|

|

|

|

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Friday, November 12,2004

Headlines---

Classified Ads--- Asset Management

LMTFinancial Leaves Leasing

NorVergence Leasing Customers Respond to Fleming

ELFF Raises $340,000 for Industry Research in 2004

USS Preble to Return December 17th to San Diego

Classified Ads---Help Wanted

Cyence Wins Microsoft Program Impact Award

Edmunds.com Reports True Cost of Incentives

News Briefs---

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

American Football Poem

######## surrounding the article denotes it is a “press release”

|

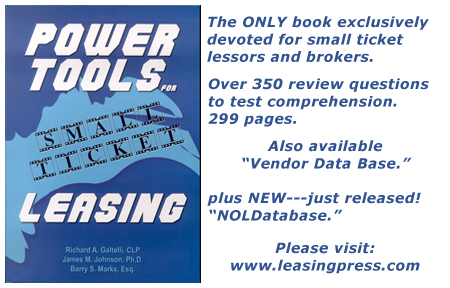

Your One stop solution for training and reference material for the Leasing Professional

|

Compiled by former banker, broker, lessor, president of United Association of Equipment Leasing, and active in the leasing business for almost thirty years.

Books and material include:

"Indirect Leasing Strategy,"

"Winning Leases with TValue 5.0,"

"Marketing the Equipment Lease,"

"The Guide Book of Leasing,"

"Documentation & Forms,"

"The Guide to Government Leasing,"

"Operating Leases: The Complete Guide,"

"International Leasing: The complete guide"

-------------------------------------------------------------------

Classified Ads--- Asset Management

Austin, TX.

20+ years exper. lease/finance. P & L responsibility, strong credit & collection management, re- marketing& accounting. Computers, construction, auto & transportation. Both commercial/ consumer portfolios.

Email: kmalone@austin.rr.com

Bloomfield Township, MI.

15+ yrs experience asset management and credit analyst.

Leadership and training skills. Audited returns, max residual, lease end and resale negotiator. E-mail: cmcozzolino@msn.com

Chicago, IL.

MBA, 15+ years exp. Long history of success in maximizing residual position through outstanding negotiation skills & lease contract management. Third party re-marketing, forecasting etc...

Email: jgambla@aol.com

Oxnard-Hollywood Beach, CA.

19 Years w/Equity Analysis/Placement and Residual Forecasting of Computer Assets. Portfolio Manager for Two Major Lessors and Strong Analyst Background w/Leading Information Services Firm.

Email: GregoryMLorenz@aol.com

Princeton, NJ.

Asset management/credit/collection 20+ years experience in equipment financing. Last five years in Asset Management including remarketing, end of lease negotiations, equipment and market evaluations

E-mail: bgaffrey@earthlink.net

Wilton, CT.

18 years exp. in IT and High Tech leasing industry. Residual forecasting, workouts, off- lease sales, mid-term restructures, auctions, all aspects of remarketing and equipment management.

Email: charrer@hotmail.com

View all jobs wanted at:

http://64.125.68.90/LeasingNews/JobPostings.htm

Post a free job wanted ad at:

http://64.125.68.90/LeasingNews/PostingForm.asp

[headlines]

Located in Phoenix, Arizona, LMTFinancial is leaving the equipment

leasing business to continue in its main business of investment banking. Under this program, fundings starts at $5,000,000 USD and typically ranges in the $50 Million to $250 Million range.

“We've been doing equipment leasing since 1996, "says Charles Loftus." The bottom line is that equipment leasing has many risks, both legal and financial. And frankly, there is an abundance of marginal to rotten credits applying for it. Contrast this to our Investment Banking business where we deal with much better credits and the amount received from a typical transaction is much higher.

“ It was a business decision to focus our resources where we get a better return and where we do a better job for our clients.”

lmtfinancial.com

----------------------------------------------------------------------

NorVergence Leasing Customers Respond to Fleming

In Wednesday's Leasing News, a copy of Michael Fleming, CAE, president of the Equipment Leasing Association, letter to the editor of the New Jersey Star Ledger regarding the NorVergence debacle was printed.

http://www.leasingnews.org/archives/November%202004/11-10-04.htm#ela

It was also noted 41 leasing companies have been named in the various law suits.

http://www.leasingnews.org/archives/November%202004/11-10-04.htm#norv

In reality, according to the poll of members on the Yahoo list serve, there were 58 leasing companies who leased NorVergence contracts.

The next bankruptcy hearing on the matter is November 30; however, the judge has given all until the end of the year to make all claims.

In the Yahoo List Serve, many of the 863 members expressed their viewpoint on Mr. Fleming's letter to the Star Ledger, and asked us to print their side. Also included are some earlier comments that readers in the leasing business may be interested to learn

( the withholding of names was Leasing News's choice):

The biggest fallacy in Michael Fleming's argument is:

"The problems related to equipment they no longer need would be the same whether the customer had leased, bought for cash, or borrowed money to buy the equipment."

The Norvergence Fraud was based on deception about the Lease of the equipment. If they had been straightforward about this box costing $10,000 - $50,000 - if it had been quoted as such and there was the option to lease, or buy for cash or borrow from a bank of your choosing - THERE WOULD HAVE BEEN NO SALES! The entire NorVergence business plan was based on deceptively hiding that there was a 60 month lease for $10k-$50k! The Screening Managers have said this. Michael Fleming and the ELA have their heads in the sand by blaming the victims for the fraud.

(name with held )

Mr. Fleming is correct that equipment leasing is a critical financing tool for small businesses. I have multiple leases on real equipment of value. But they were done upfront - we knew exactly what we were purchasing and the cost of the equipment and the financing were straightforward and negotiated in GOOD FAITH - not deceptively buried and then fraudulently separated from a telecom service contract.

