![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Tuesday, September 30, 2014

Today's Equipment Leasing Headlines

Pictures from the Past--1990

Dean Cox, CLP

Classified Ads---Legal

Richest Man in Leasing: Steven Udvar-Hazay

Top Stories: September 22--September 26

Opened Most by Readers of Leasing News

“Why I Left or Why Am I Looking?”

Career Crossroad---By Emily Fitzpatrick/RII

Leasing Industry Ads---Help Wanted

Leasing 102 by Mr. Terry Winders, CLP

Internet Lease Proposals

FDIC Summary of Deposits Thursday, October 2

---Expected to Show Further Bank Branch Reductions

Banks Prepping Ahead of "Giant Sucking Sound" of Deposit Shift

Failed banks, class of 2014

SNL Financial Feature

Reid Raycovich, CLP, Receives Cindy Spurdle Award Plaque

FDIC Announces Settlement with Merrick Bank

South Jordan, Utah, for Unfair and Deceptive Practices

CardHub Study: Record Q2 Credit Card Debt Increase

German Shepherd/Labrador Retriever Mix

Beverly Hills, California Adopt-a-Dog

Derek Jeter's Final Game at Yankee Stadium

by Ralph Mango, Leasing News Associate Editor

News Briefs---

BofA To Pay $7.7M SEC Fine For 2009 Accounting Error

Mark Hurd delivers keynote as Oracle OpenWorld Opens

Dire Warnings by Big Tobacco on E-Smoking

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe to our news

editor or bookmark us (www.leasingnews.org) as each news edition

appears on our web site.

[headlines]

--------------------------------------------------------------

Pictures from the Past--1990

Dean Cox, CLP

Chief Financial Officer, Balboa Capital, Irvine, CA

“Mr. Cox will manage all aspects of operations including Information Systems, Customer Service, and the business center. Mr. Cox plans to revolutionize Balboa Capital Corp. by implementing advanced technology systems to facilitate smoother transactions and to re-unite all departments into an integrated team.”

-

United Association of Equipment Leasing Newsline, Fall Edition, 1990

TODAY

Dean Cox

Chief Operating Officer

Enverto

[headlines]

--------------------------------------------------------------

Classified Ads---Legal

(These ads are “free” to those seeking employment

or looking to improve their position)

San Diego , CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Richest Man in Leasing: Steven Udvar-Hazay

Steven Udvar-Hazay, 68, International Lease Finance, is 146 on the list of Forbes 400 for 2014, that was just released. He has actually has fallen down the list from 133, even as he became wealthy. Forbes did report he is down $1.1 million from 2013, now at $3.7 Billion net worth.

"Steven Udvar-Hazy, commonly credited with creating the airplane leasing industry, spent the summer of 2014 doing what he usually does - placing billion-dollar orders for new airplanes. In July, at the Farnborough airshow near London, Udvar-Hazy, CEO of Air Lease Corp., placed orders at both Airbus and Boeing, 60 jets for $7.23bn and 26 jets for $3.9bn respectively, adding to the 33 planes Air Lease Corp. ordered last year. The company, which went public in 2011, is Udvar-Hazy's second billion-dollar company in the airplane leasing industry. His first, International Lease Finance Corp., was sold to AIG in 1990 for $1.3 billion. His Air Lease Corp. is competing directly with AIG's airplane leasing business. The company is currently involved in an ongoing civil suit over trade secrets with AIG. He moved to New York from Budapest, Hungary as a child.”

“A certified jet pilot, he co-founded International Lease Finance Corp. after cobbling together deals with airlines while still a student at UCLA. After graduating, Udvar-Hazy started his own California commuter airline, but struggled to stay in the black. He then realized that the money was in leasing airplanes to airlines. He's given about $100 million to Stanford University, where his children went to college, and is also the namesake of the Smithsonian's National Air and Space Museum Steven F. Udvar-Hazy Center, to which he donated $66 million."

The National Air and Space Museum's Steven F. Udvar-Hazy Center

No one else in Leasing made the Forbes 2014 400 list.

Forbes: The Richest People in America 2014

http://www.forbes.com/forbes-400/list/#tab:overall

[headlines]

--------------------------------------------------------------

Top Stories: September 22--September 26

Opened Most by Readers of Leasing News

(1) Lessor Found Liable for Embezzlement in North Carolina Bankruptcy Court

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Sep2014/9_24.htm#liable

(2) "Top Gun" Richard Baccaro

http://leasingnews.org/archives/Sep2014/9_26.htm#baccaro

(3) Join FinPac and Umpqua Bank for Happy Hour

Thursday, September 25, Newport Beach, CA

http://leasingnews.org/archives/Sep2014/9_22.htm#join

(4) New York Business Man $146 Million Bank Fraud Scheme

Alleged part of “an Albanian Crew”

http://leasingnews.org/archives/Sep2014/9_22.htm#fraud

(5) New Hires---Promotions in the Leasing Industry

http://leasingnews.org/archives/Sep2014/9_26.htm#hires

(6) Leasing 102 by Mr. Terry Winders, CLP

http://leasingnews.org/archives/Sep2014/9_22.htm#decision

(7) Archives---September 24, 2000

Congratulations to Debbie Monosson

http://leasingnews.org/archives/Sep2014/9_24.htm#archives

(Tie)(8) Barry Marks Equipment Finance Program for Community Bank

September 25 Telephone Seminar Sponsored by ICBA

http://leasingnews.org/archives/Sep2014/9_24.htm#marks

(Tie) (8) Top Stories: September 15--September 19

Opened Most by Readers of Leasing News

http://leasingnews.org/archives/Sep2014/9_22.htm#top_915

(Tie) (10) 2015 NEFA Officers and Directors Elected

Directors Terms Up

http://leasingnews.org/archives/Sep2014/9_24.htm#nefa

(Tie) (10) Leasing Industry Executives React to

ELFA Report August New Business Down 7.7%

http://leasingnews.org/archives/Sep2014/9_26.htm#elfa

(12) Quick Bridge Funding Ranked No. 1 Fastest Growing

Private Midsize Company in Orange County, California

http://leasingnews.org/archives/Sep2014/9_26.htm#quick

|

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

|

For information on placing a help wanted ad, please click here

Please see our Job Wanted section for possible new employment

[headlines]

--------------------------------------------------------------

“Why I Left or Why Am I Looking?”

Career Crossroad---By Emily Fitzpatrick/RII

Question: When speaking to a recruiter or a potential employer, I am always asked why I left my previous employers or why I am interested in leaving my current role. Can you give me some suggestions?

Answer:

The following relates to leaving or wanting to leave an employer of your own accord

(Being fired or laid off, would require a different set of responses)

This is a common inquiry that you need to be prepared for - this line of questioning will be brought up, guaranteed, at some point in any interview and must be addressed. You should have a conventional reason for leaving every job you have held. Some samples of acceptable and HONEST reasons for wanting to leave your current employer or for leaving your previous employers:

- Challenge: not growing professionally

- Location: commute … company moving … you are moving

- Advancement: nowhere for you to advance … layers of other employees ahead of you

- Money: raise not given, as promised, at time of hire

- Pride or prestige: company’s reputation has been degraded

- Security: high turnover … don’t see long-term stability

- Atmosphere: corporate culture is not what was envisioned

An Example Response Might Be:

“My current employer is a family-run business, and it is time for me to join an organization that will allow for advancement and greater challenges.”

If you have left jobs frequently (hopefully just in your youth) you are now much more settled, or you may wish to impress on the interviewer that your job-hopping was never as a result of poor performance, and that you grew professionally with each job change.

