![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, January 13, 2014

Today's Equipment Leasing Headlines

Classified Ad--Sales

Look Out!!! Readers/Bankers/Lessees

--Two Evergreen/PRR Clause Lessors Merge

Onset Financial/Mazuma Capital

by Christopher Menkin

US Bank/Lyon Financial Get Tripped up by Botched Confession

of Judgment and Involuntary BK Filings Against Guarantor

By Tom McCurnin, Leasing News Legal News Editor

Leasing 102 by Mr. Terry Winders, CLP

Rates Will Be Going Up

Net Interest Margin vs. Interest Rate Risk Exposure

by Howard Talthrop, CFA, Echo Partners

Changes in Technology Last 8 years

Businessinsider.com

If Alphabet “A” Didn’t Work…

Classified Ads---Help Wanted

“Writing a Letter of Resignation”

Career Crossroad---By Emily Fitzpatrick/RII

Bank Q4'13 earnings subdued

But Street eyes brighter outlooks for '14

By Kevin Dobbs and Marshall Schraibman

Truck Lenders Move to Deal Direct with Commercial

Repossession Agencies in 2014

by Mark Lacek, Commercial Asset Solutions

Top Stories January 7-January 9

(You May Have Missed One)

Classified ads— Asset Management

Leasing Industry Outsourcing

Shepherd/American Blue Heeler

Seattle, Washington Adopt-a-Dog

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

News Briefs----

CFO reports: "Securitization: Back From the Dead"

Fitch: U.S. Bank Loan Growth Driven by Smaller Institutions

This Trend in Transportation Is Good News for Lessors

Regulators ease new bank rule on leverage to aid economy

Toyota to make 10 million vehicles in 2014

Volkswagen says it plans to invest $7 billion in North America

The Growth of Grab-and-Go Fresh Pre-Packaged Foods

Golden Globes 2014: '12 Years,' 'Hustle,' Blanchett among top winners

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free!

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment or

looking to improve their position)

Boston, Mass. |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Look Out!!! Readers/Bankers/Lessees

--Two Evergreen/PRR Clause Lessors Merge

Onset Financial/Mazuma Capital

by Christopher Menkin

Onset Financial, South Jordan, Utah announces the completion of the acquisition of Mazuma Capital, Draper, Utah. Both companies are on the Leasing News Evergreen Clause automatic renewal list (1).

Readers should be aware that a common practice of extra payments, including residual, is the method of not only offering a lower original lease payment, but pricing that allows re-structuring of the original monthly payment. This only becomes a "trick" when the lessee is told otherwise regarding the end of the lease contract, often the wording being for "tax purposes" or is unaware of the consequences of the PPR clause. Readers not familiar need to understand the circle of PPR: one giving notice, buying for the price set by the lessor, if not automatic payment for 12 months, and if give notice to return, at their expense to the destination chosen by lessor. (4)

In several of the cases reported by Leasing News, these "extra payments" were discounted with the stream to Republic Bank, Utah, as well as to other smaller banks not aware of the consequences.

Republic Bank is in the liquidation mode, most likely due to the losses in court as well as possible banking regulations inquiries. (2)

Both Onset Financial and Mazuma Capital utilize the PPR clause as noted by contracts obtained by Leasing News as well as court cases.

According to Deseret News (3) the principals deployed the same practice at their previous company, Matrix Funding Corporation, as noted earlier, discounting often the "Evergreen clause" payments along with the original term of the lease contract. Readers, if you have not read footnote 4, please see to learn what this is all about (4)

Justin Nielsen

Founder and Chairman of the Board at Onset Financial

In the press release regarding the merger, Justin Nielsen, Onset's chief executive officer, stated," “We are excited to have Mazuma Capital as part of the Onset Financial group of companies.” An attempt was made for a comment regarding PPR and Evergreen clauses as well as the merger, but none were received. (5)

Jared Belnap

President & CEO at Mazuma Capital Corp

The status of Jared Belnap, the president and CEO at Mazuma Capital, was not mentioned in the press release. Attempts to contact Mr. Belnap were not returned, as well as whether U.S. Senator Mike Lee, who retired from the board of directors of Mazuma Capital Corporation had an interest in the merger or moral involvement in Evergreen and PPR Lease clauses (6)

Both Onset and Mazuma reportedly have reportedly moved into real estate financing, including Belnap's venture MobilityRE, as mentioned in his LinkedIn.com profile (7)

(1) Leasing News Evergreen Clause list.

http://www.leasingnews.org/Pages/lease_expiration_evergreen.html

(2) Republic Bank

(a)http://leasingnews.org/archives/Jul2012/7_11.htm#republic

(b)http://leasingnews.org/archives/Sep2012/9_07.htm#mazuma

(c) http://leasingnews.org/archives/Sep2012/9_07.htm#republic_bank

(d) http://leasingnews.org/archives/Sep2012/9_05.htm#republic

(e) Liquidation Announcement

http://leasingnews.org/archives/Sep2012/9_05.htm#republic

(3) Deseret News

http://leasingnews.org/PDF/DeseretNewsarticle.pdf

http://leasingnews.org/PDF/ExhibitCDeseret.pdf

(4) Onset Financial Lease Contract, being used in 2013:

“Section 20

n. Lessee's Options at Maturity of Base Period. At the maturity of the Base Period of any Lease, Lessee shall, provided at least one hundred fifty (150) days prior written notice is received by Lessor from Lessee via certified mail, do one of the meowing: (1) purchase the Property for a price to be determined by Lessor end Lessee, (2) renew the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) terminate the Schedule and return the Properly to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due end owing under the Schedule must first be paid in full, the provisions of Sections 8f, 8g and 7d hereof roust be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property fisted on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor end Lessee have not agreed to either option (1) or (3) by the maturity of the Base Period, or if Lessee fails to give written notice of Its option via certified marl at least one hundred fifty (150) days prior to Use maturity of the Base Period, or if an Event of Default has occurred under any Lease, then option (2) shall apply at the maturity of the Base Period. At the maturity of the renewal period provided for In option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the maturity of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at best thirty (30) days prior written notice of termination."

http://leasingnews.org/PDF/OnsetContract.pdf

(5) Onset Financial Press Release

http://www.leasingnews.org/PDF/OnsetFinancialNews_12014.pdf

(6) Mazuma Announces Resignation of Director Mike Lee

http://leasingnews.org/archives/Jan2011/1_20.htm#mazuma

(7) Jared Belnap

www.linkedin.com/pub/jared-belnap/a/5b8/62a

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

US Bank/Lyon Financial Get Tripped up by Botched Confession

of Judgment and Involuntary BK Filings Against Guarantor

By Tom McCurnin

Leasing News Legal News Editor

Involuntary Bankruptcies Are Easy to File; Hard to Contain Once Filed.

In This Case, the Lessor’s Mistake Became the Basis for Several

Separate Successful Lawsuits Against The Lessor, and Damages

for the Wrong Exceed the Guarantied Amount.

Could an Early Settlement Avoided This Disaster?

U.S. Bank, Nat. Ass'n v. Rosenberg, 2013 WL 272061 (E.D.Pa., 2013.).

Paladin: “For man also knoweth not his time: as the fishes that are taken in an evil net, and as the birds that are caught in the snare; so are the sons of men snared in an evil time, when it falleth suddenly upon them.”

Have Gun Will Travel, 1958, “In An Evil Time.”

Paladin’s point, actually a quote from Ecclesiastes 9:12, King James Bible, authorized version, fits these circumstances.

I think I’m in the majority when I say that involuntary bankruptcy proceedings are costly and risky and need to be thought through before pulling the trigger. In today’s case, an equipment lessor found out the hard way that while filing a confession of judgment and involuntary bankruptcy is simple and easy, if the lessor botches the assignment, there could be incredible blow back. Here, like fishes in a net, or a bird in a snare, the lessor got tripped up and was tagged for judgments which actually exceed its loan balance against the guarantor.

The facts follow.