The "Norvergence matter" as Mr. Fleming benignly calls it, is ALL ABOUT Leasing - trying to say otherwise will not fly with the customers or the FTC or the AG's. Keep fighting. Keep writing. If Mr. Fleming's letter to the editor gets printed, we need the NJ customers to send rebuttals to the paper - lots of them. But it's a good sign that the ELA felt a need to write this. We must not rest - the more negative publicity the better. Carry on!

(name with held )

Thanks for the article and responses, but this is nothing more than a fine piece of "Spinning" done by the leasing industry, with a major amount of inaccuracies, of course, to favor the poor leasing companies. As examples, stated below:

“The Norvergence matter is not an issue about leasing. It is about a business that sold a service that they were not able to deliver. Unfortunately, many Norvergence customers leased the equipment necessary to make the service work. The problems related to equipment they no longer need would be the same whether the customer had leased, bought for cash, or borrowed money to buy the equipment. (quote from Fleming letter.)

The Norvergence customer base had no option to buy the equipment. It was part of a service/equipment proposal. I asked to buy the equipment. I was told it could not be done. And, what happened to the section within the agreements that showed that the leasing companies would take over servicing the "complete" telecom needs of the lessees if Norvergence went bankrupt? “In the Norvergence matter, NorVergence customers selected the equipment and signed acceptances that they received the equipment and the equipment worked. ( quote from Fleming letter.)

Again, this is just not true, and I am sure Mr. Fleming knows that. The Norvergence customer was told what was going to be supplied and had no ability to select the equipment, what kind, how much and with what capabilities the equipment had. This was "presented" to customers as part of their "deal", the service/equipment package. The customers were additionally "duped" into signing delivery and acceptance documents, thinking they were signing for any package delivered by UPS, Fed EX or other delivery service, not knowingly agreeing to the functionality of said equipment, as most was not installed to evaluate whether it really worked or not.

The lessors did not select the equipment or make judgments that it was the appropriate equipment for the business.( quote from Fleming letter.)

But the leasing companies did know that they were leasing the same equipment to may different customers for wide varying prices, not a common practice in the industry, let alone legal.

As stated above, this response is so one sided and inaccurate, that the New Jersey Star ledger needs to hear the Lessee side as well. We can not allow a mouthpiece to the lease industry get away with sure falsehoods to protect themselves from any fault. Shame on them!!!

(name with held )

I suppose the ELA also condones filing lawsuits for failure to make lease payments, when in fact all lease payments have been made. Do they also condone NO prior communication from a leasing company before a lawsuit is filed?

(name with held )

Embedded in the second paragraph by ELA President Michael Fleming is the core problem that I have with this whole thing. He states that the Norvergence matter is not an issue about leasing...I agree wholeheartedly! So why are leasing companies involved?

He goes on to state that it is about a business that sold a "SERVICE" that they were not able to deliver...My question is simply, How did that "SERVICE CONTRACT" that we signed get translated or transferred into an "EQUIPMENT LEASE" to begin with? All of the comparable analysis information that we were given by our salesman initially was based on our then current phone service information that we were asked to provide as the basis of cost comparison.

As a side note, we have recently returned our "PHONE SERVICE" contract back to our original phone service vendor, signed up for a new 5 year "PHONE SERVICE CONTRACT" and I don't expect a leasing company to get involved because it is for "PHONE SERVICE" just as the Norvergence sales pitch was also made.

As you must now know, many other variables entered into that original "PHONE SERVICE AGREEMENT" that we business owners originally signed to. Among them was an agreement that we were to get blazing fast internet services through a new high speed T-1 line, carrier neutral cell phones with free roaming, $.00/per minute usage, and yearly upgrades if requested. I don' t know of any "EQUIPMENT LEASES" out there that allow you to upgrade your equipment yearly without renewing the paperwork and would you really need an equipment lease for a T-1 line and cell phones? There was also a free 800 and free 800 fax number, for the businesses to consider and so on. If interested, you can read my previous post on November 3 for a more detailed list of "PHONE SERVICE PROMISES" that were made by this company. I remain convinced that this "PHONE SERVICE CONTRACT" was misrepresented at the very least to the business owners. I maintain that I would have had no other reason to leave my current phone service provider to pursue an equipment lease in an industry that offers new technology every day. To lock up my phone equipment options for a period of 5 years without the possibility of upgrade would be foolish. That would be the equivalent of securing a bag phone equipment lease and the current technology is portable picture phones. This point is something that I was quick to point out to my Norvergence sales rep. It noted that Norvergence would match any competitors offer during the life of the service contract. Again, "THAT DOESN'T SOUND LIKE THE TERMS OF AN EQUIPMENT LEASE TO ME"

(name with held )

If 1 or 2 people make a mistake so then it is sour grapes. They should have taken more care. When 11,000 people start complaining, that's not sour grapes. That is a problem of great dimensions and consequences. I am certain that the leasing companies know how small business feels. By the way, when was the last time you purchased FIRESTONE or BRIDGESTONE tires for your car?

(name with held )

Most importantly there doesn't have to be any deep discussion about why the now "embarrassed" LC's didn't do a more comprehensive job checking Norvergence out. Obviously they knew what was going on. As I said before, this fact is the LC's biggest problem. Not yet, but later. Right now their attention is getting all the money back they can before the injunctions start being enforced. But at some point in time this is going leave the realm of who owes who what and head into criminal proceedings. I guarantee it. Please remember, when it is proven that the LC's had knowledge of NorVergence situation, and still continued to accept leases, that becomes criminal on a very large scale no different than Enron, or the rest.