Samples:

(1) “…I received an opportunity to broaden my experience with a new company that was just starting up. In hindsight, I realize that move was a mistake. It took me six months to realize I could not make a contribution there and I have been with my current company a reasonable length of time …” (2)”…I am not a job-hopper; I have been following a path to gain broad experience …”

(3)”…I am ready to settle down and make my diverse background pay off in my contributions to my new employer…”

(4)”…I have a strong desire to contribute and am looking for an employer that will keep me challenged; I think this might be the company to do that …”

NOTE: If a company has closed or downsized, it is NOT a poor reflection on the Candidate – we know in the equipment leasing/finance industry many companies closed or downsized over the years - simply explain this to any potential employer. Do NOT fail to list/disclose any company or position on your resume or during the interview process because of negative circumstances surrounding your exit.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Internet Lease Proposals

It has come to my attention that a lot of presentations or offers are handled on the internet, and unless the transaction is higher than 250 thousand dollars, personal contact is not likely. This presents a problem with a large number of potential lessees who are not familiar with what your type of lease requires regarding tax, legal and/or accounting consequences. Therefore I suggest an additional sheet attached to your proposal to explain the type of lease you are offering.

Types of leases are, Equipment Finance Agreement (EFA), Capital Lease with $1 purchase option, EFA with purchase option, EFA with “Purchase Upon Term” (Put), Operating Lease, TRAC lease, Not-for-profit lease, or Municipal Lease. Others include as skip payments, quarterly payments, different first payment for 60 days or 90 days, or seasonal payments. that you may call by a different name. There are other special leases for special equipment.

I know that part of it addresses some provisions in the lease agreement, but this reminder of their responsibilities is a good

practice that reduces the possibility of a misunderstanding.

I will spend the next few news editions to give you an idea of what to present based on what type of lease you are offering. This will not fit every circumstance, but it will give you a good start. Here is the first presentation:

Capital Lease

Dear Lessee,

This lease is a non-cancelable transaction on a lease document. We will retain title until all payments are received per the lease contract. The lease requires you to pay all assessed taxes on time. If the sales tax is not handled at the time of purchase and must be collected over the term, we will add the sales tax to your payment and remit it to the State.

The vendor will deliver the equipment and then will invoice us. We will pay the vendor upon your acceptance and satisfaction of the equipment in good working condition.

We will file a UCC-1 financing statement in the state of your business

residence in compliance with your state’s requirements to publicly record the transaction. You are required to provide insurance on the equipment and provide the lessor with a loss payable clause and an additional insured endorsement.

You are offered a $1 purchase option provided it is paid on the last day of the lease and, after its receipt, we will send you a bill of sale and release the UCC.

You are considered the tax owner for income tax purposes, so you should take the appropriate MACRS depreciation with an interest deduction.

This transaction is a capital lease for accounting purposes, so you should take the straight line depreciation on the present value of the rent stream based on your average cost of money called your incremental borrowing rate.

We appreciate your business so if you have any questions please contact

Yours truly,

_______________________

You may think that providing too much information will hurt your chances of getting the deal, but I think it makes you look more professional. It takes the stigma out of a disguised “fair market value” or Evergreen abuse with extra lease payments. Many lessees have been burned by these tricks. In addition, there will be no misunderstanding on how the transaction works for all the rules.

Leasing is different from lending even though appear the same to the average customer. The more you communicate on the internet the more your proposals need to be complete and informative.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

FDIC Summary of Deposits Thursday, October 2

---Expected to Show Further Bank Branch Reductions

SNL Financial Feature

By Kevin Dobbs and Tahir Ali

((The article does not mention the growing use of Mobile banking by Millenniums (although it mentions the increase of mobile banking), the growth of credit unions, as well as others getting into banking with little branch expense, such as the recent announcement by the Bank of Walmart. Walmart is the largest company in the United States with 4800 stores and 2.2 million employees. The retail giant is getting into banking by offering checking accounts to just about anyone 18 and older. Last week Leasing News noted that Walmart is partnering with pre-paid card purveyor Green Dot to offer GoBank. The accounts — to be available by the end of October — will have no overdraft fees, bounced check fees, or minimum account balances. They will cost $8.95 a month with direct deposits of less than $500 a month. And WalMart will be without any federal or state regulatory

framework that apples to licensed banks. And then there also

is the company ApplePay, which WalMart states it will not

accept in its stores (the company is basically seeking lower

income consumers. Editor))

When the FDIC releases its latest round of Summary of Deposits data, anticipated as soon as next week, many in the banking industry expect it will show a continuation of the trend of branch reductions. The new data release will show branching and deposit levels through June 30, 2014.

Analysts point to banks' ongoing efforts to trim costs in an environment marked by fierce competition for loans that makes revenue gains difficult, as well as low interest rates that often make loan products less profitable. Bankers and analysts also point to an established and deepening trend of lighter foot traffic in branches, as customers increasingly do more of their routine financial business online. The shift in customer behavior is forcing bankers to continually examine which branches are needed and which no longer generate enough activity to warrant the costs of staffing and maintenance.

"Technology is always going to be important," Jefferson Harralson, an analyst at Keefe Bruyette & Woods Inc., told SNL. "You're still going to see branches decline. You'll still see banks cut their less profitable branches and reinvest the savings into areas where they see growth."

Banks in the U.S. operated a total of 96,714 branches at June 20, 2013, according to last year's SOD data. That figure dropped by 1.73% over the following 12 months, an SNL Financial analysis of branch openings and closings in that period found.

Among the 10 major banking companies with the largest branch networks in the U.S., nine shrunk their branch totals between June 30 of last year and the same date this year, according to the SNL analysis. The lone exception was Wells Fargo & Co., which has more branches than any other; it did not grow its total branch count but held it steady at 6,300.

JPMorgan Chase & Co., Bank of America Corp., U.S. Bancorp, PNC Financial Services Group Inc., BB&T Corp., Regions Financial Corp., SunTrust Banks Inc., Royal Bank of Scotland Group Plc's U.S. operations and Fifth Third Bancorp all recorded decreases in their branch totals, SNL found.

Analysts also note that branch totals are declining in part because of ongoing merger-and-acquisition activity. When banks buy out a competitor they often shutter or sell off overlapping branches to minimize redundancy and save money.

Mark Fitzgibbon, head of research at Sandler O'Neill & Partners, told SNL that bank M&A is likely to continue throughout 2014 and into coming years. Small banks are struggling with heavy compliance burdens and competitive pressures, leading many to consider selling, while would-be buyers are looking to augment modest organic growth with acquisitions, he said.

Fitzgibbon also said there are signs that M&A could accelerate. Notably, he said, there is increasing talk about larger regional banks getting back into M&A as buyers. Most have been on the sidelines because regulators have made it known that intense scrutiny awaited them if they pursued larger deals. But now, he said, some larger regionals are thought to be looking at acquiring community banks.

One prominent example of this emerged earlier this month: BB&T's plan to acquire Bank of Kentucky Financial Corp. for $363 million.

Fitzgibbon said it appears regulators may be "softening their stance" on M&A, allowing regionals to at least pursue smaller targets without fear of overbearing regulatory reviews. "I think there is more M&A to come," he said.

He said the addition of regional buyers, which have greater resources for integrations and often have the ability to pay more for prized targets, could encourage potential sellers to step forward. "And if you add in the regional guys," Fitzgibbon said, "it should drive things higher simply because there would then be more guys in the mix."

All of those factors — underperforming branches, technology and shifts in consumer behavior, and M&A — are likely to contribute to an ongoing decline in branch totals, Harralson said. But, he added, the pace of decline could slow some in coming years if interest rates rise as many anticipate they will begin to do at some point in 2015.

When rates climb, the KBW analyst said, competition for deposits is bound to heat up as customers will shop around and could move their money from one bank to another if they can fetch higher interest payments on their deposits. While increasingly more Americans bank online, many often still like to go into branches to handle certain transactions, including the closing and opening of accounts.

That, coupled with the fact that branches typically serve as the faces of banks in neighborhoods and effectively function as advertising billboards for those looking to attract the attention of new customers — and their deposits — could convince banks to slow branch reduction efforts in a rising rate environment, Harralson said.

What's more, he said, historically some banks have been able to increase the interest they charge on loans faster than the interest they pay on deposits in a rising rate era. Loan demand, the thinking goes, often accelerates in periods of rising rates because such periods are typically defined in part by stronger economic activity. When demand is strong, pressure on lenders to compete via low rates can dissipate. If that were to happen, large loans made out of branches — many customers still go to branches for larger deals — would be more profitable and some branches, by extension, would become more profitable as well.

