![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

Wednesday, September 3, 2014

Today's Equipment Leasing Headlines

Archives--September 3, 2002

"Top Gun" Ignacio Sanchez, CLP

Classified Ads---Credit

Bank Refused Coverage on Banker’s Bond

for Sheldon Player’s Equipment Acquisition Resources

By Tom McCurnin, Leasing News Legal Editor

Top Stories August 25--August 29

Opened Most by Readers of Leasing News

Differences Between iPhone & Android Users

By Dave Smith, businessinsider.com

Do Not Call Registry

-and you need to make a complaint

“Interviewer Had Concerns. Help! ”

Career Crossroad---By Emily Fitzpatrick/RII

Leasing Industry Ads---Help Wanted

Leasing 102 by Mr. Terry Winders, CLP

So You Want to Start a Leasing Company?

Nine New Certified Leasing Professionals

New Total 215

End of Refi Boom Creating Opportunity for

Smaller Banks and Other Financial Firms

A Resurrection in Problem Loan Sales

SNL Financial Report

Compensation in Equipment Finance Industry

Continues to Closely Mirror Business Performance

According to ELFA Survey

Diversified Capital Credit Corp. Celebrates 20 years

Today Has Two Branch Offices

Labrador Retriever Mix

San Pedro, California Adopt-a-Dog

Collector/Collections/Consultant/Communications

Classified ads—

News Briefs---

Changes in Lease Accounting Rules Draw Closer

Nat. Assoc. Credit Management Index Steady Last 5 Months

Faster Payments Could Help Speed Economic Recovery

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe to our news

editor or bookmark us (www.leasingnews.org) as each news edition

appears on our web site.

[headlines]

--------------------------------------------------------------

Archives--September 3, 2002

"Top Gun" Ignacio Sanchez, CLP

"I grew up in Southern California and attended both San Diego State

University and California State University, Fullerton.

"I started working for Balboa Funding Group in Jan 1990 right after I

graduated from California State University, Fullerton where I graduated with a BA degree in Business Administration with my emphasis in finance. I started out as a Junior Account Executive where I was taught leasing by Jim Raeder, Shawn Giffin and Mark McQuitty. I became an account executive in June ,1990. In January, 1993, I became the Sales Manager for the Irvine office and served as sales manager for almost 4 years. As sales manager, I was in charge of all Irvine sales operations, and at times funding, credit and training of new sales reps. Even with all my responsibilities, I continued to sell and was in the top 3 in sales for Balboa Capital every year. In 1995, I became a CLP. In 1997, I stepped down as Sales Manager and went back to selling and training Jr. account executives. I continued selling there until I quit in 1998 because there was no chance of ownership.

"I received a base salary, car allowance, plus 30% of all profit on both the front and back end of my transactions.

"In 1998 I started TriStar Capital, LLC with my brother Mike Sanchez who was with Balboa for 5 years and Banc One leasing for 1 year and Robert Hendrix who was the National Sales Manager at Balboa Capital. I continue to sell and run the company with my partners. In the 4 years we have been in business we have grown rapidly and funded about 20mm in equipment cost in 2001. We hope to grow by at least 25% this year."

TODAY

Ignacio Sanchez, CLP

Business Development

TA Equipment Finance

Santa Ana, California

(August, 2012-Present)

Partner

TriStar Capital, LLC

(September, 1998-October, 2011)

Sales Manager

Balboa Capital

(1990-1998)

www.linkedin.com/pub/ignacio-sanchez/11/3b4/b81

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Bank Refused Coverage on Banker’s Bond

for Sheldon Player’s Equipment Acquisition Resources

By Tom McCurnin

Leasing News Legal Editor

(Sheldon Player in Wyoming)

Highland Bank’s $3 Million Dollar Loss Due to Forgery of EAR’s Principal, Donna Malone (the late Sheldon Player’s alleged wife), Was Claimed to Have Been Directly Caused From Forgery, Thus Triggering Bankers’ Blanket Bond. But Bank’s Insurer Obtains Summary Judgment That Loss Was Inevitable and Not Directly Related to Forged Guaranty.

Although Christmas season is not yet upon us, the Equipment Acquisition Resources (“EAR”) case is a case which continues to bless lawyers with seemingly endless litigation. There are several cases on going, such as Home Savings Bank, as well as FBI filings against the president Mark Anstett and vendor of equipment, George Ferguson (1)

Today’s case is a marginal case between victim Highland Bank and its insurer, BankInsure. The Bank thought that its EAR loss was covered under its Bankers Blanket Insurance Policy. The Insurer disagreed, and the Court ruled that it was not a covered loss. The facts follow.

A regurgitation of the complete facts surrounding the EAR scam is unnecessary here. Sheldon Player, the principal of EAR, scammed dozens of leasing companies with double financed equipment and non-existent equipment. (2)

In 2005, EAR and First Premier Capital entered into a lease agreement under which First Premier was to provide manufacturing equipment to EAR. As a condition precedent to the Lease Agreement, EAR principals Sheldon Player and Donna Malone executed personal guaranties with First Premier on May 27, 2005, guaranteeing all the obligations under the Lease Agreement. The bank believed that Ms. Malone’s guaranty was likely forged.

In 2006, First Premier approached Highland Bank on EAR's behalf, seeking to borrow $3 million to finance the equipment lease, contemplating that Highland Bank would advance $3 million acquisition cost of the equipment to First Premier, which would then advance the funds to EAR’s equipment vendor. First Premier would retain title to the equipment, and EAR would lease the equipment from First Premier under a lease schedule. Highland Bank would receive payment of its lease financing through an assignment of the rental payments due to First Premier under the Lease Agreement. As relevant here, First Premier assigned three schedules to Highland Bank for an approximate aggregate sum of $4,000,000. Before closing any of the three loans, Highland Bank did not contact EAR, Player, or Malone, did not inspect the equipment or determine its liquidation value. The Bank did not conduct a background check on Player or Malone, or ask First Premier to do so.

By 2009, Highland Bank determined that the loans were uncollectible. In 2010, Highland Bank filed suit against First Premier in Minnesota, alleging that First Premier was in default of the representations and warranties under the Assignment. Highland Bank obtained judgment against First Premier, but has been unable to collect on its judgment. First Premier is out of business.

As a last resort, Highland Bank brought suit against its insurer, BancInsure, which issued a blanket bankers bond, insuring against certain losses arising from a variety of exposures, such as forgery and counterfeiting. Highland Bank sued its insurer for a total of $2,011,618.30, the loss it incurred from the three loans.

The Bankers Bond covers financial institutions from losses resulting directly from the Bank having, in good faith, acquired any credit on the faith of any original guaranty which bears a signature which may

have been a forgery. Actual physical possession of the guaranty is a condition precedent to the Insured's having relied on the faith of such items.

Highland Bank moved for summary judgment, seeking coverage for its loss, due to forgery. BankInsure also moved for summary judgment.

BancInsure argued that there is no loss “resulting directly from” Highland Bank's extension of credit on the faith of an alleged forged document, because the Malone guaranty was worthless. According to the credit write up, the Malone guaranty was worthless because Ms. Malone had a tangible net worth of negative $4,580,000. BankInsure argued that the Bank could not demonstrate reliance on the Malone guaranty because it never examined the original document before funding the loans, a condition of the Bankers Blanket Bond.

The Court held that the loss had to be one which resulted directly from the forgery, and as we know now, the EAR leases were doomed from the start, and a loss would have occurred whether the guaranty was forged or not. Accordingly, the Court granted BankInsure’s motion for summary judgment and denied Highland Bank’s motion for summary judgment. This left Highland Bank high and dry to collect on its three EAR deals totaling over $4 million dollars. Highland Bank appealed to the 8th Circuit.

What are the lessons here for the equipment lessor?

First, Banker’s Blanket Bonds are specialized forms of insurance, which generally protect a financial institution against specific kinds of fraud and defalcation. It cannot be used as a poor man’s credit insurance.

