![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Tuesday, January 21, 2014

Today's Equipment Leasing Headlines

Archives: January 21, 2004

Orix--Down Dates

Classified Ads---Credit

Leasing 102 by Mr. Terry Winders, CLP

The Importance of Changing Lease Terms

Placard---Cashflow is King

Counterfeit Cashier’s Checks

By Tom McCurnin

"Preparing for an Interview?"

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads---Help Wanted

Big bank earnings foreshadow shaky core

results for industry-SNL Financial

Ranking the rainmakers in 2013--SNL Financial

Non-Current Loans/Charges Offs Bring Bank Down

First Bank to Fail in 2014

Meet Leasing News Advisor Ed Castagna

December’s retail sales rose over the previous month

amid a decrease of 3.1 in the Money Anxiety Index

ELFA ---2014 Schedule of Conferences, Workshops

and e-Learning Opportunities

Top Stories January 13-January 17

(You May Have Missed One)

Black Labrador Retriever

Brooklyn, New York Adopt-a-Dog

Open Positions at Leasing Funders/Various Locations

News Briefs---

Amarillo, Tenn. trucking firms merge to form billion-dollar company

Deutsche Bank posted a surprise 1.15 billion euros pre-tax loss

Deutsche Bank to rein in global bond trading in profit push

Leasing firm Avolon adds to airplane fleet after busiest year

ILFC takeover could trigger more aircraft leasing M&A - exec

Eastern Bank offers wealth of opportunity

What bank stock investors liked in 2013

FASB Issues New Private Company Accounting Alternatives

Ex-New York mayor returns to his old job

The World's Highest-Paid Musicians 2013

China central bank offers emergency funds to banks

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Football Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

| Working Capital Loans $10,000-$250,000 | |

|

|

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free!

[headlines]

--------------------------------------------------------------

Archives: January 21, 2004

Orix--Down Dates

“On February 13th, forty people will be let go in Orix's New York Office and twenty-five in Kennesaw with layoffs continuing every two weeks from then on through the end of the fiscal year (3/31).

“The layoffs will hit IT and Accounting the hardest but they will be across the board (SFG, EFG, RPG, Operations, HR).

“Also, apparently there is an internal memo among the Dallas Executives that has a timeline for vacating Kennesaw entirely.”

(name with held )

Previous Orix articles:

http://www.leasingnews.org/Conscious-Top%20Stories/Orix.htm

TODAY

"ORIX USA Corporation announced January 2, 2014 that Mr. Brian F. Prince has been appointed President & Chief Executive Officer of ORIX USA Corporation.

"Mr. Prince comes to ORIX USA with a remarkable track record in leading large global financial services organizations. Most recently, he was Chairman and Representative Director of Aozora Bank in Tokyo (“Aozora”), a Japanese commercial bank with approximately $60 billion in assets. During his tenure, he successfully strengthened Aozora’s business foundation. ORIX Corporation, the parent company of ORIX USA Corporation, held a significant minority stake in Aozora Bank.

"On December 31, 2013 Mr. James Thompson resigned from his position as CEO of the company."

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment or

looking to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

The Importance of Changing Lease Terms

The Philosophy of Leasing:

It is not the ownership, but the use of equipment

that makes you a profit.

The name of the game is to make a profit. Owning obsolete equipment doesn’t impress anyone. Obsolete equipment is not an asset. Obtaining "use" with little cash expended...having modern, efficient tools and facilities will make you more competitive and attract more business and activity.

The basic philosophy is the proper use of money; leverage: putting cash into things that make a profit such as advertising, inventory, employees, new markets, research and development, faster producing assets rather than ones that "depreciate" and at best, become "obsolete."

-----

The new accounting rules are contemplating a form of operating lease, if the term is 36 months or less. 36 months does not help equipment that requires a longer term. There is no assurance that they will grant this change, but I remind you a lease is for the “use” of the equipment--- not the “ownership,” unless there is a purchase option.

Using the ”use issue,” the question of term comes relevant. If a lease is for a true lease term, but not defined, then the lease can run forever--- but can carry the language that states that the minimum term must be 36 months. Once 36 months have passed, the lessee has the right to return the equipment--- but has no purchase option. The lease will continue until the lessee decides to return the equipment.

The reason for the minimum of 36 months is tied to the term the new accounting rules finally decide upon. Clearly a large residual will be required. It will then require a strong understanding of the equipment’s use. In addition the lease must contain specific maintenance and return language.

To protect the lessor’s residual, in addition to the maintenance agreement, there must be a way to identify or calculate the use of the equipment. Additional rent can be added, if the use exceeds the allowed maximum. This requires equipment inspections at least annually so the lease payment can be adjusted.

The concern most lessors will have is what risk they are assuming with the residual. If they understand the use and check the probability of technical changes that may affect the resale of the equipment in the future (at least by talking to the manufacture and checking with the secondary market sellers) the residual should be a safe risk.

One offsetting fact is that many of the leases will run way beyond the term required to amortize the equipment cost. This will offset any small loss you may suffer from equipment that fails to net the residual.

One of the lessors that will take advantage of this form of leasing will be the captives because of their ability to remarket the equipment.

In the past when this form of leasing was used, it was amazing how long the leases ran because with no termination date--- they went on and on and on.

When the new accounting rules are finally effective, I am sure new forms of leasing will emerge because commercial equipment leasing has been adapting to changes for over 50 years. Certainly there will be restrictions, but there also will be opportunities for both lessee and lessor.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Counterfeit Cashier’s Checks

By Tom McCurnin

Leasing News Legal News Editor

Lawyers Become the New Group to Fall Victim to Internet

Scams Promising Quick Money

Kevin Kerveng Tung, P.C. v. JP Morgan Chase & Co., 34 Misc.3d 1209(A), 943 N.Y.S.2d 792 (N.Y.Sup.,2011 2012) WL 6184896 (D. Ill. 2012).;

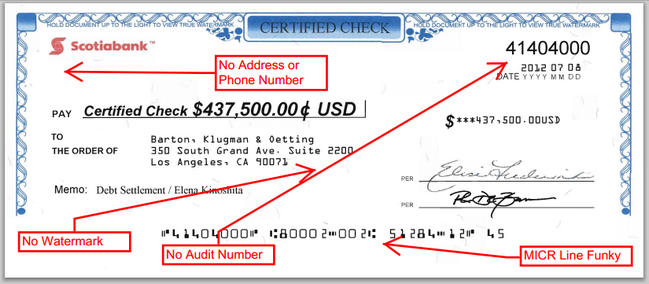

There isn’t a day that goes by that I don’t receive an email, supposedly from a foreign business needing help to collect a large commercial debt. At first, I responded, and when the “client” would only communicate by email, I got suspicious. My “spidey sense” was further alerted by the claim that all I had to do was write a demand letter, and the money would come flowing in, and I could get a 33% contingency fee. When I asked the client to call me to discuss the matter, the claim was that their English wasn’t so good, yet the emails seemed fine. Then, before I even agreed to take the case, let alone draft a demand letter, a cashier’s check came rolling in via Federal Express from Canada for $300,000.

www.leasingnews.org/PDF/JPMorganArticleCheck_1212014.pdf

I’m a banking lawyer, so I know a few things about checks, especially cashier’s checks. So upon review of the check, the first thing I noticed was the lack of a water mark on the check stock. Furthermore, there were no ABA Transit Numbers on the check, and the MCIR codes (the funny numbers at the bottom of the check) were out of sequence and not at the bottom of the check. This check obviously wouldn’t scan through the reader sorter at the bank’s processing center.

Needless to say, I didn’t take the case and didn’t deposit the check. Of course it was a scam. The collection lawyer is supposed to deposit the check, which has MICR codes so screwed up they would have to be typed and stuck on the item to process (called a “Lindy Strip”) and it is likely that this check would spend a long time in transit clearing. Meanwhile, the “client” would want his share of the monies wire transferred to him from our trust account, which of course is instantaneous. When the check was returned as counterfeit, our firm would be left holding the bag—a negative balance in the client trust fund.

I was skilled enough to spot the scam and the phony check. One New York lawyer wasn’t so lucky, and neither creative pleading nor two appeals could get him out of his predicament.

