish, so no Leasing News on Wednesday. Name is now corrected in our edition and the top story section, too. Editor )

Lease One , Lynnfield, Massachusetts

“Our program has been operating for 14 years, we charge $19,900 for a three day training, & offer lifetime support , ongoing marketing asst. plus complete underwriting which allows the associate more time to market there company & we provide everything from materials, airfare, hotel , food, equipment etc...”

Joe Angelo, Jr.

http://www.leaseone.com/equipment-leasing-opportunities.htm

[headlines]

________________________________________________________

Classified Ads----Leasing Industry Attorneys

Attorneys/Law Firms who specialize in the equipment leasing industry

California - statewide: CA "ELA"

5-attorney creditors rights law firm, in biz 25 yrs +, specialize all aspects of creditor representation. Primarily represent equipment lessors & funders, plus collection and creditor rep. in bankruptcy.

Email: phemar@hemar.com

Website: www.hemar.com

California - statewide: Encino, CA. "ELA"

24 Attorney AV-rated Law firm representing the Leasing Industry for over 25 Years. We specialize in Lease-enforcement, collection and representation in Bankruptcy Court.

Email: sjenkins@hemar-rousso.com

Website: www.hemar-rousso.com

Connecticut, Southern New England:

EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates.

Email: rcfeldman@snet.net EAEL

Law Firm - Service, Dallas, TX. ELA

Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance.

Email: dmayer@pattonboggs.com

Website: www.pattonboggs.com

Los Angeles, Statewide: CA. "ELA"

Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly basis.

Email: RGarwacki@prodigy.net

Los Angeles -statewide: CA "ELA "

Practice limited to collections, bankruptcy and problem accounts resolution. Decades of experience. 10-lawyer firm dedicated to serving you.

Call Ronald Cohn, Esq.

(818)591- 2121 or email.

Email: rrcohn@aol.com

Los Angeles, CA.

Wagner & Zielinski, successfully representing lessees/ lessors. Not a member of any leasing organization, therefore not beholden to special interests.

Richard Wagner

(562) 597-0450

www.wzlawyers.com

National:

Full staff of attorneys and legal assistants work with Group Leader Barry S. Marks to ensure prompt, cost-effective responses to client needs:

Email: poetbarry@aol.com

Website: www.leaselawyer.com

National:

Coston & Lichtman: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate; workouts, litigation, bankruptcy. Chicago & Florida offices. Jim Coston, CLP (Members: ELA/UAEL/MAEL)

Email: Jcoston@costonlaw.com

Website: www.leaselawyer.com

Northern California - Statewide: CA "EAEL" "ELA"

San Francisco expertise at Marin County prices; practice limited to equipment leasing and finance with 22 years experience, testimonials. Ken Greene, Esq.

Vox: 415 461 3777

Email: keng@kengreenelaw.com

Website: www.kengreenelaw.com

This is for Attorneys to post their legal services, who specialize in equipment leasing. If there are other offices or specialties, please mention in the 25 words allowed to describe the firm and services available. If you are a member of a leasing association, please so indicate. These ads are “free.”

http://64.125.68.90/LeasingNews/PostingFormAttorney.htm

-------------------------------------------------------------------

A Leasing Country Still Divided

by Christopher Menkin, Publisher/Editor

Leasing News received many complaints, including those who asked to be removed from our mailing list.

“ Keep your political opinions to yourself. There are many of us who HATE the Bush administration. In fact, HATE is too mild a word.”

(name with held)

“The Congratulations was just the final straw....... Remove me.”

(name with held )

Readers do not know the party I am registered to or how I voted nor how I feel about the election. Leasing News is non-partisan. We also intend to keep it non-political, unless it directly pertains to an equipment leasing issue.

It is quite proper to congratulate the winners of a baseball, football, basketball, world series, and presidential election. Both John Kerry and their side as well as Ralph Nader congratulated the president, vice-president and their wives. It was fitting for Leasing News to do the same. It was not only good manners to do so, but a sign of respect.

Leasing News has saluted or said “congratulations when the Boston Red Sox beat the Yankees, or Tampa Bay Beat the Raiders, or Arnold Schwarzenegger was elected Governor. It is the polite thing to do. It has nothing to do whether I was rooting for them or not.

When the other team wins the coach crosses the field and congratulates the winning coach. It does not mean he wanted the other team to win. It is good manners. It is sportsmanship.

It was disheartening to receive so many “passionate” e-mails to “take me off your list” for congratulating the winners of the presidential election. Senator John Kerry said in his concession speech it is a time to unite and try to work together. We will face many tough issues in the next fours years, and while we can disagree, we need to move forward united as a country.

“A house divided against itself cannot stand,” Abraham Lincoln.

http://showcase.netins.net/web/creative/lincoln/

speeches/house.htm

---------------------------------------------------------------------

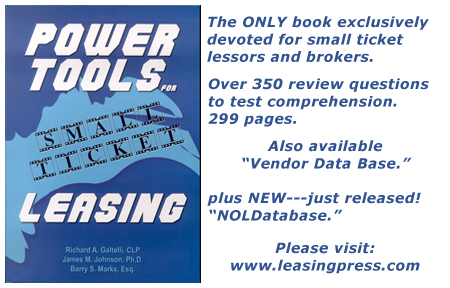

Power Tools for Leasing for Christmas, Hanukah Presents

This book is strongly recommended not only for entrepreneurs, salesmen, but all those involved in equipment leasing as it serves as a current primer, refresher, and well-written, easy to understand manual about equipment leasing.