Second, while I don’t fault the Bank giving the lawsuit the old college try, I thought the case was doomed from the start, because it was hard to argue with a straight face that the loss was directly attributable to the forged guaranty. I guess what I am saying is that I wouldn’t rely too much on these types of bonds.

Finally, as a post script, BankInsure was placed into receivership on August 21, 2014 by the Oklahoma, so the likelihood of recovery from this avenue has now been made even more remote.

The bottom line to this case is that Bankers Blanket Bonds are a specialized form of insurance which protect a financial institution from specific kinds of fraud and defalcation, and are not credit insurance. As such, they are strictly construed.

The outcome of this case was very predictable. “Before closing any of the three loans, Highland Bank did not contact EAR, Player, or Malone, did not inspect the equipment or determine its liquidation value. The Bank did not conduct a background check on Player or Malone, or ask First Premier to do so.” This pre-closing contact with the parties involved, the inspection and evaluation of the equipment in consideration of the amount to be extended, and background checks on the principals and guarantors would have provided documentation against the extension of ANY amount.

Highland Bank Case

http://www.leasingnews.org/PDF/HighlandBankCase_932014.pdf

- US Attorney Indicts EAR President Mark Anstett

and Two Others for $100 Million Leasing Fraud

http://leasingnews.org/archives/Mar2014/3_03.htm#us

- Articles on E.A.R. and Sheldon Player

http://www.leasingnews.org/Conscious-Top%20Stories/Sheldon_Player.htm

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Top Stories August 25--August 29

Opened Most by Readers of Leasing News

(1) Name This Company in the Bulletin Board Complaint

Take a Guess

http://leasingnews.org/archives/Aug2014/8_25.htm#name

(2) Balboa Capital Settles $36,454 Attorney Fee Complaint

After Getting Suit Dismissed Against Regents Capital

http://leasingnews.org/archives/Aug2014/8_25.htm#balboa

(3) A Key Part of the Economic Recovery Is Finally Happening

http://leasingnews.org/archives/Aug2014/8_29.htm#key

(4) Archives---August 25, 2004

Jim Raeder Responds to Criticism of CapitalWerks

http://leasingnews.org/archives/Aug2014/8_25.htm#archives

(5) New Hires—Promotions in the Leasing Industry

http://leasingnews.org/archives/Aug2014/8_29.htm#hires

(6) Are Accurint Reports a Consumer Credit Report?

Will This Change Their Use?

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Aug2014/8_27.htm#accurint

(7) Leasing 102 by Mr. Terry Winders, CLP

Pricing

http://leasingnews.org/archives/Aug2014/8_25.htm#pricing

(Tie)(8) Earthquake in Napa, California

http://leasingnews.org/archives/Aug2014/8_25.htm#napa

(Tie) (8) Financial Pacific Completes First Year

as Subsidiary of Umpqua Bank

http://leasingnews.org/archives/Aug2014/8_29.htm#fin

(9) Sales Make it Happen by Robert Teichman, CLP

Sales Isn't Just for the Salesperson

http://leasingnews.org/archives/Aug2014/8_27.htm#happen

(10) Napa Valley Open for Business

http://leasingnews.org/archives/Aug2014/8_27.htm#napa

[headlines]

--------------------------------------------------------------

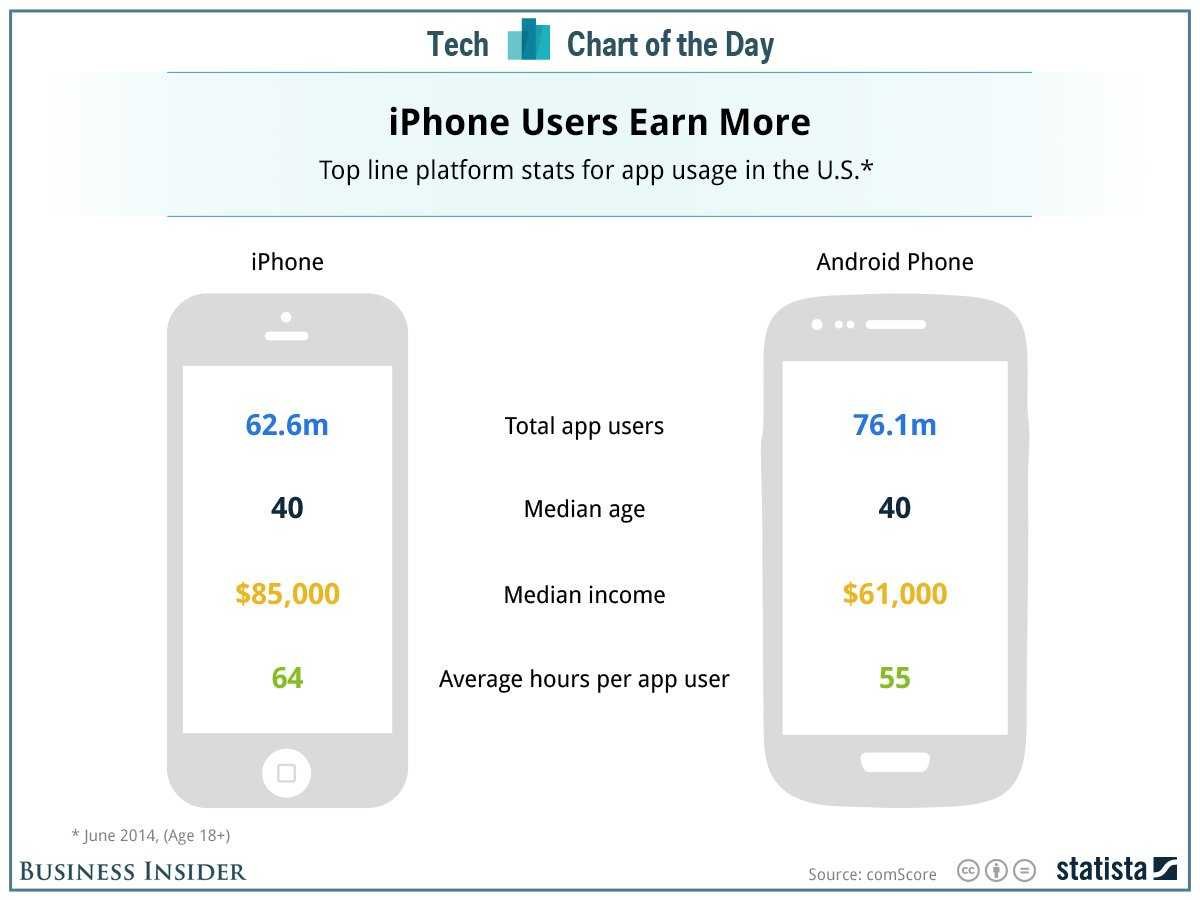

Differences Between iPhone & Android Users

By Dave Smith, businessinsider.com

Based on comScore data charted for us by Statista, there are more people using Android apps than iPhone apps — which makes sense, since Android is killing iOS in global smartphone market share — but as you can see from the chart, iPhone owners tend to spend more hours on their apps, and they also make more money in general. But that makes sense: More than 80% of Apple devices are “high-end,” while ~60% of Android devices are considered “low-end,” since they cost less than $200. Apple currently sells zero “low-end” devices.

|

[headlines]

--------------------------------------------------------------

Do Not Call Registry

--and you need to make a complaint

All telemarketers calling consumers in the United States are required to download the numbers on the Do Not Call Registry to ensure they do not call those who have registered their phone numbers. The first five area codes are free, and organizations that are exempt from the Do Not Call rules, such as some charitable organizations, may obtain the entire list for free. Telemarketers must subscribe each year for access to the Registry numbers.

For consumers who want to add their phone number to the Registry, registration is free and does not expire.

https://www.donotcall.gov/?utm_source=govdelivery

You can also verify a registration on the site above, as well as submit a complaint. You need to file a complaint to make the registry work, otherwise you will find yourself screaming more often to those who

make these calls (who will continue regardless of what you call them).