The facts follow:

Plaintiff Kevin Kerving Tung, P.C., is a lawyer in Flushing, New York, and received one of these cashier’s checks drawn on JP Morgan Chase from a third party, and deposited it into his client trust account at Citibank, and dutifully wired the funds to the miscreant. Two days later, he surmised that the matter could be a scam and the cashier’s check a counterfeit and called Chase to inquire about a possible fraud. He was informed that the check was a counterfeit and was being returned.

Tung sued JP Morgan Chase, the drawer of the cashier’s check alleging that the check (which was counterfeit) was, “on information and belief” stolen and that JP Morgan’s employees participated in the criminal act. Tung also sued JP Morgan that its negligence contributed to the making of the counterfeit check. Tung also sued JP Morgan alleging that it had a duty to investigate to recover his money. Finally Tung sued alleging that JP Morgan knew of prior counterfeit checks, and failed to alert the public and ostensibly, Tung, to the danger.

The court threw out Tung’s case, based on the fact that he had no personal contact with his supposed client, the cashier’s check had no water mark or audit number and no phone number of the branch that issued it. In short, it was a poor counterfeit. The Court found that JP Morgan owed no duty to a non-customer like Tung to protect him against his own poor judgment in accepting the supposed client and check. The Bank’s only duty is to pay or return the check within its deadline for doing so, often called its “midnight deadline.” Attorney Tung was probably out two thirds of that $205,000 check which he wired to the fraudsters, and couldn’t timely recall that wire.

This isn’t a leasing case, and isn’t terribly significant case law for bankers, but it does provide an interesting lesson on the age old adage that if it sounds too good to be true, it probably is.

For those who accept cashier’s checks for payment, just because the document says, “Cashier’s Check” doesn’t mean the item is valid. Inspect the item and wait an appropriate period of time, usually 10 days, to insure the item is genuine, and don’t release collateral until the check clears.

For lawyers reading this, make sure that the lawyer has personal contact with the client before any such engagement. If the lawyer cannot have personal contact, a phone call and a modest retainer will generally insure that the client is for real. Fraudsters will not send a lawyer a deposit—not ever. So even a modest deposit of a few hundred dollars will insure the client is for real.

JP Morgan Chase Case 1http://www.leasingnews.org/PDF/JPMorganChaseCase_1212014.pdf

JP Morgan Chase Case2

http://www.leasingnews.org/PDF/JPMorganChaseCase2_1212014.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

“Preparing for an Interview?"

Career Crossroad---By Emily Fitzpatrick/RII

Question: How do I prepare for an interview?

Answer: Over prepare!

Preparing for an interview is to be ready for any eventuality. Take the time to analyze every situation and every possible option. You will not win the job just based on your skills. As the competition for the best jobs increases, employers will be comparing more applicants for every opening, asking more questions.

During an interview, employers ask dozens of searching questions that will test your confidence, poise, and desirable personality traits. These questions might trick you into contradicting yourself – they will probe your quick thinking and job skills.

So to be prepared, make sure you take the time prior to any interview (even a phone interview) to create various scenarios and questions that the interviewer might throw at you and practice with a partner. Additionally, be able to explain IN DETAIL your experience as it relates to all the required position responsibilities.

In addition to preparing, you should know to assemble before:

- The company profile

- Reference letters.

- A list of job-related questions you may be asked.

Don’t forget to smile, even if on the telephone.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Equipment Asset Manager www.maximcc.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Big bank earnings foreshadow shaky core

results for industry

By Kevin Dobbs and Marshall Schraibman

A SNL Financial Exclusive

The biggest U.S. banks have reported sizeable profits for the fourth quarter of 2013, but JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. collectively produced only modest loan growth, struggled with margin pressure, and in cases relied heavily on the release of loan-loss reserves and cost-cutting to boost bottom lines.

The banks generally reported flattish revenue levels when compared with the third quarter, with loan growth only in the single digits. With the exception of BofA, which has been working off a deep low, net interest margins were still under pressure. NIMs at JPMorgan and Wells were down from a year earlier, while Citi's was flat. These NIM results extended a long and rarely interrupted trend over the past few years, as loan profitability has been pressured by low short-term interest rates.

"It remains a difficult environment," Gary Townsend, CEO of Hill-Townsend Capital LLC, told SNL.

To be sure, the megabanks have myriad business lines and vast balance sheets that provide multiple levers to pull in order to prop up earnings in challenging times.

Wells, for example, got a bump of $132 million in noninterest income during the fourth quarter, thanks in large part to growth in trust and investment fees. That helped to offset a declining mortgage business. Wells, the nation's largest home lender, originated $50 billion of mortgages in the final quarter of last year, 38% less than in the prior quarter, as demand for refinancing dwindled.

BofA's results, along with solid capital markets activity and other contributors, were bolstered by strong advancements in credit quality. Its fourth-quarter net charge-offs totaled $1.58 billion, or 0.68% of average outstanding loans and leases annualized, compared to 0.73% in the previous quarter and 1.40% a year earlier.

JPMorgan, among other things, offset weakness in investment banking and $1.1 billion of legal expenses in the fourth quarter with a surge in equity underwriting revenue. And Citi, which struggled with poor trading revenue, tapped into its deferred tax asset to boost earnings.

All of the big banks also lowered reserves and trimmed costs to fortify results.

But overall revenue proved difficult to grow, often because of soft bread-and-butter lending, which is the lifeblood of many community and regional banks. As such, observers say, the megabanks' results do not bode well for smaller rivals.

Such banks have fewer levers to pull and, while community and regional lenders are actively cutting costs and benefiting from declining credit expenses, many have already cut the bulk of extra expenses and credit conditions are beginning to normalize.

"We were looking for meaningful revenue growth, and generally, we're still looking," Mike Matousek, a trader at U.S. Global Investors Inc., told SNL. "That seems to be the theme."

Analysts say that, when looking at the megabanks for clues about the rest of earnings season, they typically want to see strength in ordinary business lines such as commercial and consumer lending. While not weak, such areas have yet to prove robust either.

As Marty Mosby, an analyst at Guggenheim Securities, put it to SNL this week: "You'd always rather see results driven by the core businesses."

What the industry needs now is a proven pattern of strong economic growth, one that carries over several quarters, Townsend said.

That would boost loan demand broadly and provide the Federal Reserve reason to ease downward pressure on short-term interest rates. If short rates rise, various loans would become more profitable.

"That's when I expect to see enormous profitability" among the megabanks, Townsend said. The big banks would lead the charge, he added, but the industry as a whole would benefit, assuming rates rose gradually. Surging rates could make credit too expensive and lead to a crimp in demand.

Executives at the megabanks were generally optimistic about economic conditions for 2014 during earnings calls this week, but often only cautiously so. Citi CEO Michael Corbat, for instance, said he anticipates "an improving economic environment," but he added that growth this year "won't be robust by any means."

Recently reported economic data paint a mixed picture. The nation's GDP grew at a 4.1% annual rate in the third quarter of last year and unemployment fell to 6.7% in December 2013 from 7% in November 2013. But the jobless rate decline was attributed largely to more Americans dropping out of the workforce as opposed to lofty hiring levels. The level of Americans either working or hunting for a job in December was about 63%, the lowest level in nearly four decades, according to the U.S. Department of Labor.

Ernest Goss, a Creighton University economist who researches banking, told SNL that the labor force participation level is "troubling" and indicates that the job market remains fragile and the economy, by extension, is still working to find solid ground. And results at small banks, he said, tend to reflect the economies in which they operate.

"We still have a ways to go," he said.

[headlines]

--------------------------------------------------------------

Ranking the rainmakers in 2013

By Nathan Stovall and Ranvir Vala

SNL Financial Executive

A handful of big-ticket transactions in the bank space propelled investment bankers from J.P. Morgan Securities LLC to the top of SNL's lead banker rankings in 2013.

While the most active investment banks working in the bank M&A arena dominated the rankings in the first half of the year, with most deals being smaller in size, a few large bank deals surfaced in the second half of 2013 that shook up the rankings of lead bankers advising the sector. Bankers from the likes of Sandler O'Neill & Partners LP and Stifel Financial Corp. unit Keefe Bruyette & Woods Inc. continued to prominently feature in SNL's rankings of lead bankers, with both firms easily topping the league tables in terms of number of engagements — working on 47 and 44 transactions, respectively, in 2013. However, larger bank deals firmly pushed a few investment bankers from J.P. Morgan Securities to the top of the rankings.