"So some of what is driving this [decline in branches] is a fairly temporary issue in the form of low rates causing unusually low branch profitability," Harralson. "That part could change some" and slow the overall decline. "It will be interesting to see how that works out."

[headlines]

--------------------------------------------------------------

Banks Prepping Ahead of "Giant Sucking Sound" of Deposit Shift

SNL Financial

As the prospect of rising rates looms, banks are increasingly focused on building "sticky" consumer deposits.

Consumer deposits are prized among banks, since most bankers and regulators view them as a reliable funding source that may remain steady even as the eventual turn in the interest rate cycle changes the cost of deposits and possibly leads to deposit outflows. Experts say institutions must prepare to recapture funds that will be redistributed into higher-yielding accounts — which could be a challenge for some and a surprise for others.

Consumer deposits make up 46.30% of deposits at banks with assets above $1 billion, according to an SNL analysis of regulatory data for the second quarter. The majority of that amount, 61.68%, was held in money market deposit accounts. This is the second quarter that banks have reported consumer deposit figures in regulatory filings, and the figures can differ from GAAP measures.

From a liquidity standpoint, consumer deposits are among the stickiest, most valuable deposits a bank can gather and are the least likely to run off in a crisis, said Sherief Meleis, managing director at bank analytics and advisory firm Novantas Inc. Institutions often grow retail consumers through the modest primary checking account, often called a demand deposit account or noninterest- or interest-checking account.

"All good things flow out of that primary checking," Meleis said. "It gives you the right to cross-sell, so banks are very focused on getting that primary checking account."

When rates rise, funds are liable to leave deposit accounts in search of higher yields; the risk for banks is that they would be transferred outside the institution into money market funds or other investment products. Banks should prepare for both deposit runoff and a mix-shift in the distribution of funds, in order to minimize the former and capture and contain the latter. Meleis expressed concern about how banks plan to adjust if rates jump several hundred basis points.

"Banks need to be ready for the giant sucking sound that happens when rates start rising and money starts coming out of savings and money market accounts and going to money market mutual funds and CDs," Meleis said. "They need to be ready to capture all of that in a rising rate environment. It's something banks are thinking a lot about — how do we make sure we keep the money that's going to shift out of liquid products into term?"

A Novantas analysis suggests that deposit costs would increase 48 basis points if rates rose 100 basis points, and 96 basis points if rates rose 200 basis points, based on the rising rate environment in 2004. Meleis also noted that rates in the past have climbed quickly, as much as 50 basis points in a quarter.

"There are a lot of people right now in bank pricing who have never been through a rising rate environment and they're going to be learning on the fly," he said, later adding: "It's critical that banks are ready, and because it's been flat for so long, we think many banks are not ready."

Full SNL Financial Report:

https://www.snl.com/InteractiveX/Article.aspx?cdid=A-29224099-11820

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Failed banks, class of 2014

SNL Financial Feature

By Divya Lulla and Zuhaib Gull

Regulators did not close any banks during the week ended Sept. 26, keeping the number of 2014 failures at 14. In comparison, 22 banks were closed through Sept. 19 in 2013.

The FDIC has relied less on loss-share agreements to complete its failed-bank transactions of late. None of the 14 government-assisted transactions this year included a loss-share agreement, while three of the failures in 2013 included these agreements. In 2012, 20 failures included loss-share agreements.

Failures this year have cost the FDIC's deposit insurance fund less than previous years. The median cost to the fund at the time of announcement as a percentage of the failed banks' assets is 14% in 2014 to date, down from 22% for full year 2013 and 21% in 2012.

Chicago-based GreenChoice Bank fsb ($70.3 million)

GreenChoice Bank was the third Illinois institution to fail this year after regulators shuttered Moline-based Valley Bank on June 20. Established in 1910, GreenChoice Bank operated three branches, all in Illinois. The savings bank failed to post a profit in any quarter since the end of 2008 and had a Texas ratio of 551.04% on June 30. South Holland, Ill.-based Providence Bank LLC assumed the bank's deposits, which stood at $68.7 million at the end of the second quarter. Providence Bank also purchased $67.7 million of GreenChoice Bank's assets. The FDIC retained the remaining assets for later disposition.

Leasing News on Chicago-based GreenChoice Ban:(http://leasingnews.org/archives/Jul2014/7_28.htm#bank_beatk fsb)

Conyers, Ga.-based Eastside Commercial Bank ($173.9 million)

Eastside Commercial Bank was the first Georgia bank to fail since regulators shuttered Valdosta, Ga.-based Sunrise Bank on May 10, 2013. Established in 2005, Eastside Commercial Bank operated two branches, both in Georgia. The institution posted a profit in only two quarters since the start of 2010. Atlanta-based Community & Southern Bank assumed all of Eastside's deposits, which stood at $166.9 million at June 30. The Community & Southern Holdings Inc. unit also entered into an agreement with the FDIC to buy $104.7 million of Eastside's assets. In a separate deal, the FDIC agreed to sell $42.6 million of the failed bank's loans to Macon, Ga.-based State Bank and Trust Co., a subsidiary of State Bank Financial Corp. The regulator has ![]() retained the remaining assets for later disposition.

retained the remaining assets for later disposition.

Leasing News on Conyers, Ga. based Eastside Commercial Bank(http://leasingnews.org/archives/Jul2014/7_21.htm#bank_beat)

Freedom State Bank ($22.8 million)

Freedom State Bank's closure marked the second failure in Oklahoma this year after Bank of Union was shuttered Jan. 24. Established in 1919, Freedom State Bank operated a single branch in Oklahoma before it was shut down. The FDIC had issued a prompt corrective action directive to the bank May 2.

Leasing News article on Freedom State Bank Closing:

(http://leasingnews.org/archives/Jul2014/7_01.htm#bank_beat)

Moline, Ill.-based Valley Bank ($456.4 million

Valley Bank, one of the River Valley Bancorp subsidiaries to fail June 20, operated 13 branches in Illinois before its closure. The bank's nonperforming loans ratio stood just shy of 24% at March 31, and the institution posted $51.3 million in total losses from 2010 through March 31. Valley Bank was also operating under a cease and desist order from Jan. 15.

Leasing News article on Valley Bank Closing:

(http://leasingnews.org/archives/Jun2014/6_23.htm#bank_beating)

Fort Lauderdale, Fla.-based Valley Bank ($81.8 million)

Established in 1974, Valley Bank operated four branches in Florida before its closure June 20. This was the first Florida failure since Graceville, Fla.-based Bank of Jackson County closed Oct. 30, 2013. Valley Bank was operating under a ![]() cease and desist order dated Dec. 18, 2013, and had lost $17.9 million from 2009 through March 31. The Seminole Tribe of Florida had expressed an interest in acquiring Valley Bank but

cease and desist order dated Dec. 18, 2013, and had lost $17.9 million from 2009 through March 31. The Seminole Tribe of Florida had expressed an interest in acquiring Valley Bank but ![]() withdrew its application June 4.

withdrew its application June 4.

Leasing News article on Valley Bank Closing:

(http://leasingnews.org/archives/Jun2014/6_23.htm#bank_beating)

Bel Air, Md.-based Slavie Federal Savings Bank (MHC) ($140.1 million)

Founded as a community bank in 1900, Slavie Federal Savings Bank (MHC) marks the ninth bank failure in Maryland since 1998. This was the first failure in the state since regulators closed HarVest Bank of Maryland on April 27, 2012. Prior to its closure, the OCC issued a cease and desist order to Slavie on Jan. 7. The institution had struggled to improve its capital position as its Tier 1 risk-based ratio fell to 3.83% in the first quarter from 11.92% two years prior. Furthermore, the bank failed to earn a profit in the last 11 quarters, incurring an aggregate net loss of $16.4 million over that period.