[headlines]

--------------------------------------------------------------

“Interviewer Had Concerns. Help! ”

Career Crossroad---By Emily Fitzpatrick/RII

Question: During my last interview, I could tell the interviewer had some concerns regarding my candidacy. How do I handle a situation like this in the future?

Answer: Towards the close of the interview, you should have asked the interviewer if he/she had any concerns regarding your candidacy and addressed them accordingly. However, many times the interviewer does not introduce the subject, and many job seekers will not touch this issue because they are not prepared.

Moving Forward

No matter how successful an interview seems to be going, the interviewer will have questions (maybe concerns) about the candidate’s skills and abilities relative to a position. Concerns may be caused by something that was or was not discussed; there may have been a misunderstanding of a question asked or an answer given, etc.… this is normal; seldom does a candidate fill 100% of the job specs.

A concern in the mind of the interviewer can often be corrected. However, if a concern is not addressed before the end of the interview, your candidacy could be lost; the need to deal with concerns must be made clear and obvious.

Dealing with concerns or potential weakness in any form is difficult under the best of circumstances. Perhaps the best way to approach the discussion is to request a comparison between the targeted candidate and yourself. This is a very direct question that will require an open, direct response. For example, “Mrs. Fitzpatrick, now that we have had an opportunity to talk about the position, I feel more confident than ever that I can be of assistance to your organization. Do you have any concerns about my abilities to do the job?"

The candidate must now be ready for the response and know how to handle it. Since this is a direct approach, some interviewers are able to deal with the question openly, and some have problems with it. If you hear a vague response, you are probably not being given the information you requested. You might come back and say, “… I was trying to see if you had any concerns about my ability in any specific area so that we could address them now …” If you sense the interviewer is uncomfortable, then move on.

If a concern has been raised, you do not have a lot of time to prepare your response. You should have spent time prior to the interview identifying strengths and weaknesses and preparing appropriate answers.

Bottom line, do not be afraid to ASK the interviewer their concerns AND make sure you PREPARE before the interview for every type of scenario/question/concern that may arise.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

So You Want to Start a Leasing Company?

One of the problems when you start a leasing company is to determine if you are going to be a broker, packager, or funder. Possibly a bit of all three. A broker gets a fee for introducing the lessee to a lessor. The transaction is not being completed until the lessor approves the deal. Usually the documents are created or supplied by the lessor. It is priced with the lessor in mind so the broker’s fee is part of the deal. Once the transaction is completed and funded, the broker has no further responsibilities and has earned the fee.

A packager usually structures and prices the deal and creates the documents. A packager reviews the credit requirements and any residual prior to approaching a lessor. When the deal is acceptable to the lessor, a complete package is delivered. Income to a packager is a front end fee and they may participate in the proceeds from a residual sale or re-rental that exceeds the booked residual.

If you establish the ability to fund leases by borrowed funds or invested capital, the firm must have at least three years of operating expenses because all the expenses are front end loaded while income is spread over the term of the leases. In addition, a lease loss reserve must be established that reduces income for three to five years until it gets fully established. This means that charge offs or the loss from the sale of capital assets must be taken at the same time that the loss account is being established.

One of the advantages of small companies is the ability to avoid using GAAP accounting requirements in the first few years. Cash accounting will allow for a better control of income and a better control of expenses in the near term. Once a few years elapse and the firm needs to look for institutional capital or bank loans, GAAP accounting and audits will be required.

The territory served by the new leasing entity needs to be more local that spread out among several states. There is a fact in the leasing business that as your market size increases so do your operating expenses. The vendor market is appealing, but you need to have vendors that sell in your market and avoid vendors that ask you to fund leases that are across the country as it increases your licensing, state income tax, property tax, and other requirements to do business

in each state. The cost of doing business in each State requires a couple of million dollars portfolio to just cover the operating expenses. It takes time to establish this portfolio so it is a further drag on income.

Many start-ups in the commercial equipment leasing business use all three methods of leasing so they can get income from the best source and hopes all goes well for a few years so they can establish a good footing with out many losses.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at terrywinders11@yahoo.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Nine New Certified Leasing Professionals

New Total 215

The Board of Directors of the Certified Lease Professional (CLP) Foundation announced nine attendees of the Southern California and Seattle-area Institute for Leasing Professionals that sat for the exam attained the CLP designation. The nine are:

Kimberly Bartling

Funding Manager

Alliance Funding Group

Mitch Bedke, CLP

President/Founder

Finance Capital

Nicholas Fong, CLP

Marketing Manager

First Star Capital

David Maslyk, CLP

Vice President

Bank of the West Equipment Finance

Chooney Pak, CLP

Funding Manager

Providence Capital Funding

Jennifer Pryor, CLP

Credit& Risk Manager

First Star Capital

Bobby Siddiqui, CLP

Senior Business Development Manager

Alliance Funding Group

Lauren (Zabaronick) Timlin, CLP

Senior Funding Coordinator

Banc of California

Emily Windle, CLP

Director of Operations

Finance Capital

The CLP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the equipment finance industry. There are currently 215 Certified Lease Professionals throughout the world. For more information, call Reid Raykovich, CLP at (206) 535-6281 or visit www.clpfoundation.org.

Companies with More than One CLP

1. Financial Pacific Leasing – 23

2. First American Equipment Finance – 21

3. Orion First Financial – 9

4. Allegiant Partners- 10 (includes Clearview and First Star)

5. ECS Financial Services – 7

6. Arvest Equipment Finance – 6

7. GreatAmerica Financial Services – 6

8. Ascentium Capital LLC – 5

9. Banc of California - 4

10. Innovative Lease Services, Inc. – 4

11. Maxim Commercial Capital – 4

12. Bank of the West – 4

13. Canon Financial Services-3

14. FSG Leasing - 3

15. LeaseTeam-3

16. Pacifica Capital - 3

17. GO Capital- 2

18. Alliance Funding Group -2

19. Finance Capital -2

20. Padco Financial Services- 2

21. Pinnacle Business Finance- 2

22. Portfolio Financial Servicing- 2

23. TEQ Lease – 2

Why I Became a CLP

http://www.leasingnews.org/items/CLP_logo.jpg

|

[headlines]

--------------------------------------------------------------

End of Refi Boom Creating Opportunity for

Smaller Banks and Other Financial Firms

SNL Financial Report

By Hina Nawaz and Zach Fox

Regulatory data from the second quarter showed mortgage holdings continued to decline among banks through the second quarter, with the largest banks posting the most severe declines.

Mortgage origination volume has struggled after a rise in rates in the middle of 2013 put an end to a refinancing boom. In 2012, rates on 30-year fixed-rate mortgages fell to nearly 3.5% and rates on 15-year mortgages actually dipped below 3.0%. After spiking in the second half of 2013, rates on 30-year mortgages started 2014 at roughly 4.5% and 15-year mortgages at about 3.5%.

Since then, rates have ticked down some, but they are still well above the 2012 lows. As of the week ended Aug. 22, the average 30-year mortgage carried an interest rate of 4.26% and the typical 15-year mortgage was at 3.43%.

"It shows you how dependent the mortgage industry really is on refinancing," said Guy Cecala, CEO of Inside Mortgage Finance, an industry publication.

Inside Mortgage Finance reported refinancing constituted 36% of the mortgage market in the second quarter, the lowest share since the 1980s, Cecala told SNL. On Aug. 26, the Mortgage Bankers Association released a second-quarter report on independent mortgage banks and mortgage subsidiaries of chartered banks, showing a somewhat similar trend. The report's release only showed a purchase share, as opposed to refinance share, putting the purchase share at 59% in the second quarter for the mortgage industry as a whole.

Cecala said that over the last 25 years, the refinance share has generally stayed above 50%.

