NATIONWIDE SALES POSITIONS AVAILABLE

Medical app only to 200k, Commercial app only to 150k

Superior COF’s-Superior Buying window-Superior back office

Please contact Steve Schachtel at 973-339-9900 ext. 101

or

email at sschachtel@usfunding.us

|

Tuesday, October 4, 2011

Today's Equipment Leasing Headlines

Economy Shows Signs of Life on Manufacturing Rebound

Classified Ads--- Senior Management

Career Crossroad

How do I know if it's right to move to another company?

Delivery and Acceptance Forms

Leasing 102 by Mr. Terry Winders, CLP

Leasing Industry Help Wanted

Want to End the Year With More Revenue? Here's How!

Sales Make it Happen --- by Adrian Miller

Bank Beat

2011 Fall Leasing Conference Update

Top Stories - September 26 - 30

CFOs Still See Opportunities as Outlook Dims

Compensation Starts to Bounce Back in Equipment Finance Industry

LEAF Announces New Director of Dealer Services

Envision Capital Offers Equipment Leasing/Financing Solutions

Falls Church, VA --- Adopt-a-dog

News Briefs---

Smart money is split on Bank of America

Gov't report: Fannie knew of 'robo-signing' in '03

Frontier of Frugality

Review of Foreclosure Mistakes Is Set

Can't Afford an Office? Rent a Desk for $275

AMR Shares Tumble on Bankruptcy Fears

Apple set to unveil new iPhone

Italy appeals court clears Amanda Knox of murder conviction

Knox supporters cheer appeals court's decision

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

Sports Briefs---

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

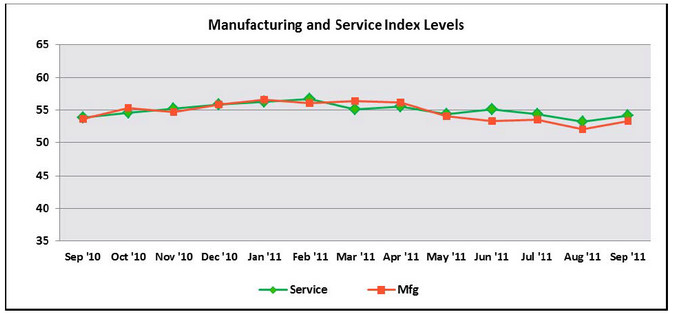

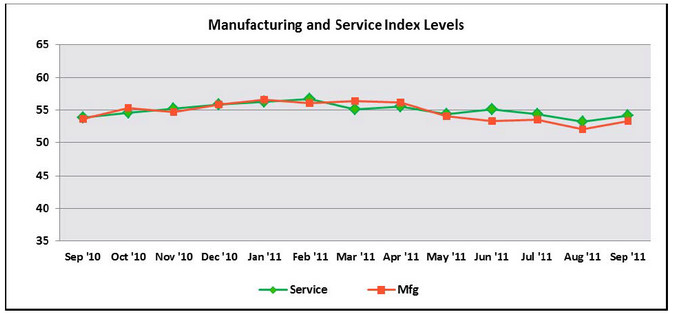

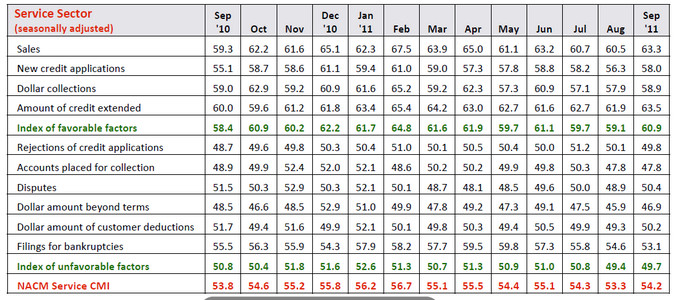

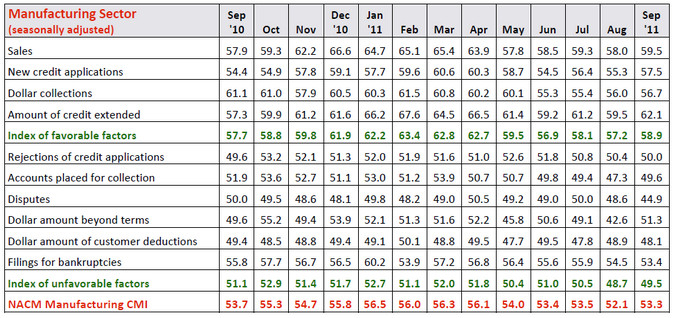

Economy Shows Signs of Life on Manufacturing Rebound

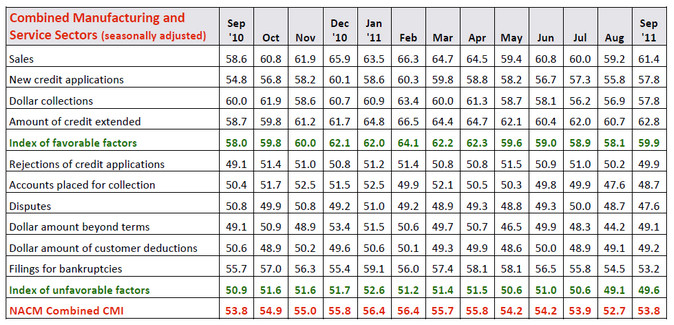

Columbia, Maryland —Are there rays of hope coming from the Credit Managers’ Index (CMI)? It would certainly seem that way after looking at the September performance. It is also a good time to look at why the CMI has been such a good tool for assessing the economy from one month to the next. It all comes down to the nature of the credit manager’s world. For all intents and purposes, the credit manager lives in the future. They may be pleased that their customer had a good month, but what they are really interested in is whether that customer will have a good month when it is time to pay that invoice. Much of what the credit function focuses on remains in the realm of 30, 60, 90 and 120 days from now. When credit professionals answer the monthly survey questions for the index, they are forecasting in many respects and that is the prime reason that the CMI as a whole tends to predict future economic behavior.

