![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Wednesday, December 31, 2014

Today's Equipment Leasing Headlines

Operation Lease Fleece, Most Received Light Sentences

All Are No Longer in Jail

Classified Ads---Credit

Investment Firm Backing Marlin Sells 1.7 Million Stock

to Another Marlin Investment Group

Former Marlin EVP & COO is Available

George D. Pelose

New Hires---Promotions in the Leasing Industry

Leasing Industry Ads---Help Wanted

2006 Prediction on Leasing Industry Holds True

Jeff Taylor, CLP

FASB--A Giant Leap for...

Another 2006 Prediction Holding True

Staying Ahead of the Pack

Allan Levine

Pleads Guilty to $53 Million Tax and Bank Fraud

The Best Movies of 2014

By Leasing News Film Reviewer Fernando Croce

Retriever, Labrador/Weimaraner

Chester County, Pennsylvania Adopt-a-Dog

Thank You--Salvation Kettle Reaches $6,535

Broke All Leasing News Records for Donations

News Briefs---

PayClip, a Latin American Square, Raises $5.2 Million

Apple Pay Dominates Our Top 25 Posts of the Year

Of the Big 5 Banks, Wells Looks Like the Year’s Winner

Shake Shack files for IPO, plans massive expansion

Arrests plummet 66% with NYPD in virtual work stoppage

SUVs make comeback as gas prices fall

At least 7.1M signed up for 2015 Obamacare plans so far

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to join

our mailing list. You may also visit each news edition at www.leasingnews.org or view our previous editions at: www.leasingnews.org/archives.htm

[headlines]

--------------------------------------------------------------

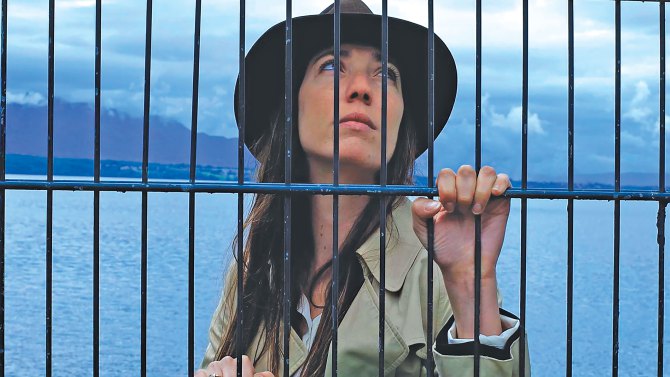

Operation Lease Fleece, Most Received Light Sentences

All Are No Longer in Jail

(It is appropriate to end the year with this story first reported November 9, 2007 as the start of what became over 30 arrests in what the FBI investigation dubbed "Operation Lease Fleece." In relationship to the leasing Ponzi schemes as well as Equipment Acquisition Resources (Sheldon Player, now deceased) or Allied Health Care Services (owner in jail, vendor out of jail), this bust was small, involving only $20 million in losses to several lending institutions. It was more the players caught which started at 23 and went up to over 30, with others not indicted and still active in the leasing industry today. Ironically, stealing from a 7-Eleven store brought more years in jail than those caught here received. The Orange County Weekly

wrote several stories about the light sentences or no sentences. (1)

(If there is anything to be learned here, hire an "excellent" attorney, should you find yourself with a knock on the door on getting caught for something you should not have done. Editor)

February 4, 2013, Mark McQuitty, co-founder of CapitalWerks, Preferred Lease, was sentenced by Judge Cormac J. Carney for 24 months starting 12 noon, March 21, 2013, plus three years’ probation and other stipulations (2). He was given a Greyhound bus ticket and took a ride with other "low risk" prisoners to Reeves II Federal Penitentiary, Pecos, Texas.

Part of the stipulations including not associating with other felons, as well as:

"The defendant shall not engage as whole or partial owner, employee, or otherwise, in any business involving equipment lease financing programs of any kind, loan programs, telemarketing activities, investment programs, or any other business involving the solicitation of fund or cold calls to customers without the express written approval of the Probation Officer prior to engagement in such employment or business. Further, the defendant shall provide the Probation Officer with access to any and all business records, client lists, and other records pertaining to the operation of any business owned in whole"

He was released on December 11, 2014.

His partner at CapitalWerks/Preferred Leasing James "Jim" Raeder was sentenced December 17, 2012:

No fine and no restitution

1 day jail (equals time served)

12 months halfway house

300 hours community service

Three years' probation

Stipulations

Leasing News reported that Adam S. Zuckerman, Laguna Beach, California, head of BrickBanc, Costa Mesa, California, appeared to be the ringleader. He received the toughest sentence. He told Leasing News he had a “great attorney” who got him a reduced sentence. March 21, 2012:

37 months in federal prison

Three years' Probation

Stipulations

He was released on February 21, 2014.

As a side story, in the series about "Adam Zuckerman: the man behind Lease Fleece?", he speaks of " "I started Heatrock after converting the building that formerly housed my previous endeavor, IntenseCity Sports Performance Centers, into an incubator/accelerator for small business,” he explains how this all happened. ”The entire facility was transformed from a 30,000 sq. ft. state of the art sports training complex into a high-tech home for 20 small companies, where we would provide guided growth and support services to take them to the next level.”

“This is where I first learned about the leasing business second hand from Jim Reader (CapitalWerks/Preferred Lease/Republic Leasing of Southern California), where he negotiated space in our building for some a few of his ‘companies.’ Little did I know five years before I ever contemplate entering ‘the business,’ that Jim was in fact housing some of the dirtiest players in the industry right under my roof.”

http://www.leasingnews.org/archives/February%202008/02-14-08.htm#fleece

“It was during this time that I met Jim Raeder and Mark McQuitty (mentioned in my opening post). Jim introduced himself as Mark business partner in CapitalWerks/Preferred Lease. He seemed very personable, honest and had an air about him that made you want to chit chat about things. Chit chat fast turned to friendship and friendship remained the only bridge between Jim and me for many years. McQuitty of course was a different animal, who made no bones about getting to the heart of the matter. He quickly agreed (through an attorney friend, Barry Falk) to invest $50k in Heatrock. He loved the idea, and of course had some ideas of his own.

“Mark wanted to place a few of his ‘companies’ inside of Heatrock as tenants. In fact, within a week, came back with Jim and their new partner, Tim Lueison, to better determine how much of the building they actually could use. After a few rounds of negotiation, Heatrock won a few new tenants. Sales Stream Inc. , ISystems, and a renegade named Beau would soon take residence at The Rock.”

http://leasingnews.org/archives/Oct2010/10_12.htm#unpublished

As to Zuckerman's story about the success of his company "IntenseCity Sports Performance Center," a long time reader of Leasing News wrote: "I provided a master lease line of credit for a company called IntenseCity. It was a large fitness facility in the Irvine Spectrum. The owner was Howard Rapport and Adam Zuckerman. About six months after the last schedule closed my boss called me into her office and told me that she received a call from Colonial Pacific that the company stopped making payment and if I would go to the facility and find out what was going on. I pulled up and Adam was loading all of the equipment into a truck. I walked up and asked him what was going on. He said “I just sold all of the equipment.” I said, “Adam, this is not your equipment to sell.” He said, “Too late I just sold it all.”

- OC Weekly Criticizes Judge Carney ocweekly.com/navelgazing/2013/04/michael_scott_grayson_verizon.php

- McQuitty Other Stipulations:

http://www.leasingnews.org/PDF/mcquity_other_stipulations.pdf

Other “Operation Lease Fleece” Sentences

http://leasingnews.org/archives/Dec2012/12_19.htm#sentences

Lease Fleece Collection:

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment

or looking to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Investment Firm Backing Marlin Sells 1.7 Million Stock

to Another Marlin Investment Group

Tuesday, December 30, 2014

MRLN -NASDAQ

Close: $20.69

52wk High: 29.58

52wk Low: 17.10

Volume: 14,905

1.7 million shares of Marlin Business Services stock on Monday, December 22. The filing noted that the block of 1,705,317 of common stock were sold at a purchase price of $20.00 per share.