(name with held )

I do not profess to have all the answers, but I do know one thing...the leases will be found to be based upon "fraud." This is the number one issue that faces the victims. The victims are also the Leasing Companies. I feel for them as much as I do myself. I was an early victim. I actually had service: 2 cell phones with unlimited talk time, "free" long distance on one of my 4 lines and Norvergence actually was re-imbursing me for my Comcast high speed internet access. At no time was the "matrix" a part of my "solution." This is what I am being sued for: a $100.00 router to the tune of $11400.00+.I was a happy customer until June 2004. Then the checks stopped, the service was cut off and I stopped paying my bill. My bill for service. I never signed anything that would obligate me to pay for a "box" without service. At least as far as I knew. I am not the smartest person out there, but I have managed to build a successful business out of nothing, like many of the my fellow victims out there.

If I could only ask you one thing, it would be: What do you see as the best way out of this whole mess for both parties? I truly believe that the Leasing Companies will suffer beyond the loss of lease income if they peruse the collection of money.

( name with held )

The people that perpetrated this crime did a lot of research before crafting a plan that would take advantage of small business people that do not have the time or money to consult there attorney every time they change there phone service. That is what they thought they were doing (changing phone service providers) not leasing equipment.

These guys are con artists. The contracts that they tricked everyone into signing are fraudulent plain and simple. The bank that is holding fraudulent paper has no more rights than the company that sold it to them once fraud has been proven.

( name with held )

I have run a telecommunications company for 20 years, and have used equipment leasing and sold same to my customers. What elides me, if indeed the leasing companies are not culpable in this situation, is that typically, it has been my experience that most leasing companies want to know the wholesale cost of the equipment being leased, and impose a limit on the mark-up. If that is indeed common practice, than it would seem that the leasing companies involved would have to have known that the prices for this equipment was being grossly inflated. If it is not a widespread practice to establish some sort of loan to value ratio for the equipment, that a reasonable person would have to ask why not.

Steve Gelmis, President

Public Interest Network Services Inc.

50 West 17th St, 9th Fl.

New York, NY 10011

212 479-1700 tel

212 479-1799 fax

---

I have been after my County, which collects personal property taxes for ****, for more than a month to confront De Lage Landen's declared value of ****** for my compute router.

De Lage Laden claims that the value of the equipment is equal to their cost of the lease, i.e.,******

I have requested that the County reduce the cost from ***** to the actual cost of less than $400. Even though I have sent them to a website showing that the actual cost of buying my matrix new is only a few hundred dollars, the County has refused to make changes -- indicating that De Lage Landen must make the change. De Lage Landen flat out refuses to make any changes even though the actual equipment costs are minimal in the actual lease. Almost all of the lease's value represents pre-paid telecommunications and internet service.

( name with held )

Didn't I read in your articles that several other leasing guru's stated the leasing companies should have seen through this. I have spoken with several leasing industry people and actually have asked them to help with legislation so the many don't suffer for the few. They stated that the leasing carriers just didn't care to look at Norvergence. They blame us for not doing the due diligence that they didn't do on their own affiliate. By the way, I never saw or spoke to anyone from my leasing companies.

( name with held )

Leasing News has heard the former president of the United Association of Equipment Leasing Bob Rodi called many things, but now we can call him a “guru.” Seriously, let's leave this article with the quote the gentleman above is referring to:

“Ethics, in this business or any other, is largely a personal decision. I used to think that, as an industry or through our affiliations with associations, that we could somehow "force" ethics upon other members of our industry. I realized how wrong I was about that. As a business person you either have ethics or you don't. If you are competing against people who don't have good business ethics then shame on you if you can't turn that against the competitor and into a positive for you. Instead of whining about how unethical your competitors are, use your ethics and good character to uncloak these characters and beat them on the street.

“Lastly, it never ceases to amaze me that funding sources know that these practices take place yet continue to preach about representations, warranties and ethics. The biggest and most respected names in the business are always associated with the worst players. As a prime example, look at this list of lenders that were lined up to get a piece of the Norvergence business. I can't be the only one in this industry that is still amazed by this even if I have become numb to it after all these years.”

Bob Rodi, CLP

President

LeaseNOW, Inc.

drlease@leasenow.com

www.leasenow.com

1-800-321-LEASE (5327) x101

--------------------------------------------------------------------

"Equipment Leasing & Finance Foundation Raises $340,000

for Industry Research in 2004 "

ELTnews

The National Development Committee for the Equipment Leasing & Finance Foundation, charged with the responsibility of coordinating the resource development initiatives of the organization, including the Foundation's 2004 Annual Campaign, is pleased to announce that their efforts are yielding major results. More than 75 percent of the industry's largest companies have agreed to participate in underwriting the Foundation and its products. More than 50 percent of small to mid-size companies are showing their support as well. Jim Renner, Chairman, National Development Committee recently announced the Foundation has raised more than $340,000 for industry research in 2004.

The Foundation has a bold vision for the future - and the future includes you. We want to develop additional studies in areas such as:

• Operation excellence and discipline

• Diversity in the workplace

• Knowledge to help enhance relationships among leasing organizations, equipment manufacturers, dealers and distributors

• Studies on In-house vs outsourced portfolio servicing options.

• Research and analysis on the effect of lowered tax rates on the leasing industry.

• Active Lease Impairment Analysis

• Off Shore Issues and Trends. Everything you need to know BEFORE you take business off shore?

The Foundation not only offers products that are unique and relevant to the strategic planning, forecasting and development of lessors, but it also offers a number of unique opportunities.

Donating to the Foundation is an opportunity to give back to the industry and donors are helping to secure the continued and future health, stability and growth of the industry. To donate, visit

www.leasefoundation.org/donors/.

Read More:

http://www.LeaseFoundation.org/positive/index.cfm?fuseaction=

display_article &artID=5200

|

------------------------------------------------------------------------

USS Preble to Return December 17th to San Diego, California

A picture I have on my desk when my son Dash graduated from the Great Lakes, Illinois USS Navy Training Facility.

The USS Preble ( Arleigh Burke Destroyer DDG-88), left it's homeport of San Diego May 27 as part of the USS Belleau Wood Expeditionary Strike Group, deployed to the western Pacific Ocean and the Central Command Area of Responsibility in support of the global war on terrorism. Recently they have been off the coast of Kuwait guarding the Abot Oil Refinery.