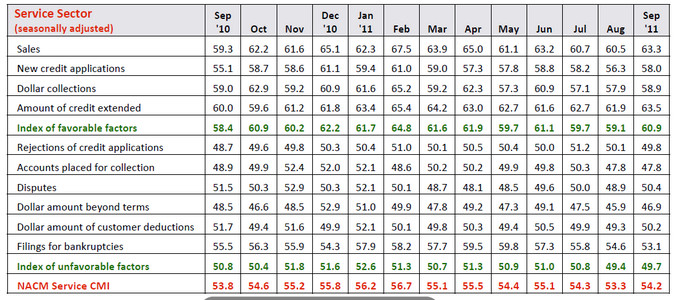

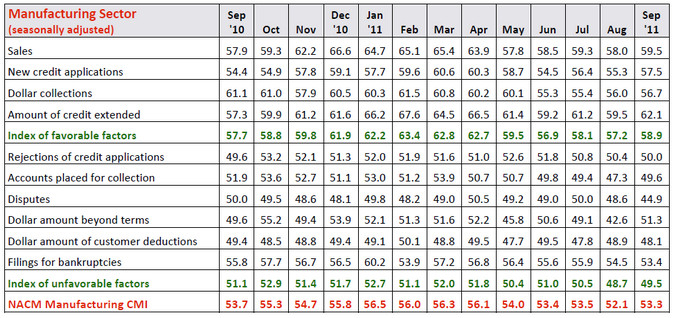

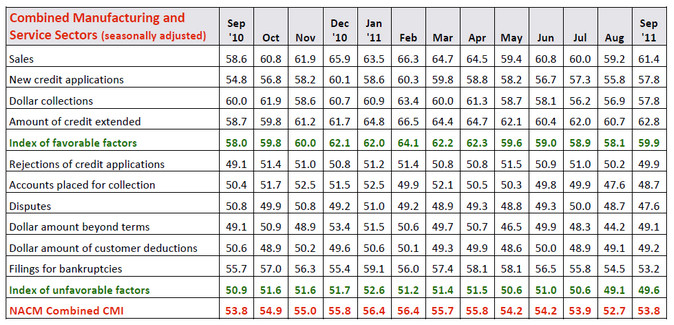

Over the past eight years, the CMI has repeatedly projected the overall performance of the U.S. economy by at least a month. In the early part of 2008, the CMI started to show weakness and was in decline well before the economy as a whole tumbled. Likewise, there were signs of recovery in the CMI earlier in 2009 than other economic data showed. “This pattern makes the data for September all the more interesting,” said Chris Kuehl, PhD, economist for the National Association of Credit Management (NACM). “For the past few months, there was a slow deterioration of key credit conditions and many were expecting to see more declines this month. Instead, the combined index returned to the levels set in July. Granted, the index had been higher than recent readings since October of last year, but moving from 52.7 to 53.8 is not insignificant and it brings the combined index back to levels seen in the spring months.”

The better news is in the breakdown of favorable and unfavorable factors. The recovery in favorable factors takes the index back to May’s levels and the lift was impressive—improving from 58.1 to 59.9. The index was last at 60 this past April. That gain was driven in no small part by additional sales, which moved solidly past 60 to 61.4 and is at the highest point since April. There were corresponding solid index numbers in new credit applications, dollar collections and the amount of credit extended. These are all very good signs for future development and suggest that in the midst of all the gloom and doom provoked by political wrangling, there is business taking place and growth manifesting itself.

There were encouraging signs in unfavorable factors as well. The majority of the readings remain below 50, still signaling weakness, but the combined score moved up slightly from 49.1 to 49.6. This is not cause for celebration, but at least the pattern has started to reverse and the expectation is that these readings will be back above 50 before too long. The category that continues to show decline is rejections of credit applications, which is not all that shocking as more than a few companies are still trying desperately to get additional credit to hold on a little longer. The number of bankruptcies declined at the same time signaling that perhaps somewhat fewer companies are struggling. It may also signal that the companies walking that financial tightrope have finally given up. The fact that more credit applications have been submitted at the same time that more are being rejected would seem to suggest experimentation is taking place. The companies almost seem to be testing the waters to see what their options might be. Sales are up and that is good news, and now there may be attempts underway to judge the enthusiasm of supplier companies to expand market presence.

“The overall sense at this stage is that there is some life left in the economy. If one only looks at the numbers from July and August, it would be a very depressing story indeed,” said Kuehl. “There is still not enough evidence to be convincing, but the most chronically optimistic could say that a recovery is at hand. The data is sufficient enough to make the case that the precipitous plunge predicted for the end of the year may not be taking place after all. Not that there is no threat of sinking back into recession, but a deep plunge seems more and more distant.”

The online CMI report for September 2011 contains the full commentary, complete with tables and graphs. CMI archives may also be viewed online.

About the National Association of Credit Management

NACM, headquartered in Columbia, Maryland, supports more than 15,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of affiliated associations are the leading resource for credit and financial management information, education, products and services designed to improve the management of business credit and accounts receivable. NACM’s collective voice has influenced federal legislative policy results concerning commercial business and trade credit to our nation’s policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. Its annual Credit Congress is the largest gathering of credit professionals in the world.

NACM has a wealth of member experts in the fields of business-to-business credit and law. Consider using NACM as a resource in the development of your next credit or finance story.

Source: National Association of Credit Management

Contact: Caroline Zimmerman, 410-740-5560

Website: www.nacm.org

[headlines]

--------------------------------------------------------------

Classified Ads--- Senior Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Europe

25+ yrs exper. management roles Chase, AT&T Capital, Heller Financial, SFS. Develop biz from “scratch to success”. Looking for challenging & pioneering job.

Email: frans@alliedproperty.net |

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Southern CA

20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant.

Email: leasecfo@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Please send to a colleague and ask them to subscribe.

We are Free!!!

-------------------------

Career Crossroad---“How do I know if it's right to move to another company?”

Q: I am thinking of accepting a position with another company; how do I know I am making the right decision?

A: I assume a major factor in making a career move is the stability the company … do your research. There are never any guarantees but there a few key factors to assist you in making your decision:

- Employee turnover rate: if it is a high rate why have employees left the company; you may want to discuss this in a 2nd interview

- Research the company’s history in doing business in an ethical and moral fashion (internally AND externally); this is easily obtained by searching out complaints, bulletins and many of the new watch dog lists created after the economic crisis … you can even research if law suits have been filed against the company

- History of paying their bills: if a company struggles to pay their bills, you might have issues collecting commissions and other compensation; you will have to conduct your own “undercover” investigation on this – speak to people in the industry

- Find out, in an interview, what the company’s volume was, is and will be, you may even feel comfortable requesting financials; most companies over the last few years have suffered; determine if their numbers fall in line with other similar businesses – if not, find out why

- Also make sure, if in a sales role, that production expectations are realistic and fall within the parameters you will be able to meet or better yet, exceed – if not, you may be let go for not meeting these goals

In conduct your research in a “covert” manner - you don’t want there to be a leak that you are considering a move while you are still employed. Additionally, make sure your new employer will be able to meet your personal and career objectives now and in the future.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

www.riirecruit.com

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

“Delivery and Acceptance Forms”

I have of late been involved as an expert witness in a few cases of fraud. The subject matter has been discussed many times in articles to the leasing industry by lawyers and writers such as me. But I am afraid many are not getting the message. The purpose of our lease documentation is to protect us, but what I observe is a cavalier attitude towards understanding how to use delivery certificates and acceptance forms properly.

To properly complete a lease transaction. you must confirm that the equipment is in place and working correctly. The statement that should be in every proposal and explained to each lessee is “the lessee warrants that the acceptance will not occur until the lessee has taken physical possession of the equipment and is satisfied with its ability to perform. In no case whatsoever should the lessee sign the acceptance certificate without meeting the foregoing conditions.” However this procedure is rarely explained to the lessee in our rush to complete the transaction and get paid.

Many companies in their “verbal” go through a list of questions, but often the lessee is coached how to answer by the vendor or even the discounter or salesman.

The amount of fraud from non-existent equipment is staggering. Often vendors want to get paid before equipment is delivered, or installed, or actually working. So the key word here is confirmation. How do you know the lessee is in possession of the equipment? How do you know the signature on the lease is genuine? How do you know the signature on the acceptance document is authorized? How do you know on what date the first piece of the equipment was received by the lessee for UCC purposes? “Confirmation” is the key.

Perhaps there are times when the size of the deal does not leave room for confirmation because it is small ticket or too far away, or in the rush to pay the vendor, maybe even the discounter or salesman involved, you are pressured thinking to yourself this is a good credit, been around a long time, and they should be responsible for any problems. Wrong!