Marlin Business Services dba Marlin Equipment Finance reported to the SEC that Peachtree Equity Investment Management, Atlanta, Georgia, sold 1,705, 317 shares at $20.00 each, reporting hold 604,617 shares Peachtree Matthew Sullivan is on the board of directors.

A SEC filing on December 23, 2014: “As described in the Schedule 13D/A filed by Red Mountain Capital Partners LLC on December 23, 2014, Red Mountain Partners, L.P. and Red Mountain Investors I LLC – Series A agreed to purchase a block of 1,705,317 shares of the Registrant’s Common Stock from WCI (Private Equity), LLC, an affiliate of Peachtree Equity Investment Management, Inc., at a purchase price of $20.00 per share. The transaction is expected to close on or about December 29, 2014.”

Red Mountain Capital Partners, Los Angeles, California reports owing 2,976,925 shares; is not reported having a seat on the board of directors.

SEC Filing on Sale:

http://www.snl.com/Cache/26766467.pdf?IID=

4089372&FID=26766467&O=3&OSID=9

Peachtree SEC Form

http://www.snl.com/irweblinkx/ShowFile.aspx

?KeyFile=26717960&Format=XML&Output=XML

Red Mountain SEC form

http://www.snl.com/irweblinkx/ShowFile.aspx

?KeyFile=26703417&Format=XML&Output=XML

[headlines]

--------------------------------------------------------------

Former Marlin EVP & COO is Available

George D. Pelose

Corporate Attorney, Board Member,

Business Advisor, Mentor

As reported in November 7, 2013 Leasing News:

MT. LAUREL, N.J., -- Marlin Business Services Corp. (Nasdaq: MRLN) announced the retirement of George D. Pelose from his position as Executive Vice President and Chief Operating Officer of the Company. Mr. Pelose, who began his Marlin career in 1999 as the Company's General Counsel, commented, "It was a very difficult decision to leave Marlin, but I believe it is the right time for me to step away so I can pursue my outside interests. Since joining Marlin in 1999, I have had the opportunity to work with many talented people to help drive Marlin to what it is today, a leader in the small ticket commercial finance arena. It has been a great privilege to have been part of the Marlin team and the Company's track record of success. I plan on working closely with Dan and his team during the first quarter of 2014 to ensure a smooth transition."

"On behalf of the entire organization, I'd like to take this opportunity to personally thank George for his significant contributions and his 15 years of dedicated service. He has led the Company through change and was instrumental in shaping Marlin and successfully growing the Company. We wish him much success as he pursues other interests," said Daniel P. Dyer, Marlin's Chief Executive Officer.

http://leasingnews.org/archives/Nov2013/11_07.htm#retirement

----

The year has passed, so now George Pelose can state he is available.

From his LinkedIn.com site:

"My name is George Pelose and I am a recently retired corporate executive seeking to use my business experience, legal expertise and life skills to help companies achieve their goals and objectives.

"During my 15 years as Executive Vice President and Chief Operating Officer of Marlin Business Services Corp. (Nasdaq: MRLN), I played an instrumental role in driving this start-up, specialty finance company into a publicly-traded, federally-regulated bank holding company that has consistently posted double digit growth and has delivered very attractive returns to its public shareholders.

"My legal degree from the University of Pennsylvania has also enabled me to practice business law and develop strong corporate governance and compliance expertise in my prior roles as General Counsel of Marlin and as a Business & Finance attorney with Morgan, Lewis & Bockius LLP.

"The business success I helped create at Marlin, coupled with my legal knowledge and expertise, puts me in an ideal position to assist business leaders, entrepreneurs and non-profit organizations seeking to build or strengthen their companies.

"Whether it involves serving as a Board Member or providing business or legal advice on an outsourced basis, I possess the technical skills, practical experience and personal desire to help organizations and their leaders successfully navigate the challenges they face and deliver on their business plans.

"If you are a business owner or entrepreneur looking for a Board Member or Advisor to help you take your company to the next level, feel free to connect with me to see whether I can help you achieve your goals."

www.linkedin.com/pub/george-pelose/6/544/79b

(No charge for the advertising, George. Happy New Year. Editor)

[headlines]

--------------------------------------------------------------

New Hires---Promotions in the Leasing Industry

Chris Bucher was hired as Director, Equipment Finance at Whitney Bank New Orleans, Louisiana. "Head of Equipment Finance charged with building and leading a commercial equipment finance company for Hancock Bank/Whitney Bank. Our mission is to build an equipment loan and lease product suite to complement our Corporate, Middle Market and Commercial Banking partners." Previously, he was National Sales Manager, Senior Vice President, Regions Equipment Finance (March 2008–December 2014)); Senior Vice President, Manager Equipment Finance Product, Capital One Bank (September, 1983 – March, 2008); Manager of the Banking Segment's Equipment Finance product (Capital One acquired Hibernia National Bank 11/2005) Head, Equipment Finance Product, Senior Vice President, Hibernia National Bank, during this period of March, 2000 – November, 2005. VP, FNJ (1983 – 1994). Education: Louisiana State University and Agricultural and Mechanical College, M.S., Finance (1982 – 1983). Louisiana State University and Agricultural and Mechanical College B.S., Finance (1980).

www.linkedin.com/pub/chris-bucher/12/931/68b

Niki Ogunyomi was promoted to Assistant Vice President-Credit at Ascentium Capital, Kingwood, Texas. She joined the firm December, 2013, as Senior Credit Analyst. Prior, she was Credit Analyst, First American Bank (September 2011–September 2014); Staff Accountant, Black Oak Partners LLC (January 2011–August 2011); Accounting Analyst, Asst. Vice President, First American Bank (March 2007–September 2010); Teller, UMB Bank (June 2006–March 2007). Organizations: Oklahoma Bankers Association, Leadership Development (2010–2010). Exchange Club of Norman; MBA Women International, Houston Chapter. Education: University of Central Oklahoma, Masters, Business Administration (2008–2010); Activities and Societies: Alpha Kappa Alpha Sorority, Inc. University of Missouri-Kansas City, BBA, Finance, Economics (2004–2006). Robert Greene $5000 scholarship recipient (2005-2006). Activities and Societies: Omicron Delta Kappa Honor Society; Alpha Kappa Alpha Sorority, Inc.

Brian Tallerico was hired as Account Executive at River Capital Finance, Westlake, Ohio. Previously he was Mortgage Processor, JPMorgan Chase (October 2012–January 2014); Mortgage Banker, Quicken Loans (June 2011– May 2012). Education: The Ohio State University, Bachelor of Science (BS), Business Family and Consumer Sciences/Human Sciences (2008 – 2011).

www.linkedin.com/pub/brian-tallerico/75/653/a66

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

[headlines]

--------------------------------------------------------------

2006 Prediction on Leasing Industry Holds True

The late Jeff Taylor, CLP, published "The Future of Equipment Leasing," August, 2006. His predictions to leasing today were uncanny.

The following is an excerpt from his book:

On September 8, 2005 the Equipment Leasing Association met with the Securities & Exchange Commission (SEC) to educate them on the positive aspects of equipment leasing throughout the world.

They stated that the global equipment leasing market is approximately $600 - $700 billion annually with the U.S. accounting for one-third of the global market (est. $220 billion in 2004).

They pointed out that Corporate America leases for the following reasons:

- Access to capital

- Lower cost of capital

- 100% financing

- Convenience

- Asset risk management

- Tax planning and minimization

- Off-balance sheet financing

- Regulatory capital and asset constraints

They also said that 77% of their member's volume was in the form of direct finance leases and conditional sales, which most experts acknowledge as alternative forms of loans. Only 9% were classified as true operating leases.

So the questions, logically, that I have to ask are:

If only 9% of the world's major company’s volume is in the form of loan financing and not true operating leases, does that mean that equipment leasing companies:

- Are afraid of offering true leases?

- Cannot afford to offer true leases?

- Will no longer take residual risk?

- No longer exist and no one notices?

My predictions for public leasing companies are as follows:

Small Ticket - will abandon true leases and all residual risk and support direct finance leases and loans to consumers. Captive companies including IBM, HP, John Deere, J & J will dominate. All transactions will be credit scored and audited for compliance.