I received my Christmas present early this year. Dash sent me an e-mail they will back in home port on December 17 th , first visiting some ports along the way back, including a five day leave in Hawaii. This was an original six month trip and I am very much looking forward to seeing him again. I told him he doesn't have to buy me a Christmas present this year as his being home ( back in the United States) was the best he could give me.

My son was also mentioned in the USS Preble Newsletter, the Commodore:

“Electrical division put in many long hours during the port visit to Jebel Ali, and has upheld a high level of intensity throughout the month of October. Once again, Petty Officer Second Class Dash Menkin steals the thunder for the division. He was pinned as an Enlisted Surface Warfare Specialist and qualified as Electric Plant Control Console operator. Everyone else is doing well and looking forward to being home for the holidays.”

http://leasingnews.org/PDF/TheCommodoreOctober2004.pdf

-----------------------------------------------------------------

Classified Ads---Help Wanted

Account Representative

BALTIMORE-BASED ACCOUNT REPRESENTATIVE - In this position, you will develop and maintain relationships with lease brokers, leasing companies, equipment vendors and direct leases throughout Maryland and Virginia. Must be knowledgeable in indirect/third party transactions ranging $15K and up. |

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

National Account Manager

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Senior Underwritter

|

Vendor Account Executive

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

Help Wanted Advertising Rates

$400.00 minimum for four lines (Lines 1 - 4)

Larger Ads

$50.00 per line: the next four lines (Lines 5 - 8)

$25.00 per line there after (Lines 9 & up)

-Company logo is not included in the linage count, company logo is FREE

Also Free: Description of your company (company description can not have more lines than your ad)

Here are examples of ads by size:

http://www.leasingnews.org/Classified/examples.htm

### Press Release#######################

CYENCE INTERNATIONAL WINS CHANNEL BUILDER AWARD IN MICROSOFT PARTNER PROGRAM IMPACT AWARDS

BURLINGTON, ONTARIO, CANADA--Cyence International Inc. has once again been recognized as a leader in collaborative solutions. Last night, Microsoft® presented Cyence International Inc. with the Channel Builder Award at the 2004 Microsoft Partner Program IMPACT Awards gala.

The second annual IMPACT Awards recognize excellence across the large and diverse community of Canadian resellers and solution providers. The Channel Builder Award acknowledges companies who have built successful business partnerships. The scope of the business challenge faced, creativity and innovation involved in the solution, and overall impact from the solution's implementation are all factors considered in determining a winner.

“We are pleased to honour Cyence International as a winner in the 2004 Microsoft Partner Program IMPACT awards. Our technology partners are true leaders in their fields, successfully delivering to customers what they need when they need it,” said Lora Gernon, Director of Partner Sales, Microsoft Canada Co. “With our annual IMPACT Awards, we celebrate our top technology partners who have demonstrated innovation and shown true dedication in providing superior support and service to customers.”

The award was a great honour Cyence International, who has enjoyed a mutually-beneficial, nine-year strategic business relationship with Microsoft®.

“This award strikes at the heart of our company philosophy, which stresses maximizing customer delight through effective collaboration,” said CEO of Cyence International, Peter Hyne. “The Cyence/Microsoft partnership has achieved a dominant position in the leasing domain.”

This is not the first time Cyence has been recognized for its excellence. In 2002, Cyence was presented with the “.NET Award of the Year” at the Microsoft Canada Innovation Awards for its innovative use of the .NET suite of products. The Burlington-based company is also a founding member of the Circle of Excellence, a recognized group of technology providers that have combined their best-of-breed capabilities to provide innovative solutions to the equipment leasing industry.

About the Microsoft Partner Program IMPACT Awards

In 2003, Microsoft Canada replaced all of its previous technology partner awards with a unified program that also recognizes customer service, marketing, and contribution to the community. This year Microsoft Canada added seven new award categories to highlight its new Partner Program competencies, for a total of 32 awards honouring achievements from top partners.

Microsoft Partner Program IMPACT Awards were open to Systems Integrators, Large Account Resellers, Direct Market Resellers, Value Added Resellers, Distributors, Systems Builders, Authorized Education Resellers, Certified Partners for Learning Solutions, Microsoft Certified Partners, Independent Software Vendors, Channel Suppliers, Microsoft Business Solutions (MBS) Partners and Original Equipment Manufacturers.

About Cyence International Inc.

Cyence International Inc. is a leading provider of Web Services software solutions for the world's banking, manufacturing, and equipment finance markets. Its software solutions, ExpressOS™ and ExpressCS™, imbed industry best practices and enable real-time, online collaboration in the end-to-end finance process.

From Origination to Credit Adjudication, Document Management to Auditing, Funding, and Booking, the Cyence solution has everything needed to streamline financial transactions and achieve operational excellence. For more information, visit www.cyence.com.

### Press Release ######################

Edmunds.com Reports True Cost of Incentives: Incentives Drop, Domestic Automaker Market Share Falls to Record Low

SANTA MONICA, Calif., -- Edmunds.com (http://www.edmunds.com), the premier online resource for automotive information, reported today that the average manufacturer incentive per vehicle sold in the United States was $2,655 per vehicle sold in October 2004, up $134, or 5.3%, from October 2003, and down $491, or 15.6%, from September 2004.

Edmunds.com's monthly True Cost of Incentives(SM) (TCI(SM)) report takes into account all of the manufacturers' various United States incentives programs, including subvented interest rates and lease programs as well as cash rebates to consumers and dealers. To ensure the greatest possible accuracy, Edmunds.com bases its calculations on sales volume, including the mix of vehicle makes and models for each month, as well as on the proportion of vehicles for which each type of incentive was used.