Leasing News asked the publisher if they also offers discounts to large companies who wish to purchase for specific departments.

“1-4 copies $79.95 each

5-9 copies $72 each

10-25 $64 each

26-50 $56 each

51 -100 $48 each

Over 100 we wash your car for a year and give back rubs to those interested.”

James

|

--------------------------------------------------------------------------

Classified---Help Wanted

Account Representative

BALTIMORE-BASED ACCOUNT REPRESENTATIVE - In this position, you will develop and maintain relationships with lease brokers, leasing companies, equipment vendors and direct leases throughout Maryland and Virginia. Must be knowledgeable in indirect/third party transactions ranging $15K and up. |

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

National Account Manager

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Senior Underwritter

|

Vendor Account Executive

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

----------------------------------------------------------------

### Press Release #########################

CIT Added to the S&P 500 Index

NEW YORK, -- CIT Group Inc. (NYSE: CIT), a

leading provider of commercial and consumer finance solutions, reported that Standard & Poor's has now included the company in the S&P 500 Index.

"We are honored to be selected by Standard and Poor's and proud to be among the companies listed in its flagship index," CIT's President and CEO Jeffrey M. Peek said. "The S&P Index has long been linked to the pulse and growth of the economy. Similarly, CIT has played an important part in fueling economic growth by helping small and mid-sized companies across a broad range of business sectors grow and expand for nearly 100 years."

CIT has been added to the S&P 500 GICS Specialized Finance Sub-Industry Index. The change went into effect October 26, 2004.

The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock's weight in the index proportionate to its market value. According to Standard and Poor's, the "500" is one of the most widely used benchmarks of U.S. equity performance and is held broadly by U.S. and international index funds.

About Standard & Poor's

Standard & Poor's, a division of The McGraw-Hill Companies (NYSE: MHP), provides independent financial information, analytical services, and credit ratings to the world's financial markets. Among the company's many products are the S&P Global 1200, the world's first global, equity, real time index; the S&P 500, the premier U.S. portfolio index; and credit ratings on more than 220,000 securities and funds worldwide. With more than 5,000 employees located in 21 countries, Standard & Poor's is an integral part of the global financial infrastructure.

About CIT

CIT Group Inc. (NYSE: CIT), a leading commercial finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has approximately $50 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in

vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. CIT has approximately 5,800 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com.

SOURCE CIT Group Inc.

### Press Release #######################

Growth of Syndicated Loan Market in U.S. Has Led a ‘Quiet Revolution'

in Capital Market, Says New Milken Institute Study

The U.S. Leveraged Loan Market: A Primer

http://www.milkeninstitute.org/publications/publications.taf?

function=detail&ID=380&cat=ResRep

The development of the syndicated loan market has led to a “quiet revolution” in America's capital market and has allowed the U.S. economy to avoid a damaging credit crunch during the last recession, according to a new study from the Milken Institute.

“This market, without great fanfare, has been one of the most rapidly growing and innovating sections of the U.S. capital market in the past 20 years,” says the report, The U.S. Leveraged Loan Market: A Primer.

Glenn Yago, the Institute's Director of Capital Studies and one of the report's authors, said that the last recession was shorter and shallower because banks were able to find buyers for loans and renew lending faster.

“Without the type of credit crunch that accompanied earlier business cycles, our economic recovery has been swifter thanks to loan syndication and trading,” Yago said.

The study, funded in part by the Loan Syndications and Trading Association (LSTA), offers the first in-depth analysis of this vast and largely unknown market and how it functions, including its value to investors, borrowers and lenders, and a description of the innovations and assets that have originated

in it.

“Syndicated loans have proven themselves to be an attractive asset class with low correlations to other assets, low volatility of returns and an attractive risk/return profile compared to many other traditional fixed-income investment categories,” says the report.

As a bridge of sorts between private and public debt markets, the syndicated loan market – in which a loan is provided not by one lender, but a group of lending institutions – has emerged as an important investment tool.

The development of this market is important for several reasons:

It provides borrowers with an alternative to high-yield bonds and conventional bank loans, and in doing so provides much-needed credit to lower-rated companies.

In times of adversity, banks can sell portions of the syndicated credits into a relatively liquid secondary market and actively manage the risks in their portfolios. This allows them to avoid unnecessary lending restrictions when the economy contracts. This helps prevent a credit crunch in the U.S. economy.

It has led to the creation of a new asset class with greater return per unit of risk than many other fixed-income assets.

Thanks to a number of financial innovations that have led to the creation of new asset classes, and the growth of the secondary market, the syndicated loan market has increased tremendously in the past 20 years.

The secondary market has grown by more than 1,600 percent in the past 12 years – from $8 billion in trading volume in 1991 to $135 billion in 2003. And the leveraged side of this market has become the largest and fastest-growing section.

Another reason for these increases is increased transparency in the market, with credit ratings and independent data and research giving investors much more information, the study says.

“From its origins as a relatively arcane market characterized by the absence of public information, the syndicated loan market has become much more transparent and information is increasingly available to outsiders rather than just a handful of large banks,” the authors say.

The study, which was co-authored by Research Analyst Don McCarthy of the Institute, can be used by investors and other parties to better understand this market, including its investment returns and risks.

