|

|

|

|

Headlines---

Classified

Ads---Senior Management/Sales Managers

It'sssssssssssssss:-)SilverMark

Capital ! ! !

Kruse-Brady-Monlux

Go MainStreet Finance

Pictures from the Past---2002---Rick

Wilbur/Jim Buckles

Housing Starts Highest

Level 17 Years/ Economic Forecast

Sunrise Int. Net Income

Up 39 Percent Year-to-Date

Sobig virus spreads quickly

by e-mail, clogging inboxes

FleetBoston Financial

Declares Regular Dividends

Amex Cheers a

Strong First Half of Year

News Briefs---

This Border ##### Denotes Press Release (Not Written By Leasing

News)

------------------------------------------------------------------------------------------

Classified

Ads---Senior Management/Sales Managers

Senior Management: Baltimore, MD

25 year veteran of commercial and equipment leasing seeking

a senior management position with leasing or asset based financing company

in the southeast (Florida preferred)

email: kellogg_md@yahoo.com

Senior Management: Denver, CO. Fortune 500 GM/SVP wants to

team up with aggressive lender looking for Western expansion mid-market

equip. finance/ leasing.20+ years experience within Rocky Mountain/Southwest

and Ca markets. email: legal@csotn.com

Senior Management: Long Island, NY

Degree Banking/Finance. 13 years leasing exp. Now prez young

leasing company where promises were not met. Interested in joining established

firm with future. Email:bob33483@yahoo.com

Senior Management: San Francisco, CA., 25 years experience

w/global leasing company, sales, marketing, business dev., P&L responsibility,

asset mgmt, brokering and remarketing. Interested in joining an est. firm

with a future. email:rcsteyer@yahoo.com

Senior Management: Portfolio Management Consultant; 25+years

experience in Collections, Customer Satisfaction, Asset Management, Recoveries,

Continuous Process Improvement, Backend Revenue Generation, Cost per Collection

Analysis. $5+Billion Portfolio expertise. email: efgefg@rogers.com

Sales Manager: Atlanta, GA

30 years in transportation Finance with strong management/

sales background. Represented company on national & region markets.

Started two successful operations- produce profits and growth. Email:pml@mindspring.com

Sales Manager: New York, NY

I have over 25 years owning an independent leasing company

that specialized in truck leasing. Tow trucks, Limos, ambulances, tractors,

etc.. Email:rfleisher@rsrcapital.com

Sales Manager: Portland, OR. 18+ yrs w/bank leasing company.

Supervised 14- 20 sales people. Willing to relocate for the proper position.

Or, seeking sales position in current location (13+yrs direct sales).

email:pthygeson@netscape.net

Sales Manager: Seattle, WA

Senior level sales professional w/ (20) plus experience in

mid market financing & leasing. The last (8) plus years being self

employed in middle market brokerage. Email:markhenley@qwest.net

Job Wanted Ads here:

http://65.209.205.32/LeasingNews/JobPostings.htm

Look for advancement

or a job in the leasing industry, free ad:

http://65.209.205.32/LeasingNews/PostingForm.asp

(We help people

find work, start networking, keeping your “name” active)

--------------------------------------------------------------------------------------

It’s Official---It is Not “Van Etten Leasing”

It’sssssssssssssss

: -) SilverMark Capital ! ! !

Otherwise Leasing News named it right a month in advance,

including

Sterling Bank and the major players. Here is the official press release:

### Press Release ###########################################

Sterling Bank Recruits Executives

to Launch

New Equipment Leasing Division

HOUSTON—Sterling Bank, a subsidiary of Sterling Bancshares,

Inc. (NASDAQ: SBIB), announced

today the hiring of four leading professionals in the field of business

equipment leasing. These experienced

professionals represent the bank’s initial staff in the leasing and equipment-financing

division it is developing.

This new division of the bank will be called SilverMark Capital™

and will provide equipment-leasing services to bank customers and to select

national vendor relationships.

“Offering an in-house business equipment leasing program

is a logical step in providing full-service banking to our customers,”

commented Sterling Bank President and Chief Executive Officer J. Downey

Bridgwater. “Our philosophy is

that to be the best, you get the best people.

That’s why we’re proud to bring aboard these four professionals. In our opinion they represent the industry’s

best in the field of commercial leasing services.”

The four leasing professionals are Frederick M. Van Etten,

Richard S. Andersen, Daniel L. Fritz, and Hernan R. Traversone.

·Fred Van Etten, named

CEO of the leasing division, has over 25 years’ experience in the commercial

leasing and asset-financing marketplace. Most notably he was co-founder,

executive vice president and chief marketing officer for First Sierra

Financial, a successful company which was sold to American Express in

2001. He holds a business administration

degree from Arizona State University and an MBA from Pepperdine University.