Leasing News article on Slavie Federal Savings Bank Closing:

(http://leasingnews.org/archives/Jun2014/6_02.htm#bank_beat)

Cincinnati-based Columbia Savings Bank ($36.5 million)

Established in 1892, Columbia Savings Bank operated out of a single branch in Cincinnati. The failure marks the first in Ohio after regulators closed Milford-based Bramble Savings Bank in 2010. The FDIC issued a ![]() prompt corrective action directive to Columbia Savings Bank on March 13, ordering it to either increase its capital levels or accept an offer to be acquired by another bank. Prior to its failure, the institution had incurred a net loss in 22 of its last 24 quarters. The aggregate loss for those quarters totaled $5.36 million.

prompt corrective action directive to Columbia Savings Bank on March 13, ordering it to either increase its capital levels or accept an offer to be acquired by another bank. Prior to its failure, the institution had incurred a net loss in 22 of its last 24 quarters. The aggregate loss for those quarters totaled $5.36 million.

Leasing News article on Columbia Savings Bank Closing:

(http://leasingnews.org/archives/May2014/5_27.htm#bank_beat)

Berwyn, Ill.-based AztecAmerica Bank ($66.3 million)

The bank was established in 2005, focusing on the Hispanic community in Chicago, according to Crain's Chicago Business. In an SNL analysis, AztecAmerica was ranked fifth in the list of banks and thrifts with the highest adjusted Texas in the first quarter. The bank had incurred net losses for 22 of the last 25 quarters for an aggregate loss of $13.8 million.

AztecAmerica Bank Report by Leasing News:

(http://leasingnews.org/archives/May2014/5_19.htm#bank_beat)

Fairfax, S.C.-based Allendale County Bank ($51.5 million)

The bank was established in 1937 and operated five branches in South Carolina. This represents the first bank failure in South Carolina since Carolina Federal Savings Bank in June 2012. The FDIC had issued a ![]() cease and desist order to Allendale County Bank in July 2013. At the end of 2013, about 56% of the company's loan portfolio consisted of consumer loans. Due to a substantial rise in its loan loss provision, the bank incurred a net loss of $3.1 million in the quarter ended Dec. 31, 2013.

cease and desist order to Allendale County Bank in July 2013. At the end of 2013, about 56% of the company's loan portfolio consisted of consumer loans. Due to a substantial rise in its loan loss provision, the bank incurred a net loss of $3.1 million in the quarter ended Dec. 31, 2013.

Allendale County Bank report by Leasing News

(http://leasingnews.org/archives/Apr2014/4_28.htm#bank_beat)

Sterling, Va.-based Millennium Bank NA ($130.3 million)

Established in 1999, the bank had two branches in northern Virginia. It was the first failure in Virginia since Bank of the Commonwealth in September 2011. The bank had incurred net losses for 23 consecutive quarters for an aggregate loss of $52.1 million. Millennium topped the list of banks having the highest adjusted Texas ratio for the quarter ended Sept. 30, 2013, according to an analysis conducted by SNL.

Millennium Bank report by Leasing News:

(http://leasingnews.org/archives/Mar2014/3_03.htm#bank_beat)

Horsham, Pa.-based Vantage Point Bank ($63.5 million)

The bank was formed in 2007 and operated one branch in the Philadelphia-Camden-Wilmington, PA-NJ-DE-MD MSA. This marks the first failure in Pennsylvania since Nova Bank in October 2012. The FDIC had issued a consent order to Vantage Point on Dec. 9, 2013. The bank had also recently experienced turnover in senior management.

Vantage Bank report by Leasing News:

(http://leasingnews.org/archives/Mar2014/3_03.htm#bank_beat)

Boise, Idaho-based Syringa Bank ($153.4 million)

Established in 1997, the bank had six branches in Idaho, five of which were in the Boise City-Nampa MSA. This was the first bank failure in Idaho since April 2009. Syringa Bank's parent, Syringa Bancorp, had received TARP funds in January 2009. Syringa Bank had incurred net losses for 19 consecutive quarters for an aggregate loss of $40.0 million. Total loans and leases were $119.8 million at year-end 2013, down from $260.2 million five years earlier.

Syringa Bank Report by Leasing News:

(http://leasingnews.org/archives/Feb2014/2_03.htm#abnk_beat)

El Reno, Okla.-based Bank of Union ($317.2 million)

Established in 1900, Bank of Union had two branches in central Oklahoma. This was the first bank failure in Oklahoma since First Capital Bank in June 2012. The FDIC issued Bank of Union a consent order in June 2013. More than half of the bank's loan portfolio was nonperforming as of Sept. 30, 2013.

Bank of Union report by Leasing News:

(http://leasingnews.org/archives/Jan2014/1_27.htm#bank_beat)

West Chicago, Ill.-based DuPage National Bank ($53.5 million)

The bank was established in 1891 and operated three branches in the Chicago MSA. DuPage National was the first bank failure in Illinois since Covenant Bank in February 2013. The bank had incurred net losses for 25 consecutive quarters for an aggregate loss of $17.7 million. As of Sept. 30, 2013, 17.41% of its gross loans were past due or nonaccrual.

DuPage Bank Report by Leasing News:

(http://leasingnews.org/archives/Jan2014/1_27.htm#bank_beat)

FDIC List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Leasing News Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Reid Raykovich, CLP, Receives Cindy Spurdle Award Plaque

Reid Raykovich, CLP, Nancy Geary, CPA, CLP

The Board of Directors of the Certified Lease Professional (CLP) Foundation is proud to announce that Reid Raykovich, CLP, Executive Director of the CLP Foundation, is the third recipient of the annual Cindy Spurdle Award of Excellence. She was presented a plaque at the National Equipment Finance Association (NEFA) Funding Symposium in San Antonio by the previous year’s winner Nancy Geary, CPA, CLP.

Cindy Spurdle was the first and only Executive Director of the CLP Foundation since its inception in May of 2000 until June 2012. The award was created to acknowledge the CLP who has contributed the most to the industry and best represents the CLP ideals and the first recipient was Theresa Kabot, CLP, K2 Funding.

Senior Vice President

Banc of California

President, CLP Foundation

David Normandin, CLP, President of the CLP Board of Directors stated, “Reid has been and continues to be committed to the success of the CLP Foundation. She has demonstrated this commitment by doing the heavy lifting that has resulted in the Foundation’s double digit growth. Additionally she has executed a new designation launch, rebuilt the partnership program, and has illustrated the Foundation’s commitment to partnering with education groups and associations to further its mission of holding a high standard for the leasing and finance industry through its certification. I have personally been impressed by Reid’s selfless dedication to the Foundation and true love of the industry and the people in it. Reid is certainly deserving of this honor and all that it signifies. The CLP community clearly agrees in its action of awarding Reid for a job well done.”

The CLP designation identifies you as a knowledgeable professional to employers, clients, customer, and peers in the leasing industry. There are currently 218 Certified Lease Professionals throughout the world. For more information, call (206) 535-6281 or visit www.clpfoundation.org

[headlines]

--------------------------------------------------------------

##### Press Release ############################

FDIC Announces Settlement with Merrick Bank,

South Jordan, Utah, for Unfair and Deceptive Practices

The Federal Deposit Insurance Corporation (FDIC) today announced a settlement with Merrick Bank, South Jordan, Utah, (Bank) for unfair and deceptive practices related to marketing and servicing of credit card "add-on products," in violation of Section 5 of the Federal Trade Commission (FTC) Act.

This action results from a review of the Bank's credit card products by the FDIC. As part of the settlement, the Bank stipulated to the issuance of a Consent Order, Order for Restitution, and Order to Pay Civil Money Penalty (collectively, FDIC Order). The FDIC Order requires the Bank to pay a civil money penalty (CMP) of $1.1 million, and restitution of approximately $15 million to harmed consumers. Consumers who are eligible for relief under the settlement are not required to take any action to receive compensation.

The Bank marketed the "PAYS Plan," a payment protection credit card add-on product that was sold from 2008 to 2013 to consumers who had a Bank credit card. The PAYS Plan provided a benefit payment towards a consumer's monthly credit card payment following certain life events such as involuntary unemployment, disability, and hospitalization.