Read the report (pdf).

About LSTA: The Loan Syndications and Trading Association is the trade association for corporate lending and loan trading, dedicated to advancing the interests of the marketplace as a whole. Its mission is to promote liquidity and transparency, foster education and communication, and set standards for the corporate lending and loan trading markets through a range of activities designed to promote just and equitable marketplace principles.

Contact

Skip Rimer, Director of Communications

(310) 570-4654

E-mail: srimer@milkeninstitute.org

About the Institute: The Milken Institute is a nonprofit, independent economic think tank whose mission is to improve the lives and economic conditions of diverse populations around the world by helping business and public policy leaders identify and implement innovative ideas for creating broad-based prosperity. It is based in Santa Monica, CA. (www.milkeninstitute.org)

The U.S. Leveraged Loan Market: A Primer

http://www.milkeninstitute.org/publications/publications.taf?

function=detail&ID=380&cat=ResRep

#### Press Release ######################

Illinois AG Files Suit Against NorVergence

MADIGAN FILES SUIT AGAINST BANKRUPT TELECOM COMPANY THAT LEFT SMALL BUSINESSES HOUNDED BY COLLECTION AGENCIES

ILLINOIS IS ONE OF FIRST STATES TO SUE NORVERGENCE

Chicago – After receiving more than 200 consumer complaints from small business clients of a New Jersey-based telecommunications company, Attorney General Lisa Madigan today filed a lawsuit in Sangamon County Circuit Court against the company that left hundreds of small business owners in Illinois without telephone and internet services but threatened with collection actions.

Madigan's office has received 207 complaints against NorVergence, Inc., a telecommunications company based in Newark, New Jersey, that set up a sales office in Oakbrook Terrace. The company was forced into bankruptcy in June 2004, leaving its customers without service but still responsible for five-year rental agreement payments to leasing companies. The total cost of those leasing agreements ranged from approximately $12,000 to $175,000. Under NorVergence's alleged scheme, the company would sell the full five-year contract with a small business to a leasing company and walk away with the profit.

Madigan's lawsuit charges NorVergence, Inc., and Peter Salzano, individually and as president of NorVergence, with multiple violations of the Illinois Consumer Fraud and Deceptive Business Practices Act. Allegations against NorVergence stem from the company's false representation of its product and services to customers.

“NorVergence preyed upon small businesses that were trying to economize on their telecommunications services,” Madigan said. “Instead, they found the business equivalent of dead air when it came time to put those services to work. It's hard enough to make it as a small business without predatory service providers. We are taking every effort to see that NorVergence is held accountable.”

According to Madigan's lawsuit, a NorVergence sales person typically offered to provide discounted telecommunications services using “voice phone calls as fast data.” NorVergence included a “Matrix” box as part of the deal, claiming that this device was necessary to allow a small business to reap a 30 percent discount on its current telecommunications costs, including long distance, DSL service, and wireless phone service. NorVergence representatives allegedly claimed the “Matrix” box would achieve the savings by converting voice calls into data.

Madigan's suit alleges the “Matrix” box failed to perform as promised and is worth only about $500, although NorVergence charged businesses between approximately $200 to $2,900 per month for rental of the “Matrix” box and its telecommunications services. After reaching extended service agreements with its customers, NorVergence then assigned those agreements to leasing companies to collect payments.

After NorVergence was forced into bankruptcy by its creditors, the leasing companies continued to demand payment from small businesses for telecommunication services that had already been shut off. In situations where the small businesses refused to submit monthly payments, the leasing companies have been accelerating the terms of the contract and demanding full payments of the five-year agreement.

On Monday, September 13, Madigan issued subpoenas to eight leasing companies currently attempting to collect payment from Illinois customers of NorVergence. Madigan requested information regarding their discussions with NorVergence and the manufacturers of the Matrix boxes, and asked the leasing companies to refrain from collecting from Illinois consumers.

Today's lawsuit asks the court to find that the NorVergence contracts are the result of fraud and, therefore, must be considered null and void. Madigan's suit also asks the court to prohibit NorVergence from future violations of Illinois' consumer protection laws. Additionally, the suit seeks civil penalties in the amount of $50,000 per violation, restitution for consumers and payment for the cost of investigation and prosecution.

Consumer Fraud Bureau Chief Elizabeth Blackston and Assistant Attorney General Jennifer Meyer are handling the case for Madigan's Springfield Consumer Fraud Bureau.

## Press Release ###########################

FTC Gets into NorVergence Fray

FTC Charges New Jersey Company with Defrauding Consumers Through Sale of its 'Matrix' Telecom Service NorVergence Claimed It Could Provide Dramatic Savings to Small Businesses

The Federal Trade Commission has charged New Jersey-based NorVergence, Inc. with defrauding consumers through misleading claims that it would provide them with years of dramatic savings on their monthly telephone, cellular, and Internet bills. It also falsely promised to provide unlimited long-distance and cellular minutes at no extra cost.

NorVergence claimed that part of the savings would be generated by a "Matrix" black box that it would install on customers' premises. In reality, according to the FTC, the black boxes, which NorVergence rented to customers for inflated prices of between $400 and

$5,700 per month, were nothing more than standard telephone routers and had little or nothing to do with savings.