Ric Andersen, senior vice president and chief

operating officer of the leasing division, was director of vendor services

and capital markets for American Express Business Finance, Inc., and directed

portfolio acquisition and syndication there.

He began his banking career while completing a BA in economics

and finance at the University of Colorado at Boulder, where he became

president and CEO of the student credit union.

He has over 15 years’ experience in finance and commercial leasing.

·Danny Fritz, senior

vice president and chief marketing officer for the leasing division, previously

served as global business development manager for Hewlett Packard Financial

Services, Inc., where he was responsible for portfolio management, business

strategies, pricing, policies and procedures, as well as global marketing

of lifecycle management programs. He

has 15 years of experience in the leasing industry and holds a BA in finance

from the University of Texas.

·Hernan Traversone, senior

vice president and chief credit officer for the division, previously served

as director of originations for the Houston credit operation of American

Express Business Finance, Inc. Prior

to that he was vice president of wholesale operations for First Sierra

Financial, Inc., where he also oversaw credit, documentation, and funding

procedures. He has over 11 years of experience in consumer and commercial

underwriting.

Earlier this year, Sterling Bank was named to FORTUNE Magazine’s

2003 List of the 100 Best Places to Work in America. With assets of $3.4 billion, it operates 35

banking offices in the greater metro areas of Dallas, Houston and San

Antonio. Sterling Bank is a subsidiary

of Sterling Bancshares, Inc., whose common stock is traded through the

Nasdaq National Market System under the symbol SBIB. For more information,

please visit the company's web site at www.banksterling.com.

#### Press Release ################################################

He’s not with SilverMark.

Is he in Houston or Costa Rico?

-----------------------------------------------------------------------------------------------

Pictures from the Past---1995---

McCommon, Malone,

Monlux, Lowe, Wehner, Dislip, Kruse

“Left to right—Jim McCommon, LaVergne Malone, Cliff Monlux,

Loretta Lowe, Skip Wehner, Alan Dishlip, and John Kruse packing heat at

Wings Over the Rockies (Denver, Colorado United Association of Equipment

Leasing Conference)

June,1995, Regional Report, United Association of Equipment

Leasing

-----------------------------------------------------------------------------------------------

Kruse-Brady-Monlux Go MainStreet Finance

“Thanks so much for your recent posting of the MainStreet

Finance Press

Release,” John Kruse said in his e-mail.” We have been buried

with calls and interest pertaining to the different products that we are

starting to offer to the leasing market.

John Kruse

Kruse is Vice President of Business Finance and Managing

Partner with MainStreet. He is very well-known in the leasing industry,

contributing

both time and support to several leasing associations. He

presently

serves on the board of directors of the United Association

of Equipment

Leasing

“There is definitely a strong interest in other forms of

finance products

that these companies can market back to their existing customers

and

prospects, “ he explains about his new company. ” There is

also an even stronger, obvious, interest in adding more profit to the

bottom line without adding any additional overhead.

“The Company will be delivering their services through marketing

and service relationships with independent CPA firms, small banks, equipment

finance companies and manufacturers who focus on service to small business

owners.

MainStreet is the brainchild of Jim Brady, Cliff Monlux and

Kruse, who together represent over 40 years of experience working in the

specialty finance market. MainStreet is exceptional in offering access

to several forms of financing from a number of different lenders across

the US through one highly efficient central service point.

The idea is to help equipment leasing finance companies leverage

their marketing investment for more revenue and stronger client relationships,

introducing other

products and acting as intermediaries for additional fee

benefit plus service

to their customers.

"Companies that

currently offer only equipment leasing and loans can now offer other forms

of financing to their lessee customers with minimum additional cost and

significant upside revenue potential,"

Kruse explains. With their

contacts, information, experience, MainStreet can increase yields, fees,

and help maintain

their customer base by offering more financial services..

“l am very fortunate to be working with Jim Brady

and Cliff Monlux again,” Kruse

says.” It's refreshing to work alongside partners who

you can trust and who's interest lies in creating quality

products that

offer true value to the customer. Much like the early days of System 1.”

System 1 was the software product and company name which

started in 1995, which took both the broker and small to medium lessor/discount

marketplace by storm. It was first

introduced for a nominal dollar amount at leasing conferences, then part

of a package for joining leasing associations, with the two fold process

of getting the first version out and working, and tying companies into

a yearly

contract for maintenance plus upgrades. As the company developed

more “sophisticated programs, the company name changed in 1999 to CapitalStream.

The System 1 Software name changed to 'Advantage', as it is today.

The company was spun off to Jim Buckles, who manages it today.