Indeed, two J.P. Morgan i-bankers — Eric Warmstein and John Simmons — stood out among investment bankers advising in the bank and thrift space in 2013. The two i-bankers each advised on four deals totaling $5.34 billion, with all of the engagements coming in the second half of the year. Fee information was available for three of the deals, with the transactions set to bring their firm close to $40 million in fees, assuming the deals close, according to SNL's analysis.

Although the deals were almost certainly weeks, if not months, in the making, two of J.P. Morgan's engagements came in quick succession in July 2013, when it advised MB Financial Inc. on the $668.7 million purchase of Taylor Capital Group Inc. and then a week later landed the sell-side advisory role on CapitalSource Inc.'s $2.3 billion sale to PacWest Bancorp.

J.P. Morgan i-bankers Warmstein, Michael Schechter, Simmons and Usman Ghani worked on the MB Financial/Taylor deal, while Sandler O'Neill Principal William Burgess and Sandler's Benjamin Schmitt advised the seller in the transaction. MB Financial told SNL earlier in 2013 that it selected J.P. Morgan for the Taylor Capital deal because the company was pleased with the work the investment bank did when it served as the lone book manager on its $201.3 million common stock offering in the fall of 2009.

J.P. Morgan landed an even larger engagement shortly thereafter, working on the PacWest/CapitalSource deal. Jefferies LLC served as lead adviser to PacWest, with i-bankers Caspar Bentinck and Frank Cicero working on the deal. Castle Creek Financial LLC and Goldman Sachs & Co. also acted as financial advisers to PacWest, with Goldman's Todd Owens and Michael Esposito serving as leads on the transaction. The deal represented Goldman's second engagement over $500 million in 2013.

The other engagement was Goldman's work advising City National Bank of Florida on its $882.8 million sale to Banco de Credito e Inversiones SA. Goldman i-bankers Tannon Krumpelman, Carlos Pertejo and Olaf Díaz-Pintado advised on the transaction. LXG Capital S.A.C bankers Pablo Luzardi and Martin Farina and Whitecap Consulting Group LLC banker Fernando Capablanca advised the buyer on the transaction.

J.P. Morgan landed three deals over $500 million in 2013, with the third deal over that size coming in September, when it advised Umpqua Holdings Corp. on its roughly $2.0 billion planned purchase of Sterling Financial Corp. J.P. Morgan i-bankers Warmstein, Simmons, Ghani and Vishal Idnani were lead bankers on that transaction.

J.P. Morgan had advised Umpqua on its purchase of Financial Pacific Holding Corp. three months earlier and had served as the sole book manager on the company's common equity offering in 2009 and again on its common equity and convertible preferred equity offering in 2010.

Meanwhile, Sandler O'Neill served on the sell side of the Umpqua/Sterling transaction, with investment bankers Jimmy Dunne III, Brian Sterling, Murray Bodine, Joel Comer, Peter Buck and Adam Keefer as lead bankers on the deal. A handful of other Sandler i-bankers were even more active in 2013, including Principal Scott Clark and Vice President Reid Brewer, who each worked on seven deals, totaling $557.4 million. Clark and Brewer's largest deal engagement came when they, along with Sandler Senior Managing Principal Jon Doyle, advised Rockville Financial Inc. on its pending merger-of-equals with United Financial Bancorp Inc. Doyle worked on four transactions totaling $727.3 million in 2013, including work as adviser to First Financial Holdings on its nearly $300 million sale to SCBT Financial.

Sandler's Peter Finnerty Jr. also served as a lead banker on the SCBT/First Financial deal. Sandler O'Neill had a deep relationship with First Financial, having served as book manager on its common stock offering in the fall of 2009. Two years later, Sandler advised the company on the sale of its insurance agency and on the sale of performing loans and distressed assets. Sandler also advised First Financial on the purchase of a failed bank in the spring of 2012.

Keefe Bruyette & Woods landed the buy-side engagement on the SCBT/First Financial transaction. KBW i-banker Jim Mabry served as lead banker to SCBT on the deal and worked on three transactions totaling $435.7 million in 2013.

Keefe Bruyette & Woods bankers found their way onto some other large transactions in 2013. Keefe Bruyette & Woods earned the buy-side engagement on the nearly $500 million United Bankshares Inc./Virginia Commerce Bancorp Inc. deal, with Robert Stapleton and Graham Nix serving as lead bankers. Keefe Bruyette & Woods had advised United Bankshares on its sale of George Mason Mortgage LLC in the summer of 2004. Sandler O'Neill won the sell-side engagement on Virginia Commerce to United Bankshares, with Bill Boyan and Andrew Shapiro serving as lead bankers on the transaction. Sandler O'Neill had served as book manager on the company's common stock offerings in July 2010 and April 2004.

Keefe Bruyette & Woods also landed the buy-side engagement on another large deal in 2013: Union First Market Bankshares Corp.'s $444.5 million purchase of StellarOne Corp. Keefe Bruyette & Woods' Scott Anderson, a managing director and co-head of depositories investment banking, served as lead banker to Union First, while Raymond James & Associates Inc. bankers Christopher Choate and Brian Nestor landed the sell-side engagement on the deal.

Keefe Bruyette & Woods has a longstanding relationship with Union First Market Bankshares, having advised the bank on its last five acquisitions. Anderson served as lead banker on several of those transactions. Keefe Bruyette & Woods also served as book manager on the company's common stock offering in September 2009.

[headlines]

--------------------------------------------------------------

Non-Current Loans/Charges Offs Bring Bank Down

First Bank to Fail in 2014

The three former branches of DuPage National Bank, West Chicago, Illinois, were closed by the Office of the Comptroller of the Currency with the Federal Deposit Insurance Company (FDIC) as receiver. The FDIC entered into a purchase and assumption agreement with Republic Bank of Chicago, Oak Brook, Illinois, to assume all of the deposits of DuPage National Bank.

The bank was founded August 29, 1891 and survived the 1930's Great Depression. It had one office in Hinsdale and two in West Chicago with 26 full time employees September 31, 2013. In 2007, the bank had 34 full time employees. The latest FDIC records available; Tier 1 risk based capital ratio: 5.17%.

Year-end 2011 Tier 1 risk based capital ratio: -13.52% with a negative net capital equity of $2,394,000.

The infusion of capital brought the bank out of its $2.4 million negative equity, but the non-current loans were still too high, charge offs too high, and profits remained negative.

(in millions, unless otherwise)

Net Equity

2006 $7.6

2007 $7.5

2008 $7.5

2009 $6.5

2010 $2.8

2011 -$2.4

2012 $3.1

9/31 $1.5

Profit

2006 $347,000

2007 -$33,000

2008 -$1.6

2009 -$2.4

2010 -$3.7

2011 -$5.2

2012 -$2.5

9/31 -$1.5

Non-Current Loans

2006 0

2007 $1.3

2008 $3.4

2009 $5.1

2010 $11.2

2011 $7.1

2012 $7.2

9/31 $4.7

Charge Offs

2006 0

2007 0

2008 $345,000 ($168,000 construction/land, $127,000 multifamily, $41,000

1-4 family, $9,000 individuals)

2009 $1.2 ($603,000 commercial, $437,000 nonfarm/non-res., $119,000 multi-family, $50,000 individuals, $25,000 1-4 family.

2010 $352,000 ( $362, 000 construction/land, $105,000 nonfarm/non-res., -$10,000 individuals)

2011 $2.5 ($1.6 nonfarm/non-res., $523,000 1-4 family, $359,000 multifamily, $20,000 commercial/industrial, $7,000 individuals

2012 $1.0 ($979,000 nonfarm/non-res., $108,000 multifamily, $28,000 construction/land, -$44,000 1-4 family, -$11,000 automobile)

9/31 $1.8 ( $909,000 construction/land, $799,000,000 nonfarm-nonres., $45,000 1-4 family, $37,000 multifamily, $3,000 commercial, $10,000 other consumer loans, $2,000 individuals, -$8,000 automobiles).

