Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists

Conferences |

Advertising | Archives

Columnists| Site Map

Contact: kitmenkin@leasingnews.org

![]()

Tuesday, March 3, 2026

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Story Credit Financing

Leases, Business Loans, SBA, Working Capital

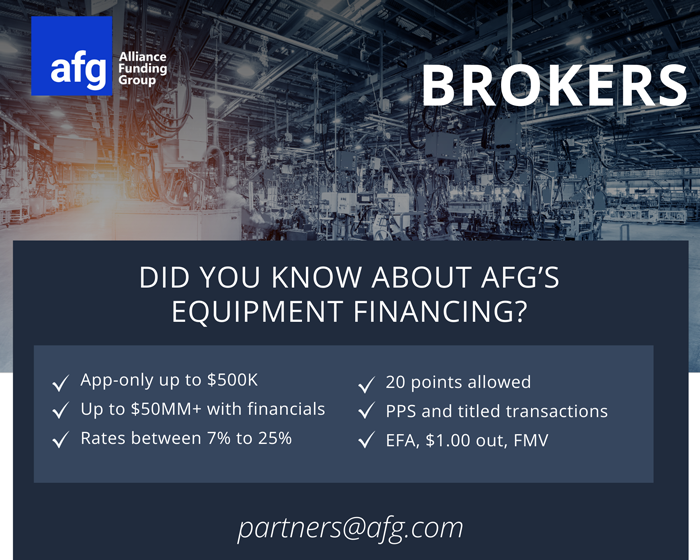

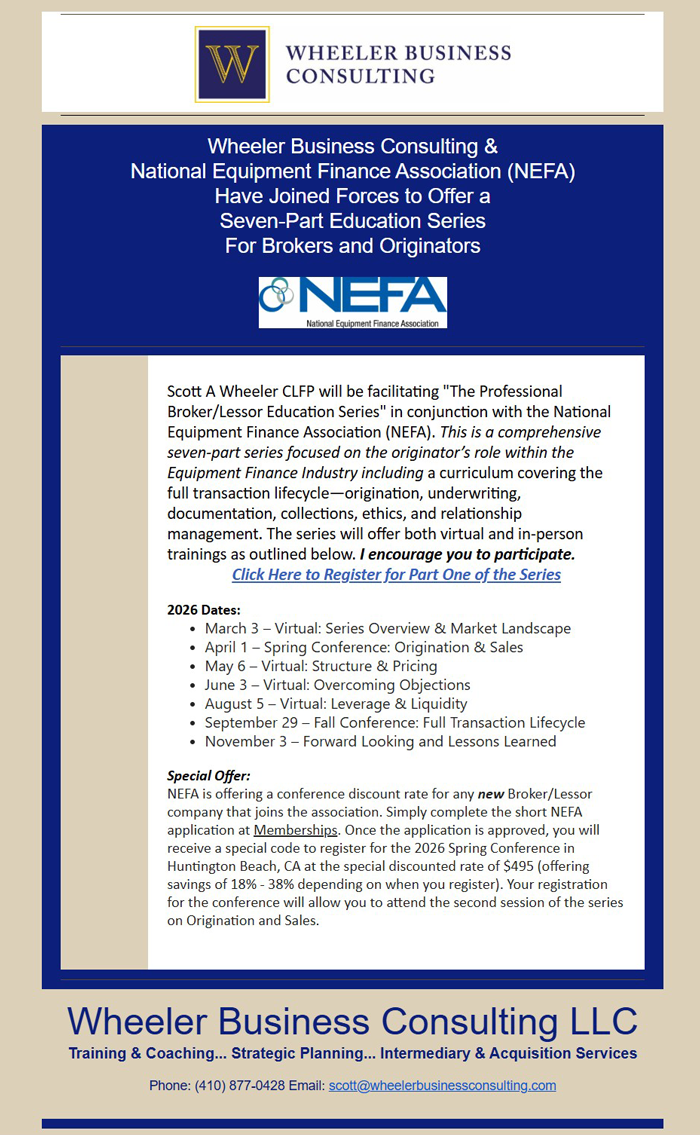

Wheeler Business Consulting

& NEFA Have Joined Forces

to Offer a Education Series For Brokers and Originators

Help Wanted Ad

Ameris Bank Equipment Finance

Your Career Will Always Mirror Your Standards

By Ken Lubin, Managing Director, ZRG Partners

Top Ten Leasing News Stories

February 24 – February 27

Leasing News Covers

Major Finance/Leasing Association Conferences

Register Now for Recommended Hotel

News Briefs

Trump says Iran war could last weeks, US citizens

in more than a dozen countries urged to leave

Trump says Iran operations are likely to last

4 to 5 weeks but could go longer

Jaime Dimon warns inflation could soar beyond

expectations as US, Israel strikes on Iran spark terror fears

Iran Is Shooting at Some of the

World’s Busiest Airports

Anthropic’s Feud With Pentagon Earns

It Fans Amid the Blowback

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Sean Garin was hired as SB Account Executive, Salesforce, Irvine, California. He is located in Huntington Beach, California. Previously, he was Senior Account Executive, LEAF Commercial Capital, Inc. (April, 2022 – February, 2026); Account Executive, Partners Capital Group (July, 2021 – April, 2022).

https://www.linkedin.com/in/sean-garin/

michael2026.jpg)

Michael Sica was hired as Partner Success Manager, PEAC Solutions, Mt. Laurel, New Jersey. He is located in Glendora, New Jersey. Previously, he was AVO National Vendor Sales Manager, Taycor Financial (February, 2025 - February, 2026). He joined Partner Success Manager, PEAC Solutions (January, 2024 - February, 2025); Vice President of Business Development, NFS Leasing (May, 2023 - January, 2024); Managing Member, Pondhawk Financial LLC (August, 2020 - May, 2023). Full Bio:

https://www.linkedin.com/in/michael-sica-8aaabb4/details/experience/

https://www.linkedin.com/in/michael-sica-8aaabb4/