Cliff Monlux and John Kruse started System 1 with Jim McCommon’s

company

Beta number one (see the 1995 Picture from past above this

story). Kruse met Jim Brady when

he was at MetLife Capital where he purchased our System 1 product. After GE purchased and subsequently closed

MetLife Capital. Brady became vice-president of Marketing at CapitalStream.

Jim was at CapitalStream for approximately 2.5 years.

Jim Brady

Jim Brady

"MainStreet is all about finding credit for small business,"

said Jim Brady, Senior Managing Partner of MainStreet Finance. "We

work with our service partners, namely CPAs, banks and other channels

to define the credit needs of their clients and help them quickly find

and qualify for appropriate financing at competitive rates" added

Brady.

MainStreet offers their channel partners the benefit of personal

advice and assistance in serving their clients as well as convenient online

access to information, qualification tools and application forms.

"MainStreet represents an innovative approach to the

challenge of small business credit in a number of ways" said Cliff

Monlux, co-Senior Managing Partner of MainStreet. "Foremost is the

idea of using professional channels for more efficient access to the small

business client" added Monlux.

Cliff

Monlus

Cliff

Monlus

More about the management of this company, with telephone

numbers and

other information is available at:

http://www.mainstreetfinance.com/managementteam.php

Jim Brady, Senior Managing Partner, can be reached at

(866)889-6886 Ext. 230

John Kruse

jfk@mainstreetfinance.com

(425) 889-6886, ext. 224

Pictures

from the Past---2002---Rick Wilbur/Jim Buckles

The famous Rick Wilbur of MediCap-lessor/discounter/superbroker/broker/

bon vivant with System 1/Software Expert Jim Buckles.

“The handsome young man in the middle is my son Carey who

is also my partner. I have no idea what we were doing there because I'm

old forgetful. Carey on the other hand was probably trying to learn more

about the capabilities of Capital Stream.

“I think the industry is beginning to catch it's collective

breath and

business is getting much stronger. Our volume is increasing

and the quality

of credit appears to be getting better.

Rick

--

From Jim Buckles--

“The picture was taken at the NAELB Regional Conference in

Marina Del Rey

last November. I was discussing the latest features of Advantage

version

2.0 (the successor to the System 1 software program) with

Rick & Carey

Wilbur. This version will be available Q2 of this year and

I will be

showing a "sneak peak" in Chicago for the NAELB

National Convention 3/19 -

23. A free training session on 2.0 and a general discussion

of Advantage

and alaQuote will be available to convention attendees on

Thursday 3/19 from

1pm - 5pm.

“Since leaving CapitalStream 2 years ago and forming Preferred

Broker

Solutions, I have been very fortunate to bring aboard two

previous System 1

people. "Technical Guru", Trevor Thompson and "Developer

Extraordinaire"

Tom Wynne. Both people have been a terrific asset to our

company and have

allowed us to grow rather rapidly, keeping up with the constant

demand of

offering superior software and the best possible customer

support available

to the Leasing Community.

“We are experiencing a very steady growth with our Advantage

customer base as

well as subscribers to our alaQuote program. alaQuote is

our web based

quoting tool that furnishes a private label Lease Calculator,

Custom Quote

Letter, Credit Application and Credit Release form which

feeds application

data into Advantage. This program is extremely easy to use

and furnishes a

professional web presence to any Leasing Professional's web

site as well as

a private label offering to their vendors.

“The industry is definitely in a regroup and reorganize phase

at the moment.

This is nothing new, we just haven't experienced this, at

this depth, in a

long time. The upswing is inevitable. This is a great time

to review how

we are all doing business, trim the fat, increase efficiencies,

target new

markets and get moving. There is no doubt that some companies

are still

doing deals, while others are just waiting for something

to happen. These

times, you have to make it happen!

Jim Buckles

jimb@pbs4u.com

--------------------------------------------------------------------------------------------

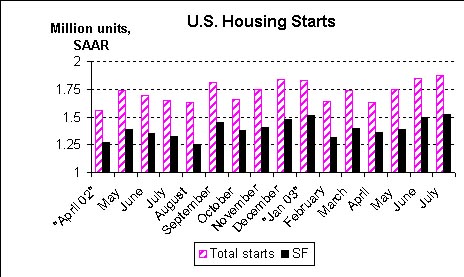

Housing

Starts Highest Level 17 Years/ Economic Forecast

“We need a significant increase

in business investment to support stronger job creation before the economy

can sustain trend growth. That

will be a challenge with the current trends in job outsourcing (globalization

impact) now spreading to white collar and professional jobs. Additionally, productivity increases , made possible by the significant

business investments made in the latter part of the 1990’s, are still

paying off, thus allowing businesses to produce more with fewer employees.