The Court stated that Lyon Financial Services entered into dozens of leases with an MRI Provider (National Medical Imaging) controlled by Maury Rosenberg. Lyon Financial sued and the parties settled with a rolling guaranty of Rosenberg, which was reduced from $7 million every month the MRI company made a payment. The MRI company defaulted after 21 months. The leases were ultimately assigned to US Bank, who purchased Lyon Financial Services and Manifest Leasing.

The case does not discuss what happened but US Bank went on the warpath and commenced an involuntary bankruptcy proceeding against the Guarantor Rosenberg in Pennsylvania. US Bank also filed a Confession of Judgment for Rosenberg, also in Pennsylvania. US Bank botched both filings in ways which are not fully discussed in the two case opinions.

Rosenberg responded in kind, and successfully got the Confession of Judgment stricken in Pennsylvania. Rosenberg also got the bankruptcy transferred to Florida and ultimately dismissed, and obtained a judgment for attorney fees against US Bank for over $1 million dollars. Rosenberg also sued in a Florida State Court and received a jury verdict awarding him $6 million dollars in damages.

US Bank twice appealed the dismissal of the bankruptcy and the award of fees, but the holding was affirmed.

I think at this point even the average reader would say, “What is wrong with this picture?” Given the two claims and the obvious mistakes the Bank made, why couldn’t the two parties work out some deal, probably to disadvantage of US Bank, and simply move on? It couldn’t get any worse, could it?

US Bank doubled down and commenced a Federal, District Court action in Pennsylvania for breach of guaranty, which mathematically seems to be in the sum of $5 million dollars.

Regrettably for the Bank things were about to get worse. Rosenberg filed an Answer with over 37 different affirmative defenses and a counterclaim for Wrongful Use of Civil Proceedings, Abuse of Process, and Breach of the Covenant of Good Faith and Fair Dealing. The Bank responded with a Motion to Dismiss.

The Bank argued that the waiver provisions in its guaranty were so all encompassing that it waived every possible defense Rosenberg had, whether related to the loan or not. The Court agreed with Rosenberg on this issue, but did strike certain affirmative defenses related to the guaranty.

As for the counterclaims, the Court struck the third claim for breach of the covenant of good faith and fair dealing, as the Bank did not owe its borrower a fiduciary duty.

So US Bank pretty much lost this round.

Fast forward nine months. On December 20, 2013 after each party filed summary judgments, the Court came down with its second opinion in the case.

On the issue of the botched confession of judgment, because Rosenberg produced evidence that the purpose of the confession of judgment was to harass him and the Bank produced evidence that the purpose of filing the confession was strictly to collect a debt, the Court found an issue of fact and denied the summary judgments of each party.

On the issue of abuse of process, the Court was unclear whether the Florida judgment fully compensated Rosenberg, or whether he could assert the same claims in this guaranty action. The Court declined to enter summary judgment and the matter will proceed to trial. No trial date has been set. This gives Rosenberg the possible avenue to sue US Bank for the same (or similar) claims asserted in the Florida jury verdict. This case suddenly went from bad to worse. This could be a complete disaster for the lessor.

The lessons for the equipment lessor are:

First, don’t be hyper-aggressive in collection actions. Sure, the knee jerk reaction was to go nuclear against the borrower and file a confession of judgment, but the lessor botched the process. If that failure wasn’t enough, the lessor was back with an involuntary bankruptcy filing, to show its borrower whose boss and likewise botched that proceeding, too. Before undertaking something out of the ordinary, stop, think and try to ascertain what the blowback might be. This case should be required reading for every collections manager. There should be more tools in your toolbox, other than a sledgehammer.

Second, as distasteful as the creditor’s relationship with the guarantor might be, the parties need to act like adults and try to resolve matters early, hopefully before really negative things harden settlement positions. With a high dollar case like this, I would have called a workout meeting and bent over backwards to resolve the matter before a suit was filed, and certainly before the nuclear option.

Third, it’s never too late to settle. The flavor I got from the cases is that the clients and lawyers honestly do not like each other. No wonder, either, when your borrower sues you in a Florida court and gets a $6,000,000 jury verdict, about a million more than the Bank is owed. That would ruin my day, too. But I still don’t understand why the Bank simply didn’t either walk away or throw some money at this case and make it go away. I read a status conference report and there are at least 4 pending cases against the Bank on similar issues filed by Rosenberg or his wife. The attorney fees in this decade long piece of litigation must be in the millions at this point, and mathematically, the Bank is now out of pocket with more lawsuits to defend. Is it too late to settle this case?

The bottom line: collections professionals need to think and act more like Paladin—think before pull the trigger and try to find a way to resolve the issue even if it is to your disliking. I’d rather have a poor settlement that a good lawsuit any day of the week. At least the former is predictable and certain.

US Bank Case (10 pages):

http://www.leasingnews.org/PDF/USBankCase_12014.pdf

US Bank Case 3 (9 pages):

http://www.leasingnews.org/PDF/USBankCase_12014.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Rates Will Be Going Up

Most of the economists and the press are presenting the future as being very bright and predict the economy will improve. The real question to us in the financial markets is what is going to happen to rates. If history is any teacher, rates should start to rise.

The dilemma for lessors is how we are committed to fixed rates. Financial institutions in the past that discovered that their source of funding was on variable rate, and most of their leases were on fixed rates, lost money. Their margins were squeezed as the cost of money increased and the lease was fixed. It was also difficult to sell off the leases. There have been times, especially the 1960’s when fixed rates were quite high and the rates dropped, but the opposite will be true in the next year or two.

Another problem with variable rate leases is that at one time few lease accounting programs could handle the changes. So we created leases that had fixed payments but a term that allowed for fewer payments or additional payments at the end of the lease, which adjusted to compensate for the rate change during the term.

Current computer based bookkeeping programs have variable rate modules. But it may be wise to acquire the modules now so you can get use to how it works before offering it to your lessees.

Variable rates will be hard to sell, but if the concern for margins is reduced by the ability to raise rates then at the start variable rates will be lower than fixed rates. Of course, lessors with investors may be able to attract more business, but most likely not in today’s market as the rates will be rising, not falling.

Variable rates will be on capital leases because they are booked like a loan. However, it will be hard to make a variable rate on true leasing because the tax consequences are affected by the size of the payments.

Funding sources tend to get tighter and want to shorten terms as rates begin to rise. Leases are easy to fund on 36 months but will get harder as the term moves to 48, 60 or 72 months.

Those that hold leases for a short time to be able to offer a larger portfolio to a funding source will find that rising rates can make holding a lease for too long may cause margins to be squeezed. In addition, accounting changes may stimulate more shorter terms than longer terms.

The future is uncertain but rates are as low as they have been in a very long time. The fact remains that any pressure on the economy will cause rates to rise. It is important to get prepared to handle a changing marketplace and be able to adapt quickly. Unprepared lessors will find themselves with a shrinking portfolio.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Senior Account Manager |

Equipment Asset Manager www.maximcc.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Net Interest Margin vs. Interest Rate Risk Exposure

by Howard Talthrop, CFA, Echo Partners

howard.lothrop@echopartners.com

(Photo provided by toffehoff)

It will come as no surprise that there has been a built in conflict in community banking recently. The conflict is between our desires (need?) to rebuild our net interest margin (NIM) and our desire (and our regulator's desire) to limit our interest rate risk exposures.

After years of lower rates, most of us have squeezed the most out of our cost of funds. So additional time in a lower rate environment chiefly serves to ratchet down any remaining asset yields. Bye Bye NIM.

So what's a community banker to do? My standard advice to clients over the past few years has been to take on some additional fixed rate loan risk where prudent. Generally, I'm talking about 5yr to 7yr exposures.

The thought process here is that the curve remains steep enough that you have at least 75bps, to well over 100bps, of built in interest rate protection available. That is, rates would have to rise significantly to get to the point where you would have been better off with floating exposures.

Couple that with the timing component (every day that rates don't rise, and that the curve does not substantially flatten, another day of built in benefit is realized in our NIM) and you can see how the math works.