Overall, combined incentives spending for domestic Chrysler, Ford and General Motors nameplates was $3,663 per unit in October, down $616 from September 2004. Chrysler lowered incentives spending in October by $133 to $3,644 per vehicle and gained 1.0% market share, achieving 12.8% in total. Ford decreased incentives spending by $637 to $3,410 per vehicle, and gained 0.3% market share, achieving 18.4%. GM had the most dramatic drop in incentives spending in October, down by $735 to $3,858 per vehicle. GM experienced a steep 6.0% decrease of its U.S. market share, falling to 25.3%, which is its lowest point since September 2002.

As a result of GM's decrease, total U.S. market share for domestic nameplates fell to 56.5%, the lowest in recorded history.

In October 2004, Korean automakers reduced incentives spending by $22 to average $2,185 per vehicle while European automakers reduced incentives spending by $167 to average $2,330 per vehicle sold. Japanese automakers spent $929 per vehicle sold in August, up slightly from $911 the prior month.

"Most manufacturers did not have to rely on incentives as heavily this month since they were selling more 2005 model year vehicles," said Dr. Jane Liu, Vice President of Data Analysis for Edmunds.com. "Also, consumers realize that 2005 models will hold their value longer than their 2004 counterparts, and are willing to pay more for them."

Of all brands, Mini spent the least on incentives, $12 per vehicle sold, while Scion spent only $73 and Lexus spent just $167. At the other end of the spectrum, Lincoln was the biggest spender in October at $4823 per vehicle sold, followed by Saab at $4,566 and Jaguar at $4,345.

Among vehicle segments, large SUVs continued to offer the highest average incentives, $4,680 per vehicle sold. Other segments with high incentives were large trucks at $3,373 and large cars at $3,258. Compact cars had the lowest average incentives at $1,449 per vehicle sold, followed by luxury sports cars at $1,880 and luxury SUVs at $1,933.

"In most cases, vehicles with high sticker prices tend to have correspondingly high incentives, but the luxury sports car and luxury SUV segments are selling without much money on the hood," observes Dr. Liu. "Products in those segments are very desirable right now, even as fuel prices fluctuate."

Midsize cars have lost the most market share since October 2003, decreasing from 16.6% to 15.6%, while large cars have gained the most market share during that period, up from 4.2% to 5.8% of the U.S. new vehicle market.

About Edmunds.com True Cost of Incentives(SM) (TCI(SM))

Edmunds.com's TCI(SM) is a comprehensive monthly report that measures automobile manufacturers' cost of incentives on vehicles sold in the United States. These costs are reported on a per vehicle basis for the industry as a whole, for each manufacturer, for each make sold by each manufacturer and for each model of each make. TCI covers all aspects of manufacturers' various incentives programs (except volume and similar bonus programs), including dealer cash, manufacturer rebates and consumer savings from subvented APR and lease programs (including subvented lease residual values used in manufacturer leasing programs). Data for the industry, the manufacturers and the makes are derived using weighted averages and are based on actual monthly sales and financing activity.

About Edmunds.com, Inc.

Edmunds.com is the premier online resource for automotive information. Its comprehensive set of data, tools and services, including Edmunds.com True Market Value(R) pricing, is generated by Edmunds.com Information Solutions and is licensed to third parties. For example, the company supplies over 800,000 pages of content for the auto sections of AOL and NYTimes.com, provides weekly data to Automotive News and delivers monthly data reports to Wall Street analysts. Edmunds.com was named "best car research" site by Forbes ASAP, has been selected by consumers as the "most useful Web site" according to every J.D. Power and Associates New Autoshopper.com Study(SM) and was ranked first in the Survey of Car-Shopping Web Sites as reported by The Wall Street Journal. The company is headquartered in Santa Monica, Calif. and maintains a satellite office outside Detroit.

SOURCE Edmunds.com, Inc.

#### Press Release ###################

-------------------------------------------------------------

News Briefs---

Mortgage rates climb amid encouraging signs of economic traction

http://www.signonsandiego.com/news/business/

20041111-0922-mortgagerates.html

Venture-Backed Mergers & Acquisitions Q3 ‘04

http://www.nvca.org/pdf/M&AQ32004.pdf

Dell Profit Rises 25% as Sales Beat Growth Rate for Industry

http://www.nytimes.com/2004/11/12/technology/

12dell.html?oref=login&pagewanted=all

Digital Passports a Draw in the Middle East

http://www.internetnews.com/bus-news/article.php/3434841

Report: Challenging IT in 2005

http://www.internetnews.com/bus-news/article.php/3434601

---------------------------------------------------------------

Sports Briefs---

Martz declares its his way or the highway

http://www.belleville.com/mld/belleville/sports/10152222.htm

Moss officially out for Green Bay game

http://www.theredzone.org/news/showarticle.asp?ArticleID=1870

Favre takes all the snaps, says sore hand is better

http://greenbaypressgazette.packersnews.com/archives/

news/pack_18578772.shtml

Realistically, Tedford isn't long for Cal

http://www.mercurynews.com/mld/mercurynews/sports/

colleges/cal/10153155.htm

Four Share Tournament of Champions Lead

http://www.nytimes.com/aponline/sports/

AP-GLF-LPGA-Tour.html

Mauresmo Makes Crushing Start, Williams Posts Second Win

http://www.nytimes.com/reuters/sports/

sports-wta-championships.html

------------------------------------------------------------------

California Nuts Briefs---

Schwarzenegger opens trade promotion tour in Japan

http://www.sanluisobispo.com/mld/sanluisobispo/10157105.htm

Governor shines star power on lucrative Japanese market

Schwarzenegger markets California

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/

2004/11/12/SCHWARZENEGGER.TMP

--------------------------------------------------------------

“Gimme that Wine”

Push-button pours

Retail wine 'automat' lets customers dispense their own samples from machines

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/

2004/11/11/WIGAL9MSSC1.DTL

Boston Wine Festival Tickets On Sale November 15 th

http://biz.yahoo.com/prnews/041111/neth026_1.html

Utah gov-elect questions state's strict liquor laws

http://www.azcentral.com/news/articles/1111wst-utahguv11-ON.html

Great red hope found at Coco Farms, Japan

http://www.japantimes.co.jp/cgi-bin/getarticle.pl5?fg20041112wc.htm

-----------------------------------------------------------

This Day in American History

1701- The Carolina Assembly passed a Vestry Act making the Church of England the official religion of the Carolina Colony. (Strong opposition by Quakers and other resident Nonconformists forced the colony's proprietors to revoke their legislation two years later.)