(Note: The FDIC charge off numbers were not totaled corrected by the bank in their report, such as 9/31 was $914,000 but the numbers added up to $1.8. There were other years with these addition errors. Editor).

Construction and Land, 1-4 family multiple residential, Multiple Family

Residential, Non-Farm Non-Residential loans.

The bank "...was first founded on August 29, 1891 as the Bank of Newton and Smiley. The founders, Captain D.C. Newton and C.E. Smiley, both veterans of the Civil War, safeguarded their townsman's money, arranged for the payment of bills and in general, performed the functions of modern day bankers.

"In 1903, The Bank of Newton and Smiley was purchased by a partnership consisting of James M. Dayton, Henry J. Stark, both of Sycamore and David A. Syme, who was originally from Scotland. The new institution was known as the Bank of West Chicago and had for its officers Henry J. Stark, President, Grant A. Dayton, Vice President and Cashier and Paul G. Brown, Assistant Cashier. This brought to the banking business in West Chicago the first of the Dayton Family, three generations of which were to play an important part in the affairs of the bank from 1903 to 1967.

"In 1908, the banking laws of the State of Illinois made it necessary to incorporate, so the State Trust and Savings Bank was incorporated with Capital Stock of $50,000 and a charter was issued to it on April 15, 1908. The bank commenced business with deposits of $200,000. David A. Syme was President, Grant A. Dayton (West Chicago's first mayor), Vice President and Cashier and Paul Brown, Assistant Cashier. Ten years later, in 1918, the bank moved from the "Stone Bank" to the present building and the bank moved in with deposits of $347,000.

"The ownership stayed the same until 1962, when Wayland Dayton sold the bank to its present owners, and on December 31, 1962, we became a nationally chartered bank known as The First National Bank of West Chicago.

"To facilitate continued growth as a full service bank in West Chicago and its surrounding areas, The First National Bank of West Chicago became DuPage National Bank on January 1, 1982. The doors to our third location in West Chicago opened on December 20th of that same year on the southwest side of our community."

http://www.dnbonline.com/about.htm

As of September 30, 2013, DuPage National Bank had approximately $61.7 million in total assets and $59.6 million in total deposits. Republic Bank of Chicago will pay the FDIC a premium of 1.20 percent to assume all of the deposits of DuPage National Bank. In addition to assuming all of the deposits of the DuPage National Bank, Republic Bank of Chicago agreed to purchase essentially all of the failed bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.6 million.

http://www.fdic.gov/news/news/press/2014/pr14004.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Leasing News Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

|

[headlines]

--------------------------------------------------------------

Meet

Leasing News Advisor

Ed Castagna

Ed joined the Leasing News Advisory Board on February 4, 2004. His contributions have been centered not only on his knowledge of leasing companies or their “assets,” but his design, understanding, and informational coordination on the World Wide Web.

Edward Castagna, CEO

InPlace Auction

68 South Service Road, Suite 100

Melville, New York 11747

Tel. (516) 229-1968

Cell (516) 297-7775

Fax. (516) 882-7924

ecastagna@inplaceauction.com

www.inplaceauction.com

Over 25 years ago, used equipment dealers and mechanics taught him what to look for and which questions to ask when evaluating machinery and equipment for resale. Since then, he's honed his appraisal skills through hands on experience and continuing education. InPlace Auction's appraisals contain insightful and common sense values delivered professionally. He has been an expert witness with a 100% rate of success in courtroom defense of challenged value. He has been retained as the face-to-face contact with defaulting business owners by a variety of Fortune 100 creditors, relying on his tact, expertise, and determination to resolve uncomfortable and potentially dangerous situations.

Ed has been trusted and charged with the difficult task of liquidating distressed companies to the bare walls. He's helped turn off the lights of thousands of companies in industries as varied as television, manufacturing, transportation, medical, municipal, financial, textile, automotive and commercial real estate just to name a few. "It's my responsibility to treat everyone with respect, regardless of their circumstances. That's how I've been able to successfully and peacefully defuse even the most precarious of situations. I know exactly how to resolve most situations, but also know when it's time to walk away and return promptly with a court order and appropriate authorities."

An early adopter of web based technology in 1988, he was the first in the industry to create a high volume internet enhanced recovery, remarketing and reporting web based service. He is now applying this experience in conjunction with the latest technology to the auction business and currently holds live and on line auctions. His latest auctions sold Intellectual Property, Real Estate, Machinery, & Building materials

He earned a B.A. in Psychology from Syracuse University, and is a graduate of the Mendenhall School of Auctioneering. He has been educated in appraisal procedure and ethics by The American Society Of Appraisers. Ed served on the Equipment Leasing and Finance Association (ELFA) Board of Directors from 2006-2009 representing its service provider members; is on the service providers business council of the ELFA; is a member of the fair Business Practices Committee.

He is one of the founding members, and serves as the current President, of the Tender Loving Care Foundation (www.tenderlc.com); is an advisory board member to South Bronx Education Foundation (www.sbef.org) and most recently was tapped to join the board of directors of the Stewart Fund. He is also a Steward of St. Brigid's R.C. Church (www.saintbrigid.net) and he says his favorite place to be is anywhere with his wife Jeanine and their two boys.

[headlines]

--------------------------------------------------------------

December’s retail sales rose over the previous month

amid a decrease of 3.1 in the Money Anxiety Index

Dan Geller, PH.D.

“We are off to a good start in 2014,” said Dan Geller, Ph.D. Behavioral Economist, “if consumers’ money anxiety will continue to decline at the current pace, we will see a noticeable improvement in the economy this year.”

December’s retail sales increased 4.1 percent over December of 2012 according to the data released by the U.S. Department of Commerce.

The increase in December’s retail sales of .02 percent from November occurred across multiple categories with food and beverages, clothing, and non-store retailers gaining the most. Such broad-based increase in sale categories indicates that consumers are less financially anxious, and they are staring to spend more than they did in the previous month and in the previous year. Additionally, this is an indication that the increase in retail sales was well distributed, and was not influenced by one single category of products.

Dan Geller, PH.D., is the author of "Money Anxiety"; www.http://moneyanxiety.com/ " It is available Amazon, Barnes and Noble, Google Play and iTunes store. The book is highly beneficial to business and financial people by helping them how and why consumers buy."

|

[headlines]

--------------------------------------------------------------

*******Announcement************************************

ELFA ---2014 Schedule of Conferences, Workshops

and e-Learning Opportunities

WASHINGTON, D.C. – Members of the equipment leasing and finance industry will have multiple opportunities to network and engage in business and professional development this year. The Equipment Leasing and Finance Association has released its 2014 calendar of events, which includes face-to-face conferences and workshops and web-based programs. Continuing education credits are available for many of the offerings.

ELFA’s 2014 lineup includes the following events:

- Equipment Management Conference & Exhibition, Feb. 23-25, Arizona Biltmore Hotel, Phoenix, Ariz.

- Executive Roundtable, March 9-11, Hyatt Regency Coconut Point, Bonita Springs, Fla.

- 13th Annual IMN/ELFA Investors Conference, March 20, McGraw Hill Auditorium, New York, N.Y.

- Principles of Leasing and Finance Workshop, April 7-9, Chicago, Ill.

- National Funding Conference, April 23-25, Swissôtel Chicago, Ill.

- Bank Best Practices Roundtable, April 23, Swissôtel Chicago, Ill.

- Captives Best Practices Roundtable, April 23, Swissôtel Chicago, Ill.

- Independent Best Practices Roundtable, April 23, Swissôtel Chicago, Ill.

- Legal Forum, May 4-6, Worthington Renaissance Fort Worth Hotel, Ft. Worth, Texas

- AGL&F/ELFA Public Sector Finance Forum, May 7-9, Mayflower Hotel, Washington, D.C.

- Credit and Collections Management Conference& Exhibition, June 1-3, Hilton Cincinnati Netherland Plaza, Cincinnati, Ohio

- Capitol Connections, June 10-11, Washington Court Hotel, Washington, D.C.

- Principles of Leasing and Finance Workshop, June 16-18, Philadelphia, Pa.