It is reality that as the dollar size of the lease goes up, the investigation into the correctness of the documentation and the physical existence of the leased equipment also goes up. However, it should always be consistent. There should be a policy in place, and if the lease is too small for an official site inspection, why not have your salesperson do an equipment inspection and take a picture of the equipment to confirm the lessee is truly satisfied. Or even the discounter, get him involved as per the “reps and warrants” he signed. It may sound like a lot of extra work right now, but every fraud case I have worked on would not have occurred if it were not for the sloppy job of the lessor or funding source. Take photos with a digital camera and send the results over the internet.

It’s very easy to do and shouldn’t slow up the process, plus you have photo’s of the equipment in case they come in handy in a default.

If I were your funding source, I would ask to see your procedures for completing a lease and confirming the existence and acceptance of the equipment, perhaps on transactions over $50,000, and definitely over $100,000. And with photo’s. I don’t understand why a site inspection is not mandatory on $100,000 deals and above, or those vendors are thoroughly looked at, too. At least digital photo’s would help.

One procedure I like is obtaining for small ticket leases are the copy of the driver’s license from the person signing the lease because it contains their signature and personal residence. The higher the transaction generally requires a company resolution to show title and authority also helps prove their right to sign your lease. Occasionally a branch manager or plant manager may not be an officer of the company, but they must have some authority to sign so you need to get a copy of that authority.

My main concern here is using the documentation confirmation forms correctly such as a properly filled in delivery certificate and a properly completed acceptance form and checking the vendor for any changes that might have occurred in location of delivery or equipment changes. Then make sure the equipment exists and is in place and in use.

Welcome to the 2011 leasing business!

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders, CLP

Anaheim, California

December 12-14th

Two and One Half-Day Seminar

sponsored by

Commerce National Bank

4040 MacArthur Blvd. Suite 100

Newport Beach CA 92660

(Orange County Airport is a half-mile away)

The seminar will contain information on how to approach leasing in 2012 with the following subjects:

- New lease language

- Proposed new accounting rules for lessee's

- Structuring and pricing for competition

- Income tax rules, Article 2A vs. Article 9

- New reasons to lease

- Questions to ask lessee

- Vendor needs

- Credit enhancements

- Documentation issues

and a take home assignment to see how to propose a lease.

Cost $450 per person

To request a complete outline contact: leaseconsulting@msn.com or for questions call 502-649-0448 |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

NATIONWIDE SALES POSITIONS AVAILABLE

Medical app only to 200k, Commercial app only to 150k

Superior COF’s-Superior Buying window-Superior back office

Please contact Steve Schachtel at 973-339-9900 ext. 101

or

email at sschachtel@usfunding.us

|

Leasing Industry Help Wanted

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Ad Pricing

Help Wanted Web Ad New Programs

Classified Ad Section

(rotates chronological above headlines and

also appears in Classified Ad section.) *

15 days in a row:

$395 four lines (a space is a line)

($25 each additional line or space)

30 days in a row:

$595 four lines (a space is a line)

($40 each additional line or space)

Design work is free. Logo is free as well as company description not to exceed the number of lines of the ad.

Also free: click to a click to a web site or a full description of the position.

Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top in a rotation basis per issue.

* Help Wanted” ads appear in each issue on a chronological basis above the top headline as a courtesy. This position is not available as a paid position, but is generally on a rotation basis. At the same time, the ad continues in the classified help wanted section in the news edition and web site, so in effect appears twice.

Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

Send Leasing News to a Colleague. We are “Free.”

Sales Make it Happen --- by Adrian Miller

Want to End the Year With More Revenue? Here's How!

As salespeople we all start the year with lofty goals of increasing revenue. Yet, the reality is many, very talented professionals fall short of achieving their targets because they are simply not utilizing fundamental revenue-increasing strategies.

December is not the time to start scrambling for business. Now is the time to think differently, try a fresh approach and hopefully meet, or exceed your goals. The famous Albert Einstein quote “The definition of insanity is doing the same thing over and over again and expecting different results” certainly applies here. The same tired techniques are comfortable yet they will always bring the same disappointing results. Are you ready to reach your goals? Great! Here's what you need to do now:

Dig deeper into existing accounts.

Hey, they already know you and love you. You have credibility and demonstrated competencies. Mine the gold that's already within reach.

One way to do this is to begin with a little sleuthing. Peruse your account's company website on a regular basis. You can find valuable information by reading their press releases, company blog and other news items that are continually being updated on their site. Are there any new or upcoming projects that might require your products or services? What about mergers, acquisitions, or changes to their corporate structure? Have there been any new decision-makers hired recently? You might be surprised by the plethora of new opportunities that are prime for the picking. And you can out about them just by a little detective work and by simply, asking. (Many sales reps stop actively probing once they have landed an account and are servicing the business!)

Cross-selling is another way to dig deeper into your existing accounts. Never assume that a customer will only continue to buy what you've sold him or her. If you are not regularly introducing new products or services, you might be leaving potential business on the table that your competition just might take.

Become a strategic networker.

Develop a networking plan of action and follow through with your action steps. Screen events carefully and don't miss opportunities to make valuable connections. Set concrete networking objectives such as establishing a number of people to meet. Quantify the results of your networking efforts, and nix networking strategies that haven't been effective.

Initiate an effective touch point management program.

Falling off the radar screen is never excusable for a sales professional. There is excellent technology available to help you stay in touch. Email communications, especially those with value-added information or links, are well-received and take very little time to execute. Establish a set number of contacts that you can make each week and stick with the plan. Once you've lost contact with a customer, they're almost always gone for good, and for sure, you have to work harder to get them back. Business redevelopment is costly and unnecessary if you are diligent about staying in touch.

Refine your sales platform and value proposition.

Take a hard and critical look at your strengths, weaknesses, threats, and opportunities (SWOT). The market is not static, and you should be continually reevaluating your position in it. A SWOT analysis is not a one-time event!

Outsource all activities that cost you time and don't bring in or drive revenue.

It's an easy trap to fall into – devoting too much of your time to taking care of administrative and clerical tasks. The reality is if you're spending your time filing, you're taking away from your time that you could be generating sales. Work smart and outsource your non-sales tasks to someone who can assist you.

Adrian Miller

Adrian Miller Sales Training

www.theblatanttruth.com

www.adrianmiller.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

|

[headlines]

--------------------------------------------------------------

Send Leasing News to a Colleague. We are “Free.”

Bank Beat

Last Friday, U.S. regulators shuttered Plano, Texas-based First International Bank, taking the number of failed banks thus far in 2011 to 74. This follows 157 bank failures in 2010, 140 in 2009 and 25 in 2008.

First International Bank, headquartered in the Dallas-area city of Plano, TX, was closed on Friday by the FDIC and the Texas Department of Banking. Founded in 1991, the First International Bank had been in business just 20 years. It had just seven branches, between Texas and Nevada.

According to the FDIC’s last estimates, First International Bank had $239.9 million in assets, according to the FDIC, as well as $208.8 million in deposits. The FDIC has taken it into receivership, and estimates that the total loss to the Deposit Insurance Fund will be about $53.8 million.

American First National Bank, an Asian-American owned bank based in Houston, TX, with five banches in that city, and four in Dallas, will be purchasing and assuming all of First International Bank’s deposits and assets. The purchase agreement should be good for customers in the Dallas area, who will soon have access to more branches.

Customers of First International Bank should expect no interruptions in service as they become American First National Bank customers. They should continue to use their own branches until certain systems are integrated, at which point they can go to existing American First National Bank branches.