In fact, the Commission contends, NorVergence had no long-term contracts with telecommunications providers and no way to assure the long-term discounts it promised. Instead, the FTC charges, NorVergence immediately sold the black box rental contracts to

finance companies for quick cash. NorVergence was able to provide a few early customers with "discounted" services only because it used the proceeds of contracts from new customers. The scheme collapsed when NorVergence was unable to provide services or pay its suppliers.

In filing its complaint in federal district court, the FTC also alleged that NorVergence rental contracts, which it sold to finance companies, contained clauses that purportedly required customers to pay even if NorVergence failed to provide any services and allowed the

finance companies to seek collections in any forum they chose, making it very difficult for customers to dispute the monthly rental fees.

NorVergence's Alleged Business Practices

Based in Newark, New Jersey, NorVergence is a New Jersey corporation that, prior to filing for bankruptcy in July 2004, sold and financed telecommunications services and related products to small businesses, nonprofit organizations, churches, and municipalities. The

company marketed its products as integrated, long-term packages, including landline and cellular telephone services and Internet access.

Starting in 2002, and continuing until it filed for bankruptcy, NorVergence's sales staff cold-called small businesses, offering to save them at least 30 percent on their total telecom bill. Using a "savings analysis" sheet, the sales representatives explained that by installing a "black box" - typically called the Matrix or Matrix 850 - at the customer's place of business, NorVergence would be able to provide such savings over the long term. In reality, the "black box" was a standard integrated access device, commonly used to connect telephone equipment to a long-distance provider's lines.

According to the Commission, these agreements were confusing and difficult to understand. One document (called a "rental agreement") required customers to pay between $400 and $7,500 per month for each Matrix 850 box, usually over a five-year term. Another document was a nonbinding agreement by NorVergence to provide telecom service at the stated price for the same term. After getting a customer to sign the agreements, NorVergence sold or assigned the rental agreement to a third-party finance company for a discounted amount of the total rental price. The fine print in the rental agreements allegedly provided that the finance companies could insist on full payment from the customers even if NorVergence failed to provide the services it had promised. Finally, language in the agreements enabled the finance companies to attempt to collect from customers in venues far from where they were located making it difficult for them to dispute the charges in court.

The Commission's Complaint

According to the Commission's complaint, NorVergence violated Section 5 of the FTC Act by misrepresenting that: 1) customers who paid for a rental agreement and associated service agreements would receive long-term discounted telecommunications services; 2)

the company would treat the applications, forms, and rental agreements signed by the customers as a unified agreement under which it would provide telecommunications services in exchange for customer payments; and 3) the equipment listed in the rental agreement would lead to substantial telecom savings.

The FTC contends, however, that consumers did not receive the long-term savings they were promised, and NorVergence did not treat the multiple contracts as one agreement to provide consumer services. Instead, NorVergence treated the rental agreement as a separate hardware financing agreement so it could sell that agreement and receive the rental income up-front, regardless of whether it provided the promised services. In addition, the FTC charges that the equipment listed in the rental agreement did not create the savings promised consumers and only provided minimal savings, if any at all.

The complaint also charges NorVergence with deceptively representing that consumers would receive substantial discounts related to their telecommunications services without disclosing that: 1) it had no long-term commitment from any service provider for the services it promised consumers it would provide; and 2) the equipment covered by the rental agreement would be of little or no value to the customer if NorVergence failed to provide the promised services. The FTC also claims that in connection with selling and financing the telecommunications products it provided, NorVergence's practice of including contract provisions authorizing the filing of lawsuits in geographic areas far from where the contract was signed was likely to cause substantial consumer harm that customers could not reasonably have avoided.

Finally, the Commission's complaint charges NorVergence with providing others with the means to commit deceptive and unfair acts by furnishing third-party finance companies with rental agreements it signed with its customers. By providing the agreements, NorVergence allegedly facilitated the finance companies' ability to file collection suits in areas outside of where the contracts were signed and to demand payment even if the consumers received no services.

The Commission vote authorizing the staff to file the complaint was 5-0. Through the complaint, filed November 4, 2004 in the U.S. District Court for the District of New Jersey, the FTC is seeking to permanently bar the defendants from violating the FTC Act in the future and to secure financial redress for consumers defrauded by NorVergence's alleged conduct. The remedies sought may include restitution, the rescission of existing contracts, and the cancellation of consumer debts claimed by the company.

NOTE: The Commission authorizes the filing of a complaint when it has "reason to believe" that the law has or is being violated, and it appears to the Commission that a proceeding is in the public interest. A complaint is not a finding or ruling that the defendants have actually violated the law.

Copies of the Commission's complaint are available from the FTC's Web site at

http://www.ftc.gov and also from the FTC's Consumer Response Center, Room 130, 600 Pennsylvania Avenue, N.W., Washington, D.C. 20580. The FTC works for the consumer to

prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. To file a complaint, or to get free information on any of 150 consumer topics, call toll-free, 1-877-FTC-HELP (1

-877-382-4357), or use the complaint form at http://www.ftc.gov. The FTC enters Internet, telemarketing, identity theft and other fraud-related complaints into Consumer Sentinel, a secure, online database available to hundreds of civil and criminal law enforcement agencies in the U.S. and abroad.