"Are we going to see it back up to 50% any time soon? Not unless rates suddenly drop dramatically, or there's an influx of well-heeled immigrants who we decide to qualify for mortgages — but nothing in the immediate future," he told SNL.

Declines in mortgage origination seem to be hitting the largest players the hardest, creating opportunities for nonbanks and smaller banks.

For example, Wells Fargo & Co. has seen retail mortgage originations tumble to $14.33 billion in the second quarter, down 71.02% from the $49.46 billion reported in the 2013 second quarter. Meanwhile, nonbank Freedom Mortgage Corp. said July 21 that the company had doubled its monthly volume over the last two years. And Inside Mortgage Finance reported originations for the company totaled $5.72 billion in the second quarter, up 31.1% from the prior-year period.

Generally, the weaker origination figures have also translated to declines in the amount of one- to four-family loans sold or held for sale by banks in the second quarter, relative to the prior-year period. The four largest, money-center banks — Wells Fargo, Bank of America Corp., Citigroup Inc. and JPMorgan Chase & Co. — all posted year-over-year declines of larger than 45% for both one- to four-family loans sold off the balance sheet, as well as such loans held for sale.

Breaking down the banking industry by asset size, it is clear that declines are hitting the largest players harder. Among bank holding companies with more than $10 billion in assets, residential loans sold in the second quarter totaled $97.66 billion, a decrease of 65.20% year over year in the second quarter, while such loans held for sale fell 42.08%. Among banks with asset size of less than $1 billion, residential loans sold in the quarter totaled $13.75 billion, a decline of 41.41%.

Inside Mortgage Finance's Cecala told SNL that the law of large numbers is playing a role — that the banks with the most volume a year ago had the farthest to fall. But he also said the shift toward more purchase activity and less refinancing volume favors smaller lenders.

"People buying homes tend to go with real estate agent recommendations, and that tends to be more local lenders," Cecala said.

While the year-over-year figures remain dour, the mortgage market showed definite signs of improvement in the second quarter relative to the start of the year. It should be noted that winter is generally the slowest season for home purchases.

Among the top five banking originators, as selected based on the most recent data available from the Home Mortgage Disclosure Act, all but one posted a quarter-over-quarter increase in retail mortgage origination in the second quarter, according to Y-9C regulatory filings for the quarter. Mortgage giant Wells Fargo posted a whopping 21.71% gain from the linked quarter, while JPMorgan was the one to post a decline, as its origination volume slipped to $4.70 billion, a 3.85% decline from the linked quarter.

The MBA report showed the second-quarter bump in origination volume also carried a return to profitability. The industry group's report, which relies on production data from 349 companies, showed a net gain of $954 on each loan originated in the second quarter, compared to a loss of $194 per loan in the first quarter.

Marina Walsh, vice president of industry analysis for MBA, said the swing to profitability was driven by the bump in origination volume, as well as lower expenses.

"It was an expense play more than a revenue play," Walsh told SNL. "It largely came from expenses going down after six quarters of going up."

![]()

[headlines]

--------------------------------------------------------------

A Resurrection in Problem Loan Sales

SNL Financial Report

By Nathan Stovall and Salman Aleem Khan

The pace of problem loan sales at banks rebounded in the second quarter, reaching the highest level in the last 18 months.

After a slow start to 2014, banks' sales of nonaccrual loans rose considerably in the second quarter. Problem loan sales at banks more than tripled in the period, jumping 222.2% from the first quarter and 12.6% from a year earlier. Inflows of nonaccrual loans dropped as well, declining 6.9% from the linked quarter and more than 29.3% from a year ago, according to SNL data.

Banks' problem loan sales bounced back even as real estate prices held virtually flat in the second quarter, with U.S. home prices climbing just 0.8% from the linked quarter, according to the Federal Housing Finance Agency. Still, the jump in volume could have come from pent-up demand, with bankers noting that problem loan sales activity was exceptionally slow in the first quarter due to the severe winter.

Even at this late stage in the credit cycle, the potential supply of problem loans that could be sold on the market remains considerable. For instance, Compass Point analysts estimate that the supply of nonperforming one- to four-family mortgage loans stood at $305 billion at the end of the second quarter, based on holdings of commercial banks, the Department of Housing and Urban Development and the government-sponsored enterprises. The analysts said pricing on recent sales has reportedly increased, even with home prices holding fairly steady. The higher pricing could lead to increased sales activity, they said.

"Given increases in pricing, we would not be surprised to see more supply come to market (and recent activity and press reports indicate this is happening)," Compass Point analysts wrote in an Aug. 26 report.

Indeed, banks significantly increased their plans to sell problem loans in the second quarter, reversing a trend witnessed over the last few quarters. Banks reported $110.48 billion in loans classified as held for sale in the second quarter, up 42.5% from $77.51 billion in the linked quarter, SNL data shows.

Some banks took opportunities to purge their balance sheets in the second quarter and continued to take hits despite the increase in prices.

"On the nonperforming side, I still think for the folks that still have meaningful nonperformers on their balance sheet, I think the bid/ask spread is still pretty wide," said Kenneth Segal, a managing director in the bank and loan advisory group at Situs. "Despite relative recovery in values, there isn't still enough value there to support motivating the folks holding these assets to sell them."

Segal, whose firm provides portfolio valuation services and has also recently worked with banks on data population and aggregation services to help with stress testing, told SNL that the spread between investors' bids and banks' carrying values has narrowed some but still remains wide enough to result in losses when banks sell problem loans.

"With the nonperformers, particularly for the smaller banks, the bid/ask spread is more narrow than it used to be, but I still think it is sufficiently wide to prevent a lot of people from truly cleaning up their balance sheet without a major capital infusion. It's still relatively challenging for a smaller bank to attract capital," Segal said.

One smaller bank that has recapitalized, Sun Bancorp Inc., sold loans at the end of the second quarter as part of a major restructuring initiative. Sun Bancorp noted in an investor presentation in late July that the sales would help lower workout expenses going forward. The company completed a cash sale of $71.4 million of individual commercial loans, resulting in a loss of roughly $11.8 million. Sun Bancorp also moved $24.7 million of nonaccrual and other "low-quality" consumer and related credit to held-for-sale, resulting in an estimated loss of $4 million.

Astoria Financial Corp. also recently engaged in sales of problem loans and managed to ink a transaction without incurring significant costs because it had already written down and taken reserves against the loans. In late July, Astoria entered an agreement to sell certain nonperforming residential mortgage loans for consideration of about $186 million, or at roughly 95 cents on the dollar.

Other banks could look to clean up their balance sheets and sell foreclosed real estate in the second half of 2014. Old Second Bancorp Inc. COO James Eccher said on the company's second-quarter earnings call in late July that it has not ruled out a bulk sale, and sales activity in general could pick up after a slow start to the year.

"We're seeing continued interest in the portfolio. First quarter, I think, it was slower than we'd like, it's probably more the weather than anything. But we do have several properties that we're in current negotiations with," Eccher said on the call, according to the transcript. "We see prices firming up a little bit. We still have about a third of the portfolio in construction-related assets which, as you know, is a little more challenging to move. But we are seeing better interest in some of those properties as well."

Some banks are still very hesitant to pursue nonaccrual sales, at least in bulk form. Capital City Bank Group Inc., for example, has long preferred selling foreclosed properties through a retail strategy versus a wholesale strategy. Capital City CFO J. Kimbrough Davis touted that strategy at an investor conference in late July, noting that the company had sold other real estate at 101% of book value over the last 26 quarters. He said holding costs on the properties were currently running at 7%, compared to the average discount of 30% to 40% that the company would receive when pursuing a sale.

The hesitation to take such large hits has kept many banks from selling problem loans and foreclosed real estate in recent years. The banking industry is also now seeing problem loan formation slow. SNL data shows that additions to nonaccruals fell again in the second quarter of 2014, dropping 6.9% sequentially to $17.11 billion. This marked the third quarter in a row that nonaccrual additions had fallen below the $20 billion level. That level previously had not been seen since the second

The amount of nonaccrual loans in the banking industry has fallen 63% since peaking in the first quarter of 2010, but much of that decline occurred in 2010 and the early part of 2011, when distressed asset sales activity was much higher.