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.htm

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

|

Gary DiLillo, President

216-658-5618 or gary@avptc.com

To learn more about the benefits of

outsourcing personal property tax,

please click here.

|

[headlines]

--------------------------------------------------------------

2011 Fall Leasing Conference Update

October 14-15, 2011

Marriott Atlanta Buckhead Hotel & Conference Center

Atlanta, Georgia

Full Schedule:

http://www.naelb.org/displaycommon.cfm?an=1&subarticlenbr=265

NAELB Eastern Regional Exhibitors

(as of September 30, 2011):

360 Equipment Finance

Amerisource Funding

Ascentium Capital, LLC

Bankers Capital

Blue Bridge Financial, LLC

Bulldog Truck & Equipment Sales

Collateral Specialists, Inc.

Dakota Financial, LLC

Financial Pacific Leasing, LLC

First Federal Leasing

instaCOVER

Maxim Commercial Capital, LLC

MicroBilt Corporation

Pawnee Leasing Corporation

Preferred Business Solutions

RLC Funding

Stalwart Contract Finance, LLC

TEAM Funding Solutions

$125 Member

$115 send member attendee

$260 Associate Member

$200 Broker Non-Member

$360 Funder Non-Member

Registration Form

https://www.paymyassociation.com/displayemailforms.cfm?SessionId=681106E0-DCEB-23C9-7430D6ADEEB457C1&emailformnbr=166184&event=358826

October 18, 2011

---8:30am to 10:00am

AZELA Fall Meeting

CoCo’s Bakery & Restaurant– Paradise Valley Mall

4514 East Cactus Road

Phoenix, AZ 85032

(602) 953-9155

Alternative Financing Seminar

– When Traditional Lease Financing Doesn’t Fit

Networking, Continental Breakfast

$10 in advance, $15 at the door

More about the Seminar:

(pdf)

www.azela.net

October 23-25th ELFA 50th Anniversary Conference

San Antonio, Texas

To those who have survived in this economy, and to those who

want to survive in this economy, this conference is a must.

Monday, October 10, 2011

Last day for mail-in and online registrations. After this date registrations can be made on-site. Please note: There are no refunds of registration fees after this date.

The 50th Anniversary Equipment Leasing and Finance Convention promises to be "the largest meeting of the equipment leasing and finance sector---Whoever you need to see is likely to be there!"

Conference Brochure:

http://www.elfaonline.org/cvweb_elfa/cgi-bin/documentdll.dll/view?DOCUMENTNUM=321

What Previous Attendees are Saying:

http://www.elfaonline.org/pub/events/2011/AC/50th/

Registration Forms:

http://www.elfaonline.org/pub/events/2011/ac/RegInfo.cfm

Share Your Anniversary Message

http://www.elfaonline.org/pub/events/2011/AC/50th/share.cfm

Keynote Speakers

General Stanley McChrystal

Former Commander of U.S. and International Forces in Afghanistan

Marin Regalia

Chief Economist and Senior Vice President for Economic and Tax Policy

United States Chamber of Commerce

Garrison Wynn

President, Wynne Solutions

November 2--November 4, 2011

Association of Government Leasing and Finance

Annual Fall Conference

Waldorf Astoria, Orlando, Florida

Join the Government Leasing Industry. Founded in 1981 AGLF

provides resources, educational forums and networking

to expand business opportunities and promote best practices

AGLF Member: $750.00

Non-Member: $875.00

http://www.aglf.org/events/aglf-annual-fall-conference

Registration:

http://members.aglf.org/source/events/event.cfm?event=FALL11

Non-Member must first create profile to log in: https://members.aglf.org//source/Join/index.cfm?action=events&Event=FALL11&type=nm

10% Off First Time Attendee

Waldorf Astoria Reservation, please note convention code for special rate:

https://secure.hilton.com/en/wa/res/choose_dates.jhtml?groupCode=ZTALY&hotel=ORLBCWA

November 6-7, Sunday, Monday

NEFA Expo Super Regional

Teaneck Marriott at Glenpointe

Teaneck, NJ

Co-Chaired by

George Parker Leasing Technologies International, Inc.,

Bruce Winter, FSG Leasing, Inc

November 11-12

Hilton, Orange County

Costa Mesa, California

Full Schedule:

http://www.naelb.org/associations/2004/files/WesternRegional2011.cfm

Registration Form with fees:

http://www.naelb.com/associations/2004/files/NAELB%202011%20Western%

20Regional%20Registration%20Form.pdf

NAELB Western Regional Exhibitors

(as of October 4, 2011):

360 Equipment Finance

Ascentium Capital

Amerisource Funding

Commerce National Bank

Dakota Financial, LLC

Financial Pacific Leasing, LLC

instaCOVER

Maxim Commercial Capital, LLC

Pawnee Leasing Corporation

Preferred Business Solutions

Quail Capital Corp.

Quiktrak, Inc.

Stalwart Contract Finance, LLC

TEAM Funding Solutions

Tetra Funding Group

April 26-28, 2012

Denver Sheraton Downtown Hotel

Denver, Colorado

[headlines]

--------------------------------------------------------------

Top Stories - September 26 - 30

Here are the top ten stories opened by readers:

FASB Delay Not New Alert

by Shawn Halladay, The Alta Group

http://leasingnews.org/archives/Sep2011/9_30.htm#fasb

Be Careful - Leasing 102 by Terry Winders

http://leasingnews.org/archives/Sep2011/9_27.htm#careful

Are you the owner of the leased asset? - Leasing 102 by Terry Winders

http://leasingnews.org/archives/Sep2011/9_30.htm#owner

LEAF Commercial Capital, Inc. Announces New Director of Major Account Development

http://leasingnews.org/archives/Sep2011/9_30.htm#leaf

US Capital Corporation Announces New SVP, Operations

http://leasingnews.org/archives/Sep2011/9_30.htm#ucc

Canadian Finance and Leasing Association Conference – Montreal

by Hugh Swandel

http://leasingnews.org/archives/Sep2011/9_27.htm#canada

M&I Equipment Finance Company Announces New Chicago-based VP

http://leasingnews.org/archives/Sep2011/9_30.htm#mi

Key Equipment Finance Names Ann E. Fries as Vice President

http://leasingnews.org/archives/Sep2011/9_30.htm#key

GreatAmerica Ranked 4th in State as Top Workplace

http://leasingnews.org/archives/Sep2011/9_27.htm#workplace

P&L Capital Corporation

joins Evergreen Notification List

and is an A+ BBB Rating

http://leasingnews.org/archives/Sep2011/9_27.htm#pl

John Kenny Receivables Management

• End of Lease Negotiations & Enforcement

• Fraud Investigations

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

-----------------------------

#### Press Release #############################

CFOs Still See Opportunities as Outlook Dims for U.S. and

Global Economies in Third-Quarter GE Capital Survey

--Layoffs have stabilized, cautious hiring continues

--Budget deficit remains leading economic concern

--More Middle-Market Insights to be Unveiled at 2011 National Middle Market Summit

U.S. chief financial officers (CFOs) of middle-market companies remain fairly positive about the state of their own industries and businesses but have tempered their views about the state of the broader U.S. and global economies, according to the latest middle-market CFO survey by GE Capital.

The survey, which took place during the third quarter of 2011, included responses from 532 CFOs of companies with an average revenue of $162 million operating across seven major industries, including: metals, mining and metals fabrication; food, beverage & agriculture; general manufacturing; healthcare; retail; technology & business services; and transportation.