“

Here is the full report:

July starts were expected to pull back some as interest

rates (30 year fixed as reported by Freddie Mac) reached 6.24 per cent,

up a full percentage point from the 5.21 percent that prevailed in June.

Starts were up 1.5 % to 1.872 million (SAAR) while single family

(SF) was up a strong 1.9% to a very respectable 1.521 million (SAAR).

The more volatile multi family (MF) sector fell a modest 0.6% to

.351 million (SAAR). Permits,

an indicator of future activity, were off 2.4% to 1.78 million (SAAR). Regionally, starts were up in all areas g except the West which

fell almost 14%.

Analysis and outlook: Housing starts reached their highest level

in 17 years as residential construction activity was not affected by the

recent rise in mortgage rates. Mortgage

rates have been moving up in recent weeks, driven by significant gains

in 10 year Treasury yields, which are rising because the bond market believes

the U.S. economic recovery is gaining strength.

As pointed out to me by a friend

and fellow Forest Service colleague (Dr.Henry Spelter), housing is “the Arnold Schwarzenegger

of the economy”. It remains one of the few bright spots in an

otherwise lethargic economy. The

main concern going forward is whether housing will remain healthy enough

to provide the rest of the economy needed support in its quest to return

to trend growth (non inflationary rate of growth) of about 3% or more. We need a significant increase in business

investment to support stronger job creation before the economy can sustain

trend growth. That will be a

challenge with the current trends in job outsourcing (globalization impact)

now spreading to white collar and professional jobs.

Additionally, productivity increases , made possible by the significant

business investments made in the latter part of the 1990’s, are still

paying off, thus allowing businesses to produce more with fewer employees.

As we mentioned in last months’

housing report, current construction activity is running about 100,000

units per year above demographically supported “sustainable demand”. The

bottom line is that housing can’t continue at the current pace, and eventually

starts will trend down toward more sustainable levels.

That may not happen for awhile longer, but sooner or later, it

will. As the economy improves,

interest rates will continue to trend upward, and this will negatively

impact affordability, and nudge housing closer to trend levels.

sent by:

Carl Villella, CLP

Acceptance Leasing and Financing Service, Inc.

1004 Sanlin Dr.

Moon Township, Pa. 15108

412-262-3225 Phone

800-586-0048 Fax

CVillella@msn.com

---------------------------------------------------------------------------------------------

#### Press Release ###############################################

Sunrise Int. Net Income Up 39 Percent Year-to-Date

GOLDEN VALLEY, Minn., --

Sunrise International Leasing Corporation (SILC), a wholly owned subsidiary

of privately held King Capital Corp., today announced financial results

for the second quarter ended June 30, 2003.

For the quarter, SILC reported revenues of $13.9 million,

compared to $31.7 million for the comparable 2002 period. Second-quarter net income increased 9 percent

to $3.7 million from $3.4 million for the prior-year period.

For the six months ended June 30, 2003, SILC reported revenues

of $34.4 million, compared to $67.6 for the comparable 2002 period.

Net income increased to $8.5 million for the six-month period,

up 39 percent from $6.1 million in 2002.

Although revenues are down significantly in the current year

due to adverse economic conditions and a worldwide decrease in capital

spending, SILC continues to record strong net income primarily as a result

of a high level of lease renewals, improved margins on the sale of used

equipment and reduced expenses. Also,

SILC's credit loss experience has consistently improved over the last

several quarters, having a positive impact on provisions for losses.

The company remains debt free on its portfolio of nearly

$100 million in gross earning equipment.

SILC has experienced substantial levels of free cash flow, allowing

the company to aggregate a portfolio of over $60 million in cash and investments.

SILC is strategically managing this portfolio to ensure that it

provides adequate yields and remains liquid enough for the company to

capitalize on its new business ventures, which include a newly formed

second placement division that actively solicits established, third-party

lessors and captive leasing companies to refer lease transactions and

lease lines of credit with companies that have limited credit options.

Outlook

Consistent with the prior quarter, SILC experienced a modest

increase in lease originations and expects this trend to further accelerate

into the next quarter and to improve substantially in 2004 due to the

implementation of major vendor programs that are currently being negotiated.

However, the company reiterated that it expects 2003 full-year

revenues to be substantially lower than the $117.4 million recognized

in the previous year.

SILC is actively searching for business partners that can

benefit from the company's unique, highly successful vendor program business

model, its customized information systems and unmatched servicing capabilities.

About Sunrise International Leasing Corporation

SILC's business consists primarily of developing and implementing

customized lease and rental programs for vendors of high technology and

related equipment and is becoming a major financing source for second

placements. SILC also is a national

major reseller of high-quality, off-lease used Sun and Cisco equipment

through Redirect Tech, its remarketing subsidiary.