Even in the face of increased regulatory attention, I still think this approach has merit, but with one key distinction.

If you are already pushing your IRR limits, or you have pushed beyond these more moderate maturity/duration limits, you might be going too far.

One way that this concept has been somewhat abused is via the investment portfolio. While both can build today's NIM, think about the differences here between investments and loans.

Increased loan duration reduces over time, even if rates rise. The securities portfolio generally focuses on items with durations that lengthen when rates rise.

Loan relationships can be leveraged into deposits, fees, and cross sell opportunities. Investments not so much.

In fact, I'd sum up the differences as loans can continue to become more beneficial over time, while typical community bank investments pretty much have nowhere to go but down after they are booked into the portfolio.

Banking, particularly community banking, is as much an art as a science. Accepting risk is part of the definition of banking. But so is knowing when to say when.

www.echopartners.com

|

[headlines]

--------------------------------------------------------------

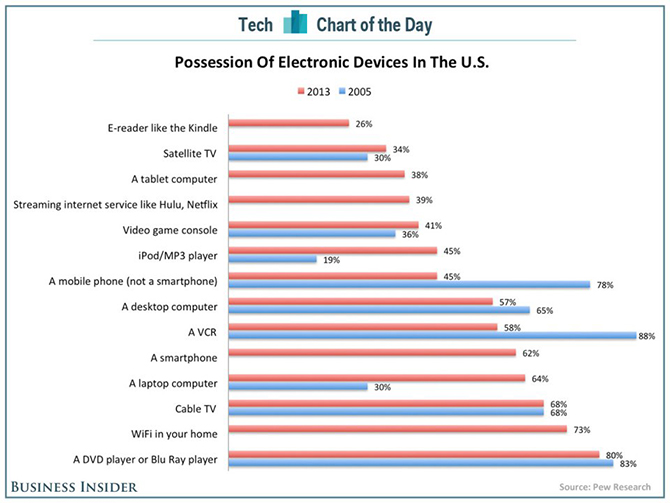

Changes in Technology Last 8 years

Businessinsider.com

The red line is 2013 and blue is 2005. Notable changes include the growth of newer devices, such as e-reader (Nook, Kindle), table computers, smartphones, internet services as Hulu, Netflix, and WiFi in your home. These were almost non-existent 8 years ago (no wiring to printer, other computers), as well as growth of other devices such as smartphones, iPads, now perhaps best referred to as “connected devices.”

Perhaps some may be surprised as more laptops in use today as that market continues; VCR's and DVDs still exists ---and cable TV does not seem to have grown nor fallen behind, either.

Having a fax machine is not even on the list!

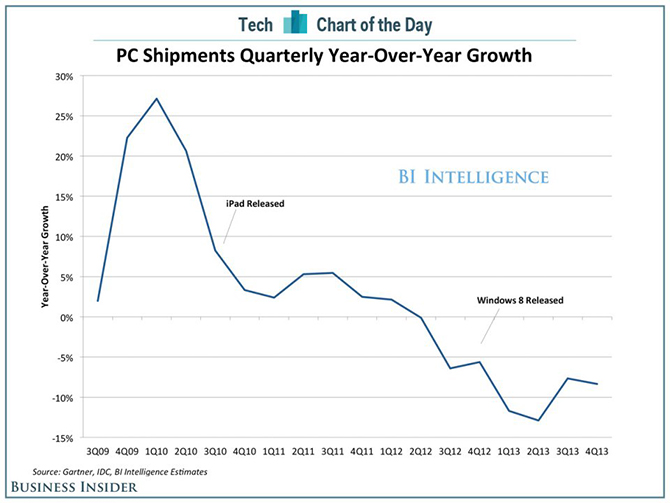

PC Sales in 2013 were the lowest in decades:

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

“Writing a Letter of Resignation”

Career Crossroad---By Emily Fitzpatrick/RII

Question: Is there a resignation letter format?

Answer: Once you have accepted an offer and are ready to resign, the next step would be to submit a formal resignation letter. No matter the size of your company, as well as if you will be letting your employer know verbally, it is important to put in writing and give to your employer.

A resignation letter should simply state your last day of employment (two-week notice) and willingness to assist in the transition process. Take care to phrase your resignation letter in a positive way.

A sample would be the following:

Effective (day and date), I will be terminating my employment with XYZ Company. I have allowed two weeks prior to my departure for assisting in the transition process.

I have recently accepted a position with another organization (no need to give your new employers name). I feel that this new opportunity is well suited to my long-term career goals.

I would be happy to train and assist my replacement, as well as complete any other organizational matters that need my attention.

Sincerely,

Kelly Jones

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.htm

[headlines]

--------------------------------------------------------------

Bank Q4'13 earnings subdued

But Street eyes brighter outlooks for '14

By Kevin Dobbs and Marshall Schraibman

A SNL Financial Feature

Wall Street's fourth-quarter 2013 earnings expectations for large U.S. banks are modest, with undercurrents of restrained loan growth, subdued mortgage income, lingering margin pressure, high regulatory compliance and legal costs, and, in the case of firms with major investment banking operations, soft capital markets revenue.

"There are a lot of issues still to clear up," Sam Pappas, president and CEO of Mystic Asset Management Inc., told SNL.

An SNL analysis of average estimates for 19 major U.S. banking companies shows that analysts, on average, anticipate that 15 of them will report fourth-quarter 2013 net income that is down from the previous quarter. A majority of them are expected to report lower revenue, as well.

Big-bank earnings season kicks off Jan. 14 with results from JPMorgan Chase & Co. and Wells Fargo & Co., Bank of America Corp. follows the next day, with Citigroup Inc. and PNC Financial Services Group Inc. slated to report Jan. 16.

Evercore Partners analyst John Pancari, in a note projecting "sluggish" earnings, said the fourth quarter was marked by flat net interest income and loan growth that was typically only in the single digits. And while net interest margin pressure, a thorn in the side of banks for years, began to ease in 2013 as long-term rates rose, NIM compression persists for many. Short-term rates remain historically low and competition is fierce; as such, new loans are often coming on at lower yields.

Meanwhile, a rise in the 10-year Treasury yield that pushed up long-term rates at points last year made 30-year mortgages less affordable. Not surprisingly, demand for mortgage refinances waned, cutting into banks' income on that front, analysts say.

For larger banks, the paltry capital markets conditions that many experienced in the third quarter of last year likely dragged into the fourth quarter, Oppenheimer & Co. analysts said in a report.

It "once again seems to be surprisingly weak," they wrote. "Despite a global bull market in equities that has taken the S&P up more than 60% in the past two years, investment bank trading profits seem likely to be down on a year-over-year basis again this quarter."

Such banks are finding little relief elsewhere, with regulatory hurdles increasing — most recently with the so-called Volcker rule, which, among other steps, restricts proprietary trading. "That creates uncertainty" for investors in that it is not clear how such banks will replace revenue the rule effectively forces them to forgo, Pappas said. "And the uncertainty hurts."

And, as Pappas noted to SNL, big banks in particular are grappling not only with heavy regulatory scrutiny but relentless legal woes. JPMorgan is a case in point. The company this month settled charges tied to money laundering in managing accounts of convicted Ponzi-scheme operator Bernard Madoff. The company will reportedly pay $1.7 billion under the settlement. Because of legal settlements, JPMorgan has said it expects fourth-quarter 2013 net income will be reduced by approximately $850 million.

"The backlash of litigation is significant," Pappas said. "I think 2014 will be another year of cleaning up on that front."

All of that noted, credit conditions improved throughout 2013, and banks focused on trimming costs and funneling the savings to the bottom line. Many analysts expect to see evidence of both again in fourth-quarter results.

Indeed, the SNL analysis of 19 major companies found that analysts expect a majority to report that fourth-quarter net charge-offs and non-interest expenses were both down from the previous quarter.

There are concerns, as the Oppenheimer analysts noted, that credit conditions "can't get much better" and therefore will "normalize upwards" and hurt earnings this year.