MEDIA CONTACT:

Mitchell J. Katz

Office of Public Affairs

202-326-2161

STAFF CONTACTS:

Randy Brook or Robert Schroeder

FTC Northwest Region

206-220-6350

### Press Release #######################

-----------------------------------------------------------------

Newsletter Advertising

http://64.125.68.91/AL/LeasingNews/PostingFormAdvertising.asp

$400.00 minimum for four lines (Lines 1 - 4)

Larger Ads

$50.00 per line: the next four lines (Lines 5 - 8)

$25.00 per line there after (Lines 9 & up)

-Company logo is not included in the linage count, company logo is FREE

Also Free: Description of your company (company description can not have more lines than your ad)

Here are examples of ads by size:

http://www.leasingnews.org/Classified/examples.htm

--------------------------------------------------------------------

News Briefs----

Oil closes under $49 at five-week low

Natural gas sinks 6% on heels of weekly U.S. storage data

http://markets.usatoday.com/custom/usatoday-com/

html-story.asp?markets=Commodities&guid=%

7B9C470CD0-0BD5-4D66-BCBD-2B71143F5B8D%7D

Led by High-End Stores, Retail Sales Rose 4.1% in Oct.

http://www.washingtonpost.com/wp-dyn/articles/

A26590-2004Nov4.html

Productivity rises 1.9% But jobless claims fall

http://www.ajc.com/business/content/business/1104/

0economy.html

Dollar Falls On Fears of U.S. Deficits

http://www.washingtonpost.com/wp-dyn/articles/

A26581-2004Nov4.html

Dollar falls to nine-year lows

http://news.ft.com/cms/s/a67665a0-2e8d-11d9-

97e3-00000e2511c8.html

Mortgage rates creep higher

http://www.usatoday.com/money/perfi/housing/

2004-11-04-mortgage_x.htm

MCI and Qwest Report Large Losses as Revenue Falls

http://www.nytimes.com/2004/11/05/business/

05phone.html?pagewanted=all

Wachovia to Pay $37 Million S.E.C. Fine

http://www.nytimes.com/2004/11/05/business/

05wachovia.html?pagewanted=all

Disney World's largest union will ask members to authorize strike

http://www.signonsandiego.com/news/business/

20041104-1344-disney-labor.html

Citizens plans push to get customers to switch banks

http://www.boston.com/business/articles/2004/11/05/

citizens_plans_push_to_get_customers_to_switch_banks/

NEWSWEEK ELECTION ISSUE: 'How He Did It'

http://biz.yahoo.com/prnews/041104/nyth186_1.html

Chirac KO's Bush offer—France Snubs the President

http://www.thesun.co.uk/article/0,,2-2004512444,00.html

2004 Tour Championship

http://www.ajc.com/sports/content/sports/pga/2004/index.html

Vikings Running Back Ready to Return

http://www.nytimes.com/aponline/sports/

AP-FBN-Vikings-Smith.html

Eagles sign cornerback Brown to six-year deal

http://www.theredzone.org/news/showarticle.asp?

ArticleID=1828

Eagles Notes | Tired of being the villain, Owens rips Lewis

http://www.philly.com/mld/inquirer/sports/10094942.htm?1c

Bills Defenders Have Plan to Stop Martin

http://www.nytimes.com/aponline/sports/

AP-FBN-Bills-Stopping-Martin.html

The Red Sox are the newest champions to grace the cover of a Wheaties box

http://www.boston.com/business/articles/2004/11/05/

a_national_league/

Once called 'girlie men,' Democrats may also be 'losers'

http://www.signonsandiego.com/news/politics/

20041104-1434-schwarzeneggerlosers.html

Schwarzenegger shows his clout on propositions

http://sfgate.com/cgi-bin/article.cgi?f=/c/a/

2004/11/04/BAG0V9LLJH1.DTL

Governor names former Rep. Tom Campbell finance director

http://www.sfgate.com/cgi-bin/article.cgi?file=/news/archive/

2004/11/04/state1451EST0060.DTL

------------------------------------------------------------------

“Gimme that Wine”

Mondavi bought by wine giant Constellation

$1 billion deal keeps brands under one roof -- family to no longer own any of business

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/

2004/11/04/MONDAVI.TMP

Napa Valley Wine Tour and California Wine Tour Perfect Excursion for California Tourists

http://www.emediawire.com/releases/2004/11/

emw174902.htm

NorthWest Wineries welcome wine lovers in fall

http://www.thenewstribune.com/soundlife/story/

4153281p-3917972c.html

Micro-sized, owner-operated wineries punch more than their weight with critics and fans

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/

2004/11/04/WIG6R9K74G1.DTL

1733- John Peter Zenger, colonial American printer and journalist, published the first issue of the New York Weekly Journal newspaper. He began his first issue, exposing Governor William Cosby's corruption. Zenger was arrested on November 17,1734, and charged with seditious libel. Zenger had reported that Governor William Cosby of New York had attempted to rig an election in Eastchester, PA, in 1733. Zenger was defended by lawyer Andrew Hamilton of Philadelphia, who convinced the jury that printing the truth does not constitute libel. His acquittal was seen as a vindication of the right of free speech and served as a precedent for freedom of the press.

1781- John Hanson elected first "President of the US in Congress assembled"

(Yes, John Hanson was the first president of the United States, not George Washington—who was the first president under the adopted constitution. Technically Hanson was the first president.)

http://www.johnhanson.net/

http://www.marshallhall.org/hanson.html

1807- Eliza Emily Chappell Porter birthday, spent a lifetime organizing schools in several states. During the Civil War gathered and distributed supplies to Union soldiers and hospitals. She joined with Mary Ann Bickerdyke in nursing soldiers in Gen. Sherman's march through Georgia.