Middle Market - will lean towards direct finance leases and loans, yet create true operating leases in which they feel they can make money in re-leasing used equipment. They will abandon consumers and focus on business markets. They will use brokers to acquire business and jettison full-time sales people.

Large Ticket - They will continue to leave the U.S. and find a home in Europe and Asia where the tax laws are more equitable and capital is abundant.

(The book is available from these sources, according to Amazon:

http://www.amazon.com/gp/offer-listing/0972704736)

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

FASB--A Giant Leap for...

Another 2006 Prediction Holding True

Shawn Halladay, who reports on accounting and software for the

banking, finance, and leasing industry, as well as acts as a Legal

Expert and is a lecturer, in 2006 started a Leasing Blog. They

were also reported in Leasing News. This one from July 19, 2006,

also predicts accurately what is happening today:

Yes, folks, the step has been taken. Both the FASB and IASB agreed yesterday to undertake a joint project designed to overhaul FAS 13, and, implicitly, IAS 17, the international lease accounting standard. The proposed timetable includes FASB staff research on the scope and implications of the project, followed by Board deliberations during 2007. A Preliminary Views document will be issued and comment will be solicited from interested parties in 2008, with a formal Exposure Draft issued for comment in 2009. If the rabble rousers get their way, all leases will end up on the balance sheet, even though this result goes against every lease accounting standard in the world, along with the civil laws of some countries.

Based on the comments, it appears that any revision to FASB 13 may only be a patch that addresses the off balance sheet treatment for lessees, since the Board does not want the complex issues involved in lessor accounting to delay progress on the project. Several members of the FASB Board specifically mentioned that the issue of materiality for small ticket transactions would be taken into account as the Board deliberates, something for which Alta principal and former ELA President Michael Fleming has pushed. The Board has requested that the ELA be represented on the project work group, which the association has agreed to.

Apparently, there was unanimous agreement by the FASB that current rules are deficient. According to FASB member Leslie F. Seidman, "…investors are concerned that existing standards do not require balance sheet recognition of significant assets and liabilities arising from leases.” There is plenty of press about this issue, also. The Analyst's Accounting Observer weblog, for instance, claims that “it's just a good idea to fix a standard that produces standardly awful results.” As the AAO points out, current lease accounting doesn't say much about the future obligations of a company's operating leases, and, although analysts adjust the balance sheet to account for the obligation, it is a haphazard, imperfect exercise. “Investors shouldn't have to jury-rig balance sheets to make them say something when they're dealing with fairly standard transactions.”

Bold talk, but, although everyone knows it needs fixing, no one has come up with realistic solutions. Furthermore, won't the same reporting problem exist if operating leases go on balance sheet? As Luca Pacioli tells us, if there is a liability there must be an asset. Now what do I do as an investor? The balance sheet shows a bunch of assets, some of which are real and some of which are leasehold interests. The real assets can be converted to cash, but not the leasehold interests. So, now I have to restate the balance sheet from information I will probably get from the footnotes to properly determine the quality of the company's assets. Sound familiar? Oh, how I love lease accounting!

Shawn Halladay

352 Denver Street, Suite 224

Salt Lake City, UT 84111

801/322-4499

shawn@amembalandhalladay.com

www.amembalandhalladay.com

Leasing News Biography:

http://www.leasingnews.org/Advisory%20Board/Halladay_Shawn.htm

[headlines]

--------------------------------------------------------------

Staying Ahead of the Pack

Allan Levine, President, Madi$on Capital, Maryland, says his company has survived for 43 years by staying ahead of the pack.

alevine@madisoncapital.com

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Pleads Guilty to $53 Million Tax and Bank Fraud

WASHINGTON, DC - Christy Romero, Special Inspector General for the Troubled Asset Relief Program (SIGTARP); Preet Bharara, the United States Attorney for the Southern District of New York; and David A. Hubbert, Deputy Assistant Attorney General for the Tax Division of the U.S. Department of Justice announced that Wilbur Anthony Huff, a Kentucky businessman, pleaded guilty in Manhattan federal court to various tax crimes that caused more than $50 million in losses to the Internal Revenue Service (IRS), in addition to a massive fraud that involved the bribery of bank officials, the fraudulent purchase of an insurance company, and the defrauding of insurance regulators. Huff entered the guilty plea before U.S. District Judge Naomi Reice Buchwald.

According to the information, plea agreement, and statements made during court proceedings:

Background

Huff was a businessman who controlled numerous entities located throughout the United States (Huff-Controlled Entities). Huff controlled the companies and their finances, using them to orchestrate a $53 million fraud on the IRS as well as other illegal schemes. However, rather than exercise control of these companies openly, Huff concealed his control by installing other individuals to oversee the companies’ day-to-day functions and to serve as the companies’ titular owners, directors, or officers. Huff also maintained a corrupt relationship with Park Avenue Bank and its executives, Charles J. Antonucci, Sr., the president and chief executive officer, and Matthew L. Morris, the senior vice president.

Tax Crimes

From 2008 to 2010, Huff controlled O2HR, a professional employer organization (PEO) located in Tampa, Fla. Like other PEOs, O2HR was paid to manage the payroll, tax, and workers’ compensation insurance obligations of its client companies. However, instead of paying $53 million in taxes that O2HR’s clients owed the IRS, and instead of paying $5 million to Providence Property and Casualty Insurance Company (Providence P&C) – an Oklahoma-based insurance company – for workers’ compensation coverage expenses for O2HR clients, Huff stole the money that his client companies had paid O2HR for those purposes. Among other things, Huff diverted millions of dollars from O2HR to fund his investments in unrelated business ventures and to pay his family members’ personal expenses. The expenses included mortgages on Huff’s homes, rent payments for his children’s apartments, staff and equipment for Huff’s farm, designer clothing, jewelry, and luxury cars.

Conspiracy to Commit Bank Bribery, Defraud Bank Regulators, and Fraudulently Purchase an Oklahoma Insurance Company

From 2007 up to and including 2010, Huff engaged in a massive multi-faceted conspiracy, in which he schemed to (i) bribe executives of Park Avenue Bank, (ii) defraud bank regulators and the board and shareholders of a publicly-traded company, and (iii) fraudulently purchase an Oklahoma insurance company. As described in more detail below, Huff paid bribes totaling hundreds of thousands of dollars in cash and other items to Morris and Antonucci, in exchange for their favorable treatment at Park Avenue Bank.

As part of the corrupt relationship between Huff and the bank executives, Huff, Morris, Antonucci, and others conspired to defraud various entities and regulators during the relevant time period. Specifically, Huff conspired with Morris and Antonucci to falsely bolster Park Avenue Bank’s capital by orchestrating a series of fraudulent transactions to make it appear that Park Avenue Bank had received an outside infusion of $6.5 million, and engaged in a series of further fraudulent actions to conceal from bank regulators the true source of the funds.

Huff further conspired with Morris, Antonucci, and others to defraud Oklahoma insurance regulators and others by making material misrepresentations and omissions regarding the source of $37.5 million used to purchase Providence Property and Casualty Insurance Company, an Oklahoma insurance company that provided workers’ compensation insurance for O2HR’s clients, and to whom O2HR owed a significant debt.

Bribery of Park Avenue Bank Executives

From 2007 to 2009, Huff paid Morris and Antonucci at least $400,000 in exchange for which they: (1) provided Huff with fraudulent letters of credit obligating Park Avenue Bank to pay an investor in one of Huff’s businesses $1.75 million if Huff failed to pay the investor back himself, (2) allowed the Huff-Controlled Entities to accrue $9 million in overdrafts, (3) facilitated intra-bank transfers in furtherance of Huff’s frauds, and (4) fraudulently caused Park Avenue Bank to issue at least $4.5 million in loans to the Huff-Controlled Entities.