SNL data shows that sales activity reached its highest level in the fourth quarter of 2010. Nonaccrual sales totaled $28.71 billion for the whole of 2010. Sales activity fell substantially in 2011, particularly in the latter half of the year when investor sentiment toward banks soured and capital raising slowed. Sales of nonaccrual loans fell to $19.00 billion in 2011, with about 40% of the overall sales activity coming during the last six months of the year, according to SNL data.

After a lackluster ending to 2011, nonaccrual sales remained slow in 2012, falling to $15.19 billion — down 20% from the previous year.

Nonaccrual sales activity in 2013 proved choppy, but ultimately finished the year at subdued levels. Sales activity was below the $3 billion level in the first quarter, in the third quarter and again in the fourth quarter, totaling $2.99 billion in the last period of the year. Overall nonaccrual sales activity in 2013 fell to $11.81 billion, down about 22% from the previous year.

Nonaccrual sales activity plunged even further in the first quarter of 2014, dropping 59% to $1.22 billion. However, after falling to levels not seen since before the credit crisis, nonaccrual sales activity jumped to $3.93 billion in the second quarter. With market conditions holding, there seems some hope that the rebound in sales activity could continue through the remainder of 2014.

![]()

|

[headlines]

--------------------------------------------------------------

### Press Release ############################

Compensation in Equipment Finance Industry

Continues to Closely Mirror Business Performance

According to ELFA Survey

WASHINGTON, D.C. - Compensation in the equipment finance industry increased modestly in 2013, according to the 2014 Equipment Leasing and Finance Compensation Survey from the Equipment Leasing and Finance Association (ELFA) and McLagan. For the fourth consecutive year, a year-over-year increase in new business volume contributed to increases in compensation, albeit at a slower rate than previous years.

The 2014 Equipment Leasing and Finance Compensation Survey measures compensation rates for the 2013 fiscal year as reported by 60 equipment finance companies representing a cross section of the equipment finance sector, including independent, bank and captive leasing and finance companies. Firms provide data for more than 90 executive, front-office and support positions, including a breakdown of salary (for 2013 and 2014), incentives (including cash bonuses and commissions), long-term awards and total compensation by company type. The survey is a collaborative initiative between ELFA and McLagan, a performance/reward consulting and benchmarking firm for the financial services industry.

Highlights from the 2014 Equipment Leasing and Finance Compensation Survey include:

· Total Compensation: On a “same-store” basis (constant incumbents in multiple survey years), total compensation was flat (+/- 1%) at median for key originations functions from 2012 to 2013. Infrastructure received marginally larger increases at median, ranging from approximately 3–6%. Notably, divisional management fared better than most other functions. The team leader / senior role experienced the greatest year-over-year variability, with many individuals receiving decreases of 20+%, while others received increases of 14+%.

· Salary: On a same-store basis, origination roles tended to have slightly lower increases between approximately 2–2.75%. Additionally, more than 25% of incumbents in key origination positions did not receive salary increases year-over-year. Salaries tended to rise between 2–4% for infrastructure roles.

· Differences by Level: Increases tended to be larger at the more senior levels (particularly in direct origination and infrastructure). Notably, the team leader / senior level for the direct and vendor origination functions was flat (+/- 1%).

· Differences by Firm Type: Generally, banks awarded higher compensation at median relative to captive and independents, particularly for senior roles. Median total compensation and salary compensation rates tended to be comparable (+/- 5%) at lower levels for infrastructure and origination roles.

Industry Trends

In 2013, new business volume in the U.S. equipment leasing and finance industry increased—for the fourth consecutive year—to levels at or near pre-recession highs. However, the rate of increase slowed in 2013 compared to the significant increases experienced in the previous three years. This trend was not experienced uniformly by all market competitors, as some organizations saw business volume increases while others experienced modest declines. Along with top-line growth, the environment has been marked by heightened competition for deals, which has put pressure on margins. The credit picture, however, remains strong, with low levels of delinquencies and charges offs. The compensation trends in the industry mirror this uneven growth, with compensation linked to industry financial performance over the last year and since the recovery began.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $827 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org and follow ELFA on Twitter @elfaonline.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Diversified Capital Credit Corp. Celebrates 20 years

Today Has Two Branch Offices

Diversified Capital Credit Corp. is celebrating 20 years of incorporation. Starting in September 1994 in a small office in New Jersey, Diversified has expanded to include branch sales offices in Georgia and Minnesota. Additionally it has added Health Care Equipment Funding, FotoFunding, Waste Funding and Telco Funding as divisions, as well as developing a number of private label programs for its vendor partners.

Bruce Smith

“Much has occurred in our industry over the last 20 years” said Bruce Smith, President and owner of Diversified Capital. “During that time, many other independent equipment finance companies have come and gone. I’m proud of the fact that our business model has allowed us to grow and flourish. Our resiliency and flexibility has enabled us to assist hundreds of vendors sell equipment to thousands of end user customers, even during the recent economic downturn. I’m looking forward to the next 20 years with a lot of optimism.”

Through its headquarters in Gillette, NJ, and branch offices, Diversified Capital and its divisions specialize in the implementation of value added leasing and financing programs that assist equipment vendors in their sales efforts.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Labrador Retriever Mix

San Pedro, California Adopt-a-Dog

ID#A1501788

“I am an unaltered female, tan Labrador Retriever mix.

“The shelter thinks I am about 2 years and 1 month old.

“I have been at the shelter since Aug 17, 2014.”

Adoption fees include spay/neuter surgery, all animals will be sterilized prior to release.

Adoption Information

For more information about this animal, call:

Harbor Animal Care and Control Center at (888) 452-7381

Ask for information about animal ID number A1501788

Los Angeles County Services

Harbor Shelter

957 N. Gaffey Street, San Pedro, CA 90731 Directions

888-4LAPET1 (888-452-7381)

Shelter Hours

Monday & Holidays: Closed

Tuesday-Saturday: 8am-5pm

Sunday: 11am-5pm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Collector/Collections/Consultant/Communications

Classified ads—

Leasing Industry Outsourcing

(Providing Services and Products)

| Collector: Atlanta, GA Asset Recovery Specialist. We get your money or we get your > equipment back for you. Physical Asset Recovery Experts! E-mail: mcrouse911@joimail.com |

Collector: Cleveland, OH Huntley Capital & Associates is your solution to late payments, no payments, and asset recovery. Call 216-337-7075. Email: ghpatey@msn.com |

||

| Collections: Dallas, Texas Contingency Fee basis. Receivables Outsourcing. We are a fully bonded nationwide licensed agency. We collect for nationally known banks and leasing companies. 800-886-8088. |

Collector: Los Angeles, CA Expert skiptracers covering Southern California. We locate skips, judgment debtors and collateral. When you can't get the job done in house, give us a call at 1-800-778-0794. E-mail: ceo@interagencyLA.com |

||

| Collector: Louisville, KY We are a full service collection agency with attorney network. 21 years experience. Please call Jon Floyd, VP at 1-800-264-6850 email: jfloyd@collectcsg.com |

Collector: Louisville, KY Euler Hermes/UMA 92 year old Global Receivables Outsourcing. Presence in 143 Countries. Work w/ 4 out of 5 Fortune 500 firms. Contingency Fee Structure. 20% off first time clients.! Andrew.Newton@eulerhermes.com 1-800-237-9386 x 205. |

||

| Collector: Mandeville, MI International commercial collection services all fees are on contingency on line access. E-mail: rmelerine@collect-now.com www.drspay.com www.collect-now.com |

|

||

Collector: Nationwide |

Collector: Saint Louis, MO Complete commercial collection agency. Licensed bonded in all states and will out performed any other agency! Call 1-800-659-7199 ext.315 E-mail: jfloyd@lindquistandtrudeau.com |

||

| Consultant: Nationwide 25 yrs. experience: Creating/Refining Business Plans to raise capital· Credit Underwriting support/policy/procedure development · Operations Support/policy/procedure development. Call: 610-246-2178, McCarthy Financial, LLC, David.mccarthy@mccarthy-financial.com |