About King Capital Corp.

King Capital Corp., established in 1975 and based in Golden

Valley, Minn., offers a wide range of leasing options to manufacturers,

distributors and resellers through its primary subsidiary, SILC, as well

as high-availability software through H.A. Technical Solutions, LLC.

#### Press Release ####################################################

------------------------------------------------------------------------------------------

Please

send to a colleague as we are trying to build our readership.

Two

Version: Free ( text format) $59.95

yr ( html/website) Free 30 Day Trial

http://www.leasingnews.org/contact_us_news.htm

This text edition is also available in an "up-grade"

format, html, where you may

click on the headlines to go to the story, plus is also in

this "new" format

posted daily on our website--- http://www.leasingnews.org/contact_us_news.htm

------------------------------------------------------------------------------------------------

Sobig virus spreads quickly by e-mail, clogging inboxes

We have received at Leasing News over a dozen “Sobig” on Tuesday. Our PC-cillin blocked it, but for one day,

would rate it high, and spreading. We

rate worm Klenz the most active, as we get a half dozen a day. Here is how PC-Cillin ranks them:

http://www.leasingnews.org/virus.htm

About Sobig---

http://www.stltoday.com/stltoday/business/stories.nsf/Business/DDF432AB325DA8F186256D880012F

732?OpenDocument&Headline=Sobig+virus+spreads+quickly+by+e-mail,+clogging+inboxes+

#### Press Release###############################################

Mark Lane New CEO at Synovus

ALBANY, Ga.----Synovus (NYSE:SNV), the parent company of

Security Bank and Trust Company, has announced the naming of Mark James

Lane as the bank's new Chief Executive Officer.

"This is a great day for Security Bank and Trust and

the entire Synovus family," said Walter M. "Sonny" Deriso,

Jr., Synovus Vice Chairman. "Mark is committed to the success of

our company through team member development, shareholder value and customer

loyalty. His passion to this company is contagious, and we will benefit

from his guidance as Security Bank and Trust's Chief Executive Officer."

Mark is a graduate of Florida State University with a degree

in Finance. During his career with Columbus Bank and Trust Company from

1989 - 1999, he held various positions in branch management, credit analysis

and commercial lending. In 1999, Mark was named President and CEO of Quincy

State Bank, also a Synovus affiliate bank located in Quincy, Florida.

Mark has been active in the Quincy, Florida community as

President of the Chamber Foundation and Director of the local Chamber

of Commerce. He is a member of the Quincy Chapter Rotary Club and the

Florida Banker's Association.

Synovus (NYSE:SNV) is a diversified financial services holding

company with more than $21 billion in assets based in Columbus, Ga. Synovus

provides integrated financial services including banking, financial management,

insurance, mortgage and leasing services through 40 affiliate banks and

other Synovus offices in Georgia, Alabama, South Carolina, Florida and

Tennessee; and electronic payment processing through an 81-percent stake

in TSYS (NYSE:TSS), the world's largest third-party processor of international

payments. Synovus is No. 9 on FORTUNE magazine's list of "The 100

Best Companies To Work For" in 2003. See Synovus on the Web at www.synovus.com.

CONTACT:

Synovus, Columbus

Media Relations

Aimee Davis, 706-644-0528

### Press Release ########################################################

FleetBoston Financial Declares Regular Dividends on Common

Stock and Series VI and Series VII Preferred Stock

BOSTON---The Board of Directors of FleetBoston Financial

today declared a regular quarterly dividend of

$.35 per share on its common stock. The dividend will be

payable on October 1, 2003 to shareholders of record on September 3, 2003.

The Board of Directors also declared a regular quarterly

dividend of $.84375 per depositary share on the corporation's Series VI

6.75% Perpetual Preferred Stock (FBF PrG). The preferred stock dividend

for this issue will be payable on October 15, 2003 to shareholders of

record on October 1, 2003.

In addition, the Board of Directors declared a regular quarterly

dividend of $.825 per depository share on the corporation's Series VII

Fixed/Adjustable Rate Noncumulative Preferred Stock. The preferred stock

dividend for this issue will be payable on October 1, 2003 to shareholders

of record on September 15, 2003.