Fraud on Bank Regulators and a Publicly-Traded Company

From 2008 to 2009, Huff, Morris, and Antonucci engaged in a scheme to prevent Park Avenue Bank from being designated as “undercapitalized” by regulators – a designation that would prohibit the bank from engaging in certain types of banking transactions and that would subject the bank to a range of potential enforcement actions by regulators. Specifically, they engaged in a series of deceptive, “round-trip” financial transactions to make it appear that Antonucci had infused the bank with $6.5 million in new capital when, in actuality, the $6.5 million was part of the bank’s pre-existing capital. Huff, Morris, and Antonucci funneled the $6.5 million from the bank through accounts controlled by Huff to Antonucci. This was done to make it appear as though Antonucci was helping to stabilize the bank’s capitalization problem, so the bank could continue engaging in certain banking transactions that it would otherwise have been prohibited from doing, and to put the bank in a better posture to receive $11 million from the Troubled Asset Relief Program. To conceal their unlawful financial maneuvering, Huff created, or directed the creation of, documents falsely suggesting that Antonucci had earned the $6.5 million through a bogus transaction involving another company Antonucci owned. Huff, Morris, and Antonucci further concealed their scheme by stealing $2.3 million from General Employment Enterprises, Inc., a publicly-traded temporary staffing company, in order to pay Park Avenue Bank back for monies used in connection with the $6.5 million transaction.

Fraud on Insurance Regulators and the Investment Firm

From July 2008 to November 2009, Huff, Morris, Antonucci, and Allen Reichman, an executive at an investment bank and financial services company headquartered in New York, N.Y. (the Investment Firm), conspired to (i) defraud Oklahoma insurance regulators into allowing Antonucci to purchase the assets of Providence P&C – the Oklahoma insurance company that was owed $5 million by O2HR and (ii) defraud the Investment Firm into providing a $30 million loan to finance the purchase. Specifically, Huff and Antonucci devised a scheme in which Antonucci would purchase Providence P&C’s assets by obtaining a $30 million loan from the Investment Firm, which used Providence P&C’s own assets as collateral for the loan. However, because Oklahoma insurance regulators had to approve any sale of Providence P&C, and because Oklahoma law forbade the use of Providence P&C’s assets as collateral for such a loan, Huff, Morris, Antonucci, and Reichman made, and conspired to make, a number of material misstatements and material omissions to the Investment Firm and Oklahoma insurance regulators concerning the true nature of the financing for Antonucci’s purchase of Providence P&C. Among other things, Reichman directed Antonucci to sign a letter that provided false information regarding the collateral that would be used for the loan, and Huff, Morris, and Antonucci conspired to falsely represent to Oklahoma insurance regulators that Park Avenue Bank – not the Investment Firm – was funding the purchase of Providence P&C.

After deceiving Oklahoma regulators into approving the sale of Providence P&C, Huff took $4 million dollars of the company’s assets, which he used to continue the scheme to defraud O2HR’s clients. Ultimately, in November 2009, the insurance company became insolvent and was placed in receivership after Huff, Morris, and Antonucci had pilfered its remaining assets.

Charles Antonucci, who was charged separately by complaint on March 15, 2010, pleaded guilty to his role in the crimes described above on October 8, 2010. Matthew L. Morris and Allen Reichman were charged by Indictment with Huff on October 1, 2012. Morris pleaded guilty in connection with the case on October 17, 2013.

Reichman is currently scheduled to go to trial before Judge Buchwald beginning on March 2, 2015. The charges against Reichman are allegations, and he is presumed innocent unless and until proven guilty beyond a reasonable doubt.

The case is being prosecuted by the U.S. Attorney’s Office for the Southern District of New York Complex Frauds and Cybercrime Unit. Assistant U.S. Attorneys Janis Echenberg and Daniel Tehrani and Special Assistant U.S. Attorney Tino Lisella are in charge of the criminal case.

### Press Release ############################

[headlines]

--------------------------------------------------------------

Leasing News: Best of 2014

By Fernando F. Croce

As the year closes, we have compiled a list of the greatest cinematic achievements to hit theaters. So make sure to check these out before awards season rolls in, and have a happy 2015!

Goodbye to Language: Arguably the greatest living film artist, Jean-Luc Godard proves that, at 84, he's still the world's youngest cinematic innovator with this endlessly fascinating drama. The story follows the troubled relationship of a couple, but that's just the launching pad for the legendary French provocateur's dazzling collection of experiments, which mix superimposed text and cultural references with abrupt musical cues and color-saturated images. Making what is easily the densest, boldest use of 3-D technology ever, Godard's picture is not just stunningly imaginative but also deeply affecting, at once inquisitive and romantic.

Stray Dogs: A leisurely stroll through the darkest corners of Taipei, this challenging and beguiling drama stars Lee Kang-sheng as a nameless family man doing his best to watch over his two small children, from holding a sign in rainy streets to finding makeshift homes in alleys and supermarkets. There's a glimmer of hope when he crosses paths with a lonely grocery clerk (Chen Shiang-chyi), but can they overcome their alienation? Filmed in director Tsai Ming-liang's trademark long takes, it may be difficult viewing, though the masterful style, combined with his concern for the characters, make it a ride worth taking.

Closed Curtain: A specialist in thoughtful allegories about cinematic creativity under duress, Iranian director Jafar Panahi serves up a self-reflexive story concering a screenwriter (Kambozia Partovi) who comes to his seaside villa to secretly work on his new drama. His solitude is interrupted by a pair of siblings (Maryam Moqadam and Hadi Saeedi), who break into his home and claim to be on the run from the police. Suspense about the characters slowly builds until a twist gives way to the blurry line between fictional narrative and behind-the-scenes realism in this intriguing, multilayered meditation on storytelling.

Under the Skin: In his first film in a decade, British filmmaker Jonathan Glazer conjures up an unforgettable slice of science-fiction with this challenging mood piece. Set in Scotland, the story follows an alien creature that takes the form of a beautiful young woman (played by Scarlett Johansson) in order to lure men to their doom. An outline of the plot may sound like a silly siren-from-outer-space thriller, but that doesn't do justice to the astonishing blend of dread and excitement in the atmosphere created by Glazer, which brings to mind such classic as "2001: A Space Odyssey" and "The Man Who Fell to Earth."

The Immigrant: A profoundly personal, richly textured drama, this intimate epic from James Gray pierces the audience's heart. Set in the early 1920s, it follows the life of a Polish immigrant (Marion Cotillard, in a breathtaking performance), who comes to Manhattan with her sister and soon becomes involved with an alternately charming and abusive man (Joaquin Phoenix). Taking some time off from the gangland tales that made his name (“Little Odessa,” “The Yards”) to penetratingly lay out the heroine's complex emotions, Gray chronicles an arrestingly acted, deeply moving vision of the American Dream.

Mr. Turner: Mike Leigh travels back in time in this superb study of 19th-century painter J.M.W. Turner. In a magnificent, award-winning performance, Timothy Spall plays Turner as a brilliant but troubled artist whose beautiful works contrast sharply with a life of prickly emotions, particularly in his relationship with his ailing father (Paul Jesson) and his put-upon housekeeper (Dorothy Atkinson). Gorgeously photographed in ways that often suggest lustrous oil canvases, this sprawling biopic towers as another addition to Leigh's gallery of flawed yet profoundly humanistic characters.

The Tale of the Princess Kaguya: This year's greatest animated picture featured not Lego adventurers or marshmallow robots, but rather a young woman's confrontation with her fate in imperial Japan. In this breathtaking release from Ghibli Studios, we follow the mysterious Kaguya's life from childhood to her adult years, as the beautiful maiden is courted by various men, including the Emperor himself. Directed by Japanese veteran animator Isao Takahata, this lyrical, delicately rendered fable that dazzles the eyes while it touches the heart.

Inherent Vice: Adapting notoriously reclusive author Thomas Pynchon's novel, writer-director Paul Thomas Anderson returns to the 1970s in this singular comedy-noir. Set in a seaside corner of Los Angeles, the splendidly convoluted narrative follows a small-time private investigator (Joaquin Phoenix ), whose life is shaken up by the sudden appearance of a former girlfriend (Katherine Waterston). Suddenly thrust into a whirlwind of bizarre characters, he must separate the real from the imaginary. A balancing act of manic humor and deep melancholy, this is a remarkable stroll through a panorama of American eccentricity.