- Tax Professionals Roundtable, June 24-25, Minneapolis, Minn.

- Operations & Technology Conference & Exhibition, Sept. 8-9, Westin Buckhead, Atlanta, Ga.

- Lease and Finance Accountants Conference & Exhibition, Sept. 8-10, Westin Buckhead, Atlanta, Ga.

- Principles of Leasing and Finance Workshop, Sept. 8-10, Denver, Colo.

- ELFA 53rd Annual Convention, Oct. 19-21, Manchester Grand Hyatt, San Diego, Calif.

- Human Capital Best Practices Roundtable, Date TBD, ELFA Headquarters, Washington, D.C.

More Information about ELFA Events & Conferences (7 pages):

http://www.leasingnews.org/PDF/ELFA2014ScheduleInfo_1212014.pdf

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $827 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

*****Announcement***************************************

John Kenny Receivables Management • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

[headlines]

--------------------------------------------------------------

Here are the top stories opened by readers:

(1) Alert: Rudy Trebels Back Soliciting Broker Business

http://leasingnews.org/archives/Jan2014/1_17.htm#alert

(2) US Bank/Lyon Financial Get Tripped up by Botched Confession of Judgment and Involuntary BK Filings Against Guarantor

By Tom McCurnin

Leasing News Legal News Editor

http://leasingnews.org/archives/Jan2014/1_13.htm#usbank

(3) Archives---January 15, 2002

Kit and Sue at Lambeau Field, Green Bay, Wis.

http://leasingnews.org/archives/Jan2014/1_15.htm#archives

(4) Look Out!!! Readers/Bankers/Lessees

--Two Evergreen/PRR Clause Lessors Merge

Onset Financial/Mazuma Capital

by Christopher Menkin

http://leasingnews.org/archives/Jan2014/1_13.htm#merge

(5) Check Your Internet Speed Connection---Why

by Kit Menkin

http://leasingnews.org/archives/Jan2014/1_15.htm#check

(6) Leasing 102 by Mr. Terry Winders, CLP

Rates Will Be Going Up

http://leasingnews.org/archives/Jan2014/1_13.htm#rates

(7) Element Financial Expects to Originate $3.8 billion

in Organic New Business in 2014

http://leasingnews.org/archives/Jan2014/1_15.htm#element

(8) Millions of off-lease vehicles to hit wholesale market 2014

http://wardsauto.com/dealerships/back-dead-leasing-gets-lively

(9) New Hires—Promotions

http://leasingnews.org/archives/Jan2014/1_17.htm#hires

(10) Involuntary Bankruptcies for Dummies

By Tom McCurnin

Leasing News Legal News Editor

http://leasingnews.org/archives/Jan2014/1_15.htm#involuntary

|

[headlines]

--------------------------------------------------------------

Black Labrador Retriever

Brooklyn, New York Adopt-a-Dog

"Mary Crawley is an approximately 2 year old lab mix from North Carolina. Our volunteer friends down south insisted on a rescue because she's such a great dog - friendly and gets along with others. Mary is spayed, UTD on vaccinations, and microchipped."

Application:

http://www.badassbrooklynanimalrescue.com/adoption-app

Badass Brooklyn Animal Rescue

Brooklyn, NY 11215

email: http://www.petfinder.com/petdetail/28174655

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Open Positions at Leasing Funders/Various Locations

You will find many jobs open in various leasing companies. Most are at the main office or a branch. The larger companies change listings and readers should click to them, as they change weekly, if not daily.

Leasing News invites other employers to list their "open positions."

The listing is free.

Advantage Funding

http://www.advantagefund.com/employment.htm

AIG

http://www.aigcorporate.com/addresources/globalcareers.html

Altec

https://careers.altec.com/psc/P90HALT_APP/APPLICANT

/HRMS/c/HRS_HRAM.HRS_CE.GBL?nocrumbs=yes&

Alter Moneta

http://www.altermoneta.com/careers/opportunities.html

Atlas Copco

http://www.atlascopco.com/us/careers/openjobs/

Ascentium Capital

http://ascentiumcapital.atsondemand.com/

Balboa Capital

http://www.balboacapital.com/about_us/careers.aspx

Bank of America

http://careers.bankofamerica.com/overview/overview.asp

Bank of Ozarks

https://bankozarks.applicantharbor.com/jobmainlist.php?a=m

Bank of the West

https://www.bankofthewest.com/about-us/careers/job-search.html

(type in state, and keyword leasing or category)

Channel Partners

http://www.channelpartners.com/careersearch.html

CIT Job Openings

http://sj.tbe.taleo.net/SJ1/ats/careers/

CSI Leasing

http://www.csileasing.com/ViewJobPostings.aspx

Data Sales

http://www.datasales.com/open_jobs.html

De Lage Landen Financial

https://tbe.taleo.net/NA4/ats/careers/jobSearch.jsp

Direct Capital

http://tbe.taleo.net/NA2/ats/careers/jobSearch.jsp

Farm Credit

http://www.farmcreditnetwork.com/careers/opportunities

Financial Pacific

http://www.finpac.com/careers.aspx

Fifth-Third Bank

https://cvg53.cvgs.net/Main/careerportal/JobAgent.cfm

First Pacific Funding

http://www.firstpacificfunding.com/reps/

GE Capital

www.ge.com/careers

GreatAmerica Leasing

http://jobs.greatamerica.com/

Home Savings Bank

http://www.home-savings-bank.com/careers.php

Huntington Bank

https://www.huntington.com/us/HNB3400.htm

Key Bank

Click here

Macrolease

http://leasingnews.org/hwanted_macrolease3.html

Marlin Business Services

https://www.marlinfinance.com/career-postings.asp

Madi$on Capital

http://www.madisoncapital.com/employment.

Meridian Bank

https://www.meridianbank.com/careers.html

Microfinancial/Timepayment

http://www.hirebridge.com/jobseeker2/Searchjobresults.asp?cid=5224

Northern California Farm Credit (office listings)

http://www.norcalfc.com/locations.html

Pacific Capital Companies

http://leasingnews.org//hwanted_pacificcap2.html

People's United Bank

https://www3.ultirecruit.com/PEO1003/JobBoard/ListJobs.aspx

PL Capital

http://www.plcapital.com/careers.asp

Prime Alliance Bank

http://www.primealliancebank.com/home/careers

Regions Bank

https://regions.taleo.net/careersection/2/jobsearch.ftl

Republic Financial

http://tbe.taleo.net/NA8/ats/careers/jobSearch.jsp

Sterling Bank

https://www.synovus.apply2jobs.com/ProfExt/index.cfm?fuseaction=m

External.showSearchInterface

Taycor Financial

http://www.taycor.com/about-taycor-financial/careers/

TCF Bank

https://tcfbank.taleo.net/careersection/corporate/jobsearch.ftl?lang=en

TD Bank

https://tderec.ijob.com/recruit/servlet/com.lawson.ijob.util.Login

US Bank

(type position in blank space and/or state)

http://www.usbank.com/cgi_w/cfm/careers/careers.cfm

Wells Fargo

https://employment.wellsfargo.com/psp/PSEA/APPLICANT

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Amarillo, Tenn. trucking firms merge to form billion-dollar company

http://amarillo.com/news/latest-news/2014-01-16/amarillo-tenn-trucking-firms-merge-form-billion-dollar-company

Deutsche Bank posted a surprise 1.15 billion euros pre-tax loss

http://www.chicagotribune.com/business/sns-rt-us-deutschebank-warning-20140119,0,2143286.story

Deutsche Bank to rein in global bond trading in profit push

http://www.chicagotribune.com/business/sns-rt-us-deutschebank-results-20140117,0,6131806.story

Leasing firm Avolon adds to airplane fleet after busiest year

http://www.independent.ie/business/irish/leasing-firm-avolon-adds-to-fleet-after-busiest-year-29923963.html

ILFC takeover could trigger more aircraft leasing M&A - exec

http://in.reuters.com/article/2014/01/20/aviation-finance-mergers-idINL5N0KU1N820140120

Eastern Bank offers wealth of opportunity

http://www.bostonglobe.com/business/2014/01/19/bank-offers-wealth-opportunity/qEZRdtWKHM5KidS5mrvSnO/story.html