1751- Margaret Molly Corbin birthday, revolutionary war hero who was near her husband at a battle when he was killed (women were on the battlefields of the war both as participants and as water, food, and munitions suppliers) and she immediately took over the cannon until she was wounded by enemy fire. Disabled, she lost the use of her left arm, she was granted a soldier's half- pay as a pension, was considered a full member of the military until mustered out in 1783. Margaret Corbin was listed on military rolls until April 1783. In 1926, the Daughters of the American Revolution had her remains moved from an obscure grave and re-interred with other soldiers behind the Old Cadet Chapel at West Point where they also erected a monument to her. Near the place of the battle, in Fort Tryon Park in New York City, a bronze plaque commemorates Margaret Corbin "the first American woman to take a soldier's part in the War for Liberty".

http://www.muzzleblasts.com/Vol3No4/Articles/MBO34-3.htm

http://www.awm.lee.army.mil/Army_Women_Notable/margaret_corbin.htm

http://www.hhoc.org/hist/

http://www.thejukejoint.com/cabcalloway1.htmlmc_corbin.htm

http://www.distinguishedwomen.com/biographies/corbin.html

1775 -General Washington forbids recruiting officers enlisting blacks who were not “free men.” He later rescinds this as many blacks enlist in the British Army to earn their freedom from slavery.(Washington was from Virginia and was one of the largest land owners and slave owners in the state. As a side note, his best friends included the father of Robert E. Lee, who was to become a Confederate general. Henry Lee was to be the main drafter of the Declaration of Independence as he was very popular, very well respected and educated, but due to a family emergency at his farm, he suggested Thomas Jefferson fill his stead. Coda: In the 1800's, Washington freed many of his slaves, who continued to work the land as “free men” and after his death granted land to those remaining.

http://www.americanrevolution.org/blk.html

http://www.mountvernon.org/education/slavery/

1815- birthday of Elizabeth Cady Stanton; American woman suffragist and reformer, Elizabeth Cady Stanton was born at Johnstown, NY. “We hold these truths to be self-evident,” she said at the first Women's Rights Convention, in 1848, “that all men and women are created equal.” For 54 years she was the women's rights movement's principal leader, organizer, theorist, and writer. Preserved the early women's movement her story in the first three volumes of the monumental History of Woman Suffrage (1881-1922) written along with Susan B. Anthony and Joseyln Gage. She died at New York, NY. Oct 26,1902 You can read some of Stanton's works in the WiiN Library:

http://www.undelete.org/library/library.html

http://www.womenshistory.about.com/library/bio/blstanton.htm

http://www.nps.gov/wori/ecs.htm

http://www.pbs.org/stantonanthony/.

http://memory.loc.gov/ammem/today/nov12.html

1864- Union General William T. Sherman orders the business district of Atlanta destroyed before he embarks on his famous March to the Sea.When Sherman captured Atlanta in early September 1864, he knew that he could not remain there for long. His tenuous supply line ran from Nashville, Tennessee, through Chattanooga, then one hundred miles through mountainous northern Georgia. The army he had just defeated, the Army of Tennessee, was still in the area and its leader, John Bell Hood, swung around Atlanta to try to damage Sherman's lifeline. Of even greater concern was the Confederate cavalry of General Nathan Bedford Forrest. Forrest was a brilliant commander who could strike quickly against the railroads and river transports on which Sherman relied. During the fall, Sherman conceived of a plan to split his enormous army. He sent part of it, commanded by General George Thomas, back toward Nashville to deal with Hood while he prepared to take the rest of the troops across Georgia. Through October, Sherman built up a massive cache of supplies in Atlanta. He then ordered a systematic destruction of Atlanta to prevent the Confederates from recovering anything once the Yankees had abandoned the city. By one estimate, 37 percent of the city was ruined. This was the same policy Sherman would apply to the rest of Georgia as he marched to Savannah. Before leaving on November 15, Sherman's forces had burned the industrial district of Atlanta and left little but a smoking shell. In retaliation, the Confederates attempt to burn New York City on November 25 th (more on this on November 25 th ) As a side note: Historians

believe much of the destruction of Atlanta was also caused by Confederate soldiers leaving no supplies for the invading Union Army, causing fires in residential areas.

http://memory.loc.gov/cgi-bin/query/D?cwar:1:./temp/~ammem_azzd:T19 :

http://memory.loc.gov/cgi-bin/query/D?cwar:3:./temp/~ammem_azzd:T19 :

http://memory.loc.gov/cgi-bin/query/D?cwar:16:./temp/~ammem_azzd:T19 :

http://memory.loc.gov/cgi-bin/query/D?cwar:6:./temp/~ammem_azzd:T19:

http://memory.loc.gov/cgi-bin/query/D?cwar:6:./temp/~ammem_azzd:T19:

http://memory.loc.gov/cgi-bin/query/D?cwar:6:./temp/~ammem_azzd:T19:

http://memory.loc.gov/cgi-bin/query/D?cwar:6:./temp/~ammem_azzd:T19:

http://memory.loc.gov/cgi-bin/query/D?cwar:6:./temp/~ammem_azzd:T19:

http://memory.loc.gov/cgi-bin/query/D?cwar:7:./temp/~ammem_azzd:T19 :

http://memory.loc.gov/cgi-bin/query/D?cwar:9:./temp/~ammem_azzd:T19 :

http://memory.loc.gov/cgi-bin/query/r?ammem/mcccartes:

@field(DOCID+@lit(mcccartes/039135f ))::

1892-William “Pudge” Heffelfinger became the first generally-acknowledged professional football player when he was paid $25 for expenses and a cash bonus of 4500. It was the cash bonus that made him professional. Scoring the winning touchdown for the Allegheny Athletic Association, he helped his team beat the Pittsburgh Athletic Club, 4-0.