The FDIC determined that the Bank violated federal law prohibiting unfair and deceptive practices by, among other things:

- misrepresenting that the PAYS Plan "Monthly Benefit" would equal the consumer's "Minimum Payment Due";

- misrepresenting that the PAYS Plan would protect the consumer's credit rating;

- misrepresenting that PAYS Plan payments would be made automatically;

- failing to adequately disclose material conditions and restrictions related to the PAYS Plan;

- failing to adequately disclose the terms and conditions for accessing the PAYS Plan hospitalization benefit; and

- requiring permanently disabled consumers to recertify their disabled status each month.

The FDIC Order requires the Bank to take affirmative steps to correct the violations, and to ensure compliance in the future with all consumer protection laws, including the FTC Act

[headlines]

--------------------------------------------------------------

### Press Release ############################

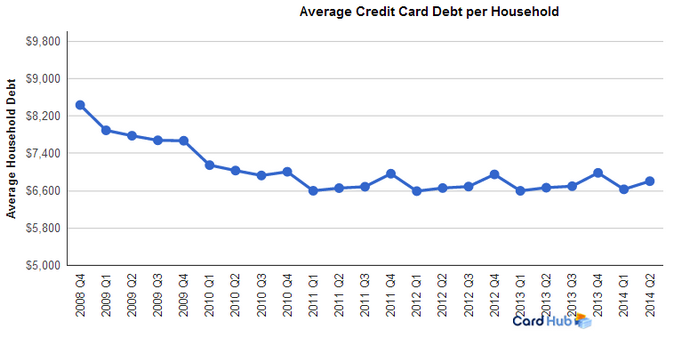

CardHub Study: Record Q2 Credit Card Debt Increase

CardHub released its Q2 Credit Card Debt Study, which shows U.S. credit card users heading in the wrong direction. After paying off $32.5 billion in amounts owed during the first quarter of 2014, we erased roughly 86% of that pay down during the subsequent three month period, adding $28.2 billion to the books in Q2. This second quarter build-up was the largest in the last six years and nearly 200% larger than what we witnessed in Q2 2009, as the economy emerged from the depths of the Great Recession.

As a result, CardHub has revised upward its projection for 2014’s credit card debt increase from $41.9 billion to $54.8 billion (41% more than in 2013).

Other Key Stats:

$6,802 – The average household’s credit card balance (up from $6,628 in Q1 2014). By the end of the year, this number is expected to be well over $7,000 and roughly $1,300 shy of an unsustainable tipping point.

$298.5 Billion – CardHub projects that by the end of 2014, consumers will have defaulted on nearly $300 billion in credit card debt since 2009.

3.32% – The quarterly credit card default rate – down 0.3% from 2013 and 23% relative to early 2012 – seems to be stabilizing near historical lows.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

German Shepherd/Labrador Retriever Mix

Beverly Hills, California Adopt-a-Dog

Greta

German Shepherd Dog & Labrador Retriever Mix

Senior

Female

Medium

The Kris Kelly Foundation Beverly Hills, CA

Contact:

http://www.thekriskellyfoundation.org/contact.php

The Kris Kelly Foundation

Santa Monica Division:

9903 Santa Monica Blvd., #474

Beverly Hills, CA 90212

The Kris Kelly Foundation

Phone: (310) 989-8800

KrisKelly@kriskellyrescue

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Derek Jeter's Final Game at Yankee Stadium

by Ralph Mango, Leasing News Associate Editor

The Captain’s Goodbye

September, 25, 2014…Yankee Stadium, The Bronx…

One of Derek Jeter’s post-career ventures is publishing children’s books, one of which is about to be released. We don’t know if Jeter is going to write them, but, if he is, he could not write a story any better than what occurred tonight, his final game in Yankee Stadium after 20 years as not only a Yankee icon, but for all of baseball. He has owned New York reminiscent of Ruth, DiMaggio, and Mantle before him.

The day was miserable, raining and there were doubts about whether the game would be played at all. When we arrived it was pouring, so we fed the kids and walked around, looking at all the Jeter and Yankee memorabilia for sale. They were selling Yankee Stadium dirt in a quarter-sized 1/8” plastic disk for $10!!! One of The Captain’s uniforms was selling for $50K.

On cue, the rain stopped and the skies cleared. Facing west, we could see the remnants of the sunset that reddened the sky…good thing they were playing the O’s rather than the Red Sox!

Bruce Springsteen’s trumpeter blared a memorable Star-Spangled Banner and we settled into our center field bleacher seats just in time to see the first two Orioles hitters homer and groans took the place of the pre-game anticipation of an historical night. But wait, it was only 2-0 and the Yanks had yet to hit. They did.

Gardner led off with a single, Jeter up next…the crowd electric with their chants of “Der-ek-Jee-ter” that would become the night’s anthem. Lost in the crowd noise, the taped voice of the late Bob Shepard announces as he has since his death many years ago, in a signature New York accent, “Now batting for the Yankees…numbuh 2…shortstop…Derek Jeetuh…numbuh 2.” With this game, we will never hear Sheaprd’s iconic voice again.

Turning to my son-in-law, I joked that if he hits one out, the whole place goes up for grabs. He nearly did as his drive rattled the left-center field wall a foot from going out…Gardner scored and Jeter walked into second with a double. On a wild throw by the O’s third

baseman on the next hitter, Jeter scored the second run and we’re tied. Unreal!

Oh, by the way, sitting next to me was a couple, both dressed in their pinstriped number 2 Yankees home jerseys. Between the bottom of the first and the top of the second, he gets down on one knee and proposes…she says yes…and the crowd around us explodes. I’m stunned…is this a dream…and I know it’s not Iowa! Unbelievable.

The pitchers settled down for the next several innings, throwing zeroes, but not the fans. It has been customary at every home game, for Yankees fans in the bleachers to shout out the names of the starting lineup until the player acknowledges, usually with a tip of the cap or a wave of his glove, but when they got to Jeter, they just kept calling his name. This would be a most unusual game, never mind that it meant nothing to either team as the Yankees were playing out the string and the O’s were just maintaining momentum for the playoffs, trying not to incur injuries.

The chants continued for the next several innings despite the fact that neither team mustered much in the way of offense. In the 7th, the Yanks pushed across three runs, two of which scored on a ground ball hit by The Captain that was thrown away in an attempt to turn a double play. It is 5-2, Yanks, and the crowd starts up again…“Der-ek-Jee-tuh”, clap, clap, clap-clap-clap. In the eighth, we start with “Thank you, Captain” over and over, louder and louder, and on the TV screens around the ball park, close-ups showed tears in his eyes and in those of Manager Joe Girardi…tears from the guy who always said and did the right thing, never revealing emotion, always direct without saying a word…On that alone, it became a most unusual game.

Top of the 9th, three outs away. We’re wondering when Girardi gestures to send a replacement out to short to allow The Captain to trot gracefully off the field to the roar of an already roaring 50,000 people, as he did last year with the Great Mariano Rivera. Jokingly, my grandson smirks, “The O’s have to tie it so Jeter can hit the game-winning homer in the bottom of the 9th.” I joked, “yeah, dream on.” But after taking the count to 0-2 on the leadoff hitter, closer Darrell Robertson, clutch all year, walks him. The next batter, Adam Jones, is almost hit with high and tight chin music, gets up, and smashes the next pitch high and far to the O’s bullpen. Suddenly its 5-4, we’re worried, and no longer thinking of the sweet exit finale.

After striking out the next hitter, Nelson Cruz, who is leading the Majors in home runs, Robertson blows the save as Steve Pearce belts one to almost the same spot and its tied, 5-5. Stunned, shocked into near silence, we look to the scoreboard and the lineup tells us Jeter bats third in the inning, so we DO have a chance at a dramatic finish.