Katie Sumner, CLFP, was hird as Senior Vice President of Sales, DLL, Cincnnati Metropolitan Area, where she is also located. Previously, she was Vice President of Business Development, Summit Funding Group, Inc. (June, 2025 - January, 2026). She joined Huntington National Bank March, 2020, as Equipment Sales Associate, promoted Equipment Finance Sales Executive (February, 2023 - June, 2025); PNC, February, 2014, Corporate Sales Development, promoted Associate Relationship Manager (April, 2018 - March, 2020); Executive Secretary to the CEO Vivid Tan, Indepednece, KY (October, 2013 - April, 2014).

Full Bio:

https://www.linkedin.com/in/katie-sumner-clfp-656b8b99/details/experience/

https://www.linkedin.com/in/katie-sumner-clfp-656b8b99/

Mike Winstead was hired as Northern Region Sales Manager, Stone Equipment Co., Inc Alabaster, Alabama. He is located in Greater Birmingham, Alabama Area. He previously was at Battle Horse Financial, starting January, 2022, Senior Vice President of Sales, promoted Chief Syndications Officer, January, 2023, promoted Chief Operating Officer (September, 2024 - February, 2026).

Key Account Manger, Caseworks of Alabama, Inc. (September, 2018 - January, 2022); Vice President, Sales, GSG Financial (April, 2017 - September, 2018); Operations Manager, Gray’s Roofing and Tree Service (June, 2016 - April, 2017). Full Bio:

https://www.linkedin.com/in/mike-winstead-15932769/details/experience/

https://www.linkedin.com/in/mike-winstead-15932769/

[headlines]

--------------------------------------------------------------

New Story Credit Financing

Leases, Business Loans, SBA, Working Capital

Those listed are responsible for updating; many have not. This is open to funder and non-funders, as well as the footnotes that explain their capabilities The full listing then will be available on the

main site listing and they are published once a month in Leasing News.

In this edition, the link to the listing and full notes follow. Starting in February, the full listing will only be in the site index. The list will be available that goes to the footnote. The new updates will be listed only by the link to the information in the Leasing News Monthly Edition.