"CFOs clearly have altered their outlook on the U.S. and global economies," said Dan Henson, president and CEO of GE Capital, Americas. "However, these same CFOs maintain a more positive outlook for their own companies, indicating that they have identified the right mix of cost controls and capital investment for a lower-growth environment. This is consistent with what we are seeing with companies in our own financing portfolio, where metrics on our customers' operating results and balance sheet health continue to be positive."

Current Views on Economy and Industry Health

CFO sentiment on the current health of the U.S. and global economies fell back into negative territory after turning slightly positive in the first quarter of 2011. When rating the health of their own industries, CFO sentiment also fell from the first quarter but to a lesser extent than for the broader economy, and remained positive.

Growth and Profitability Expectations

CFOs continue to feel better about the general health of their own industries and companies than about the broader economy. However, CFOs have lowered near-term growth expectations.

-- About one-third of CFOs (32 percent) expect their industries to grow over the next 12 months versus 55 percent in Q1,

-- A majority (62 percent) of CFOs still expect their own revenues to increase in 2011, down 10 percent from Q1,

-- 46 percent see moderate-to-higher company growth over the next one-to-three years, down from 56 percent in Q1.

Profitability expectations remain reasonably healthy, as a large majority (73 percent) of CFOs still believe they can maintain or improve profit margins in 2011, down 10 percent from the first quarter.

Hiring Outlook

Although slightly lower than first quarter expectations, 66 percent of CFOs say they have hired this year, and 68 percent expect to hire additional employees in the next 12 months. This is down from 80 percent in the first quarter, but still up from this time 12 months ago, when only 56 percent expected to hire.

-- Of those who plan to hire in the next year, they anticipate increasing their workforce by six percent on average -- a number that held steady from the first quarter survey.

Cost Structure

Despite signs of lower economic optimism, most CFOs plan to either increase (56 percent) or keep their cost structure the same (27 percent) in 2011.

"Although CFO sentiment has fallen back since the first quarter, their willingness to increase their company's cost structure shows confidence in their markets," said Henson. "Our equipment finance and lending business pipelines remain strong, which shows most industries are investing now and in the next 12 months."

Other Top Findings:

-- Capital Expenditures -- Expectations for capital expenditures increased slightly from the first quarter of the year with 37 percent of CFOs indicating their 2011 spend would be greater than 2010.

-- Credit Availability/Cost -- CFOs say credit availability has remained stable over the last 12 months and 60 percent of CFOs believe the cost of capital will remain the same throughout the remainder of the year.

-- Equipment Financing -- Thirty-seven percent of CFOs expect to consider additional financing for equipment in the next year.

-- Pricing Outlook -- Fifty-six percent of CFOs expect to raise prices on their company's products or services in 2011.

For additional survey data, including industry-level findings, contact Ned Reynolds at203-229-5717 or visit gecapital.com/cfosurvey.

More Middle-Market Insights to be unveiled at "Leading from the Middle: The 2011 National Middle Market Summit"

Furthering its focus on the U.S. middle-market, GE Capital and the Fisher College of Business at Ohio State University will host Leading from the Middle: The 2011 National Middle Market Summit on October 6, 2011. During the summit, groundbreaking research and analysis will be unveiled, and serve as a foundation for discussions on ways to encourage and drive greater growth from this important part of the U.S. economy.

Please join us via webstream by registering to attend the Summit at nationalmiddlemarketsummit.

About GE Capital

GE Capital offers consumers and businesses around the globe an array of financial products and services. For more information, visit gecapital.com or follow company news via Twitter (@GECapital). GE GE -0.55% is an advanced technology, services and finance company taking on the world's toughest challenges. For more information, visit ge.com.

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Compensation Starts to Bounce Back in the Equipment Finance Industry

Compensation levels in the equipment leasing and finance industry trended upward in 2010, according to the 2011 Equipment Leasing & Finance Compensation Survey released by the Equipment Leasing and Finance Association. From 2008 to 2009, new business volume across the equipment finance industry fell 30% and total compensation declined across the industry. However, from 2009 to 2010, new business volume improved by 9%, which translated to relatively modest total compensation growth across the industry.

The survey measures compensation rates for the 2010 fiscal year as reported by more than 50 equipment finance companies representing a cross section of the equipment finance sector, including small-ticket, middle-market, large-ticket, bank, captive and independent leasing and finance companies. Market data for more than 90 executive, front-office and support positions is provided, plus a breakdown of salary, incentives (including cash bonus and commission), long-term awards and total compensation by company type. The survey is a collaborative initiative between ELFA and McLagan, a performance/reward consulting and benchmarking firm for the financial services industry.

Highlights from the survey include:

- Direct Origination Compensation Improved - Direct equipment finance originators experienced the most significant total compensation growth in fiscal year 2010, with increases of 15% to 20%.

- Vendor Origination Compensation Improved - Within the vendor origination space, on a year-over-year basis, total compensation increased in the 5% to 15% range for the majority of the population.

- Incentive Plans Continue to Change: Equipment finance firms continue to make modifications to their incentive plans for originators, shifting away from pure volume-based plans to ones that incorporate profitability, credit-risk metrics and an element of discretion or platform performance.

Learn More

To learn more or to order a copy of the 2011 Equipment Leasing & Finance Compensation Survey, contact Bill Choi at bchoi@elfaonline.org or 202-238-3413.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $521 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its over 600 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. In 2011, ELFA is celebrating 50 years of equipping business for success. For more information, please visit www.elfaonline.org.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

#### Press Release #############################

LEAF Commercial Capital, Inc. Announces New Director of Dealer Services

LEAF Commercial Capital, Inc. (“LEAF”) announces that Donna David has joined LEAF as Director of Dealer Services.

Donna David brings a significant amount of operational experience that will assist LEAF in continuing our focus on streamlining our Dealer service and support process to help our customers further expedite the processing of their lease transactions. By utilizing the right combination of technologies and highly skilled resources, Donna will continue to elevate the service quality that LEAF delivers to the marketplace.

Donna has more than 23 years experience working in the finance industry. Her operations career started in 1991 where she was responsible for the development and deployment of the processing center for Copelco Capital and later CitiCapital. She continued in the Operations field during her tenure at GE Capital and joined LEAF as Director of Dealer Services in September 2011.

Miles Herman, President and COO stated, “This strategic addition to LEAF is essential in continuing to enhance our ability to service and support our Dealer partners. I expect this new addition to our dealer servicing team to elevate our support capabilities and assist LEAF in maintaining our service leadership in the industry.”

About LEAF Commercial Capital, Inc. (www.LEAFNow.com)

LEAF Commercial Capital, Inc. (“LEAF”) is an equipment leasing and finance company headquartered in Philadelphia, PA. LEAF’s business model assists commercial equipment dealers, resellers, distributors and manufacturers in maximizing the use of customer finance as a revenue generating strategy. LEAF is a joint venture among LEAF Financial Corporation, Resource Capital Corp. (NYSE, RSO), and Guggenheim Securities, LLC.

#### Press Release #############################

Envision Capital Group Offers Top Equipment Leasing and

Financing Solutions for Small Businesses

Envision Capital Group announces new equipment leasing and financing programs that help business owners get through this tough economy. Recent research shows increased borrowing and declining loan delinquencies among small businesses. This is a promising outlook for our economy when you consider that small businesses can account for as much as 80% of new hiring and are often a leading indicator of overall economic health.