Listen Up Philip: A letter penned in acid, Alex Ross Perry's comedy-drama packs quite a wallop. Philip (Jason Schwartzman) is an arrogant young writer who, as his second book is about to hit shelves, sets out to excoriate former colleagues and girlfriends. As he vies for inspiration, his relationships with his photographer girlfriend (Elisabeth Moss) and a literary idol (Jonathan Pryce) are laid bare under a harsh light. As brutal as it is funny, Ross Perry's scathing movie examines the often cruel world of writers with a keen eye that engages and alienates in fearlessly equal measure.

The Strange Little Cat: German director Ramon Zürcher's one-of-a-kind comedy-drama is this year's most captivating feature debut. The story is a slice-of-life view of a family in a bustling Berlin apartment, with each person going about their business while their pet cat saunters around the household. What makes the film unique, however, is Zürcher's creative way of arranging objects and movements, so that the screen feels alive with meticulously orchestrated activity and unexpected bits of business. By the end, this seemingly lightweight work accumulates stylistic creativity as well as emotional melancholy.

Receivables Management LLC • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167 |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

--------------------------------------------------------------

Retriever, Labrador/Weimaraner

Chester County, Pennsylvania Adopt-a-Dog

Mosby

24519067

Age: 5 years 16 days

Sex: Male

Size: Large

Color: Black/White

Neutered

Declawed: No

Housetrained: Unknown

Site: Chester County SPCA

Location: Main Dog Kennel

Intake Date: 12/14/2014

The Chester County SPCA

1212 Phoenixville Pike

West Chester, PA 19380

Phone: 610-692-6113

Fax: 610-436-4630 (Business Office)

Fax: 610-692-7234 (Shelter)

Tuesday - Friday: Noon - 7:00pm

Saturday - Sunday: 10:00am - 5:00pm

Closed on Mondays

Application:

http://www.marinhumanesociety.org/atf/cf/%7B1CBFF72E-B60C-4D1E-ABA7-4489FE5A93D6%7D/DogSurvey.pdf

Adoption Fee: $175

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Thank You--Salvation Kettle Reaches $6,535

Broke All Leasing News Records for Donations

Thank You Donors

| Jeffrey Allard | Larry Armstrong | Carol Baker |

| Brent Baron | Paul Bent | Bruce Cady |

| Brian Carey | Ben Carlile | Edward Castagna |

| John Caulfield | Richard Cohen | Dale Davis |

| Rob Day | Phil Dushey | Shawn Halladay |

| Larry Hartmann | Randy Haug | Don & Bonnie Dulmage |

| Jim Lahti | Theresa Kabot,CLP | Sam Khedkar |

| Jule Kreyling | Bruce Kropschot | Vern Laney |

| Andrew Lea | Allan Levine | Chip Lupacchino |

| Bruce Lurie | Barry Marks | Cliff McKenzie |

| Paul Menzel,CLP | Paul Menzel,CLP | Gerald Oestreich |

| PFSC | Klaus Pache | Susan Robert |

| Dean Rubin | Jeffrey Rudin | David Silverman |

| David Silverman | Bob Teichman,CLP | Gary Trebels |

| Terry Waggoner | Paul Weiss | Rosanne Wilson |

| Rick Wilbur | Edward Winston | Robert VanHellemont |

| Annoymous |

(Please click on kettle to learn more)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

PayClip, a Latin American Square, Raises $5.2 Million

http://bankinnovation.net/2014/12/payclip-a-latin-american-square-raises-5-2-million/

Apple Pay Dominates Our Top 25 Posts of the Year

http://bankinnovation.net/2014/12/apple-pay-dominates-our-top-25-posts-of-the-year/

Of the Big 5 Banks, Wells Looks Like the Year’s Winner

http://bankinnovation.net/2014/12/of-the-big-5-banks-wells-looks-like-the-years-winner/

Shake Shack files for IPO, plans massive expansion

http://nypost.com/2014/12/29/shake-shack-hopes-to-raise-up-to-100m-in-ipo/

Arrests plummet 66% with NYPD in virtual work stoppage

http://nypost.com/2014/12/29/arrests-plummet-following-execution-of-two-cops/

SUVs make comeback as gas prices fall

http://www.utsandiego.com/news/2014/dec/30/honda-crv-auto-show-new-car-dealers-suv/

Obamacare Enrollment Reaches at Least 7.1 Million

http://www.bloomberg.com/politics/articles/2014-12-30/obamacare-enrollment-reaches-at-least-71-million-us-says

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Beers Americans No Longer Drink

http://247wallst.com/special-report/2014/12/15/beers-americans-no-longer-drink/2/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

The 100 Best Workout Songs of 2014

http://www.sparkpeople.com/blog/blog.asp?

post=the_100_best_workout_songs_of_2014

[headlines]

--------------------------------------------------------------

Football Poem

I am the Master of my Fate

Often read before a football game:

William Ernest Henley (1875) .

Out of the night that covers me,

Black as a Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud,

Under the bludgeoning of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the horror of the shade,

And yet the menace of the years

Finds, and shall find me, unafraid.

It matters not how straight the gate,

How charged with punishments the scroll,

I am the master of my fate:

I am the Captain of my soul.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Jim Harbaugh: Being UM coach fulfills boyhood dream

http://www.crainsdetroit.com/article/20141230/NEWS/141239984/jim-harbaugh-being-um-coach-fulfills-boyhood-dream

Kawakami: Electric Jim Harbaugh shows why 49ers will regret this

http://www.mercurynews.com/tim-kawakami/ci_27220375/kawakami-electric-harbaugh-shows-why-49ers-will-regret

Lowell Cohn: 49ers' Jed York talks about keeping things classy (w/video)

http://www.pressdemocrat.com/sports/3312150-181/lowell-cohn-49ers-jed-york?page=2

49ers' Jed York faces radio interview barrage

"Says he is 'accountable." But to whom? And what? And when?

http://www.contracostatimes.com/49ers/ci_27229279/49ers-jed-york-faces-radio-interview-barrage

Oakland Raiders add nine players to their roster

http://www.mercurynews.com/raiders/ci_27230555/oakland-raiders-add-nine-players-their-roster

Madison Bumgarner Named 2014 Associated Press Male Athlete of the Year

http://bleacherreport.com/articles/2314804-madison-bumgarner-named-2014-associated-press-male-athlete-of-the-year

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Caltrans snowplow operator aids lost man on cold Christmas night

http://www.sacbee.com/news/local/crime/article5180040.html

French Laundry robbed of expensive wines

http://www.mercurynews.com/eat-drink-play/ci_27231232/french-laundry-wine-theft

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Napa Valley vineyards: A year in review

http://napavalleyregister.com/star/business/napa-valley-vineyards-a-year-in-review/article_367f6a5b-d177-5fe5-a450-b4b230401233.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1781-The first modern bank in the US, the Bank of North America, was organized by Robert Morris and received its charter from the Confederation Congress. It began operations January 7,1982, at Philadelphia.

1823- Birthday of William O. Cushing, American clergyman. He penned over 300 hymns, among them "When He Cometh," "Under His Wings" and "Hiding in Thee."

1834-Pioneer medical doctor Mary Jane Safford birthday. She assisted "Mother" Mary Ann Bickerdyke nursing Union soldiers in the Civil

War. She (as did the other women) actually went into battles waving a white Handkerchief on a stick to nurse the wounded while the fighting

was still going on. The experience of saving lives set her on the way to a

medical career. She attended the New York Medical College for Women in 1869 and then went to Germany for advance training. She became professor of women's diseases at the Boston University School of Medicine, a staff physician at a Boston hospital, and had an extensive private practice. She was the first woman to perform an ovariotomy, a very common operation in those days.

http://www.civilwarhome.com/saffordbio.htm

1837 -Birthday of John R. Sweney, American sacred chorister. He composed over 1,000 gospel tunes, including SUNSHINE ("There is Sunshine in My Soul Today") and SWENEY ("More About Jesus Would I Know").