Up first for the Yanks in the bottom of the ninth of a tie ballgame is a rookie, Pirela, and don’t ya know, he singles to left. Gardner lays down a beautiful sac bunt to get Richardson, the pinch runner, to second with one out. Next up, The Captain. What an unbelievably dramatic opportunity! I’m thinking Girardi isn’t managing this game, Disney is. The crowd is apoplectic with the possibility. We are screaming for Jeter to deliver and before we know it, he slices the first pitch past a diving first basemen, through the hole, into right field. Markakis has a strong arm and fires it dead on to the plate as we hold our breaths for a moment, but the speedy Richardson slides across with the game-winner. The Yankees win on Derek Jeter’s game-winning single in his last at bat in a Yankee uniform at Yankee Stadium!

At that moment, I heard an explosion of noise that I have never heard in the nearly one hundred Major League games I have attended in my life, all across the US, starting at Ebbetts Field in 1955. It was an instant, and then died down to a continual primal scream as the Yankees poured out of the dugout and mobbed their leader between 1B and 2B. The fans around me were half in disbelief, wonder and delight in their eyes and smiles, and half in sheer joy.

We had gone from thinking about how Girardi was going to replace The Captain is the most gracious way, not ten minutes before, to sinking to utter depression as Pearce’s homer sailed into the left field bleachers, to euphoria again as Jeter did it again, as he has for so many clutch moments in his 20 years. It could not have gone better if the O’s were in on it. Talk about a storybook ending to a storybook career with a storybook franchise of a guy who is going into the storybook writing business for kids.

It was anti-climactic that the post-game interviews were held on the field. Jeter’s teammates from the championships…Rivera, Jorge Posada, Andy Pettitte, Tino Martinez, Bernie Williams, and Manager Joe Torre all assembled for post-game hugs. Truly the end of an era and sadly what will likely be a long winter of finishing out of the playoffs again and again.

Allow me an opinion as a lifelong Yankees fan born of Bronx-born parents… The debate about Jeter’s place in Yankees lore will continue. Statistically, apart from the power numbers, he is the greatest. He ranks up with the Ruths, Gehrigs, DiMaggios, Berras, Mantles, and Munsons in terms of championships won. For my money, there is Ruth and everyone else. I am a Mantle/Berra/Ford fan because they won everything in sight when I was growing up, just as the generations of twenty-somethings today grew up with Jeter. For any number of reasons, not the least of which is his ability to deliver in the clutch, he matches DiMaggio, Mantle, Berra, and Munson, whether the regular season, playoffs, or World Series. He is a great Yankee among the greatest Yankees.

But this game was unbelievable!

http://www.leasingnews.org/PDF/CaptainsGoodbye_92014.pdf

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

BofA To Pay $7.7M SEC Fine For 2009 Accounting Error

http://www.ibtimes.com/bank-america-pay-77m-sec-fine-2009-accounting-error-1696631

Mark Hurd delivers keynote as Oracle OpenWorld Opens

http://www.sfgate.com/business/article/Mark-Hurd-delivers-keynote-as-Oracle-OpenWorld-5789037.php?cmpid=hp-hc-bustech

Dire Warnings by Big Tobacco on E-Smoking

http://www.nytimes.com/2014/09/29/business/dire-warnings-by-big-tobacco-on-e-smoking-.html?src=me

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

The Head-Scratching Case of the Vanishing Bees

http://www.nytimes.com/2014/09/29/us/the-head-scratching-case-of-the-vanishing-bees.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

The 100 Most Motivating Workout Songs of All Time

http://www.sparkpeople.com/blog/blog.asp?

post=the_100_most_motivating_workout_songs_of_all_time

[headlines]

--------------------------------------------------------------

Baseball Poem

1927 Yankees

by Robert L. Harrison ©

Published: New York Baseball Poems (1999)

Gather 'round you fans of baseball

you lovers of season past,

let me take you back to the greatest team

that ever played on grass.

Guided by Miller Huggins

known as "Murderer's Row,"

never was such a string of pearls

so feared this side of Hell.

Greedy was this awesome bunch

with Ruth and Gehrig leading the punch,

and Hoyt and Moore on the mound

shooting all the batters down.

Gasping crowds assemble

like sinners in a tent,

watching all the other teams

trying to repent.

God blessed those boys of summer

those pin-striped renegades,

with a winning passion

while others saw only the haze.

Gathering in the rosebuds

by playing excellent ball,

called the "five o'clock lightning"

taking the pennant in the fall.

Gone were any pretenders to the throne

no on stood wherever these Yankees roamed,

twenty-five men made up this team

and all had a year better than their dreams.

1927 Yankees by Robert L. Harrison ©

Fast Facts

Murderer's Row was anchored by Babe Ruth, who hit sixty home runs and batted .356; and Lou Gehrig, who had forty-seven home runs and batted .373.

The team won one-hundred ten games and the other members included: Earle Combs, who hit .356 and led the league in hits, singles and triples; San Francisco’s Tony Lazzeri, who hit eighteen home runs and batted .309; and Bob Meusel who hit .337.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Jim Harbaugh blasts Deion Sanders' report

alleging he has lost 49ers' locker room

http://www.usatoday.com/story/sports/nfl/49ers/2014/09/29/jim-harbaugh-blasts-deion-sanders-report-alleging-he-has-lost-the-49ers-locker-room/16440113/

Pressure is on GM McKenzie with Allen fired

http://espn.go.com/blog/oakland-raiders/post/_/id/6664/pressure-is-on-reggie-mckenzie-with-dennis-allen-out-in-oakland

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Gov. Jerry Brown Approves Bachelor Degrees for Junior Colleges

http://www.sacbee.com/2014/09/29/6744704/jerry-brown-approves-community.html

Photos: 50 year anniversary of the Free Speech Movement

at the University of California, Berkeley

http://photos.mercurynews.com/2014/09/29/photos-50-year-anniversary-of-the-free-speech-movement-at-the-university-of-california-berkeley/#1

Spending soars higher on relocation of Bay Bridge’s birds

http://www.sfgate.com/bayarea/article/Spending-soars-higher-on-relocation-of-Bay-5786778.php?cmpid=hp-hc-bayarea

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

It's a Vineyard Seller's Market

http://www.winesandvines.com/template.cfm?

section=news&content=139268K

In France, Inhumane Conditions for Champagne Pickers

http://www.wine-searcher.com/m/2014/09/inhumane-conditions-for-champagne-pickers

Oregon growers face ‘epic’ grape harvest

http://www.capitalpress.com/Oregon/20140924/oregon-growers-face-epic-grape-harvest

Early-harvest spot market prices soften for all but one North Coast wine grape variety

http://westernfarmpress.com/grapes/early-harvest-spot-market-prices-soften-all-one-north-coast-wine-grape-variety

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1541 - Spanish conquistador de Soto and his forces enter Tula territory in present-day western Arkansas, encountering fierce resistance.

1630 - John Billington, one of the first pilgrims to land in America, was hanged for murder, becoming the first criminal to be executed in the American Colonies. He was one of the signers of the Pilgrim's compact. He way-laid a young man, one John Newcomin (“about a former quarele, and shote him with a gune, whereof he dyed.”)

1787 - The first ship to carry the American flag around the world was the “Columbia,” a 212-ton vessel under Captain Kendrick that sailed from Boston, MA on a fur-trading mission to Canada. It was accompanied by the sloop “Washington”, under Captain Robert Gray, who exchanged commands with Captain Kendrick and completed the trip, returning to Boston on August 9, 1790. The trip took nearly three years and covered a distance of 41,899 miles. The crew explored the Queen Charlotte Island and discovered the straits of Juan de Fuca and the mouth of the Columbia River.

1788 - The Pennsylvania Legislature elected the first two members of the U.S. Senate - William Maclay of Harrisburg and Robert Morris of Philadelphia.

1811 - The first year exports exceeded imports. Imports were $43.5 million and exports were $45.3 million and of foreign merchandise (the territories) $16 million for a total exports of $61.3 million.

1851 - The barge "Mount Washington" arrived in port with cargo that included macaroni and other foods, candles, soap, fishing nets, books and mail. Mail was delivered to the post master by Capt. Ebenezer G. Libby.