As our economy continues to recover, it remains extremely important that small businesses manage their working capital very carefully. Even successful businesses can fail if cash reserves are not available. This is where Envision Capital Group can help.

Putting down a large sum of money for a piece of equipment can be risky. This can leave your business asset rich and cash poor. Without cash, a business cannot respond to market changes and new opportunities. A great way to secure the equipment needed to grow a business and improve operational efficiencies while conserving cash flow is through an equipment lease or loan.

Envision Capital specializes in a variety of customized equipment leasing and financing programs with flexible payment plans for any type of equipment that you are considering. The following is a sample of some lease options that Envision Capital Group offers.

1. Seasonal Payments: To meet seasonal fluctuations or other cash flow constraints, this type of payment allows you to arrange a payment schedule so that you are making payments which rise and fall with your business' sales cycle.

2. 90-Day Deferred Payments: This payment schedule allows you to make a smaller "contact" payment while deferring regular payments for 90 days. New equipment generally has a learning curve associated with it so a deferred payment plan can assist you while you are being trained on the equipment.

3. Step Down Payments: With this payment program you will make a larger monthly payment at the beginning of the lease and then your payments will decrease over time. This is designed for businesses that want to lower the total amount of finance charges they pay over the entire lease term.

4. Step Up Payments: This type of payment can be ideal for growing firms that are looking to start with low payments and increase them over time as revenues from their new equipment increase.

5. Monthly, Quarterly, Semi-Annual and Annual Payments: Flexible payment options are available to best meet your budget requirements.

6. Master Lease: If your business acquires equipment at different times during the year then a Master Lease Line is for you. Secure an approval for multiple purchases at one time and receive a discounted rate for the entire amount. There is only one Lease Agreement to sign.

7. No Money Down: Many banks require money up front during the lending process but with the right solution, a down payment may not always be required.

For more information about these equipment leasing and financing options for your small business, contactEnvision Capital Group today.

About Envision Capital Group Inc.

Envision Capital Group was founded to help companies obtain the equipment necessary to sustain and grow their business through leading finance by providing flexible financing and leasing options. Envision Capital Group wishes to make your equipment acquisition as simple as possible with the least amount of administrative burden on your part. Envision Capital Group prides itself on servicing all business types and all credit histories.

[headlines]

--------------------------------------------------------------

Falls Church, VA -- Adopt-a-Dog

| Breed: |

Foxhound Mix |

Color: |

Black - With Tan, Yellow Or Fawn |

Age: |

Adult |

| Size: |

Large 61-100 lbs (28-45 kg) |

Sex: |

Male |

I am already neutered, housetrained, up to date with shots, good with kids, good with dogs, and good with cats.

Fischer's Story...

Fischer is an English Foxhound. He is a very sweet boy who loves everyone. He is neutered and current on vaccines and all preventative veterinary care. Fischer is a healthy boy who would love a fenced yard and some children who are old enough to romp with him. Fischer is EXCELLENT with children. Fischer is house trained and walks pretty well on leash. He is also a drip dry dog with a short coat that is easy to groom. Fischer is an awesome playmate for children. He also knows how to settle down. This is a super family dog who is move in ready! Questions? Email: saintseton@hotmail.com or call 703-699-7534

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

----------------------------------------------------------------

This Day in American History

1582- Pope Gregory XIII issued a bulletin that decreed that the day following Thursday, Oct 4, 1582, should be Friday, Oct 15, 1582, thus correcting the Julian Calendar, then 10 days out of date relative to the seasons. All dates before this that we celebrate are not actually the “correct” days. Don't worry, the calendar was again changed by the British Calendar Act of 1751, Britain(and the American colonies)made the “Gregorian Correction” in 1752. The Act proclaimed that the day following Wednesday, September 2, should become Thursday, September 14, 1752. There was rioting in the streets by those who felt cheated and who demanded the eleven days back. The Act also provided that New Year's Day ( and the change of year number ) should fall January 1 ( instead of March 25) in 1752 and very year thereafter. As a result, 1751 only had 282 days.

1636-The General Court of the Plymouth Colony instituted a legal code, the first composed in North America, guaranteed citizens a trial by jury and stipulated that all laws were to be made with the consent of the freemen of the colony.

( lower half of: http://memory.loc.gov/ammem/today/oct04.html )

1648- Peter Stuyvesant establishes America's first volunteer firemen in New Amsterdam (New York City).

1777- Battle of Germantown. Washington planned a surprise attack against the redcoats at sunrise. He broke the army into four separate columns for battle. The American soldiers marched to Germantown by two roads, with General Sullivan to the right and General Greene to the left. Washington, along with General "Mad Anthony" Wayne, joined Sullivan and caused the British to fall back. The complicated plan had failed with the British losses at 70 killed, 450 wounded, and 14 missing. The Americans lost 152 killed, 521 wounded, and almost 400 missing. American morale was largely unaffected by the loss in that they mistakenly believed that more British were lost than American forces. Howe was impressed that the skill of the Americans had increased so much since the defeat at Brandywine. So, rather than risk a pursuit, Howe retreated to Philadelphia and fortified the city. The Battle of Germantown was fought in a morning fog that grew more dense with the smoke of battle, causing great confusion. Americans firing at each other contributed to the loss of the battle.

http://www.ilssar.org/germantown.html

http://library.thinkquest.org/10966/data/germ.shtml?tqskip1=1andtqtime=0929

http://www.virtualology.com/virtualwarmuseum.com/revolutionarywarhall

/battleofgermantown.com/

http://www.justinalee.com/Germantown.html

http://www.phmc.state.pa.us/ppet/germantown/page1.asp?secid=31

http://www.multied.com/revolt/germantown2.html

http://www.cliveden.org/Pages/battle.htm

http://patriot.net/~tpost/germantown.html

http://www.publicbookshelf.com/public_html/The_Great_Republic_By_the_

Master_Historians_Vol_II/battleof_gh.html

1810-Birthday of Eliza McCardle Johnson. She taught her husband, Andrew Johnson how to read when he was already an adult. He went on to become the 17th president of the U.S. Historically, she is not given any credit for his rise to political prominence.

http://www.whitehouse.gov/history/firstladies/ej17.html

http://www.aboutfamouspeople.com/article1065.html

1822-Birthday of Rutherford Birchard Hayes, 19th president of the US (Mar 4, 1877—Mar 3, 1881), was born at Delaware, OH. In his inaugural address, Hayes said: “He serves his party best who serves the country best.” He lost the popular vote and in a hotly contested electoral congressional vote, a promise to the “Dixie Democrats” made him president, it is said, and turned back the reconstruction of the South. He died at Fremont, OH, Jan 17, 1893.

http://memory.loc.gov/ammem/today/oct04.html

1830 -- A power printing press is patented by Isaac Adams, Boston.

1851-In San Francisco, the third Jenny Lind Theatre to occupy the same site on Kearny was opened. The other two theaters burned during fires this year.

1862- Battle at Corinth, Mississippi ends with a draw. Van Dorn, commanding Confederate forces, has Price attack Union positions under Rosecrans' command in front of Corinth in a two-day battle in attempt to push the Federals back into Tennessee and secure the vital railroad crossing at Corinth; Fierce fighting in town and at Batteries Williams and Robinett; Attack fails, and on second day Van Dorn withdraws to Chewalia. By this time many Southerners were disenchanted with him, and he was placed in charge of the mounted troops under Pemberton. Moving his division into middle Tennessee, he was killed on May 7, 1863, by Dr. George B. Peters for attentions paid by the general upon the physician's wife in Spring Hill.

http://www.civilwarhome.com/vandornbio.htm

1864- New Orleans Tribune, first black daily newspaper, forms. It is published in both French and English.

http://www.theneworleanstribune.com/aboutus.html

1895- Horace Rawlins won the first US Open Golf Championship, contested at the Newport Golf Club in Newport, RI. Rawlins shot 173 over 36 holes to defeat Willie Dunn by 2 strokes.