To update your listing, address Rick Jones (rick@leasingnews.org.)

Full listing: https://leasingnews.org/Story_Credit/Story_Credit.htm

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Help Wanted Ad

Ameris Bank Equipment Finance

--------------------------------------------------------------

Your Career Will Always Mirror Your Standards

By Ken Lubin, Managing Director, ZRG Partners

One of the biggest truths in business — and in life — is that your career will always rise or fall to the level of your standards. Not your potential. Not your intentions. Not your résumé.

Your Standards.

Low standards attract low results.

High standards attract high opportunity.

It’s that simple…and that uncomfortable.

Because how you show up every day becomes your brand. People notice your patterns long before they hear your pitch or read your bio. They see how you respond, how you prepare, and how you approach the details. Those micro-moments create trust. Or they destroy it.

Your standards show up in ways most people overlook:

Your responsiveness — Do people know you’re reliable? Or are they waiting and guessing?

Your follow-up — Do you finish conversations and commitments? Or disappear?

Your preparation — Do you walk in ready? Or scramble at the last minute?

Your energy — Do you bring momentum into the room? Or do you drain it?

Your consistency — Are you a professional? Or a sometimes-performer?

You don’t build a successful career through occasional greatness. You build it through relentless consistency — doing the right things, the right way, every single day, even when no one is watching.

When you raise your standards, you raise your career.

When you tighten your habits, you tighten your trajectory.

When you demand more of yourself, the world eventually matches it.

If you’re not where you want to be, don’t ask what’s missing.

Ask where your standards have slipped — and raise them back up.

Your future will follow your standards. It always does.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

klubin@zrgpartners.com

C: 508-733-4789

https://www.linkedin.com/in/klubin

--------------------------------------------------------------

Top Ten Most Read

February 24 – February 27

(1) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Feb2026/02_24.htm#hires

(2) New Hires/Promotions in the Leasing Business

and Related Industries Industries

https://leasingnews.org/archives/Feb2026/02_27.htm#hires

(3) 2026 AACFB Annual Conference

Last Chance for Super Save Rates

Save $100, register before March

https://leasingnews.org/archives/Feb2026/02_27.htm#aacfb

(4) Asset Management in Equipment Finance Enters

a New Erra of of Data, AI, and Telematics

By Edward Castagna, ASA, CEA

https://leasingnews.org/archives/Feb2026/02_27.htm#asset

(5) New List for Gov't Leasing/Finance

Companies/Brokers who specialize with government

https://leasingnews.org/archives/Feb2026/02_27.htm#gov

(6) CapEx Finance Index January 2026:

New Equipment Demand Hit an All-Time High

https://leasingnews.org/archives/Feb2026/02_24.htm#capex

(7) We’re Hiring

Ameris Bank Equipment Finance

Remote Positions Available

https://leasingnews.org/#ads_help

(8) Top Originators Keep It Simple

By Scot Wheeler, CLFP

https://leasingnews.org/archives/Feb2026/02_24.htm#origin

(9) Have Some Fun!

By Ken Lubin, Managing Director, ZRG Partners

https://leasingnews.org/archives/Feb2026/02_27.htm#have

(10) Major Finance/Leasing Conferences

Updated

https://leasingnews.org/archives/Feb2026/02_24.htm#conf

[headlines]

--------------------------------------------------------------

Leasing News Covers

Major Finance/Leasing Association Conferences

Register Now for Recommended Hotel

Don Cosenza, CLFP, Senior Vice President, Maxim Commercial Capital, will cover the conference for Leasing News readers:

March 30-April 1, NEFA Spring Conference

Huntington Beach, CA

https://www.nefassociation.org/event/2026-spring-conference/

Randy Haug, LTi Technology Solutions, Leasing

Person of Year 2026 will be covering the conference for Leasing News readers ----

April 14-16, ELFA National Funding Conference

Chicago, Illinois

https://www.elfaonline.org/events/national-funding-conference

Leasing News coverage by Vicki Shimkus, CLFP, Leasing News Advisory Board, Finance, Brokers Relationship Manager, Ameris Bank Equipment