But, with the U.S. economy showing signs of notable momentum — U.S. gross domestic product grew at a 4.1% annual rate in the third quarter, bolstered by steady consumer spending and increased production from both home builders and manufacturers — investors and analysts anticipate that many banks during the upcoming earnings season will provide optimistic views on the year ahead.

"While earnings will be weak, our sense is the industry's outlook will prove more upbeat — consistent with recent economic data," analysts Todd Hagerman and Robert Greene of Stern Agee & Leach wrote in a report previewing earnings.

That, coupled with conservative underwriting, could mean continued credit improvement, even as lending could potentially increase at a greater rate this year, analysts say.

The final quarter of any year is often a so-called "kitchen-sink" period, in which banks try to throw out every trouble they can, aside from the metaphorical sink. So it would not surprise investors and analysts to see banks add to reserves to deal now with future legal headaches, for example, in an effort to clear the decks for the year ahead. As such, results may look weak now but, at the same time, may not be an indicator of what is to come.

Economic conditions do in fact appear to be brightening. That should drive more business investment, lift employment and bolster loan demand, Pappas said. "That would be a big, big plus," he said.

But, given the long, slow recovery since the financial crisis of 2008, Pappas said the country — and its banks — need several quarters of solid growth to engender genuine confidence. Unemployment still hovers around 7%. "It is all very dependent on an even stronger job market and overall economy," Pappas said.

[headlines]

--------------------------------------------------------------

Truck Lenders Move to Deal Direct with Commercial

Repossession Agencies in 2014

by Mark Lacek, Commercial Asset Solutions

The Used Truck Association (UTA) held its yearly conference in November,2013 in Orlando Florida. Representatives from truck dealerships from across the country arrived to discuss issues involving the used truck industry. Also attending this important industry event were many vendors who support the trucking industry. Some of these vendors are the commercial lenders the trucking industry relies on to finance the trucks and equipment to its customers.

As an associate member of the UTA, I was afforded the opportunity to speak with the decision makers from not only Fortune 500 commercial lenders but also small to mid-size finance and leasing companies. I was amazed as one after another, representatives from the commercial finance industry were commenting to me how dissatisfied they are with the national repossession service provider 'forwarding company'. This contrasts to five years ago when all of the talk was about the "one call shop" or the "national coverage" provided by the national forwarding repossession companies. The commercial lender once again understands the value involved in a direct relationship with the company who is facilitating the repossession.

Three reasons were evident as the topic was discussed. First was productivity, second was communication and third was payment policy and procedures to the agent.

Let’s discuss the three reasons why commercial lenders are returning to a direct relationship with the recovery agency.

First, productivity or the lack thereof, the consensus among the lenders was that forwarders were only successful in the recovery of the voluntary surrenders and the less difficult assignments. Assignments of over the road trucks and trailers or assets which did not park at the debtor’s residence were often never recovered. This picking of the 'low hanging fruit' resulted in lower recovery percentages while increasing the number of charge offs. It is a well-known fact that many forwarding companies choose agencies that are paid less instead of the agency that will produce better results.

Second is Communication. Because the forwarder is the 'middleman' in the repossession process, often a debtor had brought the account up to date, filed BK or turned the asset over to the selling dealer. There were many instances where the lender had communicated this new information to the national forwarder but the forwarder had failed to resend the new account information to the designated repossession agency. This type of breakdown in communication very often resulted in litigation. All of the lenders we spoke with agree direct communication with the recovering agency results in more assignments being recovered.

The third most talked about deficiency in utilizing the national repossession forwarder was the payment procedures of the forwarding agency. Often the forwarder would pay the recovery agent less than the industry standard. For example, it is widely known that policy for most national forwarders is to pay the recovering agency half of what is actually invoiced to the lender. Another habit of the forwarder is paying the agency after 60 or 90 days. It is safe to assume the recovery agency prioritizes those assignments which pay more and pays faster. There were many occasions where the recovery agency was never paid and was forced to hold the collateral and demand payment from the lender after the invoice was paid to the forwarder.

2014 will reaffirm the value in the direct relationship between the lender and the repossession agency. More collateral will be returned in less time resulting in higher remarketing dollars while charge-offs will be brought to a minimum.

Repossessors will prioritize recovery assignments producing higher recovery percentages and the lender will spend less time in civil litigation. This is a win-win for the commercial lender and the repossession agency.

http://commercialassetsolutions.com/

Equipment Asset Manager www.maximcc.com |

[headlines]

--------------------------------------------------------------

Top Stories January 7-January 9

(You May Have Missed One)

Here are the top stories opened by readers:

(1) Fugitive Banker Accused of Faking Own Death

Found Alive, Now Arrested!

http://leasingnews.org/archives/Jan2014/1_07.htm#fugitive

(2) Rental Co. Frauds Wells, GE, First Security, Bank of Ozarks

Sells Equipment, But Keeps on Books as Rentals

http://leasingnews.org/archives/Jan2014/1_09.htm#rental

(3) Archives---January 9, 2001

BSB Leasing, Inc. Acquires Assets from UniCapital Corporation

http://leasingnews.org/archives/Jan2014/1_09.htm#archives

(4) Leasing News Person of the Year 2013

Bernard D. Boettigheimer, CLP

http://leasingnews.org/archives/Jan2014/1_07.htm#poy

(5) New Hires—Promotions

http://leasingnews.org/archives/Jan2014/1_09.htm#hires

(6) Leasing 102 by Mr. Terry Winders, CLP

How to Sell Lease Portfolios

http://leasingnews.org/archives/Jan2014/1_07.htm#how

(7) Leasing News Person of the Year 2013

Bernard D. Boettigheimer, CLP

---Reaction from Readers

http://leasingnews.org/archives/Jan2014/1_09.htm#reaction

(8) 5 largest banks own 44% of the industry

By Marshall Schraibman, SNL Financial Special Report

http://leasingnews.org/archives/Jan2014/1_07.htm#snl

(9) Navitas Lease Announces Completion of Inaugural Term

Securitization of $92.3 Million

http://leasingnews.org/archives/Jan2014/1_09.htm#navitas

(10) Companies who notify lessee in advance of lease expiration

http://leasingnews.org/archives/Jan2014/1_07.htm#notify

|

[headlines]

--------------------------------------------------------------

Classified ads— Asset Management

Leasing Industry Outsourcing

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277. Email:email |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

|

Asset Management: Orange City, FL We help Lessors Liquidate un-wanted Assets valued at $750,000+. It's an effective method of Liquidating Assets such as Jets, Planes, Helicopters, Freighters, etc. Eric R. Sanders Tel 386-789-9441 www.ValuedAssetSales.com www.The-RandolphCapital.com EQPMNTLEASING@aol.com |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |  Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968 ecastagna@inplaceauction.com |

| Asset Management: South East US- AllState Asset Management Recovery, remarketing, inspections. 25 years experience, dedicated to deliver, prompt, professional services. Call Brian @ 704-671-2376. |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. testequipmentconnection.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email:Jamie@bulldogasset.com www.bulldogasset.com |

Asset Management: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

|

[headlines]

--------------------------------------------------------------

Shepherd/American Blue Heeler

Seattle, Washington Adopt-a-Dog

Reggie

ID #: 15035238

Gender: Male

Size: Small

Age: 1 year

"Meet Reggie! This rambunctious boy is a 1-year-old Shepherd/American Blue Heeler mix. Reggie has an amazing tricolor coat with polka dot legs and a crazy, awesome Mohawk! This boy is packed with energy and is in need of lots of exercise and activity. He is very smart and will need that special someone to help him excel. If you are looking for an athletic, beautiful brown-eyed, curly-Q tailed, bubbly personality buddy - then Reggie is your guy! Adopt him today at Seattle Humane Society.

"As with all of our dogs, Reggie has been neutered, micro-chipped, vaccinated and behavior tested. He will go home with a certificate for an examination by a King County veterinarian and an identification tag. PLUS, most dog adoptions include six weeks of training in one of our on-campus dog behavior courses - a great way to start off on the right paw!