FleetBoston Financial is the seventh-largest financial holding

company in the United States, with assets of $197 billion. The company's

principal businesses, Personal Financial Services and Commercial Financial

Services, offer a comprehensive array of innovative financial solutions

to 20 million customers. Through its Personal Financial Services franchise,

Fleet offers retail banking, wealth management and investment services,

nationwide brokerage, credit card and consumer lending services. These

services are available through approximately 1,500 branches and more than

3,400 ATMs in the Northeast; through Fleet HomeLink(SM) online banking,

one of the nation's leading online banking platforms; and through telephone

banking. Fleet is the leading small business services and commercial banking

provider in the Northeast. Fleet's Commercial Financial Services Division

provides commercial lending, syndications, capital raising and advisory,

leasing, cash management, asset-based finance, foreign exchange and interest

rate derivatives to clients. FleetBoston Financial is headquartered in

Boston and listed on the New York Stock Exchange (NYSE:FBF) and the Boston

Stock Exchange (BSE: FBF).

CONTACT:

Media Contact :

FleetBoston Financial

James E. Mahoney, 617/434-9552

or

Investor Contact :

FleetBoston Financial

John A. Kahwaty, 617/434-3650

#### Press Release #######################################################

|

Escondido, CA: Lease broker office looking for Lease Coordinator/Office Manger: process credit, submit to banks,documentation/follow-up; answer phones/manage files.Leasing experience important. please send resume to:stantonleasing@sbcglobal.net or fax to (760) 738-1910 |

|

About the Company: www.odysseyequipfinance.com |

|

About the Company: www.leasingpartnerscapital.com |

------------------------------------------------------------------------------------------

Amex Cheers a Strong First Half of

Year

U-S Banker Weekly Bulletin

The American Stock Exchange had a busy and productive first

half of the year, when the Amex Composite Index rose 18 percent during

this period, outperforming

nearly every exchange index composite. During the first half,

the firm also launched eight closed-end funds, valued at more than $4

billion, and 31 new companies.

Daily volume of Amex-listed stocks rose 16 percent over the

same period in 2002. Officials underscored that a previously announced

deal is on track with GTCR

Golder Rauner, a private equity firm, to acquire Amex from

the NASD. The $110 million deal is expected to close by the end of the

year.

HP's 3Q Earnings Miss Expectations

http://www.washingtonpost.com/wp-dyn/articles/A17308-2003Aug19.html

http://www.nytimes.com/2003/08/20/technology/20HEWL.html

http://www.bayarea.com/mld/mercurynews/business/6570652.htm

Apple rolls out 64-bit Power Mac

G5 computers

Faster microprocessors mark breakthrough

for desktop users

Budget deficit hits $54.2 billion

in July

http://www.signonsandiego.com/news/business/20030819-1453-federaldeficit.html

AirTran is going to San Francisco

http://ads.specificpop.com/code?pid=303&gid=17&rid=145481734&dom=20&dow=3&hod=0

Job on the Line, Davis Promises to Fight Recall

http://www.nytimes.com/2003/08/20/national/20RECA.html?hp

Davis attacks recall as Republican power grab

http://www.signonsandiego.com/news/politics/recall/20030819-1904-ca-davisrecall.html

Text of Gov. Gray Davis' speech at UCLA

http://www.bayarea.com/mld/mercurynews/news/local/states/california/northern

_california/6571303.htm

Arnold Takes to the Airwaves with 60 Second Commercial

http://www.nytimes.com/2003/08/20/national/20SBOX.html

Schwarzenegger ad slick, short

on specifics

http://www.bayarea.com/mld/mercurynews/6572507.htm

Bustamante's budget relies on old ideas, big changes in state

law http://www.bayarea.com/mld/mercurynews/news/local/states/california/northern_

california/6570797.htm

1619- The first

Black slaves brought by the Dutch to the colony of Jamestown. The colonists

desperately needed workers for the tobacco crop. Europe was becoming “addicted “ to snuff and smoking tobacco in

a pipe, inhaling. The Indians had introduced the colonies to tobacco,

who were learning to grow and dry it. Europe was “mad” for the smoke and

snuff for gentlemen. John Rolfe writes in his diary, “About the last

of August came in a dutch man of warre that sold us twenty negars”

http://www.tobacco.org/History/Jamestown.html#aaBlacks

http://www.nps.gov/colo/Jthanout/AFRICANS.html

1704- the first

underground sewer in Boston was constructed by Francis Thrasher, at his

own expense. The move led to municipal regulations governing disposal

of refuse and garbage. By 1710, the selectmen of Boston were giving licenses

to private citizens for digging up streets for sewer construction. Now you may not think this is a big deal, but

think how waste

was removed in this time, most often just thrown raw into

the streets.