1877 -- Chief Joseph surrenders with starving remnant of Nez Perce people. At Eagle Creek in Bear Paw Mountains, Montana, Nez Perce leader Chief Joseph (In-mut-too-yah-lat-lat [Thunder coming up over the land from the water]), surrenders his rifle after months in which his starving band eluded pursuing federal troops.” From where the sun now stands, I will fight no more forever." Chief Joseph was best known for his resistance to the US Government's attempts to force his tribe onto reservations. The Nez Perce were a peaceful nation spread from Idaho to Northern Washington. Earlier in the year, the U.S. government broke a land treaty with the Nez Perce Indians, forcing the group out of their homeland in Wallowa Valley in the Northwest for relocation in Idaho. In the midst of their journey, Chief Joseph learned three young Nez Perce warriors, enraged at the loss of their homeland, had massacred a band of white settlers. Fearing retaliation by the Army, he began one of the greatest retreats in American military history. For over three months, Chief Joseph led less than 300 Nez Perce Indians toward the Canadian border, covering a distance of over 1,000 miles as the Nez Perce outmaneuvered and battled over 2,000 pursuing U.S. soldiers. Finally, only 40 miles short of his Canadian goal, they were cornered, and forcibly relocated.

1887- Louisiana sugar workers strike, 37 peaceful strikers murdered. Louisiana Militia, aided by bands of "prominent citizens," shot unarmed black sugar workers striking to gain a dollar-per-day wage, and lynched two strike leaders.

1903-Birthday of John Atanasoff, inventor of the computer. Atanasoff, working with Clifford Berry, developed the Atanasoff Berry Computer (ABC), which used binary math to solve differential equations. The computer employed vacuum tubes and other key components of later electronic computers, although it did not have a central processing unit. In 1941, Atanasoff invited John Mauchly, a University of Pennsylvania physicist with an interest in automatic calculators, to see the ABC machine in Iowa. The visit and their subsequent correspondence about computers sparked controversy many years later over who had really invented the computer. In 1973, a judge overturned Mauchly's (and his associate, Presper Eckert's) patent claims to the computer in favor of Atanasoff. Atanasoff, who later headed up two engineering firms, received the Computer Pioneer Medal in 1981 and the National Medal of Technology in 1990.

1907- Harriot Stanton Blatch, the first woman elected to the American Society of Civil Engineers in 1906 was barred from dining at the Hoffman House Hotel in New York City because she had no male escort.

http://www.uua.org/uuhs/duub/articles/harriotstantonblatch.html

1927- Walter F. Bishop, Jr. Birthday (Bop Pianist)

1928 -- Author Alvin Toffler birthday.

http://www.usatoday.com/news/opinion/columnists/toffler/toff05.htm

1933 - "Esquire" magazine was published for the first time. Considered racy for its time, it pales in comparison to today's choices of reading material. "Esquire" can now be described as sophisticated.

1939 - A barber from Canonsburg (near Pittsburgh), PA, who had quite a singing voice, recorded "That Old Gang of Mine" with the Ted Weems Orchestra. That singer was the feature of the Weems band for many years before going solo as a radio, TV and stage star. You know him as ‘The Incomparable Mr. C.', Perry Como. His string of hits for RCA Victor spans four decades. He was an NBC TV mainstay for more than a decade..

1943 - "Is You is or is You Ain't My Baby?" was the musical question by Louis Jordan and His Tympany Five on this day -- on Decca Records.

1944- singer Billie Holiday records, “Lover Man.”

1944-Top Hits

I'll Walk Alone - Dinah Shore

Is You is or is You Ain't - Bing Crosby and The Andrews Sisters

It Had to Be You - Helen Forrest and Dick Haymes

Smoke on the Water - Red Foley

1944-Birthday of singer Patti Labelle, Philadelphia, PA

1948 - Gordon MacRae hosted the premiere of a radio classic. "The Railroad Hour" debuted on ABC radio. The theme song was "I've Been Working on the Railroad" and the show was sponsored by -- get ready -- America's Railroads.

1952- “Ozzie and Harriet” was TV's longest-running sitcom. The successful radio-turned-TV show about the Nelson family starred the real-life Nelsons—Ozzie, his wife Harriet and their sons David and Ricky. Officially titled “The Adventures of Ozzie and Harriet,” this show was set in the family's home. The boys were one reason the show was successful, and Ricky used the advantage to become a pop star. David and Rick's real-life wives—June Blair and Kris Nelson—also joined the cast. The show was cancelled at the end of the 1965-66 season after 435 episodes, 409 of which were in black and white and 26 in color. The last episode aired Sept 3,1966.

1952-Top Hits

You Belong to Me - Jo Stafford

Wish You Were Here - Eddie Fisher

I Went to Your Wedding - Patti Page

Jambalaya (On the Bayou) - Hank Williams

1953 - "I Led Three Lives" was first seen in syndication (it was never on a TV network) this day. Richard Carlson starring as Herbert A. Philbrick. 'The fantastically true story of Herbert A. Philbrick, who for nine frightening years did lead three lives - average citizen, member of the Communist Party and counterspy for the F.B.I.' Richard Carlson stars as Philbrick in this 1953-56 syndicated series based on the national best-seller. It was one of the most popular TV shows in the McCarthy era.

http://www.geocities.com/TelevisionCity/Stage/2950/epg/ILedThreeLives.htm

http://www.geocities.com/TelevisionCity/Stage/2950/Spy/ILedThreeLives.htm

1954- “December Bride.” This sitcom was filmed before a live audience at Desilu Studios and took place mainly in a living room. It starred Spring Byington as widow Lily Ruskin, Frances Rafferty as her daughter Ruth Henshaw, Dean Miller as Ruth's husband, Matt, Harry Morgan as wisecracking next-door neighbor, one of my closest friends in high school was his oldest son, Chris. He played third trumpet in my band, doing most of the solo's. Pete Porter (his wife Gladys was talked about but never seen), Verna Felton as Lily's friend Hilda Crocker and Arnold Stang as Private Marvin Fisher, Pete's brother-in-law. This series spun off “Pete and Gladys” in 1960.

http://www.geocities.com/TelevisionCity/Stage/2950/SitCom/DecemberBride.htm

1955- FINALLY. I was there as a thirteen year old kid when left-hander Johnny Podres pitched a 2-0 shutout against the New York Yankees to give the Brooklyn Dodgers their only World Series championship. Before this seven-game triumph, the Dodgers had lost the series in 1920, 1941, 147, 149, 1952, and 1953. The Dodgers left Brooklyn for Los Angeles after the 1957 seasons and have never been the same; that's when I became a Chicago Cubs fan.

http://www.baseballlibrary.com/baseballlibrary/ballplayers/P/Podres_Johnny.stm

1955-Rev Sun Young Moon leaves prison in Seoul

http://www.unification.net/1984/840101.html

http://www.tparents.org/Lib-Moon-Book.htm

http://www.newcovpub.com/unification/wfwp3.html

http://www.americanatheist.org/spr00/T2/fitrakis.html

1957- “Leave It to Beaver” premieres on TV. This family sitcom was a stereotypical portrayal of American family life. It focused on Theodore “Beaver” Cleaver (Jerry Mathers) and his family: his patient, understand-ing and all-knowing father, Ward (Hugh Beaumont), impeccably dressed housewife and mother June (Barbara Billingsley) and Wally (Tony Dow), Beaver's good-natured, all-American brother. The “perfectness” of the Cleaver family was balanced by other, less-than-perfect characters played by Ken Osmond, Frank Bank, Richard Deacon, Diane Brewster, Sue Randall, Rusty Stevens and Madge Blake. The last episode aired Sept 12, 1963. “Leave It to Beaver” remained popular in reruns.

http://www.leaveittobeaver.org/

1958 - Barbara MacDonald of Timbuk 3 is born.