Bank weathered anti-German hysteria, Great Depression

http://www.pantagraph.com/news/local/bank-weathered-anti-german-hysteria-great-depression/article_7b4fa69c-7f97-11e3-8005-001a4bcf887a.html

What bank stock investors liked in 2013

http://www.ababj.com/component/k2/item/4335-what-bank-stock-investors-liked-in-2013

FASB Issues New Private Company Accounting Alternatives

http://ww2.cfo.com/accounting-tax/2014/01/fasb-issues-new-private-company-accounting-alternatives/

Ex-New York mayor returns to his old job

http://www.upi.com/Business_News/2014/01/18/Ex-New-York-mayor-returns-to-his-old-job/UPI-57161390061631/

The World's Highest-Paid Musicians 2013

http://www.forbes.com/pictures/eeel45eghfe/the-worlds-25-highest-paid-musicians-27/

China central bank offers emergency funds to banks

amid latest cash squeeze

http://www.chicagotribune.com/business/sns-rt-us-china-moneymarket-20140120,0,4888859.story

Equipment Asset Manager www.maximcc.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

CHECK OUT SMITH & WESSON’S NEW BEAST OF A REVOLVER:

THE ‘BACKPACK CANNON’

http://www.theblaze.com/stories/2014/01/20/check-out-smith-wessons-new-beast-of-a-revolver-the-backpack-cannon/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

10 Ways to Find Time for Exercise

Busting the #1 Exercise Excuse: Lack of Time

http://www.sparkpeople.com/resource/fitness_articles.asp?id=1675

[headlines]

--------------------------------------------------------------

American Football Poem

The Coach

by Poet deVine

The crowd is gone, the cheers have stopped,

and the equipment is stored away.

The team is standing on the field

because the coach is leaving today.

He led them through the hardest times,

and was proud the times they won.

But now the season's over and

his time as coach is done.

The team will go on without him,

will perform at the usual pace.

But though another coach comes in,

there'll be a void in this place.

Today when the field is emptied

and the team has met the test,

The coach can feel certain that

he will be remembered as simply the best.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Seahawks, and their fans party after winning NFC title

http://seattletimes.com/html/larrystone/2022711687_stone20xml.html

Patriots quarterback Tom Brady on Seahawks’ Richard Sherman: ‘We win with graciousness

http://sports.yahoo.com/blogs/nfl-shutdown-corner/patriots-quarterback-tom-brady-seahawks-richard-sherman-win-185803001--nfl.html

Vernon Davis offers pointed response to Richard Sherman

http://blog.sfgate.com/49ers/2014/01/20/vernon-davis-offers-pointed-response-to-richard-sherman/

Patrick Willis: 'We stay optimistic. We fight'

http://blogs.sacbee.com/49ers/archives/2014/01/patrick-willis-we-stay-optimistic-we-fight.html

Kawakami: Interesting offseason for 49ers' Harbaugh, Kaepernick

http://www.mercurynews.com/tim-kawakami/ci_24952423/kawakami-interesting-offseason-49ers-harbaugh-kaepernick

Lowell Cohn: Kaepernick's complications

http://www.pressdemocrat.com/article/20140119/sports/140119519

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

How a man claiming to be the son of Republic of Congo's president scammed Marin couple of $1.6 million

http://www.contracostatimes.com/news/ci_24950999/how-man-claiming-be-son-republic-congos-president

San Joaquin Valley farmers take drastic measures to deal with drought

http://www.sacbee.com/2014/01/20/6087268/san-joaquin-valley-farmers-take.html

These Maps Show How Dramatically Silicon Valley Has Distorted The Real Estate Market

http://www.businessinsider.com/silicon-valley-real-estate-market-maps-2014-1

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Why Cork Is Still a Show-Stopper

http://online.wsj.com/news/49704579318351114830922

Wine-Industry Related Businesses Lease Close to 1-Million Square Feet of Space in Fairfield, California

http://www.sacbee.com/2014/01/16/6078391/wine-industry-related-businesses.html

Feds apprehend Chris Edwards in Mexico on fraud charges

http://naparegister.com/news/local/feds-apprehend-chris-edwards-in-mexico-on-fraud-charges/article_28f7f864-7fe1-11e3-be49-0019bb2963f4.html

Obituary: Wine world remembers Pamela Vandyke Price

http://www.decanter.com/news/wine-news/584733/obituary-wine-world-remembers-pamela-vandyke-price

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1642 – Director of the New Netherlands colony, Willem Kieft, calls for a meeting of the Twelve (family representatives) to organize a military response to the increasing raids of the Hudson River Valley Tribe. This tribe was reacting to pressure from the growing Iroquois to the north and increasing European settlement in the south.

1648- Margaret Brent made her claim as America's first feminist by demanding a voice and vote for herself in the Maryland colonial assembly. Brent came to America in 1638 and was the first woman to own property in Maryland. At the time of her demands she was serving as secretary to Governor Leonard Calvert. She was ejected from the meetings, but when Calvert died she became his executor and acting governor, presiding over the General Assembly. History records this event as the beginning of the women’s suffrage movement in America. In 1640, she became the first woman barrister in America, officially the colonial attorney for Cecilius Calvert, Lord Proprietor of Maryland.

http://www.fa-ir.org/15_2.htm

http://earlyamerica.com/review/1998/brent.html

1738- Ethan Allan, Revolutionary War soldier and leader of the Vermont "Green Mountain Boys." Born at Litchfield, CT, he died at Burlington, VT, Feb 12, 1789. History finds him quite an opportunist who high school history books have painted quite differently than his actual deeds. He actually missed most of the Revolutionary War because he was in British prison. He led several movements, including a military effort, to join both New York and Vermont with Canada.

http://personalweb.smcvt.edu/thefort/History/EthanAllen.htm

( see: Legends, Lies and Cherished Myths of American History by Richard Shenkman )

1785 - Chippewa, Delaware, Ottawa and Wyandotte tribes signed a treaty of Fort McIntosh, ceding present-day Ohio to the United States

1801 -- "Federal Bonfire Number Two": a mysterious fire sweeps the offices of the Department of Treasury, destroying books and papers, after Republicans demanded proof that the expenditures of Timothy Pickering, the recently replaced Federalist Secretary of War, could be properly accounted for. He was censured by Congress. He was re-elected to Congress for two more terms, then retired.

http://bioguide.congress.gov/scripts/biodisplay.pl?index=p000324

http://www.qmfound.com/COL_Timothy_Pickering.htm

1812 - The famous Y-bridge in Zanesville, Ohio, was approved for construction.

http://www.vintageviews.org/vv-3/bridges/pages/bdg07_003.html

http://www.coz.org/

1824-Birthday of Thomas “Stonewall” Jackson, Confederate general and one of the most famous soldiers of the American Civil War. Born at Clarksburg, VA (now WV). At the first Battle of Bull Run on July 21, 1861, Union forces under Gen. Irvin McDowell were defeated by the Confederates. McDowell delayed the attack for two days, allowing Confederate Gen. Beauregard to call on reinforcements from the Shenandoah Valley. Their arrival late in the day gave the Confederates a numerical advantage. It was in this battle that Confederate Gen. Thomas J. Jackson was nicked named ‘Stonewall” for his firm stand at a crucial moment. On May 2, 1963, General Stonewall Jackson, leading a large part of General Lee's army, delivered a devastating blow on General Hooker's right flank. The Battle of Chancellorsville, 50 miles southwest of Washington, DC, had started the day before. It was Lee’s goal to capture Washington, and the chance encounter in Gettysburg stopped him. In this battle, General Robert E. Lee won his greatest victory over huge Union forces under General Joseph Hooker, considered a military idiot, who allowed his men to party and bring prostitutes along (thus the name Hookers ). In the North, 17,275 were killed or wounded; in the South, 12,821. Reconnoitering with his staff at day's end on May 2, Jackson and his group were mistaken for Union Soldiers and fired upon by their own forces. Jackson's shattered left arm had to be amputated. While he was hospitalized pneumonia set in; his death came on May 10th [year??] in Chancellorsville, VA.

http://memory.loc.gov/ammem/today/jan21.html

1844- John Browning, world famous gun maker and inventor who was taught gunsmithing by his Mormon pioneer father, Jonathan Browning, was born at Ogden, UT. Starting the J.M. & M.S. Browning Arms Company with his brother, he designed guns for Winchester, Remington, Stevens and Colt arms companies, as well as American and European armies. Browning had more gun patents than any other gunsmith in the world. He is best known worldwide for inventing the machine gun in 1890 and the automatic pistol in 1896. He died suddenly Nov 26, 1926- at age 71, while at Belgium on business. The company he founded, known now as Browning Arms Company, is located at Morgan, UT.