1785- Oliver Hazard

Perry, American naval hero, born at South Kingston, RI. Best remembered is his announcement of victory at the Battle of Lake Erie, September

10, 1824: “We have met the enemy, and they are ours.”

http://www.publicbookshelf.com/public_html/The_Great_Republic_By_the_Master_Historians_

Vol_III/Commodore_c.html

1794

Major General “Mad” Anthony Wayne routs Indians at Fallen Timbers, Ohio

http://www.heidelberg.edu/FallenTimbers/FTCommemorate.html

1813-African-American

Richard Allen chairs the first National Negro Convention in Philadelphia.

1833- Benjamin

Harrison, the 23rd president of the US, born at North Bend,

Ohio. He was the grandson of William

Henry Harrison, 9th president of the US. His term of office 1889-1893, was preceded and followed by the presidential

terms of Grover Cleveland ( who became the 22nd and 24th president

).

1845-Wilberforce

University established in Ohio, 1856

1866- the newly

organized National Labor Union called on Congress to mandate an eight-hour

workday. http://memory.loc.gov/ammem/today/aug20.html

1867-Anson Mills, brevet lieutenant colonel

in the Army, Fort Bridger, UT, was granted a patent for a new cartridge

belt. Moisture had previously

affected cartridge belts. Mills

invented a woven cartridge belt, and the machinery for making it, which

was adopted by both the army and Navy.

1905 –Jazz Trombonist/singer

Jack Teagarden Birthday

http://www.redhotjazz.com/tea.html

http://teagardenonline.com/bio01.htm

1911- “This message

sent around the world,” sent at 7pm from the New York Times

and received back at 7:16:30pm, traveling over 28,613 miles

via 16 relay stations

to become the first telegraph message sent around the world.

It was the front

page headline and quite an event for its era.

1912-After the

Japanese beetle invaded the East Coast and other diseases were affecting

agriculture, Congress passed a quarantine law for plants, directed against

dangerous plant diseases and injurious insect pests “ new to or not theretofore

widely prevalent or distributed within and through the United States.” Plants that could transmit white-pin, blister

rust or potato wart, and plants that might harbor the Mediterranean fruit

fly, were immediately affected. Other

species before the turn of the century

had been affected, such as the “mighty American chestnut

oak” that dominated the Northeast was basically extinct by this date.

http://ncnatural.com/NCNatural/trees/chestnut.html

1920- the first

radio station to be licensed was 8MK, owned by the Detroit News, which

began later instituted daily service with the program, “ Tonight’s Dinner.”

The call letters were changed later to WWJ.

1924-Birthday

of Jim Reeves, country music start, born at Galloway, Panola County, TX,

and died at Nashville,TN, July 31,1964, when the single-engine plane in

which he was traveling crashed in a dense fog. Reeve’s biggest hit was

“He’ll Have to Go.” (1959) and he was inducted into he Country Music Hall

of Fame in 1967.

1926-Birthday

of trombonist Frank Rosolino, Detroit, MI.

http://www.jazzcanadiana.on.ca/_ROSOLINO.htm

http://www.ita-web.org/competitions/rosolino/

1927-Birthday of

guitarist Jimmy Raney, Louisville, KY.

1931-Birthday

of drummer Frankie Capp,Worcester, MA.

http://www.centrohd.com/biogra/c2/frankie_capp_b.htm

1942-University

of Chicago scientist Glen Seaborg and his colleagues first weighed plutonium,

the first man made element.

1942-Birthday

of pianist/composer Isaac Hayes, Covington, TN

1944-Birthday

of drummer Terry Clarke, Vancouver, British Columbia.

1945- Tommy Brown

of the Brooklyn Dodgers became the youngest player in major league history

to hit a home run when he connected against pitcher Preacher Roe of the

Pittsburgh Pirates. Brown was 17 years, eight months and 14 days old.

1945-Woody Herman

Band records “Bijou.”

1954-Meteorologist/chef/author

bon vivant Al Roker born Brooklyn, NY.

http://www.alroker.com/bio.cfm

http://www.alroker.com/main.cfm

http://www.msnbc.com/onair/bios/a_roker.asp

1955---Top Hits

Rock Around the Clock - Bill Haley & His Comets

Hard to Get - Gisele MacKenzie

The Yellow Rose of Texas - Mitch Miller

I Don’t Care - Webb Pierce

1960- Connie Francis

began work on her first movie, "Where the Boys Are." She also

starred in the sequel, "When the Boys Meet the Girls."

1963---Top Hits

Fingertips - Pt 2 - Little Stevie Wonder

Blowin’ in the Wind - Peter, Paul & Mary

Judy’s Turn to Cry - Lesley Gore

Ring of Fire - Johnny Cash

1966-The thoroughbred

Buckpasser, owned by Ogden Phipps, won the Travers Stakes at Saratoga

to become the first 3-year-0ld to pass the $1 million mark in career earnings.