1862-The Battle of Stones River (Murfeesboro) begins in central Tennessee. The armies struggled in the bitter cold for three days before the Union army, commanded by General William Rosecrans, defeated the Confederates under Braxton Bragg.

http://www.civilwarhome.com/stonesriver.htm

http://www.civilwarhome.com/stones.htm

http://www.nps.gov/stri/

http://www.civilwaralbum.com/misc/stonesriver.htm

1878- Elizabeth Arden (Florence Nightingale Graham) birthday - Canadian-born U.S. cosmetic entrepreneur. Raised in poverty after her mother died when she was a child, EA held menial jobs until she emigrated to New York City where she learned basic beauty techniques at the opportune time: the new moving pictures which featured women wearing elaborate makeup that glamorized them would give impetuous to the female beauty business. In 1908 with the loan of about $1,000 from her brother she opened a luxurious women's salon on Fifth Avenue in New York City that was an immediate success. She quickly branched into creating cosmetics and by 1915 she was selling her products internationally and was a millionaire. In addition to her products, she operated more than 100 salons, health spas, etc., and became a noted racehorse owner who won the 1947 Kentucky Derby with Jet Pilot. She was a leader in improving the safety of cosmetics. At her death at 88, she still owned every bit of stock in her enterprises which had seen annual sales of $60 million. Her companies were sold to Eli Lilly Company for lack of leadership after her death.

http://www.amazon.com/exec/obidos/tg/detail/-/0382095871/

002-5050140-9686411?v=glance

1879- In the first public demonstration of his incandescent light bulb, American inventor Thomas Alva Edison lights up a street in Menlo Park, New Jersey. The Pennsylvania Railroad Company ran special trains to Menlo Park on the day of the demonstration in response to public enthusiasm over the event.

Although the first incandescent lamp had been produced 40 years earlier, no inventor had been able to come up with a practical design until Edison embraced the challenge in the late 1870s. After countless tests, he developed a high-resistance carbon-thread filament that burned steadily for hours and an electric generator sophisticated enough to power a large lighting system. in 1877 he stumbled on one of his great inventions--the phonograph--while working on a way to record telephone communication. Public demonstrations of the phonograph made the Yankee inventor world famous, and he was dubbed the "Wizard of Menlo Park." Although the discovery of a way to record and play back sound ensured him a place in the annals of history, the phonograph was only the first of several Edison creations that would transform late 19th-century life. Among other notable inventions, Edison and his assistants developed the first practical incandescent light bulb in 1879 and a forerunner of the movie camera and projector in the late 1880s. In 1887, he opened the world's first industrial research laboratory at West Orange, where he employed dozens of workers to investigate systematically a given subject. Perhaps his greatest contribution to the modern industrial world came from his work in electricity. He developed a complete electrical distribution system for light and power, set up the world's first power plant in New York City, and invented the alkaline battery, the first electric railroad, and a host of other inventions that laid the basis for the modern electrical world. One of the most prolific inventors in history, he continued to work into his 80s and acquired 1,093 patents in his lifetime. He died in 1931 at the age of 84.

1880- Chairman of the newly formed Joint Chiefs of Staff Committee throughout the US’s involvement in WWII, General George Marshall was born at

Uniontown, PA. He accompanied Roosevelt or represented the US at most Allied war conferences. He served as secretary of state and was designer

1887 (Ida) Frances Steloff birthday - U.S. founder of the legendary Gotham

Book Mart. FS Helped launch the works of Henry Miller, James Joyce, Gertrude

Stein, Anais Nin, Ezra Pound and e.e.cummings. “Died April 18,1969

http://www.adeleart.com/NinPage/Frances.html

http://www.anaisnin.com/history/Steloff.html

http://www.amazon.com/exec/obidos/ASIN/1879923084/

inktomi-bkasin-20/ref%3Dnosim/002-5050140-9686411

1905-Birthday of composer Jule Styne, London, England

http://kennedy-center.org/programs/specialevents/honors/

history/honoree/styne.html

1908-Birthday of bass player John Kirby, Baltimore, MD

http://www.bbc.co.uk/radio3/jazz/jazzprofiles/kirby.shtml

http://www.jazzdigger.com/j/Jazz_Giants/John_Kirby_Giants_of_

Jazz__B00000DAJX.htm

http://www.pricegrabber.com/search_mucontrib.php/mu_artist=J

ohn+Kirby+%2526+His+Orchestra/ut=0cea001161ce67c0

8 trumpet player Jonah Jones born Louisville, Kentucky

http://www.cabcalloway.cc/jonah_jones.htm

http://www.spaceagepop.com/jonesjon.htm

http://trumpetjazz.netfirms.com/Artists/Jonah_Jones.html

1922- Vigilantes begin a weeklong attack on the black residents of Rosewood, Florida, burning down the town and effectively wiping it off the maps. The racially motivated destruction of Rosewood was so thorough and complete that knowledge of the episode nearly disappeared along with the town. However, families of the survivors managed to keep the memory alive and eventually won some small compensation from the state of Florida in 1994. In 1922, there were 30 households and about 200 residents in Rosewood-virtually all of whom were black. The fact that the town was slightly more prosperous then some of the neighboring white communities may have contributed to the tension and jealousy between white and black area residents. The Rosewood incident started as a hunt for escaped convict Jesse Hunter, who was believed to be responsible for the rape of an area white woman. Although there was no evidence that Hunter had any connection to the town of Rosewood, an angry mob of white men began a house-by-house search in that community. Residents first tried to defend themselves, but the threatening mob, with as many as 600 armed participants, far outnumbered them. The hunt for the rapist quickly escalated into violent attacks on the people of Rosewood, in which men were killed and women were raped. Although there is not an exact tally of the deaths resulting from the Rosewood riots, reports range from 6 to 120. Many community residents survived by hiding in the surrounding swamps until the attacks ended. The incident was reported and condemned by progressive newspapers at the time, but it was largely forgotten, because the destroyed town of Rosewood was never rebuilt and in essence disappeared from the maps. Yet the persistence of the survivors-some of whom were small children at the time of the attack-finally brought the matter to the attention of the Florida legislature in 1994. The state agreed to compensate 172 survivors and their families a total of $1.85 million because law enforcement officials had done nothing to stop the riots. .

1929- Guy Lombardo and his Royal Canadians made their first annual New Year's Eve broadcast over the C-B-S network from the Roosevelt Grill in New York City. The New Year's Eve radio, and later television, programs by Lombardo became a holiday tradition. The band's rendition of "Auld Lang Syne" became familiar to millions.

1930-Birthday of singer/guitarist Odetta, Birmingham,AL

http://www.geocities.com/Hollywood/Park/8672/odetta1.html

http://www.alamhof.org/odetta.htm

http://www.vanguardrecords.com/odetta/

1931-Birthday of sax player Gil Melle, Riverside, CA.

http://www.artistdirect.com/music/artist/bio/0,,467115,00.html?

artist=Gil+Melle

http://www.gilmelle.com/default.htm

1938- Drummer Buddy Rich joins the Artie Shaw Band.

1943- Dinah Washington, 19, first records with the Lionel Hampton Band, Keynote label.

1943- John Denver, born Henry John Deutschendorf at Roswell, NM, this singer-songwriter (“Rocky Mountain High,” “Sunshine on My Shoulder”) died in a plane crash off the coast of Big Sur, California, Oct 12, 1997.

1944---Top Hits

Don’t Fence Me In - Bing Crosby & The Andrews Sisters

There Goes that Song Again - Russ Morgan

I’m Making Believe - Ella Fitzgerald & The Ink Spots

I’m Waistin’ My Tears on You - Tex Ritter

1946-The state of hostilities was officially ended by President Truman, who reminded the nation that a state of war still existed and that the state of emergency proclaimed by President Franklin D. Roosevelt was not yet rescinded. May 8, 1945 was V-E Day, victory in Europe, and August 15,1945 was V-J Day, Victory over Japan. However, the allies did not officially end the war until September, 1990, when all disputes over land, rights, and other agreements were finalized.

1948- Russell Long of Louisiana was elected Senator on November 2, 1948, and sworn in on this date in 1948 to fill a seat that had been occupied by his father and his mother, for the term expiring January 2, 1951. He was to become a powerhouse of the senate. His father, Huey Pierce Long, the boss of the Democratic party machine in Louisiana, was elected on November 4, 1930, and took the oath of office of January 25, 1932. He was assassinated in 1935 in a hail of gunfire, some believe killed by the ricochet of one of his own body guards. Rose McConnel Long, wife of Huey Long and mother of Russell Long, was appointed on January 31, 1936, to fill the seat left vacant by assassination. She served until January 2, 1937.