1882 – Edison’s first commercial hydroelectric power plant (later known as Appleton Edison Light Company) begins operation on the Fox River in Appleton, WI.

1917 - Drummer Buddy Rich birthday

http://www.buddyrich.com/bio.html

1922 - Bassist Oscar Pettiford born, Okmulgee, OK

1924 - American novelist and literary celebrity was born Truman Streckfus Persons at New Orleans, LA. He later took the name of his stepfather and became Truman Capote. Among his best remembered books: “Other Voices, Other Rooms”, “Breakfast at Tiffany's”and “In Cold Blood”.He was working on a new novel, “Answered Prayers”,at the time of his death at Los Angeles, CA, Aug 25, 1984.

1927 - George Herman ‘Babe” Ruth hit his 60th home run of the season off Tom Zachary of the Washington Senators. Ruth's record for the most homers in a single season stood for 34 years until Roger Mans hit 61 in 1961. Maris's record was broken in 1998 by Mark McGwire with 62 home runs.

1934 - On this date, The Babe played his last game for the New York Yankees. Soon after, while watching the fifth game of the World Series (between St. Louis and Detroit) and angry that he was not to be named Yankees manager, Ruth told Joe Williams, sports editor of the Scripps-Howard newspapers, that after 15 seasons he would no longer be playing for the Yankees.

1935 - Singer Johnny Mathis born Gilmer, Texas.

1935 – The Hoover Dam is dedicated.

1935 - The Gershwin musical Porgy and Bess opens at Boston's Colonial Theatre. While not commercially successful, a revival in 1942 would turn it into one of the longest-running musicals in history.

1947 - The first World Series to be televised opened with the New York Yankees beating the Brooklyn Dodgers, 5-3. The Yankees won the Series, four games to three. The entire series was telecast under the joint sponsorship of the Ford Motor Company and the Gillette Safety Razor Company at a cost of $65,000. The play-by-play descriptions were given by Bob Edge, Bob Stanton, and Bill Slater.

1951 -” Red Skelton Show” premiers. Vaudevillian and radio performer Red Skelton hosted several popular variety shows on NBC and CBS in a career that spanned 20 years. He was a gifted comedian, famous for his loony characters, sight gags, pantomimes and ad-libs. His show was also notable for introducing Johnny Carson and the Rolling Stones to national audiences.

1954 - Julie Andrews makes her Broadway debut in The Boy Friend.

1955 - James Dean meets his end. It was at the intersection of what are now highways 41 and 46 (41 and 466 then) at Cholame, California. He was 25 miles away from US 101 and would have taken that road. Dean was on his way from LA to Monterey to race his Porsche. Most people think it was Dean's fault, probably due to speed, and he did get a speeding ticket earlier that day, but police at the scene don't believe he was speeding at the time. Besides, his aluminum Porsche was no match for a big heavy Ford. This is a Y intersection, and Dean had the right of way. He was headed west on 466 into the setting sun and didn't see the approaching Ford. The Ford driver probably didn't see the silver Porsche, and turned left in front of Dean onto 41 toward Kettleman City. No time to stop. I've been to that location. I still have my 1961 Super 90.

http://www.americanlegends.com/bookstore/deanstory/intro.html

http://www.snopes.com/autos/cursed/spyder.asp

http://www.allsands.com/jamesdeanbiogr_rz_gn.htm

http://members.aol.com/jaydeebee1/memorial.html

http://www.20six.co.uk/weblogCategory/1pptzo5jz5iqo

http://www.jamesdean.com/

1956 - Top Hits

“Canadian Sunset” - Hugo Winterhalter and Eddie Heywood

“The Flying Saucer” (Parts 1 and 2) - Buchanan and Goodman

“Honky Tonk” (Parts 1 and 2) - Bill Doggett

“Don't Be Cruel/Hound Dog” - Elvis Presley

1960 - ”The Flintstones” premiered on ABC-TV. This Hanna-Barbera cartoon comedy was set in prehistoric times. Characters included two Stone Age families, Fred and Wilma Flintstone and neighbors Barney and Betty Rubble. It is widely believed that this was a take-off on “The Honeymooners” as the Fred character was the loud, boisterous persona of Ralph Kramden, and the goofy, comedic Barney was similar to Ed Norton. Also, Wilma had Alice’s dark hair while Betty was a blonde as was Trixie. In 1994, “The Flintstones” movie was released, starring John Goodman, Rick Moranis and Rosie O'Donnell. It also was the first cartoon series to be televised on prime-time.

http://www.topthat.net/webrock/

1960 - On Howdy Doody's last TV show, Clarabelle, played by Bob Keeshan who later became Captain Kangaroo, finally talks: "Goodbye Kids".

1961 - Bob Dylan plays harmonica on three cuts recorded for his friend Caroline Hester's first Columbia album. The session is produced by John Hammond and he is so impressed that he promptly signs Dylan to a deal. Now that Dylan is a part of Columbia Records, Hammond arranges for a solo recording session in October.

1961 – An early season snowfall occurred over the northern plains with the greatest total (4 inches in the Ulm-Mankato area in Minnesota). Omaha, NE had its first September snow in 70 years.

1962 - Rioting broke out when James Meredith became the first black to enroll in the all-white University of Mississippi. President Kennedy sent 3000 US troops to the area to force compliance with the law. Three people died in the fighting and 50 were injured. The next day, Meredith was enrolled and began to attend classes amid continuing disruption by protestors. On June 6, 1966, Meredith was shot while participating in a civil rights march at Mississippi. On June 25, Meredith, barely recovered, rejoined the marchers near Jackson, MS.

1964 - Top Hits

“Oh, Pretty Woman” - Roy Orbison

“Bread and Butter” - The Newbeats

“G.T.O.” - Ronny and The Daytonas

“I Guess I'm Crazy” - Jim Reeves

1966 - Three-day Acid Test opened at San Francisco State College Commons. The test was to peak on the evening of Oct. 1. The Grateful Dead perform. Posters from this era are quite the collector items.

http://www.richardandmimi.com/posters.html

1966 - At Comiskey Park in the top of the ninth inning, Roger Maris, in his last at-bat as a Yankee, slams a two-run home run as a pinch-hitter putting the club ahead of the White Sox, 5-4. As the slugger contemplates retirement, the former two-time American League MVP is stunned and embarrassed when New York trades him in the off-season to the Cardinals for utility player Charley Smith.

1967 - Van Morrison's "Brown-Eyed Girl" peaks at #10 on the singles chart.

1967 - 13th Floor Elevators; Quicksilver Messenger Service at the Avalon Ballroom in San Francisco, presented by the Family Dog collective.

1970 - A nineteen month drought in southern California came to a climax. The drought, which made brush and buildings tinder dry, set up the worst fire conditions in California history as hot Santa Anna winds sent the temperature soaring to 105 degrees at Los Angeles, and to 97 degrees at San Diego. During that last week of September, whole communities of interior San Diego County were consumed by fire. Half a million acres were burned, and the fires caused fifty million dollars damage.

1972 - Roberto Clemente of the Pittsburgh Pirates doubled against New York Mets pitcher Jon Matlack as the Pirates defeated the Mets, 5-0. It was Clemente's 3,000 career hit and his last one as he was killed in a plane crash on Dec 31, delivering relief supplies to earthquake victims in Nicaragua.

1972 - Top Hits

“Baby Don't Get Hooked on Me” - Mac Davis

“Saturday in the Park” - Chicago

“Back Stabbers” - O'Jays

“I Ain't Never” - Mel Tillis

1976 - California became the first state to enact a “Right-to-Die” law, which allowed physicians of terminally ill patients to withhold life-sustaining procedures under certain conditions,

1976 - "Two Centuries of Black American Art" opens at the Los Angeles County Museum of Art. The exhibit features over 60 lithographers, painters, and sculptors including 19th century masters Joshua Johnston, Edward Bannister, and Henry O. Tanner as well as modern artists Charles White, Romar Bearden, and Elizabeth Catlett. The exhibit's catalogue notes that the assembled artists' work proves “the human creative impulse can triumph in the face of impossible odds, and at times even because of them.”