Consultant: Burlington, CT We provide our clients with a full range of consulting services such as portfolio conversions, reconciliation, custom programming and leasing operations utilizing InfoLease. Email: info@new-millennium-assoc.com |

||

| Consultant: Europe 15 years doing deals/running own technology leasing company – looking to advise/ lead new entrants to take advantage the European market opportunity. www.clearcape.co.uk or kevin.kennedy@clearcape.co.uk |

Consultant: Henderson, NV Focus on new business development and process efficiencies to create incremental revenue and profitability. Executive level vendor experience, and satisfied outsourcing clients. Incredible track record. E-mail: rbutzek@cox.net |

||

Consultant: Sausalito, CA |

Consultant: North of Detroit, MI |

||

Consultant: Ridgefield CT. |

Email: dan@danscartoons.com Go to http://www.danscartoons.com

|

All "Outsourcing" Classified ads (advertisers are both requested

and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Changes in Lease Accounting Rules Draw Closer

http://online.wsj.com/articles/the-big-number-changes-in-lease-accounting-rules-draw-closer-1409613447

Nat. Assoc. Credit Management Index Steady Last 5 Months

http://www.leasingnews.org/PDF/NacmINDEX_932014.pdf

Faster Payments Could Help Speed Economic Recovery

http://bankinnovation.net/2014/08/faster-payments-could-help-speed-economic-recovery/

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Cash Out Your Lease on Your Car

http://www.kiplinger.com/article/cars/T009-C004-S002-cash-out-your-lease-on-your-car.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

9 Ways to Get More Out of Your Day

Time to Ignore the Hourglass

http://www.sparkpeople.com/resource/motivation_articles.asp?id=149

[headlines]

--------------------------------------------------------------

Baseball Poem

THERE WAS A BALL GAME SOMEWHERE

by Tim Peeler

Before video parlors, PCs and iPads

iTouch, Smartphones, on our ragged bicycles

We scrambled to one house or the other—

Hefners, Peelers, then the Swansons who moved

In the neighborhood, sometimes the Coffeys

From church, or the Swansons' friends from their church -

For the really big affairs with full teams,

Baseball games with football scores. Out in the heat

Most of the day, just breaking for lunchtime—

Easy pitches and little guys taking

Big cuts, ghost runners and no catcher, weird

Rules like ground rule doubles for balls driven

Into the short cow pasture fence in left

Or how to play a pop fly that rolled off

The eight-sided parsonage roof or smacked

The huge oak trees in center field or the

Maple in right-center.

Barefoot sometimes, always in shorts only,

Crew cuts and popsicle stains on our mouths—

Before Play Station and VCRs there

Was a baseball game somewhere in dust and

Sweltering heat, a game to be played by

Our rules only.

--- with the permission of the author, from his

book of baseball poetry:

“Waiting for Godot's First Pitch”

More Poems from Baseball

available from Amazon or direct from the publisher at: www.mcfarlandpub.com

[headlines]

--------------------------------------------------------------

Sports Briefs----

Harbaugh has ‘no tolerance’ for domestic abuse,

but will let legal process play out in McDonald case

http://www.sacbee.com/2014/09/02/6672041/harbaugh-has-no-tolerance-for.html

Vernon Davis 'didn't see anything'

http://espn.go.com/nfl/story/_/id/11455673/ray-mcdonald-party-attended-large-number-san-francisco-49ers-vernon-davis-says

Broncos' Wes Welker suspended four games for taking amphetamine

http://www.usatoday.com/story/sports/nfl/broncos/2014/09/02/wes-welker-suspended-four-games-amphetamine-denver/14992795/

Dallas Cowboys Sign Michael Sam, Save NFL from Stupidity

http://time.com/3257923/dallas-cowboys-sign-michael-sam-save-nfl-from-stupidity/

Schaub extends willing hand upon learning Carr will be Raiders quarterback

http://www.contracostatimes.com/raiders/ci_26454454/schaub-extends-willing-hand-upon-learning-carr-will

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

PG&E fined $1.4B for deadly 2010 gas line blast

http://www.sacbee.com/2014/09/02/6672654/pge-fined-14b-for-deadly-2010.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Standout Wine Lists in New York City

http://www.nytimes.com/2014/09/03/dining/10-of-new-york-citys-most-surprising-wine-lists.html?_r=1

Sonoma Harvest Wine Auction pulls in record $4 million

http://www.pressdemocrat.com/news/2608032-181/wine-auction-pulls-in-record

Go-to spots for the best coastal chardonnays

http://www.pressdemocrat.com/lifestyle/2586003-181/go-to-spots-for-the-best

Thousands pay respects at Baroness Philippine de Rothschild funeral

http://www.decanter.com/news/wine-news/587430/thousands-pay-respects-at-baroness-philippine-de-rothschild-funeral

The Pleasant Surprise of Chain-Restaurant Wines

http://online.wsj.com/articles/the-pleasant-surprise-of-chain-restaurant-wines-1409328776

Napa wine industry faces $48 million economic cost

http://www.winesandvines.com/template.cfm

?section=news&content=138023

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1609 - Henry Hudson discovered the island of Manhattan.

1709 - The 1st major group of Swiss and German colonists reached the Carolinas.

1752 - This date became September 14th, when Great Britain (including Scotland, Ireland, Wales and the American colonies) officially implemented the Gregorian calendar (developed by Pope Gregory XIII in 1582 to replace the Julian calendar). Actually, all dates we recorded in history were changed; therefore all the dates we celebrated before this change are not the “correct days in history.” They were all converted to this new calendar.

1777 - The first American flag flown in battle was by a detachment of light infantry and cavalry under General William Maxwell at Cooch's Bridge, DE, where they met an advance guard of British and Hessian troops under Generals Richard Howe, Charles Cornwallis, and Wilhelm von Knypahusen.

1783 - The American Revolution Officially ends as the treaty between Britain and the US is signed at Paris, France. The definite treaty of peace was signed by David Hartley, plenipotentiary of Great Britain, and Benjamin Franklin, John Jay, and John Adams of the United States. The treaty was ratified and proclaimed on January 14, 1784. It set the borders of the United States as the Great Lakes (Canada) in the north, Spanish Florida in the south, and the Mississippi River in the west. It also granted the Americans fishing rights off the Newfoundland coast.

1803 - Birthday of Prudence Crandall, born to a Quaker family at Hopkinton, RI. This American schoolteacher sparked controversy in 1834 with her efforts to educate black girls. When her private academy for girls was boycotted because she admitted a black girl, she started a school for “young ladies and misses of colour.” In two trials (1833 and 1834), she was convicted by State of Connecticut for teaching girls of color but the convictions were set aside by a legal technicality. [Delete-redundant] The white community in the small city where PC lived had objected so openly about one young woman of Black African descent at her school that she announced her intention to open a whole new school for "young ladies and little misses of color." The state legislature then passed a law forbidding the teaching of blacks without local approval that resulted in her arrest and imprisonment. It is estimated that as many as 3,000 "free" Black families were living in Connecticut at the time. All the white families withdrew their children from her school. PC and her family were jeered and stoned in public. She married, perhaps thinking it would afford her protection, but her Baptist minister husband promptly sold her school without her permission and moved the couple to Illinois where she again established a school for young girls. She became a lecturer on abolition, temperance, and woman's suffrage. In 1887 with a resurgence of interest in the anti-slavery movement, the widowed Prudence Crandall was living in poverty in Kansas. The Connecticut General Assembly apologized for the pre-Civil War treatment of her and awarded her a $400-a-year pension. Arguments from her trials were used in the landmark 1954 U.S. Supreme Court desegregation decision Brown v the Board of Education. She died January 28, 1890 at Elk Falls, KS.

http://www.chc.state.ct.us/Crandall%20Museum.htm

http://www.ohwy.com/ct/p/prucramu.htm

1821 - A hurricane made landfall at Long Island, near present-day Kennedy Airport, then moved through western Connecticut. The hurricane produced a record tide at New York City.