1850- Ella Wheeler Wilcox birthday, highly successful writer of popular novels and poetry who became the center of literary life in New York in the pre-World War I years. Her reputation was made by her Poems of Passion (1883) ?She wrote two autobiographies: The Story of a Literary Career (1905) and The Worlds and I (1918).

http://www.ellawheelerwilcox.org/

http://website.lineone.net/~cornerstone/wilcox.htm

1857- Ida Minerva Tarbell birthday, recognized as one of the major journalists of her day, exposed the Standard Oil trust in History of Standard Oil Company, renowned biographer, especially of Lincoln. Her "History of the Standard Oil," which first appeared in McClure's Magazine in nineteen installments, in 1904, was published in two volumes and drew immediate attention to the author. Her early reputation as a "trust buster" did not last, for she had in a high degree developed a sense of fairness, and this was particularly reflected in her "Life of Judge Gary," in which--contrary to all expectations--she had nothing but praise for Judge Gary. ? She was a renowned biographer, especially of Lincoln. ?She wrote "The Early Life of Abraham Lincoln" in collaboration with W. J. McCan Davis. In 1900 her "Life of Abraham Lincoln" appeared in two volumes, and is today a standard work. Other volumes on Lincoln by Miss Tarbell were "He Knew Lincoln," "Father Abraham," "In Lincoln's Chair," "Boy Scouts' Life of Lincoln," "He Knew Lincoln and Other Billy Brown Stories," "In the Footsteps of Lincoln" and "A Reporter for Lincoln.” President Theodore Roosevelt characterized her as a muckraker, a compliment in those days. Tarbell was a lesbian and in her later life became intimate friends with Anne Morgan, the daughter of J. P. Morgan who was also a liberal Republican, feminist, and supporter of working women.

http://tarbell.alleg.edu/index.html

http://www.thoemmes.com/404.asp?404;

http://www.thoemmes.com/encyclopedia/tarbell.htm

http://www.phmc.state.pa.us/ppet/tarbell/page1.asp?secid=31

1870 -- One of the nation's first train robberies. Six men, led by Big Jack Davis, hopped aboard the eastbound express for Reno, forced the train to a stop, & rode off to Virginia City with $40,000 in minted coin. 10 hours later, as the delayed engine chugged into Independence, six army deserters jumped aboard to take $4m490 that the Davis gang had overlooked. Within days, authorities captured all 13 bandits, who were sentenced variously from 10 to 15 years in prison.

1885- Birthday of Will Durant, American author and popularizer of history and philosophy. Among his books: The Story of Philosophy and The Story of Civilization (a 10-volume series of which the last four were co-authored by his wife, Ariel). Born at North Adams, MA, and died Nov 7, 1981, at

Los Angeles, CA.

1893- birthday of Raymond Fernand Loewy, the “father of streamlining,” an inventor, engineer and industrial designer whose ideas changed the look of 20th-century life, was born at Paris, France. His designs are evident in almost every area of modern life—the US Postal Service logo, the president's airplane, Air Force One, in streamlined automobiles, trains, refrigerators and pens. “Between two products equal in price, function and quality,” he said, “the better looking will outsell the other.” Loewy died at Monte Carlo, July 14,1986.

1894 -the famous Election Day snowstorm hit southern New England, dumping up 10-12 inches of snow across Connecticut causing much damage to trees and wires. Winds at Block Island, RI gusted to 60 mph

1895,-attorney George Baldwin Selden of Rochester, NY, was granted the first patent for a car. He was the first to have an original application for the internal combustion hydrocarbon motor to a road vehicle. His design resembled a horse-drawn carriage, with high wheels and a buckboard.

1895 -- Charles MacArthur, American journalist, dramatist, screenwriter, born Scranton, Pennsylvania. Much of his work was written with Ben Hecht, including The Front Page (1928), a farce about a star reporter drawn into his own story, & Twentieth Century (1932), a lively satire of the entertainment industry.

1907-Pianist Joe Sullivan Birthday

http://www.redhotjazz.com/sullivan.html

1912 – Democrat Woodrow Wilson won the United States presidential election in a landslide, becoming the only president to defeat two former presidents in one election. Thomas R. Marshall was elected vice president. The electoral vote was Wilson, 435: Theodore Roosevelt, Progressive Party, 88: William Howard Taft, Republican, 8.The popular vote was Wilson 6,293,454: Roosevelt, 4,119,538: Taft, 3,484,980: Eugene V. Debs, Socialist candidate, 900,672, Eugene W. Chafin, Prohibitionist candidate, 206,275. In congressional elections the Democrats took a 51-44 majority in the Senate, with one minor party seat, and 291-127 majority in the House, with 17 seats going to minor parties.

1912- Roy Rogers birthday. Known as the “King of the Cowboys,” Rogers was born Leonard Slye at Cincinnati, OH. His many songs included “Don't Fence Me In” and “Happy Trails to You.” He made his acting debut in Under Western Stars in 1935 and later hosted his own show, “The Roy Rogers Show,” in 1951. Rogers died at Apple Valley, CA, July 6,1998.