1967-the New York Times

reported on a new noise-reduction system for album and tape recording

developed by R. and D.W. Dolby. First used by a subsidiary of Elektra

Records, the Dolby noise reduction system became the industry standard.

1969 - Andy Williams

received a gold record for the album "Happy Heart" on Columbia

Records.

1971---Top Hits

How Can You Mend a Broken Heart - The Bee Gees

Mr. Big Stuff - Jean Knight

Take Me Home, Country Roads - John Denver

I’m Just Me - Charley Pride

1971- Texas Instruments,

Dallas, Texas introduced the first electronic pocket calculator.

It weighed about 2.5 pounds and cost $149.

It could add, subtract, multiply, and divide,

displaying the results in an LED ( light-emitting diode)

window.

1976-Gordon Lightfoot's

"The Wreck of the Edmund Fitzgerald," about an ore carrier which

sank on Lake Superior, was released as a single. The song, from the album

"Summertime Dream," made it to number two on the Billboard Hot

100

1977 - The song

"Best of My Love", by the Emotions, topped the pop charts. It

had a number one run of four weeks. http://www.70disco.com/emotions.htm

http://www.grooveentertainmentinc.com/emo.htm

1978-After 37

consecutive years, the Stan Kenton Band folds. “Peanut Vendor.”

http://www.gemlimited.com/kenton.htm

1979---Top Hits

Good Times - Chic

My Sharona - The Knack

The Main Event/Fight - Barbra Streisand

Coca Cola Cowboy - Mel Tillis

1986 - U.S. Census

Bureau officials reported that the U.S. population stood at 240,468,000

and the median age reached an all-time high of 31-1/2 years.

1987---Top Hits

I Still Haven’t Found What I’m Looking For - U2

Who’s That Girl - Madonna

Luka - Suzanne Vega

A Long Line of Love - Michael Martin Murphey

1989- About 20,000 people ended a week-long

20th anniversary celebration of the Woodstock Festival at the festival's

original site near Bethel, New York. They left behind a mountain of mud

and empty beer cans. The unsanctioned gathering had only one serious incident

- a stabbing. Folksinger Melanie was the only Woodstock veteran to show

up. She performed from a makeshift stage.

1993---Top Hits

Can t Help Falling In Love (From "Sliver")- UB40

Whoomp! (There It Is)- Tag Team

I m Gonna Be (500 Miles)- The Proclaimers

Slam-Onyx

1998- At Shea Stadium,

Cardinal first baseman Mark McGwire becomes the first player in major

league history to hit 50 home runs in three consecutive seasons. Mac's

seventh inning solo shot helps to defeat the Mets, 2-0.

2000 - Tiger Woods won the

82nd PGA Championship in Louisville, Kentucky. Woods birdied the last

two holes in regulation and won the championship in a playoff over Bob

May, becoming the first player since Ben Hogan in 1953 to win three majors

(Masters, U.S. Open, British Open) in one year. He was the first player

to win back-to-back PGA championships since Denny Shute in 1936 and 1937.

2000 -The winningest

pitcher in franchise history is honored by the Yankees during Whitey Ford

Day ceremonies at Yankee Stadium. The crafty lefty holds the team record

for victories (236) , innings pitched (3,170 1/3), strikeouts (1,956)

and shutouts (45).

2002 -A judge

issues a temporary restraining order preventing the sale of Barry Bonds'

600th career home run ball hit into the Pacific Bell Park stands on August

9. Jay Arsenault, who allegedly promised friends after being given a game

ticket to split any monetary gains if he caught the historic baseball,

has been ordered to appear in court for hearing on September 5 along with

the prized souvenir.

2002---Top Hits

Dilemma- Nelly Featuring Kelly Rowland

Hot In Herre- Nelly

Complicated- Avril Lavigne

Just A Friend 2002- Mario

Note

from the editor:

Carl

Moberg is a wireless provider of equipment, camera’s, broadcast, and other

equipment

across the United States, who’s business has grown, and from the beginning

maintained offices and shipping

facility here, originally trading it out for work on our internet server

and mail server, plus providing other expertise. When Maria Martinez-Wong

is out sick, or on vacation, as she is this week, he converts the text

to html, posts it

to

the website and sends to our HTML readers.

While he has much knowledge

on

this, it no longer is his main work, but he is picking up speed. He also

comes

in at 9am, whereas Maria comes in at 7am just to post Leasing News.

Give

him another day, and he will be quite up to speed.

Maria is back

on

Monday, and I think Carl is looking forward to it.

---------------------------------------------------------------------------------

|

|

|||||||||

|

www.leasingnews.org

Leasing News, Inc. 346 Mathew Street, Santa Clara, California 95050 kitmenkin@leasingnews.org |