"Reggie will need to live in a home with adults only. Resident dogs are required to visit Reggie prior to adoption. Cat free home."

Please see our adoption advisors for additional behavior information.

http://www.seattlehumane.org/adopt/process/start#.UtMUO7TBNyQ

Adoption Hours

Sunday – Wednesday | 11 a.m. – 6 p.m.

Thursday – Saturday | 11 a.m. – 8 p.m.

Visit Our Pets In Person

Seattle Humane Society

13212 SE Eastgate Way

Bellevue, Washington 98005

(425) 641-0080

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

CFO reports: "Securitization: Back From the Dead"

http://ww2.cfo.com/capital-markets/2014/01/securitization-back-dead/

Fitch: U.S. Bank Loan Growth Driven by Smaller Institutions

https://www.fitchratings.com/gws/en/fitchwire/fitchwirearticle/U.S.-Bank-Loan?pr_id=813733

This Trend in Transportation Is Good News for Lessors

http://www.dailyfinance.com/2014/01/06/this-trend-in-transportation-is-good-news-for-leas/

Regulators ease new bank rule on leverage to aid economy

http://www.chicagotribune.com/business/sns-rt-us-basel-banks-20140112,0,6273088.story

Toyota to make 10 million vehicles in 2014

http://www.upi.com/Business_News/2014/01/11/Toyota-to-make-10-million-vehicles-in-2014/UPI-40461389476968/

Volkswagen says it plans to invest $7 billion in North America

http://www.chicagotribune.com/classified/automotive/sns-rt-us-autoshow-detroit-vw-investment-20140112,0,3347857.story

The Growth of Grab-and-Go Fresh Pre-Packaged Foods

http://www.qsrmagazine.com/competition/feeding-them-go

Golden Globes 2014: '12 Years,' 'Hustle,' Blanchett among top winners

http://www.latimes.com/entertainment/envelope/moviesnow/la-et-mn-golden-globe-awards-2014-main,0,5157661.story#ixzz2qFx1x2fv

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Funny World Map Shows What Every Country Leads The World In

http://www.businessinsider.com/what-countries-are-best-at-2014-1

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Buy Fresh, Buy Local

www.foodroutes.org

[headlines]

--------------------------------------------------------------

American Football Poem

S.F. 49ers

Jane Griffin

Gold helmets shine in the sunlight.

The jerseys are loose and the pants are tight.

Those were the only things shining this year.

After so many losses, there's no reason to cheer.

That's what all thought but one loyal fan

Because not matter what, I believe that they can.

I know we could have won the Superbowl

If our kicker was able to make a field goal.

Many times when we could have won the game,

Because of special teams, we left the field in shame.

We'll have to wait until next season

To be the ones doing the teasin'.

The Superbowl will be our mission.

After all it's 49ers tradition.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Seahawks win because they were tougher than Saints

http://seattletimes.com/html/jerrybrewer/2022651041_brewer12xml.html

Seahawks won't sell tickets to California addresses

http://www.sfgate.com/sports/article/Seahawks-won-t-sell-tickets-to-California-5136665.php

Patriots will face the Broncos in the AFC Championship

http://www.boston.com/sports/football/patriots/extra_points/.html

Manning, Broncos get past Chargers; set up AFC title game vs. Patriots

http://www.denverpost.com/broncos/ci_24897494/manning-broncos-chargers-playoffs-afc-patriots

Peyton Manning's 'Omaha' Calls Receive Approval from City

http://bleacherreport.com/articles/1920813-peyton-mannings-omaha-calls-receive-approval-from-city

Kaepernick lifts 49ers over Panthers 23-10

http://sportsillustrated.cnn.com/football/nfl/gameflash/2014/01/

Kawakami: Survivor mentality will serve 49ers well in Seattle

http://www.contracostatimes.com/tim-kawakami/ci_24897472/kawakami-survivor-mentality-will-serve-49ers-well-seattle

"We Ran At 'em," Greg Roman Says

http://blogs.sacbee.com/49ers/archives/2014/01/game-story-we-ran-right-at-em-greg-roman-says.html

49ers roll into NFC title game

http://www.pressdemocrat.com/article/20140112/sports/140119900

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Marin, Sonoma water agencies call for conservation as drought continue

http://www.marinij.com/marinnews/ci_24880987/marin-sonoma-water-agencies-call-conservation-drought-continues

Economic recovery forgot Calif. cities in east valley

http://www.usatoday.com/story/news/nation/2014/01/12/el-centro-calif-economic-struggles-recovery/4441131/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Review: Jon Bonné's 'The New California Wine'

http://www.kcet.org/living/food/socal-spirits/review-jon-bonnes-the-new-california-wine.html

Impact of Sonoma Wine Pegged at $13.4 Billion

Is Colorado—and its pot supply—ready for weed tourism?

Leo Trentadue Passes Away

http://pressdemocrat.com/article/20140108/articles/140109656

http://www.winebusiness.com/news/?go=getArticle&dataid=126206

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1733- James Oglethorpe and 130 English colonists arrive at Charleston, SC

http://georgiahistory.i-found-it.net/georgiahistory1.html

http://www.virtualmuseumofhistory.com/internationalhall/worldleaders/

JAMESOGLETHORPE.COM/

http://ourgeorgiahistory.com/people/oglethorpe.html

http://www.cviog.uga.edu/Projects/jeo300/savanna1.htm

1794-Congress authorizes an “act making an alteration in the flag of the United States... that from and after the first day of May,1795, the Flag of the United States be fifteen stripes, alternated red and white; and that the union be fifteen stars, white, in a blue field.” The change was made so that Vermont and Kentucky would be represented on the flag. A law passed on April 4, 1818, reduced the number of stripes to 13 to represent the original 13 states, as in the first American flag, and provided one star for each state. A new star was to be added on the Fourth of July following the admission of each new state.

1807- Birthday of Union General Napoleon Bonaparte Buford, born in Woodford, Kentucky. Buford held many commands in the west and was a hero at the Battle of Belmont early in the war. Buford attended West Point and graduated in 1827, sixth out of 38 in his class. After a stint with the frontier military, he was given leave to study law at Harvard. He taught at West Point before leaving the service to become a businessman. He was an engineer and banker in Illinois during the 1840s and 1850s. When the war began, the 54-year-old Buford raised his own regiment, the 27th Illinois. He was commissioned as a colonel, and his unit was sent to Cairo, Illinois, and placed in General Ulysses S. Grant's army. On November 7, 1861, Grant attacked a Confederate camp at Belmont, Missouri, and quickly drove the Rebels away. But Grant's men became preoccupied with plundering the area, and a Confederate counterattack nearly turned to disaster for the Yankees. Buford's regiment was nearly cut off from the main Union force. He rallied his men and they fought their way out of the Confederate trap. Buford was commended for his bravery. After Belmont, Buford participated in the capture of Island No. 10, a Confederate stronghold in the Mississippi River, and Buford was left in command after its capture. Buford and his regiment fought at Corinth in October 1862, but the colonel fell seriously ill from sunstroke. He left field command and sat on the court martial of General Fitz John Porter in Washington. Buford returned to the west and was promoted to Brigadier General in charge of the District of Eastern Arkansas. He remained there for the remainder of the war, although his main military action came in chasing off Confederate raiders in the area. Buford generated controversy in his dealings with black troops. He had drawn earlier criticism for not helping refugee slaves, and now he proclaimed his preference for commanding white troops. He justified it by saying that black troops were not as well trained and they were more likely to be picked off by from southern bushwhackers. It was also true that Confederate soldiers went out of their way to attack units with Black soldiers, killing all wounded men on the field and shooting prisoners. Buford silenced some of the criticism by implementing programs for freed slaves in Arkansas that generally succeeded in taking care of their immediate needs. Poor health forced his resignation in March 1865, just before the end of the war. He was brevetted to major general following his retirement. He worked in a variety of businesses after the war and died in Chicago in 1883. Napoleon Bonaparte Buford was the older half-brother of John Buford, a Union General who commanded the Union force that first engaged the Confederates.