1833 - Benjamin H. Day launched the “New York Sun”, the first truly successful penny newspaper in the US. The Sun was sold on sidewalks by newspapers boys. By 1836, the paper was the largest seller in the country with a circulation of 30,000. It was possibly Day's concentration on human interest stories and sensationalism that made his publication a success while efforts a penny papers at Philadelphia and Boston had failed.

1838 - Frederick Douglass, a black man, boarded a train in the slave state of Maryland, dressed as a sailor with borrowed ID papers. He rode the train to Wilmington, Delaware. There he caught a steamboat to Philadelphia, the City of Brotherly Love, which was a free city. There Douglass transferred to a train that took him to New York City -- also a free city. It was in New York that he was helped by the underground railway network to freedom. Frederick Douglass became one of the nation's strongest abolitionists, fighting for the struggle against slavery and one of America's greatest orators. He published the weekly "North Star" which was later titled, "Frederick Douglass' Paper", to reach the black people. It was mostly through his urging that there were black troops serving in the Civil War. His autobiography, "Life and Times", is a narrative classic of escape to freedom.

http://memory.loc.gov/ammem/today/sep03.html

1849 - Sarah Orne Jewett’s birthday. U.S. writer of precision and amazing clarity who wrote reflectively of the life of the New England farmers and fishers. Her best works were in the short story form where her unsentimental revelations of the nuances of life became a much underrated influence on later writers although Willa Cather acknowledged her debt. Her best known story collections are “A White Heron and Other Stories” (1886) and “Deephaven” (1877). Her lifelong partnership with Anne Adams Field was openly described as a "Boston marriage" and was probably the inspiration for the Henry James novel, “The Bostonians”. Her earliest works were signed "Alice Eliot" or "A. C. Eliot." A volume of her poetry was published posthumously.

http://guweb2.gonzaga.edu/faculty/campbell/enl311/jewett.htm

http://www.traverse.com/people/dot/jewett_fields.html

http://www.womenwriters.net/domesticgoddess/catherjewett1.htm

http://images.google.com/images?q=Sarah+Orne+Jewett

http://www.amazon.com/exec/obidos/external-search/103-5362656-4423850?tag=

fast-bkasin00-20&keyword=Sarah%20Orne%2dJewett&mode=books

1855 - General William Harney and 700 soldiers take revenge for the Grattan Massacre with a brutal attack on a Sioux village in Nebraska that left 100 men, women, and children dead. The path to Harney's bloody revenge began a year before near Fort Laramie, Wyoming, when a brash young lieutenant named John Grattan and 30 of his men were killed while attempting to arrest a Teton Sioux brave accused of shooting a white man's cow. Despite the many eyewitness reports that Lieutenant Grattan had foolishly threatened the Sioux and practically forced them to attack, the incident quickly gained infamy around the nation as the "Grattan Massacre." Americans demanded swift vengeance, and the army turned to the celebrated Indian fighter, General William Harney, to lead a punitive attack against the Sioux. One Sioux boy who witnessed the brutal massacre would never forget or forgive and would take his own revenge 21 years later at the Battle of the Little Bighorn. His name was Crazy Horse.

1856 - Birthday of Louis H. Sullivan, famed Chicago architect.

(Lower half of http://memory.loc.gov/ammem/today/sep03.html )

1860 - Birthday of Edward Albert Filene, American merchant and philanthropist, at Salem, MA. Established the US credit union movement in 1921. Died at Paris, France, September 26, 1937.

1861 - Confederate forces enter Kentucky, thus ending its neutrality. Due to Kentucky's neutrality policy in the summer of 1861, men wishing to join the Confederacy traveled to Camps Boone and Burnett, near Clarksville, TN. Here, the nucleus of the Orphan Brigade was formed, which later was to be under the command of President Lincoln's brother-in-law Ben Helm. Confederate General Leonidas Polk committed a major political blunder by marching his troops into Columbus, Kentucky, negating Kentucky's avowed neutrality and causing the Unionist legislature to invite the U.S. government to drive the invaders away. Kentucky was heavily divided prior to the war. Although slavery was prevalent in the state, nationalism was strong and Unionists prevented the calling of a convention to consider secession after the firing on Fort Sumter in April. Governor Beriah Magoffin refused to send troops to either side, and a special session of the legislature in the summer of 1861 issued a warning to both the Confederate and Union armies not to deploy forces in the state. Union and Confederates alike recognized the folly of entering Kentucky into the war, as it would tip the delicate political balance to the other side. President Lincoln, a Kentucky native who carefully observed the state's neutrality, soon realized that the Confederates were acquiring resources and recruiting troops from the state. However, in three special elections held that summer, the Union cause had gained support. Kentucky's geographic location made permanent neutrality nearly impossible. The major rivers of the upper south drained into the Ohio River through Kentucky, and the state had the country's ninth largest population. Troops from both sides began to build fortifications along the border in the opening months of the war, but the Confederates made a critical blunder when General Polk occupied Columbus, Kentucky on September 3. This preemptive move against the forces of General Ulysses S. Grant, who waited across the Ohio River in Illinois, proved costly for the Confederates. Kentucky's Unionist legislature invited Federal troops in to drive away the invaders, and on September 6, Grant occupied Paducah and Southland, at the mouths of the Tennessee and Cumberland Rivers, respectively. These were vital positions that allowed the Union a tremendous advantage in the contest for Kentucky and Tennessee. During the war, some 50,000 white and 24,000 black Kentuckians fought for the North, while 35,000 joined the South.

http://www.moc.org/Articles/orphan.html

http://www.rootsweb.com/~orphanhm/campboone.htm

http://www.rootsweb.com/~orphanhm/flags.htm

http://www.oldgloryprints.com/Triumph%20at%20Chickamauga.htm

1864 - Atlanta, GA, was evacuated by the Confederate forces under General John H. Hood. The next day, General William Tecumseh Sherman troops began their occupation and were in full control of the city and the area by this day.

1865 – The Union Army commander in South Carolina orders Freedmen's Bureau to stop seizing land from the whites to give to the Blacks.

http://myphlip.pearsoncmg.com/abdemo/abpage.cfm?vbcid=2743&vid=67

http://www.theatlantic.com/issues/01mar/dubois.htm

http://www.inform.umd.edu/ARHU/Depts/History/Freedman/fbact.htm

http://eserver.org/history/freedmens-bureau.txt

1872 - Louisville, Kentucky was the meeting place of U.S. Democrats. Their national convention convened and a wing of Democrats not wanting to vote for Horace Greely, editor of the New York Tribune, who was officially nominated in Baltimore, MD, nominated Charles O'Conor of New York for President of the United States. He was the first Catholic to be nominated by his party for the office of President. They did not think Greely would win. O'Conor declined the nomination, but his name nevertheless was listed and he received approximately 30,000 votes from 23 states. Ulysses S. Grant was reelected president of the United States, defeating Horace Greeley by an electoral vote of 286 to 66. President Grant received a popular vote of 3,597,132 against 2,384,124 for Greely.

1891 - Cotton pickers organize a union and stage a strike across the

state of Texas.

1891 - John Stephens Durham, named minister to Haiti.

1895 - Birthday of NAACP Leader Charles Houston.

1895 - The first professional football game was played in Latrobe, PA. The Latrobe YMCA defeated the Jeannette Athletic Club 12-0. Latrobe's captain was Harry Ryan and Jeannette's was “Posie” Flowers. Since the regular quarterback was unable to play, John K. Braillier of Indiana, PA, was paid $10 and expenses to fill in. The following year four men were paid, and in 1897, the entire team was paid. Since 1967, St. Vincent’s College in Latrobe has been the home of the Pittsburgh Steelers training camp.