1850--French newspaper "Le Californien" established.

1853- Dr. Russell L. Hawes of Worcester, MA, received a patent for an envelope folding machine that proved practical commercially. It was not self-gumming, but nevertheless it enabled three girls to produce the finished product at the rate of about 25,000 envelopes in 10 hours, thus allowing “junk mail” to be economically sent.

1863 - A severe coastal storm dropped heavy rain on the Fredericksburg area of Virginia. It disrupted a Union Army offensive in an ill-famed "mud march"

1867 -- Patrol Special Officer, Armand Barbier, arrests His Majesty Norton I, Emperor of the United States and Protector of Mexico, for involuntary treatment of a mental disorder and thereby creates a major civic uproar. San Francisco Police Chief Patrick Crowley apologizes to His Majesty & orders him released. Several scathing newspaper editorials follow the arrest. All police officers begin to salute His Majesty when he passed them on the street.

http://www.notfrisco.com/nortoniana/index.html

http://www.zpub.com/sf/history/nort.html

1880- the first sewage –disposal system separate from the city water system was built in Memphis, TN, under the direction of George Edwin Waring. The pipes were sewage only and kept constantly cleansed with water and were well ventilated. Other cities copied this new “sewer system.”

1884- Roger Baldwin, founder of the American Civil Liberties Union, called the "country's unofficial agitator for, and defender of, its civil liberties." Born at Wellesley, MA, he died Aug 26, 1981, at Ridgewood, NJ.

1943-Birthday of bass player Steve Gilmore, Trenton, NJ

http://www.philwoods.com/gilmore.htm

http://www.playjazz.com/BA033.html

1915- First Kiwanis Club chartered at Detroit, MI.

http://www.kiwanis.org/

1917-Birthday of pianist Billy Maxted, born Racine, WI. Great pianist, he wrote many arrangements for Ray Eberle; Red Nichols; Will Bradley, and even Benny Goodman. At the end of the big band era, Billy has his own band briefly.

http://www.jazzmanrecords.com/bilmaxbigswi.html

1920 -- Palmer "Red" Raids start targeting labor activists and radicals for US government repression. Attorney General A. Mitchell Palmer orders the roundup of all suspects for prosecution & deportation where possible. The man in charge is J. Edgar Hoover. Thousands of people are arrested in a nationwide sweep. Most arrests are illegal, without warrants or justification. Thousands are eventually deported.

http://www.msu.edu/course/mc/112/1920s/Palmer/newsandpalmer.html

1920 -- Author Ernest Hemingway returns to America after his World War I experiences.

http://www.hemingwayhome.com/HTML/main_menu.html

http://www.hemingway.org/

http://www.ernest.hemingway.com/

1932 -- Annunzio Paolo Mantovani gives a concert at Queen’s Hall in England, garnering excellent reviews and launching his career. (You may know him better simply as Mantovani.)

1936-Birthday of Malka Cohen, of the 1960's Canadian folk duo of Malka and Joso, was born in Israel. She met her singing partner, Joso Spralja, in the early '60s at a Toronto coffeehouse, Yorkville 71. The couple toured Canada, and in 1966 appeared at Carnegie Hall in New York. The following year, Malka and Joso appeared before Princess Margaret in England. But 1967 also marked the end of their partnership. Malka Cohen began a second career as an independent radio interviewer.

http://www.malkamarom.com/music.html

http://www.toronto.com/profile/146821

1936-Birthday of New Orleans blues singer and guitarist Snooks Eaglin.

http://www.mnblues.com/profile/snookseaglin2000.html

http://www.bluesaccess.com/No_38/snooks.html

http://user.mc.net/~snooks/snooks/bigman.html

1938- “Wolfman Jack” born Robert Smith at Brooklyn, NY. He became famous as a disc jockey for radio stations at Mexico in the 1960s. Wolfman Jack was influential as a border radio voice because the Mexican station broadcast at 250,000 watts, five times the legal limit for American stations at the time, and therefore he was heard over a vast part of the US. During his night shift he played blues, hillbilly and other black and white music that wasn't getting a lot of exposure. He later appeared on American radio, movies and television as an icon of 1960s radio. Wolfman Jack died July 1, 1995, at Belvedere, NC.

1940- golfer Jack Nicklaus born Columbus, Ohio

http://www.nicklaus.com/

1941—Birthday of singer/song writer, guitarist Richie Havens

http://www.richiehavens.com/

http://www.mathie.demon.co.uk/rh/biograph.html

1942- Duke Ellington records “C Jam Blues”, “Perdidio”.

2942--Count Basie records "One O’clock Jump."

1943-Birthday of bass player Steve Gilmore, Trenton, NJ

http://www.philwoods.com/gilmore.htm

http://www.playjazz.com/BA033.html

1946 - On ABC radio, "The Fat Man" debuted, starring J. Scott Smart as the portly detective, who weighed 270 pounds in real life. This was one of my favorite radio shows that I remember listening to, perhaps in the late 1940's. “There he goes. Into that drug store. He's stepping on the scales. Weight? 237 pounds. Fortune? Danger. Whoooo is it? The FAT MANNNNNNNNNNN.” Later I learned perhaps my favorite author Dashiell Hammet was involved in writing for the radio show.

http://www.old-time.com/sights/fatman.html

http://www.otrcat.com/

1949—Top Hits

Buttons and Bows - Dinah Shore

A Little Bird Told Me - Evelyn Knight

On a Slow Boat to China - The Kay Kyser Orchestra (vocal: Harry Babbitt & Gloria Wood)

I Love You So Much It Hurts - Jimmy Wakely

1949- First Miles Davis Birth of the “Cool” session, Capital 1762

1950-Birthday of singer Billy Ocean, musician, songwriter, born Leslie Charles, Trinidad, West Indies.

1951 - Mildred “Babe” Didrikson Zaharias set a new women's golf record when she won the Tampa Women's Open with a medal play score at a record 288 for 72 holes. In the 1932 Olympics, Babe won two gold and one silver medal for the javelin throw, the 80-meter hurdles and the high jump, respectively. She was also skilled at basketball, baseball, billiards and golf. As well as being a member of the International Women's Sports Hall of Fame, LPGA Hall of Fame (Babe was a founding member of the LPGA), National Track and Field Hall of Fame, Olympic Hall of Fame and the World Golf Hall of Fame.

http://www.famoustexans.com/babedidrikson.htm

1953- the first gas-turbine car made was the XP-21 Firebird, built by General Motors. The 370-horespower Whirlfire turbojet was installed in the rear of the car. It had a plastic body and accommodated only the driver. Its speed was 150 miles per hour, but it was believed capable of 235 miles per hour. Since it consumed fuel faster than conventional cars, it was not commercially produced.

1954 - The first atomic-powered submarine, the "Nautilus," was launched in Groton, Connecticut, after First Lady, Mamie Eisenhower, christened it with a bottle of champagne.

http://www.ussnautilus.org/

1954 - In New York City, the gas turbine automobile was introduced with a 370 horsepower, ‘whirlfire' turbo power jet engine.

`956--Bill Haley's album "Rock Around the Clock" enters the charts.

1957 -- Filming begins on Elvis Presley's second movie, “Loving You”.

1957---Chuck Berry Records "School Day"

1957---Top Hits

Singing the Blues - Guy Mitchell

The Banana Boat Song - The Tarriers

Young Love - Tab Hunter

Singing the Blues - Marty Robbins

1957- country singer Patsy Cline won an Arthur Godfrey's "Talent Scout" show, singing "Walking After Midnight." Her single of the contest-winning song was on both the country and pop charts for a number of weeks. During the next few years, Patsy Cline became one of the top female country singers. She was killed in a plane crash in 1963.