1913 -- Los Angeles receives its first piped-in water from Owens Valley, 200 miles northeast of the city. As part of Bureau of Land Reclamation efforts to irrigate the valley for small farmers & homesteaders, J.B. Lippincott began surveying in 1903. He convinced local farmers to relinquish their water rights to him, casting an impression that he would use the water to improve the valley. He & powerful Los Angeles friends, meanwhile, quietly planned to export it through a 200-mile aqueduct. The syndicate, which included Harry Chandler of the "LA Times", began buying huge amounts of San Fernando Valley land. On Lippincott's recommendation, the California reclamation chief dropped the Owens redevelopment plan & yielded the water to the city. Now that the water is flowing, the value of Chandler's land has multiplied to $120 million, 40 times more than what he paid. When he dies as the largest land baron in Southern California, Chandler's estate was worth half a billion dollars.

1946- Chuck Connors of the Boston Celtics became the first NBA player to shatter a backboard, doing so during the pre game warm-up in “Boston Garden. Connors also played major league baseball with the Brooklyn Dodgers and the Chicago Cubs and gained fame as star of the television series, “ The Rifleman.” My father Lawrence Menkin wrote many of the episodes.

1935 - The game "Monopoly" was introduced by the Parker Brothers Company.

http://www.adena.com/adena/mo/index.htm

http://www.hasbro.com/monopoly/?CFID=

21692834&CFTOKEN=82601711

1940 - President Roosevelt won an unprecedented third term in office, beating Republican challenger Wendell L. Willkie. Henry A. Wallace was elected vice president. The electoral vote was Roosevelt, 449, Wendell L. Willike, Republican of Indiana, 82. The popular vote was Roosevelt 27,244,160: Willike, 22,305,198: Norman Thomas, Socialist candidate, 100,264: Roger W. Babson, Prohibition candidate, 57,812: Earl Browder, Communist, 48,579: John W. Aiken, Socialist Labor candidate, 14,861. In congressional elections the Democrats lost three Senate seats but kept a 66-28 majority, with two seats going to minor parties. In the House, the Democrats gained seven seats for a 268-162 lead, with five seats going to minor parties.

1944---Top Hits

I'll Walk Alone - Dinah Shore

Dance with the Dolly - The Russ Morgan Orchestra (vocal: Al Jennings)

How Many Hearts Have You Broken - The Three Suns

Smoke on the Water - Red Foley

1946 - 29-year old John F. Kennedy started his political career when today he was elected to the United States House of Representatives as a Congressman from Massachusetts

1947- Frank Sinatra cuts “ I've Got a Crush on You” with Bobby Hackett on trumpet, NYC.

1950- Billy Graham's "Hour of Decision" program was first broadcast over television.

1952---Top Hits

You Belong to Me - Jo Stafford

Wish You Were Here - Eddie Fisher

Half as Much - Rosemary Clooney

Jambalaya (On the Bayou) - Hank Williams

1956- “The Nat King Cole Show” premiered on television. Very popular African American pianist, jazz musician turned singer, Cole hosted his own variety show for NBC. The Nelson Riddle Orchestra and the Randy Van Home Singers also appeared as regulars on the show. It began as a 15-minute show which was expanded to half an hour. The show was dropped as a result of lack of sponsorship and because many affiliates declined to carry it.

1960---Top Hits

Save the Last Dance for Me - The Drifters

My Heart Has a Mind of Its Own - Connie Francis

You Talk Too Much - Joe Jones

Wings of a Dove - Ferlin Husky

1960-- Johnny Horton, who had a Number One smash "Battle of New Orleans," is killed in an auto accident in Texas. Ironically, he had just played his last show, at the Skyline in Austin, Texas-where Hank Williams had played his last show as well. Horton's widow, Billy Joe, was also Hanks Williams' widow. Johnny Horton was 33.

1961 - Strong Santa Ana winds fanned the flames of the Bel Air and Brentwood fires in southern California destroying many homes. At 10 PM the Los Angeles Civic Center reported a temperature of 74 degrees along with a dew point of 5 degrees. On the 6th, Burbank reported a relative humidity of three percent.

1964 -- Free Speech Movement (FSM) coalesces as thousands of University of California-Berkeley students rally & occupy Sproul Hall. As a reporter I covered this for KFRC, UPI, and free lanced to other media.

http://www.berkeley.edu/news/berkeleyan/2002/08/28_fsm.html

http://www.fsm-a.org/stacks/covers/narratives_cvr.html

1966 - The Motown hit, You Keep Me Hangin' On, recorded by The Supremes, debuted on Billboard's pop charts, and was Number 1 for 2 weeks. It was on the charts for a total of 10 weeks. The song was The Supremes' eighth Number 1 record.

1968---Top Hits

Hey Jude - The Beatles

Those Were the Days - Mary Hopkin

Midnight Confessions - The Grass Roots

Next in Line - Conway Twitty

1968 - Republican Richard M. Nixon won the presidency, defeating Vice President Hubert H. Humphrey and third-party candidate George C. Wallace. Spiro T. Agnew, Republican of Maryland was elected vice-president. The electoral vote was Nixon, 302: Humphrey, 191: George C. Wallace, third-party candidate, 45. One Nixon elector later cast his vote for Wallace. The popular vote was Nixon, 31,785,473: Humprhey,31,275,166: Wallace,9,906,473. The Republicans gained four seats in the House and five in the Senate but the Democrats still held majorities of 58-42 in the senate and 243-192 in the House. The Republicans gained five governorships in the election.