1905 – Birthday of Carl David Anderson, American physicist, Nobel Prize laureate (d. 1991).

1908 - Orville Wright began two weeks of flight trials that impressed onlookers with his complete control of his new Type a Military Flyer. In addition to setting an altitude record of 310 feet and an endurance record of more than one hour, he had carried aloft the first military observer, Lieutenant Frank Lahm.

1913 – Actor and producer Alan Ladd born in Hot Springs, AR. Ladd died on Jan 29, 1964 at his Palm Springs, CA home.

1915 - Birthday of pianist Memphis Slim, Memphis, TN.

1917 - Grover Cleveland Alexander of the Philadelphia Phillies pitched and won both ends of a doubleheader against the Brooklyn Dodgers. Alexander went the distance in both games, winning the opener, 5-0, and the nightcap, 9-3.

1918 - Nineteen mutinous Black soldiers were hanged and sixty-three received life sentences in federal prison. One was judged incompetent to stand trial. Two white officers faced courts-martial, but they were released.

http://www.tsha.utexas.edu/handbook/online/articles/view/HH/jch4.html

1923 – Cartoonist Mort Walker’s birthday.

1925 - Birthday of guitarist Hank Thompson, Waco, TX.

1925 – USS Shenandoah the United States' first American-built rigid airship was destroyed in a squall line over Noble County, OH. Fourteen of her 42-man crew perished, including her commander, Zachary Landsdowne.

1926 - Alto sax player Ernie Henry’s Birthday.

http://www.artistdirect.com/music/artist/bio/0,,443247,00.html

?artist=Ernie+Heny

1929 - The Dow Jones industrial average closed at 381.17. It was the peak of the bull market of the 1920s.

1934 - In London, Evangeline Cory Booth, 69, the seventh child of founder William Booth (1829-1912), became the fourth elected commander and the first woman general of the Salvation Army.

1935 - Andrew Varipapa sets bowling record of 2,652 points in 10 games

1940 - Artie Shaw and the Gramercy Five recorded "Summit Ridge Drive" and “Special Delivery Stomp” for Victor Records.

1940 - Drummer Gene Krupa records “Rhum-boogie.”

1941 – Karl Fritsch, deputy camp commandant of the Auschwitz concentration camp, experiments with the use of Zyklon B in the gassing of Soviet POWs.

1942 - Frank Sinatra bid adieu to the Tommy Dorsey Band as he started his solo singing career.

1942 – Birthday of one of The Beach Boys, Al Jardine.

1943 - The Allied invasion of Italy begins on the same day that U.S. General Eisenhower and Italian Marshal Badoglio sign the Armistice of Cassibile aboard the Royal Navy battleship HMS Nelson off Malta.

1944 URBAN, MATT Medal of Honor

Rank and organization: Lieutenant Colonel (then Captain), 2d Battalion, 60th Infantry Regiment, 9th Infantry Division, World War II. Place and date: Renouf, France, 14 June to 3 September 1944. Entered service at: Fort Bragg, North Carolina, 2 July 1941. Date and place of birth: 25 August 1919, Buffalo, New York. Lieutenant Colonel (then Captain) Matt Urban, l 12-22-2414, United States Army, who distinguished himself by a series of bold, heroic actions, exemplified by singularly outstanding combat leadership, personal bravery, and tenacious devotion to duty, during the period 14 June to 3 September 1944 while assigned to the 2d Battalion, 60th Infantry Regiment, 9th Infantry Division. On 14 June, Captain Urban’s company, attacking at Renouf, France, encountered heavy enemy small arms and tank fire. The enemy tanks were unmercifully raking his unit’s positions and inflicting heavy casualties. Captain Urban, realizing that his company was in imminent danger of being decimated, armed himself with a bazooka. He worked his way with an ammo carrier through hedgerows, under a continuing barrage of fire, to a point near the tanks. He brazenly exposed himself to the enemy fire and, firing the bazooka, destroyed both tanks. Responding to Captain Urban’s action, his company moved forward and routed the enemy. Later that same day, still in the attack near Orglandes, Captain Urban was wounded in the leg by direct fire from a 37mm tank-gun. He refused evacuation and continued to lead his company until they moved into defensive positions for the night. At 0500 hours the next day, still in the attack near Orglandes, Captain Urban, though badly wounded, directed his company in another attack. One hour later he was again wounded. Suffering from two wounds, one serious, he was evacuated to England. In mid-July, while recovering from his wounds, he learned of his unit’s severe losses in the hedgerows of Normandy. Realizing his unit’s need for battle-tested leaders, he voluntarily left the hospital and hitchhiked his way back to his unit hear St. Lo, France. Arriving at the 2d Battalion Command Post at 1130 hours, 25 July, he found that his unit had jumped-off at 1100 hours in the first attack of Operation Cobra.” Still limping from his leg wound, Captain Urban made his way forward to retake command of his company. He found his company held up by strong enemy opposition. Two supporting tanks had been destroyed and another, intact but with no tank commander or gunner, was not moving. He located a lieutenant in charge of the support tanks and directed a plan of attack to eliminate the enemy strong-point. The lieutenant and a sergeant were immediately killed by the heavy enemy fire when they tried to mount the tank. Captain Urban, though physically hampered by his leg wound and knowing quick action had to be taken, dashed through the scathing fire and mounted the tank. With enemy bullets ricocheting from the tank, Captain Urban ordered the tank forward and, completely exposed to the enemy fire, manned the machine gun and placed devastating fire on the enemy. His action, in the face of enemy fire, galvanized the battalion into action and they attacked and destroyed the enemy position. On 2 August, Captain Urban was wounded in the chest by shell fragments and, disregarding the recommendation of the Battalion Surgeon, again refused evacuation. On 6 August, Captain Urban became the commander of the 2d Battalion. On 15 August, he was again wounded but remained with his unit. On 3 September, the 2d Battalion was given the mission of establishing a crossing-point on the Meuse River near Heer, Belgium. The enemy planned to stop the advance of the allied Army by concentrating heavy forces at the Meuse. The 2d Battalion, attacking toward the crossing-point, encountered fierce enemy artillery, small arms and mortar fire which stopped the attack. Captain Urban quickly moved from his command post to the lead position of the battalion. Reorganizing the attacking elements, he personally led a charge toward the enemy’s strong-point. As the charge moved across the open terrain, Captain Urban was seriously wounded in the neck. Although unable to talk above a whisper from the paralyzing neck wound, and in danger of losing his life, he refused to be evacuated until the enemy was routed and his battalion had secured the crossing-point on the Meuse River. Captain Urban’s personal leadership, limitless bravery, and repeated extraordinary exposure to enemy fire served as an inspiration to his entire battalion. His valorous and intrepid actions reflect the utmost credit on him and uphold the noble traditions of the United States.

1946 - Founder Sidney N. Correll established United World Mission. This interdenominational agency focuses on evangelism, church planting and Christian education in 13 world countries.

1950-GOMEZ, EDUARDO C. Medal of Honor

Rank and Organization: Sergeant First Class. U.S. Army. Company 1. 8th Cavalry Regiment, 1st Cavalry Division. Place and Date: September 3, 1950, Tabu-dong, Korea. Born: October 28, 1919, Los Angeles, CA. Departed: Yes (01/29/1972). Entered Service At: G.O. Number: Date of Issue: 03/18/2014. Accredited To: Citation: Then-Sgt. Eduardo Gomez distinguished himself by defending his company as it was ruthlessly attacked by a hostile force. Notably, Gomez maneuvered across open ground to successfully assault a manned tank. Wounded during his retreat from the tank, Gomez refused medical attention, instead manning his post and firing upon the enemy until his company formed a defensive perimeter.