1948-Birthday of Donna Summer ( LaDonna Andrea Gains), singer (“Bad Girls”), born Boston, MA. In her day, she was the hottest popular female vocalist setting the disco beat. 1952---Top Hits

Why Don’t You Believe Me - Joni James

Because You’re Mine - Mario Lanza

Don’t Let the Stars Get in Your Eyes - Perry Como

Don’t Let the Stars Get in Your Eyes - Skeets McDonal

1955 - General Motors became the first U.S. corporation to earn more than one billion dollars in a single year. The company’s annual report to stockholders listed a net income of $1,189,477,082 in revenues.

1960---Top Hits

Are You Lonesome To-night? - Elvis Presley

Wonderland by Night - Bert Kaempfert

Exodus - Ferrante & Teicher

Wings of a Dove - Ferlin Husky

1960 - After playing California nightclubs as The Pendletones, Kenny and the Cadets, and Carl and the Passions, among other names, a new group emerged: The Beach Boys played their first concert under that name at the Richie Valens Memorial Centre in Long Beach, California. . The group’s first national hit, "Surfin’ Safari", was soon to be. They recorded for local (Los Angeles) Colpix Records and at the height of their popularity, Capitol Records. The Beach Boys also recorded awhile under the Reprise Records banner. My friend Bruce Johnson, who played for my “big band,” also played piano for this group. I played substitute a few times for high school graduations in the desert community, where I drove once or twice, too. The Beach Boys were inducted into The Rock and Roll Hall of Fame in 1988.

1961- the first football game to gross $1 million was played on December 31,

1961- The Green Bay Packers defeated the New York Giants 37-0 for the National Football League Championship at City Stadium, Green Bay, Wi. There were 39l,029 spectators, and the paid attendance amounted to $1,013.792. Each of the Packers received $5,195 and each of the Giants, $3,340. The packers scored two touchdowns, three field goals, and four conversions.

1962 - Governor Edmund G. Brown, of California, announced that his state was now the most populous of the 50 United States. New York’s governor, Nelson Rockefeller, disagreed and refused to concede.

1967- Playing in a wind chill of 40 degrees below zero, the Green Bay Packers won the National Football League championship game by defeating Tom Landry’s Dallas Cowboys, 21-17. The game, played at Lambeau Field in Green Bay, Wisconsin was called the Ice Bowl. During the game, the whistles of the referees actually froze to their lips. It turned out to be the coldest championship game ever. Packers quarterback Bart Starr scored the winning touchdown on a quarterback sneak with 13 seconds left to play. The bloodiest year of the war comes to an end. At year's end, 536,040 American servicemen were stationed in Vietnam, an increase of over 50,000 from 1967. Estimates from Headquarters U.S. Military Assistance Command Vietnam indicated that 181,150 Viet Cong and North Vietnamese were killed during the year. However, Allied losses were also up: 27,915 South Vietnamese, 14,584 Americans (a 56 percent increase over 1967), and 979 South Koreans, Australians, New Zealanders, and Thais were reported killed during 1968. Since January 1961, more than 31,000 U.S. servicemen had been killed in Vietnam and over 200,000 U.S. personnel had been wounded

1968---Top Hits

I Heard It Through the Grapevine - Marvin Gaye

For Once in My Life - Stevie Wonder

Stormy - Classics IV featuring Dennis Yost

Wichita Lineman - Glen Campbell

1969- Jimi Hendrix's new band debuts

Jimi Hendrix's new group, the Band of Gypsies, debuts with its first album,Band of Gypsies. Hendrix's former band, the Jimi Hendrix Experience, had dissolved after several productive years together.Hendrix was born in Seattle in 1942. He grew up playing guitar, imitating blues greats like Muddy Waters as well as early rockers. He joined the army in 1959 and became a paratrooper but was honorably discharged in 1961 after an injury, which exempted him from duty in Vietnam. In the early 1960s, Hendrix worked as a pickup guitarist, backing up musicians including Little Richard, B.B. King, Ike and Tina Turner, and Sam Cooke. He moved to New York in 1964 and played in coffeehouses, where bassist Bryan Chandler of the British group the Animals heard him. Chandler arranged to manage Hendrix and in 1966 brought him to London, where they created the Jimi Hendrix Experience with bassist Noel Redding and drummer Mitch Mitchell. The band's first single, "Hey Joe," hit No. 6 on the British pop charts, and the band became an instant sensation. In 1967, the Jimi Hendrix Experience made its first U.S. appearance, at the Monterey Pop Festival. Hendrix made a splash by burning his guitar and was quickly established as a rock superstar. In the next two years, before the band broke up in 1969, it had released such classic songs as "Purple Haze," "Foxy Lady," and "The Wind Cries Mary." The band's albums included Are You Experienced? (1967), Bold as Love (1969), andElectric Ladyland (1969).

After the band dissolved over creative tensions, Hendrix made his famous appearance at Woodstock, playing a masterful, intricate version of "The Star Spangled Banner." Later that year, he put together a new group called the Band of Gypsies, which debuted on New Year's Eve in 1969. The band put out only one album, Band of Gypsies (1969). (A second album, Band of Gypsies II, was released in 1986.) Hendrix then recorded another album, without the band, called The Cry of Love, released in 1971. Hendrix played his last concert in August 1970, at the Isle of Wight Festival in Britain. He died in London in September 1970, having choked on his own vomit following a drug overdose. He was 28 years old when he died.

1973- Kiss, whose flash-and-thrash stage shows would influence two decades of heavy metal bands, made their debut at the Academy of Music in New York. They shared the bill with Blue Oyster Cult, Iggy Pop and Teenage Lust. Kiss members Paul Stanley, Ace Frehley, Gene Simmons and Peter Criss were as famous for their painted faces and spandex costumes as they were for their music, at least in the beginning.

1974- Mick Fleetwood telephoned Stevie Nicks and Lindsay Buckingham and invited them to join Fleetwood Mac. Fleetwood became interested in the duo after producer Keith Olsen played him an album that Nicks and Buckingham had recorded at Olsen's studio. Nicks and Buckingham completed the lineup that would record the four-million-selling "Fleetwood Mac" album in 1975 and the 15-million-selling "Rumours" two years later.

1976-the Cars played their first show, in New Hampshire. The new wave group would not release its first album until 1978. It would sell a million copies.

1976---Top Hits

Tonight’s the Night (Gonna Be Alright) - Rod Stewart

You Don’t Have to Be a Star (To Be in My Show) - Marilyn McCoo and Billy Davis, Jr.

You Make Me Feel Like Dancing - Leo Sayer

Sweet Dreams - Emmylou Harris

1978-Bill Graham’s Winterland closes with the Grateful Dead

http://www.dead.net/merchandising/music/DEAM-DECD249/

http://www.dead.net/merchandising/music/DEAM-DECD249/index_cd.html

1979- The gradual U.S. withdrawal from the conflict in Southeast Asia is reflected in reduced annual casualty figures. The number of Americans killed in action dropped to 1,386 from the previous year total of 4,204. South Vietnam losses for the year totaled 21,500 men, while the combined Viet Cong and North Vietnamese total was estimated at 97,000 killed in action.After 10 years of U.S. involvement in the Vietnam War, a total of 45,627 American soldiers had been killed. The U.S. troop levels, which started the year at 280,000, were down to 159,000. This troop reduction was a direct result of the shifting American goal for the Vietnam War-no longer attempting a military victory, the U.S. was trying to gracefully extricate itself from the situation by transferring responsibility for the war to the South Vietnamese.

1982- Little Steven Van Zandt of Bruce Springsteen's E Street Band married Maureen Santora in Asbury Park, New Jersey. Springsteen was best man, and Little Richard performed the ceremony. Richard and Percy Sledge performed Sledge's hit "When a Man Loves a Woman" at the reception.

1984---Top Hits

Like a Virgin - Madonna

The Wild Boys - Duran Duran

Sea of Love - The Honeydrippers

Why Not Me - The Judds

1985 - Over 54,500 people played kazoos in downtown Rochester, New York. It got the crowd listed in the Guiness Book of World Records for ‘Most Kazoo-ers’.