1808-Birthday of Salmon Portland Chase, American statesman, born at Cornish, NH. US senator, secretary of the treasury and chief justice of the Supreme Court. Salmon P. Chase spent much of his life fighting slavery (he was popularly known as “attorney general for runaway Negroes.”) He was one of the founders of the Republican Party and his hopes for becoming a candidate for president of the US in 1856 and 1860 were dashed because his unconcealed antislavery views made him unacceptable. Died at New York, NY, May 7, 1873.

1813 - Captain Oliver Hazard Perry arrives in Presque Isle (Michigan) where he will supervise the construction of a flotilla. Two brigs, a schooner, and three gunboats will be constructed from materials transported overland and by inland waterway from Philadelphia, by way of Pittsburgh, in preparation for the naval battle for Lake Erie, where he carried the flag "Don't Give Up the Ship."

1832- President Andrew Jackson wrote Vice President Martin Van Buren expressing his opposition to South Carolina's defiance of federal authority. South Carolinians agreed and planned to use armed force to prevent duty collection in the state after February 1, 1833. The Nullification Crisis of 1832-1833 was resolved without bloodshed in March 1833. Henry Clay and John C. Calhoun, who left the vice presidency at the end of 1832 to serve South Carolina in the Senate, drafted a reduced tariff agreement that pacified South Carolina while allowing the Federal government to stand firm.

( lower half of: http://memory.loc.gov/ammem/today/jan13.html)

1834-Birthday of Horatio Alger, American clergyman and author of more than 100 popular books for boys (some 20 million copies sold). Honesty, frugality and hard work assured that the heroes of his books would find success, wealth and fame. Born at Revere, MA, he died at Natick, MA, July 18, 1899.

1846 - President James Polk dispatched General Zachary Taylor and 4,000 troops to the Texas Border as war with Mexico loomed. Mexico had severed relations with the United States in March 1845, shortly after the U.S. annexation of Texas

1847—“Capitulation of Cahuenga" ended all organized resistance to American rule in California as Los Angeles surrendered officially this date. All “rebels” were pardoned by Gen. Kearny.

On January 14, California was controlled by the United States military.

http://www.aztecclub.com/campo/CapCahuenga.htm

http://www.militarymuseum.org/Cahuenga.html

http://www.campodecahuenga.com/

1850-Birthday of Charlotte R. Ray, the first black lawyer in the United States who was also a woman and certified as the first woman admitted to practice in Washington, D.C. Many say the certification was because she signed the application C.R. Ray without using her first name. By 1878, in the face of overwhelming sexual and racial prejudice when not even black men would consult her, she returned to teaching in Brooklyn, NY. Died January 4, 1911 at the age of 61 from acute bronchitis.

http://www.womenshistory.about.com/library/bio/blbio_ray_charlotte.htm

http://www.law.howard.edu/alumni/legalgiants/huslgiantoct2k.htm

http://www.stanford.edu/group/WLHP/papers/CharlotteRay.pdf

1864 - Composer Stephen Foster was found critically ill in his hotel room three days earlier, and on this date, died in Bellevue Hospital, New York, at age 37. He only had 35 cents in his pocket, along with a little slip of paper on which he had written, "Dear friends and gentle hearts." While never a great composer, Foster wrote many of the popular songs of the era which remained a part of Americana for more than a century, including “Jeannie with the Light Brown Hair”, “Oh! Susanna”, “My Old Kentucky Home”, and “Old Folks at Home”, also known as “Swanee River”. Many of his songs - including "Oh! Susanna," "Camptown Races" and "Old Black Joe" - are written in black dialect. Foster gained much of his knowledge of blacks through his early experience in traveling minstrel shows. He became a heavy drinker, suffered from tuberculosis, and lapsed into obscurity. His last song, “Beautiful Dreamer”, which he penned just a few days before his death, joined his earlier classics

1869-First Convention of the Colored National Labor Union, the first Black labor union.

http://www.uwm.edu/Course/448-440/national.htm

http://www.africana.com/Articles/tt_631.htm

http://www.afscme.org/about/aframlink.htm

1873-P.B.S. Pinchback ends service as first black governor of Louisiana.

http://www.africana.com/Articles/tt_1153.htm

http://www.sec.state.la.us/46.htm

http://www.huarchivesnet.howard.edu/9911huarnet/pbs1.htm

http://www.gnocdc.org/orleans/11/73/snapshot.html

http://66.216.8.84/CreoleCulture/famouscreoles/Pinchback/pinchback.htm

1884-Grand entertainer Sophie Tucker was born in Poland. She was known as "The Last of the Red Hot Mamas" and her career in stage, film, cabaret, radio, TV and recording lasted more than 60 years, beginning with an appearance at her father's cafe in Hartford, Connecticut in 1905. Tucker's most famous songs were "Some of These Days," recorded in 1926, and "My Yiddish Momma," cut two years later. Sophie Tucker died in 1966.

http://memory.loc.gov/ammem/today/jan13.html

1885-Birthday of Alfred Carl Fuller, founder of the Fuller Brush Company, born at Kings County, NS, Canada. In 1906 the young brush salesman went into business on his own, making brushes at a bench between the furnace and the coal bin in his sister's basement. Died at Hartford, CT, Dec. 4, 1973.

1886 - A great blizzard struck the state of Kansas without warning. The storm claimed 50 to 100 lives, and eighty percent of the cattle in the state.

1888 - The mercury plunged to 65 degrees below zero at Fort Keough, located near Miles City MT. The reading stood as a record for the continental U.S. for sixty-six years

1892 - An Atlantic coast storm produced a record 18.6 inches of snow at Norfolk, VA, including 17.7 inches in 24 hours. The storm also produced 9.5 inches of snow at Raleigh NC, and brought snow to northern Florida for the first time in 35 years.

1909-Birthday of trombonist Quentin “Butter” Jackson, born Springfield, OH. With Duke Ellington from 1948 to 1959.

1910-Radio pioneer and electron tube inventor Lee de Forest arranged the world's first radio broadcast to the public at New York, NY. He succeeded in broadcasting the voice of Enrico Caruso along with other stars of the Metropolitan Opera to several receiving locations in the city where listeners with earphones marveled at wireless music from the air. Though only a few were equipped to listen, it was the first broadcast to reach the public and the beginning of a new era in which wireless radio communication became almost universal.

1912-Delta Sigma Theta, sorority, founded on the campus of Howard University.

http://www.deltasigmatheta.org/history/index.htm

1912 - The temperature at Oakland, MD, plunged to 40 degrees below zero to establish a state record.

1926-Birthday of arranger/trombonist Melba Liston, Kansas City, MO, Died April 23, 1999

http://hardbop.tripod.com/liston.html

http://elvispelvis.com/melbaliston.htm

http://www.jazzreview.com/articledetails.cfm?ID=438

1926-Birthday of Gwen Verdon, born Culver City, Los Angeles, CA. One of Broadway's premier female dancers and actresses, many of her most successful roles were choreographed by her husband Bob Fosse. She won Tony Awards for “Can-Can”, “Damn Yankees”, “New Girl in Town”, and “Redhead”. She also acted in movies, including “Cocoon” and the film adaptation of “Damn Yankees”. She starred in the original Broadway production of “Damn Yankees,” which my mother and father took me to see and I will never forget her performance, especially being a Brooklyn Dodger fan at the time.

http://us.imdb.com/name/nm0893862/

http://www.povonline.com/cols/COL317.htm

1927- - A woman takes a seat on the NY Stock Exchange breaking the all-male tradition.

1929-Birthday of guitarist Joe Pass

http://www.riffinteractive.com/expguitar/JoePass1.htm

http://www.classicjazzguitar.com/albums/artists_albums.jsp?artist=55

http://www.gould68.freeserve.co.uk/JoePass.html

1930 - The comic strip "Mickey Mouse" debuted in American newspapers, with Floyd Gottfredson as its ghost writer.