1959 - No. 1 Billboard Pop Hit: "Mack the Knife," Bobby Darin. The song - Darin's biggest hit - earns the singer Grammy Awards as best new artist and best vocal performance by a male.

1960-Top Hits

My Heart Has a Mind of Its Own - Connie Francis

Chain Gang - Sam Cooke

Mr. Custer - Larry Verne

Alabam - Cowboy Copas

1961- Bob Dylan makes his concert hall debut at New York's Carnegie Hall. About 50 people attended, mostly friends, and he earned 20 bucks.

1963-Eric Clapton is asked to replace Anthony "Top" Topham in the Yardbirds.

1965 - No. 1 Billboard Pop Hit: "Yesterday," The Beatles. The song, which Paul McCartney originally called "Scrambled Eggs," has been played on the radio and TV more than any other Beatles song and is the most covered song in history.

1966---- Paul VI arrived in New York City. While speaking at the UN, Paul published a document exonerating the Jews of all blame in the death of Christ. It was a whirlwind visit. Pope Paul VI arrived at Kennedy International Airport, New York City, 9:27am. He went to Saint Patrick's Cathedral, and Cardinal Spellman's residence, 11:44am, conferred with President Lyndon Baines Johnson at the Waldorf-Astoria Hotel at 1:40pm, addressed the General Assembly of the United Nations in French at 3:30pm, attended a public Mass at Yankee Stadium at 8:30pm, visited the Vatican Pavilion at the New York World's Fair at 10:25pm, and returned to Rome the same day at 111pm on an Alitalia jet liner. He was seen by about 1 million persons and by 100 million on television.

1968-Top Hits

Hey Jude - The Beatles

Hush - Deep Purple

Fire - The Crazy World of Arthur Brown

Harper Valley P.T.A. - Jeannie C. Riley 1964 Patriots' Gino Cappelletti kicks 6-of-6 field goals against Broncos

1969-Crosby, Stills & Nash's "Suite: Judy Blue Eyes" is released.

1969-CCR's "Green River" tops the LP chart.

1969 - Denver, CO, received 9.6 inches of snow. October of that year proved to be the coldest and snowiest of record for Denver, with a total snowfall for the month of 31.2 inches.

1976- Agriculture Secretary Earl Butz resigns due to telling a racial joke.He later was sentenced to five years in prison for evading taxes, but was pardoned by the president.

http://www.kpcnews.net/special-sections/reflections3/reflections17.html

http://www.tompaine.com/feature.cfm/ID/2480

1975-Pink Floyd's "Wish You Were Here" LP hits #1 on the chart. (1975)

1976 - TV audiences watched as Barbara Walters joined Harry Reasoner at the anchor desk of the "ABC Evening News" for the first time. Walters made the switch with a million-dollar paycheck, becoming the first woman to anchor a network evening newscast

1976-Top Hits

Play That Funky Music - Wild Cherry

I'd Really Love to See You Tonight - England Dan and John Ford Coley

A Fifth of Beethoven - Walter Murphy and The Big Apple Band

Here's Some Love - Tanya Tucker

1977- Pier 39 opens in San Francisco. Warren Simmons, owner and founder of PIER MARKET RESTAURANT, was the founder and builder of PIER 39.In the early 70's, Warren was looking for a waterfront location for his Tia Maria Restaurants. He came upon Pier 39, which was full of refrigerators and junked cars. Looking past the debris, Warren envisioned a world-class development and it is just that today-PIER 39.In spite of opposition from politicians, civic groups, and competitors, government regulations, red tape and skeptics,

Pier 39 opened on October 4, 1978. The only major waterfront construction in San Francisco in the last 100 years was built in spite of everything. With vision and hard work, Warren was successful in creating this unique addition to Fisherman's Wharf.Warren and his son Scooter opened Pier Market in 1983. It has become quite a tourist attraction.

1980 - No. 1 Billboard Pop Hit: "Another One Bites the Dust," Queen. The song, which stays at No. 1 for three weeks, sells more copies than any other single by the group. ELO's "All Over The World" peaks at #13 and Genesis' "Turn It On Again" peaks at #58.

1981-CBS Records releases the children's holiday album, "In Harmony," which includes Bruce Springsteen's "Santa Claus Is Coming To Town.

1984 - “There it goes! It could be, it might be, it's...” A sad day for long-suffering Chicago Cubs fans. Chicago lost to the Padres 7-1 in the National League Championship Series.

1985- Shite Muslims claim to have killed hostage William Buckley

1986 - Dan Rather, of "The CBS Evening News", was mugged by two men in New York City.

1986-Van Halen's "Love Walks In" peaks at #22 on the singles chart.

1987 - A storm brought record snows to the northeastern U.S. Snowfall totals ranged up to 21 inches at North Springfield VT. It was the earliest snow of record for some locations. The storm claimed 17 lives in central New York State, injured 332 persons, and in Vermont caused seventeen million dollars damage. The six inch snow at Albany NY was their earliest measurable snow in 117 years of records.

1987 - Southern California continued to "shake and bake". An earthquake was reported during the morning, the second in a matter of days, and during the afternoon temperatures soared well above 100 degrees. Highs of 100 degrees at San Francisco, and 108 degrees at Los Angeles and Santa Maria, were October records. San Luis Obispo was the hot spot in the nation with an afternoon high of 111 degrees.

1988-Televangelist Jim Bakker is indicted on federal charges of mail and wire fraud and of conspiring to defraud the public. The case against the founder of Praise the Lord (PTL) Ministries and three of his aides exploded in the press when it was revealed that Bakker had sex with former church secretary Jessica Hahn.

1989 - Unseasonably cold weather continued in the north central U.S., with freezing temperatures reported across much of the area from eastern North Dakota to Michigan and northwest Ohio. Thirteen cities reported record low temperatures for the date, including Saint Cloud MN, which was the cold spot in the nation with a morning low of 19 degrees.

1991-NHL NY Rangers trade Bernie Nichols to Edmonton for Mark Messier

1992 - Miami Dolphins' safety Louis Oliver grabbed three interceptions from the Buffalo Bills and returned one for a 103-yard touchdown. That return tied for the NFL's all-time longest interception return with a 103-yard return by San Diego's Vencie Glenn against Denver on November 29, 1987.

1996-Van Halen announces that former Extreme lead singer Gary Cherone was chosen as the new lead singer of the group, replacing Sammy Hagar.

1997 - "4 Seasons of Loneliness", by Boyz II Men, was the #1 single in the U.S. The song, from their "Evolution" album, was number one for one week.

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

Connect with Leasing News

![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()

![]()