1986 - The State of Florida passed Illinois to become the fifth most populous state in the country. In the lead: California, New York, Texas, and Pennsylvania.

1986- Model Donna Rice met Senator Gary Hart for the first time at a party given by singer Don Henley, formerly of the Eagles. Henley says he didn't actually introduce the two because he was busy cooking. The scandal of the married Hart's relationship with Rice would cause the senator to withdraw from the race to be the Democratic presidential candidate in 1988.

1990-The Sci-Fi Channel on cable TV begins transmitting

1993- Barbra Streisand performed her first paid concert in 22 years -- the first of two shows at the M-G-M Grand Garden in Las Vegas. The concert was delayed for more than an hour because the audience had to pass through metal detectors. There were reports Streisand earned more than 20-million dollars for the two shows. Tickets -- priced from 50- to one-thousand-dollars each -- sold out within hours. Streisand had said she quit peforming because she became shy and scared she would forget the words to her songs. Fourteen TelePrompters helped her overcome that fear during the Vegas shows.

1997 - In an attempt to nudge its Microsoft Network into a more competitive position (vs. America Online), Microsoft announced the purchase of Hotmail, the free Web-based e-mail service.

1997 - Buffalo Bills head coach Marv Levy retired after 11 years and four consecutive Super Bowl appearances. His 123 victories with the Bills are a team record. He led the Bills to eight postseason appearances and five conference championship games, winning four.

1999-Panama assumes control of canal: With the expiration of the Panama Canal Treat of 1979 at noon, the Republic of Panama assumed full responsibility of the canal and the US Panama Canal Commission ceased to exist.

1999-The world waited with great fear to see if Y2 would cause havoc and destruction. A lot of computer makers, software developers, and consultants made a lot of money as the world moved from DOS to Windows forever.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Ten Top Stories each week opened the most by readers

(click here)

“Complaints” Bulletin Board (click here)

Connect with Leasing News![]()

![]()

![]()

![]()

(chronological order)

- As Economic Headwinds Subside, Businesses

Increasingly Reach Out for Financing

- New Standard Mileage Rates Now Available

- Ben Carlile Joins Leasing News Advisory Board

- SBA Reaches Record High in Loans to Small Business

- BBB Leasing Company Ratings

December 10, 2014

- Complaints Bulletin Board BBB Ratings

- Baytree National Bank sells Equipment Leasing

and Financing Business to North Community Bank

- Direct Capital Chris Broom Buys $8 Million Home

Appears Keeping Former Tyco President Mansion in NH

- Matrix Business Capital, Long Beach, California

Bulletin Board Complaint

- Blue Bridge Financial, Buffalo, New York

Bulletin Board Complaint--Doesn't Pay Broker

- Balboa Capital Sued in Federal Court for

Bait and Switch Sales Tactics

- Direct Capital Chris Broom Buys $8 Million Home

Appears Keeping Former Tyco President Mansion in NH

- Beware Congress May Pass Changes if FASB Does Not

- Warren Capital's Clay Stevens Passes Away

Former NFL Football Player

- Largest Bank Failure in 2014

Fourth Indian-American Bank to Fail in Chicago

- Details, Details...How Important are they?

Very, When the Lessor Sneaks in a Blanket Lien

- First American Equipment Finance Now Employs Most CLPs

- Compensation Plan

-

What the Marlin 3rd Quarter Press Release Did Not Include

- Who Will be the New Head of Direct Capital?

- Dave & Mike Murray,

the Original Founders of Direct Capital

- What is Leasing?

Legal Definitions by Leasing News Legal Editor Tom McCurnin

- Vote “Yes” on CIT Bank and OneWest Bank Merger

- What Lessors Now Need to Know About Hacking

- Why Leasing News “Job Wanted” Ads Are Sparse

- Ascentium Capital Opens New England Office

- Equipment Tax Deductions

- September 2014 Broker Survey Results

- Reaction to Wheeler 2014 Broker Survey

- Victim or Might Be a Victim of Identity Theft?

- Comcast home invasion lawsuit exposes risks

for home automation, security service providers

- Quick Bridge Funding Ranked No. 1 Fastest Growing

Private Midsize Company in Orange County, California

- Richest Man in Leasing: Steven Udvar-Hazay

- Derek Jeter's Final Game at Yankee Stadium

by Ralph Mango, Leasing News Associate Editor

- Invest in Your Country

U.S. Savings Bonds

- How to be a “Leasing Expert Witness”

and Make Extra Income

- 2014 Survey Reports Expert Witness Hourly Fees

Record All-Time Highs

- Steve Crane, CLP, Joins BSB Leasing

- Alexa Report--Leasing Industry Web Site Visits

- Where to Sell Your Old Handsets or iPad

- Tiny Breathalyzer Plugs into Your Phone

- Bank Savings Are Growing

Showing Anxiety of Businesses/Consumers

- Rosanne, Richard, and the Veterans Administration

- Dean Rubin Found, Ultimate Financing

a Division of Navitas Lease Corp.

- U.S. Savings Bonds

- Balboa Capital Settles $36,454 Attorney Fee Complaint

After Getting Suit Dismissed Against Regents Capital

- Your Photograph on LinkedIn.com

- Use a Password Generator

- Banks Turn Toward Leasing for More Profit

- 15 Biggest Employers in the World

- Déjà vu on Proposed Lease Accounting Changes

- What $11.62 Trillion Worth of Household Debt Looks Like

- Broker’s Responsibility to Obtain

California Lender’s License

- Dakota Financial saves $14,400 in document storage costs

after deploying Office 365

- Programs to Protect Smartphones/Tablets/Laptops

- Who is Financing the Other Four?

by Christopher Menkin

- Top Five Leasing Company Web Sites—

in North America

- Leasing News Icon for Android Mobile Device

- The Salary You Must Earn to Buy a Home in 27 Metros

- Lease Fleece Judge Verdict on Citibank Kingpin

-

New CLP Designation---“Associate”

- Look for More Changes in Conducting Leasing

- 5 Ways to Give Your Brain a Break Right Now

- LEAF Financial Income Fund III Complaints

10K Gives Numbers

- “A Great Time to be in the Equipment Leasing Industry”

- Why Leasing News is Different

- Loan/Lease Regulations

- Take Your Banker to Lunch

- Look Out!!! --Two Evergreen/PRR Clause Lessors Merge

Onset Financial/Mazuma Capital

- Lease Police Tips on Judging Vendors

- Netiquette: Rules of Behavior For Email and the Internet

- Alert: Rudy Trebels Back Soliciting Broker Business

-

HL Leasing/John Otto--Update

- NorVergence- Year end, 2013

- The Future of Digital: 2013

-

Twelve Lawyers Against Evergreen Clause Abuse

- Wants to Go After Lessors and Their Attorneys

Re: Evergreen Clause Abuses

- Sample of Usury Laws in United States

- Balboa Capital Class Action Case Settled--$5 million?

- Old Cowboy On His Horse

- Leasing Brokers: When May You Collect a Commission?

- Is Long Term Leasing Dead?

- 5 Ways Women Are Better Bosses Than Men

- Balboa Capital, Irvine, California

$20,543.22 Bulletin Board Complaint

Alleged “Bait and Switch”

- Female Lease Finance Association Presidents

- Broker’s Responsibility to Obtain

California Lender’s License

- The Day that Albert Einstein Feared May Have Finally Arrived

- Equipment Finance Agreements Explained/Barry S. Marks

- Royal Links "True Lease" Court Ruling

- "The Memory Shock" –New Book by Barry Reitman

- Mazuma and Republic Bank Get Snared on PRR Provision

by Tom McCurnin, Esq.

- Jeff Taylor's Leasing Predictions, Spring, 2006

- Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

Purchase Option on EFA, Won’t Return $5,000 S.D.

- New Case against Mazuma Capital and Republic Bank

---Automatic Evergreen Payment---PPR

- Republic Bank out of leasing?

- Charles Schwartz and Allied Health

- Copier Wars---It's more than the lease payment

by Christopher Menkin

- Leasing Gypsies

- Verifying Tax Returns

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses

-

Settlement Costs vs. Litigation Costs