1968- Shirley Anita St. Hill Chisholm, a Democrat, was elected this day and became the first African-American woman elected to Congress. She served the Bedfor-Stuyvessant section of Brooklyn for seven terms.

1970--Midway through a Beach Boys show at L.A.'s Whiskey-a-Go-Go, Brian Wilson, making one of rare stage appearances, loses his balance several times and has to be helped backstage. His right ear, the better of the two, sustains "severe damage" because of the volume level on-stage

1971 - The Los Angeles Lakers began professional sport's longest winning streak in the history by winning the first of 33 consecutive basketball games.

1974-The first politician who was openly homosexual to win an election at the state level was Elaine Noble, a Democrat, who was elected to the Massachusetts State Legislature from the 6 th Suffolk district, the Fenway-Back Bay district of Boston, MA. She received 1,730 of the 2,931 votes cast.

http://www.womeninfilmvideo.org/rff/imagepages/image9.htm

1976- The Mariners and Blue Jays each select thirty players in the expansion draft. Seattle picks Royals' outfielder Ruppert Jones and Toronto selects Orioles' shortstop Bob Bailor as their team's respective first picks.

1976---Top Hits

If You Leave Me Now -Chicago

Rock'n Me - Steve Miller

The Wreck of the Edmond Fitzgerald - Gordon Lightfoot

Among My Souvenirs - Marty Robbins

1977 - A slow moving storm produced five to nine inch rains across northern Georgia causing the Toccoa Dam to burst. As the earthen dam collapsed the waters rushed through the Toccoa Falls Bible College killing three persons in the dorms. Thirty-eight persons perished at a trailer park along the stream.

1984 - The Supreme Court ruled the NFL could not block future franchise moves. Furthermore, the Court said the NFL had exceeded antitrust limits in attempting to stop the Oakland Raiders move to Los Angeles, California.

1984---Top Hits

Caribbean Queen (No More Love on the Run) - Billy Ocean

Purple Rain - Prince & The Revolution

Wake Me Up Before You Go-Go - Wham!

City of New Orleans - Willie Nelson

1986 - Dick Clark registered for initial public stock offerings for his television production company, DCP. On registration forms he called his product " mind candy".

1987 - Low pressure off the California coast produced stormy weather in the southwestern U.S. Flash flooding stranded 8000 persons in the Death Valley National Park of southern California. Thunder- storms over southern Nevada produced dime size hail and wind gusts to 68 mph around Las Vegas. Unseasonably mild weather in the northeastern U.S. was replaced with snow and gale force winds

1988-Top Hits

Wild, Wild West- The Escape Club

Kokomo (From The "Cocktail" Soundtrack)- The Beach Boys

The Loco-Motion- Kylie Minogue

Bad Medicine- Bon Jovi

1988 - The Beach Boys hit #1 in US with "Kokomo". They set two music-chart records with this event. It was the longest span of #1 hits (24 years, 4 months since "I Get Around") and the longest gap between #1 hits (21 years, 10 months since "Good Vibrations").

1988 - And speaking of music trivia

(thanks to http://www.rockdate.co.uk Rockdate Diary): "The Loco-Motion", by Kylie Minogue hit #4 on the "Billboard Hot 100" this day, the song became the first to reach the top-5 in the U.S. for three different artists (Little Eva in 1962, Grand Funk in 1974).

1989 - Temperatures warmed into the 80s across much of Texas. Highs of 86 degrees at Abilene, Fort Worth and San Angelo were records for the date

1991 -Elkins, WV drops to 8 degrees, the coldest so early in the season. Pittsburgh, PA drops to 11 also the coldest so early. Jackson, KY drops to 17 degrees, a daily record

1993—Top Hits

I'd Do Anything For Love (But I Won t Do That)- Meat Loaf

All That She Wants- Ace Of Base

Just Kickin It- Xscape

Again- Janet Jackson

Dreamlover- Mariah Carey

1996 - Voters returned President Clinton to the White House for a second term but kept Congress in Republican control. He defeated Republican candidate Robert “Bob” Dole by 379 to 159 electoral college votes. The reform candidate Ross Perot received no electoral votes. Al Gore was elected vice-president. The popular vote was Clinton, 45,628,667: Dole, 37,869,436: and Perot, 7,874,283. The Republicans gained two Senate seats for a 55-45 majority. The Republicans remained in control in the House, but their majority was reduced from 37 to 19, with 227 Republicans, 207 Democrats and 1 independent.

1998—Top Hits

The First Night- Monica

One Week, Barenaked-Ladies

How Deep Is Your Love- Dru Hill Featuring Redman

Lately- Divine

1999 - U.S. District Judge Thomas Penfield Jackson, in a ‘finding of fact', declared Microsoft Corporation a monopoly. Jackson wrote, “Microsoft enjoys so much power in the market for Intel-compatible PC operating systems that if it wished to exercise this power solely in terms of price, it could charge a price for Windows substantially above that which could be charged in a competitive market.”

Often read before a football game:

Willian Ernest Henley (1875) .

Out of the night that covers me,

Black as a Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud,

Under the bludgeoning of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the horror of the shade,

And yet the menace of the years

Finds, and shall find me, unafraid.

It matters not how straight the gate,

How charged with punishments the scroll,

I am the master of my fate:

I am the Captain of my soul.

|

www.leasingnews.org |