1898-Birthday of Flora Belle Ludington, innovative librarian of Mount Holyoke College who advanced the cooperative Inter-library system that allows students and researchers use of the entire library system of the United States.

1906 - The mercury soared to 106 degrees at Craftonville, CA, a November record for the U.S

1911-Trumpet player Buck Clayton birthday

http://www.harlem.org/people/clayton.html

http://www.umkc.edu/lib/spec-col/clayton.htm

http://www.harlem.org/people/clayton.html

http://www.thejukejoint.com/cabcalloway1.html

1915 - Harvard University's Theodore W. Richards became the first American to be awarded the Nobel Prize for chemistry. He was given his award in Stockholm, Sweden.

http://www.nobel.se/chemistry/laureates/1914/richards-bio.html

1920- in the wake of the growing scandal surrounding accusations that members of the Chicago White Sox conspired to fix the 1919 World Series, baseball owners appointed Federal Judge Kenesa Mountain Landis, the game's first commissioner with extremely broad powers. Landis replaced the National Commission, a three man governing board, to a seven-year term from 1921 to 1928. He received a salary of $42,500 a year plus $10,000 for expenses to rule the 16 American and National League baseball clubs. He was re-elected three times and died in office on November 24, 1944.

1925-First Louis Armstrong Hot Five recording, Chicago (Okeh label)

1920- an underwater highway tunnel with twin tubes was started this day to run from New York City to Jersey City under the Hudson River. It was named after its chief engineer, Clifford Milburn Holland. It was opened on

November 12,

1927- by President Calvin Coolidge, who gave the signal form the presidential yacht Mayflower anchored in the Potomac River off Washington, DC. In that first hour, 20,000 people walked through the tunnel from shore to shore. Vehicular traffic was allowed through on November 13, 1927. 1921, the first conference of great powers to be held on American soil and affecting American interests was the Conference on the Limitation of Armaments, which was assembled at Memorial Continental Hall in Washington, DC, from this day to February 6, 1922. Nine nations took part in this conference: The United States, Great Britain, France, Italy, Japan, China, Holland, Belgium, and Portugal. The American delegation was headed by Secretary of State Charles Evans Hughes.

1925- Louis Armstrong Hot Five makes their first recording,

Chicago, ILL Okeh

1929- birthday of Grace Kelly; American award-winning actress (Rear Window, To Catch a Thief) who became Princess Grace of Monaco when she married that country's ruler, Prince Rainier Ill, in 1956. Born at Philadelphia, PA, she died of injuries sustained in an automobile accident, Sept 14, 1982, at Monte Carlo, Monaco. 1936 –San Francisco-Oakland Bay Bridge opens.

http://www.lib.berkeley.edu/Exhibits/Bridge/sfobay.html

http://www.sfmuseum.org/assoc/bridge00.html

1933-First Sunday football game in Philadelphia (previously illegal)

1941-Madame Lillian Evanti, opera singer, founds the National Negro Opera Company.

http://www.aaregistry.com/african_american_history/223/

Americna_Negro_Theatre_formed

1942 - The naval battle of Guadalcanal began between Japanese and American forces during World War II. The battle lasted un November 15. The U.S. scored a major victory, inflicting heavy losses on a Japanese task force and preventing Japanese reinforcements from reaching the island. The early TV series “Victory at War” captures much of the famous battle.

http://www.friesian.com/history/guadal.htm

1945-Singer Neil Young born Toronto, ON, Canada.

1946- drive-in banking service was instituted by the Exchange National Bank of Chicago, IL. Ten tellers' windows protected by heavy bulletproof glass and impregnable corrugated steel were equipped with automatic slide out drawers to enable motorists to transact business without leaving their cars.

1951---Top Hits

Because of You - Tony Bennett

Sin (It's No) - Eddy Howard

And So to Sleep Again - Patti Page

Slow Poke - Pee Wee King

1955 - The worst recorded attendance to a football game occurred in the Washington State vs. San Jose State game at Pullman, Washington. The game was played as scheduled, despite high winds and a temperature of 0 degrees F. The total paid attendance was 1.

1955-Billboard publishes the results of its annual disc jockey poll. The most played R&B single is Johnny Ace's "Pledging My Love," most promising artist is Chuck Berry and the favorite R&B artist is Fats Domino. In the pop category, rock and roll is barely present. Elvis Presley is voted the most promising country & western artist.

1955 -- Sci-Fi author L. Sprague de Camp, one of my favorite authors, is elected royal chronicler of the Hyborian Legion.

http://www.lspraguedecamp.com/bio.asp

1957-"Jamboree," the first movie starring Jerry Lee Lewis, previews in Hollywood. Among those featured in the flick are Fats Domino (with whom Lewis shares top billing), Carl Perkins, Frankie Avalon, Slim Whitman and Connie Francis.

1959---Top Hits

Mack the Knife - Bobby Darin

Mr. Blue - The Fleetwoods

Don't You Know - Della Reese

Country Girl - Faron Young

1959 - Between Noon on the 11th and Noon on the 12th, a winter storm buried Helena, MT, under 21.5 inches of snow, which surpassed their previous 24 hour record by seven inches.