1931 -- The bridge connecting New York and New Jersey is named the George Washington Memorial Bridge.

1933 - Making her first professional basketball appearance, Babe (Mildred) Didrikson scored nine points as the Brooklyn Yankees defeated the Long Island Ducklings.

1936- Baptist clergyman B.B. McKinney, 50, wrote the words and tune to the gospel song, "Wherever He Leads, I'll Go," a few days before the opening of a Sunday School convention in Alabama.

1937-- The United States bars Americans from serving in the Civil War in Spain.

1938 - For Victor Records, singer Allan Jones recorded "The Donkey Serenade", which became the song most often associated with him. Allan also sang and acted in several Marx Brothers films including: "A Night at the Opera", "A Day at the Races". The film that made him a star was the operetta, "Firefly" with Jeanette MacDonald. Singer Jack Jones is the son of Allan and his actress wife, Irene Hervey ("The Count of Monte Cristo", "Play Misty for Me"). .

1941 - The four Modernaires came to sang with the Glenn Miller Band on a full time basis. In 1946, they had a ‘solo' hit with "To Each His Own".

1941-Charlie Spivak records with own band first time. Okey label.

1942 - Henry Ford patented the plastic automobile, which decreased the weight of a car by 30%.

1942 - German U-Boats begin operations of the US East Coast. The move is called operation Paukenschlag (Drum Roll). Admiral Doenitz has faced arguments from his superiors in the German Navy who do not favor the operation, and that only the larger 740-ton U-Boats are really suitable for such long range patrols. When Doenitz gives the order for the attack to begin there are 11 U-Boats in position and 10 more en route. Together they sink more than 150,000 tons during the first month. Intelligence sources had given reasonable warning of the attack but the U-Boats found virtual peace-time conditions in operation. Ship sail with lights on at night; lighthouses and buoys are still lit; there is no radio discipline - merchant ships often give their positions in plain text; there are destroyer patrols (not convoys with escorts) but these are regular and predictable and their crews are naturally inexperienced.

1949---Top Hits

Buttons and Bows - Dinah Shore

On a Slow Boat to China - The Kay Kyser Orchestra (vocal: Harry Babbitt & Gloria Wood)

A Little Bird Told Me - Evelyn Knight

I Love You So Much It Hurts - Jimmy Wakely

1953-Don Barksdale becomes the first Black person to play in an NBA All-Star Game.

http://sports.insidebayarea.com/top50.asp?story=Don_Barksdale

http://thisweek.kqed.org/segments/390/

1955 - Chase National Bank (founded in 1877) and the Bank of Manhattan Company (founded in 1799 as a water company) agreed to merge, becoming the second largest bank in the U.S. Chase Manhattan Bank is now part of JP Morgan Chase & Company, the world’s largest bank.

1957 - The Wham-O Company developed the first plastic Frisbee. The most popular theory as to how this flying disc came to be dates back to the 1920s when Yale students invented a game of catch by tossing around metal pie tins from the Frisbee Baking Company in nearby Bridgeport, Connecticut. They would frequently shout “Frisbieeeee” to warn passersby of the oncoming pie plate. Building inspector Fred Morrison puttered with and refined a plastic flying disc that he sold to WHAM-O (for $1 million) on this day in 1955. The disc was introduced to the consumer market in 1957 as the Pluto Platter (the name inspired by the U.S. obsession with UFOs). Wham-O changed the name to Frisbee in 1958, upon hearing the Yale pie-tin story. (Mattel now owns the rights to Frisbee, which has become an American icon.)

1957 - For Victor Records in Hollywood, California, Elvis Presley recorded "All Shook Up" and "That's When Your Heartaches Begin"; which became Elvis' ninth consecutive gold record.

1957---Top Hits

Singing the Blues - Guy Mitchell

The Banana Boat Song - The Tarriers

Moonlight Gambler - Frankie Laine

Singing the Blues - Marty Robbins

1958- Little Richard releases "Good Golly Miss Molly."

1961 - In the first round of the Los Angeles Open golf tournament, golfing great Arnie Palmer scored an embarrassing 12 strokes on one hole.

1962 - Singer Chubby Checker set a record, literally, with the hit, "The Twist". The song reached the #1 position for an unprecedented second time -- in two years. "The Twist" was also number one on September 26, 1960. The song, widely considered one of the most successful singles of all time, was on the Top 100 charts for 39 weeks, longer than any other single except "Red Red Wine" by UB40. When an early recording of "The Twist" by Hank Ballard and the Midnighters became the top dance song on Dick Clark's American Bandstand but failed to get much radio play, Clark suggested that a new artist should record a cover. Singer Ernest Evans of Cameo Records recorded the song and changed his name to Chubby Checker as a takeoff on Fats Domino. The song hit the charts in 1960 when it became immensely popular with teenagers, but adults started buying the record in 1962, after Chubby Checker sang "The Twist" on Ed Sullivan's October 22 show.

1962-First Operation Farm Gate missions flown. In the first Farm Gate combat missions, T-28 fighter-bombers are flown in support of a South Vietnamese outpost under Viet Cong attack.

By the end of the month, U.S. Air Force pilots had flown 229 Farm Gate sorties. Operation Farm Gate was initially designed to provide advisory support to assist the South Vietnamese Air Force in increasing its capability. The 4400th Combat Crew Training Squadron arrived at Bien Hoa Airfield in November 1961 and began training South Vietnamese Air Force personnel with older, propeller-driven aircraft. In December, President John F. Kennedy expanded Farm Gate to include limited combat missions by the U.S. Air Force pilots in support of South Vietnamese ground forces. By late 1962, communist activity and combat intensity had increased so much that President Kennedy ordered a further expansion of Farm Gate. In early 1963, additional aircraft arrived and new detachments were established at Pleiku and Soc Trang. In early 1964, Farm Gate was upgraded again with the arrival of more modern aircraft. In October 1965, another squadron of A-1E aircraft was established at Bien Hoa. Secretary of Defense Robert McNamara approved the replacement of South Vietnamese markings on Farm Gate aircraft with regular U.S. Air Force markings. By this point in the war, the Farm Gate squadrons were flying 80 percent of all missions in support of the Army of the Republic of Vietnam (ARVN). With the buildup of U.S. combat forces in South Vietnam and the increase in U.S. Air Force presence there, the role of the Farm Gate program gradually decreased in significance. The Farm Gate squadrons were moved to Thailand in 1967, and from there they launched missions against the North Vietnamese in Laos.

1962-Center Wilt Chamberlain of the Philadelphia Warriors set an NBA regular season record by scoring 73 points in a game against Chicago. Chamberlain had scored 78 points in the previous December, but that game had gone into three overtime periods.

1964 - Capitol released in the United States The Beatles' single “I Want to Hold Your Hand/I Saw Her Standing There” .

1965---Top Hits

I Feel Fine - The Beatles

She's a Woman - The Beatles

Love Potion Number Nine - The Searchers

Once a Day - Connie Smith

1965-After the NBA All-Star game in which San Francisco Warriors center Wilt Chamberlain scored 20 points and grabbed 16 rebounds, the Warriors shocked the basketball world by announcing that they were trading Chamberlain to the Philadelphia 76ers for three minor leaguers and $150,000.

1965-- Bob Dylan releases "The Times They Are A-Changin'"

1966 - On "Bewitched," Elizabeth Montgomery's character, Samantha, gave birth to her first child, Tabitha. The witch's daughter could wiggle her nose with her finger and cause problems for daddy, Darin, just like mom.

1967 -- The Dead, Junior Wells' Chicago Blues Band, & the Doors at the Fillmore, San Francisco, California.