May 5–May 7

American Association of Commercial Finance Brokers

Hilton Orlando Lake Buena Vista, Disney Springs, Orlando, Florida

Don Cosenza, CLFP, Senior Vice President, Maxim Commercial Capital, will cover the conference for Leasing News readers: DeBanked Broker Fair Returns to NYC June 1, 2026 After 1,100 Turn-Out in Miami - https://brokerfair.org/Florida

Don Cosenza, CLFP, Senior Vice President, Maxim Commercial Capital, will cover the conference for Leasing News readers:

September 28-30, NEFA Fall Conference

Omni Atlanta Hotel at Centennial Park

https://www.nefassociation.org/event/2026-fall-conference/

Don Cosenza, CLFP, Senior Vice President, Maxim Commercial Capital, will cover the conference for Leasing News readers

October 21-23, AACFB Commercial Financing Expo

Hilton Irvine, Irvine, California

https://community.aacfb.org/events/event-description?CalendarEventKey=068b9817-3c58-4aaf-b21d-01999b13a2e4&Home=%2fevents%2fcalendar

Randy Haug, LTi Technology Solutions, Leasing News Person of the Year 2024, will cover for Leasing News Readers:

October 25–27, ELFA Annual ConferenceJW Marriott Desert Springs Resort & Spa, Palm Desert, CA

Online Scheduling Coming later.

[headlines]

--------------------------------------------------------------

News Briefs

Trump says Iran war could last weeks, US citizens

in more than a dozen countries urged to leave

https://apnews.com/live/iran-us-israel-hezbollah-strikes-03-02-2026

Trump says Iran operations are likely to last

4 to 5 weeks but could go longer

https://www.stltoday.com/news/nation-world/article_66c2aaf0-e85c-5e59-ab2a-5309f4c37c17.html

Jaime Dimon warns inflation could soar beyond expectations as US,

Israel strikes on Iran spark terror fears

https://nypost.com/2026/03/02/business/jaime-dimon-warns-inflation-could-soar-beyond-expectations-as-us-israeli-strikes-on-iran-spark-terror-fears/

Iran Is Shooting at Some of the

World’s Busiest Airports

https://www.wsj.com/world/middle-east/iran-is-shooting-at-some-of-the-worlds-busiest-airports-bb660b8e?st=HKBySM&reflink=desktopwebshare_permalink

Anthropic’s Feud With Pentagon Earns

It Fans Amid the Blowback

https://www.wsj.com/tech/ai/anthropics-feud-with-pentagon-earns-it-fans-amid-the-blowback-f7e2bb83?st=xxhCAF&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

In California, About the Only Way to Get a House Is to Inherit One

https://www.wsj.com/economy/housing/in-california-about-the-only-way-to-get-a-house-is-to-inherit-one-752fa87f?st=izHSkd&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Sports Briefs

In the shadow of the Super Bowl,

Great America slowly dies

https://www.sfgate.com/travel/article/super-bowl-great-america-21316236.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

Health care unions to end historic strike

at Kaiser Permanente Health care

https://www.sfgate.com/hawaii/article/best-resort-us-21924486.ph

‘High avalanche danger’ in backcountry Lake Tahoe area

as watch goes into effect

https://www.sacbee.com/news/weather/article314807292.html

After delays, Council expected to vote on

$6.4 million for Old Sacramento boardwalk

https://www.sacbee.com/news/local/article314809411.html

Hawaii and California dominate list of best resorts

in the US

https://www.sfgate.com/hawaii/article/best-resort-us-21924486.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

US wine exports slashed by a third on back

of Canada trade spat [ Over $428 Million

https://www.thedrinksbusiness.com/2026/02/us-wine-exports-slashed-by-a-third-on-back-of-canada-trade-spat/

How to understand the surge of

California winery closures

https://www.sfchronicle.com/food/wine/article/winery-layoff-closure-california-21362937.php

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Mar2023/03_03.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()