1959 - The Kingston Trio, with members Bob Shane, Nick Reynolds and Dave Guard, was awarded a gold record for their single, "Tom Dooley", about a man named Tom Dooley who was going to be hanged - "poor boy, you're bound to, die." The Kingston Trio recorded many other hits, including: "Greenback Dollar", "M.T.A.", "Reverend Mr. Black", "Tijuana Jail", and the war protest song, "Where Have All the Flowers Gone?".

1961- The first cabinet member who was the brother of the president was Robert F. Kennedy, who took office as attorney general in the cabinet of President John F. Kennedy in Washington, DC.

1962- Snow falls in San Francisco.

1964 - After 3 years, Carl Rowen took over for Edward R. Murrow as head of the United States Information Agency (USIA), the managing force of the worldwide Voice of America. Rowen had something else in common with Murrow…they both came from news backgrounds, Rowen from NBC, and Murrow from CBS.

1965---Top Hits

Come See About Me - The Supremes

Love Potion Number Nine - The Searchers

Downtown - Petula Clark

Once a Day - Connie Smith

1965-The Byrds record "Mr. Tambourine Man"

1966 - The Beatles' George Harrison marries Patricia Anne Boyd at the Esher Register Office, Surrey, England. Fellow Beatle Paul McCartney and Manager Brian Epstein are in attendance. Pattie, a fashion model, had been Harrison's girlfriend since they met on the set of “A Hard Day's Night” two years earlier. Eventually, Boyd would begin an affair with Harrison's best friend, Eric Clapton, for whom the guitarist would write the classic "Layla."

1966 -- promoter Bill Graham began his notorious three-day "Trips Festival" at the Longshoreman's Hall in San Francisco. Music and LSD were available in large quantities. The Festival at 400 North Point St. featured the Grateful Dead, Big Brother & the Holding Company, The Loading Zone, Chinese New Years' Lion Dancers & Drum & Bugle Corps, Stroboscopic Trampoline, & Ken Kesey & His Merry Pranksters .

"Pray for the (grateful) dead & fight like hell for the living!"

Read personal stories, and more information about Tripps Festival @ postertrip.com

— (with apologies to) Mother Jones

http://www.accessplace.com/gdtc/biograh.htm

http://www.rockhall.com/hof/inductee.asp?id=112

http://www.summeroflove.com/text/haight.html

http://www.sfgate.com/cgi-bin/chronicle/article.cgi?PK5621.DTL:/

chronicle/archive/1996/05/19

http://www.halcyon.com/colinp/hipshops.htm

http://www.diggers.org/

http://www.bbhc.com/BigBrother.htm

1967 -US female Figure Skating championship won by Peggy Fleming

http://www.peggyfleming.net/

1968 --Battle for Khe Sanh begins in Vietnam.

One of the most publicized and controversial battles of the war begins at Khe Sanh, 14 miles below the DMZ and six miles from the Laotian border. Seized and activated by the U.S. Marines a year earlier, the base, which had been an old French outpost, was used as a staging area for forward patrols and was a potential launch point for contemplated future operations to cut the Ho Chi Minh Trail in Laos. The battle began on this date with a brisk firefight involving the 3rd Battalion, 26th Marines and a North Vietnamese battalion entrenched between two hills northwest of the base. During the 66-day siege, U.S. planes, dropping 5,000 bombs daily, exploded the equivalent of five Hiroshima-sized atomic bombs in the area. The siege was finally lifted on April 6 when the cavalrymen linked up with the 9th Marines south of the Khe Sanh airstrip. The official casualty count for the Battle of Khe Sanh was 205 Marines killed in action and over 1,600 wounded (this figure did not include the American and South Vietnamese soldiers killed in other battles in the region). The U.S. military headquarters in Saigon estimated that the North Vietnamese lost between 10,000 and 15,000 men in the fighting at Khe Sanh.

1969 -- The Navajo Community College, the first tribally established & operated community college in the U.S., opens at Many Farms, Arizona. Now called Dine College.

http://acept.la.asu.edu/collaborators/dine.html

http://www.dinecollege.edu/

http://shiprock.dinecollege.edu/

1970 - ABC-TV aired "The Johnny Cash Show" in prime time, after its run as a summer replacement ended. The regular season series was a shot in the arm for country music. Cash wore black, his signature, in the all-color show.

1970- Boeing, Seattle, WA introduced the Jumbo Jet, Boeing 747. The wide-bodied, two-decked aircraft was taller than a six-story building and could carry up to 490 passengers, more than could easily be handled by the terminal facilities of the time. The first 747s went into transatlantic service for Pan American Airlines.

1973---Top Hits

You're So Vain - Carly Simon

Superstition - Stevie Wonder

Crocodile Rock - Elton John

Soul Song - Joe Stampley

1974 -- Four-day postal strike begins at Jersey City, N.J.

1975- Officials at the National Hockey League All-Star game made history by allowing female reporters in the players' locker rooms, a first for American professional sports. The coaches of the two squads arranged for reporters to interview players before they took their showers.

1977 -- President Jimmy Carter issues unconditional pardon to most Vietnam draft resisters on his first full day in office. Affects between 100,000 to 500,000 people.

1978 - The soundtrack to the film "Saturday Night Fever" reached #1 on the album chart (BeeGees)

1979 -- Terry Bradshaw passes for a record four touchdowns to lead the Steelers to a 35-31 victory over the Cowboys in Super Bowl XIII. The Steelers become the first team to win three Super Bowls.

http://images.nfl.com/history/images/0121.jpg

1981---Top Hits

(Just Like) Starting Over - John Lennon

Love on the Rocks - Neil Diamond

The Tide is High - Blondie

I Love a Rainy Night - Eddie Rabbitt

1982 -- Blues guitar giant B.B. King donates his entire record collection (including about 7,000 rare blues records he played when he was a disc jockey) to the University of Mississippi's Center for the Study of Southern Culture.

http://www.island.net/~blues/bb.html

http://www.worldblues.com/bbking/

1982 - The second of two major snowstorms to hit southern Minnesota came to an end. Minneapolis received 20 inches of snow in 24 hours to break the previous record of 17 inches in 24 hours established just a few days earlier. A record 38 inches of snow covered the ground following the two storms, with drifts ten feet high.

1984 - Van Halen's single, Jump, entered the Billboard pop charts on this date, and later was in the Number 1 spot for 5 weeks, remaining on the charts for a total of 15 weeks. It eventually was certified gold for a 6 month stay.

1984-Yes hits number one on the Billboard Hot 100 with their only Top Ten hit, "Owner of a Lonely Heart".

1985 -19ºF (-28ºC), Caesar's Head, South Carolina (state record)

1985 -34ºF (-37ºC), Mt Mitchell, North Carolina (state record)

1985- Don DeLillo wins the American Book Award for his breakthrough novel, “White Noise” .

1985 - Actor Patrick Duffy announced he was leaving the CBS show, "Dallas", at the end of the television season. His request that the character of Bobby Ewing not be recast by another actor was thankfully heeded as Bobby showed up in the new season, after a miraculous rise from the dead. His first appearance after his resurrection was in the shower, when he had clearly been killed in a tremendous car crash the previous season. Duffy continued in the role of Bobby Ewing through the final episode in 1991.

1985 - Three days of snow squalls at Buffalo NY finally came to an end. The squalls, induced by relatively warm water in Lake Erie, produced 34 inches of snow at the International Airport, with up to 47 inches reported in the suburbs of Buffalo. The New York "blizzard of 85" left many counties disaster areas. (19th-21st) (Weather Channel) (Storm Data) President Reagan was sworn in for a second term in the coldest Inauguration Ceremony of record. Cold and wind resulted in wind chill readings as much as 30 degrees below zero.

1986 - Former major-league baseball player, Randy Bass, signed a contract making him the highest-paid baseball player in Japanese history. Bass signed for three years at $3.25 million to play for the Hanshin Tigers.

1986- more than 100 students from Purdue University ran naked through the streets of West Lafayette, IN, in the schools quite unofficial Nude Olympics. The runners were undeterred by a temperature just a few degrees above freezing.