1966-Donovan's "Mellow Yellow" is released. He wrote the song as under the influence of "smoking banana skins".

http://www.alohatropicals.com/mb-01.html

1967 - On Broadway, Pearl Bailey took over the lead role in the musical, "Hello Dolly". "Pearlie Mae", as Buck was called, was a hit.

1967 - The Detroit Lions set an NFL record by fumbling the football 11 times and losing it 5 of those times.

1967—Top Hits

To Sir with Love - Lulu

Soul Man - Sam & Dave

It Must Be Him - Vikki Carr

You Mean the World to Me - David Houston

1968-baseball player Sammy Sosa born San Pedro de Marcoris, Dominican Republic.

1968 -- Supreme Court voids Arkansas law banning teaching of evolution in public schools. Alabama continues warning high school students evolution is 'controversial', putting stickers on biology books.

1968 - A severe coastal storm produced high winds and record early snows from Georgia to Maine. Winds reached 90 mph in Massachusetts, and ten inches of snow blanketed interior Maine.

1972- Don Shula of the Miami Dolphins became the first NFL coach to win 100 regular season games in only 10 seasons as the Miami Dolphins defeated the New England Patriots, 52-0.

1974 - A great Alaska storm in the Bering Sea caused the worst coastal flooding of memory at Nome AK with a tide of 13.2 feet. The flooding caused 12 million dollars damage, however no lives are lost.

1975---Top Hits

Island Girl - Elton John

Lyin' Eyes - The Eagles

Who Loves You - Four Seasons

I'm Sorry - John Denver

1979-Jefferson Starship singer Marty Balin's rock opera "Rock Justice" opens a four-day run at San Francisco's Old Waldorf night club. Balin stars in and co-directs the musical, about a rock star who dreams he's on trial for not having a hit record.

1981 - The space shuttle Columbia was launched for the second time; it was the first space vehicle to be used more than once.

1983 - Lionel Richie started the first of four consecutive weeks at #1 on the music charts as "All Night Long (All Night)" became the United States most popular song.

1983---Top Hits

Islands in the Stream - Kenny Rogers & Dolly Parton

All Night Long (All Night) - Lionel Richie

One Thing Leads to Another - The Fixx

Somebody's Gonna Love You - Lee Greenwood

1984-Madonna releases the "Like A Virgin" LP.

1986 - For the first time in the history of the NBA both head coaches were absent from the game when coached K.C. Jones and Don Nelson were too sick to be at the Boston-Milwaukee game. The Boston Celtics had their 44th straight home victory as they defeated the Milwaukee Bucks 124-116.

1986- Red Sox Roger Clemens becomes only the second American League pitcher to unanimously win the Cy Young Award. Denny McLain was the first to accomplish the feat in 1968.

1987 - Heavy snow spread across much of New England. Totals in Massachusetts ranged up to 14 inches in Plymouth County. The seven inch total at the Logan Airport in Boston was their highest of record for so early in the season, and the 9.7 inch total at Providence RI was a record for November. Roads were clogged with traffic and made impassable as snowplow operators were caught unprepared for the early season snowstorm.

1988 - "Rattle and Hum", the album by U2, started a six-week run at the top of the U.S. album charts. Hum along now, as we list the tracks on the "Rattle and Hum": "Helter Skelter", "Van Diemen's Land", "Desire", "Hawkmoon 269", "All Along the Watchtower", "I Still Haven't Found What I'm Looking For", "Freedom for My People", "Silver and Gold", "Pride (In the Name of Love)", "Angel of Harlem", "Love Rescue Me", "When Love Comes to Town", "Heartland", "God Part II", "The Star Spangled Banner", "Bullet the Blue Sky", "All I Want is You".

1989 - Thirty-three cities reported record high temperatures for the date as readings soared into the 70s and 80s from the Southern and Central Plains to the Southern and Middle Atlantic Coast Region. The afternoon high of 80 degrees at Scottsbluff NE was a record for November, and highs of 76 degrees at Rapid City SD and 81 degrees at Chattanooga TN were the warmest of record for so late in the season.

1991—Top Hits

Cream - Prince & The N.P.G.

Can't Stop This Thing We Started - Bryan Adams

Real, Real, Real - Jesus Jones

Someday - Alan Jackson

1996-Reverend Jesse Jackson threatened to lead a potentially crippling boycott against Texaco if the oil giant failed to settle a lingering racial- discrimination lawsuit. Six Texaco employees initially filed the $520 million suit in 1994; the ensuing years saw the case mushroom into a complaint backed by some 1,400 workers. Despite growing pressure, Texaco was slow to respond to the case. However, Jackson's involvement, coupled with the revelation of a "secret" audio tape that captured Texaco executives making racial slurs and plotting to derail the lawsuit, helped bring the case to a close. On November 15, Texaco announced what was believed to be a $ 175 million settlement to the case, which included a one-time salary boost for minority employees, as well as the establishment of "diversity training and sensitivity programs".

1998---Top Hits

Doo Wop (That Thing)- Lauryn Hill

Lately- Divine

The First Night- Monica

One Week- Barenaked Ladies

2002- Miguel Tejada, who receives 356 points from the Baseball Writers' Association, including 21 first-place votes of the 28 cast, is selected as the American League's Most Valuable Player. The A's shortstop joins countrymen Sammy Sosa and George Bell as Dominican Republic natives to win the award.

I take the snap from center, fake to the right, fade back . . . I've got protection. I've got a receiver open downfield. . . . What the hell is this? This isn't a football, it's a shoe, a man's brown leather oxford. A cousin to a football maybe, the same skin, but not the same, a thing made for the earth, not the air. I realize that this is a world where anything is possible and I understand, also, that one often has to make do with what one has. I have eaten pancakes, for instance, with that clear corn syrup on them because there was no maple syrup and they weren't very good. Well, anyway, this is different. (My man downfield is waving his arms.) One has certain responsibilities, one has to make choices. This isn't right and I'm not going to throw it.

Louis Jenkins

|

www.leasingnews.org |