1977 - The Rolling Stones release their "Bridges to Babylon" LP.

1977 - The temperature at Wichita Falls, TX, soared to 108 degrees to establish a record for September.

1977 – "Kiss You All Over" by Exile topped the charts and stayed there for 4 weeks.

1980 - Top Hits

“Upside Down” - Diana Ross

“All Out of Love” - Air Supply

“Another One Bites the Dust” - Queen

“Old Flames Can't Hold a Candle to You” - Dolly Parton

1982 - ”Cheers” premiered. NBC sitcom revolving around the owner, employees and patrons of a Beacon Street bar at Boston. Original cast: Ted Danson as owner Sam “Mayday” Malone, Shelley Long and Rhea Perlman as waitresses Diane Chambers and Carla Tortelli, Nicholas Colasanto as bartender Ernie “Coach” Pantusso, John Ratzenberger as mailman Cliff Clavin and George Wendt as accountant Norm Peterson. Later cast members: Woody Harrelson as bartender Woody Boyd, Kelsey Grammar as Dr. Frasier Crane, Kirstie Alley as Rebecca Howe and Babe Neuwirth as Dr. Lilith Sternin Crane. The theme song “Where Everybody Knows Your Name,” was sung by Gary Portnoy and written by him and Judy Hart Angelo. Created by Glen Charles, Las Charles and James Burrows. The last episode aired Aug 19, 1993.

http://epguides.com/Cheers/

http://www.tvtome.com/Cheers/

http://members.aol.com/TampaChatr/cheers.html

http://www.cheersboston.com/index_bh.html

1984 - “Murder, She Wrote” premiers. Angela Lansbury starred as crime novelist Jessica Fletcher from Cabot Cove, Maine, who traveled the country solving murders. This top-rated detective show was unusual in having an older female star, since young men are usually preferred in leading roles on TV. Also appearing were Tom Bosley as Sheriff Amos Tupper and William Windom as Dr. Seth Hazlett. The program ran for 12 years.

http://www.mysteries.com/tv/murder.html

http://www.museum.tv/archives/etv/M/htmlM/murdershew/murdershew.htm

http://www.jumptheshark.com/m/murdershewrote.htm

1984 - Yankees first baseman Don Mattingly wins the American League batting title with a .343 average, finishing three points higher than teammate Dave Winfield. It the first of six consecutive seasons that 'Donnie Baseball' will finish hitting over .300, but will prove to be his only batting crown during a 14-year major league career.

1985 - An early season snowstorm covered the Arrowhead region of Minnesota with 7 to 9 inches of snow. 7 inches fell at Babbitt and Aurora, 7.5 inches at Isabella and 8.5 inches at Polar Lake. This was believed to be the most ever for September in this region.

1987 - Afternoon thunderstorms in Michigan produced hail an inch in diameter at Pinckney, and wind gusts to 68 mph at Wyandotte. A thunderstorm in northern Indiana produced wet snow at South Bend. Seven cities in the northwestern U.S. reported record high temperatures for the date, including readings of 98 degrees at Medford OR and 101 degrees at downtown Sacramento CA

1988 - Pitcher Orel Hershiser of the Los Angeles Dodgers extended his streak of consecutive scoreless innings to 59, thereby breaking Don Drysdale's mark by one inning. Hershiser shut out the San Diego Padres for 10 innings, but the Padres won the game 2-1, in 16 innings.

1988 - Ronald Reagan, nearing the end of his presidency, throws out the ceremonial first pitch at Wrigley Field. The former Cub announcer then spends an inning and a half doing play-by-play with Harry Caray in the WGN television booth

1988 - Top Hits

“Don't Worry Be Happy” - Bobby McFerrin

“I'll Always Love You” - Taylor Dayne

“Love Bites” - Def Leppard

“Addicted” - Dan Seals

1988 - Unseasonably warm weather prevailed over Florida, and in the western U.S. The afternoon high of 94 degrees at Fort Myers, FL was their tenth record high for the month. Highs of 98 degrees at Medford, OR and 99 degrees at Fresno, CA were records for the date, and the temperature at Borrego Springs, CA soared to 108 degrees.

1992 - George Brett of the Kansas City Royals singled off Tom Fortugno of the California Angeles in the 7th inning, thus recording the 3,000th hit of his Major League career. The single gave Brett four hits in a game for the 59th time. He was accorded a standing ovation and became so distracted that he was picked off first.

1995 - "Fantasy" by Mariah Carey topped the charts and stayed there for 8 weeks.

1997 – For the first time ever in Major League postseason history, three consecutive homers were hit in a game. The Yankees’ Time Raines, Derek Jeter, and Paul O’Neill turned the trick.

1999 - The largest regular-season crowd in San Francisco Candlestick Park history, 61,389 fans, watch the Dodgers beat the home team, 9-4 in the last baseball game to ever be played at the 'Stick'. Giant greats help mark the occasion with Juan Marichal tossing out the ceremonial first pitch before the game and Willie Mays throwing out the ballpark's final pitch after the game. Sue and I were there.

2000 - In the highest scoring game in A's franchise history, Oakland defeats the Rangers 23-2 to remain a half-game ahead of the Mariners for the western division lead as Seattle scores the most runs ever against the Angels, 21-9, assuring the team at least a tie for the American League wild card.

2004 - Merck & Co. pulled Vioxx, its heavily promoted arthritis drug, from the market after a study found it doubled the risk of heart attacks and strokes.

2007 – The Green Bay Packers’ QB, Brett Favre, throws the 421st TD pass of his career, breaking the NFL career record for most TD passes.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Ten Top Stories each week opened the most by readers

(click here)

“Complaints” Bulletin Board (click here)

Connect with Leasing News![]()

![]()

![]()

![]()

(chronological order)

- Dean Rubin Found, Ultimate Financing

a Division of Navitas Lease Corp.

- U.S. Savings Bonds

- Steve Crane, CLP, Retires from Bank of the West Leasing

To Remain on Leasing News Advisory Board

- BBB Leasing Company Ratings

September 10, 2014

- Complaints Bulletin Board BBB Ratings

- Features in Leasing News

- Enverto Introduces IMCA Express

with $100 Million Credit Facility

- A Key Part of the Economic Recovery Is Finally Happening

- Financial Pacific Completes First Year as Subsidiary of Umpqua Bank

- Balboa Capital Settles $36,454 Attorney Fee Complaint

After Getting Suit Dismissed Against Regents Capital

- Your Photograph on LinkedIn.com

- Use a Password Generator

- Banks Turn Toward Leasing for More Profit

- 15 Biggest Employers in the World

- Déjà vu on Proposed Lease Accounting Changes

- What $11.62 Trillion Worth of Household Debt Looks Like

- Broker’s Responsibility to Obtain

California Lender’s License

- Do New iPhone Models Make People Think

Their Old Ones Are Slow?

- CLP Foundation Adds Four CLPs

- Joint-Employer Ruling for McDonald's

Could Change Franchise Business

- Bank Lending Still Tight, S.F. Fed Study Finds

- August 1, 2014 Alexa Ranks Leasing Web Media

- Blue Bridge Financial Relocates Corporate Office

Opens New South Carolina Business Development Office

- Global Agreement on Financial Instrument Project

No Longer Achievable

- Brooms Give Bonuses to Direct Capital Employees

Today, Friday, First Day Ownership under CIT Bank

- Update on Vietnam Veteran Richard Wilson from his wife Rosanne

- Marlin Business Services reports 2nd Quarter

- Much Anxiety Over Having Enough Money for Retirement

- IASB completes reform of financial instruments accounting

- PayPal Could Soon Be eBay’s Biggest Source of Revenue

- Kmart offers $1 check cashing

adds to financial service, such as “lease to own”

- This Day in American History

Edited by Ralph Mango

- Dakota Financial saves $14,400 in document storage costs

after deploying Office 365

- Programs to Protect Smartphones/Tablets/Laptops

- Who is Financing the Other Four?