1968-Against the advice of Columbia Records executives, Johnny Cash visits Folsom State Prison in California to record a live album before 2000

inmates. Backed by the Tennessee Three and accompanied by June Carter, Carl Perkins, and the Statler Brothers, Cash performed in the prison cafeteria. The resulting LP, "Live At Folsom Prison" would become one of Johnny's biggest selling records, reaching #1 on the Country album chart and #13 on the Hot 200. It also produced one of his most memorable hit singles, "Folsom Prison Blues". In 2003, "Live at Folsom Prison" was certified Triple Platinum by the RIAA for sales of over three million and was ranked #88 on Rolling Stone Magazine's list of the 500 greatest albums of all time. Cash's choice to play for prisoners cemented his reputation as a hero to the downtrodden.

1968-- Cream's "Sunshine of Your Love" enters the pop charts.

1968-Dr. K.C. Pollack of the University of Florida audio lab reports tests have found that the noise generated at rock & roll concerts is harmful to teenage ears.

1968-In a game between the Minnesota North Stars and the Oakland Seals, Minnesota rookie center Bill Masterton was checked into the boards and fell heavily on his head. He suffered massive brain damage and died two days later, the only fatality in NHL history.

1969-- After his triumphant '68 "comeback" special, Elvis Presley decides to take more control of his career and begins recording in Memphis for the first time since he left Sun Records. Over the next three weeks at Chips Moman's American Recording Studios, Elvis records the songs that would return him to the top of the charts ("Suspicious Minds" and "In The Ghetto" chief among them).

1969-- The Beatles release “Yellow Submarine”

1973- Eric Clapton came back from his three-year heroin addiction problem with a concert at the Rainbow Club in London. Clapton, helped and encouraged by Pete Townshend of The Who, was back on the album charts in 1974 with "461 Ocean Boulevard."

1972-President Nixon announces that 70,000 U.S. troops will leave South Vietnam over the next three months, reducing U.S. troop strength there by May 1 to 69,000 troops. Since taking office, Nixon had withdrawn more than 400,000 American troops from Vietnam. With the reduction in total troop strength, U.S. combat deaths were down to less than 10 per week. However, Nixon still came under heavy criticism from those who charged that he was pulling out troops but, by turning to the use of air power instead of ground troops, was continuing the U.S. involvement in Vietnam rather than disengaging from the war. The last American troops would be withdrawn in March 1973 under the provisions of the Paris Peace Accords.

1972- The Beach Boys' "Surfin'" is getting airplay in Los Angeles and enters Billboard, moving up the Hot 100 chart at #118.

1973 - Carly Simon's "No Secrets" was the #1 album in the U.S. for the first of five weeks. The tracks: "The Right Thing to Do", "The Carter Family", "You're So Vain", "His Friends are More Than Fond of Robin", "(We Have) No Secrets", "Embrace Me You Child", "Waited So Long", "It Was So Easy", "Night Owl" and "When You Close Your Eyes".

1973---Top Hits

Me and Mrs. Jones - Billy Paul

Clair - Gilbert O'Sullivan

You're So Vain - Carly Simon

She's Got to Be a Saint - Ray Price

1974-A Gallup poll on religious worship showed that fewer Protestants and Roman Catholics were attending weekly services than ten years earlier, but that attendance at Jewish worship services had increased over the same period.

1974- 37 people were injured in a melee outside the Tower Records store in Los Angeles after the crowd discovered that singer Steve Miller was not going to be at a post-concert party at the store. The organizers forgot to invite him. Miller's single and album "The Joker" were riding high on the charts at the time.

1974 - Super Bowl VIII (at Houston): Miami Dolphins 24, Minnesota Vikings 7. The Dolphins win their second straight Super Bowl. Fran Tarkenton and the Vikings are the victims. MVP: Dolphins' RB Larry Csonka; Larry Csonka's 145 yards rushing help Miami claim their second straight championship. Tickets: $15.00

http://images.nfl.com/history/images/0113.jpg.

1976 - Sarah Caldwell, The Divine Miss Sarah, founder of the highly successful and artistically marvelous Boston Opera Company, the second woman in the history of the New York Philharmonic to conduct its orchestra (1975), became the first woman to conduct an opera at the Metropolitan, Verdi's La Traviata. Devoted to her Boston Opera Company and opera in general, she uses off-beat methods to draw customers by using stage innovations which included such things as motorcycles and circus acts. She was born 03-05-24.

http://www2.worldbook.com/features/whm/html/whm068.html

http://www.smithsonianassociates.org/programs/cassettes/caldwell.HTM

1978-Elvis Presley's version of Paul Anka's "My Way" goes gold in five months after the King's death. Earlier, it had become one of Presley's 78 Top Twenty-five hits.

1980 - The Grateful Dead, Beach Boys and Jefferson Starship are the featured acts at a benefit concert for the people of Kampuchea, held at the Oakland Coliseum.

1981---Top Hits

(Just Like) Starting Over - John Lennon

Love on the Rocks - Neil Diamond

Hungry Heart - Bruce Springsteen

I Think I'll Just Stay Here and Drink - Merle Haggard

1982 - Air Florida Flight 90, a Boeing 737, attempted to take off from Washington's National Airport in one of the worst blizzards in history. Ice had built up on the wings of the jetliner as it waited its turn to take off, preventing it from gaining altitude. After crashing into the 14th Street Bridge, the plane fell into the Potomac River. 74 of the 79 people on the aircraft were killed in the accident. Four people on the bridge were killed.

1982 - The worst Louisiana rainstorm in more than 100 years came to an end. More than 18 inches fell at Vinton, LA, during the three day storm. Flooding was widespread, and property damage was estimated at $100-200 million. President Reagan visited the state and declared ten parishes in northeastern Louisiana disaster areas

1984 - Wayne Gretzky extended his consecutive scoring streak to 45 games, but the Edmonton Oilers winning streak ended at an unlucky 13 when Gretzky and company lost to the Buffalo Sabres 3-1.

1985-While not a date in American history, Otto Bucher of Switzerland became the oldest golfer to record a hole-in-one when he aced the 12th hole at a golf course in Spain. Burcher was 99 years old.

1986 - NCAA member schools voted overwhelmingly in convention to adopt Proposition 48, a controversial attempt to raise the academic performance of student-athletes. Prop 48 required incoming freshmen to score 700 or more on the Scholastic Aptitude Test (SAT) or 15 on the American College Testing (ACT) exam or graduate from high school with a 2.0 grade point average in order to be eligible for athletics during freshman year.

1986 - For the first time in about 10 years, "The Wall Street Journal" broke with tradition and printed a real, honest-to-goodness picture on its front page. The story was about artist O. Winston Link and featured one of his works.

1988 - A fast moving cold front ushered arctic cold into the north central and northeastern U.S. Mason City, Iowa reported a wind chill reading of 51 degrees below zero, and Greenville, Maine reported a wind chill of 63 degrees below zero. Winds along the cold front gusted to 63 mph at Rochester, NY, and a thunderstorm along the cold front produced wind gusts to 62 mph at Buffalo, NY, along with snow and sleet.

1989 - Half a dozen cities in the northeastern U.S. reported record low temperatures for the date, including Elkins, WV, with a reading of 13 degrees below zero. Watertown, NY was the cold spot in the nation with a morning low of 37 degrees below zero

1989---Top Hits

Every Rose Has Its Thorn - Poison

My Prerogative - Bobby Brown

Two Hearts - Phil Collins

Hold Me - K.T. Oslin

1990 - A winter storm in the southwestern U.S. produced more than twelve inches of snow in the mountains of California and Nevada. In northern California, Huntington Lake was buried under 40 inches of snow, and up to 20 inches was reported in northeastern Nevada. Heavy rain soaked some of the lower elevations of California. Gibraltar Dam, California was drenched with 5.33 inches of rain in two days.

1992 - Serial killer Jeffrey Dahmer pleaded guilty but insane to the murders of 15 young men and boys. He had kept parts of his victim in his refrigerator, and also claimed to be a cannibal. He was later murdered in by an inmate who said, “God had told me to do this.”

1992-- Japan apologized for forcing Korean women to act as sex slaves for Japanese soldiers during WWII but refuses to pay reparations.